UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

(Amendment No. 1)

Under the Securities Exchange of 1934

Essential Utilities, Inc.

(Name of Issuer)

Common Stock,

par value $0.50 per share

(Title of Class of Securities)

03836W103

(CUSIP Number)

Patrice Walch-Watson

Canada Pension Plan Investment Board

One Queen Street East

Suite 2500

Toronto, Ontario M5C 2W5

Canada

Tel: (416) 868-4075

(Name, Address and Telephone Number of Person Authorized

to Receive Notices and Communications)

November 6,

2024

(Date of Event which Requires Filing of this Statement)

If the filing person has previously filed a statement

on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e),

240.13d-1(f) or 240.13d-1(g), check the following box. ¨

Note: Schedules

filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7 for

other parties to whom copies are to be sent.

*The remainder of this cover page shall be

filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent

amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this

cover page shall not be deemed to be “filed” for the purpose of section 18 of the Securities Exchange Act of 1934

(the “Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions

of the Act (however, see the Notes).

| 1 |

NAME OF REPORTING PERSONS

Canada Pension Plan Investment Board |

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See Instructions) |

(a) ¨

(b) x |

| 3 |

SEC USE ONLY |

|

| 4 |

SOURCE OF FUNDS (See Instructions)

WC |

|

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Canada |

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON WITH |

7 |

SOLE VOTING POWER

0 |

|

| 8 |

SHARED VOTING POWER

21,661,095 |

|

| 9 |

SOLE DISPOSITIVE POWER

0 |

|

| 10 |

SHARED DISPOSITIVE POWER

21,661,095 |

|

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

21,661,095 |

|

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions) |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

7.9%(1) |

|

| 14 |

TYPE OF REPORTING PERSON (See Instructions)

CO |

|

| |

|

|

|

|

(1) This calculation is based on 273,674,394 shares of common

stock, par value $0.50 per share (the “Common Stock”) of Essential Utilities, Inc. (formerly known as Aqua America, Inc.),

a Pennsylvania corporation (the “Issuer”), outstanding as of August 8, 2024, as reported in the Issuer’s

Prospectus Supplement, filed with the Securities and Exchange Commission (the “SEC”) on August 13, 2024 (the “Prospectus

Supplement”).

| 1 |

NAME OF REPORTING PERSONS

CPP Investment Board PMI-2 Inc. |

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See Instructions) |

(a) ¨

(b) x |

| 3 |

SEC USE ONLY |

|

| 4 |

SOURCE OF FUNDS (See Instructions)

AF |

|

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Canada |

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON WITH |

7 |

SOLE VOTING POWER

0 |

|

| 8 |

SHARED VOTING POWER

21,661,095 |

|

| 9 |

SOLE DISPOSITIVE POWER

0 |

|

| 10 |

SHARED DISPOSITIVE POWER

21,661,095 |

|

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

21,661,095 |

|

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions) |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

7.9%(1) |

|

| 14 |

TYPE OF REPORTING PERSON (See Instructions)

CO |

|

| |

|

|

|

|

(1) This calculation is based on 273,674,394 shares of Common

Stock of the Issuer outstanding as of August 8, 2024, as reported in the Prospectus Supplement.

Explanatory Note

This Amendment No. 1 to Schedule 13D amends

and supplements the statement on Schedule 13D filed with the SEC on March 24, 2020 (the “Statement”), relating to the

Common Stock of the Issuer. Capitalized terms used but not defined herein shall have the meanings ascribed to them in the Statement.

| Item 4. | Purpose of Transaction. |

Item 4 of the Statement is hereby amended and supplemented as follows:

On November 6, 2024, Ms. Edwina Kelly,

PMI-2’s designee to the Issuer’s Board, tendered her resignation as a member of the Board (the “Resignation”).

PMI-2 has irrevocably waived its right to designate a director to fill the vacancy left by the Resignation.

| Item 5. | Interest in Securities of the Issuer. |

Item 5 of the Statement is hereby amended and restated as follows:

(a) – (b) See Items 7 to

11 and Item 13 on page 2 of this Schedule 13D.

The Reporting Persons beneficially own, and have

shared voting power and shared dispositive power with respect to, 21,661,095 shares of the Common Stock, representing approximately 7.9%

of the outstanding Common Stock. Such percentage is calculated based on 273,674,394 shares of Common Stock outstanding as of August 8,

2024, as reported in the Prospectus Supplement.

| (c) | Except as described in Item 3 above or elsewhere in this Schedule 13D, neither of the Reporting Persons nor, to the Reporting Persons’

knowledge, any Covered Person has effected any transactions in the Common Stock during the past sixty days. |

| (d) | No person (other than the Reporting Persons) is known to the Reporting Persons or, to the Reporting Persons’ knowledge, the

Covered Persons, to have the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of,

any Common Stock covered by this Schedule 13D. |

SIGNATURE

After reasonable inquiry and to the best of my

knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Date: November 8,

2024

| |

CANADA PENSION PLAN INVESTMENT BOARD |

| |

|

| |

By |

/s/ Kathryn Daniels |

| |

|

Name: Kathryn Daniels |

| |

|

Title: Managing Director, Head of Compliance |

| |

|

| |

CPP Investment Board PMI-2 Inc. |

| |

|

| |

By |

/s/ Pierre Abinakle |

| |

|

Name: Pierre Abinakle |

| |

|

Title: Secretary |

POWER OF ATTORNEY

KNOW

ALL PERSONS BY THESE PRESENTS that the undersigned ("CPPIB") does hereby make, constitute

and appoint KATHRYN DANIELS and RYAN BARRY, as its true and lawful attorneys-in-fact (the "Attorneys-In-Fact" and

each an "Attorney-In-Fact"), to execute and deliver in its name and on its behalf, any and all filings, be

they written or oral, required to be made by CPPIB with respect to securities which may be deemed to be beneficially owned by CPPIB under:

| |

· |

Section 13 of the

Securities Exchange Act of 1934, as amended (the "Exchange Act"), including those filings required to

be submitted on Schedule 13D or Schedule 13G or any amendments thereto ("Exchange Act Filings"), |

| |

· |

do and perform any and

all acts for and on behalf of CPPIB which an Attorney-In-Fact determines may be necessary or desirable to complete and execute any

such Exchange Act Filings, and timely file such document with the Securities and Exchange Commission; and |

| |

· |

take any

other action of any type whatsoever in connection with the foregoing which, in the opinion of an Attorney-In-Fact, may be of benefit

to, in the best interest of, or legally required by, CPPIB (it being understood that the documents executed by an Attorney-In-Fact

on behalf of CPPIB pursuant to this Power of Attorney shall be in such form and shall contain such terms and conditions as such Attorney-In-Fact

may approve in the Attorney-In-Fact's sole discretion). |

CPPIB hereby grants to each

Attorney-In-Fact full power and authority to do and perform any and every act and thing whatsoever requisite, necessary, or proper to

be done in the exercise of any of the rights and powers herein granted, as fully to all intents and purposes as CPPIB might or could do

if personally present, with full power of substitution or revocation, hereby ratifying and confirming all that each Attorney-In-Fact,

or each Attorney-In-Fact's substitute or substitutes, shall lawfully do or cause to be done by virtue of this Power of Attorney and the

rights and powers herein granted.

This Power of Attorney shall

remain in full force and effect until either revoked in writing by CPPIB or until such time as the person to whom power of attorney has

been hereby granted ceases to be an employee of CPPIB.

This ·Power of Attorney

may be executed in any number of counterparts all of which taken together shall constitute one and the same instrument.

IN

WITNESS WH EREOF, the undersigned hereby executes this Power of Attorney effective as of the date set forth below.

| CANADA PENSION PLAN INVESTMENT BOARD |

|

| |

|

| By: |

/s/ Patrice Walch-Watson |

|

| Name: |

Patrice Walch-Watson |

|

| Title: |

Senior Managing Director, General Counsel & Corporate Secretary |

|

| Date: |

February 14, 2024 |

|

Schedule I

Directors and Officers of CPPIB

The name, present principal occupation or employment,

business address and citizenship of each of the directors and executive officers of CPPIB are set forth below.

Directors of CPPIB

Judith Athaide

c/o Canada Pension Plan Investment Board, One Queen Street East, Suite 2500,

Toronto, ON M5C 2W5

Principal Occupation: Corporate Executive, The Cogent Group Inc.

Citizenship: Canada, United Kingdom

Sylvia Chrominska

c/o Canada Pension Plan Investment Board, One Queen Street East, Suite 2500,

Toronto, ON M5C 2W5

Principal Occupation: Corporate Director

Citizenship: Canada

Dean Connor

c/o Canada Pension Plan Investment Board, One Queen Street East, Suite 2500,

Toronto, ON M5C 2W5

Principal Occupation: Corporate Director

Citizenship: Canada

William ‘Mark’ Evans

c/o Canada Pension Plan Investment Board, One Queen Street East, Suite 2500,

Toronto, ON M5C 2W5

Principal Occupation: Corporate Director

Citizenship: Canada

Ashleigh Everett

c/o Canada Pension Plan Investment Board, One Queen Street East, Suite 2500,

Toronto, ON M5C 2W5

Principal Occupation: Corporate Executive, Royal Canadian Securities

Limited

Citizenship: Canada

Tahira Hassan

c/o Canada Pension Plan Investment Board, One Queen Street East, Suite 2500,

Toronto, ON M5C 2W5

Principal Occupation: Corporate Director

Citizenship: Canada, Pakistan

Nadir Mohamed

c/o Canada Pension Plan Investment Board, One Queen Street East, Suite 2500,

Toronto, ON M5C 2W5

Principal Occupation: Corporate Director

Citizenship: Canada

John Montalbano

c/o Canada Pension Plan Investment Board, One Queen Street East, Suite 2500,

Toronto, ON M5C 2W5

Principal Occupation: Corporate Director

Citizenship: Canada

Barry Perry

c/o Canada Pension Plan Investment Board, One Queen Street East, Suite 2500,

Toronto, ON M5C 2W5

Principal Occupation: Corporate Director

Citizenship: Canada

Mary Phibbs

c/o Canada Pension Plan Investment Board, One Queen Street East, Suite 2500,

Toronto, ON M5C 2W5

Principal Occupation: Corporate Director

Citizenship: Australia, United Kingdom

Boon Sim

c/o Canada Pension Plan Investment Board, One Queen Street East, Suite 2500,

Toronto, ON M5C 2W5

Principal Occupation: Corporate Director

Citizenship: United States

Executive Officers of CPPIB

John Graham

c/o Canada Pension Plan Investment Board, One

Queen Street East, Suite 2500, Toronto, ON M5C 2W5

Principal Occupation: President and Chief Executive

Officer

Citizenship: Canada, United Kingdom

Maximilian Biagosch

c/o Canada Pension Plan Investment Board, One

Queen Street East, Suite 2500, Toronto, ON M5C 2W5

Principal Occupation: Senior Managing Director,

Global Head of Real Assets & Head of Europe

Citizenship: Germany

Edwin D. Cass

c/o Canada Pension Plan Investment Board, One

Queen Street East, Suite 2500, Toronto, ON M5C 2W5

Principal Occupation: Senior Managing Director &

Chief Investment Officer

Citizenship: Canada

Andrew Edgell

c/o Canada Pension Plan Investment Board, One

Queen Street East, Suite 2500, Toronto, ON M5C 2W5

Principal Occupation: Senior Managing Director &

Global Head of Credit Investments

Citizenship: Canada

Kristina Fanjoy

c/o Canada Pension Plan Investment Board, One

Queen Street East, Suite 2500, Toronto, ON M5C 2W5

Principal Occupation: Senior Managing Director &

Chief Financial Officer

Citizenship: Canada, Croatia

Caitlin Gubbels

c/o Canada Pension Plan Investment Board, One

Queen Street East, Suite 2500, Toronto, ON M5C 2W5

Principal Occupation: Senior Managing Director &

Global Head of Private Equity

Citizenship: Canada

Frank Ieraci

c/o Canada Pension Plan Investment Board, One

Queen Street East, Suite 2500, Toronto, ON M5C 2W5

Principal Occupation: Senior Managing Director &

Global Head of Active Equities and Investment Science

Citizenship: Canada

Manroop Jhooty

c/o Canada Pension Plan Investment Board, One

Queen Street East, Suite 2500, Toronto, ON M5C 2W5

Principal Occupation: Senior Managing Director &

Head of Total Fund Management

Citizenship: Canada

Michel Leduc

c/o Canada Pension Plan Investment Board, One

Queen Street East, Suite 2500, Toronto, ON M5C 2W5

Principal Occupation: Senior Managing Director &

Global Head of Public Affairs and Communications

Citizenship: Canada

Geoffrey Rubin

c/o Canada Pension Plan Investment Board, One

Queen Street East, Suite 2500, Toronto, ON M5C 2W5

Principal Occupation: Senior Managing Director &

One Fund Strategist

Citizenship: Canada, United States, Switzerland

Priti Singh

c/o Canada Pension Plan Investment Board, One

Queen Street East, Suite 2500, Toronto, ON M5C 2W5

Principal Occupation: Senior Managing Director &

Chief Risk Officer

Citizenship: Canada

Mary Sullivan

c/o Canada Pension Plan Investment Board, One

Queen Street East, Suite 2500, Toronto, ON M5C 2W5

Principal Occupation: Senior Managing Director &

Chief Talent Officer

Citizenship: Canada

Agus Tandiono

c/o Canada Pension Plan Investment Board, One

Queen Street East, Suite 2500, Toronto, ON M5C 2W5

Principal Occupation: Senior Managing Director,

Head of Asia Pacific & Active Equities Asia

Citizenship: Indonesia

Heath Tobin

c/o Canada Pension Plan Investment Board, One

Queen Street East, Suite 2500, Toronto, ON M5C 2W5

Principal Occupation: Senior Managing Director &

Global Head of Capital Markets and Factor Investing

Citizenship: Canada

Patrice Walch-Watson

c/o Canada Pension Plan Investment Board, One

Queen Street East, Suite 2500, Toronto, ON M5C 2W5

Principal Occupation: Senior Managing Director,

General Counsel & Corporate Secretary

Citizenship: Canada

Jon Webster

c/o Canada Pension Plan Investment Board, One

Queen Street East, Suite 2500, Toronto, ON M5C 2W5

Principal Occupation: Senior Managing Director &

Chief Operating Officer

Citizenship: United Kingdom

Directors of PMI-2

Pierre Abinakle

c/o CPP Investment Board PMI-2 Inc., One Queen Street East, Suite 2500,

Toronto, ON M5C 2W5

Principal Occupation: Managing Director, Legal, Canada Pension Plan

Investment Board

Citizenship: Canada

Christina Fernandez

c/o CPP Investment Board PMI-2 Inc., One Queen Street East, Suite 2500,

Toronto, ON M5C 2W5

Principal Occupation: Managing Director, Head of Tax and Structure

Management, Canada Pension Plan Investment Board

Citizenship: Australia, United Kingdom

Executive Officers of PMI-2

Pierre Abinakle

c/o CPP Investment Board PMI-2 Inc., One Queen Street East, Suite 2500,

Toronto, ON M5C 2W5

Principal Occupation: Secretary

Citizenship: Canada

John Graham

c/o CPP Investment Board PMI-2 Inc., One Queen Street East, Suite 2500,

Toronto, ON M5C 2W5

Principal Occupation: Managing Director, Legal, Canada Pension Plan

Investment Board

Citizenship: Canada, United Kingdom

Christina Fernandez

c/o CPP Investment Board PMI-2 Inc., One Queen Street East, Suite 2500,

Toronto, ON M5C 2W5

Principal Occupation: Managing Director, Head of Tax and Structure

Management, Canada Pension Plan Investment Board

Citizenship: Australia, United Kingdom

Brian Savage

c/o CPP Investment Board PMI-2 Inc., One Queen Street East, Suite 2500,

Toronto, ON M5C 2W5

Principal Occupation: Managing Director, Legal, Canada Pension Plan

Investment Board

Citizenship: Canada

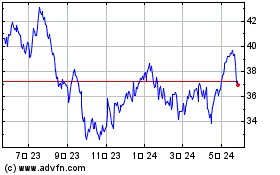

Essential Utilities (NYSE:WTRG)

過去 株価チャート

から 10 2024 まで 11 2024

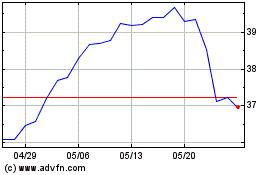

Essential Utilities (NYSE:WTRG)

過去 株価チャート

から 11 2023 まで 11 2024