Residential Secure Income PLC Dividend Declaration (4721O)

2023年2月1日 - 4:01PM

RNSを含む英国規制内ニュース (英語)

TIDMRESI

RNS Number : 4721O

Residential Secure Income PLC

01 February 2023

1 February 2023

Residential Secure Income plc

Dividend Declaration

Residential Secure Income plc (LSE: RESI), which invests in

independent retirement living and shared ownership to deliver

secure, inflation-linked returns, is pleased to declare an interim

dividend of 1.29 pence per Ordinary Share to be paid in the

financial year to 30 September 2023 in line with the year's

target(1) of 5.16 pence per share.

The full 1.29 pence of the dividend will be paid as a Property

Income Distribution ("PID") in respect of the Company's tax-exempt

property rental business.

This dividend will be paid on 10 March 2 023 to Shareholders on

the register as at 10 February 2023. The ex-dividend date is 9

February 2023.

Over time, ReSI expects its dividends to increase broadly in

line with inflation, and targets a total return in excess of 8% per

annum(1) . ReSI intends to pay dividends to Shareholders on a

quarterly basis and in accordance with the REIT regime.

(1) These are targets only and not a profit forecast. There can

be no assurance that the targets will be met.

For further information, please contact:

ReSI Capital Management Limited / Gresham

House Real Estate

Ben Fry

Brandon Holloway +44 (0) 20 7382 0900

Peel Hunt LLP

Luke Simpson

Huw Jeremy +44 (0) 20 7418 8900

KL Communications gh@kl-communications.com

Charles Gorman +44 (0) 20 3995 6673

Charlotte Francis

Millie Steyn

About ReSI plc:

Residential Secure Income plc ("ReSI plc" LSE: RESI) is a real

estate investment trust (REIT) focused on delivering secure,

inflation-linked returns with a focus on two resident sub-sectors

in UK residential - independent retirement rentals and shared

ownership - underpinned by an ageing demographic and untapped and

strong demand for affordable home ownership.

ReSI plc targets a secure, long-dated, inflation-linked dividend

of 5.16 pence per share p.a. [i] (paid quarterly) and a total

return in excess of 8.0% per annum. As at 31 December 2022,

including committed acquisitions, ReSI plc's portfolio comprises

3,303 properties, with an (unaudited) IFRS fair value of GBP364mn

[ii] .

ReSI plc's purpose is to deliver affordable, high-quality, safe

homes with great customer service and long-term stability of tenure

for residents. We achieve this through meeting demand from housing

developers, housing associations, local authorities, and private

developers for long-term investment partners to accelerate the

development of socially and economically beneficial affordable

housing.

ReSI plc's subsidiary, ReSI Housing Limited, is registered as a

for-profit Registered Provider of social housing, and so provides a

unique proposition to its housing developer partners, being a

long-term private sector landlord within the social housing

regulatory environment. As a Registered Provider, ReSI Housing can

acquire affordable housing subject to s106 planning restrictions

and housing funded by government grant.

About Gresham House and Gresham House Real Estate

Gresham House is a London Stock Exchange quoted specialist

alternative asset manager committed to operating responsibly and

sustainably, taking the long view in delivering sustainable

investment solutions.

Gresham House Real Estate has an unparalleled track record in

the affordable housing sector over 20 years, with senior members

having an average of c.30 years' experience.

Gresham House Real Estate offers long term equity investments

into UK housing, through listed and unlisted housing investment

vehicles, each focused on addressing different areas of the

affordable housing problem. Each fund aims to deliver stable and

secure inflation-linked returns whilst providing social and

environmental benefits to its residents, the local community, and

the wider economy.

Further information on ReSI plc is available at

www.resi-reit.com , and further information on Gresham House is

available at www.greshamhouse.com

[i] The dividend target and total return target are targets only

and are not profit forecasts. There can be no assurance that either

target will be met, and they should not be taken as an indication

of the Company's future results.

[ii] Excluding the finance lease gross up and including GBP2mn

of committed acquisitions.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DIVWPURWGUPWGQG

(END) Dow Jones Newswires

February 01, 2023 02:01 ET (07:01 GMT)

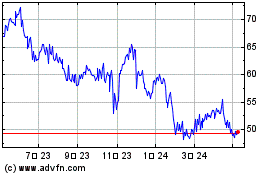

Residential Secure Income (LSE:RESI)

過去 株価チャート

から 10 2024 まで 11 2024

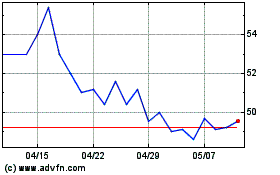

Residential Secure Income (LSE:RESI)

過去 株価チャート

から 11 2023 まで 11 2024