Critical Metals Surge Opens

Prime Opportunity for Mining Investors

November 22nd, 2024 - InvestorsHub NewsWire -- NetworkNewsWire

Editorial Coverage: Interest in the mining sector is on

the rise, fueled by growing demand for metals that are crucial to

modern industries. The shift toward clean-energy technologies,

including electric vehicles (EVs) and renewable energy systems, has

heightened the need for critical minerals, particularly lithium,

cobalt, nickel and rare earth elements ("REEs"). At the same time,

traditional metals such as copper and aluminum are seeing renewed

importance due to their essential roles in infrastructure and

energy transmission. Gold and silver remain appealing as safe-haven

assets during periods of economic uncertainty and inflation.

Additionally, the global drive for decarbonization and energy

efficiency is boosting demand for platinum group metals ("PGMs"),

which are valued for their purity, high melting points and unique

catalytic properties. These metals are integral to numerous

industrial processes and play a pivotal role in autocatalysis and

pollution control within the automotive industry. With potential

supply disruptions from major producers and geopolitical tensions

tightening the market, mining companies are well positioned for

growth. One of those companies, Platinum Group Metals

Ltd. (NYSE: PLG)

(TSX: PTM)

(Platinum

Group Metals Profile), is emerging as a

leader in the PGM space, due to the performance of its flagship

Waterberg Project in South Africa. Platinum Group Metals joins

other mining and commodity-related organizations that are focused

on strengthening their foothold in the mining sector, including

companies such as Endeavour

Silver Corporation (Canada) (NYSE:

EXK), Fortuna

Mining Corp. (NYSE:

FSM), New

Gold Inc. (NYSE

American: NGD) and Sandstorm

Gold Ltd. (NYSE: SAND).

- PGM outlook on rise due to several critical factors.

- Recognizing the rising demand for PGMs, Platinum Group Metals

is committed to developing flagship initiative.

- Company reports notable results from independent feasibility

study.

Critical Factors Lead to Positive Sector

Outlook

The platinum group metals ("PGMs") space encompasses six key

metals, including platinum, palladium, rhodium, ruthenium, iridium

and osmium. These metals are highly valued for their catalytic

capabilities, resistance to corrosion, and superior electrical

conductivity, making them indispensable across an array of

industries such as automotive, electronics and healthcare. Although

there were initial concerns that the rise of battery electric

vehicles ("BEVs") could reduce PGM demand, the industry's outlook

has improved due to several critical factors.

Renewed Auto Sector Demand for Platinum and

Palladium: The automotive industry remains a major

driver of PGM consumption, particularly for platinum and palladium,

which are essential components in catalytic converters for internal

combustion engines ("ICE") and hybrid

vehicles. While BEVs once seemed poised to dampen

demand, a slowdown in BEV sales has led to a renewed focus on ICE

and hybrid models, boosting the need for PGMs. This trend

highlights the ongoing importance of PGMs in reducing emissions,

even as the automotive sector gradually shifts toward more

sustainable technologies.

Geopolitical Risks Affecting Palladium

Supply: Russia is the leading global supplier of

palladium, accounting for a significant portion of the world's

output. However, geopolitical instability and the possibility of

sanctions on Russian exports present serious risks to

the palladium

supply chain. These uncertainties could result in supply

disruptions and increased prices, offering potential advantages to

producers operating outside Russia.

South Africa's Challenges in Platinum and Rhodium

Production: South Africa plays a dominant role in the

global production of platinum and rhodium. However, the country

faces persistent issues such

as energy shortages, labor disputes, and operational

inefficiencies, which have led to reduced output. Many of the

region's traditional platinum and palladium mines are aging, deeply

situated, and costly to maintain, raising safety concerns as well.

These production challenges further tighten supply, providing

additional upward pressure on PGM prices and underscoring their

strategic value.

Growing Investment Interest in

Platinum: Amid rising economic uncertainty and

geopolitical tensions, precious metals are increasingly sought

after as safe-haven investments. Platinum, alongside gold and

silver, has attracted significant

attention from investors. This growing investment

demand underscores the dual nature of PGMs as both industrial and

financial assets, making them particularly appealing in times of

market volatility.

Joint Effort Creates Flagship Initiative

Recognizing the rising demand for PGMs, Platinum

Group Metals is committed to addressing this need

through its flagship initiative, the South Africa–based Waterberg

Project. Originally identified by the company in November 2011,

this project focuses on key PGMs such as palladium, platinum and

rhodium, as well as gold, capitalizing on the company's specialized

knowledge to help meet growing global demand.

The

Waterberg Project is a collaborative effort

involving several partners: Platinum Group Metals; Impala Platinum

Holdings Ltd. (Implats); HJ Platinum, a consortium of Japan Oil,

Gas and Metals National Corporation and Hanwa Co.; and Black

Economic Empowerment ("BEE") partner Mnombo Wethu Consultants

("Pty") Ltd. The deposit is relatively shallow, and the planned

mine is designed as a mechanized, underground operation focused on

bulk production. This approach aims to deliver a safe, sustainable,

and scalable supply of PGMs.

The Waterberg Project offers significant opportunities for

investors seeking exposure to the PGM market. The project's

strengths include a substantial resource base, the potential for

cost-efficient production, strategic partnerships with a major

platinum producer and a Japanese consortium, and a collaboration

with a Saudi Arabia–based group working to establish a PGM smelter

in Saudi Arabia. Together, these factors position the Waterberg

Project as a unique and competitive asset in the PGM industry.

Feasibility Study Notes Project Potential

Platinum Group Metals recently reported on results from an

Independent Definitive Feasibility Study Update (2024 DFS) that the

company had undertaken, which was focused on the Waterberg Mine.

Key findings from the report include

several notable observations, including the following:

- Increased Mineral Reserve

Estimate: Proven and probable mineral reserves

increased by 20% to 23.41 million 4E oz (246.2 million tonnes at an

average grade of 2.96 4E g/t, 0.08% copper ("Cu"), and 0.17% nickel

("Ni").

- Extended Life of Mine: LOM increased from

45 years to 54 years with annual steady state average production in

concentrate of 353,208 4E oz. and peak annual production of 432,950

4E oz.

- Robust Economics: After-tax net present

value at an 8% real discount rate of $569 million and an Internal

Rate of Return of 14.2% using average long-term consensus metal

prices as of May 2024.

- One of the Lowest Cost PGM Mines in Southern

Africa: On site LOM average cash cost, including base

metal byproduct credits and smelter discounts as a cost, of $658

per 4E oz, with an all-in sustaining cost of $761 per 4E oz.

- Strong Cash Flow Generation: LOM free

after-tax cashflow of $6.50 billion at consensus prices.

- Reasonable Capital: Estimated total

project capital of $946 million, including 8.5% for contingencies,

and peak capital estimated at $776 million.

"The 2024 DFS validates the world-class nature of the Waterberg

Project," said Frank R. Hallam, Platinum Group president and CEO.

"Engineering teams from Stantec, DRA and Fraser McGill have

collaborated to achieve an optimized and de-risked mine plan while

also minimizing capital requirements. The primary objectives of the

2024 DFS were to update and minimize capital and operating costs,

and to simplify the construction, ramp up and operating profile of

the Waterberg Mine.

"I believe these objectives have been achieved," Hallam

continued. "We look forward to advancing the Waterberg Project for

the benefit of our partners and local communities, as well as all

the people of South Africa. The Waterberg Project is planned to

create approximately 2,000 jobs during construction and

approximately 1,425 mostly high skilled jobs once steady state

mining is achieved. PGMs, copper and nickel play key roles in

automotive emissions control and energy transition technologies,

including that found in battery electric, plug-in hybrid, gasoline

hybrid and hydrogen fuel cell vehicles. The Waterberg Project is a

long-life asset capable of profitably producing these critical

metals."

PGM Collaborative Venture Eyeing Breakthrough

Batteries

Another key piece that distinguishes Platinum Group Metals is

its Lion Battery Research project, a joint venture with Anglo

American Platinum. This

project aims to develop lithium-sulfur batteries

incorporating PGMs, a breakthrough that could transform energy

storage and broaden the applications of PGMs.

To advance this goal, Platinum Group Metals and Anglo

American Platinum Limited cofounded Lion

Battery Technologies. The venture focuses on integrating

palladium and platinum into lithium battery technologies. According

to the company, "The potential to drive new demand for platinum and

palladium in battery technology is both an exciting opportunity and

strategically significant for both partners." Lion Battery

Technologies has partnered with Florida International University

("FIU") to push forward a research program exploring the use of

platinum and palladium in lithium-air and lithium-sulfur batteries

to enhance their energy capacity and cycle life.

Under the terms of its agreement with FIU, Lion Battery

Technologies is granted exclusive rights to any intellectual

property developed and will oversee the commercialization of these

advancements. The company is also evaluating several complementary

opportunities to further develop next-generation battery

technologies incorporating PGMs. Lithium-air and lithium-sulfur

batteries offer much higher energy density than current lithium-ion

options, potentially delivering performance improvements by several

orders of magnitude.

The company highlights the transformative potential of these

next-generation batteries, noting their lightweight, high-power

capabilities. This makes them particularly appealing for battery

electric vehicles and a wide range of other applications beyond

transportation. As these technologies scale, they could play a

significant role in the growing market for advanced energy-storage

solutions.

Shaping the Future

The present landscape in mining offers promising opportunities

for investors interested in sectors shaping the future of energy,

technology and infrastructure. With demand on the rise, mining

investments are becoming an integral part of growth-oriented

portfolios. Numerous companies are actively working to present

compelling investment opportunities for those looking to capitalize

on the mining industry's potential.

Endeavour

Silver Corporation (Canada) (NYSE:

EXK) is a mining company focused

on discovering and mining silver, with projects and operations in

three countries, including Mexico, Chile and the United States. The

company is focused on being a leading silver producer

that creates value for its stakeholders by discovering, developing

and operating mines in a sustainable way. Endeavour's business

strategy balances short-term profitability with long-term

investments in exploration and development to extend mine lives and

build new mines to drive future profitability.

Fortuna

Mining Corp. (NYSE:

FSM) is a Canadian mid-tier

precious metals producer established in two of the world's premier

mining regions: Latin America and West Africa. The company operates

five mines as well as an advanced exploration project; these

operations are located in Argentina, Burkina Faso, Côte d'Ivoire,

Mexico, Peru and Senegal. Fortuna

Mining Corp. produces gold and silver and is

committed to generate shared value over the long-term for its

stakeholders through efficient production, environmental

stewardship and social responsibility.

New

Gold Inc. (NYSE

American: NGD) is on a mission to

be the leading intermediate gold producer, driving responsible and

profitable mining in a way that creates sustainable and enduring

value for shareholders as well as the environment. The

diversified company operates

multiple mines, producing byproducts such as silver and copper

while using multiple mining methods and types of deposits.

Sandstorm

Gold Ltd. (NYSE: SAND) holds

royalty rights on mining operations around the world. Rather than

operating mines, Sandstorm Gold provides an upfront payment in

exchange for future revenue or gold production. The result is a

diversified portfolio of mining royalties that provides stable cash

flows and an impressive growth profile because royalty companies

can outperform the underlying metals that their portfolios are

comprised of as well as amplifying investor returns.

In summary, the PGM industry is positioned for growth, driven by

the resilience of auto-sector demand, geopolitical supply risks,

and increased investment interest, all of which reinforce the

strategic importance of these versatile metals.

For more information about Platinum Group Metals, please

visit Platinum

Group Metals Ltd.

About NetworkNewsWire

NetworkNewsWire ("NNW")

is a specialized communications platform with a focus on financial

news and content distribution for private and public companies and

the investment community. It is one of 60+ brands

within the Dynamic

Brand Portfolio @ IBN that

delivers: (1) access to a vast network of

wire solutions via InvestorWire to

efficiently and effectively reach a myriad of target markets,

demographics and diverse industries; (2)

article and editorial

syndication to 5,000+ outlets; (3)

enhanced press

release enhancement to ensure maximum

impact; (4) social

media distribution via IBN to millions of social

media followers; and (5) a full array of

tailored corporate

communications solutions. With broad reach and a

seasoned team of contributing journalists and writers, NNW is

uniquely positioned to best serve private and public companies that

want to reach a wide audience of investors, influencers, consumers,

journalists and the general public. By cutting through the overload

of information in today's market, NNW brings its clients

unparalleled recognition and brand awareness. NNW is where breaking

news, insightful content and actionable information converge.

To receive SMS text alerts from NetworkNewsWire, text

"STOCKS" to 888-902-4192 (U.S. Mobile Phones Only)

For more information, please visit https://www.NetworkNewsWire.com

Please see full terms of use and disclaimers on the

NetworkNewsWire website applicable to all content provided by NNW,

wherever published or re-published: https://www.NetworkNewsWire.com/Disclaimer

NetworkNewsWire

New York, NY

www.NetworkNewsWire.com

212.418.1217 Office

Editor@NetworkNewsWire.com

NetworkNewsWire is powered by IBN

DISCLAIMER: NetworkNewsWire (NNW) is the source of the Article

and content set forth above. References to any issuer other than

the profiled issuer are intended solely to identify industry

participants and do not constitute an endorsement of any issuer and

do not constitute a comparison to the profiled issuer. The

commentary, views and opinions expressed in this release by NNW are

solely those of NNW. Readers of this Article and content agree that

they cannot and will not seek to hold liable NNW for any investment

decisions by their readers or subscribers. NNW is a news

dissemination and financial marketing solutions provider and are

NOT registered broker-dealers/analysts/investment advisers, hold no

investment licenses and may NOT sell, offer to sell or offer to buy

any security.

The Article and content related to the profiled company

represent the personal and subjective views of the Author, and are

subject to change at any time without notice. The information

provided in the Article and the content has been obtained from

sources which the Author believes to be reliable. However, the

Author has not independently verified or otherwise investigated all

such information. None of the Author, NNW, or any of their

respective affiliates, guarantee the accuracy or completeness of

any such information. This Article and content are not, and should

not be regarded as investment advice or as a recommendation

regarding any particular security or course of action; readers are

strongly urged to speak with their own investment advisor and

review all of the profiled issuer's filings made with the

Securities and Exchange Commission before making any investment

decisions and should understand the risks associated with an

investment in the profiled issuer's securities, including, but not

limited to, the complete loss of your investment.

NNW HOLDS NO SHARES OF ANY COMPANY NAMED IN THIS RELEASE.

This release contains "forward-looking statements" within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E the Securities Exchange Act of 1934, as amended and

such forward-looking statements are made pursuant to the safe

harbor provisions of the Private Securities Litigation Reform Act

of 1995. "Forward-looking statements" describe future expectations,

plans, results, or strategies and are generally preceded by words

such as "may", "future", "plan" or "planned", "will" or "should",

"expected," "anticipates", "draft", "eventually" or "projected".

You are cautioned that such statements are subject to a multitude

of risks and uncertainties that could cause future circumstances,

events, or results to differ materially from those projected in the

forward-looking statements, including the risks that actual results

may differ materially from those projected in the forward-looking

statements as a result of various factors, and other risks

identified in a company's annual report on Form 10-K or 10-KSB and

other filings made by such company with the Securities and Exchange

Commission. You should consider these factors in evaluating the

forward-looking statements included herein, and not place undue

reliance on such statements. The forward-looking statements in this

release are made as of the date hereof and NNW undertakes no

obligation to update such statements.

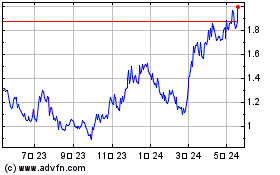

New Gold (AMEX:NGD)

過去 株価チャート

から 12 2024 まで 1 2025

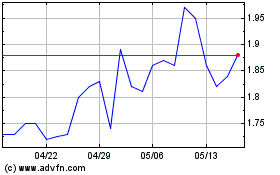

New Gold (AMEX:NGD)

過去 株価チャート

から 1 2024 まで 1 2025