Seven Hills Realty Trust Third Quarter 2023 Financial Results Exhibit 99.2

Q3 2023 2 Seven Hills Realty Trust Announces Third Quarter 2023 Results "Our third quarter results once again underscore the quality of our loan portfolio in the current lending environment. Distributable earnings increased, more than fully covering our quarterly dividend, and the credit quality of our portfolio remained strong with all loans current on debt service and a weighted average risk rating below three. We continued to actively invest our capital, closing two new loans during the quarter and one after quarter end. We remain well positioned to capitalize on new investment opportunities and continue to deliver attractive risk adjusted returns for our shareholders.” Tom Lorenzini, President and Chief Investment Officer of SEVN Conference Call A conference call to discuss SEVN's third quarter 2023 results will be held on Wednesday, November 1, 2023 at 11:00 a.m. Eastern Time. The conference call telephone number is (866) 739-7850. Participants calling from outside the United States and Canada should dial (412) 317-6592. No pass code is necessary to access the call from either number. Participants should dial in about 15 minutes prior to the scheduled start of the call. A replay of the conference call will be available through 11:59 p.m. Eastern Time on Wednesday, November 8, 2023. To access the replay, dial (412) 317-0088. The replay pass code is 1185940. A live audio webcast of the conference call will also be available in a listen only mode on SEVN's website, at www.sevnreit.com. The archived webcast will be available for replay on SEVN's website after the call. The transcription, recording and retransmission of SEVN's third quarter conference call in any way are strictly prohibited without the prior written consent of SEVN. Distributions On October 12, 2023, SEVN declared a quarterly distribution of $0.35 per common share, or approximately $5.2 million, to shareholders of record on October 23, 2023. SEVN expects to pay this distribution on or about November 16, 2023. About Seven Hills Realty Trust Seven Hills Realty Trust (Nasdaq: SEVN), or SEVN, we, our or us, is a real estate investment trust, or REIT, that originates and invests in first mortgage loans secured by middle market and transitional commercial real estate. SEVN is managed by Tremont Realty Capital, an affiliate of The RMR Group (Nasdaq: RMR), a leading U.S. alternative asset management company with approximately $36 billion in assets under management and more than 35 years of institutional experience in buying, selling, financing and operating commercial real estate. For more information about SEVN, please visit www.sevnreit.com. Newton, MA (October 31, 2023). Seven Hills Realty Trust (Nasdaq: SEVN) today announced financial results for the quarter and nine months ended September 30, 2023.

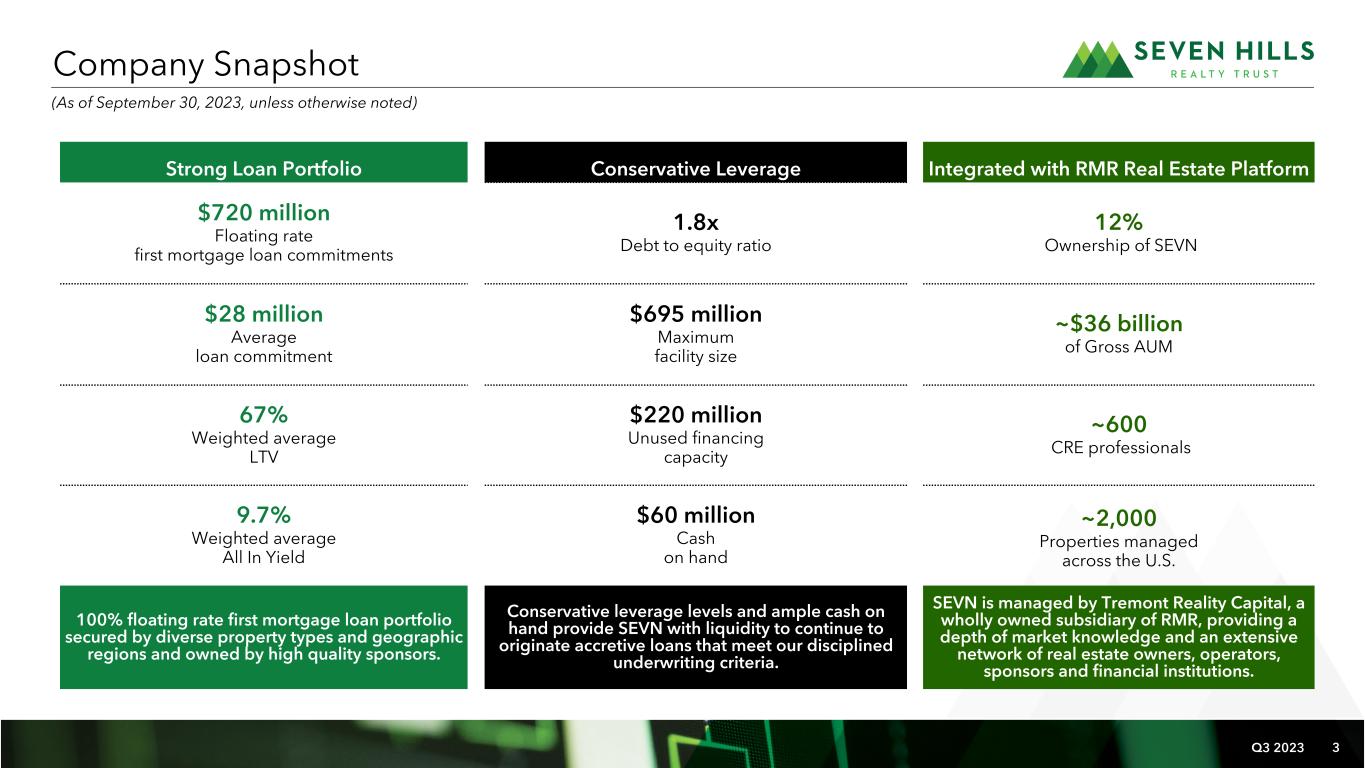

Q3 2023 3 Company Snapshot Strong Loan Portfolio Conservative Leverage Integrated with RMR Real Estate Platform $720 million Floating rate first mortgage loan commitments 1.8x Debt to equity ratio 12% Ownership of SEVN $28 million Average loan commitment $695 million Maximum facility size ~$36 billion of Gross AUM 67% Weighted average LTV $220 million Unused financing capacity ~600 CRE professionals 9.7% Weighted average All In Yield $60 million Cash on hand ~2,000 Properties managed across the U.S. 100% floating rate first mortgage loan portfolio secured by diverse property types and geographic regions and owned by high quality sponsors. Conservative leverage levels and ample cash on hand provide SEVN with liquidity to continue to originate accretive loans that meet our disciplined underwriting criteria. SEVN is managed by Tremont Reality Capital, a wholly owned subsidiary of RMR, providing a depth of market knowledge and an extensive network of real estate owners, operators, sponsors and financial institutions. (As of September 30, 2023, unless otherwise noted)

Q3 2023 4 Financial Results Investment Activity Portfolio Liquidity & Capitalization • Generated net income of $7.5 million, or $0.51 per diluted share, Distributable Earnings of $5.6 million, or $0.38 per diluted share, and Adjusted Distributable Earnings of $5.3 million, or $0.36 per diluted share. • Quarterly distribution of $0.35 per common share, declared and paid during the quarter. • Weighted average coupon of S + 3.82% and All In Yield of S + 4.26%. • Weighted average risk rating of 2.9 and an allowance for credit losses representing 0.74% of total loan commitments. • Closed two new loans during the quarter with aggregate total commitments of $44.8 million: ◦ $27.5 million loan secured by an industrial property in Fountain Inn, SC with a coupon of S + 4.25% and an All In Yield of S + 4.78%. ◦ $17.3 million loan secured by a hotel property in Scottsdale, AZ with a coupon of S + 4.25% and an All in Yield of S + 4.56%. • In October 2023, closed one new loan secured by two self-storage properties in Georgia with a total commitment of $25.3 million, a coupon of S + 3.35% and an All In Yield of S + 3.65%. • In October 2023, received $62.3 million of repayment proceeds, including $44.4 million on two loans secured by office properties in St. Louis, MO and Dublin, OH and $17.9 million of early repayment proceeds on a loan secured by a student housing property in Ames, IA. ◦ Reduces concentration of office loans to 29% of our portfolio on a pro forma basis. • Available liquidity of $280.5 million, including unused capacity of $220.1 million available under our Secured Financing Facilities and $60.4 million of cash on hand. • Weighted average coupon of S + 2.08%. • Extended the maturity date of our UBS Master Repurchase Facility to February 2025 and increased the maximum facility size to $205.0 million. Third Quarter 2023 Highlights (As of and for the three months ended September 30, 2023, unless otherwise noted) Please refer to Non-GAAP Financial Measures and Other Measures and Definitions within the Appendix for terms used throughout this document. All amounts in this presentation are unaudited.

Q3 2023 5 $634.9 $634.9 $676.5 $677.4 $675.2 $41.6 $0.9 $2.2$42.9 $3.2 $45.2 Q2 2023 Loan Portfolio Originations Fundings Repayments Q3 2023 Loan Portfolio Third Quarter 2023 Loan Portfolio Activity (dollars in millions) Total Loan Commitments (dollars in thousands) Third Quarter Originations As of September 30, 2023 Number of loans 2 26 Average loan commitment $22,375 $27,708 Total loan commitments $44,750 $720,397 Unfunded loan commitments $3,200 $45,182 Principal balance $41,550 $675,215 Weighted average coupon rate 9.57% 9.21% Weighted average All In Yield 10.01% 9.66% Weighted average Maximum Maturity 3.8 2.8 Weighted average LTV 68% 67% Weighted average floor 4.49% 1.09% Weighted average risk rating 3.0 2.9 Principal Balance Loan Portfolio Summary FINANCIAL RESULTS $677.8 Unfunded Commitments $720.4

Q3 2023 6 Retail Midwest 34% South 30% West 23% East 13% Office 34% Multifamily 33% Retail 17% Industrial 14% Hotel 2% Geographic Region (2) Property Type (2) (dollars in millions) Loan Portfolio Originations and Diversity (1) Includes loans originated by TRMT and acquired by SEVN on September 30, 2021, as a result of the Merger. (2) Based on principal balance of loans held for investment as of September 30, 2023. $128.4 $157.3 $91.2 $51.6 $38.4 $22.0 $— $37.5 $41.6 $11.1 $7.4 $4.6 $8.9 $8.6 $2.4 $— $3.2 $139.5 $164.7 $95.8 $60.5 $47.0 $24.4 $— $37.5 $44.8 Q3 2021 Q4 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Total Loan Commitments Principal Balance Loan Originations by Quarter (1) FINANCIAL RESULTS Unfunded Commitments Loan Count 6 6 3 2 1 1 0 1 2

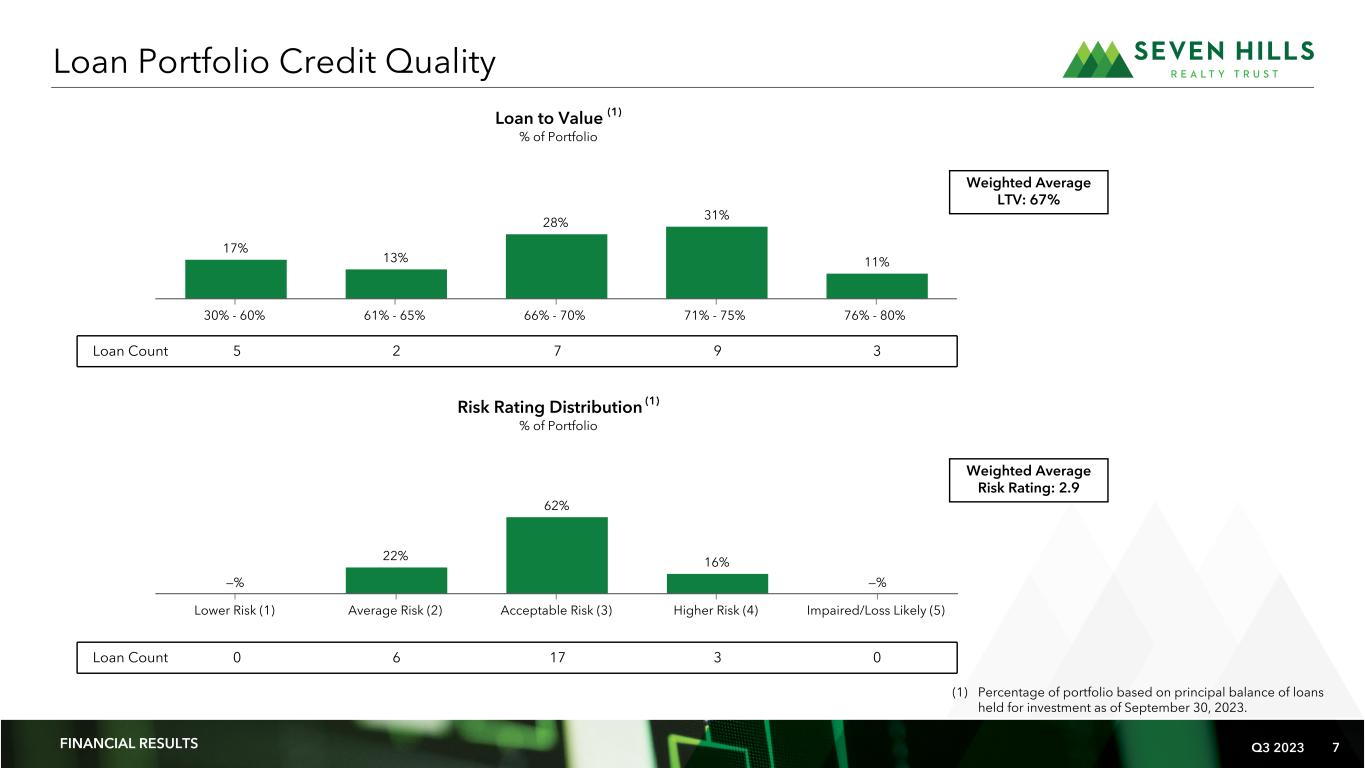

Q3 2023 7 17% 13% 28% 31% 11% 30% - 60% 61% - 65% 66% - 70% 71% - 75% 76% - 80% Loan to Value (1) % of Portfolio Loan Portfolio Credit Quality —% 22% 62% 16% —% Lower Risk (1) Average Risk (2) Acceptable Risk (3) Higher Risk (4) Impaired/Loss Likely (5) Risk Rating Distribution (1) % of Portfolio Weighted Average LTV: 67% Weighted Average Risk Rating: 2.9 (1) Percentage of portfolio based on principal balance of loans held for investment as of September 30, 2023. FINANCIAL RESULTS Loan Count 5 2 7 9 3 Loan Count 0 6 17 3 0

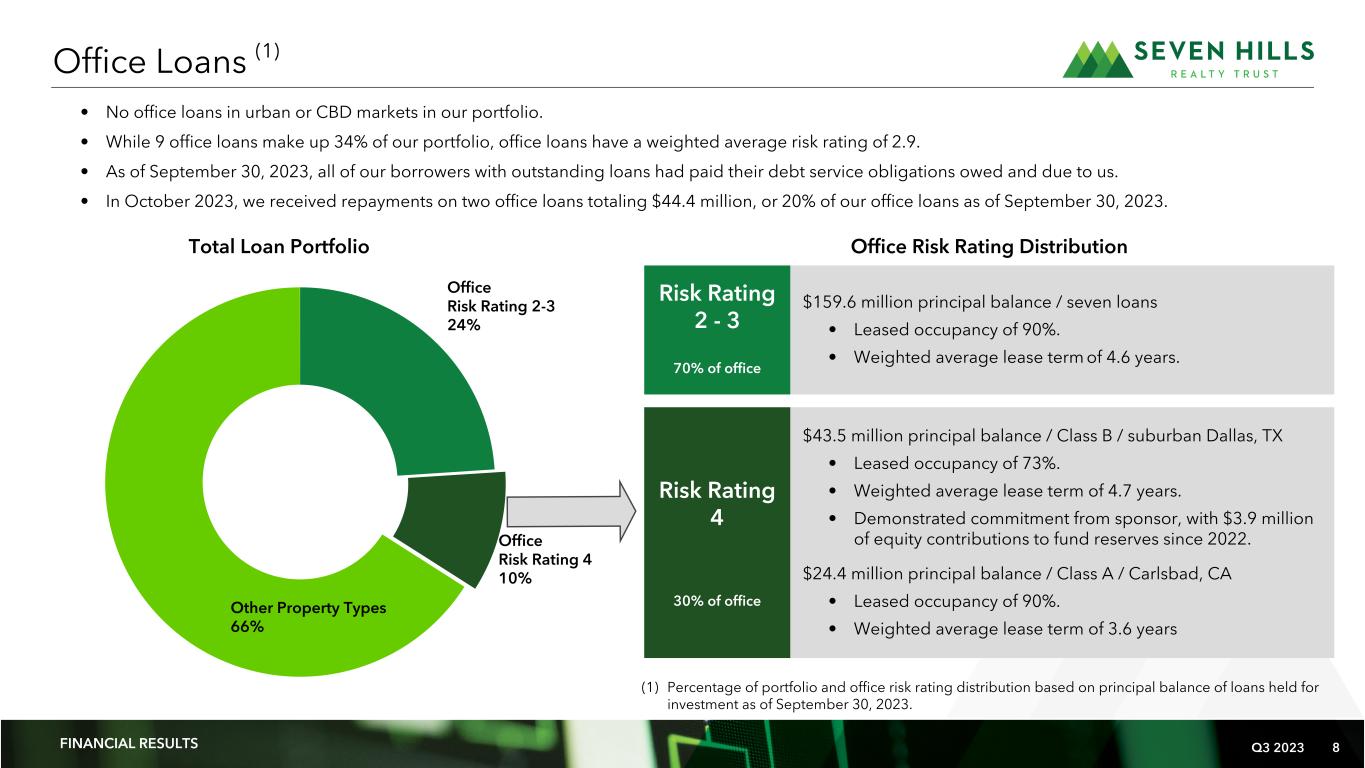

Q3 2023 8 Retail Office Risk Rating 2-3 24% Office Risk Rating 4 10% Other Property Types 66% Office Loans (1) Total Loan Portfolio FINANCIAL RESULTS (1) Percentage of portfolio and office risk rating distribution based on principal balance of loans held for investment as of September 30, 2023. • No office loans in urban or CBD markets in our portfolio. • While 9 office loans make up 34% of our portfolio, office loans have a weighted average risk rating of 2.9. • As of September 30, 2023, all of our borrowers with outstanding loans had paid their debt service obligations owed and due to us. • In October 2023, we received repayments on two office loans totaling $44.4 million, or 20% of our office loans as of September 30, 2023. Risk Rating 2 - 3 70% of office $159.6 million principal balance / seven loans • Leased occupancy of 90%. • Weighted average lease term of 4.6 years. Risk Rating 4 30% of office $43.5 million principal balance / Class B / suburban Dallas, TX • Leased occupancy of 73%. • Weighted average lease term of 4.7 years. • Demonstrated commitment from sponsor, with $3.9 million of equity contributions to fund reserves since 2022. $24.4 million principal balance / Class A / Carlsbad, CA • Leased occupancy of 90%. • Weighted average lease term of 3.6 years Office Risk Rating Distribution

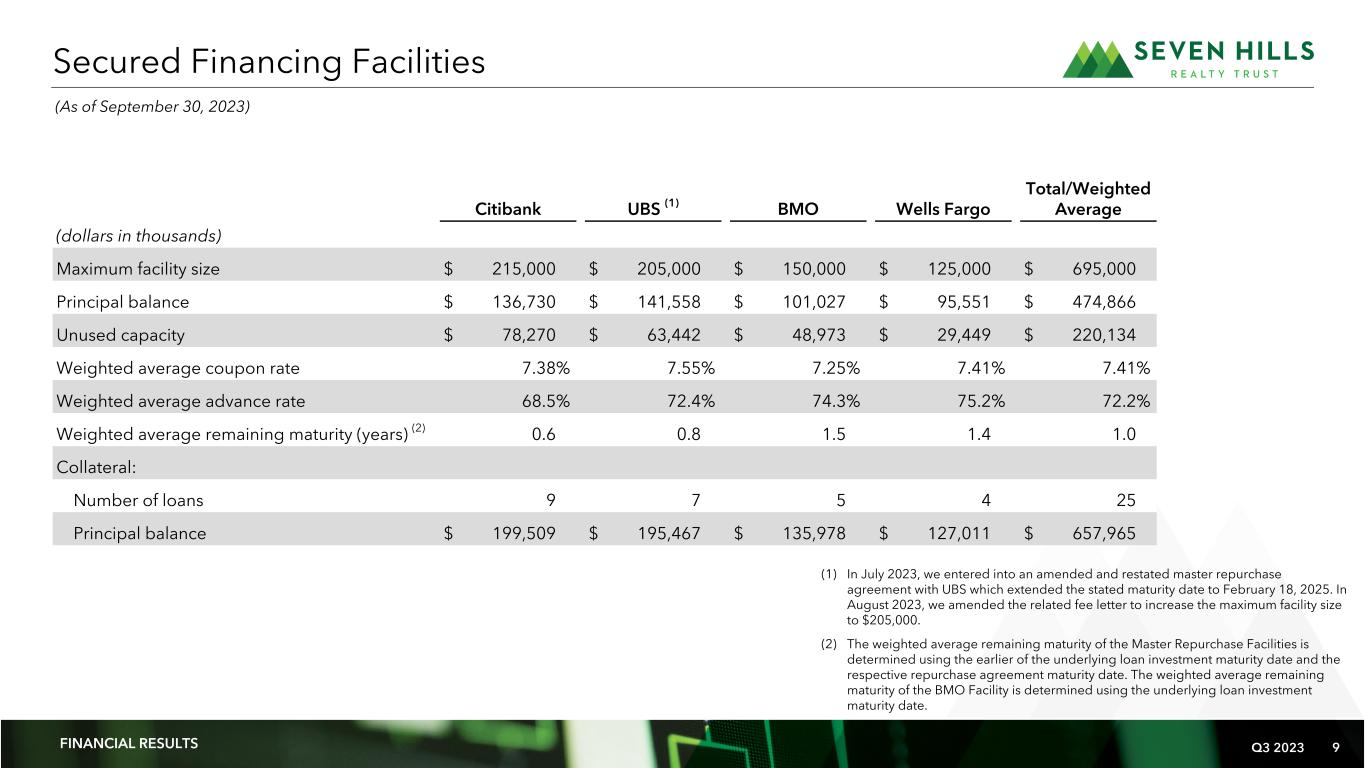

Q3 2023 9 (1) In July 2023, we entered into an amended and restated master repurchase agreement with UBS which extended the stated maturity date to February 18, 2025. In August 2023, we amended the related fee letter to increase the maximum facility size to $205,000. (2) The weighted average remaining maturity of the Master Repurchase Facilities is determined using the earlier of the underlying loan investment maturity date and the respective repurchase agreement maturity date. The weighted average remaining maturity of the BMO Facility is determined using the underlying loan investment maturity date. Secured Financing Facilities FINANCIAL RESULTS (As of September 30, 2023) Citibank UBS (1) BMO Wells Fargo Total/Weighted Average (dollars in thousands) Maximum facility size $ 215,000 $ 205,000 $ 150,000 $ 125,000 $ 695,000 Principal balance $ 136,730 $ 141,558 $ 101,027 $ 95,551 $ 474,866 Unused capacity $ 78,270 $ 63,442 $ 48,973 $ 29,449 $ 220,134 Weighted average coupon rate 7.38% 7.55% 7.25% 7.41% 7.41% Weighted average advance rate 68.5% 72.4% 74.3% 75.2% 72.2% Weighted average remaining maturity (years) (2) 0.6 0.8 1.5 1.4 1.0 Collateral: Number of loans 9 7 5 4 25 Principal balance $ 199,509 $ 195,467 $ 135,978 $ 127,011 $ 657,965

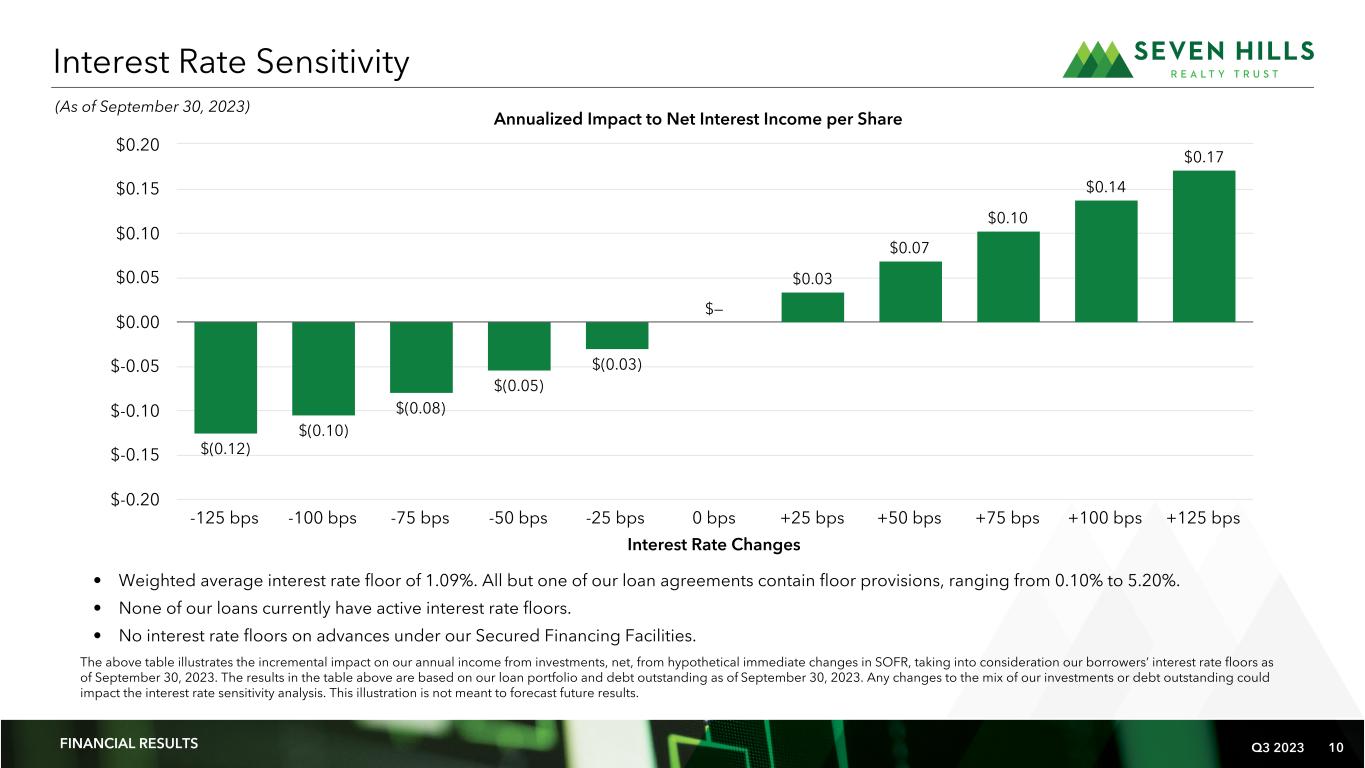

Q3 2023 10 The above table illustrates the incremental impact on our annual income from investments, net, from hypothetical immediate changes in SOFR, taking into consideration our borrowers’ interest rate floors as of September 30, 2023. The results in the table above are based on our loan portfolio and debt outstanding as of September 30, 2023. Any changes to the mix of our investments or debt outstanding could impact the interest rate sensitivity analysis. This illustration is not meant to forecast future results. Interest Rate Changes $(0.12) $(0.10) $(0.08) $(0.05) $(0.03) $— $0.03 $0.07 $0.10 $0.14 $0.17 -125 bps -100 bps -75 bps -50 bps -25 bps 0 bps +25 bps +50 bps +75 bps +100 bps +125 bps $-0.20 $-0.15 $-0.10 $-0.05 $0.00 $0.05 $0.10 $0.15 $0.20 Interest Rate Sensitivity Annualized Impact to Net Interest Income per Share FINANCIAL RESULTS • Weighted average interest rate floor of 1.09%. All but one of our loan agreements contain floor provisions, ranging from 0.10% to 5.20%. • None of our loans currently have active interest rate floors. • No interest rate floors on advances under our Secured Financing Facilities. (As of September 30, 2023)

Q3 2023 11 Appendix

Q3 2023 12 Management Our manager, Tremont, is registered with the Securities and Exchange Commission, or SEC, as an investment adviser and is owned by RMR. As of September 30, 2023, RMR had approximately $36 billion of real estate assets under management and the combined RMR managed companies had more than $5 billion of annual revenues, over 2,000 properties and over 20,000 employees. We believe Tremont’s relationship with RMR provides us with a depth of market knowledge that may allow us to identify high quality investment opportunities and to evaluate them more thoroughly than many of our competitors, including other commercial mortgage REITs. We also believe RMR’s broad platform provides us with access to RMR’s extensive network of real estate owners, operators, intermediaries, sponsors, financial institutions and other real estate related professionals and businesses with which RMR has historical relationships. We also believe that Tremont provides us with significant experience and expertise in investing in middle market and transitional CRE. Company Profile, Governance and Research Coverage APPENDIX Equity Research Coverage JMP Securities Chris Muller, CFA (212) 906-3559 cmuller@jmpsecurities.com Jones Trading Institutional Services, LLC Matthew Erdner (843) 414-9430 merdner@jonestrading.com SEVN is followed by the analysts listed above. Please note that any opinions, estimates or forecasts regarding SEVN’s performance made by these analysts do not represent opinions, estimates or forecasts of SEVN or its management. SEVN does not by its reference above imply its endorsement of or concurrence with any information, conclusions or recommendations provided by any of these analysts. Board of Trustees Barbara D. Gilmore William A. Lamkin Independent Trustee Independent Trustee Joseph L. Morea Jeffrey P. Somers Lead Independent Trustee Independent Trustee Matthew P. Jordan Adam D. Portnoy Managing Trustee Chair of the Board & Managing Trustee Executive Officers Thomas J. Lorenzini Fernando Diaz President and Chief Investment Officer Chief Financial Officer and Treasurer Contact Information Investor Relations Inquiries Seven Hills Realty Trust Financial, investor and media inquiries Two Newton Place should be directed to: 255 Washington Street, Suite 300 Kevin Barry, Senior Director, Investor Relations Newton, MA 02458.1634 at (617) 332-9530 or ir@sevnreit.com (617) 796-8253 ir@sevnreit.com www.sevnreit.com

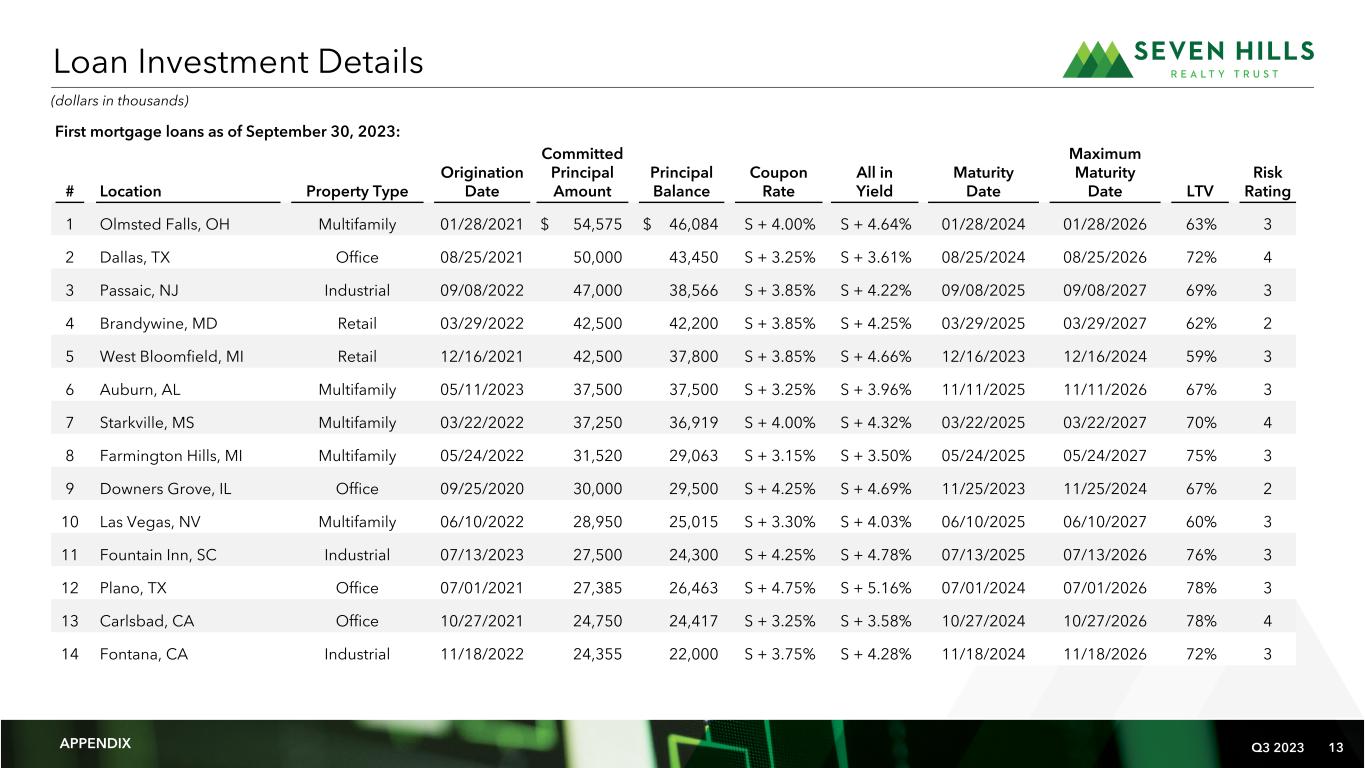

Q3 2023 13 First mortgage loans as of September 30, 2023: # Location Property Type Origination Date Committed Principal Amount Principal Balance Coupon Rate All in Yield Maturity Date Maximum Maturity Date LTV Risk Rating 1 Olmsted Falls, OH Multifamily 01/28/2021 $ 54,575 $ 46,084 S + 4.00% S + 4.64% 01/28/2024 01/28/2026 63% 3 2 Dallas, TX Office 08/25/2021 50,000 43,450 S + 3.25% S + 3.61% 08/25/2024 08/25/2026 72% 4 3 Passaic, NJ Industrial 09/08/2022 47,000 38,566 S + 3.85% S + 4.22% 09/08/2025 09/08/2027 69% 3 4 Brandywine, MD Retail 03/29/2022 42,500 42,200 S + 3.85% S + 4.25% 03/29/2025 03/29/2027 62% 2 5 West Bloomfield, MI Retail 12/16/2021 42,500 37,800 S + 3.85% S + 4.66% 12/16/2023 12/16/2024 59% 3 6 Auburn, AL Multifamily 05/11/2023 37,500 37,500 S + 3.25% S + 3.96% 11/11/2025 11/11/2026 67% 3 7 Starkville, MS Multifamily 03/22/2022 37,250 36,919 S + 4.00% S + 4.32% 03/22/2025 03/22/2027 70% 4 8 Farmington Hills, MI Multifamily 05/24/2022 31,520 29,063 S + 3.15% S + 3.50% 05/24/2025 05/24/2027 75% 3 9 Downers Grove, IL Office 09/25/2020 30,000 29,500 S + 4.25% S + 4.69% 11/25/2023 11/25/2024 67% 2 10 Las Vegas, NV Multifamily 06/10/2022 28,950 25,015 S + 3.30% S + 4.03% 06/10/2025 06/10/2027 60% 3 11 Fountain Inn, SC Industrial 07/13/2023 27,500 24,300 S + 4.25% S + 4.78% 07/13/2025 07/13/2026 76% 3 12 Plano, TX Office 07/01/2021 27,385 26,463 S + 4.75% S + 5.16% 07/01/2024 07/01/2026 78% 3 13 Carlsbad, CA Office 10/27/2021 24,750 24,417 S + 3.25% S + 3.58% 10/27/2024 10/27/2026 78% 4 14 Fontana, CA Industrial 11/18/2022 24,355 22,000 S + 3.75% S + 4.28% 11/18/2024 11/18/2026 72% 3 Loan Investment Details APPENDIX (dollars in thousands)

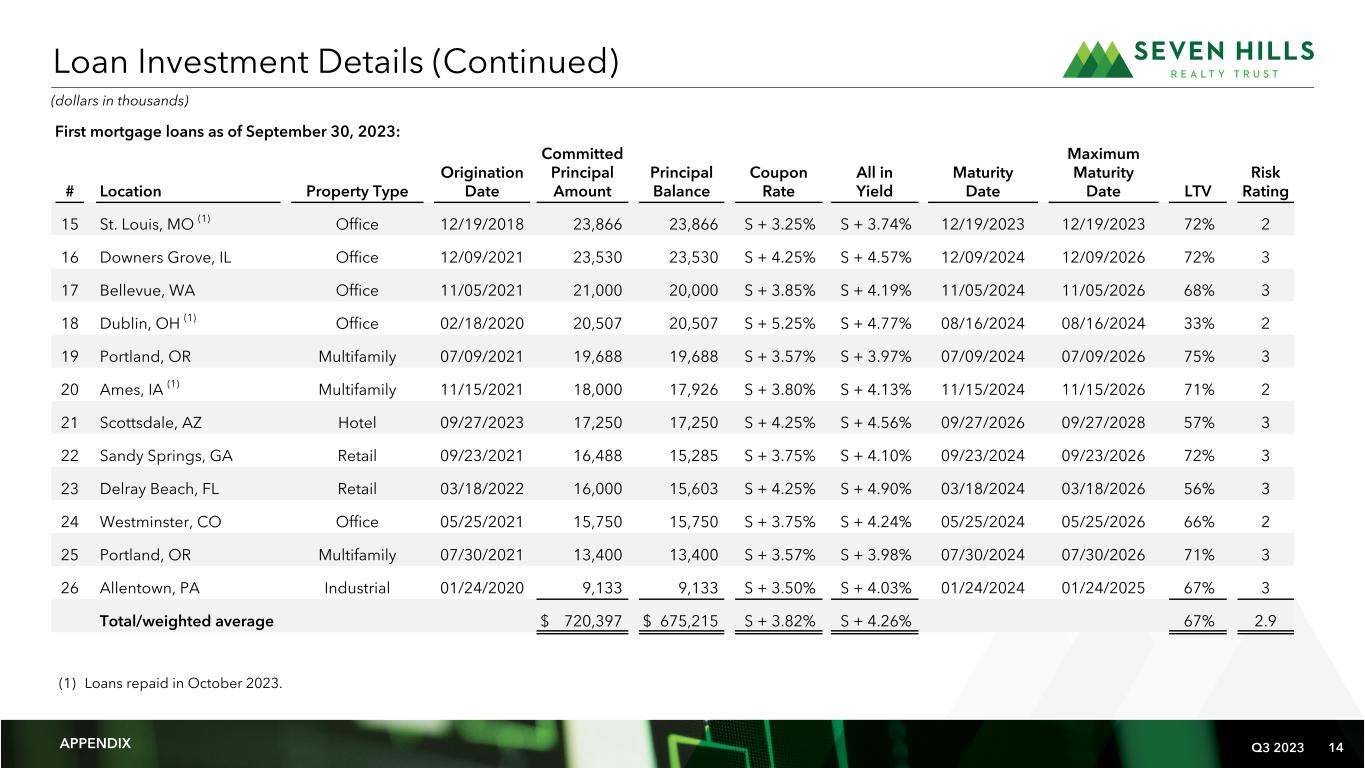

Q3 2023 14 First mortgage loans as of September 30, 2023: # Location Property Type Origination Date Committed Principal Amount Principal Balance Coupon Rate All in Yield Maturity Date Maximum Maturity Date LTV Risk Rating 15 St. Louis, MO (1) Office 12/19/2018 23,866 23,866 S + 3.25% S + 3.74% 12/19/2023 12/19/2023 72% 2 16 Downers Grove, IL Office 12/09/2021 23,530 23,530 S + 4.25% S + 4.57% 12/09/2024 12/09/2026 72% 3 17 Bellevue, WA Office 11/05/2021 21,000 20,000 S + 3.85% S + 4.19% 11/05/2024 11/05/2026 68% 3 18 Dublin, OH (1) Office 02/18/2020 20,507 20,507 S + 5.25% S + 4.77% 08/16/2024 08/16/2024 33% 2 19 Portland, OR Multifamily 07/09/2021 19,688 19,688 S + 3.57% S + 3.97% 07/09/2024 07/09/2026 75% 3 20 Ames, IA (1) Multifamily 11/15/2021 18,000 17,926 S + 3.80% S + 4.13% 11/15/2024 11/15/2026 71% 2 21 Scottsdale, AZ Hotel 09/27/2023 17,250 17,250 S + 4.25% S + 4.56% 09/27/2026 09/27/2028 57% 3 22 Sandy Springs, GA Retail 09/23/2021 16,488 15,285 S + 3.75% S + 4.10% 09/23/2024 09/23/2026 72% 3 23 Delray Beach, FL Retail 03/18/2022 16,000 15,603 S + 4.25% S + 4.90% 03/18/2024 03/18/2026 56% 3 24 Westminster, CO Office 05/25/2021 15,750 15,750 S + 3.75% S + 4.24% 05/25/2024 05/25/2026 66% 2 25 Portland, OR Multifamily 07/30/2021 13,400 13,400 S + 3.57% S + 3.98% 07/30/2024 07/30/2026 71% 3 26 Allentown, PA Industrial 01/24/2020 9,133 9,133 S + 3.50% S + 4.03% 01/24/2024 01/24/2025 67% 3 Total/weighted average $ 720,397 $ 675,215 S + 3.82% S + 4.26% 67% 2.9 Loan Investment Details (Continued) (dollars in thousands) APPENDIX (1) Loans repaid in October 2023.

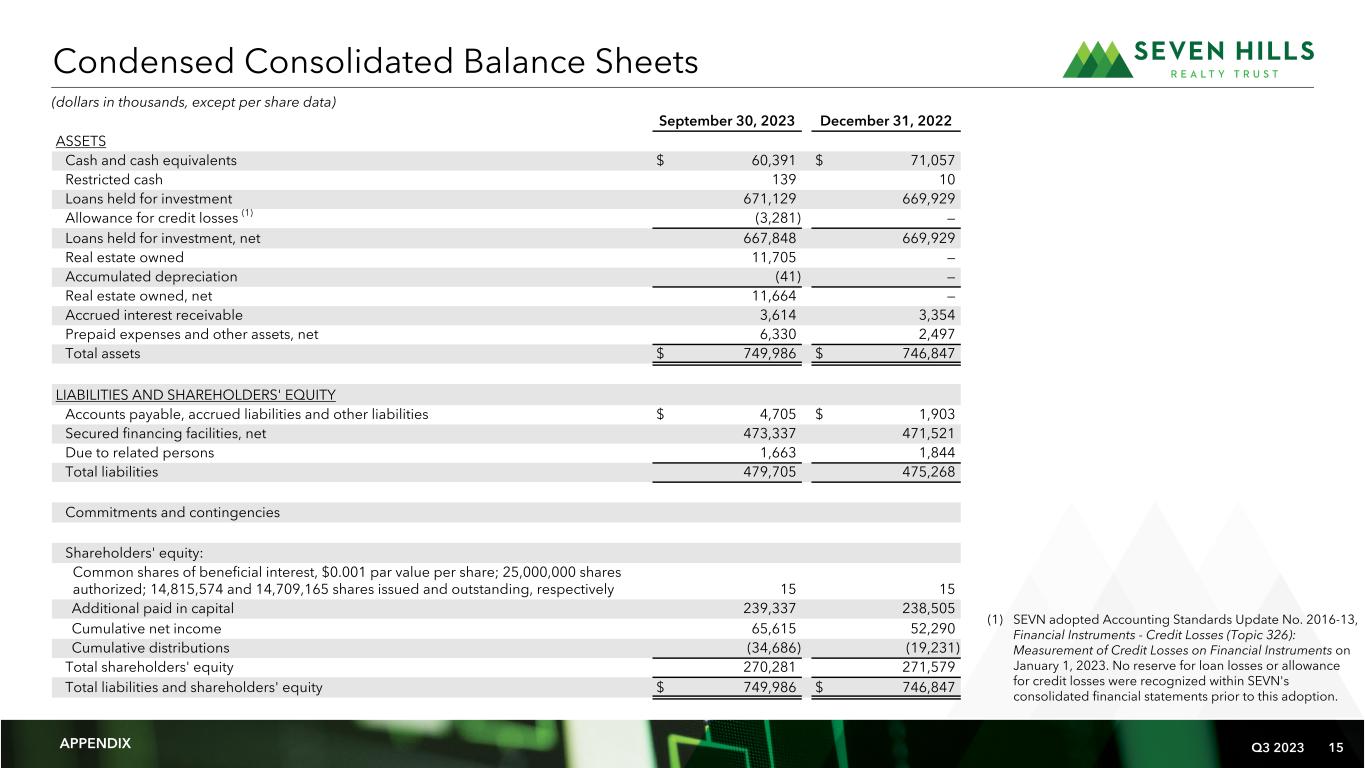

Q3 2023 15 Financial Summary September 30, 2023 December 31, 2022 ASSETS Cash and cash equivalents $ 60,391 $ 71,057 Restricted cash 139 10 Loans held for investment 671,129 669,929 Allowance for credit losses (1) (3,281) — Loans held for investment, net 667,848 669,929 Real estate owned 11,705 — Accumulated depreciation (41) — Real estate owned, net 11,664 — Accrued interest receivable 3,614 3,354 Prepaid expenses and other assets, net 6,330 2,497 Total assets $ 749,986 $ 746,847 LIABILITIES AND SHAREHOLDERS' EQUITY Accounts payable, accrued liabilities and other liabilities $ 4,705 $ 1,903 Secured financing facilities, net 473,337 471,521 Due to related persons 1,663 1,844 Total liabilities 479,705 475,268 Commitments and contingencies Shareholders' equity: Common shares of beneficial interest, $0.001 par value per share; 25,000,000 shares authorized; 14,815,574 and 14,709,165 shares issued and outstanding, respectively 15 15 Additional paid in capital 239,337 238,505 Cumulative net income 65,615 52,290 Cumulative distributions (34,686) (19,231) Total shareholders' equity 270,281 271,579 Total liabilities and shareholders' equity $ 749,986 $ 746,847 Condensed Consolidated Balance Sheets (dollars in thousands, except per share data) APPENDIX (1) SEVN adopted Accounting Standards Update No. 2016-13, Financial Instruments - Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments on January 1, 2023. No reserve for loan losses or allowance for credit losses were recognized within SEVN's consolidated financial statements prior to this adoption.

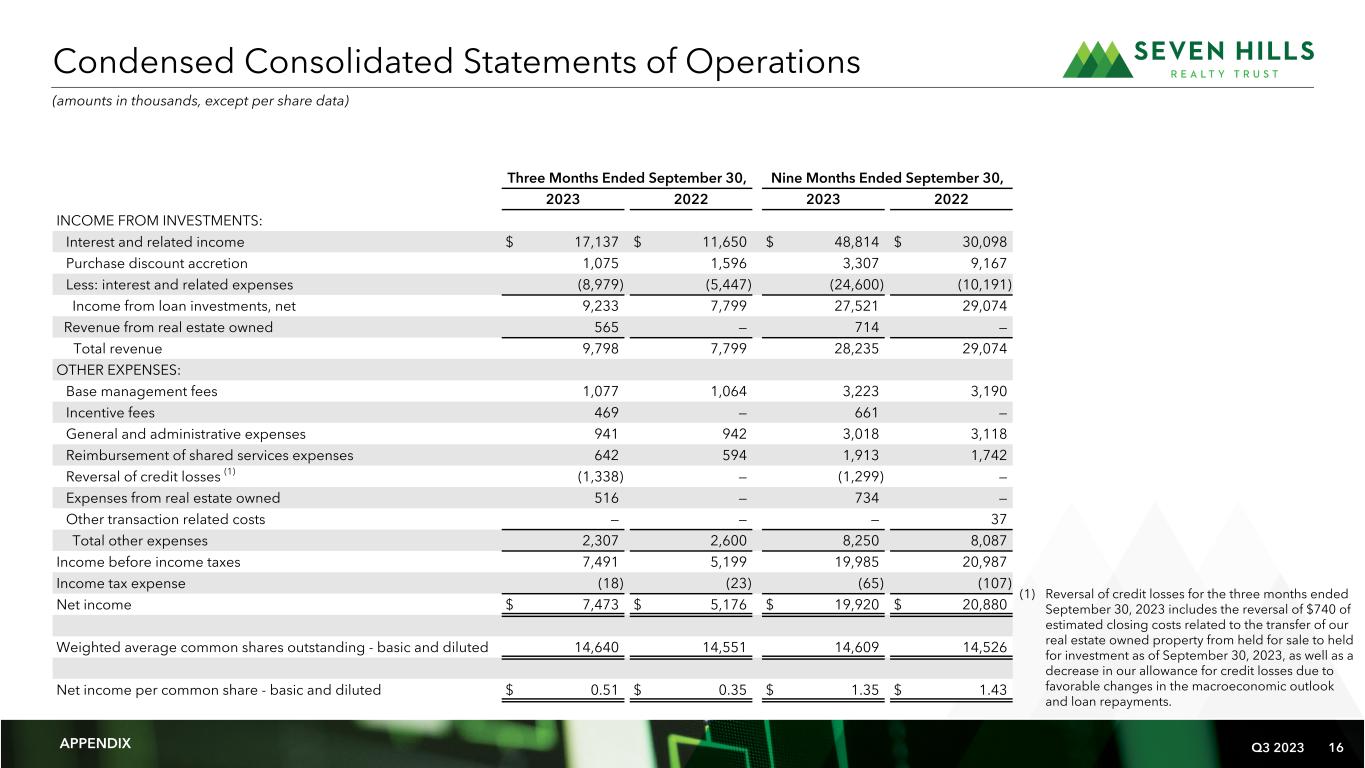

Q3 2023 16 Condensed Consolidated Statements of Operations Three Months Ended September 30, Nine Months Ended September 30, 2023 2022 2023 2022 INCOME FROM INVESTMENTS: Interest and related income $ 17,137 $ 11,650 $ 48,814 $ 30,098 Purchase discount accretion 1,075 1,596 3,307 9,167 Less: interest and related expenses (8,979) (5,447) (24,600) (10,191) Income from loan investments, net 9,233 7,799 27,521 29,074 Revenue from real estate owned 565 — 714 — Total revenue 9,798 7,799 28,235 29,074 OTHER EXPENSES: Base management fees 1,077 1,064 3,223 3,190 Incentive fees 469 — 661 — General and administrative expenses 941 942 3,018 3,118 Reimbursement of shared services expenses 642 594 1,913 1,742 Reversal of credit losses (1) (1,338) — (1,299) — Expenses from real estate owned 516 — 734 — Other transaction related costs — — — 37 Total other expenses 2,307 2,600 8,250 8,087 Income before income taxes 7,491 5,199 19,985 20,987 Income tax expense (18) (23) (65) (107) Net income $ 7,473 $ 5,176 $ 19,920 $ 20,880 Weighted average common shares outstanding - basic and diluted 14,640 14,551 14,609 14,526 Net income per common share - basic and diluted $ 0.51 $ 0.35 $ 1.35 $ 1.43 (amounts in thousands, except per share data) APPENDIX (1) Reversal of credit losses for the three months ended September 30, 2023 includes the reversal of $740 of estimated closing costs related to the transfer of our real estate owned property from held for sale to held for investment as of September 30, 2023, as well as a decrease in our allowance for credit losses due to favorable changes in the macroeconomic outlook and loan repayments.

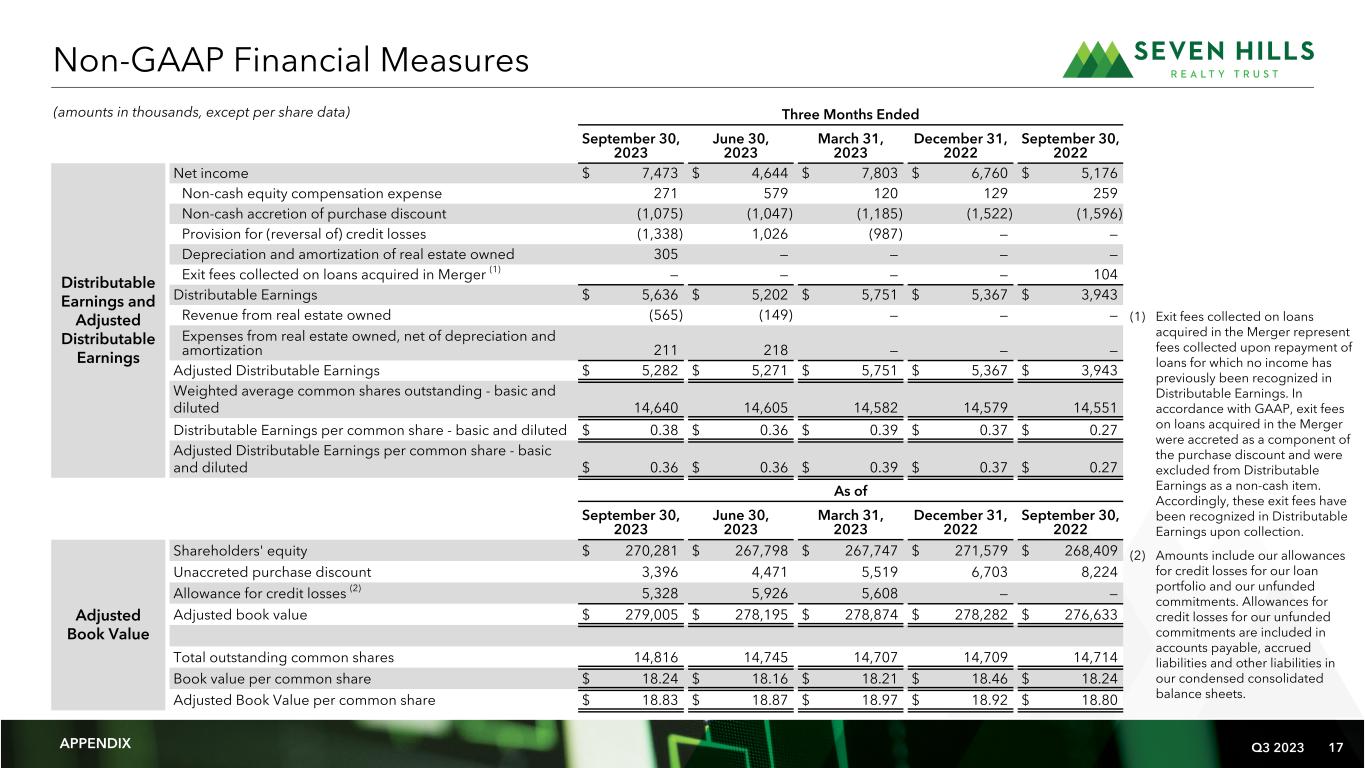

Q3 2023 17 Three Months Ended September 30, 2023 June 30, 2023 March 31, 2023 December 31, 2022 September 30, 2022 Distributable Earnings and Adjusted Distributable Earnings Net income $ 7,473 $ 4,644 $ 7,803 $ 6,760 $ 5,176 Non-cash equity compensation expense 271 579 120 129 259 Non-cash accretion of purchase discount (1,075) (1,047) (1,185) (1,522) (1,596) Provision for (reversal of) credit losses (1,338) 1,026 (987) — — Depreciation and amortization of real estate owned 305 — — — — Exit fees collected on loans acquired in Merger (1) — — — — 104 Distributable Earnings $ 5,636 $ 5,202 $ 5,751 $ 5,367 $ 3,943 Revenue from real estate owned (565) (149) — — — Expenses from real estate owned, net of depreciation and amortization 211 218 — — — Adjusted Distributable Earnings $ 5,282 $ 5,271 $ 5,751 $ 5,367 $ 3,943 Weighted average common shares outstanding - basic and diluted 14,640 14,605 14,582 14,579 14,551 Distributable Earnings per common share - basic and diluted $ 0.38 $ 0.36 $ 0.39 $ 0.37 $ 0.27 Adjusted Distributable Earnings per common share - basic and diluted $ 0.36 $ 0.36 $ 0.39 $ 0.37 $ 0.27 As of September 30, 2023 June 30, 2023 March 31, 2023 December 31, 2022 September 30, 2022 Adjusted Book Value Shareholders' equity $ 270,281 $ 267,798 $ 267,747 $ 271,579 $ 268,409 Unaccreted purchase discount 3,396 4,471 5,519 6,703 8,224 Allowance for credit losses (2) 5,328 5,926 5,608 — — Adjusted book value $ 279,005 $ 278,195 $ 278,874 $ 278,282 $ 276,633 Total outstanding common shares 14,816 14,745 14,707 14,709 14,714 Book value per common share $ 18.24 $ 18.16 $ 18.21 $ 18.46 $ 18.24 Adjusted Book Value per common share $ 18.83 $ 18.87 $ 18.97 $ 18.92 $ 18.80 Non-GAAP Financial Measures (amounts in thousands, except per share data) APPENDIX (1) Exit fees collected on loans acquired in the Merger represent fees collected upon repayment of loans for which no income has previously been recognized in Distributable Earnings. In accordance with GAAP, exit fees on loans acquired in the Merger were accreted as a component of the purchase discount and were excluded from Distributable Earnings as a non-cash item. Accordingly, these exit fees have been recognized in Distributable Earnings upon collection. (2) Amounts include our allowances for credit losses for our loan portfolio and our unfunded commitments. Allowances for credit losses for our unfunded commitments are included in accounts payable, accrued liabilities and other liabilities in our condensed consolidated balance sheets.

Q3 2023 18 We present Distributable Earnings, Distributable Earnings per common share, Adjusted Distributable Earnings, Adjusted Distributable Earnings per common share and Adjusted Book Value per common share, which are considered “non-GAAP financial measures” within the meaning of the applicable SEC rules. These non-GAAP financial measures do not represent net income, net income per common share or cash generated from operating activities and should not be considered as alternatives to net income or net income per common share determined in accordance with GAAP or as an indication of our cash flows from operations determined in accordance with GAAP, a measure of our liquidity or operating performance or an indication of funds available for our cash needs. In addition, our methodologies for calculating these non-GAAP financial measures may differ from the methodologies employed by other companies to calculate the same or similar supplemental performance measures; therefore, our reported Distributable Earnings, Distributable Earnings per common share, Adjusted Distributable Earnings and Adjusted Distributable Earnings per common share may not be comparable to distributable earnings, distributable earnings per common share, adjusted distributable earnings and adjusted distributable earnings per common share as reported by other companies. We believe that Adjusted Book Value per common share is a meaningful measure of our capital adequacy because it excludes the impact of certain non-cash estimates or adjustments, including the unaccreted purchase discount resulting from the excess of the fair value of the loans TRMT then held for investment and that we acquired as a result of the Merger, over the consideration we paid in the Merger and our allowance for credit losses for our loan portfolio and unfunded loan commitments. Adjusted Book Value per common share does not represent book value per common share or alternative measures determined in accordance with GAAP. Our methodology for calculating Adjusted Book Value per common share may differ from the methodologies employed by other companies to calculate the same or similar supplemental capital adequacy measures; therefore, our Adjusted Book Value per common share may not be comparable to the adjusted book value per common share reported by other companies. In order to maintain our qualification for taxation as a REIT, we are generally required to distribute substantially all of our taxable income, subject to certain adjustments, to our shareholders. We believe that one of the factors that investors consider important in deciding whether to buy or sell securities of a REIT is its distribution rate. Over time, Distributable Earnings, Distributable Earnings per common share, Adjusted Distributable Earnings and Adjusted Distributable Earnings per common share may be useful indicators of distributions to our shareholders and are measures that are considered by our Board of Trustees when determining the amount of distributions. We believe that Distributable Earnings, Distributable Earnings per common share, Adjusted Distributable Earnings and Adjusted Distributable Earnings per common share provide meaningful information to consider in addition to net income, net income per common share and cash flows from operating activities determined in accordance with GAAP. These measures help us to evaluate our performance excluding the effects of certain transactions, the variability of any management incentive fees that may be paid or payable and GAAP adjustments that we believe are not necessarily indicative of our current loan portfolio and operations. In addition, Distributable Earnings, excluding incentive fees, is used in determining the amount of base management and management incentive fees payable by us to Tremont under our management agreement. Distributable Earnings: We calculate Distributable Earnings and Distributable Earnings per common share as net income and net income per common share, respectively, computed in accordance with GAAP, including realized losses not otherwise included in net income determined in accordance with GAAP, and excluding: (a) depreciation and amortization of real estate owned and related intangible assets, if any; (b) non-cash equity compensation expense; (c) unrealized gains, losses and other similar non-cash items that are included in net income for the period of the calculation (regardless of whether such items are included in or deducted from net income or in other comprehensive income under GAAP), if any; and (d) one-time events pursuant to changes in GAAP and certain non-cash items, if any. Distributable Earnings are reduced for realized losses on loan investments when amounts are deemed uncollectable. This is generally at the time a loan is repaid, or in the case of foreclosure, when the underlying asset is sold, but may also be when, in our determination, it is nearly certain that all amounts due will not be collected. The realized loss amount reflected in Distributable Earnings will equal the difference between the cash received or expected to be received and the carrying value of the asset. Adjusted Distributable Earnings: We define Adjusted Distributable Earnings and Adjusted Distributable Earnings per common share as Distributable Earnings and Distributable Earnings per common share, respectively, excluding the effects of certain non-recurring transactions and revenues and expenses from real estate owned. Adjusted Book Value: Adjusted Book Value per common share is a non-GAAP measure that excludes the impact of certain non-cash estimates or adjustments, including the impact of the unaccreted purchase discount resulting from the excess of the fair value of the loans TRMT then held for investment which we acquired as a result of the Merger over the consideration we paid, the allowance for credit losses for our loan portfolio and unfunded loan commitments. Non-GAAP Financial Measures (Continued) APPENDIX

Q3 2023 19 All In Yield: All In Yield represents the yield on a loan, including amortization of deferred fees over the initial term of the loan and excluding any purchase discount accretion. BMO Facility: Amounts advanced under the facility loan agreement and security agreement with BMO Harris Bank N.A., or BMO, are pursuant to separate facility loan agreements that we refer to as BMO Facility. CBD: The central business district, or CBD, is the center of business and economic activity in major markets of the United States. GAAP: GAAP refers to generally accepted accounting principles. Gross AUM: Gross AUM refers to gross assets under management. LTV: Loan to value ratio, or LTV, represents the initial loan amount divided by the underwritten in-place value of the underlying collateral at closing. Master Repurchase Facilities: Collectively, we refer to the master repurchase facilities with UBS AG, or UBS, Citibank, N.A., or Citibank, and Wells Fargo, National Association, or Wells Fargo, as our Master Repurchase Facilities. Maximum Maturity: Maximum Maturity assumes all borrower loan extension options have been exercised, which options are subject to the borrower meeting certain conditions. Merger: On September 30, 2021, TRMT merged with and into us. We refer to this transaction as the Merger. Secured Financing Facilities: Collectively, we refer to the Master Repurchase Facilities and our BMO Facility as our Secured Financing Facilities. SOFR: SOFR refers to the Secured Overnight Financing Rate. TRMT: TRMT refers to Tremont Mortgage Trust. Other Measures and Definitions APPENDIX

Q3 2023 20 This presentation contains statements that constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other securities laws. These statements include words such as “believe”, “expect”, “anticipate”, “intend”, “plan”, “estimate”, “will”, "would", "should", “may” and negatives or derivatives of these or similar expressions. These forward-looking statements include, among others, statements about: SEVN's investment portfolio and loan investment performance; the quality of the sponsors of SEVN's borrowers; SEVN's office sector exposure; SEVN's future lending activity and opportunities; SEVN's liquidity and leverage levels and capacity; the ability of SEVN to capitalize on opportunities; SEVN's ability to achieve its investment objectives and generate attractive returns for its shareholders; the benefits and opportunities SEVN believes that Tremont's relationship with RMR provide to SEVN; and the amount and timing of future distributions. Forward-looking statements reflect SEVN's current expectations, are based on judgments and assumptions, are inherently uncertain and are subject to risks, uncertainties and other factors, which could cause SEVN's actual results, performance or achievements to differ materially from expected future results, performance or achievements expressed or implied in any forward-looking statements. Some of the risks, uncertainties and other factors that may cause SEVN's actual results, performance or achievements to differ materially from those expressed or implied by forward-looking statements include, but are not limited to, the following: SEVN's borrowers’ ability to successfully execute their business plans, including SEVN's borrowers' ability to manage and stabilize properties; whether the diversity and other characteristics of its loan portfolio will benefit SEVN to the extent it expects; SEVN's ability to carry out its business strategy and take advantage of opportunities for its business that it believes exist; the impact of inflation, geopolitical instability, interest rates and economic recession or downturn on the commercial real estate, or CRE, industry generally and specific CRE sectors applicable to SEVN's investments and lending markets, SEVN and its borrowers; fluctuations in interest rates and credit spreads may reduce the returns SEVN may receive on its investments and increase its borrowing costs; fluctuations in market demand for CRE debt and the volume of transactions and available opportunities in the CRE debt market, including the middle market; dislocations and volatility in the capital markets; SEVN's ability to utilize its Secured Financing Facilities and to obtain additional capital to enable it to attain its target leverage, to make additional investments and to increase its potential returns and the cost of that capital; SEVN's ability to pay distributions to its shareholders and sustain or increase the amount of such distributions; SEVN's ability to successfully execute, achieve and benefit from its operating and investment targets, investment and financing strategies and leverage policies; the amount and timing of cash flows SEVN receives from its investments; the ability of SEVN's manager, Tremont Realty Capital LLC, or Tremont, to make suitable investments for it, to monitor, service and administer SEVN's existing investments and to otherwise implement its investment strategy and successfully manage SEVN; SEVN's ability to maintain and improve a favorable net interest spread between the interest it earns on its investments and the interest SEVN pays on its borrowings; the extent to which SEVN earns and receives origination, extension, exit, prepayment or other fees it may earn from its investments; yields that may be available to SEVN from mortgages on middle market and transitional CRE; the duration and other terms of SEVN's loan agreements with borrowers and our ability to match our loan investments with our repurchase lending arrangements; the credit qualities of SEVN's borrowers; the ability and willingness of SEVN's borrowers to repay its investments in a timely manner or at all; the extent to which SEVN's borrowers' sponsors provide support to its borrowers or SEVN regarding its loans; SEVN's ability to maintain its exemption from registration under the Investment Company Act of 1940, as amended; events giving rise to increases in SEVN's credit loss reserves; SEVN's ability to diversify its investment portfolio based on industry and market conditions; the ability of SEVN's manager to arrange for the successful management of real estate SEVN owns and SEVN's ability to sell those properties at prices that allow SEVN to recover amounts it invested; SEVN's ability to successfully compete; market trends in SEVN's industry or with respect to interest rates, real estate values, the debt securities markets or the economy generally; reduced demand for office or retail space; regulatory requirements and the effect they may have on SEVN or its competitors; competition within the CRE lending industry; changes in the availability, sourcing and structuring of CRE lending; defaults by SEVN's borrowers; compliance with, and changes to, federal, state and local laws and regulations, accounting rules, tax laws and similar matters; limitations imposed on SEVN's business and its ability to satisfy complex rules in order for SEVN to maintain its qualification for taxation as a REIT for U.S. federal income tax purposes; actual and potential conflicts of interest with SEVN's related parties, including its Managing Trustees, Tremont, RMR, and others affiliated with them; acts of God, earthquakes, hurricanes, outbreaks or continuation of pandemics, or other public health safety events or conditions, supply chain disruptions, climate change and other man-made or natural disasters or war, terrorism, social unrest or civil disturbances; and other matters. These risks, uncertainties and other factors are not exhaustive and should be read in conjunction with other cautionary statements that are included in SEVN's periodic filings. The information contained in SEVN's filings with the SEC, including under the caption "Risk Factors" in its periodic reports, or incorporated therein, identifies important factors that could cause differences from the forward- looking statements in this presentation. SEVN's filings with the SEC are available on its website and at www.sec.gov. You should not place undue reliance on forward-looking statements. Except as required by law, SEVN undertakes no obligation to update any forward-looking statement, whether as a result of new information, future events or otherwise. Warning Concerning Forward-Looking Statements