UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended June 30, 2023

Or

☐

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____ to _____

Commission File Number: 001-41476

Treasure

Global Inc

(Exact name of registrant as specified in its charter)

| Delaware | | 36-4965082 |

| (State or other jurisdiction of

incorporation

or organization) | | (I.R.S. Employer

Identification No.) |

276 5th Avenue, Suite 704 #739,

New York, New York 10001

+6012 643 7688

(Address, including zip code, of registrant’s

principal executive offices and telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | | Trading Symbol | | Name of each exchange on which

registered |

| Common Stock, par value $0.00001 per share | | TGL | | The Nasdaq Stock Market LLC |

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes: ☐ No: ☒

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes: ☐

No: ☒

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities

Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports),

and (2) has been subject to such filing requirements for the past 90 days. Yes: ☒ No: ☐

Indicate

by check mark whether the registrant has submitted electronically, every Interactive Data File required to be submitted pursuant to Rule 405

of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files). Yes ☒ No ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company,” and “emerging growth company, in Rule 12b-2 of the Exchange Act.

| | Large accelerated filer | ☐ | Accelerated filer | ☐ |

| | Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| | Emerging Growth Company | ☒ | | |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C.7262(b)) by the registered

public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act,

indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to

previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements

that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during

the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule12b-2 of the Act). Yes: ☐ No: ☒

The aggregate market value of the Registrant’s common stock,

held by non-affiliates of the Registrant as of December 30, 2022 (which is the last business day of Registrant’s most recently completed

second fiscal quarter) based upon the reported closing price of $1.71 on The Nasdaq Capital Market on that date, was approximately $10.7

million.

The number of shares outstanding of the Registrant’s common stock,

par value $0.00001 per share, on September 25, 2023 was 20,317,579.

Table of Contents

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (this “Annual

Report”) contains “forward-looking statements.” Forward-looking statements reflect the current view about future

events. When used in this Annual Report, the words “anticipate,” “believe,” “estimate,” “expect,”

“future,” “intend,” “plan,” or the negative of these terms and similar expressions, as they relate

to us or our management, identify forward-looking statements. Such statements, include, but are not limited to, statements contained in

this Annual Report relating to our business strategy, our future operating results and liquidity and capital resources outlook. Forward-looking

statements are based on our current expectations and assumptions regarding our business, the economy and other future conditions. Because

forward–looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances

that are difficult to predict. Our actual results may differ materially from those contemplated by the forward-looking statements. They

are neither statements of historical fact nor guarantees of assurance of future performance. We caution you therefore against relying

on any of these forward-looking statements. Important factors that could cause actual results to differ materially from those in the forward-looking

statements include, without limitation:

| ● | Our

ability to effectively operate our business segments; |

| ● | Our

ability to manage our research, development, expansion, growth and operating expenses; |

| ● | Our

ability to evaluate and measure our business, prospects and performance metrics; |

| ● | Our

ability to compete, directly and indirectly, and succeed in a highly competitive and evolving industry; |

| ● | Our

ability to respond and adapt to changes in technology and customer behavior; |

| ● | Our

ability to protect our intellectual property and to develop, maintain and enhance a strong brand; and; |

| ● | Other

factors (including the risks contained in the section of this Annual Report entitled “Risk Factors”) relating to our industry,

our operations and results of operations. |

Should one or more of these risks or uncertainties

materialize, or should the underlying assumptions prove incorrect, actual results may differ significantly from those anticipated, believed,

estimated, expected, intended or planned.

Factors or events that could cause our actual

results to differ may emerge from time to time, and it is not possible for us to predict all of them. We cannot guarantee future results,

levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States,

we do not intend to update any of the forward-looking statements to conform these statements to actual results.

PRESENTATION OF INFORMATION

Except as otherwise indicated by the context,

references in this Annual Report to the “Company,” “TGL,” the “registrant,” “we,”

“our,” or “us” in this Annual Report mean Treasure Global Inc. and its subsidiaries, which include the collective

operations of Treasure Global Inc and its consolidated subsidiaries.

This Annual Report includes our audited consolidated financial statements

as of and for the fiscal years ended June 30, 2023 and 2022. These financial statements have been prepared in accordance with generally

accepted accounting principles in the United States (“U.S. GAAP”). All financial information in this Annual Report is presented

in U.S. dollars, unless otherwise indicated, and should be read in conjunction with our audited consolidated financial statements and

the notes thereto included in this Annual Report.

SUMMARY OF RISK FACTORS

Our business is subject to a number of

risks. You should be aware of these risks before making an investment decision. These risks are discussed more fully in Item 1A:

Risk Factors in this Annual Report. These risks include, among others, that:

| ● | There is substantial doubt about our ability to continue as a going concern; |

| |

● |

We have a limited operating history in an evolving industry, which makes it difficult to evaluate our future prospects and may increase the risk that we will not be successful; |

| |

● |

If we fail to raise capital when needed it will have a material adverse effect on the Company’s business, financial condition and results of operations; |

| |

● |

None of our material contracts are long term and if not renewed could have a material adverse effect on our business; |

| |

● |

We rely on email, internet search engines and application marketplaces to drive traffic to our ZCITY platform, certain providers of which offer products and services that compete directly with our products. If links to our applications and website are not displayed prominently, traffic to our ZCITY platform could decline and our business would be adversely affected; |

| |

● |

The ecommerce market is highly competitive and if the Company does not have sufficient resources to maintain research and development, marketing, sales and client support efforts on a competitive basis our business could be adversely affected; |

| |

● |

The market for our ZCITY platform is new and unproven; |

| |

● |

If we are unable to expand our systems or develop or acquire technologies to accommodate increased volume or an increased variety of operating systems, networks and devices broadly used in the marketplace our ZCITY platform could be impaired; |

| |

● |

As we increase our reliance on cloud-based applications and platforms to operate and deliver our products and services, any disruption or interference with these platforms could adversely affect our financial condition and results of operations; |

| |

● |

The Company’s failure to successfully market its ZCITY platform could result in adverse financial consequences; |

| |

● |

The Company may not be able to successfully develop and promote new products or services which could result in adverse financial consequences; |

| |

● |

A decline in the demand for goods and services of the merchants included in the ZCITY platform could result in adverse financial consequences; |

| |

● |

The effective operation of the Company’s ZCITY platform is dependent on technical infrastructure and certain third-party service providers; |

| |

● |

There is no assurance that the Company will be profitable; |

| |

● |

Illegal use of our ZCITY platform could result in adverse consequences to the Company; |

| |

● |

Malaysia is experiencing substantial inflationary pressures which may prompt the governments to take action to control the growth of the economy and inflation that could lead to a significant decrease in our profitability; |

| |

● |

The economy of Malaysia in general might not grow as quickly as expected, which could adversely affect our revenues and business prospects; |

| |

● |

Fluctuations in exchange rates in the Malaysian Ringgit could adversely affect our business and the value of our securities; |

| |

● |

Regulation of gift cards or “E-vouchers” could have adverse consequences on our business; |

| |

● |

Litigation is costly and time consuming and could have a material adverse effect our business, results or operations and reputation; |

| |

● |

Our financial statements have been prepared on a going-concern basis and our continued operations are in doubt; |

| |

● |

We face potential liability and expense for legal claims based on the content on our Platform; |

| |

● |

Our intellectual property rights may be inadequate to protect us against protect us others claiming violations of their proprietary rights and the cost of enforcement could be significant; |

| |

● |

Third parties may assert that our employees or consultants have wrongfully used or disclosed confidential information or misappropriated trade secrets; |

| |

● |

Our failure to maintain effective internal controls over financial reporting could have an adverse impact on us; |

| |

● |

We are an “emerging growth company” under the JOBS Act and we cannot be certain if the reduced disclosure requirements applicable to emerging growth companies will make our common stock less attractive to investors; |

| |

● |

The elimination of personal liability against our directors and officers under Delaware law and the existence of indemnification rights held by our directors, officers and employees may result in substantial expenses; |

| |

● |

We have not paid dividends in the past and do not expect to pay dividends in the future, and any return on investment may be limited to the value of our stock. |

PART I

Item 1.

Business

Our Mission

Our mission is to bring together the worlds of

online e-commerce and offline physical retailers; widening consumer choice and rewarding loyalty, while sustaining and enhancing our earning

potential.

Our Company

We have created an innovative online-to-offline

(“O2O”) e-commerce platform business model offering consumers and merchants instant rebates and affiliate cashback programs,

while providing a seamless e-payment solution with rebates in both e-commerce (i.e., online) and physical retailers/merchant (i.e., offline)

settings.

Our proprietary product is an internet application

(or “App”) branded “ZCITY App,” which was developed through our wholly owned subsidiary, ZCity Sdn. Bhd. (formerly

known as Gem Reward Sdn. Bhd, name change effected on July 20, 2023) (“ZCITY”). The ZCITY App was successfully launched in

Malaysia in June 2020. ZCITY is equipped with the know-how and expertise to develop additional/add-on technology-based products and services

to complement the ZCITY App, thereby growing its reach and user base.

Through simplifying a user’s e-payment gateway

experience, as well as by providing great deals, rewards and promotions with every use, we aim to make the ZCITY App Malaysia’s

top reward and payment gateway platform. Our longer-term goal is for the ZCITY App and its ever-developing technology to become one of

the most well-known commercialized applications more broadly in Southeast Asia and Japan.

As of September 25, 2023, we had 2,642,404 registered users and 2,025 registered merchants.

Corporate Structure

Treasure

Global Inc is a Delaware corporation that was incorporated on March 20, 2020. We issued 10,000,000 shares to Kok Pin

“Darren” Tan, our founder and former Chief Executive Officer on July 1, 2020, who as a result became our sole

shareholder.

ZCity Sdn. Bhd. (formerly known as Gem Reward

Sdn. Bhd, name change effected on July 20, 2023), a Malaysia private limited company was incorporated on June 6, 2017. Prior to the incorporation

of ZCITY, Kok Pin “Darren” Tan entered into a Beneficial Shareholding Agreement (“Beneficial Shareholding Agreement

1”) with two individuals, one of which is a vice president of the Company (the “Initial ZCITY Shareholders”), which

provided for the Initial Shareholders to hold the ZCITY shares issued to them in equal amounts and for the sole benefit of Kok Pin “Darren”

Tan and provided Kok Pin “Darren” Tan with control over the voting and disposition over such shares as well as control over

the issuance of additional ZCITY shares in consideration for equity in a company that had not been determined on the date of Beneficial

Shareholding Agreement 1. On November 10, 2020, Kok Pin “Darren” Tan instructed the Initial ZCITY Shareholders to issue one

million additional ZCITY shares to Chong Chan “Sam” Teo, currently our Chief Executive Officer, and as a result each Initial

ZCITY Shareholder and Chong Chan “Sam” Teo held one million shares of ZCITY. On November 10, 2020. Chong Chan “Sam”

Teo entered into a Beneficial Shareholding Agreement with Kok Pin “Darren” Tan with terms similar to Beneficial Shareholding

Agreement 1 (“Beneficial Shareholding Agreement 2” and together with the Beneficial Shareholding Agreement 1, the “Beneficial

Shareholding Agreements”). As a result of Kok Pin “Darren” Tan’s 100% ownership of our common stock and the Beneficial

Shareholding Agreements, TGL and ZCITY were both under the sole control of Kok Pin “Darren” Tan.

TGL and ZCITY were reorganized into a parent subsidiary

structure pursuant to a Share Swap Agreement, dated March 11, 2021, as amended on March 11, 2021 among TGL, the Initial ZCITY Shareholders

and Chong Chan “Sam” Teo (the “Share Swap Agreement”), in which TGL exchanged 321,585 shares of its common stock

(the “Swap Shares”) for all equity of ZCITY. Pursuant to the Share Swap Agreement, the purchase and sale of the Swap Shares

was completed on March 11, 2021, but the issuance of the Swap Shares did not occur until October 27, 2021 when TGL amended its certificate

of incorporation to increase the number of its authorized common stock to a number that was sufficient to issue the Swap Shares. As a

result of the Share Swap Agreement, (i) ZCITY became the 100% subsidiary of TGL and Kok Pin “Darren” Tan no longer had any

control over ZCITY’s ordinary shares; and (ii) Kok Pin “Darren” Tan, the Initial ZCITY Shareholders and Chong Chan “Sam”

Teo owned 100% of the TGL common stock (Darren Tan owning 97%). Subsequent to the date of the Share Swap Agreement, Kok Pin “Darren”

Tan transferred 9,529,002 of his 10,000,000 shares of TGL common stock to 16 individuals and entities and currently owns less than 5%

of our common stock.

We operate solely through our subsidiaries: (i)

ZCITY; (ii) AY Food Ventures Sdn Bhd; (iii) Morgan Global Sdn. Bhd; and (iv) Foodlink. ZCITY owns all intellectual property rights to

copyrightable, patentable, and other protectable intangible assets relating to our business, including trademarks.

Corporate Information

Our principal executive offices are located at

276 5th Avenue, Suite 704 #739, New York, New York 10001 and No.29, Jalan PPU 2A, Taman Perindustrian Pusat Bandar Puchong,

47100 Puchong, Selangor, Malaysia.

Business Developments

The following highlights recent material developments

in our business:

| |

● |

In November 2022, we announced that we signed a Memorandum of Understanding with iPay88 Holding Sdn Bhd (“iPay88”), a leading payment company that offers e-commerce, retail, online banking, e-wallets solutions and more to its merchants in Southeast Asia, to become TGL’s exclusive payment gateway partner for ZCITY, as well as a partner for TGL’s digital food and beverage (“F&B”) management platform, TAZTE. |

| |

● |

In January 2023, we announced that we signed a Memorandum of Understanding to discuss a new strategic partnership in Malaysia with Boost, a regional full spectrum fintech player. |

| |

● |

In March 2023, we announced that our Board of Directors (“Board”) appointed Ho Yi Hui as a member of the Board effective on March 20, 2023. |

| |

● |

In May 2023, we announced that we entered into a licensing agreement with Morganfield’s Holding Sdn Bhd (“Morganfield’s”), a restaurant chain specializing in comfort food and American-style barbecue, in which Morganfield’s granted TGL an exclusive worldwide license to grant sub-licensees to third parties to use Morganfield’s trademarks for the restaurant business. |

| |

● |

In May 2023, we announced that we entered into an exclusive partnership with enogy, a health and wellness brand, to expand the range of products available on our e-commerce marketplace, Zstore, targeting the large and growing health and wellness industry. |

| |

● |

In June 2023, we announced that we entered into a licensing agreement with Sigma Muhibah Sdn Bhd (“Abe Yus”), a fast-growing Malaysian group of F&B brands, in which Abe Yus granted TGL the exclusive worldwide right to grant sub-licensees to third parties to use Abe Yus’ trademarks for the F&B business chain, in line with our strategic plan to become a leading franchisor of F&B companies in Southeast Asia. |

| |

|

|

| |

● |

In July 2023, we announced that we signed a Memorandum of Understanding for a collaboration agreement with the Malaysia Retail Chain Association for TAZTE to become its exclusive partner as the recommended digital F&B management solution to its members in Malaysia. |

| |

|

|

| |

● |

In July 2023, we entered into a Collaboration Agreement (the “Collaboration Agreement”) with VCI Global Limited (NASDAQ: VCIG) (“VCI Global”), a multi-disciplinary consulting group focused on business and technology, in which VCI Global and us shall collaborate to develop an artificial intelligence (“AI”)-powered travel platform (“Platform”) which utilizes advanced technology, including high-tech and predictive technology, to assist its users in discovering the best places to visit, explore, dine and engage in various activities during their travel in Malaysia. |

| |

● |

In July 2023, we announced that we will collaborate with Borderland Music Festival 2023 to provide the first cashless and ticketing platform-powered music festival in Malaysia. |

| |

|

|

| |

● |

In August 2023, we announced that we signed a letter of intent to form an e-commerce venture in Indonesia, PT Harmoni Bagi Dunia (“HBD”) with industry pioneers Ariadi Anaya and Budihardjo Iduansjah, in which we will hold a 70% major stake in HBD. |

Recent Developments

| |

● |

In July 2023, we engaged WWC, P.C. to serve as our independent registered public accounting firm, effective July 3, 2023. |

| |

|

|

| |

● |

In August 2023, we received a letter from the Nasdaq Listing Qualifications Staff of The Nasdaq Stock Market LLC (“Nasdaq”) therein stating that for the 30 consecutive business day period between July 6, 2023 through August 16, 2023, the common stock of the Company had not maintained a minimum closing bid price of $1.00 per share required for continued listing on The Nasdaq Capital Market pursuant to Nasdaq Listing Rule 5550(a)(2) (the “Bid Price Rule”). Pursuant to Nasdaq Listing Rule 5810(c)(3)(A), the Company was provided an initial period of 180 calendar days, or until February 13, 2024 (the “Compliance Period”), to regain compliance with the Bid Price Rule. To regain compliance, the closing bid price of the Company’s common stock must meet or exceed $1.00 per share for a minimum of 10 consecutive trading days, unless extended by Nasdaq under Nasdaq Rule 5810(c)(3)(H), prior to February 13, 2024. The notice from Nasdaq has no immediate effect on the listing of the Company’s common stock and its common stock will continue to be listed on The Nasdaq Capital Market under the symbol “TGL.” The Company is currently evaluating its options for regaining compliance. There can be no assurance that the Company will regain compliance with the Bid Price Rule or maintain compliance with any of the other Nasdaq continued listing requirements. |

Market Opportunity

We expect that continued strong economic expansion,

robust population growth, rising level of urbanization, the emergence of the middle class and the increasing rate of adoption of mobile

technology provide market opportunities for our Company in Southeast Asia (“SEA”). SEA is a large economy and, as of 2022,

its gross domestic product (“GDP”) was US$3.66 trillion.1 In comparison, the respective GDP for both the European

Union (“EU”) and the United States (“US”) totaled EUR$15.8 trillion and US$25.5 trillion2 in 2022.

SEA has experienced rapid economic growth rates in recent years, far exceeding growth in major world economies such as Japan, the EU

and the US. According to the International Monetary Fund (“IMF”), Malaysia’s GDP growth averaged more than 4.5% from

2016 to 2019. However, it experienced a deficit of -5.5% in 2020 due to the COVID-19 pandemic. Nevertheless, it rebounded to 3.1% and

8.7% in 2021 and 2022 respectively, and it is expected to maintain an average annual growth rate of 4.5% for the next five years, including

2023.3 The GDP of Malaysia amounted to US$337 billion in 2020 and is projected to reach approximately US$500 billion by 2025.4

Malaysia registered a strong post-pandemic recovery in 2022. Its strong macroeconomic policy frameworks, including a track record of

fiscal prudence and a credible monetary policy framework, have served the country well.

SEA continues to enjoy robust population growth.

The United Nations Population Division estimates that the population of the SEA countries in 2000 was approximately 525 million people,

growing to 681 million in 2022. According to the World Bank, Malaysia had a population of approximately 33 million people in 2022 compared

to 23 million people in 2000.5

| 1 |

https://www.statista.com/statistics/796245/gdp-of-the-asean-countries/ |

| 2 |

https://www.statista.com/statistics/279447/gross-domestic-product-gdp-in-the-european-union-eu/ https://www.statista.com/statistics/263591/gross-domestic-product-gdp-of-the-united-states/ |

| 3 |

https://www.imf.org/en/News/Articles/2023/05/31/pr23191-malaysia-imf-executive-board-concludes-2023-article-iv-consultation-with-malaysia |

| 4 |

IMF Staff Report March 2021 |

| 5 |

https://www.worldometers.info/world-population/south-eastern-asia-population/ |

| | https://data.worldbank.org/indicator/SP.POP.TOTL?locations=MY |

A high percentage of Malaysians have lived in

cities for the last decade and that percentage is increasing. Since 2011, Malaysia’s urbanization has increased from approximately

71.61% to approximately 77.7% in 2022.6 By comparison, in 2021 the urbanization rates for China, Vietnam and India were approximately

62.51%, 37% and 35%, respectively.7

Urbanization is highly correlated with the size

and growth of the middle class. Simply put, urbanization drives middle class consumption demand. According to the World Bank, Malaysia

is likely to transition from an upper-middle-income economy to a high-income economy between 2024 and 2028, a reflection of the country’s

economic transformation development trajectory over the past decades.8 In fact, Malaysia’s gross national income per

capita is at US$11,200 according to latest estimates, only US$1,335 short of the current threshold level that defines a high-income economy.9

And despite the ongoing effects from the COVID-19

pandemic, the Internet economy continues to boom in SEA. According to a Google Temasek e-Conomy SEA 2022 Report (the “Google Report”),

internet usage in the region increased with 20 million new users added in 2022 for a total of 460 million compared to 360 million in 2019

and 440 million in 2021. An additional 100 million internet users have come online in the last three years since 2020.10 In

year 2022, 94% of Malaysia’s population is now online, compared to approximately 62% in 2013.11 It is forecasted to continuously

increase between 2024 and 2028, totaling a growth of 0.4 percentage points. 81% and 80% of Malaysia and SEA’s internet users, respectively,

have made at least one purchase online. E-commerce, online media and food delivery adoption and usage surged with the total value of goods

and services sold via the Internet, or gross merchandise value (“GMV”), in SEA, expected to reach approximately US$200 billion

by year end 2022 according to the Google Report. In fact, according to the Google Report, the SEA Internet sector GMV is forecast to grow

to over US$360 billion by 2025 up from the $300 billion forecast in the Google, Temasek, Bain SEA Report 2022.12

Malaysia’s internet economy has grown from

$14 billion in 2020 to $21 billion in 2021 (47% growth) and is expected to grow to $35 billion in 2025.13

As consumers in these markets gradually shift

towards the online platform model, the total value of internet-based transactions has grown tremendously and is expected to keep doing

so. According to the Google Report, total the GMV of South Asia’s Internet economy is expected to skyrocket from US$174 billion

in 2021 to US$363 billion in 2025.

We believe that these ongoing positive economic and demographic trends

in SEA and South Asia propel demand for our e-commerce platform.

| 6 |

https://www.statista.com/statistics/455880/urbanization-in-malaysia/ |

| 7 |

https://www.statista.com/ |

| 8 |

https://www.worldbank.org/en/country/malaysia/overview#1 |

| 9 |

The World Bank Press Release dated March 16, 2021, https://www.worldbank.org/en/news/press-release/2021/03/16/aiminghighmalaysia |

| 10 |

https://services.google.com/fh/files/misc/e_conomy_sea_2022_report.pdf |

| 11 |

https://www.statista.com/statistics/975058/internet-penetration-rate-in-malaysia/ |

| 12 |

https://www.bain.com/globalassets/noindex/2021/e_conomy_sea_2021_report.pdf

https://services.google.com/fh/files/misc/e_conomy_sea_2022_report.pdf |

| 13 |

https://www.digitalnewsasia.com/digital-economy/e-conomy-sea-report-2021-malaysias-internet-economy-crosses-us21-bil |

About the ZCITY App

SEA consumers have access to a plethora of smart

ordering, delivery and “loyalty” websites and apps, but in our experience, SEA consumers very rarely receive personalized

deals based on their purchases and behavior.

The ZCITY App targets consumers through the provision

of personalized deals based on consumers’ purchase history, location and preferences. Our technology platform allows us to identify

the spending trends of our customers (the when, where, why, and how much). We are able to offer these personalized deals through the application

of our proprietary artificial intelligence (or “AI”) technology that scours the available database to identify and create

opportunities to extrapolate the greatest value from the data, analyze consumer behavior and roll out attractive rewards-based campaigns

for targeted audiences. We believe this AI technology is currently a unique market differentiator for the ZCITY App.

We operate our ZCITY App on the hashtag: “#RewardsOnRewards.”

We believe this branding demonstrates to users the ability to spend ZCITY App-based Reward Points (or “RP”) and “ZCITY

Cash Vouchers” with discount benefits at checkout. Additionally, users can use RP while they earn rewards from selected e-Wallet

or other payment methods.

ZCITY App users do not require any on-going credit

top-up or need to provide bank card number with their binding obligations. We have partnered with Malaysia’s leading payment gateway,

iPay88, for secure and convenient transactions. Users can use our secure platform and enjoy cashless shopping experiences with rebates

when they shop with e-commerce and retail merchants through trusted and leading e-wallet providers such as Touch’n Go eWallet, Boost

eWallet, GrabPay eWallet and credit card/online banking like the “FPX” (the Malaysian Financial Process Exchange) as well

as more traditional providers such as Visa and Mastercard.

Our ZCITY App also provides the following functions:

| |

1. |

Registration and Account verification |

Users may register as a ZCITY App user

simply, using their mobile device. They can then verify their ZCITY App account by submitting a valid email address to receive new user

“ZCITY Newbie Rewards”.

| |

2. |

Geo-location-based Homepage |

Based on the users’

location, nearby merchants and exclusive offers are selected and directed to them on their homepage for a smooth, user-friendly

interaction.

Our ZCITY App is affiliated with more

than five local services providers such as Shopee and Lazada. The ZCITY App allows users to enjoy more rewards when they navigate from the

ZCITY App to a partner’s website.

| |

4. |

Bill Payment & Prepaid service |

Users can access and pay utility bills,

such as water, phone, internet and TV bills, while generating instant discounts and rewards points with each payment.

Users can purchase their preferred e-Vouchers

with instant discounts and rewards points with each checkout.

| |

6. |

User Engagement through Gamification |

Users can earn daily rewards by playing

our ZCITY App minigame “Spin & Win” where they can earn further ZCITY RP, ZCITY e-Vouchers as well as monthly grand prizes.

ZCITY has collaborated with the Ministry

of Domestic Trade and Cost of Living (KPDN) for the launch of the ‘Payung Rahmah’ program (ZCITY RAHMAH Package). This program

offers a comprehensive package of living essential e-vouchers on the ZCITY app for items such as petrol, food, and bills. ZCITY users

will be able to purchase vouchers for these items at reduced prices, thereby assisting low-income Malaysians and helping to address this

societal challenge.

| |

8. |

TAZTE Smart F&B system |

ZCITY App offers a “Smart F&B”

system that provides a one stop solution and digitalization transformation for all registered Food and Beverage (“F&B”)

outlets located in Malaysia. It also allows merchants to easily record transactions with QR Digital Payment technology, set discounts

and execute RP redemptions and rewards online on the ZCITY App.

By utilizing our CRM analytics software

to attract and retain consumers through personalized promotions, we believe that data-driven engagement can be more efficiently harnessed

to generate greater profitability.

Zstore is ZCITY App’s e-mall service

that offers group-buys and instant rebate to users with embedded AI and big data analytics to provide an express shopping experience.

The functionality and benefit of users to use the Zstore can be summarized within the chart below:

Set out below is an illustration of some of our

key partnerships by category:

Retail

Merchant Agreements. We have retail merchant agreements with Morganfield’s Holdings Sdn. Bhd, and the Alley which together

own more than 100 offline food and beverage franchises in Malaysia. Each of these retail merchants have signed our standard retail merchant

agreement which allow merchants to sell their products on the ZCITY App for which we receive a commission ranging from 1% to 10% depending

on the category of goods or services being purchased on the ZCITY App. These agreements also provide that each party may use the intellectual

property marks of the other party without charge. These agreements may be terminated by either party with 30 days’ notice. On June

6, 2023, TGL entered into a licensing agreement with the fast-growing Malaysian F&B brand, Abe Yus. This agreement grants TGL the

exclusive worldwide right to sublicense third parties to use Abe Yus’ trademarks for their F&B business chain. Serving as the

master franchisor, TGL will oversee brand loyalty and raw material supply. Additionally, all Abe Yus F&B outlets will be required

to adopt TAZTE, TGL’s digital F&B management system, across all their operations and generating more revenue through monthly

licensing fees, start-up fees for new location and supply chain management.

Services

Partners Agreements. We have service provider agreements with Coup Marketing Asia Pacific Sdn. Bhd. D/B/A Pay’s Gift

and MOL Access Portal Sdn. Bhd. D/B/A Razer Gold in which Pay’s Gift and Razer Gold provide us with e-vouchers for use on the

ZCITY App that provide users with discounts on goods and services of many top multinational and lifestyle brands, including gas,

clothing, fast food, movie theaters and others. We pay the service partner for the cost of the e-voucher plus a service fee. These

contracts provide for the use by us of the trademarks of the service providers and may be terminated at any time with 30 days’

notice. ZCITY has also entered into an agreement with Apigate Sdn Bhd, a wholly-owned subsidiary of Axiata Digital, branded as Boost

Connect. This agreement was entered into on July 28, 2023, and commenced on the same date, July 28, 2023. It shall continue until

March 1, 2024. Apigate Sdn Bhd is a global digital monetization and customer growth platform ecosystem provider, which offers us the

services for the reselling of digital vouchers.

Local Strategic Partner Agreements.

We have local strategic partner agreements with iPay88. The agreements we enter into with these local strategic partners provide us with

payment gateways (i.e, online “checkout” portals) used to enter credit card information for payment of goods and services.

The iPay88 agreement was entered into on August

6, 2021 and provides our users with payment gateways that include credit card processing, online banking services from certain banks in

Malaysia and eWallet payment processing such as Touch’ N Go eWallet, Grabpay, ShopeePay, Boost eWallet etc for which iPay88 receives

a fee ranging from 1.0% to 1.6% of the processed transaction depending on the credit card used or if the transaction is online banking

or eWallet.

ZCity

Sdn Bhd (formerly known as Gem Reward Sdn Bhd), has entered into a business partner agreement with CIMB Bank to establish a payment gateway.

This agreement enables users to conveniently make payments using their CIMB Bank credit and debit cards. Additionally, users have the

added benefit of enjoying rewards for their spending at ZCITY through this partnership.

Local Demands Agreements. We

have local demand agreements with Digi Telecommunication Sdn. Bhd. (“Digi”) and ATX Distribution Sdn. Bhd. (“ATX”)

which provide ZCITY App users bill payment services.

The Digi agreement was entered on December 16, 2021 and provides our

users with bill payment services for all of its telecommunication products and services to postpaid subscribers. We receive a commission

from Digi of 0.5% for each transaction. ZCITY App users may also use Digi’s prepaid automatic internet payment service for which

we receive a commission from Digi of 2.5% for each reload. The Digi agreement may be terminated by either party with 30 days’ notice.

CelcomDigi kicked off full-scale integration of Digi & Celcom network in December 2022. This marks one of the largest telecommunications

network deployment projects in Malaysia.

The ATX agreement was entered into on November

8, 2021 whereby ATX and provides our users with bill payment services for many companies in Malaysia, including but not limited to, certain

utilities, telecommunication companies, insurance companies, entertainment companies and charities. We receive a commission on each transaction

from ATX at different rates depending on the company for which the bill is being paid. The ATX agreement may be terminated by either party

with 30 days’ notice.

The Company has both direct and indirect

relationships with merchants and service providers. In terms of the Company’s indirect relationships, through the service

partner’s agreement the Company is able to offer e-vouchers for leading brands including, among others, Shell, Lazada

FamilyMart and Watsons; while via the iPay88 agreement, the Company gains access to other e-wallet providers, such as Boost and

Grabpay. Additionally, through the Company’s agreement with ATX Distribution, it is able to gain access to bill payment

services provided by Malaysia’s telco service provider such as, among others, CelcomDigi, U Mobile, Astro and Air

Selangor.

Download ZCITY App

ZCITY App is free to download from the Google Play Store, Apple iOS

Store, and Huawei AppGallery.

ZCITY Apps’s Reward Points Program

Operating under the hashtag #RewardsOnRewards,

we believe the ZCITY App reward points program encourages users to sign up the app, as well

as increasing user engagement and spending on purchases/repeat purchases and engenders user loyalty.

Furthermore, we believe the simplicity of the

steps to obtaining Reward Points (or “RP”) is an attractive incentive to user participation in that participants receive:

| |

● |

200 RP for registration as a new user; |

| |

|

|

| |

● |

100 RP for referral of a new user; |

| |

|

|

| |

● |

Conversion of Malaysian ringgit spent into RP; |

| |

|

|

| |

● |

50% RP of every user paid amount; and |

| |

|

|

| |

● |

25% RP of every referred user paid amount as a result of the referral. |

The key objectives of our RP are:

| ○ | RP are offered to users

for increased social engagement. |

| ○ | RP incentivizes users

with every MYR spent in order to increase the spending potential and to build users loyalty. |

| ○ | Drives loyalty and greater

customer engagement. Every new user onboarded will get 200 RP as welcoming gift. |

| ○ | Rewards users with RP

when they refer a new user. |

Offline Merchant

When using our ZCITY App to make payment to a

registered physical merchant, the system will automatically calculate the amount of RP to deduct. The deducted RP amount is based on the

percentage of profit sharing as with the merchant and the available RP of the user.

Online Merchant

When using our ZCITY App to pay utility bills

or purchase any e-vouchers, our system shows the maximum RP deduction allowed and the user determines the amount of discount deducted

subject to maximum deductions described below and the number of RP owned by such user.

Different features have different maximum deduction

amounts. For example, for bill payments, the maximum deduction is up to 3% of the bill amount. For e-vouchers, the maximum deduction is

up to 5% of the voucher amount.

In order to increase the spending power of the

user, our ZCITY App RP program will credit RP to the user for all MYR paid.

Merchant Facing Business

At present, our ZCITY merchants are concentrated

in the F&B and lifestyle sectors. Moving forward, we plan to expand our product/service offering to include grocery stores, convenience

stores, “micro-SME” (“small to medium size enterprises”) loan programs, affiliate programs

and advertising agencies.

We believe that ZCITY’s TAZTE Smart F&B

System, launched in the fourth quarter of 2022, provides merchants with a one-stop automated solution to digitalize their business. It

offers an innovative and integrated technology ecosystem that addresses and personalizes each merchant’s technological needs and

aims to be at the forefront of creating a smart consumer experience, thereby eliminating conventional and outdated standalone point of

sale (or “POS”) systems.

TAZTE allows merchants to effortlessly record

transactions with online payment or QR digital payment technology, set discounts and execute RP redemptions and rewards online, all via

our ZCITY App. It utilizes ZCITY App’s CRM analytics software to attract and retain consumers through personalized, data-driven

engagement to generate greater profitability.

TAZTE Smart F&B System also features a ‘Deviceless

Queue System’ that reduces staff headcount and a private domain delivery service that will allow merchants access to multiple dedicated

delivery partners to ensure outstanding delivery service to consumers.

Licensing Agreements

Abe Yus

On June 6, 2023, AY Food Ventures Sdn Bhd (“AYFV”),

one of our wholly owned subsidiaries entered into a licensing agreement with Sigma Muhibah Sdn Bhd, a food & beverage company, in

which Abe Yus granted AYFV the exclusive worldwide right to grant sub-licensees to any third parties to use Abe Yus’ trademarks

for its food & beverage business chain (the “Abe Yus Licensing Agreement”). As the master franchisor, AYFV will manage

brand loyalty and raw material supply. Under the Abe Yus Licensing Agreement, all the Abe Yus F&B outlets will be obligated to adopt

TAZTE, our digital F&B management system, across all our businesses.

Morganfield’s

On May 1, 2023, through our subsidiary, Morgan

Global Sdn. Bhd. and Morganfield’s Holdings Sdn. Bhd., a restaurant chain specializing in comfort food and American-style barbecue,

entered into a Worldwide Master License Agreement (the “Morganfield’s License Agreement”), in which Morganfield’s

granted us an exclusive worldwide license to grant sub-licensees to third parties to use Morganfield’s trademarks for the restaurant

business. Pursuant to the Morganfield’s License Agreement, Morganfield’s will also adopt our digital food & beverage management

system, TAZTE, in its nine franchisees in Malaysia, China and Singapore, accelerating the rollout of TAZTE in the region.

The term of the Morganfield’s License Agreement

is for a period of five years, from May 1, 2023 to May 1, 2028, and will automatically renew for another five years upon expiration of

the initial term unless the Morganfield’s License Agreement is terminated. We will be entitled the right to collect payment of the

total monthly collections from our sub-licensees, namely current licensees and the newly-appointed sub-licensees provided that we pay

to Morganfield’s the monthly management fees, the amount of which will range depending on our total monthly collection from our

sublicensees in any given period, with a minimum monthly payment of RM 90,000 in year 1, RM 100,000 in year 2, RM 110,000 in year 3, RM

120,000 in year 4 and RM 130,000 in year 5.

Foodlink

As we became closer to the F&B industry and

increased our understanding, we saw a significant opportunity that would not only support the distribution of TAZTE, but establish several

new revenue streams for us. Our strategic plan is to establish synergies with our technology solutions by becoming a master licensor of

F&B companies in Southeast Asia. We will adopt TAZTE into new restaurants, while also receiving revenue from monthly licensing fees

and start-up fees with little barrier to entry.

Under the subsidiary named “Foodlink”

that TGL has established to house F&B master franchisor activity, the subsidiary will manage all brand royalties and related IP through

lease, ownership or JV agreements; and provide F&B consulting including market & product optimization as well as supply chain monetization.

TAZTE Smart F&B System shall be adopted in Morgan Global and AY Food Venture licensee holder.

Marketing Strategy - Consumer

With the number of available apps for download

from the world’s leading app stores totaling over four million, we believe that structured and innovative user marketing strategy

is the only way to stand out in today’s app market. Aside from focusing on app development and building our app features properly,

we believe we need to get our app featured on the leading platforms to most successfully extend our reach and user base.

We believe that our ZCITY App marketing strategy

covers the user from when they first learn about our ZCITY App, to when they become a regular repeat user. The marketing strategy for

the ZCITY App involves defining our target audience, learning how best to reach them, how best to communicate with them, and analyzing

their “in-app” behavior to make continuous AI driven improvements as users move through the recruitment funnel.

Ultimately, the goal of our ZCITY App marketing

strategy is to acquire users that will not only drive repeat engagement, but will also become loyal advocates for the ZCITY App.

At the initial launch of the ZCITY App in June

2020, we combined both online and offline strategies in branding and marketing, which we believed would effectively communicate our objectives,

reaching a prospective target audience and turning that target audience into users of our ZCITY App.

Other than just user experience and features offered

in the app itself, we believe consumers are choosing brands whose messaging, marketing and values go beyond the product, and have a potentially

deeper meaning to the user. For example, they may consider brand trustworthiness and identity to be major influences on their market decisions.

As a result, we have focused on building brand loyalty to drive on going marketing success, increase repeat users and attain greater market

share.

In this regard, we have chosen to adapt various

marketing strategies, such as re-targeting users and enticing current users to use our app on multiple occasions, by providing what users

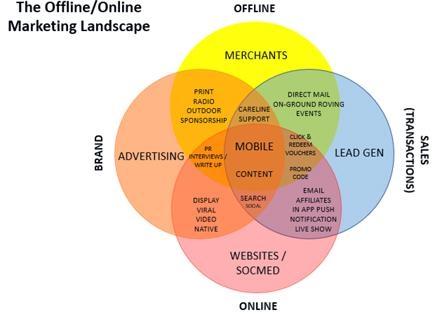

look for when they choose our app in order to increase engagement and retention. The diagram below reflects the strategies we engage in

to promote marketing success and avoid missed opportunities.

We adopt a multi-pronged approach to user outreach

through outdoor digital billboards, radio commercials, third party editorials and advertorials, social media postings on platforms such

as Facebook, Instagram, TikTok, YouTube, as well as the targeting of users through Google ads and direct email marketing to encourage

downloads and promote various campaigns.

Since the outbreak of the COVID-19 pandemic, we

have been very focused on reaching our target audience through digital media due to movement restrictions and retail closures. Advertisements

especially on social media have become more routine.

Social media-based advertising can be very targeted,

helping to convert new users into repeat users and building brand loyalty. We reach potential users based on criteria, including, among

others, job title, interests, marital status, and recent locations. We believe that it is much easier to measure and optimize social media

campaigns while they are active. If an advertisement isn’t producing the expected results, we can suspend the campaign or reallocate

funds on demand.

Another key media vehicle that we utilize is Universal

App Campaign (or “UAC”) by Google. UAC helps promote our ZCITY App across Google’s

largest properties including Google Search, Google Play Store, YouTube, and the Google Display

Network. It combines information Google has on users’ tendencies and perceived intents outside of the app (such as what they have

searched for, what other apps they have downloaded and what they watched on YouTube) with advertisers’ information on user actions

in the app.

UAC then

uses machine learning technology to make decisions for each ad by analyzing potential data signal combinations in real-time, including

the platform where users are most likely to engage with our ad (such as YouTube or Gmail), the right ad format (whether video, text, or

combination of the two) and keywords that will perform best for our marketing goals.

In addition,

in order to obtain more accurate data for analysis, AppsFlyer SDK is installed in our ZCITY App, where it provides conversion data of

user acquisition and retention campaigns. Through AppsFlyer SDK, we can monitor digital media activities to optimize our marketing budget.

The data can be utilized and turned into actionable insights (to run campaigns and promotions

which users are more favorable to) that will share our strategic and tactical business decisions, while boosting the ZCITY App

brand presence.

Marketing Strategy - Merchants “6Cs”

Strategy

In order to roll out our system, we plan to implement

our 6Cs marketing strategy: clients, convenience, competition, consistency with creative content, corporate social responsibilities and

credibility.

Clients (Soon-to-be F&B Owners). We

have forecast potential merchants by category, which will enable us to create a marketing plan that will attract them by aligning our

promotional content with their business interests and ideals. We will initiate advertisements that connect with their preferences and

generate brand loyalty. We have developed “The PILOT” program where we plan offer prospective merchant F&B owners a free

TAZTE Smart F&B system to facilitate their O2O business.

Convenience. We plan to demonstrate the

convenience provided by our ZCITY App by launching a digitalization initiative which can get a merchant up and running on our platform

within 24 hours. We believe this strategy emphasizes the ease of onboarding potential merchants and the potential positive transformation

of their business in the shortest amount of time.

Competition. To further differentiate our

system from our competitors, we expect to identify, compare and discover issues within their business model of operations against our

own business model. The “SWITCH 180” program is where we plan to offer F&B owners not only a free TAZTE Smart F&B

system, but we will also offer additional support such as artificial intelligence inventory management system and discount vouchers.

Consistency with Creative Content. We plan

to maintain a consistent brand image across all our current marketing approaches with creative and innovative content. We strive to make

our brand recognizable to stand out among competitors to increase brand awareness and recognition.

Corporate Social Responsibilities. We expect

to integrate social and environmental concerns in our business operations to gain positive publicity and recognition and greater market

exposure. For example, our “Love Delivery” program under TAZTE will allow consumers to donate food through our merchant family

to charitable establishments such as orphanages and senior centers and similar charitable organizations. Our “Green Oil” program

will allow our merchants to contribute to zero pollution by recycling used cooking oil with one of our strategic partners.

Credibility. We expect to prove our credibility

by presenting our expertise to potential merchants who are seeking alternative business strategies in the ever-expanding technological

age. We believe that promoting a credible and reliable system for merchants will increase referrals and positive reviews. Our “TAZTE

Cares <3” program offers F&B owners free business operations “health checks” and offers troubleshooting solutions

by introducing TAZTE Smart F&B System into their business.

Revenue Model

ZCITY’s revenues are generated from a diversified

mix of:

| |

● |

e-commerce activities for users; |

| |

|

|

| |

● |

services to merchants to help them grow their businesses; and |

| |

|

|

| |

● |

membership subscription fees. |

The revenue streams consist of “Consumer

Facing” revenues and “Merchant Facing” revenues.

The revenue streams can be further categorized

as following: (1) product and loyalty program revenue, (2) transaction revenue, and (3) agent subscription revenue. Please see “Management’s

Discussion and Analysis ̶ Revenue Recognition.”

Our Competitive Strengths

Powerful, Unique and Integrated App. We

have designed an application – the ZCITY App – which serves both consumers and merchants in ways that concurrently maximize

value creation and enhance the shopping experience. Furthermore, through the application of our proprietary developed AI technology, we

can offer consumers a more personalized and targeted rewards offering/experience.

Unique Loyalty Program. Operating under

our hashtag #RewardsOnRewards, we believe our RP program increases user engagement and loyalty. Through consumer redemption and platform

issuance of RP, we believe our system is advantageous to both consumers and merchants.

Attractive Markets. We currently operate

in Malaysia, which according to the IMF is expected to average annual growth rate of 4.5% GDP growth over the next five years.14

See Part I, Item 1.“Business—Market Opportunity.”

As we scale our operations, we intend to expand

to other countries in Southeast Asia, which possesses solid economic fundamentals, fast growing middle classes, favorable demographic

trends and accelerating adoption of mobile technology.

Experienced Management Team. Our executives

and directors combine decades of on-the-ground local e-commerce operations and social media marketing experience, as well as professional

expertise in the global finance field.

Our Growth Strategy

Our main goal is focused on the recruitment of

new consumers and the registration of as many TAZTE merchants as possible in the most efficient way in the shortest amount of time. We

believe that this approach establishes a cycle where more consumers lead to more merchants and more merchants lead to more consumers.

External partnerships play an important part in our business, as we will continue sourcing more delivery partners to offer our merchants

greater flexibility.

Consumer Growth. We strive to provide consumers

with a smarter shopping experience from ordering to receiving goods and services as one seamless process. Our marketing efforts will focus

on attracting consumers by awarding RP upon the execution of successful transactions (where they can redeem instant rebates).

Merchant Growth. We believe that our TAZTE

program is an example of an O2O platform focusing on transforming traditional ways of operating F&B business with digitalized smart

ecosystems which better streamline merchant business operations and directly contribute to higher revenues. We feel TAZTE has the potential

for our ZCITY App to pioneer a generation of technologically astute “Smart Merchants,” effectively encouraging more merchants

to join the technological trend. Apart from the technological advantages, merchants would be able to gain access to a significant consumer

database of nearly one million registered users currently for their own brand marketing.

Partner Growth. We are continuously enhancing

the ZCITY App through adding further strategic partnerships. We believe that collaborations will enable merchants and consumers to have

more options to choose from and the delivery speed and rates related to transparency will benefit all parties.

Expansion Growth. With our proven systems

and by leveraging our large network, leading technology, operational excellence, and product expertise, we expect the ZCITY App to launch

and scale our expansion plans to neighboring countries such as Indonesia, Thailand, and Japan, by partnering with or acquiring local establishments.

Acquisition Growth. In order to complement

our organic growth strategy, we will continue to evaluate investment and acquisition opportunities that will enable us to become market

leaders. Our anticipated investments and acquisitions of other e-commerce platforms in different verticals are expected to expand our

service offerings and attract new consumers and merchants. We expect negotiations with acquisition targets in the e-Commerce industries.

Furthermore, we would expect to finance such acquisitions through internal and potential financings from the stock market.

| 14 |

IMF: https://www.imf.org/en/News/Articles/2023/05/31/pr23191-malaysia-imf-executive-board-concludes-2023-article-iv-consultation-with-malaysia |

Strategic Partnerships

We have entered into agreements with various Malaysian

companies i.e.: Touch’nGo e-wallet marketing, iPay88, Boost eWallet, Digi and Grabpay eWallet to provide essential services to our

ZCITY App platform.

Strategic partnerships are vital to our strategy

and operations, as they enable the ZCITY App to offer more value-added services to both our consumers and merchants. Through our partnerships,

we intend to gain low-cost access to our partners’ users, where possible, to drive user conversion. Our marketing approach to acquire

strategic partners focuses on the benefits of brand awareness, stressing the ability to access a larger pool of consumers and clients

while reducing marketing expenses via joint marketing efforts like crossover marketing campaigns, digital marketing and affiliate programs.

Competitive Outlook

We compete with other online platforms and apps

for merchants, who can sell their products/services on other online shopping marketplaces and other food ordering platforms. We also compete

with other e-commerce platforms and apps, fashion and lifestyle retailers and restaurants for the attention of consumers. Consumers have

the choice of shopping with any online or offline retailer, large marketplaces or restaurant chain. We compete for consumers and merchants

based on our ability to deliver a personalized e-commerce experience with an easy-to-use mobile app, unique cross-business reward system,

instant rebate & cashback, and a trusted payment gateway which is both secure and convenient.

Within the Malaysian market, we believe the principal

competitors to the ZCITY App to include, but not limited to Fave and Shopback. We have set out below how we perceive the ZCITY App differentiates

our offering from these competitors in the Malaysian market both downstream (services provided to consumers) and upstream (services provided

to merchants).

The information with respect to Fave was obtained

from Fave’s website at https://help.myfave.com/hc/en-us/articles/115000181194-How-do-I-pay-with-FavePay-.

The information with respect to Shop Back was

obtained from Shop Back’s website at https://support.shopback.my/hc/en-us/articles/360037382453-Is-there-a-payment-method-not-eligible-for-Cashback-.

We expect to be able to successfully compete for

merchants based on our unique cross-business reward system, reward points module, instant rebate and cashback program,

upcoming new features, which we expect will build lasting customer loyalty for our merchants, as well as our personalized, data-driven

approach to customer engagement, both of which ensure that our success is aligned with that of our merchants.

Intellectual Property Matters

Our technology and ZCITY App are comprised of

copyrightable and/or patentable subject matter licensed by our Malaysian subsidiaries, ZCITY. Our intellectual property assets include

trade secrets associated with our software platform. We have successfully carried out development of our multilayer cloud-based software

platform based upon our reliance on third parties for payment and reward points deployment. As a result, we can monetize our software

by making it available in locations such as the Apple iOS Store, Google Play Store, Huawei AppGallery and compatible with existing payment

systems depending on the country’s regulatory requirements. We are currently focusing on using our intellectual property in Malaysia

and plan to expand further into Southeast Asia as part of our strategy. The loss of all of these third-party payment facilitators could

not be easily replaced and therefore could materially affect our business and results of operations.

Trademarks.

ZCITY has filed one trademark application stylized as “ ” with the trademark offices of Malaysia. The name and mark, ZCITY

App and other trade names and service marks of ZCITY in this prospectus are our property.

” with the trademark offices of Malaysia. The name and mark, ZCITY

App and other trade names and service marks of ZCITY in this prospectus are our property.

Patents. ZCITY has filed one patent application

entitled “A Revenue Allocation System” with the Patents Registration Office of Malaysia.

We manage all our intellectual property matters

in Malaysia including the registration of patents, trademarks, trade names, and service marks in the name of ZCITY, our subsidiary in

Malaysia. While we have not delineated each of our trademarks, the foregoing constitutes our material trademarks. Without prejudice to

the generality of foregoing, ZCITY is, inter alia, the direct owner of the registered trademark “ZCITY” in connection with

artificial intelligence software, electronic payment services, loyalty programs, SaaS platforms, and other subsets of our business.

Information Technology Protection. All

of our software development professionals are required to sign and are bound by the IT Infrastructure, Security, Email, Intranet Usage

Policy Manual (the “IT Policy Manual”), which governs use of our hardware, software, code, source code, data, computational

data, screen data, analytics dashboards, data displayed on screens, emails, intranet and internet. This IT Policy Manual establishes standard

practices and rules for responsible, safe, and productive use of our intellectual property, information and assets and is expected to

ensure the protection of information and prevention of any misuse.

We have internally implemented the “Active

Directory and VPN” to manage access to our assets in order to prevent any intentional or unintentional leaks of sensitive data,

documentation or information, as well as to prevent users from installing irrelevant software or malware viruses.

Our ZCITY App’s server is hosted on the

AWScloud and is compliant with SOC2, which we believe securely manages our data across six aspects:

| |

● |

Security – protects the system resources against unauthorized access. Apply security group rules as security control. Enabled AWS WAF rule for more protection. AWS WAF (Web Application Firewall) is a managed security service provided by Amazon Web Services (AWS) that helps protect web applications from various web-based attacks. It acts as a protective layer between your web applications and the internet, allowing you to control and monitor incoming traffic to your web applications. |

| |

● |

Availability – makes sure the server accessibility meets the SLA. Regularly review and report on server availability metrics to track performance against SLA targets. Provide transparent reporting to stakeholders, including customers, about server uptime and downtime. Moreover, continuously monitor and analyze server performance data (AWS) to identify areas for improvement. Implement optimizations to enhance server availability and performance over time. |

| |

● |

Processing integrity– data process monitoring couple with quality assurance procedures can help ensure processing integrity. |

| |

● |

Confidentiality – data is encrypted during network transmission. Subscripted to the cloud flare service, which offers a range of services to protect websites, applications, and company data. |

| |

● |

Privacy – data collection, use, retention,

disclosure and disposal of personal information in conformity.

|

| |

● |

Backup – Enabled AWS Backup service. It helps you centralize and automate the backup of data across various AWS services and on-premises resources. AWS Backup is designed to be efficient, scalable, and reliable. |

We practice Disaster Recovery SOP to easily overcome

disaster events efficiently. We have in place a “Disaster Recovery” (“DR”) initiative, which we rely on the “AWS”

cloud facilities to ensure as described below:

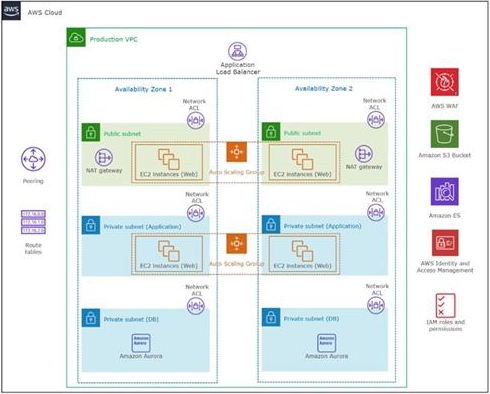

The architecture diagram shows how “AWS”

cloud architect is powered by distributed servers and database services across multiple zones to ensure disaster recovery on deployment

across multiple data centers, once the Application Load Balancer (ALB) detects the primary unavailable then it will direct all traffic

to other in-service data centers.29

| 29 |

Disaster Recovery – First-in-class automated disaster recovery mechanism with multi-AZ support https://docs.aws.amazon.com/whitepapers/latest/disaster-recovery-workloads-on-aws/disaster-recovery-options-in-the-cloud.html |

The controls for restricting user access to our

system and data, include:

| |

1) |

User authorization |

| |

|

|

| |

2) |

Maintaining the user access log |

| |

|

|

| |

3) |

Periodic review user access |

| |

|

|

| |

4) |

Revoking user access |

| |

|

|

| |

5) |

Managing Privileged User access |

| |

|

|

| |

6) |

Separation of Duties to reduce the risk of misuse of client code and assets |

| |

|

|

| |

7) |

Change management, risk management and issue management are exercised as part of Management Reviews |

Litigation

From time to time, we may become involved in legal

proceedings arising in the ordinary course of our business. We believe that we do not have any pending or threatened litigation which,

individually or in the aggregate, would have a material adverse effect on our business, results of operations, financial condition, and/or

cash flows.

Properties

We lease and maintain our offices at located at

276 5th Avenue, Suite 704 #739, New York, New York 10001 and No.29, Jalan PPU 2A, Taman Perindustrian Pusat Bandar Puchong,

47100 Puchong, Selangor, Malaysia.

Human Capital Resources

As of June 30, 2023, we had a total of 103 full-time

employees and a total of [*] independent contractors and consultants. We engage consultants on an as-needed basis to supplement existing

staff. Since the onset of the COVID-19 pandemic, we have taken an integrated approach to helping our employees manage their work and personal

responsibilities, with a strong focus on employee well-being, health, and safety.

Our human capital resources objectives include,

as applicable, identifying, recruiting, retaining, incentivizing and integrating our existing and new employees, advisors and consultants.

The principal purposes of our equity and cash incentive plans are to attract, retain and reward personnel through the granting of stock-based

and cash-based compensation awards, in order to increase stockholder value and the success of our Company by motivating such individuals

to perform to the best of their abilities and achieve our objectives.

Available Information

Our corporate website address is https://treasureglobal.co.

Our ZCITY website address is https://zcity.io. Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form

8-K, any amendments to those reports, and registration statements filed or furnished with the SEC, are available free of charge through

our website. We make these materials available through our website as soon as reasonably practicable after we electronically file such

materials with, or furnish such materials to, the SEC. The reports filed with the SEC by our executive officers and directors pursuant

to Section 16 under the Exchange Act are also made available, free of charge on our website, as soon as reasonably practicable after

copies of those filings are provided to us by those persons. These materials can be accessed through the “Investors” section

of our website. The information contained in, or that can be accessed through, our website is not part of this Annual Report on Form

10-K.

Item

1a. Risk Factors.

Investing in our common stock is highly speculative

and involves a significant degree of risk. Before you invest in our securities, you should give careful consideration to the following

risk factors, in addition to the other information included in this Annual Report on Form 10-K, including our financial statements and

related notes, before deciding whether to invest in our securities. The occurrence of any of the adverse developments described in the

following risk factors could materially and adversely harm our business, financial condition, results of operations or prospects. In that

case, the trading price of our common stock could decline, and you may lose all or part of your investment.

Risks Related to Our

Business

There is substantial doubt about our ability

to continue as a going concern.

We have incurred substantial operating losses since our inception.

For the year ended June 30, 2023, we had approximately $4.6 million cash on hand, an accumulated deficit of approximately $31.4 million

at June 30, 2023, a net loss of approximately $11.7 million for the year ended June 30, 2023, and approximately $9.6 million net cash

used by operating activities for the year ended June 30, 2023. The accompanying consolidated financial statements have been prepared on

a going concern basis, which contemplates the realization of assets and satisfaction of liabilities in the normal course of business.

We anticipate incurring additional losses until such time, if ever, that we will be able to effectively market our products.

Also,

we will seek to obtain additional capital through the sale of debt or equity financing or other arrangements to fund operations; however,

there can be no assurance that we will be able to raise needed capital under acceptable terms, if at all. The sale of additional equity

may dilute existing stockholders and newly issued shares may contain senior rights and preferences compared to currently outstanding

shares of common stock. Issued debt securities may contain covenants and limit our ability to pay dividends or make other distributions

to stockholders. If we are unable to obtain such additional financing, future operations would need to be scaled back or discontinued.

Due to these factors, management believes that there is substantial doubt in our ability to continue as a going concern for twelve months

from the issuance of these consolidated financial statements.

If we have insufficient capital to operate our business under our current

business plan, we have contingency plans for our business that include, among other things, the delay of the introduction of new products

and a reduction in headcount which is expected to substantially reduce revenue growth and delay our profitability. There can be no assurance

that our implementation of these contingency plans will not have a material adverse effect on our business.

We have a limited operating history in an

evolving industry, which makes it difficult to evaluate our future prospects and may increase the risk that we will not be successful.

We have a limited operating history on which to

base an evaluation of our business and prospects. We are subject to all the risks inherent in a small company seeking to develop, market

and distribute new services, particularly companies in evolving markets such as the internet, technology and payment systems. The likelihood

of our success must be considered, in light of the problems, expenses, difficulties, complications and delays frequently encountered in

connection with the development, introduction, marketing and distribution of new products and services in a competitive environment.

Such risks for us include, but are not limited

to, dependence on the success and acceptance of our services, the ability to attract and retain a suitable client base and the management

of growth. To address these risks, we must, among other things, generate increased demand, attract a sufficient clientele base, respond

to competitive developments, increase the “ZCITY” brand names’ visibility, successfully introduce new services, attract,

retain and motivate qualified personnel and upgrade and enhance our technologies to accommodate expanded service offerings. In view of

the rapidly evolving nature of our business and our limited operating history, we believe that period-to-period comparisons of our operating

results are not necessarily meaningful and should not be relied upon as an indication of future performance.

We are therefore subject to many of the risks

common to early-stage enterprises, including under-capitalization, cash shortages, limitations with respect to personnel, financial and

other resources and lack of revenues.

If we fail to raise capital when needed

it will have a material adverse effect on our business, financial condition and results of operations.

We have limited revenue-producing operations and

will require the proceeds from our recently concluded offering to execute our full business plan. We believe the proceeds from our previous

offering will be sufficient to cover our funding needs until part way through the first calendar quarter of 2024. Further, no assurance