Board Authorized $2 Billion Share Repurchase

Program and Approved Initiation of Quarterly Cash Dividend Program

of $75 Million

All-Equity Transaction Includes Professional

Bull Riders, On Location, and IMG

Special Committee of TKO’s Independent

Directors Unanimously Recommended Approval of Transaction

TKO Group Holdings, Inc. (“TKO”) (NYSE: TKO), a premium sports

and entertainment company, announced today that its board of

directors has authorized a share repurchase program of up to $2.0

billion of its Class A common stock and the initiation of a

quarterly cash dividend program pursuant to which holders of TKO’s

Class A common stock will receive their pro rata share of $75.0

million in quarterly distributions to be made by TKO Operating

Company, LLC.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20241023465779/en/

https://pbr.com/ (Graphic: Business

Wire)

Also today, TKO announced it has reached a definitive agreement

with Endeavor Group Holdings, Inc. (“Endeavor”) (NYSE: EDR) to

acquire Professional Bull Riders (“PBR”), On Location, and IMG in

an all-equity transaction valued at $3.25 billion. In addition to

complementing TKO’s existing core UFC and WWE businesses, the

strategic acquisition of these sports and hospitality assets from

Endeavor expands TKO’s operational footprint in the fast-growing

premium sports market and enables direct participation in the

upside from partner leagues and events.

Ariel Emanuel, Executive Chair and CEO of TKO, said: “Today’s

announcements reflect the continued strength of our underlying

business and our commitment to deploying capital through a balanced

capital allocation strategy, including through our share repurchase

program and quarterly cash dividend program. This underscores our

continued focus on delivering sustainable long-term value for our

shareholders.”

Mark Shapiro, President and COO of TKO, said: “PBR, On Location,

and IMG are industry-leading assets that meaningfully enhance TKO’s

portfolio and strengthen our position in premium sports globally.

Within TKO, they will help power the growth of our revenue streams

and position us to capture even more upside from some of the most

attractive parts of our sports ecosystem: media rights, live

events, ticket sales, premium experiences, brand partnerships, and

site fees. These assets are already built into our business

strategy at TKO and will serve to further enhance our strong track

record of execution across UFC and WWE.”

TRANSACTION EXPANDS TKO’S LEADERSHIP AND POWERS GROWTH IN

PREMIUM SPORTS

PBR is the world’s premier bull riding league organizing more

than 200 annual live events, welcoming approximately 1.25 million

fans, and reaching more than 285 million households in more than 65

territories. PBR CEO and Commissioner Sean Gleason will continue to

lead the organization.

On Location is a leading provider of premium experiences for

fans attending more than 1,200 sporting events, including the Super

Bowl, Ryder Cup, NCAA Final Four, FIFA World Cup 26, and the 2026

and 2028 Olympic and Paralympic Games, in addition to year-round

live events organized by UFC and WWE. On Location president Paul

Caine will continue to lead the organization.

IMG is one of the world's largest global distributors and

producers of sports content, packages and sells media rights and

brand partnerships, and provides industry-leading strategic

consultancy, digital services, and event management for more than

200 rightsholders. Clients include the National Football League,

English Premier League, International Olympic Committee, National

Hockey League, Major League Soccer, ATP and WTA Tours, the All

England Lawn Tennis & Croquet Club (Wimbledon), EuroLeague

Basketball, DP World Tour, and The R&A, as well as UFC, WWE,

and PBR. The acquisition of IMG does not include businesses

associated with the IMG brand in licensing, models, and tennis

representation, nor IMG’s full events portfolio. Adam Kelly will

lead IMG as president.

Transaction Details

Under the terms of the agreement, TKO will acquire the Endeavor

assets for a total consideration of $3.25 billion, based on the

25-trading-day volume-weighted average price of TKO’s Class A

common stock for the period ending on October 23, 2024. Endeavor

will receive approximately 26.14 million common units of TKO

Operating Company, LLC and will subscribe for an equal number of

shares of TKO’s Class B common stock, with Endeavor expected to own

approximately 59% of TKO alongside the other existing TKO

shareholders, who will own the remaining 41% upon completion of the

transaction. The transaction is also subject to purchase price

adjustments to be settled in cash and equity.

TKO formed a Special Committee of independent directors of the

board to review, negotiate, and consider the proposed transaction.

The Special Committee reviewed, negotiated, unanimously approved,

and recommended approval of the proposed transaction by TKO’s board

of directors. Following formal and unanimous approval by TKO’s

board of directors, the definitive agreement was signed, and the

transaction was approved by the written consent of stockholders

representing a majority of the outstanding voting interests of

TKO.

The transaction is subject to the satisfaction of customary

closing conditions and required regulatory approvals. No other

stockholder approval is required. The transaction is expected to

close in the first half of 2025.

Advisors

Morgan Stanley & Co. LLC is serving as financial advisor to

TKO. Latham & Watkins LLP is serving as legal advisor to

Endeavor. Moelis & Company LLC is serving as financial advisor

to the special committee and Skadden, Arps, Slate, Meagher &

Flom LLP as legal advisor to the special committee.

CAPITAL RETURN PROGRAM

TKO will determine at its discretion the timing and the amount

of any repurchases based on its evaluation of market conditions,

share price, and other factors. Repurchases under the share

repurchase program may be made in the open market, in privately

negotiated transactions or otherwise, and TKO is not obligated to

acquire any particular amount under the share repurchase program.

The share repurchase program has no expiration, is expected to be

completed within approximately three to four years and may be

modified, suspended, or discontinued at any time.

TKO’s dividend will be paid quarterly to TKO’s Class A common

shareholders. TKO intends to begin making quarterly cash dividend

payments on March 31, 2025. Future declarations of quarterly

dividends are subject to the determination and discretion of TKO

based on its consideration of various factors, such as its results

of operations, financial condition, market conditions, earnings,

cash flow requirements, restrictions in its debt agreements and

legal requirements and other factors that TKO deems relevant.

The share repurchase program authorization and approval to

initiate a quarterly cash dividend program are separate from and

are not conditional upon TKO closing the acquisition of PBR, On

Location, and IMG.

Webcast

TKO will make public a recorded audio webcast at 8 a.m. ET today

to discuss this transaction and capital return program. Management

will also provide an update on TKO’s expected results for the third

quarter of 2024 and full-year guidance expectations, which will be

reported on TKO’s earnings call scheduled for Wednesday, November

6, 2024, 5 p.m. ET / 2 p.m. PT. Today’s audio webcast and the

accompanying presentation materials can be accessed at

investor.tkogrp.com. The link to the webcast, as well as a

recording, will also be available on the website after the call

concludes.

About TKO

TKO Group Holdings, Inc. (NYSE: TKO) is a premium sports and

entertainment company. TKO includes UFC, the world’s premier mixed

martial arts organization, and WWE, the recognized global leader in

sports entertainment. Together, our organizations reach more than 1

billion households in approximately 210 countries and territories,

and we organize more than 300 live events year-round, attracting

more than two million fans. TKO is majority owned by Endeavor Group

Holdings, Inc. (NYSE: EDR), a global sports and entertainment

company.

About Endeavor

Endeavor (NYSE: EDR) is a global sports and entertainment

company, home to many of the world’s most dynamic and engaging

storytellers, brands, live events, and experiences. The Endeavor

network specializes in talent representation through entertainment

agency WME; sports operations and advisory, event management, media

production and distribution, and brand licensing through IMG; live

event experiences and hospitality through On Location; full-service

marketing through global cultural marketing agency 160over90; and

sports data and technology through OpenBet. Endeavor is also the

majority owner of TKO Group Holdings (NYSE: TKO), a premium sports

and entertainment company comprising UFC and WWE.

About PBR

PBR is the world’s premier bull riding organization. More than

500 bull riders compete in more than 200 events annually across the

televised PBR Unleash The Beast tour (UTB), which features the top

bull riders in the world; the PBR Pendleton Whisky Velocity Tour

(PWVT); the PBR Touring Pro Division (TPD); and the PBR’s

international circuits in Australia, Brazil, and Canada. In 2022,

PBR launched the nationally televised PBR Team Series—eight teams

of the world’s best bull riders competing for a new championship

expanding to 10 teams in 2024—as well as the PBR Challenger Series

with more than 60 annual events nationwide. The organization’s

digital assets include PBR RidePass on Pluto TV, which is home to

Western sports. PBR is a subsidiary of Endeavor, a global sports

and entertainment company. For more information, visit PBR.com, or

follow on Facebook at Facebook.com/PBR, Twitter at Twitter.com/PBR,

and YouTube at YouTube.com/PBR.

About On Location

On Location is a global leader in premium experiential

hospitality, offering ticketing, curated guest experiences, live

event production and travel management across sports,

entertainment, fashion and culture. On Location provides unrivaled

access for corporate clients and fans looking for official,

immersive experiences at marquee events, including the Olympic and

Paralympic Games, FIFA World Cup 2026, Super Bowl, NCAA Final Four,

and more. An official partner and/or service provider to over 150

iconic rights holders, such as the IOC (Milano Cortina 2026, LA

2028), FIFA, NFL, NCAA, UFC and PGA of America, and numerous

musical artists and festivals, the company also owns and operates a

number of its own unique experiences. On Location is a subsidiary

of Endeavor, a global sports and entertainment company.

About IMG

IMG is an industry-leading global sports marketing agency,

specializing in media rights management and sales, multi-channel

content production and distribution, brand partnerships, digital

services, and events management. It powers growth of revenues,

fanbases and IP for more than 200 federations, associations,

events, and teams, including the National Football League, English

Premier League, International Olympic Committee, National Hockey

League, Major League Soccer, ATP and WTA Tours, the All England

Lawn Tennis & Croquet Club (Wimbledon), EuroLeague Basketball,

DP World Tour, and The R&A, as well as UFC, WWE, and PBR. IMG

is a subsidiary of Endeavor, a global sports and entertainment

company.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. TKO intends such forward-looking statements to be covered by

the safe harbor provisions for forward-looking statements contained

in Section 27A of the Securities Act of 1933, as amended, and

Section 21E of the Securities Exchange Act of 1934, as amended. All

statements in this press release that do not relate to matters of

historical fact should be considered forward-looking statements,

including, without limitation, statements regarding the acquisition

transaction, including the anticipated timing for its closing, the

expected impacts and benefits therefrom, and the expected share

ownership of TKO following its consummation, and expectations

regarding TKO’s capital return program, including the purchases

under and completion of the share repurchase program and TKO’s

dividend program, including the expected timing and amount of

dividends thereunder. The words “believe,” “may,” “will,”

“estimate,” “potential,” “continue,” “anticipate,” “intend,”

“expect,” “could,” “contemplates,” “would,” “project,” “plan,”

“target,” and similar expressions are intended to identify

forward-looking statements, though not all forward-looking

statements use these words or expressions. Any such forward-looking

statement represents management’s expectations as of the date of

this filing. These statements are neither promises nor guarantees

and involve known and unknown risks, uncertainties and other

important factors that may cause actual results, performance or

achievements to be materially different from what is expressed or

implied by the forward-looking statements, including, but not

limited to: the risk that the transaction may not be completed in a

timely manner or at all, which may adversely affect TKO’s

businesses and the price of its securities; uncertainties as to the

timing of the consummation of the transaction and the possibility

that any or all of the various conditions to the consummation of

the transaction may not be satisfied or waived; the occurrence of

any event, change or other circumstance that could give rise to the

termination of the transaction agreement and the transaction; the

effect of the announcement, pendency or completion of the

transaction on TKO’s business relationships, operating results, and

business generally; the transaction may involve unexpected costs,

liabilities and/or delays; TKO’s businesses may suffer as a result

of uncertainty surrounding the transaction and disruptions of

management’s attention due to the transaction; the risk that

integration of the transferred businesses post-closing may not

occur as anticipated; unfavorable outcome of legal proceedings that

may be instituted against TKO following the announcement of the

transaction; the risk that TKO’s stock price may decline following

the announcement of the transaction; and risks related to the

capital return program. These and other important factors discussed

in Part I, Item 1A “Risk Factors” in TKO’s Annual Report on Form

10-K for the fiscal year ended December 31, 2023, as any such

factors may be updated from time to time in TKO’s other filings

with the Securities and Exchange Commission could cause actual

results to differ materially from those indicated by the

forward-looking statements contained in this press release.

Forward-looking statements speak only as of the date they are made

and, except as may be required under applicable law, TKO undertakes

no obligation to update or revise any forward-looking statements,

whether as a result of new information, future events or

otherwise.

Website Disclosure

Investors and others should note that TKO announces material

financial and operational information to its investors using press

releases, SEC filings and public conference calls and webcasts, as

well as its Investor Relations site at investor.tkogrp.com. TKO may

also use its website as a distribution channel of its material

information. In addition, you may automatically receive email

alerts and other information about TKO, UFC and WWE when you enroll

your email address by visiting the “Investor Email Alerts” option

under the Resources tab on investor.tkogrp.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241023465779/en/

TKO Investors: Seth Zaslow

szaslow@tkogrp.com Media: tko@brunswickgroup.com

Endeavor Investors:

investor@endeavorco.com Media: press@endeavorco.com

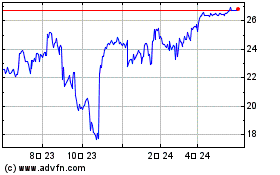

Endeavor (NYSE:EDR)

過去 株価チャート

から 10 2024 まで 11 2024

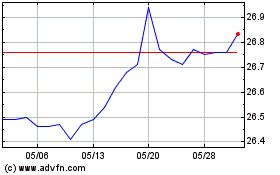

Endeavor (NYSE:EDR)

過去 株価チャート

から 11 2023 まで 11 2024