Athabasca Oil Corporation (TSX: ATH) (“Athabasca” or “the Company”)

is pleased to announce it has entered into transaction agreements

(“Transaction”) to create Duvernay Energy Corporation (“Duvernay

Energy”) with Cenovus Energy Inc. (“Cenovus”). Duvernay Energy will

be a standalone self-funded entity that will drive strong, high

netback cash flow and production growth and is expected to unlock

significant value. The transaction is aligned with Athabasca’s

strategy to maximize cash flow per share growth and return capital

to shareholders.

Transaction Overview

Athabasca and Cenovus will jointly contribute

assets into Duvernay Energy. Athabasca will own a 70% equity

interest in Duvernay Energy with Cenovus owning the remaining 30%

equity interest. Athabasca will manage Duvernay Energy through a

management and operating services agreement. Duvernay Energy’s

Board of Directors will include three members nominated by

Athabasca and one member nominated by Cenovus.

On inception, Duvernay Energy will have strong

Liquidity including seed capital of $40 million and a $50 million

new credit facility led by ATB Financial. Athabasca’s $22 million

seed capital contribution to Duvernay Energy will be within its

previous $175 million 2024 capital guidance ($135 million Thermal

Oil and $40 million Light Oil). Athabasca is also contributing ~$20

million in expenditures related to Q4 2023 drilling operations on a

100% working interest multi-well pad and long lead inventory for

future activity.

The Transaction will have an effective date of

January 1, 2024, is expected to close in the first quarter of 2024

and is subject to customary closing conditions and regulatory

approvals, including Competition Act approval. On closing the

Company will provide updated guidance for Duvernay Energy and

Athabasca.

Duvernay Energy Assets

Duvernay Energy will be positioned with

unparalleled pure-play exposure to the prolific Kaybob Duvernay

resource play. Duvernay Energy’s assets will be primarily located

in the volatile oil region.

In addition to the Company’s existing joint

venture assets, Duvernay Energy has exposure to ~46,000 acres of

100% working interest operated lands contiguous to its existing

Duvernay assets. This acreage includes new lands strategically

acquired by Athabasca through Crown land sales over the last 18

months and Cenovus’s contribution of Kaybob acreage. In total,

Duvernay Energy will have exposure to ~200,000 gross acres in the

liquids rich and oil windows with ~500 gross future well locations.

The assets are serviced by existing infrastructure including two

operated oil batteries with a gas pipeline network connected to

both the Pembina Gas Infrastructure KA facility and the Keyera

Simonette facility. Liquids are directly connected to the Pembina

Peace liquids system. Duvernay Energy will also own an 8.1% working

interest in the 7-4-63-16W5 gas facility.

Current production from Duvernay Energy is

~2,000 boe/d (~75% Liquids) with a defined and self-funded

development plan outlined in the section below.

Duvernay Energy Land Map

Duvernay Energy Development Plans

Duvernay Energy’s development plans will

leverage off significant de-risking activity on its acreage (74

horizontal wells) and on adjacent competitor activity. Duvernay

Energy will execute a self-funded development plan that will target

growth to ~25,000 boe/d (~75% Liquids) in the late 2020s with an

inventory to support a stable production profile thereafter for

approximately twenty years.

The Company has extended production history with

well results consistently supporting type curve expectations. At

Kaybob East and Two Creeks, IP365’s have averaged ~550 boe/d per

well (85% Liquids) on the last 12 wells. Latest well design will

include lateral lengths up to 4,500 meters that are expected to

yield stronger initial rates, larger reserves and improved capital

efficiencies. Individual well costs are estimated to be $10 – 14

million, depending on pad size, lateral length and proppant

loading.

The 2024 development program will include 12

gross wells (7.1 net wells) with a capital budget of ~$82 million.

The program is expected to be funded from the $40 million seed

capital contribution and cash flow from Duvernay Energy. The plan

is expected to drive strong production momentum with production

forecasted to average ~6,000 boe/d in 2025. 2024 activity consists

of:

-

100% working interest activity: A recently spudded

two-well pad at Kaybob East will be placed on production in Q2

2024. An additional two multi-well pads will spud mid-year and are

expected to be placed on-stream in early 2025.

-

30% working interest Joint Venture activity: A

three-well pad at Kaybob West is expected to spud in Q1 2024 and

will be placed on production in Q2 2024. An additional four-well

pad at Kaybob East is expected to spud in Q4 2024 and will be

placed on production in 2025.

Long-term development is expected to be funded

within cash flow and is flexible for a range of commodity prices.

The plan will be weighted to activity on Duvernay Energy’s 100%

working interest acreage and augmented by development within its

30% working interest joint venture acreage.

Strategic Rationale

Transaction Accelerates Value in

Standalone Self-Funded Duvernay Energy. The new entity

will accelerate value capture for Athabasca’s shareholders by

providing a clear path for accretive production and cash flow

growth without sacrificing Athabasca’s ability to fund capital in

its Thermal Oil division or Athabasca’s return of capital strategy.

The Transaction consolidates Athabasca’s and Cenovus’s 100% working

interest operated assets, providing flexibility and efficiencies of

scale for impactful development, along with Athabasca’s existing

30% working interest Duvernay joint venture assets that are

governed by a strong joint development agreement. Production and

cash flow growth will quickly exceed the volumes associated with

the Montney non-core disposition completed in September

2023.

During 2024, Duvernay Energy is forecasting

capital expenditures of $82 million, funded by cash flow from the

entity and seed capital of $40 million from Athabasca ($22 million)

and Cenovus ($18 million). Duvernay Energy will also benefit from

~$20 million in expenditures related to Athabasca’s Q4 2023

drilling operations on a 100% working interest multi-well pad and

long lead inventory for future activity.

Footnote: Refer to the “Reader Advisory” section within this news release for additional information on

Non‐GAAP Financial Measures (e.g. Adjusted Funds

Flow, Free Cash Flow, Net Cash,

Liquidity) and production disclosure.

1 Pricing Assumptions: 2024 US$80 WTI, US$15 Western Canadian

Select “WCS” heavy differential, C$3 AECO, and $0.75 C$/US$ FX.

2025-26 US$85 WTI, US$12.50 WCS heavy differential, C$3 AECO, and

$0.75 C$/US$ FX.

Athabasca Thermal Oil Budget

Maintained: Athabasca’s Thermal Oil division underpins the

Company’s strong free cash flow outlook, with an unchanged $135

million capital budget. At Leismer, production is expected to

increase to ~28,000 bbl/d by mid-year through a facility expansion

project and the ramp-up of eight behind pipe wells that recently

commenced steaming operations. This production level can be held

with modest sustaining capital (~$6/bbl) for many years into the

future. At Hangingstone, sustaining drilling will support base

production in 2025 and beyond with the objective of ensuring the

asset continues to deliver meaningful cash flow contributions.

Athabasca Managing for Strong Free Cash

Flow: Pro forma the Transaction, Athabasca forecasts

Adjusted Funds Flow of ~$460 million in 2024 (US$80/bbl WTI &

US$15/bbl WCS heavy differential)1, excluding its 70% equity

interest in Duvernay Energy. The capital forecast is $135 million

for Thermal Oil, a $40 million reduction in capital spending that

previously included Duvernay development. The Transaction does not

reduce Athabasca’s 2024 Free Cash Flow forecast which is maintained

at ~$325 million. The Company’s low sustaining capital requirements

are fully funded within cash flow to US$55/bbl WTI. During the

timeframe of 2024 – 2026, Athabasca forecasts >$1 billion in

Free Cash Flow1, representing over 50% of its current equity market

capitalization. Athabasca anticipates tightening of the WCS heavy

differentials from current levels as the Trans Mountain Expansion

pipeline (590,000 bbl/d) commences operations in 2024. Every $5/bbl

WTI change impacts Adjusted Funds Flow by ~$55 million annually and

every $5/bbl WCS change impacts Adjusted Funds Flow by ~$85 million

annually.

Return of Capital Commitments

Intact: Athabasca maintains its 2024 return of capital

commitments outlined in its budget release on December 6, 2023. The

Company intends to allocate 100% of Free Cash Flow to shareholders

through share buybacks. The Company anticipates completing its

current Normal Course Issuer Bid on March 15, 2024 with the

intention to renew the program thereafter with the Toronto Stock

Exchange for another 12-month period.

Financial Strength Remains: The

Company estimates 2023 year-end Liquidity of ~$455 million,

including cash of ~$370 million. The principal balance on the

Company’s senior secured second lien notes is US$157 million with

an estimated year-end Net Cash position of ~$155 million. The

Company has ~$2.8 billion in tax pools, including ~$2.3 billion of

immediately deductible non‐capital losses and exploration pools.

The Company does not anticipate paying cash taxes until 2030

($85/bbl WTI & $12.50/bbl WCS differential flat long-term

pricing).

Differentiated Assets: Duvernay

Energy’s funded growth profile complements the Company’s Thermal

assets by producing a diluent quality liquid product and creating a

natural hedge for diluent sourcing. The Thermal Oil division’s

strong margins and Free Cash Flow are supported by a pre-payout

Crown royalty structure, with royalty rates between 5 – 9%

anticipated to last into 20271. Leismer has regulatory approved

capacity of 40,000 bbl/d. Athabasca also has a fully de-risked

asset at Corner which also has regulatory approval for 40,000 bbl/d

with reservoir quality equivalent or better than Leismer.

Athabasca Executive Update

In conjunction with the Transaction, Athabasca

is pleased to announce the appointment of Mr. Bruce Beynon as Vice

President Light Oil, with primary responsibility for the

development of the assets within Duvernay Energy. Mr. Beynon is a

professional geologist with over 30 years of oil and gas industry

experience. Mr. Beynon is currently the President of Tiburon

Exploration Corp., a private consulting company. Prior thereto, Mr.

Beynon was Executive Vice President, Exploration and Corporate

Development at Baytex Energy Corporation. Prior to the merger

between Baytex and Raging River Exploration, Mr. Beynon held

several positions with Raging River including President. Mr. Mike

Wojcichowsky will assume the role of Vice President, Drilling

Completions Services and Light Oil Operations.

Mr. Robert Broen, President and CEO of Athabasca

Oil Corporation, will also assume the role of Chairman, President

and CEO of Duvernay Energy. The Board of Duvernay Energy will

consist of Mr. Rob Broen, Mr. Matt Taylor, Chief Financial Officer

of Athabasca, Mr. Cam Danyluk, General Counsel and Vice President

Corporate Development Athabasca, and Mr. Jeff Lawson, Senior

Vice-President Corporate Development, Cenovus.

Conference Call

Athabasca will be hosting a conference call for

the investment community to discuss the Transaction on Tuesday,

December 19, 2023 at 4:30 pm (MT).

To participate through the online webcast:

https://edge.media-server.com/mmc/p/6wqn4ts7

To participate through a dial-in conference

call:

https://register.vevent.com/register/BI6d50c66745394c03aa5095a2fd470d92

An archived recording of the call will be made

available on Athabasca’s website at:

https://www.atha.com/investors/presentation-events.html

Advisors

ATB Capital Markets is acting as financial

advisor for Athabasca in connection with the Transaction. ATB

Financial will lead Duvernay Energy’s new $50 million credit

facility. Norton Rose Fullbright Canada LLP is acting as legal

advisor for Athabasca.

About Athabasca Oil Corporation

Athabasca Oil Corporation is a Canadian energy

company with a focused strategy on the development of thermal and

light oil assets. Situated in Alberta’s Western Canadian

Sedimentary Basin, the Company has amassed a significant land base

of extensive, high quality resources. Athabasca’s common shares

trade on the TSX under the symbol “ATH”. For more information,

visit www.atha.com.

For more information, please contact:

| Matthew

Taylor |

Robert

Broen |

| Chief Financial Officer |

President and CEO |

| 1-403-817-9104 |

1-403-817-9190 |

| mtaylor@atha.com |

rbroen@atha.com |

Reader Advisory:

This News Release contains forward-looking

information that involves various risks, uncertainties and other

factors. All information other than statements of historical fact

is forward-looking information. The use of any of the words

“anticipate”, “plan”, “forecast”, “continue”, “estimate”, “expect”,

“may”, “will”, “project”, “target”, “should”, “believe”, “predict”,

“pursue”, “potential”, “view” and “contemplate” and similar

expressions are intended to identify forward-looking information.

The forward-looking information is not historical fact, but rather

is based on the Company’s current plans, objectives, goals,

strategies, estimates, assumptions and projections about the

Company’s industry, business and future operating and financial

results. This information involves known and unknown risks,

uncertainties and other factors that may cause actual results or

events to differ materially from those anticipated in such

forward-looking information. No assurance can be given that these

expectations will prove to be correct and such forward-looking

information included in this News Release should not be unduly

relied upon. This information speaks only as of the date of this

News Release and, except as required by applicable securities laws,

the Company undertakes no obligation to update any forward-looking

statement to reflect events or circumstances after the date on

which such statement is made or to reflect the occurrence of

unanticipated events. In particular, this News Release contains

forward-looking information pertaining to, but not limited to, the

following: the Company’s 2024 capital expenditures, production and

financial guidance, Free Cash Flow outlook, financial metrics,

timing for development projects in Thermal Oil and Light Oil

Divisions, return of capital strategy, royalty rates, timing for

future cash taxes, and other matters.

With respect to forward-looking information

contained in this News Release, assumptions have been made

regarding, among other things: commodity prices; the regulatory

framework governing royalties, taxes and environmental matters in

the jurisdictions in which the Company conducts and will conduct

business and the effects that such regulatory framework will have

on the Company, including on the Company’s financial condition and

results of operations; the Company’s financial and operational

flexibility; the Company’s financial sustainability; Athabasca's

funds flow, and free cash flow outlook; the Company’s ability to

obtain qualified staff and equipment in a timely and cost-efficient

manner; the applicability of technologies for the recovery and

production of the Company’s reserves and resources; future capital

expenditures to be made by the Company; future sources of funding

for the Company’s capital programs; the Company’s future debt

levels; future production levels; the Company’s ability to obtain

financing and/or enter into joint venture arrangements on

acceptable terms; operating costs; compliance of counterparties

with the terms of contractual arrangements; impact of increasing

competition globally; collection risk of outstanding accounts

receivable from third parties; geological and engineering estimates

in respect of the Company’s reserves and resources; recoverability

of reserves and resources; the geography of the areas in which the

Company is conducting exploration and development activities and

the quality of its assets. Certain other assumptions related to the

Company’s Reserves are contained in the report of McDaniel &

Associates Consultants Ltd. (“McDaniel”) evaluating Athabasca’s

Proved Reserves, Probable Reserves and Contingent Resources as at

December 31, 2022 (which is respectively referred to herein as the

"McDaniel Report”).

Actual results could differ materially from

those anticipated in this forward-looking information as a result

of the risk factors set forth in the Company’s Revised Annual

Information Form (“AIF”) dated May 11, 2023 and Management’s

Discussion and Analysis dated October 31, 2023, available on SEDAR

at www.sedarplus.ca, including, but not limited to: weakness in the

oil and gas industry; exploration, development and production

risks; prices, markets and marketing; market conditions; continued

impact of the COVID-19 pandemic; ability to finance capital

requirements; climate change and carbon pricing risk; regulatory

environment and changes in applicable law; gathering and processing

facilities, pipeline systems and rail; statutes and regulations

regarding the environment; political uncertainty; state of capital

markets; anticipated benefits of acquisitions and dispositions;

abandonment and reclamation costs; changing demand for oil and

natural gas products; royalty regimes; foreign exchange rates and

interest rates; reserves; hedging; operational dependence;

operating costs; project risks; financial assurances; diluent

supply; third party credit risk; indigenous claims; reliance on key

personnel and operators; income tax; cybersecurity; advanced

technologies; hydraulic fracturing; liability management;

seasonality and weather conditions; unexpected events; internal

controls; insurance; litigation; natural gas overlying bitumen

resources; competition; chain of title and expiration of licenses

and leases; breaches of confidentiality; new industry related

activities or new geographical areas; and risks related to our debt

and securities.

Also included in this News Release are estimates

of Athabasca's 2024 Outlook which are based on the various

assumptions as to production levels, commodity prices, currency

exchange rates and other assumptions disclosed in this News

Release. To the extent any such estimate constitutes a financial

outlook, it was approved by management and the Board of Directors

of Athabasca, and is included to provide readers with an

understanding of the Company’s outlook. Management does not have

firm commitments for all of the costs, expenditures, prices or

other financial assumptions used to prepare the financial outlook

or assurance that such operating results will be achieved and,

accordingly, the complete financial effects of all of those costs,

expenditures, prices and operating results are not objectively

determinable. The actual results of operations of the Company and

the resulting financial results may vary from the amounts set forth

herein, and such variations may be material. The financial outlook

contained in this New Release was made as of the date of this News

release and the Company disclaims any intention or obligations to

update or revise such financial outlook, whether as a result of new

information, future events or otherwise, unless required pursuant

to applicable law.

Oil and Gas Information

“BOEs" may be misleading, particularly if used

in isolation. A BOE conversion ratio of six thousand cubic feet of

natural gas to one barrel of oil equivalent (6 Mcf: 1 bbl) is based

on an energy equivalency conversion method primarily applicable at

the burner tip and does not represent a value equivalency at the

wellhead. As the value ratio between natural gas and crude oil

based on the current prices of natural gas and crude oil is

significantly different from the energy equivalency of 6:1,

utilizing a conversion on a 6:1 basis may be misleading as an

indication of value.Initial Production Rates

Initial Production Rates: The initial production

rates provided in this News Release should be considered to be

preliminary, except as otherwise indicated. Test results and

initial production rates disclosed herein may not necessarily be

indicative of long‐term performance or of ultimate recovery.

Reserves Information

The McDaniel Report was prepared using the

assumptions and methodology guidelines outlined in the COGE

Handbook and in accordance with National Instrument 51-101

Standards of Disclosure for Oil and Gas Activities, effective

December 31, 2022. There are numerous uncertainties inherent in

estimating quantities of bitumen, light crude oil and medium crude

oil, tight oil, conventional natural gas, shale gas and natural gas

liquids reserves and the future cash flows attributed to such

reserves. The reserve and associated cash flow information set

forth above are estimates only. In general, estimates of

economically recoverable reserves and the future net cash flows

therefrom are based upon a number of variable factors and

assumptions, such as historical production from the properties,

production rates, ultimate reserve recovery, timing and amount of

capital expenditures, marketability of oil and natural gas, royalty

rates, the assumed effects of regulation by governmental agencies

and future operating costs, all of which may vary materially. For

those reasons, estimates of the economically recoverable reserves

attributable to any particular group of properties, classification

of such reserves based on risk of recovery and estimates of future

net revenues associated with reserves prepared by different

engineers, or by the same engineers at different times, may vary.

The Company's actual production, revenues, taxes and development

and operating expenditures with respect to its reserves will vary

from estimates thereof and such variations could be material.

Reserves figures described herein have been rounded to the nearest

MMbbl or MMboe. For additional information regarding the

consolidated reserves and information concerning the resources of

the Company as evaluated by McDaniel in the McDaniel Report, please

refer to the Company’s AIF.

Reserve Values (i.e. Net Asset Value) is

calculated using the estimated net present value of all future net

revenue from our reserves, before income taxes discounted at 10%,

as estimated by McDaniel effective December 31, 2022 and based on

average pricing of McDaniel, Sproule and GLJ as of January 1,

2023.

The 500 gross total Duvernay drilling locations

referenced include: 5 proved undeveloped locations and 77 probable

undeveloped locations for a total of 82 booked locations with the

balance being unbooked locations. Proved undeveloped locations and

probable undeveloped locations are booked and derived from the

Company's most recent independent reserves evaluation as prepared

by McDaniel as of December 31, 2022 and account for drilling

locations that have associated proved and/or probable reserves, as

applicable. Unbooked locations are internal management estimates.

Unbooked locations do not have attributed reserves or resources

(including contingent or prospective). Unbooked locations have been

identified by management as an estimation of Athabasca’s multi-year

drilling activities expected to occur over the next two decades

based on evaluation of applicable geologic, seismic, engineering,

production and reserves information. There is no certainty that the

Company will drill all unbooked drilling locations and if drilled

there is no certainty that such locations will result in additional

oil and gas reserves, resources or production. The drilling

locations on which the Company will actually drill wells, including

the number and timing thereof is ultimately dependent upon the

availability of funding, commodity prices, provincial fiscal and

royalty policies, costs, actual drilling results, additional

reservoir information that is obtained and other factors.

Non-GAAP and Other Financial Measures,

and Production Disclosure

The “Adjusted Funds Flow”, “Free Cash Flow”, and

“sustaining capital” financial measures contained in this News

Release do not have standardized meanings which are prescribed by

IFRS and they are considered to be non-GAAP financial measures.

These measures may not be comparable to similar measures presented

by other issuers and should not be considered in isolation with

measures that are prepared in accordance with IFRS. Liquidity is a

supplementary financial measures.

Adjusted Funds Flow and Free Cash Flow are

non-GAAP financial measures and are not intended to represent cash

flow from operating activities, net earnings or other measures of

financial performance calculated in accordance with IFRS. The

Adjusted Funds Flow and Free Cash Flow measures allow management

and others to evaluate the Company’s ability to fund its capital

programs and meet its ongoing financial obligations using cash flow

internally generated from ongoing operating related activities.

Adjusted Funds Flow is calculated by adjusting for changes in

non‐cash working capital and settlement of provisions from cash

flow from operating activities. The Free Cash Flow measure is

calculated by subtracting Capital Expenditures from Adjusted Funds

Flow.

Liquidity is defined as cash and cash

equivalents plus available credit capacity.

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/df0b2141-7be0-46b3-9e24-30b71e684834

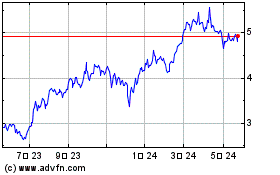

Athabasca Oil (TSX:ATH)

過去 株価チャート

から 1 2025 まで 2 2025

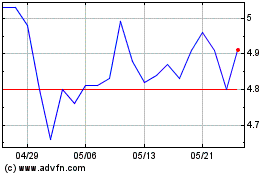

Athabasca Oil (TSX:ATH)

過去 株価チャート

から 2 2024 まで 2 2025