UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D/A

Under the Securities Exchange Act of 1934

(Amendment No. 11)*

ARMATA PHARMACEUTICALS, INC.

(Name of Issuer)

Common Stock, $0.01 par value

(Title of Class of Securities)

04216R 102

(CUSIP Number)

Innoviva, Inc.

1350 Old Bayshore Highway Suite 400

Burlingame, CA

877-202-1097

Attention: Pavel Raifeld

Chief Executive Officer

(Name, Address and Telephone Number of Person Authorized to

Receive Notices and Communications)

November 12, 2024

(Date of Event which Requires Filing of this Statement)

|

|

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e),

240.13d-1(f) or 240.13d-1(g), check the following box. ☐ |

|

|

|

|

|

|

|

Note: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See §240.13d-7 for other parties to whom

copies are to be sent.

|

|

|

|

|

|

|

|

* The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing

information which would alter disclosures provided in a prior cover page.

|

|

|

|

|

|

|

|

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the

liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

|

|

|

|

Persons who respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number.

|

|

|

1

|

NAMES OF REPORTING PERSONS

|

|

|

|

Innoviva, Inc

|

|

|

|

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

|

☒

|

| |

(b)

|

☐

|

|

|

|

|

3

|

SEC USE ONLY

|

|

|

|

|

|

|

|

|

|

|

4

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

|

|

|

|

WC

|

|

|

|

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(D) OR 2(E)

|

|

☐

|

|

|

|

|

|

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

|

|

Delaware

|

|

|

|

|

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH

|

7

|

SOLE VOTING POWER

|

|

|

|

17,421,600 (1)

|

|

|

|

|

|

|

8

|

SHARED VOTING POWER

|

|

|

|

46,756,659 (2)

|

|

|

|

|

|

|

9

|

SOLE DISPOSITIVE POWER

|

|

|

|

17,421,600 (1)

|

|

|

|

|

|

|

10

|

SHARED DISPOSITIVE POWER

|

|

|

|

46,756,659 (2)

|

|

|

|

|

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

|

|

64,178,259 (3)

|

|

|

|

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

|

|

☐

|

|

|

|

|

|

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

|

|

85.2% (4)

|

|

|

|

|

|

|

14

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

|

|

|

|

CO

|

|

|

|

|

|

| (1) |

Includes 8,710,800 shares of Common Stock owned by the Reporting Persons and 8,710,800 shares of Common Stock issuable upon exercise of the warrants to purchase Common Stock beneficially owned by the Reporting Persons.

|

| (2) |

Includes 16,365,969 shares of Common Stock owned by the Reporting Persons, 10,653,847 shares of Common Stock issuable upon exercise of the warrants to purchase Common Stock beneficially owned by the Reporting Persons, and 19,736,843 shares

of Common Stock issuable upon the conversion of a certain convertible loan held by the Reporting Persons (excluding any accrued interest) beneficially owned by the Reporting Persons.

|

| (4) |

Based on 36,183,067 shares of Common Stock outstanding as of November 13, 2024, as set forth on the Issuer’s Quarterly Report on Form 10-Q, plus 19,736,843 shares of Common Stock issuable upon the conversion of a certain convertible loan

held by the Reporting Persons, excluding any accrued interest, and shares of Common Stock issuable upon exercise of the warrants to purchase Common Stock beneficially owned by the Reporting Persons.

|

|

1

|

NAMES OF REPORTING PERSONS

|

|

|

|

Innoviva Strategic Opportunities LLC

|

|

|

|

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

|

☐

|

| |

(b)

|

☐

|

|

|

|

|

3

|

SEC USE ONLY

|

|

|

|

|

|

|

|

|

|

|

4

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

|

|

|

|

WC

|

|

|

|

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(D) OR 2(E)

|

|

☐

|

|

|

|

|

|

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

|

|

Delaware

|

|

|

|

|

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH

|

7

|

SOLE VOTING POWER

|

|

|

0

|

|

|

|

|

|

|

8

|

SHARED VOTING POWER

|

|

|

|

46,756,659 (1)

|

|

|

|

|

|

|

9

|

SOLE DISPOSITIVE POWER

|

|

|

0

|

|

|

|

|

|

|

10

|

SHARED DISPOSITIVE POWER

|

|

|

|

46,756,659 (1)

|

|

|

|

|

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

|

|

46,756,659 (2)

|

|

|

|

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

|

|

☐

|

|

|

|

|

|

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

|

|

62.1% (3)

|

|

|

|

|

|

|

14

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

|

|

|

|

OO

|

|

|

|

|

|

| (1) |

Includes 16,365,969 shares of Common Stock owned by the Reporting Persons, 10,653,847 shares of Common Stock issuable upon exercise of the warrants to purchase Common Stock beneficially owned by the Reporting Persons, and 19,736,843 shares

of Common Stock issuable upon the conversion of a certain convertible loan held by the Reporting Persons (excluding any accrued interest) beneficially owned by the Reporting Persons.

|

| (3) |

Based on 36,183,067 shares of Common Stock outstanding as of November 13, 2024, as set forth on the Issuer’s Quarterly Report on Form 10-Q, plus 19,736,843 shares of Common Stock issuable upon the conversion of a certain convertible loan

held by the Reporting Persons, excluding any accrued interest, and shares of Common Stock issuable upon exercise of the warrants to purchase Common Stock beneficially owned by the Reporting Persons.

|

Explanatory Note

This Amendment No. 11 to Schedule 13D (“Amendment No. 11”) amends and supplements the initial Statement of Beneficial Ownership on Schedule 13D, as filed with the U.S. Securities and Exchange Commission (the “SEC”) by

Innoviva, Inc. (“Innoviva”) on February 14, 2020, as amended and supplemented by Amendment No. 1 filed with the SEC on March 31, 2020 by Innoviva, as further amended and supplemented by Amendment No. 2 filed with the SEC on January 26, 2021 by Innoviva

and Innoviva Strategic Opportunities LLC, a wholly-owned subsidiary of Innoviva (“Innoviva Sub”), as further amended and supplemented by Amendment No. 3 filed with the SEC on March 17, 2021 by Innoviva and Innoviva Sub, as further amended and

supplemented by Amendment No. 4 filed with the SEC on April 1, 2021 by Innoviva and Innoviva Sub, as further amended and supplemented by Amendment No. 5 filed with the SEC on November 1, 2021 by Innoviva and Innoviva Sub, as further amended and

supplemented by Amendment No. 6 filed with the SEC on February 11, 2022 by Innoviva and Innoviva Sub, as further amended and supplemented by Amendment No. 7 filed with the SEC on April 1, 2022, as further amended and supplemented by Amendment No. 8

filed with the SEC on January 10, 2023, as further amended and supplemented by Amendment No. 9 filed with the SEC on July 11, 2023, as further amended and supplemented by Amendment No. 10 filed with the SEC on March 4, 2024 (the “Schedule 13D”), with

respect to shares of common stock, $0.01 par value per share (“Common Stock”) of Armata Pharmaceuticals, Inc., a Washington corporation (the “Issuer”), warrants to acquire additional shares of Common Stock of the Issuer (“Warrants”), and secured

convertible debt convertible into Common Stock of the Issuer. Innoviva and Innoviva Sub (collectively, the “Reporting Persons”) are filing this amendment to reflect the extension of the maturity date of each of the July 2023 Credit Agreement (as

defined below) and the Convertible Credit Agreement (as defined below).

Except as specifically amended and supplemented by this Amendment No. 11, the Schedule 13D (as amended) remains in full force and effect.

| Item 4. |

Purpose of Transaction

|

Item 4 in Schedule 13D is hereby supplemented as follows:

On November 12, 2024, the Issuer and Innoviva Sub entered into an amendment to the credit and security agreement, dated as of July 10, 2023, by and among the Issuer, Innoviva Sub and the other parties thereto (as amended,

the “July 2023 Credit Agreement” and such amendment, the “Second Amendment to July 2023 Credit Agreement”), which Second Amendment to the July 2023 Credit Agreement extended the maturity date of the July 2023 Credit Agreement to January 10, 2026. On

this same date, the Issuer and Innoviva Sub entered into an amendment to the secured convertible credit and security agreement, dated January 10, 2023, by and among the Issuer, Innoviva Sub and the other parties thereto (as amended, the “Convertible

Credit Agreement” and such amendment, the “Third Amendment to Convertible Credit Agreement”), which Third Amendment to the Convertible Credit Agreement extended the maturity date of the Convertible Credit Agreement to January 10, 2026. On the date of this Amendment No. 11, the Reporting Persons collectively own 25,076,769 shares of Common Stock of the Issuer, warrants to acquire an additional 19,364,647 shares of Common Stock of the Issuer, and the

right to acquire an additional 19,736,843 shares of Common Stock of the Issuer upon conversion of the convertible loan (excluding any accrued interest).

| Item 5. |

Interest in Securities of the Issuer

|

Item 5 in Schedule 13D is hereby supplemented as follows:

As of the date of this filing of Amendment No. 11, the Reporting Persons collectively may be deemed to have beneficial ownership of 64,178,259 shares of Common Stock, representing approximately 85.2% of the outstanding

shares of Common Stock of the Issuer as of the date of this Amendment No. 11 to Schedule 13D, based on 36,183,067 shares of Common Stock outstanding as of November 13, 2024, as set forth on the Issuer’s Quarterly Report on Form 10-Q, plus 19,736,843

shares of Common Stock issuable upon the conversion of a certain convertible loan held by the Reporting Persons (excluding any accrued interest) and shares of Common Stock issuable upon exercise of the warrants to purchase Common Stock beneficially

owned by the Reporting Persons.

Except as set forth in this Schedule 13D (as amended), the Reporting Persons did not acquire or sell any shares of Common Stock or other securities of the Issuer during the last 60 days.

| Item 6. |

Contracts, Arrangements, Understandings or Relationships With Respect to Securities of the Issuer

|

Item 6 in Schedule 13D is hereby supplemented as follows:

On November 12, 2024, the Issuer and Innoviva Sub entered into the Second Amendment to July 2023 Credit Agreement and the Third Amendment to Convertible Credit Agreement, pursuant to which the maturity dates of the July

2023 Credit Agreement and of the Convertible Credit Agreement, respectively, were extended to January 10, 2026.

The foregoing descriptions of the terms of the Second Amendment to July 2023 Credit Agreement and of the Third Amendment to Convertible Credit Agreement do not purport to be complete and are qualified in their entirety by

the full texts of such agreements, copies of which are attached hereto as Exhibits 99.1 and 99.2, respectively.

| Item 7. |

Materials to be Filed as Exhibits

|

|

|

Second Amendment to Credit and Security Agreement, dated as of November 12, 2024, by and among the Issuer, Innoviva Sub and the other parties thereto.

|

| |

|

|

|

Third Amendment to Secured Convertible Credit and Security Agreement, dated as of November 12, 2024, by and among the Issuer, Innoviva Sub and the other parties thereto.

|

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

|

Dated: November 14, 2024

|

| |

|

|

INNOVIVA, INC.

|

| |

|

| By: |

/s/ Pavel Raifeld

|

| |

Name: Pavel Raifeld

|

| |

Title: Chief Executive Officer

|

| |

|

|

INNOVIVA STRATEGIC OPPORTUNITIES LLC

|

|

BY INNOVIVA, INC. (ITS MANAGING MEMBER)

|

| |

|

| By: |

/s/ Pavel Raifeld

|

| |

Name: Pavel Raifeld

|

| |

Title: Chief Executive Officer

|

Exhibit 99.1

SECOND AMENDMENT TO

CREDIT AND SECURITY AGREEMENT

SECOND AMENDMENT TO CREDIT AND SECURITY AGREEMENT, dated as of November 12, 2024 (this “Amendment”), by and among Armata Pharmaceuticals, Inc., a Washington corporation (the “Borrower”),

each Guarantor from time to time party to the Credit Agreement (as defined below) (the “Guarantors” and, together with the Borrower, the “Loan Parties”) and Innoviva Strategic Opportunities LLC, a Delaware limited liability company,

or an affiliate thereof (the “Lender”).

W I T N E S S E T H:

WHEREAS, the Loan Parties and the Lender have entered into that certain Credit and Security Agreement, dated as of July 10, 2023 (as the same may be amended, restated, amended and restated,

supplemented or otherwise modified from time to time, the “Credit Agreement”) (capitalized terms not otherwise defined in this Amendment have the same meanings assigned thereto in the Credit Agreement).

WHEREAS, the Borrower and the Lender have agreed to amend the Credit Agreement, pursuant to, and in accordance with, Section 11.02 of the Credit Agreement in order to effect the amendments set

forth herein, to be deemed effective on the Amendment Effective Date (as defined below).

NOW, THEREFORE, in consideration of the foregoing and for other good and valuable consideration, the receipt and sufficiency of all of which is hereby acknowledged, the parties hereto hereby agree

as follows:

SECTION 1. Amendment to Credit Agreement.

(a) The definition of “Maturity Date” in Section 1.01 of the Credit Agreement is hereby amended and restated in its entirety to read as follows:

““Maturity Date” means January 10, 2026.”

SECTION 2. Representations and Warranties. Each of the Loan Parties hereby represents and warrants on the Amendment Effective Date that:

(a) Each of the Loan Parties (i) is a corporation, limited liability company or limited partnership, as applicable, duly organized, validly existing and in good standing under the laws of

the state or jurisdiction of its organization, (ii) has all requisite power and authority to conduct its business as now conducted and as presently contemplated and, in the case of the Borrower, to make the borrowings hereunder, and to execute and

deliver this Amendment, and to consummate the transactions contemplated thereby, and (iii) is duly qualified to do business and is in good standing in each jurisdiction other than the state or jurisdiction of its organization in which the character

of the properties owned or leased by it or in which the transaction of its business makes such qualification necessary, except (solely for the purposes of this subclause (iii)) where the failure to be so qualified and in good standing could

reasonably be expected to have a Material Adverse Effect. The Borrower and its Subsidiaries have obtained, and are in compliance with, all licenses, permits, approvals and other authorizations necessary for the operation of their business

(b) The execution, delivery and performance by each Loan Party of this Amendment, (i) has been duly authorized by all necessary

action, (ii) does not

and will not contravene

(A) any of its Governing Documents,

(B) any applicable Requirement of Law or

(C) any Contractual Obligation binding on or otherwise

affecting it or any of its properties, (iii) does not and will not result in or require the creation of any Lien (other than pursuant to this Amendment) upon or with respect to any of its properties, except, in the case of clause (ii)(C), to the

extent where such contravention, default, noncompliance, suspension, revocation, impairment, forfeiture or nonrenewal could not reasonably be expected to have a Material Adverse Effect.

(c) No authorization or approval or other

action by, and no notice to or filing with, any Governmental Authority is required in connection with the

due execution, delivery and performance by any Loan Party of this Amendment other than any authorization, approval, notice or filing or other

action as has been previously been obtained or taken and remains in

full force and effect on the Amendment Effective Date.

(d) This Amendment is a legal, valid and binding obligation of each Loan Party, enforceable against each, such Loan Party in accordance with its terms, except as enforceability may be

limited by applicable bankruptcy, insolvency, reorganization, moratorium or other similar laws affecting the enforcement of creditors’ rights generally and by general principles of equity.

(e) The representations and warranties of the Borrower and each other Loan Party contained in Article V of the Credit Agreement and any other Loan Document are true and correct in

all material respects (and in all respects if any such representation or warranty is already qualified by materiality) on and as of the Amendment Effective Date, except to the extent that such representations and warranties specifically refer to an

earlier date, in which case they are true and correct in all material respects (and in all respects if any such representation or warranty is already qualified by materiality) as of such earlier date.

SECTION 3. Conditions of Effectiveness of this Amendment. This Amendment shall become effective as of the date on which the following conditions shall have been satisfied (or waived) (the

“Amendment Effective Date”):

(a) the Lender (or its counsel) shall have received counterparts to this Amendment, duly executed by the Borrower and the other Loan Parties; and

(b) the Borrower shall have paid or shall pay on the Amendment Effective Date all costs, fees and expenses required to be paid pursuant to Section 7 hereof and Section 11.04 of the

Credit Agreement, including, without limitation, fees and expenses of Willkie Farr & Gallagher LLP, counsel to the Lender.

SECTION 4. Reference to and Effect on the Credit Agreement and the other Loan Documents.

(a) On and after the Amendment Effective Date, each reference in the Credit Agreement to “this Agreement,” “hereunder,” “hereof” or words of like import referring to the Credit Agreement

shall mean and be a reference to the Credit Agreement, as amended by this Amendment.

(b) The Credit Agreement, as specifically amended by this Amendment, and each of the other Loan Documents are and shall continue to be in full force and effect and are hereby in all

respects ratified and confirmed.

(c) The execution, delivery and effectiveness of this Amendment shall not, except as expressly provided herein, operate as a waiver of any right, power or remedy of the Lender under any of

the Loan Documents, nor constitute a waiver of any provision of any of the Loan Documents. On and after the Amendment Effective Date, this Amendment shall for all purposes constitute a Loan Document.

(d) This Amendment shall not extinguish the Loans or any other Obligations outstanding under the Credit Agreement. Nothing contained herein shall be construed as a substitution or novation

of the Loans or any other Obligations outstanding under the Credit Agreement, which shall remain outstanding after the Amendment Effective Date as modified hereby.

(e) The Loan Parties expressly acknowledge and agree that (i) there has not been, and this Amendment does not constitute or establish, a novation with respect to the Credit Agreement or

any other Loan Document, or a mutual departure from the strict terms, provisions, and conditions thereof and (ii) nothing in this Amendment shall affect or limit the Lender’s right to demand payment of liabilities owing from the Loan Parties to the

Lender under, or to demand strict performance of the terms, provisions and conditions of, the Credit Agreement and the other Loan Documents, to exercise any and all rights, powers, and remedies under the Credit Agreement or the other Loan Documents

or at law or in equity, or to do any and all of the foregoing, immediately at any time after the occurrence and continuance of an Event of Default under the Credit Agreement or the other Loan Documents.

SECTION 5. Reaffirmation. Each Loan Party hereby reaffirms its obligations under the Credit Agreement and each other Loan Document to which it is a party, in each case as amended by this

Amendment and acknowledges and agrees that the grants of security interests by and the guarantees of the Loan Parties contained in the Loan Documents are, and shall remain, in full force and effect immediately after giving effect to this Amendment.

SECTION 6. Execution in Counterparts; Electronic Signatures. This Amendment may be executed by one or more of the parties to this Amendment on any number of separate counterparts

(including by facsimile or other electronic imaging means), and all of said counterparts taken together shall be deemed to constitute one and the same instrument. Delivery of an executed signature page of this Amendment by facsimile or other

electronic transmission (e.g. “pdf” or “tif” format) shall be effective as delivery of a manually executed counterpart hereof. The words “execution”, “execute”, “signed”, “signature” and words of like import in or related to this Amendment or any

other document to be signed in connection with this Amendment and the transactions contemplated hereby shall be deemed to include electronic signatures, the electronic matching of assignment terms and contract formations on electronic platforms

approved by the Lender, or the keeping of records in electronic form, each of which shall be of the same legal effect, validity or enforceability as a manually executed signature or the use of a paper-based recordkeeping system, as the case may be,

to the extent and as provided for in any applicable law, including the Federal Electronic Signatures in Global and National Commerce Act, the New York State Electronic Signatures and Records Act, or any other similar state laws based on the Uniform

Electronic Transactions Act; provided that notwithstanding anything contained herein to the contrary the Lender is under no obligation to agree to accept electronic signatures in any form or in any format unless expressly agreed to by the

Lender pursuant to procedures approved by it.

SECTION 7. Costs and Expenses. The Borrower agrees to reimburse the Lender for its reasonable out of pocket expenses in connection with this Amendment, including the reasonable fees,

charges and disbursements of Willkie Farr & Gallagher LLP, counsel for the Lender, in each case, to the extent that an invoice that sets forth such costs and expense in reasonable detail has been provided to the Borrower in accordance with

Section 11.04 of the Credit Agreement.

SECTION 8.

Governing Law; Consent to Jurisdiction; Service of Process and Venue; Waiver of Jury Trial, Etc.

The provisions of Sections 11.09 (

GOVERNING LAW), 11.10 (

CONSENT TO JURISDICTION; SERVICE OF PROCESS AND VENUE) and 11.11 (

WAIVER OF JURY TRIAL, ETC.) of the

Credit Agreement are hereby incorporated in this Amendment,

mutatis mutandis, and shall have the same effect as if this Amendment were a part of the Credit Agreement.

SECTION 9. Headings. The section headings used in this Amendment are included herein for convenience of reference only and shall not constitute a part of this Amendment for any other

purpose, be given any substantive effect, affect the construction hereof or be taken into consideration in the interpretation hereof.

[Signature Pages Follow]

IN WITNESS WHEREOF, the parties hereto have caused this Amendment to be executed by their respective signatories thereunto duly authorized, as of the date

first above written.

| |

ARMATA PHARMACEUTICALS, INC.,

|

| |

as Borrower

|

| |

|

|

| |

By: |

|

|

| |

C3J THERAPEUTICS, INC,

|

| |

as Guarantor

|

| |

|

|

| |

By: |

/s/ Deborah Birx

|

|

| |

Name: |

Deborah Birx

|

| |

Title:

|

CEO |

| |

C3 JIAN, LLC, |

| |

as Guarantor

|

| |

|

|

| |

By: |

/s/ Deborah Birx

|

|

| |

Name: |

Deborah Birx

|

| |

Title:

|

CEO |

[Signature Page to Second Amendment to Credit and Security Agreement]

| |

INNOVIVA STRATEGIC OPPORTUNITIES LLC, |

| |

as Lender

|

| |

|

| |

By: Innoviva, Inc. (its managing member) |

| |

|

|

| |

By: |

|

|

| |

Name: |

Pavel Raifeld

|

| |

Title:

|

Chief Executive Officer |

[Signature Page to Second Amendment to Credit and Security Agreement]

Exhibit 99.2

THIRD AMENDMENT TO SECURED CONVERTIBLE

CREDIT AND SECURITY AGREEMENT

THIRD AMENDMENT TO SECURED CONVERTIBLE CREDIT AND SECURITY AGREEMENT, dated as of November 12, 2024 (this “Amendment”), by and among Armata Pharmaceuticals, Inc., a Washington corporation (the

“Borrower”), each Guarantor from time to time party to the Credit Agreement (as defined below) (the “Guarantors” and, together with the Borrower, the “Loan Parties”) and Innoviva Strategic Opportunities LLC, a Delaware limited

liability company, or an affiliate thereof (the “Lender”).

W I T N E S S E T H:

WHEREAS, the Loan Parties and the Lender have entered into that certain Secured Convertible Credit and Security Agreement, dated as of January 10, 2023 (as the same may be amended, restated, amended

and restated, supplemented or otherwise modified from time to time, the “Credit Agreement”) (capitalized terms not otherwise defined in this Amendment have the same meanings assigned thereto in the Credit Agreement).

WHEREAS, the Borrower and the Lender have agreed to amend the Credit Agreement, pursuant to, and in accordance with, Section 11.02 of the Credit Agreement in order to effect the amendments set forth

herein, to be deemed effective on the Amendment Effective Date (as defined below).

NOW, THEREFORE, in consideration of the foregoing and for other good and valuable consideration, the receipt and sufficiency of all of which is hereby acknowledged, the parties hereto hereby agree as

follows:

SECTION 1. Amendment to Credit Agreement.

(a) The definition of “Maturity Date” in Section 1.01 of the Credit Agreement is hereby amended and restated in its entirety to read as follows:

““Maturity Date” means January 10, 2026.”

SECTION 2. Representations and Warranties. Each of the Loan Parties hereby represents and warrants on the Amendment Effective Date

that:

(a) Each of the Loan Parties (i) is a corporation, limited liability company or limited partnership, as applicable, duly organized, validly existing and in good standing under the laws of

the state or jurisdiction of its organization, (ii) has all requisite power and authority to conduct its business as now conducted and as presently contemplated and, in the case of the Borrower, to make the borrowings hereunder, and to execute and

deliver this Amendment, and to consummate the transactions contemplated thereby, and (iii) is duly qualified to do business and is in good standing in each jurisdiction other than the state or jurisdiction of its organization in which the character

of the properties owned or leased by it or in which the transaction of its business makes such qualification necessary, except (solely for the purposes of this subclause (iii)) where the failure to be so qualified and in good standing could

reasonably be expected to have a Material Adverse Effect. The Borrower and its Subsidiaries have obtained, and are in compliance with, all licenses, permits, approvals and other authorizations necessary for the operation of their business

(b) The execution, delivery and performance by each Loan Party of this Amendment, (i) has been duly authorized by all necessary

action, (ii) does not

and will not contravene

(A) any of its Governing Documents,

(B) any applicable Requirement of Law or

(C) any Contractual Obligation binding on or otherwise

affecting it or any of its properties, (iii) does not and will not result in or require the creation of any Lien (other than pursuant to this Amendment) upon or with respect to any of its properties, except, in the case of clause (ii)(C), to the

extent where such contravention, default, noncompliance, suspension, revocation, impairment, forfeiture or nonrenewal could not reasonably be expected to have a Material Adverse Effect.

(c) No authorization or approval or other

action by, and no notice to or filing with, any Governmental Authority is required in connection with the due

execution, delivery and performance by any Loan Party of this Amendment other than any authorization, approval, notice or filing or other

action as has been previously been obtained or taken and remains in full

force and effect on the Amendment Effective Date.

(d) This Amendment is a legal, valid and binding obligation of each Loan Party, enforceable against each, such Loan Party in accordance with its terms, except as enforceability may be

limited by applicable bankruptcy, insolvency, reorganization, moratorium or other similar laws affecting the enforcement of creditors’ rights generally and by general principles of equity.

(e) The representations and warranties of the Borrower and each other Loan Party contained in Article V of the Credit Agreement and any other Loan Document are true and correct in

all material respects (and in all respects if any such representation or warranty is already qualified by materiality) on and as of the Amendment Effective Date, except to the extent that such representations and warranties specifically refer to an

earlier date, in which case they are true and correct in all material respects (and in all respects if any such representation or warranty is already qualified by materiality) as of such earlier date.

SECTION 3. Conditions of Effectiveness of this Amendment. This Amendment shall become effective as of the date on which the following conditions

shall have been satisfied (or waived) (the “Amendment Effective Date”):

(a) the Lender (or its counsel) shall have received counterparts to this Amendment, duly executed by the Borrower and the other Loan Parties; and

(b) the Borrower shall have paid or shall pay on the Amendment Effective Date all costs, fees and expenses required to be paid pursuant to

Section 7

hereof and Section 11.04 of the Credit Agreement, including, without limitation, fees and expenses of Willkie Farr & Gallagher LLP, counsel to the Lender.

SECTION 4. Reference to and Effect on the Credit Agreement and the other Loan Documents.

(a) On and after the Amendment Effective Date, each reference in the Credit Agreement to “this Agreement,” “hereunder,” “hereof” or words of like import referring to the Credit Agreement

shall mean and be a reference to the Credit Agreement, as amended by this Amendment.

(b) The Credit Agreement, as specifically amended by this Amendment, and each of the other Loan Documents are and shall continue to be in full force and effect and are hereby in all respects

ratified and confirmed.

(c) The execution, delivery and effectiveness of this Amendment shall not, except as expressly provided herein, operate as a waiver of any right, power or remedy of the Lender under any of

the Loan Documents, nor constitute a waiver of any provision of any of the Loan Documents. On and after the Amendment Effective Date, this Amendment shall for all purposes constitute a Loan Document.

(d) This Amendment shall not extinguish the Loans or any other Obligations outstanding under the Credit Agreement. Nothing contained herein shall be construed as a substitution or novation

of the Loans or any other Obligations outstanding under the Credit Agreement, which shall remain outstanding after the Amendment Effective Date as modified hereby.

(e) The Loan Parties expressly acknowledge and agree that (i) there has not been, and this Amendment does not constitute or establish, a novation with respect to the Credit Agreement or any

other Loan Document, or a mutual departure from the strict terms, provisions, and conditions thereof and (ii) nothing in this Amendment shall affect or limit the Lender’s right to demand payment of liabilities owing from the Loan Parties to the

Lender under, or to demand strict performance of the terms, provisions and conditions of, the Credit Agreement and the other Loan Documents, to exercise any and all rights, powers, and remedies under the Credit Agreement or the other Loan Documents

or at law or in equity, or to do any and all of the foregoing, immediately at any time after the occurrence and continuance of an Event of Default under the Credit Agreement or the other Loan Documents.

SECTION 5. Reaffirmation. Each Loan Party hereby reaffirms its obligations under the Credit Agreement and each other Loan Document to which it is a

party, in each case as amended by this Amendment and acknowledges and agrees that the grants of security interests by and the guarantees of the Loan Parties contained in the Loan Documents are, and shall remain, in full force and effect immediately

after giving effect to this Amendment.

SECTION 6. Execution in Counterparts; Electronic Signatures. This Amendment may be executed by one or more of the parties to this Amendment on any

number of separate counterparts (including by facsimile or other electronic imaging means), and all of said counterparts taken together shall be deemed to constitute one and the same instrument. Delivery of an executed signature page of this

Amendment by facsimile or other electronic transmission (e.g. “pdf” or “tif” format) shall be effective as delivery of a manually executed counterpart hereof. The words “execution”, “execute”, “signed”, “signature” and words of like import in or

related to this Amendment or any other document to be signed in connection with this Amendment and the transactions contemplated hereby shall be deemed to include electronic signatures, the electronic matching of assignment terms and contract

formations on electronic platforms approved by the Lender, or the keeping of records in electronic form, each of which shall be of the same legal effect, validity or enforceability as a manually executed signature or the use of a paper-based

recordkeeping system, as the case may be, to the extent and as provided for in any applicable law, including the Federal Electronic Signatures in Global and National Commerce Act, the New York State Electronic Signatures and Records Act, or any other

similar state laws based on the Uniform Electronic Transactions Act; provided that notwithstanding anything contained herein to the contrary the Lender is under no obligation to agree to accept electronic signatures in any form or in any

format unless expressly agreed to by the Lender pursuant to procedures approved by it.

SECTION 7. Costs and Expenses. The Borrower agrees to reimburse the Lender for its reasonable out of pocket expenses in connection with this

Amendment, including the reasonable fees, charges and disbursements of Willkie Farr & Gallagher LLP, counsel for the Lender, in each case, to the extent that an invoice that sets forth such costs and expense in reasonable detail has been provided

to the Borrower in accordance with Section 11.04 of the Credit Agreement.

SECTION 8. Governing Law; Consent to Jurisdiction; Service of Process and Venue; Waiver of Jury Trial, Etc.

The

provisions of Sections 11.09 (

GOVERNING LAW), 11.10 (

CONSENT TO JURISDICTION; SERVICE OF PROCESS AND VENUE) and 11.11 (

WAIVER OF JURY

TRIAL, ETC.) of the Credit Agreement are hereby incorporated in this Amendment,

mutatis mutandis, and shall have the same effect as if this Amendment were a part of the Credit Agreement.

SECTION 9. Headings. The section headings used in this Amendment are included herein for convenience of reference only and shall not constitute a

part of this Amendment for any other purpose, be given any substantive effect, affect the construction hereof or be taken into consideration in the interpretation hereof.

[Signature Pages Follow]

IN WITNESS WHEREOF, the parties hereto have caused this Amendment to be executed by their respective signatories thereunto duly authorized, as of the date

first above written.

| |

ARMATA PHARMACEUTICALS, INC.,

|

| |

as Borrower

|

| |

|

|

| |

By: |

/s/ Deborah Birx

|

|

| |

Name: |

Deborah Birx

|

| |

Title:

|

CEO |

| |

C3J THERAPEUTICS, INC, |

| |

as Guarantor |

| |

|

|

| |

By: |

/s/ Deborah Birx

|

|

| |

Name: |

Deborah Birx

|

| |

Title:

|

CEO |

| |

C3 JIAN, LLC,

|

| |

as Guarantor |

| |

|

|

| |

By: |

/s/ Deborah Birx

|

|

| |

Name: |

Deborah Birx

|

| |

Title:

|

CEO |

[Signature Page to Third Amendment to Secured Convertible Credit and Security Agreement]

| |

INNOVIVA STRATEGIC OPPORTUNITIES LLC, |

| |

as Lender |

| |

|

| |

By: Innoviva, Inc. (its managing member) |

| |

|

|

| |

By: |

|

|

| |

Name: |

Pavel Raifeld |

| |

Title:

|

Chief Executive Officer |

[Signature Page to Third Amendment to Secured Convertible Credit and Security Agreement]

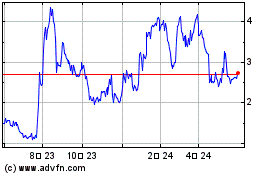

Armata Pharmaceuticals (AMEX:ARMP)

過去 株価チャート

から 10 2024 まで 11 2024

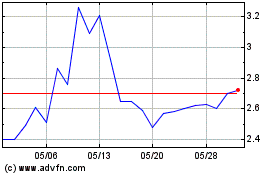

Armata Pharmaceuticals (AMEX:ARMP)

過去 株価チャート

から 11 2023 まで 11 2024