Form 8-K - Current report

2024年8月27日 - 5:05AM

Edgar (US Regulatory)

false

0001711012

CN

0001711012

2024-08-20

2024-08-20

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

August 20, 2024

| SENMIAO TECHNOLOGY LIMITED |

| (Exact name of registrant as specified in its charter) |

| Nevada |

|

001-38426 |

|

35-2600898 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

16F, Shihao Square, Middle Jiannan Blvd.

High-Tech Zone, Chengdu

Sichuan, People’s Republic of China |

|

610000 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: +86 28 61554399

| Not Applicable |

| (Former name or former address, if changed since last report) |

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common Stock, par value $0.0001 per share |

|

AIHS |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.01. Completion of Acquisition or Disposition of Assets

On August 20, 2024, Sichuan

Senmiao Zecheng Business Consulting Co., Ltd. (the “Transferor”), a wholly-owned subsidiary of Senmiao Technology Limited

(the “Company”), consummated the previously announced transaction (the “Acquisition”) contemplated by the Acquisition

Agreement with Debt Assumption Takeover (the “Acquisition Agreement”) with Jiangsu Yuelaiyuexing Technology Co., Ltd. (the

“Purchaser”), and other parties thereto, including the acquisition by the Purchaser of 100% of the Transferor’s equity

interest in Hunan Xixingtianxia Technology Co., Ltd. (the “Target”), a wholly-owned subsidiary of the Transferor.

The pro forma financial information

required to be filed by Item 9.01(b) of Form 8-K is filed as Exhibit 99.1 to this Current Report.

Item 9.01. Financial Statements and Exhibits.

(b) Pro Forma Financial Information

The unaudited pro forma condensed

consolidated financial statements of the Company have been derived from the Company’s historical consolidated financial statements

and are being presented to give effect to the Acquisition. The pro forma financial statements and the related notes thereto are filed

as Exhibit 99.1 to this Current Report on Form 8-K.

(d) The following exhibits are being filed herewith.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

SENMIAO TECHNOLOGY LIMITED |

| |

|

|

| Date: August 26, 2024 |

By: |

/s/ Xiaoyuan Zhang |

| |

Name: |

Xiaoyuan Zhang |

| |

Title: |

Chief Financial Officer |

2

Exhibit 99.1

SENMIAO TECHNOLOGY LIMITED

Unaudited Pro Forma Condensed Combined Balance Sheet

(Expressed in U.S. dollar, except for the number of shares)

As of June 30, 2024

| | |

June 30, 2024 | | |

Pro Forma adjustments | | |

June 30, 2024 | |

| | |

Consolidated | | |

disposal of

XXTX | | |

Pro Forma Consolidated | |

| | |

(Unaudited) | | |

(Unaudited) | | |

(Unaudited) | |

| | |

| | |

(a) | | |

| |

| ASSETS | |

| | |

| | |

| |

| Current assets | |

| | |

| | |

| |

| Cash and cash equivalents | |

$ | 748,869 | | |

$ | (34,588 | ) | |

$ | 714,281 | |

| Restricted cash | |

| 2,588 | | |

| - | | |

| 2,588 | |

| Accounts receivable, net | |

| 20,156 | | |

| (8,103 | ) | |

| 12,053 | |

| Accounts receivable, a related party | |

| 1,878 | | |

| - | | |

| 1,878 | |

| Finance lease receivables, current | |

| 179,356 | | |

| - | | |

| 179,356 | |

| Prepayments, other receivables and other current assets, net | |

| 1,001,171 | | |

| (275,894 | ) | |

| 725,277 | |

| Due from related parties, net, current | |

| 319,679 | | |

| (3,986 | ) | |

| 315,693 | |

| Total current assets | |

| 2,273,697 | | |

| (322,571 | ) | |

| 1,951,126 | |

| | |

| | | |

| | | |

| | |

| Property and equipment, net | |

| 2,341,445 | | |

| (892 | ) | |

| 2,340,553 | |

| | |

| | | |

| | | |

| | |

| Other assets | |

| | | |

| | | |

| | |

| Operating lease right-of-use assets, net | |

| 51,489 | | |

| - | | |

| 51,489 | |

| Operating lease right-of-use assets, net, a related party | |

| 37,060 | | |

| - | | |

| 37,060 | |

| Financing lease right-of-use assets, net | |

| 294,241 | | |

| - | | |

| 294,241 | |

| Intangible assets, net | |

| 548,671 | | |

| (117,421 | ) | |

| 431,250 | |

| Finance lease receivable, non-current | |

| 102,192 | | |

| - | | |

| 102,192 | |

| Due from a related party, net, non-current | |

| 2,922,894 | | |

| - | | |

| 2,922,894 | |

| Other non-current assets | |

| 635,733 | | |

| - | | |

| 635,733 | |

| Total other assets | |

| 4,592,280 | | |

| (117,421 | ) | |

| 4,474,859 | |

| | |

| | | |

| | | |

| | |

| Total assets | |

$ | 9,207,422 | | |

$ | (440,884 | ) | |

$ | 8,766,538 | |

| | |

| | | |

| | | |

| | |

| LIABILITIES, MEZZANNIE EQUITY AND EQUITY | |

| | | |

| | | |

| | |

| Current liabilities | |

| | | |

| | | |

| | |

| Borrowings from a financial institution, current | |

$ | 141,536 | | |

$ | (141,536 | ) | |

$ | - | |

| Accounts payable | |

| 152,784 | | |

| (45,125 | ) | |

| 107,659 | |

| Advances from customers | |

| 123,350 | | |

| - | | |

| 123,350 | |

| Income tax payable | |

| 19,889 | | |

| - | | |

| 19,889 | |

| Accrued expenses and other liabilities | |

| 3,803,459 | | |

| (231,897 | ) | |

| 3,571,562 | |

| Due to related parties | |

| 194,707 | | |

| - | | |

| 194,707 | |

| Operating lease liabilities, current | |

| 14,104 | | |

| - | | |

| 14,104 | |

| Operating lease liabilities -a related party | |

| 51,993 | | |

| - | | |

| 51,993 | |

| Financing lease liabilities, current | |

| 331,462 | | |

| - | | |

| 331,462 | |

| Derivative liabilities | |

| 297,120 | | |

| - | | |

| 297,120 | |

| Current liabilities - discontinued operations | |

| 461,005 | | |

| - | | |

| 461,005 | |

| Total current liabilities | |

| 5,591,409 | | |

| (418,558 | ) | |

| 5,172,851 | |

| | |

| | | |

| | | |

| | |

| Other liabilities | |

| | | |

| | | |

| | |

| Borrowings from a financial institution, non-current | |

| 35,384 | | |

| (35,384 | ) | |

| - | |

| Operating lease liabilities, non-current | |

| 15,334 | | |

| - | | |

| 15,334 | |

| Financing lease liabilities, non-current | |

| 63,368 | | |

| - | | |

| 63,368 | |

| Deferred tax liability | |

| 9,413 | | |

| (9,413 | ) | |

| - | |

| Total other liabilities | |

| 123,499 | | |

| (44,797 | ) | |

| 78,702 | |

| | |

| | | |

| | | |

| | |

| Total liabilities | |

| 5,714,908 | | |

| (463,355 | ) | |

| 5,251,553 | |

| | |

| | | |

| | | |

| | |

| Commitments and contingencies | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | |

| Mezzanine Equity | |

| | | |

| | | |

| | |

| Series A convertible preferred stock (par value $1,000 per share, 5,000 shares authorized; 991 shares issued and outstanding at June 30, 2024) | |

| 234,364 | | |

| - | | |

| 234,364 | |

| | |

| | | |

| | | |

| | |

| Stockholders’ equity | |

| | | |

| | | |

| | |

| Common stock (par value $0.0001 per share, 500,000,000 shares authorized; 10,518,040 shares issued and outstanding at June 30, 2024 ) | |

| 1,051 | | |

| - | | |

| 1,051 | |

| Additional paid-in capital | |

| 43,950,123 | | |

| - | | |

| 43,950,123 | |

| Accumulated deficit | |

| (42,057,688 | ) | |

| 393,980 | | |

| (41,663,708 | ) |

| Accumulated other comprehensive loss | |

| (1,734,325 | ) | |

| (371,509 | ) | |

| (2,105,834 | ) |

| Total Senmiao Technology Limited stockholders’ equity | |

| 159,161 | | |

| 22,471 | | |

| 181,632 | |

| | |

| | | |

| | | |

| | |

| Non-controlling interests | |

| 3,098,989 | | |

| - | | |

| 3,098,989 | |

| | |

| | | |

| | | |

| | |

| Total equity | |

| 3,258,150 | | |

| 22,471 | | |

| 3,280,621 | |

| | |

| | | |

| | | |

| | |

| Total liabilities, mezzanine equity and equity | |

$ | 9,207,422 | | |

$ | (440,884 | ) | |

$ | 8,766,538 | |

The

Unaudited Pro Forma Financial Information include the following pro forma adjustments to give effect to the disposal of XXTX:

| (a) | To eliminate assets and liabilities of XXTX and its subsidiaries

as of June 30, 2024. |

SENMIAO TECHNOLOGY LIMITED

Unaudited Pro Forma Condensed Combined Balance Sheet

(Expressed in U.S. dollar, except for the number of shares)

As of March 31, 2024

| | |

3/31/2024 | | |

Pro Forma adjustments | | |

3/31/2024 | |

| | |

Consolidated | | |

disposal of XXTX | | |

Pro Forma Consolidated | |

| | |

(Audited) | | |

(Unaudited) | | |

(Unaudited) | |

| | |

| | |

a | | |

| |

| ASSETS | |

| | |

| | |

| |

| Current assets | |

| | |

| | |

| |

| Cash and cash equivalents | |

$ | 792,299 | | |

$ | (54,580 | ) | |

$ | 737,719 | |

| Restricted cash | |

| 2,337 | | |

| - | | |

| 2,337 | |

| Accounts receivable, net | |

| 34,013 | | |

| (14,130 | ) | |

| 19,883 | |

| Finance lease receivables, current | |

| 144,166 | | |

| - | | |

| 144,166 | |

| Prepayments, other receivables and other current assets, net | |

| 1,022,813 | | |

| (344,444 | ) | |

| 678,369 | |

| Due from related parties, net, current | |

| 655,532 | | |

| (6,368 | ) | |

| 649,164 | |

| Total current assets | |

| 2,651,160 | | |

| (419,522 | ) | |

| 2,231,638 | |

| | |

| | | |

| | | |

| | |

| Property and equipment, net | |

| 2,676,524 | | |

| (1,266 | ) | |

| 2,675,258 | |

| | |

| | | |

| | | |

| | |

| Other assets | |

| | | |

| | | |

| | |

| Operating lease right-of-use assets, net | |

| 60,862 | | |

| - | | |

| 60,862 | |

| Operating lease right-of-use assets, net, a related party | |

| 47,128 | | |

| - | | |

| 47,128 | |

| Financing lease right-of-use assets, net | |

| 355,383 | | |

| - | | |

| 355,383 | |

| Intangible assets, net | |

| 590,727 | | |

| (140,698 | ) | |

| 450,029 | |

| Finance lease receivable, non-current | |

| 92,524 | | |

| - | | |

| 92,524 | |

| Due from a related party, net, non-current | |

| 2,747,313 | | |

| - | | |

| 2,747,313 | |

| Other non-current assets | |

| 639,863 | | |

| - | | |

| 639,863 | |

| Total other assets | |

| 4,533,800 | | |

| (140,698 | ) | |

| 4,393,102 | |

| | |

| | | |

| | | |

| | |

| Total assets | |

$ | 9,861,484 | | |

$ | (561,486 | ) | |

$ | 9,299,998 | |

| | |

| | | |

| | | |

| | |

| LIABILITIES, MEZZANNIE EQUITY AND EQUITY | |

| | | |

| | | |

| | |

| Current liabilities | |

| | | |

| | | |

| | |

| Borrowings from a financial institution, current | |

$ | 142,456 | | |

$ | (142,456 | ) | |

$ | - | |

| Accounts payable | |

| 140,532 | | |

| (44,129 | ) | |

| 96,403 | |

| Advances from customers | |

| 122,461 | | |

| - | | |

| 122,461 | |

| Income tax payable | |

| 20,019 | | |

| - | | |

| 20,019 | |

| Accrued expenses and other liabilities | |

| 3,648,407 | | |

| (366,405 | ) | |

| 3,282,002 | |

| Due to related parties | |

| 170,986 | | |

| - | | |

| 170,986 | |

| Operating lease liabilities, current | |

| 14,007 | | |

| - | | |

| 14,007 | |

| Operating lease liabilities -a related party | |

| 51,741 | | |

| - | | |

| 51,741 | |

| Financing lease liabilities, current | |

| 279,768 | | |

| - | | |

| 279,768 | |

| Derivative liabilities | |

| 288,833 | | |

| - | | |

| 288,833 | |

| Current liabilities - discontinued operations | |

| 464,000 | | |

| - | | |

| 464,000 | |

| Total current liabilities | |

| 5,343,210 | | |

| (552,990 | ) | |

| 4,790,220 | |

| | |

| | | |

| | | |

| | |

| Other liabilities | |

| | | |

| | | |

| | |

| Borrowings from a financial institution, non-current | |

| 71,228 | | |

| (71,228 | ) | |

| - | |

| Operating lease liabilities, non-current | |

| 20,430 | | |

| - | | |

| 20,430 | |

| Financing lease liabilities, non-current | |

| 126,637 | | |

| - | | |

| 126,637 | |

| Deferred tax liability | |

| 11,611 | | |

| (11,611 | ) | |

| - | |

| Total other liabilities | |

| 229,906 | | |

| (82,839 | ) | |

| 147,067 | |

| | |

| | | |

| | | |

| | |

| Total liabilities | |

| 5,573,116 | | |

| (635,829 | ) | |

| 4,937,287 | |

| | |

| | | |

| | | |

| | |

| Commitments and contingencies | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | |

| Mezzanine Equity | |

| | | |

| | | |

| | |

| Series A convertible preferred stock (par value $1,000 per share, 5,000 shares authorized; 991 shares issued and outstanding at March 31, 2024) | |

| 234,364 | | |

| - | | |

| 234,364 | |

| | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | |

| Stockholders’ equity | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | |

| Common stock (par value $0.0001 per share, 500,000,000 shares authorized; 10,518,040 shares issued and outstanding at March 31, 2024 )* | |

| 1,051 | | |

| - | | |

| 1,051 | |

| Additional paid-in capital | |

| 43,950,123 | | |

| - | | |

| 43,950,123 | |

| Accumulated deficit | |

| (41,384,268 | ) | |

| 443,712 | | |

| (40,940,556 | ) |

| Accumulated other comprehensive loss | |

| (1,672,005 | ) | |

| (369,369 | ) | |

| (2,041,374 | ) |

| Total Senmiao Technology Limited stockholders’ equity | |

| 894,901 | | |

| 74,343 | | |

| 969,244 | |

| | |

| | | |

| | | |

| | |

| Non-controlling interests | |

| 3,159,103 | | |

| - | | |

| 3,159,103 | |

| | |

| | | |

| | | |

| | |

| Total equity | |

| 4,054,004 | | |

| 74,343 | | |

| 4,128,347 | |

| | |

| | | |

| | | |

| | |

| Total liabilities, mezzanine equity and equity | |

$ | 9,861,484 | | |

$ | (561,486 | ) | |

$ | 9,299,998 | |

The

Unaudited Pro Forma Financial Information include the following pro forma adjustments to give effect to the disposal of XXTX:

| (a) | To eliminate assets and liabilities of XXTX and its subsidiaries

as of March 31, 2024. |

SENMIAO TECHNOLOGY LIMITED

Unaudited Pro Forma Condensed Combined Statement of Operations

(Expressed in U.S. dollar, except for the number of shares)

For the Three Months Ended June 30, 2024

| | |

Consolidated | | |

Pro Forma adjustments | | |

Pro Forma Adjustment | | |

Pro Forma Consolidated | |

| | |

(Unaudited) | | |

disposal of XXTX | | |

Reverse elimination related to XXTX | | |

(Unaudited) | |

| | |

| | |

(a) | | |

(b) | | |

| |

| Revenues | |

| | |

| | |

| | |

| |

| Revenues | |

$ | 1,117,157 | | |

$ | (243,391 | ) | |

$ | 678 | | |

$ | 874,444 | |

| Revenues, a related party | |

| 5,243 | | |

| - | | |

| - | | |

| 5,243 | |

| Total revenues | |

| 1,122,400 | | |

| (243,391 | ) | |

| 678 | | |

| 879,687 | |

| | |

| | | |

| | | |

| | | |

| | |

| Cost of revenues | |

| | | |

| | | |

| | | |

| | |

| Cost of revenues | |

| (800,238 | ) | |

| 175,826 | | |

| - | | |

| (624,412 | ) |

| Cost of revenues, a related party | |

| (1,627 | ) | |

| - | | |

| - | | |

| (1,627 | ) |

| Total cost of revenues | |

| (801,865 | ) | |

| 175,826 | | |

| - | | |

| (626,039 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Gross profit | |

| 320,535 | | |

| (67,565 | ) | |

| 678 | | |

| 253,648 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses | |

| | | |

| | | |

| | | |

| | |

| Selling, general and administrative expenses | |

| (940,268 | ) | |

| 87,448 | | |

| (678 | ) | |

| (853,498 | ) |

| Provision for credit losses | |

| (173,441 | ) | |

| - | | |

| - | | |

| (173,441 | ) |

| Total operating expenses | |

| (1,113,709 | ) | |

| 87,448 | | |

| (678 | ) | |

| (1,026,939 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Loss from operations | |

| (793,174 | ) | |

| 19,883 | | |

| - | | |

| (773,291 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other income (expense) | |

| | | |

| | | |

| | | |

| | |

| Other income, net | |

| 47,656 | | |

| 3,803 | | |

| - | | |

| 51,459 | |

| Interest expense | |

| (5,860 | ) | |

| 5,860 | | |

| - | | |

| - | |

| Interest expense on finance leases | |

| (5,088 | ) | |

| - | | |

| - | | |

| (5,088 | ) |

| Change in fair value of derivative liabilities | |

| (8,287 | ) | |

| - | | |

| - | | |

| (8,287 | ) |

| Total other income, net | |

| 28,421 | | |

| 9,663 | | |

| - | | |

| 38,084 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss before income taxes | |

| (764,753 | ) | |

| 29,546 | | |

| - | | |

| (735,207 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Income tax benefit | |

| 1,935 | | |

| (1,935 | ) | |

| - | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | |

| Net Loss | |

| (762,818 | ) | |

| 27,611 | | |

| - | | |

| (735,207 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss attributable to non-controlling interests from operations | |

| 89,398 | | |

| - | | |

| - | | |

| 89,398 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss attributable to the Company’s stockholders | |

$ | (673,420 | ) | |

$ | 27,611 | | |

$ | - | | |

$ | (645,809 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

$ | (762,818 | ) | |

$ | 27,611 | | |

$ | - | | |

$ | (735,207 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other comprehensive loss | |

| | | |

| | | |

| | | |

| | |

| Foreign currency translation adjustment | |

| (33,036 | ) | |

| 2,140 | | |

| - | | |

| (30,896 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Comprehensive loss | |

| (795,854 | ) | |

| 29,751 | | |

| - | | |

| (766,103 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| less: Total comprehensive loss attributable to noncontrolling interests | |

| (60,114 | ) | |

| - | | |

| - | | |

| (60,114 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Total comprehensive loss attributable to stockholders | |

$ | (735,740 | ) | |

$ | 29,751 | | |

$ | - | | |

$ | (705,989 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average number of common stock | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted | |

| 10,518,040 | | |

| 10,518,040 | | |

| 10,518,040 | | |

| 10,518,040 | |

| Net loss per share - basic and diluted | |

$ | (0.06 | ) | |

$ | 0.00 | | |

$ | - | | |

$ | (0.07 | ) |

The

Unaudited Pro Forma Financial Information include the following pro forma adjustments to give effect to the disposal of XXTX:

| (a) | To eliminate revenue, costs of revenue, operating and other

expenses of XXTX and its subsidiaries for the three months ended June 30, 2024. |

| (b) | Reflect the reversal of intercompany transaction between

XXTX and other entities in Senmiao Group for the three months ended June 30, 2024 as a result of deposal of XXTX. |

SENMIAO TECHNOLOGY LIMITED

Unaudited Pro Forma Condensed Combined Statement of Operations

(Expressed in U.S. dollar, except for the number of shares)

For the Year Ended March 31, 2024

| | |

Consolidated | | |

Pro Forma adjustments | | |

Pro Forma Adjustment | | |

Pro Forma Consolidated | |

| | |

(Audited) | | |

Disposal of XXTX | | |

Reverse elimination related to XXTX | | |

(Unaudited) | |

| | |

| | |

(a) | | |

(b) | | |

| |

| Revenues | |

| | |

| | |

| | |

| |

| Revenues | |

$ | 6,779,686 | | |

$ | (2,494,397 | ) | |

$ | 68,362 | | |

$ | 4,353,651 | |

| Revenues, a related party | |

| 34,742 | | |

| - | | |

| - | | |

| 34,742 | |

| Total revenues | |

| 6,814,428 | | |

| (2,494,397 | ) | |

| 68,362 | | |

| 4,388,393 | |

| | |

| | | |

| | | |

| | | |

| | |

| Cost of revenues | |

| | | |

| | | |

| | | |

| | |

| Cost of revenues | |

| (4,781,009 | ) | |

| 1,858,557 | | |

| - | | |

| (2,922,452 | ) |

| Cost of revenues, a related party | |

| (472,848 | ) | |

| - | | |

| - | | |

| (472,848 | ) |

| Total cost of revenues | |

| (5,253,857 | ) | |

| 1,858,557 | | |

| - | | |

| (3,395,300 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Gross profit | |

| 1,560,571 | | |

| (635,840 | ) | |

| 68,362 | | |

| 993,093 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses | |

| | | |

| | | |

| | | |

| | |

| Selling, general and administrative expenses | |

| (4,115,436 | ) | |

| 1,053,585 | | |

| (68,362 | ) | |

| (3,130,213 | ) |

| Provision for credit losses | |

| (1,725,746 | ) | |

| - | | |

| - | | |

| (1,725,746 | ) |

| Stock-based compensation | |

| (444,300 | ) | |

| - | | |

| - | | |

| (444,300 | ) |

| Total operating expenses | |

| (6,285,482 | ) | |

| 1,053,585 | | |

| (68,362 | ) | |

| (5,300,259 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Loss from operations | |

| (4,724,911 | ) | |

| 417,745 | | |

| - | | |

| (4,307,166 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other income (expense) | |

| | | |

| | | |

| | | |

| | |

| Other income, net | |

| 315,450 | | |

| 42,742 | | |

| - | | |

| 358,192 | |

| Interest expense | |

| (17,630 | ) | |

| 17,116 | | |

| - | | |

| (514 | ) |

| Interest expense on finance leases | |

| (29,088 | ) | |

| - | | |

| - | | |

| (29,088 | ) |

| Change in fair value of derivative liabilities | |

| 212,949 | | |

| - | | |

| - | | |

| 212,949 | |

| Total other income, net | |

| 481,681 | | |

| 59,858 | | |

| - | | |

| 541,539 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss before income taxes | |

| (4,243,230 | ) | |

| 477,603 | | |

| - | | |

| (3,765,627 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Income tax benefit (expense) | |

| 9,016 | | |

| (29,222 | ) | |

| | | |

| (20,206 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net Loss | |

| (4,234,214 | ) | |

| 448,381 | | |

| - | | |

| (3,785,833 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss attributable to non-controlling interests from operations | |

| 565,240 | | |

| - | | |

| - | | |

| 565,240 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss attributable to the Company’s stockholders | |

$ | (3,668,974 | ) | |

$ | 448,381 | | |

$ | - | | |

$ | (3,220,593 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

$ | (4,234,214 | ) | |

$ | 448,381 | | |

$ | - | | |

$ | (3,785,833 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other comprehensive loss | |

| | | |

| | | |

| | | |

| | |

| Foreign currency translation adjustment | |

| (418,784 | ) | |

| 1,203 | | |

| - | | |

| (417,581 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Comprehensive loss | |

| (4,652,998 | ) | |

| 449,584 | | |

| - | | |

| (4,203,414 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| less: Total comprehensive loss attributable to noncontrolling interests | |

| (527,591 | ) | |

| - | | |

| - | | |

| (527,591 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Total comprehensive loss attributable to stockholders | |

$ | (4,125,407 | ) | |

$ | 449,584 | | |

$ | - | | |

$ | (3,675,823 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average number of common stock | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted | |

| 8,863,190 | | |

| 8,863,190 | | |

| 8,863,190 | | |

| 8,863,190 | |

| Net loss per share - basic and diluted | |

$ | (0.41 | ) | |

$ | 0.05 | | |

$ | - | | |

$ | (0.43 | ) |

The

Unaudited Pro Forma Financial Information include the following pro forma adjustments to give effect to the disposal of XXTX:

| (a) | To eliminate revenue, costs of revenue, operating and other

expenses of XXTX and its subsidiaries for the year ended March 31, 2024. |

| (b) | Reflect the reversal of intercompany transaction between

XXTX and other entities in Senmiao Group for the year ended March 31, 2024 as a result of deposal of XXTX. |

4

v3.24.2.u1

Cover

|

Aug. 20, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 20, 2024

|

| Entity File Number |

001-38426

|

| Entity Registrant Name |

SENMIAO TECHNOLOGY LIMITED

|

| Entity Central Index Key |

0001711012

|

| Entity Tax Identification Number |

35-2600898

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

16F, Shihao Square, Middle Jiannan Blvd.

|

| Entity Address, Address Line Two |

High-Tech Zone

|

| Entity Address, City or Town |

Chengdu

|

| Entity Address, Country |

CN

|

| Entity Address, Postal Zip Code |

610000

|

| City Area Code |

+86 28

|

| Local Phone Number |

61554399

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

AIHS

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

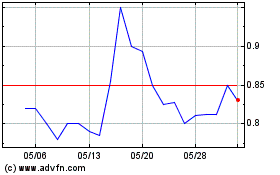

Senmiao Technology (NASDAQ:AIHS)

過去 株価チャート

から 11 2024 まで 12 2024

Senmiao Technology (NASDAQ:AIHS)

過去 株価チャート

から 12 2023 まで 12 2024