false000151722800015172282024-05-202024-05-20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 20, 2024

COMMSCOPE HOLDING COMPANY, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Delaware |

|

001-36146 |

|

27-4332098 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

3642 E. US Highway 70

Claremont, North Carolina 28610

(Address of principal executive offices)

Registrant’s telephone number, including area code: (828) 459-5000

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of each class |

Trading Symbol |

Name of each exchange on which registered |

Common Stock, par value $0.01 per share |

COMM |

The NASDAQ Stock Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

|

|

|

Emerging growth company |

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On May 20, 2024, CommScope, LLC, a subsidiary of CommScope Holding Company, Inc. (the “Company”), entered into a Long-Term Cash Incentive Award Agreement (collectively, the “Agreements”) with each of Charles L. Treadway, its President and Chief Executive Officer, and Kyle D. Lorentzen, its Executive Vice President and Chief Financial Officer. Pursuant to the terms of the Agreements, each of Mr. Treadway and Mr. Lorentzen is eligible to earn a cash incentive award equal to an amount of up to 40 basis points and 20 basis points, respectively, of the financial benefits to the Company derived from the successful execution of certain corporate and strategic initiatives in fiscal year 2024 (the “Performance Year”). The final amount of such awards, as determined by the Compensation Committee, will be paid in three equal installments in March 2025, September 2025, and March 2026 (or such later times as provided in the Agreements), conditioned on the executive’s continuous employment with the Company through such dates; provided that, in the event of the executive’s death or termination by the Company other than for “cause” (as defined in the Agreements) after the Performance Year, any earned but unpaid portion of the award will be paid to the executive (or his estate, as the case may be) in a single lump sum within sixty days following such event (or such later times as provided in the Agreements), conditioned upon the executive’s (i) execution and non-revocation of a release of claims within forty-five days following his termination date and (ii) continued compliance with the restrictive covenants in his severance protection agreement with the Company.

In addition, on May 20, 2024, CommScope, LLC entered into a Long-Term Cash Incentive Award Agreement with each of the other executive officers of the Company, including but not limited to Justin C. Choi, its Senior Vice President, Chief Legal Officer and Secretary, and Bartolomeo A. Giordano, its Senior Vice President, NICS, pursuant to which each of these other executives is eligible to earn a cash incentive award to be determined by the Compensation Committee based upon its assessment of management’s performance for the Performance Year in certain key strategic and financial objectives. The awards for these other executives have a stated target value ($950,000 for Mr. Choi and $600,000 for Mr. Giordano) and a potential payout rate from 0% to 150% of target based on the Compensation Committee’s assessment of management’s performance. The final amount of such awards, as determined by the Compensation Committee, will be paid in three equal installments in March 2025, September 2025, and March 2026 (or such later times as provided in the Agreements), conditioned on the executive’s continuous employment with the Company through such dates. These awards for other executives have the same provisions relating to termination of employment as the Agreements for Mr. Treadway and Mr. Lorentzen, as described above.

Item 9.01. Financial Statements and Exhibits

Exhibit. Description.

10.1 Form of Long-Term Cash Incentive Award Agreement

104 Cover Page Interactive Data File (embedded within the Inline XBRL document)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: May 21, 2024

|

|

|

|

|

|

COMMSCOPE HOLDING COMPANY, INC. |

|

|

|

|

|

By: |

/s/ Justin C. Choi |

|

|

Justin C. Choi Senior Vice President, Chief Legal Officer and Secretary |

LONG-TERM CASH INCENTIVE AWARD AGREEMENT

This LONG-TERM CASH INCENTIVE AWARD AGREEMENT (the “Agreement”) is made and entered into this [●] day of [●], 2024, by and between CommScope, LLC (the “Company”), and [Employee Name] (“Executive”). For purposes of this Agreement, the Company and Executive are referred to collectively as the “Parties.”

RECITALS

In order to recognize Executive’s valuable leadership and contributions to the success of the Company, to provide Executive with an opportunity to earn additional compensation based on the Company’s achievement of performance objectives for fiscal year 2024 (the “Performance Year”) as described on the Appendix to this Agreement, and to encourage Executive’s continued commitment, dedication, and services to the Company following the Performance Year, the Company wishes to provide the long-term cash incentive opportunity to the Executive, as provided in this Agreement.

Accordingly, in consideration of the mutual promises contained herein and other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the Parties agree as follows:

1. Effectiveness. This Agreement shall be effective as of the date first written above (the “Effective Date”).

2. Long-Term Cash Incentive Award Opportunity.

(a) Subject to the terms and conditions of this Agreement, Executive shall have the opportunity to receive a cash incentive award as determined by the Compensation Committee of the Board of Directors of the Company (the “Committee”) in accordance with the Appendix to this Agreement, subject to withholding for taxes and other similar items. Any long-term cash incentive award amount earned by Executive pursuant to this Agreement and the Appendix hereto (the “Earned Amount”) shall be paid to Executive in approximately equal installments in March 2025, September 2025, and March 2026, or as otherwise provided in the Appendix to this Agreement, in each case conditioned upon Executive’s continuous employment with the Company through such dates, subject to Section 3.

(b) The Parties agree that any Earned Amount paid to Executive is over and above any payments to which Executive may otherwise be eligible to receive.

3. Termination of Employment.

(a) In the event that, prior to the full payment of the Earned Amount, (i) Executive terminates his/her employment with the Company, whether by resignation, retirement or otherwise, or (ii) the Company terminates Executive’s employment for Cause (as such term is defined in Executive’s Severance Protection Agreement with the Company), then Executive shall not be entitled to payment of any then-remaining installments of the Earned Award.

(b) In the event that, following the end of the Performance Year but prior to the full payment of the Earned Amount, (i) Executive’s employment with the Company is terminated by the Company for any reason other than Cause, or (ii) Executive dies, and (iii) on the date of such termination or death no grounds exist for the Company to terminate Executive’s employment for Cause, then, except as otherwise provided in the Appendix to this Agreement, the Company shall pay Executive (or Executive’s estate, as the case may be) any then-remaining installments of the Earned Amount, payable in a lump sum within sixty (60) days following the earlier of the date of such termination (the “Termination Date”) or the date of Executive’s death, as the case may be. Other than in the event of Executive’s death, the payment of any portion of the Earned Amount pursuant to this Section 3(b) shall be contingent upon (i) Executive executing, within forty-five (45) days after the Termination Date, a full general release of claims and covenant not to sue in a form provided by the Company (the “Release Agreement”) and not revoking such Release Agreement within any revocation period specified in the Release Agreement, and (ii) Executive’s continued compliance with the restrictive covenants contained in Executive’s Severance Protection Agreement with the Company in accordance with the terms thereof. The Release Agreement shall be provided to the Executive within five (5) business days following the Termination Date.

(c) The Parties agree that this Agreement does not create any rights in Executive beyond the potential right to payment of any long-term cash incentive award amount that may be earned hereunder. The award opportunity provided herein should be viewed as an indication of the Company’s confidence in and appreciation of Executive’s abilities and contributions, and as an additional form of compensation to meet a special purpose. Any Earned Amount will be in addition to any other compensation or benefits that Executive may otherwise be eligible to receive from the Company and is not a permanent or recurring element of Executive’s compensation at the Company, nor will it impact any other element of compensation for which Executive may otherwise be eligible.

4.Employment Status. Nothing in this Agreement shall be construed as a commitment, guarantee, agreement, or understanding of any kind or nature that the Company will continue to employ Executive, nor will this Agreement affect in any way the right of the Company to terminate Executive’s employment at any time and for any reason (unless otherwise agreed to by the Parties separately in writing). Executive acknowledges and agrees that he/she is an “at will” employee.

5.Section 409A. This Agreement shall be interpreted and administered in a manner so that any amount or benefit payable hereunder shall be paid or provided in a manner that is either exempt from or compliant with the requirements of Section 409A of the Internal Revenue Code of 1986, as amended (the “Code”), and applicable Internal Revenue Service guidance and Treasury Regulations issued thereunder. Nevertheless, the tax treatment of the payments and benefits provided under the Agreement is not warranted or guaranteed. Neither the Company, its affiliates, nor their directors, officers, employees or advisers shall be held liable for any taxes, interest, penalties or other monetary amounts owed by Executive as a result of the application of Section 409A of the Code.

(a)Applicable Law; Forum Selection; Consent to Jurisdiction. The Parties agree that this Agreement shall be governed by and construed and interpreted in accordance with the laws of the State of North Carolina without giving effect to its conflicts of law principles. Executive agrees that the exclusive forum for any action to enforce this Agreement, as well as any action relating to or arising out of this Agreement, shall be the state or federal courts of the State of North Carolina. With respect to any such court action, Executive hereby (a) irrevocably submits to the personal jurisdiction of such courts; (b) consents to service of process; (c) consents to venue; and (d) waives any other requirement (whether imposed by statute, rule of court, or otherwise) with respect to personal jurisdiction, service of process, or venue. Both Parties hereto further agree that the state and federal courts of the State of North Carolina are convenient forums for any dispute that may arise herefrom and that neither party shall raise as a defense that such courts are not convenient forums.

(b)Severability. The invalidity or unenforceability of any provision of this Agreement shall not affect the validity or enforceability of any other provision of this Agreement.

(c) Waiver. Failure of either Party to insist, in one or more instances, on performance by the other in strict accordance with the terms and conditions of this Agreement shall not be deemed a waiver or relinquishment of any right granted in this Agreement or of the future performance of any such term or condition or of any other term or condition of this Agreement, unless such waiver is contained in a writing signed by the Party making the waiver.

(d)Entire Agreement; Amendment. This Agreement contains the entire agreement between the Company and Executive with respect to the subject matter hereof and, from and after the date hereof, this Agreement shall supersede any other agreement, written or oral, between the Parties relating to the subject matter of this Agreement. This Agreement may not be amended or modified otherwise than by a written agreement executed by the Parties hereto or their respective successors and legal representatives.

(e)Assignment. The rights and obligations of the Company may be assigned, and this Agreement shall be binding and inure to the benefit of the Company, its successors and assigns. No right, obligation or duty of this Agreement may be assigned by Executive without the prior written consent of the Company.

(f)Construction. The Parties understand and agree that because they both have been given the opportunity to have counsel review and revise this Agreement, the normal rule of construction to the effect that any ambiguities are to be resolved against the drafting party shall not be employed in the interpretation of this Agreement. Instead, the language of all parts of this Agreement shall be construed as a whole, and according to its fair meaning, and not strictly for or against either of the Parties.

(g)Counterparts. This Agreement may be executed in counterparts (including by means of electronic signature, such as DocuSign), each of which shall be deemed an original, but all of which together shall constitute a single instrument. Execution of this Agreement may be

made by providing a signed original copy or providing a signature via facsimile or other electronic means, such as portable document format (PDF).

[signatures appear on following page]

IN WITNESS WHEREOF, the Parties hereto have duly executed and delivered this Retention Agreement.

Executive

Date:

CommScope, LLC

By:

Name:

Title:

Date:

v3.24.1.1.u2

Document and Entity Information

|

May 20, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

May 20, 2024

|

| Entity Registrant Name |

COMMSCOPE HOLDING COMPANY, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Central Index Key |

0001517228

|

| Entity File Number |

001-36146

|

| Entity Tax Identification Number |

27-4332098

|

| Entity Address, Address Line One |

3642 E

|

| Entity Address, Address Line Two |

US Highway 70

|

| Entity Address, City or Town |

Claremont

|

| Entity Address, State or Province |

NC

|

| Entity Address, Postal Zip Code |

28610

|

| City Area Code |

828

|

| Local Phone Number |

459-5000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

COMM

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

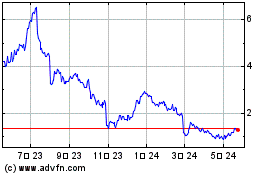

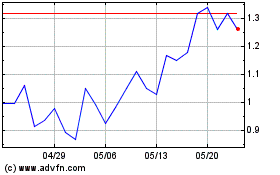

CommScope (NASDAQ:COMM)

過去 株価チャート

から 5 2024 まで 6 2024

CommScope (NASDAQ:COMM)

過去 株価チャート

から 6 2023 まで 6 2024