false

0000072741

8-K

2024-11-04

false

0000023426

¨

¨

¨

¨

8-K

2024-11-04

false

0000013372

¨

¨

¨

¨

0000315256

¨

8-K

2024-11-04

false

¨

¨

¨

0000072741

2024-11-04

2024-11-04

0000072741

es:TheConnecticutLightAndPowerCompanyMember

2024-11-04

2024-11-04

0000072741

es:NstarElectricCompanyMember

2024-11-04

2024-11-04

0000072741

es:PublicServiceCompanyOfNewHampshireMember

2024-11-04

2024-11-04

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

November 4, 2024

Commission

File Number |

Registrant; State of Incorporation

Address; and Telephone Number |

I.R.S. Employer

Identification No. |

| |

|

|

| 1-5324 |

EVERSOURCE

ENERGY

(a Massachusetts

voluntary association)

300

Cadwell Drive

Springfield,

Massachusetts 01104

Telephone: (800)

286-5000 |

04-2147929 |

| |

|

|

| 0-00404 |

THE

CONNECTICUT LIGHT AND POWER COMPANY

(a Connecticut

corporation)

107

Selden Street

Berlin,

Connecticut

06037-1616

Telephone: (800)

286-5000

|

06-0303850 |

| |

|

|

| 1-02301 |

NSTAR

ELECTRIC COMPANY

(a Massachusetts

corporation)

800

Boylston Street

Boston,

Massachusetts

02199

Telephone: (800)

286-5000 |

04-1278810 |

| |

|

|

| 1-6392 |

PUBLIC

SERVICE COMPANY OF NEW HAMPSHIRE

(a New

Hampshire corporation)

Energy

Park

780

North Commercial Street

Manchester,

New

Hampshire 03101-1134

Telephone: (800)

286-5000

|

02-0181050 |

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Securities registered pursuant to Section 12(b) of the Act: |

| Registrant |

Title of each class |

Trading

Symbol(s) |

Name of

each exchange on

which registered |

| Eversource Energy |

Common

Shares, $5.00 par value per share

|

ES |

New

York Stock Exchange |

| The Connecticut Light and Power Company |

None |

N/A |

N/A |

| NSTAR Electric Company |

None |

N/A |

N/A |

| Public Service Company of New Hampshire |

None |

N/A |

N/A |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the

Securities Exchange Act of 1934 (17 CFR §240.12b-2).

| |

Emerging

growth

company |

| Eversource Energy |

¨ |

| The Connecticut Light and Power Company |

¨ |

| NSTAR Electric Company |

¨ |

| Public Service Company of New Hampshire |

¨ |

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act.

| Eversource Energy |

¨ |

| The Connecticut Light and Power Company |

¨ |

| NSTAR Electric Company |

¨ |

| Public Service Company of New Hampshire |

¨ |

| Document Type |

8-K |

| Document Period End Date |

2024-11-04 |

| Amendment Flag |

false |

| CIK |

0000023426 |

| THE CONNECTICUT LIGHT_Written communications |

¨ |

| THE CONNECTICUT LIGHT_Soliciting material pursuant to |

¨ |

| THE CONNECTICUT LIGHT_Pre-commencement communications pursuant |

¨ |

| THE CONNECTICUT LIGHT_Pre-commencement communications pursuant |

¨ |

| Document Type |

8-K |

| Document Period End Date |

2024-11-04 |

| Amendment Flag |

false |

| CIK |

0000013372 |

| NSTAR ELECTRIC_Written communications |

¨ |

| NSTAR ELECTRIC_Soliciting material pursuant to |

¨ |

| NSTAR ELECTRIC_Pre-commencement communications pursuant |

¨ |

| NSTAR ELECTRIC_Pre-commencement communications pursuant |

¨ |

| CIK |

0000315256 |

| Public Service Company_Written communications |

¨ |

| Document Type |

8-K |

| Document Period End Date |

2024-11-04 |

| Amendment Flag |

false |

| Public Service Company_Soliciting material pursuant to |

¨ |

| Public Service Company_Pre-commencement communications pursuant |

¨ |

| Public Service Company_Pre-commencement communications pursuant |

¨ |

| |

|

| |

|

| |

|

| Section 2 |

Financial Information |

| Item 2.02 | Results of Operations and Financial Conditions. |

On November 4, 2024, Eversource Energy issued

a news release announcing its unaudited results of operations for the third quarter and nine months ended September 30, 2024, and

related financial information for certain of its subsidiaries as of and for the same period. A copy of the news release and related unaudited

financial reports are attached as Exhibits 99.1 and 99.2 and are incorporated herein by reference thereto.

The information contained in this Item 2.02, including

Exhibits 99.1 and 99.2, shall not be deemed “filed” with the Securities and Exchange Commission (“SEC”) nor incorporated

by reference in any registration statement filed by Eversource Energy or any subsidiary thereof under the Securities Act of 1933, as amended

(the “Securities Act”), unless specified otherwise.

| Item 7.01 | Regulation FD Disclosure. |

On November 5, 2024, Eversource Energy will

webcast a conference call with financial analysts during which senior management will discuss the company’s financial performance

through the third quarter of 2024. The webcast will be accessible from the Investors section of the Eversource Energy website at www.eversource.com.

Attached as Exhibit 99.3 and incorporated herein by reference are the slides to be discussed by Eversource Energy during the conference

call.

The information contained in this Item 7.01, including

Exhibit 99.3, shall not be deemed “filed” with the SEC nor incorporated by reference into any registration statement

filed by Eversource Energy or any subsidiary thereof under the Securities Act, unless specified otherwise.

| Section 9 |

Financial Statements and Exhibits |

| Item 9.01 | Financial Statements and Exhibits. |

[The remainder of this page left blank intentionally.]

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrants have duly caused this report to be signed on their behalf by the undersigned hereunto duly authorized.

| |

EVERSOURCE ENERGY

THE CONNECTICUT LIGHT AND POWER COMPANY

NSTAR ELECTRIC COMPANY

PUBLIC SERVICE COMPANY OF NEW HAMPSHIRE

(Registrants) |

| |

|

| November 4, 2024 |

By: |

/s/ Jay S. Buth |

| |

|

Jay S. Buth |

| |

|

Vice President, Controller and Chief Accounting Officer |

Exhibit 99.1

Eversource Energy Reports Third Quarter 2024

Results

HARTFORD, Conn. and BOSTON, Mass. (November 4, 2024) –

Eversource Energy (NYSE: ES) today reported a loss of $(118.1) million, or $(0.33) per share, for the third quarter of 2024, compared

with earnings of $339.7 million, or $0.97 per share, for the third quarter of 2023. Eversource Energy earnings totaled $739.1 million,

or $2.08 per share, in the first nine months of 2024, compared with earnings of $846.2 million, or $2.42 per share, in the first nine

months of 2023. For non-GAAP recurring earnings, Eversource Energy earned $405.9 million1, or $1.13 per share1

in the third quarter of 2024, compared with earnings of $339.7 million, or $0.97 per share, for the third quarter of 2023. Non-GAAP recurring

earnings totaled $1.26 billion1, or $3.56 per share1, in the first nine months of 2024, and $1.18 billion1,

or $3.38 per share1, in the first nine months of 2023.

Results for the third quarter of 2024 and first nine months of 2024

include an aggregate net after-tax loss of $524.0 million, or $1.48 per share, on a year-to-date basis, related to Eversource Energy's

sales and complete divestiture of its offshore wind investment. Results for the first nine months of 2023 included an after-tax impairment

charge of $331.0 million, or $0.95 per share, related to Eversource Energy’s estimate of the change in fair value of its offshore

wind investment. In addition, results include an after-tax land abandonment loss and other charges that totaled $6.9 million in the first

nine months of 2023.

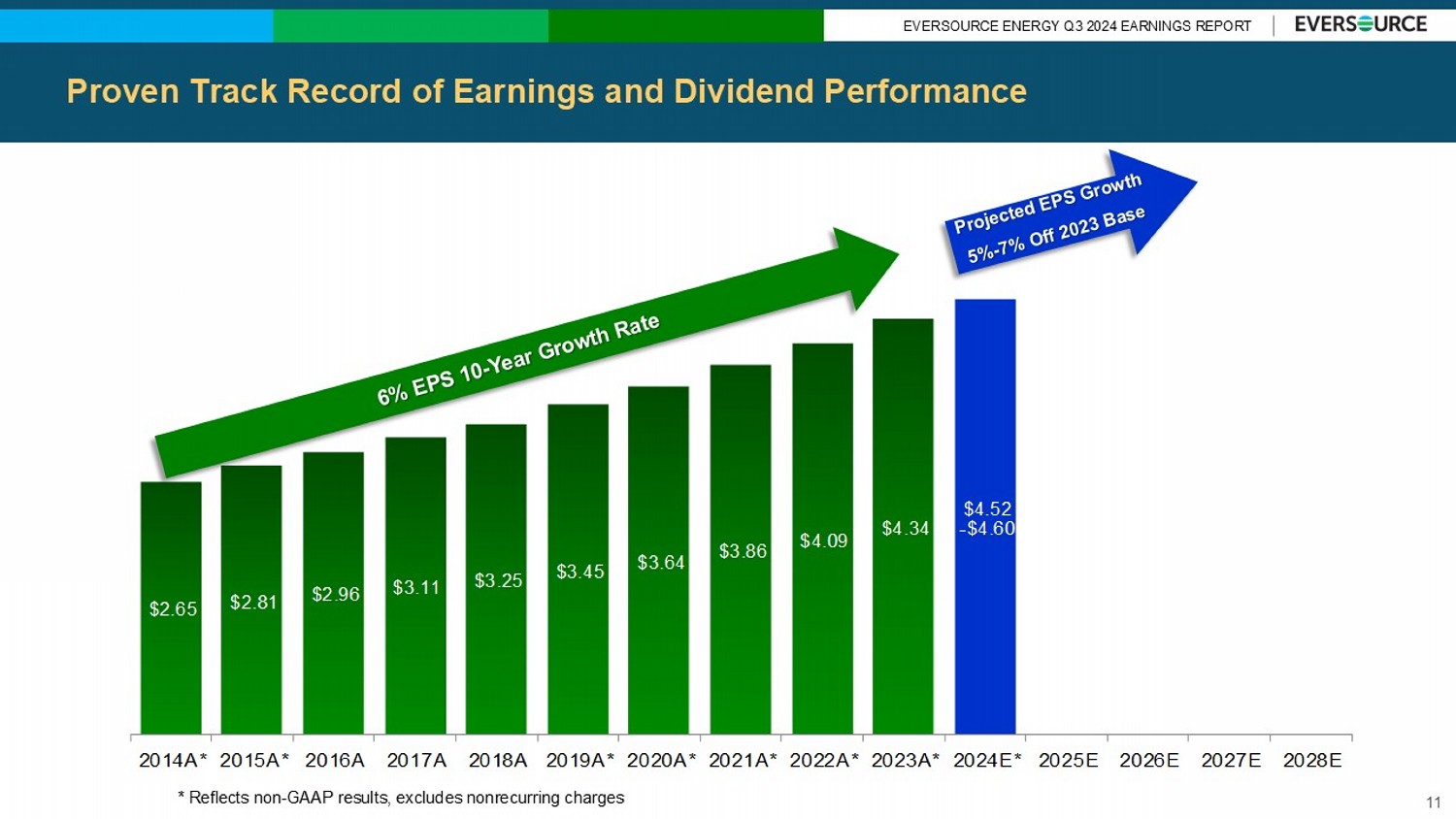

The Company is updating its 2024 non-GAAP recurring earnings

projection to a range of $4.52 per share and $4.60 per share from the initial projection of $4.50 per share and $4.67 per share. The

update reflects the impact of higher than anticipated interest expense. The Company reaffirms its annual long-term earnings per

share growth rate within the range of 5 to 7 percent from a 2023 base of $4.34 per share1, and increases its previous

forecasted capital investments of $23.1 billion to $23.7 billion for the period 2024 to 2028, as a result of the recently approved

Electric Sector Modernization Plan (ESMP) in Massachusetts.

“During the third quarter, we posted solid operational and financial

results, once again displaying the talent and commitment of our diverse, dedicated team of over 10,000 employees. I am also very proud

of the Eversource crews who worked hard in difficult conditions, providing mutual assistance in Virginia, to repair the heartbreaking

damage wrought by Hurricane Helene,” said Chairman, President and Chief Executive Officer Joe Nolan. “Following our exit

from offshore wind development, our investment thesis is very clear. We are a pure-play regulated utility, focused on providing innovative

technology and safe and reliable services to all our customers. We have a long runway for growth driven by regulated investments enabling

consistent return of value to all of our stakeholders.”

Electric Transmission

Eversource Energy’s transmission segment earned $174.9 million

in the third quarter of 2024 and $540.6 million in the first nine months of 2024, compared with earnings of $160.3 million in the third

quarter of 2023 and $476.4 million in the first nine months of 2023. Transmission segment results improved in both periods due primarily

to a higher level of investment in Eversource’s electric transmission system.

Electric Distribution

Eversource Energy’s electric distribution segment earned $203.5

million in the third quarter of 2024 and $521.3 million in the first nine months of 2024, compared with earnings of $173.3 million in

the third quarter of 2023 and $504.3 million in the first nine months of 2023. Improved results in both periods were due primarily to

base distribution rate increases at NSTAR Electric and PSNH, and continued investments in our distribution system. Third quarter results

also improved due to lower storm-related operations and maintenance (O&M) expense, partially offset by higher interest, depreciation

and property tax expense. Year-to-date results were impacted by the absence of the prior year benefit related to a favorable regulatory

decision in New Hampshire, as well as higher interest, O&M, depreciation and property tax expense.

Natural Gas Distribution

Eversource Energy’s natural gas distribution segment lost $(30.2)

million in the third quarter of 2024 and earned $187.4 million in the first nine months of 2024, compared with a loss of $(33.7) million

in the third quarter of 2023 and earnings of $148.2 million in the first nine months of 2023. Improved results in the third quarter were

due primarily to higher revenues associated with investments in our natural gas infrastructure, as well as a lower effective tax rate,

partially offset by higher property taxes, depreciation, non-tracked O&M and interest expense. Improved results for the first nine

months were due primarily to higher revenues, lower non-tracked O&M and a lower effective tax rate, partially offset by higher depreciation,

interest and property tax expense.

Water Distribution

Eversource Energy’s water distribution segment earned $23.7

million in the third quarter of 2024 and $37.1 million in the first nine months of 2024, compared with earnings of $16.6 million in the

third quarter of 2023 and $27.4 million in the first nine months of 2023. Higher earnings in the third quarter were due primarily to

higher revenues from our water acquisition and lower depreciation expense. Higher earnings for the first nine months were due primarily

to higher revenues and lower depreciation expense, partially offset by higher non-tracked O&M and interest expense.

Eversource Parent and Other Companies

Eversource Energy parent and other companies, excluding the offshore

wind and other impacts noted above, earned $34.0 million1 in the third quarter of 2024 and lost $(23.3) million1

in the first nine months of 2024, compared with earnings of $23.2 million in the third quarter of 2023 and $27.8 million1

in the first nine months of 2023. Improved third quarter results primarily reflect a lower effective tax rate, partially offset by higher

interest expense. Lower results for the first nine months were due primarily to higher interest expense and the absence of the prior

year net benefit from the planned liquidation of Eversource's investment in a clean energy fund in 2023, partially offset by a lower

effective tax rate.

Eversource Energy Consolidated Earnings

The following table reconciles consolidated GAAP earnings per share

for the third quarter and first nine months of 2024 and 2023:

| |

|

|

|

|

Third

Quarter |

|

|

First Nine

Months |

|

| |

2023 |

|

|

Reported GAAP EPS |

|

$ |

0.97 |

|

|

$ |

2.42 |

|

| |

|

|

|

Higher electric transmission segment earnings in 2024, net of

share dilution |

|

|

0.03 |

|

|

|

0.16 |

|

| |

|

|

|

Higher electric distribution segment revenues, partially offset

by higher interest, depreciation, property taxes and share dilution, and the year-to-date (YTD) absence of a prior year regulatory

benefit in New Hampshire |

|

|

0.07 |

|

|

|

0.03 |

|

| |

|

|

|

Higher natural gas distribution segment revenues and lower YTD

non-tracked O&M, partially offset by higher depreciation, interest and YTD share dilution |

|

|

0.01 |

|

|

|

0.11 |

|

| |

|

|

|

Higher water distribution segment earnings due to lower depreciation

expense and higher revenues, partially offset by higher O&M and interest expense |

|

|

0.02 |

|

|

|

0.02 |

|

| |

|

|

|

At parent and other companies, a lower effective tax rate, partially

offset by higher interest expense, as well as the YTD absence of a prior year benefit from the liquidation of an investment in a

clean energy fund |

|

|

0.03 |

|

|

|

(0.14 |

) |

| |

|

|

|

Losses on Offshore Wind Investments, and absence of transaction

and other charges from 2023 |

|

|

(1.46 |

) |

|

|

(0.52 |

) |

| |

2024 |

|

|

Reported GAAP EPS |

|

$ |

(0.33 |

) |

|

$ |

2.08 |

|

Financial results for the third quarter and first nine months of 2024

and 2023 for Eversource Energy’s business segments and parent and other companies are noted below:

Three months ended:

| (in millions, except EPS) | |

September 30,

2024 | | |

September 30,

2023 | | |

Increase/

(Decrease) | | |

2024 EPS 1 | | |

2023 EPS | | |

Increase/

(Decrease) | |

| Electric Transmission | |

$ | 174.9 | | |

$ | 160.3 | | |

$ | 14.6 | | |

$ | 0.49 | | |

$ | 0.46 | | |

$ | 0.03 | |

| Electric Distribution | |

| 203.5 | | |

| 173.3 | | |

| 30.2 | | |

| 0.57 | | |

| 0.50 | | |

| 0.07 | |

| Natural Gas Distribution | |

| (30.2 | ) | |

| (33.7 | ) | |

| 3.5 | | |

| (0.09 | ) | |

| (0.10 | ) | |

| 0.01 | |

| Water Distribution | |

| 23.7 | | |

| 16.6 | | |

| 7.1 | | |

| 0.07 | | |

| 0.05 | | |

| 0.02 | |

| Parent and Other Companies 1 | |

| 34.0 | | |

| 23.2 | | |

| 10.8 | | |

| 0.09 | | |

| 0.06 | | |

| 0.03 | |

| Loss on Offshore

Wind Investments | |

| (524.0 | ) | |

| — | | |

| (524.0 | ) | |

| (1.46 | ) | |

| — | | |

| (1.46 | ) |

| Reported (Loss)/Earnings | |

$ | (118.1 | ) | |

$ | 339.7 | | |

$ | (457.8 | ) | |

$ | (0.33 | ) | |

$ | 0.97 | | |

$ | (1.30 | ) |

Nine months ended:

| (in millions, except EPS) | |

September 30,

2024 | | |

September 30,

2023 | | |

Increase/ (Decrease) | | |

2024 EPS 1 | | |

2023 EPS 1 | | |

Increase/ (Decrease) | |

| Electric Transmission | |

$ | 540.6 | | |

$ | 476.4 | | |

$ | 64.2 | | |

$ | 1.52 | | |

$ | 1.36 | | |

$ | 0.16 | |

| Electric Distribution | |

| 521.3 | | |

| 504.3 | | |

| 17.0 | | |

| 1.47 | | |

| 1.44 | | |

| 0.03 | |

| Natural Gas Distribution | |

| 187.4 | | |

| 148.2 | | |

| 39.2 | | |

| 0.53 | | |

| 0.42 | | |

| 0.11 | |

| Water Distribution | |

| 37.1 | | |

| 27.4 | | |

| 9.7 | | |

| 0.10 | | |

| 0.08 | | |

| 0.02 | |

| Parent and Other Companies 1 | |

| (23.3 | ) | |

| 27.8 | | |

| (51.1 | ) | |

| (0.06 | ) | |

| 0.08 | | |

| (0.14 | ) |

| Losses on Offshore Wind Investments | |

| (524.0 | ) | |

| (331.0 | ) | |

| (193.0 | ) | |

| (1.48 | ) | |

| (0.95 | ) | |

| (0.53 | ) |

| Transaction and other charges | |

| — | | |

| (6.9 | ) | |

| 6.9 | | |

| — | | |

| (0.01 | ) | |

$ | 0.01 | |

| Reported Earnings | |

$ | 739.1 | | |

$ | 846.2 | | |

$ | (107.1 | ) | |

$ | 2.08 | | |

$ | 2.42 | | |

$ | (0.34 | ) |

Eversource Energy has approximately 364

million common shares outstanding and operates New England’s largest energy delivery system. It serves approximately 4.4

million electric, natural gas and water customers in Connecticut, Massachusetts and New Hampshire.

CONTACT:

Rima Hyder

(781) 441-8062

| Note:

Eversource Energy will webcast a conference call with senior management on November 5, 2024, beginning at 9 a.m. Eastern

Time. The webcast and associated slides can be accessed through Eversource Energy’s website at www.eversource.com. |

1 All per-share amounts in this news release are reported

on a diluted basis. The only common equity securities that are publicly traded are common shares of Eversource Energy. The earnings discussion

includes financial measures that are not recognized under generally accepted accounting principles (non-GAAP) referencing earnings and

EPS excluding losses on the offshore wind investments, a loss on the disposition of land that was initially acquired to construct the

Northern Pass Transmission project and was subsequently abandoned, and certain transaction and transition costs. EPS by business is also

a non-GAAP financial measure and is calculated by dividing the net income attributable to common shareholders of each business by the

weighted average diluted Eversource Energy common shares outstanding for the period. The earnings and EPS of each business do not represent

a direct legal interest in the assets and liabilities of such business, but rather represent a direct interest in Eversource Energy’s

assets and liabilities as a whole. Eversource Energy uses these non-GAAP financial measures to evaluate and provide details of earnings

results by business and to more fully compare and explain results without including these items. This information is among the primary

indicators management uses as a basis for evaluating performance and planning and forecasting of future periods. Management believes

the impacts of the losses on the offshore wind investments, the loss on the disposition of land associated with an abandoned project,

and transaction and transition costs are not indicative of Eversource Energy's ongoing costs and performance. Management views these

charges as not directly related to the ongoing operations of the business and therefore not an indicator of baseline operating performance.

Due to the nature and significance of the effect of these items on net income attributable to common shareholders and EPS, management

believes that the non-GAAP presentation is a more meaningful representation of Eversource Energy's financial performance and provides

additional and useful information to readers of this report in analyzing historical and future performance of the business. These non-GAAP

financial measures should not be considered as alternatives to reported net income attributable to common shareholders or EPS determined

in accordance with GAAP as indicators of Eversource Energy's operating performance.

This document includes statements concerning Eversource

Energy’s expectations, beliefs, plans, objectives, goals, strategies, assumptions of future events, future financial

performance or growth and other statements that are not historical facts. These statements are “forward-looking

statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Generally, readers can identify these

forward-looking statements through the use of words or phrases such as “estimate,” “expect,”

“anticipate,” “intend,” “plan,” “project,” “believe,”

“forecast,” “should,” “could” and other similar expressions. Forward-looking statements involve

risks and uncertainties that may cause actual results or outcomes to differ materially from those included in the forward-looking

statements. Forward-looking statements are based on the current expectations, estimates, assumptions or projections of management

and are not guarantees of future performance. These expectations, estimates, assumptions or projections may vary materially from

actual results. Accordingly, any such statements are qualified in their entirety by reference to, and are accompanied by, the

following important factors that may cause our actual results or outcomes to differ materially from those contained in our

forward-looking statements, including, but not limited to: cyberattacks or breaches, including those resulting in the compromise of

the confidentiality of our proprietary information and the personal information of our customers; the ability to qualify for

investment tax credits; variability in the costs and projected returns of the Revolution Wind and South Fork Wind offshore wind

projects and the risk of deterioration of market conditions in the offshore wind industry;

disruptions in the capital markets or other events that make our access to necessary capital more difficult or costly; changes in

economic conditions, including impact on interest rates, tax policies, and customer demand and payment ability; ability or inability

to commence and complete our major strategic development projects and opportunities; acts of war or terrorism, physical attacks or

grid disturbances that may damage and disrupt our electric transmission and electric, natural gas, and water distribution systems;

actions or inaction of local, state and federal regulatory, public policy and taxing bodies; substandard performance of third-party

suppliers and service providers; fluctuations in weather patterns, including extreme weather due to climate change; changes in

business conditions, which could include disruptive technology or development of alternative energy sources related to our current

or future business model; contamination of, or disruption in, our water supplies; changes in levels or timing of capital

expenditures; changes in laws, regulations or regulatory policy, including compliance with environmental laws and regulations;

changes in accounting standards and financial reporting regulations; actions of rating agencies; and other presently unknown or

unforeseen factors.

Other risk factors are detailed in Eversource Energy’s reports

filed with the Securities and Exchange Commission (SEC). They are updated as necessary and available on Eversource Energy’s website

at www.eversource.com and on the SEC’s website at www.sec.gov. All such factors are difficult to predict

and contain uncertainties that may materially affect Eversource Energy’s actual results, many of which are beyond our control.

You should not place undue reliance on the forward-looking statements, as each speaks only as of the date on which such statement is

made, and, except as required by federal securities laws, Eversource Energy undertakes no obligation to update any forward-looking statement

or statements to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated

events.

Exhibit 99.2

EVERSOURCE ENERGY

AND SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF (LOSS)/INCOME

| |

|

For the Three Months Ended September 30, |

|

|

For the Nine Months Ended September 30, |

|

| (Thousands of Dollars, Except Share Information) |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| Operating Revenues |

|

$ |

3,063,224 |

|

|

$ |

2,791,482 |

|

|

$ |

8,929,321 |

|

|

$ |

9,216,467 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Purchased Power, Purchased Natural Gas and Transmission |

|

|

917,858 |

|

|

|

1,168,599 |

|

|

|

2,995,245 |

|

|

|

4,232,912 |

|

| Operations and Maintenance |

|

|

510,439 |

|

|

|

500,711 |

|

|

|

1,437,826 |

|

|

|

1,382,563 |

|

| Depreciation |

|

|

366,145 |

|

|

|

329,528 |

|

|

|

1,060,650 |

|

|

|

962,477 |

|

| Amortization |

|

|

243,957 |

|

|

|

(143,979 |

) |

|

|

127,495 |

|

|

|

(438,460 |

) |

| Energy Efficiency Programs |

|

|

148,054 |

|

|

|

162,425 |

|

|

|

506,821 |

|

|

|

531,199 |

|

| Taxes Other Than Income Taxes |

|

|

264,371 |

|

|

|

243,645 |

|

|

|

740,414 |

|

|

|

704,989 |

|

| Total Operating Expenses |

|

|

2,450,824 |

|

|

|

2,260,929 |

|

|

|

6,868,451 |

|

|

|

7,375,680 |

|

| Operating Income |

|

|

612,400 |

|

|

|

530,553 |

|

|

|

2,060,870 |

|

|

|

1,840,787 |

|

| Interest Expense |

|

|

300,576 |

|

|

|

222,283 |

|

|

|

822,640 |

|

|

|

624,140 |

|

| Losses on Offshore Wind Investments |

|

|

464,019 |

|

|

|

— |

|

|

|

464,019 |

|

|

|

401,000 |

|

| Other Income, Net |

|

|

112,555 |

|

|

|

79,123 |

|

|

|

318,870 |

|

|

|

262,980 |

|

| (Loss)/Income Before Income Tax Expense |

|

|

(39,640 |

) |

|

|

387,393 |

|

|

|

1,093,081 |

|

|

|

1,078,627 |

|

| Income Tax Expense |

|

|

76,537 |

|

|

|

45,850 |

|

|

|

348,309 |

|

|

|

226,743 |

|

| Net (Loss)/Income |

|

|

(116,177 |

) |

|

|

341,543 |

|

|

|

744,772 |

|

|

|

851,884 |

|

| Net Income Attributable to Noncontrolling

Interests |

|

|

1,880 |

|

|

|

1,880 |

|

|

|

5,639 |

|

|

|

5,639 |

|

| Net (Loss)/Income Attributable

to Common Shareholders |

|

$ |

(118,057 |

) |

|

$ |

339,663 |

|

|

$ |

739,133 |

|

|

$ |

846,245 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic (Loss)/Earnings Per Common Share |

|

$ |

(0.33 |

) |

|

$ |

0.97 |

|

|

$ |

2.09 |

|

|

$ |

2.42 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted (Loss)/Earnings Per Common Share |

|

$ |

(0.33 |

) |

|

$ |

0.97 |

|

|

$ |

2.08 |

|

|

$ |

2.42 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted Average Common Shares Outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

359,520,518 |

|

|

|

349,704,155 |

|

|

|

354,483,338 |

|

|

|

349,461,219 |

|

| Diluted |

|

|

359,817,657 |

|

|

|

349,851,969 |

|

|

|

354,744,846 |

|

|

|

349,731,320 |

|

The

data contained in this report is preliminary and is unaudited. This report is being submitted for the sole purpose of providing information

to shareholders about Eversource Energy and Subsidiaries and is not a representation, prospectus, or intended for use in connection with

any purchase or sale of securities.

Exhibit 99.3

EVERSOURCE ENERGY Q3 2024 EARNINGS REPORT EVERSOURCE ENERGY Q3 2024 EARNINGS REPORT NOVEMBER 5, 2024 CUSTOMER COMMUNITY FINANCIAL EMPLOYEE CLEAN ENERGY RELIABILITY Exhibit 99.3

EVERSOURCE ENERGY Q3 2024 EARNINGS REPORT Safe Harbor Statement 1 All per - share amounts in this presentation are reported on a diluted basis. The only common equity securities that are publicly traded are common shares of Eversource Energy. The earnings discussion includes financial measures that are not recognized under generally accepted accounting principles (non - GAAP) referencing earnings and EPS excludin g losses on the offshore wind investments, a loss on the disposition of land that was initially acquired to construct the Northern Pass Transmission project and was subsequently abandoned, and certain transactio n a nd transition costs. EPS by business is also a non - GAAP financial measure and is calculated by dividing the net income attributable to common shareholders of each business by the weighted average diluted Eversource En erg y common shares outstanding for the period. The earnings and EPS of each business do not represent a direct legal interest in the assets and liabilities of such business, but rather represent a direct interest in Eversource Energy’s assets and liabilities as a whole. Eversource Energy uses these non - GAAP financial measures to evaluate and provide details of earnings results by business and to more fully compare and explain resu lts without including these items. This information is among the primary indicators management uses as a basis for evaluating performance and planning and forecasting of future periods. Management believes the impacts of th e losses on the offshore wind investments, the loss on the disposition of land associated with an abandoned project, and transaction and transition costs are not indicative of Eversource Energy's ongoing costs and perfor man ce. Management views these charges as not directly related to the ongoing operations of the business and therefore not an indicator of baseline operating performance. Due to the nature and significance of the effect o f t hese items on net income attributable to common shareholders and EPS, management believes that the non - GAAP presentation is a more meaningful representation of Eversource Energy's financial performance and provides add itional and useful information to readers of this report in analyzing historical and future performance of the business. These non - GAAP financial measures should not be considered as alternatives to reported net income a ttributable to common shareholders or EPS determined in accordance with GAAP as indicators of Eversource Energy's operating performance. This document includes statements concerning Eversource Energy’s expectations, beliefs, plans, objectives, goals, strategies, as sumptions of future events, future financial performance or growth and other statements that are not historical facts. These statements are “forward - looking statements” within the meaning of the Private Securities Litigat ion Reform Act of 1995. Generally, readers can identify these forward - looking statements through the use of words or phrases such as “estimate,” “expect,” “anticipate,” “intend,” “plan,” “project,” “believe,” “forecast,” “ sho uld,” “could” and other similar expressions. Forward - looking statements involve risks and uncertainties that may cause actual results or outcomes to differ materially from those included in the forward - looking statements. Forward - lo oking statements are based on the current expectations, estimates, assumptions or projections of management and are not guarantees of future performance. These expectations, estimates, assumptions or projections may var y m aterially from actual results. Accordingly, any such statements are qualified in their entirety by reference to, and are accompanied by, the following important factors that may cause our actual results or outcom es to differ materially from those contained in our forward - looking statements, including, but not limited to: cyberattacks or breaches, including those resulting in the compromise of the confidentiality of our proprietary i nfo rmation and the personal information of our customers; the ability to qualify for investment tax credits and investment tax credit adders; variability in the costs and final investment returns of the Revolution Wind and South Fork Wi nd offshore wind projects as it relates to the purchase price post - closing adjustment under the terms of the sale agreement for these projects ; disruptions in the capital markets or other events that make our access to necessary capital more difficult or costly; chan ges in economic conditions, including impact on interest rates, tax policies, and customer demand and payment ability; ability or inability to commence and complete our major strateg ic development projects and opportunities; acts of war or terrorism, physical attacks or grid disturbances that may damage and disrupt our electric transmission and electric, natural gas, and water distribution systems; ac tions or inaction of local, state and federal regulatory, public policy and taxing bodies; substandard performance of third - party suppliers and service providers; fluctuations in weather patterns, including extreme weat her due to climate change; changes in business conditions, which could include disruptive technology or development of alternative energy sources related to our current or future business model; contamination of, or di sruption in, our water supplies; changes in levels or timing of capital expenditures; changes in laws, regulations or regulatory policy, including compliance with environmental laws and regulations; changes in accounting s tan dards and financial reporting regulations; actions of rating agencies; and other presently unknown or unforeseen factors. Other risk factors are detailed in Eversource Energy’s reports filed with the Securities and Exchange Commission (SEC). They ar e updated as necessary and available on Eversource Energy’s website at www.eversource.com and on the SEC’s website at www.sec.gov . All such factors are difficult to predict and contain uncertainties that may materially affect Eversource Energy’s actual res ults, many of which are beyond our control. You should not place undue reliance on the forward - looking statements, as each speaks only as of the date on which suc h statement is made, and, except as required by federal securities laws, Eversource Energy undertakes no obligation to update any forward - looking statement or statements to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events .

EVERSOURCE ENERGY Q3 2024 EARNINGS REPORT Agenda Business Update ▪ Key Strategic Priorities ▪ Electric Transmission and Distribution Investment Growth ▪ Massachusetts Clean Energy Transition 2 Joe Nolan Chairman, President & CEO John Moreira EVP, CFO & Treasurer Financial Update ▪ Q3 2024 Financial Results ▪ Regulatory Update ▪ Financing Activity Update

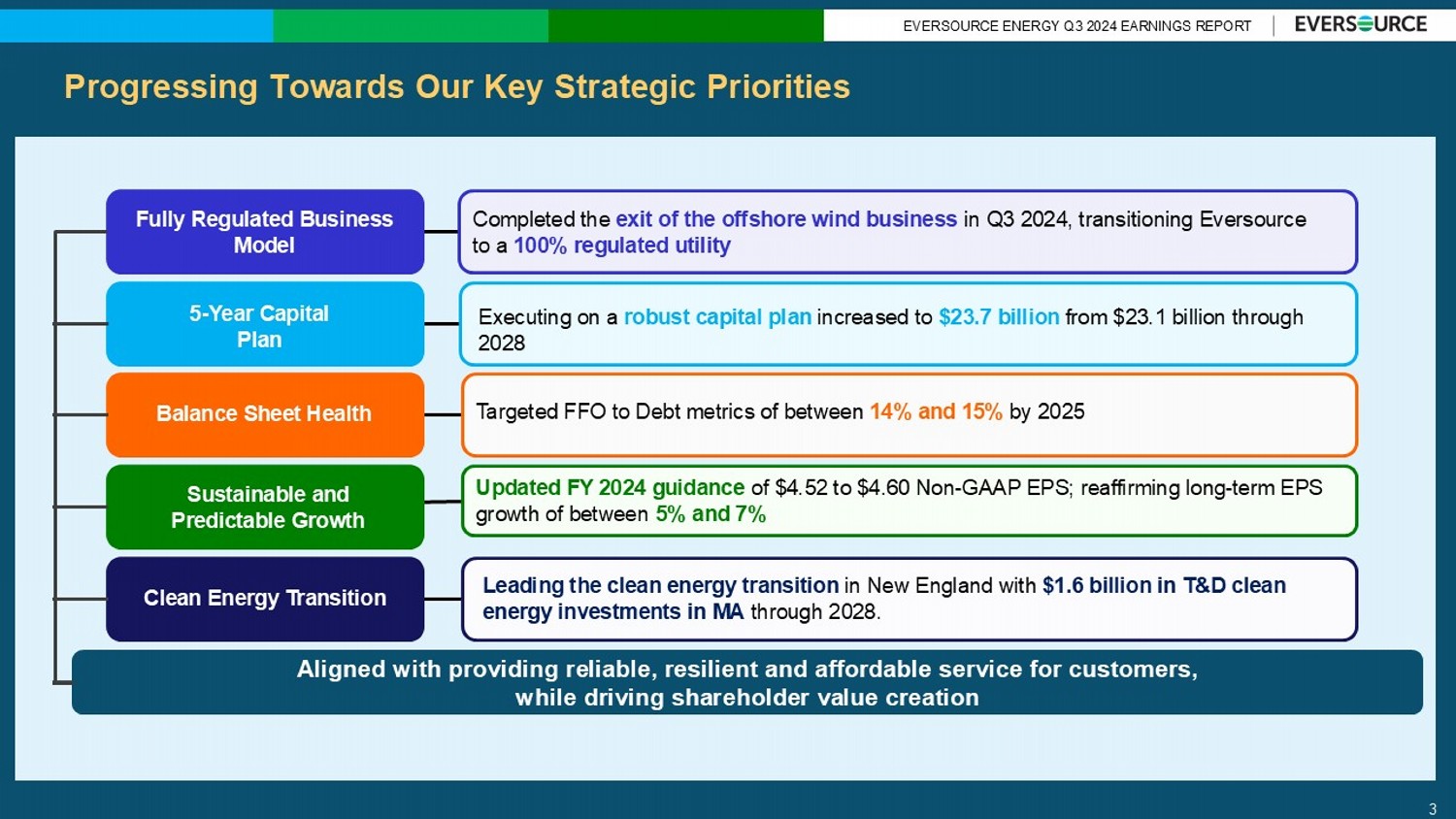

EVERSOURCE ENERGY Q3 2024 EARNINGS REPORT Aligned with providing reliable, resilient and affordable service for customers, while driving shareholder value creation Progressing Towards Our Key Strategic Priorities Updated FY 2024 guidance of $4.52 to $4.60 Non - GAAP EPS; reaffirming long - term EPS growth of between 5% and 7% Fully Regulated Business Model Balance Sheet Health Clean Energy Transition Completed the exit of the offshore wind business in Q3 2024, transitioning Eversource to a 100% regulated utility Targeted FFO to Debt metrics of between 14% and 15% by 2025 Leading the clean energy transition in New England with $1.6 billion in T&D clean energy investments in MA through 2028. 5 - Year Capital Plan Executing on a robust capital plan increased to $23.7 billion from $23.1 billion through 2028 Sustainable and Predictable Growth 3

EVERSOURCE ENERGY Q3 2024 EARNINGS REPORT Clean Energy Transition 4 Electric Distribution □ Electric Distribution Sector Modernization Plan approved by Massachusetts DPU for $600 million of capital investments □ Distribution Energy Resources clusters capital investments of $1 billion Expand Utility - Owned Solar and Battery Investments □ Solar proposals in Massachusetts and New Hampshire □ Expansion of Cape Cod Battery Energy Storage System Electric Transmission □ Dept. Of Energy funding secured for Clean Energy Hub in Southeastern Connecticut □ Enable renewable resources to connect to the electric grid

EVERSOURCE ENERGY Q3 2024 EARNINGS REPORT 5 Advanced Meter Infrastructure (AMI) □ Project on track – meter installation in 2025 □ Successful implementation of New Customer Information System Battery Project □ Expansion of Cape Cod Battery Energy Storage System □ Received $19.5 million in DOE funding Electric Sector Modernization Plan (ESMP) □ Received DPU approval August 2024 □ Incremental $600 million of capital expenditure Key Massachusetts Carbon Reducing Priorities

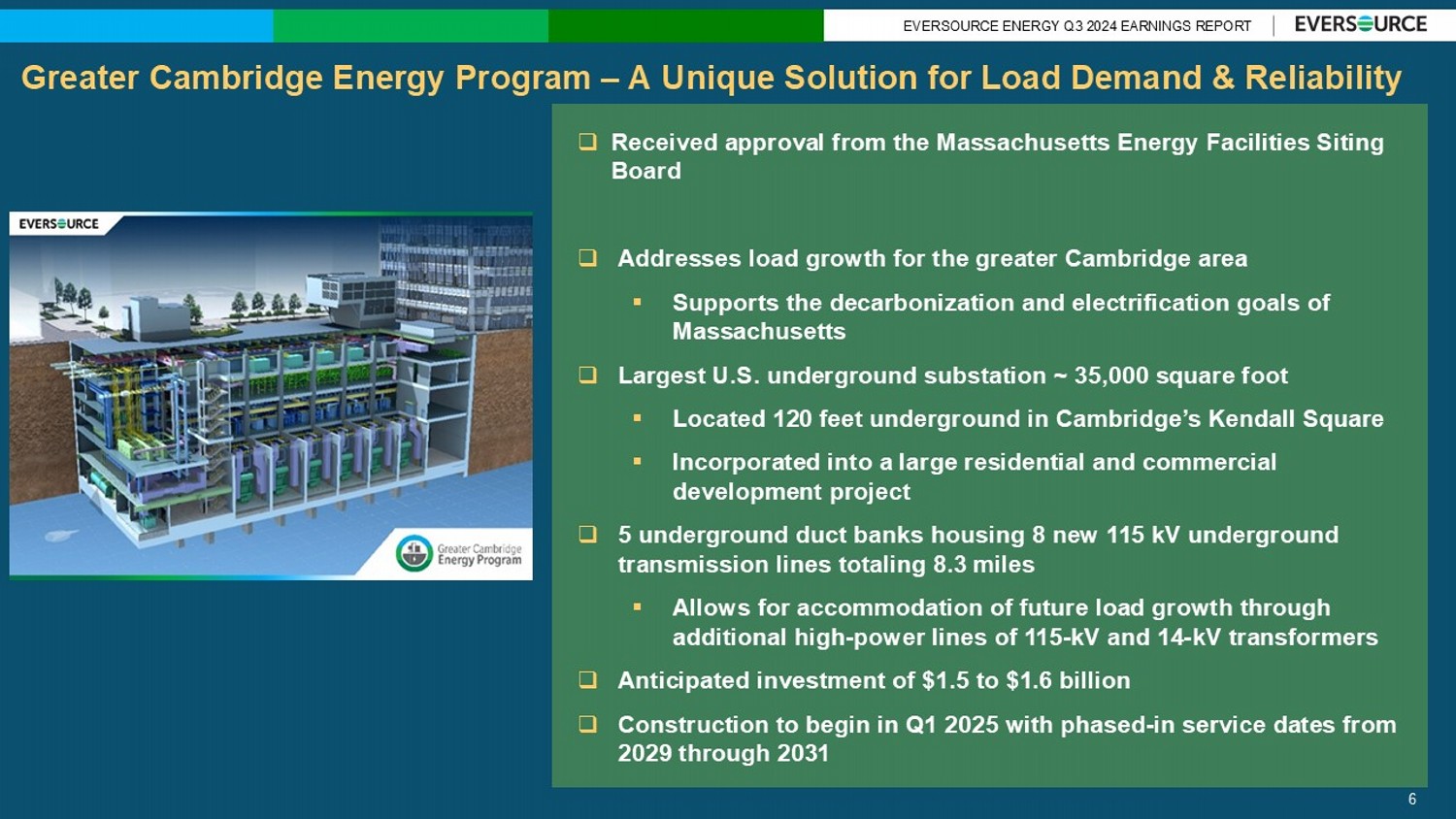

EVERSOURCE ENERGY Q3 2024 EARNINGS REPORT 6 □ Received approval from the Massachusetts Energy Facilities Siting Board □ Addresses load growth for the greater Cambridge area ▪ Supports the decarbonization and electrification goals of Massachusetts □ Largest U.S. underground substation ~ 35,000 square foot ▪ Located 120 feet underground in Cambridge’s Kendall Square ▪ Incorporated into a large residential and commercial development project □ 5 underground duct banks housing 8 new 115 kV underground transmission lines totaling 8.3 miles ▪ Allows for accommodation of future load growth through additional high - power lines of 115 - kV and 14 - kV transformers □ Anticipated investment of $1.5 to $1.6 billion □ Construction to begin in Q1 2025 with phased - in service dates from 2029 through 2031 Greater Cambridge Energy Program – A Unique Solution for Load Demand & Reliability

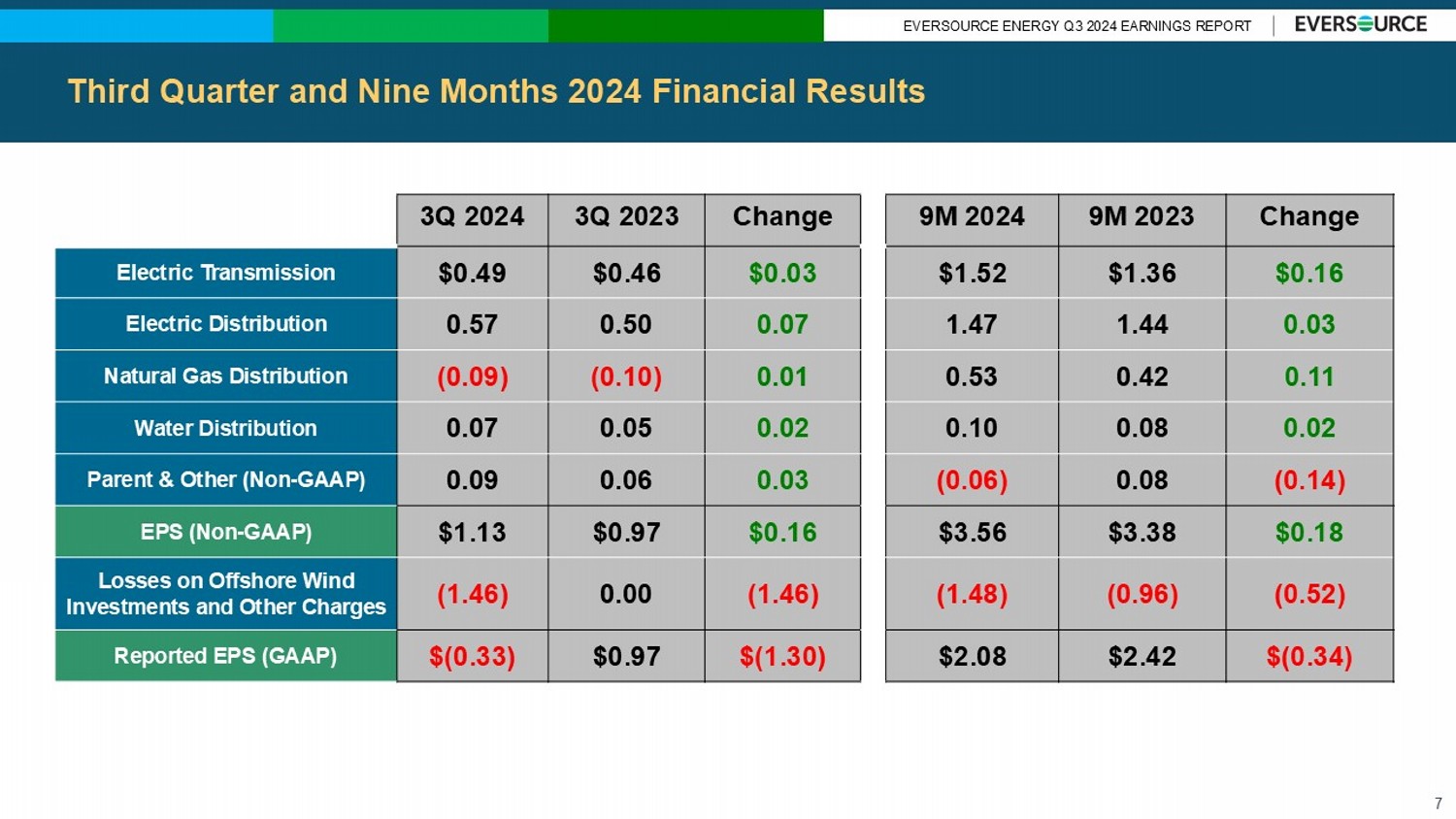

EVERSOURCE ENERGY Q3 2024 EARNINGS REPORT Third Quarter and Nine Months 2024 Financial Results 7 Change 9M 2023 9M 2024 Change 3Q 2023 3Q 2024 $0.16 $1.36 $1.52 $0.03 $0.46 $0.49 Electric Transmission 0.03 1.44 1.47 0.07 0.50 0.57 Electric Distribution 0.11 0.42 0.53 0.01 (0.10) (0.09) Natural Gas Distribution 0.02 0.08 0.10 0.02 0.05 0.07 Water Distribution (0.14) 0.08 (0.06) 0.03 0.06 0.09 Parent & Other (Non - GAAP) $0.18 $3.38 $3.56 $0.16 $0.97 $1.13 EPS (Non - GAAP) (0.52) (0.96) (1.48) (1.46) 0.00 (1.46) Losses on Offshore Wind Investments and Other Charges $(0.34) $2.42 $2.08 $(1.30) $0.97 $(0.33) Reported EPS (GAAP)

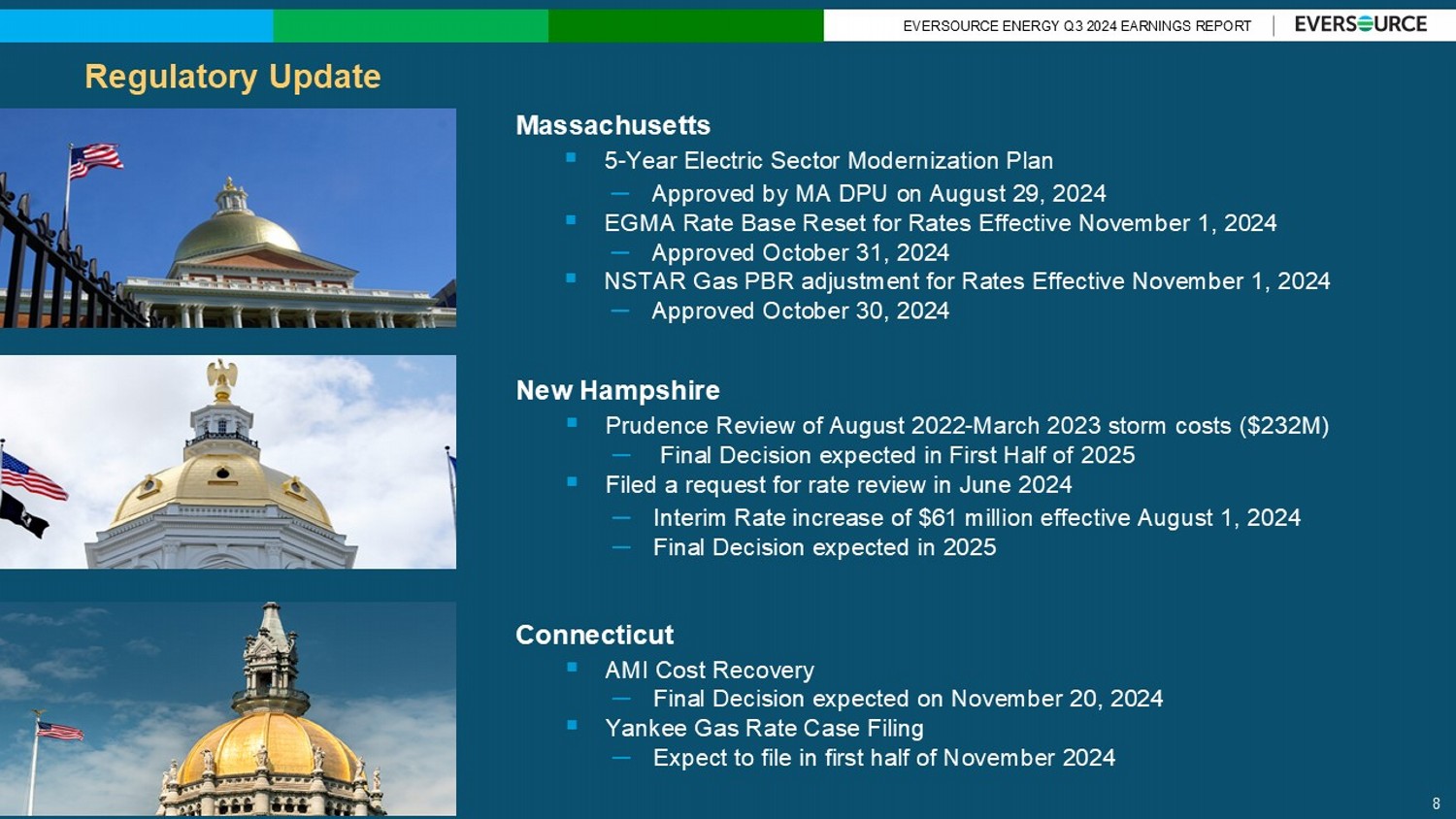

EVERSOURCE ENERGY Q3 2024 EARNINGS REPORT Regulatory Update Massachusetts ▪ 5 - Year Electric Sector Modernization Plan – Approved by MA DPU on August 29, 2024 ▪ EGMA Rate Base Reset for Rates Effective November 1, 2024 – Approved October 31, 2024 ▪ NSTAR Gas PBR adjustment for Rates Effective November 1, 2024 – Approved October 30, 2024 New Hampshire ▪ Prudence Review of August 2022 - March 2023 storm costs ($232M) – Final Decision expected in First Half of 2025 ▪ Filed a request for rate review in June 2024 – Interim Rate increase of $61 million effective August 1, 2024 – Final Decision expected in 2025 Connecticut ▪ AMI Cost Recovery – Final Decision expected on November 20, 2024 ▪ Yankee Gas Rate Case Filing – Expect to file in first half of November 2024 8

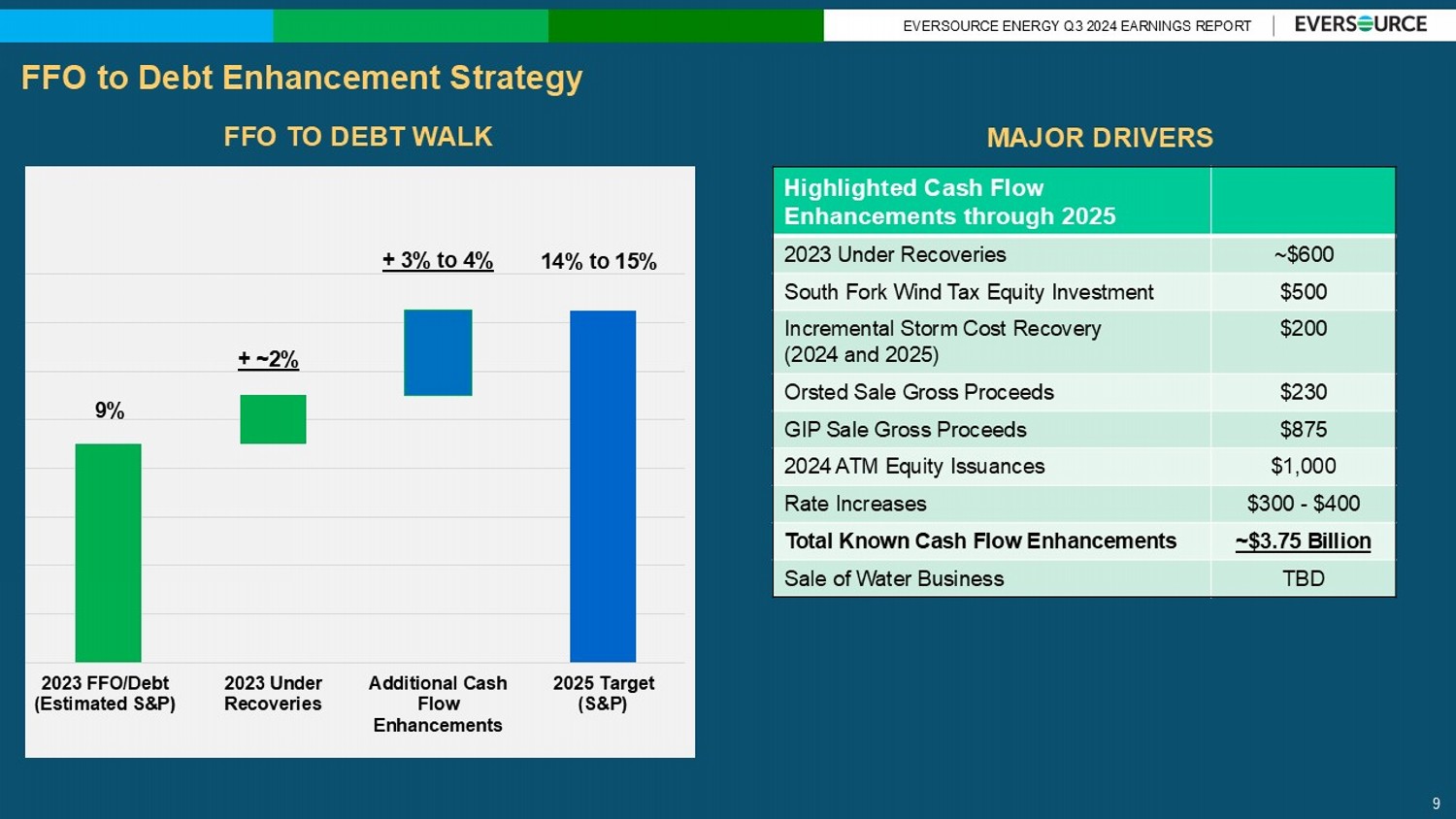

EVERSOURCE ENERGY Q3 2024 EARNINGS REPORT FFO to Debt Enhancement Strategy 2024 - 2025 FFO/Debt 14% - 15% at S&P FFO TO DEBT WALK 9% + ~2% + 3% to 4% 14% to 15% 2023 FFO/Debt (Estimated S&P) 2023 Under Recoveries Additional Cash Flow Enhancements 2025 Target (S&P) Highlighted Cash Flow Enhancements through 2025 ~$600 2023 Under Recoveries $500 South Fork Wind Tax Equity Investment $200 Incremental Storm Cost Recovery (2024 and 2025) $230 Orsted Sale Gross Proceeds $875 GIP Sale Gross Proceeds $1,000 2024 ATM Equity Issuances $300 - $400 Rate Increases ~$3.75 Billion Total Known Cash Flow Enhancements TBD Sale of Water Business MAJOR DRIVERS 9

EVERSOURCE ENERGY Q3 2024 EARNINGS REPORT

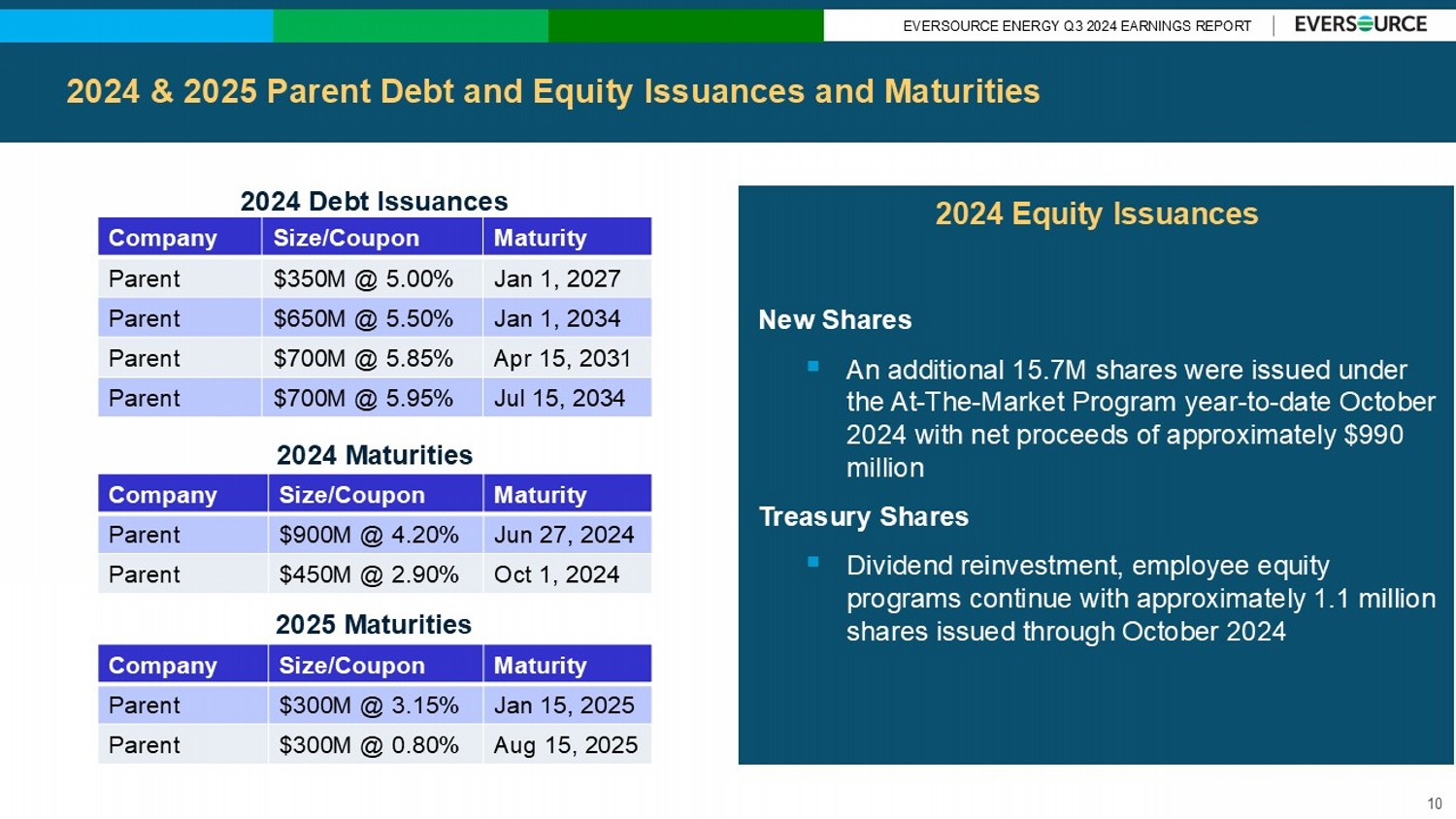

2024 2025 Parent Debt and Equity Issuances and Maturities

Company

Size/Coupon

Maturity

Parent

$900M @ 4.20%

Jun 27, 2024

Parent

$450M @ 2.90%

Oct 1, 2024

2024 Debt Issuances

2024 Maturities

Company

Size/Coupon

Maturity

Parent

$350M @ 5.00%

Jan 1, 2027

Parent

$650M @ 5.50%

Jan 1, 2034

Parent

$700M @ 5.85%

Apr 15, 2031

Parent

$700M @ 5.95%

Jul 15, 2034

New Shares

..

An additional 15.7M shares were issued under the At-The-Market Program year-to-date October 2024 with net proceeds of approximately $990 million

Treasury Shares

..

Dividend reinvestment, employee equity programs continue with approximately 1.1 million shares issued through October 2024

2024 Equity Issuances

10

2025 Maturities

Company

Size/Coupon

Maturity

Parent

$300M @ 3.15%

Jan 15, 2025

Parent

$300M @ 0.80%

Aug 15, 2025

EVERSOURCE ENERGY Q3 2024 EARNINGS REPORT $2.65 $2.81 $2.96 $3.11 $3.25 $3.45 $3.64 $3.86 $4.09 $4.34 $4.52 - $4.60 2014A* 2015A* 2016A 2017A 2018A 2019A* 2020A* 2021A* 2022A* 2023A* 2024E* 2025E 2026E 2027E 2028E * Reflects non - GAAP results, excludes nonrecurring charges 11 Proven Track Record of Earnings and Dividend Performance

EVERSOURCE ENERGY Q3 2024 EARNINGS REPORT APPENDIX 12

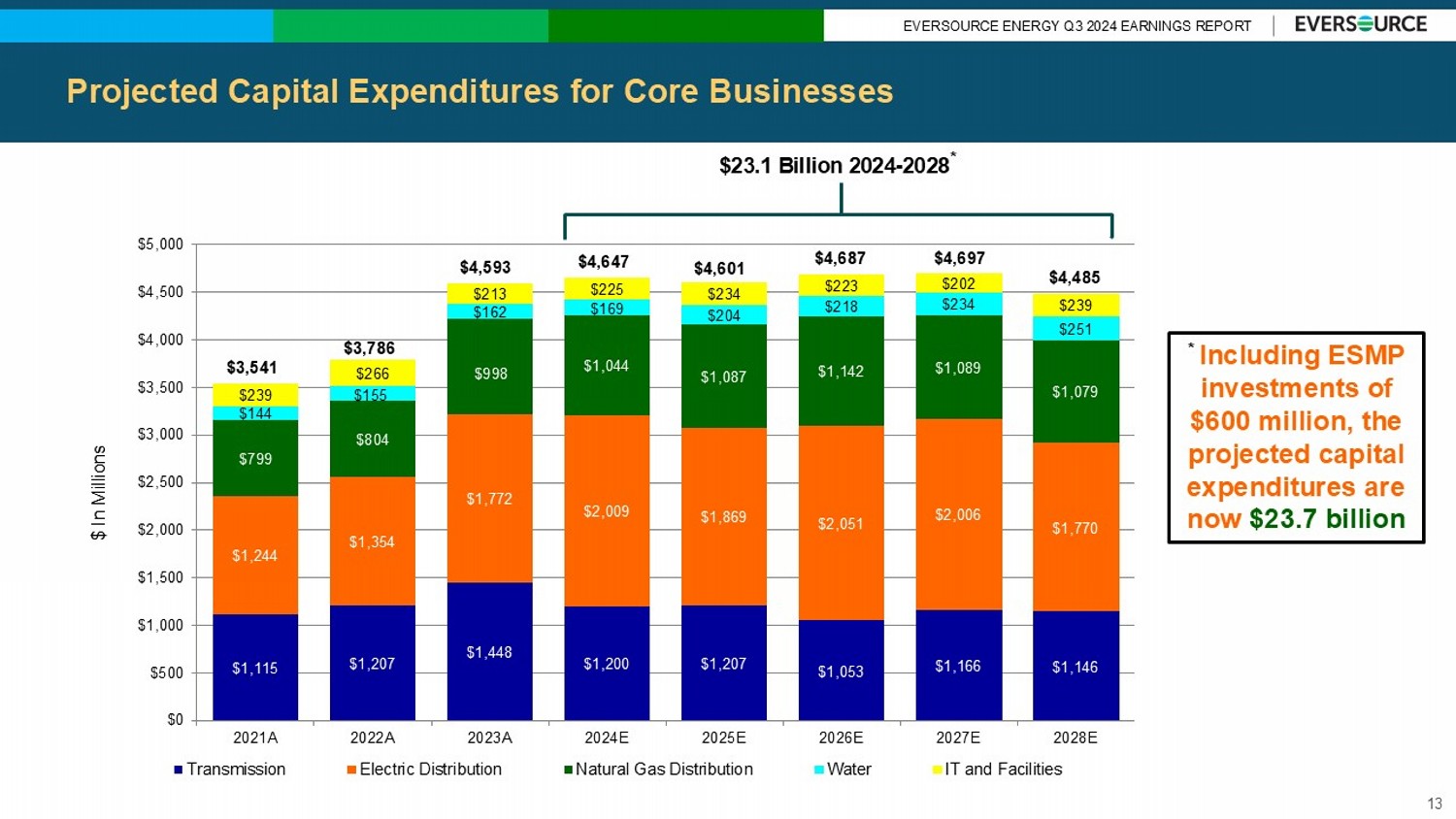

EVERSOURCE ENERGY Q3 2024 EARNINGS REPORT $1,115 $1,207 $1,448 $1,200 $1,207 $1,053 $1,166 $1,146 $1,244 $1,354 $1,772 $2,009 $1,869 $2,051 $2,006 $1,770 $799 $804 $998 $1,044 $1,087 $1,142 $1,089 $1,079 $144 $155 $162 $169 $204 $218 $234 $251 $239 $266 $213 $225 $234 $223 $202 $239 $3,541 $3,786 $4,593 $4,647 $4,601 $4,687 $4,697 $4,485 $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 $4,000 $4,500 $5,000 2021A 2022A 2023A 2024E 2025E 2026E 2027E 2028E Transmission Electric Distribution Natural Gas Distribution Water IT and Facilities $ In Millions $23.1 Billion 2024 - 2028 * Projected Capital Expenditures for Core Businesses 13 * Including ESMP investments of $600 million, the projected capital expenditures are now $23.7 billion

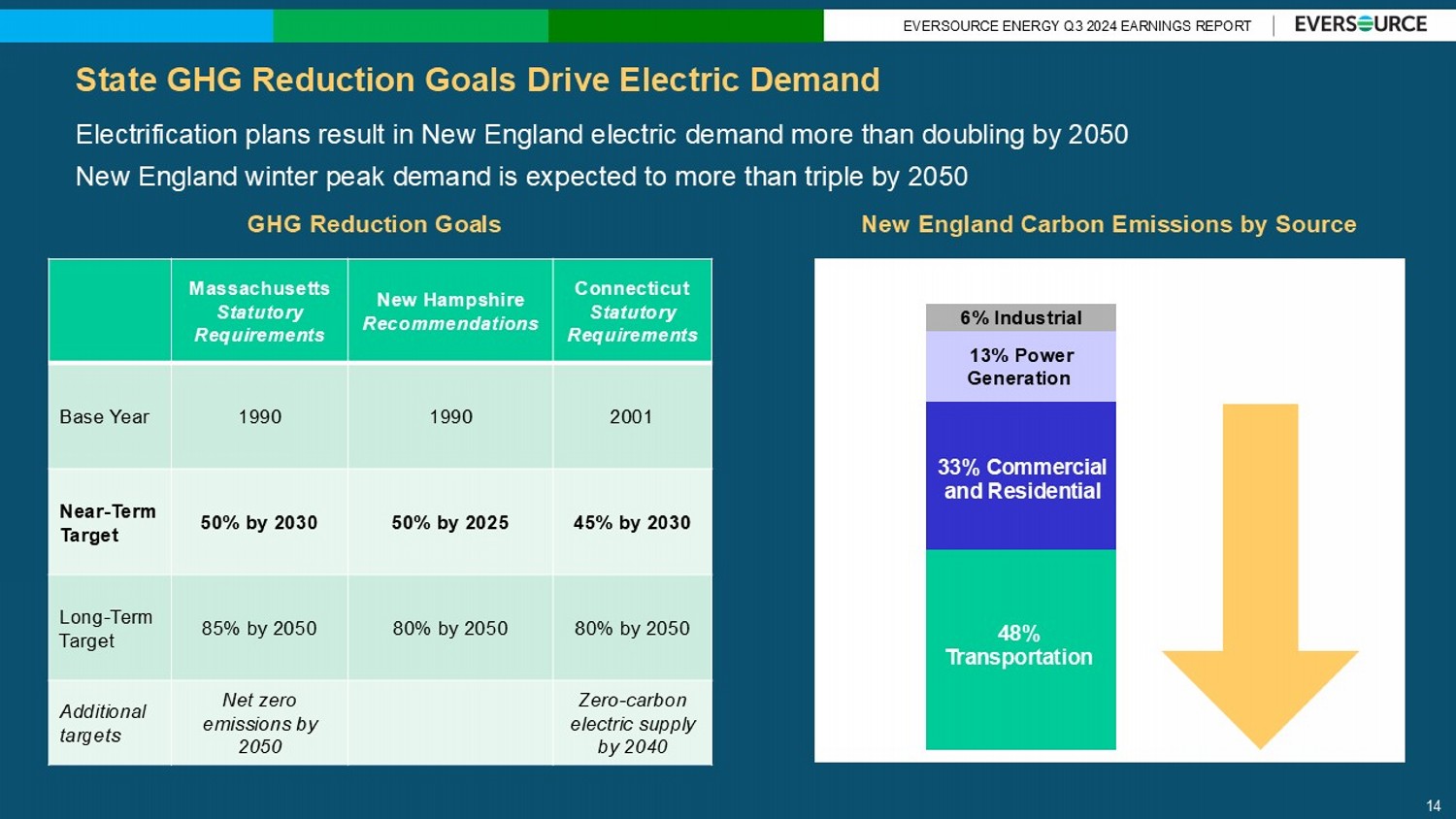

EVERSOURCE ENERGY Q3 2024 EARNINGS REPORT State GHG Reduction Goals Drive Electric Demand 14 Connecticut Statutory Requirements New Hampshire Recommendations Massachusetts Statutory Requirements 2001 1990 1990 Base Year 45% by 2030 50% by 2025 50% by 2030 Near - Term Target 80% by 2050 80% by 2050 85% by 2050 Long - Term Target Zero - carbon electric supply by 2040 Net zero emissions by 2050 Additional targets 48% Transportation 33% Commercial and Residential 13% Power Generation 6% Industrial GHG Reduction Goals New England Carbon Emissions by Source Electrification plans result in New England electric demand more than doubling by 2050 New England winter peak demand is expected to more than triple by 2050

v3.24.3

Cover

|

Nov. 04, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 04, 2024

|

| Entity File Number |

1-5324

|

| Entity Registrant Name |

EVERSOURCE

ENERGY

|

| Entity Central Index Key |

0000072741

|

| Entity Tax Identification Number |

04-2147929

|

| Entity Incorporation, State or Country Code |

MA

|

| Entity Address, Address Line One |

300

Cadwell Drive

|

| Entity Address, City or Town |

Springfield

|

| Entity Address, State or Province |

MA

|

| Entity Address, Postal Zip Code |

01104

|

| City Area Code |

800

|

| Local Phone Number |

286-5000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Shares, $5.00 par value per share

|

| Trading Symbol |

ES

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| The Connecticut Light And Power Company [Member] |

|

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 04, 2024

|

| Entity File Number |

0-00404

|

| Entity Registrant Name |

THE

CONNECTICUT LIGHT AND POWER COMPANY

|

| Entity Central Index Key |

0000023426

|

| Entity Tax Identification Number |

06-0303850

|

| Entity Incorporation, State or Country Code |

CT

|

| Entity Address, Address Line One |

107

Selden Street

|

| Entity Address, City or Town |

Berlin

|

| Entity Address, State or Province |

CT

|

| Entity Address, Postal Zip Code |

06037-1616

|

| City Area Code |

800

|

| Local Phone Number |

286-5000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Nstar Electric Company [Member] |

|

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 04, 2024

|

| Entity File Number |

1-02301

|

| Entity Registrant Name |

NSTAR

ELECTRIC COMPANY

|

| Entity Central Index Key |

0000013372

|

| Entity Tax Identification Number |

04-1278810

|

| Entity Incorporation, State or Country Code |

MA

|

| Entity Address, Address Line One |

800

Boylston Street

|

| Entity Address, City or Town |

Boston

|

| Entity Address, State or Province |

MA

|

| Entity Address, Postal Zip Code |

02199

|

| City Area Code |

800

|

| Local Phone Number |

286-5000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Public Service Company Of New Hampshire [Member] |

|

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 04, 2024

|

| Entity File Number |

1-6392

|

| Entity Registrant Name |

PUBLIC

SERVICE COMPANY OF NEW HAMPSHIRE

|

| Entity Central Index Key |

0000315256

|

| Entity Tax Identification Number |

02-0181050

|

| Entity Incorporation, State or Country Code |

NH

|

| Entity Address, Address Line One |

Energy

Park

|

| Entity Address, Address Line Two |

780

North Commercial Street

|

| Entity Address, City or Town |

Manchester

|

| Entity Address, State or Province |

NH

|

| Entity Address, Postal Zip Code |

03101-1134

|

| City Area Code |

800

|

| Local Phone Number |

286-5000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

dei_LegalEntityAxis=es_TheConnecticutLightAndPowerCompanyMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

dei_LegalEntityAxis=es_NstarElectricCompanyMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

dei_LegalEntityAxis=es_PublicServiceCompanyOfNewHampshireMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

NSTAR Electric (PK) (USOTC:NSARP)

過去 株価チャート

から 12 2024 まで 1 2025

NSTAR Electric (PK) (USOTC:NSARP)

過去 株価チャート

から 1 2024 まで 1 2025