0001815974

false

FY

No

No

0001815974

2022-07-01

2023-06-30

0001815974

2022-12-31

0001815974

2023-09-14

0001815974

2023-06-30

0001815974

2022-06-30

0001815974

2021-07-01

2022-06-30

0001815974

us-gaap:CommonStockMember

2021-06-30

0001815974

us-gaap:AdditionalPaidInCapitalMember

2021-06-30

0001815974

us-gaap:RetainedEarningsMember

2021-06-30

0001815974

2021-06-30

0001815974

us-gaap:CommonStockMember

2022-06-30

0001815974

us-gaap:AdditionalPaidInCapitalMember

2022-06-30

0001815974

us-gaap:RetainedEarningsMember

2022-06-30

0001815974

us-gaap:CommonStockMember

2021-07-01

2022-06-30

0001815974

us-gaap:AdditionalPaidInCapitalMember

2021-07-01

2022-06-30

0001815974

us-gaap:RetainedEarningsMember

2021-07-01

2022-06-30

0001815974

us-gaap:CommonStockMember

2022-07-01

2023-06-30

0001815974

us-gaap:AdditionalPaidInCapitalMember

2022-07-01

2023-06-30

0001815974

us-gaap:RetainedEarningsMember

2022-07-01

2023-06-30

0001815974

us-gaap:CommonStockMember

2023-06-30

0001815974

us-gaap:AdditionalPaidInCapitalMember

2023-06-30

0001815974

us-gaap:RetainedEarningsMember

2023-06-30

0001815974

us-gaap:IPOMember

2022-09-28

0001815974

ANEB:VernalisDevelopmentLimitedMember

2020-05-01

2020-05-31

0001815974

ANEB:VernalisDevelopmentLimitedMember

srt:MinimumMember

2020-05-01

2020-05-31

0001815974

ANEB:VernalisDevelopmentLimitedMember

srt:MaximumMember

2020-05-01

2020-05-31

0001815974

us-gaap:IPOMember

ANEB:VernalisDevelopmentLimitedMember

2021-05-01

2021-05-31

0001815974

us-gaap:PrivatePlacementMember

2022-09-27

2022-09-28

0001815974

us-gaap:PrivatePlacementMember

2022-09-28

0001815974

us-gaap:IPOMember

2021-05-04

0001815974

ANEB:StockIncentivePlan2020Member

srt:MaximumMember

2020-06-01

2020-06-30

0001815974

ANEB:StockIncentivePlan2020Member

2021-10-22

0001815974

ANEB:StockIncentivePlan2020Member

2020-06-01

2020-06-30

0001815974

ANEB:StockIncentivePlan2020Member

2023-06-30

0001815974

ANEB:StockIncentivePlan2020Member

2022-06-30

0001815974

ANEB:OptionsMember

2022-07-01

2023-06-30

0001815974

ANEB:OptionsMember

2021-07-01

2022-06-30

0001815974

ANEB:UnvestedStockOptionsMember

2023-06-30

0001815974

ANEB:UnvestedStockOptionsMember

2022-07-01

2023-06-30

0001815974

srt:MinimumMember

2022-07-01

2023-06-30

0001815974

srt:MaximumMember

2022-07-01

2023-06-30

0001815974

srt:MinimumMember

2021-07-01

2022-06-30

0001815974

srt:MaximumMember

2021-07-01

2022-06-30

0001815974

us-gaap:ResearchAndDevelopmentExpenseMember

2022-07-01

2023-06-30

0001815974

us-gaap:ResearchAndDevelopmentExpenseMember

2021-07-01

2022-06-30

0001815974

us-gaap:GeneralAndAdministrativeExpenseMember

2022-07-01

2023-06-30

0001815974

us-gaap:GeneralAndAdministrativeExpenseMember

2021-07-01

2022-06-30

0001815974

us-gaap:EmployeeStockOptionMember

2022-07-01

2023-06-30

0001815974

us-gaap:EmployeeStockOptionMember

2021-07-01

2022-06-30

0001815974

us-gaap:WarrantMember

2022-07-01

2023-06-30

0001815974

us-gaap:WarrantMember

2021-07-01

2022-06-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

FORM

10-K

(Mark

One)

| ☒ |

ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the fiscal year ended June 30, 2023

or

| ☐ |

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission

File No. 001-40388

ANEBULO

PHARMACEUTICALS, INC.

(Exact

name of Registrant as specified in its charter)

| Delaware |

|

85-1170950 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(I.R.S.

Employer

Identification

No.) |

| |

|

|

1017

Ranch Road 620 South, Suite 107

Lakeway,

Texas |

|

78734 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

(512)

598-0931

(Registrant’s

telephone number, including area code)

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock |

|

ANEB |

|

Nasdaq

Stock Market LLC |

Securities

registered pursuant to Section 12(g) of the Act: None

Indicate

by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ☐ NO ☒

Indicate

by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. YES ☐ NO ☒

Indicate

by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate

by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant

was required to submit such files). Yes ☒ No ☐

Indicate

by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer |

☐ |

|

Accelerated

filer |

☐ |

| Non-accelerated

filer |

☒ |

|

Smaller

reporting company |

☒ |

| |

|

|

Emerging

growth company |

☒ |

If

an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate

by check mark whether the Registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report. ☐

If

securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant

included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate

by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation

received by any of the registrant’s executive officers during the relevant recovery period pursuant to § 240.1D-1(b). ☐

Indicate

by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the voting and

non-voting common stock held by non-affiliates of the Registrant was $9,468,006

based on the closing price of the Registrant’s common stock on the Nasdaq Capital Market on December 31, 2022. The calculation

of the aggregate market value of voting and non-voting common stock excludes shares held by executive officers, directors and

stockholders that the Registrant concluded were affiliates of the Registrant on such date. Exclusion of such shares should not be

construed to indicate that any such person possesses the power, direct or indirect, to direct or cause the direction of the

management or policies of the Registrant or that such person is controlled by or under common control with the Registrant.

The

number of shares of the Registrant’s common stock, par value $0.001 per share, outstanding as of September 14, 2023 was 25,633,217

shares.

DOCUMENTS

INCORPORATED BY REFERENCE

Portions

of the Registrant’s definitive proxy statement (the “Proxy Statement”) that will be filed for the 2023 Annual Meeting

of Stockholders are incorporated by reference in Part III of this Annual Report on Form 10-K. The Proxy Statement will be filed with

the U.S. Securities and Exchange Commission within 120 days after the end of the fiscal year to which this Annual Report relates.

Anebulo

Pharmaceuticals, Inc.

Table

of Contents

In

this Annual Report on Form 10-K (this “Annual Report”), unless otherwise stated or as the context otherwise requires, references

to “Anebulo Pharmaceuticals,” “Anebulo,” “the Company,” “we,” “us,” “our”

and similar references refer to Anebulo Pharmaceuticals, Inc. The Anebulo logo, and other trademarks or service marks of Anebulo Pharmaceuticals,

Inc. appearing in this Annual Report are the property of Anebulo Pharmaceuticals, Inc. This Annual Report also contains registered marks,

trademarks and trade names of other companies. All other trademarks, registered marks and trade names appearing in this Annual Report

are the property of their respective holders. We do not intend our use or display of other companies’ trade names, trademarks or

service marks to imply a relationship with, or endorsement or sponsorship of us by, these other companies.

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

Annual Report contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which are subject the “safe

harbor” created by those sections. These forward-looking statements about us and our industry involve substantial risks and uncertainties

and our actual results could differ materially from those anticipated in these forward-looking statements as a result of various factors,

including those set forth below under Part I, Item 1A, “Risk Factors” in this Annual Report. All statements other than statements

of historical facts contained in this Annual Report, including statements regarding our future financial condition, business strategy

and plans, and objectives of management for future operations, are forward-looking statements. In some cases, you can identify forward-looking

statements by terminology such as “believe,” “may,” “could,” “will,” “estimate,”

“continue,” “anticipate,” “intend,” “seek,” “plan,” “expect,”

“should,” “would,” “potentially” or the negative of these terms or similar expressions in this Annual

Report.

We

have based these forward-looking statements largely on our current expectations, beliefs, estimates and projections, and various assumptions,

many of which, by their nature, are inherently uncertain and beyond our control. In addition, statements that “we believe”

and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available

to us as of the date of this Annual Report, and while we believe such information forms a reasonable basis for such statements, such

information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry

into, or review of, all potentially available relevant information. These forward-looking statements include, but are not limited to,

statements about:

| |

● |

our

expectations regarding our capital requirements, revenue, expenses and other operating results, and needs for additional financing; |

| |

● |

the

timing or outcome of any of our regulatory submissions; |

|

● |

the

timing and conduct of our clinical trials, including statements regarding the timing, progress and results of current and future

nonclinical studies and clinical trials, and our research and development programs; |

| |

● |

the

clinical utility, potential advantages and timing or likelihood of regulatory filings and approvals of ANEB-001; |

| |

● |

our

expectations regarding future growth; |

| |

● |

our

ability to obtain and maintain adequate intellectual property rights and adequately protect and enforce such rights; |

| |

● |

our

ability to maintain our existing licensing arrangements and enter into and maintain other collaborations or licensing arrangements; |

| |

● |

our

estimates regarding the commercial potential and market opportunity for our product candidates; |

| |

● |

the

performance of our third-party suppliers and manufacturers; |

| |

● |

our

ability to compete effectively with existing competitors and new market entrants; |

| |

● |

the

impact on our business of economic or political events or trends; and |

| |

● |

the

impact of governmental laws and regulations. |

You

should not place undue reliance on these forward-looking statements. Unless required by law, we undertake no obligation to update or

revise any forward-looking statements to reflect new information or future events or developments. Thus, you should not assume that our

silence over time means that actual events are bearing out as expressed or implied in such forward-looking statements. You should carefully

read this Annual Report, including the section titled “Risk Factors” and the documents that we reference in this Annual Report

and have filed as exhibits to this Annual Report completely and with the understanding that our actual future results may be materially

different from what we expect. We qualify all of the forward-looking statements in this report by these cautionary statements.

SUMMARY

OF RISK FACTORS

Our

business is subject to numerous risks and uncertainties of which you should be aware, including those described in the section entitled

“Risk Factors.” These risks include the following:

| |

● |

We

have not generated any revenue since our inception and expect to incur future losses and may never become profitable. Our business

is highly dependent on our lead product candidate, ANEB-001, and we must complete clinical testing before we can seek regulatory

approval and begin commercialization of any of our product candidates. |

| |

● |

We

currently rely on a license from a third party, and in the future may rely on additional licenses from other third parties, in relation

to our development of ANEB-001, and if we fail to comply with our obligations under our current or future intellectual property license

agreements or otherwise experience disruptions to our business relationships with our current or any future licensors, we could lose

intellectual property rights that are important to our business. |

| |

● |

We

currently have no product revenue and will need to raise additional capital in the future, which may be unavailable to us or may

cause dilution or place significant restrictions on our ability to operate. |

| |

● |

Our

current and future operations substantially depend on our Founder and Chief Executive Officer and our ability to hire other key personnel,

the loss of any of whom could disrupt our business operations. |

| |

● |

If

we are unable to obtain and maintain patent protection for important aspects of ANEB-001, or if the scope of the patent protection

obtained is not sufficiently broad, our competitors could develop and commercialize products that are similar or identical to ours,

and our ability to successfully commercialize our current or future product candidates may be adversely affected. |

| |

● |

We

currently have no marketing and sales organization and we have no direct experience marketing pharmaceutical products. If we are

unable to establish our own marketing and sales capabilities, or enter into agreements with third parties to market and sell our

products after approval, we may not be able to generate product revenues. |

| |

● |

We

are relying on clinical trials performed by our licensor Vernalis Development Limited, formerly

Vernalis (R&D) Limited (“Vernalis”), a third party, for a different indication,

and the FDA or a foreign equivalent regulator may disagree with our ability to reference

clinical data from third-party trials. |

| |

● |

If

we are not able to obtain any required regulatory approvals for ANEB-001, we will not be

able to commercialize our lead drug candidate and our ability to generate revenue will be

limited. |

| |

● |

Clinical

drug development involves a lengthy and expensive process with an uncertain outcome, and results of earlier studies and trials may

not be predictive of future trial results. |

| |

● |

Interim,

topline and preliminary data from our preclinical studies or clinical trials may change as more data become available, and are subject

to audit and verification procedures that could result in material changes in the final data.

|

| |

● |

Any

products we develop may become subject to unfavorable pricing regulations, third-party coverage and reimbursement practices or healthcare

reform initiatives, thereby harming our business. |

| |

● |

Our

product candidates, the methods used to deliver them or their dosage levels may cause undesirable side effects or have other properties

that could delay or prevent their regulatory approval, limit the commercial profile of an approved label or result in significant

negative consequences following any regulatory approval. |

| |

● |

New

drugs, which may be developed by others, could impair our ability to maintain and grow our business and remain competitive. |

| |

● |

We

depend on third parties in connection with our preclinical testing and clinical trials, which may result in costs and delays that

prevent us from obtaining regulatory approval or successfully commercializing ANEB-001 or future product candidates. |

| |

● |

We

will be completely dependent on third parties to manufacture ANEB-001, and our commercialization of ANEB-001 could be halted, delayed

or made less profitable if those third parties fail to obtain manufacturing approval from the FDA or comparable foreign regulatory

authorities, fail to provide us with sufficient quantities of ANEB-001 or fail to do so at acceptable quality levels or prices. |

| |

● |

The

trading price and volume of our common stock in the public markets has experienced, and may in the future experience, volatility

due to a variety of factors, many of which are beyond our control. |

The

summary risk factors described above should be read together with the text of the full risk factors below, in the section entitled “Risk

Factors” and the other information set forth in this Annual Report, including our financial statements and the related notes, as

well as in other documents that we file with the SEC. The risks summarized above or described in full below are not the only risks that

we face. Additional risks and uncertainties not precisely known to us, or that we currently deem to be immaterial may also materially

adversely affect our business, financial condition, results of operations and future growth prospects.

PART

I

Item

1. Business.

Overview

We

are a clinical-stage biotechnology company developing novel solutions for people suffering from acute cannabinoid intoxication

(“ACI”) and substance addiction. Our lead product candidate, ANEB-001, is intended to rapidly reverse the negative

effects of ACI and reduce time to recovery. The more severe signs and symptoms of ACI range from profound sedation to anxiety and

panic to psychosis with hallucinations. There is no approved medical treatment currently available to specifically alleviate the

symptoms of ACI and we are not aware of any competing products that are further along in the development process than ANEB-001 in

reversing the effects of delta-9-tetrahydrocannabinol, better known as THC, the primary psychoactive constituent of cannabis.

Previous clinical trials conducted by a third party have shown that ANEB-001 is rapidly absorbed, well tolerated and when repeatedly

administered to obese subjects led to weight loss, an effect that is consistent with central CB1 antagonism. In March 2021, our

European clinical trial application (“CTA”), which is equivalent to an investigational new drug application in the

United States, was accepted in the Netherlands to allow us to utilize ANEB-001 in a Phase 2 human proof-of-concept trial (the

“Netherlands Trial”) for potential use as a treatment for ACI. The study was designed to evaluate the safety,

tolerability, pharmacokinetics, and effectiveness of a single dose of ANEB-001 in treating healthy subjects challenged with THC. We

announced on January 3, 2022 that the first patient had been dosed in the Netherlands Trial. On May 11, 2022, we announced the

dosing of all 60 subjects in Part A of the Netherlands Trial. On March 28, 2023, we announced complete results from Part A and Part

B of the Netherlands Trial, in a total of 134 subjects. Dosing of an additional 20 subjects in an open-label extension of the study

(Part C) was initiated in July 2023 and completed in August 2023. We met with the FDA in July 2023 for a Type B meeting to discuss

the Part A and B Phase 2 data and the potential path forward for Phase 3 development of ANEB-001 and, received the minutes of

the meeting in August 2023. The FDA indicated that a single well-controlled study of ANEB-001 in ACI patients presenting to the

emergency department combined with a larger THC challenge study in volunteers could potentially provide substantial evidence to

support a new drug application. In addition, an observational study in patients presenting to emergency departments with ACI is

currently ongoing. The study will determine concentrations of cannabinoids and metabolites in plasma and gather information on signs

and symptoms, patients’ disposition and selected assessments, where possible. We believe the data generated from the

Netherlands Trial provide support for our development pathway.

ACI

has become a widespread health issue in the United States, particularly in the increasing number of states that have legalized

cannabis for medical and recreational use. Excessive

ingestion of THC via edible products such as candies and brownies, and intoxication from synthetic cannabinoids (also known as

“synthetics,” “K2” or “spice”), are two leading causes of THC-related emergency room visits.

Synthetic cannabinoids are analogous to fentanyl for opioids insofar as they are more potent at the cannabinoid receptor than their

natural product congener THC.

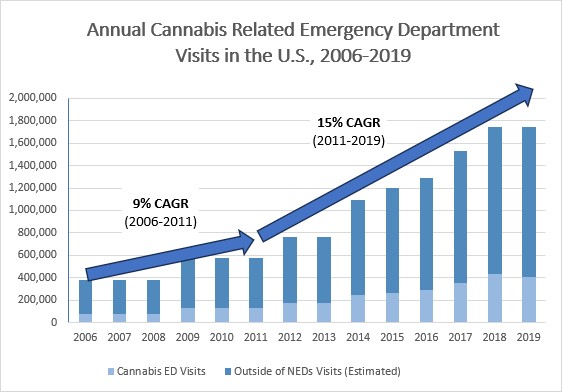

In

recent years, hospital emergency rooms across the United States have seen a dramatic increase in patient visits with cannabis-related

conditions. Before the legalization of cannabis, an estimated 450,000 patients visited hospital emergency rooms annually for cannabis-related

conditions. In 2014, this number more than doubled to an estimated 1.1 million patients, according to data published in “Trends

and Related Factors of Cannabis-Associated Emergency Department Visits in the United States: 2006-2014,” Journal of Addiction Medicine

(May/June 2019), which provided a national estimate analyzing data from The Nationwide Emergency Department Sample (“NEDS”),

the largest database of U.S. hospital-owned emergency department visits. Based on our own analysis of the most recent NEDS data, we believe

that the number of emergency department visits grew to 1.7 million patients in 2019 and was growing at an approximately 15% compounded

annual growth rate between 2011 and 2019. We believe the number of cannabis-related emergency department visits, including other health

problems associated with ACI such as depression, anxiety and mental disorders will continue to increase substantially as more states

pass laws legalizing cannabis for medical or recreational use. Given the consequences, there is an urgent need for a treatment to rapidly

reverse the symptoms of ACI.

Our

Lead Product Candidate

Our

objective is to develop and commercialize new treatments options for patients suffering from ACI and substance addiction. Our lead

product candidate is ANEB-001, a potent, small molecule antagonist of cannabinoid binding receptor type-1 (“CB1”), the

primary receptor involved in the psychotropic effects of cannabinoids, with the potential to address the unmet medical need for a

therapy to treat ACI. ANEB-001 is an orally bioavailable, rapidly absorbed treatment that we anticipate will rapidly reverse the

symptoms of ACI and reduce the time to recovery. Our proprietary position in the treatment of ACI is protected by one issued US

patent and one allowed US patent and rights to six additional patent applications, two pending

Patent Cooperation Treaty (PCT) applications and additional international patent applications, covering various methods of use of

the compound, aspects of ANEB-001, and delivery systems. We began our Phase 2 trial in the Netherlands on December 2021 and

announced complete data from Part A and Part B of the Netherlands Trial in March 2023. Dosing of an additional 20 subjects in an

open-label extension of the study (Part C) was initiated in July 2023 and completed in August 2023. In July 2023, we met with

the FDA for a Type B meeting to discuss the Part A and B Phase 2 data and the potential path forward for Phase 3 development of

ANEB-001, and received the minutes of the meeting in August 2023. The FDA indicated that a single well-controlled study of ANEB-001

in ACI patients presenting to the emergency department combined with a larger THC challenge study in volunteers could potentially

provide substantial evidence to support a new drug application. We are targeting to initiate Phase 3 registrational studies in the

first half of calendar 2024.

Cannabinoids

are a class of chemical compounds that are naturally occurring and are primarily found in cannabis plant extracts. The two major cannabinoids

found in cannabis plant extracts include THC and CBD. These compounds bind themselves to CB1 and CB2 cannabinoid receptors, which are

found throughout the body. Specifically, CB1 receptors are concentrated in the brain and central nervous system, while CB2 receptors

are found mostly in peripheral organs and are associated with the immune system. When the chemical compounds bind themselves to these

cannabinoid receptors, the process elicits certain physiological responses. Physiological responses to cannabinoids may vary among individuals.

Some of the effects of cannabinoids have been shown to impact nervous system functions, immune responses, muscular motor functions, gastrointestinal

maintenance, blood sugar management, and the integrity of ocular functions.

Individuals

can use or consume cannabinoids in natural or unnatural formulations, orally or by inhalation, and intentionally and unintentionally,

all of which can result in intoxication. Natural formulations include edibles and marijuana cigarettes; unnatural formulations include

synthetics. Individuals consume cannabinoids orally by ingesting edibles or synthetics and by inhalation through smoking marijuana cigarettes

or synthetics. Cannabinoids can also be ingested unintentionally through these same methods where, for example, children consume edibles

by mistaking them for common consumer items like candy that would not otherwise contain THC. Symptoms of ACI produced by edibles and

synthetics can include psychosis, panic and anxiety, feelings of paranoia, agitation, hallucinations, nausea, vomiting, cardiac arrhythmias,

seizures and death. Many of these symptoms can require emergency medical attention and can take hours to days to resolve depending on

the particular product and amount ingested. Currently, there is no specific treatment to reverse ACI and physicians have to rely on supportive

care, including benzodiazepines, and wait for the body to metabolize the THC or synthetic cannabinoid.

We are relying on studies performed by a third party for a different indication,

obesity, and the FDA or a foreign equivalent regulator may disagree with our ability to reference the clinical data generated by such

third-party trials in connection with the indication for ACI and addiction. See “Risk Factors —Risks Related to Product Development,

Regulatory Approval, Manufacturing and Commercialization —We are relying on clinical trials performed by our licensor Vernalis,

a third party, for a different indication, and the FDA or a foreign equivalent regulator may disagree with our ability to reference clinical

data from third-party trials.”

Our

Market Opportunity

ACI

has become a widespread health issue in the United States as an increasing number of states have legalized cannabis for medical or recreational

use. As of June 30, 2023, cannabis was legal for recreational use in 23 states and the District of Columbia and for medical use

in 38 states.

ACI

frequently occurs due to the ingestion of edibles, which can contain relatively large amounts of THC, and consumption of synthetics.

Symptoms of ACI produced by edibles and synthetics can include psychosis, panic and anxiety, feelings of paranoia, agitation, hallucinations,

nausea, vomiting, cardiac arrhythmias, seizures and death. These symptoms can require emergency medical attention and can take hours

to days to resolve. According to an article published in the Journal of Addiction Medicine that analyzed data from NEDS, an estimated

1.1 million emergency department visits were associated with cannabis in 2014. We have performed our own independent analysis of all

currently available NEDS datasets and estimated that the number of cannabis-associated emergency department visits increased to 1.7 million patients in 2019. The number of cannabis-associated emergency department visits has grown at a 15% compounded annual growth rate

from 2011 to 2019, which is when states first began legalizing recreational cannabis use.

Source

for 2006-2014: Shen, J. J., Shan, G., Kim, P. C., Yoo, J. W., Dodge-Francis, C., & Lee, Y.-J. (2018). Trends and Related Factors

of Cannabis-Associated Emergency Department Visits in the United States. Journal of Addiction Medicine, doi:10.1097/adm.0000000000000479,

Source for 2015-2019: Company analysis of NEDS database.

We

believe that both the number of cannabis-associated emergency department visits and the unmet medical need will continue to grow due

to the increasing availability and consumption of edibles. In THC-containing edibles, the dose of THC can be as much as eight times more potent than a rolled marijuana cigarette. Edibles are frequently manufactured

as common consumer products, such as brownies, cookies, candies and gummy snacks with brightly-colored packaging. THC concentrations

in edibles peak after a delay of about two to four hours from ingestion. This time to peak concentration contrasts with smoking cannabis,

which causes THC concentrations to peak in about three to 10 minutes from inhalation. Consumers possibly will approach edibles with the

same serving size expectations as consumer products without THC. Moreover, children are particularly at risk for accidentally consuming

edibles due to the edibles’ brightly-colored packaging and formulation into candies and sweets. The confluence of these factors

can be dangerous and increases the risk of ACI. Emergency department visits were 33 times more likely for edibles as compared with other

routes of cannabis consumption, according to the recent article “Mental Health-related Emergency Department Visits Associated with

Cannabis in Colorado,” published in Academic Emergency Medicine (May 2018). Sales of edibles are rapidly growing, according to

data collected by Statista, and are expected to continue growing into the future.

In

November 2020, we sponsored a survey of U.S. physicians concerning patient emergency room visits for ACI within the past 12 months. Based

on a survey of 27 emergency room physicians throughout the United States, the surveyed physicians saw on average 10.5 patients (a range

of two to 45 patients) with cannabis intoxication per month. The survey asked these physicians to rank on a scale of 1 to 10 (i) the

need for a cannabinoid antagonist to treat cannabis intoxication; (ii) the likelihood of their prescribing a cannabinoid antagonist that

reverses cannabis intoxication within 30 minutes of administration; and (iii) the likelihood of such cannabinoid antagonist reducing

the need for supportive medication to manage certain cannabis intoxication symptoms, such as agitation and acute psychosis. In response

to these questions, the surveyed physicians ranked the need for a cannabinoid antagonist at an average of 7.52 out of 10, the likelihood

of prescribing a cannabinoid antagonist that reverses cannabis intoxication within 30 minutes of administration at an average of 7.44

out of 10, and the likelihood of a specific cannabinoid antagonist reducing the need for supportive medication to manage certain ACI

symptoms at an average of 7.48 out of 10. Although the survey pertained specifically to a cannabinoid antagonist that reverses cannabis

intoxication within 30 minutes, we believe the survey results are indicative of likely prescribing behavior for any otherwise comparable

product that takes effect rapidly even if not specifically within 30 minutes.

We

believe that the market opportunity for our lead product candidate, ANEB-001, will continue to expand and accelerate if additional states

pass laws to legalize recreational cannabis use. In Colorado, one of the first states to legalize recreational marijuana, the Colorado

Department of Health and Environment reported that by 2018 marijuana use by adults one or more times during the past 30 days roughly

doubled in the years following the state’s legalization of cannabis. On April 1, 2022, the U.S. House of Representatives, for the

second time, voted in favor of a bill to decriminalize marijuana at the federal level by removing cannabis from the list of controlled

substances under the Controlled Substances Act. Although it is currently uncertain whether this bill will be subsequently approved by

the U.S. Senate and signed into law by the President, in the event the use of cannabis is legalized in the United States at the federal

level, we believe that the greater anticipated number of users will significantly increase the potential need for our lead candidate.

We believe that intoxication due to synthetic cannabinoids is an area with particularly high unmet medical need. Synthetics are among

the fastest growing class of psychoactive drugs worldwide and can be as much as 85 times as potent as THC. This likely reflects the structural

promiscuity of the CB1 receptor. In addition, the negative effects of an intoxication from synthetics can be longer lasting and more

severe when compared with THC. These negative effects could include seizures and other dangerous outcomes. Compared with natural cannabis

products, synthetics have lower shipping weights and can more readily evade traditional drug screening methods.

Our

Growth Strategy

Our

goal is to create a therapeutic to treat the underlying cause of ACI. As noted above, there are currently no FDA approved medical treatments

on the market to specifically alleviate the negative neuropsychological effects of ACI. The absence and growing unmet need for such a

treatment gives us the unique opportunity to create a novel solution and become a leader in the cannabinoid treatment space. To achieve

our goal, our strategy will be guided by the following principles:

| |

● |

Develop and commercialize our ANEB-001 antagonist in

the United States. We commenced our Netherlands Trial in December 2021 and announced complete results from Part A and Part B of the

Netherlands Trial in March 2023. Dosing of an additional 20 subjects in an open-label extension of the

study (Part C) was initiated in July 2023 and completed in August 2023. In July 2023, we met with the FDA for a Type B meeting to discuss the Part

A and B Phase 2 data and the potential path forward for Phase 3 development of ANEB-001, and received the minutes of the meeting

in August 2023. The FDA indicated that a single well-controlled study of ANEB-001 in ACI patients presenting to the emergency department

combined with a larger THC challenge study in volunteers could potentially provide substantial evidence to support a new drug application. |

| |

|

|

| |

● |

Explore

strategic collaborations to commercialize ANEB-001. Our plan is to widely commercialize ANEB-001, if approved. To accomplish

this objective, we may partner with companies that possess a direct sales force and sales representatives. |

| |

|

|

| |

● |

Strive

for capital efficiency in developing ANEB-001. We aim to be capital efficient in our development of ANEB-001 by outsourcing our

clinical research and data management. We anticipate this will lower our clinical development costs and improve our ability to efficiently

commercialize ANEB-001 if it is approved by the FDA. |

| |

|

|

| |

● |

Introduce

promising product candidate extensions. We are in the initial stages of developing a non-oral formulation of ANEB-001. |

| |

|

|

| |

● |

Develop

future product candidates to treat substance-related addiction. We intend to leverage our expertise in the endocannabinoid system

to develop additional product candidates for the treatment of substance addiction. CB1 antagonists have been shown to be promising

in treating substance-related addiction. We believe that there is a large and growing unmet medical need for new treatment options

because of the opioid epidemic. |

Our

Clinical Trials and Milestones

We

are developing ANEB-001 as an acute treatment to quickly and effectively combat the symptoms of ACI. ANEB-001 was originally under development

by Vernalis as a potential chronic treatment for obesity and other metabolic indications.

Preclinical

Data

The

initial preclinical characterization of ANEB-001 was performed at Vernalis’ internal laboratory in the United Kingdom between

2003 and 2006. The compound was tested as a displacer in established radioligand binding assays for the CB1 receptor. ANEB-001

displaced the antagonist radioligand, [3H]-SR141716A from the human CB1 receptor with high affinity (0.55 nM) and was shown to be a

competitive antagonist in cAMP assays. In vitro testing as a displacer in 90 binding assays and 19 enzyme and functional assays,

showed that ANEB-001 had >1000x selectivity with the human CB1 receptor over all other tested receptors. Further, Vernalis

demonstrated that oral administration of ANEB-001 reduced THC-induced hypolocomotion in mice after 30 minutes, effectively reversing

the action of THC. C57 mice administered THC 3 mg/kg in 10 minutes pre-test exhibited reduced locomotor activity when placed in

automated locomotor activity cages for 15 minutes. Providing it orally at a dose of 30 mg/kg 30 minutes pre-test significantly

reversed the action of THC on the total activity time parameter (p<0.01 by one way ANOVA and Newman Keuls test, n=7 per

group).

Historical

Clinical Studies

In

2006 and 2007, two Phase 1 studies for the treatment of obesity were conducted by Vernalis for ANEB-001.

First

Phase 1 trial

The

Phase 1 study (V24343-1Ob-01) administered single (Part A) and multiple (Part B) ascending doses of ANEB-001 dosed daily for

up to 14 days in otherwise healthy overweight and mildly obese subjects.

| |

● |

Part

A randomized 18 healthy volunteers to receive either a placebo (n=18) or two single oral doses of ANEB-001, with doses ranging from

1 mg to 200 mg. No severe adverse events were observed in either group in Part A. There was no difference between treatment groups

in Part A in overall incidence, number of or severity of adverse events. Probable drug-related events in the treatment arm were nausea

(22%), dizziness (11%), hiccups (8%), and decreased appetite (8%). |

| |

|

|

| |

● |

Part

B randomized 32 obese volunteers to receive either a placebo (eight obese volunteers) or four different doses of ANEB-001 for 14

days (24 obese volunteers). No severe adverse events were observed in either group in Part B, but an increased number of mild and

moderate adverse events was observed in the obese volunteers who received the two higher dose arms (200/50 mg and 100 mg). The observed

adverse events included nausea, vomiting, diarrhea, dizziness, hiccups, decreased appetite, hyperhidrosis and feeling hot. We believe

these adverse events are “on-target,” meaning they reflect CB1 antagonism, because these adverse events have also been

observed with other CB1 antagonists. |

Pharmacokinetic

measurements in Part A of the Phase 1 study demonstrated that ANEB-001 was rapidly absorbed by the body following oral administration

and achieved blood concentrations anticipated to be sufficient to block the CB1 cannabinoid receptor.

Vernalis

also measured the impact of ANEB-001 on anxiety and depression in Part B of the Phase 1 study. Vernalis measured anxiety by using

the Spielberger state score, a commonly used measure of trait and state anxiety. Vernalis found no significant impact on anxiety,

except for the 200/50 mg arm (which represents a loading does of 200mg followed by a once daily (“OD”) 50mg dose), which showed increased anxiety at all assessment times. The change was driven by a single subject and

may be explained by somatic adverse events, which contributed to the Spielberger score. For depression, HAMD21 was used and small

increases were noted in the 75/15 mg and 200/50 mg dose, which we believe were likely driven by somatic symptoms.

Summarizing

the results from the Phase 1 study, ANEB-001 doses between 1 mg and 150 mg were found to be very well tolerated in both single and multiple

doses with an adverse events profile similar to placebo. There was no observed effect on the cardiovascular system, ECGs, labs or physical

exams and no significant effects on anxiety or depression scores.

With

regard to pharmacodynamics, a marked reduction in test meal energy intake was seen even at the lowest dose level in Phase 1 Part B (p<0.01

on Day 14 for OD 100 mg, p<0.05 on Day 7 for OD 100 mg, not statistically significant for all other cohorts). Further, Vernalis observed

statistically significant decreases in body weight (p<0.001 on Day 14 for OD 100 mg, p<0.05 for OD 50/5 mg and OD 200/50 mg, not

significant for OD75/15 mg) indicating that ANEB-001 was able to cross the blood-brain barrier and antagonize central cannabinoid receptors.

P-value is the probability that the difference between two data sets was due to chance. The smaller the p-value, the more likely the

differences are not due to chance alone. In general, if the p-value is less than or equal to 0.05, the outcome is considered statistically

significant. The FDA’s evidentiary standard of efficacy generally relies on a p-value of less than or equal to 0.05.

Second

Phase 1 trial

The

second Phase 1 study conducted by Vernalis (V24343-1Ob-02) compared the pharmacokinetics of a single oral dose (1 to 200 mg) of ANEB-001

between fed and fasted states in eight subjects that were lean and in eight subjects that were overweight. There were no apparent differences

in the tolerability of ANEB-001 between the subjects that were in fed and fasted states or between subjects that were lean and overweight.

Total AUC (or area under the curve) was approximately 30% higher in subjects in the fed state compared to the subjects in the fasted

state, with similar systemic exposure for the lean and overweight subjects.

The

results of the historical Phase 1 studies demonstrate that ANEB-001 was well tolerated among healthy and obese subjects. There were no

serious adverse events. The most commonly reported adverse event was gastrointestinal discomfort, which also occurred in subjects that

were administered placebos. Based on the promising results of the historical Phase 1 studies, we believe ANEB-001 may offer the following

clinical and product benefits:

| |

● |

Oral

bioavailability. ANEB-001 will be available as an oral treatment in the form of a pill, capsule or tablet. |

| |

|

|

| |

● |

Rapid

onset of action. ANEB-001 has shown CB1 antagonist effects in clinical studies – rapid reversal of signs

and symptoms of ACI – in as little as 1 hour. |

| |

|

|

| |

● |

Low

likelihood of drug-to-drug interactions. Preclinical testing demonstrated that ANEB-001 did not inhibit the metabolic enzymes

cytochromes 1A2, 2C9, 2C19, 2D6 and 3A4 at pharmacologically relevant concentrations. |

| |

|

|

| |

● |

Potential

First-in-Class Treatment. We are currently not aware of any competing products that are further along in the development process

than ANEB-001 to specifically reverse the symptoms of ACI. |

| |

|

|

| |

● |

No

serious adverse events. A single dose of the drug is unlikely to produce adverse events associated with chronic dosing. The most

commonly reported adverse effect in the previous Phase 1 studies was gastrointestinal discomfort, which also occurred in subjects

who were administered a placebo. |

Anebulo

Clinical Studies

Phase

2 THC Challenge Study in Healthy Volunteers

We

commenced the Netherlands Trial in December 2021 at the Center for Human Drug Research (“CHDR”) in the Netherlands to

evaluate the safety, tolerability, pharmacokinetics, and effectiveness of a single dose of ANEB-001 in treating healthy subjects

challenged with delta-9-tetrahydrocannabinol, better known as THC, the primary psychoactive constituent of cannabis.

Part

A of the study was a randomized, double-blind, placebo-controlled trial in 60 healthy adult occasional cannabis users randomized to

three treatment arms of 20 subjects per arm. All subjects were challenged with a single oral dose of 10.5 mg THC and then treated

with single oral doses of 50 mg ANEB-001, 100 mg ANEB-001, or placebo. Subjects were monitored for 24 hours to assess safety,

tolerability, and pharmacokinetics, and repeatedly tested to determine potential effects on endpoints related to ACI symptoms. The

tests also included a series of validated measures of subjective CNS symptoms using visual analog scale (“VAS”)

assessments, as well as objective measures of intoxication. Part B of the study was an adaptive design that included six cohorts of

up to 15 healthy adults to examine different doses of THC and ANEB-001, and the impact of delayed dosing of ANEB-001 or placebo.

Part B of the study was a randomized, double-blind, placebo-controlled phase. A total of 74 subjects participated in Part B. On

March 28, 2023, we announced complete results from our Part A and Part B of the Netherlands Trial in a total of 134 subjects. Dosing of an additional 20 subjects in an open-label extension of the study (Part C)

was initiated in July 2023 and completed in August 2023. Part C of the study was an open-label phase with 2 cohorts of 10 subjects. We

believe the data generated from the Netherlands Trial provide support for our development pathway.

Data

from Part A of the study previously showed positive protective effects of a single oral dose of 50 or 100 mg ANEB-001 when

co-administered with an oral challenge dose of 10.5 mg THC. Subjects challenged with 10.5 mg THC and treated with placebo showed

substantial CNS effects including feeling high, decreased alertness, increased body sway, and increased heart rate. Compared to

placebo, treatment of subjects with ANEB-001 led to a significant, robust, and sustained reduction in the VAS feeling high score (p

< 0.0001 at both dose levels) and improvement in the VAS alertness scale (p < 0.01). In addition, the proportion of subjects

reporting feeling high on the VAS was significantly reduced by ANEB-001 (p < 0.001). Although THC-induced effects on body sway

and heart rate in Part A of the study were small, there was also a trend towards statistical improvement of these parameters with ANEB-001

treatment compared to placebo. The 50 mg and 100 mg doses had similar results, suggesting that lower doses should be

explored.

These

data demonstrated a highly statistically significant reduction in key symptoms of ACI, with only 10% of subjects in the 50 mg ANEB-001

group and 30% in the 100 mg group reporting feeling high compared to 75% of subjects in the placebo group (p < 0.001). ANEB-001 was

well tolerated in these healthy volunteers. Preliminary safety information showed all adverse events were mild and transient, except

in the case of one subject in the 50 mg ANEB-001 group who experienced moderate nausea and vomiting.

Based on the encouraging

data from Part A, we initiated Part B of the study at CHDR on July 26, 2022. In total, Parts A and B of the Phase 2 study enrolled

134 healthy subjects. In Part B of the study, subjects were challenged with substantially higher oral doses of THC (21, 30, or 40

mg) and treated with lower doses of ANEB-001 (10 or 30 mg) or a matching placebo. Delayed dosing of ANEB-001 was also examined by

introducing a one-hour pause between the THC challenge and treatment with the ANEB-001 or placebo. The final cohort of the study

included the administration of a high-fat meal prior to the THC challenge.

Based on

the final data for Part B of the study, a single low oral dose of ANEB-001 (10 mg) administered 1 hour after a THC challenge rapidly and

statistically significantly reversed key psychotropic effects of THC doses as high as 30 mg, including a reduction in the VAS for feeling high (p=<0.0001) and improvement in VAS alertness (p=0.0042) and reduced body sway (p=0.0196). In a pre-specified

pooled analysis of data for the combined 21 mg or 30 mg THC dose levels, a single 10 mg of ANEB-001 administered one hour after THC achieved

statistical significance on all primary outcomes, including a reduction in VAS feeling high (p=<0.0001), improvement in VAS alertness

(p=0.0024), reduced body sway (p=0.0014), and reduction in heart rate (p=0.0125). ANEB-001 also reduced the time required for the THC

effects to normalize back to baseline.

The Phase 2 study was

conducted in the Netherlands by the CHDR. A total of 134 healthy subjects were enrolled. All subjects received oral THC challenge

doses. In total, 91 subjects received single oral doses of ANEB-001. Pharmacodynamic outcomes were assessed by mixed-effect model

repeated measures (“MMRM”) analysis of covariance (“ANCOVA”) through 8 hours post-ANEB-001 dosing. Safety was assessed by continuous

observation for 24 hours and followed up at 7 to 14 days after treatment. ANEB-001 was well tolerated in this study and there were

no serious adverse events. At the 30 mg THC dose, prior to dosing ANEB-001 or placebo, subjects developed mild to moderate

THC-related symptoms including moderate euphoria, nausea, and/or vomiting, and mild bradyphrenia, dizziness, paresthesia, and/or

feeling emotional. After delayed dosing of 10 mg ANEB-001 or placebo following a 21 mg or 30 mg THC challenge dose, the adverse

events considered possibly or probably related to ANEB-001 were mild except for one case of moderate nausea/vomiting at THC doses of

21 mg and 30 mg; the incidence of dizziness and euphoria was greater in the placebo treated subjects. Administration of a high-fat

meal delayed the absorption of THC resulting in blunted effects of a 30 mg THC dose on many of the outcomes. However, delayed dosing

of 10 mg ANB-001 still significantly reduced VAS feeling high in fed subjects (p=0.0030).

Part

C of the study was an open-label phase with two cohorts of 10 subjects each. Subjects in Cohort 7 received a single oral dose of 40

mg of THC together with a single oral dose of 10 mg of ANEB-001. Subjects in Cohort 8 received a single oral dose of 60 mg of THC

together with a single oral dose of 20 mg of ANEB-001. In the earlier Part B of the study, a single oral dose of 40 mg THC without

ANEB-001 was not well tolerated due to overt THC-related effects. However, the use of even higher THC challenge doses was considered

acceptable by an independent institutional review board (“IRB”) provided that all subjects would also receive ANEB-001.

Part C of the study was therefore conducted as open-label without a placebo arm. Subjective and objective assessments performed

during the open-label Part C of the study were similar to those used in Parts A and B, with the addition of several new outcome

measures intended to explore further evidence of clinically meaningful effects. Based on preliminary safety observations, THC

challenge doses of 40 mg and 60 mg were well-tolerated when dosed in combination with ANEB-001, and all treatment-related adverse

events were mild and transient. Full safety, pharmacokinetic (“PK”), and pharmacodynamic data from the study, as well as results at

higher doses of THC, are expected in fourth quarter of calendar 2023. In total, 183 subjects have been dosed with

ANEB-001 in the Phase 1 and Phase 2 studies.

We

have enrolled our first subject in our observational PK study in the United States . The purpose of the study is to gather data on

ACI subjects in the emergency department setting. The PK data for THC and THC metabolites is expected to further support PK/PD

modeling efforts and ANEB-001 development.

We

believe the Phase 2 study provides support for our continuing discussions with the FDA and potential future discussions with

comparable foreign regulatory authorities, and allows us to design and conduct more extensive clinical trials with the goal of

generating additional clinical data that will ultimately enable us to file a marketing application with the FDA.

Vernalis

License Agreement

On

May 26, 2020, we entered into an exclusive license agreement (the “License Agreement”) with Vernalis Development Limited,

formerly Vernalis (R&D) Limited (“Vernalis”). Pursuant to the License Agreement, Vernalis granted us an exclusive worldwide

royalty-bearing license to develop and commercialize a compound that we refer to as ANEB-001, as well as access to and a right of reference

with respect to any regulatory materials under its control. The License Agreement allows us to sublicense the rights thereunder to any

person with similar or greater financial resources and expertise without Vernalis’ prior consent, provided the proposed sublicensee

is not developing or commercializing a product that contains a CB1 antagonist or is for the same indication covered by the trials or

market authorization for ANEB-001. In exchange for the exclusive license, we agreed to pay Vernalis a non-refundable signature fee of

$150,000, total potential developmental milestone payments of up to $29,900,000, total potential sales milestone payments of up to $35,000,000,

and low to mid-single digit royalties on net sales.

Under

the License Agreement, we purchased the API for ANEB-001 from Vernalis on an “as is” basis for $20,000. We have the sole

discretion to carry out the development and commercialization of ANEB-001, including obtaining regulatory approvals, and we are responsible

for all costs and expenses in connection therewith. We have access to certain regulatory materials, including study reports from clinical

and non-clinical trials, under Vernalis’ control. We agreed to use commercially reasonable efforts to (i) develop and commercialize

ANEB-001 in the United States and certain European countries and (ii) conduct a Phase 2 and human clinical trial within specified periods,

which periods could be extended for a nominal fee. We also agreed to provide Vernalis with periodic reports of our activities and notice

of market authorization within specified timeframes.

With

respect to intellectual property, both parties agreed to retain sole ownership over their respective intellectual property as of the

date of the License Agreement. In addition, we retain the sole right over certain patent rights (including patent applications) and know-how

controlled by us that are necessary or reasonably useful to developing and commercializing ANEB-001 during the term of the License Agreement.

The

License Agreement continues for an indefinite term unless and until it is terminated or until such time as all royalties and other sums

cease to be payable thereunder. Our obligations to pay royalties commence upon the first commercial sale of our product and cease upon

the later to occur of: (i) the tenth anniversary of the first commercial sale of our product, or (ii) the expiration date of the regulatory

exclusivity of our product. We may terminate the License Agreement in its entirety at any time by providing 60 days’ prior notice

to Vernalis. Moreover, a party may terminate the License Agreement for cause (i) upon written notice when the other party commits a material

breach not remedied within the specified timeframes and defaults on its obligations thereunder, or (ii) when the other party is insolvent

as more particularly described therein. In the event of termination, all rights and licenses granted by Vernalis will revert immediately

to Vernalis; all outstanding sums as of the termination date will be immediately due and payable to Vernalis; and we will return or destroy,

at Vernalis’ request, any regulatory materials, information pertaining to ANEB-001, and any unused API purchased from Vernalis.

If Vernalis terminates the License Agreement due to our material breach or insolvency, or if we terminate the License Agreement at will,

both parties will negotiate in good faith to grant Vernalis a license to such intellectual property and regulatory materials needed to

develop and commercialize ANEB-001 and provide appropriate compensation to us within six months of the termination date.

Competition

The

clinical biotechnology industry is a competitive industry characterized by technological innovation and growth. Our competitors include

other biotechnology and pharmaceutical companies, academic institutions, and public and private research institutions. These entities

engage in efforts to research, discover and develop new medicines and treatments for substance use. These entities also seek patent protection

and licensing revenues for their research results and may compete with us in recruiting skilled talent. Some of these entities are larger

and better funded than us. Our management can make no assurances that we can effectively compete with these competitors. Potential current

competitors include Aelis Farma, which is developing a medication based on a pregnenolone derivative to treat cannabis use disorders,

and Indivior PLC, which is developing a drinabant injection to treat acute cannabis overdose.

Research

and Development

We

are making, and expect to continue to make, substantial expenditures to fund proprietary research and development of our ANEB-001

product candidate and to support preclinical testing and clinical trials necessary for regulatory filings. Our research and

development team, including a third-party CRO, is continually undertaking efforts to advance research and development goals. During

the fiscal years ended June 30, 2023 and June 30, 2022, we incurred research and development expenses of approximately $5,600,000

and $2,962,000, respectively.

Regulation

Government

Regulation and Product Approval

We

operate in an extensively regulated industry. Governmental authorities at all levels in the United States and in other countries regulate

aspects of bringing therapeutics, drugs, and other biologics to market, including research, testing, safety, product approval, development,

manufacture, efficacy, quality control, packaging, storage, record-keeping, promotion, labeling, advertising, marketing, distribution,

sales, imports and exports of our products.

As

a therapeutic product for human use, ANEB-001 will be subject to regulation in the United States by the FDA under the Federal Food, Drug

and Cosmetic Act (“FDCA”) and similar regulatory requirements in other countries. Regulatory requirements include, among

other things, rigorous preclinical and clinical testing. The processes obtaining regulatory approval, commercializing our product and

maintaining compliance with applicable statutes and regulations require the substantial expenditure of time and financial resources and

play a significant role in our research and development, production, and marketing activities. Failure to comply with these regulatory

processes and other requirements could delay our ability to receive regulatory approvals, adversely affect the commercialization of our

product, and hinder our ability to receive royalties or revenues.

In

the United States, the FDA regulates drugs under the FDCA and its implementing regulations. Failure to comply with such regulations

during and after the product development and approval process could result in administrative or judicial sanctions. Such sanctions

include the FDA’s refusal to approve pending applications, withdrawal of an approval, placement on a clinical hold, untitled

or warning letters, product recalls, seizure of products, partial or complete suspension of production or distribution, injunctions,

fines, refusal of government contracts, restitution, disgorgement, civil penalties and criminal penalties. The FDA generally

requires the following before a drug can be marketed in the United States:

| |

● |

Completion

of preclinical laboratory tests, animal studies and formulation studies according to Good Laboratory Practices regulations; |

| |

|

|

| |

● |

Submission

of an IND, which must become effective before the commencement of human clinical studies; |

| |

|

|

| |

● |

Approval

by an independent IRB, at each clinical site before the initiation of each trial; |

| |

|

|

| |

● |

Performance

of adequate and well-controlled human clinical studies according to Good Clinical Practice (“GCP”) regulations, to establish

the safety and efficacy of the proposed drug for its intended use; |

| |

|

|

| |

● |

Preparation

and submission of a New Drug Application (“NDA”); |

| |

|

|

| |

● |

Satisfactory

completion of an FDA inspection of the manufacturing facility or facilities where the product, or its components, are produced to

ensure compliance with current Good Manufacturing Practice (“CGMP”) regulations and to ensure that the facilities, methods,

and controls are adequate to preserve the drug’s identity, strength, quality, and purity; and |

| |

|

|

| |

● |

FDA

review and approval of the NDA. |

Given

that the testing and approval process requires a substantial commitment of time, effort and financial resources, we cannot ensure that

our product will be granted approval on a timely basis.

As

part of the IND, an IND sponsor must submit the preclinical test results, along with manufacturing information, analytical data and any

available clinical data or literature, to the FDA. The sponsor must also include a protocol detailing the objectives of the initial clinical

study, the parameters for monitoring safety, and the effectiveness criteria to be assessed (among other things) if the initial clinical

study lends itself to an efficacy evaluation. Some preclinical testing may continue after submission of the IND. The IND becomes automatically

effective 30 days after receipt by the FDA, unless the FDA raises questions or concerns in response to a proposed clinical study and

places the study on a clinical hold within the 30-day timeframe. In such a case, the IND sponsor and the FDA must resolve any outstanding

issues before commencing the clinical study. The FDA may impose clinical holds due to safety concerns or non-compliance on all product

candidates within a certain pharmaceutical class at any time before or during clinical studies. In addition, the FDA can impose partial

clinical holds prohibiting the initiation of clinical studies for a certain dose or of a certain duration.

In

accordance with GCP regulations, all clinical studies must be conducted under the supervision of one or more qualified investigators.

These regulations require informed consent in writing from all research subjects before their participation in any clinical study. An

IRB must review and approve the plan for any clinical study before it commences at any institution, and the IRB must continuously review

and re-approve the study at least annually. Among other things, the IRB considers whether the risks to individual participants in the

clinical study are minimal and reasonable in relation to the anticipated benefits. The IRB also approves the information regarding the

clinical study and the consent form that must be given to each clinical study subject or his or her legal representative. The IRB must

also monitor the clinical study until completed. Each new clinical protocol and any amendments thereto must be submitted to the FDA for

review, and to the IRB for approval. The protocols detail the objectives of the clinical study, dosing procedures, subject selection

and exclusion criteria, and the parameters to be used to monitor subject safety (among other things). Study sites are subject to inspection

for compliance with GCP.

Information

about certain clinical trials must be submitted within specific timeframes to the National Institutes of Health, for public dissemination

on the ClinicalTrials.gov website.

Human

clinical studies are typically conducted in three sequential phases that may overlap or be combined:

| |

● |

Phase

1. In Phase 1, the product is initially introduced to a limited number of healthy human subjects or patients and may be tested

for safety, dosage tolerance, absorption, metabolism, distribution and excretion and, if possible, to gain early evidence on effectiveness.

In the case of certain products intended to treat severe or life-threatening diseases, particularly when the product is suspected

or known to be unavoidably toxic, initial human testing may be conducted in patients. |

| |

|

|

| |

● |

Phase

2. Phase 2 involves clinical studies in a limited patient population to identify potential adverse effects and safety risks,

to preliminarily evaluate the efficacy of the product for specific diseases and to determine dosage tolerance, optimal dosage and

schedule. |

| |

|

|

| |

● |

Phase

3. In Phase 3, clinical studies are often conducted on a larger number of subjects or in a patient population located in

geographically dispersed clinical sites to further evaluate the dosage, clinical efficacy and safety of the product. Phase 3

clinical studies are intended to determine the overall risks and benefits of the product and provide an adequate basis for product

labeling. |

Progress

reports explaining the results of the clinical studies must be submitted to the FDA at least annually. Safety reports must be submitted

to the FDA and the investigators for serious and unexpected suspected adverse events. There is no guarantee that Phase 1, Phase 2 and

Phase 3 testing will be completed successfully within any specified period, if at all. The FDA or the sponsor may suspend or terminate

a clinical study at any time for various reasons, including a finding that the research subjects or patients are being exposed to an

unacceptable health risk. Likewise, an IRB can suspend or terminate approval of a clinical study at its institution if the clinical study

is not being conducted in accordance with the IRB’s requirements or if the drug has been associated with unexpected serious harm

to patients.

U.S.

Review and Approval Processes

Upon

the successful completion of the required clinical testing, an NDA is submitted to the FDA requesting approval to market the product.

The NDA reports the results of product development, preclinical and clinical studies, descriptions of the manufacturing process, analytical

tests conducted on the drug, proposed labeling and other relevant information.

In

connection with the submission of an NDA, the payment of a substantial application user fee is required (although a waiver is available

under limited circumstances, including, for the first human drug application submitted by a small business or its affiliate). The sponsor

of an approved NDA is also required to pay annual program user fees.

The

FDA may also require a Risk Evaluation and Mitigation Strategy (“REMS”) to mitigate any identified or suspected serious risks.

The REMS typically includes risk minimization tools, medication guides, assessment plans, physician communication plans, and elements

to ensure safe use, including restricted distribution methods, and patient registries.

The

FDA reviews all NDAs submitted to ensure they are sufficiently complete for substantive review before it accepts them for filing. Rather

than accept an application for filing, the FDA may request additional information. In such a case, an applicant must re-submit the application

along with the additional information, which remains subject to further FDA review. Once an application is accepted for filing, the FDA

performs an in-depth substantive review to determine whether the product is safe and effective for its intended use.

The

FDA may refer the NDA to an advisory committee consisting of experts for review, evaluation and recommendation regarding its approval

and any conditions that may apply thereto. The FDA, while not bound by the recommendation of an advisory committee, considers such recommendations

when making decisions. Before approving an NDA, the FDA will also inspect one or more clinical sites to ensure clinical data supporting

the submission comply with GCP.

The

FDA may refuse to approve an NDA if regulatory requirements are not satisfied or additional clinical data and information is required.

Even after such data and information is furnished, the FDA may refuse to approve an NDA for failure to satisfy regulatory requirements.

Data from clinical studies may not always be conclusive. Moreover, the FDA may disagree with the applicant’s interpretation of

the data.

After

evaluating an application, the FDA may issue an approval letter or a complete response letter indicating completion of the review cycle.

A complete response letter typically sets forth specific conditions that must be satisfied to secure final approval of the application

and may require additional clinical or preclinical testing for the FDA to reconsider the application. The FDA may identify minor deficiencies,

such as requiring labeling changes, or major deficiencies, such as requiring additional clinical studies. The complete response letter

may also recommend actions to ready the application for approval. An applicant can respond to a complete response letter by correcting

all deficiencies and re-submitting the application, withdrawing the application or requesting a hearing.

Even

after additional information is submitted, the FDA may determine that an application does not satisfy regulatory requirements and reject

it. Once all conditions have been met to the FDA’s satisfaction, the FDA will typically issue an approval letter authorizing commercial

marketing of the drug with specific prescribing information for specific indications.

Even

after regulatory approval is obtained, approval may be restricted to specific diseases and dosages or limited indications for use. Such

limitations could affect the commercial value of the product. On the product labeling, the FDA may require certain contraindications,

warnings or precautions. In addition, the FDA may require post-approval studies, including Phase 4 clinical studies, to further evaluate

safety and effectiveness. The FDA may also require testing and surveillance programs to monitor the safety of approved commercialized

products. After approval, certain changes to the approved product remain subject to additional testing requirements, FDA review and approval.

Such changes to the approved product include adding new indications, manufacturing changes, and additional labeling claims.

Approved

products manufactured or distributed in accordance with the FDA regulatory process remain subject to continuing FDA oversight post-approval.

Continuing regulatory requirements include periodic reporting, record-keeping, product sampling, product distribution, and advertising

and reporting on adverse experiences, deviations, and other issues with the product. In addition, most post-approval changes to the approved

product, including adding new indications or other labeling claims, remain subject to prior FDA review and approval. There are also continuing

obligations to pay annual user fees for marketed products, as well as new application fees for supplemental applications with clinical

data.

The

FDA strictly regulates the information presented on products on the market, including information on labeling, advertising, and promotion

of products. Products may only be promoted for the approved indications and in accordance with the provisions of the approved label.

The FDA and other agencies actively enforce the rules prohibiting the promotion of off-label use. A company that improperly promotes

off-label use may be subject to significant liability. Manufacturers must also continue to comply with extensive CGMP regulations, which

requires a commitment of time and financial resources. FDA review and approval is generally required for post-approval changes to the

manufacturing process and other changes to the approved product, including the addition of new indications and additional labeling claims.

Manufacturers

and others involved in the manufacturing and distribution of approved products must register their establishments with the FDA and certain

state agencies. The FDA and state agencies may periodically inspect these establishments, sometimes without prior notice, to ensure compliance