UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, DC 20549

SCHEDULE 13D/A-15

Under the Securities Exchange Act of 1934

Golden

Minerals Company

(Name of Issuer)

Common Stock

(Title of Class of Securities)

381119106

(CUSIP Number)

Mike de Leeuw, Director

Sentient Executive GP IV, Limited, General Partner

Of Sentient GP IV, L.P., General Partner of Sentient

Global Resources Fund IV, L.P.,

Governors Square, Building 4, 2nd Floor,

23 Lime Tree Bay Avenue

P.O. Box 32315, Grand Cayman KY1-1209, Cayman Islands

345-946-0921

(Name, Address and Telephone Number of Person Authorized

to

Receive Notices and Communications)

(with copy to)

Clifford L. Neuman, Esq.

Clifford L. Neuman, PC

6800 N. 79th Street, Suite 200

Niwot, CO. 80503

(303) 449-2100

September 12, 2024

(Date of Event which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G to

report the acquisition that is the subject of this Schedule 13D, and if filing this schedule because of §§240.13d-1(e), 240.13d-1(f)

or 240.13d-1(g), check the following box. [ ]

Note: Schedules filed in paper format shall include a signed original and

five copies of the schedule including all exhibits. See § 240.13d-7 for other parties to whom copies are to be sent.

*The remainder of this cover page shall be filled out for a reporting person’s

initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which

would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not

be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise

subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

| CUSIP

No. 381119106 |

|

Page

2 of 9 |

| 1. |

NAMES

OF REPORTING PERSONS I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

Sentient

GP IV, L.P. |

| 2. |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See Instructions)

(a)

☒

(b)

☐ |

| 3. |

SEC

USE ONLY

|

| 4. |

SOURCE

OF FUNDS (See Instructions)

OO |

| 5. |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS

REQUIRED PURSUANT TO ITEM 2(d) or 2(e) ☐

|

| 6. |

CITIZENSHIP

OR PLACE OF ORGANIZATION

Cayman

Islands |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON WITH: |

7. |

SOLE

VOTING POWER 0

|

| 8. |

SHARED

VOTING POWER 0

|

| 9. |

SOLE

DISPOSITIVE POWER 0

|

| 10. |

SHARED

DISPOSITIVE POWER 0

|

| 11. |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

0 |

| 12. |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

☐ |

| 13. |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

0% |

| 14. |

TYPE

OF REPORTING PERSON

CO |

| CUSIP

No. 381119106 |

|

Page

3 of 9 |

| 1. |

NAMES

OF REPORTING PERSONS I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

Sentient

Global Resources Fund IV, L.P. |

| 2. |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See Instructions)

(a)

☒

(b)

☐ |

| 3. |

SEC

USE ONLY

|

4. |

SOURCE

OF FUNDS (See Instructions)

OO |

|

5. |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS

REQUIRED PURSUANT TO ITEM 2(d) or 2(e) ☐

|

6. |

CITIZENSHIP

OR PLACE OF ORGANIZATION

Cayman

Islands |

|

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON WITH: |

7. |

SOLE

VOTING POWER 682,958

|

|

8. |

SHARED

VOTING POWER 0

|

|

9. |

SOLE

DISPOSITIVE POWER 682,958

|

|

10. |

SHARED

DISPOSITIVE POWER 0

|

|

11. |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

682,958 |

|

12. |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

☐ |

|

13. |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

4.54% |

|

14. |

TYPE

OF REPORTING PERSON

PN |

| CUSIP

No. 381119106 |

|

Page

4 of 9 |

| 1. |

NAMES

OF REPORTING PERSONS I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

Sentient

Executive GP IV, Limited |

| 2. |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See Instructions)

(a)

☒

(b)

☐ |

| 3. |

SEC

USE ONLY

|

4. |

SOURCE

OF FUNDS (See Instructions)

OO |

5. |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS

REQUIRED PURSUANT TO ITEM 2(d) or 2(e) ☐

|

6. |

CITIZENSHIP

OR PLACE OF ORGANIZATION

Cayman

Islands |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON WITH: |

7. |

SOLE

VOTING POWER 0

|

8. |

SHARED

VOTING POWER 0

|

9. |

SOLE

DISPOSITIVE POWER 0

|

10. |

SHARED

DISPOSITIVE POWER 0

|

11. |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

0 |

12. |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

☐ |

13. |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

0% |

14. |

TYPE

OF REPORTING PERSON

CO |

| CUSIP

No. 381119106 |

|

Page

5 of 9 |

| Item

1. |

Security

and Issuer |

This

filing relates to the Common Stock (the “Common Stock”) of Golden Minerals Company (“Golden Minerals” or the

“Issuer”), a Delaware corporation. The address of Golden Minerals’ principal office is 350 Indiana Street, Suite 800,

Golden, Colorado 80401.

| Item

2. | Identity

and Background is amended to read as follows: |

(a)

– (c) This Schedule was initially filed jointly by: (i) Sentient Global Resources Fund III, L.P. (“Fund III”), (ii)

SGRF III Parallel I, L.P. (“Parallel I”), (iii) Sentient Executive GP III, Limited (“Sentient Executive III”),

(iv) Sentient GP III, L.P. (“GP III); (v) Sentient Global Resources Fund IV, L.P. (“Fund IV”); (vi) Sentient GP IV,

L.P. (“GP IV”); and (vii) Sentient Executive GP IV, Limited (“Sentient Executive IV”). In 2021, Sentient Global

Resources Fund III, L.P. and its affiliated entities disposed of all their interests in Golden Minerals. As a result, this Amended Report

is being filed by Fund IV and its affiliated entities (collectively referred to herein as the “Reporting Persons” or “Sentient”).

Sentient Executive IV is the general partner of the general partner of Fund IV and makes the investment decisions for those entities.

Fund

IV is a Cayman Islands limited partnership. The sole general partner is Sentient GP IV, L.P. which is a Cayman Islands limited partnership

(“GP IV”). The sole general partner of GP IV is Sentient Executive IV which is a Cayman Islands exempted company. The principal

business of Fund IV is making investments in public and private companies engaged in mining and other natural resources activities. The

principal business of GP IV is performing the functions of and serving as the sole general partner of Fund IV, and other similar funds

and the principal business of Sentient Executive IV is performing the functions of and serving as the sole general partner of GP IV.

Investment decisions related to investments of Fund IV are made by Sentient Executive IV with the approval of Fund IV.

The

principal offices of each of the Reporting Persons is: Governors Square, Building 4, 2nd Floor, 23 Lime Tree Bay Avenue, PO

Box 32315, Grand Cayman KY1-1209, Cayman Islands.

(d)

During the past 5 years, none of the Reporting Persons, and to the best knowledge of the Reporting Persons, none of the Schedule A Persons

has been convicted in a criminal proceeding (excluding traffic violations and similar misdemeanors).

(e)

During the past 5 years, none of the Reporting Persons, and to the best knowledge of the Reporting persons, none of the Schedule A Persons

a party to a civil proceeding of a judicial or administrative body of competent jurisdiction that resulted in a judgment, decree or final

order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding

any violation with respect to such laws, or a party to a civil proceeding of a judicial or administrative body of competent jurisdiction

that resulted in a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to,

federal or state securities laws or finding any violation with respect to such laws.

(f)

The citizenship of the Schedule A Persons who are natural persons is set forth on Schedule A and incorporated herein by this reference.

| Item

3. | Source

and Amount of Funds or Other Consideration |

The

funds used by Fund IV to make the investments in Golden Minerals described below are funds held by it for investment.

| CUSIP

No. 381119106 |

|

Page

6 of 9 |

| Item

4. | Purpose

of Transaction is amended to read as follows: |

(a)

The disposition of securities of the Issuer.

On

September 9, 2024 Fund IV sold an aggregate of 45,082 shares of common stock at a price of $0.271 per share. On September 10, 2024, Fund

IV sold an aggregate of 86,259 shares of common stock at a price of $0.270 per share. On September 11, 2024, Fund IV sold an aggregate

of 15,563 shares of common stock at a price of $0.270 per share. On September 12, 2024, Fund IV sold an aggregate 124,742 shares of common

stock at a price of $0.270 per share. On September 13, 2024, Fund IV sold an aggregate of 257,690 shares of common stock at a price of

$0.268 per share. The shares were sold in market transactions.

As

a result of the transactions described above, Fund IV owns an aggregate of 682,958 shares of common stock of the Issuer.

Summary

of Ownership

The

following table shows the number of shares of the Issuer’s Common Stock after giving effect to the transactions described in this

Schedule 13D/A-15 and the percentage ownership of Fund IV.

| | |

Number

of Shares owned as of September 16, 2024 | | |

Total

ownership as a % of fully diluted shares as of September 16, 2024 | |

| Fund

IV | |

| 682,958 | | |

| 4.54 | % |

The

percentage of outstanding shares is based upon the Issuer having a total of 15,035,048 shares of Common Stock issued and outstanding

as of August 12, 2024 as reported by the Issuer in its Quarterly Report on Form 10-Q for the quarter ended June 30, 2024.

The

Reporting Persons reserve the right to acquire beneficial ownership or control over additional securities of the Issuer.

(b)

Any extraordinary corporate transaction, such as a merger, reorganization or liquidation, involving the Issuer or any of its subsidiaries.

None.

The Reporting Persons reserve the right to explore future opportunities.

(c)

A sale or transfer of a material amount of assets of the Issuer or any of its subsidiaries.

None.

(d)

Any change in the present board or directors or management of the Issuer, including plans or proposals to change the number of term of

directors or to fill any existing vacancies on the board.

None.

(e)

Any material change in the present capitalization or dividend policy of the Issuer.

None.

(f)

Any other material change in the Issuer’s business or corporate structure. None, except as set forth herein.

None.

(g)

Changes to the Issuer’s charter, bylaws or instruments corresponding thereto or other actions which may impede the acquisition

of control of the Issuer by any person.

None.

| CUSIP

No. 381119106 |

|

Page

7 of 9 |

(h)

Causing a class of securities of the Issuer to be delisted form a national securities exchange or to cease to be authorized to be quoted

in an inter-dealer quotation system of a registered national securities association.

None.

(i)

Causing a class of equity securities of the Issuer becoming eligible for termination of registration pursuant to Section 12(g)(4) of

the Act.

None.

(j)

Any action similar to any of those enumerated above.

None.

| Item

5. | Interest

in Securities of the Issuer is amended to read as follows: |

Giving

effect to the transactions covered by this Report, Fund IV sold 529,336 shares of the Issuer’s Common Stock and has remaining an

aggregate of 682,958 shares, representing 4.54% of the total issued and outstanding shares of the Issuer. As a result of this Report,

Fund IV is no longer subject to reporting requirements under Section 13d of the Exchange Act.

| Item

6. | Contracts,

Arrangements, Understandings or Relationships with Respect to Securities of the Issuer |

None.

| Item

7. | Material

to be Filed as Exhibits |

None

| CUSIP

No. 381119106 |

|

Page

8 of 9 |

Signatures

After

reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete

and correct.

| Sentient

GP IV, L.P. |

|

| |

|

|

| By: |

/s/

Mike de Leeuw |

|

| |

Mike

de Leeuw, Director |

|

| Date: |

September

16, 2024 |

|

| |

|

| Sentient

Executive GP IV, Limited |

|

| |

|

| By

|

/s/

Mike de Leeuw |

|

| |

Mike

de Leeuw, Director |

|

| Date: |

September

16, 2024 |

|

| |

|

|

| Sentient

Global Resources Fund IV, L.P. |

|

| By:

Sentient GP IV, L.P., General Partner |

|

| By:

Sentient Executive GP IV, Limited, |

|

| General

Partner |

|

| |

|

| By: |

/s/

Mike de Leeuw |

|

| |

Mike

de Leeuw, Director |

|

| Date: |

September

16, 2024 |

|

| CUSIP

No. 381119106 |

|

Page

9 of 9 |

SCHEDULE

A

The

(i) name, (ii) title, (iii) citizenship, (iv) principal occupation and (v) business address of each director of Sentient Executive GP

IV, Limited are as follows. Sentient Executive GP IV, Limited does not have any executive officers.

| Name |

|

Title |

|

Citizenship |

|

Principal

Occupation |

|

Business

Address |

| |

|

|

|

|

|

|

|

|

| Mike

de Leeuw |

|

Director |

|

Cayman

Islands Australian |

|

Investment

Manager |

|

Governors

Square

Building

4, 2nd Floor

23

Lime Tree Bay Avenue

P.O.

Box 32315

Grand

Cayman KY1-1209

Cayman

Islands |

| |

|

|

|

|

|

|

|

|

| Greg

Link |

|

Director |

|

Cayman

Islands New Zealand |

|

Director |

|

Governors

Square

Building

4, 2nd Floor

23

Lime Tree Bay Avenue

P.O.

Box 32315

Grand

Cayman KY1-1209

Cayman

Islands |

| |

|

|

|

|

|

|

|

|

| Pieter

Britz |

|

Director

|

|

Australian |

|

Director |

|

1

Harstaf Close

Belrose,

NSW 2085

Australia |

| |

|

|

|

|

|

|

|

|

| Peter

Weidmann |

|

Director |

|

Germany |

|

Investor

Relations Manager |

|

Zentnerstrasse

42

80796

Munich

Germany |

| |

|

|

|

|

|

|

|

|

| Andrew

Pullar |

|

Director

|

|

Australian

United Kingdom |

|

Director |

|

81

Douglas Street

St

Ives, NSW 2075

Australia |

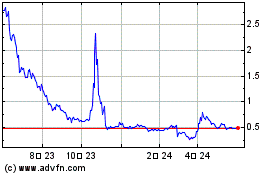

Golden Minerals (AMEX:AUMN)

過去 株価チャート

から 10 2024 まで 11 2024

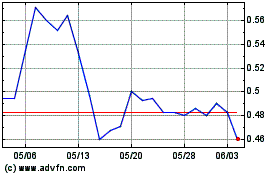

Golden Minerals (AMEX:AUMN)

過去 株価チャート

から 11 2023 まで 11 2024