0001084048false00010840482023-11-082023-11-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (date of earliest event reported) November 8, 2023

Ziff Davis, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | |

Delaware | | 0-25965 | | 47-1053457 |

(State or other jurisdiction of incorporation or organization) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

114 5th Avenue, 15th Floor

New York, New York 10011

(Address of principal executive offices)

(212) 503-3500

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.01 par value | ZD | Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02 Results of Operations and Financial Condition.

On November 8, 2023, Ziff Davis, Inc. (the “Company”) issued a press release (the “Press Release”) announcing its preliminary unaudited financial results for the third quarter ended September 30, 2023 and reaffirming its financial guidance for fiscal year 2023.

A copy of the Press Release is furnished as Exhibit 99.1 to this Form 8-K.

Item 7.01 Regulation FD Disclosure.

On November 9, 2023, at 8:30 a.m. Eastern Time, the Company will host its third quarter 2023 earnings conference call and Webcast. Via the Webcast, the Company will present portions of its November 2023 Investor Presentation, which contains a summary of the Company’s preliminary unaudited financial results for the fiscal quarter ended September 30, 2023, financial estimates for fiscal year 2023, and certain other financial and operating information regarding the Company. A copy of this presentation is furnished as Exhibit 99.2 to this Form 8-K.

NOTE: The information in this Item 7.01 is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”) or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit Number | | Description |

| 99.1 | | |

| 99.2 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

This Current Report on Form 8-K contains forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. Such forward-looking statements are subject to numerous assumptions, risks and uncertainties that could cause actual results to differ materially from those described in such statements. Such forward-looking statements are based on management’s expectations or beliefs as of November 8, 2023. Factors that might cause such differences include, but are not limited to, a variety of economic, competitive, and regulatory factors, many of which are beyond the Company’s control and are described in the Company’s Annual Report on Form 10-K filed by the Company on March 1, 2023 with the Securities and Exchange Commission (the “SEC”) and the other reports the Company files from time to time with the SEC. The Company undertakes no obligation to revise or publicly release any updates to such statements based on future information or actual results.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | Ziff Davis, Inc. (Registrant) |

| | | |

| Date: | November 8, 2023 | By: | /s/ Jeremy Rossen |

| | | Jeremy Rossen

Executive Vice President, General Counsel and Secretary |

Ziff Davis Reports Third Quarter 2023 Financial Results and

Reaffirms 2023 Guidance

NEW YORK, NY -- Ziff Davis, Inc. (NASDAQ: ZD) (“Ziff Davis” or “the Company”) today reported unaudited financial results for the third quarter ended September 30, 2023.

“Given the marked improvement in the third quarter with our Digital Media segment returning to positive organic growth, we believe we’re turning the corner,” said Vivek Shah, Chief Executive Officer of Ziff Davis. “We’re also making solid progress on AI enablement across our portfolio."

THIRD QUARTER 2023 RESULTS

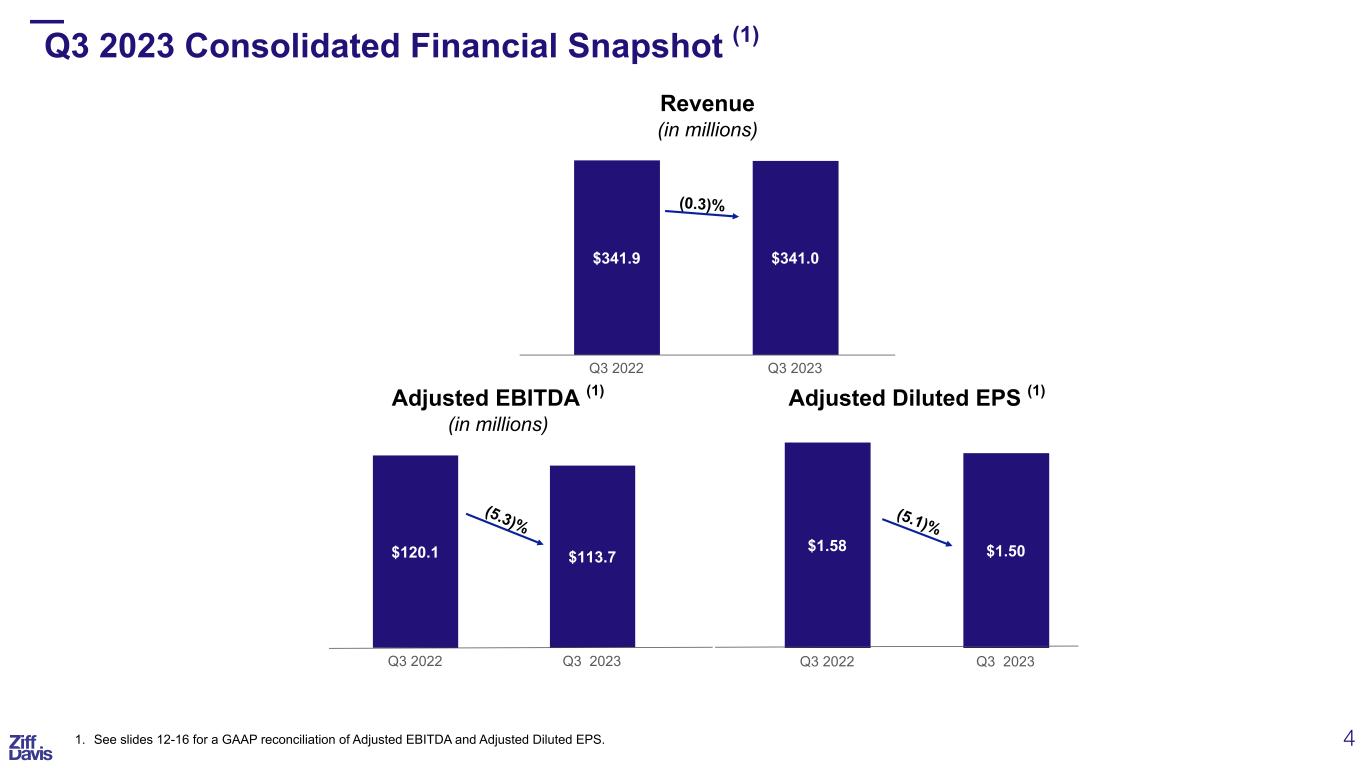

•Q3 2023 quarterly revenues decreased 0.3% to $341.0 million compared to $341.9 million for Q3 2022.

•(Loss) income from operations decreased 145.9% to $(13.3) million compared to $29.0 million for Q3 2022 primarily due to the recognition of a $56.9 million goodwill impairment during the three months ended September 30, 2023, which exceeded the recognition of a $27.4 million goodwill impairment during the three months ended September 30, 2022.

•Net (loss) income decreased to $(31.0) million compared to $18.2 million for Q3 2022 primarily due to the recognition of a $56.9 million goodwill impairment during the three months ended September 30, 2023, which exceeded the net impact of a $20.7 million goodwill impairment, net of tax, and a $7.7 million gain on extinguishment of debt, net of tax, both of which were recognized during the three months ended September 30, 2022.

•Net (loss) income per diluted share(1) decreased to $(0.67) in Q3 2023 compared to $0.39 for Q3 2022.

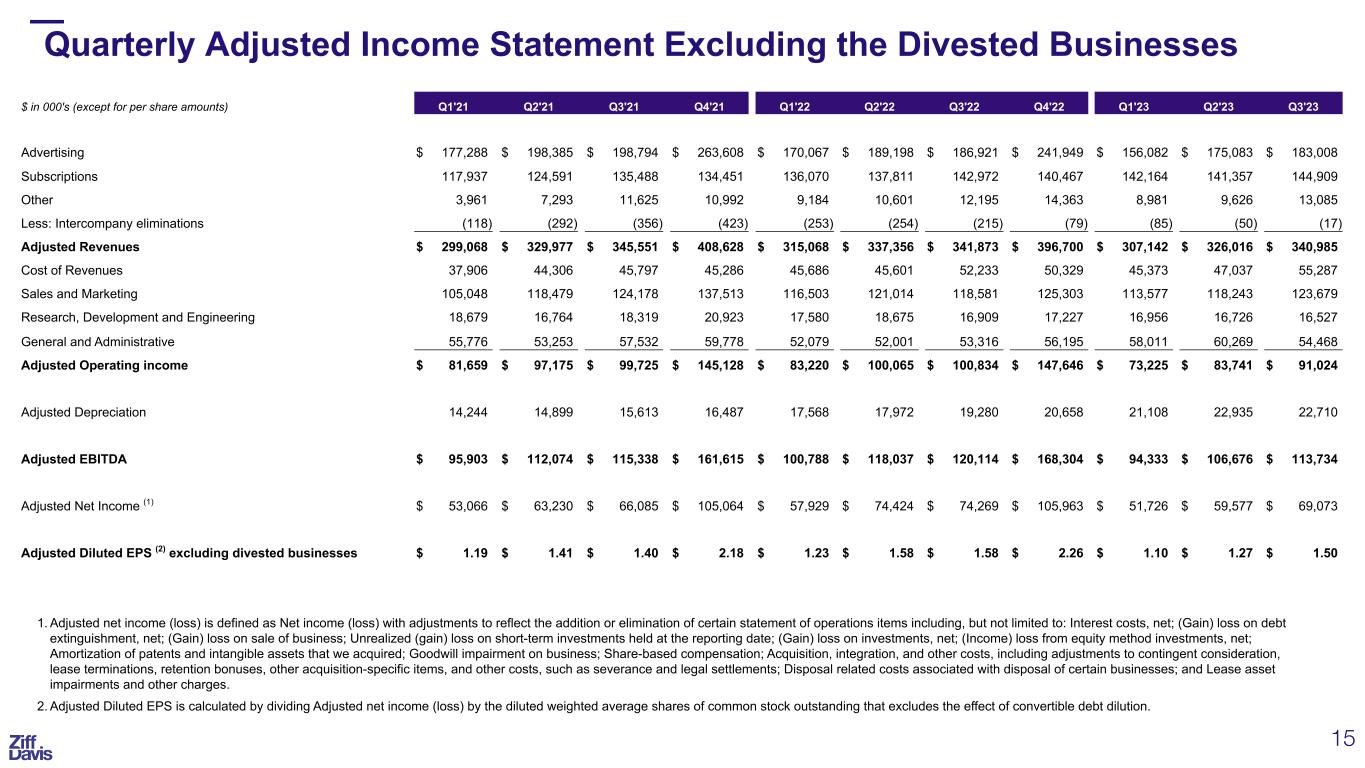

•Adjusted EBITDA(2) for the quarter decreased 5.3% to $113.7 million compared to $120.1 million for Q3 2022.

•Adjusted net income(2) decreased 7.0% to $69.1 million compared to $74.3 million for Q3 2022.

•Adjusted net income per diluted share(1)(2) (or “Adjusted diluted EPS”) for the quarter decreased 5.1% to $1.50 compared to $1.58 for Q3 2022.

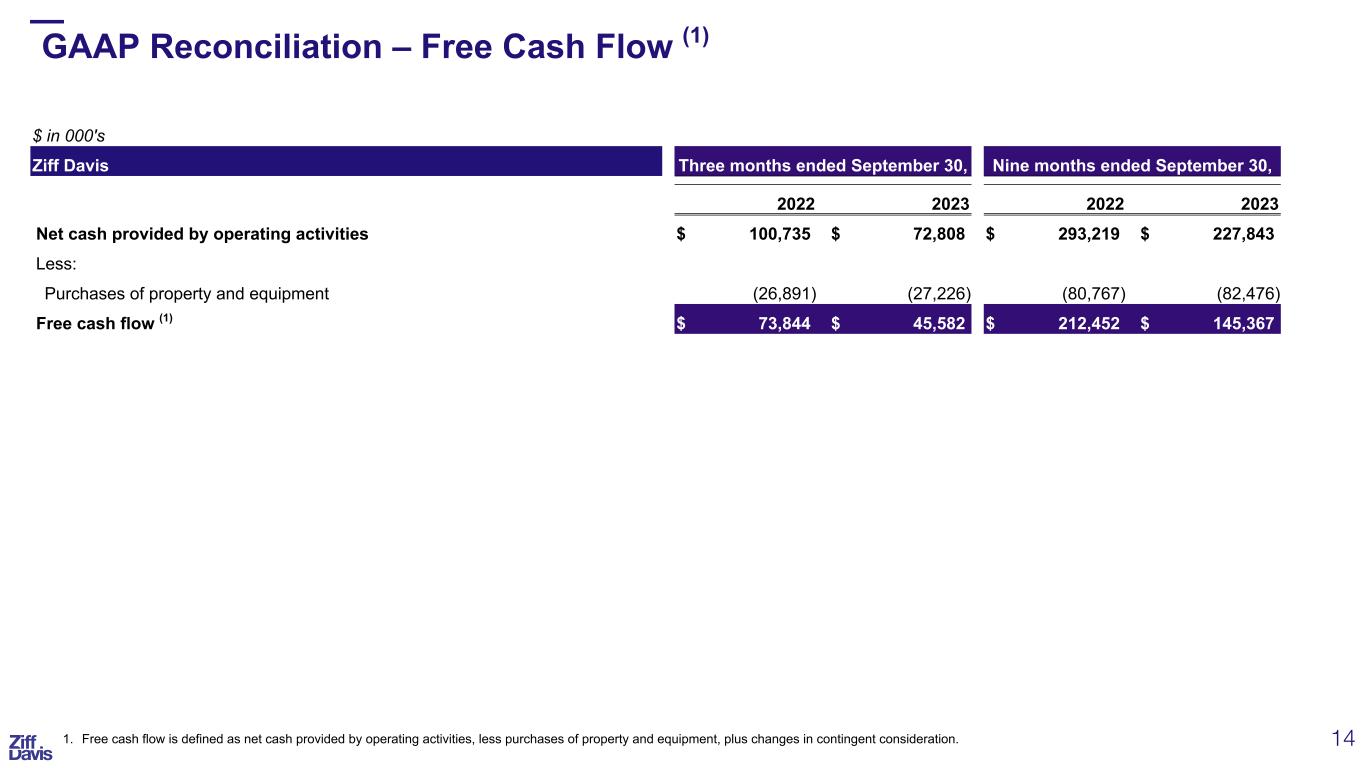

•Net cash provided by operating activities was $72.8 million in Q3 2023 compared to $100.7 million in Q3 2022. Free cash flow(2) was $45.6 million in Q3 2023 compared to $73.8 million in Q3 2022.

•Ziff Davis ended the quarter with approximately $830.6 million in cash, cash equivalents, and investments after deploying approximately $44.6 million primarily related to share repurchases.

The following table reflects results for the three and nine months ended September 30, 2023 and 2022, respectively (in millions, except per share amounts).

| | | | | | | | | | | | | | | | | | | | | |

| Three months ended September 30, | | % Change | Nine months ended September 30, | % Change |

| 2023 | 2022 | | 2023 | 2022 |

| Revenues | | | | | | | |

| Digital Media | $267.9 | $263.7 | | 1.6% | $754.9 | $756.7 | (0.2)% |

| Cybersecurity and Martech | $73.1 | $78.2 | | (6.5)% | $219.2 | $237.6 | (7.7)% |

Total revenues(3) | $341.0 | $341.9 | | (0.3)% | $974.1 | $994.3 | (2.0)% |

(Loss) income from operations | $(13.3) | $29.0 | | (145.9)% | $51.9 | $105.5 | (50.8)% |

Operating (loss) income margin | (3.9)% | 8.5% | | (12.4)% | 5.3% | 10.6% | (5.3)% |

Net (loss) income | $(31.0) | $18.2 | | (270.3)% | $(21.9) | $(3.7) | (491.9)% |

Net (loss) income per diluted share(1) | $(0.67) | $0.39 | | (271.8)% | $(0.47) | $(0.08) | (487.5)% |

Adjusted EBITDA(2) | $113.7 | $120.1 | | (5.3)% | $314.7 | $338.9 | (7.1)% |

Adjusted EBITDA margin(2) | 33.3% | 35.1% | | (1.8)% | 32.3% | 34.1% | (1.8)% |

Adjusted net income(2) | $69.1 | $74.3 | | (7.0)% | $180.4 | $206.6 | (12.7)% |

Adjusted diluted EPS(1)(2) | $1.50 | $1.58 | | (5.1)% | $3.86 | $4.41 | (12.5)% |

| Net cash provided by operating activities | $72.8 | $100.7 | | (27.7)% | $227.8 | $293.2 | (22.3)% |

Free cash flow(2) | $45.6 | $73.8 | | (38.2)% | $145.4 | $212.5 | (31.6)% |

Notes:

| | | | | | | | |

| (1) | | GAAP effective tax rates were approximately (20.7)% and 45.9% for the three months ended September 30, 2023 and 2022, respectively, and (1,040.8)% and 83.9% for the nine months ended September 30, 2023 and 2022, respectively. Adjusted effective tax rates were approximately 22.9% and 22.6% for the three months ended September 30, 2023 and 2022, respectively, and 23.8% and 22.8% for the nine months ended September 30, 2023 and 2022, respectively. |

| (2) | | For definitions of non-GAAP financial measures and reconciliations of GAAP to non-GAAP financial measures refer to section “Non-GAAP Financial Measures,” further in this report. |

| (3) | | The revenues associated with each of the businesses may not foot precisely since each is presented independently. |

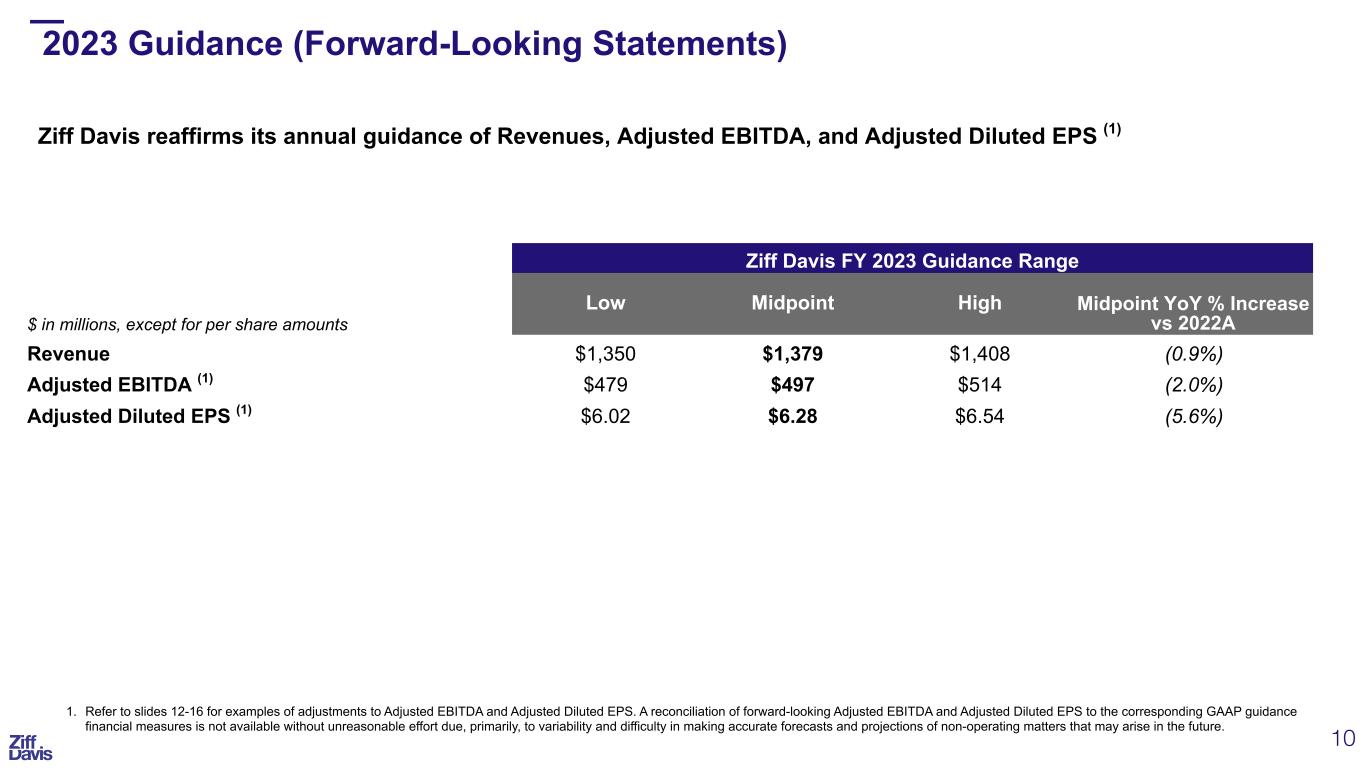

ZIFF DAVIS GUIDANCE

The Company reaffirms its guidance for fiscal year 2023 as follows (in millions, except per share data):

| | | | | | | | | | | | | | | | | |

| | | 2023 Range of Estimates | | |

| | | Low | | High | | | | |

| Revenue | | | $ | 1,350.0 | | | $ | 1,408.0 | | | | | |

| Adjusted EBITDA | | | $ | 479.0 | | | $ | 514.0 | | | | | |

| Adjusted diluted EPS* | | | $ | 6.02 | | | $ | 6.54 | | | | | |

* Adjusted diluted EPS for 2023 excludes share-based compensation ranging between $32 million and $34 million, amortization of acquired intangibles, and the impact of any currently unanticipated items, in each case net of tax. It is anticipated that the Adjusted effective tax rate for 2023 will be between 23.0% and 25.0%.

A reconciliation of forward-looking Adjusted EBITDA and Adjusted diluted EPS to the corresponding GAAP guidance financial measures is not available without unreasonable effort due, primarily, to variability and difficulty in making accurate forecasts and projections of non-operating matters that may arise in the future.

Earnings Conference Call and Audio Webcast

Ziff Davis will host a live audio webcast and conference call discussing its third quarter 2023 financial results on Thursday, November 9, 2023, at 8:30AM ET. The live webcast and call will be accessible by phone by dialing (844) 985-2014 or via www.ziffdavis.com. Following the event, the audio recording and presentation materials will be archived and made available at www.ziffdavis.com.

About Ziff Davis

Ziff Davis, Inc. (NASDAQ: ZD) is a vertically focused digital media and internet company whose portfolio includes leading brands in technology, shopping, gaming and entertainment, connectivity, health, cybersecurity, and martech. For more information, visit www.ziffdavis.com.

Contact:

Alan Steier

Investor Relations

Ziff Davis, Inc.

investor@ziffdavis.com

Rebecca Wright

Corporate Communications

Ziff Davis, Inc.

press@ziffdavis.com

“Safe Harbor” Statement Under the Private Securities Litigation Reform Act of 1995: Certain statements in this Press Release are “forward-looking statements” within the meaning of The Private Securities Litigation Reform Act of 1995, including those contained in Vivek Shah’s quote and the “Ziff Davis Guidance” section regarding the Company’s expected fiscal 2023 financial performance. These forward-looking statements are based on management’s current expectations or beliefs and are subject to numerous assumptions, risks, and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. These factors and uncertainties include, among other items: the Company’s ability to grow advertising revenues, profitability, and cash flows, particularly in light of an uncertain U.S. or worldwide economy, including the possibility of economic downturn or recession; the Company’s ability to make interest and debt payments; the Company’s ability to identify, close, and successfully transition acquisitions; subscriber growth and retention; variability of the Company’s revenue based on changing conditions in particular industries and the economy generally; protection of the Company’s proprietary technology or infringement by the Company of intellectual property of others; the risk of losing critical third-party vendors or key personnel; the risks associated with fraudulent activity, system failure, or a security breach; risks related to our ability to adhere to our internal controls and procedures; the risk of adverse changes in the U.S. or international regulatory environments, including but not limited to the imposition or increase of taxes or regulatory-related fees; the risks related to supply chain disruptions, inflationary conditions, and rising interest rates; the risk of liability for legal and other claims;

and the numerous other factors set forth in Ziff Davis’ filings with the Securities and Exchange Commission (“SEC”). For a more detailed description of the risk factors and uncertainties affecting Ziff Davis, refer to the 2022 Annual Report on Form 10-K filed by Ziff Davis on March 1, 2023, and the other reports filed by Ziff Davis from time-to-time with the SEC, each of which is available at www.sec.gov. The forward-looking statements provided in this press release, including those contained in Vivek Shah’s quote and in the “Ziff Davis Guidance” portion regarding the Company’s expected fiscal 2023 financial performance are based on limited information available to the Company at this time, which is subject to change. Although management’s expectations may change after the date of this Press Release, the Company undertakes no obligation to revise or update these statements.

ZIFF DAVIS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(UNAUDITED, IN THOUSANDS)

| | | | | | | | | | | |

| September 30, 2023 | | December 31, 2022 |

| ASSETS | | | |

| Cash and cash equivalents | $ | 660,624 | | | $ | 652,793 | |

| | | |

| Short-term investments | 29,797 | | | 58,421 | |

Accounts receivable, net of allowances of $7,388 and $6,868, respectively | 291,485 | | | 304,739 | |

| Prepaid expenses and other current assets | 81,757 | | | 68,319 | |

| | | |

| Total current assets | 1,063,663 | | | 1,084,272 | |

| Long-term investments | 140,167 | | | 127,871 | |

Property and equipment, net of accumulated amortization of $308,368 and $255,586, respectively | 186,165 | | | 178,184 | |

| Intangible assets, net | 367,943 | | | 462,815 | |

| Goodwill | 1,539,663 | | | 1,591,474 | |

| Deferred income taxes | 8,573 | | | 8,523 | |

| Other assets | 77,053 | | | 80,131 | |

| TOTAL ASSETS | $ | 3,383,227 | | | $ | 3,533,270 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Accounts payable | $ | 127,818 | | | $ | 120,829 | |

| Accrued employee related costs | 37,011 | | | 42,178 | |

| Other accrued liabilities | 47,219 | | | 39,539 | |

| Income taxes payable, current | 4,985 | | | 19,712 | |

| Deferred revenue, current | 182,741 | | | 187,904 | |

| | | |

| Accrued liabilities and other current liabilities | 19,724 | | | 22,286 | |

| Total current liabilities | 419,498 | | | 432,448 | |

| Long-term debt | 1,000,743 | | | 999,053 | |

| Deferred revenue, noncurrent | 8,000 | | | 9,103 | |

| Deferred income taxes | 51,098 | | | 79,007 | |

| Income taxes payable, noncurrent | 8,486 | | | 11,675 | |

| Other long-term liabilities | 91,264 | | | 109,373 | |

| TOTAL LIABILITIES | 1,579,089 | | | 1,640,659 | |

| | | |

| | | |

| Common stock | 460 | | | 473 | |

| Additional paid-in capital | 462,812 | | | 439,681 | |

| | | |

| Retained earnings | 1,426,979 | | | 1,537,830 | |

| Accumulated other comprehensive loss | (86,113) | | | (85,373) | |

| TOTAL STOCKHOLDERS’ EQUITY | 1,804,138 | | | 1,892,611 | |

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | $ | 3,383,227 | | | $ | 3,533,270 | |

ZIFF DAVIS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(UNAUDITED, IN THOUSANDS EXCEPT SHARE AND PER SHARE DATA)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended September 30, | | Nine months ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Total revenues | $ | 340,985 | | | $ | 341,873 | | | $ | 974,143 | | | $ | 994,297 | |

| Operating costs and expenses: | | | | | | | |

| Cost of revenues | 55,526 | | | 52,603 | | | 148,677 | | | 144,707 | |

| Sales and marketing | 125,062 | | | 119,474 | | | 360,916 | | | 361,013 | |

| Research, development, and engineering | 17,597 | | | 17,735 | | | 53,328 | | | 55,883 | |

| General and administrative | 99,269 | | | 95,658 | | | 302,481 | | | 299,842 | |

| Goodwill impairment on business | 56,850 | | | 27,369 | | | 56,850 | | | 27,369 | |

| Total operating costs and expenses | 354,304 | | | 312,839 | | | 922,252 | | | 888,814 | |

(Loss) income from operations | (13,319) | | | 29,034 | | | 51,891 | | | 105,483 | |

| Interest expense, net | (2,817) | | | (8,560) | | | (17,780) | | | (28,419) | |

| Gain on debt extinguishment, net | — | | | 10,112 | | | — | | | 11,505 | |

| | | | | | | |

| Gain (loss) on investments, net | — | | | 471 | | | 357 | | | (47,772) | |

| Unrealized (loss) gain on short-term investments held at the reporting date, net | (6,019) | | | 4,201 | | | (29,560) | | | (14,165) | |

| Other (loss) income, net | (3,571) | | | 4,218 | | | (5,982) | | | 12,962 | |

(Loss) income before income taxes and income (loss) from equity method investment, net | (25,726) | | | 39,476 | | | (1,074) | | | 39,594 | |

| Income tax expense | (5,335) | | | (18,100) | | | (11,180) | | | (33,231) | |

Income (loss) from equity method investment, net | 90 | | | (3,191) | | | (9,665) | | | (10,077) | |

Net (loss) income | $ | (30,971) | | | $ | 18,185 | | | $ | (21,919) | | | $ | (3,714) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Basic | $ | (0.67) | | | $ | 0.39 | | | $ | (0.47) | | | $ | (0.08) | |

| Diluted | $ | (0.67) | | | $ | 0.39 | | | $ | (0.47) | | | $ | (0.08) | |

| Weighted average shares outstanding: | | | | | | | |

| Basic | 46,062,097 | | | 46,871,897 | | | 46,612,660 | | | 46,967,671 | |

| Diluted | 46,062,097 | | | 46,871,897 | | | 46,612,660 | | | 46,967,671 | |

ZIFF DAVIS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED, IN THOUSANDS) | | | | | | | | | | | |

| | Nine months ended September 30, |

| 2023 | | 2022 |

| Cash flows from operating activities: | | | |

Net loss | $ | (21,919) | | | $ | (3,714) | |

Adjustments to reconcile net loss to net cash provided by operating activities: | | | |

| Depreciation and amortization | 167,333 | | | 174,880 | |

| Non-cash operating lease costs | 7,248 | | | 9,043 | |

| Share-based compensation | 24,393 | | | 20,806 | |

| Provision for credit losses (benefit) on accounts receivable | 2,296 | | | (1,142) | |

| Deferred income taxes, net | (25,658) | | | (13,552) | |

| Gain on extinguishment of debt, net | — | | | (11,505) | |

| | | |

| Goodwill impairment on business | 56,850 | | | 27,369 | |

| Changes in fair value of contingent consideration | — | | | (2,305) | |

| Loss from equity method investments | 9,665 | | | 10,077 | |

| Unrealized loss on short-term investments held at the reporting date | 29,560 | | | 14,165 | |

| (Gain) loss on investment, net | (357) | | | 47,772 | |

| Other | 5,113 | | | 2,320 | |

| Decrease (increase) in: | | | |

| Accounts receivable | 11,043 | | | 85,121 | |

| Prepaid expenses and other current assets | (10,059) | | | 3,177 | |

| Other assets | (7,961) | | | (8,667) | |

| Increase (decrease) in: | | | |

| Accounts payable | 1,955 | | | (11,445) | |

| Deferred revenue | (6,820) | | | (25,400) | |

| Accrued liabilities and other current liabilities | (14,839) | | | (23,781) | |

Net cash provided by operating activities | 227,843 | | | 293,219 | |

| Cash flows from investing activities: | | | |

| Purchases of property and equipment | (82,476) | | | (80,767) | |

| Acquisition of businesses, net of cash received | (9,492) | | | (104,094) | |

| | | |

| Investment in available-for-sale securities | — | | | (15,000) | |

| | | |

| | | |

| Purchases of equity investments | (11,790) | | | — | |

| Proceeds from sale of equity investments | 3,174 | | | — | |

| | | |

| | | |

| Other | (4,154) | | | — | |

| Net cash used in investing activities | (104,738) | | | (199,861) | |

| Cash flows from financing activities: | | | |

| | | |

| Payment of debt | — | | | (166,904) | |

| | | |

| | | |

| Proceeds from term loan | — | | | 112,286 | |

| Debt extinguishment costs | — | | | (756) | |

| | | |

| Repurchase of common stock | (107,341) | | | (76,545) | |

| Issuance of common stock under employee stock purchase plan | 4,725 | | | 5,235 | |

| Proceeds from exercise of stock options | — | | | 148 | |

| Deferred payments for acquisitions | (14,141) | | | (14,734) | |

| Other | (53) | | | (559) | |

Net cash used in financing activities | (116,810) | | | (141,829) | |

| Effect of exchange rate changes on cash and cash equivalents | 1,536 | | | (24,454) | |

| Net change in cash and cash equivalents | 7,831 | | | (72,925) | |

| Cash and cash equivalents at beginning of year | 652,793 | | | 694,842 | |

| Cash and cash equivalents at end of year | $ | 660,624 | | | $ | 621,917 | |

Non-GAAP Financial Measures

To supplement our condensed consolidated financial statements, which are prepared and presented in accordance with U.S. generally accepted accounting principles (“GAAP”), we use the following non-GAAP financial measures: Adjusted EBITDA, Adjusted EBITDA margin, Adjusted net income (loss), Adjusted net income (loss) per diluted share, Free cash flow, and Adjusted effective tax rate (collectively the “non-GAAP financial measures”). The presentation of this financial information is not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP.

We use these non-GAAP financial measures for financial and operational decision making and as a means to evaluate period-to-period comparisons. We believe that these non-GAAP financial measures provide meaningful supplemental information regarding our performance and liquidity by excluding certain items that may not be indicative of our recurring core business operating results or, in certain cases, may be non-cash in nature. We believe that both management and investors benefit from referring to these non-GAAP financial measures in assessing our performance and when planning, forecasting, and analyzing future periods. These non-GAAP financial measures also facilitate management’s internal comparisons to our historical performance and liquidity. We believe these non-GAAP financial measures are useful to investors both because (1) they allow for greater transparency with respect to key metrics used by management in its financial and operational decision-making and (2) they are used by our institutional investors and the analyst community to help them analyze the health of our business.

These non-GAAP financial measures are not measures presented in accordance with GAAP, and our use of these terms may vary from that of other companies. These non-GAAP financial measures are not based on any comprehensive set of accounting rules or principles. These non-GAAP financial measures have limitations in that they do not reflect all of the amounts associated with the Company’s results of operations determined in accordance with GAAP.

Non-GAAP financial measures exclude the certain items listed below. Excluding these items from the non-GAAP measures facilitates comparisons to historical operating results and comparisons to peers, many of which exclude similar items. We believe that non-GAAP financial measures excluding these items provide meaningful supplemental information regarding operational performance. We further believe these measures are useful to investors in that they allow for greater transparency of certain line items in the Company’s financial statements.

Adjusted EBITDA is defined as Net income (loss) with adjustments to reflect the addition or elimination of certain items including:

•Interest expense, net. Interest expense is generated primarily from interest due on outstanding debt, partially offset by interest income generated from the interest earned on cash, cash equivalents, and investments;

•(Gain) loss on debt extinguishment, net. This is a non-cash expense that relates to a non-cash debt-for-equity exchange effectuated to settle amounts of senior secured term loans of the Company under its Credit Agreement with common stock of Consensus Cloud Solutions, Inc. (“Consensus”) owned by the Company. We believe this (gain) loss does not represent recurring core business operating results of the Company;

•(Gain) loss on sale of business. This gain or loss relates to the sales of businesses and does not represent recurring core business operating results of the Company.

•Unrealized (gain) loss on short-term investments held at the reporting date. This is a non-cash item as it relates to the change in the carrying value of our investment in Consensus depending on the share price of Consensus common stock and does not represent recurring core business operating results of the Company;

•(Gain) loss on investments, net. This item relates to the disposition of the portion of our investment in Consensus. The amount of gain or loss depends on the share price of Consensus common stock and does not represent recurring core business operating results of the Company;

•Other (income) expense, net. This income or expense relates to other non-operating items and does not represent recurring core business operating results of the Company;

•Income tax (benefit) expense. This benefit or expense depends on the pre-tax loss or income of the Company, statutory tax rates, tax regulations and different tax rates in various jurisdictions in which the Company operates and which the Company does not have the control over;

•(Income) loss from equity method investments, net. This is a non-cash expense as it relates to our investment in OCV Fund I, LP (the “Fund”). We believe that gain or loss resulting from our equity method investment does not represent recurring core business operating results of the Company;

•Depreciation and amortization. This is a non-cash expense at it relates to use and associated reduction in value of certain assets including equipment, fixtures, and certain capitalized internal-used software and website development costs, and identifiable definite-lived intangible assets of the acquired businesses. This also includes the reduction in value of certain acquired intangible assets that represent the cost incurred by the acquiree to build value prior to the acquisition and the amortization of this cost does not represent recurring core business operating results of the Company;

•Share-based compensation. This is a non-cash expense as it relates to awards granted under the various share-based incentive plans of the Company. We view the economic cost of share-based awards to be the dilution to our share base;

•Acquisition, integration, and other costs, including adjustments to contingent consideration, lease terminations, retention bonuses, other acquisition-specific items, and other costs, such as severance and legal settlements. These are non-recurring expenses that do not represent recurring core business operating results of the Company;

•Disposal related costs associated with disposal of certain businesses. These are non-recurring expenses that do not represent recurring core business operating results of the Company;

•Lease asset impairments and other charges. These expenses are incurred in connection with impaired right-of-use (“ROU”) assets of the Company. Associated expenses are comprised of insurance, utility, and other charges related to assets that are no longer in use, and partially offset by the sublease income earned. These expenses do not represent recurring core business operating results of the Company; and

•Goodwill impairment on business. This is a non-cash expense that is recorded when the carrying value of the reporting unit exceeds its fair value and does not represent recurring core business operating results of the Company.

Adjusted EBITDA margin is calculated by dividing Adjusted EBITDA by Total revenues.

Adjusted net income (loss) is defined as Net income (loss) with adjustments to reflect the addition or elimination of certain statement of operations items including, but not limited to:

•Interest costs, net. This reflects the difference between the imputed and coupon interest expense associated with the 4.625% Senior Notes and a charge that the Company determined to be penalty interest associated with the 1.75% Convertible Notes in each period presented, offset in part by a certain interest income earned by the Company. These net expenses do not represent recurring core business operating results of the Company;

•(Gain) loss on debt extinguishment, net. This is a non-cash expense that relates to a non-cash debt-for-equity exchange effectuated to settle amounts of senior secured term loans of the Company under its Credit Agreement with common stock of Consensus owned by the Company. We believe this gain or loss does not represent recurring core business operating results of the Company;

•(Gain) loss on sale of business. This gain or loss relates to the sales of businesses and does not represent recurring core business operating results of the Company;

•Unrealized (gain) loss on short-term investments held at the reporting date. This is a non-cash item as it relates to the change in the carrying value of our investment in Consensus depending on the share price of Consensus common stock and does not represent recurring core business operating results of the Company;

•(Gain) loss on investments, net. This item relates to the disposition of the portion of our investment in Consensus. The amount of gain or loss depends on the share price of Consensus common stock and does not represent recurring core business operating results of the Company;

•(Income) loss from equity method investments, net. This is a non-cash income or expense as it relates to our investment in the OCV Fund. We believe that gains or losses resulting from our equity method investment do not represent recurring core business operating results of the Company;

•Amortization of patents and intangible assets that we acquired. This is a non-cash expense as it primarily relates to identifiable definite-lived intangible assets of the acquired businesses. We believe that acquired intangible assets represent cost incurred by the acquiree to build value prior to the acquisition and the amortization of this cost does not represent recurring core business operating results of the Company;

•Goodwill impairment on business. This is a non-cash expense that is recorded when the carrying value of the reporting unit exceeds its fair value and does not represent recurring core business operating results of the Company;

•Share-based compensation. This is a non-cash expense as it relates to awards granted under the various incentive plans of the Company. We view the economic cost of share-based awards to be the dilution to our share base;

•Acquisition, integration and other costs, including adjustments to contingent consideration, lease terminations, retention bonuses, other acquisition-specific items, and other costs, such as severance and legal settlements. These are non-recurring expenses that do not represent recurring core business operating results of the Company;

•Disposal related costs associated with disposal of certain businesses. These are non-recurring expenses associated with the disposal of certain businesses that do not represent recurring core business operating results of the Company; and

•Lease asset impairments and other charges. These expenses are incurred in connection with impaired ROU assets of the Company. Associated expenses comprised of insurance, utility, and other charges related to assets that are no longer in use, and partially offset by the sublease income earned. These expenses do not represent recurring core business operating results of the Company.

Adjusted net income (loss) per diluted share is calculated by dividing Adjusted net income (loss) by the diluted weighted average shares of common stock outstanding that excludes the effect of convertible debt dilution.

Free cash flow is defined as Net cash provided by operating activities, less purchases of property and equipment, plus changes in contingent consideration.

ZIFF DAVIS, INC. AND SUBSIDIARIES

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES

(UNAUDITED, IN THOUSANDS)

The following table sets forth a reconciliation of Net (loss) income to Adjusted EBITDA: | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended September 30, | | Nine months ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

Net (loss) income | $ | (30,971) | | | $ | 18,185 | | | $ | (21,919) | | | $ | (3,714) | |

| Interest expense, net | 2,817 | | | 8,560 | | | 17,780 | | | 28,419 | |

| Gain on debt extinguishment, net | — | | | (10,112) | | | — | | | (11,505) | |

| | | | | | | |

| Unrealized loss (gain) on short-term investments held at the reporting date | 6,019 | | | (4,201) | | | 29,560 | | | 14,165 | |

| (Gain) loss on investments, net | — | | | (471) | | | (357) | | | 47,772 | |

Other loss (income), net | 3,571 | | | (4,218) | | | 5,982 | | | (12,962) | |

Income tax expense | 5,335 | | | 18,100 | | | 11,180 | | | 33,231 | |

(Income) loss from equity method investment, net | (90) | | | 3,191 | | | 8,165 | | | 10,077 | |

| Depreciation and amortization | 55,854 | | | 55,937 | | | 167,333 | | | 174,880 | |

| Share-based compensation | 6,774 | | | 6,386 | | | 24,393 | | | 20,806 | |

| Acquisition, integration, and other costs | 4,457 | | | 2,708 | | | 11,351 | | | 7,673 | |

| Disposal related costs | 1,633 | | | 24 | | | 1,842 | | | 1,328 | |

| Lease asset impairments and other charges | 1,485 | | | (1,344) | | | 2,583 | | | 1,400 | |

| Goodwill impairment on business | 56,850 | | | 27,369 | | | 56,850 | | | 27,369 | |

| Adjusted EBITDA | $ | 113,734 | | | $ | 120,114 | | | $ | 314,743 | | | $ | 338,939 | |

ZIFF DAVIS, INC. AND SUBSIDIARIES

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES

(UNAUDITED, IN THOUSANDS)

The following table sets forth Revenues and a reconciliation of (Loss) income from operations to Adjusted EBITDA by segment: | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended September 30, 2023 |

| Digital

Media | | Cybersecurity

and Martech | | Corporate | | Total |

| Revenues | $ | 267,934 | | | $ | 73,051 | | | $ | — | | | $ | 340,985 | |

| | | | | | | |

(Loss) income from operations | $ | (12,922) | | | $ | 12,527 | | | $ | (12,924) | | | $ | (13,319) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Depreciation and amortization | 44,907 | | | 10,941 | | | 6 | | | 55,854 | |

| Share-based compensation | 2,579 | | | 399 | | | 3,796 | | | 6,774 | |

| Acquisition, integration, and other costs | 4,138 | | | 263 | | | 56 | | | 4,457 | |

| Disposal related costs | 452 | | | 203 | | | 978 | | | 1,633 | |

| Lease asset impairments and other charges | 1,379 | | | 106 | | | — | | | 1,485 | |

| Goodwill impairment on a business | 56,850 | | | — | | | — | | | 56,850 | |

| Adjusted EBITDA | $ | 97,383 | | | $ | 24,439 | | | $ | (8,088) | | | $ | 113,734 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended September 30, 2022 |

| Digital

Media | | Cybersecurity and Martech | | Corporate | | Total |

| Revenues | $ | 263,683 | | | $ | 78,190 | | | $ | — | | | $ | 341,873 | |

| | | | | | | |

| Income (loss) from operations | $ | 27,106 | | | $ | 14,038 | | | $ | (12,110) | | | $ | 29,034 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Depreciation and amortization | 44,631 | | | 11,445 | | | (139) | | | 55,937 | |

| Share-based compensation | 2,471 | | | 1,086 | | | 2,829 | | | 6,386 | |

| Acquisition, integration, and other costs | 1,989 | | | 344 | | | 375 | | | 2,708 | |

| Disposal related costs | — | | | — | | | 24 | | | 24 | |

| Lease asset impairments and other charges | (1,233) | | | (111) | | | — | | | (1,344) | |

| Goodwill impairment on a business | 27,369 | | | — | | | — | | | 27,369 | |

| Adjusted EBITDA | $ | 102,333 | | | $ | 26,802 | | | $ | (9,021) | | | $ | 120,114 | |

Figures above are net of intercompany costs and revenues.

ZIFF DAVIS, INC. AND SUBSIDIARIES

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES

(UNAUDITED, IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

The following table sets forth a reconciliation of Net (loss) income to Adjusted net income with adjustments presented on after-tax basis:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended September 30, |

| 2023 | | Per diluted share* | | 2022 | | Per diluted share* |

Net (loss) income | $ | (30,971) | | | $ | (0.67) | | | $ | 18,185 | | | $ | 0.39 | |

| | | | | | | |

| Interest costs | 336 | | | 0.01 | | | 81 | | | — | |

| Gain on debt extinguishment, net | — | | | — | | | (7,701) | | | (0.16) | |

Loss on sale of business | 3,433 | | | 0.07 | | | — | | | — | |

Unrealized loss on short-term investments held at the reporting date | 4,465 | | | 0.10 | | | 8,191 | | | 0.17 | |

Gain on investments, net | — | | | — | | | (812) | | | (0.02) | |

(Income) loss from equity method investment, net | (90) | | | — | | | 3,191 | | | 0.07 | |

| Amortization | 25,070 | | | 0.55 | | | 26,012 | | | 0.55 | |

| Share-based compensation | 6,813 | | | 0.15 | | | 5,489 | | | 0.12 | |

| Acquisition, integration, and other costs | 1,334 | | | 0.03 | | | 2,051 | | | 0.04 | |

| Disposal related costs | 1,144 | | | 0.02 | | | (69) | | | — | |

| Lease asset impairments and other charges | 689 | | | 0.01 | | | (985) | | | (0.02) | |

| Goodwill impairment on business | 56,850 | | | 1.23 | | | 20,636 | | | 0.44 | |

| | | | | | | |

| Adjusted net income | $ | 69,073 | | | $ | 1.50 | | | $ | 74,269 | | | $ | 1.58 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Nine months ended September 30, |

| 2023 | | Per diluted share* | | 2022 | | Per diluted share* |

Net loss | $ | (21,919) | | | $ | (0.47) | | | $ | (3,714) | | | $ | (0.08) | |

| Interest costs | 5,901 | | | 0.13 | | | 254 | | | 0.01 | |

| Gain on debt extinguishment, net | — | | | — | | | (9,094) | | | (0.19) | |

Loss on sale of business | 3,521 | | | 0.08 | | | — | | | — | |

Unrealized loss on short-term investments held at the reporting date | 22,146 | | | 0.47 | | | 25,513 | | | 0.54 | |

| (Gain) loss on investments, net | (268) | | | (0.01) | | | 47,299 | | | 1.01 | |

Loss from equity method investment, net | 8,540 | | | 0.18 | | | 10,077 | | | 0.21 | |

| Amortization | 75,488 | | | 1.62 | | | 90,474 | | | 1.93 | |

| Share-based compensation | 20,811 | | | 0.44 | | | 17,165 | | | 0.37 | |

| Acquisition, integration, and other costs | 6,487 | | | 0.14 | | | 5,877 | | | 0.13 | |

| Disposal related costs | 1,300 | | | 0.03 | | | 1,054 | | | 0.02 | |

| Lease asset impairment and other charges | 1,519 | | | 0.03 | | | 1,081 | | | 0.02 | |

| Goodwill impairment on business | 56,850 | | | 1.22 | | | 20,636 | | | 0.44 | |

| | | | | | | |

| Adjusted net income | $ | 180,376 | | | $ | 3.86 | | | $ | 206,622 | | | $ | 4.41 | |

* The reconciliation of Net (loss) income per diluted share to Adjusted net income per diluted share may not foot since each is calculated independently.

ZIFF DAVIS, INC. AND SUBSIDIARIES

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES

(UNAUDITED, IN THOUSANDS)

The following are the adjustments to certain statement of operations items used to derive Adjusted net income, which we believe provide useful information about our operating results and enhance the overall understanding of past financial performance and future prospects of the Company.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended September 30, 2023 |

| GAAP amount | Adjustments | Adjusted non-GAAP amount |

| Interest costs, net | (Gain) loss on debt extinguishment | (Gain) loss on sale of business | Unrealized (gain) loss on short-term investments held at the reporting date | (Gain) loss on investments, net | (Income) loss from equity method investments, net | Amortization | Share-based compensation | Acquisition, integration, and other costs | Disposal related costs | Lease asset impairments and other charges | Goodwill impairment of business |

| Cost of revenues | $ | (55,526) | | $ | — | | $ | — | | $ | — | | $ | — | | $ | — | | $ | — | | $ | 158 | | $ | 76 | | $ | 5 | | $ | — | | $ | — | | $ | — | | $ | (55,287) | |

| Sales and marketing | $ | (125,062) | | — | | — | | — | | — | | — | | — | | — | | 323 | | 1,056 | | 4 | | — | | — | | $ | (123,679) | |

| Research, development, and engineering | $ | (17,597) | | — | | — | | — | | — | | — | | — | | — | | 840 | | 227 | | 3 | | — | | — | | $ | (16,527) | |

| General and administrative | $ | (99,269) | | — | | — | | — | | — | | — | | — | | 32,986 | | 5,535 | | 3,169 | | 1,626 | | 1,485 | | — | | $ | (54,468) | |

| Goodwill impairment on business | $ | (56,850) | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — | | 56,850 | | $ | — | |

| Interest expense, net | $ | (2,817) | | 388 | | — | | (538) | | — | | — | | — | | — | | — | | — | | — | | — | | — | | $ | (2,967) | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Unrealized loss on short-term investments held at period end | $ | (6,019) | | — | | — | | — | | 6,019 | | — | | — | | — | | — | | — | | — | | — | | — | | $ | — | |

Other (loss) income, net | $ | (3,571) | | — | | — | | 5,115 | | — | | — | | — | | — | | — | | — | | — | | — | | — | | $ | 1,544 | |

| Income tax expense | $ | (5,335) | | (52) | | — | | (1,144) | | (1,554) | | — | | — | | (8,074) | | 39 | | (3,123) | | (489) | | (796) | | — | | $ | (20,528) | |

Income from equity method investment, net | $ | 90 | | — | | — | | — | | — | | — | | (90) | | — | | — | | — | | — | | — | | — | | $ | — | |

| Total non-GAAP adjustments | | $ | 336 | | $ | — | | $ | 3,433 | | $ | 4,465 | | $ | — | | $ | (90) | | $ | 25,070 | | $ | 6,813 | | $ | 1,334 | | $ | 1,144 | | $ | 689 | | $ | 56,850 | | |

ZIFF DAVIS, INC. AND SUBSIDIARIES

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES

(UNAUDITED, IN THOUSANDS)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended September 30, 2022 |

| GAAP amount | Adjustments | Adjusted non-GAAP amount |

| Interest costs, net | (Gain) loss on debt extinguishment | (Gain) loss on sale of business | Unrealized (gain) loss on short-term investments held at the reporting date | (Gain) loss on investments, net | (Income) loss from equity method investments, net | Amortization | Share-based compensation | Acquisition, integration, and other costs | Disposal related costs | Lease asset impairments and other charges | Goodwill impairment of business |

| Cost of revenues | $ | (52,603) | | $ | — | | $ | — | | $ | — | | $ | — | | $ | — | | $ | — | | $ | 242 | | $ | 63 | | $ | 65 | | $ | — | | $ | — | | $ | — | | $ | (52,233) | |

| Sales and marketing | $ | (119,474) | | — | | — | | — | | — | | — | | — | | — | | 772 | | 1,083 | | — | | (962) | | — | | $ | (118,581) | |

| Research, development, and engineering | $ | (17,735) | | — | | — | | — | | — | | — | | — | | — | | 568 | | 258 | | — | | — | | — | | $ | (16,909) | |

| General and administrative | $ | (95,658) | | — | | — | | — | | — | | — | | — | | 36,415 | | 4,983 | | 1,302 | | 24 | | (382) | | — | | $ | (53,316) | |

| Goodwill impairment on business | $ | (27,369) | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — | | 27,369 | | $ | — | |

| Interest expense, net | $ | (8,560) | | 106 | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — | | $ | (8,454) | |

| Gain on debt extinguishment, net | $ | 10,112 | | — | | (10,211) | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — | | $ | (99) | |

| | | | | | | | | | | | | | |

| Gain on investment, net | $ | 471 | | — | | — | | — | | — | | (471) | | — | | — | | — | | — | | — | | — | | — | | $ | — | |

| Unrealized gain on short-term investments held at period end | $ | 4,201 | | — | | — | | — | | (4,201) | | — | | — | | — | | — | | — | | — | | — | | — | | $ | — | |

| Other income, net | $ | 4,218 | | — | | — | | — | | — | | (450) | | — | | — | | — | | — | | (111) | | — | | — | | $ | 3,657 | |

| Income tax expense | $ | (18,100) | | (25) | | 2,510 | | — | | 12,392 | | 109 | | — | | (10,645) | | (897) | | (657) | | 18 | | 359 | | (6,733) | | $ | (21,669) | |

| Loss from equity method investment, net | $ | (3,191) | | — | | — | | — | | — | | — | | 3,191 | | — | | — | | — | | — | | — | | — | | $ | — | |

| Total non-GAAP adjustments | | $ | 81 | | $ | (7,701) | | $ | — | | $ | 8,191 | | $ | (812) | | $ | 3,191 | | $ | 26,012 | | $ | 5,489 | | $ | 2,051 | | $ | (69) | | $ | (985) | | $ | 20,636 | | |

ZIFF DAVIS, INC. AND SUBSIDIARIES

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES

(UNAUDITED, IN THOUSANDS)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nine months ended September 30, 2023 |

| GAAP amount | Adjustments | Adjusted non-GAAP amount |

| Interest costs, net | | (Gain) loss on sale of business | Unrealized (gain) loss on short-term investments held at the reporting date | (Gain) loss on investments, net | (Income) loss from equity method investments, net | Amortization | Share-based compensation | Acquisition, integration, and other costs | Disposal related costs | Lease asset impairments and other charges | Goodwill impairment of business |

| Cost of revenues | $ | (148,677) | | $ | — | | | $ | — | | $ | — | | $ | — | | $ | — | | $ | 543 | | $ | 246 | | $ | 191 | | $ | — | | $ | — | | $ | — | | $ | (147,697) | |

| Sales and marketing | $ | (360,916) | | — | | | — | | — | | — | | — | | — | | 2,285 | | 3,128 | | 4 | | — | | — | | $ | (355,499) | |

| Research, development, and engineering | $ | (53,328) | | — | | | — | | — | | — | | — | | — | | 2,581 | | 535 | | 3 | | — | | — | | $ | (50,209) | |

| General and administrative | $ | (302,481) | | — | | | — | | — | | — | | (1,500) | | 100,037 | | 19,281 | | 7,497 | | 1,835 | | 2,583 | | — | | $ | (172,748) | |

| Goodwill impairment on business | $ | (56,850) | | — | | | — | | — | | — | | — | | — | | — | | — | | — | | — | | 56,850 | | $ | — | |

| Interest expense, net | $ | (17,780) | | 7,808 | | | (538) | | — | | — | | — | | — | | — | | — | | — | | — | | — | | $ | (10,510) | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Gain on investment, net | $ | 357 | | — | | | — | | — | | (357) | | — | | — | | — | | — | | — | | — | | — | | $ | — | |

| Unrealized loss on short-term investments held at period end | $ | (29,560) | | — | | | — | | 29,560 | | — | | — | | — | | — | | — | | — | | — | | — | | $ | — | |

| Other loss, net | $ | (5,982) | | — | | | 5,233 | | — | | — | | — | | — | | — | | — | | — | | — | | — | | $ | (749) | |

| Income tax expense | $ | (11,180) | | (1,907) | | | (1,174) | | (7,414) | | 89 | | 375 | | (25,092) | | (3,582) | | (4,864) | | (542) | | (1,064) | | — | | $ | (56,355) | |

| Loss from equity method investment, net | $ | (9,665) | | — | | | — | | — | | — | | 9,665 | | — | | — | | — | | — | | — | | — | | $ | — | |

| Total non-GAAP adjustments | | $ | 5,901 | | | $ | 3,521 | | $ | 22,146 | | $ | (268) | | $ | 8,540 | | $ | 75,488 | | $ | 20,811 | | $ | 6,487 | | $ | 1,300 | | $ | 1,519 | | $ | 56,850 | | |

ZIFF DAVIS, INC. AND SUBSIDIARIES

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES

(UNAUDITED, IN THOUSANDS)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nine months ended September 30, 2022 |

| GAAP amount | Adjustments | Adjusted non-GAAP amount |

| Interest costs, net | (Gain) loss on debt extinguishment | | Unrealized (gain) loss on short-term investments held at the reporting date | (Gain) loss on investments, net | (Income) loss from equity method investments, net | Amortization | Share-based compensation | Acquisition, integration, and other costs | Disposal related costs | Lease asset impairments and other charges | Goodwill impairment of business |

| Cost of revenues | $ | (144,707) | | $ | — | | $ | — | | | $ | — | | $ | — | | $ | — | | $ | 779 | | $ | 289 | | $ | 119 | | $ | — | | $ | — | | $ | — | | $ | (143,520) | |

| Sales and marketing | $ | (361,013) | | — | | — | | | — | | — | | — | | — | | 2,447 | | 2,468 | | — | | — | | — | | $ | (356,098) | |

| Research, development, and engineering | $ | (55,883) | | — | | — | | | — | | — | | — | | — | | 2,048 | | 671 | | — | | — | | — | | $ | (53,164) | |

| General and administrative | $ | (299,842) | | — | | — | | | — | | — | | — | | 119,281 | | 16,022 | | 4,415 | | 1,328 | | 1,400 | | — | | $ | (157,396) | |

| Goodwill impairment on business | $ | (27,369) | | — | | — | | | — | | — | | — | | — | | — | | — | | — | | — | | 27,369 | | $ | — | |

| Interest expense, net | $ | (28,419) | | 337 | | — | | | — | | — | | — | | — | | — | | — | | — | | — | | — | | $ | (28,082) | |

| Gain on debt extinguishment, net | $ | 11,505 | | — | | (12,060) | | | — | | — | | — | | — | | — | | — | | — | | — | | — | | $ | (555) | |

| | | | | | | | | | | | | | |

| Loss on investment, net | $ | (47,772) | | — | | — | | | — | | 47,772 | | — | | — | | — | | — | | — | | — | | — | | $ | — | |

| Unrealized loss on short-term investments held at period end | $ | (14,165) | | — | | — | | | 14,165 | | — | | — | | — | | — | | — | | — | | — | | — | | $ | — | |

| Other income, net | $ | 12,962 | | — | | — | | | — | | (624) | | — | | — | | — | | — | | (111) | | — | | — | | $ | 12,227 | |

| Income tax expense | $ | (33,231) | | (83) | | 2,966 | | | 11,348 | | 151 | | — | | (29,586) | | (3,641) | | (1,796) | | (163) | | (319) | | (6,733) | | $ | (61,087) | |

| Loss from equity method investment, net | $ | (10,077) | | — | | — | | | — | | — | | 10,077 | | — | | — | | — | | — | | — | | — | | $ | — | |

| Total non-GAAP adjustments | | $ | 254 | | $ | (9,094) | | | $ | 25,513 | | $ | 47,299 | | $ | 10,077 | | $ | 90,474 | | $ | 17,165 | | $ | 5,877 | | $ | 1,054 | | $ | 1,081 | | $ | 20,636 | | |

ZIFF DAVIS, INC. AND SUBSIDIARIES

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES

(UNAUDITED, IN THOUSANDS)

The following tables set forth a reconciliation of Net cash provided by operating activities to Free cash flow:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2023 | Q1 | | Q2 | | Q3 | | Q4 | | YTD |

| Net cash provided by operating activities | $ | 115,307 | | | $ | 39,728 | | | $ | 72,808 | | | $ | — | | | $ | 227,843 | |

| Less: Purchases of property and equipment | (30,017) | | | (25,233) | | | (27,226) | | | — | | | (82,476) | |

| | | | | | | | | |

| Free cash flow | $ | 85,290 | | | $ | 14,495 | | | $ | 45,582 | | | $ | — | | | $ | 145,367 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2022 | Q1 | | Q2 | | Q3 | | Q4 | | YTD |

| Net cash provided by operating activities | $ | 116,511 | | | $ | 75,973 | | | $ | 100,735 | | | $ | 43,225 | | | $ | 336,444 | |

| Less: Purchases of property and equipment | (30,502) | | | (23,374) | | | (26,891) | | | (25,387) | | | (106,154) | |

| | | | | | | | | |

| Free cash flow | $ | 86,009 | | | $ | 52,599 | | | $ | 73,844 | | | $ | 17,838 | | | $ | 230,290 | |

www.ziffdavis.com©2023 Ziff Davis. All rights reserved. THIRD QUARTER 2023 RESULTS November 8, 2023 Exhibit 99.2

2 Certain statements in this presentation are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, particularly those regarding our 2023 Financial Guidance. Such forward-looking statements are subject to numerous assumptions, risks and uncertainties that could cause actual results to differ materially from those described in those statements. These forward-looking statements are based on management’s expectations or beliefs as of November 8, 2023. Readers should carefully review the Risk Factors slide of this presentation, as well as the risk factors set forth in our Annual Report on Form 10-K filed by us on March 1, 2023 with the Securities and Exchange Commission (“SEC”) and the other reports we file from time to time with the SEC. We undertake no obligation to revise or publicly release any updates to such statements based on future information or actual results. Such forward-looking statements address the following subjects, among others: • Future operating results • Ability to acquire businesses on acceptable terms and integrate and recognize synergies from acquired businesses • Deployment of cash and investment balances to grow the company • Subscriber growth, retention, usage levels and average revenue per account • Digital media and cloud services growth • International growth • New products, services, features and technologies • Corporate spending including stock repurchases • Intellectual property and related licensing revenues • Liquidity and ability to repay or refinance indebtedness • Systems capacity, coverage, reliability and security • Regulatory developments and taxes All information in this presentation speaks as of November 8, 2023 and any redistribution or rebroadcast of this presentation after that date is not intended and will not be construed as updating or confirming such information. Capitalized terms not otherwise defined in this presentation have the meanings set forth in Ziff Davis' November 8, 2023 earnings press release. Third-Party Information All third-party trademarks, including names, logos and brands, referenced by the Company in this presentation are property of their respective owners. All references to third-party trademarks are for identification purposes only and shall be considered nominative fair use under trademark law. Industry, Market and Other Data Certain information contained in this presentation concerning our industry and the markets in which we operate, including our general expectations and market position, market opportunity and market size, is based on reports from various sources. Because this information involves a number of assumptions and limitations, you are cautioned not to give undue weight to such information. We have not independently verified market data and industry forecasts provided by any of these or any other third-party sources referred to in this presentation. In addition, projections, assumptions and estimates of our future performance and the future performance of the industry in which we operate are necessarily subject to a high degree of uncertainty and risk due to a variety of factors. These and other factors could cause results to differ materially from those expressed in the estimates made by third parties and by us. Non-GAAP Financial information Included in this presentation are certain financial measures that are not calculated in accordance with U.S. generally accepted accounting principles ("GAAP") and are designed to supplement, and not substitute, Ziff Davis’ financial information presented in accordance with GAAP. The non-GAAP measures as defined by Ziff Davis may not be comparable to similar non-GAAP measures presented by other companies. The presentation of such measures, which may include adjustments to exclude unusual or non-recurring items, should not be construed as an inference that Ziff Davis’ future results or leverage will be unaffected by other unusual or non-recurring items. Please see the appendix to this presentation for how we define these non-GAAP measures, a discussion of why we believe they are useful to investors and certain limitations thereof, and reconciliations thereof to the most directly comparable GAAP measures. Divested Businesses Unless otherwise specified, all financial data and operating metrics presented herein for Ziff Davis are presented giving effect to the February 2021 divestiture of the Voice assets in the United Kingdom, as well as the September 2021 sale of the Company’s B2B Backup businesses, together, (the “Divested Businesses”), and the separation of Consensus Cloud Solutions, Inc. (“Consensus”) as described in the Form 10 filed by Consensus with the Securities and Exchange Commission, as if they had occurred prior to the periods presented. Safe Harbor for Forward-looking Statements

3 Some factors that could cause actual results to differ materially from those expressed or implied by the forward-looking statements contained in this presentation include, but are not limited to, our ability and intention to: • Achieve business and financial objectives in light of burdensome domestic and international telecommunications, internet or other regulations, including regulations related to data privacy, access, security, retention, and sharing; • Successfully manage our growth, including but not limited to our operational and personnel-related resources, and integration of newly acquired businesses; • Successfully adapt to technological changes and diversify services and related revenues at acceptable levels of financial return; • Successfully develop and protect our intellectual property, both domestically and internationally, including our brands, patents, trademarks and domain names, and avoid infringing upon the proprietary rights of others; • Manage certain risks associated with environmental, social and governmental matters, including related reporting obligations, that could adversely affect our reputation and performance; • Recruit and retain key personnel; • Avoid disruptions to our operations, financial position, and reputation as a result of the collapse of certain banks and potentially other financial institutions; and • Other factors set forth in our Annual Report on Form 10-K filed by us on March 1, 2023 with the SEC and the other reports we file from time to time with the SEC. • Sustain growth or profitability, particularly in light of an uncertain U.S. or worldwide economy, including the possibility of an economic downturn or recession, continuing inflation, continuing supply chain disruptions and other factors and their related impact on customer acquisition and retention rates, customer usage levels, and credit and debit card payment declines; • Maintain and increase our customer base and average revenue per user; • Generate sufficient cash flow to make interest and debt payments, reinvest in our business, and pursue desired activities and businesses plans while satisfying restrictive covenants relating to debt obligations; • Acquire businesses on acceptable terms and successfully integrate and realize anticipated synergies from such acquisitions; • Continue to expand our businesses and operations internationally in the wake of numerous risks, including adverse currency fluctuations, difficulty in staffing and managing international operations, higher operating costs as a percentage of revenues, or the implementation of adverse regulations; • Maintain our financial position, operating results and cash flows in the event that we incur new or unanticipated costs or tax liabilities, including those relating to federal and state income tax and indirect taxes, such as sales, value-added and telecommunication taxes; • Accurately estimate the assumptions underlying our effective worldwide tax rate; • Maintain favorable relationships with critical third-party vendors whose financial condition will not negatively impact the services they provide; • Create compelling digital media content facilitating increased traffic and advertising levels and additional advertisers or an increase in advertising spend, and effectively target digital media advertisements to desired audiences; • Manage certain risks inherent to our business, such as costs associated with fraudulent activity, system failure or security breach; effectively maintaining and managing our billing systems; time and resources required to manage our legal proceedings; liability for legal and other claims; or adhering to our internal controls and procedures; • Compete with other similar providers with regard to price, service, functionality; Risk Factors

4 $341.9 $341.0 Q3 2022 Q3 2023 Q3 2023 Consolidated Financial Snapshot (1) (0.3)% $120.1 $113.7 Q3 2022 Q3 2023 $1.58 $1.50 Q3 2022 Q3 2023 (5.3)% (5.1)% 1. See slides 12-16 for a GAAP reconciliation of Adjusted EBITDA and Adjusted Diluted EPS. Adjusted EBITDA (1) (in millions) Adjusted Diluted EPS (1) Revenue (in millions)

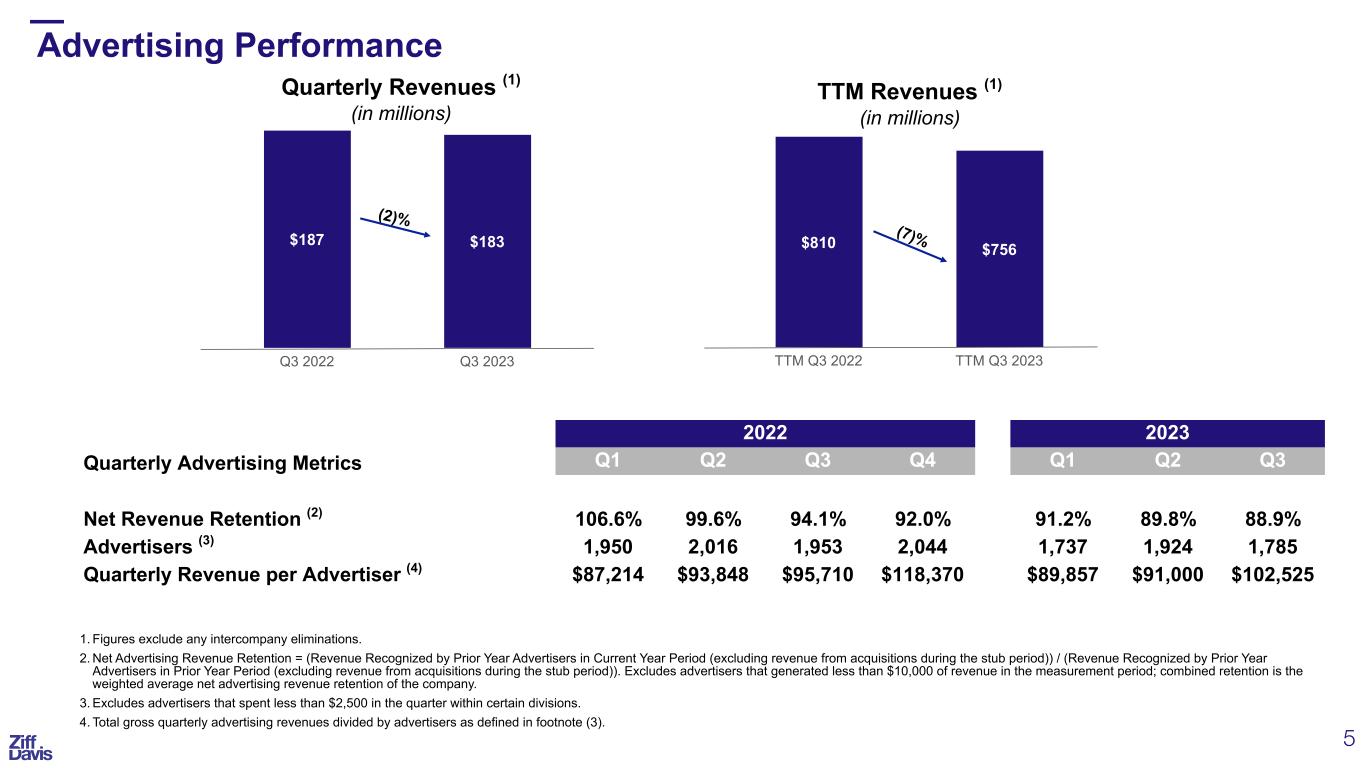

5 Advertising Performance $187 $183 Q3 2022 Q3 2023 (2)% $810 $756 TTM Q3 2022 TTM Q3 2023 (7)% 2022 2023 Quarterly Advertising Metrics Q1 Q2 Q3 Q4 Q1 Q2 Q3 Net Revenue Retention (2) 106.6% 99.6% 94.1% 92.0% 91.2% 89.8% 88.9% Advertisers (3) 1,950 2,016 1,953 2,044 1,737 1,924 1,785 Quarterly Revenue per Advertiser (4) $87,214 $93,848 $95,710 $118,370 $89,857 $91,000 $102,525 1. Figures exclude any intercompany eliminations. 2. Net Advertising Revenue Retention = (Revenue Recognized by Prior Year Advertisers in Current Year Period (excluding revenue from acquisitions during the stub period)) / (Revenue Recognized by Prior Year Advertisers in Prior Year Period (excluding revenue from acquisitions during the stub period)). Excludes advertisers that generated less than $10,000 of revenue in the measurement period; combined retention is the weighted average net advertising revenue retention of the company. 3. Excludes advertisers that spent less than $2,500 in the quarter within certain divisions. 4. Total gross quarterly advertising revenues divided by advertisers as defined in footnote (3). Quarterly Revenues (1) (in millions) TTM Revenues (1) (in millions)

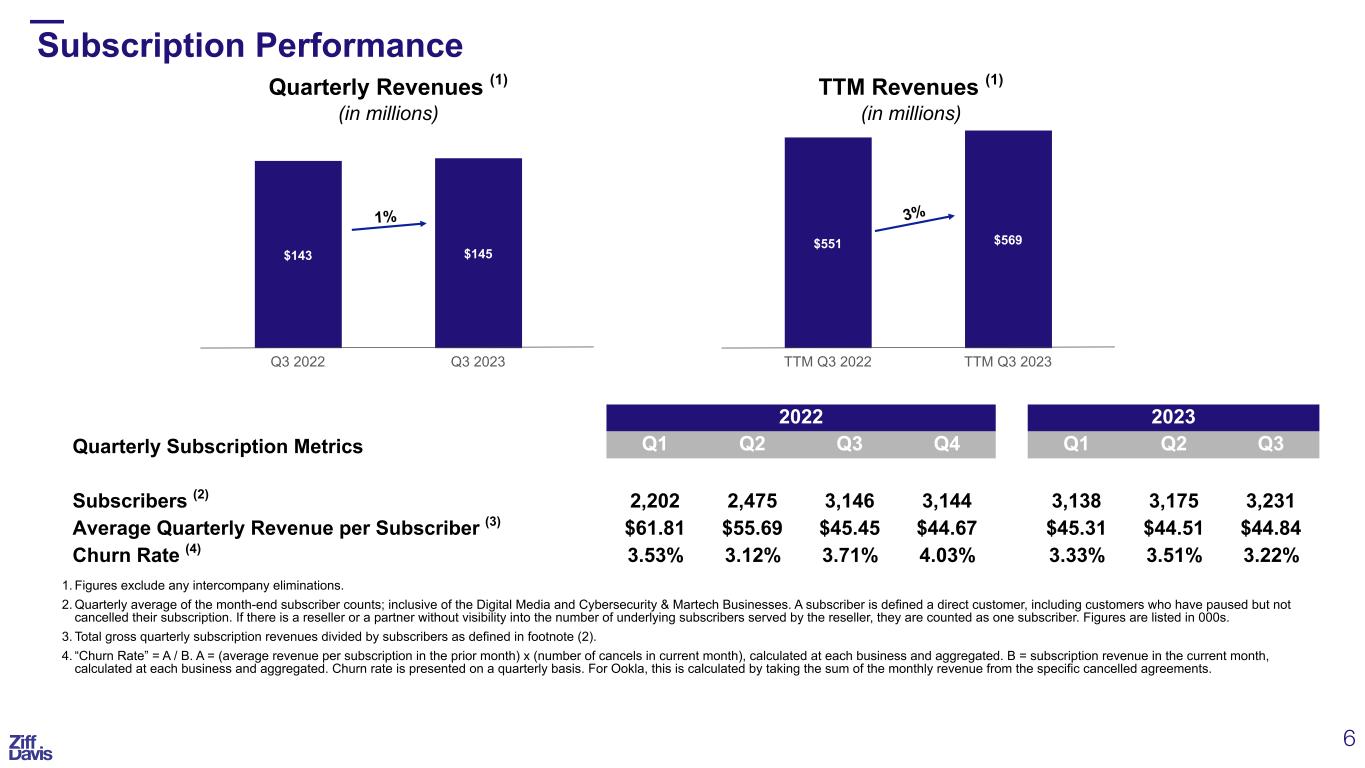

6 Subscription Performance $143 $145 Q3 2022 Q3 2023 1% $551 $569 TTM Q3 2022 TTM Q3 2023 3% 2022 2023 Quarterly Subscription Metrics Q1 Q2 Q3 Q4 Q1 Q2 Q3 Subscribers (2) 2,202 2,475 3,146 3,144 3,138 3,175 3,231 Average Quarterly Revenue per Subscriber (3) $61.81 $55.69 $45.45 $44.67 $45.31 $44.51 $44.84 Churn Rate (4) 3.53% 3.12% 3.71% 4.03% 3.33% 3.51% 3.22% 1. Figures exclude any intercompany eliminations. 2. Quarterly average of the month-end subscriber counts; inclusive of the Digital Media and Cybersecurity & Martech Businesses. A subscriber is defined a direct customer, including customers who have paused but not cancelled their subscription. If there is a reseller or a partner without visibility into the number of underlying subscribers served by the reseller, they are counted as one subscriber. Figures are listed in 000s. 3. Total gross quarterly subscription revenues divided by subscribers as defined in footnote (2). 4. “Churn Rate” = A / B. A = (average revenue per subscription in the prior month) x (number of cancels in current month), calculated at each business and aggregated. B = subscription revenue in the current month, calculated at each business and aggregated. Churn rate is presented on a quarterly basis. For Ookla, this is calculated by taking the sum of the monthly revenue from the specific cancelled agreements. Quarterly Revenues (1) (in millions) TTM Revenues (1) (in millions)

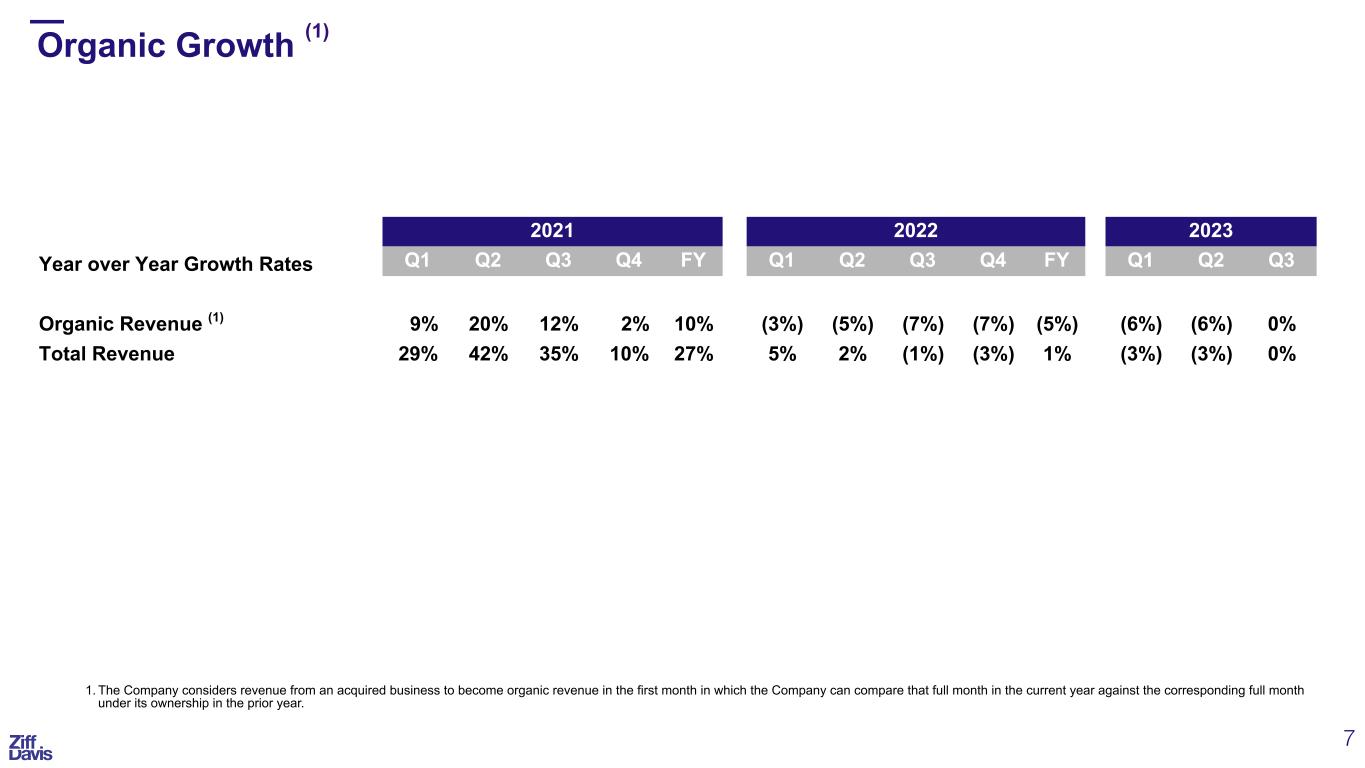

7 Organic Growth 2021 2022 2023 Year over Year Growth Rates Q1 Q2 Q3 Q4 FY Q1 Q2 Q3 Q4 FY Q1 Q2 Q3 Organic Revenue (1) 9% 20% 12% 2% 10% (3%) (5%) (7%) (7%) (5%) (6%) (6%) 0% Total Revenue 29% 42% 35% 10% 27% 5% 2% (1%) (3%) 1% (3%) (3%) 0% 1. The Company considers revenue from an acquired business to become organic revenue in the first month in which the Company can compare that full month in the current year against the corresponding full month under its ownership in the prior year. (1)

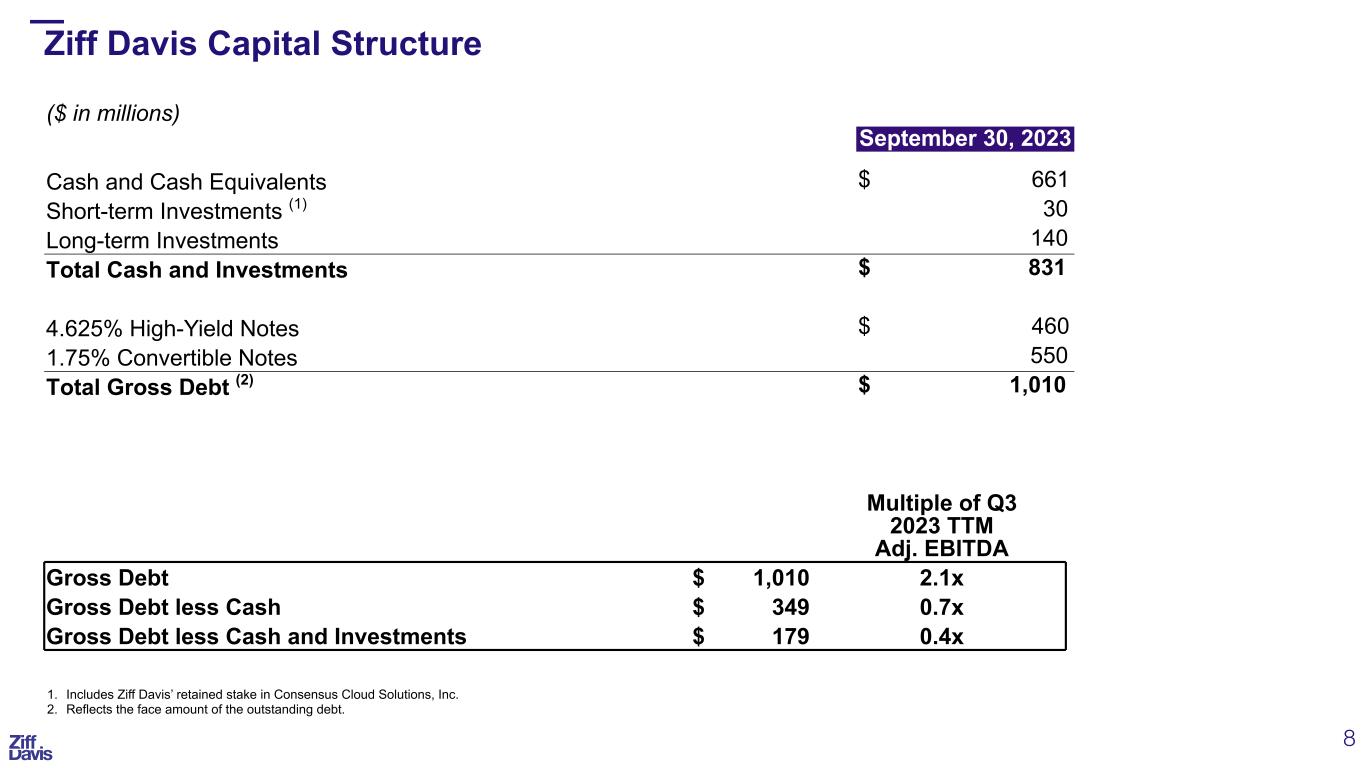

8 Ziff Davis Capital Structure ($ in millions) September 30, 2023 Cash and Cash Equivalents $ 661 Short-term Investments (1) 30 Long-term Investments 140 Total Cash and Investments $ 831 4.625% High-Yield Notes $ 460 1.75% Convertible Notes 550 Total Gross Debt (2) $ 1,010 Multiple of Q3 2023 TTM Adj. EBITDA Gross Debt $ 1,010 2.1x Gross Debt less Cash $ 349 0.7x Gross Debt less Cash and Investments $ 179 0.4x 1. Includes Ziff Davis’ retained stake in Consensus Cloud Solutions, Inc. 2. Reflects the face amount of the outstanding debt.

2023 FINANCIAL GUIDANCE

10 2023 Guidance (Forward-Looking Statements) Ziff Davis reaffirms its annual guidance of Revenues, Adjusted EBITDA, and Adjusted Diluted EPS (1) Ziff Davis FY 2023 Guidance Range $ in millions, except for per share amounts Low Midpoint High Midpoint YoY % Increase vs 2022A Revenue $1,350 $1,379 $1,408 (0.9%) Adjusted EBITDA (1) $479 $497 $514 (2.0%) Adjusted Diluted EPS (1) $6.02 $6.28 $6.54 (5.6%) 1. Refer to slides 12-16 for examples of adjustments to Adjusted EBITDA and Adjusted Diluted EPS. A reconciliation of forward-looking Adjusted EBITDA and Adjusted Diluted EPS to the corresponding GAAP guidance financial measures is not available without unreasonable effort due, primarily, to variability and difficulty in making accurate forecasts and projections of non-operating matters that may arise in the future.

SUPPLEMENTAL INFORMATION

12 GAAP Reconciliation - Adjusted EBITDA $ in 000's Ziff Davis Three months ended September 30, 2022 2023 Net income (loss) $ 18,185 $ (30,971) Interest expense, net 8,560 2,817 Gain on debt extinguishment, net (10,112) — Unrealized (gain) loss on short-term investments held at the reporting date (4,201) 6,019 Gain on investments, net (471) — Other (income) loss, net (4,218) 3,571 Income tax expense 18,100 5,335 Loss (income) from equity method investment, net 3,191 (90) Depreciation and amortization 55,937 55,854 Share-based compensation 6,386 6,774 Acquisition, integration, and other costs 2,708 4,457 Disposal related costs 24 1,633 Lease asset impairments and other charges (1,344) 1,485 Goodwill impairment on business 27,369 56,850 Adjusted EBITDA $ 120,114 $ 113,734 Note: Adjusted EBITDA is defined as Net income (loss) with adjustments to reflect the addition or elimination of certain items including: Interest expense, net; (Gain) loss on debt extinguishment, net; (Gain) loss on sale of business; Unrealized (gain) loss on short-term investments held at the reporting date; (Gain) loss on investments, net; Other (income) expense, net; Income tax (benefit) expense; (Income) loss from equity method investments, net; Depreciation and amortization; Share-based compensation; Acquisition, integration, and other costs, including adjustments to contingent consideration, lease terminations, retention bonuses, other acquisition-specific items, and other costs, such as severance and legal settlements; Disposal related costs associated with disposal of certain businesses; Lease asset impairments and other charges; and Goodwill impairment on business.

13 Q3 2023 and 2022 Reconciliation of GAAP to Non-GAAP Financial Measures Q3 2023 GAAP amount Interest Costs, net (Gain) loss on debt extinguishment (Gain) loss on sale of business Unrealized (gain) loss on short-term investments held at the reporting date (Gain) loss on investments, net (Income) loss from equity method investments, net Amortization Share-based compensation Acquisition, integration, and other costs Disposal related costs Lease asset impairments and other charges Goodwill impairment of business Adjusted non-GAAP amount $ in 000's Cost of revenues $(55,526) $– $– $– $– $– $– $158 $76 $5 $– $– $– $(55,287) Sales and marketing $(125,062) – – – – – – – 323 1,056 4 – – $(123,679) Research, development, and engineering $(17,597) – – – – – – – 840 227 3 – – $(16,527) General and administrative $(99,269) – – – – – – 32,986 5,535 3,169 1,626 1,485 – $(54,468) Goodwill impairment on business $(56,850) – – – – – – – – – – – 56,850 $– Interest expense, net $(2,817) 388 – (538) – – – – – – – – – $(2,967) Unrealized loss on short-term investments held at period end $(6,019) – – – 6,019 – – – – – – – – $– Other (loss) income, net $(3,571) – – 5,115 – – – – – – – – – $1,544 Income tax expense $(5,335) (52) – (1,144) (1,554) – – (8,074) 39 (3,123) (489) (796) – $(20,528) Income from equity method investment, net $90 – – – – – (90) – – – – – – $– Total non-GAAP Adjustments $336 $— $3,433 $4,465 $— $(90) $25,070 $6,813 $1,334 $1,144 $689 $56,850 Q3 2022 GAAP amount Interest Costs, net (Gain) loss on debt extinguishment (Gain) loss on sale of business Unrealized (gain) loss on short-term investments held at the reporting date (Gain) loss on investments, net (Income) loss from equity method investments, net Amortization Share-based compensation Acquisition, integration, and other costs Disposal related costs Lease asset impairments and other charges Goodwill impairment of business Adjusted non-GAAP amount $ in 000's Cost of revenues $(52,603) $– $– $– $– $– $– $242 $63 $65 $– $– $– $(52,233) Sales and marketing $(119,474) – – – – – – – 772 1,083 – (962) – $(118,581) Research, development, and engineering $(17,735) – – – – – – – 568 258 – – – $(16,909) General and administrative $(95,658) – – – – – – 36,415 4,983 1,302 24 (382) – $(53,316) Goodwill impairment on business $(27,369) – – – – – – – – – – – 27,369 $– Interest expense, net $(8,560) 106 – – – – – – – – – – – $(8,454) Gain on debt extinguishment, net $10,112 – (10,211) – – – – – – – – – – $(99) Gain on investment, net $471 – – – – (471) – – – – – – – $– Unrealized gain on short-term investments held at period end $4,201 – – – (4,201) – – – – – – – – $– Other income, net $4,218 – – – – (450) – – – – (111) – – $3,657 Income tax expense $(18,100) (25) 2,510 – 12,392 109 – (10,645) (897) (657) 18 359 (6,733) $(21,669) Loss from equity method investment, net $(3,191) – – – – – 3,191 – – – – – – $– Total non-GAAP Adjustments $81 $(7,701) $— $8,191 $(812) $3,191 $26,012 $5,489 $2,051 $(69) $(985) $20,636

14 $ in 000's Ziff Davis Three months ended September 30, Nine months ended September 30, 2022 2023 2022 2023 Net cash provided by operating activities $ 100,735 $ 72,808 $ 293,219 $ 227,843 Less: Purchases of property and equipment (26,891) (27,226) (80,767) (82,476) Free cash flow (1) $ 73,844 $ 45,582 $ 212,452 $ 145,367 1. Free cash flow is defined as net cash provided by operating activities, less purchases of property and equipment, plus changes in contingent consideration. GAAP Reconciliation – Free Cash Flow (1)

15 Quarterly Adjusted Income Statement Excluding the Divested Businesses $ in 000's (except for per share amounts) Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Q2'22 Q3'22 Q4'22 Q1'23 Q2'23 Q3'23 Advertising $ 177,288 $ 198,385 $ 198,794 $ 263,608 $ 170,067 $ 189,198 $ 186,921 $ 241,949 $ 156,082 $ 175,083 $ 183,008 Subscriptions 117,937 124,591 135,488 134,451 136,070 137,811 142,972 140,467 142,164 141,357 144,909 Other 3,961 7,293 11,625 10,992 9,184 10,601 12,195 14,363 8,981 9,626 13,085 Less: Intercompany eliminations (118) (292) (356) (423) (253) (254) (215) (79) (85) (50) (17) Adjusted Revenues $ 299,068 $ 329,977 $ 345,551 $ 408,628 $ 315,068 $ 337,356 $ 341,873 $ 396,700 $ 307,142 $ 326,016 $ 340,985 Cost of Revenues 37,906 44,306 45,797 45,286 45,686 45,601 52,233 50,329 45,373 47,037 55,287 Sales and Marketing 105,048 118,479 124,178 137,513 116,503 121,014 118,581 125,303 113,577 118,243 123,679 Research, Development and Engineering 18,679 16,764 18,319 20,923 17,580 18,675 16,909 17,227 16,956 16,726 16,527 General and Administrative 55,776 53,253 57,532 59,778 52,079 52,001 53,316 56,195 58,011 60,269 54,468 Adjusted Operating income $ 81,659 $ 97,175 $ 99,725 $ 145,128 $ 83,220 $ 100,065 $ 100,834 $ 147,646 $ 73,225 $ 83,741 $ 91,024 Adjusted Depreciation 14,244 14,899 15,613 16,487 17,568 17,972 19,280 20,658 21,108 22,935 22,710 Adjusted EBITDA $ 95,903 $ 112,074 $ 115,338 $ 161,615 $ 100,788 $ 118,037 $ 120,114 $ 168,304 $ 94,333 $ 106,676 $ 113,734 Adjusted Net Income (1) $ 53,066 $ 63,230 $ 66,085 $ 105,064 $ 57,929 $ 74,424 $ 74,269 $ 105,963 $ 51,726 $ 59,577 $ 69,073 Adjusted Diluted EPS (2) excluding divested businesses $ 1.19 $ 1.41 $ 1.40 $ 2.18 $ 1.23 $ 1.58 $ 1.58 $ 2.26 $ 1.10 $ 1.27 $ 1.50 1. Adjusted net income (loss) is defined as Net income (loss) with adjustments to reflect the addition or elimination of certain statement of operations items including, but not limited to: Interest costs, net; (Gain) loss on debt extinguishment, net; (Gain) loss on sale of business; Unrealized (gain) loss on short-term investments held at the reporting date; (Gain) loss on investments, net; (Income) loss from equity method investments, net; Amortization of patents and intangible assets that we acquired; Goodwill impairment on business; Share-based compensation; Acquisition, integration, and other costs, including adjustments to contingent consideration, lease terminations, retention bonuses, other acquisition-specific items, and other costs, such as severance and legal settlements; Disposal related costs associated with disposal of certain businesses; and Lease asset impairments and other charges. 2. Adjusted Diluted EPS is calculated by dividing Adjusted net income (loss) by the diluted weighted average shares of common stock outstanding that excludes the effect of convertible debt dilution.

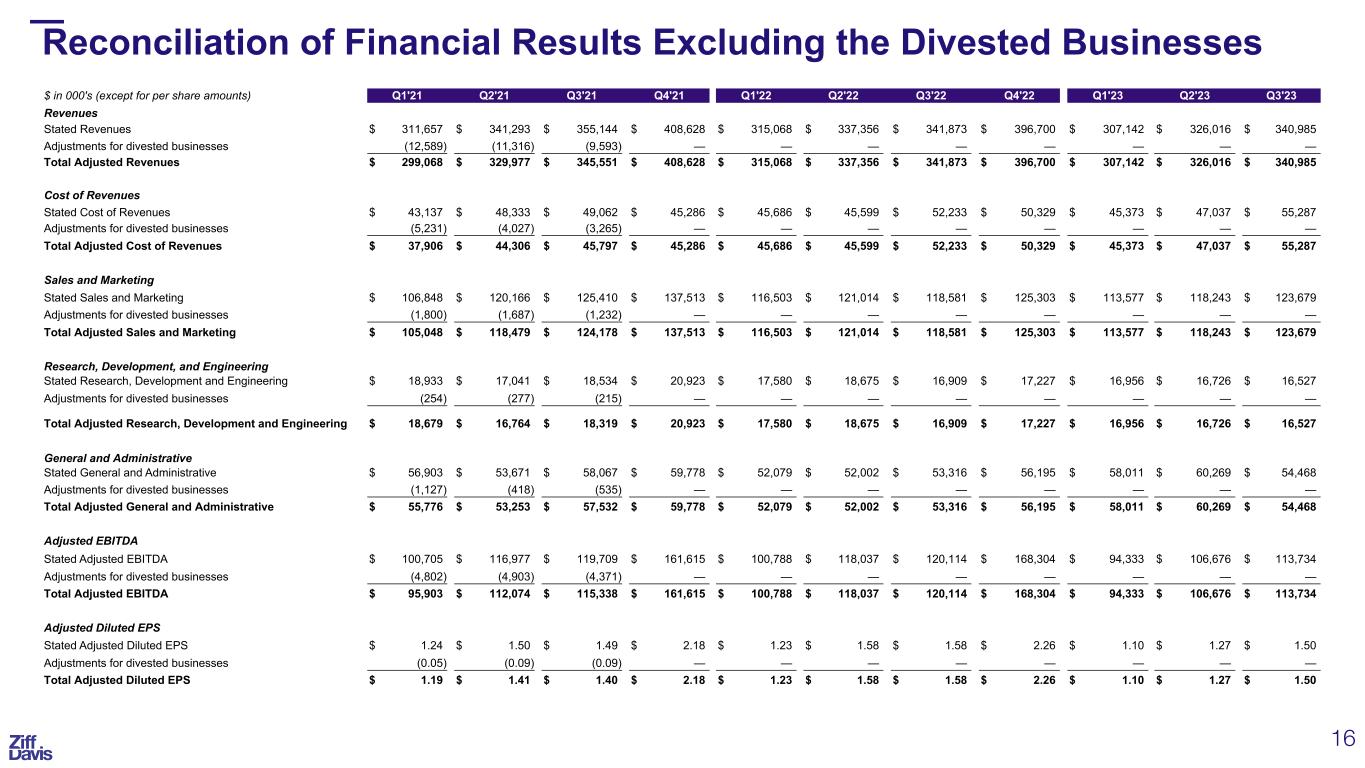

16 Reconciliation of Financial Results Excluding the Divested Businesses $ in 000's (except for per share amounts) Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Q2'22 Q3'22 Q4'22 Q1'23 Q2'23 Q3'23 Revenues Stated Revenues $ 311,657 $ 341,293 $ 355,144 $ 408,628 $ 315,068 $ 337,356 $ 341,873 $ 396,700 $ 307,142 $ 326,016 $ 340,985 Adjustments for divested businesses (12,589) (11,316) (9,593) — — — — — — — — Total Adjusted Revenues $ 299,068 $ 329,977 $ 345,551 $ 408,628 $ 315,068 $ 337,356 $ 341,873 $ 396,700 $ 307,142 $ 326,016 $ 340,985 Cost of Revenues Stated Cost of Revenues $ 43,137 $ 48,333 $ 49,062 $ 45,286 $ 45,686 $ 45,599 $ 52,233 $ 50,329 $ 45,373 $ 47,037 $ 55,287 Adjustments for divested businesses (5,231) (4,027) (3,265) — — — — — — — — Total Adjusted Cost of Revenues $ 37,906 $ 44,306 $ 45,797 $ 45,286 $ 45,686 $ 45,599 $ 52,233 $ 50,329 $ 45,373 $ 47,037 $ 55,287 Sales and Marketing Stated Sales and Marketing $ 106,848 $ 120,166 $ 125,410 $ 137,513 $ 116,503 $ 121,014 $ 118,581 $ 125,303 $ 113,577 $ 118,243 $ 123,679 Adjustments for divested businesses (1,800) (1,687) (1,232) — — — — — — — — Total Adjusted Sales and Marketing $ 105,048 $ 118,479 $ 124,178 $ 137,513 $ 116,503 $ 121,014 $ 118,581 $ 125,303 $ 113,577 $ 118,243 $ 123,679 Research, Development, and Engineering Stated Research, Development and Engineering $ 18,933 $ 17,041 $ 18,534 $ 20,923 $ 17,580 $ 18,675 $ 16,909 $ 17,227 $ 16,956 $ 16,726 $ 16,527 Adjustments for divested businesses (254) (277) (215) — — — — — — — — Total Adjusted Research, Development and Engineering $ 18,679 $ 16,764 $ 18,319 $ 20,923 $ 17,580 $ 18,675 $ 16,909 $ 17,227 $ 16,956 $ 16,726 $ 16,527 General and Administrative Stated General and Administrative $ 56,903 $ 53,671 $ 58,067 $ 59,778 $ 52,079 $ 52,002 $ 53,316 $ 56,195 $ 58,011 $ 60,269 $ 54,468 Adjustments for divested businesses (1,127) (418) (535) — — — — — — — — Total Adjusted General and Administrative $ 55,776 $ 53,253 $ 57,532 $ 59,778 $ 52,079 $ 52,002 $ 53,316 $ 56,195 $ 58,011 $ 60,269 $ 54,468 Adjusted EBITDA Stated Adjusted EBITDA $ 100,705 $ 116,977 $ 119,709 $ 161,615 $ 100,788 $ 118,037 $ 120,114 $ 168,304 $ 94,333 $ 106,676 $ 113,734 Adjustments for divested businesses (4,802) (4,903) (4,371) — — — — — — — — Total Adjusted EBITDA $ 95,903 $ 112,074 $ 115,338 $ 161,615 $ 100,788 $ 118,037 $ 120,114 $ 168,304 $ 94,333 $ 106,676 $ 113,734 Adjusted Diluted EPS Stated Adjusted Diluted EPS $ 1.24 $ 1.50 $ 1.49 $ 2.18 $ 1.23 $ 1.58 $ 1.58 $ 2.26 $ 1.10 $ 1.27 $ 1.50 Adjustments for divested businesses (0.05) (0.09) (0.09) — — — — — — — — Total Adjusted Diluted EPS $ 1.19 $ 1.41 $ 1.40 $ 2.18 $ 1.23 $ 1.58 $ 1.58 $ 2.26 $ 1.10 $ 1.27 $ 1.50

v3.23.3

Document and Entity Information Document

|

Nov. 08, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Nov. 08, 2023

|

| Entity Registrant Name |

Ziff Davis, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|