false

0001648087

0001648087

2024-10-01

2024-10-01

0001648087

AREB:CommonStock0.001ParValueMember

2024-10-01

2024-10-01

0001648087

AREB:CommonStockPurchaseWarrantsMember

2024-10-01

2024-10-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported) October 1, 2024

AMERICAN

REBEL HOLDINGS, INC.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

001-41267 |

|

47-3892903 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

5115

Maryland Way, Suite 303

Brentwood,

Tennessee |

|

37027 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (833) 267-3235

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

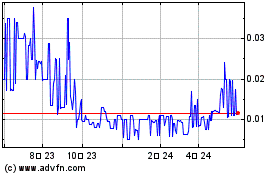

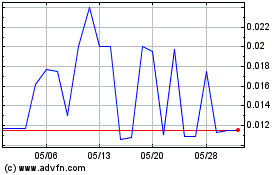

| Common

Stock, $0.001 par value |

|

AREB |

|

The

Nasdaq Stock Market LLC |

| Common

Stock Purchase Warrants |

|

AREBW |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01. Entry into a Material Definitive Agreement.

On

October 4, 2024, the Company entered into a Securities Purchase Agreement with 1800 Diagonal Lending, LLC, an accredited investor

(“the Lender”), pursuant to which the Lender made a loan to the Company, evidenced by a promissory note in the principal

amount of $122,960 (the “Note”). An original issue discount of $16,960 and fees of $6,000 were applied on the issuance date,

resulting in net loan proceeds to the Company of $100,000. Accrued, unpaid interest and outstanding principal, subject to adjustment,

is required to be paid in nine payments of $15,574.89, with the first payment due on October 30, 2024, and remaining eight payments due

on the 30th day of each month thereafter (a total payback to the Lender of $140,174).

Upon

the occurrence and during the continuation of any Event of Default, the Note shall become immediately due and payable and the Company

will be obligated to pay to the Lender, in full satisfaction of its obligations, an amount equal to 150% times the sum of (w) the then

outstanding principal amount of the Note plus (x) accrued and unpaid interest on the unpaid principal amount of the Note to the date

of payment plus (y) default interest, if any, at the rate of 22% per annum on the amounts referred to in clauses (w) and/or (x) plus

(z) any amounts owed to the Lender pursuant to the conversion rights referenced below.

Only

upon an occurrence of an event of default under the Note, the Lender may convert the outstanding unpaid principal amount of the Note

into restricted shares of common stock of the Company at a discount of 25% of the market price. The Lender agreed to limit the amount

of stock received to less than 4.99% of the total outstanding common stock. There are no warrants or other derivatives attached to this

Note. The Company agreed to reserve a number of shares of common stock equal to four times the number of shares of common stock which

may be issuable upon conversion of the Note at all times.

The

foregoing descriptions of the Note and the Securities Purchase Agreement and of all of the parties’ rights and obligations under

the Note and the Securities Purchase Agreement are qualified in its entirety by reference to the Note and the Securities Purchase Agreement,

copies of which are filed as Exhibits 10.1 and 10.2 respectively to this Current Report on Form 8-K, and of which are incorporated herein

by reference.

Item

2.03. Creation of a Direct Financial Obligation or an Obligation Under an Off-Balance Sheet Arrangement of a Registrant.

The

information set forth above in Item 1.01 of this Current Report on Form 8-K is incorporated herein by reference.

Item

3.02 Sale of Unregistered Securities.

On

October 1, 2024, the Company issued 53,334 shares of Series D Convertible Preferred stock, valued at $7.50 per share, to a lender pursuant

to the terms of a settlement agreement.

On

October 1, 2024, the Company sold 31,500 shares of Series D Convertible Preferred Stock, for $7.50 per share for total proceeds to the

Company of $236,250, to two accredited investors.

The

issuance and sale of the shares of preferred stock will not be registered under the Securities Act of 1933, as amended, in reliance upon

the exemption from the registration requirements of that Act provided by Section 4(a)(2) thereof. The recipients/purchasers of shares

were accredited investors with the experience and expertise to evaluate the merits and risks of an investment in securities of the Company

and the financial means to bear the risks of such an investment.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934 the registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

| |

AMERICAN

REBEL HOLDINGS, INC. |

| |

|

|

| Date:

October 8, 2024 |

By: |

/s/ Charles A. Ross, Jr. |

| |

|

Charles A. Ross, Jr. |

| |

|

Chief

Executive Officer |

Exhibit

10.1

THE

ISSUANCE AND SALE OF THE SECURITIES REPRESENTED BY THIS CERTIFICATE HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED,

OR APPLICABLE STATE SECURITIES LAWS. THE SECURITIES MAY NOT BE OFFERED FOR SALE, SOLD, TRANSFERRED OR ASSIGNED IN THE ABSENCE OF (A)

AN EFFECTIVE REGISTRATION STATEMENT FOR THE SECURITIES UNDER THE SECURITIES ACT OF 1933, AS AMENDED, OR (B) AN OPINION OF COUNSEL (WHICH

COUNSEL SHALL BE SELECTED BY THE HOLDER), IN A GENERALLY ACCEPTABLE FORM, THAT REGISTRATION IS NOT REQUIRED UNDER SAID ACT.

THE

ISSUE PRICE OF THIS NOTE IS $122,960.00

THE

ORIGINAL ISSUE DISCOUNT IS $16,960.00

| Principal

Amount: $122,960.00 |

Issue

Date: October 4, 2024 |

| Purchase

Price: $106,000.00 |

|

PROMISSORY

NOTE

FOR

VALUE RECEIVED, AMERICAN REBEL HOLDINGS, INC., a Nevada corporation (hereinafter called the “Borrower”), hereby

promises to pay to the order of 1800 DIAGONAL LENDING LLC, a Virginia limited liability company, or registered assigns (the “Holder”)

the sum of $122,960.00 together with any interest as set forth herein, on June 30, 2025 (the “Maturity Date”), and to pay

interest on the unpaid principal balance hereof from the date hereof (the “Issue Date”) as set forth herein. This Note may

not be prepaid in whole or in part except as otherwise explicitly set forth herein. Any amount of principal or interest on this Note

which is not paid when due shall bear interest at the rate of twenty two percent (22%) per annum from the due date thereof until the

same is paid (“Default Interest”). All payments due hereunder (to the extent not converted into common stock, $0.001 par

value per share (the “Common Stock”) in accordance with the terms hereof) shall be made in lawful money of the United States

of America. All payments shall be made at such address as the Holder shall hereafter give to the Borrower by written notice made in accordance

with the provisions of this Note. Each capitalized term used herein, and not otherwise defined, shall have the meaning ascribed thereto

in that certain Securities Purchase Agreement dated the date hereof, pursuant to which this Note was originally issued (the “Purchase

Agreement”).

This

Note is free from all taxes, liens, claims and encumbrances with respect to the issue thereof and shall not be subject to preemptive

rights or other similar rights of stockholders of the Borrower and will not impose personal liability upon the holder thereof.

The

following terms shall apply to this Note:

ARTICLE

I. GENERAL TERMS

1.1

Interest. A one-time interest charge of fourteen percent (14%) (the “Interest Rate”) shall be applied on the Issuance

Date to the principal amount ($122,960.00 * fourteen percent (14%) = $17,214.00). Interest hereunder shall be paid as set forth herein

to the Holder or its assignee in whose name this Note is registered on the records of the Company regarding registration and transfers

of Notes in cash or, in the Event of Default, at the Option of the Holder, converted into share of Common Stock as set forth herein.

1.2

Mandatory Monthly Payments. Accrued, unpaid Interest and outstanding principal, subject to adjustment, shall be paid in nine (9)

payments each in the amount of $15,574.89 (a total payback to the Holder of $140,174.00). The first payment shall be due October 30,

2024 with eight (8) subsequent payments on the 30th day of each month thereafter (the February 2025 payment shall be due on

February 28, 2025). The Company shall have a five (5) day grace period with respect to each payment. The Company has right to accelerate

payments or prepay in full at any time with no prepayment penalty. All payments shall be made by bank wire transfer to the Holder’s

wire instructions, attached hereto as Exhibit A. For the avoidance of doubt, a missed payment shall be considered an Event of Default.

ARTICLE

II. CERTAIN COVENANTS

2.1

Sale of Assets. So long as the Borrower shall have any obligation under this Note, the Borrower shall not, without the Holder’s

written consent, sell, lease or otherwise dispose of any significant portion of its assets outside the ordinary course of business in

one or a series of transactions which would render the Borrower a “shell company” as such term is defined in Rule 144 (as

defined herein).

ARTICLE

III. EVENTS OF DEFAULT

If

any of the following events of default (each, an “Event of Default”) shall occur:

3.1

Failure to Pay Principal and Interest. The Borrower fails to pay the principal hereof or interest thereon when due on this Note,

whether at maturity, upon acceleration or otherwise and such breach continues for a period of five (5) business days after written notice

from the Holder.

3.2

Breach of Covenants. The Borrower breaches any material covenant or other material term or condition contained in this Note and

any collateral documents including but not limited to the Purchase Agreement and such breach continues for a period of twenty (20) days

after written notice thereof to the Borrower from the Holder.

3.3

Breach of Representations and Warranties. Any representation or warranty of the Borrower made herein or in any agreement, statement

or certificate given in writing pursuant hereto or in connection herewith (including, without limitation, the Purchase Agreement), shall

be false or misleading in any material respect when made and the breach of which has (or with the passage of time will have) a material

adverse effect on the rights of the Holder with respect to this Note or the Purchase Agreement.

3.4

Receiver or Trustee. The Borrower or any subsidiary of the Borrower shall make an assignment for the benefit of creditors, or

apply for or consent to the appointment of a receiver or trustee for it or for a substantial part of its property or business, or such

a receiver or trustee shall otherwise be appointed.

3.5

Bankruptcy. Bankruptcy, insolvency, reorganization or liquidation proceedings or other proceedings, voluntary or involuntary,

for relief under any bankruptcy law or any law for the relief of debtors shall be instituted by or against the Borrower or any subsidiary

of the Borrower on or after the Issue Date.

3.6

Delisting of Common Stock. The Borrower shall fail to maintain the listing of the Common Stock on the Nasdaq National Market,

the Nasdaq SmallCap Market, the New York Stock Exchange, or the NYSE American Stock Exchange (collectively, the “Exchanges”).

3.7

Failure to Comply with the Exchange Act. The Borrower shall fail to materially comply with the reporting requirements of the Exchange

Act; and/or the Borrower shall cease to be subject to the reporting requirements of the Exchange Act.

3.8

Liquidation. Any dissolution, liquidation, or winding up of Borrower or any substantial portion of its business.

3.9

Cessation of Operations. Any cessation of operations by Borrower or Borrower admits it is otherwise generally unable to pay its

debts as such debts become due, provided, however, that any disclosure of the Borrower’s ability to continue as a “going

concern” shall not be an admission that the Borrower cannot pay its debts as they become due.

3.10

[intentionally deleted].

3.11

Replacement of Transfer Agent. In the event that the Borrower proposes to replace its transfer agent, the Borrower fails to provide,

prior to the effective date of such replacement, a fully executed Irrevocable Transfer Agent Instructions in a form as initially delivered

pursuant to the Purchase Agreement (including but not limited to the provision to irrevocably reserve shares of Common Stock in the Reserved

Amount) signed by the successor transfer agent to Borrower and the Borrower.

Upon

the occurrence and during the continuation of any Event of Default, the Note shall become immediately due and payable and the Borrower

shall pay to the Holder, in full satisfaction of its obligations hereunder, an amount equal to 150% times the sum of (w)

the then outstanding principal amount of this Note plus (x) accrued and unpaid interest on the unpaid principal amount of this

Note to the date of payment (the “Mandatory Prepayment Date”) plus (y) Default Interest, if any, on the amounts referred

to in clauses (w) and/or (x) plus (z) any amounts owed to the Holder pursuant to Article IV hereof (the then outstanding principal

amount of this Note to the date of payment plus the amounts referred to in clauses (x), (y) and (z) shall collectively be known

as the “Default Amount”) and all other amounts payable hereunder shall immediately become due and payable, all without demand,

presentment or notice, all of which hereby are expressly waived, together with all costs, including, without limitation, legal fees and

expenses, of collection, and the Holder shall be entitled to exercise all other rights and remedies available at law or in equity.

ARTICLE

IV. CONVERSION RIGHTS

4.1

Conversion Right. After the occurrence of an Event of Default, at any time, the Holder shall have the right, to convert all or

any part of the outstanding and unpaid amount of this Note into fully paid and non-assessable shares of Common Stock, as such Common

Stock exists on the Issue Date, or any shares of capital stock or other securities of the Borrower into which such Common Stock shall

hereafter be changed or reclassified at the conversion price determined as provided herein (a “Conversion”); provided,

however, that in no event shall the Holder be entitled to convert any portion of this Note in excess of that portion of this Note

upon conversion of which the sum of (1) the number of shares of Common Stock beneficially owned by the Holder and its affiliates (other

than shares of Common Stock which may be deemed beneficially owned through the ownership of the unconverted portion of the Notes or the

unexercised or unconverted portion of any other security of the Borrower subject to a limitation on conversion or exercise analogous

to the limitations contained herein) and (2) the number of shares of Common Stock issuable upon the conversion of the portion of this

Note with respect to which the determination of this proviso is being made, would result in beneficial ownership by the Holder and its

affiliates of more than 4.99% of the outstanding shares of Common Stock. For purposes of the proviso to the immediately preceding sentence,

beneficial ownership shall be determined in accordance with Section 13(d) of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), and Regulations 13D-G thereunder, except as otherwise provided in clause (1) of such proviso. The beneficial ownership

limitations on conversion as set forth in the section may NOT be waived by the Holder. The number of shares of Common Stock to be

issued upon each conversion of this Note shall be determined by dividing the Conversion Amount (as defined below) by the applicable Conversion

Price then in effect on the date specified in the notice of conversion, in the form attached hereto as Exhibit B(the “Notice of

Conversion”), delivered to the Borrower by the Holder in accordance with Section 4.4 below; provided that the Notice of Conversion

is submitted by facsimile or e-mail (or by other means resulting in, or reasonably expected to result in, notice) to the Borrower before

6:00 p.m., New York, New York time on such conversion date (the “Conversion Date”); however, if the Notice of Conversion

is sent after 6:00pm, New York, New York time the Conversion Date shall be the next business day. The term “Conversion Amount”

means, with respect to any conversion of this Note, the sum of (1) the principal amount of this Note to be converted in such conversion

plus (2) at the Holder’s option, accrued and unpaid interest, if any, on such principal amount at the interest rates provided

in this Note to the Conversion Date, plus (3) at the Holder’s option, Default Interest, if any, on the amounts referred

to in the immediately preceding clauses (1) and/or (2) plus (4) at the Holder’s option, any amounts owed to the Holder pursuant

to Sections 4.4 hereof. Notwithstanding anything in this Agreement to the contrary, and in addition to the limitations set forth herein,

if the Borrower has not obtained Stockholder Approval, the Borrower shall not issue a number of shares of Common Stock under this Agreement,

which when aggregated with all other securities that are required to be aggregated for purposes of Rule 5635(d), would exceed 19.99%

of the shares of Common Stock outstanding as of the date of definitive agreement with respect to the first of such aggregated transactions

(the “Conversion Limitation”). For purposes of this section, “Stockholder Approval” means such approval as may

be required by the applicable rules and regulations of the Nasdaq Stock Market LLC (or any successor entity) from the stockholders of

the Company with respect to the issuance of the shares under this Agreement that, when taken together with any other securities that

are required to be aggregated with the issuance of the shares issued under this Agreement for purposes of Rule 5635(d) of the Nasdaq

Stock Market LLC (“Rule 5635(d)”), would exceed 19.99% of the issued and outstanding common stock as of the date of definitive

agreement with respect to the first of such aggregated transactions. “Principal Market” means the Exchanges, the quotation

platforms maintained by the OTC Markets Group) or an equivalent replacement exchange, and all rules and regulations relating to such

exchange. Upon the occurrence of an Event of Default pursuant to Section 3.6 hereof, the Conversion Limitation shall no longer apply

to limit the issuance of shares in conversion of this Note.

4.2

Conversion Price. The Conversion Price shall mean 75% multiplied by the Market Price (as defined herein) (representing a discount

rate of 25%)(subject to equitable adjustments for stock splits, stock dividends or rights offerings by the Borrower relating to the Borrower’s

securities or the securities of any subsidiary of the Borrower, combinations, recapitalization, reclassifications, extraordinary distributions

and similar events). “Market Price” means the lowest Trading Price (as defined below) for the Common Stock during the ten

(10) Trading Day period ending on the latest complete Trading Day prior to the Conversion Date. “Trading Price” means, for

any security as of any date, the closing bid price on the or applicable exchange or trading market (the “Trading Market”)

as reported by a reliable reporting service (“Reporting Service”) designated by the Holder (i.e. Bloomberg) or, if the Trading

Market is not the principal trading market for such security, the closing bid price of such security on the principal securities exchange

or trading market where such security is listed or traded or, if no closing bid price of such security is available in any of the foregoing

manners, the average of the closing bid prices of any market makers for such security that are listed in the “pink sheets”.

If the Trading Price cannot be calculated for such security on such date in the manner provided above, the Trading Price shall be the

fair market value as mutually determined by the Borrower and the holders of a majority in interest of the Notes being converted for which

the calculation of the Trading Price is required in order to determine the Conversion Price of such Notes. “Trading Day”

shall mean any day on which the Common Stock is tradable for any period on the Trading Market, or on the principal securities exchange

or other securities market on which the Common Stock is then being traded.

The

Holder shall be entitled to deduct $1,500.00 from the conversion amount in each Notice of Conversion to cover Holder’s deposit

fees associated with each Notice of Conversion. Any additional expenses incurred by Holder with respect to the Borrower’s transfer

agent, for the issuance of the Common Stock into which this Note is convertible into, shall immediately and automatically be added to

the balance of the Note at such time as the expenses are incurred by Holder.

4.3

Authorized Shares. The Borrower covenants that during the period that the Note is outstanding, the Borrower will reserve from

its authorized and unissued Common Stock a sufficient number of shares, free from preemptive rights, to provide for the issuance of Common

Stock upon the full conversion of this Note issued pursuant to the Purchase Agreement. The Borrower is required at all times to have

authorized and reserved four times the number of shares that is actually issuable upon full conversion of the Note (based on the Conversion

Price of the Note in effect from time to time initially 238,467 shares) (the “Reserved Amount”). The Reserved Amount shall

be increased (or decreased) from time to time (and in the case of each payment received by the Holder hereunder) in accordance with the

Borrower’s obligations hereunder. The Borrower represents that upon issuance, such shares will be duly and validly issued, fully

paid and non-assessable. In addition, if the Borrower shall issue any securities or make any change to its capital structure which would

change the number of shares of Common Stock into which the Notes shall be convertible at the then current Conversion Price, the Borrower

shall at the same time make proper provision so that thereafter there shall be a sufficient number of shares of Common Stock authorized

and reserved, free from preemptive rights, for conversion of the outstanding Note. The Borrower (i) acknowledges that it has irrevocably

instructed its transfer agent to issue certificates for the Common Stock issuable upon conversion of this Note, and (ii) agrees that

its issuance of this Note shall constitute full authority to its officers and agents who are charged with the duty of executing stock

certificates to execute and issue the necessary certificates for shares of Common Stock in accordance with the terms and conditions of

this Note.

If,

at any time the Borrower does not maintain the Reserved Amount it will be considered an Event of Default under this Note.

4.4

Method of Conversion.

(a)

Mechanics of Conversion. As set forth in Section 4.1 hereof, at any time following an Event of Default, and during the continuation

thereof, the balance due pursuant to this Note may be converted by the Holder in whole or in part at any time from time to time after

the Issue Date, by (A) submitting to the Borrower a Notice of Conversion

(by facsimile, e-mail or other reasonable means of communication dispatched on the Conversion Date prior to 6:00 p.m., New York, New

York time) and (B) subject to Section 4.4(b), surrendering this Note at the principal office of the Borrower

(upon payment in full of any amounts owed hereunder).

(b)

Surrender of Note Upon Conversion. Notwithstanding anything to the contrary set forth herein, upon conversion of this Note in

accordance with the terms hereof, the Holder shall not be required to physically surrender this Note to the Borrower unless the entire

unpaid principal amount of this Note is so converted. The Holder and the Borrower shall maintain records showing the principal amount

so converted and the dates of such conversions or shall use such other method, reasonably satisfactory to the Holder and the Borrower,

so as not to require physical surrender of this Note upon each such conversion.

(c)

Delivery of Common Stock Upon Conversion. Upon receipt by the Borrower from the Holder of a facsimile transmission or e-mail (or

other reasonable means of communication) of a Notice of Conversion meeting the requirements for conversion as provided in this Section

4.4, the Borrower shall issue and deliver or cause to be issued and delivered to or upon the order of the Holder certificates for the

Common Stock issuable upon such conversion within three (3) business days after such receipt subject to the terms hereof and applicable

rules of the Principal Market (as defined hereinbelow) (the “Deadline”) (and, solely in the case of conversion of the entire

unpaid principal amount hereof, surrender of this Note) in accordance with the terms hereof and the Purchase Agreement. Upon receipt

by the Borrower of a Notice of Conversion, the Holder shall be deemed to be the holder of record of the Common Stock issuable upon such

conversion, the outstanding principal amount and the amount of accrued and unpaid interest on this Note shall be reduced to reflect such

conversion, and, unless the Borrower defaults on its obligations hereunder, all rights with respect to the portion of this Note being

so converted shall forthwith terminate except the right to receive the Common Stock or other securities, cash or other assets, as herein

provided, on such conversion. If the Holder shall have given a Notice of Conversion as provided herein, the Borrower’s obligation

to issue and deliver the certificates for Common Stock shall be absolute and unconditional, irrespective of the absence of any action

by the Holder to enforce the same, any waiver or consent with respect to any provision thereof, the recovery of any judgment against

any person or any action to enforce the same, any failure or delay in the enforcement of any other obligation of the Borrower to the

holder of record, or any setoff, counterclaim, recoupment, limitation or termination, or any breach or alleged breach by the Holder of

any obligation to the Borrower, and irrespective of any other circumstance which might otherwise limit such obligation of the Borrower

to the Holder in connection with such conversion.

(d)

Delivery of Common Stock by Electronic Transfer. In lieu of delivering physical certificates representing the Common Stock issuable

upon conversion, provided the Borrower is participating in the Depository Trust Company (“DTC”) Fast Automated Securities

Transfer (“FAST”) program, upon request of the Holder and its compliance with the provisions set forth herein, the Borrower

shall use its best efforts to cause its transfer agent to electronically transmit the Common Stock issuable upon conversion to the Holder

by crediting the account of Holder’s Prime Broker with DTC through its Deposit and Withdrawal at Custodian (“DWAC”)

system.

(e)

Failure to Deliver Common Stock Prior to Deadline. Without in any way limiting the Holder’s right to pursue other remedies,

including actual damages and/or equitable relief, the parties agree that if delivery of the Common Stock issuable upon conversion of

this Note is not delivered by the Deadline due to willful and purposeful action and/or inaction of the Borrower, the Borrower shall pay

to the Holder $2,000 per day in cash, for each day beyond the Deadline that the Borrower fails to deliver such Common Stock (the “Fail

to Deliver Fee”); provided; however that the Fail to Deliver Fee shall not be due if the failure is a result of a third party (i.e.,

transfer agent; and not the result of any failure to pay such transfer agent) despite the best efforts of the Borrower to effect delivery

of such Common Stock. Such cash amount shall be paid to Holder by the fifth day of the month following the month in which it has accrued

or, at the option of the Holder (by written notice to the Borrower by the first day of the month following the month in which it has

accrued), shall be added to the principal amount of this Note, in which event interest shall accrue thereon in accordance with the terms

of this Note and such additional principal amount shall be convertible into Common Stock in accordance with the terms of this Note. The

Borrower agrees that the right to convert is a valuable right to the Holder. The damages resulting from a failure, attempt to frustrate,

interference with such conversion right are difficult if not impossible to qualify. Accordingly, the parties acknowledge that the liquidated

damages provision contained in this Section 4.4(e) are justified.

4.5

Concerning the Shares. The shares of Common Stock issuable upon conversion of this Note may not be sold or transferred unless:

(i) such shares are sold pursuant to an effective registration statement under the Act or (ii) the Borrower or its transfer agent shall

have been furnished with an opinion of counsel (which opinion shall be in form, substance and scope customary for opinions of counsel

in comparable transactions) to the effect that the shares to be sold or transferred may be sold or transferred pursuant to an exemption

from such registration (such as Rule 144 or a successor rule) (“Rule 144”); or (iii) such shares are transferred to an “affiliate”

(as defined in Rule 144) of the Borrower who agrees to sell or otherwise transfer the shares only in accordance with this Section 4.5

and who is an Accredited Investor (as defined in the Purchase Agreement).

Any

restrictive legend on certificates representing shares of Common Stock issuable upon conversion of this Note shall be removed and the

Borrower shall issue to the Holder a new certificate therefore free of any transfer legend if the Borrower or its transfer agent shall

have received an opinion of counsel from Holder’s counsel, in form, substance and scope customary for opinions of counsel in comparable

transactions, to the effect that (i) a public sale or transfer of such Common Stock may be made without registration under the Act, which

opinion shall be accepted by the Company so that the sale or transfer is effected; or (ii) in the case of the Common Stock issuable upon

conversion of this Note, such security is registered for sale by the Holder under an effective registration statement filed under the

Act; or otherwise may be sold pursuant to an exemption from registration. In the event that the Company does not reasonably accept the

opinion of counsel that properly conforms to applicable securities laws provided by the Holder with respect to the transfer of Securities

pursuant to an exemption from registration (such as Rule 144), it will be considered an Event of Default pursuant to this Note.

4.6

Effect of Certain Events.

(a)

Effect of Merger, Consolidation, Etc. At the option of the Holder, the sale, conveyance or disposition of all or substantially

all of the assets of the Borrower, the effectuation by the Borrower of a transaction or series of related transactions in which more

than 50% of the voting power of the Borrower is disposed of, or the consolidation, merger or other business combination of the Borrower

with or into any other Person (as defined below) or Persons when the Borrower is not the survivor shall be deemed to be an Event of Default

(as defined in Article III) pursuant to which the Borrower shall be required to pay to the Holder upon the consummation of and as a condition

to such transaction an amount equal to the Default Amount (as defined in Article III). “Person” shall mean any individual,

corporation, limited liability company, partnership, association, trust or other entity or organization.

(b)

Adjustment Due to Merger, Consolidation, Etc. If, at any time when this Note is issued and outstanding and prior to conversion

of all of the Note, there shall be any merger, consolidation, exchange of shares, recapitalization, reorganization, or other similar

event, as a result of which shares of Common Stock of the Borrower shall be changed into the same or a different number of shares of

another class or classes of stock or securities of the Borrower or another entity, or in case of any sale or conveyance of all or substantially

all of the assets of the Borrower other than in connection with a plan of complete liquidation of the Borrower, then the Holder of this

Note shall thereafter have the right to receive upon conversion of this Note, upon the basis and upon the terms and conditions specified

herein and in lieu of the shares of Common Stock immediately theretofore issuable upon conversion, such stock, securities or assets which

the Holder would have been entitled to receive in such transaction had this Note been converted in full immediately prior to such transaction

(without regard to any limitations on conversion set forth herein), and in any such case appropriate provisions shall be made with respect

to the rights and interests of the Holder of this Note to the end that the provisions hereof (including, without limitation, provisions

for adjustment of the Conversion Price and of the number of shares issuable upon conversion of the Note) shall thereafter be applicable,

as nearly as may be practicable in relation to any securities or assets thereafter deliverable upon the conversion hereof. The Borrower

shall not affect any transaction described in this Section 4.6(b) unless (a) it first gives, to the extent practicable, ten (10) days

prior written notice (but in any event at least five (5) days prior written notice) of the record date of the special meeting of stockholders

to approve, or if there is no such record date, the consummation of, such merger, consolidation, exchange of shares, recapitalization,

reorganization or other similar event or sale of assets (during which time the Holder shall be entitled to convert this Note) and (b)

the resulting successor or acquiring entity (if not the Borrower) assumes by written instrument the obligations of this Note. The above

provisions shall similarly apply to successive consolidations, mergers, sales, transfers or share exchanges.

(c)

Adjustment Due to Distribution. If the Borrower shall declare or make any distribution of its assets (or rights to acquire its

assets) to holders of Common Stock as a dividend, stock repurchase, by way of return of capital or otherwise (including any dividend

or distribution to the Borrower’s stockholders in cash or shares (or rights to acquire shares) of capital stock of a subsidiary

(i.e., a spin-off)) (a “Distribution”), then the Holder of this Note shall be entitled, upon any conversion of this Note

after the date of record for determining stockholders entitled to such Distribution, to receive the amount of such assets which would

have been payable to the Holder with respect to the shares of Common Stock issuable upon such conversion had such Holder been the holder

of such shares of Common Stock on the record date for the determination of stockholders entitled to such Distribution.

ARTICLE

V. MISCELLANEOUS

5.1

Failure or Indulgence Not Waiver. No failure or delay on the part of the Holder in the exercise of any power, right or privilege

hereunder shall operate as a waiver thereof, nor shall any single or partial exercise of any such power, right or privilege preclude

other or further exercise thereof or of any other right, power or privileges. All rights and remedies existing hereunder are cumulative

to, and not exclusive of, any rights or remedies otherwise available.

5.2

Notices. All notices, demands, requests, consents, approvals, and other communications required or permitted hereunder shall be

in writing and, unless otherwise specified herein, shall be (i) personally served, (ii) deposited in the mail, registered or certified,

return receipt requested, postage prepaid, (iii) delivered by reputable air courier service with charges prepaid, or (iv) transmitted

by hand delivery, telegram, or facsimile, addressed as set forth below or to such other address as such party shall have specified most

recently by written notice. Any notice or other communication required or permitted to be given hereunder shall be deemed effective (a)

upon hand delivery or delivery by facsimile, with accurate confirmation generated by the transmitting facsimile machine, at the address

or number designated below (if delivered on a business day during normal business hours where such notice is to be received), or the

first business day following such delivery (if delivered other than on a business day during normal business hours where such notice

is to be received) or (b) on the second business day following the date of mailing by express courier service, fully prepaid, addressed

to such address, or upon actual receipt of such mailing, whichever shall first occur. The addresses for such communications shall be:

If

to the Borrower, to:

AMERICAN

REBEL HOLDINGS, INC.

5115

Maryland Way, Suite 303

Brentwood,

Tennessee 37027

Attn:

Charles A. Ross, Jr., Chief Executive Officer Email: andy@andyross.com

If

to the Holder:

1800

DIAGONAL LENDING LLC

1800

Diagonal Road, Suite 623

Alexandria

VA 22314

Attn:

Curt Kramer, President Email: ckramer6@bloomberg.net

5.3

Amendments. This Note and any provision hereof may only be amended by an instrument in writing signed by the Borrower and the

Holder. The term “Note” and all reference thereto, as used throughout this instrument, shall mean this instrument (and the

other Notes issued pursuant to the Purchase Agreement) as originally executed, or if later amended or supplemented, then as so amended

or supplemented.

5.4

Assignability. This Note shall be binding upon the Borrower and its successors and assigns, and shall inure to be the benefit

of the Holder and its successors and assigns. Each transferee of this Note must be an “accredited investor” (as defined in

Rule 501(a) of the Securities and Exchange Commission). Notwithstanding anything in this Note to the contrary, this Note may be pledged

as collateral in connection with a bona fide margin account or other lending arrangement; and may be assigned by the Holder without

the consent of the Borrower.

5.5

Cost of Collection. If default is made in the payment of this Note, the Borrower shall pay the Holder hereof costs of collection,

including reasonable attorneys’ fees.

5.6

Governing Law. This Note shall be governed by and construed in accordance with the laws of the Commonwealth of Virginia without

regard to principles of conflicts of laws. Any action brought by either party against the other concerning the transactions contemplated

by this Note shall be brought only in the Circuit Court of Fairfax County, Virginia or in the Alexandria Division of the United States

District Court for the Eastern District of Virginia. The parties to this Note hereby irrevocably waive any objection to jurisdiction

and venue of any action instituted hereunder and shall not assert any objection or defense based on lack of jurisdiction or venue or

based upon forum non conveniens. The Borrower and Holder waive trial by jury. The Holder shall be entitled to recover from the

Borrower its reasonable attorney’s fees and costs incurred in connection with or related to any Event of Default by the Company,

as defined in Article III hereof. In the event that any provision of this Note or any other agreement delivered in connection herewith

is invalid or unenforceable under any applicable statute or rule of law, then such provision shall be deemed inoperative to the extent

that it may conflict therewith and shall be deemed modified to conform with such statute or rule of law. Any such provision which may

prove invalid or unenforceable under any law shall not affect the validity or enforceability of any other provision hereof or any agreement

delivered in connection herewith. Each party hereby irrevocably waives personal service of process and consents to process being served

in any suit, action or proceeding in connection with this Note, any agreement or any other document delivered in connection with this

Note by mailing a copy thereof via registered or certified mail or overnight delivery (with evidence of delivery) to such party at the

address in effect for notices to it under this Note and agrees that such service shall constitute good and sufficient service of process

and notice thereof. Nothing contained herein shall be deemed to limit in any way any right to serve process in any other manner permitted

by law.

5.7

Purchase Agreement. By its acceptance of this Note, each party agrees to be bound by the applicable terms of the Purchase Agreement.

5.8

Remedies. The Borrower acknowledges that a breach by it of its obligations hereunder will cause irreparable harm to the Holder,

by vitiating the intent and purpose of the transaction contemplated hereby. Accordingly, the Borrower acknowledges that the remedy at

law for a breach of its obligations under this Note will be inadequate and agrees, in the event of a breach or threatened breach by the

Borrower of the provisions of this Note, that the Holder shall be entitled, in addition to all other available remedies at law or in

equity, and in addition to the penalties assessable herein, to an injunction or injunctions restraining, preventing or curing any breach

of this Note and to enforce specifically the terms and provisions thereof, without the necessity of showing economic loss and without

any bond or other security being required.

IN

WITNESS WHEREOF, Borrower has caused this Note to be signed in its name by its duly authorized officer this on October 4, 2024

| AMERICAN

REBEL HOLDINGS, INC. |

|

| |

|

|

| By:

|

|

|

| |

Charles

A. Ross, Jr. |

|

| |

Chief

Executive Officer |

|

EXHIBIT

A – WIRE INSTRUCTIONS

| Bank

Name: |

|

United

Bank Fairfax |

| Bank

Address: |

|

11185

Fairfax Road, Fairfax, VA 22030 |

| Routing

Number: |

|

056004445

|

| Beneficiary

Account Number: |

|

86475980 |

| Beneficiary: |

|

1800

Diagonal Lending LLC |

| Mailing

Address: |

|

1800

Diagonal Road, Suite 623, Alexandria, VA 22314 |

EXHIBIT

B — NOTICE OF CONVERSION

The

undersigned hereby elects to convert $ principal amount of the Note (defined below) into that number of shares of Common Stock

to be issued pursuant to the conversion of the Note (“Common Stock”) as set forth below, of AMERICAN REBEL HOLDINGS, INC.,

a Nevada corporation (the “Borrower”) according to the conditions of the convertible note of the Borrower dated as of October

4, 2024 (the “Note”), as of the date written below. No fee will be charged to the Holder for any conversion, except for transfer

taxes, if any.

Box

Checked as to applicable instructions:

| |

☐ |

The Borrower shall electronically

transmit the Common Stock issuable pursuant to this Notice of Conversion to the account of the undersigned or its nominee with DTC

through its Deposit Withdrawal Agent Commission system (“DWAC Transfer”). |

Name

of DTC Prime Broker:

Account

Number:

| |

☐ |

The undersigned hereby requests

that the Borrower issue a certificate or certificates for the number of shares of Common Stock set forth below (which numbers are based

on the Holder’s calculation attached hereto) in the name(s) specified immediately below or, if additional space is necessary,

on an attachment hereto: |

| Date of conversion: | |

| | |

| Applicable Conversion Price: | |

$ | | |

| Number of shares of common

stock to be issued pursuant to conversion of the Notes: | |

| | |

| Amount of Principal Balance

due remaining under the Note after this conversion: | |

| | |

| 1800

DIAGONAL LENDING LLC |

|

| |

|

|

| By: |

|

|

| Name: |

Curt

Kramer |

|

| Title: |

President |

|

| Date:

|

|

|

Exhibit 10.2

SECURITIES

PURCHASE AGREEMENT

This

SECURITIES PURCHASE AGREEMENT (the “Agreement”), dated as of October 4, 2024, by and between AMERICAN REBEL HOLDINGS,

INC., a Nevada corporation, with its address at 5115 Maryland Way, Suite 303, Brentwood, Tennessee 37027 (the “Company”),

and 1800 DIAGONAL LENDING LLC, a Virginia limited liability company, with its address at 1800 Diagonal Road, Suite 623, Alexandria

VA 22314 (the “Buyer”).

WHEREAS:

A.

The Company and the Buyer are executing and delivering this Agreement in reliance upon the exemption from securities registration afforded

by the rules and regulations as promulgated by the United States Securities and Exchange Commission (the “SEC”) under the

Securities Act of 1933, as amended (the “1933 Act”); and

B.

Buyer desires to purchase and the Company desires to issue and sell, upon the terms and conditions set forth in this Agreement, a promissory

note of the Company, in the form attached hereto as Exhibit A, in the aggregate principal amount of $122,960.00 (including $16,960.00

of Original Issue Discount) (the “Note”); and

NOW

THEREFORE, the Company and the Buyer severally (and not jointly) hereby agree as follows:

1.

Purchase and Sale of the Securities.

a.

Purchase of the Securities. On the Closing Date (as defined below), the Company shall issue and sell to the Buyer and the Buyer

agrees to purchase from the Company the Securities as is set forth immediately below the Buyer’s name on the signature pages hereto.

b.

Form of Payment. On the Closing Date (as defined below), (i) the Buyer shall pay the purchase price for the Securities be issued

and sold to it at the Closing (as defined below) (the “Purchase Price”) by wire transfer of immediately available funds to

the Company, in accordance with the Company’s written wiring instructions, against delivery of the Securities, and (ii) the Company

shall deliver such duly executed Note on behalf of the Company against delivery of such Purchase Price.

c.

Closing Date. Subject to the satisfaction (or written waiver) of the conditions thereto set forth in Section 6 and Section 7 below,

the date and time of the issuance and sale of the Securities pursuant to this Agreement (the “Closing Date”) shall be 12:00

noon, Eastern Standard Time on or about October 7, 2024, or such other mutually agreed upon time. The closing of the transactions contemplated

by this Agreement (the “Closing”) shall occur on the Closing Date at such location as may be agreed to by the parties.

2.

Buyer’s Representations and Warranties. The Buyer represents and warrants to the Company that:

a.

Investment Purpose. As of the date hereof, the Buyer is purchasing the Note and the shares of Common Stock issuable upon conversion

of or otherwise pursuant to the Note (such shares of Common Stock being collectively referred to herein as the “Conversion Shares”

and, collectively with the Note, the “Securities”) for its own account and not with a present view towards the public sale

or distribution thereof, except pursuant to sales registered or exempted from registration under the 1933 Act.

b.

Accredited Investor Status. The Buyer is an “accredited investor” as that term is defined in Rule 501(a) of Regulation

D (an “Accredited Investor”).

c.

Reliance on Exemptions. The Buyer understands that the Securities are being offered and sold to it in reliance upon specific exemptions

from the registration requirements of United States federal and state securities laws and that the Company is relying upon the truth

and accuracy of, and the Buyer’s compliance with, the representations, warranties, agreements, acknowledgments and understandings

of the Buyer set forth herein in order to determine the availability of such exemptions and the eligibility of the Buyer to acquire the

Securities.

d.

Information. The Company has not disclosed to the Buyer any material nonpublic information and will not disclose such information

unless such information is disclosed to the public prior to or promptly following such disclosure to the Buyer.

e.

Legends. The Buyer understands that the Securities have not been registered under the 1933 Act; and may bear a restrictive legend

in substantially the following form:

“THE

SECURITIES REPRESENTED BY THIS INSTRUMENT HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES

ACT”), OR UNDER ANY STATE SECURITIES LAWS, AND MAY NOT BE PLEDGED, SOLD, ASSIGNED, HYPOTHECATED OR OTHERWISE TRANSFERRED UNLESS

(1) A REGISTRATION STATEMENT WITH RESPECT THERETO IS EFFECTIVE UNDER THE SECURITIES ACT AND ANY APPLICABLE STATE SECURITIES LAWS OR (2)

THE ISSUER OF SUCH SECURITIES RECEIVES AN OPINION OF COUNSEL TO THE BUYER OF SUCH SECURITIES, WHICH COUNSEL AND OPINION ARE REASONABLY

ACCEPTABLE TO THE ISSUER’S TRANSFER AGENT, THAT SUCH SECURITIES MAY BE PLEDGED, SOLD, ASSIGNED, HYPOTHECATED OR OTHERWISE TRANSFERRED

WITHOUT AN EFFECTIVE REGISTRATION STATEMENT UNDER THE SECURITIES ACT AND APPLICABLE STATE SECURITIES LAWS.”

The

legend set forth above shall be removed and the Company shall issue a certificate without such legend to the Buyer of any Security upon

which it is stamped, if, unless otherwise required by applicable state securities laws, (a) such Security is registered for sale under

an effective registration statement filed under the 1933 Act or otherwise may be sold pursuant to an exemption from registration without

any restriction as to the number of securities as of a particular date that can then be immediately sold, or (b) such Buyer provides

the Company with an opinion of counsel, in form, substance and scope customary for opinions of counsel in comparable transactions, to

the effect that a public sale or transfer of such Security may be made without registration under the 1933 Act, which opinion shall be

accepted by the Company so that the sale or transfer is effected. The Buyer agrees to sell all Securities, including those represented

by a certificate(s) from which the legend has been removed, in compliance with applicable prospectus delivery requirements, if any. In

the event that the Company does not reasonably accept the opinion of counsel that properly conforms to applicable securities laws provided

by the Buyer with respect to the transfer of any Securities pursuant to an exemption from registration, such as Rule 144, at the Deadline,

it will be considered an Event of Default pursuant to Section 3.2 of the Note.

f.

Authorization; Enforcement. This Agreement has been duly and validly authorized. This Agreement has been duly executed and delivered

on behalf of the Buyer, and this Agreement constitutes a valid and binding agreement of the Buyer enforceable in accordance with its

terms.

3.

Representations and Warranties of the Company. The Company represents and warrants to the Buyer that:

a.

Organization and Qualification. The Company and each of its Subsidiaries (as defined below), if any, is a corporation duly organized,

validly existing and in good standing under the laws of the jurisdiction in which it is incorporated, with full power and authority (corporate

and other) to own, lease, use and operate its properties and to carry on its business as and where now owned, leased, used, operated

and conducted. “Subsidiaries” means any corporation or other organization, whether incorporated or unincorporated, in which

the Company owns, directly or indirectly, any equity or other ownership interest.

b.

Authorization; Enforcement. (i) The Company has all requisite corporate power and authority to enter into and perform this Agreement,

the Note and to consummate the transactions contemplated hereby and thereby and to issue the Securities, in accordance with the terms

hereof and thereof, (ii) the execution and delivery of this Agreement, the Note by the Company and the consummation by it of the transactions

contemplated hereby and thereby (including without limitation, the issuance of the Note has been duly authorized by the Company’s

Board of Directors and no further consent or authorization of the Company, its Board of Directors, or its shareholders is required, (iii)

this Agreement has been duly executed and delivered by the Company by its authorized representative, and such authorized representative

is the true and official representative with authority to sign this Agreement and the other documents executed in connection herewith

and bind the Company accordingly, and (iv) this Agreement constitutes, and upon execution and delivery by the Company of the Note, each

of such instruments will constitute, a legal, valid and binding obligation of the Company enforceable against the Company in accordance

with its terms.

c.

Capitalization. As of the date hereof, the authorized common stock of the Company consists of 600,000,000 authorized shares of

Common Stock, $0.001 par value per share, of which 1,084,491 shares are issued and outstanding. All of such outstanding shares of capital

stock are, or upon issuance will be, duly authorized, validly issued, fully paid and non-assessable.

d.

Issuance of Shares. The Securities are duly authorized and reserved for issuance in accordance with its respective terms, will

be validly issued, fully paid and non-assessable, and free from all taxes, liens, claims and encumbrances with respect to the issue thereof

and shall not be subject to preemptive rights or other similar rights of shareholders of the Company and will not impose personal liability

upon the Buyer thereof.

e.

No Conflicts. The execution, delivery and performance of this Agreement, the Note by the Company and the consummation by the Company

of the transactions contemplated hereby and thereby will not (i) conflict with or result in a violation of any provision of the Certificate

of Incorporation or By-laws, or (ii) violate or conflict with, or result in a breach of any provision of, or constitute a default (or

an event which with notice or lapse of time or both could become a default) under, or give to others any rights of termination, amendment,

acceleration or cancellation of, any agreement, indenture, patent, patent license or instrument to which the Company or any of its Subsidiaries

is a party, or (iii) result in a violation of any law, rule, regulation, order, judgment or decree (including federal and state securities

laws and regulations and regulations of any self-regulatory organizations to which the Company or its securities are subject) applicable

to the Company or any of its Subsidiaries or by which any property or asset of the Company or any of its Subsidiaries is bound or affected

(except for such conflicts, defaults, terminations, amendments, accelerations, cancellations and violations as would not, individually

or in the aggregate, have a Material Adverse Effect). The businesses of the Company and its Subsidiaries, if any, are not being conducted,

and shall not be conducted so long as the Buyer owns any of the Securities, in violation of any law, ordinance or regulation of any governmental

entity. “Material Adverse Effect” means any material adverse effect on the business, operations, assets, financial condition

or prospects of the Company or its Subsidiaries, if any, taken as a whole, or on the transactions contemplated hereby or by the agreements

or instruments to be entered into in connection herewith.

f.

SEC Documents; Financial Statements. The Company has filed all reports, schedules, forms, statements and other documents required

to be filed by it with the SEC pursuant to the reporting requirements of the Securities Exchange Act of 1934, as amended (the “1934

Act”) (all of the foregoing filed prior to the date hereof and all exhibits included therein and documents (other than exhibits

to such documents) incorporated by reference therein, being hereinafter referred to herein as the “SEC Documents”). As a

result of the May 3, 2024 BF Borgers SEC action and the inability of BF Borgers to appear or practice before the SEC, all of the Company’s

financial statements, references and disclosures are specifically excluded from the definition of SEC Documents, the Company cannot rep

or warrant to any such financial statements. Upon written request the Company will deliver to the Buyer true and complete copies of the

SEC Documents, except for such exhibits and incorporated documents. As of their respective dates or if amended, as of the dates of the

amendments, the SEC Documents complied in all material respects with the requirements of the 1934 Act and the rules and regulations of

the SEC promulgated thereunder applicable to the SEC Documents, and none of the SEC Documents, at the time they were filed with the SEC,

contained any untrue statement of a material fact or omitted to state a material fact required to be stated therein or necessary in order

to make the statements therein, in light of the circumstances under which they were made, not misleading. None of the statements made

in any such SEC Documents is, or has been, required to be amended or updated under applicable law (except for the re-audit of the Company’s

financial statements for the years ended December 31, 2022 and 2023 and except for such statements as have been amended or updated in

subsequent filings prior the date hereof). The Company is subject to the reporting requirements of the 1934 Act.

g.

Absence of Certain Changes. Since June 30, 2024, except as set forth in the SEC Documents and for the BF Borgers SEC action, there

has been no material adverse change and no material adverse development in the assets, liabilities, business, properties, operations,

financial condition, results of operations, prospects or 1934 Act reporting status of the Company or any of its Subsidiaries.

h.

Absence of Litigation. Except as set forth in the SEC Documents, there is no action, suit, claim, proceeding, inquiry or investigation

before or by any court, public board, government agency, self-regulatory organization or body pending or, to the knowledge of the Company

or any of its Subsidiaries, threatened against or affecting the Company or any of its Subsidiaries, or their officers or directors in

their capacity as such, that could have a Material Adverse Effect. The Company and its Subsidiaries are unaware of any facts or circumstances

which might give rise to any of the foregoing.

i.

No Integrated Offering. Neither the Company, nor any of its affiliates, nor any person acting on its or their behalf, has directly

or indirectly made any offers or sales in any security or solicited any offers to buy any security under circumstances that would require

registration under the 1933 Act of the issuance of the Securities to the Buyer. The issuance of the Securities to the Buyer will not

be integrated with any other issuance of the Company’s securities (past, current or future) for purposes of any shareholder approval

provisions applicable to the Company or its securities.

j.

No Brokers. The Company has taken no action which would give rise to any claim by any person for brokerage commissions, transaction

fees or similar payments relating to this Agreement or the transactions contemplated hereby.

k.

No Investment Company. The Company is not, and upon the issuance and sale of the Securities as contemplated by this Agreement

will not be an “investment company” required to be registered under the Investment Company Act of 1940 (an “Investment

Company”). The Company is not controlled by an Investment Company.

l.

Breach of Representations and Warranties by the Company. If the Company breaches any of the material representations or warranties

set forth in this Section 3 which is continuing after the applicable cure period as set forth in the Note, if any, and in addition to

any other remedies available to the Buyer pursuant to this Agreement, it will be considered an Event of default under Article III of

the Note.

4.

COVENANTS.

a.

Reasonable Commercial Efforts. The Company shall use its reasonable commercial efforts to satisfy timely each of the conditions

described in Section 7 of this Agreement.

b.

Use of Proceeds. The Company shall use the proceeds for general working capital purposes.

c.

Expenses. At the Closing, the Company’s obligation with respect to the transactions contemplated by this Agreement is to

reimburse Buyer’ expenses shall be $6,000.00 for Buyer’s legal fees and due diligence fee.

d.

Corporate Existence. So long as the Buyer beneficially owns any Note, the Company shall maintain its corporate existence and shall

not sell all or substantially all of the Company’s assets, except with the prior written consent of the Buyer.

e.

Breach of Covenants. If the Company breaches any of the material covenants set forth in this Section 4, and in addition to any

other remedies available to the Buyer pursuant to this Agreement which is continuing after the applicable cure period as set forth in

the Note, it will be considered an event of default under Article III of the Note.

f.

Failure to Comply with the 1934 Act. So long as the Buyer beneficially owns the Note, the Company shall comply with the reporting

requirements of the 1934 Act; and the Company shall continue to be subject to the reporting requirements of the 1934 Act.

g.

The Buyer is Not a “Dealer”. The Buyer and the Company hereby acknowledge and agree that the Buyer has not: (i) acted

as an underwriter; (ii) acted as a market maker or specialist; (iii) acted as “de facto” market maker; or (iv) conducted

any other professional market activities such as providing investment advice, extending credit and lending securities in connection;

and thus that the Buyer is not a “Dealer” as such term is defined in the 1934 Act.

h.

Trading Activities. Neither the Buyer nor its affiliates has an open short position in the common stock of the Company and the

Buyer agrees that it shall not, and that it will cause its affiliates not to, engage in any short sales of or hedging transactions with

respect to the common stock of the Company.

5.

Transfer Agent Instructions. The Company shall issue irrevocable instructions to its transfer agent to issue certificates, registered

in the name of the Buyer or its nominee, for the shares underlying any conversion of the Note upon default of the Note (the “Conversion

Shares”) in such amounts as specified from time to time by the Buyer to the Company upon conversion of the Note in accordance with

the terms thereof (the “Irrevocable Transfer Agent Instructions”). In the event that the Company proposes to replace its

transfer agent, the Company shall provide, prior to the effective date of such replacement, a fully executed Irrevocable Transfer Agent

Instructions in a form as initially delivered pursuant to this Agreement (including but not limited to the provision to irrevocably reserve

shares of Common Stock in the Reserved Amount as such term is defined in the Note) signed by the successor transfer agent to Company

and the Company. Prior to registration of the Conversion Shares under the 1933 Act or the date on which the Conversion Shares may be

sold pursuant to an exemption from registration, all such certificates shall bear the restrictive legend specified in Section 2(e) of

this Agreement. The Company warrants that: (i) no instruction other than the Irrevocable Transfer Agent Instructions referred to in this

Section 5, will be given by the Company to its transfer agent and that the Securities shall otherwise be freely transferable on the books

and records of the Company as and to the extent provided in this Agreement and the Note; (ii) it will not direct its transfer agent not

to transfer or delay, impair, and/or hinder its transfer agent in transferring (or issuing)(electronically or in certificated form) any

certificate for Conversion Shares to be issued to the Buyer upon conversion of or otherwise pursuant to the Note as and when required

by the Note and this Agreement; and (iii) it will not fail to remove (or directs its transfer agent not to remove or impairs, delays,

and/or hinders its transfer agent from removing) any restrictive legend (or to withdraw any stop transfer instructions in respect thereof)

on any certificate for any Conversion Shares issued to the Buyer upon conversion of or otherwise pursuant to the Note as and when required

by the Note and/or this Agreement. If the Buyer provides the Company and the Company’s transfer, at the cost of the Buyer, with

an opinion of counsel in form, substance and scope customary for opinions in comparable transactions, to the effect that a public sale

or transfer of such Securities may be made without registration under the 1933 Act, the Company shall permit the transfer, and, in the

case of the Conversion Shares, promptly instruct its transfer agent to issue one or more certificates, free from restrictive legend,

in such name and in such denominations as specified by the Buyer. The Company acknowledges that a breach by it of its obligations hereunder

will cause irreparable harm to the Buyer, by vitiating the intent and purpose of the transactions contemplated hereby. Accordingly, the

Company acknowledges that the remedy at law for a breach of its obligations under this Section 5 may be inadequate and agrees, in the

event of a breach or threatened breach by the Company of the provisions of this Section, that the Buyer shall be entitled, in addition

to all other available remedies, to an injunction restraining any breach and requiring immediate transfer, without the necessity of showing

economic loss and without any bond or other security being required.

6.

Conditions to the Company’s Obligation to Sell. The obligation of the Company hereunder to issue and sell the Securities

to the Buyer at the Closing is subject to the satisfaction, at or before the Closing Date of each of the following conditions thereto,

provided that these conditions are for the Company’s sole benefit and may be waived by the Company at any time in its sole discretion:

a.

The Buyer shall have executed this Agreement and delivered the same to the Company.

b.

The Buyer shall have delivered the Purchase Price in accordance with Section 1(b) above.

c.

The representations and warranties of the Buyer shall be true and correct in all material respects as of the date when made and as of

the Closing Date as though made at that time (except for representations and warranties that speak as of a specific date), and the Buyer

shall have performed, satisfied and complied in all material respects with the covenants, agreements and conditions required by this

Agreement to be performed, satisfied or complied with by the Buyer at or prior to the Closing Date.

d.

No litigation, statute, rule, regulation, executive order, decree, ruling or injunction shall have been enacted, entered, promulgated

or endorsed by or in any court or governmental authority of competent jurisdiction or any self-regulatory organization having authority

over the matters contemplated hereby which prohibits the consummation of any of the transactions contemplated by this Agreement.

7.

Conditions to The Buyer’s Obligation to Purchase. The obligation of the Buyer hereunder to purchase the Securities at the

Closing is subject to the satisfaction, at or before the Closing Date of each of the following conditions, provided that these conditions

are for the Buyer’s sole benefit and may be waived by the Buyer at any time in its sole discretion:

a.

The Company shall have executed this Agreement and delivered the same to the Buyer.

b.

The Company shall have delivered to the Buyer the duly executed Note, in accordance with Section 1(b) above.

c.

The Irrevocable Transfer Agent Instructions, in form and substance satisfactory to the Buyer, shall have been delivered to and acknowledged

in writing by the Company’s Transfer Agent.

d.

The representations and warranties of the Company shall be true and correct in all material respects as of the date when made and as

of the Closing Date as though made at such time (except for representations and warranties that speak as of a specific date) and the

Company shall have performed, satisfied and complied in all material respects with the covenants, agreements and conditions required

by this Agreement to be performed, satisfied or complied with by the Company at or prior to the Closing Date. The Buyer shall have received

a certificate or certificates, executed by the chief executive officer of the Company, dated as of the Closing Date, to the foregoing

effect and as to such other matters as may be reasonably requested by the Buyer including, but not limited to certificates with respect

to the Board of Directors’ resolutions relating to the transactions contemplated hereby.

e.

No litigation, statute, rule, regulation, executive order, decree, ruling or injunction shall have been enacted, entered, promulgated

or endorsed by or in any court or governmental authority of competent jurisdiction or any self-regulatory organization having authority

over the matters contemplated hereby which prohibits the consummation of any of the transactions contemplated by this Agreement.

f.

No event shall have occurred which could reasonably be expected to have a Material Adverse Effect on the Company including but not limited

to a change in the 1934 Act reporting status of the Company or the failure of the Company to be timely in its 1934 Act reporting obligations.

8.

Governing Law; Miscellaneous.

a.

Governing Law. This Agreement shall be governed by and construed in accordance with the laws of the Commonwealth of Virginia without

regard to principles of conflicts of laws. Any action brought by either party against the other concerning the transactions contemplated

by this Agreement shall be brought only in the Circuit Court of Fairfax County, Virginia or in the Alexandria Division of the United

States District Court for the Eastern District of Virginia. The parties to this Agreement hereby irrevocably waive any objection to jurisdiction

and venue of any action instituted hereunder and shall not assert any objection or defense based on lack of jurisdiction or venue or

based upon forum non conveniens. The Company and Buyer waive trial by jury. The Buyer shall be entitled to recover from the Company

its reasonable attorney’s fees and costs incurred in connection with or related to any Event of Default by the Company, as defined

in Article III of the Note. Each party hereby irrevocably waives personal service of process and consents to process being served in

any suit, action or proceeding in connection with this Agreement, the Note or any related document or agreement by mailing a copy thereof

via registered or certified mail or overnight delivery (with evidence of delivery) to such party at the address in effect for notices

to it under this Agreement and agrees that such service shall constitute good and sufficient service of process and notice thereof. Nothing

contained herein shall be deemed to limit in any way any right to serve process in any other manner permitted by law.

b.

Counterparts. This Agreement may be executed in one or more counterparts, each of which shall be deemed an original but all of

which shall constitute one and the same agreement and shall become effective when counterparts have been signed by each party and delivered

to the other party.

c.

Headings. The headings of this Agreement are for convenience of reference only and shall not form part of, or affect the interpretation

of, this Agreement.

d.

Severability. In the event that any provision of this Agreement is invalid or unenforceable under any applicable statute or rule

of law, then such provision shall be deemed inoperative to the extent that it may conflict therewith and shall be deemed modified to

conform with such statute or rule of law. Any provision hereof which may prove invalid or unenforceable under any law shall not affect

the validity or enforceability of any other provision hereof.

e.

Entire Agreement; Amendments. This Agreement and the instruments referenced herein contain the entire understanding of the parties

with respect to the matters covered herein and therein and, except as specifically set forth herein or therein, neither the Company nor

the Buyer makes any representation, warranty, covenant or undertaking with respect to such matters. No provision of this Agreement may

be waived or amended other than by an instrument in writing signed by each of the parties hereto.

f.

Notices. All notices, demands, requests, consents, approvals, and other communications required or permitted hereunder shall be

in writing and, unless otherwise specified herein, shall be (i) personally served, (ii) deposited in the mail, registered or certified,

return receipt requested, postage prepaid, (iii) delivered by reputable air courier service with charges prepaid, or (iv) transmitted

by hand delivery, telegram, or facsimile, addressed as set forth below or to such other address as such party shall have specified most

recently by written notice. Any notice or other communication required or permitted to be given hereunder shall be deemed effective (a)