UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For the month of November, 2024

Commission File No. 0001-34184

SILVERCORP METALS INC.

(Translation of registrant’s name into English)

Suite 1750 - 1066 West Hastings Street

Vancouver, BC Canada V6E 3X1

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F

Form 20-F [ ] Form 40-F [ X ]

1

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

| Dated: November 1, 2024 |

SILVERCORP METALS INC. |

| |

/s/ Jonathan Hoyles |

| |

Jonathan Hoyles |

| |

General Counsel and Corporate Secretary |

2

EXHIBIT INDEX

|

|

| EXHIBIT |

DESCRIPTION OF EXHIBIT |

3

Exhibit 99.1

BAIYUNPU GOLD-LEAD-ZINC PROJECT

Hunan Province, China

National

Instrument 43-101 Mineral Resource

Technical Report

Silvercorp Metals Inc.

Qualified Persons:

Mr. Tony Cameron,

Principal Mining Engineer (FAUSIMM)

Mr. Song Huang, Senior Geology Consultant (MAIG) |

|

|

| |

|

|

Job Number: ADV-HK-00157

Date: 30th June 2024 |

Tony Cameron

RPMGlobal Asia Limited

Room 1118, Level 11, China World Office

1,

1 Jianguomenwai Avenue,

Chaoyang District,

Beijing 100004 China

Phone: +86 10 5387 6410

TCameron@rpmglobal.com

I, Tony Cameron am working as a Consultant

for RPMGlobal Asia Limited, Room 1118, Level 11, China World Office 1, 1 Jianguomenwai Avenue, Chaoyang District, Beijing 100004 China.

This certificate applies

to the National Instrument 43-101 Mineral Resource Technical Report of Baiyunpu Gold-Lead-Zinc Project, Hunan Province, China, prepared

for Silvercorp, dated 30th June 2024 (the “Technical Report”), do hereby

certify that:

| 1. | I am a professional Mining Engineer

having graduated with an undergraduate degree of Bachelor of Engineering (Mining) from the University of Queensland in 1988. In addition,

I have obtained a First Class Mine Manager’s Certificate (No. 509) in Western Australia, a Graduate Diploma in Business from Curtin

University (Western Australia) in 2000, and a Masters of Commercial Law from Melbourne University in 2004. |

| 2. | I am a Fellow of the Australasian Institute of Mining and Metallurgy (“AusIMM”),

Membership No. 108264. |

| 3. | I have worked as a mining engineer

for a total of thirty-five years since my graduation from university. Over the last twenty-three years I have worked as a consulting

mining engineer on mine planning and evaluations for base metals operations and development projects worldwide. |

| 4. | I have read the definition of

“qualified person” as set out in National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI

43-101”) and certify that, by reason of my education, affiliation with a professional association (as defined in NI 43-101) and

past relevant work experience, I am a “qualified person” for the purposes of NI 43-101. |

| 5. | I

visited the BYP Gold-Lead-Zinc Project site between the 19th and

21st of September, 2018. |

| 6. | I am responsible for the preparation of Sections 1, 15 and 16 of the Technical

Report. |

| 7. | I have had no prior involvement with the properties that are the subject

of the Technical Report. |

| 8. | I am independent of Silvercorp in accordance with the application of Section

1.5 of NI 43-101. |

| 9. | I have read NI 43-101 and Form

43-101F1 and the Technical Report has been prepared in compliance with that instrument and form. |

| 10. | I consent to the filing of the

Technical Report with any stock exchange or any other regulatory authority and any publication by them for regulatory purposes, including

electronic publication in the public company files on their website and accessible by the public, of the Technical Report. |

| 11. | To

the best of my knowledge, information and belief, the Technical Report contains all scientific

and technical information that is required to be disclosed to make the Technical Report not

misleading as of the effective date of the report, 30th June, 2024. |

Dated at Beijing, China, 31st

July, 2024

/s/ Tony Cameron

Tony Cameron, FAusIMM (QP)

| | |

| | ADV-HK-00157 | National Instrument 43-101 Mineral Resource Technical Report | 30th June 2024 | | | Page i of vii | |

| | |

| This report has been prepared for Silvercorp Metals Inc.and must be read in its entirety and is subject to all assumptions, limitations and disclaimers contained in the body of the report. © RPMGlobal Asia Limited 2024 |

Song Huang

RPMGlobal Asia Limited

Room 1118, Level 11, China World Office

1,

1 Jianguomenwai Avenue,

Chaoyang

District, Beijing 100004 China

Phone: +86 10 5387 6410

Shuang@rpmglobal.com

I, Song Huang am working as a Consultant

for RPMGlobal Asia Limited, Room 1118, Level 11, China World Office 1, 1 Jianguomenwai Avenue, Chaoyang District, Beijing 100004 China.

This certificate applies to

the National Instrument 43-101 Mineral Resource Technical Report of Baiyunpu Gold-Lead-Zinc Project, Hunan Province, China, prepared

for Silvercorp, dated 30th June 2024 (the “Technical Report”), do hereby certify that:

| 1. | I am a registered member of the Australian Institute of Geoscience (“AIG”),

Membership No. 6157. |

| 2. | I am a graduate of the University

of Science & Technology Beijing and hold a D.Sc in Geology, which was awarded in 2020. |

| 3. | I have been continuously and actively

engaged in the assessment, development, and operation of mineral Projects since my graduation from university in 2009. |

| 4. | I am a Qualified Person for the

purposes of the National Instrument 43-101 of the Canadian Securities Administrators (“NI 43-101”). |

| 5. | I

conducted a three day visit to the BYP Project site between the 19th and 21st

of November, 2018, and another one day visit to the BYP Project site between the 16th

and 27th of March, 2024. |

| 6. | I am responsible for the preparation of Sections 1 to 14 and 17 to 27 of

the Technical Report. |

| 7. | I have had no prior involvement with the properties that are the subject

of the Technical Report. |

| 8. | I am independent of Silvercorp in accordance with the application of Section

1.5 of NI 43-101. |

| 9. | I have read NI 43-101 and Form

43-101F1 and all related Sections of the Technical Report have been prepared in compliance with that instrument and form. |

| 10. | I consent to the filing of the

Technical Report with any stock exchange or any other regulatory authority and any publication by them for regulatory purposes, including

electronic publication in the public company files on their website and accessible by the public, of the Technical Report. |

| 11. | To

the best of my knowledge, information and belief, the Technical Report contains all scientific

and technical information that is required to be disclosed to make the Technical Report not

misleading as of the effective date of the report, 30th June, 2024. |

Dated at Beijing, China, 31st

July, 2024

/s/ Song Huang

Song Huang, MAIG (QP)

| | |

| | ADV-HK-00157 | National Instrument 43-101 Mineral Resource Technical Report | 30th June 2024 | | | Page ii of vii | |

| | |

| This report has been prepared for Silvercorp Metals Inc.and must be read in its entirety and is subject to all assumptions, limitations and disclaimers contained in the body of the report. © RPMGlobal Asia Limited 2024 |

TABLE OF CONTENTS

| 1 |

EXECUTIVE SUMMARY |

1 |

| |

|

|

| 1.1 |

Introduction |

1 |

| 1.2 |

Scope and Terms of Reference |

1 |

| 1.3 |

Project Summary |

2 |

| 1.4 |

Statement of Mineral Resources |

3 |

| 1.5 |

Recommendations |

5 |

| 1.6 |

Opportunities and Risks |

5 |

| |

|

|

| 2 |

INTRODUCTION AND TERMS OF REFERENCE |

7 |

| |

|

|

| 2.1 |

Background |

7 |

| 2.2 |

Source of Information |

7 |

| 2.3 |

Participants |

8 |

| 2.4 |

Limitations and Exclusions |

8 |

| 2.5 |

Capability and Independence |

8 |

| |

|

|

| 3 |

RELIANCE ON OTHER EXPERTS |

10 |

| |

|

|

| 4 |

PROPERTY DESCRIPTION AND LOCATION |

11 |

| |

|

|

| 4.1 |

Property Ownership |

14 |

| 4.2 |

Review of Ownership Documents |

15 |

| |

|

|

| 5 |

ACCESSIBILITY,

CLIMATE, LOCAL RESOURCES, INFRASTRUCTURE AND PHYSIOGRAPHY |

16 |

| |

|

|

| 5.1 |

Accessibility and Infrastructure |

16 |

| 5.2 |

Climate and Physiography |

16 |

| |

|

|

| 6 |

HISTORY |

17 |

| |

|

|

| 6.1 |

Exploration History |

17 |

| 6.2 |

Mineral Resource Estimation History |

17 |

| 6.3 |

Mining History |

18 |

| |

|

|

| 7 |

GEOLOGICAL SETTING AND MINERALIZATION |

20 |

| |

|

|

| 7.1 |

Regional Geology |

20 |

| 7.2 |

Project Geology |

20 |

| 7.3 |

Mineralization |

21 |

| |

|

|

| 8 |

DEPOSIT TYPES |

27 |

| |

|

|

| 8.1 |

Mississippi Valley Type (MVT) Deposits |

27 |

| 8.2 |

Carlin Type Deposits |

28 |

| |

|

|

| 9 |

EXPLORATION |

29 |

| |

|

|

| 9.1 |

Geological Mapping |

29 |

| 9.2 |

Geochemical Surveys |

29 |

| 9.3 |

Geophysical Surveys |

29 |

| 9.4 |

Tunneling Program |

29 |

| |

|

|

| 10 |

DRILLING |

31 |

| | |

| | ADV-HK-00157 | National Instrument 43-101 Mineral Resource Technical Report | 30th June 2024 | | | Page iii of vii | |

| | |

| This report has been prepared for Silvercorp Metals Inc.and must be read in its entirety and is subject to all assumptions, limitations and disclaimers contained in the body of the report. © RPMGlobal Asia Limited 2024 |

| 10.1 |

Pre-2011 Drilling |

31 |

| 10.2 |

Post-2011 Drilling |

31 |

| |

|

|

| 11 |

SAMPLE PREPARATION, ANALYSIS AND SECURITY |

39 |

| |

|

|

| 11.1 |

Sample collection |

39 |

| 11.2 |

Sample Handling Protocols and Security |

39 |

| 11.3 |

Assay Laboratory Sample Preparation and Analysis |

39 |

| 11.4 |

Quality Control Data |

40 |

| |

|

|

| 12 |

DATA VERIFICATION |

49 |

| |

|

|

| 12.1 |

Validation of Mineralization |

49 |

| 12.2 |

Drill Hole Location Validation |

50 |

| 12.3 |

Sample Pulp Validation |

50 |

| 12.4 |

Database validation |

51 |

| 12.5 |

Assessment of Data |

51 |

| |

|

|

| 13 |

MINERAL PROCESSING AND METALLURGICAL TESTING |

52 |

| |

|

|

| 13.1 |

Historical Production |

52 |

| 13.2 |

Test Samples |

52 |

| 13.3 |

Mineralogy and Occurrences of the Payable Elements |

53 |

| 13.4 |

Metallurgical Test Results |

55 |

| 13.5 |

Summary of Mineral Processing and Metallurgical Testing |

59 |

| |

|

|

| 14 |

MINERAL RESOURCE ESTIMATES |

62 |

| |

|

|

| 14.1 |

Data |

62 |

| 14.2 |

Geology and Resource Interpretation |

64 |

| 14.3 |

Preparation of Wireframes |

64 |

| 14.4 |

Compositing and Statistics |

68 |

| 14.5 |

Geospatial Analysis |

80 |

| 14.6 |

Mineral Resource Estimation |

88 |

| |

|

|

| 15 |

MINERAL RESERVE ESTIMATES |

109 |

| |

|

|

| 16 |

MINING METHODS |

110 |

| |

|

|

| 17 |

RECOVERY METHODS |

111 |

| |

|

|

| 18 |

PROJECT INFRASTRUCTURE |

112 |

| |

|

|

| 18.1 |

Tailings Management |

112 |

| 18.2 |

Waste Rock Storage |

112 |

| 18.3 |

Power Supply |

112 |

| 18.4 |

Access |

113 |

| 18.5 |

Water Supply |

113 |

| 18.6 |

Other |

113 |

| |

|

|

| 19 |

MARKET STUDIES AND CONTRACTS |

114 |

| |

|

|

| 20 |

ENVIRONMENTAL STUDIES, PERMITTING AND SOCIAL AND COMMUNITY

IMPACT |

115 |

|

|

|

| 20.1 |

Introduction |

115 |

| | |

| | ADV-HK-00157 | National Instrument 43-101 Mineral Resource Technical Report | 30th June 2024 | | | Page iv of vii | |

| | |

| This report has been prepared for Silvercorp Metals Inc.and must be read in its entirety and is subject to all assumptions, limitations and disclaimers contained in the body of the report. © RPMGlobal Asia Limited 2024 |

| 20.2 |

Laws and Regulations |

115 |

| 20.3 |

Waste and Tailings Disposal Management |

116 |

| 20.4 |

Site Monitoring |

117 |

| 20.5 |

Status with Project E&S Approvals and Permitting Requirements |

117 |

| 20.6 |

Social |

118 |

| 20.7 |

Biodiversity |

118 |

| 20.8 |

Remediation and Reclamation |

118 |

| 20.9 |

Site Closure Plan |

119 |

| |

|

|

| 21 |

CAPITAL AND OPERATING COSTS |

120 |

| |

|

|

| 22 |

ECONOMIC ANALYSIS |

121 |

| |

|

|

| 23 |

ADJACENT PROPERTIES |

122 |

| |

|

|

| 24 |

OTHER RELEVANT DATA AND INFORMATION |

123 |

| |

|

|

| 25 |

INTERPRETATION AND CONCLUSIONS |

124 |

| |

|

|

| 26 |

RECOMMENDATIONS |

125 |

| |

|

|

| 27 |

REFERENCES |

126 |

LIST OF TABLES

| Table 1-1 |

BYP Project Mineral Resource Estimate as at 30th June

2024 (1.2 g/t Au and 2.2% ZnEq cut-off) |

4 |

| Table 4-1 |

Application Mining License of Baiyunpu Gold, Lead and Zinc Mine |

14 |

| Table 4-2 |

Coordinates of adjusted Corner Points of BYP Mine (National 2000 Coordinate System) |

15 |

| Table 6-1 |

Mineral Resources for Gold Zones as of December 2011 (AMC) |

18 |

| Table 6-2 |

Mineral Resources for Lead and Zinc Zones as of December 2011 (AMC) |

18 |

| Table 6-3 |

Mineral Resources for Gold Zones as of December 2019 (RPM, 1.6 g/t Au cut-off) |

18 |

| Table 6-4 |

Mineral Resources for Lead&Zinc and Overlap Zones as of December 2019 (RPM, 3% PbEq cut-off) |

18 |

| Table 7-1 |

Lead-Zinc mineralized Zone Orientation Summary |

25 |

| Table 7-2 |

Gold mineralized Zone Orientation Summary |

26 |

| Table 7-3 |

Mineralized Zone Numbering by Exploration Stage |

26 |

| Table 9-1 |

Historical Tunneling Program |

29 |

| Table 9-2 |

Significant Intersections from Underground Sampling |

30 |

| Table 10-1 |

Historical Drilling Programs |

31 |

| Table 10-2 |

Significant Intercepts of the Pre-2011 Drilling Programs |

32 |

| Table 10-3 |

Significant Intercepts of the 2011-2014 Drilling Program |

33 |

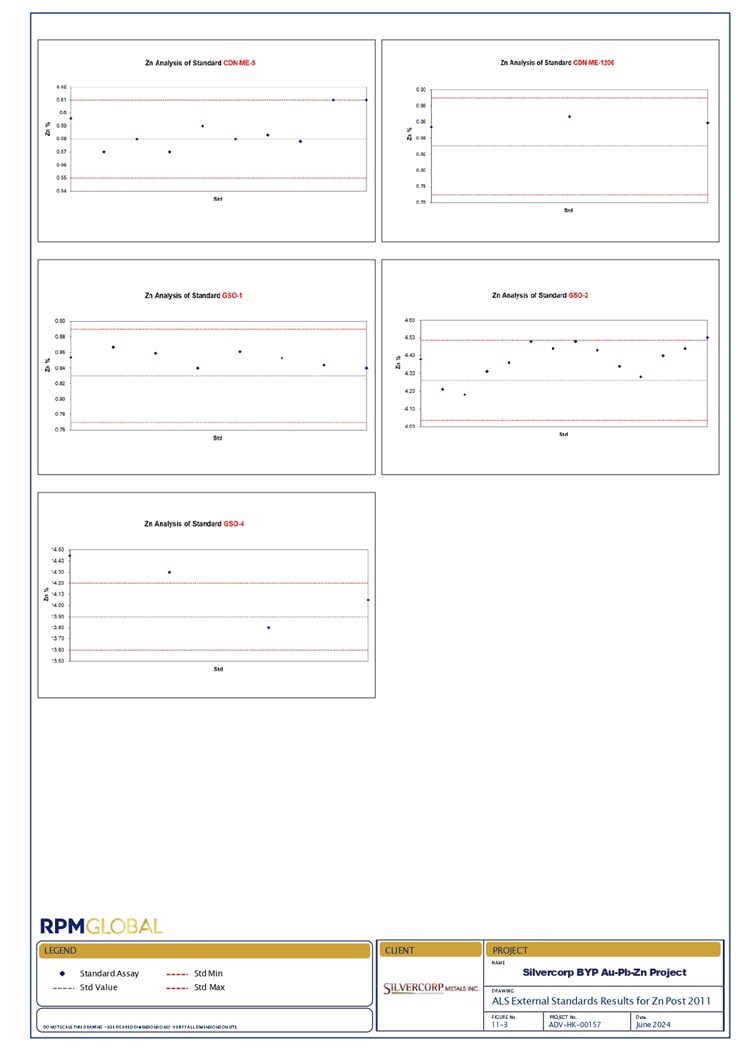

| Table 11-1 |

Details of External Standards Used for the Project Post 2011 |

41 |

| Table 13-1 |

Historical Metallurgy and Production (2011) |

52 |

| Table 13-2 |

Gold Samples Used for Gold Metallurgical Testing (2010) |

53 |

| Table 13-3 |

Gold Samples Used for Gold Metallurgical Testing (2018) |

53 |

| Table 13-4 |

Samples Used for Lead and Zinc Metallurgical Testing (2010) |

53 |

| Table 13-5 |

Summary of Mineralogy of the Gold Samples (2010) |

53 |

| Table 13-6 |

Summary of Mineralogy of the Gold Samples (2018) |

54 |

| Table 13-7 |

Summary of Gold Mineralogical Analysis |

54 |

| Table 13-8 |

Summary of Mineralogy of the Samples |

55 |

| Table 13-9 |

Summary of Lead Mineralogy |

55 |

| Table 13-10 |

Summary of Zinc Mineralogy |

55 |

| Table 13-11 |

Mass Balance of BYP Gold Mineralization Flotation Tests - 2010 |

57 |

| Table 13-12 |

Mass Balance of BYP Gold Mineralization Flotation Tests - 2018 |

57 |

| Table 13-13 |

Flotation Results of Locked Cycle Test (1971-1977) |

57 |

| | |

| | ADV-HK-00157 | National Instrument 43-101 Mineral Resource Technical Report | 30th June 2024 | | | Page v of vii | |

| | |

| This report has been prepared for Silvercorp Metals Inc.and must be read in its entirety and is subject to all assumptions, limitations and disclaimers contained in the body of the report. © RPMGlobal Asia Limited 2024 |

| Table 13-14 |

Head Grade of the Blended Test Sample |

57 |

| Table 13-15 |

Comparison of Locked Cycle Test Results (Grade) |

58 |

| Table 13-16 |

Comparison of Locked Cycle Test Results (Metal Recovery) |

58 |

| Table 13-17 |

Mass Balances of Pb Zn Flotation tests (Option 3) (%) |

58 |

| Table 13-18 |

PbS Concentrate Composition (%) (Option 3) |

59 |

| Table 13-19 |

ZnS Concentrate Composition (%) (Option 3) |

59 |

| Table 13-20 |

Mass Balances of Pb-Zn Flotation Tests Using Recycled Water (Option 3) |

59 |

| Table 14-1 |

BYP Project - Summary of Data Used in the Mineral Resource Estimate |

63 |

| Table 14-2 |

Bulk Density Summary |

64 |

| Table 14-3 |

BYP Project – Lead-Zinc Deposit Metals Correlation Matrix |

69 |

| Table 14-4 |

Summary Statistics for 2m Composites for Au in Au Mineralization Domain |

71 |

| Table 14-5 |

Summary Statistics for 2m Composites for Pb in Pb-Zn Mineralization Domain (obj 1-15) |

72 |

| Table 14-6 |

Summary Statistics for 2m Composites for Pb in Pb-Zn Mineralization Domain (obj 16-31) |

73 |

| Table 14-7 |

Summary Statistics for 2m Composites for Zn in Pb-Zn Mineralization Domain (obj 1-15) |

74 |

| Table 14-8 |

Summary Statistics for 2m Composites for Zn in Pb-Zn Mineralization Domain (obj 16-31) |

75 |

| Table 14-9 |

BYP Project – Top-Cuts Applied to Domains |

77 |

| Table 14-10 |

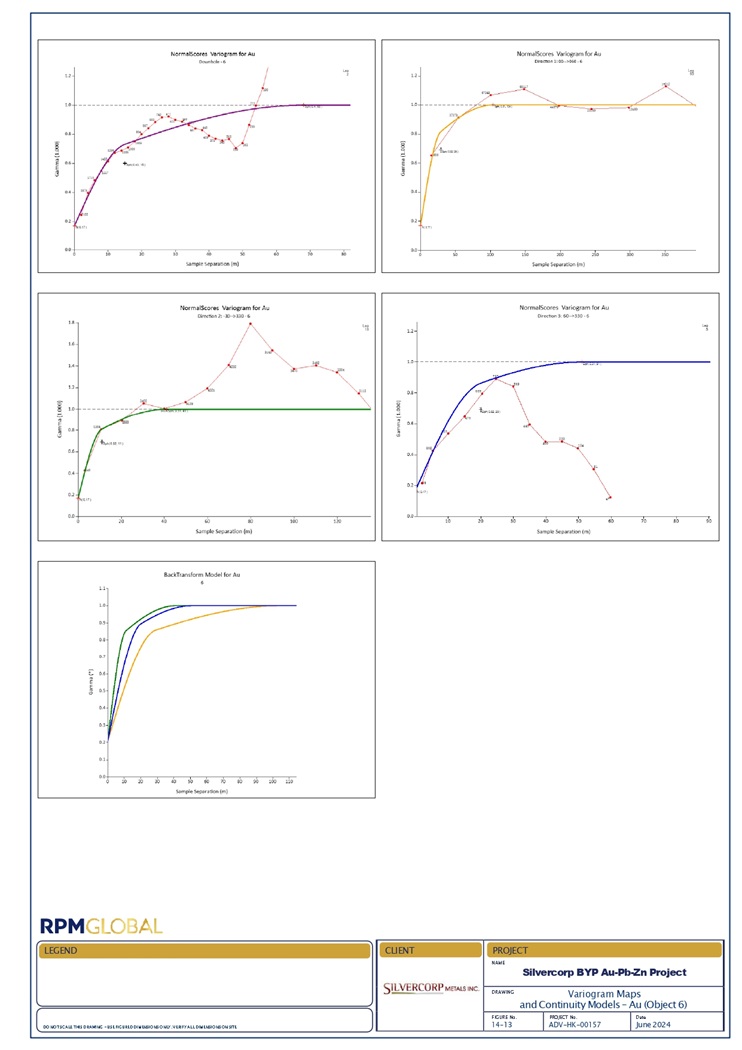

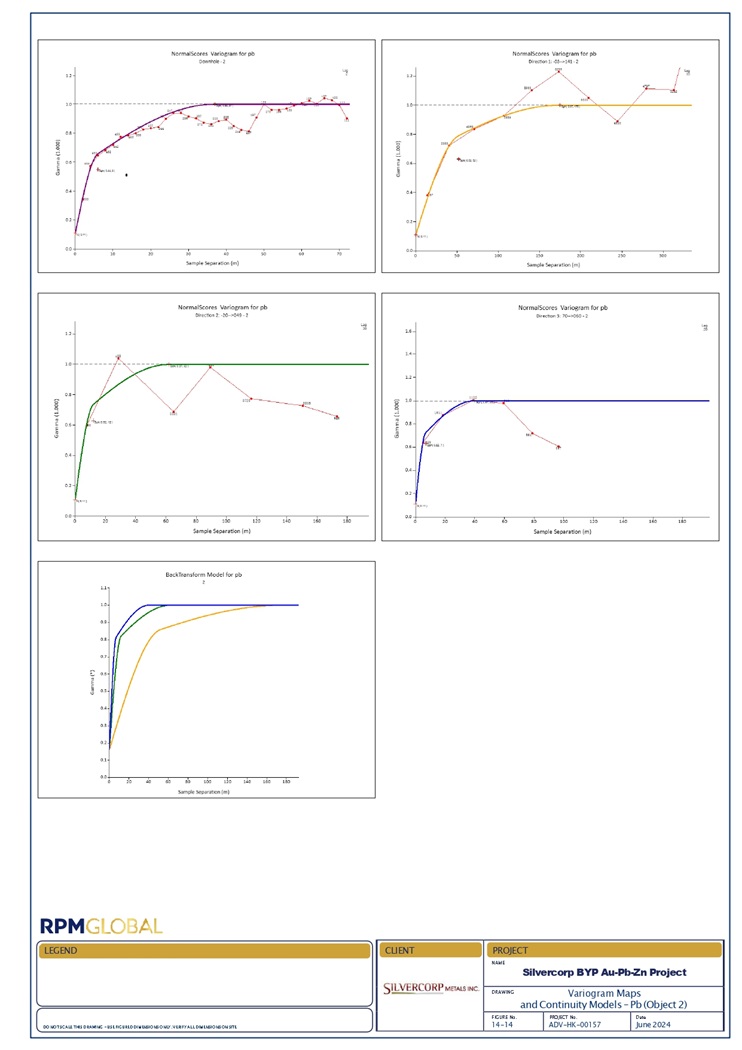

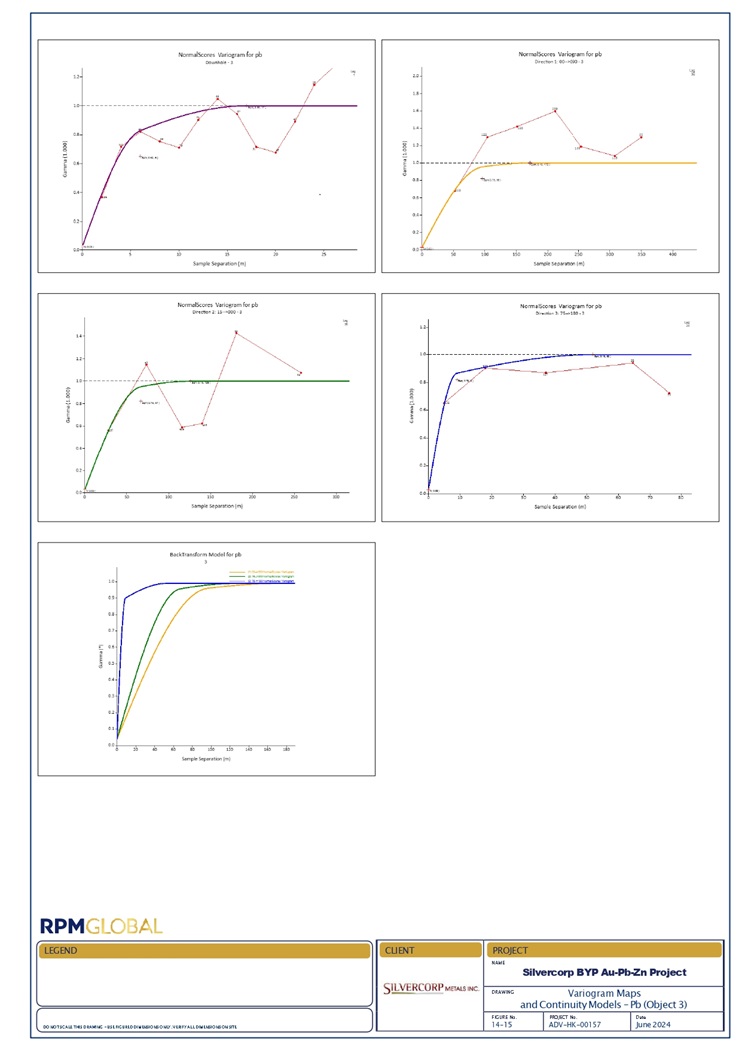

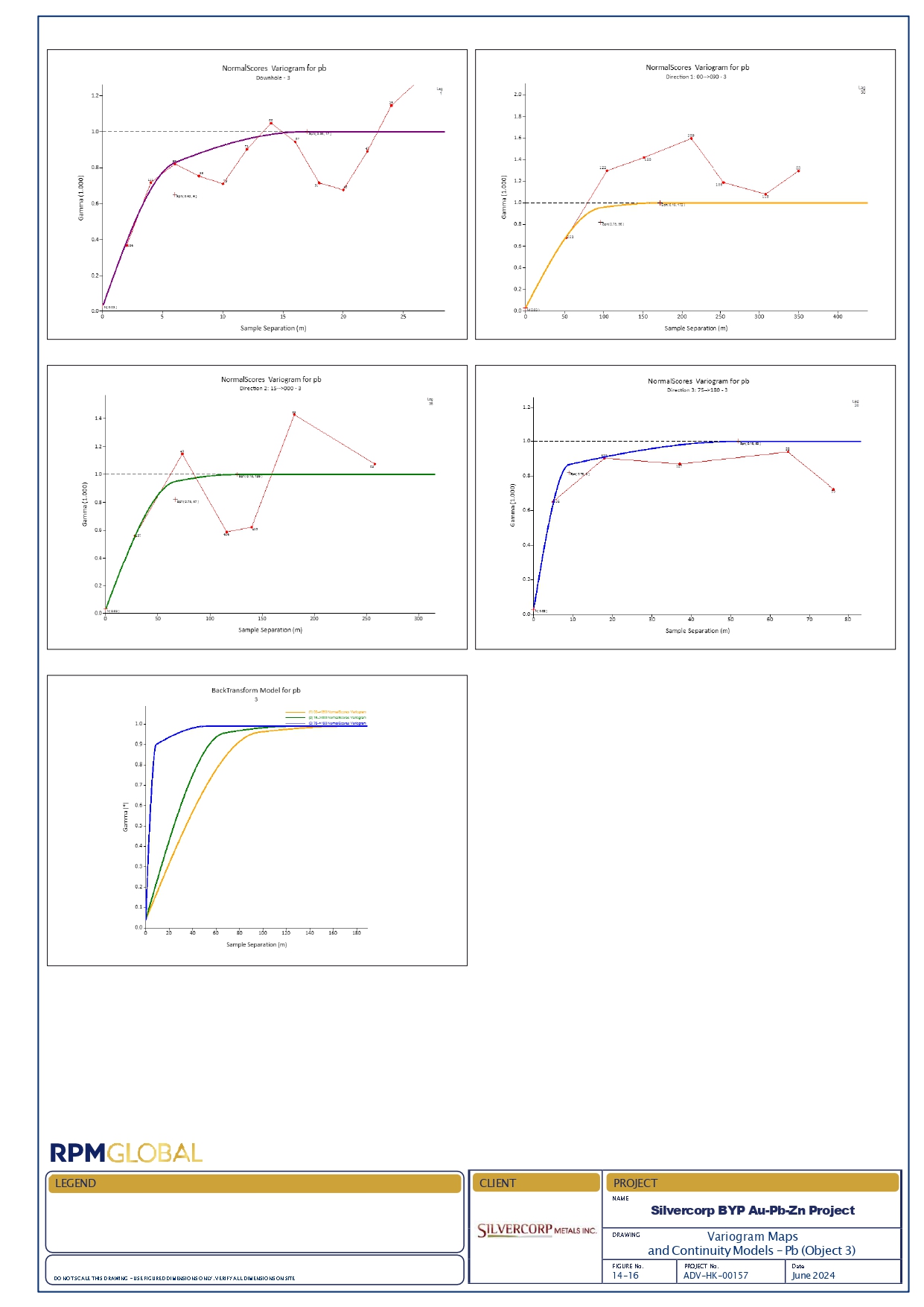

BYP Project – Interpreted Variogram Analysis |

80 |

| Table 14-11 |

BYP Au-Pd-Zn Project - Block Model Parameters |

88 |

| Table 14-12 |

Block Model Coding – Type |

88 |

| Table 14-13 |

Block Model Coding – Domain |

89 |

| Table 14-14 |

Block Sizes Assessment |

89 |

| Table 14-15 |

Search Radii Assessed |

90 |

| Table 14-16 |

Maximum Number of Samples Assessed |

90 |

| Table 14-17 |

BYP Project – OK Estimation Parameters for Au |

92 |

| Table 14-18 |

BYP Project – OK Estimation Parameters for Pb and Zn |

92 |

| Table 14-19 |

Average Composite Input v Block Model Output – Gold Zone |

94 |

| Table 14-20 |

Average Composite Input v Block Model Output – Lead and Zinc Zone |

95 |

| Table 14-21 |

Reconciliation Summary Table |

97 |

| Table 14-22 |

BYP Project Mineral Resource Estimate as at 30th June 2024 (1.2 g/t

Au and 2.2% ZnEq cut-off) |

103 |

| Table 14-23 |

Mineral Resource Estimate at Various Au Cut-offs |

104 |

| Table 14-24 |

Mineral Resource Estimate at Various ZnEq Cut-offs |

104 |

LIST OF FIGURES

| Figure 4-1 |

General Location map of the BYP Project |

12 |

| Figure 4-2 |

Detailed Location map of the BYP Project |

13 |

| Figure 7-1 |

Regional Geology Map |

22 |

| Figure 7-2 |

Project Geology Map |

23 |

| Figure 7-3 |

Mineralization Zones on the Property |

24 |

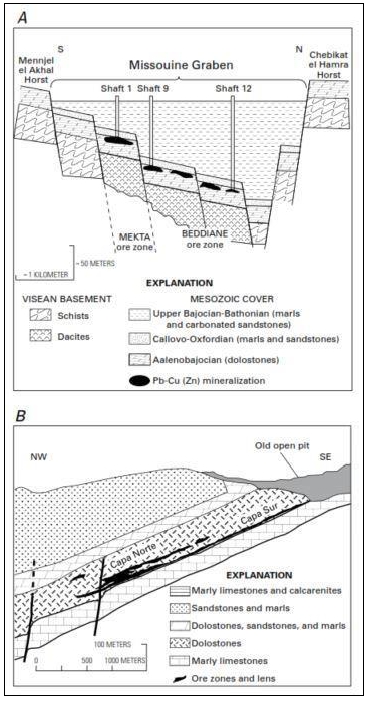

| Figure 8-1 |

Deposit Models of MVT Deposits from Morocco (A) and Spain (B) (Leach et al, 2010) |

27 |

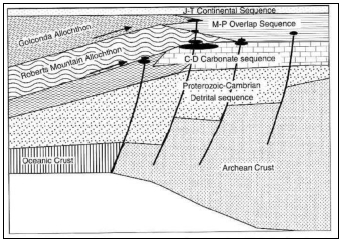

| Figure 8-2 |

Carlin Type Deposit Formation (Hofstra and Cline, 2000) |

28 |

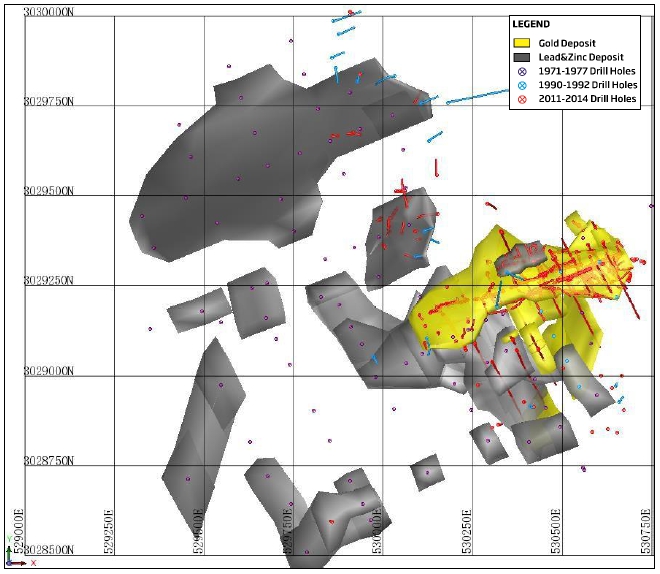

| Figure 10-1 |

Plan Map Showing Collar Locations by Exploration Stage |

32 |

| Figure 10-2 |

Drill Rig XY-42T at Hole ZK2110 |

36 |

| Figure 10-3 |

Underground Drill Rig XY-4 |

36 |

| Figure 10-4 |

Core Storage Room and Core Boxes |

37 |

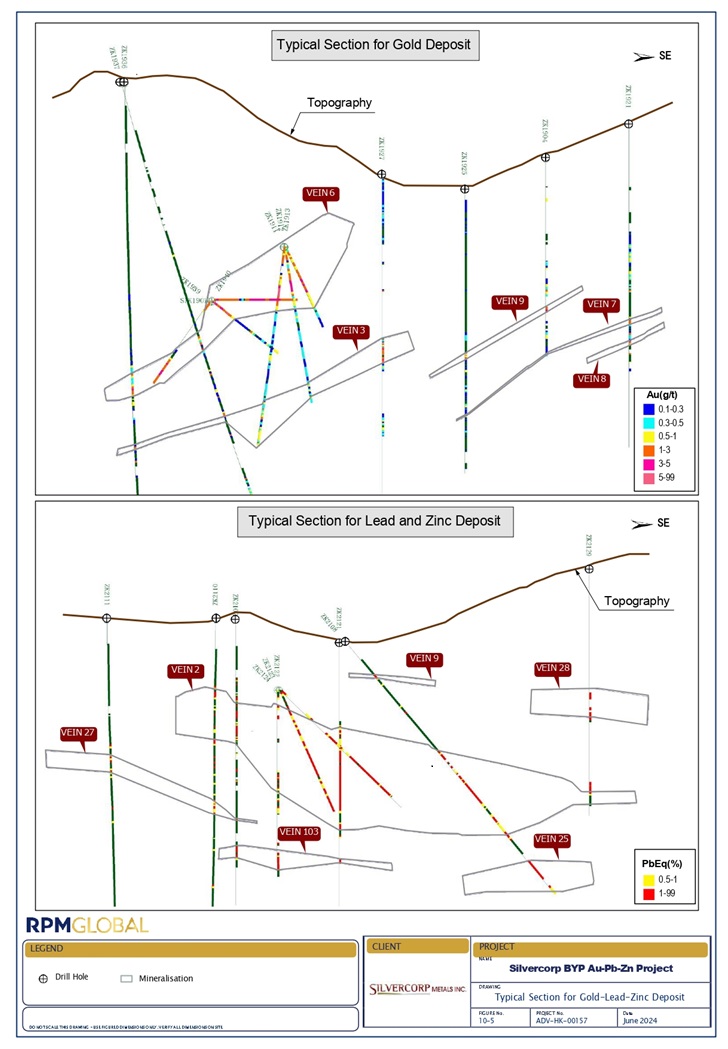

| Figure 10-5 |

Typical Cross-Section for the-lead-zinc Deposit |

38 |

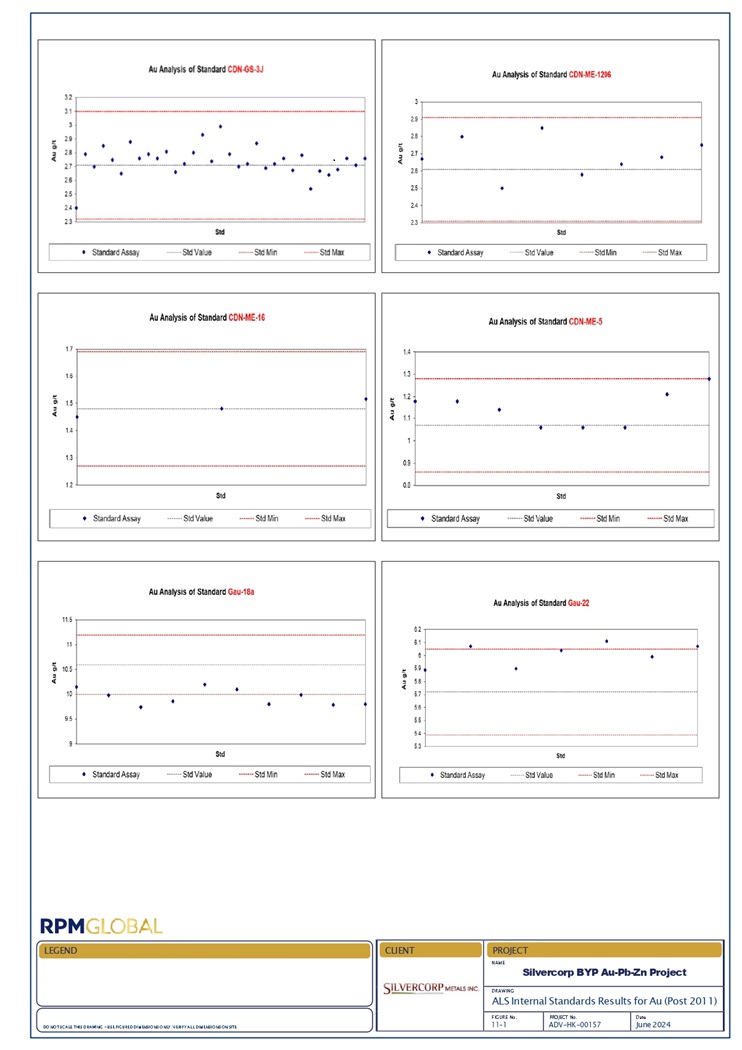

| Figure 11-1 |

ALS External Standards Results for Au Post 2011 |

42 |

| Figure 11-2 |

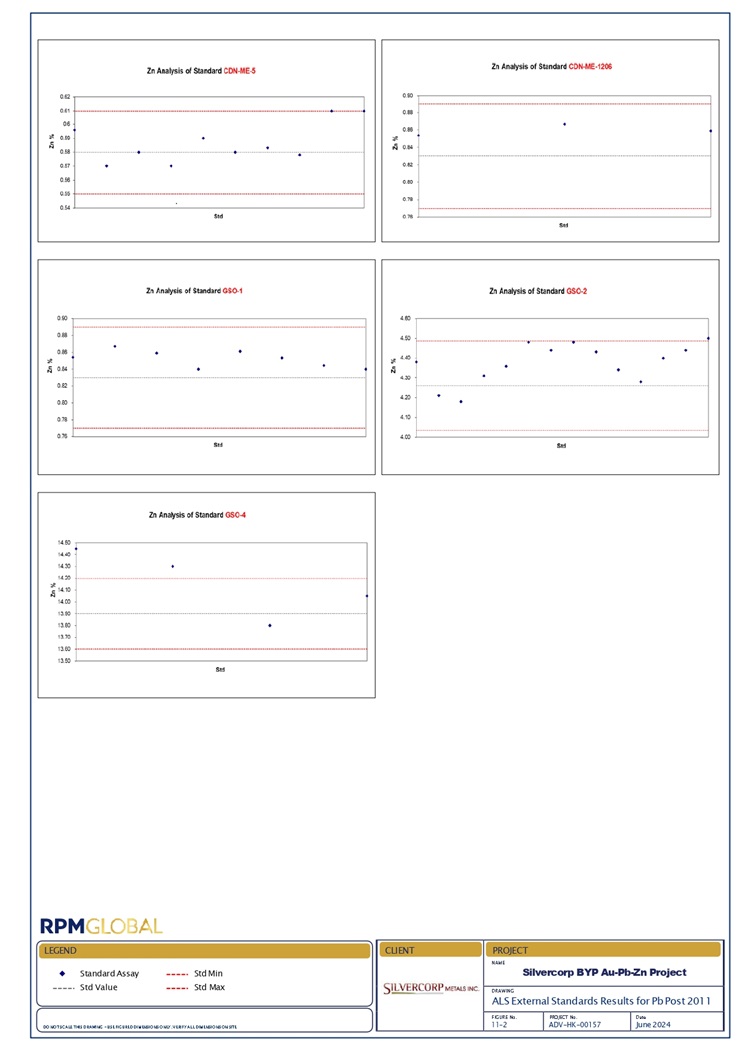

ALS External Standards Results for Pb Post 2011 |

43 |

| Figure 11-3 |

ALS External Standards Results for Zn Post 2011 |

44 |

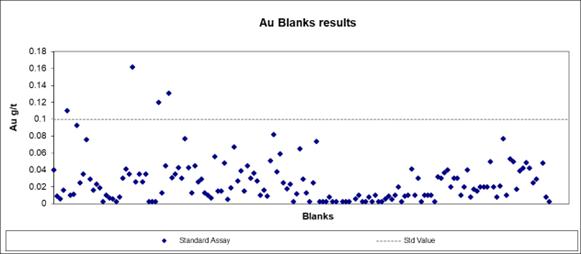

| Figure 11-4 |

Internal Blank Results for Au Post 2011 |

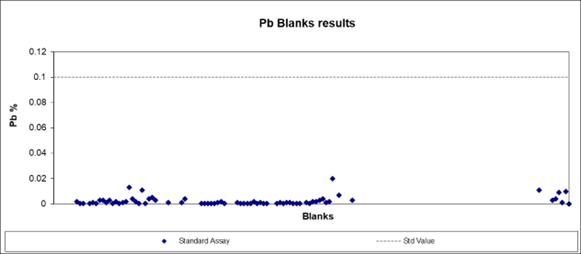

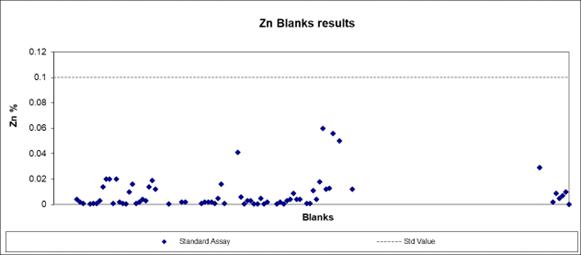

45 |

| Figure 11-5 |

Internal Blank Results for Pb Post 2011 |

45 |

| Figure 11-6 |

Internal Blank Results for Zn Post 2011 |

45 |

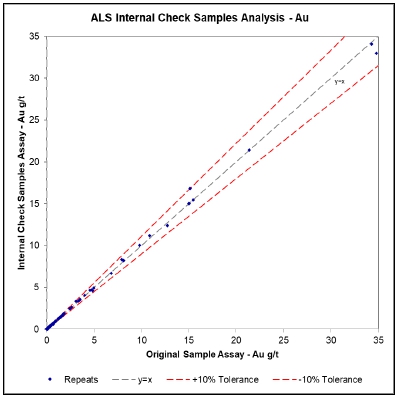

| Figure 11-7 |

ALS internal Check Samples for Au Post 2011 |

47 |

| Figure 11-8 |

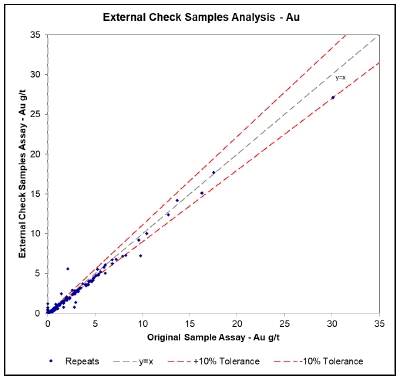

Zhengzhou Laboratory External Check Samples for Au Post 2011 |

47 |

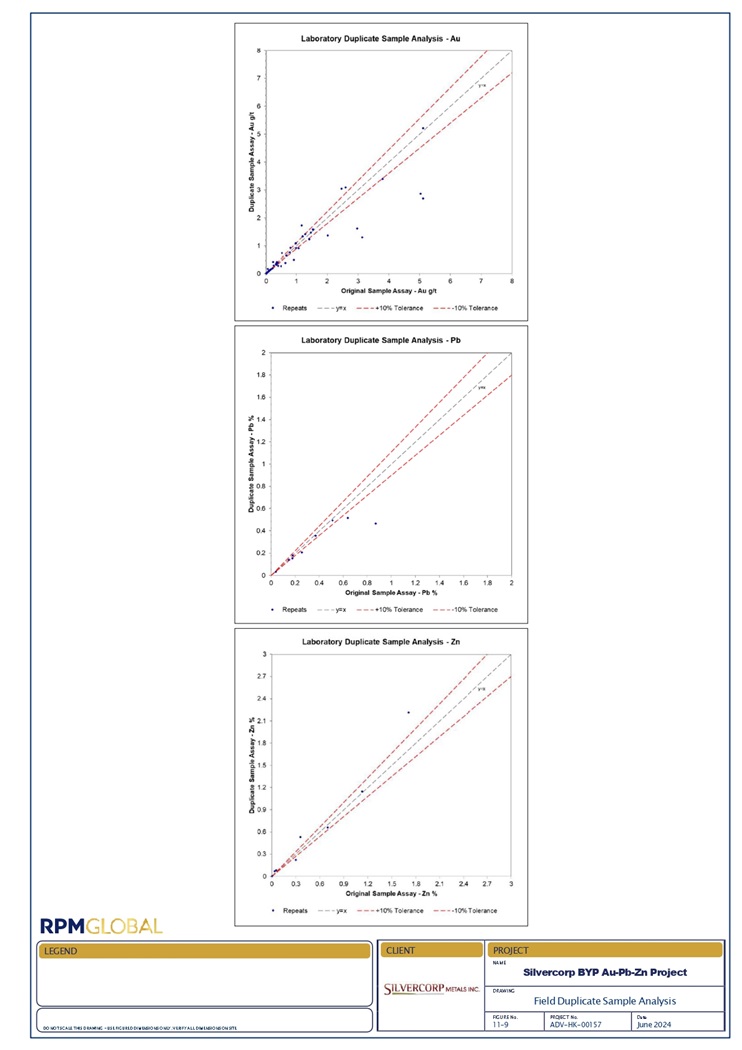

| Figure 11-9 |

Field Duplicate Samples Analysis |

48 |

| Figure 12-1 |

Gold mineralized Core Intervals from 72.73m to 77.95m Showing Argillaceous Siltstone and Quartz Sandstone (ZK19-102) |

49 |

| Figure 12-2 |

Pb and Zn mineralized Core Interval from 192m to 198m Showing Limestone and Dolomites (ZK2110) |

49 |

| | |

| | ADV-HK-00157 | National Instrument 43-101 Mineral Resource Technical Report | 30th June 2024 | | | Page vi of vii | |

| | |

| This report has been prepared for Silvercorp Metals Inc.and must be read in its entirety and is subject to all assumptions, limitations and disclaimers contained in the body of the report. © RPMGlobal Asia Limited 2024 |

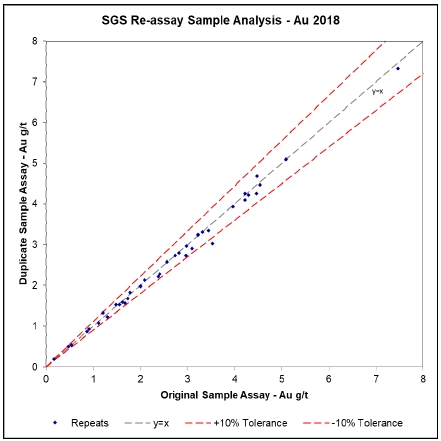

| Figure 12-3 |

Sample Pulp Re-assay Results for Au |

50 |

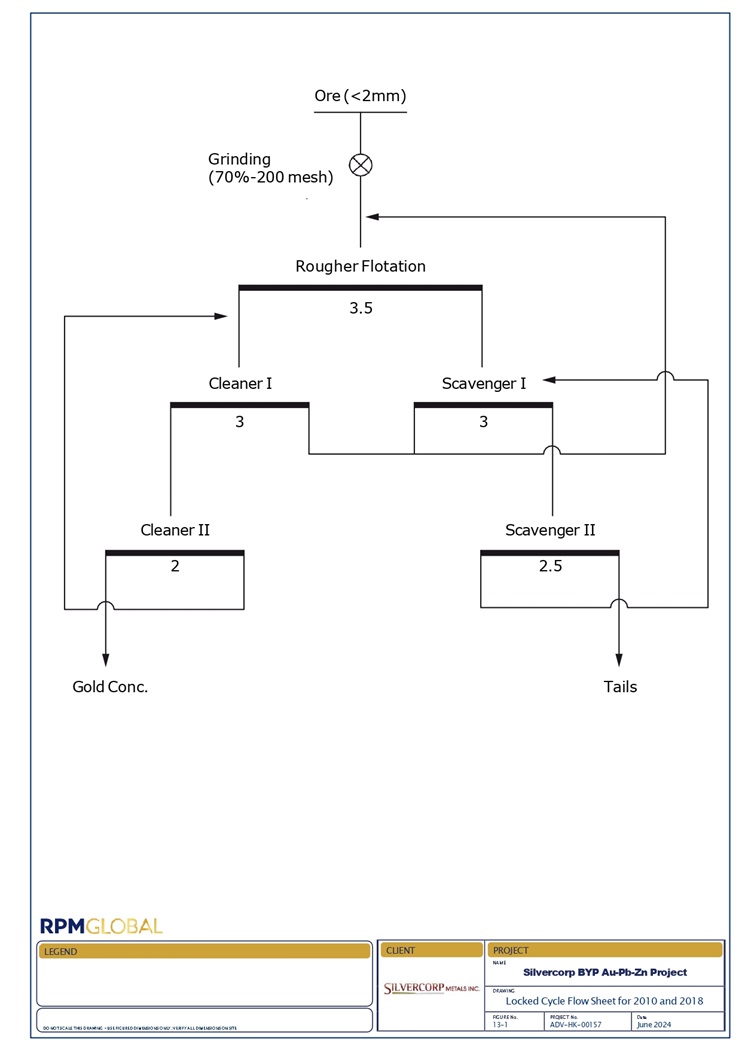

| Figure 13-1 |

Locked Cycle Flow sheet for 2010 and 2018 Flotation Studies |

56 |

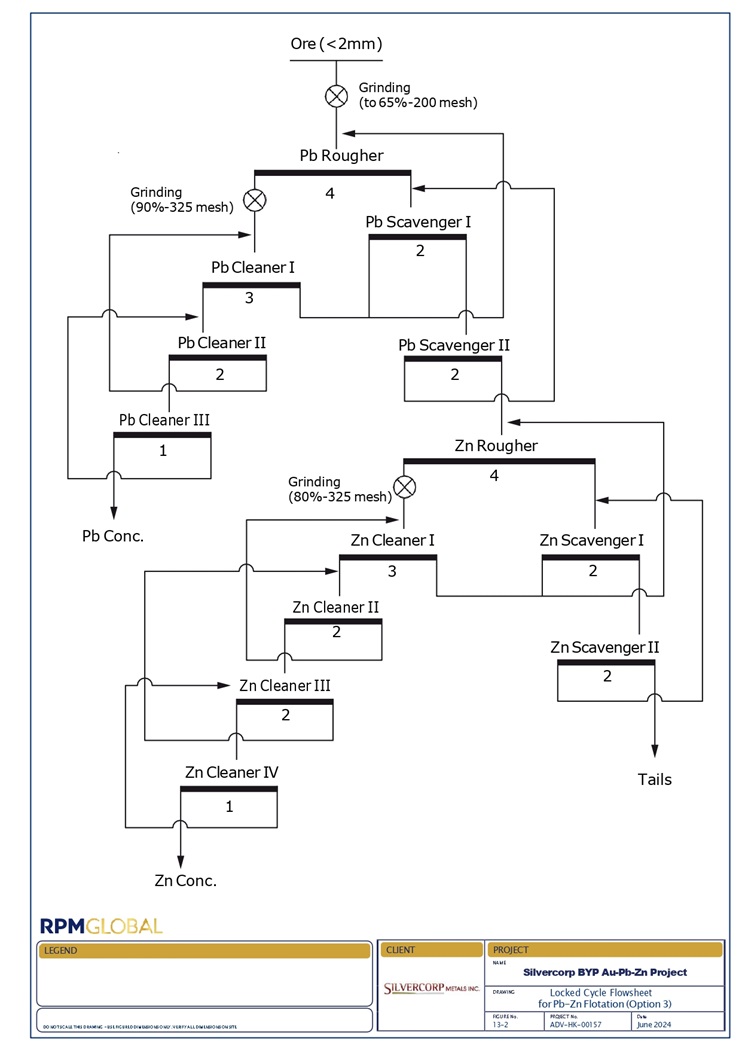

| Figure 13-2 |

Locked Cycle Flow sheet for Pb-Zn Flotation (Option 3) |

61 |

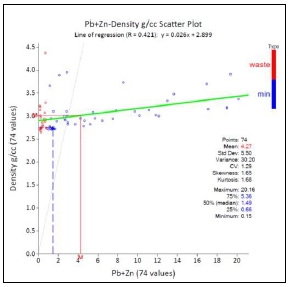

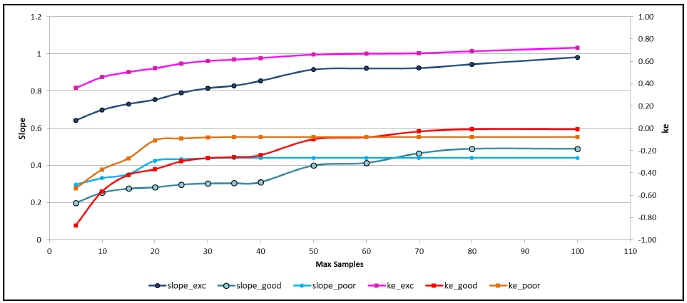

| Figure 14-1 |

Regression analysis results |

63 |

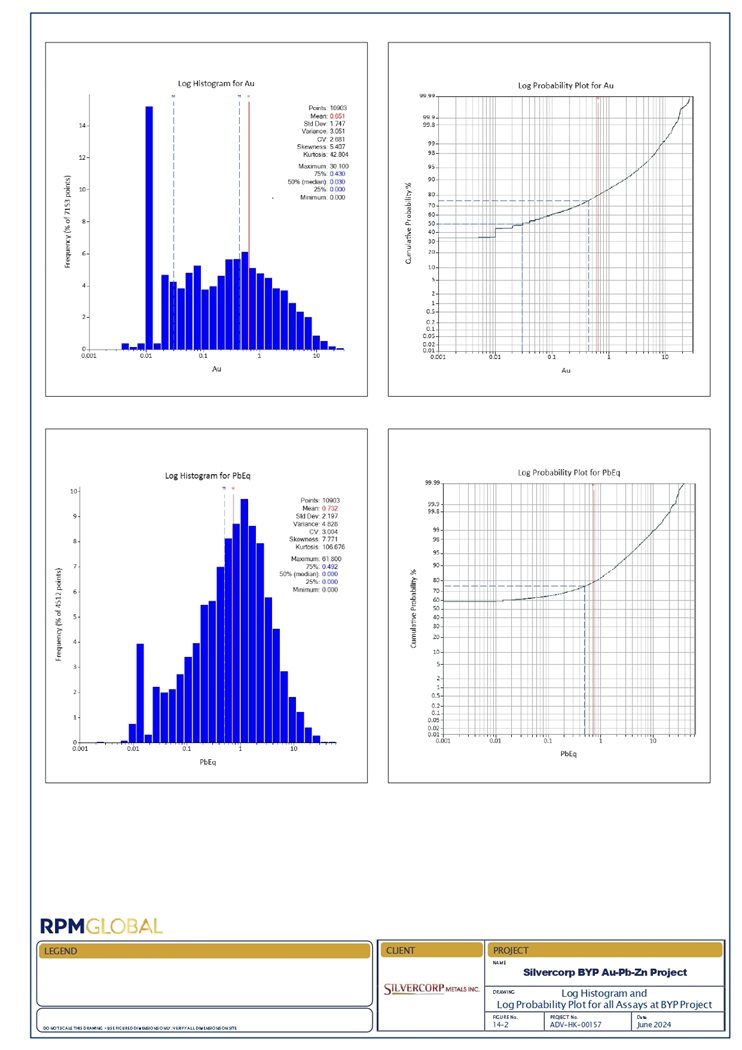

| Figure 14-2 |

Log Histogram and Log Probability Plot for All Assays at BYP Project |

65 |

| Figure 14-3 |

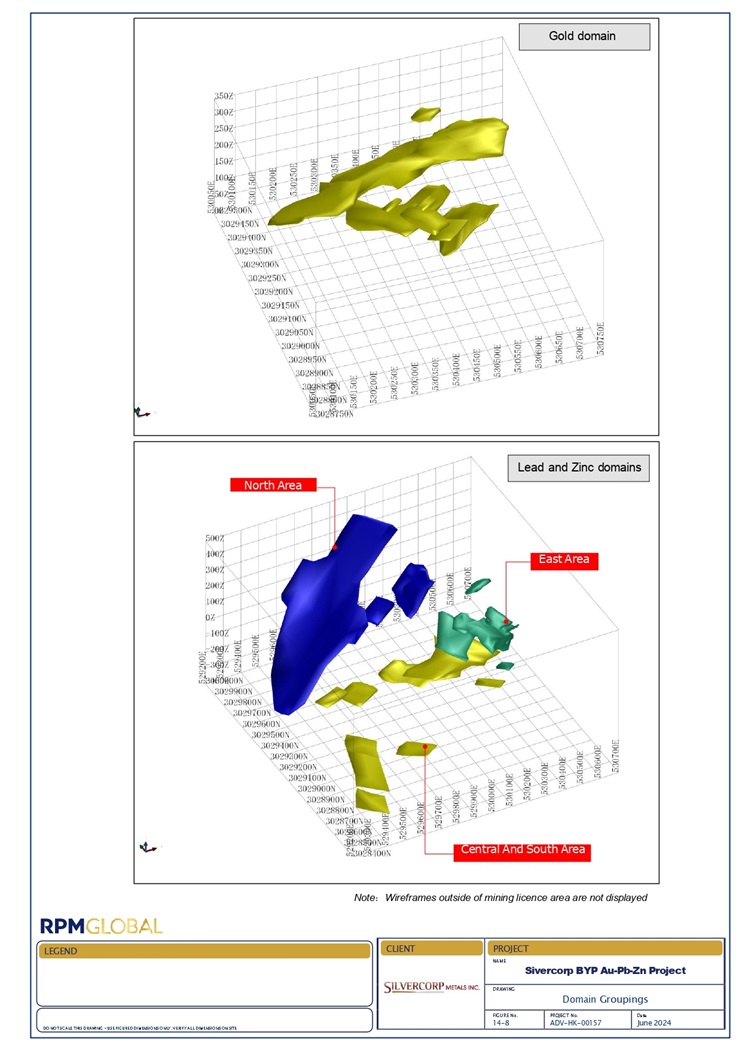

3D Views of Mineralization Domains |

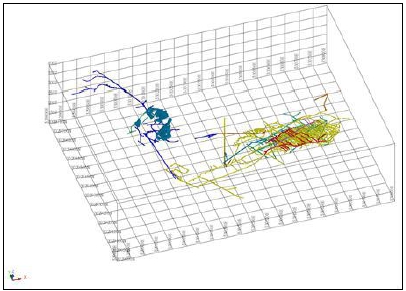

66 |

| Figure 14-4 |

3D View of Underground Developments |

67 |

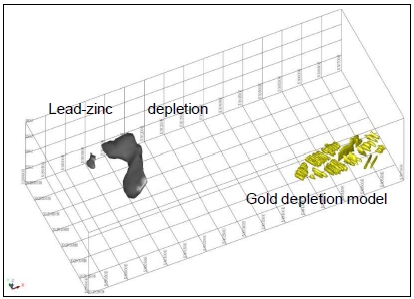

| Figure 14-5 |

3D View of Underground Depletions |

67 |

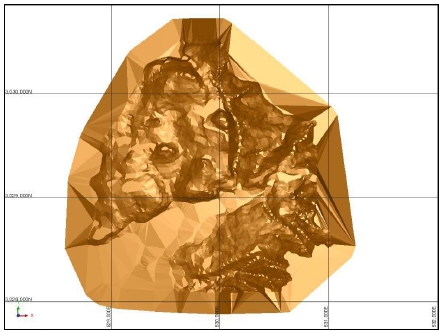

| Figure 14-6 |

3D View of Topography |

68 |

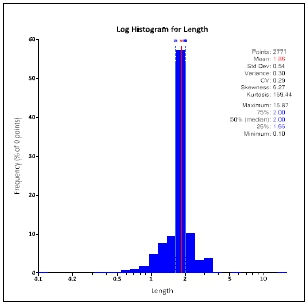

| Figure 14-7 |

Sample Lengths inside Wireframes |

69 |

| Figure 14-8 |

Domain Groupings |

70 |

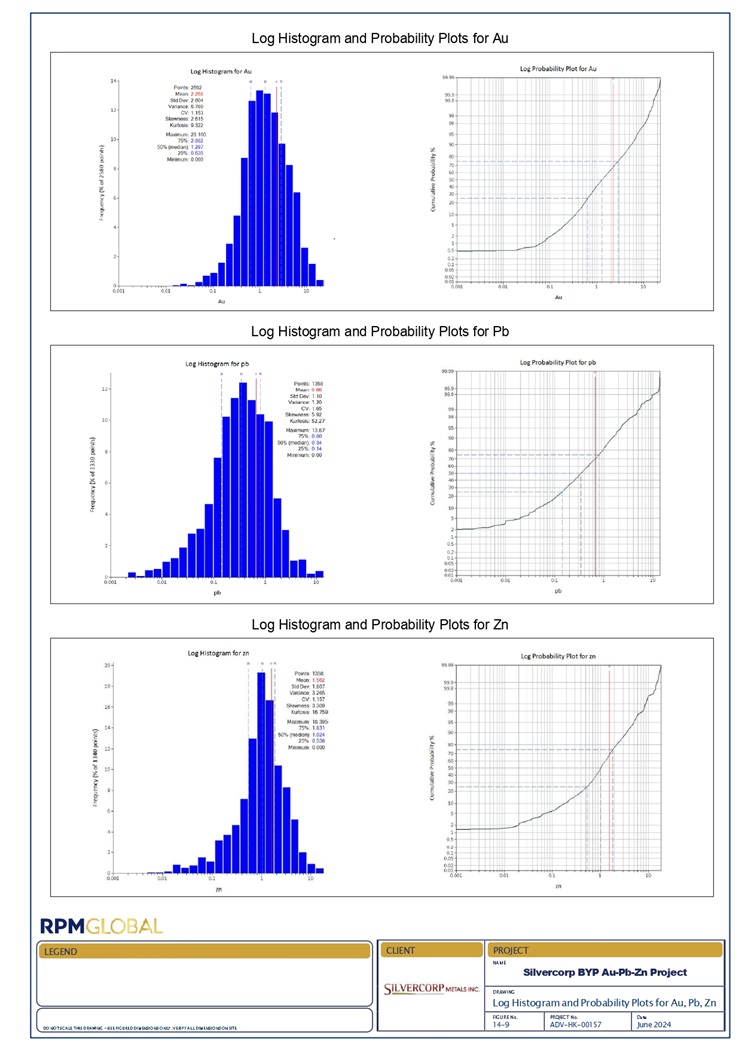

| Figure 14-9 |

Log Histogram and Probability Plots for Au, Pb, Zn |

76 |

| Figure 14-10 |

Histogram and Probability Plots for Gold Domain 6 |

77 |

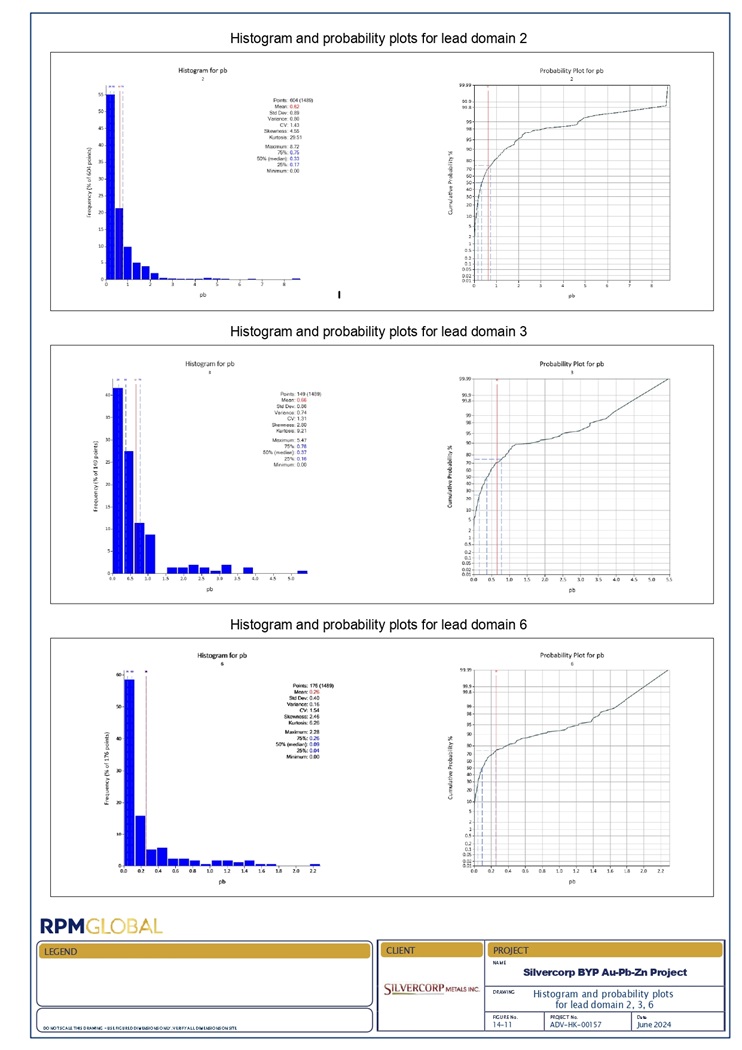

| Figure 14-11 |

Histogram and Probability Plots for Lead Domain 2, 3, 6 |

78 |

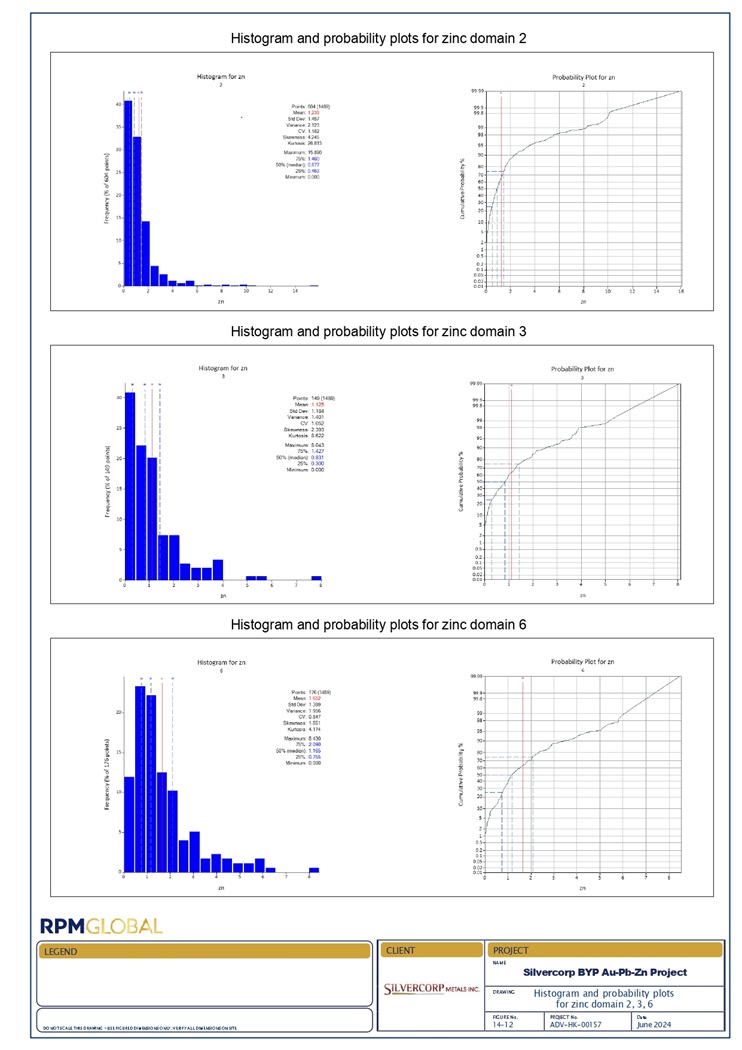

| Figure 14-12 |

Histogram and Probability Plots for Zinc Domain 2, 3, 6 |

79 |

| Figure 14-13 |

Variogram Maps and Continuity Models – Au (Object 6) |

81 |

| Figure 14-14 |

Variogram Maps and Continuity Models – Pb (Object 2) |

82 |

| Figure 14-15 |

Variogram Maps and Continuity Models – Pb (Object 3) |

83 |

| Figure 14-16 |

Variogram Maps and Continuity Models – Pb (Object 6) |

84 |

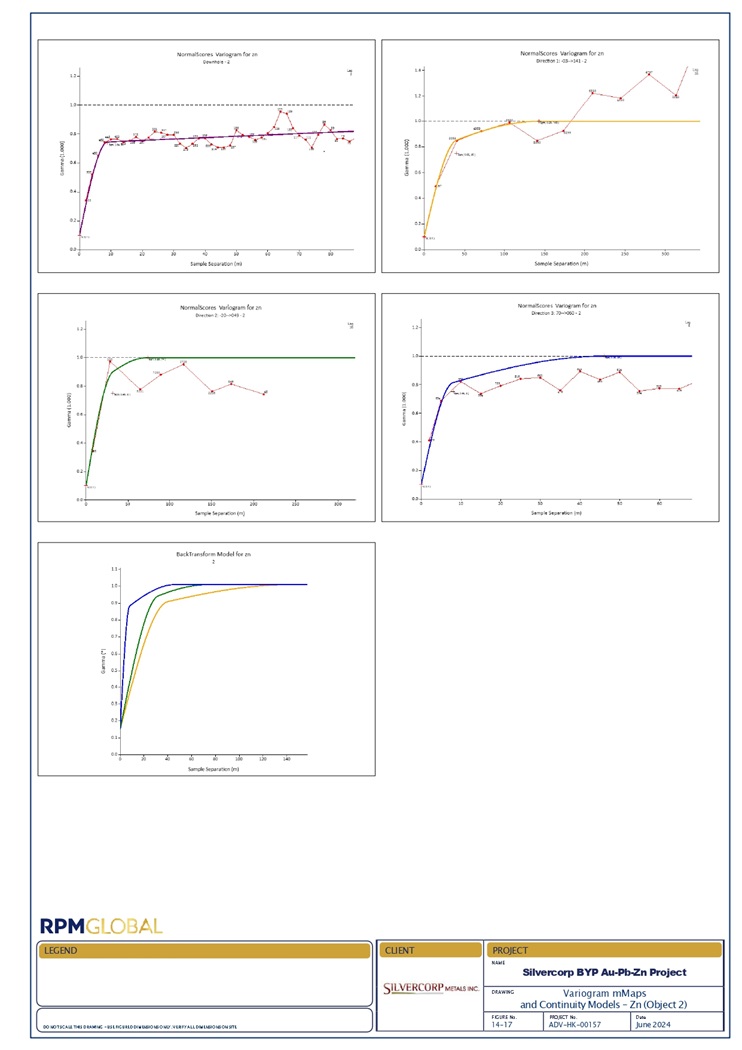

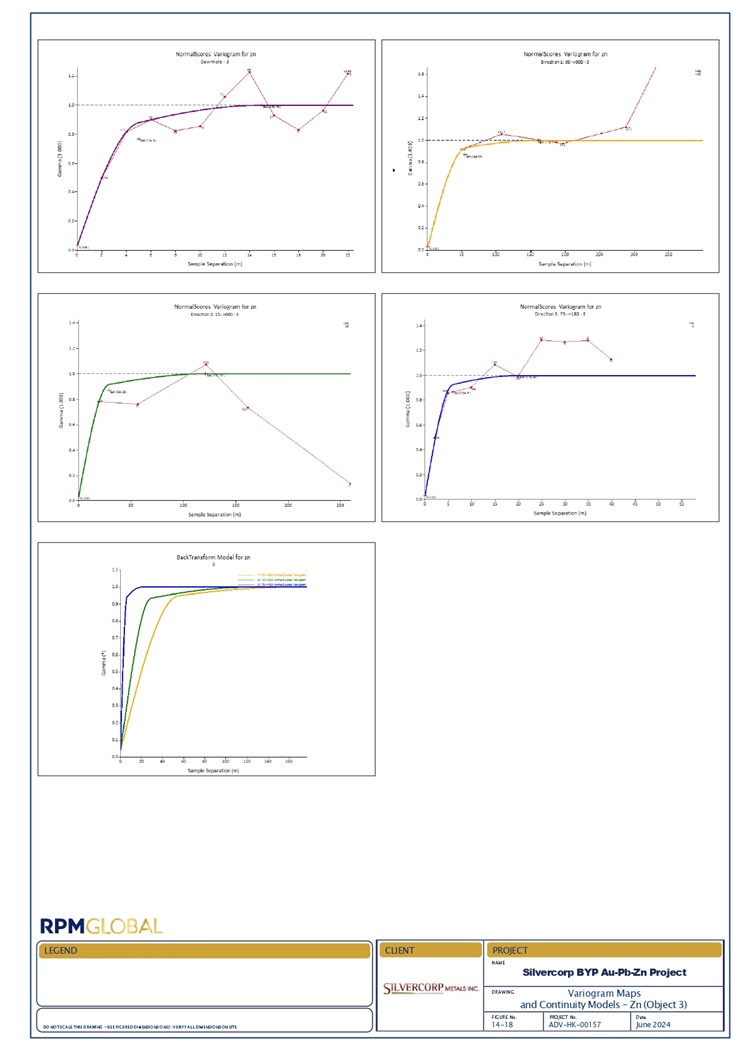

| Figure 14-17 |

Variogram Maps and Continuity Models – Zn (Object 2) |

85 |

| Figure 14-18 |

Variogram Maps and Continuity Models – Zn (Object 3) |

86 |

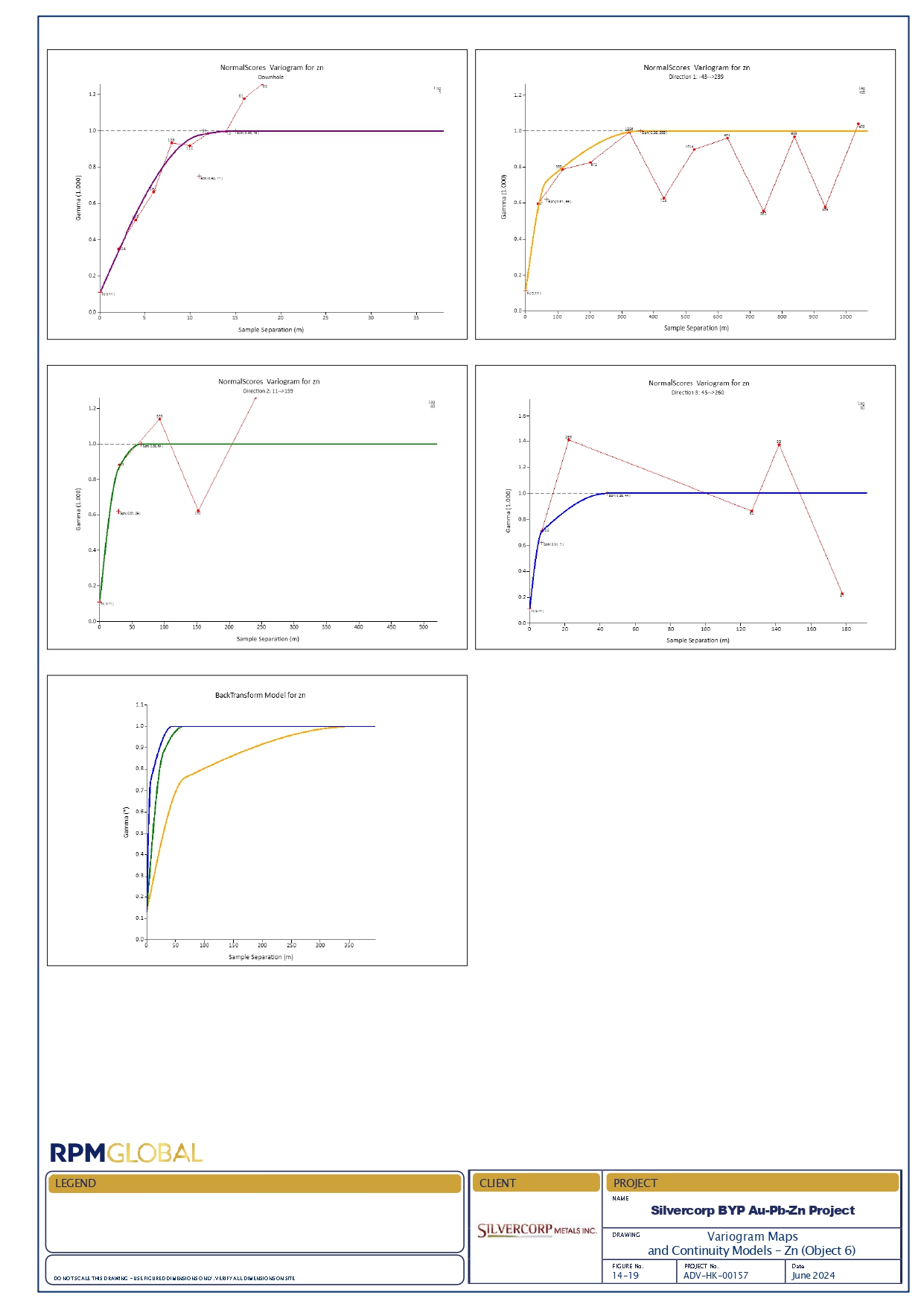

| Figure 14-19 |

Variogram Maps and Continuity Models – Zn (Object 6) |

87 |

| Figure 14-20 |

Block Size Analysis Chart |

89 |

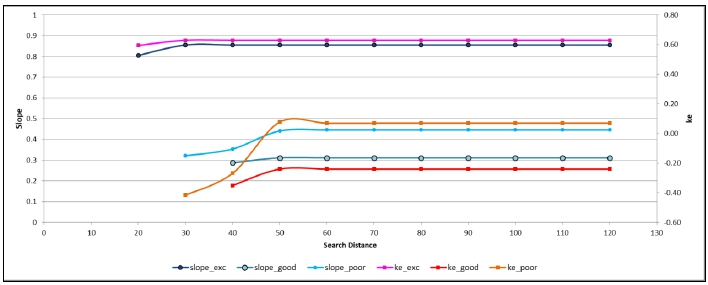

| Figure 14-21 |

Search Radii Analysis Chart |

90 |

| Figure 14-22 |

Maximum Number of Samples Analysis Chart |

91 |

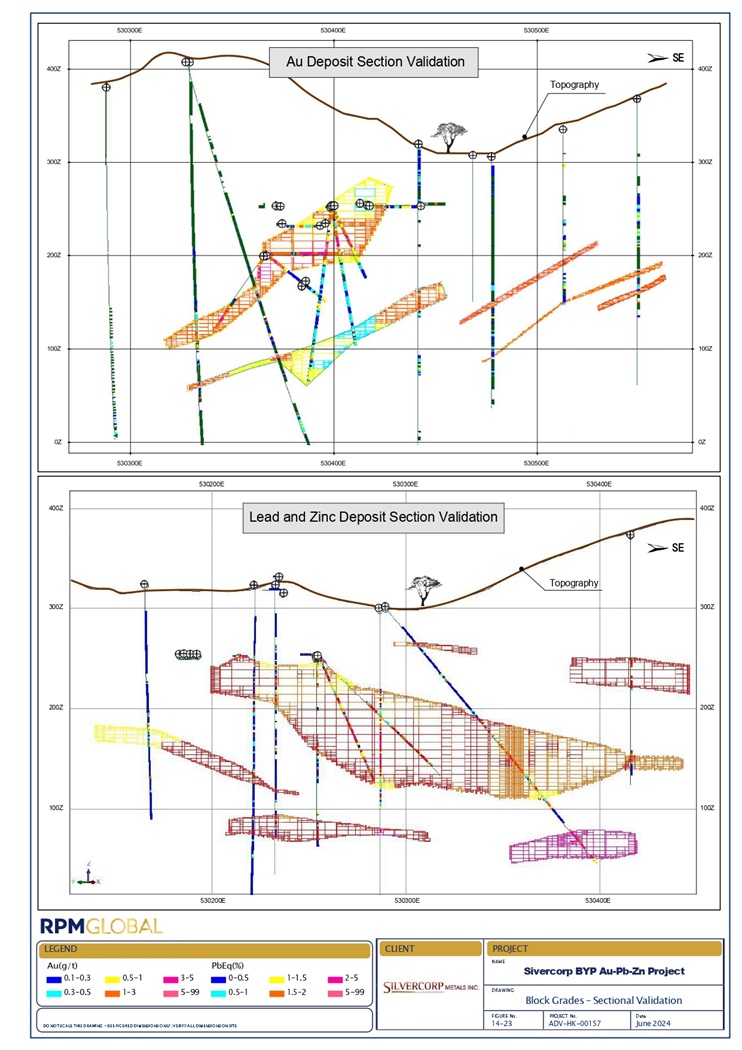

| Figure 14-23 |

Au Block Grades – Sectional Validation |

93 |

| Figure 14-24 |

Block Model Validation by easting and elevation for Au pod 6 |

98 |

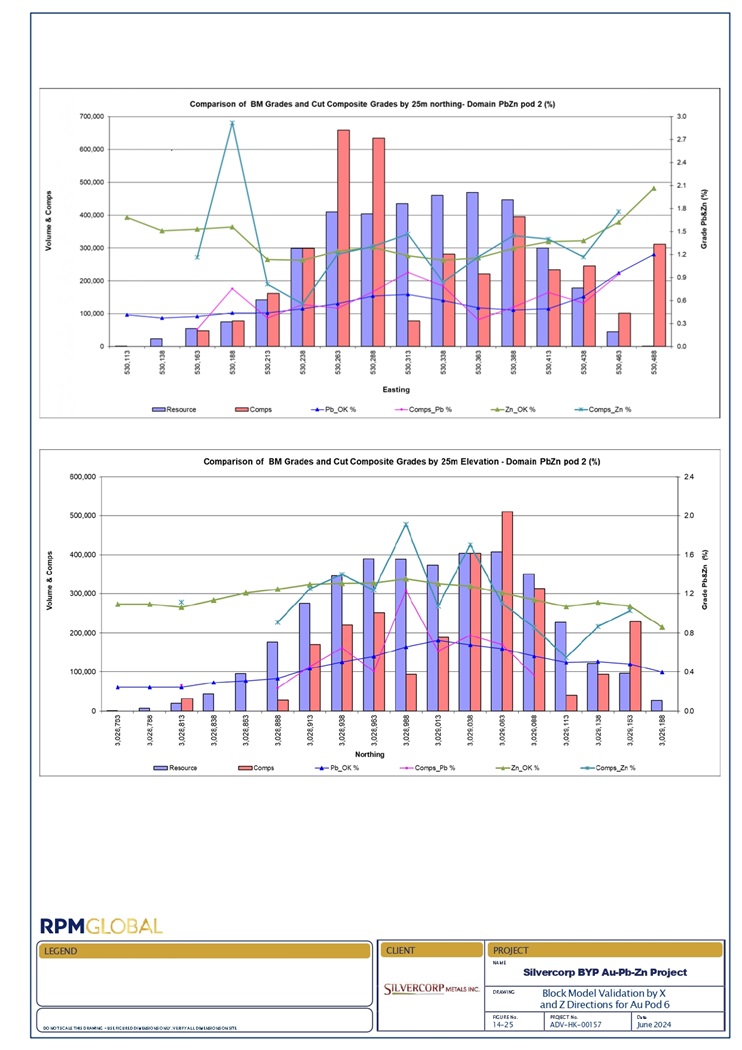

| Figure 14-25 |

Block Model Validation by easting and northing for Pb & Zn pod 2 |

99 |

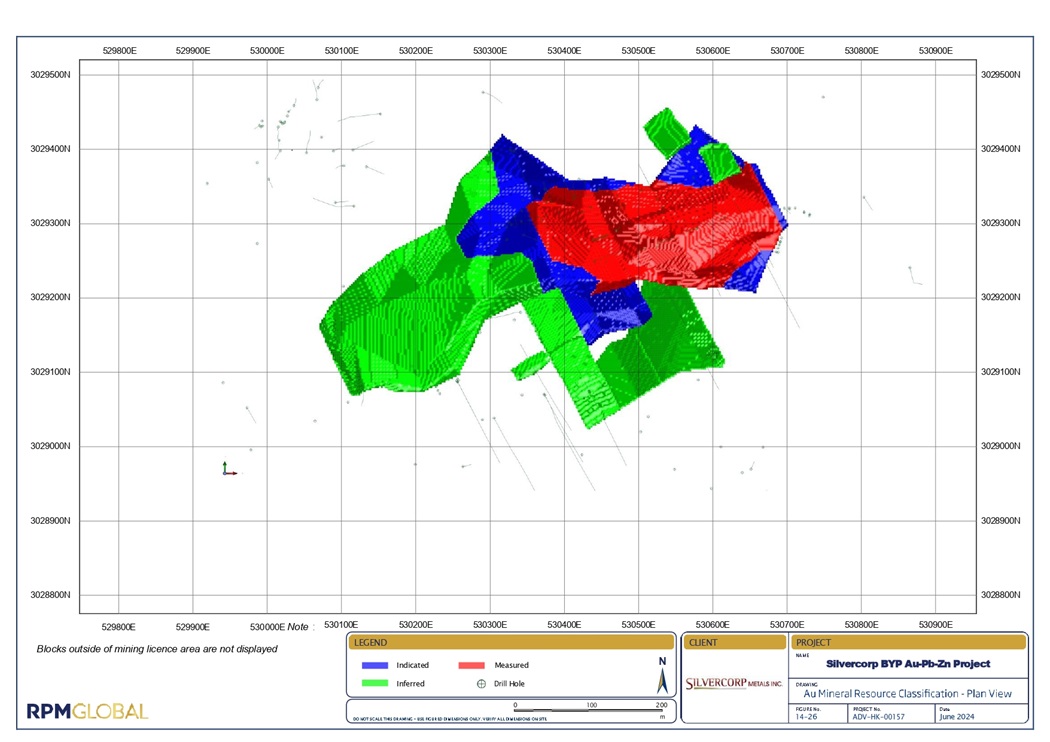

| Figure 14-26 |

Au Mineral Resource Classification - Plan View |

101 |

| Figure 14-27 |

Pb - Zn Mineral Resource Classification – Plan View |

102 |

| Figure 14-28 |

Tonnage and Grade Curves |

106 |

| Figure 14-29 |

Tonnage and Bench Curves |

107 |

LIST OF APPENDICES

| Appendix A. |

Glossary |

| Appendix B. |

RPM Team Experience |

| | |

| | ADV-HK-00157 | National Instrument 43-101 Mineral Resource Technical Report | 30th June 2024 | | | Page vii of vii | |

| | |

| This report has been prepared for Silvercorp Metals Inc.and must be read in its entirety and is subject to all assumptions, limitations and disclaimers contained in the body of the report. © RPMGlobal Asia Limited 2024 |

RPMGlobal Asia Limited (“RPM”)

was requested by Silvercorp Metals Inc. (“Silvercorp”, the “Client”) to complete an Updated Mineral Resource

Technical Report (“MRTR” or the “Report”) of the Baiyunpu (“BYP”) Gold-Lead-Zinc Project (the “Project”,

“Property” or “Relevant Asset”), in March 2024 for the purose of the Report’s filing update on SEDAR in

accordance with the requirements of Canadian National Instrument 43-101 (“NI 43-101”) of the Canadian Securities Administrators

and the Company’s reporting obligations as a Reporting Issuer in Canada. This updates the information in the NI 43-101 Report dated

30th April 2019 which was also compiled by RPM.

On November 8th,

2010, Silvercorp, through its wholly owned subsidiary Wonder Success Ltd, acquired a 70% equity interest in Xinshao Yunxiang Mining Co.

Ltd. (“Yunxiang Mining”, the “Company”), a private mining company in Hunan Province, China, which owns the BYP

Gold-Lead-Zinc mine as its primary asset. The mine was previously permitted to extract lead and zinc. The Company hold the surface land

rights which cover the main mine areas until 2063, precluding other entities from applying for the surface and sub-surface rights of

the mine areas.

RPM understands the Company has

submitted the 2018 BYP resource reconciliation report which is required and has been reviewed and filed by the Hunan Provincial Department

of Land and Resources. In 2018 the most recent development and utilization report was prepared for the Company by the Hunan Lantian Survey

and Design Co.Ltd, a registered Design Institute. An application for renewal of the mining licence was postponed from 2018 to 2023 due

to the establishment of an adjacent natural scenic area which overlapped a portion of the licence area. As the southern portion of the

tenement overlapped the new scenic areas, the mining license boundary was adjusted to remove the overlap, and the mining licence renewal

application was planned to be submitted in late 2024 including the extraction of gold in addition to lead and zinc.

| 1.2 | Scope and Terms of Reference |

This Report includes an independent

Mineral Resource estimate update for the BYP Gold-Lead-Zinc Project completed by RPM and a review of the potential processing options

reviewed subsequent to the previous NI 43-101 Report dated 30th April 2019. RPM considers that the medium to low grade nature

of the combined gold, lead and zinc mineralization and the substantial thickness and size of the deposit suggest reasonable expectations

that the Project has potential for eventual economic extraction using underground mining techniques and employing conventional mineral

processing methods to recover the gold, lead and zinc.

RPM’s technical team (“the

Team”) consisted of geologists, mining engineers and processing engineers. In September 2018, Tony Cameron (Mining Engineer, QP),

Song Huang (Geology Consultant) and Zhao Hong (Resource Geologist), undertook a site visit to the Project to familiarise themselves with

site conditions, sampling and sample handling procedures and had open discussions with the Company personnel on technical aspects relating

to the Project as a part of this Report. In March 2024, Song Huang (Senior Geology Consultant, QP) undertook a second site visit to the

project to assess the condition of project infrastructure and better understand the impact on the project due to the establishment of

the adjacent natural scenic area.

Since the latest Mineral Resource

estimate, the subject of the previous Technical Report dated 30th April 2019, the Company has not undertaken any mining or

processing activities or carried out any additional exploration work. RPM found the Company management and technical personnel to be

cooperative and open in facilitating RPM’s work during the site visits.

In addition to the work undertaken by

RPM to generate an estimate of Mineral Resources, this Report includes information provided by the Client and the Company and verified

by RPM where applicable, either directly from the site and other offices, or from reports by other organisations whose work is the property

of the Client. The data used for the Mineral Resource estimate completed by RPM and contained in this Report, has been provided by the

Client and the Company and verified by the Qualified Persons. The Report specifically excludes all aspects of legal issues, marketing,

commercial and financing matters, insurance,

| | |

| | ADV-HK-00157 | National Instrument 43-101 Mineral Resource Technical Report | 30th June 2024 | | | Page 1 of 126 | |

| | |

| This report has been prepared for Silvercorp Metals Inc.and must be read in its entirety and is subject to all assumptions, limitations and disclaimers contained in the body of the report. © RPMGlobal Asia Limited 2024 |

land titles and usage agreements, and

any other agreements/contracts that the Client and the Company may have entered into except to the extent required pursuant to NI 43-101.

In RPM’s opinion, the information

provided by the Client and the Company was reasonable and nothing was discovered during review of the data and the preparation of this

Report that indicated there was any material error or miss-representation in respect of that information.

RPM has independently assessed the Relevant

Asset by reviewing historical technical reports, drill hole databases, original sampling data, sampling methodology, development potential

and metallurgical test work resulting in a Mineral Resource estimate. All opinions, findings and conclusions expressed in the report are

those of the Qualified Persons named herein and are not warranted in any way, expressed or implied.

| § | The BYP Gold-Lead-Zinc (“Au-Pb-Zn”)

project is located in Hunan Province, China, approximately 23 km northwest of Shaoyang city. A paved provincial highway, S217, runs across

the south margin of the Property. The BYP mill, underground entrance and tailings storage areas are connected to the S217 provincial highway

by a 3 km paved road. |

| § | The Project was in operation between 2006 and 2014

to commercially extract Pb and Zn, as such significant infrastructure is located on-site including an underground mine, processing plant,

and tails storage facility along with various supporting infrastructure to support mining. |

| § | The Company holds the surface land use rights over

the Mining License area until 2063, however the latest Mining License which was approved for lead and zinc mining only was last renewed

by the Hunan Provincial Department of Land and Resources on April 8th, 2013 and expired on October 8th, 2017. The Company is in the process

of applying to renew the mining license to permit extraction of Au, Pb, and Zn following adjustment of the boundary to exclude the southern

section that overlapped the adjacent natural scenic area. |

| § | Exploration works undertaken within the BYP Gold-Lead-Zinc

deposit area by several geology institutes and mining companies since the 1970s has established that the mineralization is a combined

fine-disseminated Carlin-type gold and carbonate-hosted Mississippi Valley Type (“MVT”) lead-zinc mineralized system. During

the 1972-1977 exploration stage, 84 drill holes totaling 31,032.58 m and related geological mapping, geophysical and geochemical works

were used to define the lead-zinc deposit; the gold deposit was identified in the 1990-1992 exploration stage with 21 holes totaling 5,120.62

m. All later exploration stages focused on both gold and lead-zinc mineralization. During the 2002-2008 exploration stage, a total of

5,404.58 m of channel samples were taken. The latest exploration stage was completed in 2011-2014 by Yunxiang Mining whose 70% equity

interest was acquired by Silvercorp in November, 2010. During this stage, 64 new infill and extensional diamond core holes (including

42 holes drilled during 2011-2012 and 22 holes drilled during 2013-2014) were drilled with a total length of 13,334.92m at the BYP deposit

and 4,959 m of channel samples (including 3,882m in 2011-2012 and 1,077m in 2013-2014) were taken, forming the updated Mineral Resource

estimate stated in this Report. |

| § | Lead and zinc mining commenced in 2006, and gold

pilot mining commenced in 2011. All production from the mine ceased in July 2014. The operation produced 307,000 tons of lead-zinc mineralized

material at an average recovered grade of 0.46% Pb and 2.9% Zn for 1,403 tons of recovered lead and 8,936 tons of recovered zinc, plus

221,000 tons of gold mineralized material at an average recovered grade of 3.56 g/t Au for 788 kg of recovered gold. |

| § | The Property is located in an uplift belt that is

part of the accretionary wedge of the subduction zone between the Yangtze and South China Plates. The regional sedimentary sequence comprises

Precambrian-Cambrian glacial and pyroclastic rocks, Ordovician-Silurian flysch facies rocks and Devonian clastic and carbonate rocks.

Concealed intrusions have been detected in some areas. Parts of the Precambrian formations contain abundant volcanic material and are

geochemically anomalous in gold, antimony, tungsten and arsenic. Mineralization on the Property consists of gold and lead-zinc. To date,

eleven gold and thirty lead-zinc mineralized zones have been defined. |

| § | Gold mineralized zones occur as stratiform or lenticular

zones in fractured clastic rocks in the lower portion of the Middle Devonian sedimentary sequence. The distribution of gold mineralization

is structurally controlled by two major NE-trending faults: F3 and F5. The average grade of the zones is generally in the range of 2 g/t

to 3 g/t Au. Zone 6 is the most important gold zone, containing more than |

| | |

| | ADV-HK-00157 | National Instrument 43-101 Mineral Resource Technical Report | 30th June 2024 | | | Page 2 of 126 | |

| | |

| This report has been prepared for Silvercorp Metals Inc.and must be read in its entirety and is subject to all assumptions, limitations and disclaimers contained in the body of the report. © RPMGlobal Asia Limited 2024 |

70% of the total current estimated

gold resource at BYP. Lead and zinc zones show characteristics of strata-bound mineralization and occur within the thickly bedded carbonate

rocks in the upper portion of the Middle Devonian sedimentary sequence. However, the form, occurrence and size of individual zones are

controlled and affected by pre-mineralization and post-mineralization faults and folds. The general trend of mineralized zones is conformable

with the host rock, with dip angles ranging from 0° to 30°.

| § | RPM

conducted a review of the sampling, sample preparation, analysis, and security control procedures

on a desktop basis and during the site visits between 19th and 21st

September, 2018 and 26th/27th March, 2024. RPM found the results of

analytical work completed by the Company to be acceptable for Mineral Resource estimation

purposes. |

| § | The processing facility on site operated between

2006 and 2014 and had a capacity of 500 tpd. This plant was able to produce separate flotation concentrates for both lead-zinc and gold

mineralized material. Historical records indicate a 50% lead concentrate was produced at 82% lead recovery while a 45% zinc concentrate

was produced at 90% zinc recovery from a feed grade averaging 0.46% Pb and 2.9% Zn. Gold mineralized material with a feed grade of 3.56g/t

Au was made into a pyrite concentrate grading 40g/t gold with a reported 90% gold recovery. This processing plant has not operated for

10 years and was noted to be in poor state of repair during the 2018 and 2024 site visits. |

| § | The processing test work which underpins the Company’s

restart plans has generally shown a good response. The average gold recovery based on producing a pyrite concentrate (48.61 g/t Au) was

found to be 87.41% from a feed grade of 3.20 g/t Au, which is similar to the historical records. |

| § | The test work employed a higher feed grade (1.24%

Pb and 4.08% Zn) than the historical average which resulted in significantly better concentration grades, namely 56% Pb and 52% Zn. The

average recoveries for lead and zinc were 85.87% and 92.71%, which are similar to the historical metallurgical results. |

| § | In order to accommodate the increased power and water

requirements, infrastructure upgrades will be required. |

| 1.4 | Statement of Mineral Resources |

RPM has independently updated the

estimation of the Mineral Resources contained within the Project, based on the data as of 30th June, 2024 and the proposed mining license

boundary. The Mineral Resource estimate and underlying data complies with the guidelines provided in the CIM Definition Standards under

NI 43-101 RPM therefore considers it is suitable for public reporting. The Mineral Resources update was completed by Mr. Song Huang of

RPM. The Mineral Resources are reported at a number of Au or Zn equivalent (“ZnEq”) cut-off grades.

The Statement of Mineral Resources has

been constrained by the topography and historical depletion wireframes, and with cut-off grades of 1.2 g/t Au for the gold domain and

2.2% Zn equivalent for the lead-zinc domain inside the mining license area.

Two physically separate domains are reported

by RPM:

| § | Gold Area: This resource area is physically separate

from the Lead and Zinc Area and hosts Carlin style gold mineralization which was the focus of the recent resource drilling and underground

development. |

| § | Lead and Zinc Area: This resource area is physically

separate from the Gold Area and hosts primarily Mississippi Valley Type lead zinc mineralization. |

The results of the Mineral Resource estimate

for the BYP deposit are presented in Table 1-1 below,

| | |

| | ADV-HK-00157 | National Instrument 43-101 Mineral Resource Technical Report | 30th June 2024 | | | Page 3 of 126 | |

| | |

| This report has been prepared for Silvercorp Metals Inc.and must be read in its entirety and is subject to all assumptions, limitations and disclaimers contained in the body of the report. © RPMGlobal Asia Limited 2024 |

Table

1-1 BYP Project Mineral Resource Estimate as at 30th June 2024 (1.2 g/t Au and 2.2% ZnEq

cut-off)

|

Area |

Classification |

Au Mineral Resource |

| Quantity |

Au |

Au |

| Mt |

g/t |

koz |

|

Gold area |

Measured |

3.3 |

2.7 |

294 |

| Indicated |

1.8 |

2.8 |

162 |

| Measured & Indicated |

5.1 |

2.8 |

456 |

| Inferred |

1.6 |

2.2 |

116 |

|

Area |

Classification |

Pb and Zn Mineral Resource |

| Quantity |

Pb |

Zn |

Pb Metal |

Zn Metal |

| Mt |

% |

% |

kt |

kt |

| Lead and Zinc area |

Indicated |

3.8 |

0.6 |

2.3 |

25 |

87 |

| Inferred |

2.8 |

0.7 |

2.5 |

19 |

71 |

Note:

| 1. | The Statement of Estimates of Mineral Resources

has been compiled under direction of Mr. Song Huang, who is a full-time employee of RPM and Member of the Australian Institute of Geoscientists

and has sufficient experience that is relevant to the style of mineralization and type of deposit under consideration and to the activity

that they have undertaken to qualify as a Qualified Person as defined in the CIM Standards of Disclosure. |

| 2. | All

Mineral Resources figures reported in the table above represent estimates based on drilling

completed up to 30th June

2024. Mineral Resource estimates are not precise calculations, being dependent on the interpretation

of limited information on the location, shape and continuity of the occurrence and on the

available sampling results. The totals contained in the above table have been rounded to

reflect the relative uncertainty of the estimate. Rounding may cause some computational discrepancies. |

| 3. | Silvercorp holds a 70% equity interest of BYP

project, the Statement of Mineral Resources is reported on a 100% basis and does not reflect the ownership status. |

| 4. | Zn

Equivalent (ZnEq)

calculated using long term "Energy & Metals Consensus Forecasts" June 2024

average of USD$2,220/oz for Au, USD$2,370/t for Pb, USD$3,110/t for Zn (increasing 20% by

prediction) and processing recovery of 87.41% Au, 85.87% Pb and 92.71% Zn based on 2018 BYP

development and utilization plan report. Based on grades and contained metal for Au, Pb and

Zn, it is assumed that all commodities have reasonable potential to be economically extractable. |

| a. | The

formulas used for equivalent grade is: ZnEq=

Zn + Pb*0.7058 + Au*2.1638 |

| b. | The formula used for Au ounces is: Au Oz = [Tonnage x Au grade (g/t)]/31.1035 |

| 5. | Mineral Resources are reported on a dry in-situ basis. |

| 6. | Mineral Resources are reported at a 1.2 g/t Au

cut-off or a 2.2% Zn equivalent cut-off. Cut-off parameters were selected based on an RPM internal cut-off calculator in which the gold

price of USD$2,220 per ounce, Lead price of USD$2,370/t and Zinc price of USD$3,110/t, inflated by 120% of prices from "Energy &

Metals Consensus Forecasts" to reflect long term price movements were applied, and the mining cost of USD$41 per tonne, processing

cost of USD$16 per tonne milled and processing recovery of 87.41% Au, 85.87% Pb and 92.71% Zn. |

| 7. | Mining license depth limit of “Above RL -220m” was applied

for the Mineral Resource reporting. |

| 8. | The Mineral Resources referred to above have not

been subject to detailed economic analysis and therefore have not been demonstrated to have actual economic viability. |

RPM used a 1.2 g/t Au cut-off

grade and a 2.2% ZnEq cut-off grade for reporting the Mineral Resource estimates. These

cut-off grades were calculated using mining and processing cost and recovery parameters developed for the Project. In developing these

parameters RPM has utilised operating costs based on in-house databases of similar operations in the region and processing recoveries

based on latest preliminary test work as outlined in Section 13, along with the prices noted above in determining the appropriate

cut-off grades.

It is further noted that in the development

of any mine it is likely, given the location of the Project, that CAPEX will be required, and this is not included in the mining costs

assumed.

Given the above analysis, RPM considers

the mineralization reasonable for eventual economic extraction by underground mining methods, however, highlights that additional studies

and drilling are required to confirm economic viability.

| | |

| | ADV-HK-00157 | National Instrument 43-101 Mineral Resource Technical Report | 30th June 2024 | | | Page 4 of 126 | |

| | |

| This report has been prepared for Silvercorp Metals Inc.and must be read in its entirety and is subject to all assumptions, limitations and disclaimers contained in the body of the report. © RPMGlobal Asia Limited 2024 |

The recommendations provided in this

Report are based on observations made during the site visits and subsequent geological and metallurgical reviews undertaken as part of

the Mineral Resource estimation detailed in Section 14.

| § | Approximately 50% of gold mineralized bodies have

been classified as Measured, 26% of the gold mineralized bodies and 55% of the lead-zinc mineralized bodies have been classified as Indicated,

and 24% of the gold mineralized bodies and 45% of the lead-zinc mineralized bodies have been classified as Inferred. Mineral Resources

are estimated with insufficient confidence to allow the application of Modifying Factors to support mine planning and evaluation of the

economic viability of the remainder of the deposit. RPM recommends additional drilling to increase confidence in the existing Inferred

Mineral Resource, focusing on the areas with widely spaced drilling and resultant low levels of confidence. RPM considers a total of 24

drill holes for around 9,000 m (12 drill holes for extensional drilling and 12 drill holes for infill drilling would be appropriate. Drill

holes could be drilled from underground levels to reduce the total exploration cost. RPM estimates a minimum exploration cost of around

USD 500,000 to 800,000. |

| § | Further monitoring of the slight bias, overestimation

and underestimation observed in two standard samples of high-grade assays at the ALS Laboratory is recommended. RPM suggests more frequent

use of internal standard samples to closely monitor the accuracy of assays. |

| § | RPM recommends that the Company continue recording

density measurements which would cost approximately USD 25,000, ensuring that the density measurement intervals correspond directly with

geological logging and sampling intervals. It is recommended that density measurements be obtained from all 1 m intervals through the

mineralized zone in order to continue compiling a dataset with sufficient spatial distribution to validate and apply regression formulae

for density calculation or geostatistical estimation, rather than assigning average density values. |

| § | Following on from the increased geological understanding

of the mineralization styles and likely run of mine feed grades of any operation, RPM recommends the Company undertake processing test

work on samples from different areas that are representative of the deposit, which would cost approximately USD 60,000. This test work

would identify the grinding requirements, as well as gold recoveries and processing requirements based on conventional flow sheets as

well as the potential for recovering the metals into marketable products. |

| § | At the successful completion of the recommended exploration

work and metallurgical test work program RPM recommends the Company undertakes a Pre-Feasibility Study (“PFS”) which should

consider the various opportunities for the Project’s development. The successful completion of a PFS showing positive economics

would allow for the reporting of Mineral Reserves. The proposed PFS would take 6 to 12 months to complete inclusive of drilling with an

approximate cost of USD 600,000. |

| 1.6 | Opportunities and Risks |

The key opportunities for the Project

include:

| § | RPM considers there is good potential to expand

the currently defined resource with further drilling. Mineralization is open along strike and dip directions for both the gold and the

lead-zinc zones. Extensional drilling of the main zones has potential to delineate continuations of the known mineralization. A cost estimate

has been provided in Section 1.5 above. |

| § | There were some mineralized samples taken from lower

elevations without adequate exploration control. Based on this, there is potential for underground exploration to discover additional

Mineral Resources. |

| § | There is an opportunity to increase the level of

confidence in the Inferred Mineral Resource with closer spaced extensional and infill drilling within the main mineralized zones. |

The key risks to the Project include:

| § | Considering the variable market price the deposit

may not be economically extractable if the metal prices decease or operating costs increase. |

| | |

| | ADV-HK-00157 | National Instrument 43-101 Mineral Resource Technical Report | 30th June 2024 | | | Page 5 of 126 | |

| | |

| This report has been prepared for Silvercorp Metals Inc.and must be read in its entirety and is subject to all assumptions, limitations and disclaimers contained in the body of the report. © RPMGlobal Asia Limited 2024 |

| § | RPM considers that sampling and assaying methodology

and procedures were satisfactory for the recent drilling. Quality Assurance/Quality Control (“QA/QC”) protocols were adequate,

and a review of the data did not show any consistent bias or reasons to doubt the assay data. Standard gold sample Gau-18a returned assays

with slightly lower grades than the standard values at around -3D limit lines. All other CRMs show good correlation with original values

and assays inside the ±3D limit lines. Due to a slight bias shown by a few CRM samples and an inadequate number of total samples,

there is a low risk to the accuracy and representativeness of the QA/QC samples. |

| § | A total of 104 density measurements were obtained

from core drilled at the Project. Among the 104 samples, 24 density samples were taken from gold mineralization zones, 50 density samples

were taken from lead-zinc mineralization zones and the remaining 30 density samples were taken from wall-rock zones. This number of mineralized

density measurements is at the lower end of the range for being a statistically significant number of samples to determine a density regression

equation. Considering the variable market price for Lead and Zinc, the Lead and Zinc deposit may not be economically extractable if the

metal prices decrease. |

| § | The Company currently holds surface land use rights

over the Project valid until 2063. However, the Company does not hold valid Mining Licenses and, as at the Effective Date has not applied

for the Mining Licenses for gold, lead and zinc. In addition, several other permits are required to be granted to allow extraction of

any minerals. If these permits and licences are not granted the Project cannot recommence production. |

| § | There is no detailed management plans as in the monitoring phase. |

The illustrations supporting the various

sections of the Report are located within the relevant sections immediately following the references to the illustrations. For ease of

reference, an index of tables and illustrations is provided at the beginning of the Report.

The opinions and conclusions presented

in this Report are based largely on the data provided to RPM during the site visits, during meetings with the Company personnel, and the

reports supplied by the Company or the Client. RPM considers that the information and estimates contained herein are reliable under these

conditions, and subject to the qualifications set forth.

RPM operates as an independent technical

consultant providing resource evaluation, mining engineering and mine valuation services to the resources and financial services industries.

This Report was prepared on behalf of RPM by technical specialists.

RPM has been paid, and has agreed to

be paid, professional fees for the preparation of this Report. None of RPM’s staff or sub-consultants who contributed to this Report

has any interest in:

| § | the Company, securities of the Company or companies associated with the Company; or |

Drafts of the Report were provided

to the Client for the purpose of confirming the accuracy of factual material and the reasonableness of assumptions relied upon in the

Report. This Report is mainly based on information provided by the Client and the Company, either directly from the Project site and

other associated offices or from reports by other organisations whose work is the property of the Client or the Company. The Report is

based on information made available to RPM by 30th June, 2024.

| | |

| | ADV-HK-00157 | National Instrument 43-101 Mineral Resource Technical Report | 30th June 2024 | | | Page 6 of 126 | |

| | |

| This report has been prepared for Silvercorp Metals Inc.and must be read in its entirety and is subject to all assumptions, limitations and disclaimers contained in the body of the report. © RPMGlobal Asia Limited 2024 |

| 2 | Introduction and Terms of Reference |

RPMGlobal Limited (“RPM”)

was requested by Silvercorp Metals Inc. (“Silvercorp”, the “Client”) to complete an Updated Mineral Resource Technical

Report (the “Report”) of the Baiyunpu (“BYP”) Gold-Lead-Zinc project (the “Project” or “Relevant

Asset”) in Hunan Province, China. The Report is based on a CIM Mineral Resource estimate which meets the requirements of Canadian

National Instrument 43-101 (“NI 43-101”) of the Canadian Securities Administrators.

On November 8th,

2010, Silvercorp, through its wholly-owned subsidiary Wonder Success Ltd, acquired a 70% equity interest in Xinshao Yunxiang Mining Co.

Ltd. (“Yunxiang Mining”, the “Company”), a private mining company in Hunan Province, China, which owns the BYP

Gold-Lead-Zinc mine as its primary asset. The mine was previously permitted to extract lead and zinc. The Company hold the surface land

rights which cover the main mine areas until 2063 precluding other entities from applying for the surface and sub-surface rights of the

mine areas.

RPM understands the Company has submitted

the 2018 BYP resource reconciliation report which is required and has been reviewed and filed by the Hunan Provincial Department of Land

and Resources. In 2018 the most recent development and utilization report was prepared for the Company by the Hunan Lantian Survey and

Design Co. Ltd, a registered Design Institute. An application for renewal of the mining licence was postponed from 2018 to 2023 due to

the establishment of an adjacent natural scenic area which overlapped a portion of the licence area. After the inflection points of the

mining licence were adjusted to ensure the tenement boundary did not impinge on the natural scenic area, the mining licence renewal application

was planned to be submitted in late 2024 including the extraction of gold in addition to lead and zinc.

The following terms of reference are used

in the Technical Report:

| § | “Silvercorp”, the “Client” refer to Silvercorp Metals Inc. |

| § | Yunxiang Mining, the “Company” refers to Xinshao Yunxiang Mining Co. Ltd |

| § | “RPM” refers to RPMGlobal Asia Limited and its representatives. |

| § | “Project” refers to the BYP gold-lead-zinc deposit located in south central China. |

| § | Gold grade is described in terms of grams per dry

metric ton (g/t), lead and zinc grades as a percent (%) with tonnage stated in dry metric tons. |

| § | Resource

definitions are as set forth in the “Canadian Institute of Mining, Metallurgy and Petroleum,

CIM Standards on Mineral Resource and Mineral Reserves – Definitions and Guidelines”

adopted by the CIM Council on 10th May, 2014. |

The primary source documents for this

Report were:

| § | BYP Gold-Lead-Zinc Property, NI 43-101 Technical

Report, P R Stephenson, AMC Mining Consultants (Canada) Ltd, June 2012. |

| § | BYP Gold-Lead-Zinc Property, NI 43-101 Technical

Report, Bob Dennis, Tony Cameron and Song Huang, RPMGlobal Asia Limited, April 2019. |

| § | “BYP Au-Pb-Zn Project”, Mining License (4300002012063210125603). |

| § | Mining licence Inflection points’ coordinates

adjustment document for Baiyunpu Lead-Zinc-Gold Mine, Xinshao County, Hunan Province, Hunan Provincial Geological and Mineral Exploration

and Development Bureau Team 407, March 2022. |

| § | Drilling database – supplied in multiple Access

databases which include collar, assay, survey and lithology data: |

| | |

| | ADV-HK-00157 | National Instrument 43-101 Mineral Resource Technical Report | 30th June 2024 | | | Page 7 of 126 | |

| | |

| This report has been prepared for Silvercorp Metals Inc.and must be read in its entirety and is subject to all assumptions, limitations and disclaimers contained in the body of the report. © RPMGlobal Asia Limited 2024 |

| § | Previous 3D geological models |

| § | Underground developments models |

| - | 16

underground developments models. (1XJ, 2XJ, 150, 200, 232, 240, 252+, 252XPD, 261, 279, 336,

336CKQ, 336XPD, MXJ, SJ, TFTJ.dxf) |

| - | 63 depletion models for Au and 1 depletion model for Pb & Zn |

| - | Detailed topographic survey points and smoothed contour

lines were provided by Silvercorp and surveyed by DGPS total station in UTM WGS84 Datum as of 2012. As there has been no surface mining

activity between 2012 and 2024, the topography model is still considered suitable for the 2024 resource estimation update. |

The latest site visit

was carried out over March 26th and 27th, 2024 by RPM consultant Mr Song Huang.

Mr Tony Cameron supervised the work of RPM staff and edited or reviewed all portions of the final report.

Project participants included:

| § | Tony Cameron, Principal Mining Engineer, (Beijing) |

| § | Song Huang, Senior Geology consultant, (Beijing) |

| § | Rodney Graham, Geologist / Manager Mongolia (Ulaanbaatar) |

| § | Philippe Baudry, Executive General Manager, (Sydney) |

Details of the participants’ relevant

experience are outlined in Appendix B.

| 2.4 | Limitations and Exclusions |

The review was based on various

reports, plans and tabulations provided by the Client or the Company either directly from the mine site and other offices, or from reports

by other organizations whose work is the property of the Company. The Company has not advised RPM of any material change, or event likely

to cause material change, to the operations or forecasts since the date of asset inspections.

The work undertaken for this report

is that required an independent technical review of the information, coupled with such inspections as the participants considered appropriate

to prepare this report.

It specifically excludes all aspects

of legal issues, commercial and financing matters, land titles and agreements, except such aspects as may directly influence technical,

operational or cost issues and where applicable to the NI 43-101 guidelines.

RPM has specifically excluded making

any comments on the competitive position of the Relevant Asset compared with other similar and competing producers around the world. RPM

strongly advises that any potential investors make their own comprehensive assessment of both the competitive position of the Relevant

Asset in the market, and the fundamental of the uranium markets at large.

| 2.5 | Capability and Independence |

RPM provides advisory services

to the mining and finance sectors. Within its core expertise it provides independent technical reviews, resource evaluation, mining engineering

and mine valuation services to the resources and financial services industries.

| | |

| | ADV-HK-00157 | National Instrument 43-101 Mineral Resource Technical Report | 30th June 2024 | | | Page 8 of 126 | |

| | |

| This report has been prepared for Silvercorp Metals Inc.and must be read in its entirety and is subject to all assumptions, limitations and disclaimers contained in the body of the report. © RPMGlobal Asia Limited 2024 |

All opinions, findings and conclusions

expressed in this Technical Report are those of RPM and its specialist advisors as outlined in Section 2.3.

Drafts of this Report were provided

to the Client, but only for the purpose of confirming the accuracy of factual material and the reasonableness of assumptions relied upon

in this Technical Report.

RPM has been paid, and has agreed to

be paid, professional fees based on a fixed fee basis for its preparation of this Report.

This Technical Report was prepared on

behalf of RPM by the signatories to this Technical Report whose experiences are set out in Appendix B of this Technical Report.

The specialists who contributed to the findings within this Report have each consented to the matters based on their information in the

form and context in which it appears.

| | |

| | ADV-HK-00157 | National Instrument 43-101 Mineral Resource Technical Report | 30th June 2024 | | | Page 9 of 126 | |

| | |

| This report has been prepared for Silvercorp Metals Inc.and must be read in its entirety and is subject to all assumptions, limitations and disclaimers contained in the body of the report. © RPMGlobal Asia Limited 2024 |

| 3 | Reliance

on Other Experts |

All Sections of this Report, with

the exception of Section 3 were prepared using information provided by or on behalf of the Client or other third parties and verified

by RPM were applicable or based on observations made by RPM.

A list of the reports that contributed

to this Report is provided in Section 27.

| | |

| | ADV-HK-00157 | National Instrument 43-101 Mineral Resource Technical Report | 30th June 2024 | | | Page 10 of 126 | |

| | |

| This report has been prepared for Silvercorp Metals Inc.and must be read in its entirety and is subject to all assumptions, limitations and disclaimers contained in the body of the report. © RPMGlobal Asia Limited 2024 |

| 4 | Property Description and Location |

The general location of the Project is

shown in Figure 4-1.

The Property is located 23 km northwest

of Shaoyang city, central Hunan Province, People’s Republic of China (Figure 4-1). Administratively the Property belongs

to Baiyunpu Village, Jukoupu Township, Xinshao County, Shaoyang City (Figure 4-2). The Property is located in the central section

of the east-west-trending Longshan – Baimashan regional metallogenic zone in central Hunan province. The geographic coordinate’s

extents are:

| § | Easting: 111°17′30″~111°19′00″,

and |

| § | Northing: 27°21′30″~27°23′00″ |

The surface area of the

proposed mining license is 3.2350 km².

| | |

| | ADV-HK-00157 | National Instrument 43-101 Mineral Resource Technical Report | 30th June 2024 | | | Page 11 of 126 | |

| | |

| This report has been prepared for Silvercorp Metals Inc.and must be read in its entirety and is subject to all assumptions, limitations and disclaimers contained in the body of the report. © RPMGlobal Asia Limited 2024 |

The BYP Project is owned by Xinshao

Yunxiang Mining Co. Ltd. (“Yunxiang Mining”). The Project is a joint venture consisting of a foreign investor and a local

shareholder. In November, 2010, Silvercorp, through a wholly-owned subsidiary, acquired a 70% equity interest in Yunxiang Mining. Silvercorp

is a publically-listed company on the main boards of the Toronto and New York Stock Exchanges.

RPM understands the Company has submitted

the 2018 BYP resource reconciliation report which is one of the required steps in applying for a renewal of the mining license, and that

this reconciliation report has been reviewed and filed by the Hunan Provincial Department of Land and Resources. In 2018 the most recent

development and utilization report was prepared for the Company by the Hunan Lantian Survey and Design Co. Ltd, a registered Design Institute.

After the inflection points of the mining license were adjusted to ensure the tenement boundary did not impinge on the natural scenic

area and had been approved by Hunan Provincial Department of Natural Resources in April 2024, the mining license renewal application is

understood to be submitted in late 2024.

The adjusted surface area of the mining

license under application is 3.2350km². The revised mining license renewal application includes gold extraction in addition to lead

and zinc. RPM understands that, in line with regulations, the royalty for gold extraction will be calculated and paid by the Company prior

to granting of the new license. Available details of the new applied mining license are provided in below Table 4-1.

Table 4-1 Application

Mining License of Baiyunpu Gold, Lead and Zinc Mine

| Detail/Mine |

Baiyunpu Gold, Lead and Zinc Mine |

| Name of Certificate |

PRC Mining Right Permit |

| Certificate No. |

To be updated |

| Mine Right Holder |

Xinshao Yunxiang Mining Co. Ltd |

| Location |

Baiyunpu Village, Jukoupu Town, Xinshao County, Hunan Province |

| Name of Mine |

Baiyunpu Lead, Zinc and Gold Mine, Xinshao County |

| Company Type |

Limited |

| Mining Mineral Class |

Gold, Lead, Zinc, |

| Mining Method |

Underground mining |

| ROM production capacity |

To be updated |

| Mine Area |

3.2350 sq.km |

| Mining Elevation |

490 m asl to -220 m asl |

| Valid Period |

To be updated |

| Issue Date |

To be updated |

| Issuer |

Department of Land and Resources of Hunan Province |

|

Source: RPM received photocopy of the document. |

The corner coordinates of the mining license

are shown below in Table 4-2.

Production at the

mine is still suspended. There are 3 personnel residents at site who are responsible for daily checks and maintenance of surface infrastructure

and activities related to the license renewal process.

| | |

| | ADV-HK-00157 | National Instrument 43-101 Mineral Resource Technical Report | 30th June 2024 | | | Page 14 of 126 | |

| | |

| This report has been prepared for Silvercorp Metals Inc.and must be read in its entirety and is subject to all assumptions, limitations and disclaimers contained in the body of the report. © RPMGlobal Asia Limited 2024 |

Table 4-2

Coordinates of adjusted Corner Points of BYP Mine (National 2000 Coordinate System)

| Corners |

Northing (mN) |

Easting (mE) |

| 1 |

3028245.200 |

37529351.010 |

| 2 |

3028795.200 |

37529351.010 |

| 3 |

3028795.200 |

37528909.218 |

| 4 |

3030139.020 |

37528909.218 |

| 5 |

3030145.020 |

37531375.030 |

| 6 |

3029190.581 |

37531378.504 |

| 7 |

3029103.347 |

37530671.879 |

| 8 |

3028452.882 |

37529628.759 |

| 9 |

3028324.642 |

37529628.759 |

| |

|

|

| Source: the information regarding the

latest expired mining license is sourced from the documents provided. |

| 4.2 | Review of Ownership Documents |

A

photocopy of the business permit, granted on 21st September, 2017 was provided to RPM. The business permit remains valid until

21st September, 2030. The business permit number is 9143050075804471XE. The Company’s location is Baiyunpu Village 12#,

Jukoupu Town, Xinshao County. The Company is designated as Limited Liability Company (Taiwan, Hong Kong, Macao and Inland Cooperation).

There

are four land utilisation permits (numbers 0002234, 0002235, 0002236 and 0002237). The land areas of the permits are 591 m2,

15,746 m2, 1,208 m2, and 10,092 m2, respectively. All of the land utilisation permits were granted on

13th September, 2017 by Xinshao County Bureau of National Land and Resources. Their validity period is from 16th

January, 2013 to 15th January, 2063. All the surface land rights are at the main projects areas which the current license

application are located.

The Company holds the surface land use

rights which cover the main Project areas until 2063 precluding other entities from applying for the surface and sub-surface rights of

the mine areas. RPM understands the Company has submitted the 2018 BYP resource reconciliation report which is one of the required steps

in applying for a renewal of the mining license, and that this reconciliation report has been reviewed and filed by the Hunan Provincial

Department of Land and Resources.

In 2018 the most recent development and

utilization report was prepared for the Company by the Hunan Lantian Survey and Design Co. Ltd, a registered Design Institute. In RPM’s

experience, as the land use right provides the priority right for any subsequent mining license application, there should be no impediment

to the granting of a new mining license provided the Client completes the necessary mining and environmental studies as required under

the Chinese system.

RPM recommends that potential investors complete

their own legal due diligence on this matter.

| | |

| | ADV-HK-00157 | National Instrument 43-101 Mineral Resource Technical Report | 30th June 2024 | | | Page 15 of 126 | |

| | |

| This report has been prepared for Silvercorp Metals Inc.and must be read in its entirety and is subject to all assumptions, limitations and disclaimers contained in the body of the report. © RPMGlobal Asia Limited 2024 |

| 5 | Accessibility, Climate, Local Resources, Infrastructure and Physiography |

| 5.1 | Accessibility and Infrastructure |

The Property is located at the southwest

margin of the north-east trending Dachengshan mountain range. The southwest side of the range forms the lowest portion of the Property,

the other three sides being occupied by high hills. This geographic feature gives the landform an ‘armchair-like’ morphology.

Elevation ranges from 241 m above sea

level in the southwest to 862 m above sea level in the northeast. The north-west, west and southwest parts are a combination of low mountains

and hills that formed from erosion of carbonate rocks.

A paved provincial highway, S217 (Shaoyang-Xinhua),

runs across the southern margin of the Property. The BYP mill, underground entrance and tailings storage areas are connected to S217 by

a 3 km paved road. Shaoyang City, the major local city with a population of more than half a million, is located about 23 km southeast

of the Property. Shaoyang is connected to other major cities in Hunan Province and nationwide by rail and expressways. It takes about

3.5 hours to drive by expressway from Shaoyang to the provincial capital city of Changsha, where an airport with both domestic and international

flights is located.

| 5.2 | Climate and Physiography |

The

climate is subtropical continental and wet, with an annual average temperature of 17.0℃ and an average annual precipitation of

1,353 mm. Maximum temperatures range from a recorded maximum of 39.8ºC to a minimum of -10.8ºC. The climate is suitable for

year-round exploration and mining.

The high mountainous area is covered with

forest, while most of the low hills have been developed as farmland. Several streams run through the Property, the surface stream and

well water and underground recycled water provide sufficient water for local daily living and industry use. The current 10 kV power supply

at the Property is provided from a 35 kV substation at Xintianpu and a 110 kV substation at Jukoupu, respectively. Both are located 11

km from the Property.

Yunxiang Mining has acquired the surface

rights to the land covered by the mining permit for mining and processing operations. The district of Shaoyang is one of the most densely

populated areas in Hunan province. There is an historical tradition of mining in adjacent areas. Skilled labor is available for all levels

of mining and related activities.

| | |

| | ADV-HK-00157 | National Instrument 43-101 Mineral Resource Technical Report | 30th June 2024 | | | Page 16 of 126 | |

| | |

| This report has been prepared for Silvercorp Metals Inc.and must be read in its entirety and is subject to all assumptions, limitations and disclaimers contained in the body of the report. © RPMGlobal Asia Limited 2024 |

The BYP lead-zinc mineralization

was discovered in 1977 by 468 Team of Hunan Provincial Geological Bureau and gold mineralization was discovered in 1980 by the Geology

Investigation Institute of the Hunan Provincial Geology Bureau. Historically, a series of exploration stages were carried out as outlined

below:

| § | 1971-1977:

General exploration was carried out by 468 Team of Hunan Provincial Geological Bureau,

including 217.4 m of adits, 201.35 m of shallow shafts, 2,700 cubic meters of trenching,

84 drill holes for 31,032.58 m and other miscellaneous sample collection and testing activities. |

| § | 1980:

Gold mineralization was discovered in Dachengshan area by the Geology Investigation Institute

of Hunan Provincial Geology Bureau. |

| § | 1990-1992:

Prospecting for gold was completed by 418 Team of Hunan Provincial Geology and Mineral

Bureau, with 21 holes drilled in the Baiyunchong portion for a total length of 5,121 m. Four

mineralized zones (Zones V, VI, VII and XII) were discovered and further explored during

this stage. |

| § | 2003-2005:

Yunxiang Mining Company (previously Tianxiang Mining Company) took channel samples, with

a total length of 1,290 m, carried out special hydrogeological investigations within an 8

km2 area, and conducted small-scale processing test work. |

| § | 2006:

The 418 Team of Hunan Provincial Geology and Mineral Bureau prepared “Hunan Province

Xinshao County – Baiyunpu Lead-Zinc Mine General Geological Exploration Report”

in October 2006, which was approved and filed by the Hunan Provincial Land and Resources

Department. |

| § | 2011-2014:

General exploration for gold was completed by Yunxiang Mining Company. The 418 Team of

Hunan Provincial Geology and Mineral Bureau verified all exploration works and compiled the

2013 general exploration report. Exploration activities mainly included 65 surface and underground

holes with total of 13,517.13 m, and 146 groups of underground channel samples for 4,556.51

m. Two holes drilled in 2014 were not included in the 2013 general exploration report. |

| § | 2017:

Resource & Reserve Reconciliation report. The 418 Team of Hunan Provincial Geology

and Mineral Bureau carried out geological verification work including tunnel measurements

(1,757 m), tunnel logging (643 m) and supplemental core logging (42 m). In addition, 279

samples were collected from twelve holes completed in 2011-2014 following creation of the

joint venture enterprise in 2011. The holes were mainly drilled during tunneling operations

for exploration and production, leading to the discoveries of the Zone XIII Pb-Zn, and Zone

3-1 and Zone 4 gold mineralized zones. |

| 6.2 | Mineral Resource Estimation History |