Investment Firm Makes Bitcoin Its Strategic Reserve – Impact On Price

2024年5月14日 - 4:00AM

NEWSBTC

Early-stage investment firm Metaplanet announced on Monday that

it’s adopting Bitcoin (BTC) as its sole “strategic treasury reserve

asset.” This audacious decision signals a growing confidence in the

controversial cryptocurrency as a legitimate store of value and

hedge against traditional economic woes. Related Reading: CEO Drops

Bombshell: Trump Campaign Eyes Crypto-Friendly Policies Yen Under

Pressure, Bitcoin On The Rise Metaplanet’s decision comes amidst a

backdrop of sustained economic pressures in Japan. A weakening yen,

coupled with high government debt levels and persistently

low-interest rates, seems to have pushed the firm to seek

alternative havens for its reserves. Bitcoin, with its finite

supply and decentralized nature, appears to be their answer.

‘Bitcoin-First, Bitcoin-Only’ Approach In a clear statement of

intent, Metaplanet outlined its new “Bitcoin-first, Bitcoin-only

approach” to treasury management. The company plans to

strategically convert its existing yen liabilities and future share

issuances into BTC, effectively accumulating more of the digital

asset over time. This strategy echoes the recent moves of US-based

MicroStrategy, which has become a major institutional holder of

Bitcoin. A screenshot of Metaplanet's press release. Believing In

The ‘Absolutely Scarce’ Asset Metaplanet’s press release paints a

glowing picture of the top crypto asset’s potential. They view it

as “fundamentally superior” to traditional currencies and other

investment options, highlighting its scarcity and lack of a central

issuer. They are impressed by Bitcoin’s proof-of-work (PoW)

consensus mechanism, emphasizing how it creates a progressively

higher cost of production for the remaining coins yet to be mined.

This, they argue, stands in stark contrast to traditional

commodities whose supply can be readily increased. Bitcoin is now

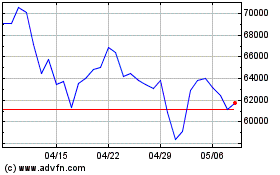

trading at $62.896. Chart: TradingView Following The Footsteps Of A

Corporate Bitcoin Believer There are clear parallels between

Metaplanet’s strategy and that of MicroStrategy. The US firm has

aggressively amassed Bitcoin, currently holding over 1% of the

entire circulating supply. Metaplanet, though smaller, has

reportedly acquired over 117 BTC since April, signaling their

commitment to replicating this strategy. While Metaplanet’s

decision reflects a growing institutional interest in Bitcoin, it

also carries significant risks. Bitcoin’s price remains highly

volatile, with the potential for substantial losses if the market

takes a downturn. Additionally, the regulatory landscape

surrounding cryptocurrencies is still evolving, and future

regulations could negatively impact Bitcoin’s viability as a

reserve asset. Related Reading: Analyst Predicts Injective (INJ)

Breakout: $50 Price Range On The Horizon A Digital Canary In The

Coal Mine? Metaplanet’s bold move serves as a fascinating case

study. Their all-in bet on Bitcoin raises questions about the

future of traditional reserve assets and the potential for wider

adoption of cryptocurrencies by institutional investors. Impact On

Bitcoin Price The company’s investment, while significant for a

single firm, represents a relatively small portion of the total

Bitcoin market capitalization. However, the news itself could

generate positive sentiment and short-term price increases,

especially if it entices other institutional investors to follow

suit. Conversely, if Metaplanet’s strategy backfires and they are

forced to sell their Bitcoin holdings at a loss, it could trigger a

broader sell-off and price decline. Ultimately, the long-term

impact will depend on how this bold move by Metaplanet plays out,

alongside broader market forces and evolving regulations. Featured

image from Pexels, chart from TradingView

Bitcoin (COIN:BTCUSD)

過去 株価チャート

から 4 2024 まで 5 2024

Bitcoin (COIN:BTCUSD)

過去 株価チャート

から 5 2023 まで 5 2024