Form S-3ASR - Automatic shelf registration statement of securities of well-known seasoned issuers

2024年5月16日 - 5:56AM

Edgar (US Regulatory)

As filed with the Securities and Exchange Commission on May 15, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

ATLAS ENERGY SOLUTIONS INC.

(Exact name of registrant as specified in its charter)

| |

Delaware

(State or other jurisdiction

of incorporation or organization)

|

|

|

93-2154509

(I.R.S. Employer

Identification No.)

|

|

5918 W. Courtyard Drive, Suite 500

Austin, Texas 78730

(512) 220-1200

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

John Turner

Chief Executive Officer and President

5918 W. Courtyard Drive, Suite 500

Austin, Texas 78730

(512) 220-1200

(Address, including zip code, and telephone number, including area code, of agent for service)

Copies of all communications, including communications sent to agent for service, should be sent to:

Thomas G. Zentner

Vinson & Elkins L.L.P.

200 West 6th Street, Suite 2500

Austin, Texas 78701

(512) 542-8400

APPROXIMATE DATE OF COMMENCEMENT OF PROPOSED SALE TO THE PUBLIC:

From time to time on or after the effective date of this registration statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective on filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☒

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Securities Exchange Act of 1934, as amended.

| |

Large accelerated filer

|

|

|

☐

|

|

|

|

|

|

Accelerated filer

|

|

|

☐

|

|

| |

Non-accelerated filer

|

|

|

☒

|

|

|

|

|

|

Smaller reporting company

|

|

|

☐

|

|

| |

|

|

|

|

|

|

|

|

|

Emerging growth company

|

|

|

☒

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for comply with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act. ☐

PROSPECTUS

Atlas Energy Solutions Inc.

Common Stock

Preferred Stock

Depositary Shares

Warrants

Atlas Energy Solutions Inc. (the “Company,” “we,” “our” or “us”) may offer and sell the following securities from time to time in one or more transactions and in amounts, at prices and on terms to be determined by market conditions at the time of our offerings: (i) common stock, par value $0.01 per share (the “Common Stock”), (ii) preferred stock, $0.01 per share, (iii) depositary shares and (iv) warrants to purchase any of the other securities that may be sold under this prospectus.

We may offer and sell these securities from time to time in amounts, at prices and on terms to be determined by market conditions and other factors at the time of our offerings, including at prevailing market prices or at prices negotiated with buyers. We may offer and sell these securities through agents, through underwriters or dealers or directly to one or more purchasers, including existing stockholders. This prospectus provides you with a general description of these securities and the general manner in which we will offer the securities. Each time securities are offered, we will provide a prospectus supplement that will contain specific information about the terms of that offering, including, among other things, the specific amounts and prices of the securities being offered and the terms of the offering. For example, any specific allocation of the net proceeds of an offering of securities to a specific purpose will be determined at the time of the offering and will be described in any applicable prospectus supplement. The prospectus supplement may also add, update or change information contained in this prospectus.

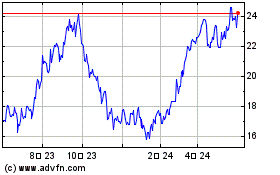

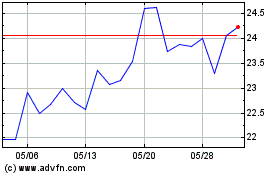

Our Common Stock is traded on The New York Stock Exchange (“NYSE”) under the symbol “AESI”. The closing price for our Common Stock on May 14, 2024, was $23.36 per share, as reported on the NYSE.

Our principal executive offices are located at 5918 W. Courtyard Drive, Suite 500, Austin, Texas 78730, and our telephone number at that address is (512) 220-1200.

Investing in our securities involves risk. You should carefully read the information under the heading “Risk Factors” on page 8 of this prospectus and the risk factors contained in any applicable prospectus supplement and the documents incorporated by reference herein or therein before making a decision to purchase our securities.

Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is May 15, 2024.

TABLE OF CONTENTS

| |

|

|

Page

|

|

|

|

|

|

|

|

1 |

|

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

6 |

|

|

|

|

|

|

|

|

8 |

|

|

|

|

|

|

|

|

9 |

|

|

|

|

|

|

|

|

10 |

|

|

|

|

|

|

|

|

15

|

|

|

|

|

|

|

|

|

16

|

|

|

|

|

|

|

|

|

17 |

|

|

|

|

|

|

|

|

19 |

|

|

|

|

|

|

|

|

19 |

|

|

|

|

|

|

|

|

20

|

|

|

We have not authorized anyone to give you any information or to make any representations about us or the transactions we discuss in this prospectus other than those contained in this prospectus, any accompanying prospectus supplement or any free writing prospectus we have prepared. If you are given any information or representations about these matters that is not discussed in this prospectus, you must not rely on that information. This prospectus is not an offer to sell or a solicitation of an offer to buy securities anywhere or to anyone where or to whom we are not permitted to offer or sell securities under applicable law. The delivery of this prospectus does not, under any circumstances, mean that there has not been a change in our affairs since the date of this prospectus. Subject to our obligation to amend or supplement this prospectus as required by law and the rules and regulations of the U.S. Securities and Exchange Commission, the information contained in this prospectus is correct only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of these securities.

ABOUT THIS PROSPECTUS

This prospectus is part of an “automatic shelf” registration statement that we filed with the U.S. Securities and Exchange Commission (the “SEC”), as a “well-known seasoned issuer” as defined in Rule 405 under the Securities Act of 1933, as amended (the “Securities Act”), using a “shelf” registration process. This prospectus provides you with a general description of us and the securities that may be offered, including our Common Stock. More specific terms of any securities we offer may be provided in a prospectus supplement or free writing prospectus that describes, among other things, the specific amounts and prices of the securities being offered, any specific allocation of the net proceeds of an offering of securities to a specific purpose and other terms of the offering. Any prospectus supplement or free writing prospectus may also add, update or change information contained in this prospectus with respect to that offering. If there is any inconsistency between the information in this prospectus and any applicable prospectus supplement or free writing prospectus, you should rely on the prospectus supplement or free writing prospectus, as applicable. Before purchasing any shares, you should carefully read both this prospectus and any applicable prospectus supplement (and any applicable free writing prospectus), together with the additional information described under the headings “Where You Can Find More Information” and “Incorporation of Certain Documents by Reference.”

You should assume that the information appearing in this prospectus and any applicable prospectus supplement to this prospectus is accurate only as of the date on its respective cover, that the information appearing in any applicable free writing prospectus is accurate only as of the date of that free writing prospectus and that any information incorporated by reference is accurate only as of the date of the document incorporated by reference, unless we indicate otherwise. Our business, financial condition, results of operations and prospects may have changed since those dates. This prospectus incorporates by reference, and any applicable prospectus supplement or free writing prospectus may contain and incorporate by reference, market data, industry statistics and forecasts that are based on independent industry publications and other publicly available information. Although we believe these sources are reliable, we do not guarantee the accuracy or completeness of this information and we have not independently verified this information. In addition, the market and industry data and forecasts that may be included or incorporated by reference in this prospectus, any applicable prospectus supplement or any applicable free writing prospectus may involve estimates, assumptions and other risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk Factors” contained in this prospectus, any applicable prospectus supplement and any applicable free writing prospectus, and under similar headings in other documents that are incorporated by reference into this prospectus. Accordingly, investors should not place undue reliance on this information.

WHERE YOU CAN FIND MORE INFORMATION

We have filed with the SEC a registration statement on Form S-3 to register the offer and sale of the shares covered hereby. This prospectus, which forms part of the registration statement, does not contain all of the information included in that registration statement. For further information about us and the shares covered by this prospectus, you should refer to the registration statement and its exhibits. Statements contained in this prospectus as to the contents of any contract, agreement or any other document are summaries of the material terms of such contract, agreement or other document and are not necessarily complete. With respect to each of these contracts, agreements or other documents filed as an exhibit to the registration statement, reference is made to the exhibits for a more complete description of the matter involved. Certain information is also incorporated by reference in this prospectus as described under “Incorporation of Certain Documents by Reference.”

We are subject to the information and periodic reporting requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and, in accordance therewith, file periodic reports, proxy statements and other information with the SEC. Such periodic reports, proxy statements and other information, including our registration statement, of which this prospectus constitutes a part, and the exhibits and schedules thereto, are available at the website of the SEC at www.sec.gov. We also furnish our stockholders with annual reports containing our financial statements audited by an independent registered public accounting firm and quarterly reports containing our unaudited financial information. We maintain a website at atlas.energy. You may access our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports, filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act with the SEC free of charge at our website as soon as reasonably practicable after such material is electronically filed with, or furnished to, the SEC. The reference to our website or web address does not constitute incorporation by reference of the information contained at that site, and investors should not rely on such information in making a decision to purchase our Common Stock.

We have not authorized anyone to provide you with any information other than that contained in this prospectus or in a document to which we expressly have referred you. We take no responsibility for and can provide no assurance as to the reliability of any other information that others may give you. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

The information in this prospectus and the documents incorporated by reference herein contains forward-looking statements that are subject to risks and uncertainties. All statements, other than statements of historical fact, regarding our strategy, future operations, financial position, estimated revenues and losses, projected costs, prospects, plans and objectives of management are forward-looking statements. Additionally, the information in this prospectus and the documents incorporated by reference herein includes forward-looking statements related to the recently completed Hi-Crush Transaction (as defined herein). When used in this prospectus and the documents incorporated by reference herein, the words “may,” “forecast,” “continue,” “could,” “would,” “will,” “plan,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “project” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words.

These forward-looking statements are based on our current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events. When considering forward-looking statements, you should keep in mind the risk factors and other cautionary statements described under the heading “Risk Factors” in this prospectus and the documents incorporated by reference herein. By their nature, forward-looking statements involve known and unknown risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. Although we believe that the forward-looking statements contained in this prospectus and the documents incorporated by reference herein are based on reasonable assumptions, you should be aware that many factors could affect our actual financial results or results of operations and could cause actual results to differ materially from those in such forward-looking statements, including but not limited to:

•

our ability to successfully integrate the business of Hi-Crush Inc. (“Hi-Crush”);

•

higher than expected costs to operate our proppant production and processing facilities and develop the Dune Express, an overland conveyor infrastructure solution currently under construction;

•

the amount of proppant we are able to produce, which could be adversely affected by, among other things, operating difficulties and unusual or unfavorable geologic conditions;

•

the volume of proppant we are able to sell and our ability to enter into supply contracts for our proppant on acceptable terms;

•

the prices we are able to charge, and the margins we are able to realize, from our proppant sales;

•

the demand for and price of proppant, particularly in the Permian Basin;

•

the success of our electric dredging transition efforts;

•

fluctuations in the demand for certain grades of proppant;

•

the domestic and foreign supply of and demand for oil and natural gas;

•

the effects of actions by, or disputes among or between, members of the Organization of Petroleum Exporting Countries and other oil producing nations with respect to production levels or other matters related to the prices of oil and natural gas;

•

changes in the price and availability of natural gas, diesel fuel or electricity that we use as fuel sources for our proppant production facilities and related equipment;

•

the availability of capital and our liquidity;

•

the level of competition from other companies;

•

pending legal or environmental matters;

•

changes in laws and regulations (or the interpretation thereof) or increased public scrutiny related to the proppant production and oil and natural gas industries, silica dust exposure or the environment;

•

facility shutdowns in response to environmental regulatory actions;

•

technical difficulties or failures;

•

liability or operational disruptions due to pit-wall or pond failure, environmental hazards, fires, explosions, chemical mishandling or other industrial accidents;

•

unanticipated ground, grade or water conditions;

•

inability to obtain government approvals or acquire or maintain necessary permits or mining, access or water rights;

•

changes in the price and availability of transportation services;

•

inability of our customers to take delivery;

•

difficulty collecting on accounts receivable;

•

the level of completion activity in the oil and natural gas industry;

•

inability to obtain necessary production equipment or replacement parts;

•

the amount of water available for processing;

•

any planned or future expansion projects or capital expenditures;

•

our ability to finance equipment, working capital and capital expenditures;

•

inability to successfully grow organically, including through future land acquisitions;

•

inaccuracies in estimates of volumes and qualities of our frac sand reserves;

•

failure to meet our minimum delivery requirements under our supply agreements;

•

material nonpayment or nonperformance by any of our significant customers;

•

development of either effective alternative proppants or new processes that replace hydraulic fracturing;

•

our ability to borrow funds and access the capital markets;

•

our ability to comply with covenants contained in our debt instruments;

•

the potential deterioration of our customers’ financial condition, including defaults resulting from actual or potential insolvencies;

•

changes in global political or economic conditions, including sustained inflation as well as financial market instability or disruptions to the banking system due to bank failures, both generally and in the markets we serve;

•

the impact of geopolitical developments and tensions, war and uncertainty in oil-producing countries (including the invasion of Ukraine by Russia, the Israel-Hamas war, continued instability in the Middle East, including from the Houthi rebels in Yemen, and any related political or economic responses and counter-responses or otherwise by various global actors or the general effect on the global economy);

•

health epidemics, such as the COVID-19 pandemic, natural disasters or inclement or hazardous weather conditions, including but not limited to cold weather, droughts, flooding, tornadoes and the physical impacts of climate change;

•

physical, electronic and cybersecurity breaches;

•

the effects of litigation;

•

plans, objectives, expectations and intentions described in this prospectus or any documents incorporated by reference herein that are not historical; and

•

other factors discussed elsewhere in this prospectus, including under the heading “Risk Factors.”

We caution you that these forward-looking statements are subject to numerous risks and uncertainties, most of which are difficult to predict and many of which are beyond our control. These risks include, but are not limited to, the risks described under the heading “Risk Factors.”

You are cautioned not to place undue reliance on any forward-looking statements. Although forward-looking statements reflect our good faith beliefs at the time they are made, forward-looking statements involve known and unknown risks, uncertainties and other factors, including the factors described under “Item 1A. Risk Factors” of our Annual Report on Form 10-K for the year ended December 31, 2023 (the “2023 Annual Report”) and in our subsequent filings with the SEC. Should one or more of such risks or uncertainties occur, or should underlying assumptions prove incorrect, our actual results and plans could differ materially from those expressed in any forward-looking statements. All forward-looking statements, expressed or implied, included in this prospectus or any documents incorporated by reference herein are expressly qualified in their entirety by this cautionary statement. This cautionary statement should also be considered in connection with any subsequent written or oral forward-looking statements that we or persons acting on our behalf may issue. Except as otherwise required by applicable law, we disclaim any duty to update any forward-looking statements to reflect events or circumstances after the date of this prospectus.

ABOUT ATLAS ENERGY SOLUTIONS INC.

Overview

Atlas Energy Solutions Inc. (referred to herein as “Atlas,” the “Company,” “we,” “us,” “our” and like expressions) is a leading proppant producer and proppant logistics provider, serving primarily the Permian Basin of West Texas and New Mexico. We operate 12 proppant production facilities across the Permian Basin with a combined annual production capacity of 28 million tons, including both large-scale in-basin facilities and smaller distributed mining units. We manage a portfolio of leading-edge logistics assets, which includes our 42-mile Dune Express conveyor system, which is currently under construction and is scheduled to come online in the fourth quarter of 2024. In addition to our conveyor infrastructure, we manage a fleet of 120 trucks, which are capable of delivering expanded payloads due to our custom-manufactured trailers and patented drop-depot process. Our approach to managing both our proppant production and proppant logistics operations is intently focused on leveraging technology, automation and remote operations to drive efficiencies.

We are a low-cost producer of various high-quality, locally sourced proppants used during the well completion process. We offer both dry and damp sand, and carry various mesh sizes including 100 mesh and 40/70 mesh. Proppant is a key component necessary to facilitate the recovery of hydrocarbons from oil and natural gas wells.

Our logistics platform is designed to increase the efficiency, safety and sustainability of the oil and natural gas industry within the Permian Basin. Proppant logistics is increasingly a differentiating factor affecting customer choice among proppant producers. The cost of delivering sand, even short distances, can be a significant component of customer spending on their well completions given the substantial volumes that are utilized in modern well designs.

We continue to invest in and pursue leading-edge technologies, including autonomous trucking, digital infrastructure, and artificial intelligence, to support opportunities to gain efficiencies in our operations. To this end, we have recently taken delivery of next-generation dredge mining assets to drive efficiencies in our proppant production operations. These technology-focused investments aim to improve our cost structure and also combine to produce beneficial environmental and community impacts.

While our core business is fundamentally aligned with a lower emissions economy, our core obligation has been, and will always be, to our stockholders. We recognize that maximizing value for our stockholders requires that we optimize the outcomes for our broader stakeholders, including our employees and the communities in which we operate. We are proud of the fact that our approach to innovation in the hydrocarbon industry while operating in an environmentally responsible manner creates immense value. Since our founding in 2017, our core mission has been to improve human beings’ access to the hydrocarbons that power our lives while also delivering differentiated social and environmental progress. Our Atlas team has driven innovation and has produced industry-leading environmental benefits by reducing energy consumption, emissions, and our aerial footprint. We call this Sustainable Environmental and Social Progress.

We were founded in 2017 by Ben M. “Bud” Brigham, our Executive Chairman, and are led by an entrepreneurial team with a history of constructive disruption bringing significant and complementary experience to this enterprise, including the perspective of longtime E&P operators, which provides for an elevated understanding of the end users of our products and services. Our executive management team has a proven track record with a history of generating positive returns and value creation. Our experience as E&P operators was instrumental to our understanding of the opportunity created by in-basin sand production and supply in the Permian Basin, which we view as North America’s premier shale resource and which we believe will remain its most active through economic cycles.

Our Corporate Information

Atlas is a publicly listed company and trades on the New York Stock Exchange (the “NYSE”) under the ticker symbol “AESI.”

Our principal executive offices are located at 5918 W. Courtyard Drive, Suite 500, Austin, Texas 78730, and our telephone number at that address is (512) 220-1200. Our website address is atlas.energy. Information contained on, or that is or becomes accessible through, our website does not constitute a part of this prospectus.

For additional information about our company, please read the documents listed under the heading “Incorporation of Certain Documents by Reference.”

RISK FACTORS

Investment in any securities offered pursuant to this prospectus and any applicable prospectus supplement involves risks. You should carefully consider the risk factors incorporated by reference from our 2023 Annual Report and any subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K (other than, in each case, information furnished rather than filed) that we file after the date of this prospectus, and all other information contained or incorporated by reference into this prospectus, as updated by our subsequent filings under the Exchange Act, and the risk factors and other information contained in any applicable prospectus supplement and any applicable free writing prospectus before acquiring any of such securities. Our business, prospects, financial condition or operating results could be harmed by any of these risks, as well as other risks not currently known to us or that we currently consider immaterial. The occurrence of any of these risks might cause you to lose all or part of your investment in the offered securities. Before deciding whether to invest in our securities, you should also refer to the other information contained in or incorporated by reference into this prospectus, including the sections entitled “Incorporation of Certain Documents by Reference” and “Cautionary Statement Regarding Forward-Looking Statements.”

USE OF PROCEEDS

Except as otherwise provided in any applicable prospectus supplement, we intend to use the net proceeds we receive from the sale of securities for general corporate purposes, which may include repayment of indebtedness, financing of future acquisitions and capital expenditures and additions to working capital.

Any specific allocation of the net proceeds of an offering of securities to a specific purpose will be determined at the time of the offering and will be described in any applicable prospectus supplement.

DESCRIPTION OF CAPITAL STOCK

Atlas is incorporated in the State of Delaware. The rights of stockholders of Atlas are generally governed by Delaware law, as well as Atlas’s Amended and Restated Certificate of Incorporation (the “Charter”) and Amended and Restated Bylaws (the “Bylaws”). The following description of Atlas’s common stock, par value $0.01 per share (the “Common Stock”), and Atlas’s preferred stock, par value $0.01 per share (the “Preferred Stock”), is a summary and is qualified in its entirety by reference to the Charter and Bylaws.

General

Atlas’s authorized capital stock consists of 2,000,000,000 shares of stock, comprising: 1,500,000,000 shares of Common Stock and 500,000,000 shares of Preferred Stock. Unless Atlas’s board of directors (the “Board”) determines otherwise, Atlas issues all shares of its capital stock in uncertificated form.

Common Stock

Voting Rights

Holders of shares of Common Stock are entitled to one vote per share held of record on all matters to be voted upon by the stockholders. The holders of Common Stock do not have cumulative voting rights in the election of directors.

Dividend Rights

Holders of Common Stock are entitled to ratably receive dividends when and if declared by the Board out of funds legally available for that purpose, subject to any statutory or contractual restrictions on the payment of dividends and to any prior rights and preferences that may be applicable to any outstanding Preferred Stock.

Liquidation Rights

Upon Atlas’s liquidation, dissolution, distribution of assets or other winding up, the holders of Common Stock are entitled to receive ratably the assets available for distribution to the stockholders after payment of liabilities and the liquidation preference of any outstanding shares of Preferred Stock.

Other Matters

The shares of Common Stock have no preemptive or conversion rights and are not subject to further calls or assessment by Atlas. There are no redemption or sinking fund provisions applicable to the Common Stock. All outstanding shares of Common Stock are fully paid and non-assessable.

Preferred Stock

The Charter authorizes the Board, subject to any limitations prescribed by law, without further stockholder approval, to establish and issue from time to time one or more classes or series of Preferred Stock covering up to an aggregate of 500,000,000 shares. Each class or series of Preferred Stock will cover the number of shares and will have the powers, preferences, rights, qualifications, limitations and restrictions determined by the Board, which may include, among others, dividend rights, liquidation preferences, voting rights, conversion rights, preemptive rights and redemption rights. Except as provided by law or in a preferred stock designation, the holders of Preferred Stock will not be entitled to vote at or receive notice of any meeting of stockholders.

Anti-Takeover Effects of Provisions of Delaware Law and Atlas’s Organizational Documents

Charter and Bylaws

Provisions of the Charter and Bylaws may delay or discourage transactions involving an actual or potential change in control or change in Atlas’s management, including transactions in which stockholders

might otherwise receive a premium for their shares or transactions that Atlas stockholders might otherwise deem to be in their best interests.

Among other things, the Charter and Bylaws have:

•

established advance notice procedures regarding stockholder proposals relating to the nomination of candidates for election as directors or new business to be brought before meetings of the stockholders. These procedures provide that notice of stockholder proposals must be timely given in writing to Atlas’s corporate secretary prior to the meeting at which the action is to be taken. Generally, to be timely, notice must be received at Atlas’s principal executive offices not less than 90 days nor more than 120 days prior to the first anniversary date of the annual meeting for the preceding year. The Bylaws specify the requirements as to form and content of all stockholders’ notices. These requirements may preclude stockholders from bringing matters before the stockholders at an annual or special meeting.

•

provided the Board the ability to authorize undesignated preferred stock. This ability makes it possible for the Board to issue, without stockholder approval, preferred stock with voting or other rights or preferences that could impede the success of any attempt to change control of Atlas. These and other provisions may have the effect of deterring hostile takeovers or delaying changes in control or management of Atlas.

•

provided that subject to the rights of the holders of any series of preferred stock to elect directors under specified circumstances and the terms of the Amended and Restated Stockholders’ Agreement, dated October 2, 2023, by and between Atlas, AESI Holdings Inc., a Delaware corporation (f/k/a Atlas Energy Solutions Inc.) (“Old Atlas”), and the parties signatory thereto (the “A&R Stockholders’ Agreement”), the authorized number of directors may be changed only by resolution of the Board.

•

provided that all vacancies, including newly created directorships, may, except as otherwise required by law or, if applicable, the rights of holders of a series of preferred stock, and subject to the terms of the A&R Stockholders’ Agreement, be filled by the affirmative vote of a majority of directors then in office, even if such directors constitute less than a quorum.

•

provided that, subject to the terms of the A&R Stockholders’ Agreement, the Bylaws can be amended or repealed at any regular or special meeting of stockholders or by the Board.

•

provided that any action required or permitted to be taken by the stockholders must be effected at a duly called annual or special meeting of stockholders and may not be effected by any consent in writing in lieu of a meeting of such stockholders, subject to the rights of the holders of any series of preferred stock with respect to such series.

•

provided that, subject to the terms of the A&R Stockholders’ Agreement, each of the Charter and Bylaws may be amended by the affirmative vote of the holders of at least two-thirds of then-outstanding common stock.

•

provided that special meetings of our stockholders may only be called by the Board (pursuant to a resolution adopted by a majority of the Board), the chief executive officer or the chairman of the Board.

•

provided for the Board to be divided into three classes of directors, with each class as nearly equal in number as possible, serving staggered three-year terms, other than directors that may be elected by holders of preferred stock, if any. This system of electing and removing directors may tend to discourage a third party from making a tender offer or otherwise attempting to obtain control of Atlas because it generally makes it more difficult for stockholders to replace a majority of the directors.

•

provided that, subject to the terms of the A&R Stockholders’ Agreement, the affirmative vote of the holders of at least 662∕3% of the voting power of all then-outstanding Atlas capital stock entitled to vote generally in the election of directors, voting together as a single class, shall be required to remove any or all of the directors from office and such removal may only be for cause.

Authorized but Unissued Capital Stock

The Delaware General Corporation Law (the “DGCL”) does not require stockholder approval for any issuance of authorized shares. However, the listing requirements of the NYSE, which will apply so long as

the common stock remains listed on the NYSE, require stockholder approval of certain issuances equal to or exceeding 20% of the then-outstanding voting power or then-outstanding number of shares of common stock. These additional shares may be used for a variety of corporate purposes, including future public offerings, to raise additional capital or to facilitate acquisitions.

One of the effects of the existence of unissued and unreserved common stock or preferred stock may be to enable the Board to issue shares to persons friendly to current management, which issuance could render more difficult or discourage an attempt to obtain control of Atlas by means of a merger, tender offer, proxy contest or otherwise, and thereby protect the continuity of management and possibly deprive the stockholders of Atlas of opportunities to sell their shares of common stock at prices higher than prevailing market prices.

Anti-Takeover Provisions under Section 203 of the Delaware General Corporation Law

Section 203 of the DGCL (“Section 203”), subject to certain exceptions set forth therein, prohibits a Delaware corporation from engaging in any business combination (as defined in Section 203) with any interested stockholder (as defined in Section 203) for a period of three years following the date that the stockholder became an interested stockholder, unless:

•

the business combination or the transaction that resulted in the stockholder becoming an interested stockholder is approved by the board of directors before the date the interested stockholder attained that status;

•

upon consummation of the transaction that resulted in the stockholder becoming an interested stockholder, the interested stockholder owned at least 85% of the voting stock of the corporation outstanding at the time the transaction commenced; or

•

on or after such time the business combination is approved by the board of directors and authorized at a meeting of stockholders by at least two thirds of the outstanding voting stock that is not owned by the interested stockholder.

A corporation may elect not to be subject to Section 203. Under the Charter, Atlas has elected not to be governed by or subject to the provisions of Section 203.

Designation Rights

Among other things, the A&R Stockholders’ Agreement provides the right to designate nominees for election to the Board as follows:

•

so long as the Principal Stockholders (as defined in the A&R Stockholders’ Agreement) collectively beneficially own greater than 50% of the common stock, Ben M. Brigham, the Company’s Executive Chairman, or his affiliates will have the right to determine the size of the Board and designate all members of the Board, including the right to designate all individuals to be included in the slate of directors to be nominated by the Board for election by the stockholders of Atlas;

•

so long as the Principal Stockholders collectively beneficially own at least 35% but not greater than 50% of the common stock, Mr. Brigham or his affiliates will have the right to designate four members of the Board, including the right to designate four individuals to be included in the slate of directors to be nominated by the Board for election by the stockholders of Atlas;

•

so long as the Principal Stockholders collectively beneficially own at least 25% but not greater than 35% of the common stock, Mr. Brigham or his affiliates will have the right to designate three members of the Board, including the right to designate three individuals to be included in the slate of directors to be nominated by the Board for election by the stockholders of Atlas;

•

so long as the Principal Stockholders collectively beneficially own at least 10% but not greater than 25% of the common stock, Mr. Brigham or his affiliates will have the right to designate two members of the Board, including the right to designate two individuals to be included in the slate of directors to be nominated by the Board for election by the stockholders of Atlas; and

•

so long as the Principal Stockholders collectively beneficially own at least 5% but not greater than 10% of the common stock, Mr. Brigham or his affiliates will have the right to designate one member

of the Board, including the right to designate one individual to be included in the slate of directors to be nominated by the Board for election by the stockholders of Atlas.

Additionally, each of the Principal Stockholders will agree to cause its respective shares of common stock to be voted in favor of the election of each of the nominees designated by Mr. Brigham or his affiliates. These provisions may have the effect of deferring, delaying or discouraging hostile takeovers, or changes in control of us or our management.

Corporate Opportunity

Under the Charter, to the extent permitted by law:

•

the Principal Stockholders and their affiliates, and any member of the Board that is not also an officer of Atlas, have the right to, and have no duty to abstain from exercising such right to, conduct business with any business that is competitive or in the same line of business as we are, do business with any of our clients or customers, or invest or own any interest publicly or privately in, or develop a business relationship with, any business that is competitive or in the same line of business as we are;

•

if the Principal Stockholders or their affiliates, or any member of the Board that is not also an officer of Atlas, acquire knowledge of a potential transaction that could be a corporate opportunity, they have no duty to offer such corporate opportunity to us; and

•

Atlas has renounced any interest or expectancy in, or in being offered an opportunity to participate in, such corporate opportunities.

Forum Selection

The Charter provides that unless Atlas consents in writing to the selection of an alternative forum, the Court of Chancery of the State of Delaware (or, if the Court of Chancery of the State of Delaware does not have jurisdiction, the Superior Court of the State of Delaware, or, if the Superior Court of the State of Delaware does not have jurisdiction, the United States District Court for the District of Delaware, in each case, subject to that court having personal jurisdiction over the indispensable parties named defendants therein) will, to the fullest extent permitted by applicable law, be the sole and exclusive forum for any stockholder (including a beneficial owner) to bring:

•

any derivative action or proceeding brought on Atlas’s behalf;

•

any action asserting a claim for a breach of a fiduciary duty owed by any of Atlas’s directors, officers, employees or stockholders to Atlas or its stockholders;

•

any action asserting a claim arising pursuant to any provision of the DGCL, the Charter or the Bylaws (as either may be amended or restated), or as to which the DGCL confers jurisdiction to the Court of Chancery of the State of Delaware, the Charter or Bylaws; or

•

any other action asserting a claim against Atlas that is governed by the internal affairs doctrine.

The Charter also provides that, unless Atlas consents in writing to an alternate forum, to the fullest extent permitted by applicable law, the federal district courts of the United States will be the exclusive forum for resolving any complaint asserting a cause of action arising under the Securities Act. Notwithstanding the foregoing, the exclusive forum provision will not apply to suits brought to enforce any liability or duty created by the Exchange Act or any other claim for which the federal courts have exclusive jurisdiction. While the Delaware courts have determined that such choice of forum provisions are facially valid, a stockholder may nevertheless seek to bring a claim in a venue other than those designated in the exclusive-forum provisions, and there can be no assurance that such provisions will be enforced by a court in those other jurisdictions. If a court were to find the exclusive-forum provisions contained in the Charter to be inapplicable or unenforceable in an action, Atlas may incur additional costs associated with resolving such action in other jurisdictions, which could harm our business.

Limitation of Liability and Indemnification Matters

The Charter limits the liability of Atlas’s directors for monetary damages for breach of their fiduciary duty as directors, except for liability that cannot be eliminated under the DGCL. Delaware law provides

that directors of a company will not be personally liable for monetary damages for breach of their fiduciary duty as directors, except for liabilities:

•

for any breach of their duty of loyalty to Atlas or its stockholders;

•

for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law;

•

for unlawful payment of dividend or unlawful stock repurchase or redemption, as provided under Section 174 of the DGCL; or

•

for any transaction from which the director derived an improper personal benefit.

Any amendment, repeal or modification of these provisions will be prospective only and would not affect any limitation on liability of a director for acts or omissions that occurred prior to any such amendment, repeal or modification.

The Bylaws also provide that Atlas will indemnify its directors and officers to the fullest extent permitted by Delaware law. The Bylaws also permit us to purchase insurance on behalf of any officer, director, employee or other agent for any liability arising out of that person’s actions as Atlas’s officer, director, employee or agent, regardless of whether Delaware law would permit indemnification.

Our Transfer Agent

Equiniti Trust Company, LLC (“EQ”) is transfer agent and registrar for Atlas’s common stock.

Listing of Common Stock

The common stock is listed on the NYSE under the symbol “AESI.”

DESCRIPTION OF DEPOSITARY SHARES

We may offer depositary shares (either separately or together with other securities) representing fractional interests in our Preferred Stock of any series. In connection with the issuance of any depositary shares, we will enter into a deposit agreement with a bank or trust company, as depositary, which will be named in the applicable prospectus supplement. Depositary shares will be evidenced by depositary receipts issued pursuant to the related deposit agreement. Immediately following our issuance of the Preferred Stock related to the depositary shares, we will deposit the Preferred Stock with the relevant preferred stock depositary and will cause the preferred stock depositary to issue, on our behalf, the related depositary receipts. Subject to the terms of the deposit agreement, each owner of a depositary receipt will be entitled, in proportion to the fraction of a share of Preferred Stock represented by the related depositary share, to all the rights, preferences and privileges of, and will be subject to all of the limitations and restrictions on, the preferred stock represented by the depositary receipt (including, if applicable, dividend, voting, conversion, exchange redemption and liquidation rights).

DESCRIPTION OF WARRANTS

We may issue warrants for the purchase of our Common Stock, Preferred Stock or any combination thereof. Warrants may be issued independently or together with our securities offered by any prospectus supplement and may be attached to or separate from any such offered securities. Each series of warrants will be issued under a separate warrant agreement to be entered into between us and a bank or trust company, as warrant agent, all as set forth in the prospectus supplement relating to the particular issue of warrants. The warrant agent will act solely as our agent in connection with the warrants and will not assume any obligation or relationship of agency or trust for or with any holders of warrants or beneficial owners of warrants. The following summary of certain provisions of the warrants does not purport to be complete and is subject to, and is qualified in its entirety by reference to, all provisions of the warrant agreements.

You should refer to the prospectus supplement relating to a particular issue of warrants for the terms of and information relating to the warrants, including, where applicable:

(1)

the number of securities purchasable upon exercise of the warrants and the price at which such securities may be purchased upon exercise of the warrants;

(2)

the date on which the right to exercise the warrants commences and the date on which such right expires (the “Expiration Date”);

(3)

the United States federal income tax consequences applicable to the warrants;

(4)

the amount of the warrants outstanding as of the most recent practicable date; and

(5)

any other terms of the warrants.

Warrants will be offered and exercisable for United States dollars only. Warrants will be issued in registered form only. Each warrant will entitle its holder to purchase such number of securities at such exercise price as is in each case set forth in, or calculable from, the prospectus supplement relating to the warrants. The exercise price may be subject to adjustment upon the occurrence of events described in such prospectus supplement. After the close of business on the Expiration Date (or such later date to which we may extend such Expiration Date), unexercised warrants will become void. The place or places where, and the manner in which, warrants may be exercised will be specified in the prospectus supplement relating to such warrants.

Prior to the exercise of any warrants, holders of the warrants will not have any of the rights of holders of securities, including the right to receive payments of any dividends on the securities purchasable upon exercise of the warrants, or to exercise any applicable right to vote.

PLAN OF DISTRIBUTION

We may use any one or more of the following methods when selling our securities under this prospectus:

•

underwritten transactions;

•

privately negotiated transactions;

•

exchange distributions and/or secondary distributions;

•

sales in the over-the-counter market;

•

ordinary brokerage transactions and transactions in which the broker solicits purchasers;

•

broker-dealers may agree with us to sell a specified number of such securities at a stipulated price per share;

•

a block trade (which may involve crosses) in which the broker or dealer so engaged will attempt to sell the securities as agent but may position and resell a portion of the block as principal to facilitate the transaction;

•

purchases by a broker or dealer as principal and resale by such broker or dealer for its own account pursuant to this prospectus;

•

short sales and delivery of shares of our Common Stock to close out short positions;

•

sales by broker-dealers of shares of our Common Stock that are loaned or pledged to such broker-dealers;

•

“at-the-market” offerings into an existing trading market in accordance with Rule 415(a)(4) under the Securities Act;

•

a combination of any such methods of sale; and

•

any other method permitted pursuant to applicable law.

We may also sell our shares of common stock under Rule 144 under the Securities Act, if available, or pursuant to other available exemptions from the registration requirements under the Securities Act, rather than under this prospectus.

We may prepare prospectus supplements for secondary offerings that will disclose the terms of the offering, including the name or names of any underwriters, dealers or agents, the purchase price of the shares, any underwriting discounts and other items constituting compensation to underwriters, dealers or agents. Shares covered by this prospectus may be sold in one or more transactions at a fixed price or prices, which may be changed, or at:

•

market prices prevailing at the time of any sale under this registration statement;

•

prices related to market prices; or

•

negotiated prices.

An agent may directly solicit, from time to time, offers to purchase the shares. Any such agent may be deemed to be an “underwriter” as that term is defined in the Securities Act. Any agents involved in the offer or sale of the shares and any commissions payable by us to these agents will be named and described in any applicable prospectus supplement. The agents may also be our customers or may engage in transactions with or perform services for us in the ordinary course of business.

If we utilize any underwriters in the sale of shares in respect of which this prospectus is delivered, we will enter into an underwriting agreement with those underwriters at the time of sale to them. We will set forth the names of these underwriters and the terms of the transaction in the prospectus supplement, which will be used by the underwriters to make resales of the shares in respect of which this prospectus is delivered to the public. The underwriters may also be our customers or may engage in transactions with or perform services for us in the ordinary course of business.

If we utilize a dealer in the sale of the shares in respect of which this prospectus is delivered, we will sell those shares to the dealer, as principal. The dealer may then resell those shares to the public at varying prices

to be determined by the dealer at the time of resale. The dealers may also be our customers or may engage in transactions with or perform services for us in the ordinary course of business.

Offers to purchase shares may be solicited directly by any selling stockholder and the sale thereof may be made by any selling stockholder directly to institutional investors or others, who may be deemed to be underwriters within the meaning of the Securities Act, with respect to any resale thereof. The terms of any such sales will be described in any applicable prospectus supplement relating thereto.

We may agree to indemnify underwriters, dealers and agents who participate in the distribution of securities against certain liabilities to which they may become subject in connection with the sale of the shares, including liabilities arising under the Securities Act.

We may offer our shares into an existing trading market in accordance with Rule 415(a)(4) under the Securities Act and on the terms described in the prospectus supplement relating thereto. Underwriters, dealers, and agents who participate in any at-the-market offerings will be described in the prospectus supplement relating thereto.

In addition, we may enter into derivative transactions with third parties, or sell shares not covered by this prospectus to third parties in privately negotiated transactions. If the applicable prospectus supplement so indicates, in connection with those derivatives, the third parties may sell shares covered by this prospectus and the applicable prospectus supplement, including in short sale transactions. If so, we may use shares pledged by us or borrowed from us or others to settle those sales or to close out any related open borrowings of stock, and may use securities received from us in settlement of those derivatives to close out any related open borrowings of stock. The third party in such sale transactions will be an underwriter and, if not identified in this prospectus, will be named in the applicable prospectus supplement (or a post-effective amendment).

In addition, we may otherwise loan or pledge shares to a financial institution or other third party that in turn may sell the shares short using this prospectus and an applicable prospectus supplement. Such financial institution or other third party may transfer its economic short position to investors in our shares or in connection with a concurrent offering of other securities.

The specific terms of any lock-up provisions in respect of any given offering will be described in any applicable prospectus supplement.

The underwriters, dealers and agents may engage in transactions with us, or perform services for us, in the ordinary course of business for which they receive compensation.

To the extent required, this prospectus may be amended or supplemented from time to time to describe a specific plan of distribution.

LEGAL MATTERS

Vinson & Elkins L.L.P. will pass upon certain legal matters relating to the issuance and sale of the securities offered hereby on behalf of Atlas Energy Solutions Inc. Additional legal matters may be passed upon for us or any underwriters, dealers or agents by counsel that we will name in the applicable prospectus supplement.

EXPERTS

The consolidated financial statements of Atlas Energy Solutions Inc. appearing in the 2023 Annual Report (on Form 10-K) for the year ended December 31, 2023 have been audited by Ernst & Young LLP, independent registered public accounting firm, as set forth in their report thereon included therein, and incorporated herein by reference. Such financial statements are, and audited financial statements to be included in subsequently filed documents will be, incorporated herein in reliance upon the reports of Ernst & Young LLP pertaining to such financial statements as of the respective dates (to the extent covered by consents filed with the SEC) given on the authority of such firm as experts in accounting and auditing.

Certain estimates of our proven mineral reserves incorporated by reference in this prospectus and elsewhere in the registration statement were derived from the report of John T. Boyd Company, independent mining engineers and geologists, as of December 31, 2023, and have been included herein on the authority of John T. Boyd Company as experts with respect to the matters covered by such report and in giving such report.

Hi-Crush Inc.

The combined carve-out financial statements of Hi-Crush Inc. at December 31, 2023 and 2022, and for the years then ended, appearing in our Current Report on Form 8-K filed with the SEC on May 8, 2024, have been audited by Whitley Penn LLP, independent auditors, as set forth in their report thereon incorporated by reference herein, and are incorporated by reference in reliance upon such report given on the authority of such firm as experts in accounting and auditing.

Certain estimates of Hi-Crush’s proven and probable mineral reserves incorporated by reference in this prospectus and elsewhere in the registration statement were estimated and compiled for reporting purposes by Hi-Crush’s reserve engineer and audited by John T. Boyd Company, independent mining engineers and geologists, as of December 31, 2023.

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

The SEC allows us to “incorporate by reference” into this prospectus the information we provide in other documents filed by us with the SEC. The information incorporated by reference is an important part of this prospectus and any prospectus supplement. We incorporate by reference the following documents that we have filed with the SEC (other than portions of these documents that were deemed to have been furnished and not filed in accordance with SEC rules, including pursuant to Item 2.02 or Item 7.01 of any Current Report on Form 8-K (including any financial statements or exhibits relating thereto furnished pursuant to Item 9.01), unless otherwise indicated therein):

•

•

•

•

Our Current Reports on Form 8-K filed on February 14, 2024, February 27, 2024, March 5, 2024 (Two Filings), April 18, 2024, May 6, 2024 (Two Filings), and May 10, 2024 (in each case excluding any information furnished pursuant to Item 2.02 or Item 7.01) and our Current Report on Form 8-K/A filed on May 8, 2024; and

•

In addition, all documents subsequently filed by us with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act (other than portions of these documents that are deemed to have been furnished and not filed in accordance with SEC rules, including pursuant to Item 2.02 or Item 7.01 of any Current Report on Form 8-K (including any financial statements or exhibits relating thereto furnished pursuant to Item 9.01), unless otherwise indicated therein), until all offerings under the registration statement of which this prospectus is a part are completed or terminated, will be considered to be incorporated by reference into this prospectus and to be a part of this prospectus from the dates of the filing of such documents. The most recent information that we file with the SEC automatically updates and supersedes more dated information.

Upon request, we will provide to each person, including any beneficial owner, to whom this prospectus is delivered, a copy of any or all of the reports or documents that have been incorporated by reference in this prospectus. If you would like a copy of any of these documents, at no cost, please write or call us at:

Atlas Energy Solutions Inc.

5918 W. Courtyard Drive, Suite 500

Austin, Texas 78730

(512) 220-1200

Attn: General Counsel and Secretary

Atlas Energy Solutions Inc.

Common Stock

Preferred Stock

Depositary Shares

Warrants

PROSPECTUS

PROSPECTUS

Atlas Energy Solutions Inc.

9,436,084 Shares of Common Stock

This prospectus relates to the proposed resale from time to time of up to 9,436,084 shares of the common stock, par value $0.01 per share (the “Common Stock”), of Atlas Energy Solutions Inc. (the “Company,” “we,” “our” or “us”), by the selling stockholders identified herein. These shares of common stock may be offered and sold by the selling stockholders named in this prospectus or in any supplement to this prospectus from time to time in accordance with the provisions set forth under “Plan of Distribution.”

The selling stockholders may offer and sell the shares of common stock offered by this prospectus from time to time on any exchange on which the shares of common stock are listed on terms to be negotiated with buyers. They may also offer and sell the shares of common stock in private sales or through one or more underwriters, dealers or agents, or through a combination of these methods. The selling stockholders may sell the shares of common stock at prevailing market prices or at prices negotiated with buyers. The selling stockholders will be responsible for any commissions due to brokers, dealers or agents. We will be responsible for all other offering expenses. We will not receive any of the proceeds from the sale by the selling stockholders of the shares of common stock offered by this prospectus.

We are registering these 9,436,084 shares of our common stock for sale by the selling stockholders named in the section of this prospectus titled “Selling Stockholders” pursuant to that certain Registration Rights and Lock-Up Agreement (the “Hi-Crush Registration Rights Agreement”), dated March 5, 2024, by and between the Company and certain of the Hi-Crush Stockholders (as defined herein) signatory thereto. The shares registered hereby are subject to certain lock up restrictions as set forth in the Hi-Crush Registration Rights Agreement.

Our common stock is listed on the New York Stock Exchange under the symbol “AESI.” On May 14, 2024, the last reported sale price of our common stock on the New York Stock Exchange was $23.36 per share.

Our principal executive offices are located at 5918 W. Courtyard Drive, Suite 500, Austin, Texas 78730, and our telephone number at that address is (512) 220-1200.

Investing in our Common Stock involves risk. You should carefully read the information under the heading “Risk Factors” on page 9 of this prospectus and the risk factors contained in any applicable prospectus supplement and the documents incorporated by reference herein or therein before making a decision to purchase our securities.

Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is May 15, 2024.

TABLE OF CONTENTS

| |

|

|

|

|

|

2 |

|

|

| |

|

|

|

|

|

3 |

|

|

| |

|

|

|

|

|

4 |

|

|

| |

|

|

|

|

|

7 |

|

|

| |

|

|

|

|

|

9 |

|

|

| |

|

|

|

|

|

10 |

|

|

| |

|

|

|

|

|

11 |

|

|

| |

|

|

|

|

|

14 |

|

|

| |

|

|

|

|

|

19 |

|

|

| |

|

|

|

|

|

21 |

|

|

| |

|

|

|

|

|

21 |

|

|

| |

|

|

|

|

|

22

|

|

|

Neither we nor the selling stockholders have authorized anyone to give you any information or to make any representations about us or the transactions we discuss in this prospectus other than those contained in this prospectus, any accompanying prospectus supplement or any free writing prospectus we have prepared. If you are given any information or representations about these matters that is not discussed in this prospectus, you must not rely on that information. This prospectus is not an offer to sell or a solicitation of an offer to buy securities anywhere or to anyone where or to whom we are not permitted to offer or sell securities under applicable law. The delivery of this prospectus does not, under any circumstances, mean that there has not been a change in our affairs since the date of this prospectus. Subject to our obligation to amend or supplement this prospectus as required by law and the rules and regulations of the U.S. Securities and Exchange Commission, the information contained in this prospectus is correct only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of these securities.

ABOUT THIS PROSPECTUS

This prospectus is part of an “automatic shelf” registration statement that we filed with the U.S. Securities and Exchange Commission (the “SEC”), as a “well-known seasoned issuer” as defined in Rule 405 under the Securities Act of 1933, as amended (the “Securities Act”), using a “shelf” registration process. Using this process, the selling stockholders may offer the securities described in this prospectus in one or more offerings. This prospectus provides you with a general description of us and the securities that may be offered by the selling stockholders. Because each of the selling stockholders may be deemed to be an “underwriter” within the meaning of the Securities Act, each time securities are offered by the selling stockholders pursuant to this prospectus, the selling stockholders may be required to provide you with this prospectus and, in certain cases, a prospectus supplement that will contain specific information about the selling stockholders and the terms of the securities being offered. We may also authorize one or more free writing prospectuses to be provided to you that may contain material information relating to these offerings. Any prospectus supplement or free writing prospectus may also add, update or change information contained in this prospectus with respect to that offering. If there is any inconsistency between the information in this prospectus and any applicable prospectus supplement or free writing prospectus, you should rely on the prospectus supplement or free writing prospectus, as applicable. Before purchasing any shares, you should carefully read both this prospectus and any applicable prospectus supplement (and any applicable free writing prospectus), together with the additional information described under the headings “Where You Can Find More Information” and “Incorporation of Certain Documents by Reference.”

Neither we nor the selling stockholders have authorized anyone to provide you with any information or to make any representations other than those contained in this prospectus, any applicable prospectus supplement or any free writing prospectus prepared by or on behalf of us or to which we have referred you. We and the selling stockholders take no responsibility for and can provide no assurance as to the reliability of any other information that others may give you. The selling stockholders will not make an offer to sell these shares in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus and any applicable prospectus supplement to this prospectus is accurate only as of the date on its respective cover, that the information appearing in any applicable free writing prospectus is accurate only as of the date of that free writing prospectus and that any information incorporated by reference is accurate only as of the date of the document incorporated by reference, unless we indicate otherwise. Our business, financial condition, results of operations and prospects may have changed since those dates. This prospectus incorporates by reference, and any applicable prospectus supplement or free writing prospectus may contain and incorporate by reference, market data, industry statistics and forecasts that are based on independent industry publications and other publicly available information. Although we believe these sources are reliable, we do not guarantee the accuracy or completeness of this information and we have not independently verified this information. In addition, the market and industry data and forecasts that may be included or incorporated by reference in this prospectus, any applicable prospectus supplement or any applicable free writing prospectus may involve estimates, assumptions and other risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk Factors” contained in this prospectus, any applicable prospectus supplement and any applicable free writing prospectus, and under similar headings in other documents that are incorporated by reference into this prospectus. Accordingly, investors should not place undue reliance on this information.

WHERE YOU CAN FIND MORE INFORMATION

We have filed with the SEC a registration statement on Form S-3 to register the offer and sale of the shares covered hereby. This prospectus, which forms part of the registration statement, does not contain all of the information included in that registration statement. For further information about us and the shares covered by this prospectus, you should refer to the registration statement and its exhibits. Statements contained in this prospectus as to the contents of any contract, agreement or any other document are summaries of the material terms of such contract, agreement or other document and are not necessarily complete. With respect to each of these contracts, agreements or other documents filed as an exhibit to the registration statement, reference is made to the exhibits for a more complete description of the matter involved. Certain information is also incorporated by reference in this prospectus as described under “Incorporation of Certain Documents by Reference.”

We are subject to the information and periodic reporting requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and, in accordance therewith, file periodic reports, proxy statements and other information with the SEC. Such periodic reports, proxy statements and other information, including our registration statement, of which this prospectus constitutes a part, and the exhibits and schedules thereto, are available at the website of the SEC at www.sec.gov. We also furnish our stockholders with annual reports containing our financial statements audited by an independent registered public accounting firm and quarterly reports containing our unaudited financial information. We maintain a website at atlas.energy. You may access our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports, filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act with the SEC free of charge at our website as soon as reasonably practicable after this material is electronically filed with, or furnished to, the SEC. The reference to our website or web address does not constitute incorporation by reference of the information contained at that site.

We have not authorized anyone to provide you with any information other than that contained in this prospectus or in a document to which we expressly have referred you. We take no responsibility for and can provide no assurance as to the reliability of any other information that others may give you. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

The information in this prospectus and the documents incorporated by reference herein contains forward-looking statements that are subject to risks and uncertainties. All statements, other than statements of historical fact, regarding our strategy, future operations, financial position, estimated revenues and losses, projected costs, prospects, plans and objectives of management are forward-looking statements. Additionally, the information in this prospectus and the documents incorporated by reference herein includes forward-looking statements related to the recently completed Hi-Crush Transaction (as defined herein). When used in this prospectus and the documents incorporated by reference herein, the words “may,” “forecast,” “continue,” “could,” “would,” “will,” “plan,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “project” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words.

These forward-looking statements are based on our current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events. When considering forward-looking statements, you should keep in mind the risk factors and other cautionary statements described under the heading “Risk Factors” in this prospectus and the documents incorporated by reference herein. By their nature, forward-looking statements involve known and unknown risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. Although we believe that the forward-looking statements contained in this prospectus and the documents incorporated by reference herein are based on reasonable assumptions, you should be aware that many factors could affect our actual financial results or results of operations and could cause actual results to differ materially from those in such forward-looking statements, including but not limited to:

•

our ability to successfully integrate the business of Hi-Crush Inc. (“Hi-Crush”);

•

higher than expected costs to operate our proppant production and processing facilities and develop the Dune Express, an overland conveyor infrastructure solution currently under construction;

•

the amount of proppant we are able to produce, which could be adversely affected by, among other things, operating difficulties and unusual or unfavorable geologic conditions;

•

the volume of proppant we are able to sell and our ability to enter into supply contracts for our proppant on acceptable terms;

•

the prices we are able to charge, and the margins we are able to realize, from our proppant sales;

•

the demand for and price of proppant, particularly in the Permian Basin;

•

the success of our electric dredging transition efforts;

•

fluctuations in the demand for certain grades of proppant;

•

the domestic and foreign supply of and demand for oil and natural gas;

•