- Petroleum Additives Sales Up 2.6% in

the Third Quarter, 6.9% in the First Nine Months

- Third Quarter Net Income Down 2.2%

and Earnings Per Share Up 1.6% versus Third Quarter of

2017

- Nine Months Net Income Down 7.8% and

Earnings Per Share Down 6.0% versus Nine Months of 2017

- 385,181 Shares Repurchased in the

First Nine Months of 2018

NewMarket Corporation (NYSE:NEU) Chairman and Chief Executive

Officer, Thomas E. Gottwald, released the following earnings report

of the Company’s operations for the third quarter and first nine

months of 2018.

Net income for the third quarter of 2018 was $58.5 million,

compared to net income of $59.8 million for the third quarter of

2017. Earnings per share increased 1.6% to $5.12 per share from

$5.04 per share in the prior year period. For the first nine months

of 2018, net income was $171.9 million, or $14.78 per share,

compared to net income of $186.4 million, or $15.73 per share, for

the first nine months of last year.

Sales for the petroleum additives segment for the third quarter

of 2018 were $560.5 million, up 2.6% versus the same period last

year, due mainly to increased selling prices. Petroleum additives

operating profit for the third quarter of 2018 was $75.8 million, a

9.9% decrease over third quarter operating profit last year of

$84.2 million. The decrease was due mainly to higher raw material

and conversion costs plus unfavorable changes in foreign currency

rates, which were only partially offset by increased selling

prices. Petroleum additives operating margin for the quarter was

13.5% compared to 15.4% in the prior-year quarter. Shipments

between quarterly periods were down 3.6% from the same period last

year with decreases in both lubricant additives and fuel additives

shipments. All regions except Asia Pacific showed decreases in both

lubricant additives and fuel additives shipments.

Petroleum additives sales for the first nine months of the year

were $1.7 billion compared to sales in the first nine months of

last year of $1.6 billion, or an increase of 6.9%. This increase

was due mainly to selling prices, changes in foreign currency rates

and product mix. Petroleum additives operating profit for the first

nine months of the year was $231.5 million compared to $270.8

million for the first nine months of 2017, or a decrease of 14.5%.

The decrease was due mainly to higher raw material and conversion

costs, as well as unfavorable changes in foreign currency rates,

partially offset by increased selling prices. Petroleum additives

operating margin for the first nine months of 2018 was 13.3%

compared to 16.6% in the prior-year nine month period. Shipments

decreased slightly between periods, with increases in lubricant

additives shipments offset by decreases in fuel additives

shipments. Asia Pacific was the region contributing to the increase

in lubricant additives shipments. Europe and North America were the

primary drivers for the decrease in fuel additives shipments.

The effective income tax rate for the third quarter of 2018 was

14.4%, down from the rate of 22.4% in the same period last year.

The effective rate for the first nine months of 2018 was 21.6%,

down from the rate in 2017 of 25.6%. The rates in both 2018 periods

were lower due mainly to the Tax Cuts and Jobs Act of 2017,

including the reduction of deferred tax liabilities related to

pension contributions.

We have continued to see downward pressure on our operating

margins, consistent with the last few quarters, which is directly

related to the steady rise in raw material costs we have seen over

the past two years. While we have made some progress in adjusting

our selling prices to help compensate for the increase in costs, we

have continued to experience the lag between when the price

increases go into effect and when we start to see margins improve.

We expect this lag to continue until raw material prices stabilize.

Margin improvement will continue to be our number one priority for

the remainder of this year and into 2019.

During the first nine months of 2018, we funded capital

expenditures of $55.1 million, paid dividends of $60.8 million and

repurchased 385,181 shares of our common stock for a total of

$148.6 million, through a combination of borrowing under our

revolving credit facility and cash from operations.

We make decisions that we believe will promote the greatest

long-term value for our shareholders, customers and employees. We

will remain focused on our long-term objectives, including margin

improvement in the coming months. We believe the fundamentals of

how we run our business - a long-term view, safety-first culture,

customer-focused solutions, technology-driven product offerings,

and world-class supply chain capability - will continue to be

beneficial for all of our stakeholders.

Sincerely,

Thomas E. Gottwald

The Company has disclosed the non-GAAP financial measure EBITDA

and the related calculation in the schedules included with this

earnings release. EBITDA is defined as income from continuing

operations before the deduction of interest and financing expenses,

income taxes, depreciation and amortization. The Company believes

that even though this item is not required by or presented in

accordance with United States generally accepted accounting

principles (GAAP), this additional measure enhances understanding

of the Company’s performance and period to period comparability.

The Company believes that this item should not be considered an

alternative to net income determined under GAAP.

As a reminder, a conference call and Internet webcast is

scheduled for 3:00 p.m. EDT on Thursday, October 25, 2018, to

review third quarter 2018 financial results. You can access the

conference call live by dialing 1-877-407-9210 (domestic) or

1-201-689-8049 (international) and requesting the NewMarket

conference call. To avoid delays, callers should dial in five

minutes early. A teleconference replay of the call will be

available until November 1, 2018 at 11:59 p.m. EDT by dialing

1-877-481-4010 (domestic) or 1-919-882-2331 (international). The

replay ID number is 37828. The call will also be broadcast via the

Internet and can be accessed through the Company’s website at

www.NewMarket.com or www.investorcalendar.com. A webcast replay

will be available for 3 months.

NewMarket Corporation, through its subsidiaries Afton Chemical

Corporation and Ethyl Corporation, develops, manufactures, blends,

and delivers chemical additives that enhance the performance of

petroleum products. From custom-formulated additive packages to

market-general additives, the NewMarket family of companies

provides the world with the technology to make engines run

smoother, machines last longer, and fuels burn cleaner.

Some of the information contained in this press release

constitutes forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995. Although

NewMarket’s management believes its expectations are based on

reasonable assumptions within the bounds of its knowledge of its

business and operations, there can be no assurance that actual

results will not differ materially from expectations.

Factors that could cause actual results to differ materially

from expectations include, but are not limited to, the availability

of raw materials and distribution systems; disruptions at

manufacturing facilities, including single-sourced facilities; the

ability to respond effectively to technological changes in our

industry; failure to protect our intellectual property rights;

failure to attract and retain a highly-qualified workforce; hazards

common to chemical businesses; competition from other

manufacturers; sudden or sharp raw material price increases; the

gain or loss of significant customers; the occurrence or threat of

extraordinary events, including natural disasters and terrorist

attacks; risks related to operating outside of the United States;

the impact of fluctuations in foreign exchange rates; an

information technology system failure or security breach;

political, economic, and regulatory factors concerning our

products; current and future governmental regulations; resolution

of environmental liabilities or legal proceedings; our inability to

realize expected benefits from investment in our infrastructure or

from recent or future acquisitions, or our inability to

successfully integrate recent or future acquisitions into our

business; and other factors detailed from time to time in the

reports that NewMarket files with the Securities and Exchange

Commission, including the risk factors in Item 1A. “Risk Factors”

of our 2017 Annual Report on Form 10-K, which is available to

shareholders upon request.

You should keep in mind that any forward-looking statement made

by NewMarket in the foregoing discussion speaks only as of the date

on which such forward-looking statement is made. New risks and

uncertainties arise from time to time, and it is impossible for us

to predict these events or how they may affect the Company. We have

no duty to, and do not intend to, update or revise the

forward-looking statements in this discussion after the date

hereof, except as may be required by law. In light of these risks

and uncertainties, you should keep in mind that the events

described in any forward-looking statement made in this discussion,

or elsewhere, might not occur.

NEWMARKET CORPORATION AND

SUBSIDIARIES

SEGMENT RESULTS AND OTHER FINANCIAL

INFORMATION

(In thousands, except per-share amounts,

unaudited)

Third Quarter EndedSeptember

30, Nine Months EndedSeptember 30,

2018 2017 2018

2017 Revenue: Petroleum additives $ 560,522 $ 546,159

$ 1,743,632 $ 1,630,345 All other (a) 2,644

2,257 7,731 8,077

Total

$ 563,166 $ 548,416

$ 1,751,363 $ 1,638,422

Segment operating profit: Petroleum additives $ 75,824 $

84,173 $ 231,494 $ 270,841 All other (a) (2,295 )

1,093 (1,966 ) 2,943

Segment

operating profit 73,529 85,266 229,528

273,784 Corporate unallocated expense (5,402 ) (6,534 )

(16,033 ) (17,561 ) Interest and financing expenses (7,807 ) (5,564

) (18,536 ) (16,496 ) Other income (expense), net 7,994

3,809 24,231 10,773

Income before income tax expense $

68,314 $ 76,977 $

219,190 $ 250,500 Net

income $ 58,481 $ 59,772

$ 171,931 $ 186,437

Earnings per share - basic and diluted $

5.12 $ 5.04 $

14.78 $ 15.73

Notes to Segment Results and Other Financial

Information

Certain prior year amounts have been reclassified to reflect the

adoption of Accounting Standard Update No. 2017-07,

"Compensation-Retirement Benefits (Topic 715): Improving the

Presentation of Net Periodic Pension Cost and Net Periodic

Postretirement Benefit Cost". There was no impact to income before

income tax expense.

(a) "All other" includes the results of our TEL business, as

well as certain contracted manufacturing and services.

NEWMARKET CORPORATION AND

SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

INCOME

(In thousands, except per-share amounts,

unaudited)

Third Quarter EndedSeptember

30, Nine Months EndedSeptember 30,

2018 2017 2018

2017 Net sales $ 563,166 $ 548,416 $ 1,751,363 $ 1,638,422

Cost of goods sold 422,283 389,539 1,307,838

1,147,232 Gross profit 140,883 158,877 443,525 491,190

Selling, general, and administrative expenses 37,741 43,633 120,653

123,486 Research, development, and testing expenses 34,994

36,545 106,018 111,694 Operating profit 68,148

78,699 216,854 256,010 Interest and financing expenses, net 7,807

5,564 18,536 16,496 Other income (expense), net 7,973

3,842 20,872 10,986

Income before income tax

expense 68,314 76,977 219,190

250,500 Income tax expense 9,833 17,205

47,259 64,063

Net income $ 58,481

$ 59,772 $ 171,931 $

186,437 Earnings per share - basic and diluted

$ 5.12 $ 5.04 $ 14.78

$ 15.73 Cash dividends declared per share

$ 1.75 $ 1.75 $ 5.25

$ 5.25

Notes to Consolidated Statements of Income

Certain prior year amounts have been reclassified to reflect the

adoption of Accounting Standard Update No. 2017-07,

"Compensation-Retirement Benefits (Topic 715): Improving the

Presentation of Net Periodic Pension Cost and Net Periodic

Postretirement Benefit Cost". There was no impact to net

income.

NEWMARKET CORPORATION AND

SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(In thousands except share amounts,

unaudited)

September 30, 2018

December 31, 2017 ASSETS Current

assets: Cash and cash equivalents $ 147,935 $ 84,166 Trade and

other accounts receivable, less allowance for doubtful accounts

($178 - 2018; $215 - 2017) 347,903 335,317 Inventories 388,986

383,097 Prepaid expenses and other current assets 30,343

31,074

Total current assets

915,167 833,654 Property, plant,

and equipment, at cost 1,417,732 1,474,962 Less accumulated

depreciation and amortization 770,925 822,681

Net property, plant, and equipment

646,807 652,281 Intangibles (net

of amortization) and goodwill 137,533 144,337 Prepaid pension cost

125,618 66,495 Deferred income taxes 4,628 4,349 Deferred charges

and other assets 10,174 11,038

Total

assets $ 1,839,927 $

1,712,154 LIABILITIES AND SHAREHOLDERS' EQUITY

Current liabilities: Accounts payable $ 152,624 $ 159,408 Accrued

expenses 94,235 107,999 Dividends payable 18,257 19,055 Income

taxes payable 10,866 16,340 Other current liabilities 3,263

13,991

Total current liabilities

279,245 316,793 Long-term debt

818,477 602,900 Other noncurrent liabilities 178,133

190,812

Total liabilities

1,275,855 1,110,505

Shareholders' equity: Common stock and paid-in capital (without par

value; issued and outstanding shares - 11,404,031 at September 30,

2018 and 11,779,978 at December 31, 2017) 0 0 Accumulated other

comprehensive loss (148,453 ) (145,994 ) Retained earnings

712,525 747,643

Total shareholders'

equity 564,072 601,649

Total liabilities and shareholders' equity $

1,839,927 $ 1,712,154

NEWMARKET CORPORATION AND

SUBSIDIARIES

SELECTED CONSOLIDATED CASH FLOW

DATA

(In thousands, unaudited)

Nine Months EndedSeptember

30, 2018 2017 Net income $ 171,931

$ 186,437 Depreciation and amortization 53,463 39,196 Cash pension

and postretirement contributions (61,860 ) (19,566 ) Noncash

pension and postretirement expense 4,129 5,976 Working capital

changes (69,190 ) (34,945 ) Deferred income tax expense 10,257

8,639 Capital expenditures (55,136 ) (120,973 ) Acquisition of

business (net of $1,131 cash acquired) 0 (183,930 ) Net borrowings

(repayments) under revolving credit facility 215,619 (146,000 )

Issuance of 3.78% senior notes 0 250,000 Repurchases of common

stock (148,649 ) 0 Dividends paid (60,778 ) (62,227 ) All other

3,983 (9,765 ) Increase (decrease) in cash and

cash equivalents

$ 63,769 $

(87,158 )

NEWMARKET CORPORATION AND

SUBSIDIARIES

NON-GAAP FINANCIAL INFORMATION

(In thousands, unaudited)

Third Quarter EndedSeptember 30,

Nine Months EndedSeptember 30, 2018

2017 2018 2017 Net Income $

58,481 $ 59,772 $ 171,931

$ 186,437 Add: Interest and financing expenses, net

7,807 5,564 18,536 16,496 Income tax expense 9,833 17,205 47,259

64,063 Depreciation and amortization 17,958 14,301

52,607 38,380

EBITDA $ 94,079

$ 96,842 $ 290,333 $

305,376

View source

version on businesswire.com: https://www.businesswire.com/news/home/20181024005786/en/

NewMarket CorporationBrian D. Paliotti,

804.788.5555Investor RelationsFax:

804.788.5688investorrelations@newmarket.com

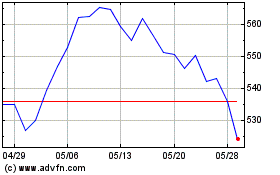

NewMarket (NYSE:NEU)

過去 株価チャート

から 6 2024 まで 7 2024

NewMarket (NYSE:NEU)

過去 株価チャート

から 7 2023 まで 7 2024