Filed pursuant to Rule 424(b)(5)

Registration No. 333-266748

PROSPECTUS SUPPLEMENT

(To Prospectus dated August 18, 2022)

1,375,000 Ordinary Shares

Pre-Funded Warrants to Purchase up to 1,656,250

Ordinary Shares

1,656,250 Ordinary Shares

Underlying the Pre-Funded Warrants

We are offering 1,375,000 ordinary shares, no

par value (“Ordinary Shares” or the “Shares”). The purchase price of each Share is $1.28. The Shares are being

sold in this offering to an institutional investor under a securities purchase agreement dated December 26, 2023, between us and the investor.

We are also offering on a “best efforts” basis pre-funded warrants to purchase up to 1,656,250 of our Ordinary Shares to the

purchaser whose purchase of additional Shares in this offering would otherwise result in the purchaser, together with its affiliates and

certain related parties, beneficially owning more than 9.99% of our outstanding Ordinary Shares immediately following the consummation

of this offering (the “Pre-Funded Warrants”). The purchase price of each Pre-Funded Warrant is equal to $1.279, which is equal

to the sale price of the Shares less $0.001, the exercise price of each Pre-Funded Warrant. The Pre-Funded Warrants are immediately

exercisable and may be exercised at any time until all of the Pre-Funded Warrants are exercised in full. This prospectus supplement also

relates to the Ordinary Shares issuable upon the exercise of any Pre-Funded Warrants sold in this offering.

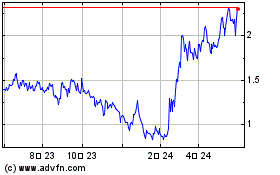

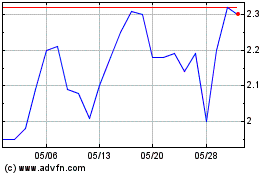

The Ordinary Shares are listed on the Nasdaq Capital

Market under the symbol “IINN.” On December 22, 2023, the last reported sale price of the Ordinary Shares on the Nasdaq Capital

Market was $1.19 per share. There is no established public trading market for the Pre-Funded Warrants, and we do not expect a market to

develop. In addition, we do not intend to apply for a listing of the Pre-Funded Warrants on any national securities exchange or other

nationally recognized trading system.

In a concurrent private placement (the “Private

Placement”), we are also selling to the purchaser of Shares and Pre-Funded Warrants in this offering, warrants to purchase up to

3,031,250 of our Ordinary Shares, or the Private Placement Warrants. The Private Placement Warrants will have an exercise price of $1.28

per share, are exercisable immediately upon issuance and will remain exercisable for a period of 3.5 years from the issuance date. The

Private Placement Warrants and the Ordinary Shares issuable upon exercise of the Private Placement Warrants are not being registered under

the Securities Act of 1933, as amended (the “Securities Act”) are not being offered pursuant to this prospectus supplement

and the accompanying prospectus, and are being offered pursuant to the exemption provided in Section 4(a)(2) under the Securities Act

and Rule 506(b) promulgated thereunder.

On December 26, 2023, the aggregate market value

of our outstanding Ordinary Shares held by non-affiliates was approximately $3.9 million based on 9,156,387 Ordinary Shares outstanding

held by non-affiliates and a price per share of $1.28, the closing price of our Ordinary Shares on October 27, 2023. Pursuant to General

Instruction I.B.5 of Form F-3, we may not sell securities registered on Form F-3 with a value more than one-third of the aggregate market

value of our Ordinary Shares held by non-affiliates in any 12-month period, so long as the aggregate market value of our Ordinary Shares

held by non-affiliates remains less than $75.0 million. As of the date hereof, we have been deemed to have sold approximately $3.9

million of our Ordinary Shares pursuant to General Instruction I.B.5 of Form F-3 during the prior 12 calendar month period that ends on,

and includes, the date hereof and this offering.

We are an emerging growth company, as defined

in the Jumpstart Our Business Startups Act of 2012, and have elected to comply with certain reduced public company reporting requirements.

Investing in our Ordinary Shares involves

a high degree of risk. See “Risk Factors” beginning on page S-5 of this prospectus supplement and in the documents

incorporated by reference into this prospectus supplement.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus

supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

We have engaged H.C. Wainwright & Co., LLC

(the “placement agent”), as our exclusive placement agent in connection with this offering. This offering is being conducted

on a reasonable “best efforts” basis and the placement agent has no obligation to buy any of the securities from us or to

arrange for the purchase or sale of any specific number or dollar amount of securities. We have agreed to pay the placement agent fees

set forth in the table below and in the “Plan of Distribution” section beginning on page S-16 of this prospectus supplement.

| | |

PER SHARE | | |

PER

PRE- FUNDED

WARRANT | | |

TOTAL | |

| Offering price | |

$ | 1.28 | | |

$ | 1.279 | | |

$ | 3,878,343.75 | |

| Placement agent fees(1) | |

$ | 0.0896 | | |

$ | 0.0896 | | |

$ | 271,600 | |

| Proceeds to us (before expenses) | |

$ | 1.1904 | | |

$ | 1.1894 | | |

$ | 3,606,743.75 | |

| (1) | We have agreed to pay the

placement agent a placement agent’s fee equal to $271,600, or 7% of the aggregate purchase price of the Shares and Pre-Funded

Warrants sold in this offering. See “Plan of Distribution” beginning on page S-16 of this prospectus supplement for a

description of the compensation payable to the placement agent. |

Delivery of the securities offered pursuant to

this prospectus supplement and accompanying prospectus is expected to be made on or about December 28, 2023, subject to satisfaction of

customary closing conditions.

H.C. Wainwright

& Co.

Prospectus Supplement dated December 26, 2023

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus relates to

part of a registration statement on Form F-3 that we have filed with the Securities and Exchange Commission (the “SEC”) utilizing

a “shelf” registration process. Under this shelf registration process, we may sell the securities described in our base prospectus

included in the shelf registration statement in one or more offerings up to a total aggregate offering price of $50,000,000. As of December

26, 2023, we have been deemed to have sold $3.9 million of our Ordinary Shares under that shelf registration statement. We sometimes

refer to the Ordinary Shares as the “securities” throughout this prospectus.

This document contains two

parts. The first part is this prospectus supplement, which describes the terms of this offering of the Ordinary Shares, and also adds,

updates and changes information contained in the accompanying prospectus and the documents incorporated herein and therein by reference.

The second part is the accompanying prospectus, which gives more general information about us, some of which may not apply to this offering.

You should read both this prospectus supplement and the accompanying prospectus, including the information incorporated by reference

herein and therein. To the extent the information contained in this prospectus supplement differs or varies from the information contained

in the accompanying prospectus or any document filed prior to the date of this prospectus supplement and incorporated herein or therein

by reference, the information in this prospectus supplement will control; provided, that if any statement in one of these documents is

inconsistent with a statement in another document having a later date, the statement in the document having the later date modifies or

supersedes the earlier statement. In addition, this prospectus supplement and the accompanying prospectus do not contain all of the information

provided in the registration statement that we filed with the Securities and Exchange Commission (the “SEC”) that contains

the accompanying prospectus (including the exhibits to the registration statement). For further information about us, you should refer

to that registration statement, which you can obtain from the SEC as described elsewhere in this prospectus supplement under “Where

You Can Find More Information” and “Incorporation of Certain Information by Reference.” You may obtain a copy of this

prospectus supplement, the accompanying prospectus and any of the documents incorporated by reference without charge by requesting it

from us in writing or by telephone at the following address or telephone number: Inspira Technologies Oxy B.H.N. Ltd., 2 Ha-Tidhar St.,

Ra’anana, 4366504 Israel, Israel, Tel: +972 996 644 88.

You should rely only on the

information contained in or incorporated by reference into this prospectus supplement and the accompanying prospectus. We have not authorized

anyone to provide you with information that is different. No dealer, salesperson or other person is authorized to give any information

or to represent anything not contained in or incorporated by reference into this prospectus supplement and the accompanying prospectus,

and you must not rely upon any information or representation not contained in or incorporated by reference into this prospectus supplement

or the accompanying prospectus. This prospectus supplement and the accompanying prospectus do not constitute an offer to sell or solicitation

of an offer to buy these securities in any circumstances under which the offer or solicitation is unlawful. We are offering to sell,

and seeking offers to buy, our securities offered hereby only in jurisdictions where offers and sales are permitted. You should not assume

that the information we have included in this prospectus supplement or the accompanying prospectus is accurate as of any date other than

the date of this prospectus supplement or the accompanying prospectus, respectively, or that any information we have incorporated by

reference is accurate as of any date other than the date of the document incorporated by reference, regardless of the time of delivery

of this prospectus supplement and the accompanying prospectus or of any of our securities. Our business, financial condition, results

of operations and prospects may have changed since those dates.

In this prospectus, “we,”

“us,” “our,” the “Company” and “Inspira” refer to Inspira Technologies Oxy B.H.N. Ltd.

Our reporting currency is

the U.S. dollar and our functional currency is New Israeli Shekels. Unless otherwise expressly stated or the context otherwise requires,

references in this prospectus to “NIS” are to New Israeli Shekels, , and references to “dollars” or “$”

are to U.S. dollars.

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights

information contained elsewhere or incorporated by reference into this prospectus supplement and the accompanying prospectus. This summary

does not contain all of the information that you should consider before investing in our securities. You should carefully read the entire

prospectus supplement and the accompanying prospectus, including the “Risk Factors” section, starting on page S-5 of this

prospectus supplement and in the documents incorporated by reference into this prospectus supplement and the accompanying prospectus,

as well as the financial statements and notes thereto and the other information incorporated by reference herein and therein, before

making an investment decision.

We are a specialty medical

device company engaged in the research, development, manufacturing, and marketing of proprietary respiratory support technology that

is intended to reduce the need for invasive mechanical ventilation, or IMV, which is the standard of care today for the treatment of

acute respiratory failure. Although it may be sometimes lifesaving, IMV is associated with increased risks, costs of care, extended lengths

of stay, frequent incidence of infections, ventilator dependence and mortality. Using our state-of-the-art respiratory support technology,

our goal is to set a new standard of care and to provide patients with acute respiratory failure an opportunity to maintain spontaneous

breathing and avoid the need for intubation, coma and various risks associated with the use of IMV. As part of our strategy to reach

this goal, and in parallel to pursuing regulatory approvals, we are actively working to establish collaborations with strategic partners,

globally ranked hospitals, medical device companies and distributors both for endorsement and early clinical adoption. We plan

to target intensive care units, or ICUs, general medical units, operating theaters, emergency medical services and small urban and rural

hospitals, with the goal of making our solutions more accessible to millions of patients worldwide. We expect for these activities to

support our strategy plan to reach market penetration and adoption of our respiratory support technology.

We are developing the following

products:

The INSPIRATM

ART500

The INSPIRA ART500 system

(Augmented Respiratory Technology) (also known as the ART system or ART), described herein as the INSPIRA ART500, INSPIRA ART500 device

or INSPIRA ART500 system, our flagship product, is a respiratory support technology targeting to utilize direct blood oxygenation to

boost patient saturation levels within minutes while the patient is awake & spontaneously breathing. The aim of our products is to

reduce the need for IMV with the potential to reduce risks, complications and high costs and potentially allowing for larger patient

populations in and beyond ICU settings. The INSPIRA ART500 is being designed as a new intent of use for long-term (longer than 6 hours)

respiratory support that provides assisted extracorporeal circulation and physiologic gas exchange (oxygenation and CO2 removal) of the

patient’s blood in adults with acute respiratory failure, targeting to allow for treatment of patients while they are awake. The

INSPIRA ART500 is being designed to potentially prevent the need for invasive mechanical ventilation, targeting acute respiratory failure

patients in ICUs and general medical units. The next generation INSPIRA ART500 is expected to be submitted to the U.S. Food and Drug

Administration, or FDA, for regulatory approval via the pre-market approval application or De Novo regulatory pathways.

The HYLATM

Blood Sensor

The HYLA blood sensor, described

herein as the HYLA or HYLA blood sensor, originally designed as a key and core technology for the INSPIRA ART500, is being developed

also as a stand-alone device to be integrated or used in extracorporeal procedures. The HYLA is a non-invasive optical blood sensor designed

to perform real-time and continuous blood measurements, potentially minimizing the need to take actual blood samples from patients. The

HYLA’s measurements can assist physicians in the monitoring of patient’s clinical condition. The HYLA blood sensor is being

designed as a clip-on sensor, attached to the outer walls of a blood tube, that may potentially reduce risks, complications, and costs.

The HYLA blood sensor may have broad application potential, benefiting patients undergoing procedures such as cardiopulmonary bypass

operations, Extracorporeal Membrane Oxygenation, or ECMO and Cardiopulmonary bypass, pending regulatory approvals.

The INSPIRATM

ART100

The INSPIRA ART100 Device

(previously referred to as the ALICE, Liby or ECLS system), described herein as the INSPIRA ART100, or the INSPIRA ART100 device, an

advanced form of life support system better known by the medical industry as a cardiopulmonary bypass system, or CPB, is being designed

for use in surgical procedures requiring cardiopulmonary bypass for 6 hours or less. The INSPIRA ART100 device is expected to be submitted

to the FDA for 510k clearance, during the second half of 2023. The INSPIRA ART100is designed to be a new generation CPB system with potential

advantages to medical device design with ergonomic configuration and intuitive user-centric software and display to increase functionality,

as well as a large touchscreen with novel colorful graphical representation that increases the visibility and functionality of data displayed

to the medical staff. The INSPIRA ART100 device is being designed to be lightweight and highly durable and will be equipped with long

battery life to maximize its portability. The INSPIRA ART100device, designed as a CPB, shall be indicated for use in surgical procedures

requiring cardiopulmonary bypass for 6 hours or less.

We have a goal to set a new

standard of care in various areas of patient care. As part of our strategy to reach these goals, and in parallel to pursuing regulatory

approvals, we are actively working to establish collaborations with strategic partners and globally ranked health centers to provide

endorsement and clinical adoption for regional deployments of our respiratory support, heart-lung bypass, ECMO and blood monitoring products

and technologies. We plan to target ICUs, general medical units, Operating theaters, emergency medical services and small urban and rural

hospitals, with the goal of making our solutions more accessible to millions of patients.

Corporate Information

We are an Israeli corporation

based in Ra’anana, Israel and were incorporated in Israel in 2018 under the name Clearx Medical Ltd. On April 10, 2018, our name

was changed to Insense Medical Ltd. and on July 30, 2020, our name was changed to our current name, Inspira Technologies Oxy B.H.N. Ltd.

Our principal executive offices are located at 2 Ha-Tidhar St., Ra’anana, 4366504 Israel. Our telephone number in Israel is 972

996 644 88. Our website address is www.inspira-technologies.com. The information contained on, or that can be accessed through,

our website is not part of this prospectus. We have included our website address in this prospectus solely as an inactive textual reference.

THE OFFERING

| Ordinary Shares

offered by us |

|

1,375,000 Ordinary

Shares. |

| |

|

|

| Per share offering price: |

|

$1.28 |

| |

|

|

| Pre-Funded Warrants: |

|

We are also offering Pre-Funded Warrants to purchase up to 1,656,250 of

our Ordinary Shares to the purchaser whose purchase of additional Shares in this offering would otherwise result in the purchaser, together

with its affiliates and certain related parties, beneficially owning more than 9.99% of our outstanding Ordinary Shares immediately following

the consummation of this offering. The purchase price of each Pre-Funded Warrant is equal to $1.279, which is equal to the purchase price

of the Shares less $0.001, the exercise price of each Pre-Funded Warrant. The Pre-Funded Warrants are immediately exercisable and may

be exercised at any time until all of the Pre-Funded Warrants are exercised in full. This offering also relates to the Ordinary Shares

issuable upon exercise of any Pre-Funded Warrants sold in this offering. |

| |

|

|

| Ordinary Shares outstanding

prior to the offering |

|

12,620,789 Ordinary Shares. |

| |

|

|

| Ordinary Shares to be outstanding

after this offering |

|

15,652,039 Ordinary

Shares (assuming full exercise of the Pre-Funded Warrants). |

| |

|

|

| Use of proceeds |

|

We intend to use the net proceeds from the

sale of securities under this prospectus for general corporate purposes, which include financing our research and development, including

human observational studies, system engineering and other regulatory approval processes ,business development marketing activities

and implementation of our commercialization strategy.

See “Use of Proceeds” on page

S-11 of this prospectus supplement. |

| |

|

|

| Best Efforts: |

|

We have agreed to issue

and sell the securities offered hereby to the investors through the placement agent, and the placement agent has agreed to offer and

sell such securities on a reasonable “best efforts” basis. The placement agent is not required to sell any specific

number or dollar amount of the securities offered hereby, but will use its best efforts to sell such securities. See “Plan of

Distribution” on page S-16 of this prospectus supplement. |

| |

|

|

| Risk factors |

|

Investing in the Ordinary

Shares involves a high degree of risk. See “Risk Factors” beginning on page S-5 of this prospectus supplement and in

the documents incorporated by reference into this prospectus supplement and the accompanying prospectus for a discussion of the risks

you should carefully consider before deciding to invest in the Ordinary Shares. |

| |

|

|

| Nasdaq Capital Market symbol |

|

Our Ordinary Shares are

listed on the Nasdaq under the symbol “IINN.” We do not intend to apply for a listing of the Pre-Funded Warrants on any

national securities exchange or other nationally recognized trading system. |

| |

|

|

| Concurrent Private Placement: |

|

In the concurrent Private Placement, we are also selling, to the purchaser

of Shares and Pre-Funded Warrants in this offering, Private Placement Warrants to purchase up to 3,031,250 Ordinary Shares. The Private

Placement Warrants will have an exercise price of $1.28 per share and are exercisable immediately upon issuance and will remain exercisable

for a period of 3.5 years from the issuance date. The Private Placement Warrants and the Ordinary Shares issuable upon exercise of the

Private Placement Warrants are not being registered under the Securities Act, are not being offered pursuant to this prospectus supplement

and the accompanying prospectus, and are being offered pursuant to the exemption provided in Section 4(a)(2) under the Securities Act

and Rule 506(b) promulgated thereunder.

|

Unless otherwise indicated,

the number of Ordinary Shares outstanding prior to and after this offering is based on 12,620,789 Ordinary Shares outstanding as of December

26, 2023, and excludes the following as of such date:

| ● | 462,800

Ordinary Shares issuable upon the exercise of options to directors, employees and consultants under our equity incentive plan, outstanding

as of such date, with exercise prices ranging between NIS 0.37 (approximately $0.11) to NIS 0.97 (approximately $0.29) per share, and

29,400 Ordinary Shares issuable upon the exercise of options to consultants under our equity incentive plan, outstanding as of such date,

with exercise price of $3.08. 444,164 of the total options were vested as of such date; |

| ● | 465,212

Restricted Share Unites, or RSUs, granted to directors, employees, and consultants under our equity incentive plan, none of which were

vested as of such date; |

| ● | 71,638

Ordinary Shares reserved for future issuance under our equity incentive plan; |

| ● | 169,016

Ordinary Shares issuable upon the exercise of warrants issued to InSense Medical Pty Ltd. in connection with a certain termination agreement,

with an exercise price of $5.50 per Ordinary Share; |

| ● | 795,832

Ordinary Shares issuable upon the exercise of warrants issued in connection with certain equity investment agreements, which we refer

to as Simple Agreements for Future Equity, or SAFEs and an additional 3,247 Ordinary Shares issuable upon the exercise of warrants

issued to promoters in connection with such SAFEs; |

| ● | 353,750

Ordinary Shares issuable upon the exercise of warrants issued in connection with a certain convertible loan, and an additional 13,340

Ordinary Shares issuable upon the exercise of warrants issued to promoters in connection with such convertible loan agreements; and |

| ● | No exercise of warrants

issued in the concurrent Private Placement and to the placement agent as compensation for this offering. |

RISK FACTORS

Investing in our securities

involves significant risks. Before making an investment decision, you should carefully consider the risks described below and in our

most recent Annual Report on Form 20-F, and in our other SEC filings incorporated by reference into this prospectus supplement and the

accompanying prospectus, and in any amendment or update thereto reflected in our subsequent filings with the SEC and incorporated by

reference into this prospectus supplement and the accompanying prospectus, together with all of the other information appearing in this

prospectus supplement or the accompanying prospectus or incorporated by reference herein or therein, including in light of your particular

investment objectives and financial circumstances. The risks so described are not the only risks we face. Additional risks not presently

known to us or that we currently deem immaterial may also impair our business operations and become material. Our business, financial

condition and results of operations could be materially adversely affected by any of these risks. The trading price of our securities

could decline due to any of these risks, and you may lose all or part of your investment. The discussion of risks includes or refers

to forward-looking statements; you should read the explanation of the qualifications and limitations on such forward-looking statements

discussed elsewhere in this prospectus supplement under the caption “Cautionary Statement Regarding Forward-Looking Statements”

below.

Risks Related to this Offering

Since we have broad discretion in how we

use the proceeds from this offering, we may use the proceeds in ways with which you disagree.

We intend to use the net

proceeds of this offering for working capital and for other general corporate purposes, which include financing our operations, research

and development, including human observational studies, system engineering and other regulatory approval processes, business development

marketing activities and implementation of our commercialization strategy. Accordingly, our management will have significant flexibility

in applying the net proceeds of this offering. You will be relying on the judgment of our management with regard to the use of these

net proceeds, and you will not have the opportunity, as part of your investment decision, to assess whether the proceeds are being used

in ways with which you would agree. It is possible that the net proceeds will be invested in a way that does not yield us a favorable,

or any, return. The failure of our management to use the net proceeds effectively could have a material adverse effect on our business,

financial condition, operating results and cash flow.

You may experience future dilution as a result of future equity

offerings.

In order to raise additional capital, we may in

the future offer additional Ordinary Shares or other securities convertible into or exchangeable for Ordinary Shares at prices that may

not be the same as the price per share in this offering. We may sell shares or other securities in any other offering at a price per

share that is less than the price per share paid by investors in this offering, and investors purchasing shares or other securities in

the future could have rights superior to existing shareholders. The price per share at which we sell additional Ordinary Shares, or securities

convertible or exchangeable into Ordinary Shares, in future transactions may be higher or lower than the price per share paid by investors

in this offering.

Investors in this offering will incur immediate

dilution from the offering price.

Because the price per Ordinary

Share of the Ordinary Shares being offered is higher than the book value per share of the Ordinary Shares, you will incur immediate dilution

in the net tangible book value of the Ordinary Shares you purchase in this offering. Accordingly, at the offering price of $1.28 per share,

you will experience immediate and substantial dilution of $0.55 per Ordinary Share, with respect to the net tangible book value of the

Ordinary Shares. See “Dilution” for a more detailed discussion of the dilution you will incur in this offering.

We may need additional financing in the

future. We may be unable to obtain additional financing or if we obtain financing it may not be on terms favorable to us. You may lose

your entire investment.

Based on our current plans,

we believe our existing cash and cash equivalents, along with cash generated from this offering, will be sufficient to fund our operating

expense and capital requirements for at least 12 months from the date of this prospectus supplement, although there is no assurance of

this and we may need additional funds in the future. If our capital resources are insufficient to meet future capital requirements, we

will have to raise additional funds. We may be unable to obtain additional funds through financing activities, and if we obtain financing

it may not be on terms favorable to us. If we are unable to obtain additional funds on terms favorable to us, we may be required to cease

or reduce our operating activities. If we must cease or reduce our operating activities, you may lose your entire investment.

The price of the Ordinary Shares may be

volatile.

The market price of the Ordinary

Shares has fluctuated in the past. Consequently, the current market price of the Ordinary Shares may not be indicative of future market

prices, and we may be unable to sustain or increase the value of your investment in the Ordinary Shares.

We have never paid cash dividends on our

share capital, and we do not anticipate paying any cash dividends in the foreseeable future.

We have never declared or

paid cash dividends, and we do not anticipate paying cash dividends in the foreseeable future. Therefore, you should not rely on an investment

in Ordinary Shares as a source for any future dividend income. Our board of directors has complete discretion as to whether to distribute

dividends. Even if our board of directors decides to declare and pay dividends, the timing, amount and form of future dividends, if any,

will depend on our future results of operations and cash flow, our capital requirements and surplus, the amount of distributions, if

any, received by us from our subsidiaries, our financial condition, contractual restrictions and other factors deemed relevant by our

board of directors.

This offering is being conducted on a

reasonable “best efforts” basis.

The placement agent is offering

the Shares on a reasonable “best efforts” basis, and the placement agent is under no obligation to purchase any securities

for its own account. The placement agent is not required to sell any specific number or dollar amount of securities in this offering but

will use its best efforts to sell the securities offered in this prospectus supplement. As a reasonable “best efforts” offering,

there can be no assurance that the offering contemplated hereby will ultimately be consummated.

There is no public market for the

Pre-Funded Warrants being offered in this offering.

There is no established public trading market

for the Pre-Funded Warrants being offered in this offering, and we do not expect a market to develop. In addition, we do not intend to

apply to list the Pre-Funded Warrants on any securities exchange or nationally recognized trading system. Without an active market, the

liquidity of the Pre-Funded Warrants will be limited.

Holders of our Pre-Funded Warrants will have no rights as a

shareholder until they acquire our Ordinary Shares.

Until you acquire our Ordinary Shares upon exercise

of your Pre-Funded Warrants, you will have no rights with respect to our Ordinary Shares issuable upon exercise of your Pre-Funded Warrants.

Upon exercise of your Pre-Funded Warrants, you will be entitled to exercise the rights of a shareholder only as to matters for which

the record date occurs after the exercise date.

The Pre-Funded Warrants are speculative

in nature.

The Pre-Funded Warrants offered hereby do not

confer any rights of share ownership on their holders, such as voting rights or the right to receive dividends, but rather merely represent

the right to acquire Ordinary Shares at a fixed price. Specifically, commencing on the date of issuance, holders of the Pre-Funded Warrants

may acquire the Ordinary Shares issuable upon exercise of such warrants at an exercise price of $1.28 per share. Moreover, following

this offering, the market value of the Pre-Funded Warrants is uncertain and there can be no assurance that the market value of the Pre-Funded

Warrants will equal or exceed their offering price.

Provisions of the Pre-Funded Warrants offered

by this prospectus could discourage an acquisition of us by a third party.

Certain provisions of the Pre-Funded Warrants

offered by this prospectus could make it more difficult or expensive for a third party to acquire us. The Pre-Funded Warrants prohibit

us from engaging in certain transactions constituting “fundamental transactions” unless, among other things, the surviving

entity assumes our obligations under the Pre-Funded Warrants. Further, the Pre-Funded Warrants provide that, in the event of certain

transactions constituting “fundamental transactions,” with some exception, holders of such warrants will have the right,

at their option, to require us to repurchase such Pre-Funded Warrants at a price described in such warrants. These and other provisions

of the Pre-Funded Warrants offered by this prospectus could prevent or deter a third party from acquiring us even where the acquisition

could be beneficial to you.

Risks Related to our Israeli Operations

Our principal

executive offices, most of our research and development activities and other significant operations are located in Israel, and, therefore,

our results may be adversely affected by political, economic and military instability in Israel, including the recent attack by Hamas

and other terrorist organizations from the Gaza Strip and Israel’s war against them.

Our

executive offices, corporate headquarters and principal research and development facilities are located in Israel. In addition, all of

our officers and directors are residents of Israel. Accordingly, political, economic and military and security conditions in Israel and

the surrounding region may directly affect our business. Any conflicts, political instability, terrorism, cyberattacks or any other hostilities

involving Israel or the interruption or curtailment of trade between Israel and its present trading partners could adversely affect our

operations. Ongoing and revived hostilities in the Middle East or other Israeli political or economic factors, could harm our operations.

In

October 2023, Hamas terrorists infiltrated Israel’s border with the Gaza Strip and conducted a series of attacks on civilian and

military targets. Hamas has also launched extensive rocket attacks on Israeli population and industrial centers located along Israel’s

border with the Gaza Strip and in other areas within the State of Israel. These attacks have resulted in extensive deaths, injuries and

kidnapping. Following the attack, Israel’s security cabinet declared war against Hamas and a military campaign against these terrorist

organizations commenced in parallel to their continued rocket and terror attacks.

The

intensity and duration of Israel’s current war against Hamas is difficult to predict, as are such war’s economic implications

on the Company’s business and operations and on Israel’s economy in general. The potential deterioration of Israel’s economy,

as a direct and indirect result of these events, may have a material adverse effect on the Company and its ability to effectively conduct

its operations.

In

connection with the Israeli security cabinet’s declaration of war against Hamas and possible hostilities with other organizations,

several hundred thousand Israeli military reservists were drafted to perform immediate military service. Five (5) of our employees have

been drafted. Three (3) of those employees have since returned from reserve duty, but there can be no guarantee that they will not be

called in again. None of the employees called up holds a key position in our Company. Additional employees may be called up, for service

in the current or future wars or other armed conflicts with Hamas, and such persons may be absent for an extended period of time. As

a result, our operations may be disrupted by such absences, which in turn may materially and adversely affect our business, prospects,

financial condition and results of operations.

Following the attack by Hamas

on Israel, Hezbollah in Lebanon has also launched missile, rocket, and shooting attacks against Israeli military sites, troops, and towns

in northern Israel. In response to these attacks, the Israel Defense Forces has carried out targeted strikes on sites belonging to Hezbollah

in southern Lebanon. It is possible that other terrorist organizations, including Palestinian military organizations in the West Bank,

as well as other hostile countries, such as Iran, will join the hostilities. Such hostilities may include terror and missile attacks.

Any hostilities involving Israel or the interruption or curtailment of trade between Israel and its trading partners could adversely

affect our operations and delay in project timelines. Any armed conflicts or political instability in the region would likely negatively

affect business conditions with respect to fundraising and time to market. As of the date of this prospectus, we are not experiencing,

and we do not anticipate any material change in our ability to operate in the field of research and development and our timelines regrading

all of our projects in process remain the same.

The

State of Israel and Israeli companies have been the subject of boycotts, divestment and sanctions in the past from state and non-state

actors. These actions could expand in number and scope and may have an adverse impact on our operating results, financial condition or

the expansion of our business.

The

Israeli government has pursued extensive changes to Israel’s judicial system. In response to the foregoing developments, individuals,

organizations and institutions, both within and outside of Israel, have voiced concerns that the proposed changes may negatively impact

the business environment in Israel due in part to the reluctance of foreign investors to invest or transact business in Israel, increased

volatility in foreign exchange rates involving the Israeli new shekel, downgrades in the credit rating of Israel, increased volatility

in securities markets, and other changes in macroeconomic conditions. All of these risks have been compounded by the current war against

Hamas. To the extent that any of these negative developments do occur, they may have an adverse effect on our business, our results of

operations and our ability to raise additional funds, if deemed necessary by our management and board of directors.

The termination or reduction of tax and

other incentives that the Israeli government provides to Israeli companies may increase our costs and taxes.

The Israeli government currently

provides tax and capital investment incentives to Israeli companies, as well as grant and loan programs relating to research and development

and marketing and export activities. In recent years, the Israeli government has reduced the benefits available under these programs

and the Israeli governmental authorities may in the future further reduce or eliminate the benefits of these programs. We may take advantage

of these benefits and programs in the future; however, there can be no assurance that such benefits and programs will be available to

us. If we qualify for such benefits and programs and fail to meet the conditions thereof, the benefits could be canceled and we could

be required to refund any benefits we might already have enjoyed and become subject to penalties. Additionally, if we qualify for such

benefits and programs and they are subsequently terminated or reduced, it could have an adverse effect on our financial condition and

results of operations.

We may be required to pay monetary remuneration

to our Israeli employees for their inventions, even if the rights to such inventions have been duly assigned to us.

We enter into agreements

with our Israeli employees pursuant to which such individuals agree that any inventions created in the scope of their employment are

either owned exclusively by us or are assigned to us, depending on the jurisdiction, without the employee retaining any rights. A portion

of our intellectual property has been developed by our Israeli employees during their employment for us. Under the Israeli Patent Law,

5727-1967, or the Patent Law, inventions conceived by an employee during the course of his or her employment and within the scope of

said employment are considered “service inventions.” Service inventions belong to the employer by default, absent a specific

agreement between the employee and employer otherwise. The Patent Law also provides that if there is no agreement regarding the remuneration

for the service inventions, even if the ownership rights were assigned to the employer, the Israeli Compensation and Royalties Committee,

or the Committee, a body constituted under the Patent Law, shall determine whether the employee is entitled to remuneration for these

inventions. The Committee has not yet determined the method for calculating this Committee-enforced remuneration. While it has previously

been held that an employee may waive his or her rights to remuneration in writing, orally or by conduct, litigation is pending in the

Israeli labor court is questioning whether such waiver under an employment agreement is enforceable. Although our Israeli employees have

agreed that we exclusively own any rights related to their inventions, we may face claims demanding remuneration in consideration for

employees’ service inventions. As a result, we could be required to pay additional remuneration or royalties to our current and/or

former employees, or be forced to litigate such claims, which could negatively affect our business.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

STATEMENTS

This prospectus supplement,

the accompanying prospectus and certain information incorporated by reference in this prospectus supplement and the accompanying prospectus

contain “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the U.S.

Securities Exchange Act of 1934, as amended, or the Exchange Act, and other securities laws. Forward-looking statements are often characterized

by the use of forward-looking terminology such as “may,” “will,” “should,” “expects,”

“plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential”

“intends” or “continue,” or the negative of these terms or other comparable terminology.

These

forward-looking statements may include, but are not limited to, statements relating to our objectives, plans and strategies, statements

that contain projections of results of operations or of financial condition, expected capital needs and expenses, statements relating

to the research, development, completion and use of our products, and all statements (other than statements of historical facts) that

address activities, events or developments that we intend, expect, project, believe or anticipate will or may occur in the future.

Forward-looking

statements are not guarantees of future performance and are subject to risks and uncertainties. We have based these forward-looking statements

on assumptions and assessments made by our management in light of their experience and their perception of historical trends, current

conditions, expected future developments and other factors they believe to be appropriate

Important

factors that could cause actual results, developments and business decisions to differ materially from those anticipated in these forward-looking

statements include, among other things:

| ● | our

planned level of revenues and capital expenditures; |

| ● | our

available cash our ability to obtain additional funding; |

| ● | our ability to market and sell our products; |

| ● | our

expectation regarding the sufficiency of our existing cash and cash equivalents to fund our current operations; |

| ● | our

ability to advance the development of our products and future potential product candidates; |

| ● | our

ability to commercialize our products and future potential product candidates and future sales of our products or any other future potential

product candidates; |

| ● | our

assessment of the potential of our products and future potential product candidates to treat certain indications; |

| ● | our

planned level of capital expenditures and liquidity; |

| ● | our

plans to continue to invest in research and development to develop technology for new products; |

| ● | our

ability to maintain our relationships with suppliers, manufacturers, distributors, and other partners; |

| ● | anticipated

actions of the FDA, state regulators, if any, or other similar foreign regulatory agencies, including approval to conduct clinical trials,

the timing and scope of those trials and the prospects for regulatory approval or clearance of, or other regulatory action with respect

to our products or services; |

| ● | the

regulatory environment and changes in the health policies and regimes in the countries in which we intend to operate, including the impact

of any changes in regulation and legislation that could affect the medical device industry; |

| ● | our

ability to meet our expectations regarding the commercial supply of our products and future product candidates; |

| ● | our

ability to retain key office holders; |

| ● | our

ability to internally develop new inventions and intellectual property; |

| ● | the

overall global economic environment; |

| ● | the

impact of competition and new technologies; |

| ● | general

market, political and economic conditions in the countries in which we operate; |

| ● | the

impact of competition and new technologies; |

| ● | our

ability to internally develop new inventions and intellectual property; |

| ● | changes

in our strategy; and |

These

statements are only current predictions and are subject to known and unknown risks, uncertainties, and other factors that may cause our

or our industry’s actual results, levels of activity, performance or achievements to be materially different from those anticipated

by the forward-looking statements. We discuss many of these risks in this prospectus in greater detail under the heading “Risk

Factors” and elsewhere in this prospectus. You should not rely upon forward-looking statements as predictions of future events.

Although

we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels

of activity, performance, or achievements. Except as required by law, we are under no duty to update or revise any of the forward-looking

statements, whether as a result of new information, future events or otherwise, after the date of this prospectus.

USE OF PROCEEDS

We estimate the net proceeds

to us from the sale of Shares this offering will be approximately $3.42 million, after deducting the placement agent fees and estimated

offering expenses payable by us.

We intend to use the net

proceeds from the sale of securities under this prospectus supplement for general corporate purposes, which include financing our

operations, research and development, including human observational studies, system engineering and other regulatory approval

processes, business development marketing activities and implementation of our commercialization strategy. The timing and amount of

our actual expenditures will be based on many factors, and we cannot specify with certainty all of the particular uses of the net

proceeds from this offering. Accordingly, our management will have significant discretion and flexibility in applying the net

proceeds of this offering. We have no current commitments or binding agreements with respect to any material acquisition of or

investment in any technologies, products or companies.

Pending our use of the net

proceeds from this offering, we may invest the net proceeds of this offering in a variety of capital preservation investments, including

but not limited to short-term, investment grade, interest bearing instruments and U.S. government securities.

DIVIDEND POLICY

We have never declared or

paid any cash dividends on our Ordinary Shares and do not anticipate paying any cash dividends in the foreseeable future. Payment of

cash dividends, if any, in the future will be at the discretion of our board of directors and will depend on then-existing conditions,

including our financial condition, operating results, contractual restrictions, capital requirements, business prospects and other factors

our board of directors may deem relevant.

The Companies Law imposes

further restrictions on our ability to declare and pay dividends. Under the Companies Law, we may declare and pay dividends only if,

upon the determination of our board of directors, there is no reasonable concern that the distribution will prevent us from being able

to meet the terms of our existing and foreseeable obligations as they become due. Under the Companies Law, the distribution amount is

further limited to the greater of retained earnings or earnings generated over the two most recent years legally available for distribution

according to our then last reviewed or audited financial statements, provided that the end of the period to which the financial statements

relate is not more than six months prior to the date of distribution. In the event that we do not meet such earnings criteria, we may

seek the approval of a court in order to distribute a dividend. The court may approve our request if it is convinced that there is no

reasonable concern that the payment of a dividend will prevent us from satisfying our existing and foreseeable obligations as they become

due.

DESCRIPTION OF THE SECURITIES WE ARE OFFERING

We are offering through this

prospectus supplement and the accompanying prospectus (i) 1,3750,000 Ordinary Shares, and (ii) 1,656,250 Pre-Funded Warrants to purchase

up to 1,656,250 of our Ordinary Shares. We are also registering the offer and sale of shares of our Ordinary Shares issuable from time

to time upon exercise of the Pre-Funded Warrants offered hereby.

Ordinary Shares

The material terms and provisions of our Ordinary

Shares are described in Exhibit 2.1 to our Annual Report on Form 20-F for the year ended December 31, 2022, filed with

the SEC on March 31, 2023, which descriptions are supplemented as set forth below.

Pre-Funded Warrants Issued in This Offering

The following summary of

certain terms and provisions of the Pre-Funded Warrants that are being offered hereby is not complete and is subject to, and qualified

in its entirety by the provisions of, the Pre-Funded Warrants. You should carefully review the terms and provisions of the form of the

Pre-funded Warrant for a complete description of the terms and conditions of the Pre-Funded Warrants.

The term “pre-funded” refers

to the fact that the purchase price of our Ordinary Shares in this offering includes almost the entire exercise price that will be paid

under the Pre-Funded Warrants, except for a nominal remaining exercise price of $0.001. The purpose of the Pre-Funded Warrants

is to enable investors that may have restrictions on their ability to beneficially own more than 4.99% (or, upon election of the holder,

9.99%) of our outstanding Ordinary Shares following the consummation of this offering the opportunity to make an investment in the Company

without triggering their ownership restrictions, by receiving Pre-Funded Warrants in lieu of our Ordinary Shares which would

result in such ownership of more than 4.99% (or 9.99%), and receive the ability to exercise their option to purchase the shares underlying

the Pre-Funded Warrants at such nominal price at a later date.

Duration and Exercise Price.

The Pre-Funded Warrants offered hereby will entitle the holder thereof to purchase up to an aggregate of 1,656,250 of our Ordinary Shares

at an exercise price of $0.001 per share, commencing immediately on the date of issuance until exercised in full.

Exercisability. The

Pre-Funded Warrants will be exercisable, at the option of each holder, in whole or in part, by delivering to us a duly executed exercise

notice accompanied by payment in full for the number of Ordinary Shares purchased upon such exercise (except in the case of a cashless

exercise as discussed below). A holder (together with its affiliates) may not exercise any portion of such holder’s warrants to

the extent that the holder would own more than 4.99% (or, at the election of the holder, 9.99%) of our outstanding Ordinary Shares immediately

after exercise, except that upon notice from the holder to us, the holder may increase or decrease the amount of ownership of outstanding

Ordinary Shares after exercising the holder’s Pre-Funded Warrants up to 9.99% of the number of Ordinary Shares outstanding immediately

after giving effect to the exercise, as such percentage ownership is determined in accordance with the terms of the Pre-Funded Warrants,

provided that any increase in this limitation shall not be effective until 61 days after notice to us.

Cashless Exercise.

In lieu of making the cash payment otherwise contemplated to be made to us upon the exercise of a Pre-Funded Warrant in payment of the

aggregate exercise price, the holder may elect instead to receive upon such exercise (either in whole or in part) the net number of Ordinary

Shares determined according to a formula set forth in the Pre-Funded Warrant.

Exercise Price Adjustment.

The exercise price of the Pre-Funded Warrants is subject to appropriate adjustment in the event of certain share dividends and distributions,

stock splits, stock combinations, reclassifications or similar events affecting our Ordinary Shares.

Fundamental Transaction.

In the event of any fundamental transaction, as described in the Pre-funded Warrants and generally including any merger with or into another

entity, sale of all or substantially all of our assets, tender offer or exchange offer, reclassification of our Ordinary Shares or acquisition

of more than 50% of the voting power represented by our Ordinary Shares, then upon any subsequent exercise of a Pre-Funded Warrant, the

holder will have the right to receive as alternative consideration, for each Ordinary Share that would have been issuable upon such exercise

immediately prior to the occurrence of such fundamental transaction, the number of Ordinary Shares of the successor or acquiring corporation

or of our Company, if it is the surviving corporation, and any additional consideration receivable upon or as a result of such transaction

by a holder of the number of Ordinary Shares for which the Pre-Funded Warrant is exercisable immediately prior to such event.

Transferability. In

accordance with its terms and subject to applicable laws, a Pre-Funded Warrant may be transferred at the option of the holder upon surrender

of the Pre-Funded Warrant to us together with the appropriate instruments of transfer and payment of funds sufficient to pay any transfer

taxes (if applicable).

Fractional Shares.

No fractional shares of Ordinary Shares will be issued upon the exercise of the Pre-Funded Warrants. Rather, the number of Ordinary Shares

to be issued will, at our election, either be rounded up to the nearest whole number or we will pay a cash adjustment in respect of such

final fraction in an amount equal to such fraction multiplied by the exercise price.

Exchange Listing. There

is no established trading market for the Pre-Funded Warrants, and we do not expect a market to develop. In addition, we do not intend

to apply for the listing of the Pre-Funded Warrants on any national securities exchange or other trading market. Without an active trading

market, the liquidity of the Pre-Funded Warrants will be limited.

Rights as a Stockholder.

Except as otherwise provided in the Pre-Funded Warrants or by virtue of such holder’s ownership of shares of our Ordinary Shares,

the holder of a Pre-Funded Warrant does not have the rights or privileges of a holder of our Ordinary Shares, including any voting rights,

until the holder exercises the Pre-Funded Warrant.

CAPITALIZATION

The following table sets

forth our total liabilities and shareholders’ equity as of June 30, 2023:

| ● | on

an as adjusted basis to give additional effect to the sale of 3,031,250 Ordinary Shares (or equivalent) in this offering at an

offering price of $1.28 per share, after deducting placement agent fees and estimated offering expenses payable by us. |

The following table sets

forth our capitalization and shareholders’ equity as of June 30, 2023 and should be read in conjunction with “Use of Proceeds,”

our financial statements and related notes that are incorporated by reference into this prospectus supplement and the accompanying prospectus

and the other financial information included or incorporated by reference into this prospectus supplement and the accompanying prospectus.

| U.S. dollars in thousands | |

As of

June 30,

2023 Actual | | |

As of

June 30,

2023

As

Adjusted | |

| | |

| | |

| |

| Cash and cash equivalents | |

| 3,324 | | |

| 6,748 | |

| Deposits | |

| 5,643 | | |

| 5,643 | |

| Restricted cash | |

| 60 | | |

| 60 | |

| Financials liability at Fair Value | |

| 438 | | |

| 2,382 | |

| Shareholders’ equity (deficit): | |

| | | |

| | |

| Share capital and additional paid in capital | |

| 54,831 | | |

| 56,583 | |

| Foreign exchange reserve | |

| (2,360 | ) | |

| (2,360 | ) |

| | |

| | | |

| | |

| Accumulated deficit | |

| (44,919 | ) | |

| (45,191 | ) |

| Total shareholders’ equity (deficit) | |

| 7,552 | | |

| 9,032 | |

| Total capitalization | |

| 10,840 | | |

| 14,264 | |

The above discussion and

table are based on 11,993,855 Ordinary Shares outstanding as of June 30, 2023, and excludes the following as of such date:

| ● | 500,772

Ordinary Shares issuable upon the exercise of options to directors, employees and consultants under our equity incentive plan, outstanding

as of such date, with exercise prices ranging between NIS 0.37 (approximately $0.12) to NIS 0.97 (approximately $0.29) per share, and

29,400 Ordinary Shares issuable upon the exercise of options to consultants under our equity incentive plan, outstanding as of such date,

with exercise price of $3.08. 459,291 of the total options were vested as of such date; |

| ● | 1,067,305

RSUs granted to directors, employees, and consultants under our equity incentive plan, none of which were vested as of such date; |

| ● | 36,550

Ordinary Shares reserved for future issuance under our equity incentive plan; |

| ● | 169,016

Ordinary Shares issuable upon the exercise of warrants issued to InSense Medical Pty Ltd. in connection with a certain termination agreement,

with an exercise price of $5.50 per Ordinary Share; |

| ● | 795,832

Ordinary Shares issuable upon the exercise of warrants issued in connection with certain equity investment agreements, which we refer

to as SAFEs and an additional 3,247 Ordinary Shares issuable upon the exercise of warrants issued to promoters in connection with

such SAFEs; and |

| ● | 353,750

Ordinary Shares issuable upon the exercise of warrants issued in connection with a certain convertible loan, and an additional 13,340

Ordinary Shares issuable upon the exercise of warrants issued to promoters in connection with such convertible loan agreements. |

DILUTION

If you invest in our Ordinary

Shares, you will experience immediate dilution to the extent of the difference between the offering price of the Ordinary Shares

in this offering and the net tangible book value per Ordinary Share immediately after the offering.

Our net tangible book value

per Ordinary Share is determined by dividing our total tangible assets, less total liabilities, by the actual number of outstanding Ordinary

Shares. The net tangible book value of our Ordinary Shares as of June 30, 2023 was approximately $0.90 per share. Net tangible book value

per share represents the amount of our total tangible assets less our total liabilities, divided by 11,993,855, the total number of Ordinary

Shares outstanding at June 30, 2023.

After giving effect to the

sale of 3,031,250 of our Ordinary Shares (or equivalent) in this offering at an offering price of $1.28 per share, and after deducting

placement agent fees and estimated offering expenses payable by us, our as adjusted net tangible book value as of June 30, 2023 would

have been approximately $10.9 million, or $0.763 per share. This amount represents an immediate increase in net tangible book value of

$0.10 per share as a result of this offering and an immediate dilution of approximately $0.55 per share to investors purchasing Ordinary

Shares in this offering.

The following table illustrates

this dilution on a per Ordinary Share basis. The as adjusted information is illustrative only and will adjust based on the actual prices

to the public, the actual number of Ordinary Shares sold, and other terms of the offering determined at the times our Ordinary Shares

are sold pursuant to this prospectus. The Ordinary Shares sold in this offering, if any, will be sold from time to time at various prices.

| Offering price per Ordinary Share |

|

|

|

|

|

$ |

1.28 |

|

| Net tangible book value per Ordinary Share as of June 30, 2023 |

|

$ |

0.63 |

|

|

|

|

|

| Increase in net tangible book value per Ordinary Share attributable to investors purchasing Ordinary Shares in this offering |

|

$ |

0.10 |

|

|

|

|

|

| As adjusted net tangible book value per Ordinary Share after offering |

|

|

|

|

|

$ |

0.73 |

|

| Dilution per Ordinary Share to investors purchasing Ordinary Shares in the offering |

|

|

|

|

|

$ |

0.55 |

|

The above discussion and

table are based on 11,993,855 Ordinary Shares outstanding as of June 30, 2023. To the extent that outstanding options or warrants are

exercised, or we issue additional Ordinary Shares under our incentive equity plan, you may experience further dilution. In addition,

we may choose to raise additional capital due to market conditions or strategic considerations even if we believe that we have sufficient

funds for our current and future operating plans. To the extent that additional capital is raised through the sale of equity or convertible

debt securities, the issuance of those securities could result in further dilution to the holders of our Ordinary Shares and the Ordinary

Shares.

PRIVATE

PLACEMENT TRANSACTION

In a concurrent Private Placement,

we are selling to purchaser of securities in this offering Private Placement Warrants to purchase up to 3,031,250 of our Ordinary Shares.

The Private Placement Warrants

will have an exercise price of $1.28 per share and are exercisable immediately upon issuance and will remain exercisable for a period

of three and one-half years from their issuance date.

The Private Placement Warrants

and the Ordinary Shares issuable upon the exercise of the Private Placement Warrants are not being registered under the Securities Act,

are not being offered pursuant to this prospectus supplement and the accompanying prospectus and are being offered pursuant to the exemption

provided in Section 4(a)(2) under the Securities Act and Rule 506(b) promulgated thereunder. Accordingly, purchasers may only sell Ordinary

Shares issued upon exercise of the Private Placement Warrants pursuant to an effective registration statement under the Securities Act

covering the resale of those shares, an exemption under Rule 144 under the Securities Act or another applicable exemption under the Securities

Act.

If a Fundamental Transaction (as defined in the Private Placement Warrants)

occurs, then the successor entity will succeed to, and be substituted for us, and may exercise every right and power that we may exercise

and will assume all of our obligations under the Private Placement Warrants with the same effect as if such successor entity had been

named in the Private Placement Warrants itself. If holders of our Ordinary Shares are given a choice as to the securities, cash or property

to be received in such a Fundamental Transaction, then the holder shall be given the same choice as to the consideration it would receive

upon any exercise of the Private Placement Warrants following such a Fundamental Transaction. Additionally, as more fully described in

the Private Placement Warrants, in the event of certain Fundamental Transactions, the holders of Private Placement Warrants will be entitled

to receive consideration in an amount equal to the Black Scholes value of Private Placement Warrants on the date of consummation of such

Fundamental Transaction.

A holder of Private Placement

Warrants will not have the right to exercise any portion of its warrants if the holder, together with its affiliates, would beneficially

own in excess of 4.99% at the election of the investor, of the number of our Ordinary Shares outstanding immediately after giving effect

to such exercise, or the Beneficial Ownership Limitation; provided, however, that upon notice to us, the holder may increase or decrease

the Beneficial Ownership Limitation, provided further that in no event shall the Beneficial Ownership Limitation exceed 9.99% and any

increase in the Beneficial Ownership Limitation will not be effective until 61 days following notice of such increase from the holder

to us.

The exercise price and number

of the Ordinary Shares issuable upon the exercise of the Private Placement Warrants will be subject to adjustment for stock splits, reverse

splits, and similar capital transactions, as described in the Private Placement Warrants.

PLAN OF DISTRIBUTION

We engaged H.C. Wainwright &

Co., LLC (“Wainwright” or the “Placement Agent”) to act as our exclusive placement agent in connection with this

offering. The Placement Agent is not purchasing or selling any securities offered by us in this offering, nor is it required to arrange

for the purchase and sale of any specific number or dollar amount of such securities, other than to use its “reasonable best efforts”

to arrange for the sale of such securities by us. Therefore, we may not sell all of securities being offered. The terms of this offering

were subject to market conditions and negotiations between us, the Placement Agent and prospective investors. The Placement Agent will

have no authority to bind us by virtue of the engagement letter. We have entered into a securities purchase agreement directly with the

institutional investor who has agreed to purchase securities in this offering. We will only sell securities in this offering to investors

who have entered into securities purchase agreements.

Delivery of the securities

offered hereby is expected to take place on or about December 28, 2023, subject to satisfaction of certain closing conditions.

We have agreed to pay the

Placement Agent (i) a cash fee equal to 7.0% of the aggregate gross proceeds of this offering, (ii) a management fee equal to

1.0% of the gross proceeds raised in this offering, (iii) a non-accountable expense allowance of $85,000, and (iv) $15,950

for the clearing expenses of the Placement Agent in connection with this offering.

We have also agreed to pay

Wainwright a tail fee equal to the cash and warrant compensation in this offering if any investor who had been contacted by Wainwright

in connection with this offering during the term of our engagement of Wainwright, provides us with capital in any offering during the 12-month period

following expiration or termination of our engagement of Wainwright, subject to certain exceptions.

The following table shows

the per share and total placement agent fees we will pay to the Placement Agent in connection with the sale of Ordinary Shares and Pre-funded

Warrants pursuant to this prospectus supplement and the accompanying prospectus, assuming the purchase of all Ordinary Shares and Pre-funded

Warrants offered hereby. Wainwright is also acting as the placement agent for the private placement transaction.

| | |

Per Share | | |

Per

Pre-funded Warrant | | |

Total | |

| Offering price | |

$ | 1.28 | | |

$ | 1.279 | | |

$ | 3,878,343.75 | |

| Placement agent fees | |

$ | 0.0896 | | |

$ | 0.0896 | | |

$ | 271,600.00 | |

| Proceeds to us, before expenses | |

$ | 1.1904 | | |

$ | 1.1894 | | |

$ | 3,606,743.75 | |

We estimate the total expenses

of this offering paid or payable by us will be approximately $454,000. After deducting the fees due to the placement agent and

our estimated expenses in connection with this offering, we expect the net proceeds from this offering will be approximately $3.42 million.

Subsequent Equity Sales

Under the terms of the securities

purchase agreement, from the date of such agreement until 15 days after the closing of this offering, neither we nor any subsidiary shall

(i) issue, enter into any agreement to issue or announce the issuance or proposed issuance of any Ordinary Shares or Ordinary Share

equivalents, or (ii) file any registration statement or prospectus, or any amendment or supplement thereto, subject to certain exceptions.

We have also agreed under

the terms of the securities purchase agreement, until six months after the closing of this offering, not to (i) issue or sell any

debt or equity securities that are convertible into, exchangeable or exercisable for, or include the right to receive, additional Ordinary

Shares either (A) at a conversion price, exercise price or exchange rate or other price that is based upon, and/or varies with, the

trading prices of or quotations for the Ordinary Shares at any time after the initial issuance of such debt or equity securities or (B) with

a conversion, exercise or exchange price that is subject to being reset at some future date after the initial issuance of such debt or

equity security or upon the occurrence of specified or contingent events directly or indirectly related to our business or the market

for our Ordinary Shares or (ii) enter into, or effect a transaction under, any agreement, including, but not limited to, an equity

line of credit or an “at-the-market offering”, subject to certain exceptions.

Placement Agent Warrants

In addition, we have agreed

to issue to the Placement Agent, or its designees, at the closing of this offering, warrants to purchase 7.0% of the number of shares

of our Ordinary Shares (and Ordinary Shares underlying the Pre-funded Warrants) sold in this offering (or warrants to purchase

up to 212,188 shares of our Ordinary Shares). Such warrants will have substantially the same terms as the Private Placement Warrants being

sold and issued in the private placement, except that the Placement Agent’s warrants will have an exercise price equal to 125% of

the offering price per share (or $1.60 per share). Neither the Placement Agent’s warrants nor the shares of our Ordinary Shares

issuable upon exercise thereof are being registered hereby.

Indemnification

We have agreed to indemnify

the Placement Agent against certain liabilities, including liabilities under the Securities Act and liabilities arising from

breaches of representations and warranties contained in our engagement letter with the Placement Agent. We have also agreed to contribute

to payments the Placement Agent may be required to make in respect of such liabilities.

Right of First Refusal

We have also granted Wainwright,

subject to certain exceptions, a right of first refusal for a period of twelve (12) months following the closing of this offering

to act as sole book-running manager, sole underwriter or sole placement agent for each and every future debt financing or refinancing

and public or private equity offering by us.

Other Relationships

From time to time, Wainwright

may provide in the future various advisory, investment and commercial banking and other services to us in the ordinary course of business,

for which they have received and may continue to receive customary fees and commissions. However, except as disclosed in this prospectus

supplement, we have no present arrangements with Wainwright for any further services.

Regulation M Compliance

The Placement Agent may be

deemed to be an underwriter within the meaning of Section 2(a)(11) of the Securities Act, and any commissions received by it and

any profit realized on the sale of our Ordinary Shares offered hereby by it while acting as principal might be deemed to be underwriting

discounts or commissions under the Securities Act. The Placement Agent will be required to comply with the requirements of the Securities

Act and the Exchange Act, including, without limitation, Rule 10b-5 and Regulation M under the Exchange

Act. These rules and regulations may limit the timing of purchases and sales of our securities by the Placement Agent. Under these

rules and regulations, the Placement Agent may not (i) engage in any stabilization activity in connection with our securities;

and (ii) bid for or purchase any of our securities or attempt to induce any person to purchase any of our securities, other than

as permitted under the Exchange Act, until they have completed their participation in the distribution.

Transfer Agent and Registrar

The transfer agent and registrar for our Ordinary Shares is Equiniti Trust Company, LLC (“EQ”).

Trading Market

Our Ordinary Shares is listed

on the Nasdaq Capital Market under the symbol “IINN.” We do not intend to apply for listing of the Pre-funded Warrants or

the Warrants on any securities exchange or other nationally recognized trading system.

LEGAL MATTERS

Certain legal matters concerning

this offering will be passed upon for us by Sullivan & Worcester LLP, New York, New York. Certain legal matters with respect to the

legality of the issuance of the securities offered by this prospectus and other legal matters concerning this offering relating to Israeli

law will be passed upon for us by Sullivan & Worcester Tel Aviv (Har-Even & Co.), Tel Aviv, Israel.

EXPERTS

The financial statements

as of December 31, 2022 and 2021 and for each of the three years in the period ended December 31, 2022, incorporated by reference into

this prospectus and in the registration statement have been so incorporated in reliance on the report of Ziv Haft, a member firm of BDO,

an independent registered public accounting firm, incorporated herein by reference, given on the authority of said firm as experts in

auditing and accounting.

WHERE YOU CAN FIND MORE INFORMATION