An Expansion of BHP's Escondida Copper Mine Makes Sense -- Market Talk

2023年9月12日 - 8:55AM

Dow Jones News

2315 GMT [Dow Jones]--The economics of an expansion of BHP's

majority-owned Escondida copper mine in Chile "are compelling," and

the miner would benefit from forging ahead with an expansion of

both concentrator and heap leach capacity, Goldman Sachs analysts

Paul Young and Caleb Heiner say in a note. An expansion of the

mining operation, part owned by Rio Tinto, could cost about $8

billion, but it could also increase copper output by roughly 20%

and keep volumes above 1 million metric tons annually to 2035, the

analysts say. Project returns could be around 20%, they add. Young

and Heiner say that while they already include an expansion at

Escondida in their base case estimates for BHP and Rio Tinto,

Visible Alpha data seem to suggest it isn't baked into consensus

forecasts. (rhiannon.hoyle@wsj.com)

(END) Dow Jones Newswires

September 11, 2023 19:40 ET (23:40 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

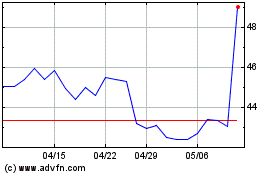

BHP (ASX:BHP)

過去 株価チャート

から 10 2024 まで 11 2024

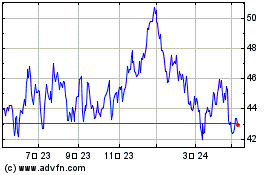

BHP (ASX:BHP)

過去 株価チャート

から 11 2023 まで 11 2024