Verde AgriTech Ltd (TSX: “NPK”)

("

Verde” or the “

Company”)

announces its financial results for the period ended March 31, 2024

(“

Q1 2024”).

Verde's Q1 2024 results were affected by adverse

climate conditions, which reduced overall fertilizer demand in

Brazil. This contrasts with Q1 2023, which benefitted from record

potash prices and agricultural commodity prices, in good part as a

consequence of the outbreak of Ukraine-Russia war.

In 2022, Brazilian farmers committed to

purchasing agricultural inputs in advance for the 2023 "second

crop” (known locally as safrinha) of corn that is sowed after the

main crop. That year, agricultural commodity prices were high and

the outlook for the 2023 safrinha of corn was still excellent. The

application of fertilizers for the safrinha usually occurs in the

first quarter of the year, which further drove the positive

financial results for Verde in Q1 2023.

In Q1 2024, however, a "perfect storm" hit the

Brazilian fertilizer market. Startin in the second half of 2023,

the El Niño effects altered rainfall patterns, severely affecting

Brazil's agricultural cycle all the way through early 2024. The

irregular and unpredictable precipitation complicated agricultural

planning, increasing risks to crop productivity and profitability.

Consequently, many soybean farmers postponed planting, leading to a

widespread decision to forego planting the safrinha corn. This

resulted in a significant decrease in fertilizer demand in the

first quarter of 2024.

All in all, the Company's results for Q1 2024

are lower than those for Q1 2022 and Q1 2023, quarters that

benefitted from the previously mentioned geopolitical factors. When

compared to the sales volume and revenue of Q1 2021 however, the Q1

2024 results were approximately five times greater, confirming the

broader trend:

|

|

Q1 2021 |

Q1 2024 |

∆Q1 21-24 |

|

Sales (‘000 tons) |

17 |

85 |

400% |

|

Revenue (C$’000) |

831 |

5,068 |

510% |

|

|

|

|

|

|

|

FY 2021 |

FY 2024 |

∆FY 21-24 |

|

Sales (‘000 tons) |

400 |

TBD |

TBD |

|

Revenue (C$’000) |

27,709 |

TBD |

TBD |

“Though we are disappointed with the overall

market conditions and results for Q1 2024, these were still over

five times greater than Q1 2021. In that year, by December 2021,

Verde had delivered 400 thousand tonnes. The fundamentals are in

place and Verde’s new sales and marketing teams are making

significant progress, this makes me very excited about the

long-term trajectory for our Company. Now that Verde was recognized

as one of the world's Top 100 most promising carbon removal

companies by the XPRIZE Carbon Removal competition, it is clear

that the faster we can spread greater and greater quantities of our

products to agricultural land, the better the planet will be”,

declared Verde’s Founder, President & CEO Cristiano Veloso.

First Quarter 2024

Highlights

Operational and Financial Highlights

- Sales in

Q1 2024 were 85,000 tonnes, compared to 108,000 tonnes in Q1 2023

and 16,558 tonnes in Q1 2021.

- Revenue

in Q1 2024 was $5.1 million, compared to $11.1 million in Q1 2023

and $0.8 million in Q1 2021.

- Cash and

other receivables held by the Company in Q1 2024 were $17.3

million, compared to $34.3 million in Q1 2023 and 4.9 million in Q1

2021.

- EBITDA

before non-cash events was -$0.7 million in Q1 2024, compared to

$2.0 million in Q1 2023 and a -$0.9 million in Q1 2021.

- Net loss

in Q1 2024 was $4.8 million, compared to a $0.1 million loss in Q1

2023 and a $1.8 million loss in Q1 2021.

Other Highlights

- The

Product sold in Q1 2024 has the potential to capture up to 1,131

tons of carbon dioxide (“CO2”) from the atmosphere via Enhanced

Rock Weathering (“ERW”).1 The potential net amount of carbon

captured, represented by carbon dioxide removal (“CDR”), is

estimated at 716 tons of CO2.2 In addition to the carbon removal

potential, Verde’s Q1 2024 sales avoided the emissions of 316 tons

of CO2e, by substituting potassium chloride (“KCl”)

fertilizers.3

- Combining

the potential carbon removal and carbon emissions avoided by the

use our Product since the start of production in 2018, Verde’s

total impact stands at 260,341 tons of CO2.4

- 6,736

tons of chloride have been prevented from being applied into soils

Q1 2024, by farmers who used the Product in lieu of KCl

fertilizers.5 A total of 153,299 tons of chloride has been

prevented from being applied into soils by Verde’s customers since

the Company started production.6

________________________1 Out of the total sales in Q1 2024,

40,127 tons were sold in compliance with our Monitoring,

Verification, and Report (“MRV”) Protocol, qualifying them as

potential carbon credits. The carbon capture potential of Verde's

products, through Enhanced Rock Weathering (ERW), is 120 kg CO2e

per ton of K Forte®. For further information, see “Verde’s Products

Remove Carbon Dioxide From the Air”.2 Net Carbon Dioxide Removal

(CDR): volume of 1 ton of Long-Term CO2 Removal, equivalent to 1

carbon credit.3 K Forte® is a fertilizer produced in Brazil using

national raw materials. Its production process has low energy

consumption from renewable sources and, consequently, a low

environmental and GHG emissions footprint. Whereas the high carbon

footprint of KCl results from a complex production process,

involving extraction, concentration, and granulation of KCl, in

addition to the long transportation distances to Brazil, given that

95% of the KCl consumed in the country is imported. 12Mt of K

Forte® is equivalent to 2Mt of KCl in K2O content. Emissions

avoided are calculated as the difference between the weighted

average emissions for KCl suppliers to produce, deliver, and apply

their product in each customer's city and the emissions determined

according to K Forte®'s Life Cycle Assessment for its production,

delivery, and application in each customer's city.4 From 2018 to Q1

2024, the Company has sold 1.93 million tons of Product, which can

remove up to 212,067 tons of CO2. Additionally, this amount of

Product could potentially prevent up to 48,274 tons of CO2

emissions.5 Verde’s Product is a salinity and chloride-free

replacement for KCl fertilizers. Potassium chloride is composed of

approximately 46% of chloride, which can have biocidal effects when

excessively applied to soils. According to Heide Hermary (Effects

of some synthetic fertilizers on the soil ecosystem, 2007),

applying 1 pound of potassium chloride to the soil is equivalent to

applying 1 gallon of Clorox bleach, with regard to killing soil

microorganisms. Soil microorganisms play a crucial role in

agriculture by capturing and storing carbon in the soil, making a

significant contribution to the global fight against climate

change.6 1 ton of Product (10% K2O) has 0.1 tons of K2O, which is

equivalent to 0.17 tons of potassium chloride (60% K2O), containing

0.08 tons of chloride.

Subsequent event

- In the

second quarter of 2024, the Company initiated a Strategic Debt

Restructuring Plan, which includes seeking specific Preliminary

Judicial Relief to obtain temporary protection against actions and

foreclosures by 7 banks. This request is aimed at ensuring

stability while we renegotiate terms with our financial creditors.

In compliance with legal requirements, all loan payment obligations

have been suspended since April 2024. It is important to emphasize

that this measure does not affect the Company's operations, nor

does it compromise our contractual obligations to suppliers.

Negotiations with the banks are progressing constructively, and the

Company anticipates achieving a significant improvement in debt

terms, including a substantial extension of the payment period, a

grace period, and a reduction in interest rates. This strategy is

aligned with Verde’s long-term objectives and reaffirms the

Company’s commitment to financial and

operational sustainability.

Q1 2024 in Review

Agricultural Market

Following the onset of the Ukraine-Russia

conflict in early 2022, the agricultural sector experienced a

historic surge in the prices of inputs and commodities. Notably,

the average potash price jumped by 204% in Q1 2022, peaking at

US$1,200 per ton in March 2022, compared to an average of US$293 in

Q1 2021.7 This spike in KCl CFR prices in 2022 was so significant

that, despite a downward trend beginning in the latter half of the

year, the market in 2023 still benefited the effects of the

record-high levels reached in 2022. The average KCl CFR price in Q1

2024 had dropped by 40% compared to Q1 2023, and by 66% compared to

Q1 2022.

The Association of Soybean and Corn Producers of

Brazil (Aprosoja) reported that during the 2023 soybean planting

period, most regions faced excessively dry conditions, while the

south experienced excessive rainfall. This variability forced some

farmers to plant soybeans in dry soil, attempting to avoid

disrupting the subsequent safrinha corn planting. Regrettably,

these soybeans often failed to thrive, leading to two or three

replanting attempts, which significantly increased expenses on

seeds, pesticides, fuel, and labor.

This series of challenges persisted into 2024,

creating a "perfect storm" scenario. Ongoing El Niño effects from

2023 altered rainfall patterns, severely affecting crop harvests in

2024. The irregular and unpredictable precipitation complicated

agricultural planning, increasing the risks to crop productivity

and profitability. Consequently, many soybean farmers, challenged

by insufficient rainfall, postponed planting, leading to a

widespread decision to forego planting safrinha corn. This resulted

in a significant decrease in fertilizer demand in the first quarter

of 2024.

The market prices for Brazil's main crops

remained stable in Q1 2024 with minor variations, although they

continued to be significantly lower than the levels observed in Q1

2022 and Q1 2023. A sack of soybeans, previously valued at R$207 in

the market, is now trading below R$120,8 while the sack of corn has

dropped from R$103 to R$61.9

Global market competition

In 2022, Brazil experienced its highest interest

rates since 2006, a situation that has been showing signs of

improvement since H2 2023 but still impacts the Company's financing

conditions.

The current SELIC interest rate is 10.5%.10 The

Central Bank of Brazil projects the SELIC rate to reach 9.8% per

annum by the end of 2024, 9.0% in 2025 and 2026.11 Annual inflation

forecast for 2024 and 2025 are 3.8% and 3.7% respectively.12

Brazilian farmers have grappled with tight

working capital amid challenging market conditions in 2023, and

they have sought for input suppliers offering the most favorable

payment terms and interest rates, allowing them to defer payment

until after the harvest, typically between 9 to 12 months later.

Verde’s ability to provide financing with longer tenors is

considerably lower compared to international players13, which

represents terms less competitive for its customers. Unlike its

competitors, Verde does not have the option to incur most of its

cost of debt in US dollar-denominated liabilities. Overall, the

Company is not able to provide financing for more than 20% of its

revenue due to constraints related to lines of credit.

Verde’s average cost of debt is 14.4% per annum.

To incentivize sales, the Company offers its customers a credit

line that charges a spread to its finance cost to comprise

operational costs, provisions, and expected credit losses, leading

to an average lending cost of 17.5% for credit-based purchases.

This approach, while necessary in the agricultural sector,

increases the risk of non-payment for suppliers such as fertilizer

companies, reflecting the heightened financial pressures within the

sector.

Currency exchange rate

Canadian dollar devaluated by 4% versus

Brazilian Real in Q1 2024 compared to Q1 2023.

________________________7 Source: Acerto Limited

Report.8 Soybeans Paranaguá. As of Q1 2022 and Q1 2024. Source:

EPEA – ESALQ / USP.9 As of Q1 2022 and Q1 2024. Source: EPEA –

ESALQ / USP.10 As of May 08, 2024. Source: Brazilian Central Bank11

Source: Brazilian Central Bank.12 As of May 08, 2024. Source:

Brazilian Central Bank.13 Verde’s normal credit term is 30 to 120

days upon shipment, depending on the period of the year, while

competitors can provide 180-360 days to collect its payments.

Q1 2024 Results Conference

Call

The Company will host a conference call on

Thursday, May 16, 2024, at 08:00 am Eastern Time, to discuss Q1

2024 results and provide an update. Subscribe using the link below

and receive the conference details by email.

|

Date: |

Thursday, May 16, 2024 |

|

Time: |

08:00 am Eastern Time |

|

Subscription link: |

https://bit.ly/Q1-2024_ResultsPresentation |

The questions must be submitted in advance

through the following link up to 48 hours before the conference

call: https://bit.ly/Q1-2024-ResultsPresentation_Questions.

The Company’s first quarter financial statements

and related notes for the period ended March 31, 2024 are available

to the public on SEDAR at www.sedar.com and the Company’s website

at www.investor.verde.ag/.

Results of Operations

The following table provides information about

three months ended March 31, 2024, as compared to the three months

ended March 31, 2023. All amounts in CAD $’000.

|

All amounts in CAD $’000 |

3 months ended Mar 31, 2024 |

3 months ended Mar 31, 2023 |

|

Tons sold (‘000) |

85 |

|

108 |

|

|

Average revenue per ton sold $ |

60 |

|

103 |

|

|

Average production cost per ton sold $ |

(20 |

) |

(25 |

) |

|

Average gross profit per ton sold $ |

40 |

|

78 |

|

|

Average gross margin |

67 |

% |

76 |

% |

|

|

|

|

|

Revenue |

5,068 |

|

11,125 |

|

|

Production costs |

(1,671 |

) |

(2,710 |

) |

|

Gross Profit |

3,397 |

|

8415 |

|

|

Gross Margin |

67 |

% |

76 |

% |

|

Sales and marketing expenses |

(970 |

) |

(1,207 |

) |

|

Product delivery freight expenses |

(1,595 |

) |

(3,867 |

) |

|

General and administrative expenses |

(1,501 |

) |

(1,372 |

) |

|

EBITDA (1) |

(670 |

) |

1,969 |

|

|

Share Based, Equity and Bonus Payments (Non-Cash Event)

(2) |

(1,777 |

) |

(28 |

) |

|

Depreciation and Amortization (3) |

(919 |

) |

(911 |

) |

|

Operating (Loss) / Profit after non-cash

events |

(3,366 |

) |

1,030 |

|

|

Interest Income/Expense (4) |

(1,377 |

) |

(1,042 |

) |

|

Net (Loss) / Profit before tax |

(4,743 |

) |

(12 |

) |

|

Income tax (5) |

(9 |

) |

(96 |

) |

|

Net (Loss) / Profit |

(4,752 |

) |

(108 |

) |

(1) – Non GAAP measure(2) – Included in General and

Administrative expenses in financial statements (3) – Included in

General and Administrative expenses and Cost of Sales in financial

statements (4) – Please see Summary of Interest-Bearing Loans and

Borrowings notes(5) – Please see Income Tax notes

External Factors

Revenue and costs are affected by external

factors including changes in the exchange rates between the C$ and

R$ along with fluctuations in potassium chloride spot CFR Brazil,

agricultural commodities prices, interest rates, among other

factors. For further details, please refer to the Q1 2024 Review

section:

Financial and operating results

In Q1 2024, revenue from sales fell by 54%,

accompanied by a 42% reduction in the average revenue per ton

compared to Q1 2023. Excluding freight expenses (FOB price), the

average revenue per ton decreased by 38% in Q1 2024 compared to Q1

2023. The proportion of products sold in jumbo bags, which command

a higher sales price per ton compared to bulk, represented 6% of

the Company's total volume sold, down from 24% in Q1 2023. This

shift further affected the average revenue per ton in Q1 2024.

Sales declined by 21% in Q1 2024 compared to Q1

2023, due to the conditions outlined in the Q1 2024 Review

section.

The decline in EBITDA is primarily due to the

reduced revenue in Q1 2024.

The Company generated a net loss of $4.8 million

in Q1 2024, compared to a net loss of $0.1 million in Q1 2023.

Basic loss per share was $0.09 for Q1 2024,

compared to a loss of $0.002 for Q1 2023.

Production costs

In Q1 2024, total production costs were reduced

by 37% compared to Q1 2023, influenced by the decrease in sales

volume. The average cost per ton experienced a 18% reduction

compared to Q1 2023, due to the commissioning of Plant 2 in 2022.

This new plant operates at a lower production cost compared to

Plant 1 due to enhanced operational efficiency. In 2022, Plant 1

operated across four work shifts to fulfil market demand. With the

inauguration of Plant 2, it became possible to reduce headcounts at

Plant 1, with both plants operating just one shift each from 2023.

Sales from Plant 2 constituted 86% of the total sales in Q1 2024.

Moreover, the decrease in the proportion of sales made with Jumbo

Bags to 6% in Q1 2024, down from 24% in Q1 2023, also contributed

to the reduction in average production cost.

Production costs include all direct costs from

mining, processing, and the addition of other nutrients to the

Product, such as Sulphur and Boron. It also includes the logistics

costs from the mine to the plant and related salaries.

Sales, General and Administrative

Expenses:

SG&A represents a non-operating segment that

includes corporate and administrative functions, essential for

supporting the Company's operating segments.

Sales Expenses

|

CAD $’000 |

3 months ended Mar 31, 2024 |

3 months ended Mar 31, 2022 |

|

Sales and marketing expenses |

837 |

|

1,070 |

|

|

Fees paid to independent sales agents |

133 |

|

137 |

|

|

Total |

970 |

|

1,207 |

|

Sales and marketing expenses cover salaries for

employees, car rentals, domestic travel in Brazil, hotel

accommodations, and Product promotion at marketing events. The 22%

reduction in these expenses in Q1 2024 compared to Q1 2023 is

attributed to Verde's decision to scale back investments in media

channels that were not anticipated to yield short-term returns.

As part of the Company’s marketing and sales

strategy, Verde compensates its independent sales agents via

commission-based remuneration. Despite a decrease in overall sales

for the first quarter of 2024, the proportion of sales made by

these agents increased significantly, accounting for 58% of total

sales in Q1 2024, up from 30% in Q1 2023. Due to the overall

decline in sales volume, the fees paid to independent sales agents

decreased by 3% in Q1 2024 compared to the same period in 2023.

Product delivery freight expenses

Expenses decreased by 59% compared to the same

period last year. The volume sold as CIF (Cost Insurance and

Freight) in Q1 2024 represented 66% of total sales, slightly less

than the 68% in Q1 2023. However, the Company achieved a reduction

in average freight costs per ton for products sold on a CIF basis,

to $29 in Q1 2024 from $53 in the comparable period of the previous

year. The 46% decrease in freight costs can primarily be attributed

to a reduction in the percentage of sales made to regions that are

more distant from Verde's production facilities.

Sales, General and Administrative

Expenses (Continued):

General and Administrative Expenses

|

CAD $’000 |

3 months ended Mar 31, 2024 |

3 months ended Mar 31, 2023 |

|

General administrative expenses |

805 |

|

916 |

|

|

Allowance for expected credit losses |

146 |

|

4 |

|

|

Legal, professional, consultancy and audit costs |

341 |

|

317 |

|

|

IT/Software expenses |

181 |

|

112 |

|

|

Taxes and licenses fees |

28 |

|

23 |

|

|

Total |

1,501 |

|

1,372 |

|

General administrative expenses include general

office expenses, rent, bank fees, insurance, foreign exchange

variances and remuneration of executives, directors of the Board

and administrative staff. General administrative decreased by 12%

compared to the same period last year, due to a reduction in

leasing expenses, such as water trucks and metallic structures to

support operations.

According to Verde's sales policy, any customer

payments that are overdue for more than 12 months must be

provisioned for. The increase in the allowance for expected credit

losses in Q1 2024 compared to Q1 2023 is attributed to the

financial constraints faced by farmers, which are a result of low

prices for agricultural commodities, among other factors, as

outlined in the Q1 2024 Review section.

Legal, professional and audit costs include fees

along with accountancy, audit and regulatory costs. Consultancy

fees encompass consultants employed in Brazil, such as accounting

services, patent processes, lawyer’s fees and regulatory

consultants.

IT/Software expenses include software licenses

such as Microsoft Office, Customer Relationship Management (“CRM”)

software and Enterprise Resource Planning (ERP). Expenses increased

by 62% in Q1 2024 compared to the same period last year due to an

increase in costs associated with the Company’s CRM software.

Share Based, Equity and Bonus Payments (Non-Cash

Event)

Share Based, Equity and Bonus Payments (Non-Cash

Events) encompass expenses associated with stock options granted to

employees and directors, as well as equity compensation and

non-cash bonuses awarded to key management personnel. In Q1 2024,

the costs associated with share-based payments increase to $1,777

compared to $28 for the same period last year. This increase was

primarily due to new options issuance.

Liquidity and Cash Flows

For additional details see the consolidated

statements of cash flows for the quarters ended March 31, 2024 and

March 31, 2023 in the quarterly financial statements.

|

Cash generated from / (utilised in):CAD

$’000 |

3 months endedMar 31, 2024 |

3 months endedMar 31, 2023 |

|

Operating activities |

(2,859 |

) |

(3,277 |

) |

|

Investing activities |

(269 |

) |

(1,889 |

) |

|

Financing activities |

(772 |

) |

8,163 |

|

On March 31, 2024, the Company held cash of

$3,200 a decrease of $1,089 on the same period in 2023.

Operating activities

In agricultural sales, credit transactions are

common due to the cyclical nature of farming income, which sees

fluctuations with seasonal highs during harvests and lows during

planting. This cycle necessitates that farmers have access to

essential inputs like seeds, fertilizers, and pesticides ahead of

their selling season. To accommodate this, credit terms are

offered, allowing farmers to procure these inputs in advance and

align their payments with their revenue cycle.

The Company’s credit terms vary according to the

needs of its clients, tailored to the specific requirements of each

farmer. This includes considerations such as the crop cycle,

creditworthiness, and other relevant factors, with terms extending

up to 360 days upon shipment depending on the period of year. This

strategy ensures farmers have the necessary resources for each

planting season, while Verde secures its financial interests

through aligned payment schedules.

In Q1 2024, net cash utilised in operating

activities decreased to $2,859, compared to $3,277 utilized in Q1

2023.

Trade and other receivables decreased by 61% in

Q1 2024, to $14,078 compared to $29,996 in Q1 2023. This is

expected as the Company had lower revenues from sales in the

quarter.

Investing activities

Cash utilized from investing activities

decreased to $269 in Q1 2024, compared to $1,889 in Q1 2023. This

reduction is attributable to the significant infrastructure

investments in Plant 2 and mineral property during 2023.

Financing activities

Cash utilized in financing activities increased

to $772 in Q1 2024, compared to $8,163 (generated) in Q1 2023. This

was due to additional loans being acquired during 2023.

Financial condition

The Company’s current assets decreased to

$19,570 in Q1 2024, compared to $36,937 in Q1 2023. Current

liabilities decreased to $28,629 in Q1 2024, compared to $29,707 in

Q1 2023; providing a working capital deficit of $9,059 in Q1 2024,

compared to the working capital surplus of $7,230 in Q1 2023.

About Verde AgriTech

Verde AgriTech is dedicated to advancing

sustainable agriculture through the innovation of specialty

multi-nutrient potassium fertilizers. Our mission is to increase

agricultural productivity, enhance soil health, and significantly

contribute to environmental sustainability. Utilizing our unique

position in Brazil, we harness proprietary technologies to develop

solutions that not only meet the immediate needs of farmers but

also address global challenges such as food security and climate

change. Our commitment to carbon capture and the production of

eco-friendly fertilizers underscores our vision for a future where

agriculture contributes positively to the health of our planet.

For more information on how we are leading the

way towards sustainable agriculture and climate change mitigation

in Brazil, visit our website at https://verde.ag/en/home/.

Corporate Presentation

For further information on the Company, please

view shareholders’ deck:

https://verde.docsend.com/view/5gv6evjdt8x2g7m7

Company Updates

Verde invites you to subscribe for updates. By

signing up, you'll receive the latest news about the Company's

projects, achievements, and future plans.

Subscribe here:

http://cloud.marketing.verde.ag/InvestorsSubscription

Cautionary Language and Forward-Looking

Statements

All Mineral Reserve and Mineral Resources

estimates reported by the Company were estimated in accordance with

the Canadian National Instrument 43-101 and the Canadian Institute

of Mining, Metallurgy, and Petroleum Definition Standards (May 10,

2014). These standards differ significantly from the requirements

of the U.S. Securities and Exchange Commission. Mineral Resources

which are not Mineral Reserves do not have demonstrated economic

viability.

This document contains "forward-looking

information" within the meaning of Canadian securities legislation

and "forward-looking statements" within the meaning of the United

States Private Securities Litigation Reform Act of 1995. This

information and these statements, referred to herein as

"forward-looking statements" are made as of the date of this

document. Forward-looking statements relate to future events or

future performance and reflect current estimates, predictions,

expectations or beliefs regarding future events and include, but

are not limited to, statements with respect to:

|

(i) |

|

the estimated amount and grade of Mineral Resources and Mineral

Reserves; |

|

(ii) |

|

the estimated amount of CO2 removal per ton of rock; |

|

(iii) |

|

the PFS representing a viable development option for the

Project; |

|

(iv) |

|

estimates of the capital costs of constructing mine facilities and

bringing a mine into production, of sustaining capital and the

duration of financing payback periods; |

|

(v) |

|

the estimated amount of future production, both produced and

sold; |

|

(vi) |

|

timing of disclosure for the PFS and recommendations from the

Special Committee; |

|

(vii) |

|

the Company’s competitive position in Brazil and demand for potash;

and, |

|

(viii) |

|

estimates of operating costs and total costs, net cash flow, net

present value and economic returns from an operating mine. |

Any statements that express or involve

discussions with respect to predictions, expectations, beliefs,

plans, projections, objectives or future events or performance

(often, but not always, using words or phrases such as "expects",

"anticipates", "plans", "projects", "estimates", "envisages",

"assumes", "intends", "strategy", "goals", "objectives" or

variations thereof or stating that certain actions, events or

results "may", "could", "would", "might" or "will" be taken, occur

or be achieved, or the negative of any of these terms and similar

expressions) are not statements of historical fact and may be

forward-looking statements.

All forward-looking statements are based on

Verde's or its consultants' current beliefs as well as various

assumptions made by them and information currently available to

them. The most significant assumptions are set forth above, but

generally these assumptions include, but are not limited to:

|

(i) |

|

the presence of and continuity of resources and reserves at the

Project at estimated grades; |

|

(ii) |

|

the estimation of CO2 removal based on the chemical and

mineralogical composition of assumed resources and reserves; |

|

(iii) |

|

the geotechnical and metallurgical characteristics of rock

conforming to sampled results; including the quantities of water

and the quality of the water that must be diverted or treated

during mining operations; |

|

(iv) |

|

the capacities and durability of various machinery and

equipment; |

|

(v) |

|

the availability of personnel, machinery and equipment at estimated

prices and within the estimated delivery times; |

|

(vi) |

|

currency exchange rates; |

|

(vii) |

|

Super Greensand® and K Forte® sales prices, market size and

exchange rate assumed; |

|

(viii) |

|

appropriate discount rates applied to the cash flows in the

economic analysis; |

|

(ix) |

|

tax rates and royalty rates applicable to the proposed mining

operation; |

|

(x) |

|

the availability of acceptable financing under assumed structure

and costs; |

|

(xi) |

|

anticipated mining losses and dilution; |

|

(xii) |

|

reasonable contingency requirements; |

|

(xiii) |

|

success in realizing proposed operations; |

|

(xiv) |

|

receipt of permits and other regulatory approvals on acceptable

terms; and |

|

(xv) |

|

the fulfilment of environmental assessment commitments and

arrangements with local communities. |

Although management considers these assumptions

to be reasonable based on information currently available to it,

they may prove to be incorrect. Many forward-looking statements are

made assuming the correctness of other forward looking statements,

such as statements of net present value and internal rates of

return, which are based on most of the other forward-looking

statements and assumptions herein. The cost information is also

prepared using current values, but the time for incurring the costs

will be in the future and it is assumed costs will remain stable

over the relevant period.

By their very nature, forward-looking statements

involve inherent risks and uncertainties, both general and

specific, and risks exist that estimates, forecasts, projections

and other forward-looking statements will not be achieved or that

assumptions do not reflect future experience. We caution readers

not to place undue reliance on these forward-looking statements as

a number of important factors could cause the actual outcomes to

differ materially from the beliefs, plans, objectives,

expectations, anticipations, estimates assumptions and intentions

expressed in such forward-looking statements. These risk factors

may be generally stated as the risk that the assumptions and

estimates expressed above do not occur as forecast, but

specifically include, without limitation: risks relating to

variations in the mineral content within the material identified as

Mineral Resources and Mineral Reserves from that predicted;

variations in rates of recovery and extraction; the geotechnical

characteristics of the rock mined or through which infrastructure

is built differing from that predicted, the quantity of water that

will need to be diverted or treated during mining operations being

different from what is expected to be encountered during mining

operations or post closure, or the rate of flow of the water being

different; developments in world metals markets; risks relating to

fluctuations in the Brazilian Real relative to the Canadian dollar;

increases in the estimated capital and operating costs or

unanticipated costs; difficulties attracting the necessary work

force; increases in financing costs or adverse changes to the terms

of available financing, if any; tax rates or royalties being

greater than assumed; changes in development or mining plans due to

changes in logistical, technical or other factors; changes in

project parameters as plans continue to be refined; risks relating

to receipt of regulatory approvals; delays in stakeholder

negotiations; changes in regulations applying to the development,

operation, and closure of mining operations from what currently

exists; the effects of competition in the markets in which Verde

operates; operational and infrastructure risks and the additional

risks described in Verde's Annual Information Form filed with SEDAR

in Canada (available at www.sedar.com) for the year ended December

31, 2021. Verde cautions that the foregoing list of factors that

may affect future results is not exhaustive.

When relying on our forward-looking statements

to make decisions with respect to Verde, investors and others

should carefully consider the foregoing factors and other

uncertainties and potential events. Verde does not undertake to

update any forward-looking statement, whether written or oral, that

may be made from time to time by Verde or on our behalf, except as

required by law.

For additional information please contact:

Cristiano Veloso, Chief

Executive Officer and Founder

Tel: +55 (31) 3245 0205; Email:

investor@verde.ag

www.verde.ag | www.investor.verde.ag

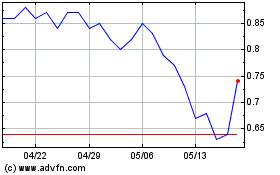

Verde Agritech (TSX:NPK)

過去 株価チャート

から 11 2024 まで 12 2024

Verde Agritech (TSX:NPK)

過去 株価チャート

から 12 2023 まで 12 2024