0001822492false00018224922023-11-082023-11-08

8K UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

__________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 8, 2023

Hillman Solutions Corp.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-39609 | | 85-2096734 |

| (State or other jurisdiction | | (Commission File No.) | | (I.R.S. Employer |

| of incorporation) | | | | Identification No.) |

1280 Kemper Meadows Drive

Cincinnati, Ohio 45240

(Address of principal executive offices)

Registrant’s telephone number, including area code: (513) 851-4900

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbols | Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share | HLMN | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On November 8, 2023, Hillman Solutions Corp. (the “Company”) issued a press release, furnished as Exhibit 99.1 and incorporated herein by reference, announcing the Company's selected summary financial results for its thirteen and thirty-nine weeks ended September 30, 2023.

The information provided pursuant to Item 2.02, including the exhibit attached hereto, is being furnished and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in any such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| Date: November 8, 2023 | Hillman Solutions Corp. | |

|

|

|

| By: | /s/ Robert O. Kraft |

| Name: | Robert O. Kraft |

| Title: | Chief Financial Officer |

Hillman Reports Third Quarter 2023 Results

CINCINNATI, November 8, 2023 -- Hillman Solutions Corp. (Nasdaq: HLMN) (the “Company” or “Hillman”), a leading provider of hardware products and merchandising solutions, reported financial results for the thirteen and thirty-nine weeks ended September 30, 2023.

Third Quarter 2023 Highlights (Thirteen weeks ended September 30, 2023)

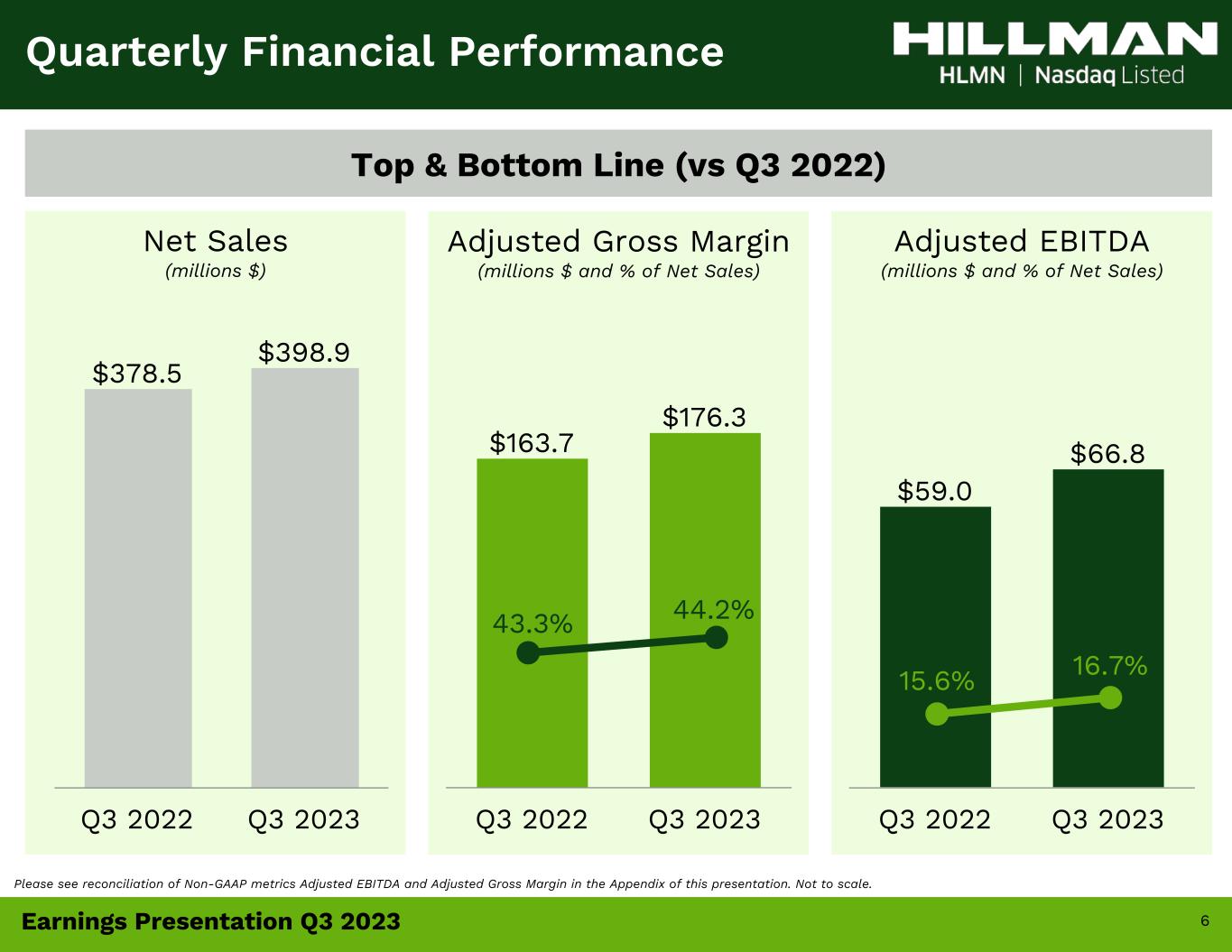

•Net sales increased 5.4% to $398.9 million compared to $378.5 million in the prior year quarter

•Net income totaled $5.1 million, or $0.03 per diluted share, compared to net loss of $(9.5) million, or $(0.05) per diluted share, in the prior year quarter

•Adjusted diluted EPS1 was $0.11 per diluted share compared to $0.14 per diluted share in the prior year quarter

•Adjusted EBITDA1 totaled $66.8 million compared to $59.0 million in the prior year quarter

Third Quarter YTD 2023 Highlights (Thirty-nine weeks ended September 30, 2023)

•Net sales decreased (0.6)% to $1,128.7 million compared to $1,135.7 million in the prior year period

•Net income totaled $0.5 million, or $0.00 per diluted share, compared to net loss of $(2.5) million, or $(0.01) per diluted share, in the prior year period

•Adjusted diluted EPS1 was $0.30 per diluted share compared to $0.38 per diluted share in the prior year period

•Adjusted EBITDA1 totaled $165.0 million compared to $165.3 million in the prior year period

•Net cash provided by operating activities totaled $171.5 million compared to $63.2 million in the prior year period

•Free Cash Flow1 totaled $119.3 million compared to $16.8 million in the prior year period

1) Denotes Non-GAAP metric. For additional information, including our definitions, use of, and reconciliations of these metrics to the most directly comparable financial measures under GAAP, please see the reconciliations toward the end of the press release.

1

Balance Sheet and Liquidity at September 30, 2023

•Gross debt was $811.1 million, compared to $918.8 million on December 31, 2022; net debt1 outstanding was $771.8 million, compared to $887.7 million on December 31, 2022

•Liquidity available totaled approximately $291.2 million, consisting of $251.9 million of available borrowing under the revolving credit facility and $39.3 million of cash and equivalents

Management Commentary

Doug Cahill, Chairman, President and Chief Executive Officer of Hillman, commented: “During the quarter our team successfully navigated the challenging macroeconomic environment to produce mid-single-digit top line growth and double-digit Adjusted EBITDA growth. Margins improved to historical norms, driven by strength in our Hardware and Protective Solutions segment, lower priced inventory being sold, and the resilience of Hillman’s competitive moat. Additionally, we continued to reduce inventory which, together with our improved bottom line, has driven robust year to date free cash flow of $119.3 million. We used this free cash flow to pay down debt, allowing us to improve our net debt to adjusted EBITDA ratio to 3.7 times continuing the downward trend for the fifth straight quarter.”

“Hillman has proven resilient throughout multiple economic cycles. Despite lower foot traffic at our customers, our business remains partially insulated because of our focus on small ticket items used for necessary repair and maintenance projects. We expect gross margins to expand sequentially into the fourth quarter as we derive the benefits of new business wins, our prior pricing actions, and prudent cost controls. We have narrowed our top and bottom line guidance within our original range to reflect the macro environment. We continue to see our business produce free cash flow at healthy levels, which gives us confidence to increase our free cash flow outlook for the year. We look forward to entering 2024 on solid footing to capture market share and with a much stronger balance sheet to build additional value in our Company.”

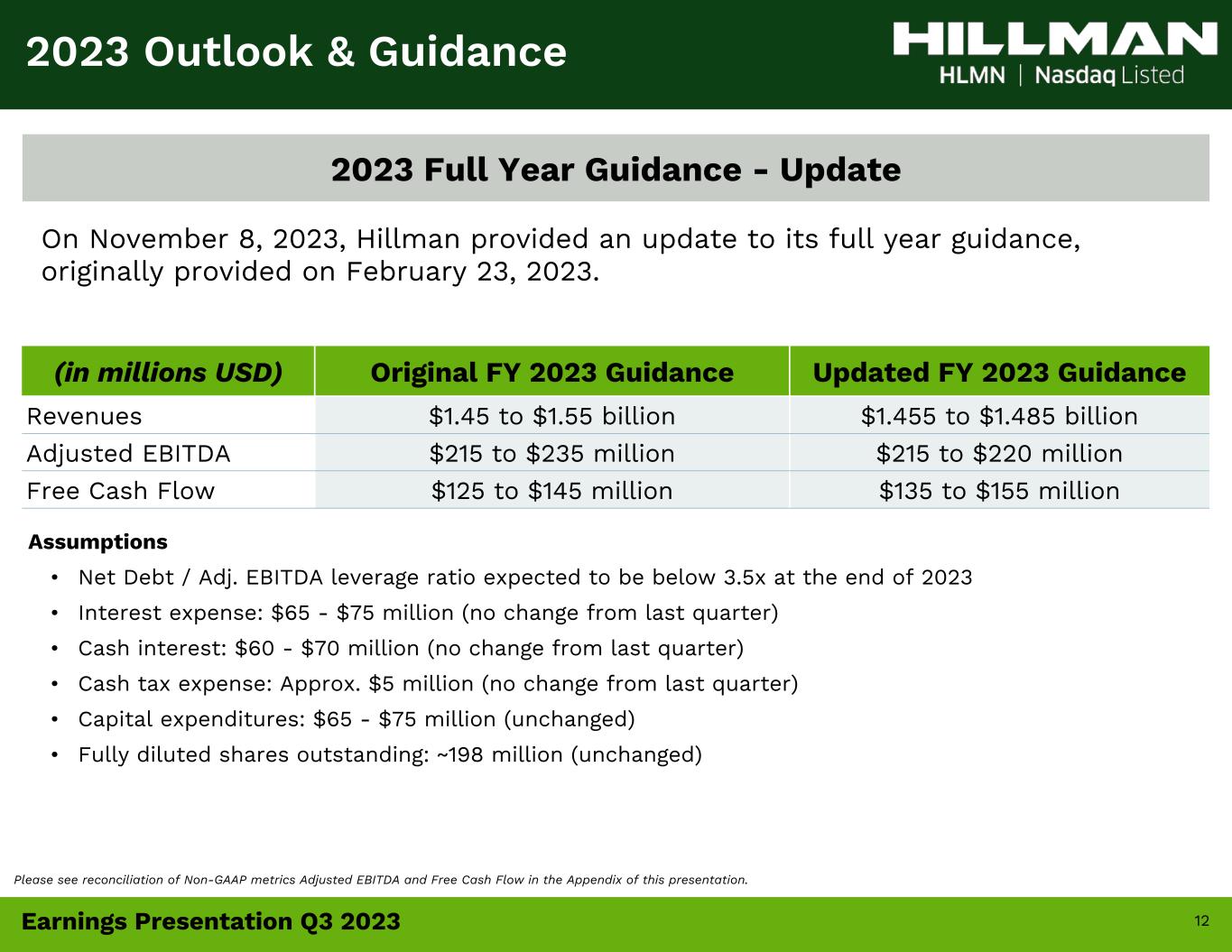

Full Year 2023 Guidance - Update

Based on year-to-date performance and improved visibility on the remainder of the year, management is updating its full year 2023 guidance originally provided on February 27, 2023.

| | | | | | | | |

| Original 2023 Guidance | Updated 2023 Guidance |

| Net Sales | $1.45 to $1.55 billion | $1.455 to $1.485 billion |

Adjusted EBITDA1 | $215 to $235 million | $215 to $220 million |

Free Cash Flow1 | $125 to $145 million | $135 to $155 million |

1) Denotes Non-GAAP metric. For additional information, including our definitions, use of, and reconciliations of these metrics to the most directly comparable financial measures under GAAP, please see the reconciliations toward the end of the press release.

2

Third Quarter 2023 Results Presentation

Hillman plans to host a conference call and webcast presentation today, November 8, 2023, at 8:30 a.m. Eastern Time to discuss its results. Chairman, President, and Chief Executive Officer Doug Cahill, Chief Financial Officer Rocky Kraft, and Chief Operating Officer Jon Michael Adinolfi will host the results presentation.

Date: Wednesday, November 8, 2023

Time: 8:30 a.m. Eastern Time

Listen-Only Webcast: https://edge.media-server.com/mmc/p/vrzpqs3k

A webcast replay will be available approximately one hour after the conclusion of the call using the link above.

Hillman’s quarterly presentation and Form 10-Q are expected to be filed with the SEC and posted to its Investor Relations website, https://ir.hillmangroup.com, before the webcast presentation begins.

About Hillman Solutions Corp.

Founded in 1964 and headquartered in Cincinnati, Ohio, Hillman is a leading North American provider of complete hardware solutions, delivered with industry best customer service to over 40,000 locations. Hillman designs innovative product and merchandising solutions for complex categories that deliver an outstanding customer experience to home improvement centers, mass merchants, national and regional hardware stores, pet supply stores, and OEM & Industrial customers. Leveraging a world-class distribution and sales network, Hillman delivers a “small business” experience with “big business” efficiency. For more information on Hillman, visit www.hillmangroup.com.

Forward Looking Statements

All statements made in this press release that are consider to be forward-looking are made in good faith by the Company and are intended to qualify for the safe harbor from liability established by Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934, and the Private Securities Litigation Reform Act of 1995. You should not rely on these forward-looking statements as predictions of future events. Words such as "expect," "estimate," "project," "budget," "forecast," "anticipate," "intend," "plan," “target”, “goal”, "may," "will," "could," "should," "believes," "predicts," "potential," "continue," and similar expressions are intended to identify such forward-looking statements. These forward-looking statements include, without limitation, the Company’s expectations with respect to future performance. These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from the expected results. Most of these factors are outside the Company's control and are difficult to predict. Factors that may cause such differences include, but are not limited to: (1) unfavorable economic conditions that may affect operations, financial condition and cash flows including spending on home

1) Denotes Non-GAAP metric. For additional information, including our definitions, use of, and reconciliations of these metrics to the most directly comparable financial measures under GAAP, please see the reconciliations toward the end of the press release.

3

renovation or construction projects, inflation, recessions, instability in the financial markets or credit markets; (2) increased supply chain costs, including raw materials, sourcing, transportation and energy; (3) the highly competitive nature of the markets that we serve; (4) the ability to continue to innovate with new products and services; (5) direct and indirect costs associated with the May 2023 ransomware attack, and our receipt of expected insurance receivables associated with that cybersecurity incident; (6) seasonality; (7) large customer concentration; (8) the ability to recruit and retain qualified employees; (9) the outcome of any legal proceedings that may be instituted against the Company; (10) adverse changes in currency exchange rates; (11) the impact of COVID-19 on the Company’s business; or (12) regulatory changes and potential legislation that could adversely impact financial results. The foregoing list of factors is not exclusive, and readers should also refer to those risks that are included in the Company’s filings with the Securities and Exchange Commission (“SEC”), including this Annual Report on Form 10-K filed on February 27, 2023. Given these uncertainties, current or prospective investors are cautioned not to place undue reliance on any such forward looking statements.

Except as required by applicable law, the Company does not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements in this communication to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based.

Contact:

Michael Koehler

Vice President of Investor Relations & Treasury

513-826-5495

IR@hillmangroup.com

1) Denotes Non-GAAP metric. For additional information, including our definitions, use of, and reconciliations of these metrics to the most directly comparable financial measures under GAAP, please see the reconciliations toward the end of the press release.

4

HILLMAN SOLUTIONS CORP.

Condensed Consolidated Statement of Net Income, GAAP Basis

(dollars in thousands) Unaudited

| | | | | | | | | | | | | | | | | | | | | | | |

| Thirteen Weeks Ended

September 30, 2023 | | Thirteen Weeks Ended

September 24, 2022 | | Thirty-nine Weeks Ended

September 30, 2023 | | Thirty-nine Weeks Ended

September 24, 2022 |

| Net sales | $ | 398,943 | | | $ | 378,538 | | | $ | 1,128,669 | | | $ | 1,135,665 | |

| Cost of sales (exclusive of depreciation and amortization shown separately below) | 222,644 | | | 214,802 | | | 643,652 | | | 648,221 | |

| Selling, warehouse, general and administrative expenses | 113,359 | | | 133,246 | | | 335,876 | | | 366,013 | |

| Depreciation | 14,434 | | | 14,312 | | | 44,939 | | | 41,738 | |

| Amortization | 15,583 | | | 15,557 | | | 46,733 | | | 46,644 | |

| Other (income) expense, net | (1,819) | | | 1,070 | | | 841 | | | (3,124) | |

| Income (loss) from operations | 34,742 | | | (449) | | | 56,628 | | | 36,173 | |

| Interest expense, net | 16,728 | | | 14,696 | | | 52,880 | | | 38,857 | |

| Income (loss) before income taxes | 18,014 | | | (15,145) | | | 3,748 | | | (2,684) | |

| Income tax expense (benefit) | 12,957 | | | (5,679) | | | 3,278 | | | (147) | |

| Net income (loss) | $ | 5,057 | | | $ | (9,466) | | | $ | 470 | | | $ | (2,537) | |

| | | | | | | |

| Basic income (loss) per share | $ | 0.03 | | | $ | (0.05) | | | $0.00 | | $ | (0.01) | |

| Weighted average basic shares outstanding | 194,794 | | | 194,370 | | | 194,662 | | | 194,171 | |

| | | | | | | |

| Diluted income (loss) per share | $ | 0.03 | | | $ | (0.05) | | | $0.00 | | $ | (0.01) | |

| Weighted average diluted shares outstanding | 196,575 | | | 194,370 | | | 195,832 | | | 194,171 | |

HILLMAN SOLUTIONS CORP.

Condensed Consolidated Balance Sheets

(dollars in thousands)

Unaudited

| | | | | | | | | | | |

| | September 30, 2023 | | December 31, 2022 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 39,262 | | | $ | 31,081 | |

Accounts receivable, net of allowances of $2,312 ($2,405 - 2022) | 129,709 | | | 86,985 | |

| Inventories, net | 397,077 | | | 489,326 | |

| Other current assets | 29,778 | | | 24,227 | |

| Total current assets | 595,826 | | | 631,619 | |

Property and equipment, net of accumulated depreciation of $362,422 ($333,452 - 2022) | 200,121 | | | 190,258 | |

| Goodwill | 824,305 | | | 823,812 | |

Other intangibles, net of accumulated amortization of $461,240 ($414,275 - 2022) | 688,451 | | | 734,460 | |

| Operating lease right of use assets | 88,578 | | | 66,955 | |

| | | |

| Other assets | 14,633 | | | 23,586 | |

| Total assets | $ | 2,411,914 | | | $ | 2,470,690 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 159,332 | | | $ | 131,751 | |

| Current portion of debt and financing lease liabilities | 10,697 | | | 10,570 | |

| Current portion of operating lease liabilities | 13,814 | | | 12,285 | |

| Accrued expenses: | | | |

| Salaries and wages | 9,188 | | | 15,709 | |

| Pricing allowances | 10,917 | | | 9,246 | |

| Income and other taxes | 5,786 | | | 5,300 | |

| Interest | 352 | | | 697 | |

| Other accrued liabilities | 23,390 | | | 29,854 | |

| Total current liabilities | 233,476 | | | 215,412 | |

| Long-term debt | 780,043 | | | 884,636 | |

| Deferred tax liabilities | 142,103 | | | 140,091 | |

| Operating lease liabilities | 81,795 | | | 61,356 | |

| Other non-current liabilities | 14,897 | | | 12,456 | |

| Total liabilities | $ | 1,252,314 | | | $ | 1,313,951 | |

| Commitments and contingencies (Note 6) | | | |

| Stockholders' equity: | | | |

Common stock, $0.0001 par, 500,000,000 shares authorized, 194,827,369 issued and outstanding at September 30, 2023 and 194,548,411 issued and outstanding at December 31, 2022 | 20 | | | 20 | |

| Additional paid-in capital | 1,415,059 | | | 1,404,360 | |

| Accumulated deficit | (226,147) | | | (226,617) | |

| Accumulated other comprehensive loss | (29,332) | | | (21,024) | |

| Total stockholders' equity | 1,159,600 | | | 1,156,739 | |

| Total liabilities and stockholders' equity | $ | 2,411,914 | | | $ | 2,470,690 | |

HILLMAN SOLUTIONS CORP.

Condensed Consolidated Statement of Cash Flows

(dollars in thousands)

Unaudited

| | | | | | | | | | | |

| | Thirty-nine Weeks Ended

September 30, 2023 | | Thirty-nine Weeks Ended

September 24, 2022 |

| Cash flows from operating activities: | | | |

| Net income (loss) | $ | 470 | | | $ | (2,537) | |

| Adjustments to reconcile net income (loss) to net cash provided by operating activities: | | | |

| Depreciation and amortization | 91,672 | | | 88,382 | |

| Deferred income taxes | 1,835 | | | 5,670 | |

| Deferred financing and original issue discount amortization | 3,993 | | | 2,251 | |

| Stock-based compensation expense | 9,111 | | | 10,789 | |

| | | |

| | | |

| | | |

| | | |

| Change in fair value of contingent consideration | 2,614 | | | (2,926) | |

| | | |

| Changes in operating items: | | | |

| Accounts receivable, net | (42,883) | | | (19,482) | |

| Inventories, net | 92,833 | | | (6,004) | |

| Other assets | (5,697) | | | (5,549) | |

| Accounts payable | 27,220 | | | (34,648) | |

| Other accrued liabilities | (9,691) | | | 27,286 | |

| | | |

| | | |

| Net cash provided by operating activities | 171,477 | | | 63,232 | |

| Net cash from investing activities | | | |

| Acquisition of business, net of cash received | (300) | | | (2,500) | |

| Capital expenditures | (52,145) | | | (46,431) | |

| | | |

| Other investing activities | (318) | | | — | |

| Net cash used for investing activities | (52,763) | | | (48,931) | |

| Cash flows from financing activities: | | | |

| Repayments of senior term loans | (86,383) | | | (6,384) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Borrowings on revolving credit loans | 172,000 | | | 161,000 | |

| Repayments of revolving credit loans | (197,000) | | | (154,000) | |

| Principal payments under finance lease obligations | (1,687) | | | (998) | |

| Proceeds from exercise of stock options | 1,600 | | | 1,885 | |

| Payments of contingent consideration | (1,175) | | | (115) | |

| Other financing activities | 883 | | | 1,809 | |

| Cash payments related to hedging activities | — | | | (1,421) | |

| Net cash (used for) provided by financing activities | (111,762) | | | 1,776 | |

| Effect of exchange rate changes on cash | 1,229 | | | (1,454) | |

| Net increase in cash and cash equivalents | 8,181 | | | 14,623 | |

| Cash and cash equivalents at beginning of period | 31,081 | | | 14,605 | |

| Cash and cash equivalents at end of period | $ | 39,262 | | | $ | 29,228 | |

Reconciliations of Non-GAAP Financial Measures to the Most Directly Comparable GAAP Financial Measures

The Company uses non-GAAP financial measures to analyze underlying business performance and trends. The Company believes that providing these non-GAAP financial measures enhances the Company’s and investors’ ability to compare the Company’s past financial performance with its current performance. These non-GAAP financial measures are provided as supplemental information to the financial measures presented in this press release that are calculated and presented in accordance with GAAP. Non-GAAP financial measures should not be considered a substitute for, or superior to, financial measures determined or calculated in accordance with GAAP. The Company’s definitions of its non-GAAP financial measures may not be comparable to similarly titled measures reported by other companies. Because GAAP financial measures on a forward-looking basis are not accessible, and reconciling information is not available without unreasonable effort, reconciliations to GAAP financial measures are not provided for forward-looking non-GAAP measures. For the same reasons, the Company is unable to address the probable significance of the unavailable information, which could be material to future results.

Non-GAAP financial measures such as consolidated adjusted EBITDA and Adjusted Diluted Earnings per Share (EPS) exclude from the relevant GAAP metrics items that neither relate to the ordinary course of the Company’s business, nor reflect the Company’s underlying business performance.

Reconciliation of Adjusted EBITDA (Unaudited)

(dollars in thousands)

Adjusted EBITDA is a non-GAAP financial measure and is the primary basis used to measure the operational strength and performance of our businesses as well as to assist in the evaluation of underlying trends in our businesses. This measure eliminates the significant level of noncash depreciation and amortization expense that results from the capital-intensive nature of our businesses and from intangible assets recognized in business combinations. It is also unaffected by our capital and tax structures, as our management excludes these results when evaluating our operating performance. Our management use this financial measure to evaluate our consolidated operating performance and the operating performance of our operating segments and to allocate resources and capital to our operating segments. Additionally, we believe that Adjusted EBITDA is useful to investors because it is one of the bases for comparing our operating performance with that of other companies in our industries, although our measure of Adjusted EBITDA may not be directly comparable to similar measures used by other companies.

| | | | | | | | | | | | | | | | | | | | | | | |

| Thirteen Weeks Ended

September 30, 2023 | | Thirteen Weeks Ended

September 24, 2022 | | Thirty-nine Weeks Ended

September 30, 2023 | | Thirty-nine Weeks Ended

September 24, 2022 |

| Net income (loss) | $ | 5,057 | | | $ | (9,466) | | | $ | 470 | | | $ | (2,537) | |

| Income tax expense (benefit) | 12,957 | | | (5,679) | | | 3,278 | | | (147) | |

| Interest expense, net | 16,728 | | | 14,696 | | | 52,880 | | | 38,857 | |

| | | | | | | |

| | | | | | | |

| Depreciation | 14,434 | | | 14,312 | | | 44,939 | | | 41,738 | |

| Amortization | 15,583 | | | 15,557 | | | 46,733 | | | 46,644 | |

| | | | | | | |

| EBITDA | $ | 64,759 | | | $ | 29,420 | | | $ | 148,300 | | | $ | 124,555 | |

| | | | | | | |

| Stock compensation expense | 3,069 | | | 2,485 | | | 9,111 | | | 10,789 | |

Restructuring and other (1) | 179 | | | 916 | | | 3,027 | | | 1,481 | |

Litigation expense (2) | 79 | | | 25,255 | | | 339 | | | 28,968 | |

Transaction and integration expense (3) | 289 | | | 178 | | | 1,599 | | | 2,393 | |

| Change in fair value of contingent consideration | (1,553) | | | 719 | | | 2,614 | | | (2,926) | |

| Total adjusting items | 2,063 | | | 29,553 | | | 16,690 | | | 40,705 | |

| Adjusted EBITDA | $ | 66,822 | | | $ | 58,973 | | | $ | 164,990 | | | $ | 165,260 | |

(1)Includes consulting and other costs associated with distribution center relocations and corporate restructuring activities. 2023 includes costs associated with the cybersecurity event that occurred in May 2023.

(2)Litigation expense includes legal fees associated with our litigation with Hy-Ko Products Company LLC.

(3)Transaction and integration expense includes professional fees and other costs related to the CCMP secondary offerings in 2022 and 2023.

Reconciliation of Adjusted Diluted Earnings Per Share

(in thousands, except per share data)

Unaudited

We define Adjusted Diluted EPS as reported diluted EPS excluding the effect of one-time, non-recurring activity and volatility associated with our income tax expense. The Company believes that Adjusted Diluted EPS provides further insight and comparability in operating performance as it eliminates the effects of certain items that are not comparable from one period to the next. The following is a reconciliation of reported diluted EPS from continuing operations to Adjusted Diluted EPS from continuing operations:

| | | | | | | | | | | | | | | | | | | | | | | |

| Thirteen Weeks Ended

September 30, 2023 | | Thirteen Weeks Ended

September 24, 2022 | | Thirty-nine Weeks Ended

September 30, 2023 | | Thirty-nine Weeks Ended

September 24, 2022 |

| Reconciliation to Adjusted Net Income | | | | | | | |

| Net income (loss) | $ | 5,057 | | | $ | (9,466) | | | $ | 470 | | | $ | (2,537) | |

Remove adjusting items (1) | 2,063 | | | 29,553 | | | 16,690 | | | 40,705 | |

| Remove amortization expense | 15,583 | | | 15,557 | | | 46,733 | | | 46,644 | |

Remove tax benefit on adjusting items and amortization expense (2) | (1,055) | | | (7,685) | | | (4,907) | | | (10,720) | |

| Adjusted Net Income | $ | 21,648 | | | $ | 27,959 | | | $ | 58,986 | | | $ | 74,092 | |

| | | | | | | |

| Reconciliation to Adjusted Diluted Earnings per Share | | | | | | | |

| Diluted Earnings per Share | $ | 0.03 | | | $ | (0.05) | | | $ | 0.00 | | | $ | (0.01) | |

Remove adjusting items (1) | 0.01 | | | 0.15 | | | 0.09 | | | 0.21 | |

| Remove amortization expense | 0.08 | | | 0.08 | | | 0.24 | | | 0.24 | |

Remove tax benefit on adjusting items and amortization expense (2) | (0.01) | | | (0.04) | | | (0.03) | | | (0.05) | |

| Adjusted Diluted Earnings per Share | $ | 0.11 | | | $ | 0.14 | | | $ | 0.30 | | | $ | 0.38 | |

| | | | | | | |

Reconciliation to Adjusted Diluted Shares Outstanding (3) | | | | | | | |

| Diluted Shares, as reported | 196,575 | | | 194,370 | | | 195,832 | | | 194,171 | |

| Non-GAAP dilution adjustments: | | | | | | | |

| Dilutive effect of stock options and awards | — | | | 655 | | | — | | | 1,456 | |

| Adjusted Diluted Shares | 196,575 | | | 195,025 | | | 195,832 | | | 195,627 | |

Note: Adjusted EPS may not add due to rounding.

(1)Please refer to "Reconciliation of Adjusted EBITDA" table above for additional information on adjusting items. See "Per share impact of Adjusting Items" table below for the per share impact of each adjustment.

(2)We have calculated the income tax effect of the non-GAAP adjustments shown above at the applicable statutory rate of 25.1% for the U.S. and 26.2% for Canada except for the following items:

a.The tax impact of stock compensation expense was calculated using the statutory rate of 25.1%, excluding certain awards that are non-deductible.

b.The tax impact of acquisition and integration expense was calculated using the statutory rate of 25.1%, excluding certain charges that were non-deductible.

c.Amortization expense for financial accounting purposes was offset by the tax benefit of deductible amortization expense using the statutory rate of 25.1%.

(3)Diluted shares on a GAAP basis for the thirteen and thirty-nine weeks ended September 30, 2023 include the dilutive impact of 1,781 and 1,170 options and awards, respectfully.

Per Share Impact of Adjusting Items

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Thirteen Weeks Ended

September 30, 2023 | | Thirteen Weeks Ended

September 24, 2022 | | Thirty-nine Weeks Ended

September 30, 2023 | | Thirty-nine Weeks Ended

September 24, 2022 |

| Stock compensation expense | | $ | 0.02 | | | $ | 0.01 | | | $ | 0.05 | | | $ | 0.06 | |

| Restructuring and other costs | | 0.00 | | 0.00 | | 0.02 | | 0.01 | |

| Litigation expense | | 0.00 | | 0.13 | | 0.00 | | 0.15 | |

| Transaction and integration expense | | 0.00 | | 0.00 | | 0.01 | | 0.01 | |

| Change in fair value of contingent consideration | | (0.01) | | | 0.00 | | 0.01 | | (0.01) | |

| Total adjusting items | | $ | 0.01 | | | $ | 0.15 | | | $ | 0.09 | | | $ | 0.21 | |

Note: Adjusting items may not add due to rounding.

Reconciliation of Net Debt

We define Net Debt as reported gross debt less cash on hand. Net debt is not defined under U.S. GAAP and may not be computed the same as similarly titled measures used by other companies. The Company believes that Net Debt provides further insight and comparability into liquidity and capital structure. The following is a the calculation of Net Debt:

| | | | | | | | | | | |

| September 30, 2023 | | December 31, 2022 |

| Revolving loans | $ | 47,000 | | | $ | 72,000 | |

| Senior term loan, due 2028 | 753,980 | | | 840,363 | |

| Finance leases and other obligations | 10,118 | | | 6,406 | |

| Gross debt | $ | 811,098 | | | $ | 918,769 | |

| Less cash | 39,262 | | | 31,081 | |

| Net debt | $ | 771,836 | | | $ | 887,688 | |

Reconciliation of Free Cash Flow

We calculate free cash flow as cash flows from operating activities less capital expenditures. Free cash flow is not defined under U.S. GAAP and may not be computed the same as similarly titled measures used by other companies. We believe free cash flow is an important indicator of how much cash is generated by our business operations and is a measure of incremental cash available to invest in our business and meet our debt obligations.

| | | | | | | | | | | |

| Thirty-nine Weeks Ended

September 30, 2023 | | Thirty-nine Weeks Ended

September 24, 2022 |

| Net cash provided by operating activities | $ | 171,477 | | | $ | 63,232 | |

| Capital expenditures | (52,145) | | | (46,431) | |

| Free cash flow | $ | 119,332 | | | $ | 16,801 | |

Source: Hillman Solutions Corp

###

Quarterly Earnings Presentation Q3 2023 November 8, 2023

2Earnings Presentation Q3 2023 PresBuilder Placeholder - Delete this box if you see it on a slide, but DO NOT REMOVE this box from the slide layout All statements made in this presentation that are consider to be forward-looking are made in good faith by the Company and are intended to qualify for the safe harbor from liability established by Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934, and the Private Securities Litigation Reform Act of 1995. You should not rely on these forward-looking statements as predictions of future events. Words such as "expect," "estimate," "project," "budget," "forecast," "anticipate," "intend," "plan," “target”, “goal”, "may," "will," "could," "should," "believes," "predicts," "potential," "continue," and similar expressions are intended to identify such forward-looking statements. These forward-looking statements include, without limitation, the Company’s expectations with respect to future performance. These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from the expected results. Most of these factors are outside the Company's control and are difficult to predict. Factors that may cause such differences include, but are not limited to: (1) unfavorable economic conditions that may affect operations, financial condition and cash flows including spending on home renovation or construction projects, inflation, recessions, instability in the financial markets or credit markets; (2) increased supply chain costs, including raw materials, sourcing, transportation and energy; (3) the highly competitive nature of the markets that we serve; (4) the ability to continue to innovate with new products and services; (5) direct and indirect costs associated with the May 2023 ransomware attack, and our receipt of expected insurance receivables associated with that cybersecurity incident; (6) seasonality; (7) large customer concentration; (8) the ability to recruit and retain qualified employees; (9) the outcome of any legal proceedings that may be instituted against the Company; (10) adverse changes in currency exchange rates; (11) the impact of COVID-19 on the Company’s business; or (12) regulatory changes and potential legislation that could adversely impact financial results. The foregoing list of factors is not exclusive, and readers should also refer to those risks that are included in the Company’s filings with the Securities and Exchange Commission (“SEC”), including the Annual Report on Form 10-K filed February 27, 2023. Given these uncertainties, current or prospective investors are cautioned not to place undue reliance on any such forward looking statements. Except as required by applicable law, the Company does not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements in this communication to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based. Presentation of Non-GAAP Financial Measures In addition to the results provided in accordance with U.S. generally accepted accounting principles (“GAAP”) throughout this presentation the company has provided non-GAAP financial measures, which present results on a basis adjusted for certain items. The company uses these non-GAAP financial measures for business planning purposes and in measuring its performance relative to that of its competitors. The company believes that these non- GAAP financial measures are useful financial metrics to assess its operating performance from period-to-period by excluding certain items that the company believes are not representative of its core business. These non-GAAP financial measures are not intended to replace, and should not be considered superior to, the presentation of the company’s financial results in accordance with GAAP. The use of the non-GAAP financial measures terms may differ from similar measures reported by other companies and may not be comparable to other similarly titled measures. These non-GAAP financial measures are reconciled from the respective measures under GAAP in the appendix below. The company is not able to provide a reconciliation of the company’s non-GAAP financial guidance to the corresponding GAAP measures without unreasonable effort because of the inherent difficulty in forecasting and quantifying certain amounts necessary for such a reconciliation such as certain non-cash, nonrecurring or other items that are included in net income and EBITDA as well as the related tax impacts of these items and asset dispositions / acquisitions and changes in foreign currency exchange rates that are included in cash flow, due to the uncertainty and variability of the nature and amount of these future charges and costs. Forward Looking Statements

3Earnings Presentation Q3 2023 • Net sales increased 5.4% to $398.9 million versus Q3 2022 ◦ Hardware Solutions increased 8.3% ◦ Robotics and Digital Solutions ("RDS") down (1.4)% ◦ Canada down (9.4)% ◦ Protective Solution increased 13.5% • GAAP net income totaled $5.1 million, or $0.03 per diluted share, compared to net loss of $(9.5) million, or $(0.05) per diluted share, in Q3 2022 • Adjusted EBITDA totaled $66.8 million compared to $59.0 million in Q3 2022 • Adjusted EBITDA (ttm) / Net Debt: 3.7x at quarter end, improved from 4.2x from December 31, 2022 Q3 2023 Financial Review Please see reconciliation tables in the Appendix of this presentation for non-GAAP metrics. Highlights for the 13 Weeks Ended September 30, 2023

4Earnings Presentation Q3 2023 Q3 2023 Operational Review Highlights for the 13 Weeks Ended September 30, 2023 • Updated full year 2023 guidance • Inventory reduced by $33 million during the quarter; bringing year-to-date total to $92 million; expects to reduce by another $5 - $10 million during Q4 2023 • Fill rates averaged approximately 94% year to date • Rolled out new business win in HS and launched nationwide off- shelf promotion in PS - expect to launch PS new business win at top-five customer in Q4 2023 • Cost of goods peaked in May 2023 (driven by high container costs during the Summer of 2022) - resulting margins returned to historical averages during quarter • Named Vendor of the Year by Tractor Supply and Mid-States Distributing

5Earnings Presentation Q3 2023 • Net sales decreased (0.6)% to $1,128.7 million versus the 39 weeks ended September 24, 2022 ◦ Hardware Solutions +5.2% ◦ Robotics and Digital Solutions ("RDS") (1.1)% ◦ Canada (7.6)% ◦ Protective Solutions (6.2)% (excl. COVID sales) • GAAP net income totaled $0.5 million, or $0.00 per diluted share, compared to net loss of $(2.5) million, or $(0.01) per diluted share, during the 39 weeks ended September 24, 2022 • Adjusted EBITDA totaled $165.0 million compared to $165.3 million during the the 39 weeks ended September 24, 2022 • Free Cash Flow totaled $119.3 million compared to $16.8 million during the 39 weeks ended September 24, 2022 Q3 2023 Financial Review Please see reconciliation tables in the Appendix of this presentation for non-GAAP metrics. Highlights for the 39 Weeks Ended September 30, 2023

6Earnings Presentation Q3 2023 Quarterly Financial Performance Adjusted EBITDA (millions $ and % of Net Sales) Please see reconciliation of Non-GAAP metrics Adjusted EBITDA and Adjusted Gross Margin in the Appendix of this presentation. Not to scale. Top & Bottom Line (vs Q3 2022) Net Sales (millions $) Adjusted Gross Margin (millions $ and % of Net Sales) $59.0 $66.8 Q3 2022 Q3 2023 16.7%15.6% $163.7 $176.3 Q3 2022 Q3 2023 $378.5 $398.9 Q3 2022 Q3 2023 44.2%43.3%

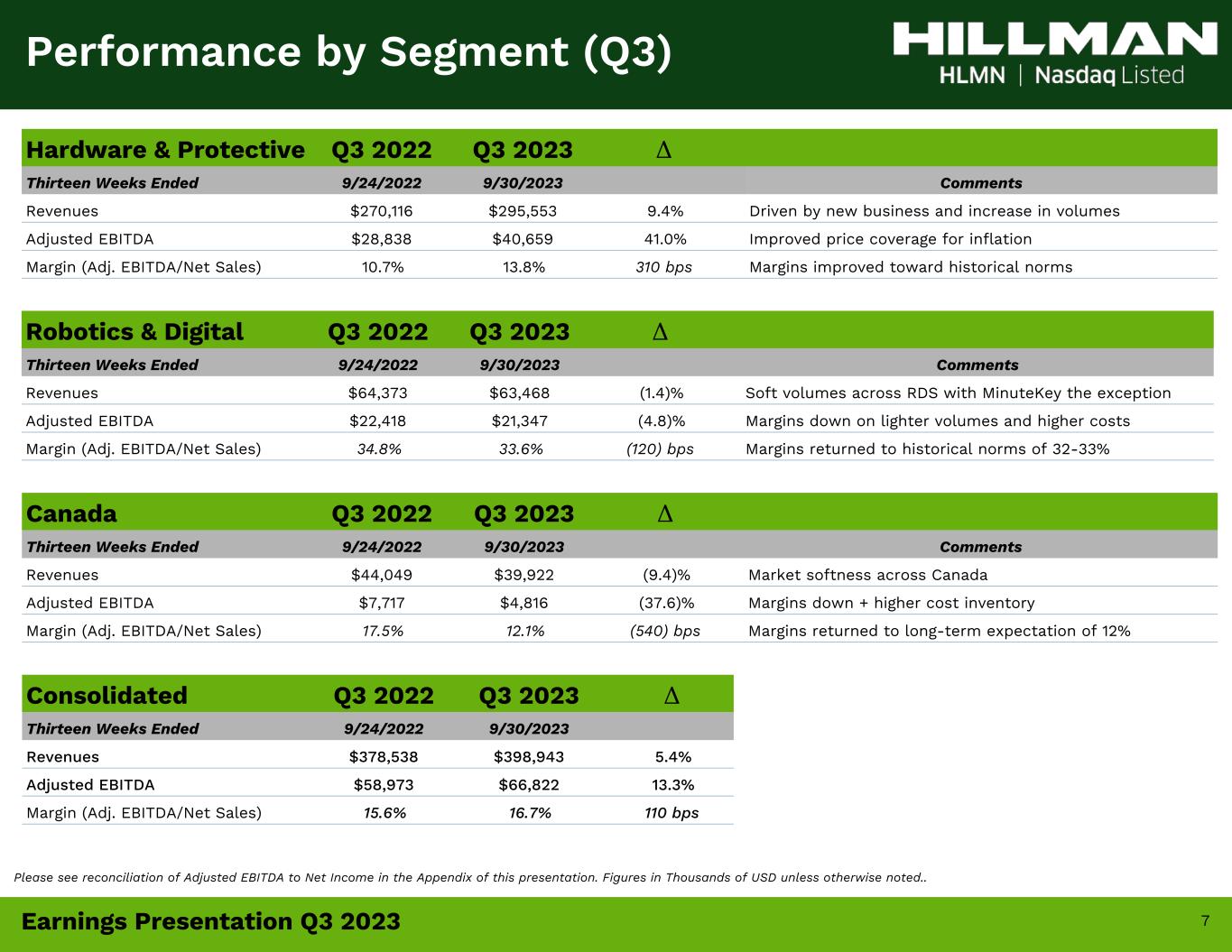

7Earnings Presentation Q3 2023 Hardware & Protective Q3 2022 Q3 2023 Δ Thirteen Weeks Ended 9/24/2022 9/30/2023 Comments Revenues $270,116 $295,553 9.4% Driven by new business and increase in volumes Adjusted EBITDA $28,838 $40,659 41.0% Improved price coverage for inflation Margin (Adj. EBITDA/Net Sales) 10.7% 13.8% 310 bps Margins improved toward historical norms Robotics & Digital Q3 2022 Q3 2023 Δ Thirteen Weeks Ended 9/24/2022 9/30/2023 Comments Revenues $64,373 $63,468 (1.4)% Soft volumes across RDS with MinuteKey the exception Adjusted EBITDA $22,418 $21,347 (4.8)% Margins down on lighter volumes and higher costs Margin (Adj. EBITDA/Net Sales) 34.8% 33.6% (120) bps Margins returned to historical norms of 32-33% Canada Q3 2022 Q3 2023 Δ Thirteen Weeks Ended 9/24/2022 9/30/2023 Comments Revenues $44,049 $39,922 (9.4)% Market softness across Canada Adjusted EBITDA $7,717 $4,816 (37.6)% Margins down + higher cost inventory Margin (Adj. EBITDA/Net Sales) 17.5% 12.1% (540) bps Margins returned to long-term expectation of 12% Consolidated Q3 2022 Q3 2023 Δ Thirteen Weeks Ended 9/24/2022 9/30/2023 Revenues $378,538 $398,943 5.4% Adjusted EBITDA $58,973 $66,822 13.3% Margin (Adj. EBITDA/Net Sales) 15.6% 16.7% 110 bps Performance by Segment (Q3) Please see reconciliation of Adjusted EBITDA to Net Income in the Appendix of this presentation. Figures in Thousands of USD unless otherwise noted..

8Earnings Presentation Q3 2023 Hardware & Protective YTD '22 YTD '23 Δ Thirty-nine weeks ended 9/24/2022 9/30/2023 Comments Revenues $812,931 $818,198 0.6% New business and price offset soft volumes in PS Adjusted EBITDA $80,705 $87,385 8.3% Improved price coverage for inflation Margin (Adj. EBITDA/Net Sales) 9.9% 10.7% 80 bps Robotics & Digital YTD '22 YTD '23 Δ Thirty-nine weeks ended 9/24/2022 9/30/2023 Comments Revenues $189,066 $186,990 (1.1)% Soft volumes across RDS with MinuteKey the exception Adjusted EBITDA $62,899 $63,388 0.8% Shift to higher margin MinuteKey Margin (Adj. EBITDA/Net Sales) 33.3% 33.9% 60 bps Canada YTD '22 YTD '23 Δ Thirty-nine weeks ended 9/24/2022 9/30/2023 Comments Revenues $133,668 $123,481 (7.6)% Market softness across Canada Adjusted EBITDA $21,656 $14,217 (34.4)% Margins down + higher cost inventory Margin (Adj. EBITDA/Net Sales) 16.2% 11.5% (470) bps Consolidated YTD '22 YTD '23 Δ Thirty-nine weeks ended 9/24/2022 9/30/2023 Revenues $1,135,665 $1,128,669 (0.6)% Adjusted EBITDA $165,260 $164,990 (0.2)% Margin (Adj. EBITDA/Net Sales) 14.6% 14.6% 0 bps Performance by Segment (YTD) Please see reconciliation of Adjusted EBITDA to Net Income in the Appendix of this presentation. Figures in Thousands of USD unless otherwise noted..

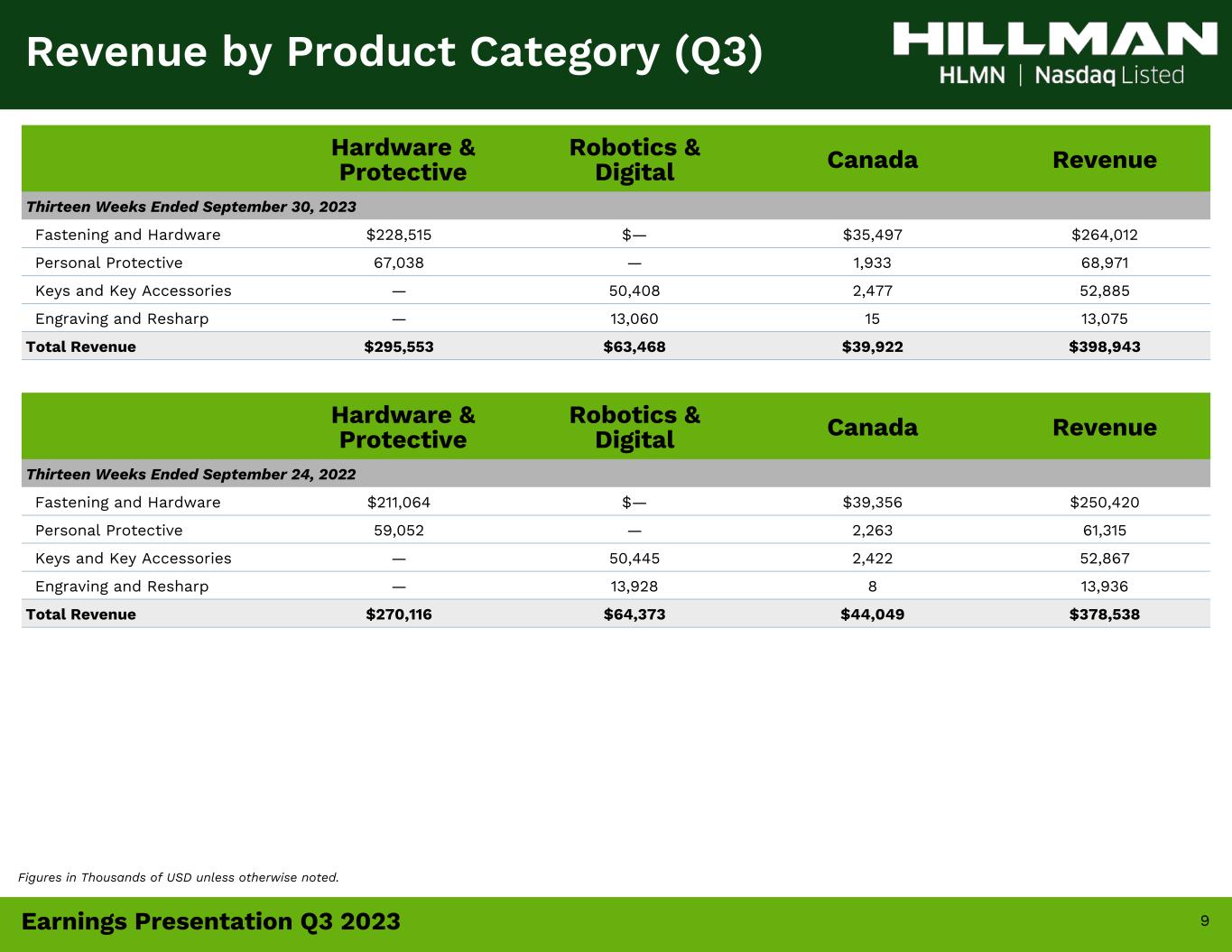

9Earnings Presentation Q3 2023 Hardware & Protective Robotics & Digital Canada Revenue Thirteen Weeks Ended September 30, 2023 Fastening and Hardware $228,515 $— $35,497 $264,012 Personal Protective 67,038 — 1,933 68,971 Keys and Key Accessories — 50,408 2,477 52,885 Engraving and Resharp — 13,060 15 13,075 Total Revenue $295,553 $63,468 $39,922 $398,943 Revenue by Product Category (Q3) Hardware & Protective Robotics & Digital Canada Revenue Thirteen Weeks Ended September 24, 2022 Fastening and Hardware $211,064 $— $39,356 $250,420 Personal Protective 59,052 — 2,263 61,315 Keys and Key Accessories — 50,445 2,422 52,867 Engraving and Resharp — 13,928 8 13,936 Total Revenue $270,116 $64,373 $44,049 $378,538 Figures in Thousands of USD unless otherwise noted.

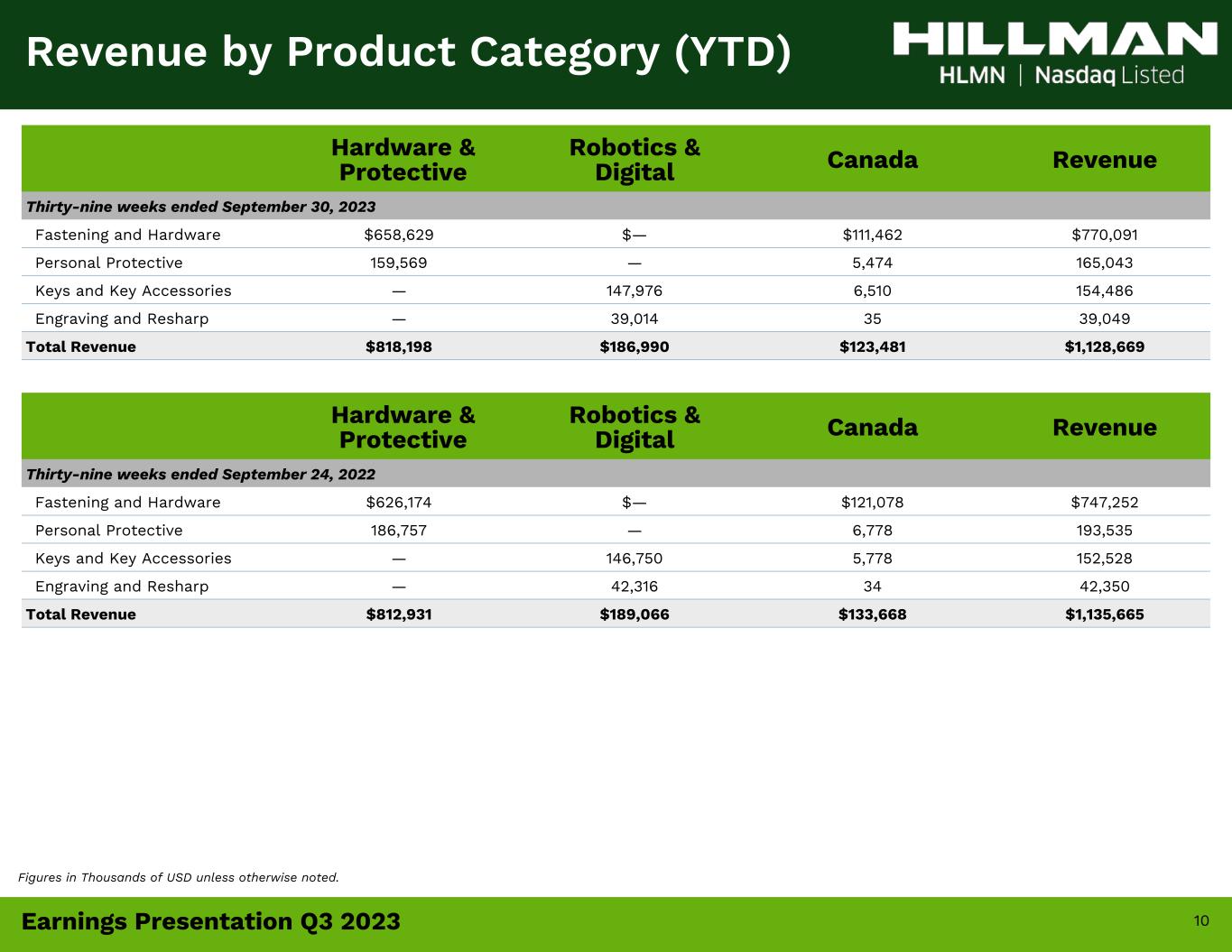

10Earnings Presentation Q3 2023 Hardware & Protective Robotics & Digital Canada Revenue Thirty-nine weeks ended September 30, 2023 Fastening and Hardware $658,629 $— $111,462 $770,091 Personal Protective 159,569 — 5,474 165,043 Keys and Key Accessories — 147,976 6,510 154,486 Engraving and Resharp — 39,014 35 39,049 Total Revenue $818,198 $186,990 $123,481 $1,128,669 Revenue by Product Category (YTD) Hardware & Protective Robotics & Digital Canada Revenue Thirty-nine weeks ended September 24, 2022 Fastening and Hardware $626,174 $— $121,078 $747,252 Personal Protective 186,757 — 6,778 193,535 Keys and Key Accessories — 146,750 5,778 152,528 Engraving and Resharp — 42,316 34 42,350 Total Revenue $812,931 $189,066 $133,668 $1,135,665 Figures in Thousands of USD unless otherwise noted.

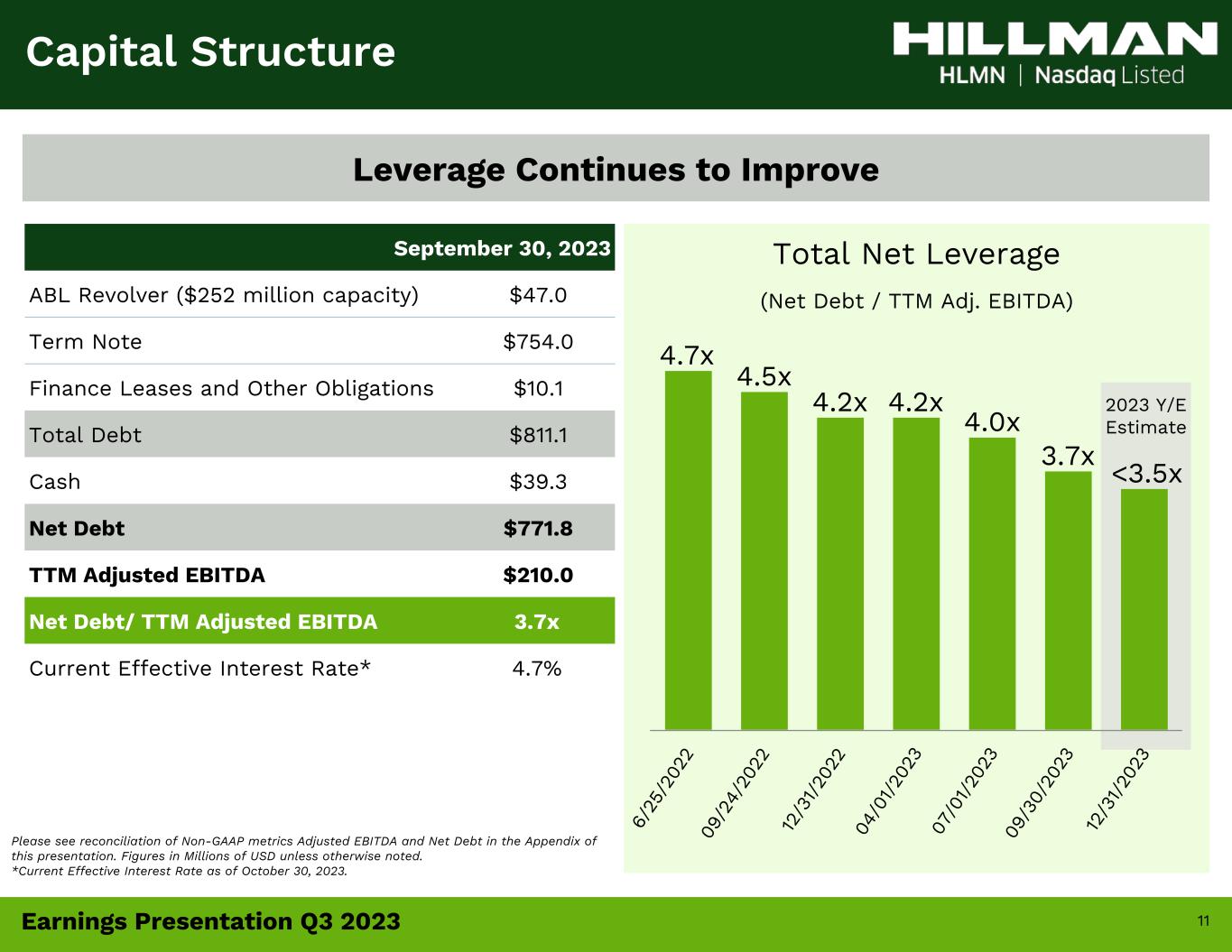

11Earnings Presentation Q3 2023 Total Net Leverage (Net Debt / TTM Adj. EBITDA) Capital Structure September 30, 2023 ABL Revolver ($252 million capacity) $47.0 Term Note $754.0 Finance Leases and Other Obligations $10.1 Total Debt $811.1 Cash $39.3 Net Debt $771.8 TTM Adjusted EBITDA $210.0 Net Debt/ TTM Adjusted EBITDA 3.7x Current Effective Interest Rate* 4.7% Leverage Continues to Improve 2023 Y/E Estimate Please see reconciliation of Non-GAAP metrics Adjusted EBITDA and Net Debt in the Appendix of this presentation. Figures in Millions of USD unless otherwise noted. *Current Effective Interest Rate as of October 30, 2023. <3.5x 4.7x 4.5x 4.2x 4.2x 4.0x 3.7x 6/ 25 /2 02 2 09 /2 4/ 20 22 12 /3 1/ 20 22 04 /0 1/ 20 23 07 /0 1/ 20 23 09 /3 0/ 20 23 12 /3 1/ 20 23

12Earnings Presentation Q3 2023 2023 Outlook & Guidance (in millions USD) Original FY 2023 Guidance Updated FY 2023 Guidance Revenues $1.45 to $1.55 billion $1.455 to $1.485 billion Adjusted EBITDA $215 to $235 million $215 to $220 million Free Cash Flow $125 to $145 million $135 to $155 million Assumptions • Net Debt / Adj. EBITDA leverage ratio expected to be below 3.5x at the end of 2023 • Interest expense: $65 - $75 million (no change from last quarter) • Cash interest: $60 - $70 million (no change from last quarter) • Cash tax expense: Approx. $5 million (no change from last quarter) • Capital expenditures: $65 - $75 million (unchanged) • Fully diluted shares outstanding: ~198 million (unchanged) On November 8, 2023, Hillman provided an update to its full year guidance, originally provided on February 23, 2023. 2023 Full Year Guidance - Update Please see reconciliation of Non-GAAP metrics Adjusted EBITDA and Free Cash Flow in the Appendix of this presentation.

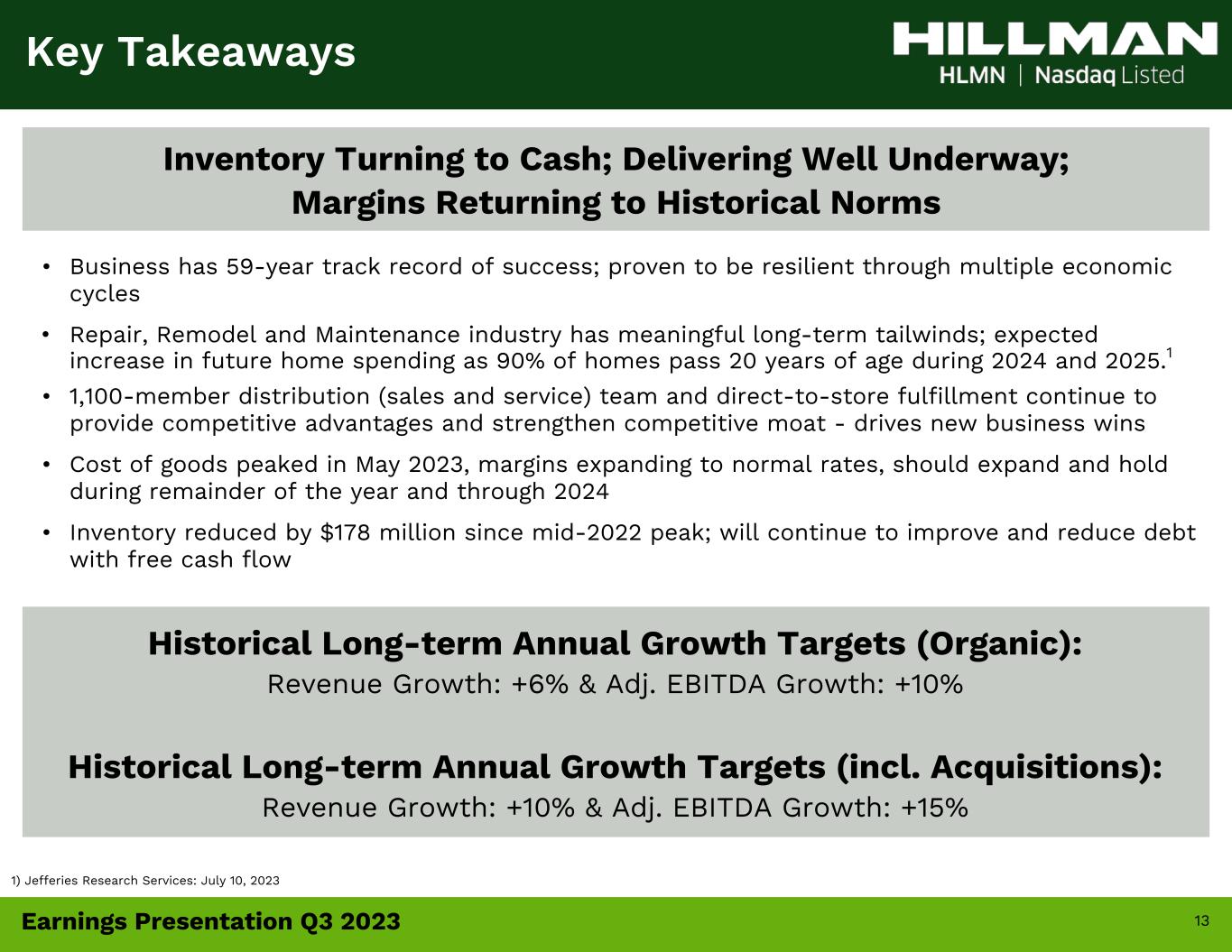

13Earnings Presentation Q3 2023 Key Takeaways Inventory Turning to Cash; Delivering Well Underway; Margins Returning to Historical Norms Historical Long-term Annual Growth Targets (Organic): Revenue Growth: +6% & Adj. EBITDA Growth: +10% Historical Long-term Annual Growth Targets (incl. Acquisitions): Revenue Growth: +10% & Adj. EBITDA Growth: +15% • Business has 59-year track record of success; proven to be resilient through multiple economic cycles • Repair, Remodel and Maintenance industry has meaningful long-term tailwinds; expected increase in future home spending as 90% of homes pass 20 years of age during 2024 and 2025.1 • 1,100-member distribution (sales and service) team and direct-to-store fulfillment continue to provide competitive advantages and strengthen competitive moat - drives new business wins • Cost of goods peaked in May 2023, margins expanding to normal rates, should expand and hold during remainder of the year and through 2024 • Inventory reduced by $178 million since mid-2022 peak; will continue to improve and reduce debt with free cash flow 1) Jefferies Research Services: July 10, 2023

14 Appendix

15Earnings Presentation Q3 2023 Investment Highlights Significant runway for incremental growth: Organic + M&A Management team with proven operational and M&A expertise Strong financial profile with 59-year track record Market and innovation leader across multiple categories Indispensable partner embedded with winning retailers Customers love us, trust us and rely on us Large, predictable, growing and resilient end markets

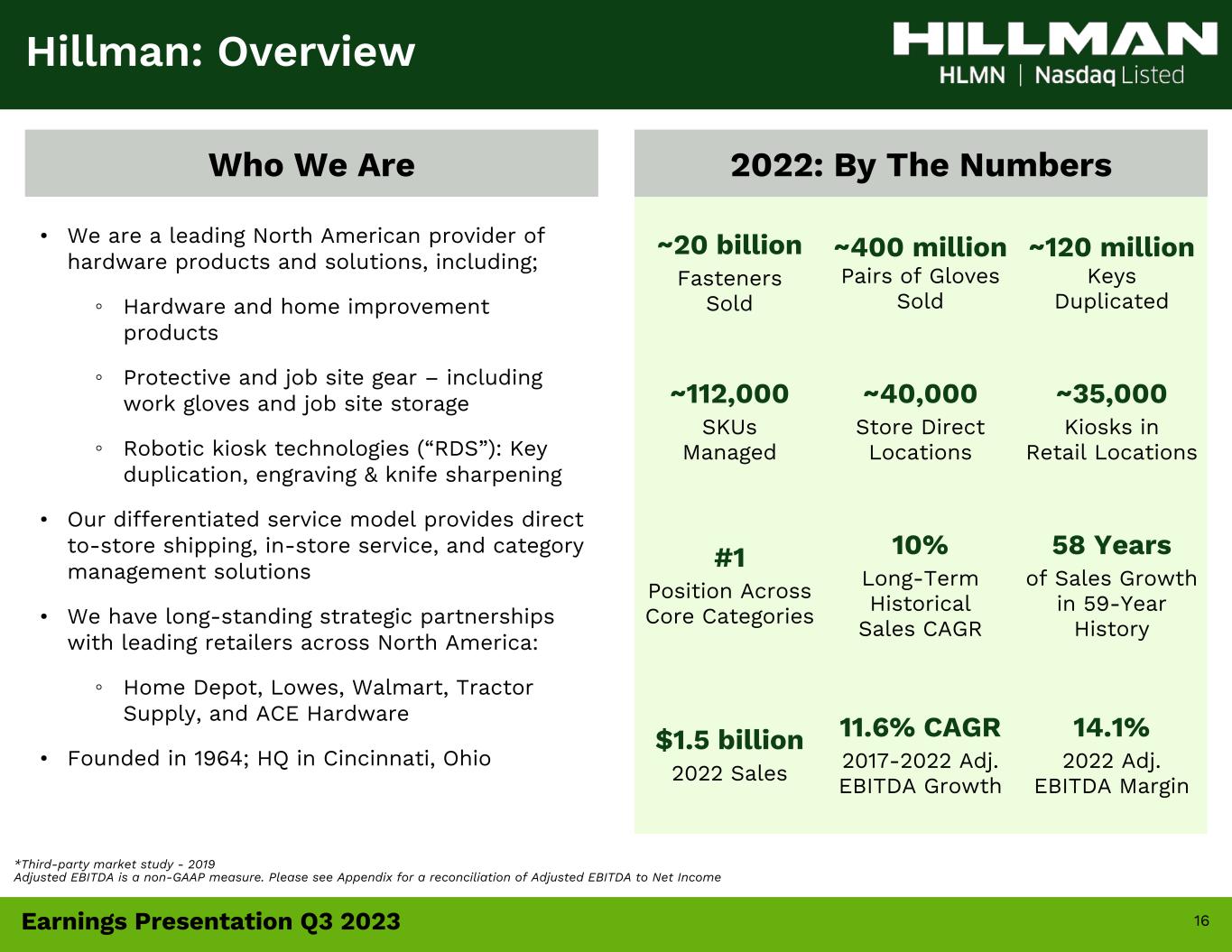

16Earnings Presentation Q3 2023 Hillman: Overview Who We Are *Third-party market study - 2019 Adjusted EBITDA is a non-GAAP measure. Please see Appendix for a reconciliation of Adjusted EBITDA to Net Income ~20 billion Fasteners Sold ~400 million Pairs of Gloves Sold ~120 million Keys Duplicated ~112,000 SKUs Managed ~40,000 Store Direct Locations ~35,000 Kiosks in Retail Locations #1 Position Across Core Categories 10% Long-Term Historical Sales CAGR 58 Years of Sales Growth in 59-Year History $1.5 billion 2022 Sales 11.6% CAGR 2017-2022 Adj. EBITDA Growth 14.1% 2022 Adj. EBITDA Margin 2022: By The Numbers • We are a leading North American provider of hardware products and solutions, including; ◦ Hardware and home improvement products ◦ Protective and job site gear – including work gloves and job site storage ◦ Robotic kiosk technologies (“RDS”): Key duplication, engraving & knife sharpening • Our differentiated service model provides direct to-store shipping, in-store service, and category management solutions • We have long-standing strategic partnerships with leading retailers across North America: ◦ Home Depot, Lowes, Walmart, Tractor Supply, and ACE Hardware • Founded in 1964; HQ in Cincinnati, Ohio

17Earnings Presentation Q3 2023 Primary Product Categories #1 in Segment Representative Top Customers #1 in Segment #1 in Segment Key and Fob Duplication Personalized Tags Knife Sharpening Fasteners & Specialty Gloves Builders Hardware & Metal Shapes Safety / PPE Construction Fasteners Work Gear Picture Hanging Source: Third party industry report. Hardware Solutions Protective Solutions Robotics & Digital Solutions

18Earnings Presentation Q3 2023 Thirteen weeks ended September 24, 2022 September 30, 2023 Net (loss) income $(9,466) $5,057 Income tax (benefit) expense (5,679) 12,957 Interest expense, net 14,696 16,728 Depreciation 14,312 14,434 Amortization 15,557 15,583 EBITDA $29,420 $64,759 Stock compensation expense 2,485 3,069 Restructuring and other (1) 916 179 Litigation expense (2) 25,255 79 Transaction and integration expense (3) 178 289 Change in fair value of contingent consideration 719 (1,553) Adjusted EBITDA $58,973 $66,822 Adjusted EBITDA Reconciliation Footnotes: 1. Includes consulting and other costs associated with severance related to our distribution center relocations and corporate restructuring activities. 2. Litigation expense includes legal fees associated with our litigation with Hy-Ko Products Company LLC. 3. Transaction and integration expense includes professional fees and other costs related to the CCMP secondary offerings in 2022 and 2023.

19Earnings Presentation Q3 2023 Thirty-nine weeks ended September 24, 2022 September 30, 2023 Net (loss) income $(2,537) $470 Income tax (benefit) expense (147) 3,278 Interest expense, net 38,857 52,880 Depreciation 41,738 44,939 Amortization 46,644 46,733 EBITDA $124,555 $148,300 Stock compensation expense 10,789 9,111 Restructuring and other(1) 1,481 3,027 Litigation expense (2) 28,968 339 Transaction and integration expense (3) 2,393 1,599 Change in fair value of contingent consideration (2,926) 2,614 Adjusted EBITDA $165,260 $164,990 Adjusted EBITDA Reconciliation Footnotes: 1. Includes consulting and other costs associated with severance related to our distribution center relocations and corporate restructuring activities. 2023 includes costs associated with the cybersecurity event that occurred in May 2023. 2. Litigation expense includes legal fees associated with our litigation with Hy-Ko Products Company LLC. 3. Transaction and integration expense includes professional fees and other costs related to the CCMP secondary offerings in 2022 and 2023.

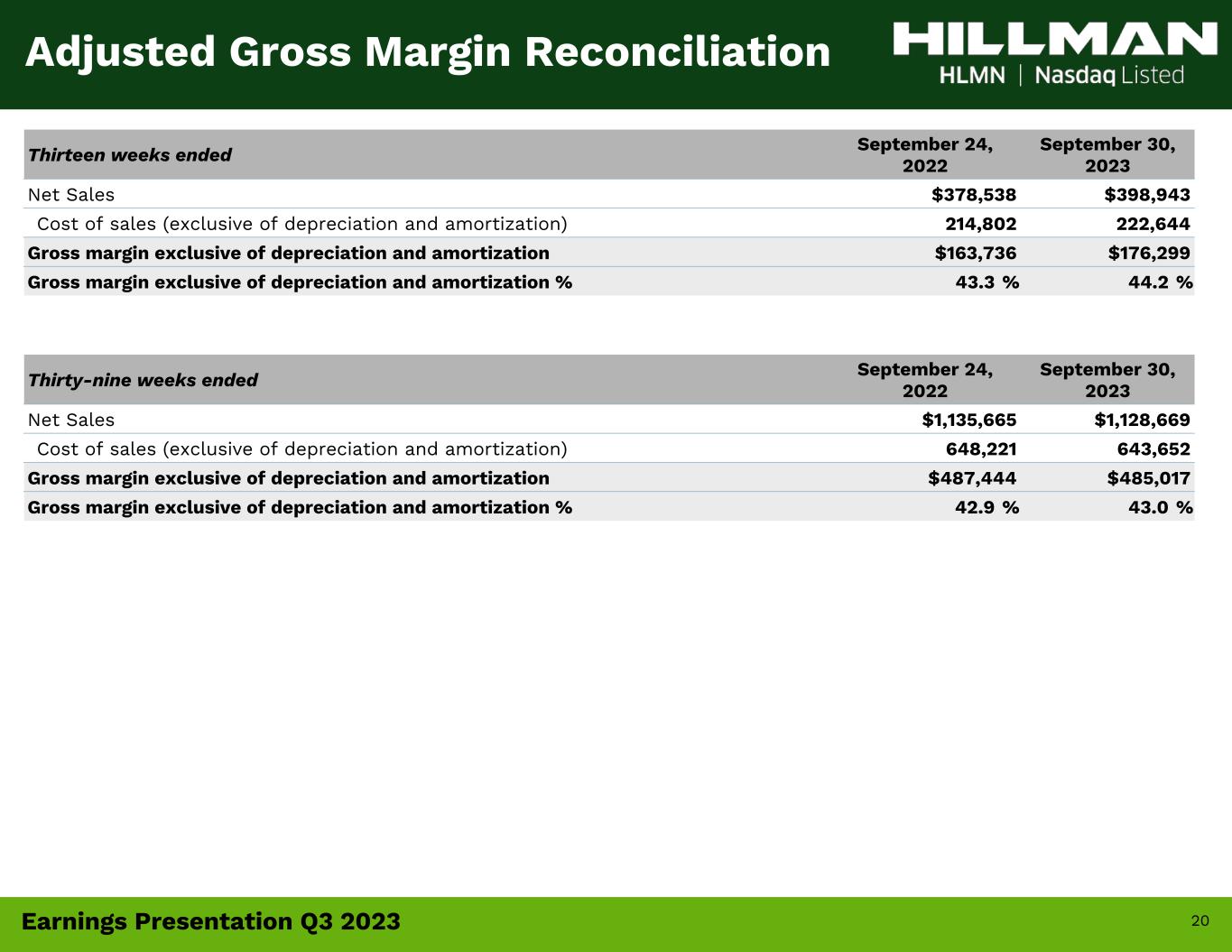

20Earnings Presentation Q3 2023 Thirteen weeks ended September 24, 2022 September 30, 2023 Net Sales $378,538 $398,943 Cost of sales (exclusive of depreciation and amortization) 214,802 222,644 Gross margin exclusive of depreciation and amortization $163,736 $176,299 Gross margin exclusive of depreciation and amortization % 43.3 % 44.2 % Thirty-nine weeks ended September 24, 2022 September 30, 2023 Net Sales $1,135,665 $1,128,669 Cost of sales (exclusive of depreciation and amortization) 648,221 643,652 Gross margin exclusive of depreciation and amortization $487,444 $485,017 Gross margin exclusive of depreciation and amortization % 42.9 % 43.0 % Adjusted Gross Margin Reconciliation

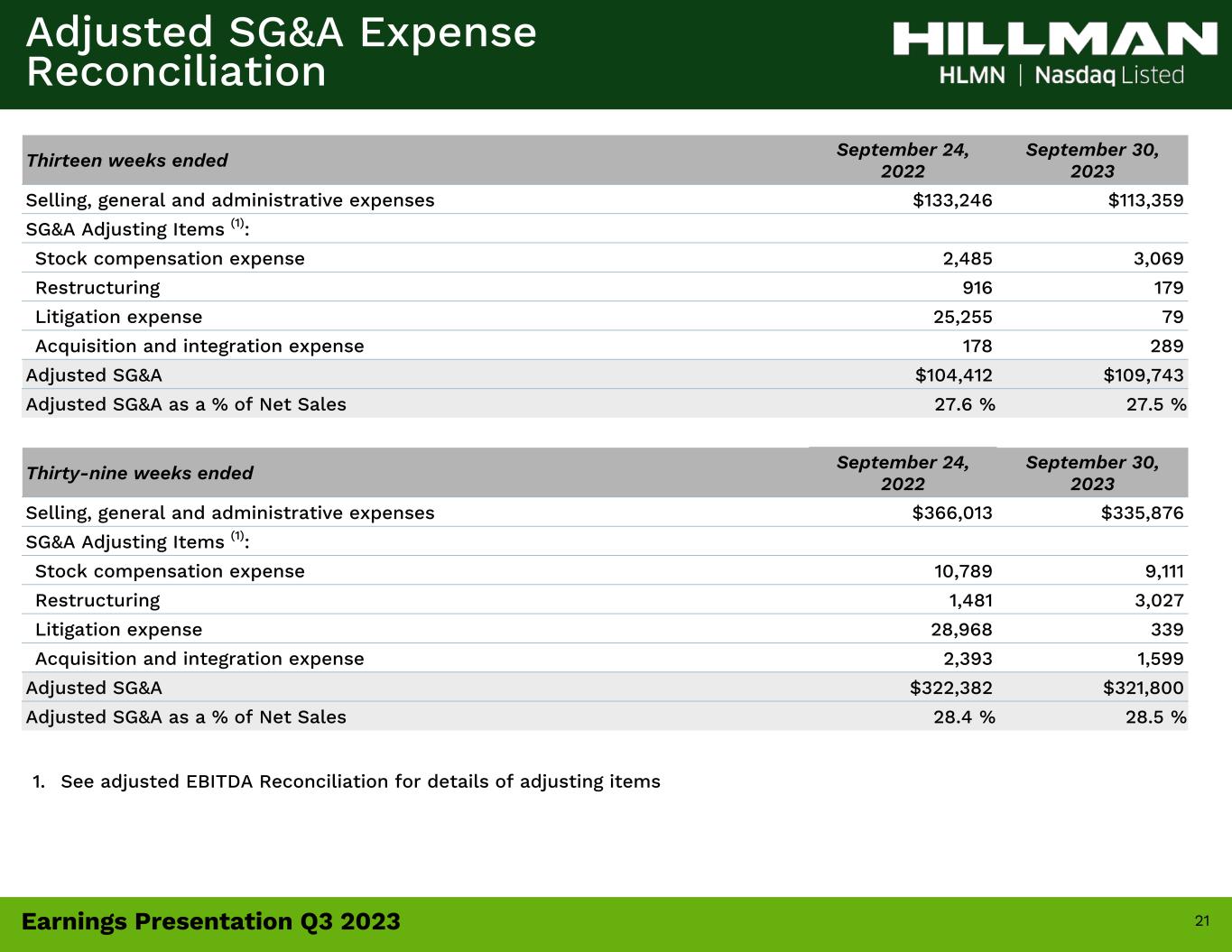

21Earnings Presentation Q3 2023 Thirteen weeks ended September 24, 2022 September 30, 2023 Selling, general and administrative expenses $133,246 $113,359 SG&A Adjusting Items (1): Stock compensation expense 2,485 3,069 Restructuring 916 179 Litigation expense 25,255 79 Acquisition and integration expense 178 289 Adjusted SG&A $104,412 $109,743 Adjusted SG&A as a % of Net Sales 27.6 % 27.5 % Thirty-nine weeks ended September 24, 2022 September 30, 2023 Selling, general and administrative expenses $366,013 $335,876 SG&A Adjusting Items (1): Stock compensation expense 10,789 9,111 Restructuring 1,481 3,027 Litigation expense 28,968 339 Acquisition and integration expense 2,393 1,599 Adjusted SG&A $322,382 $321,800 Adjusted SG&A as a % of Net Sales 28.4 % 28.5 % Adjusted SG&A Expense Reconciliation 1. See adjusted EBITDA Reconciliation for details of adjusting items

22Earnings Presentation Q3 2023 As of December 31, 2022 September 30, 2023 Revolving loans $72,000 $47,000 Senior term loan 840,363 753,980 Finance leases and other obligations 6,406 10,118 Gross debt $918,769 $811,098 Less cash 31,081 39,262 Net debt $887,688 $771,836 Net Debt & Free Cash Flow Reconciliations Thirty-nine Weeks Ended September 24, 2022 September 30, 2023 Net cash provided by operating activities $63,232 $171,477 Capital expenditures (46,431) (52,145) Free cash flow $16,801 $119,332 Reconciliation of Net Debt Reconciliation of Free Cash Flow

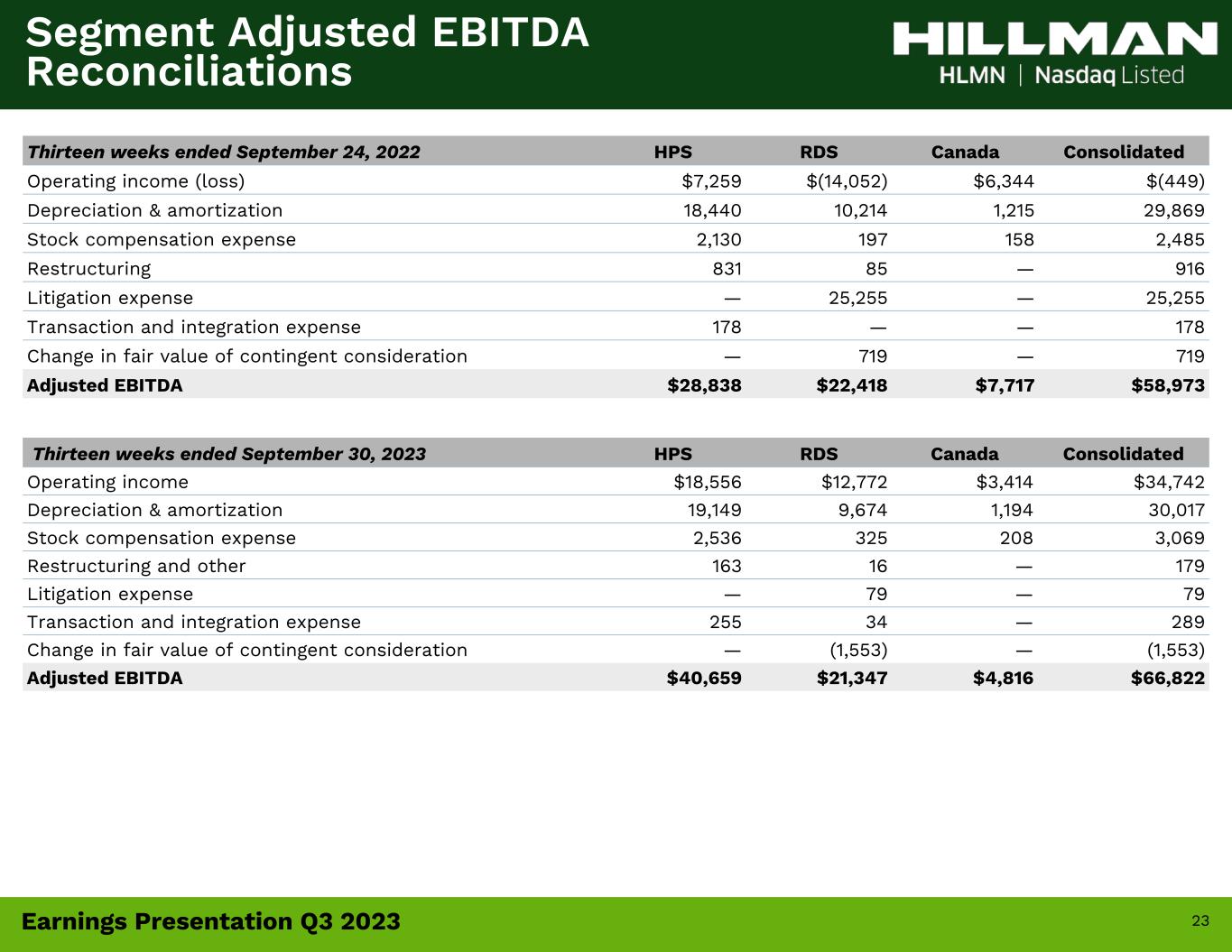

23Earnings Presentation Q3 2023 Thirteen weeks ended September 30, 2023 HPS RDS Canada Consolidated Operating income $18,556 $12,772 $3,414 $34,742 Depreciation & amortization 19,149 9,674 1,194 30,017 Stock compensation expense 2,536 325 208 3,069 Restructuring and other 163 16 — 179 Litigation expense — 79 — 79 Transaction and integration expense 255 34 — 289 Change in fair value of contingent consideration — (1,553) — (1,553) Adjusted EBITDA $40,659 $21,347 $4,816 $66,822 Thirteen weeks ended September 24, 2022 HPS RDS Canada Consolidated Operating income (loss) $7,259 $(14,052) $6,344 $(449) Depreciation & amortization 18,440 10,214 1,215 29,869 Stock compensation expense 2,130 197 158 2,485 Restructuring 831 85 — 916 Litigation expense — 25,255 — 25,255 Transaction and integration expense 178 — — 178 Change in fair value of contingent consideration — 719 — 719 Adjusted EBITDA $28,838 $22,418 $7,717 $58,973 Segment Adjusted EBITDA Reconciliations

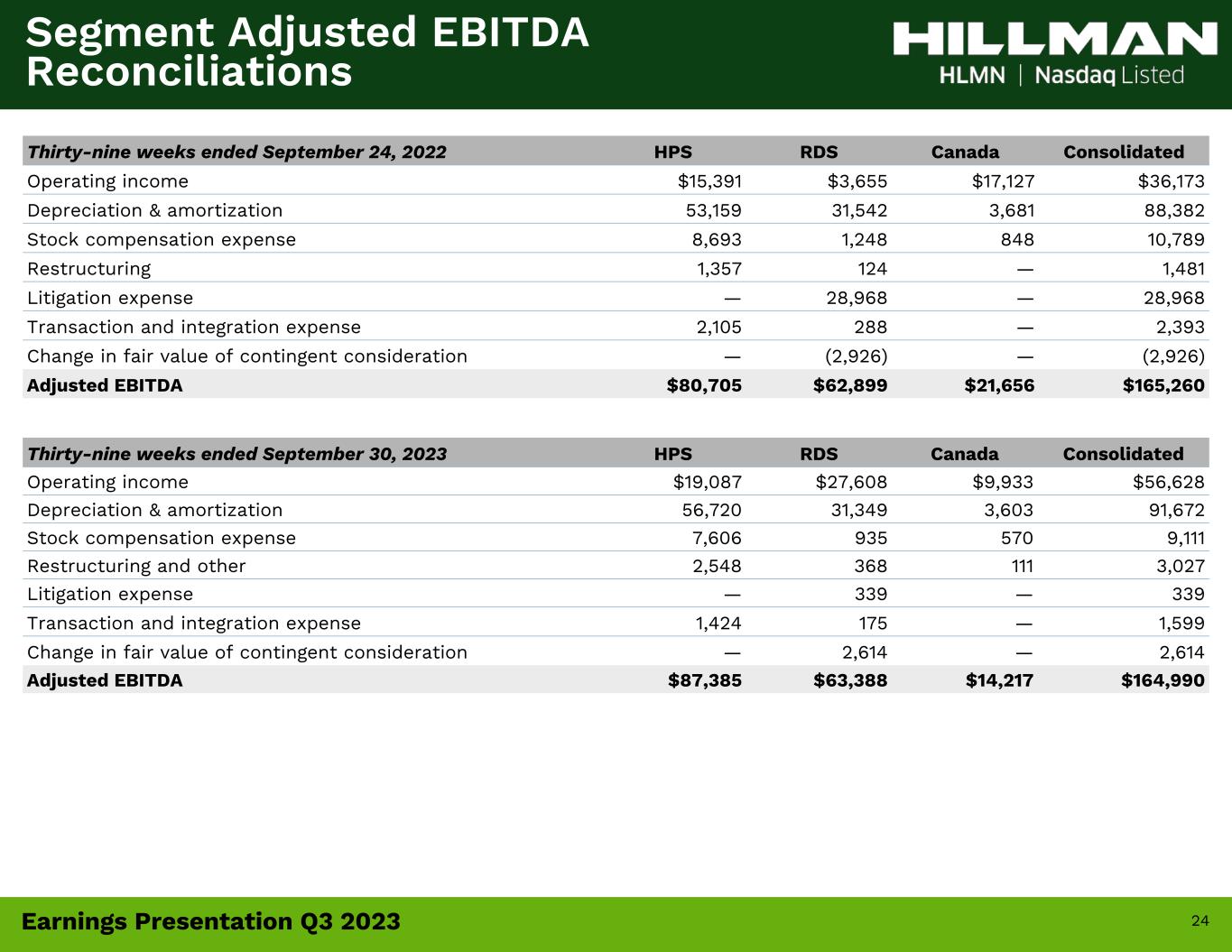

24Earnings Presentation Q3 2023 Thirty-nine weeks ended September 30, 2023 HPS RDS Canada Consolidated Operating income $19,087 $27,608 $9,933 $56,628 Depreciation & amortization 56,720 31,349 3,603 91,672 Stock compensation expense 7,606 935 570 9,111 Restructuring and other 2,548 368 111 3,027 Litigation expense — 339 — 339 Transaction and integration expense 1,424 175 — 1,599 Change in fair value of contingent consideration — 2,614 — 2,614 Adjusted EBITDA $87,385 $63,388 $14,217 $164,990 Thirty-nine weeks ended September 24, 2022 HPS RDS Canada Consolidated Operating income $15,391 $3,655 $17,127 $36,173 Depreciation & amortization 53,159 31,542 3,681 88,382 Stock compensation expense 8,693 1,248 848 10,789 Restructuring 1,357 124 — 1,481 Litigation expense — 28,968 — 28,968 Transaction and integration expense 2,105 288 — 2,393 Change in fair value of contingent consideration — (2,926) — (2,926) Adjusted EBITDA $80,705 $62,899 $21,656 $165,260 Segment Adjusted EBITDA Reconciliations

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

Hillman Solutions (NASDAQ:HLMN)

過去 株価チャート

から 4 2024 まで 5 2024

Hillman Solutions (NASDAQ:HLMN)

過去 株価チャート

から 5 2023 まで 5 2024