As

filed with the Securities and Exchange Commission on October 7, 2024

Registration

No. 333-

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

S-1

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

U.S.

GOLD CORP.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

1000 |

|

22-1831409 |

(State

or other jurisdiction of

incorporation or organization) |

|

(Primary

Standard Industrial Classification Code Number)

|

|

(I.R.S.

Employer

Identification Number) |

1910

E. Idaho Street, Suite 102-Box 604

Elko,

NV 89801

(800)

557-4550

(Address,

including zip code, and telephone number,

including

area code, of registrant’s principal executive offices)

George

Bee

Chief

Executive Officer and President

1910

E. Idaho Street, Suite 102-Box 604

Elko,

NV 89801

(800)

557-4550

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Copies

to:

Brian

Boonstra

Davis Graham & Stubbs LLP

1550 Seventeenth Street, Suite 500

Denver, Colorado 80202

(303) 892-7348

Approximate

date of commencement of proposed sale to the public: As soon as practicable after the effective date of registration statement.

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, check the following box. ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company,

or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller

reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer ☐ |

Accelerated

filer ☐ |

| Non-accelerated

filer ☒ |

Smaller

reporting company ☒ |

| |

Emerging

growth company ☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The

information in this prospectus is not complete and may be changed. The selling stockholders named in this prospectus may not sell these

securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an

offer to sell these securities and the selling stockholders named in this prospectus are not soliciting an offer to buy these securities

in any state where the offer or sale is not permitted.

Subject

to Completion, Dated October 7, 2024

PROSPECTUS

1,400,000

Shares of Common Stock

This

prospectus relates to the offer and resale by the selling stockholders named herein (the “selling stockholders”) of up to

1,400,000 shares of our common stock, par value $0.001 per share (“common stock”), issuable upon the exercise of warrants

(the “Warrants”) issued to the selling stockholders in a private placement pursuant to a securities purchase agreement, dated

as of April 15, 2024, by and among us and the selling stockholders (the “Purchase Agreement”).

The

shares of common stock that may be offered and sold by the selling stockholders under this prospectus are shares that we may issue to

the selling stockholders, from time to time following the date of this prospectus, upon exercise of the Warrants issued pursuant to the

Purchase Agreement. See “Selling Stockholders” for additional information regarding the selling stockholders.

We

are not selling any securities under this prospectus and will not receive any of the proceeds from the sale of the shares of common stock

by the selling stockholders. However, we will receive proceeds from the exercise of the Warrants if the Warrants are exercised for cash.

We intend to use those proceeds, if any, for general corporate purposes.

Each

selling stockholder named in this prospectus, or its donees, pledgees, transferees or other successors-in-interest, may offer or resell

the shares of common stock from time to time through public or private transactions at prevailing market prices, at prices related to

prevailing market prices or at privately negotiated prices. The selling stockholders will bear all commissions and discounts, if any,

attributable to the sale of shares, and all selling and other expenses incurred by the selling stockholders. We will bear all costs,

expenses and fees in connection with the registration of the shares of common stock subject to resale hereunder. For additional information

on the methods of sale that may be used by the selling stockholders, see “Plan of Distribution” beginning on page 13

of this prospectus. The selling stockholders may be deemed to be “underwriters” within the meaning of Section 2(a)(11) of

the Securities Act of 1933, as amended (the “Securities Act”).

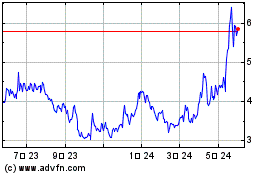

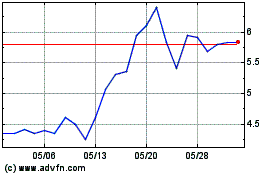

Our

common stock is listed on the Nasdaq Capital Market (“Nasdaq”) under the symbol “USAU.” On October 4, 2024, the

last reported sale price of our common stock as reported on Nasdaq was $5.72 per share.

You

should read this prospectus, together with additional information described under the headings “Where You Can Find More Information”

and “Documents Incorporated by Reference” carefully before you invest in any of our securities.

Investing

in our securities involves a high degree of risk. These risks are described in the “Risk Factors” section beginning on page

6 of this prospectus. You should also consider the risk factors described or referred to in any documents incorporated by reference

in this prospectus, and in any applicable prospectus supplement, before investing in these securities.

Neither

the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of these

securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this prospectus is , 2024.

TABLE

OF CONTENTS

About

this Prospectus

Important

information is incorporated by reference into this prospectus. You may obtain the information incorporated by reference without charge

by following the instructions under the sections of this prospectus entitled “Where You Can Find More Information”

and “Documents Incorporated by Reference.” You should carefully read this prospectus as well as additional information described

under the section of this prospectus entitled “Documents Incorporated by Reference,” before deciding to invest in

our common shares.

Unless

the context requires otherwise, references in this prospectus to “the Company,” “we,” “us” and “our”

refer to U.S. Gold Corp. and its consolidated subsidiaries as a combined entity, and “this offering” refers to the offering

contemplated in this prospectus.

Neither

us nor any of the selling stockholders authorized anyone to provide any information or to make any representations other than those contained

in this prospectus or in any free writing prospectus prepared by or on behalf of us or to which we have referred you. We take no responsibility

for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer

to sell only the shares offered hereby, but only under the circumstances and in the jurisdictions where it is lawful to do so. The information

contained in this prospectus or in any applicable free writing prospectus is current only as of its date, regardless of its time of delivery

or any sale of shares of our common stock. Our business, financial condition, results of operations and prospects may have changed since

that date. We are not, and the selling stockholders are not, making an offer of these securities in any jurisdiction where such offer

is not permitted.

Cautionary

Note Regarding Forward-Looking Statements

This

prospectus and the information incorporated by reference in this prospectus contain “forward-looking statements” within the meaning of the United States Private Securities Litigation

Reform Act of 1995. Such forward-looking statements concern our anticipated results and developments in our operations in future periods,

planned exploration and development of our properties, plans related to our business and other matters that may occur in the future.

These statements relate to analyses and other information that are based on forecasts of future results, estimates of amounts not yet

determinable and assumptions of management. These statements include, but are not limited to, comments regarding:

| |

● |

The

timing of the preparation, filing, and satisfaction of the conditions of our mine construction and operating permits for the CK Gold

Project; |

| |

|

|

| |

● |

The

timing and process of completing conditions surrounding our approved mine operating permit and closure plan for the CK Gold Project; |

| |

|

|

| |

● |

The

assumptions and projections contained in the CK Gold Project Prefeasibility Study, including estimated mineral resources and mineral

reserves, mine life, projected operating and capital costs, projected production, internal rate of return (“IRR”) and

Net Present Value (“NPV”) calculations, and the possibility of upside potential at the project; |

| |

|

|

| |

● |

The

planned extensions of our leases; |

| |

|

|

| |

● |

Our

planned expenditures; |

| |

|

|

| |

● |

Future

exploration plans and expectations related to our properties; |

| |

|

|

| |

● |

Our

cash and liquidity forecasts; |

| |

|

|

| |

● |

Our

anticipation of future environmental and regulatory impacts; and |

| |

|

|

| |

● |

Our

business and operating strategies. |

Words

such as “may,” “should,” “could,” “would,” “predicts,” “potential,”

“continue,” “expects,” “anticipates,” “future,” “intends,” “plans,”

“believes,” “estimates,” and similar expressions, as well as statements in future tense, are intended to identify

forward-looking statements. Forward-looking statements should not be read as a guarantee of future performance or results and may not

be accurate indications of when such performance or results will actually be achieved. Forward-looking statements are based on information

we have when those statements are made or our management’s good faith belief as of that time with respect to future events, and

are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in or

suggested by the forward-looking statements. Important factors that could cause such differences include, but are not limited to:

| |

● |

deviations

from the assumptions and projections set forth in the prefeasibility study for the CK Gold Project; |

| |

|

|

| |

● |

unfavorable

results from our exploration activities; |

| |

|

|

| |

● |

decreases

in gold, copper or silver prices; |

| |

|

|

| |

● |

whether

we are able to raise the necessary capital required to continue our business on terms acceptable to us or at all, and the likely

negative effect of volatility in metals prices or unfavorable exploration results; |

| |

|

|

| |

● |

whether

we will be able to begin to mine and sell minerals successfully or profitably at any of our current properties at current or future

metals prices; |

| |

● |

potential

delays in our exploration activities or other activities to advance properties towards mining resulting from environmental consents

or permitting delays or problems, accidents, problems with contractors, disputes under agreements related to exploration properties,

unanticipated costs and other unexpected events; |

| |

|

|

| |

● |

our

ability to retain key management and mining personnel necessary to successfully operate and grow our business; |

| |

|

|

| |

● |

economic

and political events affecting the market prices for gold, copper, silver, and other minerals that may be found on our exploration

properties; |

| |

|

|

| |

● |

fluctuations

in interest rates and inflation rates; |

| |

|

|

| |

● |

changes

in governmental rules and regulations or actions taken by regulatory authorities; |

| |

|

|

| |

● |

our

ability to maintain compliance with Nasdaq’s listing standards; |

| |

|

|

| |

● |

volatility

in the market price of our common stock; |

| |

|

|

| |

● |

our

ability to fund our business with our current cash reserves based on our currently planned activities; |

| |

|

|

| |

● |

our

ability to raise the necessary capital required to continue our business on terms acceptable to us or at all, and the likely negative

effect of volatility in metals prices or unfavorable exploration results; |

| |

|

|

| |

● |

our

expected cash needs and the availability and plans with respect to future financing; |

| |

|

|

| |

● |

our

ability to retain key management and mining personnel necessary to successfully operate and grow our business; |

| |

|

|

| |

● |

the

factors set forth under “Risk Factors” on page 6 of this prospectus; and |

| |

|

|

| |

● |

other

factors listed from time to time in registration statements, reports or other materials that we have filed with or furnished to the

SEC, including our most recent Annual Report on Form 10-K for the fiscal year ended April 30, 2024, which is incorporated by reference

into this prospectus. |

We

caution you that the forward-looking statements highlighted above do not encompass all of the forward-looking statements made in this

prospectus or in the documents incorporated by reference in this prospectus.

We

have based the forward-looking statements contained in this prospectus and in the documents incorporated by reference in this prospectus

primarily on our current expectations and projections about future events and trends that we believe may affect our business, financial

condition, results of operations and prospects. The outcomes of the events described in these forward-looking statements are subject

to risks, uncertainties and other factors that could cause actual results and experience to differ from those projected, including, but

not limited to, the risk factors described herein and the risk factors set forth in Part I—Item 1A, “Risk Factors”

in our Annual Report on Form 10-K for the year ended April 30, 2024 and elsewhere in the documents incorporated by reference into this

prospectus. Moreover, we operate in a very competitive and challenging environment. New risks and uncertainties emerge from time to time,

and it is not possible for us to predict all risks and uncertainties that could have an impact on the forward-looking statements contained

in this prospectus and in the documents incorporated by reference in this prospectus. We cannot assure you that the results, events and

circumstances reflected in the forward-looking statements will be achieved or occur, and actual results, events or circumstances could

differ materially from those described in the forward-looking statements.

The

forward-looking statements contained in this prospectus and in the documents incorporated by reference in this prospectus relate only

to events as of the date on which the statements are made. We do not undertake any obligation to release publicly any revisions to such

forward-looking statements to reflect events or circumstances after the date of this prospectus or to reflect the occurrence of unanticipated

events. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements and you should

not place undue reliance on our forward-looking statements. Our forward-looking statements do not reflect the potential impact of any

future acquisitions, mergers, dispositions, joint ventures, other strategic transactions or investments we may make.

Prospectus

Summary

The

following is a summary of the principal features of this offering and should be read together with the more detailed information and

financial data and statements contained elsewhere in this prospectus and in the documents incorporated by reference herein and therein.

This summary does not contain all of the information you should consider before investing in our securities and is qualified in its entirety

by the information contained elsewhere in this prospectus and the documents incorporated by reference herein. You should carefully read

the entire prospectus and the documents incorporated by reference herein, including our historical financial statements and the notes

to the financial statements in our most recently filed Annual Report on Form 10-K and our Quarterly Reports on Form 10-Q. You should

also carefully consider the information provided in the “Risk Factors” and “Cautionary Note Regarding Forward-Looking

Statements” sections of this prospectus before deciding to invest in our securities.

Overview

of the Company

U.S.

Gold Corp. is a gold, copper and precious metals development and exploration company pursuing exploration opportunities primarily in

Wyoming, Nevada and Idaho. While we are an exploration and development company that owns certain mining leases and other mineral rights

comprising the CK Gold Project in Wyoming, the Keystone Project in Nevada and the Challis Gold Project in Idaho, most of our recent activity

has focused on moving the CK Gold Project along the development pathway. Our CK Gold Project’s property contains proven and probable

mineral reserves and accordingly is classified as a development stage property, as defined in subpart 1300 of Regulation S-K (“S-K

1300”) promulgated by the Securities and Exchange Commission (the “SEC”). None of our other properties contain proven

and probable mineral reserves and all activities are exploratory in nature. We do not currently have any revenue-producing activities.

Corporate

Information

Our

principal executive offices are located at 1910 E. Idaho Street, Suite 102-Box 604, Elko, NV 89801 and our telephone number at that address

is (800) 557-4550. Our web site address is www.usgoldcorp.gold. Information on our website is not incorporated in this prospectus and is not part of this prospectus, unless otherwise stated.

U.S.

Gold Corp., formerly known as Dataram Corporation (the “Company”), was originally incorporated in the State of New Jersey

in 1967 and was subsequently re-incorporated under the laws of the State of Nevada in 2016. Effective June 26, 2017, the Company changed

its name to U.S. Gold Corp. from Dataram Corporation.

For

a complete description of our business, financial condition, results of operations and other important information, we refer you to our

filings with the SEC that are incorporated by reference in this prospectus, including our most recently filed Annual Report on Form 10-K

and Quarterly Reports on Form 10-Q. For instructions on how to find copies of these documents, see the section of this prospectus entitled

“Where You Can Find More Information.”

April

2024 Offering

On

April 15, 2024, we entered into a securities purchase agreement (the “Purchase Agreement”) whereby we issued and sold,

in a registered direct offering (the “Registered Direct Offering”), an aggregate of 1,400,000 shares of the Company’s

common stock at a purchase price of $3.50 per share (the “Offering Shares”). The offer and sale of the Offering Shares pursuant

to the Purchase Agreement was made under our effective shelf registration statement on Form S-3 (File No. 333-262415), which was declared

effective by the SEC on May 12, 2022, and the related prospectus supplement dated April 15, 2024. Accordingly, the Offering Shares we

issued and sold under the Purchase Agreement are not included in the 1,400,000 shares of common stock that are being registered for resale

pursuant to the registration statement that includes this prospectus and are not part of the offering covered by this prospectus.

Further,

under the Purchase Agreement in a concurrent private placement (the “Private Placement” and, together with the Registered

Direct Offering, the “Transactions”), we issued and sold Warrants to purchase up to 1,400,000 shares of common stock at an

exercise price of $4.48 (the “Warrants”). Each Warrant is exercisable six months from the date of issuance and has a term

expiring five years after such initial exercise date. The aggregate gross proceeds from the Transactions were approximately $4.9 million.

The

Offering

| Common

Stock Being Offered by the Selling Stockholders |

|

Up

to 1,400,000 shares |

| |

|

|

| Common

Stock Outstanding Before the Offering |

|

10,770,416

shares (as of October 4, 2024) |

| |

|

|

| Common

Stock to be Outstanding After Giving Effect to the Issuance of 1,400,000 Shares Registered Hereunder |

|

12,170,416

shares |

| |

|

|

| Use

of Proceeds |

|

We

will not receive any proceeds from the sale of shares of common stock in this offering. However, we will receive proceeds from the

exercise of the Warrants if the Warrants are exercised for cash. If all Warrants are exercised, we would receive approximately $6.3

million in aggregate gross proceeds. We intend to use those proceeds, if any, for working capital requirements and general corporate

purposes. |

| |

|

|

| Nasdaq

Trading Symbol for Common Stock |

|

“USAU” |

| |

|

|

| Risk

Factors |

|

Investing

in our securities involves a high degree of risk. You should carefully review and consider the section of this prospectus entitled

“Risk Factors” for a discussion of factors to consider before deciding to invest in shares of our common stock. |

Risk

Factors

Investing

in shares of our common stock involves a high degree of risk. Before making an investment decision, you should carefully consider the

risks described under “Risk Factors” in our most recently filed Annual Report on Form 10-K and our Quarterly Reports on Form

10-Q, together with all of the other information appearing in or incorporated by reference into this prospectus before deciding whether

to purchase any of the common stock being offered. Our business, financial condition or results of operations could be materially adversely

affected by any of these risks. Those risks and uncertainties are not the only risks and uncertainties we face. Additional risks and

uncertainties not presently known to us or that we currently deem immaterial also may impair our business operations. If any of these

risks actually occur, our business, results of operations and financial condition could suffer. The trading price of shares of our common

stock could decline due to any of these risks, and you may lose all or part of your investment.

Use

of Proceeds

The

shares of common stock covered by this prospectus are being sold by the selling stockholders. We will not receive any proceeds from the

resale of the shares of common stock by any of the selling stockholders because the shares of common stock will be sold for the account

of each of the selling stockholders, respectively.

Selling

Stockholders

This

prospectus relates to the possible resale by the selling stockholders named below of shares of common stock that may be issued to the

selling stockholders upon exercise of the Warrants. We are filing the registration statement of which this prospectus forms a part pursuant

to the provisions of the Purchase Agreement, in which we agreed to provide certain registration rights with respect to sales by the selling

stockholders of the shares of common stock that may be issued to the selling stockholders upon exercise of the Warrants.

The

selling stockholders, may, from time to time, offer and sell pursuant to this prospectus any or all of the shares of common stock. The

selling stockholders may sell some, all or none of the shares of common stock. We do not know how long the selling stockholders will

hold the shares of common stock before selling them, and we currently have no agreements, arrangements or understandings with the selling

stockholders regarding the sale of any of the shares of common stock.

The

following table presents information regarding the selling stockholders and the shares of common stock that each of them may offer and

sell from time to time under this prospectus. The table is prepared based on information supplied to us by the selling stockholders or

information available to us as of October 4, 2024. None of the selling stockholders nor any of their affiliates has held a position or

office, or had any other material relationship, with us or any of our predecessors or affiliates. The number of shares of common stock

beneficially owned by the selling stockholders has been determined in accordance with Section 13(d) of the Securities Exchange Act of

1934, as amended (the “Exchange Act”) and Rule 13d-3 thereunder. The percentage of shares beneficially owned prior to this

offering is based on 10,770,416 shares of our common stock actually outstanding as of October 4, 2024.

| | |

Beneficial Ownership

Prior to this Offering | | |

| | |

Beneficial Ownership

After this Offering(3) | |

| Name | |

Number

of Shares(1) | | |

% | | |

Maximum Number of Shares to be

Sold in this

Offering(2) | | |

Number

of Shares | | |

% | |

| | |

| | |

| | |

| | |

| | |

| |

| Phoenix Gold Fund Limited(4) | |

| 865,319 | | |

| 7.8 | % | |

| 140,000 | | |

| 725,319 | | |

| 6.0 | % |

| Jennifer Peltrier | |

| 180,000 | | |

| 1.7 | % | |

| 90,000 | | |

| 90,000 | | |

| * | |

| Lowell Schmidt | |

| 460,000 | | |

| 4.3 | % | |

| 230,000 | | |

| 230,000 | | |

| 1.9 | % |

| Dave Schmidt | |

| 350,000 | | |

| 3.3 | % | |

| 175,000 | | |

| 175,000 | | |

| 1.4 | % |

| Michael Ho | |

| 250,000 | | |

| 2.3 | % | |

| 125,000 | | |

| 125,000 | | |

| 1.0 | % |

| Porter Partners, L.P.(5) | |

| 290,916 | | |

| 2.7 | % | |

| 115,000 | | |

| 175,916 | | |

| 1.4 | % |

| Thomas B. Akin | |

| 761,201 | | |

| 7.0 | % | |

| 140,000 | | |

| 621,201 | | |

| 5.1 | % |

| Goal Capital Inc.(6) | |

| 36,000 | | |

| * | | |

| 18,000 | | |

| 18,000 | | |

| * | |

| Brett Whalen | |

| 120,000 | | |

| 1.1 | % | |

| 60,000 | | |

| 60,000 | | |

| * | |

| Scott Kelly | |

| 15,000 | | |

| * | | |

| 7,500 | | |

| 7,500 | | |

| * | |

| Tim Sorensen | |

| 46,000 | | |

| * | | |

| 23,000 | | |

| 23,000 | | |

| * | |

| Robert Pollock | |

| 31,000 | | |

| * | | |

| 23,500 | | |

| 7,500 | | |

| * | |

| William Murray John | |

| 120,000 | | |

| 1.1 | % | |

| 60,000 | | |

| 60,000 | | |

| * | |

| Ian Godfrey | |

| 23,000 | | |

| * | | |

| 11,500 | | |

| 11,500 | | |

| * | |

| Harrison Pokrandt | |

| 20,000 | | |

| * | | |

| 10,000 | | |

| 10,000 | | |

| * | |

| Harry Pokrandt | |

| 40,000 | | |

| * | | |

| 20,000 | | |

| 20,000 | | |

| * | |

| Heather Pokrandt | |

| 40,000 | | |

| * | | |

| 20,000 | | |

| 20,000 | | |

| * | |

| Mitchell Pokrandt | |

| 20,000 | | |

| * | | |

| 10,000 | | |

| 10,000 | | |

| * | |

| Zara Pokrandt | |

| 20,000 | | |

| * | | |

| 10,000 | | |

| 10,000 | | |

| * | |

| ZCR Corp.(7) | |

| 23,000 | | |

| * | | |

| 11,500 | | |

| 11,500 | | |

| * | |

| Crestmont Invest LTD(8) | |

| 50,000 | | |

| * | | |

| 25,000 | | |

| 25,000 | | |

| * | |

| Jan Michelle Bikic | |

| 50,000 | | |

| * | | |

| 25,000 | | |

| 25,000 | | |

| * | |

| Alfred Simon Gregorian | |

| 30,000 | | |

| * | | |

| 15,000 | | |

| 15,000 | | |

| * | |

| James R. Paterson | |

| 50,000 | | |

| * | | |

| 25,000 | | |

| 25,000 | | |

| * | |

| Hugh Nash | |

| 10,000 | | |

| * | | |

| 5,000 | | |

| 5,000 | | |

| * | |

| Frank Borowicz | |

| 10,000 | | |

| * | | |

| 5,000 | | |

| 5,000 | | |

| * | |

* The percentage of common stock beneficially owned is less than 1%.

| |

(1) |

The

figures in this column are based on the shares of common stock and the shares of common stock underlying Warrants acquired by each

selling stockholder in the Transactions, unless the Company is aware of and has access to other information. |

| |

(2) |

Assumes

the sale of the maximum number of shares registered pursuant to this prospectus. |

| |

|

|

| |

(3) |

Assumes

the sale of all shares of common stock registered pursuant to this prospectus, although the selling stockholders are under no obligation

known to us to sell any shares of common stock at this time. |

| |

|

|

| |

(4) |

David

Crichton Watt and Lawrence William Hill have voting and dispositive power over the securities held for the account of this selling

stockholder, as its directors. The selling stockholder’s address is Suite 10.3, 10th Fl, West Wing, Rohas Pure Circle, No.

9, Jalan P. Ramlee. Kuala Lumpur, 50250. |

| |

|

|

| |

(5) |

Jeffrey

Porter, has sole voting and dispositive power over the securities held for the account of this selling stockholder, as its general

partner. The selling stockholder’s address is 300 Drakes Landing Rd, Ste 171, Greenbrae, California 94904. |

| |

|

|

| |

(6) |

Danny

Gravelle, has sole voting and dispositive power over the securities held for the account of this selling stockholder, as its president.

The selling stockholder’s address is 34 Via Di Nola, Laguna Niguel, California, 92677. |

| |

|

|

| |

(7) |

Mark

Wellings, has sole voting and dispositive power over the securities held for the account of this selling stockholder, as its president.

The selling stockholder’s address is 2 Hughland Avenue, Toronto, Ontrario, Canada M4W 2A3. |

| |

|

|

| |

(8) |

Peter

Grut, has sole voting and dispositive power over the securities held for the account of this selling stockholder, as its director.

The selling stockholder’s address is Gryon House, 17 Avenue De L’Annonciade, 9800 Monaco. |

Security

Ownership of Certain Beneficial Owners and Management

The

following table contains information about the beneficial ownership (unless otherwise indicated) of our common stock as of October 4,

2024 by:

| |

● |

each

person known by us to beneficially hold 5% or more of our outstanding common stock, |

| |

|

|

| |

● |

each

of our directors, |

| |

|

|

| |

● |

each

of our named executive officers, and |

| |

|

|

| |

● |

all

of our executive officers and directors as a group. |

All

information is taken from or based upon ownership filings made by such persons with the SEC or upon information provided by such persons

to us. Except as otherwise noted, we believe that all of the persons and groups shown below have sole voting and investment power with

respect to the common stock indicated.

| | |

Amount

of

Beneficial

Ownership of Common Stock(1) | |

| Name

of Beneficial Owner | |

Number | | |

Percent | |

| Luke Norman(2) | |

| 527,247 | | |

| 4.81 | ]% |

| | |

| | | |

| | |

| George Bee(3) | |

| 428,732 | | |

| 3.89 | % |

| | |

| | | |

| | |

| Robert W.

Schafer(4) | |

| 129,757 | | |

| 1.20 | % |

| | |

| | | |

| | |

| Johanna Fipke(5) | |

| - | | |

| * | |

| | |

| | | |

| | |

| Michael Waldkirch(6) | |

| 34,450 | | |

| * | |

| | |

| | | |

| | |

| Eric Alexander(7) | |

| 89,275 | | |

| * | |

| | |

| | | |

| | |

| Kevin Francis(8) | |

| 38,181 | | |

| * | |

| | |

| | | |

| | |

| Current Directors and Executive

Officers as a group (7 persons) | |

| 1,247,642 | | |

| 10.96 | % |

| | |

| | | |

| | |

| Phoenix Gold Fund Ltd(9) | |

| 865,319 | | |

| 7.84 | % |

| | |

| | | |

| | |

| Thomas B.

Akin(10) | |

| 761,201 | | |

| 6.96 | % |

*The

percentage of common stock beneficially owned is less than 1%.

| |

(1) |

For

each holder that holds restricted stock, options, restricted stock units, warrants or other securities that are currently vested

or exercisable or that vest or become exercisable within 60 days of October 4, 2024, we treat the common stock underlying those securities

as owned by that holder and as outstanding shares when we calculate that holder’s percentage ownership of our common stock.

We do not treat that common stock as outstanding when we calculate the percentage ownership of any other holder. |

| |

|

|

| |

(2) |

Includes:

(i) 345,517 unrestricted shares of common stock; (ii) 3,463 shares of common stock underlying vested RSUs; (iii) options to purchase

30,310 shares of common stock, all of which are currently exercisable; and (iv) warrants to purchase 147,957 shares of common stock,

all of which are currently exercisable. Mr. Norman has no voting rights with respect to the RSUs until the underlying shares are

issued. |

| |

(3) |

Includes:

(i) 175,566 unrestricted shares of common stock; (ii) 225,450 shares of common stock underlying vested RSUs, which are issuable upon

Mr. Bee’s resignation from the Company (subject to acceleration and forfeiture in certain circumstances); (iii) options to

purchase 30,928 shares of common stock, of which 26,946 are currently exercisable; and (iv) warrants to purchase 770 shares of common

stock, all of which are currently exercisable. Excludes: options to purchase 3,982 shares of common stock. Mr. Bee has no voting

rights with respect to the RSUs until the underlying shares are issued. |

| |

|

|

| |

(4) |

Includes:

(i) 100,750 unrestricted shares of common stock; (ii) 7,927 shares of common stock underlying vested RSUs which are issuable upon

Mr. Schafer’s resignation from the Company (subject to acceleration and forfeiture in certain circumstances); (iii) options

to purchase 20,310 shares of common stock, all of which are currently exercisable; and (iv) warrants to purchase 770 shares of common

stock, all of which are currently exercisable. Mr. Schafer has no voting rights with respect to the RSUs until the underlying shares

are issued. |

| |

|

|

| |

(5) |

Ms.

Fipke was (i) elected to the Board at the Company’s annual meeting held on April 26, 2024 and (ii) does not currently have

beneficial ownership of any shares of the Company’s common stock. |

| |

|

|

| |

(6) |

Includes:

(i) 6,154 unrestricted shares of common stock; (ii) 7,409 shares of common stock underlying vested RSUs, which are issuable upon

Mr. Waldkirch’s resignation from the Company (subject to acceleration and forfeiture in certain circumstances); (iii) options

to purchase 20,310 shares of common stock, all of which are currently exercisable; and (iv) warrants to purchase 577 shares of common

stock, all of which are currently exercisable. Mr. Waldkirch has no voting rights with respect to the RSUs until the underlying shares

are issued. |

| |

|

|

| |

(7) |

Includes:

(i) 1,540 unrestricted shares of common stock; (ii) 67,186 shares of common stock underlying vested RSUs, which are issuable upon

Mr. Alexander’s resignation from the Company (subject to acceleration and forfeiture in certain circumstances); (iii) options

to purchase 21,372 shares of common stock, of which 19,779 are currently exercisable; and (iv) warrants to purchase 770 shares of

common stock, all of which are currently exercisable. Excludes: options to purchase 1,593 shares of common stock. Mr. Alexander has

no voting rights with respect to RSUs until the underlying shares are issued. |

| |

|

|

| |

(8) |

Includes:

(i) 308 unrestricted shares of common stock; (ii) 19,794 shares of common stock underlying vested RSUs, which are issuable upon Mr.

Francis’s resignation from the Company (subject to acceleration and forfeiture in certain circumstances); (iii) options to

purchase 18,900 shares of common stock, of which 17,925 are currently exercisable; and (iv) warrants to purchase 154 shares of common

stock, all of which are currently exercisable. Excludes: options to purchase 975 shares of common stock. Mr. Francis has no voting

rights with respect to RSUs until the underlying shares are issued. |

| |

|

|

| |

(9) |

The

number of shares held was obtained from the Schedule 13G/A filed by AIMS Asset Management Sdn. Bhd. (“AIMS”) on behalf

of its fund under management, Phoenix Gold Fund Ltd (“Phoenix”) with the SEC on April 23, 2024, which reports ownership

as of April 23, 2024. The Schedule 13G/A filing indicates that Phoenix had sole power to vote or direct the vote of 865,319 shares

of our common stock and sole power to dispose or to direct the disposition of 865,319 shares of our common stock. The business address

of AIMS is Suite 10.3, West Wing, Rohas Tecnic, No. 9 Jalan P.Ramlee, 50250 Kuala Lumpur, Malaysia. |

| |

|

|

| |

(10) |

The

number of shares held was obtained from the Schedule 13G filed by Thomas B. Akin with the SEC on May 7, 2024, which reports ownership

as of May 7, 2024. The Schedule 13G filing indicates that Mr. Akin had sole power to vote or direct the vote of 621,201 shares of

our common stock and sole power to dispose or to direct the disposition of 621,201 shares of our common stock. Mr. Akin’s residential

address is 30 Liberty Ship Way, Suite 3110 Sausalito, California 94965. |

Certain

Relationships and Related Party Transactions

Review

of Related Person Transactions

We

do not have a formal written policy for the review and approval of transactions with related parties. However, the Audit Committee Charter

establishes the Audit Committee’s responsibility to review and approve any related party transaction and our Code of Ethics and

Business Conduct provides guidelines for reviewing any related party transaction. In particular, our Code of Ethics and Business Conduct

prohibits conflicts of interest and provides non-exclusive examples of conduct that would violate the prohibition. If any of our employees

are unsure as to whether a conflict of interest exists, the employee is instructed to consult with the Company’s Compliance Officer.

We

annually require each of our directors and executive officers to complete a directors’ or officers’ questionnaire, respectively,

that elicits information about related party transactions. Our board and legal counsel annually review all transactions and relationships

disclosed in the directors’ and officers’ questionnaires, and the board makes a formal determination regarding each director’s

independence. If a director were determined no longer to be independent, that director, if he or she serves on any of the Audit Committee,

the Nominating and Corporate Governance Committee, or the Compensation Committee, would be removed from such committee prior to (or otherwise

would not participate in) any future meetings of the committee. If the transaction were to present a conflict of interest, the board

would determine the appropriate response.

Plan

of Distribution

Each

selling stockholder of the shares of common stock and any of their pledgees, assignees and successors-in-interest may, from time to time,

sell any or all of their shares of common stock covered hereby on Nasdaq or any other stock exchange, market or trading facility on which

the shares of common stock are traded or in private transactions. These sales may be at fixed or negotiated prices. A selling stockholder

may use any one or more of the following methods when selling securities:

| |

● |

ordinary

brokerage transactions and transactions in which the broker-dealer solicits purchasers; |

| |

|

|

| |

● |

block

trades in which the broker-dealer will attempt to sell the securities as agent but may position and resell a portion of the block

as principal to facilitate the transaction; |

| |

|

|

| |

● |

purchases

by a broker-dealer as principal and resale by the broker-dealer for its account; |

| |

|

|

| |

● |

an

exchange distribution in accordance with the rules of the applicable exchange; |

| |

|

|

| |

● |

privately

negotiated transactions; |

| |

|

|

| |

● |

settlement

of short sales; |

| |

|

|

| |

● |

in

transactions through broker-dealers that agree with the selling stockholders to sell a specified number of such securities at a stipulated

price per security; |

| |

|

|

| |

● |

through

the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise; |

| |

|

|

| |

● |

a

combination of any such methods of sale; or |

| |

|

|

| |

● |

any

other method permitted pursuant to applicable law. |

The

selling stockholders may also sell securities under Rule 144 under the Securities Act or any other exemption from registration under

the Securities Act, if available, rather than under this prospectus.

Broker-dealers

engaged by the selling stockholders may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive commissions

or discounts from the selling stockholders (or, if any broker-dealer acts as agent for the purchaser of securities, from the purchaser)

in amounts to be negotiated, but, except as set forth in a supplement to this prospectus, in the case of an agency transaction not in

excess of a customary brokerage commission in compliance with FINRA Rule 2440; and in the case of a principal transaction a markup or

markdown in compliance with FINRA IM-2440.

In

connection with the sale of shares of common stock or interests therein, the selling stockholders may enter into hedging transactions

with broker-dealers or other financial institutions, which may in turn engage in short sales of the shares of common stock in the course

of hedging the positions they assume. The selling stockholders may also sell shares of common stock short and deliver these securities

to close out their short positions, or loan or pledge the securities to broker-dealers that in turn may sell these shares of common stock.

The selling stockholders may also enter into option or other transactions with broker-dealers or other financial institutions or create

one or more derivative securities which require the delivery to such broker-dealer or other financial institution of shares of common

stock offered by this prospectus, which shares of common stock such broker-dealer or other financial institution may resell pursuant

to this prospectus (as supplemented or amended to reflect such transaction).

The

selling stockholders and any broker-dealers or agents that are involved in selling the shares of common stock may be deemed to be “underwriters”

within the meaning of the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers

or agents and any profit on the resale of the shares of common stock purchased by them may be deemed to be underwriting commissions or

discounts under the Securities Act. Each selling stockholder has informed us that it does not have any written or oral agreement or understanding,

directly or indirectly, with any person to distribute the securities.

We

are required to pay certain fees and expenses incurred by us incident to the registration of the shares of common stock. We have agreed

to indemnify the selling stockholders against certain losses, claims, damages and liabilities, including liabilities under the Securities

Act.

The

securities will be sold only through registered or licensed brokers or dealers if required under applicable state securities laws. In

addition, in certain states, the securities covered hereby may not be sold unless they have been registered or qualified for sale in

the applicable state or an exemption from the registration or qualification requirement is available and is complied with.

Under

applicable rules and regulations under the Exchange Act, any person engaged in the distribution of the resale securities may not simultaneously

engage in market making activities with respect to the Common Stock for the applicable restricted period, as defined in Regulation M,

prior to the commencement of the distribution. In addition, the selling stockholders will be subject to applicable provisions of the

Exchange Act and the rules and regulations thereunder, including Regulation M, which may limit the timing of purchases and sales of the

Common Stock by the selling stockholders or any other person. We will make copies of this prospectus available to the selling stockholders

and have informed them of the need to deliver a copy of this prospectus to each purchaser at or prior to the time of the sale (including

by compliance with Rule 172 under the Securities Act).

Description

of Common Stock

We

are authorized to issue 200,000,000 shares of common stock. As of October 4, 2024, we had 10,770,416 shares of common stock issued and

outstanding.

Dividend

Rights

Holders

of our common stock will be entitled to receive dividends when, as and if declared by our board, out of funds legally available for their

payment, subject to the rights of holders of any preferred stock that we may issue.

Voting

Rights

Holders

of our common stock are entitled to one vote per share on all matters as to which holders of common stock are entitled to vote. Holders

of not less than a majority of all of the shares of the stock entitled to vote at any meeting of stockholders constitute a quorum unless

otherwise required by law.

Election

of Directors

Our

directors are elected by a plurality of the votes cast by the holders of our common stock in a meeting at which a quorum is present.

“Plurality” means that the individuals who receive the largest number of votes cast are elected as directors, up to the maximum

number of directors to be chosen at the meeting. Our stockholders may vote to remove any director or the entire board of directors, with

or without cause, by the affirmative vote of two-thirds (2/3) of shares entitled to vote at an election of the directors.

Liquidation

In

the event of any liquidation, dissolution or winding up of the Company, holders of our common stock are entitled to share ratably in

all assets remaining after payment of liabilities, subject to prior distribution rights of preferred stock then outstanding.

Redemption

Our

common stock is not redeemable or convertible.

Other

Provisions

All

our outstanding common stock is, and the common stock offered by this prospectus or obtainable upon exercise or conversion of other securities

offered hereby, if issued in the manner described in this prospectus, will be, fully paid and non-assessable.

You

should read the prospectus relating to any offering of common stock, or of securities convertible, exchangeable or exercisable for common

stock, for the terms of the offering, including the number of shares of common stock offered, any initial offering price and market prices

relating to the common stock.

This

section is a summary and may not describe every aspect of our common stock that may be important to you. We urge you to read applicable

Nevada law, our articles of incorporation, as amended, and our amended and restated bylaws, as currently in effect, because they, and

not this description, define your rights as a holder of our common stock. See “Where You Can Find More Information” on page

16 of this prospectus for information on how to obtain copies of these documents.

Interest

of Named Experts and Counsel

No

expert or counsel named in this prospectus as having prepared or certified any part of this prospectus or having given an opinion upon

the validity of the securities being registered or upon other legal matters in connection with the registration or offering of the common

stock was employed on a contingency basis, or had, or is to receive, in connection with the offering, a substantial interest, direct

or indirect, in the Company. Nor was any such person connected with the Company as a promoter, managing or principal underwriter, voting

trustee, director, officer of employee.

Legal

Matters

The

validity of the issuance of the securities offered hereby will be passed upon for us by Davis Graham & Stubbs LLP.

Experts

The

consolidated financial statements of the Company as of April 30, 2023 and 2024, incorporated in this prospectus by reference to our Annual

Report on Form 10-K for the year ended April 30, 2024 (which contains an explanatory paragraph relating to the Company’s ability

to continue as a going concern), have been audited by Marcum LLP, independent registered public accounting firm, as set forth in their

report, and are incorporated by reference in reliance upon such report given on the authority of such firm as experts in accounting and

auditing.

The

estimate of our mineral resources with respect to the CK Gold Project incorporated by reference in this prospectus have been included

in reliance on a technical report summary prepared by Gustavson Associates, LLC, John A. Wells and Mark C. Shutty.

Where

You Can Find More Information

We

have filed with the SEC a registration statement on Form S-1 under the Securities Act with respect to the shares of common stock being

offered by this prospectus. This prospectus does not contain all of the information in the registration statement of which this prospectus

is a part and the exhibits to such registration statement. For further information with respect to us and the common stock offered by

this prospectus, we refer you to the registration statement of which this prospectus is a part and the exhibits to such registration

statement. Statements contained in this prospectus as to the contents of any contract or any other document are not necessarily complete,

and in each instance, we refer you to the copy of the contract or other document filed as an exhibit to the registration statement of

which this prospectus is a part. Each of these statements is qualified in all respects by this reference.

You

may read and copy the registration statement of which this prospectus is a part, as well as our reports, proxy statements and other information,

at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for more

information about the operation of the Public Reference Room. The SEC maintains an Internet site that contains reports, proxy and information

statements, and other information regarding issuers that file electronically with the SEC, including U.S. Gold Corp. The SEC’s

Internet site can be found at http://www.sec.gov. You may also request a copy of these filings, at no cost, by writing us at 1910

E. Idaho Street, Suite 102-Box 604, Elko, Nevada 89801, or telephoning us at (800) 557-4550.

We

are subject to the information and reporting requirements of the Exchange Act and, in accordance with this law, file periodic reports,

proxy statements and other information with the SEC. These periodic reports, proxy statements and other information are available for

inspection and copying at the SEC’s public reference facilities and the website of the SEC referred to above. We also maintain

a website at www.usgoldcorp.gold. You may access these materials free of charge as soon as reasonably practicable after they are

electronically filed with, or furnished to, the SEC. Information contained on our website is not a part of this prospectus and the inclusion

of our website address in this prospectus is an inactive textual reference only.

Disclosure

of Commission Position on Indemnification for Securities Act Liabilities

Insofar

as indemnification for liabilities arising under the Securities Act may be permitted to our directors, officers, and persons controlling

us pursuant to the provisions described in Item 14 of the registration statement of which this prospectus is a part or otherwise, we

have been advised that in the opinion of the SEC such indemnification is against public policy as expressed in the Securities Act and

is therefore unenforceable. In the event that a claim for indemnification against such liabilities (other than our payment of expenses

incurred or paid by our directors, officers, or controlling persons in the successful defense of any action, suit, or proceeding) is

asserted by our directors, officers, or controlling persons in connection with the common stock being registered, we will, unless in

the opinion of our counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question

whether such indemnification by us is against public policy as expressed in the Securities Act and will be governed by the final adjudication

of the issue.

Documents

Incorporated by Reference

The

SEC permits us to incorporate by reference the information contained in documents we have filed with the SEC, which means that we can

disclose important information to you by referring you to those documents rather than including them in this prospectus. The information

incorporated by reference is considered to be part of this prospectus and you should read it with the same care that you read this prospectus.

We are incorporating by reference the documents listed below, which we have already filed with the SEC:

| |

● |

our

Annual Report on Form 10-K for the year ended April 30, 2024, filed with the SEC on July 29, 2024; |

| |

|

|

| |

● |

our

Quarterly Report on Form 10-Q for the quarterly period ended July 31, 2024, filed with the SEC on September 16, 2024; |

| |

|

|

| |

● |

Amendment

No. 1 to our Annual Report on Form 10-K for the year ended April 30, 2024, filed with the SEC on August 28, 2024; and |

| |

|

|

| |

● |

the

description of our common stock contained in our Annual Report on Form 10-K for the year ended April 30, 2021, filed with the SEC

on July 29, 2021, including any subsequent amendment or report filed for the purpose of updating such description. |

We

also incorporate by reference any future filings (other than current reports furnished under Item 2.02 or Item 7.01 of Form 8-K and exhibits

filed on such form that are related to such items unless such Form 8-K expressly provides to the contrary) made with the SEC pursuant

to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act, including those made after the date of the initial filing of the registration

statement of which this prospectus is a part and prior to effectiveness of such registration statement, until we file a post-effective

amendment that indicates the termination of the offering of the securities made by this prospectus and such future filings will become

a part of this prospectus from the respective dates that such documents are filed with the SEC. Any statement contained herein or in

a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes hereof

to the extent that a statement contained herein or in any other subsequently filed document which is also incorporated or deemed to be

incorporated herein modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as

so modified or superseded, to constitute a part of this prospectus.

We

will provide without charge to each person to whom a copy of this prospectus is delivered, upon written or oral request, a copy of any

or all of the reports or documents that have been incorporated by reference in this prospectus but not delivered with this prospectus

(other than an exhibit to these filings, unless we have specifically incorporated that exhibit by reference in this prospectus). Any

such request should be addressed to us at:

U.S.

Gold Corp.

Attention:

Corporate Secretary

1910

E. Idaho Street, Suite 102-Box 604

Elko,

NV 89801

(800)

557-4550

You

may also access the documents incorporated by reference in this prospectus through our website at www.usgoldcorp.gold. Except for the

specific incorporated documents listed above, no information available on or through our website shall be deemed to be incorporated in

this prospectus or the registration statement of which it forms a part.

1,400,000

Shares of Common Stock

PROSPECTUS

October

7, 2024

PART

II

INFORMATION

NOT REQUIRED IN PROSPECTUS

Item

13. Other Expenses of Issuance and Distribution

The

following table sets forth the costs and expenses payable by U.S. Gold Corp., or the Registrant, in connection with the sale and distribution

of the securities being registered. All amounts are estimated except the SEC registration fee.

| Item | |

Amount | |

| SEC registration fee | |

$ | 1,229 | |

| Legal fees and expenses | |

| 25,000 | |

| Accounting fees and expenses | |

| 5,000 | |

| Printing, transfer agent fees and miscellaneous expenses | |

| 2,500 | |

| Total | |

$ | 33,729 | |

Item

14. Indemnification of Directors and Officers

Section

78.7502(1) of the Nevada Revised Statutes (“NRS”) provides that a corporation may indemnify any person who was or is a party

or is threatened to be made a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative

or investigative (except an action by or in the right of the corporation) by reason of the fact that such person is or was a director,

officer, employee or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee

or agent of another corporation, partnership, joint venture, trust or other enterprise, against expenses (including attorneys’

fees), judgments, fines and amounts paid in settlement actually and reasonably incurred in connection with such action, suit or proceeding

if such person: (i) is not liable for a breach of fiduciary duties that involved intentional misconduct, fraud or a knowing violation

of law; or (ii) acted in good faith and in a manner which he or she reasonably believed to be in or not opposed to the best interests

of the corporation, and, with respect to any criminal action or proceeding, had no reasonable cause to believe his or her conduct was

unlawful.

NRS

Section 78.7502(2) further provides that a corporation may indemnify any person who was or is a party or is threatened to be made a party

to any threatened, pending or completed action or suit by or in the right of the corporation to procure a judgment in its favor by reason

of the fact that such person is or was a director, officer, employee or agent of the corporation, or is or was serving at the request

of the corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise,

against expenses, including amounts paid in settlement and attorneys’ fees actually and reasonably incurred in connection with

the defense or settlement of the action or suit if such person: (i) is not liable for a breach of fiduciary duties that involved intentional

misconduct, fraud or a knowing violation of law; or (ii) acted in good faith and in a manner that he or she reasonably believed to be

in or not opposed to the best interests of the corporation. Indemnification may not be made for any claim, issue or matter as to which

such a person has been adjudged by a court of competent jurisdiction, after exhaustion of all appeals therefrom, to be liable to the

corporation or for amounts paid in settlement to the corporation, unless and only to the extent that the court in which the action or

suit was brought or other court of competent jurisdiction determines upon application that in view of all the circumstances of the case

the person is fairly and reasonably entitled to indemnity for such expenses as the court deems proper.

To

the extent that a director, officer, employee or agent of a corporation has been successful on the merits or otherwise in defense of

any action, suit or proceeding referred to in subsections (1) and (2) of NRS Section 78.7502, as described above, or in defense of any

claim, issue or matter therein, the corporation shall indemnify him or her against expenses (including attorneys’ fees) actually

and reasonably incurred by such person in connection with the defense.

The

articles of incorporation, as amended, and the second amended and restated bylaws of the Company provide that the Company shall, to the

fullest extent permitted by the NRS, as now or hereafter in effect, indemnify any person who was or is a party or is threatened to be

made a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative,

except an action by or in the right of the Company, by reason of the fact that he is or was a director, officer, employee or agent of

the Company, or is or was serving at the request of the Company as a director, officer, employee or agent of another corporation, partnership,

joint venture, trust or other enterprise, against expenses, including attorneys’ fees, judgments, fines and amounts paid in settlement

actually and reasonably incurred by him in connection with the action, suit or proceeding if he: (i) is not liable pursuant to NRS Section

78.138; or (ii) acted in good faith and in a manner which he reasonably believed to be in or not opposed to the best interests of the

Company, and, with respect to any criminal action or proceeding, had no reasonable cause to believe his conduct was unlawful.

Item

15. Recent Sales of Unregistered Securities.

During

the preceding three years, the Company has issued the following securities that were not registered under the Securities Act:

| (1) | On

April 15, 2024, the Company entered into a Securities Purchase Agreement with certain investors,

pursuant to which, and upon the terms and subject to the conditions and limitations set forth

in the agreement, the Company agreed to issue warrants to purchase up to 1,400,000 shares

of the Company’s common stock to the investors at an exercise price of $4.48. Each

warrant is exercisable six months from the date of issuance and has a term expiring five

years after such initial exercise date. |

The

offer, sale and issuance of the securities described in the paragraph above was offered and sold without registration under the Securities

Act in reliance on the exemptions provided by Section 4(a)(2) of the Securities Act and/or Regulation D promulgated thereunder. Each

of the recipients of securities in this transaction had adequate access, through business or other relationships to information about

the Company.

Item

16. Exhibits and Financial Statement Schedules.

EXHIBITS

| Exhibit

No |

|

Description |

| 2.1 |

|

Articles of Merger as filed with the Nevada Secretary of State on May 23, 2017 (incorporated by reference from Exhibit 3.1 to the Current Report on Form 8-K filed with the Securities and Exchange Commission, SEC file number 001-08266, on May 26, 2017). |

| 3.1 |

|

Articles of Incorporation filed with the Secretary of State of the State of Nevada (incorporated by reference from the Current Report on Form 8-K filed with the Securities and Exchange Commission, SEC file number 001-08266, on January 8, 2016). |

| 3.2 |

|

Certificate of Amendment to Articles of Incorporation dated July 6, 2016 (incorporated by reference from the Current Report on Form 8-K filed with the Securities and Exchange Commission, SEC file number 001-08266, on July 8, 2016). |

| 3.3 |

|

Certificate of Designation of Preferences, Rights and Limitations of Series A Preferred Stock (incorporated by reference from the Current Report on Form 8-K filed with the Securities and Exchange Commission, SEC file number 001-08266, on January 8, 2016). |

| 3.4 |

|

Certificate of Designations, Preferences and Rights of 0% Series B Convertible Preferred Stock (incorporated by reference from the Current Report on Form 8-K filed with the Securities and Exchange Commission, SEC file number 001-08266, on January 21, 2016). |

| 3.5 |

|

Certificate of Designation of Rights, Powers, Preferences, Privileges and Restrictions of 0% Series D Convertible Preferred Stock (incorporated by reference from the Current Report on Form 8-K filed with the Securities and Exchange Commission, SEC file number 001-08266, on August 5, 2016). |

| 3.6 |

|

Certificate of Designations, Preferences and Rights of the Company’s 0% Series C Convertible Preferred Stock (incorporated by reference from the Current Report on Form 8-K filed with the Securities and Exchange Commission, SEC file number 001- 08266 on May 26, 2017). |

| 3.7 |

|

Amended and Restated Bylaws (incorporated by reference from the Current Report on Form 8-K filed with the Securities and Exchange Commission, SEC file number 001-08266, on February 23, 2016). |

| 3.8 |

|

Certificate of Designations, Rights, Powers, Preferences, Privileges and Restrictions of the Company’s 0% Series F Convertible Preferred Stock (incorporated by reference from Exhibit 3.1 to the Current Report on Form 8-K filed with the Securities and Exchange Commission, SEC file number 001-08266 on June 20, 2019). |

| 3.9 |

|

Certificate of Amendment of Articles of Incorporation of U.S. Gold Corp (incorporated by reference from Exhibit 3.1 to the Current Report on Form 8-K filed with the Securities and Exchange Commission, SEC file number 001-08266 on March 19, 2020). |

| 3.10 |

|

Certificate of Designation of 0% Series G Convertible Preferred Stock (incorporated by reference from Exhibit 3.1 to the Current Report on Form 8-K filed with the Securities and Exchange Commission, SEC file number 001-08266, on March 30, 2020). |

| 3.11 |

|

Certificate of Amendment to Articles of Incorporation dated May 2, 2017 (incorporated by reference from Exhibit 3.1 to the Current Report on Form 8-K filed with the Securities and Exchange Commission, SEC file number 001-08266 on May 5, 2017). |

| 3.12 |

|

Certificate of Designations of Series H Convertible Preferred Stock (incorporated by reference from Exhibit 3.1 to the Current Report on Form 8-K filed with the Securities and Exchange Commission, SEC file number 001-08266 on August 13, 2020). |

| 3.13 |

|

Certificate of Designations of Series I Convertible Preferred Stock (incorporated by reference from Exhibit 3.1 to the Current Report on Form 8-K filed with the Securities and Exchange Commission, SEC file number 001-08266 on August 13, 2020). |

| 4.1 |

|

Form of Common Stock Purchase Warrant (incorporated by reference from Exhibits to the Current Report on Form 8-K with the Securities and Exchange Commission, SEC file number 001-08266, filed on May 12, 2011). |

| 4.2 |

|

Form of Class A Warrant Certificate (incorporated by reference from Exhibit 4.3 to the Current Report on Form 8-K filed with the Securities and Exchange Commission, SEC file number 001-08266 on June 20, 2019). |

| 4.3 |

|

Description of Securities (incorporated by reference from Exhibit 4.3 to the Annual Report on Form 10-K filed with the Securities and Exchange Commission, SEC file number 001-08266, on July 29, 2021). |

| 4.4 |

|

Form of Common Warrant (incorporated by reference from Exhibit 4.1 to the Current Report on Form 8-K filed with the Securities and Exchange Commission, SEC file number 001-08266, on January 28, 2021). |

| 4.5 |

|

Form of Common Stock Purchase Warrant (incorporated by reference from Exhibit 4.1 to the Current Report on Form 8-K filed with the Securities and Exchange Commission, SEC file number 001-08266, on February 18, 2022). |

| 4.6 |

|

Form of Common Stock Purchase Warrant (incorporated by reference from Exhibit 4.1 to the Current Report on Form 8-K filed with the Securities and Exchange Commission, SEC file number 001-08266, on March 21, 2022). |

| 4.7 |

|

Form of Common Stock Purchase Warrant (incorporated by reference from Exhibit 4.1 to the Current Report on Form 8-K filed with the Securities and Exchange Commission, SEC file number 001-08266, on April 10, 2023). |

| 4.8 |

|

Amendment No. 1 to Warrants (incorporated by reference from Exhibit 4.2 to the Current Report on Form 8-K filed with the Securities and Exchange Commission, SEC file number 001-08266, on April 10, 2023). |

| 4.9 |

|

Form of Warrant (incorporated by reference from Exhibit 4.1 to the Current Report on Form 8-K filed with the Securities and Exchange Commission, SEC file number 001-08266, on April 19, 2024). |

| 5.1 |

|

Opinion of Davis Graham & Stubbs LLP.* |

| 10.1 |

|

2014 Equity Incentive Plan (incorporated by reference from Exhibits to a Definitive Proxy Statement for an Annual Meeting of Shareholders held on November 10, 2014, filed with the Securities and Exchange Commission, SEC file number 001-08266, on October 21, 2014). |

| 10.2 |

|

2017 Equity Incentive Plan (incorporated by reference from Appendix A to a Definitive Proxy Statement for an Annual Meeting of Shareholders held on July 31, 2017, filed with the Securities and Exchange Commission, SEC file number 001- 08266, on July 12, 2017). |

| 10.3 |

|

Consulting Agreement dated January 7, 2021 by and between Ryan K. Zinke and U.S. Gold Corp. (incorporated by reference from Exhibit 10.3 to the Annual Report on Form 10-K filed with the Securities and Exchange Commission, SEC file number 001-08266, on July 29, 2021). |

| 10.4 |

|

Employment Agreement dated December 4, 2020 by and between George Bee and U.S. Gold Corp. (incorporated by reference from Exhibit 10.1 to the Current Report on Form 8-K filed with the Securities and Exchange Commission, SEC File number 001- 08266, on December 10, 2020). |

| 10.5 |

|

Employment Agreement dated December 4, 2020 by and between Eric Alexander and U.S. Gold Corp. (incorporated by reference from Exhibit 10.3 to the Current Report on Form 8-K filed with the Securities and Exchange Commission, SEC File number 001- 08266, on December 10, 2020). |

| 10.6 |

|

Employment Agreement dated July 19, 2021 by and between Kevin Francis and U.S. Gold Corp. (incorporated by reference from Exhibit 10.1 to the Current Report on Form 8-K filed with the Securities and Exchange Commission, SEC File number 001- 08266, on July 19, 2021). |

| 10.7 |

|

U.S. Gold Corp 2020 Stock Incentive Plan (incorporated by reference from Exhibit 10.1 to the Current Report on Form 8-K filed with the Securities and Exchange Commission, SEC File number 001-08266, on September 24, 2019). |

| 10.8 |

|

First Amendment to the U.S. Gold Corp. 2020 Stock Incentive Plan (incorporated by reference from Exhibit 10.1 to the Current Report on Form 8-K filed with the Securities and Exchange Commission, SEC File number 001-08266, on November, 10, 2020). |

| 10.9 |

|

Form of Leak-Out Agreement (incorporated by reference from Exhibit 10.2 to the Current Report on Form 8-K filed with the Securities and Exchange Commission, SEC file number 001-08266, on August 13, 2020). |

| 10.10 |

|

Form of Restricted Stock Unit Award Agreement under the U.S. Gold Corp. 2020 Stock Incentive Plan (incorporated by reference from Exhibit 10.5 of the Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission, SEC file number 001-08266, on December 16, 2019). |

| 10.11 |

|

Form of Restricted Stock Award Agreement under the U.S. Gold Corp. 2020 Stock Incentive Plan (incorporated by reference from Exhibit 10.6 of the Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission, SEC file number 001-08266, on December 16, 2019). |

| 10.12 |

|