RNS Number:0853E

ITIS Holdings PLC

21 November 2002

21st November 2002

ITIS Holdings plc

Interim results for the six months ended 30th September 2002

Highlights

* New 5 year agreement signed with the AA providing ITIS with the exclusive

rights to operate AA Roadwatch branded telephone and telematics services;

* Growing revenues from UK Government contracts for Floating Vehicle Data

(FVD);

* Turnover up 76% to #1,103,000 (2001: #628,000);

* Operating loss reduced by 26% to #3,748,000 (2001: loss #5,034,000);

* Strong cash position of #13.8 million.

Stuart Marks, Chief Executive of ITIS Holdings plc commented:

"ITIS is now consistently winning new business and key contracts. The recent

announcement with the AA is demonstrative of our ability to secure long term

contracts with high profile brands. Vehicle manufacturers increasingly like our

unique position in the areas of traffic data collection (FVD), distribution

(RDS-TMC) and vehicle security (NavTrak). As a result we continue to believe

that we are excellently positioned to take advantage of this market as it

expands in the future."

Enquiries:

Stuart Marks, Chief Executive

ITIS Holdings plc

Telephone: 0161 929 5788

Ginny Pulbrook , Director

Citigate Dewe Rogerson

Telephone: 020 7282 2940

Financial Overview

For the six month period ended 30th September 2002 turnover increased by 76% to

#1,103,000 (2001: #628,000). The increased revenue and the stringent cost

reduction programme initiated last year has enabled us to reduce the operating

loss for the financial period to #3,748,000 (2001: loss #5,034,000),

substantially reduce cash outflow and safeguard our cash position.

At September 30th 2002, the cash balance of ITIS remained strong at #13.8

million. We are seeing a reducing trend in monthly cash burn which will

continue into the second half of the year and, as a result, the Directors are

confident that ITIS has sufficient cash both to develop and to grow the

business.

Business review

The AA

On the 11th October ITIS announced a new five year contract with Automobile

Association Developments Limited, part of the Automobile Association Limited

(AA), to exclusively operate AA Roadwatch branded telephone and telematics

services and to exploit new opportunities for selling and marketing traffic

information.

ITIS intends to build upon its new ownership of these telephone based traffic

information services, by expanding its business into this important growth area.

The new contract provides ITIS with a secure, long term revenue stream, which

will significantly enhance Group revenues with immediate effect.

ITIS' traffic information service is now available under the AA Roadwatch brand

on all mobile phone networks, whilst Vodafone and T-Mobile also have their own

short dial services. Our traffic information also enhances route information

given over the AA's web site.

The market

The market has gathered increased momentum as vehicle manufacturers define their

strategies for location related services. All major manufacturers are now

introducing these services into their vehicles either as an option (in the case

of NavTrak) or as standard equipment (RDS-TMC). Significantly, as part of this

step change, in house organisations that had been set up to develop and operate

these services have been disbanded and the manufacturers are now choosing to

work with specialist providers like ITIS, who have the necessary skills,

technology and delivery channels.

Importantly, as the market develops so do the opportunities to expand our

offering. In addition to the provision of content to in-vehicle applications,

our traffic information service is now available on all mobile phone networks

under the AA Roadwatch brand. Government agencies are increasingly turning to

ITIS's traffic data, collated by FVD, for analysing congestion and evaluating

strategic transport needs.

Floating Vehicle Data

ITIS now operates the world's largest commercial FVD system providing full

coverage of the UK's Strategic Road Network totalling some 8,200 miles.

Importantly this project was delivered on time and below budget.

FVD is becoming increasingly valuable to a wide range of customers and we are

benefiting from existing contracts with the AA, vehicle manufacturers and the UK

Government agencies, as they provide important reference sites to potential

customers.

In October 2002 we announced a 5 year contract with the Scottish Executive to

supply a comprehensive journey time planner and a traffic delay information

service. Today, we are pleased to announce that ITIS is providing Transport For

London (TFL) data on congestion patterns that will help measure the impact of

congestion charging in London before and after its launch.

As the software and systems are fully scaleable, FVD can also be licenced to

other operators outside the UK. In particular, we have received many enquiries

from USA and as a result of this interest we acquired a US patent on 1st

November, which mirrors our FVD technology, and potentially opens up this

valuable market.

RDS-TMC

RDS-TMC remains the only international standard for providing traffic data to a

navigational system. Virtually all screen based Satellite Navigation systems

are TMC compliant and vehicle manufacturers see this as a low cost entry point

to providing driver information services.

We continue to develop our RDS-TMC offering and are working with a number of

manufacturers to make RDS-TMC available on their navigation hardware.

Currently the service is fully operational with Toyota and BMW as well as

leading aftermarket navigation suppliers such as VDO Dayton and Alpine.

ITIS provides the RDS-TMC service using the AS/1 licence which enables our

traffic data to be transmitted nationally using the Classic FM network. The

licence expires on 31st December 2003 and in October this year, ITIS submitted

its application to the Radio Authority to operate the licence for the next 8

years. Although the formal process is expected to be completed during

December, the Radio Authority announced that the only application they received

was from ITIS.

NavTrak

Our focus with NavTrak, through the development and launch of NavTrak ADR

(Automatic Driver Recognition), has been to develop a product that sets the

industry standard and is attractive to vehicle manufacturers and insurers alike.

NavTrak ADR now uniquely addresses the key concerns of manufacturers and

insurers: detecting theft with the owners keys, delivering low current drain and

offering full service coverage across Europe including police liaison in 20

countries.

During the period we connected 1,085 NavTrak units. While satisfactory, the

figure does reflect the challenges of selling aftermarket products without the

endorsement of vehicle manufacturers and we are now undergoing rigorous

evaluation with a number of prestige manufacturers for endorsement of NavTrak

which will substantially enhance our volume opportunity.

New Partners

PTV AG provides software, consulting and research for travel, traffic and

transportation planning in the B2B market. They are the European Market Leader

specialising in innovative technologies which ensure continuous mobility in the

business fields of Traffic, Mobility and Logistics. ITIS is supporting PTV's

web based Telematics platform for OEM's with ITIS Dynamic Traffic Data, and

working closely with PTV on joint applications to further promote FVD to the

public. Through our agreement with PTV GmbH, ITIS is providing realtime traffic

information to a website recently launched by Toyota (www.getmethere.co.uk).

Board changes

We are delighted to announce that Andrew Forrest has been appointed to the Board

as Finance Director with immediate effect. Andrew, previously the Company's

Financial Controller, has been with the Company since May 2000.

Outlook

We are very encouraged by the business relationships we have created both with

the AA and vehicle manufacturers for whom we are now offering a wide range of in

car information services. As revenues continue to grow the Directors remain

confident that the Company can continue to reduce cash burn towards achieving

positive cash flow.

Notes

Andrew Derek Forrest has confirmed that there are no companies or partnerships

of which he is or has been a director or partner at any time in the last five

years and that there is no additional information with regards to his

appointment that would require disclosure pursuant to paragraph (f) of Schedule

Two of the AIM Rules.

Consolidated profit and loss account

Six months to Six months to Year ended

30 September 30 September 31 March

2002 2001 2002

Unaudited Unaudited Audited

# # #

Turnover 1,102,945 628,280 1,480,520

Cost of sales (2,045,412) (1,697,201) (3,895,119)

__________ __________ __________

Gross loss (942,467) (1,068,921) (2,414,599)

Other operating costs - Other (2,805,831) (3,965,262) (7,153,051)

- Impairment of fixed assets - - (896,000)

__________ __________ __________

Operating loss (3,748,298) (5,034,183) (10,463,650)

Share of operating loss of discontinued joint venture - (275,000) (659,678)

Goodwill amortisation - joint venture - (141,667) (236,111)

Profit on sale of joint venture - - 1,533,971

Interest receivable 284,357 679,486 1,089,214

Interest payable and similar charges (1,929) - (7,121)

__________ __________ __________

Loss on ordinary activities before taxation (3,465,870) (4,771,364) (8,743,375)

Tax on loss on ordinary activities - - 255,843

__________ __________ __________

Loss for the financial period (3,465,870) (4,771,364) (8,487,532)

====== ====== ======

Loss per ordinary share (p) (3.5) (4.8) (8.6)

====== ====== ======

The Group has no recognised gains or losses other than those shown in the profit

and loss account above.

Consolidated Balance Sheet

30 September 30 September 31 March

2002 2001 2002

Unaudited Unaudited Audited

# # #

Fixed assets

Intangible assets 414,502 456,500 435,501

Tangible assets 387,861 1,202,263 474,371

Investments

- Joint ventures

- share of gross assets - 705,878 -

- share of gross liabilities - (180,878) -

- associated goodwill - 661,111 -

__________ __________ __________

802,363 2,844,874 909,872

__________ __________ __________

Current assets

Stocks 152,179 104,959 109,648

Debtors

- due within one year 2,119,471 3,458,519 2,825,139

- due after more than one year 500,000 - 500,000

Cash at bank and in hand 13,812,444 19,718,863 17,079,443

__________ __________ __________

16,584,094 23,282,341 20,514,230

Creditors: Amounts falling due within one year (1,548,043) (3,070,182) (2,083,237)

__________ __________ __________

Net current assets 15,036,051 20,212,159 18,430,993

__________ __________ __________

Total assets less current liabilities 15,838,414 23,057,033 19,340,865

Creditors: Amounts falling due after more than one year (342,224) (378,805) (378,805)

__________ __________ __________

Net assets 15,496,190 22,678,228 18,962,060

======== ========= =========

Capital and reserves

Called-up share capital 5,186,286 5,186,286 5,186,286

Share premium account 37,342,877 37,342,877 37,342,877

Profit and loss account (27,032,973) (19,850,935) (23,567,103)

__________ __________ __________

Equity shareholders' funds 15,496,190 22,678,228 18,962,060

======== ========= =========

Consolidated Cash Flow Statement

Six months to Six months to Year ended

30 September 30 September 31 March

2002 2001 2002

Unaudited Unaudited Audited

# # #

Net cash outflow from operating activities (3,504,057) (5,481,010) (9,595,338)

__________ __________ __________

Returns on investments and servicing of finance

Interest paid - - (5,835)

Interest element of finance lease rental payments (1,929) - (1,286)

Interest received 284,357 67,665 1,027,135

__________ __________ __________

Net cash inflow from returns on investments and servicing of finance 282,428 67,665 1,020,014

__________ __________ __________

Taxation

Research and development tax credit - - 255,843

__________ __________ __________

Net cash inflow from taxation - - 255,843

__________ __________ __________

Capital expenditure and financial investment

Purchase of tangible fixed assets (30,278) (632,929) (705,235)

Sale of tangible fixed assets 5,000 6,500 6,500

__________ __________ __________

Net cash outflow from capital expenditure (25,278) (626,429) (698,735)

__________ __________ __________

Acquisitions and disposals

Investment in joint venture - - (490,040)

Disposal of joint venture - - 859,000

__________ __________ __________

Net cash inflow from acquisitions and disposals - - 368,960

__________ __________ __________

Cash outflow before financing (3,246,907) (6,039,774) (8,649,256)

__________ __________ __________

Financing

Issue of shares to minorities - - 200

Capital element of finance lease rental payments (20,092) - (30,138)

__________ __________ __________

Net cash outflow from financing (20,092) - (29,938)

__________ __________ __________

Decrease in cash (3,266,999) (6,039,774) (8,679,194)

=========== ========= ========

Notes (unaudited)

1. Accounting policies

The interim accounts have been prepared using accounting policies stated in the

Company's Report and Accounts for the year ended 31 March 2002 and are

unaudited.

2. Preparation of the interim financial information

The summarised results for the six months to 30 September 2002 have been

prepared in accordance with the accounting policies adopted in the accounts for

the year to 31 March 2002. These and the comparative results for the half year

to 30 September 2001 are non-statutory accounts within the meaning of Section

240 of the Companies Act 1985 and have not been reported upon by the auditors

under Section 235 of the Companies Act 1985.

The comparative figures for the year ended 31 March 2002 are an abridged version

of the Company's full accounts and, together with other financial information

contained in these interim results, do not constitute statutory accounts of ITIS

Holdings PLC within the meaning of section 240 of the Companies Act 1985. The

statutory accounts for the year ended 31 March 2002 have been delivered to the

Registrar of Companies. The report of the auditors was not qualified and did not

contain a statement under Section 237 (2) and (3) of the Companies Act 1985.

3. Loss per share

Six months to Six months to Year ended

30 September 30 September 31 March

2002 2001 2002

Unaudited Unaudited Audited

# # #

Loss for the financial period (3,465,870) (4,771,364) (8,487,532)

__________ __________ __________

Weighted average number of ordinary shares 98,420,884 98,420,884 98,420,884

in issue

__________ __________ __________

Loss per ordinary share (p) (3.5) (4.8) (8.6)

__________ __________ __________

Due to losses made, there is no difference between loss per ordinary share and

diluted loss per ordinary share.

4. Net cash outflow from operating activities

Six months to Six months to Year ended

30 September 30 September 31 March

2002 2001 2002

Unaudited Unaudited Audited

# #

#

Operating loss (3,748,298) (5,034,183) (10,463,650)

Depreciation and amortisation of licenses 134,954 340,967 346,533

Impairment of fixed asstes - - 896,000

Increase in stocks (42,531) (11,080) (15,769)

Decrease (increase) in debtors 705,668 (1,539,051) (674,616)

(Decrease) increase in creditors (551,683) 762,700 316,527

Profit on disposal of tangible fixed assets (2,167) (363) (363)

__________ __________ __________

Net cash outflow from operating activities (3,504,057) (5,481,010) (9,595,338)

========== ========= =========

5. Reconciliation of net cash flow to movement in net funds

Six months to Six months to Year ended

30 September 30 September 31 March

2002 2001 2002

Unaudited Unaudited Audited

#

# #

Decrease in cash in the period (3,266,999) (6,039,774) (8,679,194)

Cash inflow from decrease in lease funding 20,092 - 30,138

__________ __________ __________

Change in net funds (3,246,907) (6,039,774) (8,649,056)

New finance lease - - (80,368)

__________ __________ __________

(3,246,907) (6,039,774) (8,729,424)

Net funds brought forward 17,029,213 25,758,637 25,758,637

__________ __________ __________

Net funds carried forward 13,782,306 19,718,863 17,029,213

========= ======= =======

6. Reconciliation of movements in Group shareholders' funds

Six months to Six months to Year ended

30 September 30 September 31 March

2002 2001 2002

Unaudited Unaudited Audited

# # #

Loss for the financial period (3,465,870) (4,771,364) (8,487,532)

__________ __________ __________

Net reduction from shareholders' funds (3,465,870) (4,771,364) (8,487,532)

Opening shareholders' funds 18,962,060 27,449,592 27,449,592

__________ __________ __________

Closing shareholders' funds 15,496,190 22,678,228 18,962,060

========== ========= ======

7. Interim statement

A copy of this announcement will be circulated to all registered shareholders of

the Company and copies will be available for members of the public upon

application to the Registered Office at Station House, Stamford New Road,

Altrincham, Cheshire, WA14 1EP.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR BKKKBCBDDFDB

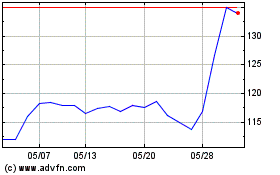

Ithaca Energy (LSE:ITH)

過去 株価チャート

から 6 2024 まで 7 2024

Ithaca Energy (LSE:ITH)

過去 株価チャート

から 7 2023 まで 7 2024