Bitcoin To Top Above $168,500 Based On This Indicator, Analyst Reveals

2024年12月24日 - 5:00AM

NEWSBTC

An analyst has explained how Bitcoin could see a top beyond the

$168,500 mark based on the historical trend in this indicator.

Bitcoin Mayer Multiple Could Reveal Location Of Next Price Top In a

new post on X, analyst Ali Martinez has discussed where the BTC top

could lie based on the Mayer Multiple. The “Mayer Multiple” refers

to an indicator that keeps track of the ratio between the Bitcoin

price and its 200-day moving average (MA). The 200-day MA has

historically proven to be a significant level for BTC, often

serving as the boundary between bearish and bullish trends. As

such, the distance of the price from this MA, which is what the

Mayer Multiple measures, can be useful to watch. Related Reading:

XRP Could Be The Altcoin To Recover Quickly, CryptoQuant Analyst

Explains Why When the Mayer Multiple has a high value, it means the

asset is trading significantly above the 200-day MA, which could

imply potential overbought conditions. On the other hand, the

metric being low could suggest a bullish reversal may be due for

BTC. Now, here is the chart shared by Martinez that shows the trend

in the Bitcoin Mayer Multiple represented as an oscillator over the

history of the cryptocurrency: As is visible in the above graph,

the Bitcoin Mayer Multiple is currently around halfway to the level

that has usually signaled overheated conditions for the coin’s

price. The level in question is situated at the 2.4 mark. When the

metric assumes this value, the price of the asset becomes 2.4 times

the 200-day MA. In the same chart, a price line corresponding to

this level is also shown. It’s apparent that Bitcoin formed some of

its major historical tops when it broke through the line. So far in

the current cycle, Bitcoin hasn’t been able to retest the level

yet. And it may not be able to do so for a while, either since the

Mayer Multiple would only equal 2.4 when the cryptocurrency’s price

rises to around the $168,500 level. Related Reading: XRP, Solana

Among Altcoins Witnessing TD Buy Signal, Analyst Reveals An

important level relevant to the Mayer Multiple that BTC did retest

during this cycle was the 0.8 line. Just like the 2.4 level serves

as a signal for potential overheated conditions, this line can

imply the coin may be reaching a bottom. Bitcoin successfully found

a rebound at the line earlier in the year, confirming that a

transition towards a bear market hadn’t taken place yet. It

now remains to be seen whether the asset would go on to retest the

top level next or if another plunge to this bottom level will

happen first. BTC Price Bitcoin slipped toward the $92,000 level on

Friday, but it seems the asset has made some recovery since then,

as it sits at $96,000 to kick off the new week. Featured image from

Dall-E, Glassnode.com, chart from TradingView.com

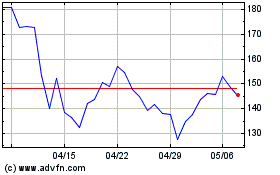

Solana (COIN:SOLUSD)

過去 株価チャート

から 11 2024 まで 12 2024

Solana (COIN:SOLUSD)

過去 株価チャート

から 12 2023 まで 12 2024