false

0001451448

MT

0001451448

2023-12-19

2023-12-19

0001451448

us-gaap:CommonStockMember

2023-12-19

2023-12-19

0001451448

GMBL:CommonStockPurchaseWarrantsMember

2023-12-19

2023-12-19

0001451448

GMBL:Sec10.0SeriesCumulativeRedeemableConvertiblePreferredStockMember

2023-12-19

2023-12-19

0001451448

GMBL:CommonStockPurchaseWarrantsoneMember

2023-12-19

2023-12-19

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): December 19, 2023

ESPORTS

ENTERTAINMENT GROUP, INC.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

001-39262 |

|

26-3062752 |

(State

or other jurisdiction

of

incorporation or organization) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

BLOCK

6,

TRIQ

PACEVILLE,

ST.

JULIANS STJ

3109

MALTA

(Address

of principal executive offices)

356

2713 1276

(Registrant’s

telephone number, including area code)

Not

Applicable

(Former

Name or Former Address, if Changed Since Last Report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common Stock |

|

GMBL |

|

The Nasdaq Stock Market

LLC |

| Common Stock Purchase Warrants |

|

GMBLW |

|

The Nasdaq Stock Market

LLC |

| 10.0% Series A Cumulative

Redeemable Convertible Preferred Stock |

|

GMBLP |

|

The Nasdaq Stock Market

LLC |

| Common Stock Purchase Warrants |

|

GMBLZ |

|

The Nasdaq Stock Market

LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

7.01. Regulation FD Disclosure.

On

December 20, 2023, Esports Entertainment Group, Inc. (the “Company”) issued a press release regarding a pending reverse split

of its common stock. A copy of the press release is furnished herewith as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated

herein by reference.

The

information contained in this Item 7.01 and Exhibit 99.1 furnished as part of Item 9.01 of this Current Report on Form 8-K is being furnished

and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any registration

statement or other filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by

specific reference to such filing.

Item

8.01. Other Events.

On

December 19, 2023, the Company received a notice from The Nasdaq Stock Market LLC’s (“Nasdaq”) Hearings Panel (the

“Panel”), that the Panel had granted the Company an exception until January 24, 2024, to demonstrate compliance

with the Listing Rule 5550(a)(2) (the “Bid Price Rule”) by maintaining a closing bid price of $1.00 or higher for twenty

consecutive trading sessions. If the Company successfully cures the Bid Price Rule deficiency, the Panel will then determine if it will

grant an extension until April 15, 2024, to cure the $2,500,000 minimum stockholders’ equity requirement, as outlined in Nasdaq

Listing Rule 5550(b)(1) (the “Equity Rule”).

The

Company is in the process of taking definitive steps to comply with this and all applicable conditions and criteria for continued listing

on Nasdaq. There can be no assurance that the Company will regain compliance or if the Company will be able to evidence compliance with

all applicable requirements for continued listing that will satisfy the Panel.

Item

9.01. Financial Statements and Exhibits.

(d)

Exhibits.

Forward-Looking

Statements

The

information contained herein includes forward-looking statements, as defined in the Private Securities Litigation Reform Act of 1995.

Forward-looking statements generally can be identified by words such as “anticipates,” “believes,” “estimates,”

“expects,” “intends,” “plans,” “predicts,” “projects,” “will be,”

“will continue,” “will likely result,” and similar expressions. These statements relate to future events or to

our future financial performance, and involve known and unknown risks, uncertainties and other factors that may cause our actual results,

levels of activity, performance, or achievements to be materially different from any future results, levels of activity, performance

or achievements expressed or implied by these forward-looking statements. You should not place undue reliance on forward-looking statements

since they involve known and unknown risks, uncertainties and other factors which are, in some cases, beyond our control and which could,

and likely will, materially affect actual results, levels of activity, performance or achievements. Factors that could cause or contribute

to such differences include, but are not limited to, those discussed in our most recent Annual Report on Form 10-K and those discussed

in other documents we file with the SEC, including, our ability to maintain compliance with Nasdaq Listing Rules and maintain the listing

of our securities on Nasdaq, our obligations under our outstanding preferred stock and the settlement agreement, and our ability to continue

as a going concern. Any forward-looking statement reflects our current views with respect to future events and is subject to these and

other risks, uncertainties and assumptions relating to our operations, results of operations, growth strategy and liquidity. We assume

no obligation to publicly update or revise these forward-looking statements for any reason, or to update the reasons actual results could

differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future,

unless required by law.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its

behalf by the undersigned hereunto duly authorized.

| Date: December

20, 2023 |

|

|

| |

|

|

| |

ESPORTS

ENTERTAINMENT GROUP, INC. |

| |

|

|

| |

By: |

/s/

Michael Villani |

| |

Name: |

Michael Villani |

| |

Title: |

Chief Financial Officer |

Exhibit 99.1

Esports

Entertainment Group Announces Reverse Stock Split

St.

Julian’s, Malta–December 20,

2023–Esports Entertainment Group, Inc. (NASDAQ: GMBL) (NASDAQ: GMBLP) (NASDAQ: GMBLW) (NASDAQ: GMBLZ) (“Esports Entertainment”,

“EEG”, or the “Company”), a leading, global iGaming company and business-to-business (B2B) esports content

and solutions provider, today announced that its Board of Directors has approved a 1-for-400 reverse stock split of the Company’s

common stock, par value $0.001 (the “Common Stock”). The reverse stock split will become effective at 4:01 PM ET on December

21, 2023. The Common Stock is expected to begin trading on a split-adjusted basis on the Nasdaq Capital Market under the same symbol

“GMBL” when the market opens on December 22, 2023, with the new CUSIP number 29667K603.

The

reverse stock split was approved by the Board of Directors in accordance with Nevada law, under which no stockholder approval is required.

As a result of the reverse stock split, every 400 shares of common stock issued and outstanding as of the effective date will be automatically

combined into one share of common stock with no change in the $0.001 par value per share. The exercise prices and the number of shares

issuable upon exercise, of the outstanding stock options and warrants, and the number of shares available for future issuance under the

equity incentive plans will be adjusted in accordance with their respective terms. The reverse stock split will affect all stockholders

uniformly and will not affect any stockholder’s ownership percentage of the Company’s shares, with the exception of those

holders of fractional shares. The reverse stock split will reduce the number of outstanding shares of Common Stock from approximately

426 million to approximately 1.065 million shares and also proportionately reduce the number of authorized shares of Common Stock from

500 million to 1.25 million shares. In order to raise capital to maintain compliance with minimum equity listing requirements, we intend

to seek stockholder approval to increase the number of authorized shares of common stock at our annual shareholders meeting.

The

reverse stock split will also apply to common stock issuable upon the conversion of the Company’s Series C Convertible Preferred

Stock and Series D Convertible Preferred Stock, with the Conversion Price, as defined in their Certificates of Designation, being subject

to adjustment under the terms of their respective Certificates of Designation and the previously disclosed settlement and waiver agreement,

dated October 6, 2023. The conversion provision of the 10% Series A Cumulative Redeemable Convertible Preferred Stock, which is convertible

into shares of Common Stock, will also be adjusted to reflect the Company’s reverse stock splits.

The

reverse stock split is being effected after the Board of Director’s consideration of a variety of factors, including the current

trading price of the Common Stock and regaining compliance with Listing Rule 5810(c)(3)(A)(iii) (the “Low Priced Stocks Rule),”

as well as Nasdaq $1.00 minimum bid price requirement Listing Rule 5550(a)(2) (the “Minimum Bid Price Rule”). The Company

presented its plan to regain compliance with the Low Priced Stocks Rule and the Minimum Bid Price Rule, as well as its compliance with

the $2.5 million minimum stockholders’ equity requirement, as outlined in Listing Rule 5550(b)(1) (“Equity Rule”),

at its Panel hearing on December 14, 2023. On December 19, 2023, the Panel granted the Company an exception until January 24,

2024 to demonstrate compliance with the Low Priced Stocks Rule and the Minimum Bid Price Rule (“Bid Price Compliance”). Upon

determining Bid Price Compliance, the Panel will determine whether to grant the Company a further extension to regain compliance with

the Equity Rule.

No

fractional shares will be issued in connection with the reverse stock split. Any fractional shares of common stock resulting from the

reverse stock split will be rounded up to the nearest whole post-split share and no shareholders will receive cash in lieu of fractional

shares.

Stockholders

holding their shares electronically in book-entry form are not required to take any action to receive post-split shares. Stockholders

owning shares through a bank, broker or other nominee will have their positions automatically adjusted to reflect the reverse stock split,

subject to brokers’ particular processes, and will not be required to take any action in connection with the reverse stock split.

For those stockholders holding physical stock certificates, the Company’s transfer agent, VStock Transfer, LLC, will send instructions

for exchanging those certificates for shares held electronically in book-entry form or for new certificates, in either case representing

the post-split number of shares.

About

Esports Entertainment Group

Esports

Entertainment Group is a global MGA-licensed, “esports-focused” iGaming B2C operator and a US-focused B2B provider of esports

solutions. The Company owns and operates the world’s leading esport venue management system, currently deployed in over 800 global

locations, including more than 100 colleges and universities. The Company’s strategy is to capitalize on the multi-billion-dollar

market for esports and esports wagering by leveraging its leading position in the industry. The Company is also targeting the rapidly

growing market for short-form esports wagerable content, which features competitive, short-cycle head-to-head leagues that are optimized

for betting. In addition to its plans to distribute esports content, the Company currently provides B2C-focused wagering through its

MGA-licensed suite of brands. For additional information about the Company, please visit www.esportsentertainmentgroup.com.

Forward-Looking

Statements

The

information contained herein includes forward-looking statements, as defined in the Private Securities Litigation Reform Act of 1995.

Forward-looking statements generally can be identified by words such as “anticipates,” “believes,” “estimates,”

“expects,” “intends,” “plans,” “predicts,” “projects,” “will be,”

“will continue,” “will likely result,” and similar expressions. These statements relate to future events or to

our strategies, targeted markets, and future financial performance, and involve known and unknown risks, uncertainties and other factors

that may cause our actual results, levels of activity, performance, or achievements to be materially different from any future results,

levels of activity, performance or achievements expressed or implied by these forward-looking statements. You should not place undue

reliance on forward-looking statements since they involve known and unknown risks, uncertainties and other factors which are, in some

cases, beyond our control and which could, and likely will, materially affect actual results, levels of activity, performance or achievements.

Factors that could cause or contribute to such differences include, but are not limited to, those discussed in our most recent Annual

Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q, and those discussed in other documents we file with the SEC, including,

our ability to maintain compliance with Nasdaq Listing Rules and stay listed on Nasdaq, our obligations under our preferred stock outstanding,

and our ability to continue as a going concern. Any forward-looking statement reflects our current views with respect to future events

and is subject to these and other risks, uncertainties and assumptions relating to our operations, results of operations, growth strategy

and liquidity. We assume no obligation to publicly update or revise these forward-looking statements for any reason, or to update the

reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes

available in the future, unless required by law. The safe harbor for forward-looking statements contained in the Private Securities Litigation

Reform Act of 1995 protects companies from liability for their forward-looking statements if they comply with the requirements of such

Act.

Contact:

Crescendo

Communications, LLC

Tel: (212) 671-1021

Email: GMBL@crescendo-ir.com

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=GMBL_CommonStockPurchaseWarrantsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=GMBL_Sec10.0SeriesCumulativeRedeemableConvertiblePreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=GMBL_CommonStockPurchaseWarrantsoneMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

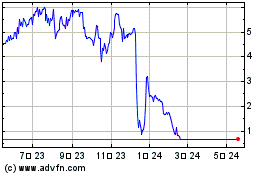

Esports Entertainment (NASDAQ:GMBLP)

過去 株価チャート

から 4 2024 まで 5 2024

Esports Entertainment (NASDAQ:GMBLP)

過去 株価チャート

から 5 2023 まで 5 2024