TIDMGENF

RNS Number : 9740N

Genflow Biosciences PLC

28 September 2023

PRESS RELEASE

28 September 2023

Genflow Biosciences Plc

("Genflow" or "the Company")

HALF YEAR RESULTS

Genflow (LSE: GENF) is pleased to announce its half year results

for the six-month period ended 30 June 2023.

Chairman's Statement

It is with pleasure that I take this opportunity to update

shareholders of Genflow Biosciences Plc ("Genflow" or the

"Company") on the Company's performance during the first six months

of 2023.

The Company continues to maintain a secure financial position

and has sufficient cash reserves until March 2025. This is

inclusive of grant funding which has been approved at the time of

reporting and is due to be received in the coming months. The

Company continues to seek further non-dilutive research grants

which management will use to expedite specific phases of planned

research and development.

The Company has continued to make progress with its two

principal longevity programs:

1. NASH (Non-Alcoholic Steatohepatitis) - where the Company is

seeking to reverse aging fibrotic livers to normal functionality.

The Company is seeking to ensure swift first-in-human trials;

and

2. Werner Syndrome - where the Company is seeking to improve the

lives of patients suffering with this accelerated aging

disease.

Most notably in relation to our NASH program, the Company

submitted a detailed application dossier for the Chemistry,

Manufacturing, and Controls (CMC) of the Group's proposed medical

treatment of NASH, which was presented to the Belgian regulatory

authorities (FAMHP) in early June 2023. The Company was pleased

with the advice received from the FAHMP to advance clinical trials

of its drug, GF-1002, with patients suffering from NASH (rather

than in healthy volunteers). This follows promising results from

the Company's research in in-vitro human cells and in-vivo rodent

studies.

The Company's NASH clinical trials are scheduled to begin in

approximately 18 months following dialogue and subsequent agreement

with the European Medicine Agency.

Other notable progress with the Group's two longevity programs

includes:

-- The Company is conducting in-vivo evaluations of its

centenarian SIRT6 gene therapy in four different NASH mice models

in conjunction with four leading partners in the field: The

University of Liverpool, UK, The University of Rochester, US, the

International Clinical Research Center (FNUSA-ICRC) , Czech

Republic and Physiogenex, France.

These studies have been wide reaching and have included the

analysation of over 700 mice, with the intention of understanding

the efficacy and safety of the Company's drug candidate in animal

models with NASH and has generated essential information in

preparation for clinical trials in humans. Final reports are

expected by the end of 2023.

-- The Company has initiated a manufacturing program under Good

Manufacturing Practices (GMP) conditions, which will applied in

both the NASH and Werner Syndrome projects.

-- The Company's partnership with Organips in France, has made

it possible to limit the use of animal models in our research by

opting for the use of artificial organs built with human cell

organoids. These organoids mimic the function of a natural organ,

therefore they deliver more relevant information on the potential

safety and efficacy of the drug in humans. While organoids offer

several advantages, they also have limitations and do not fully

replicate the complexity and multicellular interactions of whole

organs in the human body.

-- The Group has expanded its intellectual property portfolio

through a provisional patent application focussing on the ability

to edit its SIRT6 gene. If granted, the patent will represent a

significant breakthrough in the field of gene editing, with

potential implications for longevity and other forms of gene

therapy.

Admittance to the OTCQB

In June 2023, the Company was pleased to announce that, after a

successful application process, its Ordinary Shares began trading

on the OTCQB Venture Market in the United States ("U.S."). The new

U.S. trading avenue expands access to a broader pool of investors

and enables investors in the U.S. to trade during U.S. trading

hours and in U.S. dollars, thereby easing cross-border trading.

The move is particularly exciting for Genflow as it not only

expands the Company's reach to a larger investor base and has the

potential to enhance liquidity for our shares, but also provides

the Company with a platform to showcase our innovative solutions

and technologies to a wider audience, raising our profile and

increasing visibility within the global biotech industry, and

specifically, longevity.

Governance and the Board

To enhance the Company's current objectives and priorities in

the U.S., including the Company's admission to OTCQB, the Board of

Directors proactively restructured both itself and the Company's

Scientific Advisory Board ("SAB").

In May 2023, I was pleased to be promoted to Chairperson of the

Board and Vera Gorbunova PhD was promoted to Chairperson of the

SAB. My experience in financing, coupled with a familiarity with

the U.S. public markets, I hope will play a crucial role as the

Company seeks to strengthen its links with the U.S. market and

investors. We believe that Dr. Gorbunova's outstanding

contributions to the field of longevity and her invaluable insights

in this sector will be instrumental in guiding the Company's

scientific research.

Yassine Bendiabdallah remains a key member of our Board and will

continue to act as a Non-Executive Director, and Dr Eric Verdin

remains a key member of the SAB.

The SAB also welcomed Professor Dr Sven Francque, a renowned

expert in the field of non-alcoholic fatty liver disease (NAFLD)

and NASH.

Financial Overview

As of 30 June 2023, the Group had cash reserves of GBP1,507,437

(31 December 2022: GBP2,356,225) which has been derived from equity

fundraising consecutive with admission to the London Stock Exchange

in January 2022 and the receipt of research and development grants.

The Company remains debt free.

Administration expenses for 30 June 2023 totalled GBP815,477 (30

June 2022: GBP696,402), which primarily consisted of research and

development costs of GBP415,157 (30 June 2022: GBP97,304), legal

and professional fees totalling GBP87,428 (30 June 2022:

GBP267,535) and Directors' fees of GBP187,409 (30 June 2022:

GBP172,851).

Other Comprehensive Income was charged with a translation gain

of GBP26,749 upon converting the Subsidiary's results for the

period to GBP.

Future

On behalf of the Board, I thank you for your continued support

and look forward to growing the Company's presence and continuing

to build upon Genflow's position in the longevity sector both in

Europe and the US. The recent recommendation from the FAHMP to

commence Phase I/II clinical trials in NASH patients is a key

milestone for Genflow, and I am excited for the Company to progress

further towards gaining approval from the European Medicine Agency

to commence human clinical trials over the next 18 months.

Tamara Joseph

Chairman

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 30 June 2023

Unaudited Audited Unaudited

30 June 31 December 30 June

Note 2023 2022 2022

Non-Current assets

Property, plant & equipment 3,991 2,351 -

------------ -------------- ------------

Total Non-Current assets 3,991 2,351 -

------------ -------------- ------------

Current assets

Trade and other receivables 6 400,891 258,885 70,527

Cash and cash equivalents 1,507,437 2,356,225 2,945,624

------------ -------------- ------------

Total Current assets 1,908,328 2,615,110 3,016,151

------------ -------------- ------------

Total assets 1,912,319 2,617,461 3,016,151

------------ -------------- ------------

Current liabilities

Trade and other payables 194,134 250,988 149,288

------------ -------------- ------------

Total Current liabilities 194,134 250,988 149,288

------------ -------------- ------------

Total liabilities 194,134 250,988 149,288

============ ============== ============

Net Assets 1,718,185 2,366,473 2,866,863

============ ============== ============

Equity

Share capital 7 87,752 87,752 87,752

Share premium 7 4,190,900 4,190,900 4,190,900

Other reserves 204,592 231,341 170,200

Retained earnings/loss (2,765,059) (2,143,520) (1,581,989)

============ ============== ============

Total equity 1,718,185 2,366,473 2,866,863

============ ============== ============

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE SIX MONTHSED 30 JUNE 2023

Notes Unaudited Audited Unaudited

6 Months 12 Months 6 Months

ended ended ended

30 June 31 December 30 June

2023 2022 2022

Other operating income 194,068 487,293 -

Operating profit

------------- ------------ ----------

Administrative expenses 4 (815,477) (1,822,236) (696,402)

Other losses - - (77,082)

----------

Operating loss (621,409) (1,334,943) (773,484)

Finance income/(costs) (130) (382) (310)

Profit/(Loss) before tax (621,539) (1,335,325) (773,794)

Tax expense - - -

------------- ------------ ----------

Profit/ (Loss) for the period

/ year attributable to owners

of the parent (621,539) (1,335,325) (773,794)

============= ============ ==========

Other Comprehensive (loss)

/ income:

Items that could be reclassified

to profit or loss

Exchange differences on translation

of foreign operations (26,749) 75,158 14,017

Total comprehensive (loss)

/ income for the period / year

attributable to owners of the

parent (648,288) (1,260,167) (759,777)

============= ============ ==========

Loss per share (cents) from

continuing operations attributable

to owners of the Parent - Basic

& Diluted 5 (0.210) (0.457) (0.267)

CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE SIX MONTHSED 30 JUNE 2023

Unaudited Audited Unaudited

6 Months 12 Months 6 Months

ended ended ended

30 June 31 December 30 June

2023 2022 2022

Cash flows used in operating activities:

Loss after taxation (621,539) (1,335,325) (773,794)

Adjustments for:

Depreciation & amortisation 413 129 -

Share based payments - 72,000 -

Net finance income - - 90

Increase in trade and other receivables (142,229) (206,339) (17,980)

Increase in trade and other payables (107,585) 29,561 (139)

Foreign exchange 26,749 71,120 14,017

--------------------------------------------------- ---------- --------------- ------------

Net cash outflow from operating

activities (844,191) (1,368,324) (777,806)

--------------------------------------------------- ---------- --------------- ------------

Cash flow used in investing activities:

Purchase of property, plant & equipment (4,528) (2,480) -

Cash acquired through business combinations - - -

Net cash used in investing activities (4,528) (2,480) -

--------------------------------------------------- ---------- --------------- ------------

Cash flow from financing activities:

Proceeds from issue of shares - 3,762,920 3,762,830

Cost of share issue - (263,404) (263,404)

--------------------------------------------------- ---------- --------------- ------------

Net cash generated from financing

activities - 3,499,516 3,499,426

--------------------------------------------------- ---------- --------------- ------------

Net (decrease)/increase in cash

and cash equivalents (848,719) 2,128,183 2,721,620

Cash and cash equivalents at beginning

of period / year 2,356,225 224,004 224,004

FX on cash (69) 4,038 -

Cash and cash equivalents at end

of period 1,507,437 2,356,225 2,945,624

--------------------------------------------------- ---------- --------------- ------------

Non- Cash Investing and Financing Activities

Unaudited 6 months ended 30 June 2022 and audited 12 months

ended 31 December 2022- 900,000 Ordinary shares were issued at

nominal value as non-cash consideration to three Directors of the

Company in lieu of fees.

Unaudited 6 months ended 30 June 2022 and audited 12 months

ended 31 December 2022 - 203,833,878 Ordinary shares were issued at

nominal value as non-cash consideration for the acquisition of

Genflow Biosciences Srl, as part of a share for share exchange

arrangement.

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE SIX MONTHSED 30 JUNE 2023

Share

Share capital premium Other reserves Retained earnings/loss Total

------------- --------- ---------------- ------------------------ ------------

Unaudited- 30 June 2023

At 1 January 2023 87,752 4,190,900 231,341 (2,143,520) 2,366,473

Loss of the period - - - (621,539) (621,539)

Exchange differences on

translation of foreign operations - - (26,749) - (26,749)

------------- --------- ---------------- ------------------------ ------------

Total comprehensive income for the

period - - (26,749) (621,539) (648,288)

------------- --------- ---------------- ------------------------ ------------

Transactions with owners

Issue of share capital - - - - -

Costs of issue - - - - -

Share based payments - - - - -

------------- --------- ---------------- ------------------------ ------------

Total Transactions with owners - - - - -

------------- --------- ---------------- ------------------------ ------------

At 30 June 2023 (unaudited) 87,752 4,190,900 204,592 (2,765,059) 1,718,185

============= ========= ================ ======================== ============

Unaudited- 30 June 2022

At 1 January 2022 73,371 633,765 156,183 (808,195) 55,124

Loss of the period - - - (773,794) (773,794)

Exchange differences on

translation of foreign operations - - 14,017 - 14,017

------------- --------- ---------------- ------------------------ ------------

Total comprehensive income for the

period - - 14,017 (773,794) (759,777)

------------- --------- ---------------- ------------------------ ------------

Transactions with owners

Issue of share capital 14,111 3,748,809 - - 3,762,920

Costs of issue - (263,404) - - (263,404)

Share based payments 270 71,730 - - 72,000

------------- --------- ---------------- ------------------------ ------------

Total Transactions with owners 14,381 3,557,135 - - 3,571,516

------------- --------- ---------------- ------------------------ ------------

At 30 June 2022 (unaudited) 87,752 4,190,900 170,200 (1,581,989) 2,866,863

============= ========= ================ ======================== ============

Audited- 31 December 2022

At 1 January 2022 73,371 633,765 156,183 (808,195) 55,124

Loss for the year - - - (1,335,325) (1,335,325)

Exchange differences on

translation of foreign operations - - 75,158 - 75,158

Total comprehensive profit/(loss)

for the period - - 75,158 (1,335,325) (1,260,163)

------------- --------- ---------------- ------------------------ ------------

Transactions with Owners

Issue of ordinary shares 14,381 3,820,539 - - 3,834,920

Cost of issue - (263,404) - - (263,404)

Merger of entity under common - - - - -

control

------------- --------- ---------------- ------------------------ ------------

Total Transactions with owners 14,381 3,557,135 - - 3,571,516

------------- --------- ---------------- ------------------------ ------------

At 31 December 2022 (audited) 87,752 4,190,900 231,341 (2,143,520) 2,366,473

============= ========= ================ ======================== ============

1. Reporting Entity

Genflow Biosciences Plc (the "Company") is a company domiciled

in the United Kingdom. The consolidated interim financial

information as at, and for the six months ended, 30 June 2023

comprise the results of the Company and its subsidiaries (together

referred to as the "Group").

The consolidated financial statements of the Group as at, and

for the year ended, 31 December 2022 are available upon request

from the Company's registered office at 6 Heddon Street, London,

W1B 4BT or a t genflowbio.com.

2. BASIS OF PREPARATION

The financial information set out in this report is based on the

consolidated financial information of the Company and its

subsidiary companies. The financial information of the Group for

the 6 months ended 30 June 2023 was approved and authorised for

issue by the Board of the Company on 27 September 2023. The interim

results have not been audited. This financial information has been

prepared in accordance with the accounting policies that are

expected to be applied in the Report and Accounts of the Company

for the year ended 31 December 2022 and are consistent with the

recognition and measurement requirements of IFRS as adopted by the

United Kingdom. The comparative information for the full year ended

31 December 2022 is not the Group's full annual accounts for that

period but has been derived from the annual financial statements

for that period.

The consolidated financial information incorporates the results

of the Group as at 30 June 2023. The corresponding amounts are for

the year ended 31 December 2022 and for the 6 month period ended 30

June 2022.

The Group financial information is presented in Pound Sterling

and values are rounded to the nearest pound.

The same accounting policies, presentation and methods of

computation are followed in the interim consolidated financial

information as were applied in the Group's latest annual audited

financial statements except for those that relate to new standards

and interpretations effective for the first time for periods

beginning on (or after) 1 January 2023 and will be adopted in the

2023 annual financial statements.

A number of new standards and amendments became effective on 1

January 2023 and have been adopted by the Group. None of these

standards have materially affected the Group.

3. GOING CONCERN

As the Group's assets are not generating revenue an operating

loss has been reported and an operating loss is expected in the 12

months to 30 June 2024. However, the Directors believe that the

Group will have sufficient funds to meet its immediate working

capital requirements and undertake its targeted operating

activities over the next 18 months from the date of approval of

these financial statements.

In March 2022, Genflow Biosciences Srl was awarded a

non-dilutive research grant of up to EUR3.375m from the regional

government of Wallonia in southern Belgium. The total grant has

been approved by the relevant authorities, however it has not yet

been received at the time of reporting. Once received, management

will use the funds to expedite specific phases of planned research

and development. Management has prepared a forecast covering an

18-month post-period end and believes that current cash reserves

will adequately meet the working capital requirements of the Group

in addition to meeting research and development commitments.

As such, the Directors have a reasonable expectation that the

Group has, and will have, future access to adequate resources to

continue in operational existence for the foreseeable future and,

therefore, continue to adopt the going concern basis in preparing

the interim financial statements.

4. EXPENSES BY NATURE

Unaudited Audited

6 Months Year ended Unaudited

ended 31 December 6 Months ended

30 June 2023 2022 30 June 2022

GBP GBP GBP

------------------------------- -------------- ------------- ----------------

Directors' fees 187,409 360,495 172,851

Professional, legal and

consulting fees 87,428 423,324 267,535

PR and marketing 63,903 165,889 89,935

Accounting related services 8,638 7,245 591

Insurance 19,563 33,423 17,305

Office and administrative

expenses 5,092 4,496 2,303

IT and software services 1,492 2,249 396

Travel and entertainment 13,255 14,193 15,062

Research and development

costs 415,157 724,465 97,304

Share based payments - 72,000 -

AIM costs 15,938 - 26,177

Other expenses (2,398) 14,457 6,943

------------------------------- -------------- ------------- ----------------

Total administrative expenses 815,477 1,822,236 696,402

------------------------------- -------------- ------------- ----------------

5. PROFIT/(LOSS) PER SHARE

Unaudited Unaudited

6 Months Audited 6 Months

ended Year ended ended

30 June 31 December 30 June

2023 2022 2022

GBP GBP GBP

Net loss for the year from

continued operations attributable

to equity shareholders (621,539) (1,335,321) (773,794)

Weighted average number of

shares for the period/year 292,506,618 292,506,618 289,858,193

Basic profit/(loss) per

share for continued operations

(expressed in pence) (0.210) (0.457) (0.267)

------------ ------------- ------------

6. TRADE AND OTHER DEBTORS

Trade and other debtors Audited

Year ended Unaudited

Unaudited 31 December 6 Months

6 Months ended 2022 ended

30 June 2023 GBP 30 June 2022

GBP GBP

------------------------- ---------------- ------------- ---------------

VAT receivable 48,205 32,612 37,230

Prepayments 22,854 131,414 30,076

Other receivables 329,832 94,859 3,221

------------------------- ---------------- ------------- ---------------

400,891 258,885 70,527

------------------------- ---------------- ------------- ---------------

Trade and other receivables are all due within one year. The

fair value of all receivables is the same as their carrying values

stated above. These assets, excluding prepayments, are the only

form of financial asset within the Group, together with cash and

cash equivalents. There are no trade receivables therefore an aging

analysis has not been provided.

As at 30 June 2023, GBP324,830 (31 December 2022: GBP92,535) in

'other receivables' relates to grant receivable.

7. Share capital

Company Number of Ordinary Share Total

shares shares premium GBP

GBP GBP

------------------------------ ------------ --------- ---------- ----------

Issued and fully paid

At 1 January 2022 244,570,118 73,371 633,765 707,136

Issue of Ordinary Shares -

17 January 2022 47,936,500 14,381 3,820,539 3,834,920

------------------------------ ------------ --------- ---------- ----------

Deduction of cost of capital - - (263,404) (263,404)

At 30 June 2022 292,506,618 87,752 4,190,900 4,278,652

------------------------------ ------------ --------- ---------- ----------

At 30 June 2023 292,506,618 87,752 4,190,900 4,278,652

------------------------------ ------------ --------- ---------- ----------

On 17 January 2022, the Company issued and allotted 47,036,500

new Ordinary Shares at a price of 8 pence per share for gross

proceeds of GBP3,762,920. On the same day, the Company issued and

allotted 900,000 new Ordinary Shares at nominal value in lieu of

fees of GBP72,000.

8. COMMITMENTS

The commitments stated in the Group's Annual Financial

Statements for the year ended 31 December 2022 remain in place.

9. EVENTS AFTER THE REPORTING DATE

On 20 September 2023, the Company announced that it received a

recommendation from the FAHMP to commence clinical trials of its

drug, GF-1002, with patients suffering from NASH (rather than in

healthy volunteers).

Market Abuse Regulation (MAR) Disclosure

Certain information contained in this announcement would have

been deemed inside information for the purposes of Article 7 of

Regulation (EU) No 596/2014 until the release of this

announcement.

For further information please contact:

Genflow Biosciences Plc

Dr Eric Leire

Chief Executive +32 477 495 881

-----------------

Clear Capital Markets Ltd

-----------------

Corporate Broker +44 203 869 6080

-----------------

About Genflow

Genflow is a UK-based biotechnology company established in 2020.

The Company is developing gene therapies designed to target the

aging process and to reduce and delay the incidence of age-related

diseases. This will be done through novel therapeutics targeting

aging in humans by using adeno-associated virus ("AAV") vectors to

deliver copies of the Sirtuin-6 ("SIRT6") gene variant that is

found in centenarians into cells.

Its mission is to increase understanding of the factors that

control and impact lifespan. Genflow researches, develops, and

commercialises therapeutic solutions to lengthen health span, the

amount of time we live in good health, creating biological

interventions that enable longer and healthier lives. Genflow is

dedicated to the development and commercialisation of novel

therapeutics targeting aging in dogs and humans. By treating aging,

Genflow can contribute to a decrease in healthcare costs and lessen

the emotional and societal burden that comes with an aging

population.

To learn more visit www.genflowbio.com

-Ends-

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR EVLBLXKLZBBX

(END) Dow Jones Newswires

September 28, 2023 02:00 ET (06:00 GMT)

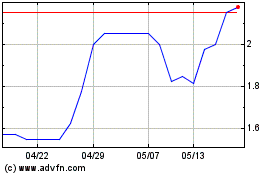

Genflow Biosciences (LSE:GENF)

過去 株価チャート

から 4 2024 まで 5 2024

Genflow Biosciences (LSE:GENF)

過去 株価チャート

から 5 2023 まで 5 2024