UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2024

Commission File Number: 001-39173

I-MAB

2440 Research Boulevard, Suite 400

Rockville, MD 20850

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

EXPLANATORY NOTE

I-Mab (the “Registrant”) is filing this Form 6-K to furnish a press release issued on November 14, 2024, announcing financial results as of and for the three and nine months ended September 30, 2024, which is furnished herewith as Exhibit 99.1. In addition, the Registrant is updating its Investor Presentation, as set forth in Exhibit 99.2 to this Form 6-K.

Exhibit 99.1 to this Report on Form 6-K shall be deemed to be incorporated by reference into the Registrant’s Registration Statements on Form S-8 (File No. 333-239871, File No. 333-256603, File No. 333-265684 and File No. 333-279842) and to be a part thereof from the date on which this report is filed, to the extent not superseded by documents or reports subsequently filed or furnished.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

I-MAB |

|

|

|

By |

: |

/s/ Joseph Skelton |

|

Name |

: |

Joseph Skelton |

|

Title |

: |

Chief Financial Officer |

Date: November 14, 2024

Exhibit 99.1

I-Mab Reports Third Quarter 2024 Results

•Givastomig data presented at ESMO 2024 and SITC 2024 highlights encouraging monotherapy data

•On track to dose first patient in randomized Phase 2 study of uliledlimab in first-line mNSCLC in 1H 2025

•Appointed Dr. Sean Fu as permanent CEO effective November 1, 2024

•Estimated cash runway into 2027, based on $184.4 million in cash and cash equivalents, and short-term investments as of September 30, 2024

ROCKVILLE, MD, November 14, 2024 – I-Mab (NASDAQ: IMAB) (the “Company”), a U.S.-based, global biotech company, exclusively focused on the development of highly differentiated immunotherapies for the treatment of cancer, today announced financial results for the three and nine months ended September 30, 2024, and highlighted recent pipeline progress and business updates.

“I-Mab is making excellent progress in advancing the development of our pipeline projects, supported by our strong cash balance, streamlined operating model, and a focused in-licensing strategy,” said Dr. Sean Fu, CEO and Board Member of I-Mab. “In addition, Phase 1 data presented this year for uliledlimab, givastomig, and ragistomig at four international medical conferences highlight the strength of our early data sets for each program. These results have provided us with a strong foundation for advancing each molecule into expanded clinical trials, including Phase 2 studies, in the next year.”

Pipeline Overview and Potential Upcoming Milestones:

Uliledlimab (CD73 antibody): Initiating a randomized Phase 2 combination study in first-line metastatic non-small cell lung cancer ("mNSCLC")

Uliledlimab (TJ004309) is an antibody designed to target CD73, the rate-limiting enzyme critical for adenosine-driven immunosuppression in the tumor microenvironment. I-Mab owns worldwide rights to uliledlimab outside of Greater China.

Pharmacokinetic/pharmacodynamic ("PK/PD") Phase 1 data presented at the 2024 World Conference on Lung Cancer ("WCLC 2024") in September showed that uliledlimab achieved full target engagement with a positive correlation between the overall response rate ("ORR") in patients with mNSCLC and uliledlimab exposure.

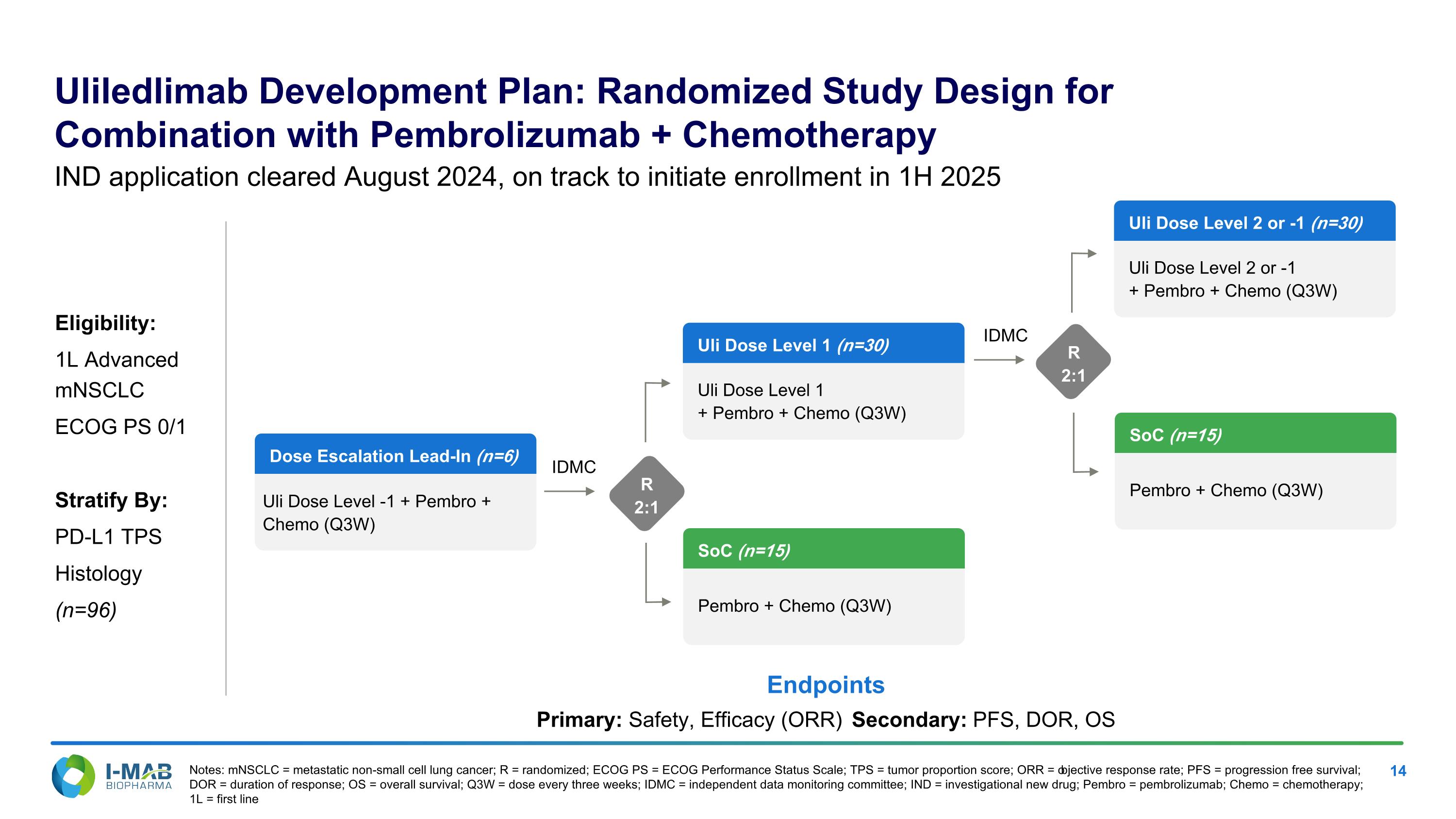

The Company is on track to dose the first patient in the randomized Phase 2 study in patients with first-line mNSCLC testing multiple doses of uliledlimab in combination with pembrolizumab plus chemotherapy versus standard of care in 1H 2025.

Givastomig (Claudin 18.2 x 4-1BB bispecific antibody): Ongoing Phase 1b escalation and expansion study in combination with nivolumab plus chemotherapy in first-line metastatic gastric cancer

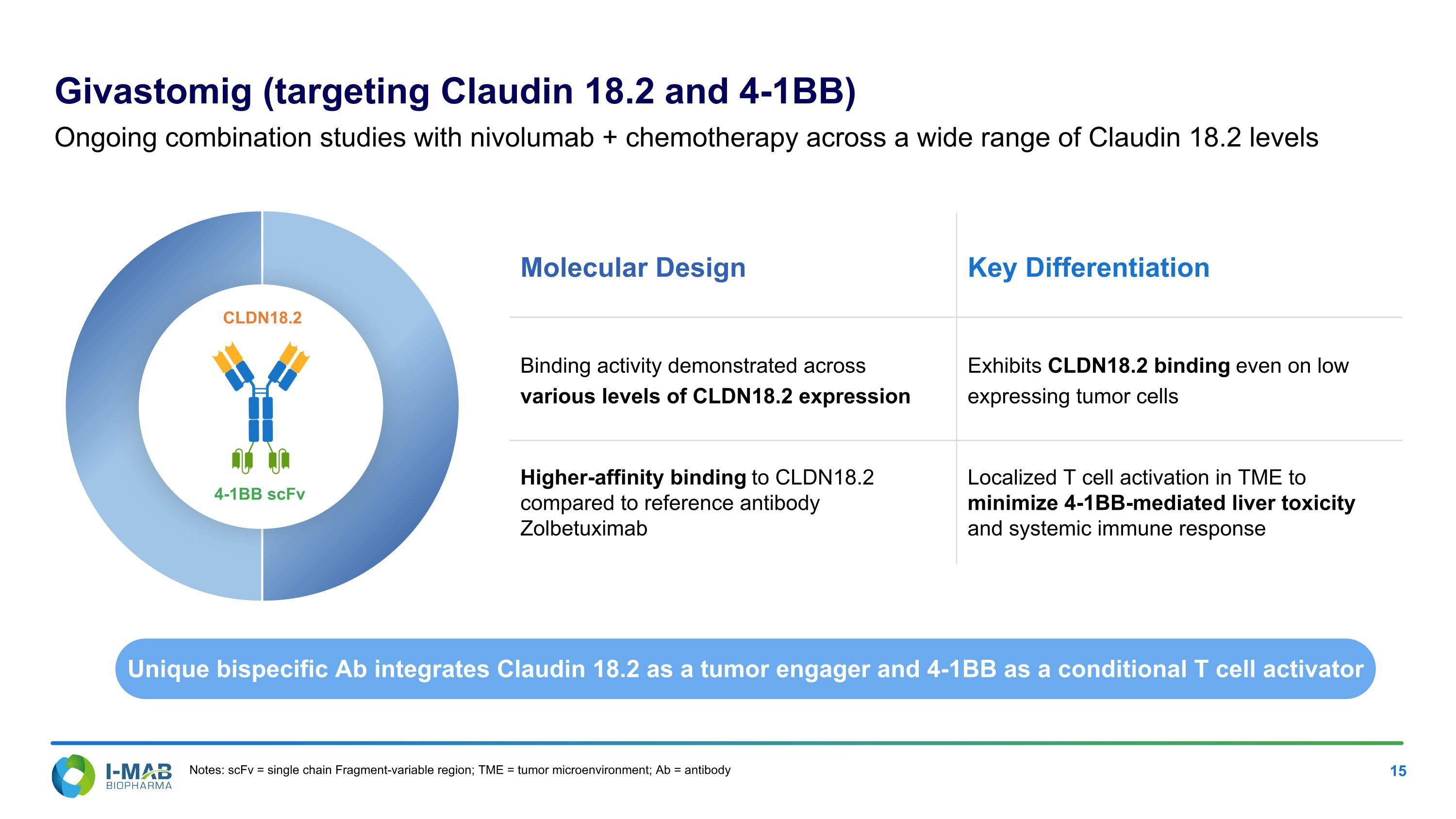

Givastomig (TJ033721 / ABL111) is a bispecific antibody targeting Claudin 18.2 (“CLDN 18.2”)-positive tumor cells that conditionally activates T cells via 4-1BB in the tumor microenvironment, with potential CLDN 18.2 specificity even in tumors with low levels of CLDN 18.2 expression. The program is being jointly developed with ABL Bio.

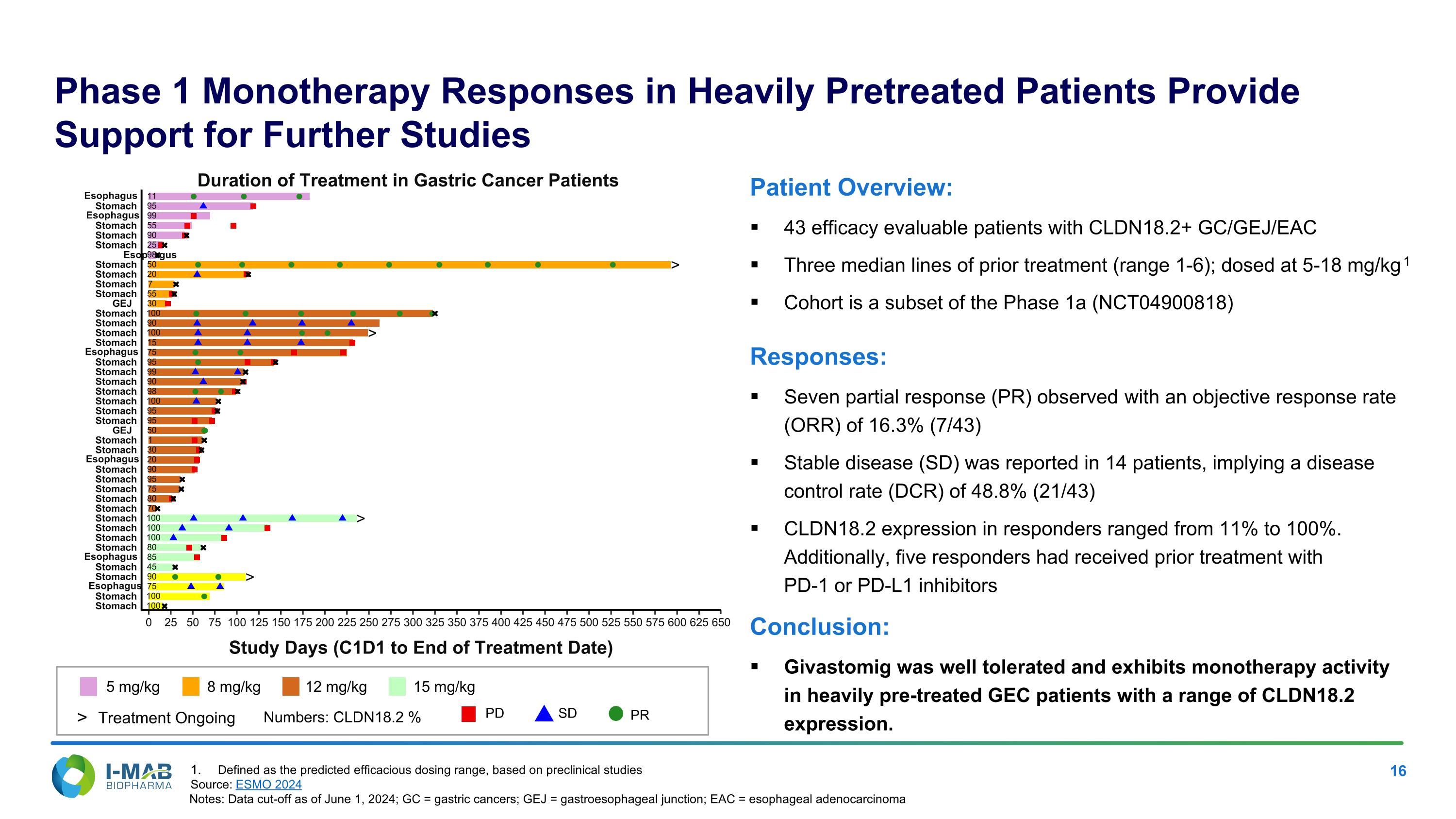

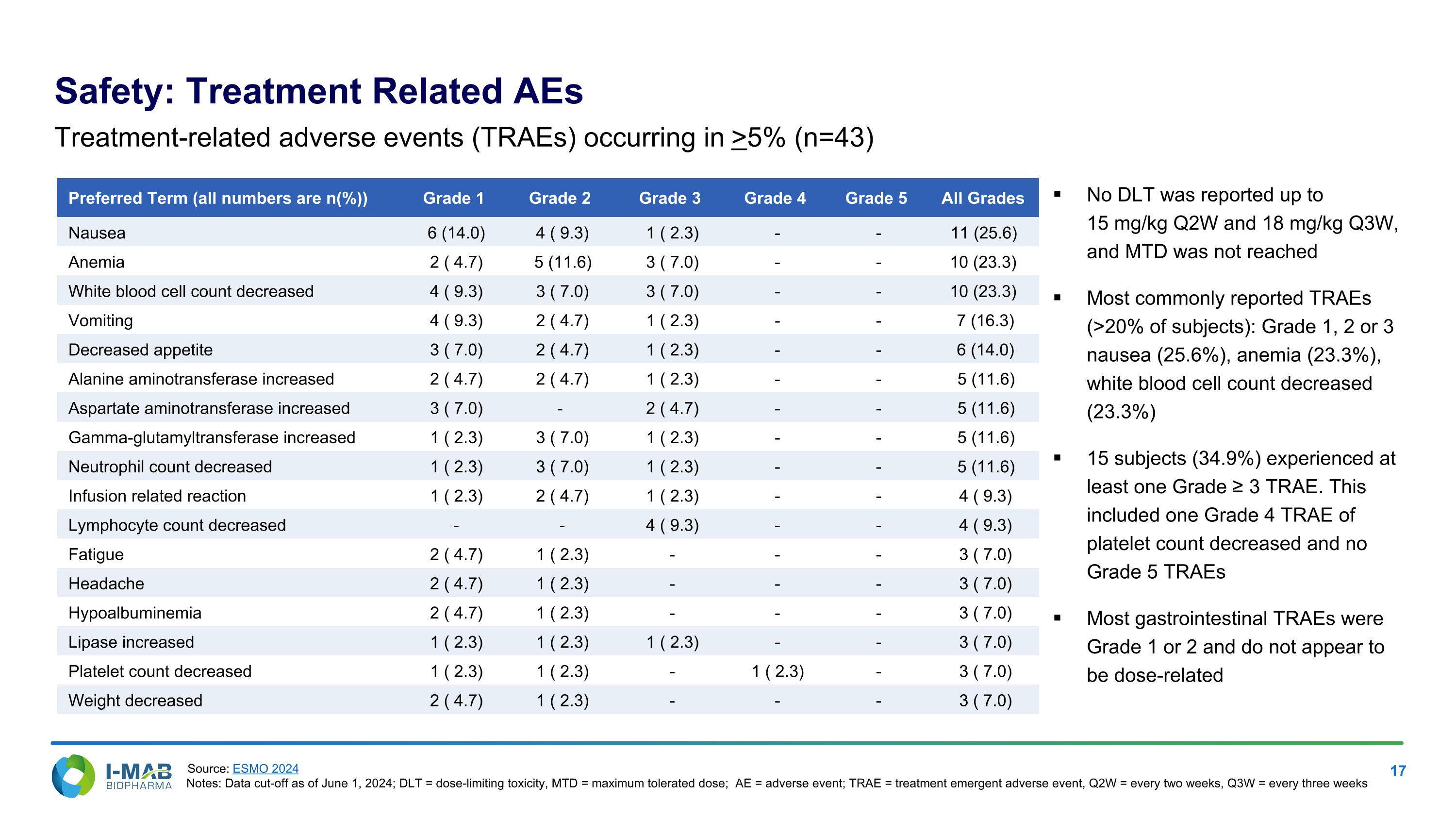

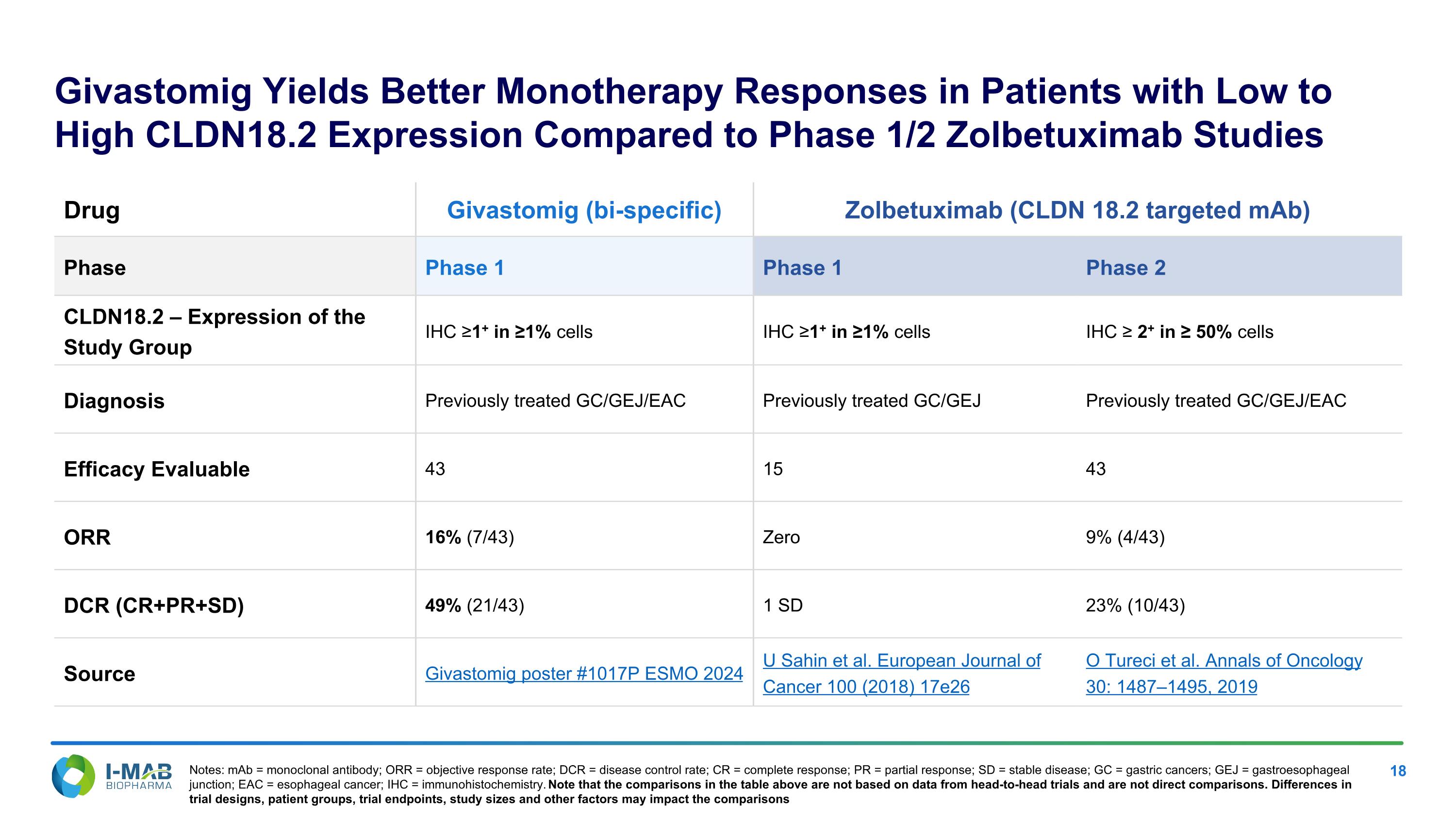

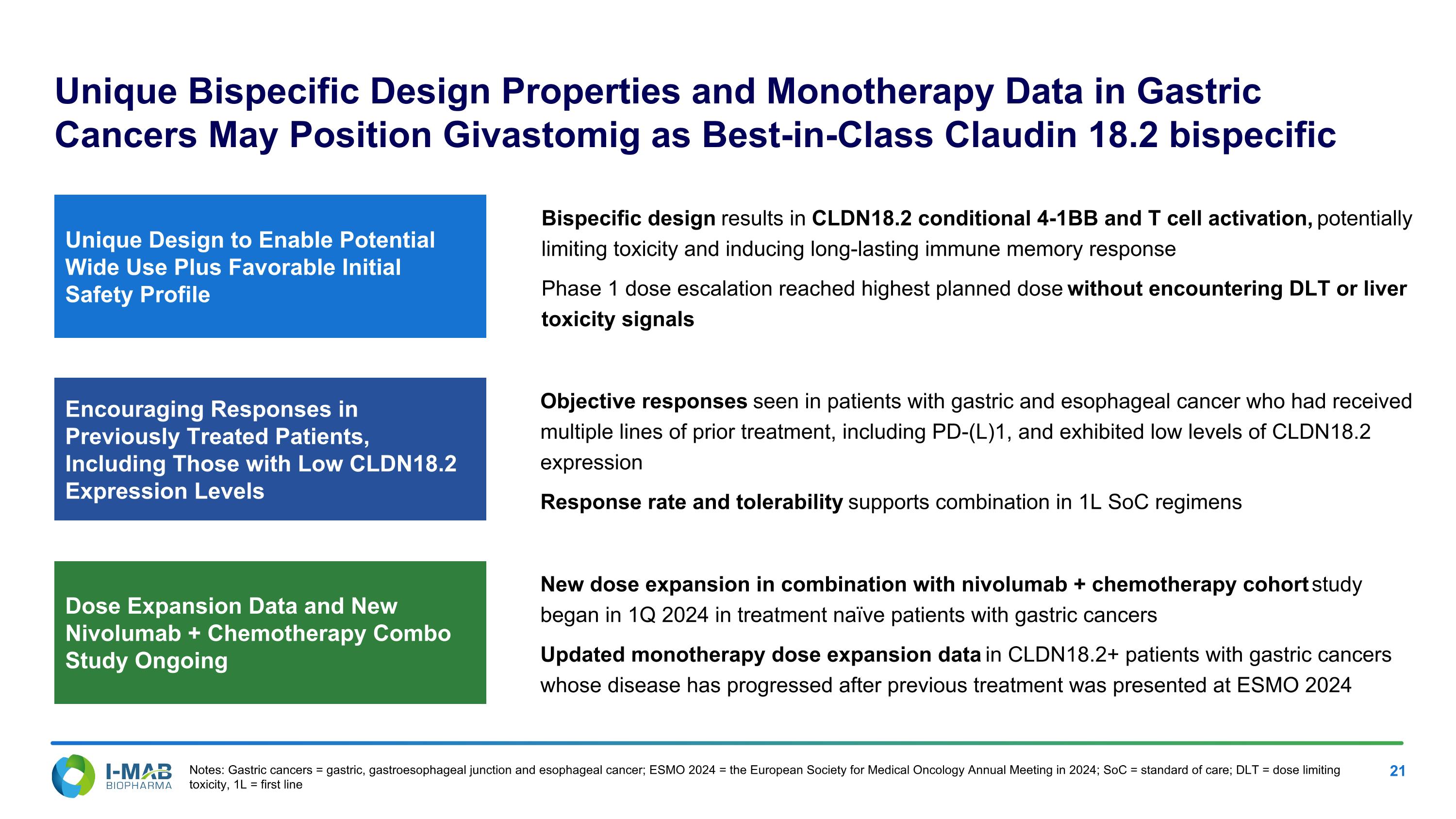

Topline Phase 1 monotherapy dose escalation and dose expansion data presented at the European Society for Medical Oncology ("ESMO 2024") in September 2024 showed promising objective responses in patients with gastric cancers expressing CLDN 18.2 across low and high levels and defined the optimal monotherapy dose range (8-12 mg/kg). The study showed an ORR of 16.3% (7/43), including seven partial responses ("PR") at doses between 5 mg/kg and 18 mg/kg, with five of the seven patients (71%) having received prior checkpoint inhibitor therapy. Stable disease ("SD") was reported in 14 patients, with a disease control rate ("DCR") of 48.8% (21/43 patients). The safety profile was favorable, with mainly grade 1 or 2 treatment-related adverse events ("TRAEs") and no observations of dose-limiting toxicities ("DLTs") or identification of a maximum tolerated dose ("MTD").

I-Mab presented a poster highlighting Phase 1 pharmacokinetic modeling data for optimizing dose estimation of givastomig at the Society for Immunotherapy of Cancer (“SITC 2024”) on November 9, 2024, based on three clinical studies and additional nonclinical data. The studies demonstrated a dose-response relationship for givastomig and supported 8-12 mg/kg administered every two weeks ("Q2W") as the optimal monotherapy dose range for gastric cancer patients.

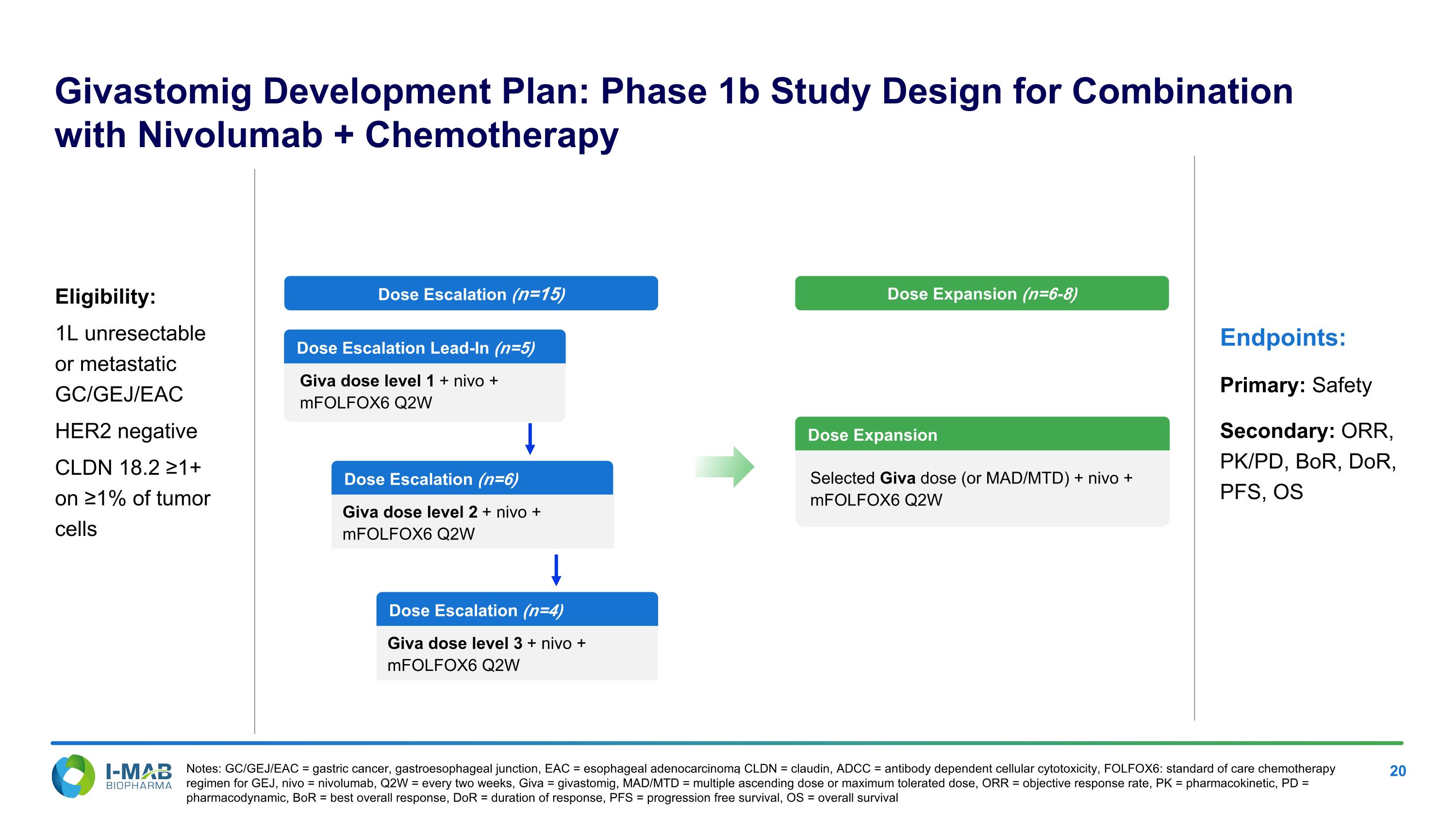

Topline data from the on-going Phase 1b study evaluating givastomig in combination with nivolumab plus chemotherapy are expected in 2H 2025 in patients with treatment-naïve CLDN 18.2-positive metastatic gastric cancer. The primary endpoint is safety, with secondary endpoints including tumor response, PK/PD, and survival.

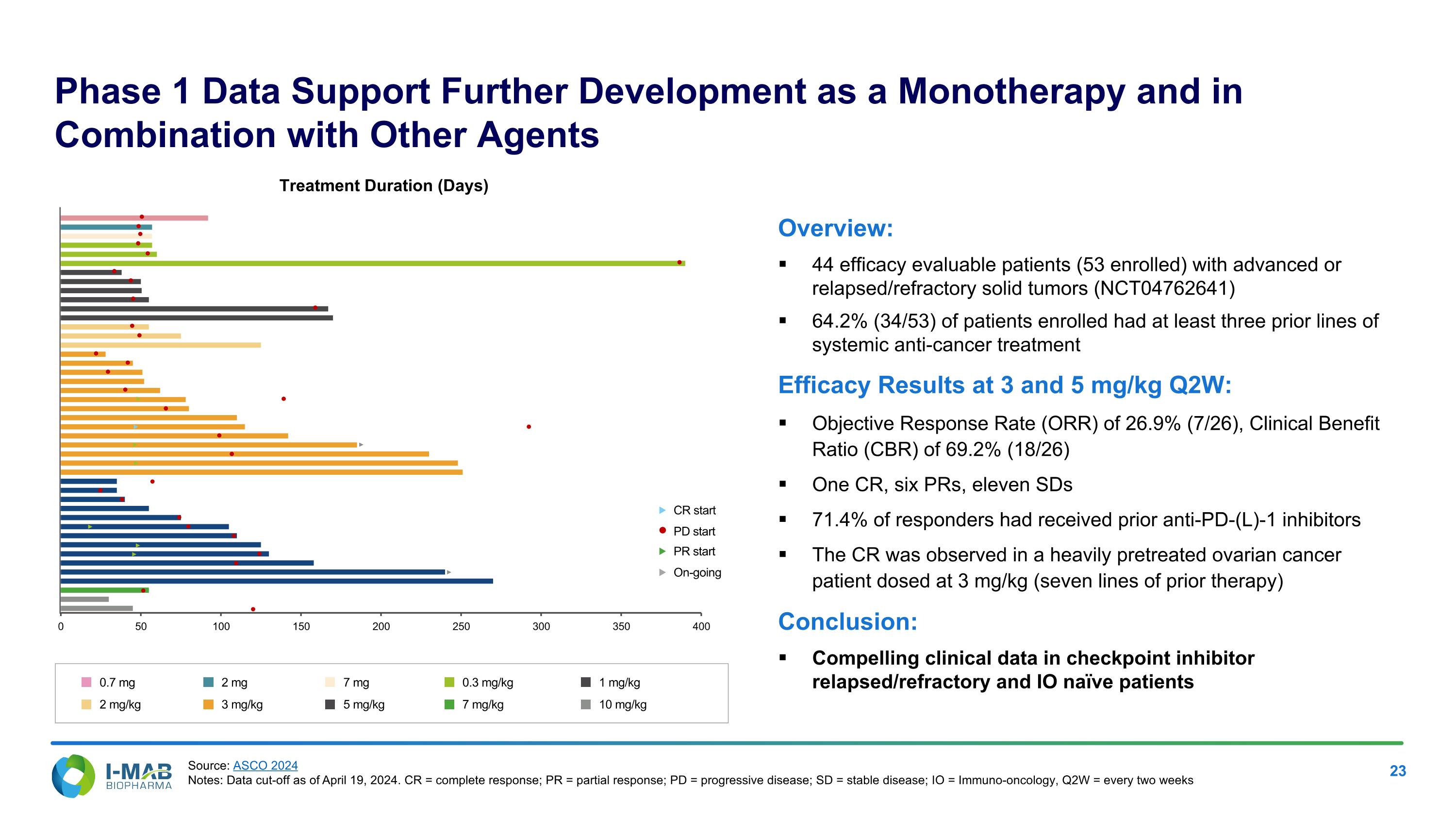

Ragistomig (PD-L1 x 4-1BB bispecific antibody): Ongoing Phase 1 dose escalation and dose expansion in advanced and/or PD-L1 positive, solid tumors

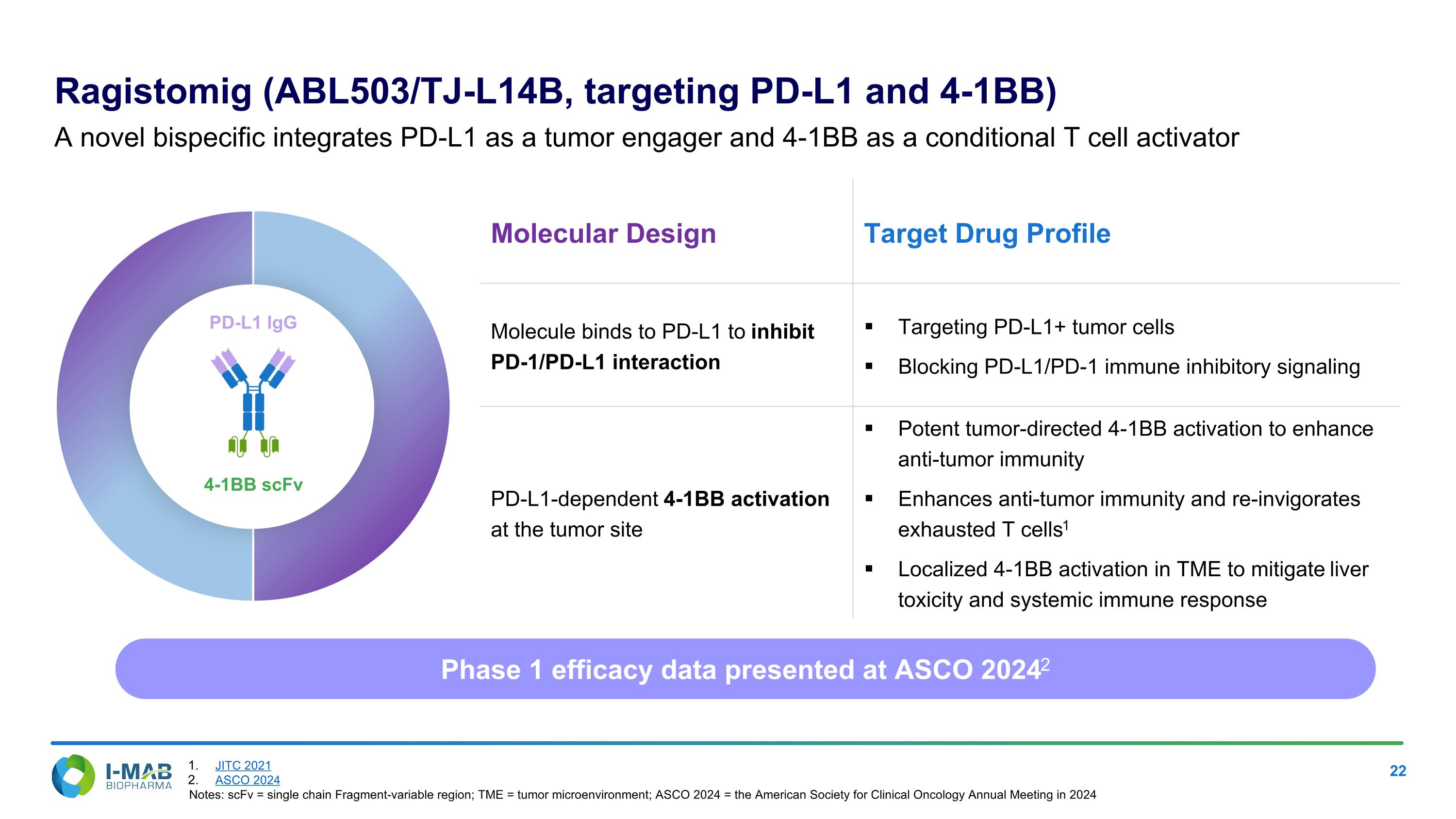

Ragistomig (TJ-L14B / ABL503) is a bispecific, Fc-silent antibody designed to provide anti-PD-L1 activity and conditional 4-1BB-driven T-cell activation in one molecule. The program is being jointly developed with ABL Bio.

In October, the United States Patent and Trademark Office ("USPTO") issued a composition of matter patent for ragistomig, providing coverage through February 2039, before consideration of any potential patent term extensions.

Additional dose schedules are being explored to maximize the therapeutic index in advanced and/or PD-L1-positive solid tumors.

Significant Strategic Progress and Corporate Development

•Appointment of Dr. Sean (Xi-Yong) Fu, PhD, MBA, as Chief Executive Officer: Dr. Fu was appointed as the Company’s permanent Chief Executive Officer (“CEO”) effective November 1, 2024. Dr. Fu has served as the Company's Interim CEO since July 15, 2024. Dr. Fu will continue to serve as a member of the I-Mab Board of Directors. Dr. Fu has over 20 years of experience in the life sciences industry, leading and developing clinical-stage assets.

•Sanofi S.A. ("Sanofi") / TJ Biopharma ("TJ Bio") agreement for uliledlimab: On September 25, 2024, Sanofi and TJ Bio entered into a collaboration agreement to develop and commercialize uliledlimab in Greater China. The agreement includes an initial payment and near-term milestone payments totaling approximately €32 million, with the potential to receive up to €213 million in success-based milestone payments plus tiered royalties based on sales, with upside from potential expanded indications. I-Mab holds worldwide rights, excluding Greater China.

•Settlement of remaining repurchase obligations: I-Mab settled the remaining RMB equivalent of approximately $15 million in redemption obligations related to the divestiture of its China operations in mid-September 2024. As previously disclosed, in connection with the divestiture of I-Mab's China operations, certain non-participating shareholders of TJ Bio commenced arbitration against I-Mab Biopharma Hong Kong Limited. As reported in the Company's 1H 2024 business update, the RMB equivalent of $17.3 million related to the ongoing arbitration with certain non-participating shareholders was settled from funds previously placed into escrow, which was accounted for in prepayments and other current assets. I-Mab’s ownership in TJ Bio post-settlement of the repurchase obligations is approximately 15%. As a result of the settlement of the redemption obligations, the corresponding put right liability was fully extinguished.

Third Quarter 2024 Financial Results

Cash Position

As of September 30, 2024, the Company had cash and cash equivalents, and short-term investments of $184.4 million, compared to $311.0 million as of December 31, 2023. There was $10.8 million of cash classified as discontinued operations as of December 31, 2023. The Company expects its existing cash and cash related balances to be sufficient to fund its current operating plan into 2027.

Shares Outstanding

As of September 30, 2024, the Company had 187,452,500 ordinary shares issued and outstanding, representing the equivalent of 81,501,087 ADSs, assuming the conversion of all ordinary shares into ADSs.

Research & Development Expenses

Research and development ("R&D") expenses were $4.5 million and $15.7 million for the three and nine months ended September 30, 2024, respectively, compared to $5.1 million and $13.3 million for the three and nine months ended September 30, 2023, respectively. R&D costs for the three months ended September 30, 2024, were $0.6 million lower than the comparable period in 2023, primarily due to streamlined clinical pipeline activities. R&D costs for the nine months ended September 30, 2024, were $2.4 million higher than the comparable period in 2023, driven by higher clinical trial costs associated with the preparation of enrollment for the uliledlimab Phase 2 combination study and increased spend on the givastomig Phase 1b dose expansion study. These higher costs were partially offset by decreased share-based compensation expense.

Administrative Expenses

Administrative expenses were $7.9 million and $22.3 million for the three and nine months ended September 30, 2024, respectively, compared to $5.9 million and $19.9 million for the three and nine months ended September 30, 2023, respectively. The increase of $2.0 million and $2.4 million for the three and nine months ended September 30, 2024, respectively, were primarily driven by legal costs associated with the litigation against Inhibrx, Inc., partially offset by lower share-based compensation expense.

Other Income (Expenses), Net

Other income (expenses), net were $(10.5) million and $(5.0) million for the three and nine months ended September 30, 2024, respectively, compared to $2.4 million and $(9.1) million for the three and nine months ended September 30, 2023, respectively. The $12.9 million increase in other expenses for the three months ended September 30, 2024, was primarily driven by the settlement of the TJ Bio repurchase obligations. The $4.1 million decrease in other expenses for the nine months ended September 30, 2024, was primarily driven by a smaller impact from foreign exchange losses for the current period, partially offset by the settlement of the TJ Bio repurchase obligations.

Net Loss from Continuing Operations

Net loss from continuing operations was $(20.5) million and $(38.9) million for the three and nine months ended September 30, 2024, respectively, compared to $(8.2) million and $(45.3) million for the three and nine months ended September 30, 2023, respectively.

About I-Mab

I-Mab (NASDAQ: IMAB) is a U.S.-based, global biotech company, exclusively focused on the development of highly differentiated immunotherapies for the treatment of cancer. I-Mab has established operations in the U.S. in Rockville, Maryland, and Short Hills, New Jersey. For more information, please visit https://www.i-mabbiopharma.com and follow us on LinkedIn and X.

Exchange Rate Information

As part of I-Mab’s strategic transition to a US-based biotech, effective April 2, 2024, the Company changed its reporting currency from RMB to USD. As indicated in its interim financial results, reported on August 28, 2024, the Company applied this change retrospectively to its historical results of operations and financial statements, as if the Company had always used the U.S. dollar as its reporting currency.

I-Mab Forward Looking Statements

This announcement contains forward-looking statements. These statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as “will”, “expects”, “believes”, “designed to”, “anticipates”, “future”, “intends”, “plans”, “potential”, “estimates”, “confident”, and similar terms or the negative thereof. I-Mab may also make written or oral forward-looking statements in its periodic reports to the U.S. Securities and Exchange Commission (the “SEC”), in its annual report to shareholders, in press releases and other written materials and in oral statements made by its officers, directors or employees to third parties. Statements that are not historical facts, including statements about I-Mab’s beliefs and expectations, are forward-looking statements. Forward-looking statements in this press release include, without limitation, statements regarding: the Company’s pipeline and capital strategy; the projected advancement of the Company’s portfolio and anticipated milestones and related timing; the market opportunity and I-Mab’s potential next steps (including the potential expansion, differentiation, or commercialization) for uliledlimab, givastomig and ragistomig; the Company’s expectations regarding the impact of data from ongoing and future clinical trials; the Company's financial condition and results of operations; the Company’s expectations regarding its cash runway; timing and progress of studies and trials (including with respect to patient enrollment); the availability of data and information from ongoing studies and trials; and the patent protection available for the Company's product candidates. Forward-looking statements involve inherent risks and uncertainties that may cause actual results to differ materially from those contained in these forward-looking statements, including but not limited to the following: I-Mab’s ability to demonstrate the safety and efficacy of its drug candidates; the clinical results for its drug candidates, which may or may not support further development or New Drug Application/Biologics License Application (NDA/BLA) approval; the content and timing of decisions made by the relevant regulatory authorities regarding regulatory approval of I-Mab’s drug candidates; I-Mab’s ability to achieve commercial success for its drug candidates, if approved; I-Mab’s ability to obtain and maintain protection of intellectual property for its technology and drugs; I-Mab’s reliance on third parties to conduct drug development, manufacturing and other services; and I-Mab’s limited operating history and I-Mab’s ability to obtain additional funding for operations and to complete the development and commercialization of its drug candidates, as well as those risks more fully discussed in the “Risk Factors” section in I-Mab’s most recent annual report on Form 20-F, as well as discussions of potential risks, uncertainties, and other important factors in I-Mab’s subsequent filings with the SEC. All forward-looking statements are based on information currently available to I-Mab. I-Mab undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise, except as may be required by law.

I-Mab Investor & Media Contacts

|

|

Tyler Ehler |

|

Senior Director, Investor Relations |

|

IR@imabbio.com |

|

|

|

|

|

I-Mab

Consolidated Balance Sheets

(All amounts in thousands, except for share data)

|

|

|

|

|

|

|

|

|

|

|

As of September 30, |

|

|

As of December 31, |

|

|

|

2024 |

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

(Unaudited) |

|

|

(Unaudited) |

|

Assets |

|

|

|

|

|

|

Current assets |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

79,327 |

|

|

$ |

290,799 |

|

Short-term investments |

|

|

105,064 |

|

|

|

20,172 |

|

Prepayments and other current assets |

|

|

3,820 |

|

|

|

714 |

|

Current assets of discontinued operations |

|

|

— |

|

|

|

17,428 |

|

Total current assets |

|

|

188,211 |

|

|

|

329,113 |

|

Property, equipment and software |

|

|

186 |

|

|

|

1,772 |

|

Operating lease right-of-use assets |

|

|

3,505 |

|

|

|

3,768 |

|

Investments at fair value - available for sale securities |

|

|

39,343 |

|

|

|

— |

|

Other non-current assets |

|

|

1,437 |

|

|

|

248 |

|

Non-current assets of discontinued operations |

|

|

— |

|

|

|

33,127 |

|

Total assets |

|

$ |

232,682 |

|

|

$ |

368,028 |

|

|

|

|

|

|

|

|

Liabilities and shareholders’ equity |

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

Accruals and other payables |

|

$ |

11,018 |

|

|

$ |

7,895 |

|

Operating lease liabilities, current |

|

|

753 |

|

|

|

624 |

|

Current liabilities of discontinued operations |

|

|

— |

|

|

|

49,484 |

|

Total current liabilities |

|

|

11,771 |

|

|

|

58,003 |

|

Put right liabilities, non-current |

|

|

— |

|

|

|

13,819 |

|

Operating lease liabilities, non-current |

|

|

3,028 |

|

|

|

3,253 |

|

Other non-current liabilities |

|

|

— |

|

|

|

105 |

|

Non-current liabilities of discontinued operations |

|

|

— |

|

|

|

50,851 |

|

Total liabilities |

|

$ |

14,799 |

|

|

$ |

126,031 |

|

|

|

|

|

|

|

|

Shareholders’ equity |

|

|

|

|

|

|

Ordinary shares (US$0.0001 par value, 800,000,000 shares authorized

as of September 30, 2024 and December 31, 2023; 187,452,500 and

185,613,662 shares issued and outstanding as of September 30,

2024 and December 31, 2023, respectively) |

|

|

19 |

|

|

|

19 |

|

Treasury stock |

|

|

(6,225 |

) |

|

|

(8,001 |

) |

Additional paid-in capital |

|

|

1,459,196 |

|

|

|

1,380,918 |

|

Accumulated other comprehensive income |

|

|

41,869 |

|

|

|

42,013 |

|

Accumulated deficit |

|

|

(1,276,976 |

) |

|

|

(1,172,952 |

) |

Total shareholders’ equity |

|

|

217,883 |

|

|

|

241,997 |

|

Total liabilities and shareholders’ equity |

|

$ |

232,682 |

|

|

$ |

368,028 |

|

I-Mab

Consolidated Statements of Comprehensive Loss

(All amounts in thousands, except for share and per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Unaudited) |

|

|

(Unaudited) |

|

Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

Licensing and collaboration revenue |

|

$ |

— |

|

|

$ |

315 |

|

|

$ |

— |

|

|

$ |

627 |

|

Total revenues |

|

|

— |

|

|

|

315 |

|

|

|

— |

|

|

|

627 |

|

Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

Research and development expenses (Note 1) |

|

|

(4,475 |

) |

|

|

(5,088 |

) |

|

|

(15,740 |

) |

|

|

(13,286 |

) |

Administrative expenses (Note 2) |

|

|

(7,937 |

) |

|

|

(5,861 |

) |

|

|

(22,315 |

) |

|

|

(19,895 |

) |

Loss from operations |

|

|

(12,412 |

) |

|

|

(10,634 |

) |

|

|

(38,055 |

) |

|

|

(32,554 |

) |

Interest income |

|

|

2,449 |

|

|

|

2,483 |

|

|

|

5,289 |

|

|

|

6,989 |

|

Other income (expenses), net |

|

|

(10,528 |

) |

|

|

2,379 |

|

|

|

(5,048 |

) |

|

|

(9,102 |

) |

Equity in loss of affiliates (Note 3) |

|

|

— |

|

|

|

(2,449 |

) |

|

|

(1,038 |

) |

|

|

(10,640 |

) |

Loss from continuing operations before income tax

expense |

|

|

(20,491 |

) |

|

|

(8,221 |

) |

|

|

(38,852 |

) |

|

|

(45,307 |

) |

Income tax expense |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Loss from continuing operations |

|

$ |

(20,491 |

) |

|

$ |

(8,221 |

) |

|

$ |

(38,852 |

) |

|

$ |

(45,307 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Discontinued operations: |

|

|

|

|

|

|

|

|

|

|

|

|

Loss from operations of discontinued operations

(Note 4) |

|

$ |

— |

|

|

$ |

(25,035 |

) |

|

$ |

(6,898 |

) |

|

$ |

(94,522 |

) |

Income tax expense |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Gain on sale of discontinued operations |

|

|

— |

|

|

|

— |

|

|

|

32,582 |

|

|

|

— |

|

Income (loss) from discontinued operations |

|

$ |

— |

|

|

$ |

(25,035 |

) |

|

$ |

25,684 |

|

|

$ |

(94,522 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss attributable to I-Mab |

|

$ |

(20,491 |

) |

|

$ |

(33,256 |

) |

|

$ |

(13,168 |

) |

|

$ |

(139,829 |

) |

Net loss attributable to ordinary shareholders |

|

$ |

(20,491 |

) |

|

$ |

(33,256 |

) |

|

$ |

(13,168 |

) |

|

$ |

(139,829 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss attributable to I-Mab |

|

$ |

(20,491 |

) |

|

$ |

(33,256 |

) |

|

$ |

(13,168 |

) |

|

$ |

(139,829 |

) |

Foreign currency translation adjustments net of tax |

|

|

1,071 |

|

|

|

(13,547 |

) |

|

|

(494 |

) |

|

|

8,887 |

|

Total comprehensive loss attributable to I-Mab |

|

$ |

(19,420 |

) |

|

$ |

(46,803 |

) |

|

$ |

(13,662 |

) |

|

$ |

(130,942 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss from continuing operations per share

attributable to ordinary shareholders

—Basic and diluted |

|

$ |

(0.11 |

) |

|

$ |

(0.04 |

) |

|

$ |

(0.21 |

) |

|

$ |

(0.24 |

) |

Net loss from continuing operations per ADS

attributable to ordinary shareholders (Note 5)

—Basic and diluted |

|

$ |

(0.25 |

) |

|

$ |

(0.09 |

) |

|

$ |

(0.48 |

) |

|

$ |

(0.55 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) from discontinued operations per

share attributable to ordinary shareholders

—Basic and diluted |

|

$ |

- |

|

|

$ |

(0.13 |

) |

|

$ |

0.14 |

|

|

$ |

(0.49 |

) |

Net income (loss) from discontinued operations per

ADS attributable to ordinary shareholders (Note 5)

—Basic and diluted |

|

$ |

- |

|

|

$ |

(0.30 |

) |

|

$ |

0.32 |

|

|

$ |

(1.13 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss attributable to ordinary shareholders

—Basic and diluted |

|

$ |

(0.11 |

) |

|

$ |

(0.17 |

) |

|

$ |

(0.07 |

) |

|

$ |

(0.73 |

) |

Net loss per ADS attributable to ordinary

shareholders (Note 5)

—Basic and diluted |

|

$ |

(0.25 |

) |

|

$ |

(0.39 |

) |

|

$ |

(0.16 |

) |

|

$ |

(1.68 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-average number of ordinary shares

outstanding —Basic and diluted |

|

|

187,440,440 |

|

|

|

192,922,665 |

|

|

|

186,485,241 |

|

|

|

191,306,670 |

|

Notes:

(1) Includes share-based compensation expense of $0.6 million and $0.9 million for the three and nine months ended September 30, 2024, respectively, compared to $0.6 million and $2.3 million for the three and nine months ended September 30, 2023, respectively.

(2) Includes share-based compensation expense of $(0.3) million and ($3.7) million for the three and nine months ended September 30, 2024, respectively, compared to $1.5 million and $6.2 million for the three and nine months ended September 30, 2023, respectively. The period ended September 30, 2024 includes forfeitures as a result of the divestiture of China operations and organizational changes.

(3) Includes share-based compensation expense of $0.0 million and ($0.7) million for the three and nine months ended September 30, 2024, respectively, compared to $0.1 million and $0.7 million for the three and nine months ended September 30, 2023, respectively. The period ended September 30, 2024 includes forfeitures as a result of the divestiture of China operations.

(4) Includes share-based compensation expense of $0.0 million and ($11.5) million for the three and nine months ended September 30, 2024, respectively, compared to $2.7 million and $14.8 million for the three and nine months ended September 30, 2023, respectively. The period ended September 30, 2024 includes forfeitures as a result of the divestiture of China operations.

(5) Each 10 ADSs represents 23 ordinary shares.

Transforming Potential into Reality I-Mab Biopharma November 14, 2024

Legal Disclaimer. This presentation has been prepared by I-Mab (the “Company”) solely for informational purposes. Certain of the information included herein was obtained from various sources, including certain third parties, and has not been independently verified by the Company. By viewing or accessing the information contained in this presentation, you hereby acknowledge and agree that no representations, warranties, or undertakings, express or implied, are made by the Company or any of its directors, shareholders, employees, agents, affiliates, advisors, or representatives as to, and no reliance should be placed on the truth, accuracy, fairness, completeness, or reasonableness of the information or opinions presented or contained in, and omission from, this presentation. Neither the Company nor any of its directors, employees, agents, affiliates, advisors, or representatives shall be responsible or liable whatsoever (in negligence or otherwise) for any loss, howsoever arising from any information presented or contained in this presentation or otherwise arising in connection with the presentation, except to the extent required by applicable law. The information presented or contained in this presentation speaks only as of the date hereof and is subject to change without notice. No Offer or Solicitation. This presentation does not constitute an offer to buy or sell or a solicitation of an offer to buy or sell any securities or instrument of the Company or to participate in any investment activity or trading strategy, nor may it or any part of it form the basis of or to be relied on in connection with any contract or commitment whatsoever. NOTHING HEREIN CONSTITUTES AN OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO BUY ANY SECURITIES OR INSTRUMENT IN ANY STATE OR JURISDICTION. This presentation does not purport to and does not contain all relevant information relating to the Company or its securities, particularly with respect to the risks and special considerations involved with an investment in the securities of the Company. Nothing contained in this presentation shall be relied upon as a promise or representation as to the past or future performance of the Company. Past performance does not guarantee or predict future performance. You acknowledge that any assessment of the Company that may be made by you will be independent of this presentation and that you will be solely responsible for your own assessment of the market and the market position of the Company, and that you will conduct your own analysis and be solely responsible for forming your own view of the potential future performance of the business of the Company. This presentation includes statistical and other industry and market data that we obtained from industry publications and research, surveys, and studies conducted by third parties, and our own estimates of potential market opportunities. All of the market data used in this presentation involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such data. Industry publications and third-party research, surveys and studies generally indicate that their information has been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. Our estimates of the potential market opportunities for our product candidates include several key assumptions based on our industry knowledge, industry publications, third-party research, and other surveys, which may be based on a small sample size and may fail to accurately reflect market opportunities. While we believe that our internal assumptions are reasonable, no independent source has verified such assumptions. Forward Looking Statements. This presentation contains forward-looking statements. These statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as “future”, “promising”, “may”, “plans”, “potential”, “will”, “could position”, “promise”, “advance”, “target”, “design”, “strategy”, “pipeline”, and “project”, and similar terms or the negative thereof. Statements that are not historical facts, including statements about I-Mab's beliefs and expectations, are forward-looking statements. The forward-looking statements in this presentation include, without limitation, statements regarding the following: the Company’s pipeline and capital strategy; the potential benefits, advantages, promise, attributes, and target usage of uliledlimab; the projected advancement of the Company’s portfolio and anticipated milestones and related timing; the market opportunity and I-Mab’s potential next steps (including the potential expansion, differentiation, or commercialization) for uliledlimab, givastomig and ragistomig; the Company’s expectations regarding the impact of data from ongoing and future trials; the timing of the settlement of remaining redemption obligations; the benefits of the Company’s collaboration with development partners; the Company’s ability to continue to comply with certain audit requirements; the timing and progress of studies (including with respect to patient enrollment and dosing); the availability of data and information from ongoing studies; and the Company’s expectations regarding its cash runway. These forward-looking statements involve inherent risks and uncertainties that could cause actual results to differ materially from those expressed or implied in such forward-looking statements. These risks and uncertainties include, but are not limited to, the following: I-Mab’s ability to demonstrate the safety and efficacy of its drug candidates; the clinical results for its drug candidates, which may or may not support further development or new drug application/biologics license application approval; the content and timing of decisions made by the relevant regulatory authorities regarding regulatory approval of I-Mab’s drug candidates; I-Mab’s ability to achieve commercial success for its drug candidates, if approved; I-Mab’s ability to obtain and maintain protection of intellectual property for its technology and drugs; I-Mab’s reliance on third parties to conduct drug development, manufacturing and other services; I-Mab’s limited operating history and I-Mab’s ability to obtain additional funding for operations and to complete the development and commercialization of its drug candidates; and discussions of potential risks, uncertainties, and other important factors in I-Mab’s most recent annual report on Form 20-F and I-Mab’s subsequent filings with the U.S. Securities and Exchange Commission (the “SEC”). I-Mab may also make written or oral forward-looking statements in its periodic reports to the SEC, in its annual report to shareholders, in press releases and other written materials, and in oral statements made by its officers, directors, or employees to third parties. All forward-looking statements are based on information currently available to I-Mab. I-Mab undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by law. Disclaimer

Completed divestiture of China operations Streamlined organization with US leadership team Defined clinical strategy for immunotherapeutic pipeline Executing on clinical strategy via disciplined capital approach Transition to a US-Based Biotech Primarily Complete

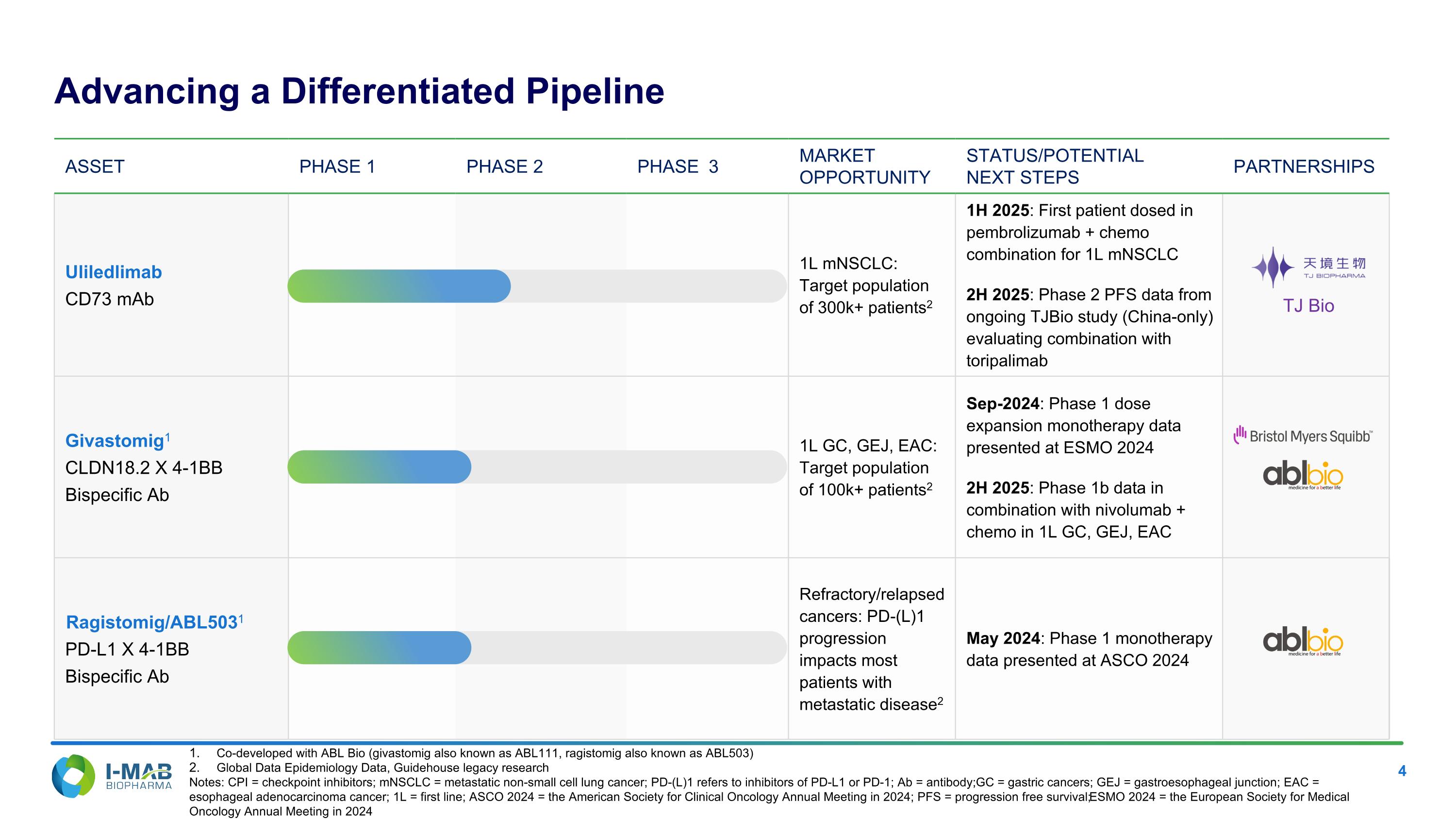

Asset PHASE 1 PHASE 2 PHASE 3 MARKET OPPORTUNITY STATUS/POTENTIAL NEXT STEPS PARTNERSHIPS Uliledlimab CD73 mAb 1L mNSCLC: Target population of 300k+ patients2 1H 2025: First patient dosed in pembrolizumab + chemo combination for 1L mNSCLC 2H 2025: Phase 2 PFS data from ongoing TJBio study (China-only) evaluating combination with toripalimab Givastomig1 CLDN18.2 X 4-1BB Bispecific Ab 1L GC, GEJ, EAC: Target population of 100k+ patients2 Sep-2024: Phase 1 dose expansion monotherapy data presented at ESMO 2024 2H 2025: Phase 1b data in combination with nivolumab + chemo in 1L GC, GEJ, EAC Ragistomig/ABL5031 PD-L1 X 4-1BB Bispecific Ab Refractory/relapsed cancers: PD-(L)1 progression impacts most patients with metastatic disease2 May 2024: Phase 1 monotherapy data presented at ASCO 2024 Advancing a Differentiated Pipeline TJ Bio Co-developed with ABL Bio (givastomig also known as ABL111, ragistomig also known as ABL503) Global Data Epidemiology Data, Guidehouse legacy research Notes: CPI = checkpoint inhibitors; mNSCLC = metastatic non-small cell lung cancer; PD-(L)1 refers to inhibitors of PD-L1 or PD-1; Ab = antibody; GC = gastric cancers; GEJ = gastroesophageal junction; EAC = esophageal adenocarcinoma cancer; 1L = first line; ASCO 2024 = the American Society for Clinical Oncology Annual Meeting in 2024; PFS = progression free survival; ESMO 2024 = the European Society for Medical Oncology Annual Meeting in 2024

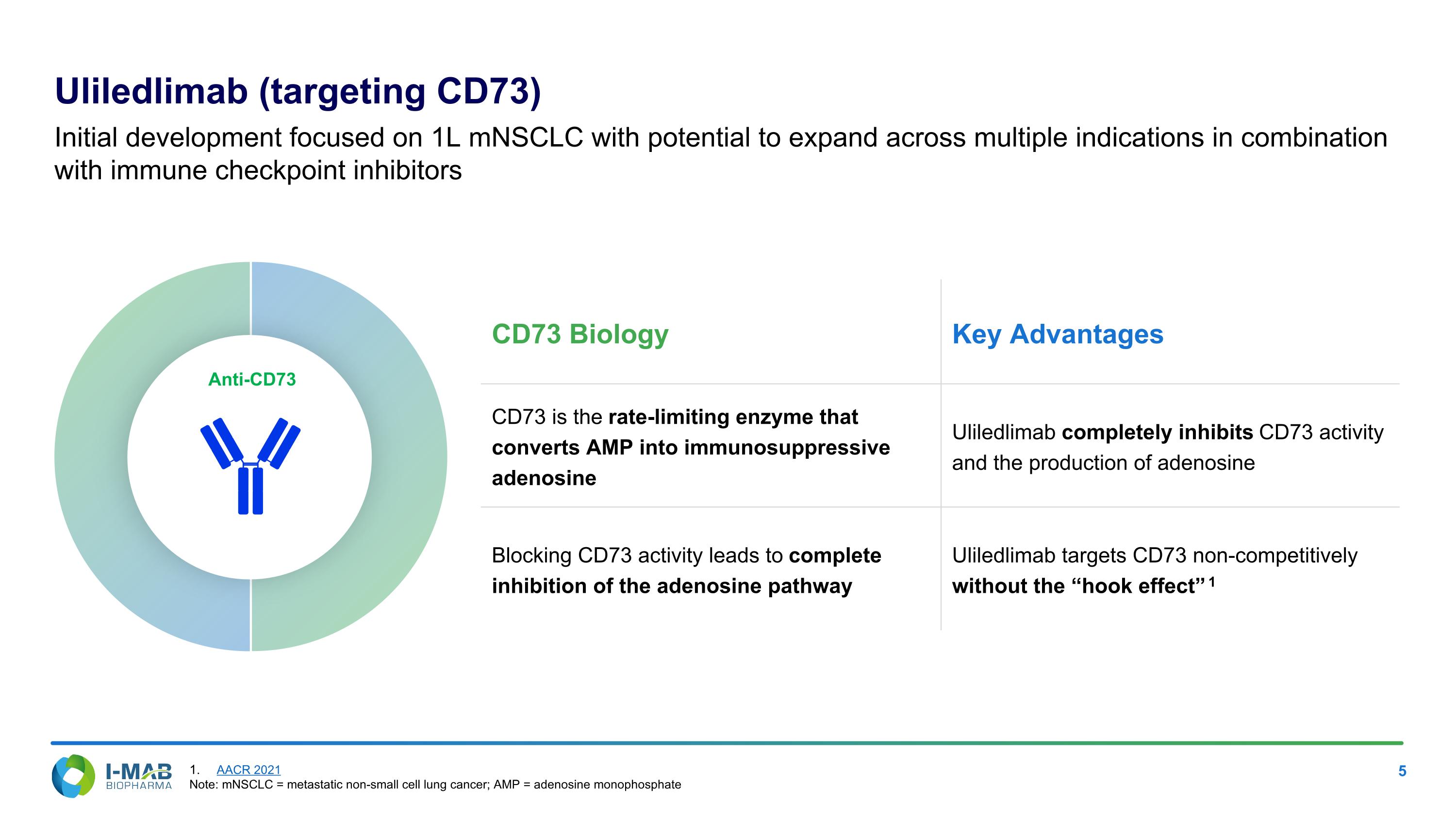

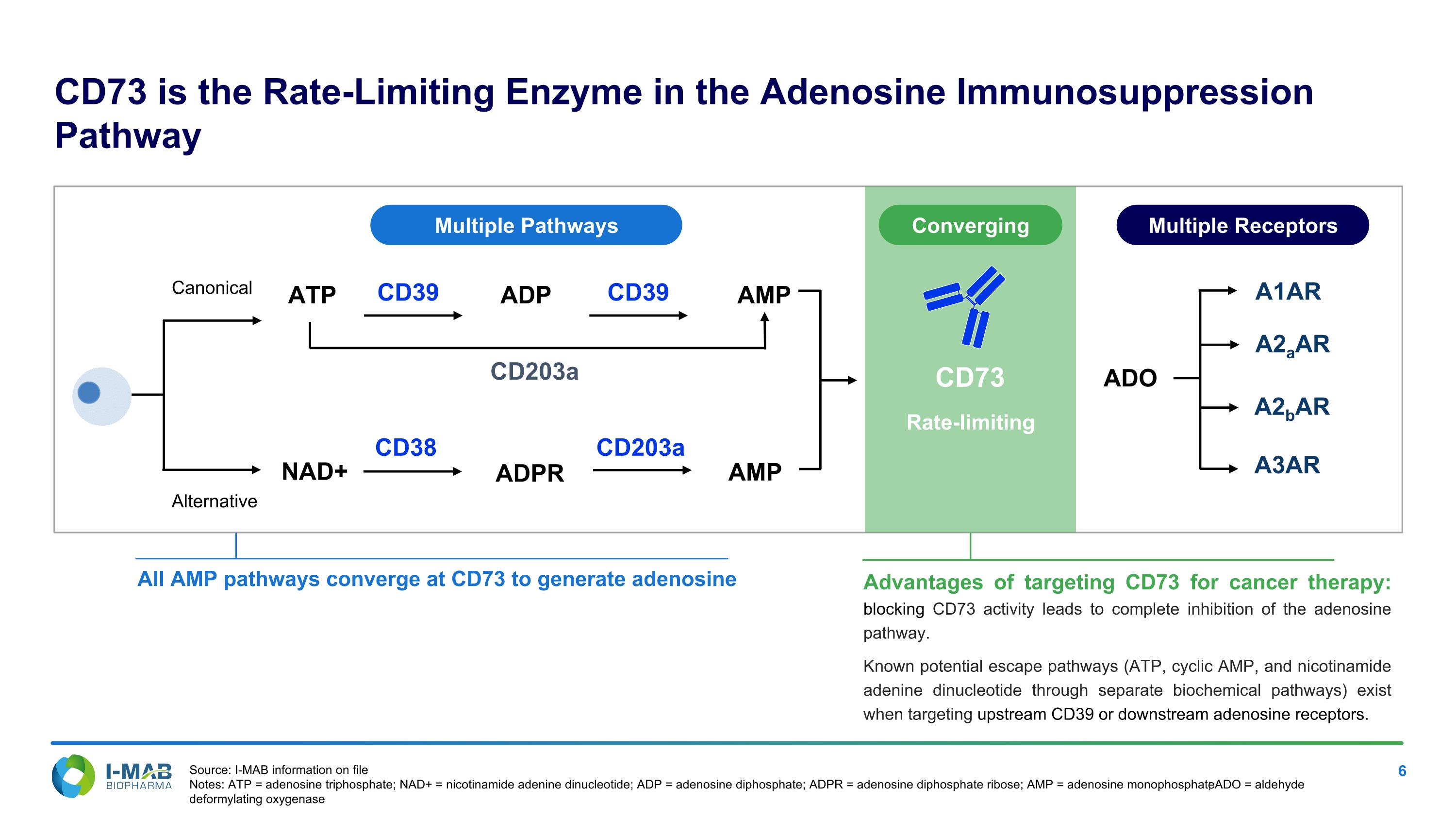

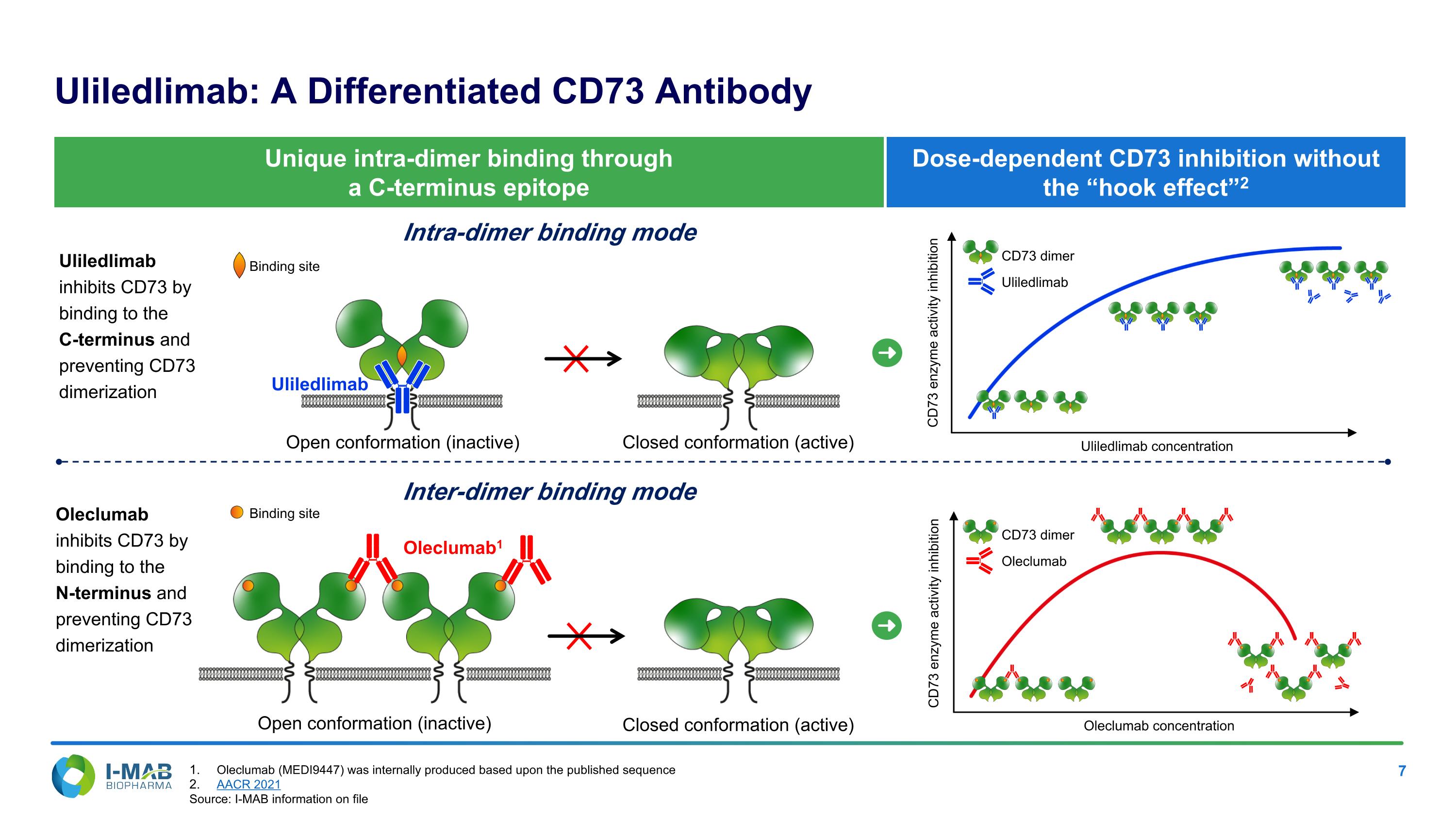

AACR 2021 Note: mNSCLC = metastatic non-small cell lung cancer; AMP = adenosine monophosphate Uliledlimab (targeting CD73) Initial development focused on 1L mNSCLC with potential to expand across multiple indications in combination with immune checkpoint inhibitors Anti-CD73 CD73 Biology Key Advantages CD73 is the rate-limiting enzyme that converts AMP into immunosuppressive adenosine Uliledlimab completely inhibits CD73 activity and the production of adenosine Blocking CD73 activity leads to complete inhibition of the adenosine pathway Uliledlimab targets CD73 non-competitively without the “hook effect” 1

CD73 is the Rate-Limiting Enzyme in the Adenosine Immunosuppression Pathway All AMP pathways converge at CD73 to generate adenosine Advantages of targeting CD73 for cancer therapy: blocking CD73 activity leads to complete inhibition of the adenosine pathway. Known potential escape pathways (ATP, cyclic AMP, and nicotinamide adenine dinucleotide through separate biochemical pathways) exist when targeting upstream CD39 or downstream adenosine receptors. NAD+ ATP CD39 CD203a ADP CD38 ADPR CD39 AMP CD203a AMP ADO A1AR A2aAR A2bAR A3AR Canonical Alternative Multiple Pathways Multiple Receptors CD73 Rate-limiting Converging Source: I-MAB information on file Notes: ATP = adenosine triphosphate; NAD+ = nicotinamide adenine dinucleotide; ADP = adenosine diphosphate; ADPR = adenosine diphosphate ribose; AMP = adenosine monophosphate; ADO = aldehyde deformylating oxygenase

CD73 enzyme activity inhibition Dose-dependent CD73 inhibition without the “hook effect”2 Uliledlimab: A Differentiated CD73 Antibody Open conformation (inactive) Closed conformation (active) Oleclumab1 Intra-dimer binding mode Inter-dimer binding mode Open conformation (inactive) Closed conformation (active) Unique intra-dimer binding through a C-terminus epitope Uliledlimab inhibits CD73 by binding to the C-terminus and preventing CD73 dimerization Oleclumab inhibits CD73 by binding to the N-terminus and preventing CD73 dimerization Uliledlimab CD73 enzyme activity inhibition Uliledlimab concentration Oleclumab concentration Uliledlimab CD73 dimer Oleclumab CD73 dimer Binding site Binding site Oleclumab (MEDI9447) was internally produced based upon the published sequence AACR 2021 Source: I-MAB information on file

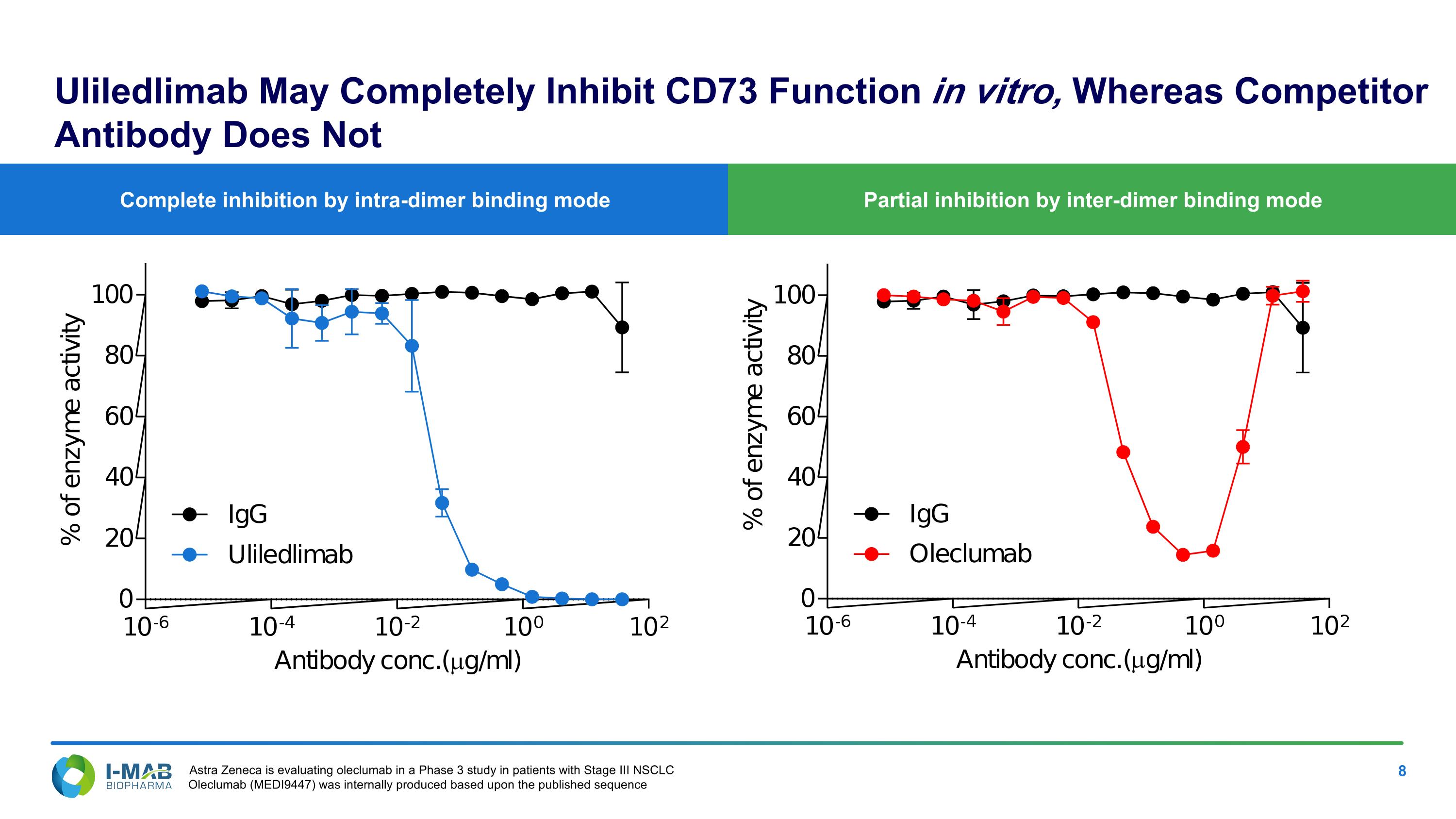

Partial inhibition by inter-dimer binding mode Complete inhibition by intra-dimer binding mode Uliledlimab May Completely Inhibit CD73 Function in vitro, Whereas Competitor Antibody Does Not Astra Zeneca is evaluating oleclumab in a Phase 3 study in patients with Stage III NSCLC Oleclumab (MEDI9447) was internally produced based upon the published sequence

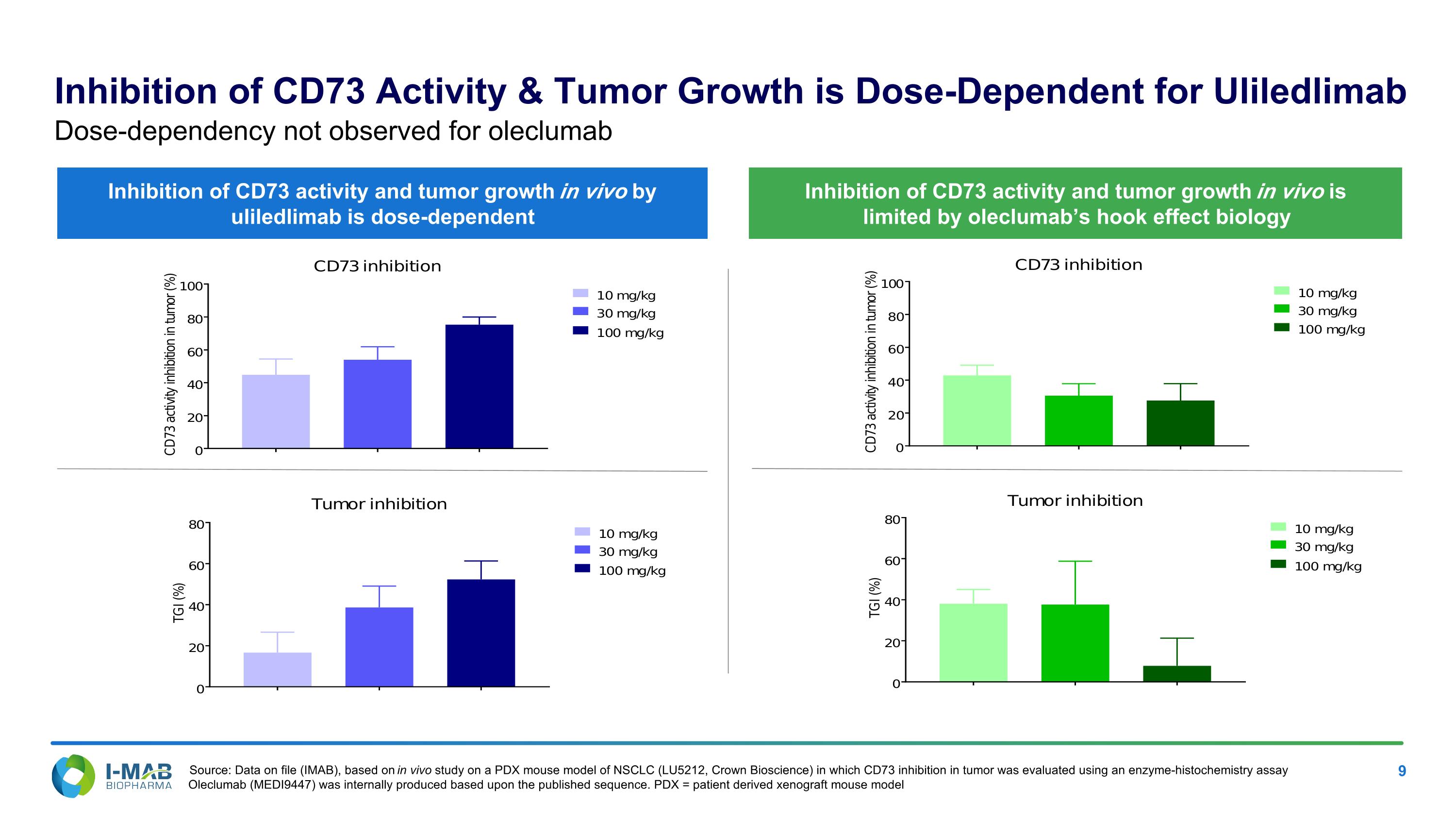

Inhibition of CD73 Activity & Tumor Growth is Dose-Dependent for Uliledlimab Inhibition of CD73 activity and tumor growth in vivo is limited by oleclumab’s hook effect biology Inhibition of CD73 activity and tumor growth in vivo by uliledlimab is dose-dependent Dose-dependency not observed for oleclumab Source: Data on file (IMAB), based on in vivo study on a PDX mouse model of NSCLC (LU5212, Crown Bioscience) in which CD73 inhibition in tumor was evaluated using an enzyme-histochemistry assay Oleclumab (MEDI9447) was internally produced based upon the published sequence. PDX = patient derived xenograft mouse model

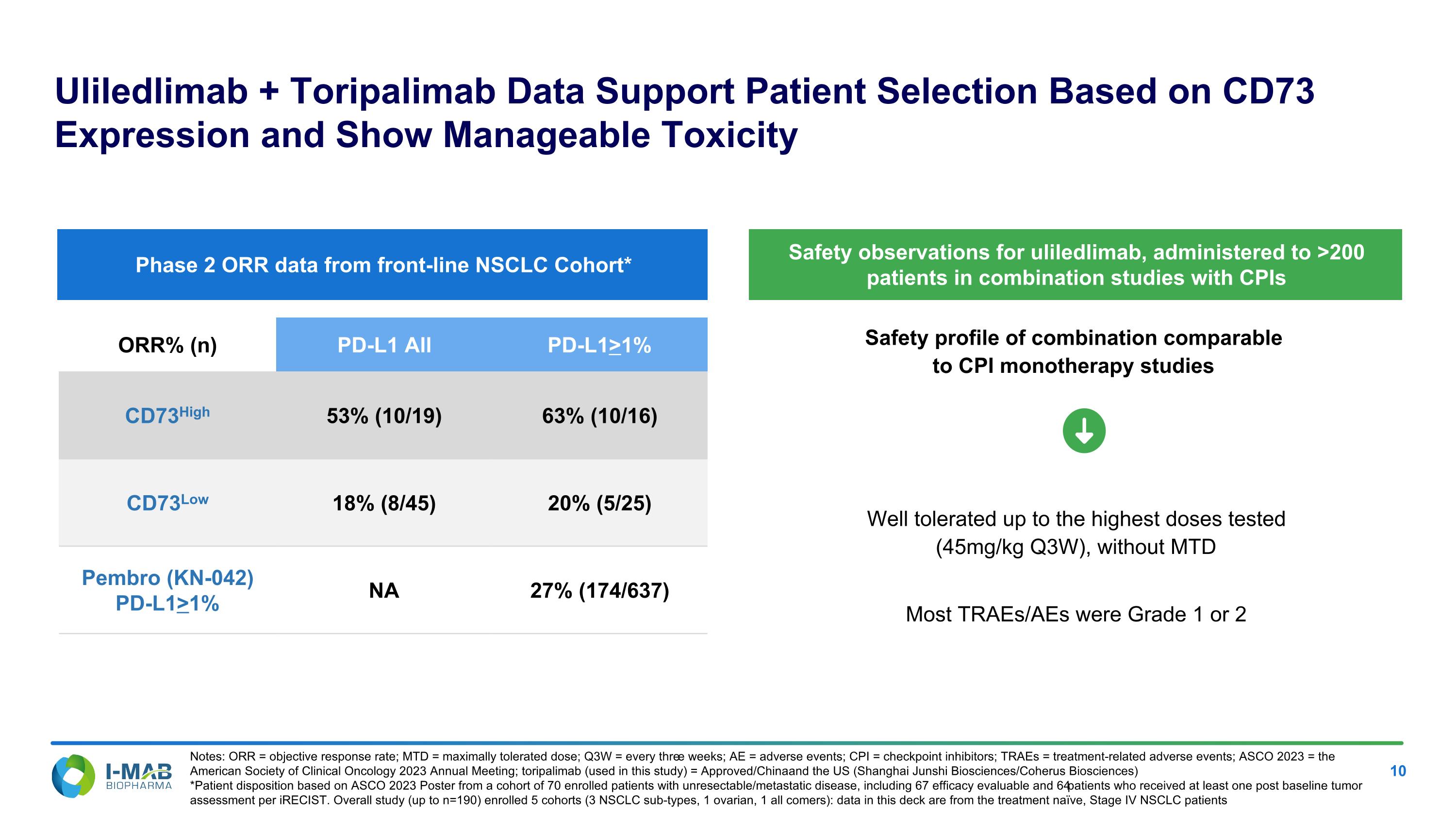

Safety profile of combination comparable �to CPI monotherapy studies Uliledlimab + Toripalimab Data Support Patient Selection Based on CD73 Expression and Show Manageable Toxicity Notes: ORR = objective response rate; MTD = maximally tolerated dose; Q3W = every three weeks; AE = adverse events; CPI = checkpoint inhibitors; TRAEs = treatment-related adverse events; ASCO 2023 = the American Society of Clinical Oncology 2023 Annual Meeting; toripalimab (used in this study) = Approved/China and the US (Shanghai Junshi Biosciences/Coherus Biosciences) *Patient disposition based on ASCO 2023 Poster from a cohort of 70 enrolled patients with unresectable/metastatic disease, including 67 efficacy evaluable and 64 patients who received at least one post baseline tumor assessment per iRECIST. Overall study (up to n=190) enrolled 5 cohorts (3 NSCLC sub-types, 1 ovarian, 1 all comers): data in this deck are from the treatment naïve, Stage IV NSCLC patients Well tolerated up to the highest doses tested �(45mg/kg Q3W), without MTD Most TRAEs/AEs were Grade 1 or 2 ORR% (n) PD-L1 All PD-L1>1% CD73High 53% (10/19) 63% (10/16) CD73Low 18% (8/45) 20% (5/25) Pembro (KN-042) PD-L1>1% NA 27% (174/637) Phase 2 ORR data from front-line NSCLC Cohort* Safety observations for uliledlimab, administered to >200 patients in combination studies with CPIs

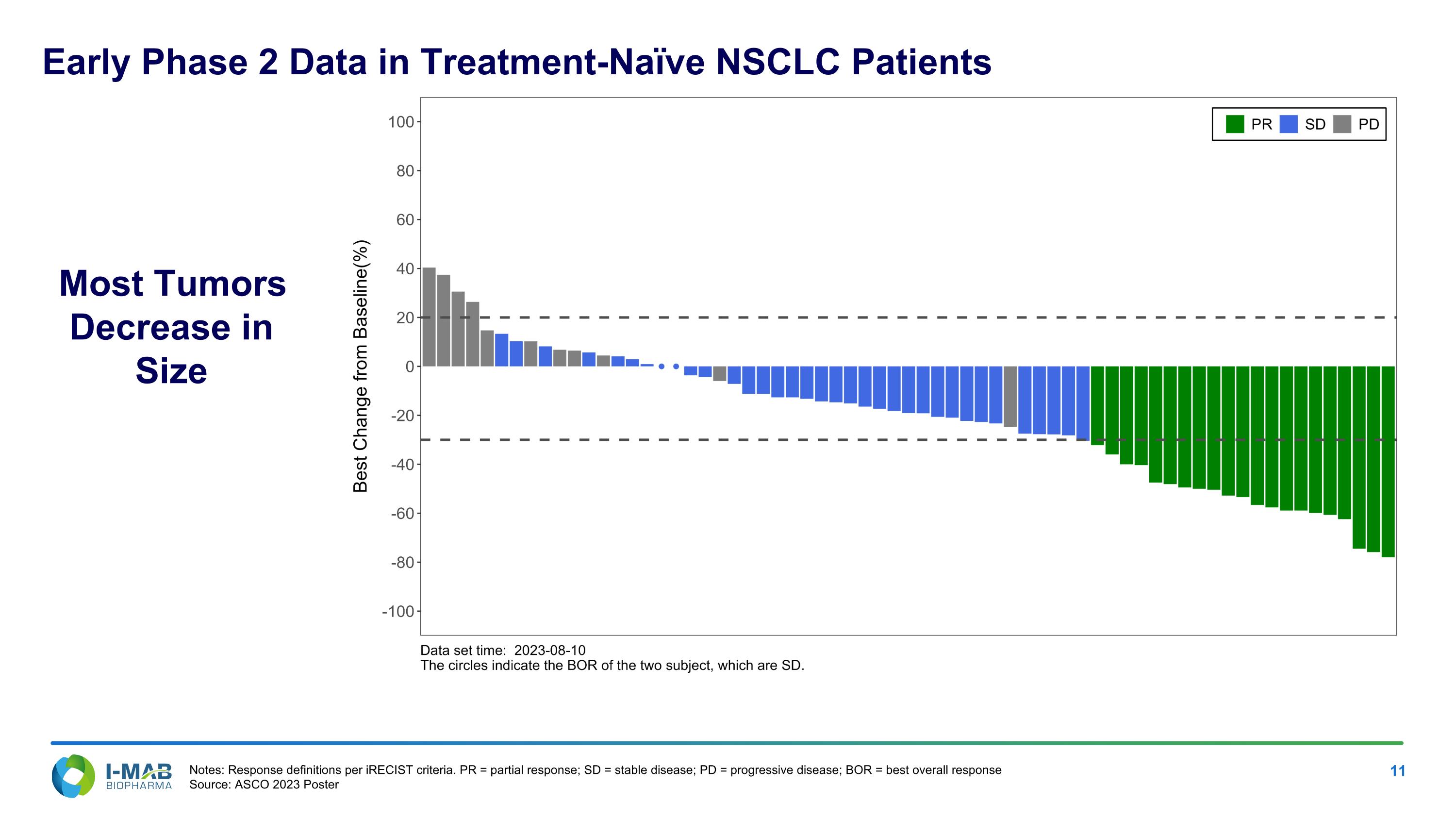

Most Tumors Decrease in Size Notes: Response definitions per iRECIST criteria. PR = partial response; SD = stable disease; PD = progressive disease; BOR = best overall response Source: ASCO 2023 Poster Early Phase 2 Data in Treatment-Naïve NSCLC Patients

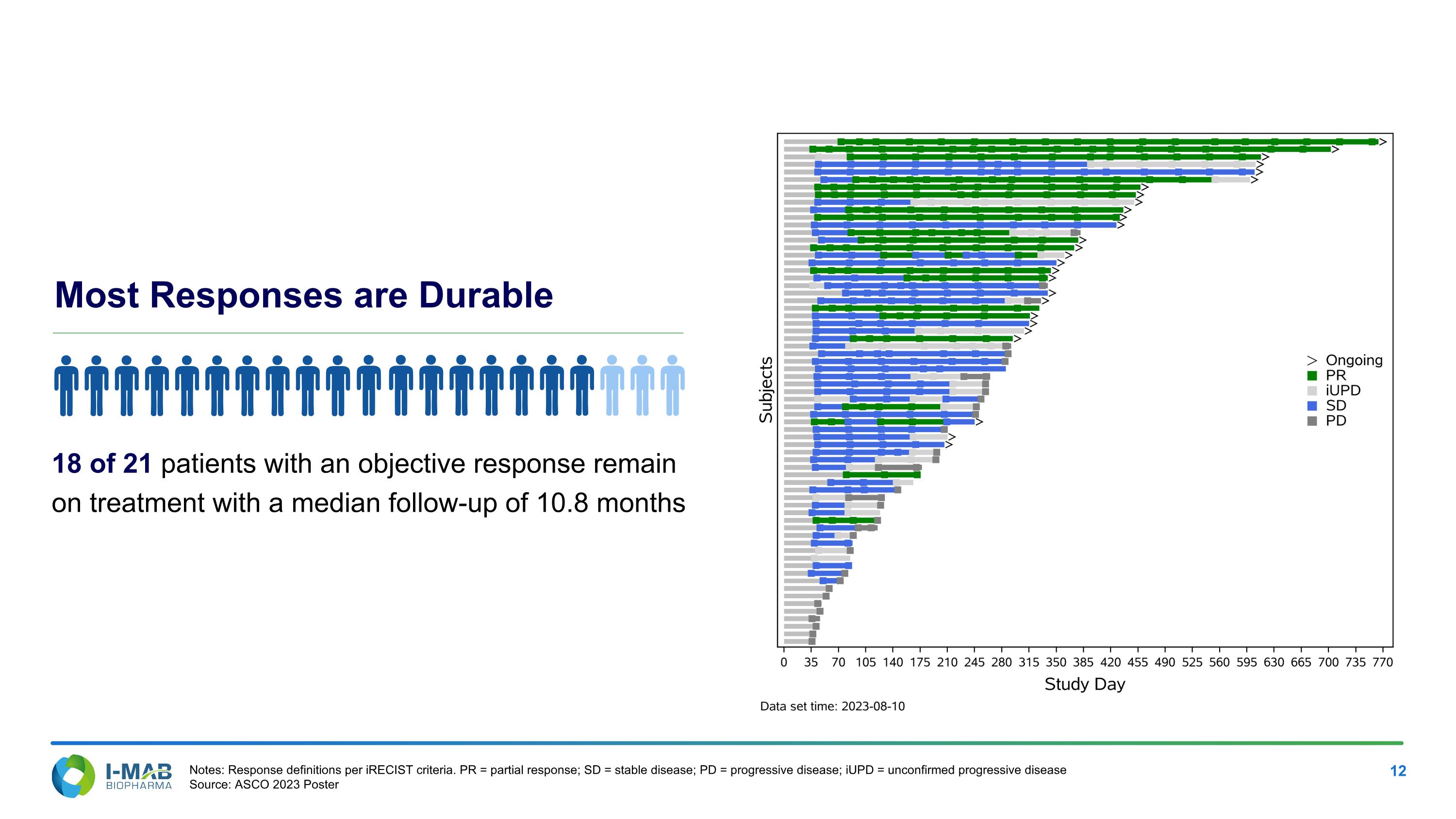

Most Responses are Durable 18 of 21 patients with an objective response remain on treatment with a median follow-up of 10.8 months Notes: Response definitions per iRECIST criteria. PR = partial response; SD = stable disease; PD = progressive disease; iUPD = unconfirmed progressive disease Source: ASCO 2023 Poster

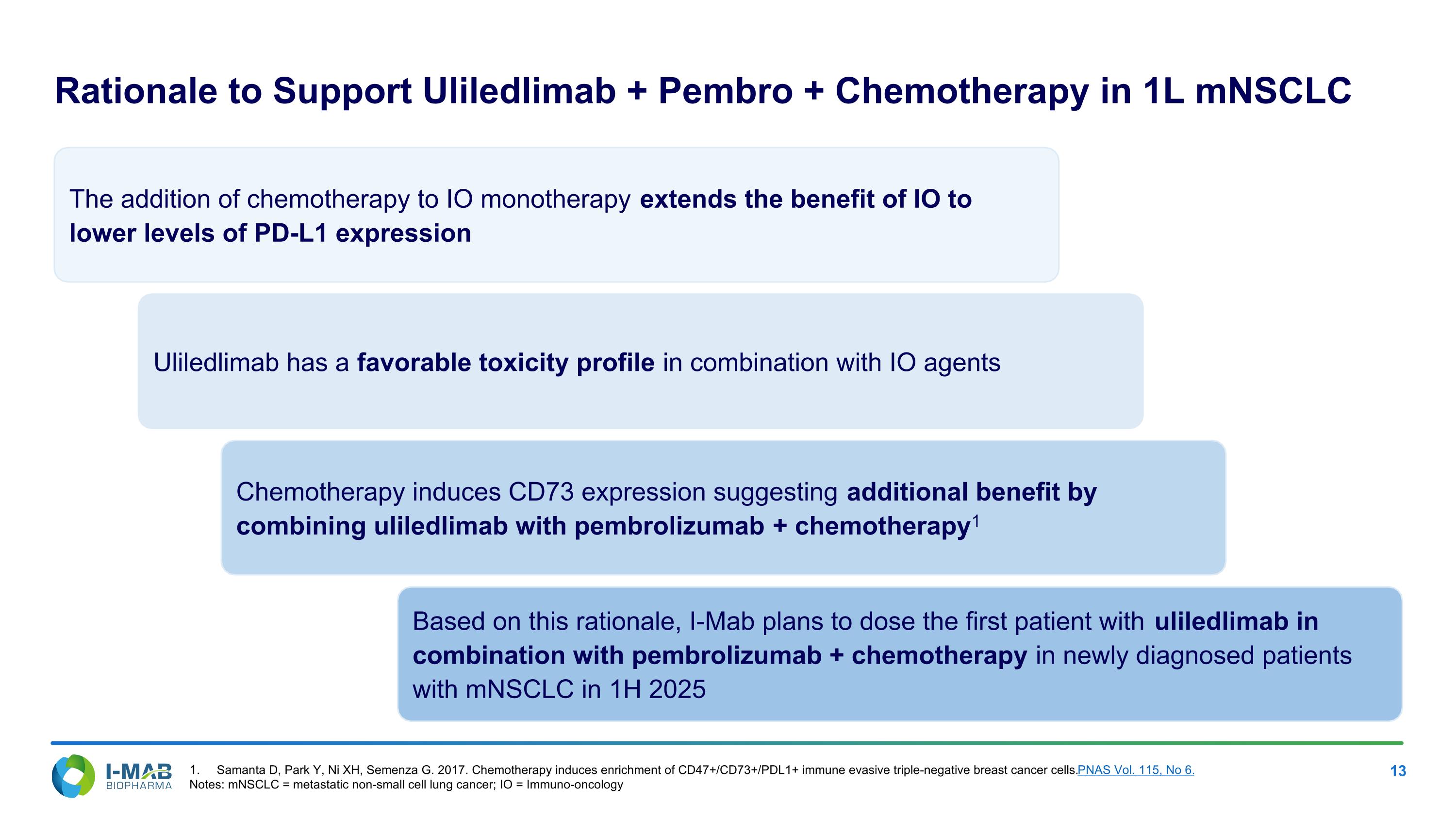

Rationale to Support Uliledlimab + Pembro + Chemotherapy in 1L mNSCLC Samanta D, Park Y, Ni XH, Semenza G. 2017. Chemotherapy induces enrichment of CD47+/CD73+/PDL1+ immune evasive triple-negative breast cancer cells. PNAS Vol. 115, No 6. Notes: mNSCLC = metastatic non-small cell lung cancer; IO = Immuno-oncology The addition of chemotherapy to IO monotherapy extends the benefit of IO to lower levels of PD-L1 expression Uliledlimab has a favorable toxicity profile in combination with IO agents Chemotherapy induces CD73 expression suggesting additional benefit by combining uliledlimab with pembrolizumab + chemotherapy1 Based on this rationale, I-Mab plans to dose the first patient with uliledlimab in combination with pembrolizumab + chemotherapy in newly diagnosed patients with mNSCLC in 1H 2025

Uliledlimab Development Plan: Randomized Study Design for Combination with Pembrolizumab + Chemotherapy Notes: mNSCLC = metastatic non-small cell lung cancer; R = randomized; ECOG PS = ECOG Performance Status Scale; TPS = tumor proportion score; ORR = objective response rate; PFS = progression free survival; DOR = duration of response; OS = overall survival; Q3W = dose every three weeks; IDMC = independent data monitoring committee; IND = investigational new drug; Pembro = pembrolizumab; Chemo = chemotherapy; 1L = first line IND application cleared August 2024, on track to initiate enrollment in 1H 2025 Eligibility: 1L Advanced mNSCLC ECOG PS 0/1 Stratify By: PD-L1 TPS Histology (n=96) Endpoints Primary: Safety, Efficacy (ORR) Secondary: PFS, DOR, OS IDMC Dose Escalation Lead-In (n=6) Uli Dose Level -1 + Pembro + Chemo (Q3W) SoC (n=15) Pembro + Chemo (Q3W) Uli Dose Level 1 (n=30) Uli Dose Level 1 + Pembro + Chemo (Q3W) R 2:1 IDMC R 2:1 Uli Dose Level 2 or -1 (n=30) Uli Dose Level 2 or -1 + Pembro + Chemo (Q3W) SoC (n=15) Pembro + Chemo (Q3W)

Molecular Design Key Differentiation Binding activity demonstrated across various levels of CLDN18.2 expression Exhibits CLDN18.2 binding even on low expressing tumor cells Higher-affinity binding to CLDN18.2 compared to reference antibody Zolbetuximab Localized T cell activation in TME to minimize 4-1BB-mediated liver toxicity and systemic immune response Givastomig (targeting Claudin 18.2 and 4-1BB) Ongoing combination studies with nivolumab + chemotherapy across a wide range of Claudin 18.2 levels Unique bispecific Ab integrates Claudin 18.2 as a tumor engager and 4-1BB as a conditional T cell activator 4-1BB scFv CLDN18.2 Notes: scFv = single chain Fragment-variable region; TME = tumor microenvironment; Ab = antibody

Phase 1 Monotherapy Responses in Heavily Pretreated Patients Provide Support for Further Studies 5 mg/kg 8 mg/kg 12 mg/kg 15 mg/kg Numbers: CLDN18.2 % > Treatment Ongoing PD SD PR Patient Overview: 43 efficacy evaluable patients with CLDN18.2+ GC/GEJ/EAC Three median lines of prior treatment (range 1-6); dosed at 5-18 mg/kg1 Cohort is a subset of the Phase 1a (NCT04900818) Responses: Seven partial response (PR) observed with an objective response rate (ORR) of 16.3% (7/43) Stable disease (SD) was reported in 14 patients, implying a disease control rate (DCR) of 48.8% (21/43) CLDN18.2 expression in responders ranged from 11% to 100%. Additionally, five responders had received prior treatment with�PD-1 or PD-L1 inhibitors Conclusion: Givastomig was well tolerated and exhibits monotherapy activity in heavily pre-treated GEC patients with a range of CLDN18.2 expression. Duration of Treatment in Gastric Cancer Patients Stomach Stomach Esophagus Stomach Stomach Esophagus Stomach Stomach Stomach Stomach Stomach Stomach Stomach Stomach Stomach Esophagus Stomach Stomach Stomach Stomach Stomach Stomach Stomach Stomach Stomach Esophagus Stomach Stomach Stomach Stomach GEJ Stomach Stomach Stomach Stomach Esophagus Stomach Stomach Stomach Esophagus Stomach Esophagus > > > > 100 100 75 90 45 85 80 100 100 100 70 80 75 95 90 20 30 1 50 95 95 100 98 90 99 95 75 15 100 90 100 30 55 7 20 50 98 25 90 55 99 95 11 0 25 50 75 100 125 150 175 200 225 250 275 300 325 350 375 400 425 450 475 500 525 550 575 600 625 650 Study Days (C1D1 to End of Treatment Date) GEJ Defined as the predicted efficacious dosing range, based on preclinical studies Source: ESMO 2024 Notes: Data cut-off as of June 1, 2024; GC = gastric cancers; GEJ = gastroesophageal junction; EAC = esophageal adenocarcinoma

Safety: Treatment Related AEs Preferred Term (all numbers are n(%)) Grade 1 Grade 2 Grade 3 Grade 4 Grade 5 All Grades Nausea 6 (14.0) 4 ( 9.3) 1 ( 2.3) - - 11 (25.6) Anemia 2 ( 4.7) 5 (11.6) 3 ( 7.0) - - 10 (23.3) White blood cell count decreased 4 ( 9.3) 3 ( 7.0) 3 ( 7.0) - - 10 (23.3) Vomiting 4 ( 9.3) 2 ( 4.7) 1 ( 2.3) - - 7 (16.3) Decreased appetite 3 ( 7.0) 2 ( 4.7) 1 ( 2.3) - - 6 (14.0) Alanine aminotransferase increased 2 ( 4.7) 2 ( 4.7) 1 ( 2.3) - - 5 (11.6) Aspartate aminotransferase increased 3 ( 7.0) - 2 ( 4.7) - - 5 (11.6) Gamma-glutamyltransferase increased 1 ( 2.3) 3 ( 7.0) 1 ( 2.3) - - 5 (11.6) Neutrophil count decreased 1 ( 2.3) 3 ( 7.0) 1 ( 2.3) - - 5 (11.6) Infusion related reaction 1 ( 2.3) 2 ( 4.7) 1 ( 2.3) - - 4 ( 9.3) Lymphocyte count decreased - - 4 ( 9.3) - - 4 ( 9.3) Fatigue 2 ( 4.7) 1 ( 2.3) - - - 3 ( 7.0) Headache 2 ( 4.7) 1 ( 2.3) - - - 3 ( 7.0) Hypoalbuminemia 2 ( 4.7) 1 ( 2.3) - - - 3 ( 7.0) Lipase increased 1 ( 2.3) 1 ( 2.3) 1 ( 2.3) - - 3 ( 7.0) Platelet count decreased 1 ( 2.3) 1 ( 2.3) - 1 ( 2.3) - 3 ( 7.0) Weight decreased 2 ( 4.7) 1 ( 2.3) - - - 3 ( 7.0) Treatment-related adverse events (TRAEs) occurring in >5% (n=43) No DLT was reported up to 15 mg/kg Q2W and 18 mg/kg Q3W, and MTD was not reached Most commonly reported TRAEs (>20% of subjects): Grade 1, 2 or 3 nausea (25.6%), anemia (23.3%), white blood cell count decreased (23.3%) 15 subjects (34.9%) experienced at least one Grade ≥ 3 TRAE. This included one Grade 4 TRAE of platelet count decreased and no Grade 5 TRAEs Most gastrointestinal TRAEs were Grade 1 or 2 and do not appear to be dose-related Source: ESMO 2024 Notes: Data cut-off as of June 1, 2024; DLT = dose-limiting toxicity, MTD = maximum tolerated dose; AE = adverse event; TRAE = treatment emergent adverse event, Q2W = every two weeks, Q3W = every three weeks

Givastomig Yields Better Monotherapy Responses in Patients with Low to High CLDN18.2 Expression Compared to Phase 1/2 Zolbetuximab Studies Drug Givastomig (bi-specific) Zolbetuximab (CLDN 18.2 targeted mAb) Phase Phase 1 Phase 1 Phase 2 CLDN18.2 – Expression of the Study Group IHC ≥1+ in ≥1% cells IHC ≥1+ in ≥1% cells IHC ≥ 2+ in ≥ 50% cells Diagnosis Previously treated GC/GEJ/EAC Previously treated GC/GEJ Previously treated GC/GEJ/EAC Efficacy Evaluable 43 15 43 ORR 16% (7/43) Zero 9% (4/43) DCR (CR+PR+SD) 49% (21/43) 1 SD 23% (10/43) Source Givastomig poster #1017P ESMO 2024 U Sahin et al. European Journal of Cancer 100 (2018) 17e26 O Tureci et al. Annals of Oncology �30: 1487–1495, 2019 Notes: mAb = monoclonal antibody; ORR = objective response rate; DCR = disease control rate; CR = complete response; PR = partial response; SD = stable disease; GC = gastric cancers; GEJ = gastroesophageal junction; EAC = esophageal cancer; IHC = immunohistochemistry. Note that the comparisons in the table above are not based on data from head-to-head trials and are not direct comparisons. Differences in trial designs, patient groups, trial endpoints, study sizes and other factors may impact the comparisons

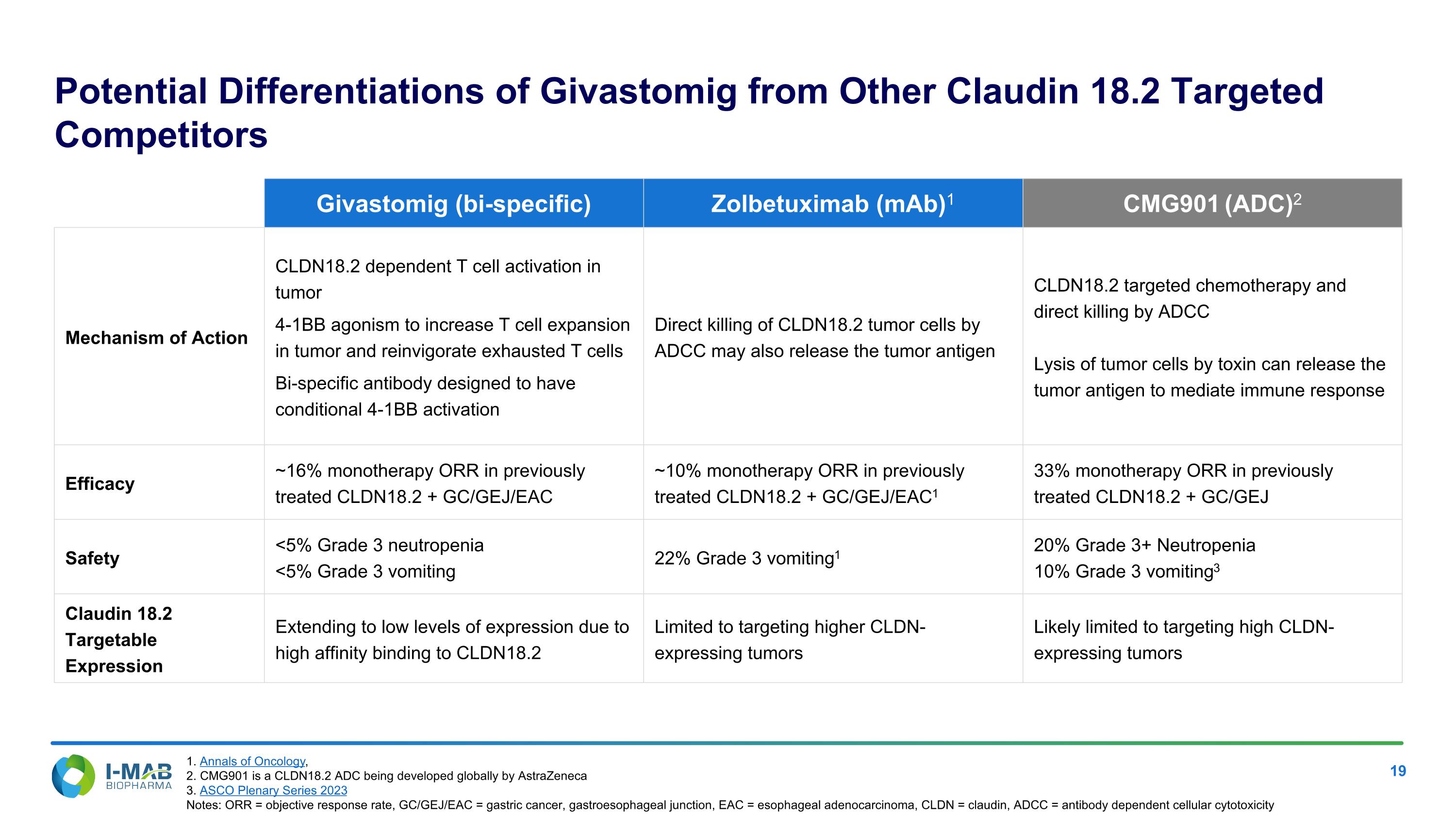

Potential Differentiations of Givastomig from Other Claudin 18.2 Targeted Competitors Givastomig (bi-specific) Zolbetuximab (mAb)1 CMG901 (ADC)2 Mechanism of Action CLDN18.2 dependent T cell activation in tumor 4-1BB agonism to increase T cell expansion in tumor and reinvigorate exhausted T cells Bi-specific antibody designed to have conditional 4-1BB activation Direct killing of CLDN18.2 tumor cells by ADCC may also release the tumor antigen CLDN18.2 targeted chemotherapy and direct killing by ADCC Lysis of tumor cells by toxin can release the tumor antigen to mediate immune response Efficacy ~16% monotherapy ORR in previously treated CLDN18.2 + GC/GEJ/EAC ~10% monotherapy ORR in previously treated CLDN18.2 + GC/GEJ/EAC1 33% monotherapy ORR in previously treated CLDN18.2 + GC/GEJ Safety <5% Grade 3 neutropenia <5% Grade 3 vomiting 22% Grade 3 vomiting1 20% Grade 3+ Neutropenia 10% Grade 3 vomiting3 Claudin 18.2 Targetable Expression Extending to low levels of expression due to high affinity binding to CLDN18.2 Limited to targeting higher CLDN-expressing tumors Likely limited to targeting high CLDN-expressing tumors 1. Annals of Oncology, 2. CMG901 is a CLDN18.2 ADC being developed globally by AstraZeneca 3. ASCO Plenary Series 2023 Notes: ORR = objective response rate, GC/GEJ/EAC = gastric cancer, gastroesophageal junction, EAC = esophageal adenocarcinoma, CLDN = claudin, ADCC = antibody dependent cellular cytotoxicity

Givastomig Development Plan: Phase 1b Study Design for Combination with Nivolumab + Chemotherapy Eligibility: 1L unresectable or metastatic GC/GEJ/EAC HER2 negative CLDN 18.2 ≥1+ on ≥1% of tumor cells Endpoints: Primary: Safety Secondary: ORR, PK/PD, BoR, DoR, PFS, OS Notes: GC/GEJ/EAC = gastric cancer, gastroesophageal junction, EAC = esophageal adenocarcinoma, CLDN = claudin, ADCC = antibody dependent cellular cytotoxicity, FOLFOX6: standard of care chemotherapy regimen for GEJ, nivo = nivolumab, Q2W = every two weeks, Giva = givastomig, MAD/MTD = multiple ascending dose or maximum tolerated dose, ORR = objective response rate, PK = pharmacokinetic, PD = pharmacodynamic, BoR = best overall response, DoR = duration of response, PFS = progression free survival, OS = overall survival Dose Escalation Lead-In (n=5) Giva dose level 1 + nivo + mFOLFOX6 Q2W Dose Escalation (n=15) Dose Expansion (n=6-8) Dose Expansion Selected Giva dose (or MAD/MTD) + nivo + mFOLFOX6 Q2W Dose Escalation (n=6) Giva dose level 2 + nivo + mFOLFOX6 Q2W Dose Escalation (n=4) Giva dose level 3 + nivo + mFOLFOX6 Q2W

Unique Design to Enable Potential Wide Use Plus Favorable Initial Safety Profile Encouraging Responses in Previously Treated Patients, Including Those with Low CLDN18.2 Expression Levels Dose Expansion Data and New Nivolumab + Chemotherapy Combo Study Ongoing Unique Bispecific Design Properties and Monotherapy Data in Gastric Cancers May Position Givastomig as Best-in-Class Claudin 18.2 bispecific Objective responses seen in patients with gastric and esophageal cancer who had received multiple lines of prior treatment, including PD-(L)1, and exhibited low levels of CLDN18.2 expression Response rate and tolerability supports combination in 1L SoC regimens New dose expansion in combination with nivolumab + chemotherapy cohort study began in 1Q 2024 in treatment naïve patients with gastric cancers Updated monotherapy dose expansion data in CLDN18.2+ patients with gastric cancers whose disease has progressed after previous treatment was presented at ESMO 2024 Bispecific design results in CLDN18.2 conditional 4-1BB and T cell activation, potentially limiting toxicity and inducing long-lasting immune memory response Phase 1 dose escalation reached highest planned dose without encountering DLT or liver toxicity signals Notes: Gastric cancers = gastric, gastroesophageal junction and esophageal cancer; ESMO 2024 = the European Society for Medical Oncology Annual Meeting in 2024; SoC = standard of care; DLT = dose limiting toxicity, 1L = first line

Molecular Design Target Drug Profile Molecule binds to PD-L1 to inhibit PD-1/PD-L1 interaction Targeting PD-L1+ tumor cells Blocking PD-L1/PD-1 immune inhibitory signaling PD-L1-dependent 4-1BB activation at the tumor site Potent tumor-directed 4-1BB activation to enhance anti-tumor immunity Enhances anti-tumor immunity and re-invigorates exhausted T cells1 Localized 4-1BB activation in TME to mitigate liver toxicity and systemic immune response Ragistomig (ABL503/TJ-L14B, targeting PD-L1 and 4-1BB) A novel bispecific integrates PD-L1 as a tumor engager and 4-1BB as a conditional T cell activator 4-1BB scFv PD-L1 IgG Phase 1 efficacy data presented at ASCO 20242 JITC 2021 ASCO 2024 Notes: scFv = single chain Fragment-variable region; TME = tumor microenvironment; ASCO 2024 = the American Society for Clinical Oncology Annual Meeting in 2024

Phase 1 Data Support Further Development as a Monotherapy and in Combination with Other Agents Overview: 44 efficacy evaluable patients (53 enrolled) with advanced or relapsed/refractory solid tumors (NCT04762641) 64.2% (34/53) of patients enrolled had at least three prior lines of systemic anti-cancer treatment Efficacy Results at 3 and 5 mg/kg Q2W: Objective Response Rate (ORR) of 26.9% (7/26), Clinical Benefit Ratio (CBR) of 69.2% (18/26) One CR, six PRs, eleven SDs 71.4% of responders had received prior anti-PD-(L)-1 inhibitors The CR was observed in a heavily pretreated ovarian cancer patient dosed at 3 mg/kg (seven lines of prior therapy) Conclusion: Compelling clinical data in checkpoint inhibitor relapsed/refractory and IO naïve patients Treatment Duration (Days) CR start PR start On-going PD start 0.7 mg 2 mg/kg 2 mg 3 mg/kg 7 mg 5 mg/kg 0.3 mg/kg 7 mg/kg 1 mg/kg 10 mg/kg Source: ASCO 2024 Notes: Data cut-off as of April 19, 2024. CR = complete response; PR = partial response; PD = progressive disease; SD = stable disease; IO = Immuno-oncology, Q2W = every two weeks

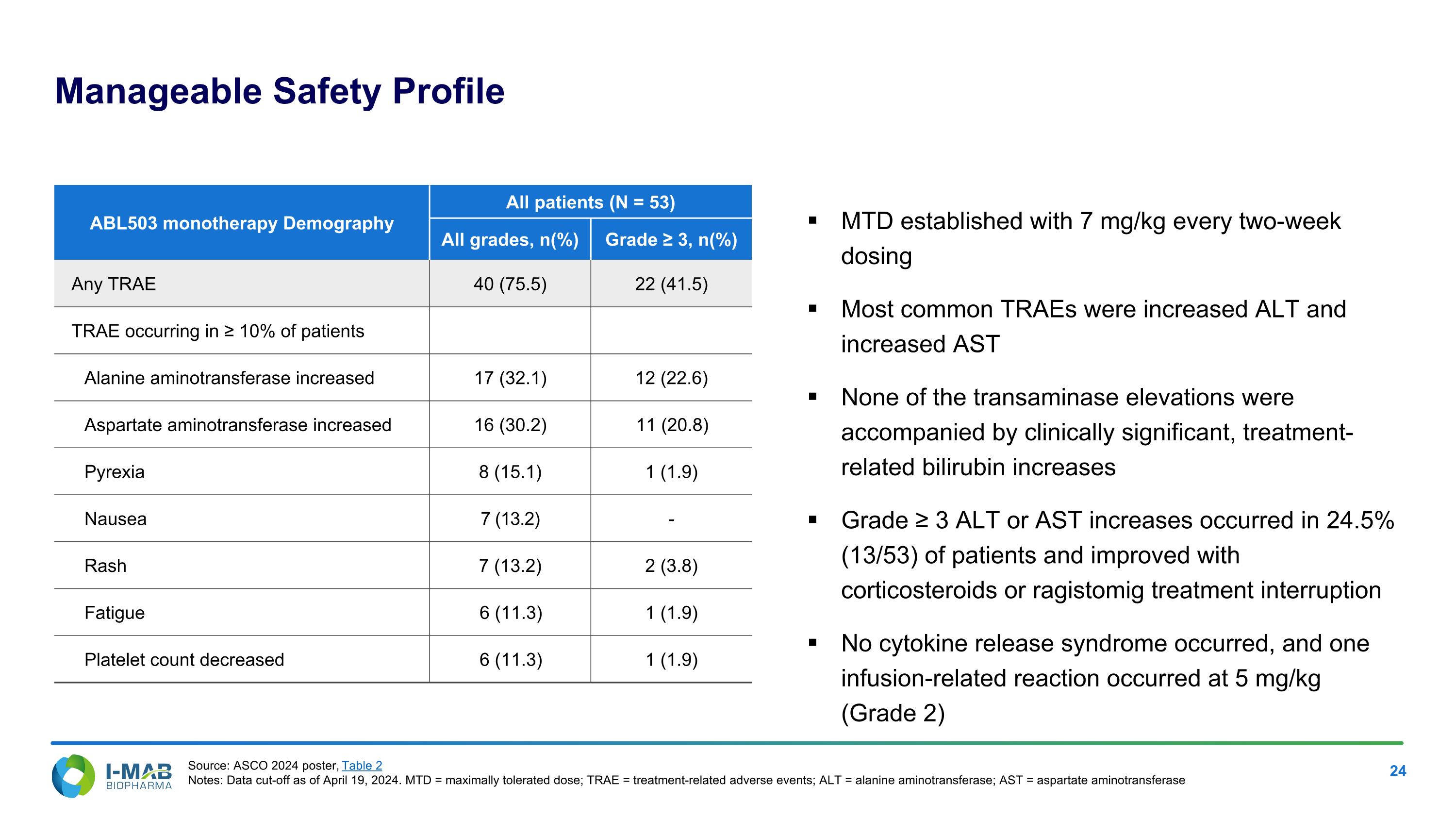

Manageable Safety Profile MTD established with 7 mg/kg every two-week dosing Most common TRAEs were increased ALT and increased AST None of the transaminase elevations were accompanied by clinically significant, treatment-related bilirubin increases Grade ≥ 3 ALT or AST increases occurred in 24.5% (13/53) of patients and improved with corticosteroids or ragistomig treatment interruption No cytokine release syndrome occurred, and one infusion-related reaction occurred at 5 mg/kg (Grade 2) ABL503 monotherapy Demography All patients (N = 53) All grades, n(%) Grade ≥ 3, n(%) Any TRAE 40 (75.5) 22 (41.5) TRAE occurring in ≥ 10% of patients Alanine aminotransferase increased 17 (32.1) 12 (22.6) Aspartate aminotransferase increased 16 (30.2) 11 (20.8) Pyrexia 8 (15.1) 1 (1.9) Nausea 7 (13.2) - Rash 7 (13.2) 2 (3.8) Fatigue 6 (11.3) 1 (1.9) Platelet count decreased 6 (11.3) 1 (1.9) Source: ASCO 2024 poster, Table 2 Notes: Data cut-off as of April 19, 2024. MTD = maximally tolerated dose; TRAE = treatment-related adverse events; ALT = alanine aminotransferase; AST = aspartate aminotransferase

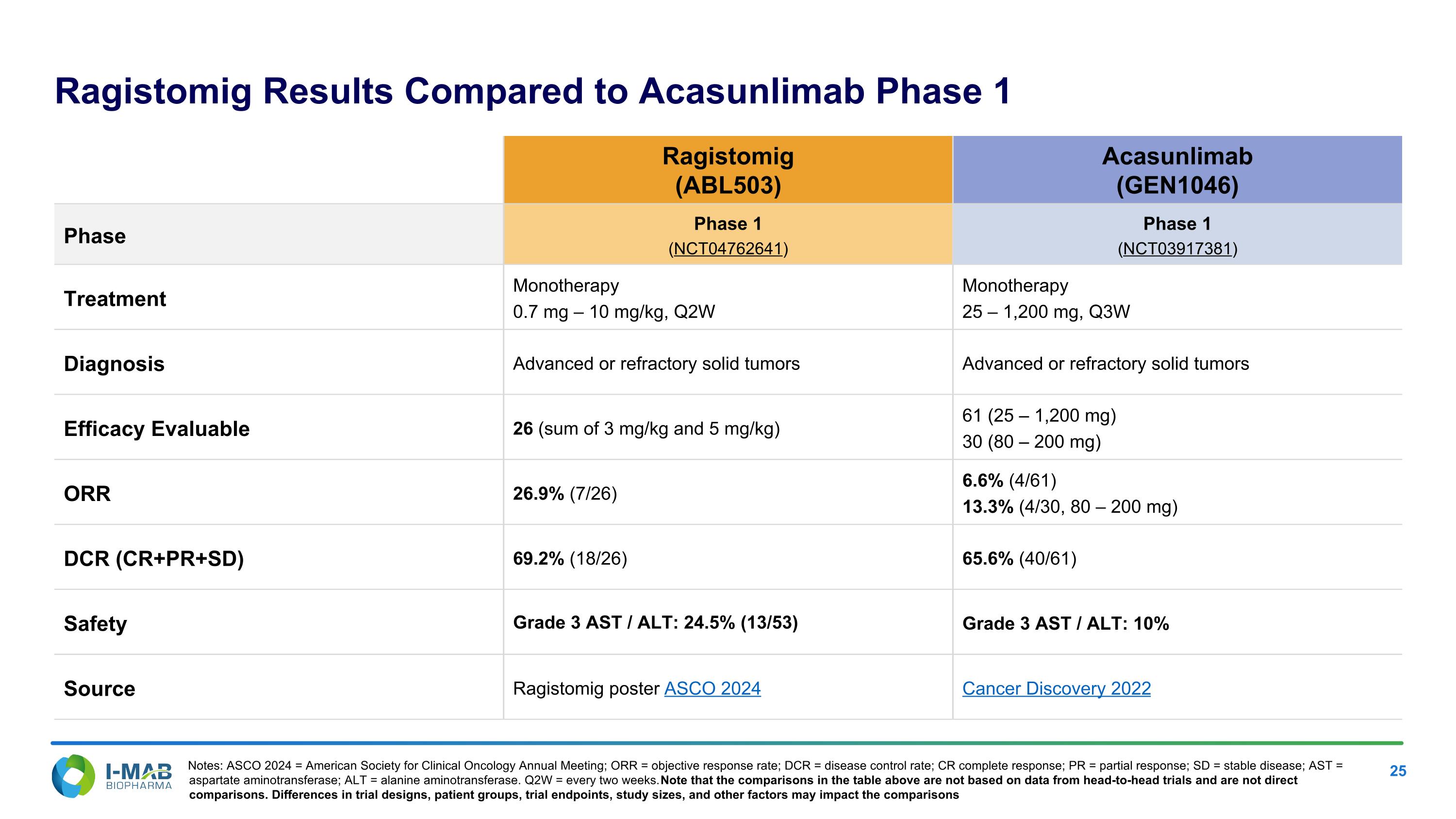

Ragistomig Results Compared to Acasunlimab Phase 1 Ragistomig (ABL503) Acasunlimab (GEN1046) Phase Phase 1 (NCT04762641) Phase 1 (NCT03917381) Treatment Monotherapy 0.7 mg – 10 mg/kg, Q2W Monotherapy 25 – 1,200 mg, Q3W Diagnosis Advanced or refractory solid tumors Advanced or refractory solid tumors Efficacy Evaluable 26 (sum of 3 mg/kg and 5 mg/kg) 61 (25 – 1,200 mg) 30 (80 – 200 mg) ORR 26.9% (7/26) 6.6% (4/61) 13.3% (4/30, 80 – 200 mg) DCR (CR+PR+SD) 69.2% (18/26) 65.6% (40/61) Safety Grade 3 AST / ALT: 24.5% (13/53) Grade 3 AST / ALT: 10% Source Ragistomig poster ASCO 2024 Cancer Discovery 2022 Notes: ASCO 2024 = American Society for Clinical Oncology Annual Meeting; ORR = objective response rate; DCR = disease control rate; CR complete response; PR = partial response; SD = stable disease; AST = aspartate aminotransferase; ALT = alanine aminotransferase. Q2W = every two weeks. Note that the comparisons in the table above are not based on data from head-to-head trials and are not direct comparisons. Differences in trial designs, patient groups, trial endpoints, study sizes, and other factors may impact the comparisons

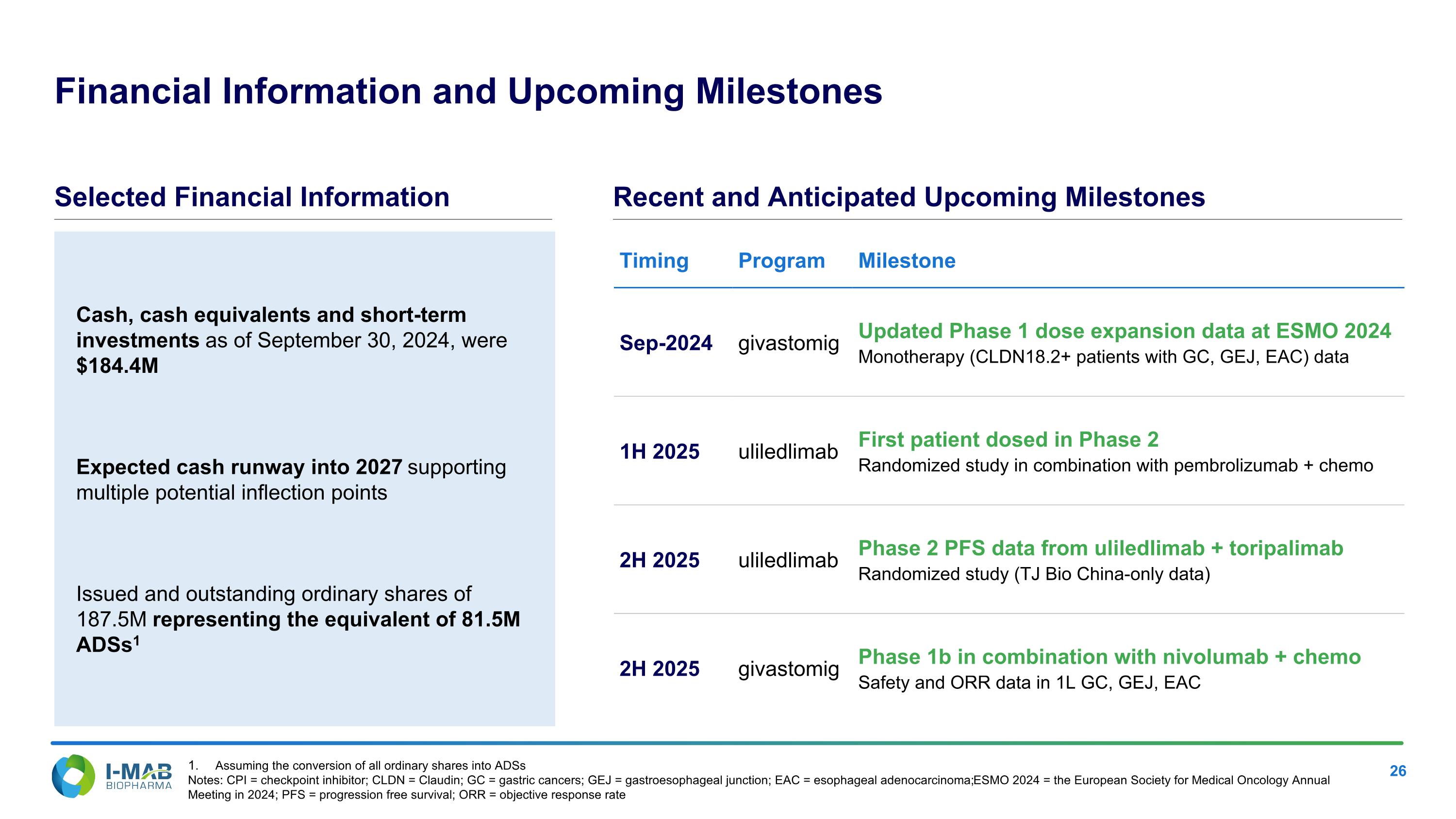

Cash, cash equivalents and short-term investments as of September 30, 2024, were $184.4M Expected cash runway into 2027 supporting multiple potential inflection points Issued and outstanding ordinary shares of 187.5M representing the equivalent of 81.5M ADSs1 Financial Information and Upcoming Milestones Timing Program Milestone Sep-2024 givastomig Updated Phase 1 dose expansion data at ESMO 2024 Monotherapy (CLDN18.2+ patients with GC, GEJ, EAC) data 1H 2025 uliledlimab First patient dosed in Phase 2 Randomized study in combination with pembrolizumab + chemo 2H 2025 uliledlimab Phase 2 PFS data from uliledlimab + toripalimab Randomized study (TJ Bio China-only data) 2H 2025 givastomig Phase 1b in combination with nivolumab + chemo Safety and ORR data in 1L GC, GEJ, EAC Selected Financial Information Recent and Anticipated Upcoming Milestones Assuming the conversion of all ordinary shares into ADSs Notes: CPI = checkpoint inhibitor; CLDN = Claudin; GC = gastric cancers; GEJ = gastroesophageal junction; EAC = esophageal adenocarcinoma; ESMO 2024 = the European Society for Medical Oncology Annual Meeting in 2024; PFS = progression free survival; ORR = objective response rate

Stay connected I-Mab Biopharma IR Contact Tyler Ehler Sr. Director, Investor Relations IR@imabbio.com

I MAB (NASDAQ:IMAB)

過去 株価チャート

から 3 2025 まで 4 2025

I MAB (NASDAQ:IMAB)

過去 株価チャート

から 4 2024 まで 4 2025