Filed by Spirit AeroSystems Holdings, Inc.

pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject company: Spirit AeroSystems Holdings, Inc.

Commission file number: 001-33160

Additional Belfast and Casablanca Q&A

Employee terms and conditions

Is there an acquisition or

transition-to-Airbus premium for employees?

| · | We are still in the early stages of integration planning. |

| · | We cannot speak on behalf of Airbus regarding their specific plans for post

transaction closing. |

| · | Over the coming months, we will seek to provide further updates as we work

through these processes. |

Will voluntary redundancy packages be offered?

| · | There will be no voluntary redundancy packages offered prior to the closing

of these transactions, which, subject to closing conditions, we expect to happen in mid-2025. |

| · | We cannot comment on Boeing’s or Airbus’ post-closing operational

structures. Over the coming months, we will seek to provide further updates as we work through these processes. |

Is the company going to ask employees if they prefer working for

Boeing, Airbus or other interested parties?

| · | We are committed to working through this process with Boeing and Airbus in

a way that limits disruption for our programs and employees. |

| · | Until the transactions close, it remains business as usual across our sites. |

| · | There is still much work to be done and decisions to be made as we progress

negotiations of the definitive agreements with Airbus and integration planning with Boeing. |

| · | Over the coming months, we will seek to provide further updates as we work

through these processes and will inform and consult with employees and/or their representatives before any changes to roles, responsibilities

or reporting relationships are made in various jurisdictions, as may be legally required. |

Retention / Recruitment

Are we going to lay off employees

working on non-Airbus activities? Or will they be transferred to another owner?

| · | The term sheet contemplates that the non-Airbus

programs in Casablanca will be retained by Spirit (i.e., acquired by Boeing). |

| · | However, we are evaluating options for these operations.

The ultimate owner for these operations because of this process may be Boeing or a different owner. |

| · | Until the closing of the transactions, Spirit will continue to operate as

a standalone independent company. |

Will current recruitment exercises continue in Belfast? And what

will happen to our graduate and apprentice programmes?

| · | Until the closing of these transactions, which,

subject to closing conditions, we expect to occur in mid-2025, it’s business as usual for Spirit. |

| · | We have been actively recruiting to meet the production

rates required by our customers. |

| · | We remain focused on delivering on those commitments

and aligning our workforce with customer demand. |

Will the Belfast skills enhancement programme continue?

| · | Until the closing of these transactions, it’s

business as usual for Spirit and the skills enhancements programme will continue. |

| · | Our focus remains on delivering quality aircraft

structures for the airlines, the flying public and the aviation industry. |

| · | We are committed to working through this process

in a way that limits disruption for our programs and especially our employees, and we will keep you informed as we move forward. |

Belfast assets

Who are the potential buyers of the balance of the Belfast site?

| · | Spirit is currently pursuing the divestiture of operations in Belfast, Northern

Ireland other than those that support Airbus programs. Any decisions that might affect employees in Belfast will be subject to any legally

required employee information and consultation. |

| · | Over the coming months, we will seek to provide further updates as we work

through these processes. |

Are we in active discussions? What if no buyer can be found for

Belfast by mid-2025?

| · | We are committed to finding a buyer who values the Belfast business and its

growth potential. |

| · | With our strong, engineering-backed capabilities, we are confident our Northern

Ireland business offers an attractive proposition for potential buyers. |

Why does Boeing not consider retaining the rest of the Belfast site

which is non-Airbus?

| · | We are evaluating options for the non-Airbus programs.

The ultimate owner for those operations because of this process may be Boeing or a different owner. |

What will happen to the A220 mid-fuselage programme in Belfast?

| · | Under the term sheet with Airbus, Airbus will assume

ownership of our A220 program in Belfast. |

Who owns the critical IP for our RTI process and how will this be

handled in the future with Airbus?

| · | Short Brothers PLC will retain use of the IP it requires to continue its

operations. |

What will happen to Short Brothers PLC?

| · | The Short Brothers Pension Scheme will continue to provide benefits to its

members. |

| · | We will seek to provide these employees with further updates as we work through

these processes. |

What will happen to the Belfast leadership team?

| · | No decisions have been made on any potential post-closing management structure

of Spirit. |

| · | Until the transactions close, Spirit will continue to operate as a standalone

independent company and, right now, it is business as usual across our sites. |

Given our Belfast cash challenges, do we have enough financial support

to continue to operate and for how long?

| · | Spirit will continue to operate as a standalone company until the transactions

with Boeing and Airbus are completed, and that includes our Belfast operations. |

Casablanca assets

What will happen to non-Airbus activities in Casablanca, including

MRO?

| · | The term sheet contemplates that the non-Airbus programs in Casablanca will

be retained by Spirit (i.e., acquired by Boeing). |

| · | However, we are evaluating options for these operations. The ultimate owner

for these operations as a result of this process may be Boeing or a different owner. |

Who will be the new owner

of Casablanca - Airbus Atlantic, Airbus Canada?

| · | We cannot comment on Airbus’s post-closing

operational structures. |

Is Airbus only interested

in buying our Casablanca facility to support its current operations at its Casablanca Airport facility?

| · | We can’t speak on behalf of Airbus. |

| · | However, according to Airbus’s announcement,

Airbus is interested in our Casablanca facility for its capabilities. |

What is the future of our

Shared Services activities in Casablanca, which are currently supporting our Belfast site?

| · | We are currently evaluating options for Casablanca assets that may not be acquired by

Boeing or Airbus. |

| · | Over the coming months, we will seek to provide further updates as we work

through these processes. |

| · | Until the transactions close, Spirit will continue to operate as a standalone

independent company and, right now, it is business as usual across our sites. |

What is the future of A321

FTB Casablanca work package that supports Prestwick?

| · | No decisions have been made on current operations

/ work packages. |

| · | Over the coming months, we will seek to provide further updates as we work

through these processes. |

| · | Until the transactions close, Spirit will continue to operate as a standalone

independent company and, right now, it’s business as usual across our sites. |

What is the future of A220

FLE and A220 keel beam in Casablanca? Are they going to be relocated to Belfast?

| · | No decisions have been made on current operations

/ work packages. |

| · | Over the coming months, we will seek to provide further updates as we work

through these processes. |

| · | Until the transactions close, Spirit will continue to operate as a standalone

independent company and, right now, it is business as usual across our sites. |

Who will be leading our union

negotiations in Casablanca next year?

| · | The negotiations with our unions in Casablanca are separate from the transactions

we announced. |

| · | We are committed to working through this process in a way that limits disruption

for our programs and especially our employees. |

| · | We will keep you informed as we move forward. |

| · | Until the transactions close, Spirit will continue to operate as a standalone

independent company and, right now, it is business as usual across our sites. |

Important Information and Where to Find It

In connection with the proposed transaction

between Spirit AeroSystems Holdings, Inc. (“Spirit”) and The Boeing Company (“Boeing”), Boeing

will file with the U.S. Securities and Exchange Commission (“SEC”) a registration statement on Form S-4, which

will include a proxy statement of Spirit that will also be a prospectus of Boeing with respect to shares of common stock of Boeing to

be issued in the proposed transaction (the “proxy statement/prospectus”). Spirit and Boeing may also file other documents

with the SEC regarding the proposed transaction. This communication is not a substitute for the registration statement, the proxy statement/prospectus

or any other document Spirit or Boeing may file with the SEC. Investors and security holders are urged to read the proxy statement/prospectus

and any other relevant documents that are filed or will be filed with the SEC when they become available, because they contain or will

contain important information about the proposed transaction and related matters. Investors and security holders may obtain free copies

of the registration statement and the proxy statement/prospectus (when they become available) and other documents that are filed or will

be filed with the SEC by Spirit or Boeing through the SEC’s website at https://www.sec.gov. Copies of documents filed with

the SEC by Spirit will be available free of charge through Spirit’s website at https://investor.spiritaero.com/corporate-profile/default.aspx.

Copies of documents filed with the SEC by Boeing will be available free of charge through Boeing’s website at www.boeing.com/investors.

The information included on, or accessible through, Boeing’s or Spirit’s website is not incorporated by reference into this

communication.

Participants in the Solicitation

Spirit and its directors and certain of Spirit’s executive officers

and other employees, and Boeing and certain of its directors, executive officers and other employees, may be deemed to be participants

in the solicitation of proxies from Spirit’s stockholders in connection with the proposed transaction between Spirit and Boeing.

A description of participants’ direct or indirect interests, by security holdings or otherwise, will be included in the proxy statement/prospectus

relating to the proposed transaction when it is filed with the SEC. Information regarding Spirit’s directors and executive officers

is contained in the “Proposal 1 – Election of Directors,” “Corporate Governance,” “Director

Compensation,” “Stock Ownership” and “Compensation Discussion and Analysis” sections of Spirit’s definitive

proxy statement for its 2024 annual meeting of stockholders, filed with the SEC on March 12, 2024, under the heading “Executive

Officers of the Registrant” in Part I of Spirit’s Annual Report on Form 10-K for the fiscal year ended December 31,

2023, filed with the SEC on February 22, 2024, in Item 5.07 of Spirit’s Current Report on Form 8-K filed with the SEC

on April 29, 2024, in Spirit’s Current Reports on Form 8-K filed with the SEC on June 5, 2024 and July 22, 2024,

and under “Officers & Directors” accessed through the “Corporate Governance” link on Spirit’s website

at https://investor.spiritaero.com/corporate-profile/default.aspx. Information regarding Boeing’s directors and executive

officers is contained in the “Proxy Summary – Leadership Changes,” “Election of Directors (Item 1),”

“Corporate Governance,” “Compensation Discussion and Analysis,” “Compensation of Executive Officers”

and “Stock Ownership Information” sections of the definitive proxy statement for Boeing’s 2024 annual meeting of shareholders,

filed with the SEC on April 5, 2024, in Item 10 of Boeing’s Annual Report on Form 10-K for the fiscal year ended

December 31, 2023, filed with the SEC on January 31, 2024, in Boeing’s Current Reports on Form 8-K filed with the

SEC on December 11, 2023, March 25, 2024, and May 17, 2024, and in Boeing’s February 22, 2024 press release,

available on Boeing’s investor relations website at www.boeing.com/investors, relating to the appointment of a new Chief

Human Resources Officer. Additional information regarding ownership of Spirit’s securities by its directors and executive officers

and of Boeing’s securities by its directors and executive officers is included in such persons’ SEC filings on Forms 3 and 4.

These documents and the other SEC filings described in this paragraph may be obtained free of charge as described above under the heading

“Important Information and Where to Find It.”

No Offer or Solicitation

This communication is not intended to and shall not constitute an offer

to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which

such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act

of 1933, as amended.

Cautionary Statement Regarding Forward-Looking Statements

This communication includes “forward-looking statements”

that involve many risks and uncertainties. Forward-looking statements generally can be identified by the use of forward-looking terminology

such as “aim,” “anticipate,” “believe,” “could,” “continue,” “estimate,”

“expect,” “forecast,” “goal,” “intend,” “may,” “might,” “model,”

“objective,” “outlook,” “plan,” “potential,” “predict,” “project,”

“seek,” “should,” “target,” “will,” “would,” and other similar words, or phrases,

or the negative thereof, unless the context requires otherwise. Forward-looking statements in this communication include, but are not

limited to, statements regarding the proposed acquisition of Spirit (together with its consolidated subsidiaries, the “Company”)

by Boeing (the “Boeing Merger Transaction”) and the proposed divestiture of a portion of the Company’s business

to Airbus SE (“Airbus”) and its affiliates (the “Airbus Business Disposition”) in connection with

the Boeing Merger Transaction as contemplated by the term sheet between Spirit AeroSystems, Inc., a wholly owned subsidiary of Spirit

(the “Operating Company”), and Airbus, including, without limitation, statements about the expected timing of completion

of the Boeing Merger Transaction and the Airbus Business Disposition (together, the “Transactions,” and each a “Transaction”)

and other aspects of the Transactions. Forward-looking statements are based on circumstances as of the date on which the statements are

made and they reflect management’s current views with respect to future events and are subject to risks and uncertainties, both

known and unknown. Actual results may vary materially from those anticipated in forward-looking statements. Investors should not place

undue reliance on any forward-looking statements.

Important factors that could cause actual results to differ materially

from those in the forward-looking statements include risks and uncertainties relating to the Transactions, including, among others: the

possible inability of the Company to negotiate and enter into definitive agreements with Airbus and its affiliates with respect to the

Airbus Business Disposition; the possible inability of the parties to a Transaction to obtain the required regulatory approvals for such

Transaction and to satisfy the other conditions to the closing of such Transaction (including, in the case of the Boeing Merger Transaction,

approval of the merger agreement by Spirit’s stockholders) on a timely basis or at all; the possible occurrence of events that may

give rise to a right of one or more of the parties to the Boeing Merger Transaction merger agreement to terminate such merger agreement;

the risk that the Boeing Merger Transaction merger agreement is terminated under circumstances requiring Spirit to pay a termination fee;

the risk that the Company is unable to consummate the Transactions on a timely basis or at all for any reason, including, without limitation,

failure to obtain the required regulatory approvals, failure to obtain Spirit stockholder approval of the Boeing Merger Transaction merger

agreement or failure to satisfy other conditions the closing of either of the Transactions; the potential for the announcement or pendency

of the Transactions or any failure to consummate the Transactions to adversely affect the market price of Spirit’s common stock

or the Company’s financial performance or business relationships; risks relating to the value of Boeing’s common stock to

be issued in the Boeing Merger Transaction; the possibility that the anticipated benefits of the Transactions cannot be realized in full

or at all or may take longer to realize than expected; the possibility that costs or difficulties related to the integration of the Company’s

operations with those of Boeing will be greater than expected; risks relating to significant transaction costs; the intended or actual

tax treatment of the Transactions; potential litigation or other legal or regulatory action relating to the Transactions or otherwise

relating to the Company or other parties to the Transactions that could be instituted against the Company or such other parties or Spirit’s

or such other parties’ respective directors and officers and the effect of the outcome of any such litigation or other legal or

regulatory action; risks associated with contracts containing provisions that may be triggered by the Transactions; potential difficulties

in retaining and hiring key personnel or arising in connection with labor disputes during the pendency of or following the Transactions;

the risk of other Transaction-related disruptions to the business, including business plans and operations, of the Company; the potential

for the Transactions to divert the time and attention of management from ongoing business operations; the potential for contractual restrictions

under the agreements relating to the Transactions to adversely affect the Company’s ability to pursue other business opportunities

or strategic transactions; and competitors’ responses to the Transactions.

Additional important factors that could cause actual results to differ

materially from those reflected in the forward-looking statements and that should be considered in evaluating the Company’s outlook

include, but are not limited to, the following: the continued fragility of the global aerospace supply chain including the Company’s

dependence on its suppliers, as well as the cost and availability of raw materials and purchased components, including increases in energy,

freight, and other raw material costs as a result of inflation or continued global inflationary pressures; the Company’s ability

and its suppliers’ ability and willingness to meet stringent delivery (including quality and timeliness) standards and accommodate

changes in the build rates or model mix of aircraft under existing contractual commitments, including the ability or willingness to staff

appropriately or expend capital for current production volumes and anticipated production volume increases; the Company’s ability

to maintain continuing, uninterrupted production at its manufacturing facilities and its suppliers’ facilities; the Company’s

ability, and its suppliers’ ability, to attract and retain the skilled work force necessary for production and development in an

extremely competitive market; the effect of economic conditions, including increases in interest rates and inflation, on the demand for

the Company’s and its customers’ products and services, on the industries and markets in which it operates in the U.S. and

globally, and on the global aerospace supply chain; the general effect of geopolitical conditions, including Russia’s invasion of

Ukraine and the resultant sanctions being imposed in response to the conflict, including any trade and transport restrictions; the war

in Israel and the Gaza Strip and the potential for expansion of the conflict in the surrounding region, which may impact certain suppliers’

ability to continue production or make timely deliveries of supplies required to produce and timely deliver the Company’s products,

and may result in sanctions being imposed in response to the conflict, including trade and transport restrictions; the Company’s

relationships with the unions representing many of its employees, including the Company’s ability to successfully negotiate new

agreements, and avoid labor disputes and work stoppages with respect to its union-represented employees; the impact of significant

health events, such as pandemics, contagions or other public health emergencies (including the COVID-19 pandemic) or fear of such events,

on the demand for the Company’s and its customers’ products and services and on the industries and markets in which the Company

operates in the U.S. and globally; the timing and conditions surrounding the full worldwide return to service (including receiving the

remaining regulatory approvals) of the B737 MAX, future demand for the aircraft, and any residual impacts of the B737 MAX grounding on

production rates for the aircraft; the Company’s reliance on Boeing and Airbus and its affiliates for a significant portion of its

revenues; the business condition and liquidity of the Company’s customers and their ability to satisfy their contractual obligations

to the Company; the certainty of the Company’s backlog, including the ability of customers to cancel or delay orders prior to shipment

on short notice, and the potential impact of regulatory approvals of existing and derivative models; the Company’s ability to accurately

estimate and manage performance, cost, margins, and revenue under its contracts, and the potential for additional forward losses on new

and maturing programs; the Company’s accounting estimates for revenue and costs for its contracts and potential changes to those

estimates; the Company’s ability to continue to grow and diversify its business, execute its growth strategy, and secure replacement

programs, including its ability to enter into profitable supply arrangements with additional customers; the outcome of product warranty

or defective product claims and the impact settlement of such claims may have on the Company’s accounting assumptions; competitive

conditions in the markets in which the Company operates, including in-sourcing by commercial aerospace original equipment manufacturers;

the Company’s ability to successfully negotiate, or re-negotiate, future pricing under its supply agreements with Boeing, Airbus

and its affiliates and other customers; the possibility that the Company’s cash flows may not be adequate for its additional capital

needs; any reduction in the Company’s credit ratings; the Company’s ability to access the capital or credit markets to fund

its liquidity needs, and the costs and terms of any additional financing; the Company’s ability to avoid or recover from cyber or

other security attacks and other operations disruptions; legislative or regulatory actions, both domestic and foreign, impacting the Company’s

operations, including the effect of changes in tax laws and rates and the Company’s ability to accurately calculate and estimate

the effect of such changes; spending by the U.S. and other governments on defense; pension plan assumptions and future contributions;

the effectiveness of the Company’s internal control over financial reporting; the outcome or impact of ongoing or future litigation,

arbitration, claims, and regulatory actions or investigations, including the Company’s exposure to potential product liability and

warranty claims; adequacy of the Company’s insurance coverage; the Company’s ability to continue selling certain receivables

through its receivables financing programs; the Company’s ability to effectively integrate recent acquisitions, along with other

acquisitions it pursues, and generate synergies and other cost savings therefrom, while avoiding unexpected costs, charges, expenses,

and adverse changes to business relationships and business disruptions; and the risks of doing business internationally, including fluctuations

in foreign currency exchange rates, impositions of tariffs or embargoes, trade restrictions, compliance with foreign laws, and domestic

and foreign government policies.

The factors described above are not exhaustive, and it is not possible

for Spirit to predict all factors that could cause actual results to differ materially from those reflected in its forward-looking statements.

These factors speak only as of the date hereof, and new factors may emerge or changes to the foregoing factors may occur that could impact

the Company’s business or the Transactions. As with any projection or forecast, these statements are inherently susceptible to uncertainty

and changes in circumstances. Except to the extent required by law, Spirit undertakes no obligation to, and expressly disclaims any obligation

to, publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise. Refer

to the section captioned “Risk Factors” in Spirit’s Annual Report on Form 10-K for the fiscal year ended December 31,

2023, filed with the SEC on February 22, 2024, for a more complete discussion of the factors described in the immediately preceding

paragraph and other factors that may affect the Company’s business.

Certain Labor Matters

The binding term sheet with Airbus (the “Airbus Term Sheet”)

provides that no binding agreement has been made with respect to the French aspects of the transactions contemplated under the Airbus

Term Sheet (the “Airbus French Transactions”). Prior to the Company and Airbus and its affiliates entering into definitive

agreements that are applicable to the Airbus French Transactions, the Operating Company and Airbus have agreed to comply with their respective

information and consultation obligations with applicable employees and employee representatives. The Airbus Term Sheet also provides that

the parties will complete necessary labor consultations and obtain necessary approvals from applicable unions and works councils in various

jurisdictions, as may be legally required.

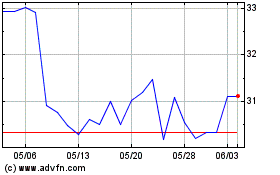

Spirit Aerosystems (NYSE:SPR)

過去 株価チャート

から 7 2024 まで 7 2024

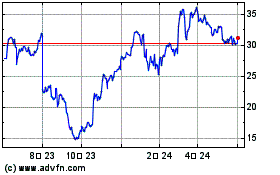

Spirit Aerosystems (NYSE:SPR)

過去 株価チャート

から 7 2023 まで 7 2024