UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 12b-25

NOTIFICATION OF LATE FILING

SEC FILE NUMBER: 001-41867

CUSIP NUMBER: 82455M109

|

|

|

|

|

|

(Check one): |

|

☐ Form 10-K ☐ Form 20-F ☐ Form 11-K ☒ Form 10-Q ☐ Form 10-D ☐ Form N-SAR ☐ Form N-CSR |

|

|

|

|

For Period Ended: March 29, 2024 |

|

|

|

|

☐ Transition Report on Form 10-K |

|

|

|

|

☐ Transition Report on Form 20-F |

|

|

|

|

☐ Transition Report on Form 11-K |

|

|

|

|

☐ Transition Report on Form 10-Q |

|

|

|

|

☐ Transition Report on Form N-SAR |

|

|

|

|

For the Transition Period Ended: |

|

|

|

Read Instruction (on back page) Before Preparing Form. Please Print or Type. Nothing in this form shall be construed to imply that the Commission has verified any information contained herein. |

If the notification relates to a portion of the filing checked above, identify the Item(s) to which the notification relates:

PART I - REGISTRANT INFORMATION

Shimmick Corporation

Full Name of Registrant

N/A

Former Name if Applicable

530 Technology Drive, Suite 300

Address of Principal Executive Office (Street and Number)

Irvine, CA 92618

City, State and Zip Code

PART II - RULES 12b-25(b) AND (c)

If the subject report could not be filed without unreasonable effort or expense and the registrant seeks relief pursuant to Rule 12b-25(b), the following should be completed. (Check box if appropriate)

|

|

|

|

|

|

|

|

|

|

☒ |

|

(a) |

|

The reasons described in reasonable detail in Part III of this form could not be eliminated without unreasonable effort or expense; |

|

(b) |

|

The subject annual report, semi-annual report, transition report on Form 10-K, Form 20-F, Form 11-K, Form N-SAR or Form N-CSR, or portion thereof, will be filed on or before the fifteenth calendar day following the prescribed due date; or the subject quarterly report of transition report on Form 10-Q or subject distribution report on Form 10-D, or portion thereof will be filed on or before the fifth calendar day following the prescribed due date; and |

|

(c) |

|

The accountant’s statement or other exhibit required by Rule 12b-25(c) has been attached if applicable. |

PART III - NARRATIVE

State below in reasonable detail why Forms 10-K, 20-F, 11-K, 10-Q, 10-D, N-SAR, N-CSR, or the transition report portion thereof, could not be filed within the prescribed time period.

Shimmick Corporation (the “Company”) is unable, without unreasonable effort or expense, to file its Quarterly Report on Form 10-Q (“Form 10-Q”) for the period ended March 29, 2024 (“Q1 2024”) within the prescribed timeframe as a result of ongoing negotiations with the lender under the Company’s Revolving Credit Facility Agreement (“Revolving Credit Facility”). Specifically, as result of the Company’s Q1 2024 financial results, the Company is no longer in compliance with the leverage covenant set forth in the Revolving Credit Facility (the “Default”). As a result of the Default, the lender has the right to declare all amounts outstanding immediately due and payable and terminate all commitments to extend further credit under the Revolving Credit Facility. As of March 29, 2024, there was approximately $32 million outstanding under the Revolving Credit Facility. To date, the lender has not exercised its right to accelerate repayment of the outstanding borrowings, and the Company is in the process of negotiating a waiver and amendment with the lender as well as pursuing alternative financing arrangements with other potential lenders. If the Company is unable to obtain a waiver or new financing arrangement or the lender exercises its right to accelerate repayment, it may impact the Company’s ability to continue as a going concern. In addition, if the lender exercises its right to accelerate repayment and the Company is unable to repay those amounts, the Company could be forced to

curtail its operations, reorganize its capital structure (including through bankruptcy proceedings) or liquidate some or all of its assets in a manner that could adversely impact our business. Accordingly, the Company has been unable to complete its Q1 2024 Form 10-Q. However, the Company expects to file the Form 10-Q within five calendar days of the prescribed filing date.

Forward-Looking Statements

This form contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"). These forward-looking statements are often characterized by the use of words such as “may,” “should,” “expects,” “plans,” “anticipates,” “could,” “intends,” “targets,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “potential” or “continue” or the negative of these terms or other similar words. Forward-looking statements are only predictions based on our current expectations and our projections about future events, and we undertake no obligation to update any forward-looking statement to reflect events or circumstances, including, but not limited to, unanticipated events, after the date on which such statement is made, unless otherwise required by law. Forward-looking statements contained in this release include, but are not limited to, statements about our expectations regarding negotiations with MidCap, ability to obtain a waiver, expectations regarding acceleration of borrowings and the corresponding impact on the timing of our Quarterly Report on 10-Q. These statements involve risks and uncertainties, and actual results may differ materially from any future results expressed or implied by the forward-looking statements. Forward-looking statements are only predictions based on our current expectations and our projections about future events, and we undertake no obligation to update any forward-looking statement to reflect events or circumstances, including, but not limited to, unanticipated events, after the date on which such statement is made, unless otherwise required by law.

We wish to caution readers that, although we believe any forward-looking statements are based on reasonable assumptions, certain important factors may have affected and could in the future affect our actual financial results and could cause our actual financial results for subsequent periods to differ materially from those expressed in any forward-looking statement made by or on our behalf, including, but not limited to, the following: our ability to accurately estimate risks, requirements or costs when we bid on or negotiate a contract; the impact of our fixed-price contracts; qualifying as an eligible bidder for contracts; the availability of qualified personnel, joint venture partners and subcontractors; inability to attract and retain qualified managers and skilled employees and the impact of loss of key management; higher costs to lease, acquire and maintain equipment necessary for our operations or a decline in the market value of owned equipment; subcontractors failing to satisfy their obligations to us or other parties or any inability to maintain subcontractor relationships; marketplace competition; our limited operating history as an independent company following our separation from AECOM; our inability to obtain bonding; disputes with our prior owner, AECOM, and requirements to make future payments to AECOM; AECOM defaulting on its contractual obligations to us or under agreements in which we are beneficiary; our limited number of customers; dependence on subcontractors and suppliers of materials; any inability to secure sufficient aggregates; an inability to complete a merger or acquisition or to integrate an acquired company’s business; adjustments in our contact backlog; accounting for our revenue and costs involves significant estimates, as does our use of the input method of revenue recognition based on costs incurred relative to total expected costs; any failure to comply with covenants under any current indebtedness, and future indebtedness we may incur; the adequacy of sources of liquidity; cybersecurity attacks against, disruptions, failures or security breaches of, our information technology systems; seasonality of our business; pandemics and health emergencies; commodity products price fluctuations and rising inflation and/or interest rates; liabilities under environmental laws, compliance with immigration laws, and other regulatory matters, including changes in regulations and laws; climate change; deterioration of the U.S. economy; geopolitical risks, including those related to the war between Russia and Ukraine and the conflict in the Gaza Strip and the conflict in the Red Sea Region; our ability to timely file reports with the Securities and Exchange Commission; and other risks detailed in our filings with the Securities and Exchange Commission, including the “Risk Factors” section in our Annual Report on

Form 10-K for the fiscal year ended December 29, 2023 and those described from time to time in our future reports with the SEC.

PART IV - OTHER INFORMATION

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) |

|

|

|

Name and telephone number of person to contact in regard to this notification |

|

|

|

|

|

|

|

|

|

|

|

Devin J. Nordhagen, Executive Vice President, Chief Financial Officer and Treasurer |

|

|

|

833 |

|

|

|

723-2021 |

|

|

|

|

(Name) |

|

|

|

(Area Code) |

|

|

|

(Telephone Number) |

|

|

|

(2) |

|

|

|

Have all other periodic reports required under Section 13 or 15(d) of the Securities Exchange Act of 1934 or Section 30 of the Investment Company Act of 1940 during the preceding 12 months or for such shorter period that the registrant was required to file such report(s) been filed? If answer is no, identify report(s). Yes ☒ No ☐ |

|

|

|

|

|

|

|

|

|

|

|

(3) |

|

|

|

Is it anticipated that any significant change in results of operations from the corresponding period for the last fiscal year will be reflected by the earnings statements to be included in the subject report or portion thereof? Yes ☐ No ☒ |

If so, attach an explanation of the anticipated change, both narratively and quantitatively, and, if appropriate, state the reasons why a reasonable estimate of the results cannot be made.

Shimmick Corporation

(Name of Registrant as Specified in Charter)

has caused this notification to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date: May 13, 2024 |

|

|

|

By: |

|

/s/ Devin J. Nordhagen |

|

|

|

|

Name: |

|

Devin J. Nordhagen |

|

|

|

|

Title: |

|

Executive Vice President, Chief Financial Officer and Treasurer |

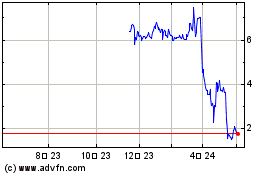

Shimmick (NASDAQ:SHIM)

過去 株価チャート

から 11 2024 まで 12 2024

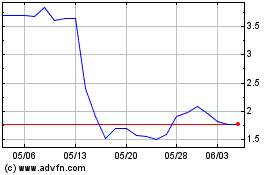

Shimmick (NASDAQ:SHIM)

過去 株価チャート

から 12 2023 まで 12 2024