Uniswap Price Loses Momentum, Are The Bears Back?

2022年9月24日 - 1:00PM

NEWSBTC

The Uniswap price had risen to almost $6 on its chart, but the

bulls were unable to maintain that level. Over the last 24 hours,

the coin again lost momentum and fell south on its chart. Over the

last 24 hours, UNI registered a 0.9% increase in its price. In the

past week, the coin negated most of its gains and lost 1.2% of its

market value. The Uniswap price technical outlook was bearish, and

selling strength was higher, causing the price to drop further on

its chart. Although Uniswap tried to move in a different direction

than the broader market, the bulls gave up. Bitcoin also lost the

$19,000 price mark and is closing in on its immediate support

level. For the Uniswap price to revisit the $6 price mark, buyers

need to re-enter the market. Although just 48 hours ago the coin

displayed a bullish stance, an increase in the number of sellers

has invalidated the chance of a bullish revival. The global

cryptocurrency market cap today was $958 billion, with a 0.4%

negative change in the last 24 hours. Uniswap Price Analysis: One

Day Chart UNI was trading at $5.73 at the time of writing. The coin

was trading very close to the $6 mark. However, the buyers exited

the market. Overhead resistance for Uniswap price stood at $6, and

if UNI can move over the $6.40 price level, the altcoin’s upward

movement could be anticipated. The nearest support level for the

coin stood at $5. A fall from the $5 price mark could push UNI to

trade near the $4 price zone. The amount of Uniswap traded in the

previous session indicated that selling strength increased on the

one-day chart. Technical Analysis The altcoin’s technical

indicators note the bears taking over as buying strength dipped on

the one-day chart. For most of the month of September, buying

strength remained low for the altcoin. The Relative Strength Index

was below the half-line and that meant a lower amount of buying

strength on the one-day chart. Uniswap price was below the 20-SMA

line. This meant bearishness for the coin. It meant that sellers

were driving the price momentum in the market. Related Reading:

Compound Prepares For A Major Rally To $80, Here Is Why The

technical outlook for Uniswap was also mixed as the indicators also

picked up on buy signal for the coin. Despite buyers remaining low,

indicators indicated that there could be a possibility of buy

signal for the altcoin. The Moving Average Convergence Divergence

points toward the price momentum and overall price action of the

coin. MACD underwent a bullish crossover and started to depict tiny

green histograms as buy signals for UNI. This meant that, with more

buyers, UNI could recover its chart. The Chaikin Money Flow

displays capital inflows and outflows. CMF climbed above the

half-line, signalling more capital inflows compared to outflows.

Related Reading: Will Polkadot Network Progress Give An Ailing DOT

Renewed Vigor? Featured image from GreenBiz, chart from

TradingView.com

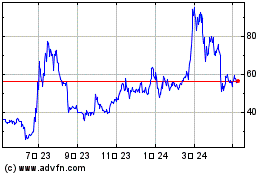

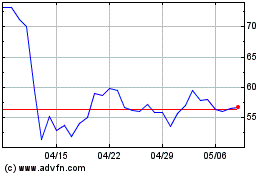

Compound (COIN:COMPUSD)

過去 株価チャート

から 10 2024 まで 11 2024

Compound (COIN:COMPUSD)

過去 株価チャート

から 11 2023 まで 11 2024