0000931148false00009311482024-08-062024-08-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 6, 2024

GRAFTECH INTERNATIONAL LTD.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 1-13888 | 27-2496053 |

(State or other

jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

982 Keynote Circle

Brooklyn Heights, OH 44131

(Address of principal executive offices) (Zip Code)

(216) 676-2000

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading

Symbol(s) | Name of each exchange on which registered |

| Common stock, $0.01 par value per share | EAF | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

Item 3.01 | Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing. |

On August 6, 2024, GrafTech International Ltd. (the “Company”) received written notice (the “Notice”) from the New York Stock Exchange (the “NYSE”) that it is not in compliance with the continued listing standard set forth in Section 802.01C of the NYSE’s Listed Company Manual (“Section 802.01C”) because the average closing price of the Company’s common stock per the Notice was less than $1.00 per share over the consecutive 30 trading-day period ended August 5, 2024. The Notice does not result in the immediate delisting of the Company’s common stock from the NYSE.

In accordance with applicable NYSE rules, the Company plans to timely notify the NYSE that it intends to cure the stock price deficiency and return to compliance with the applicable NYSE continued listing standards. The Company can regain compliance at any time within a six-month cure period following its receipt of the Notice if, on the last trading day of any calendar month during such cure period, the Company has both: (i) a closing share price of at least $1.00 and (ii) an average closing share price of at least $1.00 over the 30 trading-day period ending on the last trading day of the applicable calendar month. The Company intends to remain listed on the NYSE and is considering all available options to regain compliance with the NYSE’s continued listing standards, including, but not limited to, a reverse stock split, subject to stockholder approval. Section 802.01C provides for an extension to the six-month cure period if the action required to cure the price condition requires stockholder approval, in which case, the action needs to be approved by no later than the Company’s next annual stockholder’s meeting and promptly implemented thereafter.

The Notice has no immediate impact on the listing of the Company’s common stock, which will continue to be listed and traded on the NYSE during such cure period, subject to the Company’s compliance with other NYSE continued listing standards. The Company’s common stock will continue to trade on the NYSE under the symbol “EAF” with the designation of “.BC” to indicate the status of the shares as “below criteria.” If the Company does not regain compliance with the minimum share price requirement, the Company’s common stock will be subject to suspension and delisting from the NYSE. If the Company’s common stock ultimately were to be delisted, it could negatively impact the Company by reducing the liquidity and market price of the Company’s common stock. Furthermore, the Notice is not anticipated to impact the ongoing business operations of the Company or its reporting requirements with the U.S. Securities and Exchange Commission.

Cautionary Note Regarding Forward-Looking Statements

This Current Report on Form 8-K may contain forward-looking statements within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements reflect our current views with respect to, among other things, financial projections, plans and objectives of management for future operations, and future economic performance. Examples of forward-looking statements include, among others, statements we make regarding future estimated volume, pricing and revenue, anticipated levels of capital expenditures and cost of goods sold, anticipated reduction in our costs resulting from our cost rationalization initiatives and one-time costs of implementation and guidance relating to adjusted EBITDA and free cash flow. You can identify these forward-looking statements by the use of forward-looking words such as “will,” “may,” “plan,” “estimate,” “project,” “believe,” “anticipate,” “expect,” “foresee,” “intend,” “should,” “would,” “could,” “target,” “goal,” “continue to,” “positioned to,” “are confident,” or the negative versions of those words or other comparable words. Any forward-looking statements contained in this Current Report on Form 8-K are based upon our historical performance and on our current plans, estimates and expectations considering information currently available to us. The inclusion of this forward-looking information should not be regarded as a representation by us that the future plans, estimates, or expectations contemplated by us will be achieved. Our expectations and targets are not predictions of actual performance and historically our performance has deviated, often significantly, from our expectations and targets. These forward-looking statements are subject to various risks and uncertainties and assumptions relating to our operations, financial results, financial condition, business, prospects, growth strategy and liquidity. Accordingly, there are or will be important factors that could cause our actual results to differ materially from those indicated in these statements. We believe that these factors include, but are not limited to: the risk that the Notice and noncompliance with NYSE continued listing standards may impact the Company’s results of operations, business operations and reputation and the trading prices and volatility of the Company’s common stock; risks and uncertainties associated with our ability to access the capital and credit markets could adversely affect our results of operations, cash flows and financial condition; our ability to regain compliance with NYSE continued listing standards within the applicable cure period, including, if necessary, our ability to get stockholder approval to effectuate a reverse stock split or any other action requiring stockholder approval; and our ability to continue to meet NYSE continued listing standards. These factors should not be construed as exhaustive and should be read in conjunction with the Risk Factors and other cautionary statements that are included in our most recent Annual Report on Form 10-K and other filings with the SEC. The forward-looking statements made in this Current Report on Form 8-K relate only to events as of the date on which the statements are made. Except as required by law, we do not undertake any obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise.

| | | | | |

Item 7.01 | Regulation FD Disclosure. |

As required by Section 802.01C, the Company issued a press release on August 7, 2024, announcing that it had received the notice of noncompliance with the NYSE’s continued listing standards. A copy of the press release is being furnished herewith as Exhibit 99.1 and is incorporated herein by reference in its entirety.

The information furnished pursuant to this Item 7.01 and Exhibit 99.1 of this Current Report on Form 8-K shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, whether made before, on or after the date hereof and regardless of any general incorporation language in such filings, except to the extent set forth by specific reference in such filings.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

104 Cover Page Interactive Data File (embedded within the Inline XBRL document)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | GRAFTECH INTERNATIONAL LTD. |

| | |

| | |

| Date: | August 7, 2024 | By: | /s/ Catherine Hedoux-Delgado |

| | | Catherine Hedoux-Delgado |

| | | Interim Chief Financial Officer and Treasurer |

GrafTech Receives Continued Listing Standards Notice from NYSE BROOKLYN HEIGHTS, Ohio – August 7, 2024 – GrafTech International Ltd. (NYSE: EAF) (“GrafTech” or the “Company”) announced today that it received written notice (the “Notice”) from the New York Stock Exchange (the “NYSE”) that it is not in compliance with the NYSE’s continued listing standards because the average closing price of the Company’s common stock per the Notice was less than $1.00 per share over the consecutive 30 trading-day period ended August 5, 2024. The Notice does not result in the immediate delisting of the Company’s common stock from the NYSE. In accordance with applicable NYSE rules, the Company plans to timely notify the NYSE that it intends to cure the stock price deficiency and return to compliance with the applicable NYSE continued listing standards. The Company can regain compliance at any time within a six-month cure period following its receipt of the Notice if, on the last trading day of any calendar month during such cure period, the Company has both: (i) a closing share price of at least $1.00 and (ii) an average closing share price of at least $1.00 over the 30 trading-day period ending on the last trading day of the applicable calendar month. The Company intends to remain listed on the NYSE and is considering all available options to regain compliance with the NYSE’s continued listing standards, including, but not limited to, a reverse stock split, subject to stockholder approval. The NYSE rules provide for an extension to the six-month cure period if the action required to cure the price condition requires stockholder approval, in which case, the action needs to be approved by no later than the Company’s next annual stockholder’s meeting and promptly implemented thereafter. The Notice has no immediate impact on the listing of the Company’s common stock, which will continue to be listed and traded on the NYSE during such cure period, subject to the Company’s compliance with other NYSE continued listing standards. Furthermore, the Notice is not anticipated to impact the ongoing business operations of the Company or its reporting requirements with the U.S. Securities and Exchange Commission (“SEC”). About GrafTech GrafTech International Ltd. is a leading manufacturer of high-quality graphite electrode products essential to the production of electric arc furnace steel and other ferrous and non-ferrous metals. The Company has a competitive portfolio of low-cost, ultra-high power graphite electrode manufacturing facilities, with some of the highest capacity facilities in the world. We are the only large-scale graphite electrode producer that is substantially vertically integrated into petroleum needle coke, our key raw material for graphite electrode manufacturing. This unique position provides us with competitive advantages in product quality and cost. Exhibit 99.1

Cautionary Note Regarding Forward‑Looking Statements This press release may contain forward-looking statements within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements reflect our current views with respect to, among other things, financial projections, plans and objectives of management for future operations, and future economic performance. Examples of forward-looking statements include, among others, statements we make regarding future estimated volume, pricing and revenue, anticipated levels of capital expenditures and cost of goods sold, anticipated reduction in our costs resulting from our cost rationalization initiatives and one-time costs of implementation and guidance relating to adjusted EBITDA and free cash flow. You can identify these forward-looking statements by the use of forward-looking words such as “will,” “may,” “plan,” “estimate,” “project,” “believe,” “anticipate,” “expect,” “foresee,” “intend,” “should,” “would,” “could,” “target,” “goal,” “continue to,” “positioned to,” “are confident,” or the negative versions of those words or other comparable words. Any forward-looking statements contained in this press release are based upon our historical performance and on our current plans, estimates and expectations considering information currently available to us. The inclusion of this forward-looking information should not be regarded as a representation by us that the future plans, estimates, or expectations contemplated by us will be achieved. Our expectations and targets are not predictions of actual performance and historically our performance has deviated, often significantly, from our expectations and targets. These forward-looking statements are subject to various risks and uncertainties and assumptions relating to our operations, financial results, financial condition, business, prospects, growth strategy and liquidity. Accordingly, there are or will be important factors that could cause our actual results to differ materially from those indicated in these statements. We believe that these factors include, but are not limited to: the risk that the Notice and noncompliance with NYSE continued listing standards may impact the Company’s results of operations, business operations and reputation and the trading prices and volatility of the Company’s common stock; risks and uncertainties associated with our ability to access the capital and credit markets could adversely affect our results of operations, cash flows and financial condition; our ability to regain compliance with NYSE continued listing standards within the applicable cure period, including, if necessary, our ability to get stockholder approval to effectuate a reverse stock split or any other action requiring stockholder approval; and our ability to continue to meet NYSE continued listing standards. These factors should not be construed as exhaustive and should be read in conjunction with the Risk Factors and other cautionary statements that are included in our most recent Annual Report on Form 10-K and other filings with the SEC. The forward-looking statements made in this press release relate only to events as of the date on which the statements are made. Except as required by law, we do not undertake any obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise. Contact: Michael Dillon 216-676-2000 investor.relations@graftech.com

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

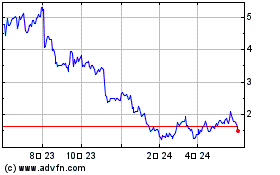

GrafTech (NYSE:EAF)

過去 株価チャート

から 12 2024 まで 1 2025

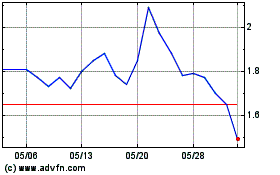

GrafTech (NYSE:EAF)

過去 株価チャート

から 1 2024 まで 1 2025