Regulatory News:

La Française des Jeux (FDJ) (Paris:FDJ) announces the success of

its tender offer for Kindred Group plc, a leading player in the

online betting and gaming sector in Europe.

At the end of the offer period ending on 2 October, 195,659,291

Kindred Swedish Depository Receipts (SDRs), representing 90.66% of

the Group's capital1, were tendered. FDJ had also acquired

2,400,000 Kindred SDRs directly from Veralda, representing 1.11% of

the Group's share capital1.

With the condition precedent of controlling more than 90% of

Kindred's share capital1 fulfilled, FDJ decided to complete the

acquisition of Kindred Group plc. Settlement-delivery for Kindred

shareholders who have tendered their SDRs to the offer will take

place from 11 October and FDJ will implement a squeeze-out

procedure on Nasdaq Stockholm.

In addition, FDJ announces that it is extending its offer until

18 October 2024 at 5 p.m. CEST to enable Kindred shareholders who

have not tendered their shares to do so on unchanged terms, i.e.

SEK 130 per SDR. Settlement and delivery will take place from 29

October.

Kindred is one of the top five online betting and gaming players

in Western Europe, present in seven of the top ten European

markets, chief among them the Netherlands, the UK, France, Sweden

and Belgium. It offers a comprehensive online offering (sports and

horse betting, poker and casino), operating brands such as Unibet

and 32Red.

This transaction of nearly €2.5 billion creates a European

champion with a diversified and balanced profile, based on monopoly

activities, primarily lotteries, in France and Ireland, and on

online sports betting and gaming activities open to competition in

Europe.

The new combined group resulting from this offer will generate

around 26% of its revenue internationally, and its online gaming

range open to competition will account for around 27% of its

business.

Stéphane Pallez, Chairwoman and CEO of the FDJ Group,

said: "I am delighted to announce today the acquisition of Kindred,

a leading European player in the competitive online betting and

gaming sector. Kindred has strong brands, recognised technological

excellence and an attractive growth and profitability profile, all

of which will bolster FDJ's strengths. The two groups also share

high standards for responsible gaming and a business model that

combines performance and responsibility. This acquisition creates a

new European champion that intends to pursue its strategy of

sustainable and profitable growth for the benefit of all its

stakeholders.”

More detailed information on the new Group and Kindred is

provided in the appendix.

1 Excluding treasury stock.

About FDJ Group

France's leading gaming operator and one of the industry leaders

worldwide, FDJ offers responsible gaming to the general public in

the form of lottery games (draws and instant games), sports betting

(through its ParionsSport point de vente et ParionsSport en ligne

brands), horse-race betting and poker. FDJ's performance is driven

by a large portfolio of iconic brands, the leading local sales

network in France, a growing market, and recurring investments. The

Group implements an innovative strategy to increase the

attractiveness of its gaming and service offering across all

distribution channels, by offering a responsible customer

experience. FDJ Group is listed on the regulated market of Euronext

Paris (Compartment A – FDJ.PA) and is part of the SBF 120, Euronext

100, Euronext Vigeo 20, EN EZ ESG L 80, STOXX Europe 600, MSCI

Europe and FTSE Euro indices. For more information, visit

www.groupefdj.com

Appendix

Part 1: Information about the new

Group

- A European gaming champion and a top player in the French

Online Betting & Gaming markets opened to competition

- The new group will be among the top 3

operators in Europe’s gaming sector with an enhanced financial

profile on the basis of the 2023 GGR (Gross Gaming Revenue1).

- In France, through this acquisition, added

to the acquisition of ZEbet in September 2023, FDJ group will

become the third largest operator in the online sports betting and

gaming open to competition sector (sports betting, horse racing and

poker) (source: FDJ; on the basis of 2023 GGR). In France, FDJ is a

main leading gaming operator, and has exclusive rights to operate

offline and online lottery, and offline sports betting.

- A balanced group in terms of activities, markets and

distribution channels

- With this acquisition being completed,

FDJ’s international presence will expand to account for

approximately 26% of its revenue, compared to 4% currently.

- Kindred’s cutting-edge digital expertise

and technology platforms will accelerate FDJ’s digitalization - The

online share of revenue is expected to rise from 12% for FDJ to 34%

for the combined group. Online Betting and Gaming (OB&G)

markets open to competition is expected to account for

approximately 27% of the revenue, versus 3% before the acquisition,

while business under exclusive rights (France & Ireland) will

account for 69% of combined Group Revenue.

- A unique responsible gaming approach

- The combined group will operate only on

markets that are locally regulated or on the path of becoming

regulated, meaning that the group is going to exit of all the

markets on which it operates on a non-locally regulated basis. The

locally regulated footprint includes in particular Netherlands,

Sweden, United Kingdom, France, Belgium, Denmark, Romania, Italy,

Estonia and Australia while in Finland there is a clear path to

regulation.

- FDJ and Kindred are the sole gaming /

gambling operators having committed themselves with clear

objectives to reduce part of their revenues from high risks

players

- A combined group to benefit from significantly stronger

revenue and earnings growth with a strengthen financial

profile

- Kindred’s growth and earnings profile is

very consistent with FDJ ones

- As from FY 2025, Kindred will have an

accretive impact on combined group growth with:

- enhanced revenue, recurring EBITDA and Free Cash Flows growth,

e.g. a yearly acceleration of revenue growth by more than 50 basis

points;

- a significant increase in the Group’s earnings per share and

earnings growth.

- FDJ estimates2 that it would have recorded

combined revenue of around €3.5 billion and combined recurring

EBITDA3 of around €840 million for the full 2023 financial year if

Kindred had been acquired on 1 January 2023, and combined revenue

of €1.9 billion and combined recurring EBITDA of around €490

million for the first half of 2024 if Kindred had been acquired on

1 January 2024.

- As soon as possible in 2025, the new group

will present its activities with four business units:

FDJ Group operating model post

Kindred integration

France Monooply

(FDJ : Lottery

and point-of-sale sports

betting)

Competitive online betting

& gaming

Kindred (B2C and Relax) +

FDJ’s online sports betting & Poker & ZEturf

International lottery

Premier Lotteries Ireland +

Lottery B2B operations

Payment & Services

~ 64%*

~ 30%*

~ 4%*

~ 2%*

* % of projected 2025 revenue

- FDJ will finance this acquisition using a large part of its

available cash and through a bridge loan with leading French and

international banks. The FDJ Group:

- Reiterates aiming a mid-term net debt to recurring EBITDA ratio

of ≤2x.

- Aims to refinance the bridge loan on attractive market

terms4

Part 2: Information about

Kindred5

1. Introduction

Kindred Group plc (“Kindred”) is one of the world’s leading

online gambling operators, with business across Europe and

Australia, offering over 3 million active B2C customers a great

form of entertainment in a sustainable environment.

The company, which employs approximately 2,500 people,

representing more than 70 nationalities, has offices located in

many places such as Amsterdam, Antwerp, Belgrade, Bengaluru,

Copenhagen, Darwin, Gibraltar, London, Madrid, Malta, Paris,

Stockholm, Sydney, Tallinn. It is listed on Nasdaq Stockholm Large

Cap.

Kindred is a member of the European Gaming and Betting

Association (EGBA) and founding member of IBIA (International

Betting Integrity Association). Kindred Group is audited and

certified by eCOGRA for compliance with the 2014 EU Recommendation

on Consumer Protection and Responsible Gambling (2014/478/EU).

Founded in 1997 to provide customers with a safe way to place a

bet in the modern digital world, Kindred built a reputation as a

disrupter and innovator, quickly gaining a loyal customer base

around the world.

For over 25 years now, Kindred led the shift from traditional

offline gambling to online, making it a more accessible form of

entertainment. Kindred achieved to do so by establishing

significant market share in key regulated markets across the

globe.

Kindred is home to nine gambling brands known around the world.

Each of the brands has its own unique offering and identity, built

on the desire to offer customers a thrilling and safe entertainment

experience.

B2C

Kindred provides its customers with gambling products across

four categories. Share of 2023 Gross winnings revenue (GWR) of

£1,171.9m, per product segment is:

Sports betting: 38 % Casinos & games: 57 % Poker: 3 % Other:

2 %

The Gross winnings revenue converted in EUR was 1,353.7m (using

average YTD at Dec 31st 2023 EUR/GBP rate of 0,865675).

1. Sports betting

- Unibet, a brand active since 1997, is offering a

premium all-product gambling experience, a wide range of Sports

betting events, Casino and Games, Poker and Bingo in 20 different

languages across more than 100 countries.

- 32Red, established in 2002, is the home of casino

entertainment, offering personalised and exclusive gaming

experiences. As well as sports betting and Live Casino, 32Red

delivers more than 400 of the best casino slot games powered by

Microgaming.

Kindred engages in bookmaking across a diverse range of sports

and events. The group makes gains or losses based on the bets

placed by customers, depending on the underlying outcomes of the

event.

The sports betting market continues to expand rapidly, as do the

customer choices within it. New technologies in data and

personalisation, as well as the growth in popularity of apps, are

increasing the attractiveness for players.

For operators, the sports betting margin is volatile due to the

events' natural unpredictability and seasonal nature – but, over

time, the company has seen its average margin gradually

increase.

Kindred is a leader in customer experience and local product

positioning. The group attracts and retains customers through

attractive odds, a huge variety of betting options across the many

sports, and an experience featuring high availability and

combinations of outcomes – both pre-match and in-play. Kindred has

seen tremendous growth in customers placing combinations and

accumulators, which are more profitable than single bets. Its

popular BetBuilder product allows customers to build their own

accumulator bets within a single match that Kindred is streaming.

Kindred has also made navigational improvements during the year and

offer greater streaming options.

A wide range of exciting events

Football is the number-one sport in most of Kindred’s markets,

followed by tennis and basketball – but the betting portfolio also

includes the chance to bet on events such as political elections,

TV shows and global entertainment shows.

— Football is the bread and butter, and accounts for the

majority of the sports revenues by quite some distance. The 'big

three' competitions are the Premier League, La Liga and the

Champions League, but many local leagues also feature and are an

important attraction. The major international events are also key

and the 2023 Women's World Cup was the most popular women's

football event to date.

— There's always a tennis match to enjoy onsite, and

Kindred streams all ATP, WTA and Grand Slams, offering them live on

Kindred’s site. With all the big tennis stars in attendance and

five-set men's matches, the Grand Slams bring in good revenue.

— NBA basketball is a popular product, and benefits from

streaming. With 1,230 matches across the season, NBA is played

almost every day.

— Horse racing is also an important product in certain

territories, such as the UK, Australia and Sweden. Kindred

guarantees the best odds, alongside racing-form data and

information, streamed races and results. The group has a

proprietary racing platform, the award-winning Kindred Racing

Platform (KRP).

— Ice hockey is one of the most popular sports across the

Nordic region and supports the localisation strategy of Kindred.

The offering has increased in popularity through BetBuilder product

and the streaming proposition. The group is also a partner to the

NHL in expanding its fanbase in Sweden.

— Czech Liga pro table tennis is the key 'filler' sport –

that is, it's played all day long and the group streams the

matches. It's fast, fun and matches finish within 20 minutes.

— Esports betting performs well with a younger audience.

It requires niche targeting, and Kindred offers an esports lobby

with streaming and integrated stats. As with the table tennis,

games like FIFA offer round-the-clock betting opportunities and

finish quickly.

Top sports ranks based on sportsbook

(GWR)

Football

58%

Tennis

15%

Racing

8%

Basketball

6%

Ice hockey

4%

Focus on Kindred Sportsbook Platform (KSP)

Having spent three years in meticulous development, Kindred’s

proprietary sportsbook platform (KSP) moved into a live

production-testing environment in early 2024. Building on the many

tried-and-tested principles of the award-winning Kindred Racing

Platform (KRP), Kindred is planning to roll KSP out to all Kindred

markets over time.

Having its own sports platform Kindred aims to meet the changing

needs of the customers across all markets. The rationale behind the

investment in its own tech includes growing revenue, optimising

costs and maintaining security of supply.

KSP embraces the latest machine learning, automation and

algorithmic decision-making technologies that will enable the group

to evolve in-play betting, create real-time customer relevance,

customise rewards, and provide an experience adapted to local

market requirements.

Kindred is continuing to recruit top industry talent in both

sportsbook and technology to pursue its ambition of a platform

that's unparalleled in its sector in capability, scalability and

supporting growth. With the launch of KSP, the group is aiming to

establish a true position of strength across its entire range of

sports products.

The new in-house Kindred sportsbook platform (KSP) will continue

to develop through 2024, focusing on integrating the alert system

into the platform, in readiness for full deployment in 2026.

Extract of Kindred’s Interim report Q2 2024:

Kindred Sportsbook Platform (KSP) remains firmly on

track

The KSP project remains firmly on track, with key features and

functionality being released ahead of our planned market rollout,

starting later this year. Live customers from selected test markets

are already using the platform and providing valuable feedback and

insight for the Product and Development teams. Kindred is already

supporting competitive levels of concurrent in-play events. Nils

Anden, Chief Executive Officer of Kindred, is particularly excited

about the impending ability of the group to offer multi-market

pricing, offering, and concessions. This will enable Kindred to

safely extend its appeal to customers.

The KSP project is progressing well, achieving several key

milestones during the quarter. The production launch is now live in

five selected markets. Quant pre-match football prices have been

published for monitored test matches, including a Euro 2024

fixture. Algorithmic propensity models are now automatically making

profile changes in KSP Racing.

2. Casinos & games

- Unibet, a brand active since 1997, is offering a

premium all-product gambling experience, a wide range of Sports

betting events, Casino and Games, Poker and Bingo in 20 different

languages across more than 100 countries.

- 32Red, established in 2002, is the home of casino

entertainment, offering personalised and exclusive gaming

experiences. As well as sports betting and Live Casino, 32Red

delivers more than 400 of the best casino slot games powered by

Microgaming.

- Casinohuone is an online casino launched in 2005 to

offer a full-house gaming experience with casino, poker, lotto and

bingo.

- Maria Casino, launched in 2006 with a presence in the

Nordic countries is offering its players a full house casino

experience in a modern environment.

- Kolikkopelit is a well-known online casino, operating

since 2010. The idea behind this brand is simple: delivering

entertaining games and content to players.

- Bingo.com, acquired in December 2014, has developed

into one of the top bingo brands in the Nordics. The brand offers a

selection of both bingo, casino and live casino games.

- Highrolling, launched in January 2017 to cater for

rollers, who bet big and seek a more premium casino experience.

- Vlad Cazino, launched in February 2018, was the first

dedicated online casino in the Romanian market.

- Otto Kasino is Kindred’s first pay-and-play brand,

launched in July 2020. It offers its customers a completely new

mobile casino experience fully designed around speed and

simplicity.

A customer makes a wager on a casino game, and the group

generates a margin through the house edge (i.e. the mathematical

advantage that assures a return). In the two sub-segments, RNG

(random number generator) and Live, Kindred aims to enhance the

margin sustainably, while at the same time reducing the cost of

sales. The group uses over 100 different casino product suppliers

as well as Relax Gaming, Kindred’s in-house supplier

Growth across the casino & games segment was its fastest

growing product area across 2023. The strength of a growing casino

product with a stable and consistent margin has created an exciting

foundation to grow upon even further.

Casino growth is integral to achieving core market growth.

Within multi-product territories, the market for online casino is

significantly larger and less volatile than for sports betting. Its

eight non-Unibet brands are all casino brands, so improving casino

allows to take better advantage of this attractive brand portfolio.

Going forward, as part of the renewed strategy Kindred is focusing

more of its efforts and resources on creating a better casino

experience.

Casino & games represented 57% of total GWR in 2023, despite

not being available in France and Australia due to regulations.

Kindred works with its industry’s leading game suppliers to ensure

it has the depth and quality of casino games that customers expect,

and currently offer a portfolio of over 3,400 games from more than

120 game suppliers. It has also been releasing exclusive

casino-game content through Kindred’s Relax Gaming division.

Alongside RNG (random number generator) games, Kindred offers

'live' online casino across its market portfolio. It does this

through seven studios offering a replica of a bricks-and-mortar

casino, with human dealers and croupiers hosting tables for the

most popular games including roulette and blackjack. These are

offered in five languages and include nine Unibet-branded games.

Kindred operates nine customer-facing casino brands, with the

Unibet brand dominating the share of revenue, and 32Red also

generating a key share to support its growth in the UK market. Its

hyper-local approach offers different products, languages and

player support in each country to meet its customer demand and

provide the best experience.

Exclusive games: In 2023, Kindred launched 693 games from

90 different suppliers (a 13% year-on-year increase in games

launched), and this high variety of content is vital to attracting,

reactivating or retaining players. Even better is offering

high-quality games no one else can provide. Through its in-house

studio, Relax Gaming, the group offered players seven fully

exclusive titles this year, and launched 56 games that were

exclusive either in a specific market, or for a period of time,

before being released to competitors. These headline titles grab

attention, help gain share from competitors and help generate a

unique selling point for Kindred’s brands.

3. Poker & other (including bingo)

- Unibet, a brand active since 1997, is offering a

premium all-product gambling experience, a wide range of Sports

betting events, Casino and Games, Poker and Bingo in 20 different

languages across more than 100 countries.

- Casinohuone is an online casino launched in 2005 to

offer a full-house gaming experience with casino, poker, lotto and

bingo.

- Highrolling, launched in January 2017 to cater for

rollers, who bet big and seek a more premium casino experience.

In poker, a customer pays a rake (commission) to Kindred for

hosting a poker game, and the loyalty programmes (rake-backs) are

dynamic and partly skill-based. In bingo, a customer places a bet

and the group generates a margin from the house edge. Its poker and

bingo products are supplied exclusively by Relax Gaming

Kindred’s aim is to provide the best poker experience for the

casual and recreational poker player, and its exclusive poker

product is provided in house by Relax Gaming. Its longest serving

Unibet poker ambassadors help Kindred keep in touch with its

players and gather the feedback it need to continue improving the

player experience Gaming.

Anytime, anywhere: Focus on mobiles, with full-feature

iOS and Android apps and a mobile web solution where no download is

required. Unibet offers the full poker product range on downloads

to PC and Mac, iOS and Android apps, and is available on the web.

Other brands offer a similar variety of availability.

Maintaining integrity: The Group does not allow any

third-party software tools that give players an unfair advantage.

It tries to balance the skill level of the players so games run

smoothly, everyone has a chance of winning.

Attracting and retaining: Integrated promotions and

loyalty system is designed to provide the right number of players

to ensure enjoyable games, minimum waiting times and large enough

prize pools. In addition, the two-year poker-data project has

allowed the group to build tools to measure player value, redesign

its loyalty system, and reduce its bonus spend without seeing any

negative effect.

Offering variety: In October 2023, the group launched a

completely new multi-table tournament (MTT) schedule with the aim

of using tournaments primarily as an acquisition tool to other

poker games that generate greater revenue. MTTs have a large prize

pool and are attractive to casual players, so they are also a good

way to reactivate lapsed players. Another part of the refresh was a

unified qualifier tree – one place to qualify for nearly every live

event (live events feature human dealers in a studio set-up). This

has allowed Kindred to capitalise on a recent boom in live

poker.

B2B

Additionally, Kindred owns 93% of Relax Gaming (over 99% at

end-June 2024), a leading supplier of Slots, Bingo, and Table

games. Its B2B business – Relax Gaming – generates revenue through

the aggregator channel and by offering its exclusive content to a

diverse array of operators. The business is highly scalable, making

an increasingly significant profit contribution to the Group.

The integration of Relax Gaming has enabled Kindred to create

its own exclusive content and create genuine differentiation in its

casino product. In addition, many Relax Gaming products are

available on tier-one competitor sites, providing Kindred with a

highly scalable B2B business model. Its work with Relax Gaming has

been progressing, and it will accelerate it even further next year,

with its games contributing a greater share of revenue than before

and increasing market share in the USA. The group released seven

games bespoke to Kindred in 2023, with plans in place for many

more.

Kindred provides a differentiated entertainment offering to its

customers through proprietary technology across all product

segments, with business across the world as Kindred holds 13 local

licenses across Europe and Australia.

Its international expansion as an Online Betting and Gaming

operator (OB&G) allows Kindred to be among the top 5 players in

Western Europe6 active in 7 out of the top 10 markets.

2. Kindred CSR

strategy

Kindred’s strategy, renewed in 2022, focuses on the topics most

relevant to its stakeholders and its business. Its responsible

gambling, product integrity and secure platform pillars are

supported by the foundation of compliance, its people, its

community and environmental management.

The focus areas relate to material topics identified through

Kindred last materiality assessment in 2022, in line with Global

Reporting Initiative Universal Standards (GRIUS) 2021. This

approach evaluates the effect and significance its activities or

business relationships might have on the economy, environment and

people. Kindred recognises that impacts can be real or potential,

negative or positive, short term or long term, intended or

unintended, and reversible or irreversible.

Governance and compliance are in place to manage a range of

related risks and opportunities relating to anti‑corruption,

anti‑money laundering, fair competition, financial stability, and

responsible sourcing.

Responsible gambling A secure platform

Product integrity Ambition Make gambling 100% enjoyable Keep

operations and customers safe at all times Deliver fun, fair and

transparent products Target No revenue derived from harmful

gambling By 2025, Kindred aims to achieve zero unmitigated

exploitable vulnerabilities and zero compromised player accounts By

2025, Kindred aims to have integrity enforcement covering all areas

susceptible to deviations and risks, focusing on material

compliance, and education Focus areas - Journey towards zero

- Cybersecurity - Detecting and reporting suspicious

betting activity - Player protection - Anti-money

laundering (AML) - Product transparency - Collaboration

for impact - Ethical marketing

Responsible business

Ensure long-lasting relationships with partners, colleagues and

communities based on trust and respect,always guided by Kindred's

rules

3. Kindred principal

subsidiaries

At 31 December 2023, the principal subsidiaries of Kindred are

as follows7:

Name of subsidiary

Place of incorporation

Proportion of ownership and voting

power %

Betchoice Corporation Pty Ltd

Australia

100%

Kindred South Development Pty Ltd

Australia

100%

Unibet Australia Pty Ltd

Australia

100%

Blankenberge Casino-Kursaal NV

Belgium

100%

Geerit BVBA

Belgium

100%

Kindred Belgium NV

Belgium

100%

Star Matic BVBA

Belgium

100%

Unibet ON Inc

Canada

100%

Kindred Denmark ApS

Denmark

100%

Kindred Estonia OU

Estonia

100%

Relax Tech Services Oü

Estonia

93%

Relax Tech Finland Oy

Finland

93%

Kindred France SAS

France

100%

32 Red Limited

Gibraltar

100%

Kindred (Gibraltar) Limited

Gibraltar

100%

Platinum Gaming Limited

Gibraltar

100%

Relax Gaming (Gibraltar) Ltd

Gibraltar

93%

Firstclear Limited

Great Britain

100%

Kindred (London) Limited

Great Britain

100%

Kindred Services Limited

Great Britain

100%

Kindred Individuals Private Limited

India

100%

Relax Gaming International Ltd

Isle of Man

93%

Kindred Italy SRL

Italy

100%

Kindred IP Limited

Malta

100%

Lexbyte Digital Limited

Malta

100%

Maria Holdings Limited

Malta

100%

Moneytainment Media Limited

Malta

100%

Optdeck Service Limited

Malta

100%

Relax Gaming Ltd

Malta

93%

Relax Holding Ltd

Malta

93%

Spooniker Ltd

Malta

100%

SPS Betting France Limited

Malta

100%

Trannel International Limited

Malta

100%

Unibet (Belgium) Limited

Malta

100%

Unibet (Denmark) Limited

Malta

100%

Unibet (Germany) Limited

Malta

100%

Unibet (Holding) Ltd

Malta

100%

Unibet (Italia) Limited

Malta

100%

Unibet Services Limited

Malta

100%

Relax Tech Services DOO

Serbia

93%

Kindred Spain Tech, S.L.

Spain

100%

Kindred People AB

Sweden

100%

PR Entertainment (I Stockholm) AB

Sweden

100%

Relax Tech Sweden AB

Sweden

93%

Kindred Nederland B.V.

The Netherlands

100%

Unibet Interactive Inc.

USA

100%

4. Kindred financial

statements

In 2023, the financial statements were as follows8:

Revenue9 GBP (m)

Free cash flow GBP (m)

Underlying EBITDA GBP

(m)

Underlying EBITDA margin

(%)

1,210.5

103.3

204.5

17%

+13%

+48%

+58%

+5pp

The financial statements converted in euro were as follows

(using average YTD at Dec 31st 2023 EUR/GBP rate of 0,865675):

- Revenue: EUR 1,398.2m

- Underlying EBITDA: EUR 236.2m

- Free cash-flow: EUR 119.3m

Revenue: Gross winnings revenue (GWR) from the

Group’s

Free cash-flow: Net cash generated from operating

activities, excluding movements in customer balances, less cash

flows from investment activities (including acquisitions) and lease

payments.

Underlying EBITDA: EBITDA before items affecting

comparability.

Underlying EBITDA margin %: Underlying EBITDA as a

percentage of revenue.

5. Risks related to

the activity of Kindred

The activities of Kindred are subject to the same risks as FDJ’s

activities, with the following exceptions, specific to Kindred:

- Risks associated with non-locally regulated markets

On the one hand, Kindred’s presence in certain non-locally

regulated countries could give rise to material fines,

penalties, legal claims or not be granted a license.

On the other hand, as the combined group will only operate on

markets that are locally regulated or on the path of becoming

regulated, operational risks related to the exit from

non-locally regulated markets, such as Norway and dotcoms in

particular, might occur.

- Local increase of constraints and/or changes in tax

regulation in certain countries where Kindred operates

These restrictions or adverse policies are often related to

responsible gambling and player protection (e.g. players limits,

advertising restriction, etc.) or tnew tax measures at the national

and international levels. They might affect Kindred strategy and

could result in increased costs and complexity or have a negative

financial impact.

As described in Kindred Annual and Sustainability Report and

Accounts 2023, Kindred is expecting to have some impacts from

changes in regulation on their business for 2024, in core markets

such as the UK and the Netherlands. On the tax front, the Group is

constantly dealing with unilateral changes in the legislation in

jurisdictions where it has activity in addition to changes to the

international tax framework. The absence of official positions from

governments, lack of consistent interpretation across different

jurisdictions and misalignment in the timing of implementation of

international tax rules increases the uncertainty and the

complexity of the Group’s tax affairs.

- Risks linked to the roll-out of the new in-house Kindred

Sportsbook Platform (KSP)

The new in-house Kindred Sportsbook Platform (KSP) moved into a

live production-testing environment in early 2024. It will continue

to develop with a progressive market rollout in readiness for full

deployment expected in 2026.

As in any major IT project, several operational risks are

related to the deployment of the platform (quality of development,

cost management, roadmap delivery, etc.). The KSP project is

crucial as it enables high product quality and differentiation

while adding to the Group’s scalability and long-term

profitability. Hence, the failure of the KSP project could have a

negative impact on Kindred's expected results.

Beside these risks related to the activity of Kindred, the

acquisition project itself raises risks related to any integration

of acquisition, particularly in terms of:

- Managing post-acquisition business continuity in a complex

multi-jurisdictional structure;

- Business plan implementation (value creation, achievement of

expected synergies, etc.);

- Deployment of a unified corporate culture within the new

FDJ-Kindred Group.

Others - Litigations and arbitration

proceedings

The main litigations proceedings involving Kindred group are

explained hereinbelow:

1. Claims pending

before the local Dutch and German courts against Kindred

A number of legacy customer claims are currently pending before

the local Dutch courts against a number of operators, including

Kindred. All cases revolve around two primary arguments as follows

(i) the nullity of the gambling contract between Kindred and the

customer as Kindred did not hold a local license and (ii) the

alleged violation by Kindred of its duty of care and the subsequent

recovery of the customer’s net losses. A case has been referred to

the European Court of Justice in Germany. In the Netherlands,

District courts have referred it to the Dutch Supreme Court.

2. The ongoing

litigation between Kindred and the Hungary regulator

On 1 January 2023, the Hungarian Gambling Act was amended to

introduce a licensing regime for online sports betting. While

Kindred supports the introduction of a local regulatory framework,

international operators are de facto excluded from the licensing

process due to several requirements that are incompatible with the

European Union (“EU”) law, including the requirement to have

a local Hungarian branch.

In August 2023, the Hungarian regulator issued a

cease-and-desist order against Kindred and started blocking domain

names. Kindred has appealed the order on the basis that the

cease-and-desist violates the fundamental freedom to provided

services, that the Hungarian licensing regime remains non-compliant

with EU laws, and that the current regime does not provide a

framework that would allow non-Hungarian based operators to enter

the Hungarian market.

Kindred is pursuing an injunction to suspend this blocking until

a final ruling is issued by the court.

_________________________________ 1 Gross gaming revenue =

stakes – player winnings 2 FDJ has estimated the combined revenue

and recurring EBITDA for the 2023 financial year and for the first

half of 2024 in order to illustrate the significant effects that

the Kindred acquisition would have had on the FDJ Group if it had

occurred on 1 January 2023 and 1 January 2024, respectively, and on

the basis of the scope that would effectively be retained by FDJ.

This scope was announced on 22 January 2024, with the planned exit

of Norway and other .com sites, unless there is a clear opportunity

for a local licence (for example, in Finland, where a draft bill

aims to introduce a licensing system for online betting, online

slot machines and casino games by early 2027). Kindred has also

announced its gradual exit from the US market, completed by the end

of the first half of 2024. As Kindred has not published any

financial information on those markets in the scope of

consolidation that the Group has announced it will not retain, FDJ

has estimated Kindred’s revenue and recurring EBITDA in this

consolidation scope for the 2023 financial year and for the first

half of 2024 without taking into account potential synergies and

exit costs and using a consistent presentation of revenue. This

information has been prepared on the basis of Kindred's IFRS

financial statements, harmonizing the presentation of sales with

that of the FDJ Group (i.e. the sum of net gaming income and income

from other activities). The average EUR/GBP rate used is 0,865675

for 2023 and 0,854647 for the 1 half of 2024. 3 Recurring EBITDA:

recurring operating profit(/loss) adjusted for depreciation and

amortisation expense. 4 FDJ considers that the in-depth

investigation by the European Commission into the remuneration paid

by FDJ to the French State (€380 million) for securing exclusive

rights for point-of-sale sports betting and for lottery (cf. 2023

Universal Registration Document p.189 and 359) should not result in

a material impact on its financial situation as, according to FDJ,

there are no element justifying that the consideration for the

exclusive rights should exceed the upper part of the ranges

submitted to the Commission des participations et des transferts in

its opinion n°2019 – A.C. – 1 of 7 October 2019 5 Unless otherwise

indicated, all the information stated is based on Kindred 2023

annual report or Kindred 2024 Q2 report or Kindred’s publications

on its website 6 Based on 2022 GGR 7 Extract from Kindred Group plc

Annual and Sustainability Report and Accounts of 2023

https://www.kindredgroup.com/globalassets/documents/investor-relations-related-documents/financial-reports/2023/asr/kindred-group-annual-and-sustainability-report-2023.pdf

8 Extract from Kindred Group plc Annual and Sustainability Report

and Accounts of 2023:

https://www.kindredgroup.com/globalassets/documents/investor-relations-related-documents/financial-reports/2023/asr/kindred-group-annual-and-sustainability-report-2023.pdf

9 Revenue = Gross Winning Revenue from B2C + Other revenue from B2B

activities

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241003152660/en/

Media Contact +33 (0)1 41 10 33 82 |

servicedepresse@lfdj.com

Investor Relations Contact +33 (0)1 41 04 19 74 |

invest@lfdj.com

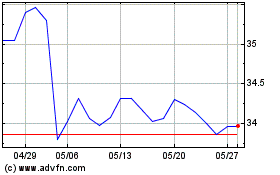

Francaise Des Jeux (EU:FDJ)

過去 株価チャート

から 10 2024 まで 11 2024

Francaise Des Jeux (EU:FDJ)

過去 株価チャート

から 11 2023 まで 11 2024