Ero Copper Corp. (TSX: ERO, NYSE: ERO) ("Ero" or the “Company”) is

pleased to announce an update of its National Instrument 43-101

(“NI 43-101”) compliant mineral reserve and resource estimates for

its Xavantina Operations, located in Mato Grosso State, Brazil. The

updated mineral reserve and mineral resource estimates incorporate

drilling activities and mining depletion on the properties through

June 30, 2024.

HIGHLIGHTS

- 19% increase in proven and probable

mineral reserves as compared to the 2023 estimate, including a 24%

increase at the Santo Antônio Vein.

- Proven and probable mineral reserve

compound annual growth rate ("CAGR") of approximately 62% from 2018

to 2024.

- 26% increase in measured and

indicated mineral resources, inclusive of mineral reserves, as

compared to the 2023 estimate, including a 31% increase at the

Santo Antônio Vein.

- Excess mill capacity of

approximately 25% continues to offer further expansion potential in

the near- and medium-term.

"Our ongoing exploration program at the

Xavantina Operations continues to deliver exceptional results,"

stated David Strang, Chief Executive Officer. "When we acquired

this asset in 2016, it had no mineral reserves, no mine life, and

annual production of just 25,000 ounces. We have since transformed

it into a robust operation with nearly 600,000 ounces of measured

and indicated resources, including 459,000 ounces of proven and

probable reserves. The successful completion of our NX 60

Initiative in 2023, highlighted by first production from the

Matinha Vein, was a major milestone, positioning Xavantina to

sustain annual production of approximately 55,000 to 60,000 ounces

in the years ahead.

"We are equally excited about Xavantina's

untapped potential, both near the mine and regionally. Our dual

strategy remains focused on extending mine life and discovering new

vein structures to expand mine and mill feed, enabling us to fully

utilize the mill’s installed capacity of up to 300,000 tonnes per

annum."

Xavantina Operations Proven &

Probable Mineral Reserve Evolution Since IPO

Note: Mineral reserve estimates were prepared in

accordance with the Canadian Institute of Mining, Metallurgy and

Petroleum (“CIM”) Definition Standards for Mineral Resources and

Mineral Reserves, adopted by the CIM Council on May 10, 2014 (the

“CIM Standards”), and the CIM Estimation of Mineral Resources and

Mineral Reserves Best Practice Guidelines, adopted by CIM Council

on November 29, 2019 (the “CIM Guidelines”), using geostatistical

and/or classical methods, plus economic and mining parameters

appropriate for the deposit. Please refer to the Notes on Mineral

Reserves and Mineral Resources section of this press release for a

discussion on the assumptions, parameters and methods used to

estimate the mineral reserves for 2024. 2024 mineral reserve

estimate effective date of June 30, 2024. Please see the 2018

Xavantina Technical Report, the 2019 Xavantina Technical Report,

the 2020 Xavantina Technical Report, the January 2022 Press

Release, the 2022 Xavantina Technical Report and the 2023 AIF, as

applicable and as defined below, for a discussion on the

assumptions, parameters and methods used to estimate the mineral

reserves for 2018, 2019, 2020, 2021, 2022 and 2023, respectively.

All figures have been rounded to the relative accuracy of the

estimates.

2024 MINERAL RESERVE AND RESOURCE

ESTIMATE

|

|

2023 Mineral Reserves & Resources |

2024 Mineral Reserves & Resources |

Change |

|

|

Tonnes |

|

Grade |

|

Contained |

|

Tonnes |

|

Grade |

|

Contained |

|

Contained |

|

% |

|

(kt) |

|

(Au gpt) |

|

Au (koz) |

|

(kt) |

|

(Au gpt) |

|

Au (koz) |

|

Au (koz) |

|

|

|

Santo Antônio Vein |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Proven Reserves |

290 |

|

8.57 |

|

80.0 |

|

223 |

|

9.68 |

|

69.4 |

|

(10.5) |

|

|

(13) |

|

|

Probable Reserves |

1,072 |

|

7.80 |

|

268.7 |

|

1,155 |

|

9.76 |

|

362.3 |

|

93.6 |

|

|

35 |

|

|

Proven & Probable Reserves |

1,362 |

|

7.96 |

|

348.7 |

|

1,378 |

|

9.75 |

|

431.8 |

|

83.1 |

|

|

24 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Measured Resources |

277 |

|

10.54 |

|

93.7 |

|

333 |

|

9.57 |

|

102.3 |

|

8.7 |

|

|

9 |

|

|

Indicated Resources |

1,042 |

|

9.92 |

|

332.2 |

|

1,222 |

|

11.57 |

|

454.6 |

|

122.3 |

|

|

37 |

|

|

Measured & Indicated |

1,318 |

|

10.05 |

|

425.9 |

|

1,554 |

|

11.15 |

|

556.9 |

|

131.0 |

|

|

31 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Inferred Resources |

154 |

|

9.05 |

|

45.0 |

|

259 |

|

13.49 |

|

112.2 |

|

67.2 |

|

|

150 |

|

|

Matinha Vein |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Proven Reserves |

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

|

NA |

|

|

Probable Reserves |

144 |

|

7.81 |

|

36.1 |

|

93 |

|

9.20 |

|

27.5 |

|

(8.6) |

|

|

(24) |

|

|

Proven & Probable Reserves |

144 |

|

7.81 |

|

36.1 |

|

93 |

|

9.20 |

|

27.5 |

|

(8.6) |

|

|

(24) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Measured Resources |

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

|

NA |

|

|

Indicated Resources |

150 |

|

9.90 |

|

47.6 |

|

130 |

|

9.59 |

|

40.1 |

|

(7.5) |

|

|

(16) |

|

|

Measured & Indicated |

150 |

|

9.90 |

|

47.6 |

|

130 |

|

9.59 |

|

40.1 |

|

(7.5) |

|

|

(16) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Inferred Resources |

202 |

|

11.94 |

|

77.5 |

|

216 |

|

11.54 |

|

80.3 |

|

2.7 |

|

|

4 |

|

|

Brás & Buracão Veins |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Measured Resources |

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

|

NA |

|

|

Indicated Resources |

7 |

|

3.36 |

|

0.7 |

|

7 |

|

3.36 |

|

0.7 |

|

— |

|

|

— |

|

|

Measured & Indicated |

7 |

|

3.36 |

|

0.7 |

|

7 |

|

3.36 |

|

0.7 |

|

— |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Inferred Resources |

157 |

|

4.71 |

|

23.8 |

|

157 |

|

4.71 |

|

23.8 |

|

— |

|

|

— |

|

|

Total Xavantina Operations |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Proven Reserves |

290 |

|

8.57 |

|

80.0 |

|

223 |

|

9.68 |

|

69.4 |

|

(10.5) |

|

|

(13) |

|

|

Probable Reserves |

1,215 |

|

7.80 |

|

304.8 |

|

1,248 |

|

9.72 |

|

389.8 |

|

85.1 |

|

|

28 |

|

|

Proven & Probable Reserves |

1,505 |

|

7.95 |

|

384.7 |

|

1,471 |

|

9.71 |

|

459.2 |

|

74.5 |

|

|

19 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Measured Resources |

277 |

|

10.54 |

|

93.7 |

|

333 |

|

9.57 |

|

102.3 |

|

8.7 |

|

|

9 |

|

|

Indicated Resources |

1,198 |

|

9.88 |

|

380.6 |

|

1,359 |

|

11.34 |

|

495.4 |

|

114.9 |

|

|

30 |

|

|

Measured & Indicated Resources |

1,474 |

|

10.00 |

|

474.2 |

|

1,691 |

|

10.99 |

|

597.8 |

|

123.5 |

|

|

26 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Inferred Resources |

513 |

|

8.86 |

|

146.2 |

|

632 |

|

10.64 |

|

216.2 |

|

70.0 |

|

|

48 |

|

Note: 2024 mineral reserve and resource

estimates are effective as at June 30, 2024. 2023 mineral reserve

and resource estimates are effective as at December 31, 2023.

Presented mineral resources are inclusive of mineral reserves. All

figures have been rounded to reflect the relative accuracy of the

estimates. Summed amounts may not add due to rounding. Mineral

resources that are not mineral reserves do not have a demonstrated

economic viability. See below notes on mineral reserve and resource

estimates for additional technical and scientific information.

NOTES ON MINERAL RESERVES AND

RESOURCES

The 2024 mineral reserve and mineral resource

estimates are effective as at June 30, 2024. Mineral resources are

presented, including mineral reserves. All figures have been

rounded to the relative accuracy of the estimates. Summed amounts

may not add due to rounding. Mineral resources that are not mineral

reserves do not have a demonstrated economic viability.

The 2024 mineral reserve and resource estimates

for the Xavantina Operations are prepared under the supervision of

and verified by Mr. Cid Gonçalves Monteiro Filho, SME RM

(04317974), MAIG (No. 8444), FAusIMM (No. 329148) and Resource

Manager of the Company who is a “qualified person” within the

meanings of NI 43-101.

Reference herein of $ or USD is to United States

dollars and BRL is to Brazilian reais. Mineral Reserves for the

Xavantina Operations have been estimated using a gold price of

$1,900/oz, and the exchange rate used for mineral reserve and

resource estimates was USD/BRL 5.10.

Grade shells using a value of 1.20 gpt gold were

used to generate a 3D mineralization model of the Xavantina

Operations. Within the grade shells, mineral resources were

estimated using ordinary kriging within 10 meter by 10 meter by 2

meter block size, with a minimum sub- block size of 1.0 meter by

1.0 meter by 0.5 meter, and the mineral resource estimate was

constrained using a minimum stope dimension of 2.0 meters by 2.0

meters by 1.5 meters, a cut-off of 1.20 gpt based on underground

mining and processing costs of US$72 per tonne and a gold price of

US$1,900 per ounce.

The 2024 mineral reserve estimates were prepared

in accordance with the CIM Standards and the CIM Guidelines, using

geostatistical and/or classical methods, plus economic and mining

parameters appropriate for the deposit. Mineral reserves are the

economic portion of the measured and indicated mineral resources.

Mineral reserve estimates include operational dilution of 17.4%

plus planned dilution of approximately 8.5% within each stope for

room- and-pillar mining areas and operational dilution of 3.2% plus

planned dilution of 21.2% for cut-and-fill mining areas. Mining

recovery of 92.5% and 94.7% assumed for room-and-pillar and

cut-and-fill areas, respectively. Practical mining shapes

(wireframes) were designed using geological wireframes / mineral

resource block models as a guide.

Where applicable, for scientific and technical

information on historic mineral resource and reserve estimates on

the Xavantina Operations, please refer to the following

reports:

- The “Xavantina Operations – Update

Information with respect to the Xavantina Operations” section

within the Company's 2023 Annual Information Form dated March 7,

2024, prepared under the supervision of and verified by Mr. Cid

Gonçalves Monteiro Filho, SME RM (04317974), MAIG (No. 8444),

FAusIMM (No. 329148) and Resource Manager of the Company (the “2023

AIF”) for technical information and assumptions related to the 2023

mineral reserve and mineral resource estimate, with an effective

date of December 31, 2023.

- The NI 43-101 technical report

entitled "Technical Report on the Xavantina Operations, Mato

Grosso, Brazil" dated May 12, 2023 with an effective date of

October 31, 2022, prepared by Porfirio Cabaleiro Rodrigues, FAIG,

Leonardo de Moraes Soares, MAIG and Guilherme Gomides Ferreira,

MAIG, all of GE21 Consultoria Mineral Ltda. (“GE21”) for technical

information and assumptions related to the 2022 mineral reserve and

mineral resource estimate (the “2022 Xavantina Technical

Report”).

- The Company's Press Release dated

January 6, 2022, for technical information and assumptions related

to the 2021 mineral reserve and mineral resource estimate, with an

effective date of September 30, 2021 prepared by or under the

supervision of and verified by Mr. Emerson Ricardo Re, MSc, MBA,

MAusIMM (CP) (No. 305892), Registered Member (No. 0138) (Chilean

Mining Commission) and Resource Manager of the Company as at the

date of the press release, who was a Qualified Person as such term

is defined under NI 43-101 (the “January 2022 Press Release”).

- The NI 43-101 technical report

entitled “Mineral Resource and Mineral Reserve Estimate of the NX

Gold Mine, Nova Xavantina" dated January 8, 2021, with an effective

date of September 30, 2020, prepared by Porfirio Cabaleiro

Rodriguez, MAIG, Leonardo de Moraes Soares, MAIG, Bernardo Horta

Cerqueira Viana, MAIG, Paulo Roberto Bergmann, FAusIMM, all of GE21

for technical information and assumptions related to the 2020

mineral reserve and mineral resource estimate (the “2020 Xavantina

Technical Report”).

- The NI 43-101 technical report

entitled “Mineral Resource and Mineral Reserve Estimate of the NX

Gold Mine, Nova Xavantina" dated February 3, 2020 with an effective

date of September 30, 2019, prepared by Porfirio Cabaleiro

Rodrigues, FAIG, Leonardo de Moraes Soares, MAIG and Paulo Roberto

Bergmann, all of GE21 for technical information and assumptions

related to the 2019 mineral reserve and mineral resource estimate

(the “2019 Xavantina Technical Report”).

- The NI 43-101 technical report

entitled “Mineral Resource and Mineral Reserve Estimate of the NX

Gold Mine, Nova Xavantina" dated January 21, 2019 with an effective

date of August 31, 2018, prepared by Porfirio Cabaleiro Rodrigues,

FAIG, Leonardo Apparicio da Silva, MAIG and Leonardo de Moraes

Soares, MAIG, all of GE21 for technical information and assumptions

related to the 2018 mineral reserve and mineral resource estimate

(the “2018 Xavantina Technical Report”).

QUALIFIED PERSONS

Mr. Cid Gonçalves Monteiro Filho, SME RM

(04317974), MAIG (No. 8444), FAusIMM (No. 329148) has reviewed,

verified and approved the scientific and technical information

contained in this press release, including the sampling, analytical

and test data underlying the information contained in this press

release. Mr. Monteiro is Resource Manager of the Company and is a

“qualified person” within the meanings of NI 43-101.

QUALITY ASSURANCE & QUALITY

CONTROL

Current QA/QC Program

At the Xavantina Operations, the Company is

currently drilling underground with third-party contracted core

drill rigs. During the period from October 2022 to June 2024, third

party drill rigs were operated by Trust Drilling Solutions and

Servitec Foraco Sondagem S.A. who are independent of the Company.

Drill core is logged, photographed and split in half using a

diamond core saw at our secure core logging and storage facilities.

Half of the drill core is retained on site and the other half-core

is used for analysis, with samples collected on a minimum of 0.2

meters and a maximum of 2.0 meters with an average length of 0.5

meters. Sampling commences at least 1.0 meter before the start of

the mineralized zone and continues at least 1.0 meter beyond the

limit of the mineralized zone. Sample collection is performed at

our core logging facilities with all sample preparation performed

at ALS Brasil Ltda.'s laboratory or SGS Geosol - Laboratórios

Ltda's laboratory, both of which are located in Goiânia, Brazil.

Samples are analyzed by the certified laboratories of ALS Peru S.A.

or SGS Geosol - Laboratórios Ltda, both of whom are independent of

the Company. Gold content is preferentially determined using screen

fire assay. If the sample isn't sufficiently weighted, fire assay

is used. All sample results used in the preparation of the 2024

updated mineral resource and reserve estimate have been monitored

through a quality assurance and quality control ("QA/QC") program

that includes the insertion of certified standards, blanks and

field duplicates at a rate of one standard, one blank, and one

field duplicate sample per every 20 samples for a blended rate of

approximately 5%.

QA/QC Validation

The QA/QC validation process undertaken for the

2024 updated mineral resource and reserve estimates for the

Xavantina Operations is consistent with the process set out in the

2022 Xavantina Technical Report.

ABOUT ERO COPPER CORP

Ero Copper is a high-margin, high-growth copper

producer with operations in Brazil and corporate headquarters in

Vancouver, B.C. The Company's primary asset is a 99.6% interest in

the Brazilian copper mining company, Mineração Caraíba S.A.

("MCSA"), 100% owner of the Company's Caraíba Operations, which are

located in the Curaçá Valley, Bahia State, Brazil, and the Tucumã

Operation, an open pit copper mine located in Pará State, Brazil.

The Company also owns 97.6% of NX Gold S.A. ("NX Gold") which owns

the Xavantina Operations, an operating gold and silver mine located

in Mato Grosso State, Brazil. In July 2024, the Company signed a

definitive earn-in agreement with Vale Base Metals for a 60%

interest in the Furnas Copper-Gold Project, located in the Carajás

Mineral Province in Pará State, Brazil. For more information on the

earn-in agreement, please see the Company's press releases dated

October 30, 2023 and July 22, 2024. Additional information on the

Company and its operations, including technical reports on the

Caraíba Operations, Xavantina Operations, Tucumã Operation and the

Furnas Copper-Gold Project, can be found on the Company’s website

(www.erocopper.com), on SEDAR+ (www.sedarplus.ca/landingpage/) and

on EDGAR (www.sec.gov). The Company’s shares are publicly traded on

the Toronto Stock Exchange and the New York Stock Exchange under

the symbol “ERO”.

FOR MORE INFORMATION, PLEASE

CONTACT

Courtney Lynn, SVP, Corporate Development,

Investor Relations & Sustainability (604) 335-7504

info@erocopper.com

CAUTION REGARDING FORWARD LOOKING INFORMATION

AND STATEMENTS

This press release contains “forward-looking

statements” within the meaning of the United States Private

Securities Litigation Reform Act of 1995 and “forward-looking

information” within the meaning of applicable Canadian securities

legislation (collectively, “forward-looking statements”).

Forward-looking statements include statements that use

forward-looking terminology such as “may”, “could”, “would”,

“will”, “should”, “intend”, “target”, “plan”, “expect”, “budget”,

“estimate”, “forecast”, “schedule”, “anticipate”, “believe”,

“continue”, “potential”, “view” or the negative or grammatical

variation thereof or other variations thereof or comparable

terminology. Forward-looking statements may include, but are not

limited to, statements with respect to the Company's expected

production at the Xavantina Operations; the estimation of mineral

reserves and mineral resources; the discovery of additional

mineralized veins and the associated positive impact on throughput

rates; the significance of any particular exploration program or

result and the Company’s expectations for current and future

exploration plans including, but not limited to, planned areas of

additional exploration and the potential to convert any portion of

the inferred mineral resource base to economically viable mineral

reserves; and any other statement that may predict, forecast,

indicate or imply future plans, intentions, levels of activity,

results, performance or achievements.

Forward-looking statements are not a guarantee

of future performance. There can be no assurance that

forward-looking statements will prove to be accurate, as actual

results and future events could differ materially from those

anticipated in such statements. Forward-looking statements involve

statements about the future and are inherently uncertain, and the

Company’s actual results, achievements or other future events or

conditions may differ materially from those reflected in the

forward-looking statements due to a variety of risks, uncertainties

and other factors, including, without limitation, those referred to

herein and in the Company's most recent Annual Information Form

under the heading “Risk Factors”.

The Company’s forward-looking statements are

based on the assumptions, beliefs, expectations and opinions of

management on the date the statements are made, many of which may

be difficult to predict and beyond the Company’s control. In

connection with the forward-looking statements contained in this

press release and in the AIF, the Company has made certain

assumptions about, among other things: favourable equity and debt

capital markets; the ability to raise any necessary additional

capital on reasonable terms to advance the production, development

and exploration of the Company’s properties and assets; future

prices of copper, gold and other metal prices; the timing and

results of exploration and drilling programs; the accuracy of any

mineral reserve and mineral resource estimates; the geology of the

Caraíba Operations, the Xavantina Operations, the Tucumã Operation

and the Furnas Copper-Gold Project being as described in the

respective technical report for each property; production costs;

the accuracy of budgeted exploration, development and construction

costs and expenditures; the price of other commodities such as

fuel; future currency exchange rates and interest rates; operating

conditions being favourable such that the Company is able to

operate in a safe, efficient and effective manner; work force

continuing to remain healthy in the face of prevailing epidemics,

pandemics or other health risks, political and regulatory

stability; the receipt of governmental, regulatory and third party

approvals, licenses and permits on favourable terms; obtaining

required renewals for existing approvals, licenses and permits on

favourable terms; requirements under applicable laws; sustained

labour stability; stability in financial and capital goods markets;

availability of equipment; positive relations with local groups and

the Company’s ability to meet its obligations under its agreements

with such groups; and satisfying the terms and conditions of the

Company’s current loan arrangements. Although the Company believes

that the assumptions inherent in forward-looking statements are

reasonable as of the date of this press release, these assumptions

are subject to significant business, social, economic, political,

regulatory, competitive and other risks and uncertainties,

contingencies and other factors that could cause actual actions,

events, conditions, results, performance or achievements to be

materially different from those projected in the forward-looking

statements. The Company cautions that the foregoing list of

assumptions is not exhaustive. Other events or circumstances could

cause actual results to differ materially from those estimated or

projected and expressed in, or implied by, the forward-looking

statements contained in this press release. There can be no

assurance that forward-looking statements will prove to be

accurate, as actual results and future events could differ

materially from those anticipated in such statements. Accordingly,

readers should not place undue reliance on forward-looking

statements.

Forward-looking statements contained herein are

made as of the date of this press release and the Company disclaims

any obligation to update or revise any forward-looking statement,

whether as a result of new information, future events or results or

otherwise, except as and to the extent required by applicable

securities laws.

CAUTIONARY NOTES REGARDING MINERAL RESOURCE AND

MINERAL RESERVE ESTIMATES

Unless otherwise indicated, all reserve and

resource estimates included in this press release and the documents

incorporated by reference herein have been prepared in accordance

with National Instrument 43-101, Standards of Disclosure for

Mineral Projects (“NI 43-101") and the Canadian Institute of

Mining, Metallurgy and Petroleum (the “CIM”) — CIM Definition

Standards on Mineral Resources and Mineral Reserves, adopted by the

CIM Council, as amended (the “CIM Standards”). NI 43-101 is a rule

developed by the Canadian Securities Administrators that

establishes standards for all public disclosure an issuer makes of

scientific and technical information concerning mineral projects.

Canadian standards, including NI 43-101, differ significantly from

the requirements of the United States Securities and Exchange

Commission (the “SEC”), and reserve and resource information

included herein may not be comparable to similar information

disclosed by U.S. companies. In particular, and without limiting

the generality of the foregoing, this press release and the

documents incorporated by reference herein use the terms “measured

resources,” “indicated resources” and “inferred resources” as

defined in accordance with NI 43-101 and the CIM Standards.

Further to recent amendments, mineral property

disclosure requirements in the United States (the “U.S. Rules”) are

governed by subpart 1300 of Regulation S-K of the U.S. Securities

Act of 1933, as amended (the “U.S. Securities Act”) which differ

from the CIM Standards. As a foreign private issuer that is

eligible to file reports with the SEC pursuant to the

multi-jurisdictional disclosure system (the “MJDS”), Ero is not

required to provide disclosure on its mineral properties under the

U.S. Rules and will continue to provide disclosure under NI 43-101

and the CIM Standards. If Ero ceases to be a foreign private issuer

or loses its eligibility to file its annual report on Form 40-F

pursuant to the MJDS, then Ero will be subject to the U.S. Rules,

which differ from the requirements of NI 43-101 and the CIM

Standards.

Pursuant to the new U.S. Rules, the SEC

recognizes estimates of “measured mineral resources”, “indicated

mineral resources” and “inferred mineral resources.” In addition,

the definitions of “proven mineral reserves” and “probable mineral

reserves” under the U.S. Rules are now “substantially similar” to

the corresponding standards under NI 43-101. Mineralization

described using these terms has a greater amount of uncertainty as

to its existence and feasibility than mineralization that has been

characterized as reserves. Accordingly, U.S. investors are

cautioned not to assume that any measured mineral resources,

indicated mineral resources, or inferred mineral resources that Ero

reports are or will be economically or legally mineable. Further,

“inferred mineral resources” have a greater amount of uncertainty

as to their existence and as to whether they can be mined legally

or economically. Under Canadian securities laws, estimates of

“inferred mineral resources” may not form the basis of feasibility

or pre-feasibility studies, except in rare cases. While the above

terms under the U.S. Rules are “substantially similar” to the

standards under NI 43-101 and CIM Standards, there are differences

in the definitions under the U.S. Rules and CIM Standards.

Accordingly, there is no assurance any mineral reserves or mineral

resources that Ero may report as “proven mineral reserves”,

“probable mineral reserves”, “measured mineral resources”,

“indicated mineral resources” and “inferred mineral resources”

under NI 43-101 would be the same had Ero prepared the reserve or

resource estimates under the standards adopted under the U.S.

Rules.

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/e58950c7-9d23-4393-8b31-68d25a1628f6

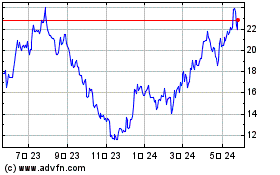

Ero Copper (NYSE:ERO)

過去 株価チャート

から 2 2025 まで 3 2025

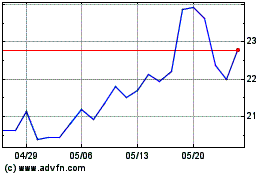

Ero Copper (NYSE:ERO)

過去 株価チャート

から 3 2024 まで 3 2025