Eni Signs Agreement With Energy Infrastructure Partners to Invest in Plenitude

2023年12月21日 - 5:38PM

Dow Jones News

By Andrea Figueras

Eni said investment services provider Energy Infrastructure

Partners will invest in its low-carbon unit Plenitude and become a

minority shareholder.

Energy Infrastructure Partners will acquire up to 9% equity

stake in Plenitude through a capital increase, for an investment of

up to 700 million euros ($766 million) by early 2024, Eni said.

The transaction implies an equity value for Plenitude post money

of up to around EUR8 billion and will reinforce the subsidiary's

balance sheet, reducing corporate debt and supporting the company's

strategic plan, it said.

This agreement will support the company's growth in the

production of energy from renewable sources, in the market for the

sale of energy and energy efficiency solutions for retail and

business customers, and in the deployment of charging

infrastructure for electric mobility in Italy and Europe, Plenitude

said.

The deal is also set to improve Eni's capital structure,

reducing its consolidated net financial leverage and optimizing its

capital base, said Eni's Chief Executive Claudio Descalzi.

Write to Andrea Figueras at andrea.figueras@wsj.com

(END) Dow Jones Newswires

December 21, 2023 03:23 ET (08:23 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

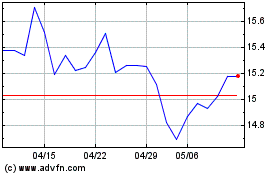

Eni (BIT:ENI)

過去 株価チャート

から 10 2024 まで 11 2024

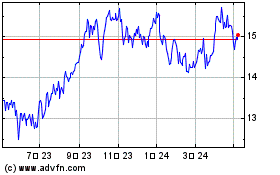

Eni (BIT:ENI)

過去 株価チャート

から 11 2023 まで 11 2024