TIDMARBB

RNS Number : 3288W

Arbuthnot Banking Group PLC

14 April 2023

THIS ANNOUNCEMENT (INCLUDING THE APPIX) AND THE INFORMATION

CONTAINED HEREIN IS RESTRICTED AND IS NOT FOR RELEASE, PUBLICATION

OR DISTRIBUTION, IN WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN,

INTO OR FROM THE UNITED STATES, AUSTRALIA, CANADA, JAPAN, THE

REPUBLIC OF SOUTH AFRICA OR ANY OTHER JURISDICTION IN WHICH SUCH

RELEASE, PUBLICATION OR DISTRIBUTION WOULD BE UNLAWFUL.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF REGULATION 2014/596/EU AS IT FORMS PART OF UK

DOMESTIC LAW BY VIRTUE OF THE EUROPEAN UNION (WITHDRAWAL) ACT 2018,

AS AMED ("MAR"). IN ADDITION, MARKET SOUNDINGS WERE TAKEN IN

RESPECT OF THE MATTERS CONTAINED IN THIS ANNOUNCEMENT, WITH THE

RESULT THAT CERTAIN PERSONS BECAME AWARE OF SUCH INSIDE

INFORMATION. UPON THE PUBLICATION OF THIS ANNOUNCEMENT, THIS INSIDE

INFORMATION IS NOW CONSIDERED TO BE IN THE PUBLIC DOMAIN AND SUCH

PERSONS SHALL THEREFORE CEASE TO BE IN POSSESSION OF INSIDE

INFORMATION.

For immediate release

14 April 2023

Arbuthnot Banking Group plc

Placing and Subscription raising approximately GBP12.0

million

Arbuthnot Banking Group plc (AIM: ARBB) ("Arbuthnot", the

"Company" or the "Group ") is pleased to announce an oversubscribed

conditional placing of and subscription for new voting ordinary

shares in the Company ("Ordinary Shares") at a price of 925 pence

per share (the "Placing Price"), raising approximately GBP12.0

million (before expenses) (the "Fundraising").

Fundraising highlights

-- Fundraising raising gross proceeds of approximately GBP1 2 .0 million by way of:

o a conditional agreement with Sir Henry Angest, Chairman and

Chief Executive of the Company, to subscribe for 729,843 new

Ordinary Shares (the " Subscription Shares ") at the Placing Price

to raise approximately GBP 6.75 million (the " Subscription ");

and

o a conditional placing to raise approximately GBP5.25 million

at the Placing Price through the issue of 567,454 new Ordinary

Shares (the "Placing Shares" and, together with the Subscription

Shares, the "New Ordinary Shares") to certain existing and new

institutional investors (the "Placing").

-- Following the announcement of the Group's final results on 30

March 2023, which reported a significant increase in profitability,

the net proceeds of the Fundraising will be used to enable the

Company to maintain its current loan growth momentum in 2023 and

beyond. It will also strengthen the Group's ability to take

advantage of the opportunities that are expected to emerge given

the current conditions in the non-bank lending markets despite the

increase in the countercyclical capital buffer in July 2023 from 1%

to 2%, which will increase the Group's regulatory capital

requirements.

-- The Group has benefitted in the past from its strong balance

sheet during times of greater turbulence in the financial and

banking markets. As at 31 December 2022, the CET1 ratio was 11.6%,

which the Fundraising will result in a pro forma increase of 80

basis points to 12.4%.

-- Shore Capital Stockbrokers Limited ("Shore Capital" or the

"Bookrunner") acted as Financial Adviser, Broker and Bookrunner in

connection with the Placing.

-- The New Ordinary Shares will represent approximately 8.0 per

cent. of the Company's issued Ordinary Share capital (excluding

390,274 Ordinary Shares held in Treasury) as enlarged by the New

Ordinary Shares ("Enlarged Ordinary Share Capital") and will be

issued fully paid and ranking pari passu in all respects with the

existing voting Ordinary Shares in issue. The New Ordinary Shares

will not be entitled to receive the final dividend declared in

respect of the financial year ended 31 December 2022.

-- The Placing Price represents a discount of approximately 3.4

per cent. to the closing middle market price of 957.5 pence per

Ordinary Share on 13 April 2023, being the last practicable date

before this announcement of the Fundraising.

-- The Placing and Subscription are conditional, amongst other

things, on the approval by Shareholders of resolutions to be

proposed at a general meeting of the Company which is expected to

be convened on 4 May 2023 (the "General Meeting") to approve the

issue of the New Ordinary Shares on a non pre-emptive basis (the

"Resolutions"), the admission of the New Ordinary Shares to trading

on AIM and AQSE and the Placing Agreement not having been

terminated. A circular (the "Circular") containing details of the

Fundraising and the notice of the General Meeting is expected to be

posted to Shareholders on or around 18 April 2023 and will include

instructions on how to vote at the General Meeting.

-- Subject to, inter alia, the passing of the Resolutions, the

New Ordinary Shares are expected to be admitted to trading on AIM

and AQSE on or around 5 May 2023.

Sir Henry Angest, Chairman and Group Chief Executive,

commented:

"The Group has invested over many years in developing Arbuthnot

Latham as a bank built on providing a high level of service and

strong client relationships. As our results announced on 30 March

2023 show, this business model is now delivering substantially

increased profits while maintaining strong capital and liquidity.

In the last few months, we have seen greater volatility and

uncertainty return to the banking sector, which represents a series

of potential opportunities for us to continue our rate of growth.

Against this backdrop we have decided to raise GBP12.0 million of

new equity capital to further strengthen our balance sheet to be

able to pursue these opportunities, whilst meeting the increase in

regulatory capital requirements being required by the regulator

across the banking sector."

General Meeting, admission and settlement

The Placing and Subscription are conditional, amongst other

things, upon the approval by Shareholders of the Resolutions at the

General Meeting, which is expected to be convened at the offices of

Arbuthnot at Arbuthnot House, 7 Wilson Street, London EC2M 2SN at

11.00 a.m. on 4 May 2023.

The Circular, containing details of the Fundraising and the

notice of the General Meeting, which is expected to be posted to

Shareholders on or around 18 April 2023, will include instructions

on how to vote at the General Meeting. The Circular, when

published, will be available on the Company's website at:

www.arbuthnotgroup.com.

Applications will be made to the London Stock Exchange and AQSE

for the New Ordinary Shares to be admitted to trading on AIM and

AQSE ("Admission"). Subject to, inter alia, the passing of the

Resolutions, it is expected that Admission will take place and

dealings will commence in the New Ordinary Shares at 8.00 a.m. on 5

May 2023.

Following Admission, the total number of ordinary shares of

GBP0.01 (1 penny) each with voting rights attached in the capital

of the Company will be 16,576,619, of which 390,274 are held in

Treasury. Therefore, the total number of voting rights in the

Company will be 16,186,345 upon Admission, and this figure may be

used by Shareholders as the denominator for the calculations by

which they will determine if they are required to notify their

interest in, or a change to their interest in, the Company under

the FCA's Disclosure Guidance and Transparency Rules.

Director participation and Related Party Transaction

The participation of Sir Henry Angest, through Flowidea Limited

(a company of which he is the sole beneficial owner), in the

Subscription as a Director of the Company and a substantial

shareholder for the purposes of the AIM Rules and the AQSE Rules,

constitutes a related party transaction pursuant to each of Rule 13

of the AIM Rules and Rule 4.6 of the AQSE Rules.

Following Admission, the beneficial interest in the Ordinary

Shares of Sir Henry Angest will be as follows:

Shareholder Number of Percentage of Number of New Number of Percentage of

existing existing Ordinary Ordinary Shares Ordinary Shares Enlarged Ordinary

Ordinary Shares Share capital subscribed for following Share

(excluding Ordinary Admission Capital (excluding

Shares held in Ordinary Shares

treasury) held in treasury)

Sir Henry Angest 8,376,401 56.26% 729,843 9,106,244 56.26%

For the purpose of the AIM Rules, the directors of the Company

with the exception of Sir Henry Angest and Frederick Angest (the

"Independent Directors") consider, having consulted with Grant

Thornton, the Company's nominated adviser, that the terms of Sir

Henry Angest's participation in the Subscription are fair and

reasonable insofar as Shareholders are concerned. For the purposes

of the AQSE Rules, the Independent Directors consider that, having

exercised reasonable care, skill and diligence, the participation

by Sir Henry Angest in the Subscription is fair and reasonable as

far as Shareholders are concerned.

This Announcement should be read in its entirety. In particular,

you should read and understand the information provided in the

"Important Notices" section below.

Capitalised terms not otherwise defined in the text of this

Announcement are defined in the Appendix to this Announcement.

This Announcement should be read in conjunction with the full

text of the Circular to be posted to Shareholders, copies of which

shall be available on the Company's website at:

www.arbuthnotgroup.com .

The person responsible for arranging for the release of this

information on behalf of the Company is Andrew Salmon.

Enquiries:

Arbuthnot Banking Group plc 020 7012 2400

Sir Henry Angest, Chairman and Chief Executive

Andrew Salmon, Group Chief Operating Officer

James Cobb, Group Finance Director

Shore Capital (Financial Adviser, Broker and

Bookrunner) 020 7408 4090

Daniel Bush

David Coaten

Tom Knibbs

Lucy Bowden

Grant Thornton UK LLP (Nominated Adviser and

AQSE Corporate Adviser) 020 7383 5100

Colin Aaronson

Samantha Harrison

George Grainger

Ciara Donnelly

H/Advisors Maitland (Financial PR) 020 7379 5151

Sam Cartwright

IMPORTANT NOTICES

The distribution of this Announcement and/or information

relating to the Fundraising and/or issue of the Placing Shares in

certain jurisdictions may be restricted by law. No action has been

taken by the Company or Shore Capital or any of their respective

affiliates, agents, directors, officers, consultants, partners, or

employees ("Representatives " ) that would permit an offer of the

Placing Shares or possession or distribution of this Announcement

or any other offering or publicity material relating to such

Placing Shares in any jurisdiction where action for that purpose is

required. Persons into whose possession this Announcement comes are

required by the Company and Shore Capital to inform themselves

about and to observe any such restrictions.

This Announcement or any part of it is for information purposes

only and does not constitute or form part of any offer to issue or

sell, or the solicitation of an offer to acquire, purchase or

subscribe for, any securities.

Shore Capital Stockbrokers Limited and Shore Capital and

Corporate Limited (together "Shore Capital" or the "Bookrunner"),

are authorised and regulated by the Financial Conduct Authority

(the "FCA") in the United Kingdom and are acting exclusively for

the Company and no one else in connection with the Placing, and

Shore Capital will not be responsible to anyone (including any

subscribers pursuant to the Placing) other than the Company for

providing the protections afforded to its clients or for providing

advice in relation to the Placing or any other matters referred to

in this Announcement. No representation or warranty, express or

implied, is or will be made as to, or in relation to, and no

responsibility or liability is or will be accepted by Shore Capital

or by any of its Representatives as to, or in relation to, the

accuracy or completeness of this Announcement or any other written

or oral information made available to or publicly available to any

interested party or its advisers, and any liability therefor is

expressly disclaimed.

Grant Thornton UK LLP, is authorised and regulated by the FCA in

the United Kingdom. Grant Thornton UK LLP acts as nominated adviser

to the Company and will not be responsible to anyone other than the

Company for providing the protections afforded to its clients or

for providing advice in relation to the Placing or any other

matters referred to in this Announcement. No representation or

warranty, express or implied, is or will be made as to, or in

relation to, and no responsibility or liability is or will be

accepted by Grant Thornton UK LLP or by any of its Representatives

as to, or in relation to, the accuracy or completeness of this

Announcement or any other written or oral information made

available to or publicly available to any interested party or its

advisers, and any liability therefore is expressly disclaimed.

Grant Thornton UK LLP's responsibilities as the Company's nominated

adviser under the AIM Rules for Nominated Advisers are owed solely

to London Stock Exchange plc and are not owed to the Company or to

any director of the Company or to any other person.

None of the information in this Announcement has been

independently verified or approved by the Bookrunner or any of its

directors, officers, partners, agents, employees, affiliates,

advisors, consultants, or persons connected with them as defined in

the Financial Services and Markets Act 2000, as amended ("FSMA")

(together, "Affiliates") . Save for any responsibilities or

liabilities, if any, imposed on the Bookrunner by FSMA or by the

regulatory regime established under it, no responsibility or

liability whatsoever whether arising in tort, contract or

otherwise, is accepted by the Bookrunner or any of its Affiliates

whatsoever for the contents of the information contained in this

Announcement (including, but not limited to, any errors, omissions

or inaccuracies in the information or any opinions) or for any

other statement made or purported to be made by or on behalf of the

Bookrunner or any of its Affiliates in connection with the Company,

the Placing Shares, the Placing, or for any loss, cost or damage

suffered or incurred howsoever arising, directly or indirectly,

from any use of this Announcement or its contents or otherwise in

connection with this Announcement or from any acts or omissions of

the Company in relation to the Placing. The Bookrunner and its

Affiliates accordingly disclaim all and any responsibility and

liability whatsoever, whether arising in tort, contract or

otherwise (save as referred to above) in respect of any statements

or other information contained in this Announcement and no

representation or warranty, express or implied, is made by the

Bookrunner or any of its Affiliates as to the accuracy,

completeness or sufficiency of the information contained in this

Announcement.

No statement in this Announcement is intended to be a profit

forecast or estimate, and no statement in this Announcement should

be interpreted to mean that earnings per share of the Company for

the current or future financial years would necessarily match or

exceed the historical published earnings per share of the

Company.

The price of shares and any income expected from them may go

down as well as up and investors may not get back the full amount

invested upon disposal of the shares. Past performance is no guide

to future performance, and persons needing advice should consult a

suitably qualified independent financial adviser.

Neither the content of the Company's website (or any other

website) nor the content of any website accessible from hyperlinks

on the Company's website (or any other website) is incorporated

into, or forms part of, this Announcement.

FORWARD LOOKING STATEMENTS

This Announcement may contain, or may be deemed to contain,

"forward-looking statements" with respect to certain of the

Company's plans and its current goals and expectations relating to

its future financial condition, performance, strategic initiatives,

objectives and results. Forward-looking statements sometimes use

words such as "aim", "anticipate", "target", "expect", "estimate",

"intend", "plan", "goal", "believe", "seek", "may", "could",

"outlook" or other words of similar meaning. By their nature, all

forward-looking statements involve risk and uncertainty because

they relate to future events and circumstances which are beyond the

control of the Company, including amongst other things, United

Kingdom domestic and global economic business conditions,

market-related risks such as fluctuations in interest rates and

exchange rates, the policies and actions of governmental and

regulatory authorities, the effect of competition, inflation,

deflation, the timing effect and other uncertainties of future

acquisitions or combinations within relevant industries, the effect

of tax and other legislation and other regulations in the

jurisdictions in which the Company and its affiliates operate, the

effect of volatility in the equity, capital and credit markets on

the Company's profitability and ability to access capital and

credit, a decline in the Company's credit ratings; the effect of

operational risks; and the loss of key personnel. As a result, the

actual future financial condition, performance and results of the

Company may differ materially from the plans, goals and

expectations set forth in any forward-looking statements. Any

forward-looking statements made in this Announcement by or on

behalf of the Company speak only as of the date they are made.

Except as required by applicable law or regulation, the Company and

the Bookrunner expressly disclaims any obligation or undertaking to

publish any updates or revisions to any forward-looking statements

contained in this Announcement to reflect any changes in the

Company's expectations with regard thereto or any changes in

events, conditions or circumstances on which any such statement is

based.

APPIX - EXTRACTS FROM THE CIRCULAR

Letter from the Chairman

1. Introduction

The Company has completed, conditional on Shareholder approval,

a Placing and Subscription for New Ordinary Shares at a price of

925 pence each with certain existing and new institutional

investors to raise approximately GBP12.0 million (before

commissions and expenses) (the "Fundraising").

It is proposed that the Net Proceeds will be used to enable the

Company to maintain its current loan growth momentum in 2023 and

beyond. It will also strengthen the Group's ability to take

advantage of the opportunities that are expected to emerge given

the current conditions in the non-bank lending markets despite the

increase in the countercyclical capital buffer in July 2023 from 1%

to 2%, which will increase the Group's regulatory capital

requirements. Further details of the rationale for the Fundraising

and the intended use of the Net Proceeds can be found in paragraph

2.4 below.

In order to maintain his beneficial shareholding of

approximately 56 per cent. of the Ordinary Shares, the Chairman and

Chief Executive of the Company, Sir Henry Angest, has agreed to

subscribe for 729,843 New Ordinary Shares pursuant to the

Subscription via Flowidea Limited, a company of which he is the

sole beneficial owner.

The purpose of the Circular is to set out the reasons for, and

provide further information on, the Fundraising, to explain why the

Board considers the Fundraising to be in the best interests of the

Company and its Shareholders as a whole and to convene the

necessary General Meeting at which resolutions will be proposed to

approve the issue of the New Ordinary Shares on a non-pre-emptive

basis.

2. Details of the Fundraising and use of proceeds

The Company has conditionally raised approximately GBP12.0

million (before commissions and expenses) through the conditional

placing of the Placing Shares and conditional issue of the

Subscription Shares at the Placing Price. The Placing Price

represents a discount of 3.4 per cent. against the mid-market

closing price on 13 April 2023, being the last practicable date

before the announcement of the Fundraising. The Group has

benefitted in the past from its strong balance sheet during times

of greater turbulence in the financial and banking markets. As at

31 December 2022, the CET1 ratio was 11.6%, which the Fundraising

will result in a pro forma increase of 80 basis points to

12.4%.

The New Ordinary Shares, when issued, will represent

approximately 8.0 per cent. of the Company's Enlarged Ordinary

Share Capital immediately following Admission. The New Ordinary

Shares will rank in full for all dividends made, paid or declared

on the Ordinary Shares by reference to a record date on or after

the date of Admission and otherwise equally with the Ordinary

Shares in issue from the date of Admission. It is expected that the

New Ordinary Shares will be admitted to trading on each of AIM and

AQSE on 5 May 2023. The New Ordinary Shares will not be entitled to

the final dividend payable in respect of the financial year ended

31 December 2022 which will be paid to Shareholders on the register

on 21 April 2023.

The Placing and Subscription (which are not being underwritten)

are conditional, amongst other things, upon:

(a) the Placing Agreement becoming unconditional in all respects

(save for Admission) and not having been terminated in accordance

with its terms prior to Admission;

(b) the Subscription Agreement not having been varied (other

than with the prior consent of Shore Capital) or terminated prior

to Admission;

(c) the Resolutions being approved at the General Meeting; and

(d) Admission of the New Ordinary Shares becoming effective on

or before 8.00 am on 5 May 2023, or such later date as the Company

and Shore Capital may agree, being no later than 8.00 am on 19 May

2023.

2.1. The Placing Agreement

Pursuant to the Placing Agreement, SCS has conditionally agreed

to use its reasonable endeavours, as agent for the Company, to

procure subscribers for the Placing Shares with certain

institutional and other investors.

The Placing Agreement contains warranties from the Company in

favour of Shore Capital in relation to, inter alia, the accuracy of

the information in the Circular and other matters relating to the

Company and the Group. In addition, the Company has agreed to

indemnify Shore Capital in relation to certain liabilities they may

incur in respect of the Placing. Shore Capital has the right to

terminate the Placing Agreement in certain circumstances prior to

Admission, in particular, in the event of a breach of the

warranties given in the Placing Agreement, the failure of the

Company to comply with its obligations under the Placing Agreement,

the variation or termination of the Subscription Agreement without

the prior consent of Shore Capital, the occurrence of a force

majeure event which in Shore Capital's opinion may be material and

adverse to the Group or the Placing, or a material adverse change

affecting the financial position or business or prospects of the

Group.

2.2. The Subscription Agreement

Pursuant to the terms of the Subscription Agreement, Sir Henry

Angest (via Flowidea Limited, a company of which he is the sole

beneficial owner), the Chairman and Chief Executive of the Company,

has agreed, subject to the satisfaction of certain conditions, to

subscribe for 729,843 new Ordinary Shares at the Placing Price. Sir

Henry Angest is interested in approximately 56 per cent. of the

voting rights in the Company and will remain interested in

approximately 56 per cent. of the voting rights in the Company

following Admission as a result of the Subscription.

2.3. Settlement and dealings

Applications will be made to the London Stock Exchange for the

New Ordinary Shares to be admitted to trading on AIM and to the

Aquis Exchange for the New Ordinary Shares to be admitted to

trading on AQSE. It is expected that Admission to each of AIM and

AQSE will become effective and that dealings in the New Ordinary

Shares will commence on 5 May 2023, subject to the passing of the

Resolutions at the General Meeting.

The New Ordinary Shares being issued pursuant to the Placing and

Subscription will, on Admission, rank in full for all dividends and

other distributions declared, made or paid on the Ordinary Shares

by reference to a record date on or after Admission and will

otherwise rank pari passu in all respects with the existing

Ordinary Shares. The New Ordinary Shares will not be entitled to

the final dividend payable in respect of the financial year ended

31 December 2022 which will be paid to Shareholders on the register

on 21 April 2023.

2.4. Rationale for the Fundraising and use of proceeds

In 2020, the Group articulated to Shareholders its "Future

State" capital allocation strategy, which set out its approach to

leverage its substantial deposit book to drive growth through its

lending businesses, which generate high returns on capital

employed, to grow net interest margins and returns on equity.

For the year ended 31 December 2022, the Group reported

significantly increased profitability, driven by higher net

interest margins as a result of the execution of its strategy,

combined with the increased Bank of England bank rate and a low

cost of deposits (as well as the benefit of a lag in the repricing

of deposits). In the current environment, the Group has continued

to grow its lending book whilst also tightening credit appetite.

Customer deposit balances reached GBP3.1 billion at the end of 2022

and the Board believes that the current market dislocation will

provide further opportunities to deliver continued lending growth,

whilst also allowing the Group to take advantage of opportunities

that may arise given current market conditions.

The increase in Group profitability has brought forward the

creation of capital to fund its continued growth. However, in order

to enable the Company to maintain its current loan growth momentum

in 2023 and beyond alongside the increase in the countercyclical

capital buffer ("CCyB") in July 2023 (further details of which are

set out below), the Company is seeking to raise approximately

GBP12.0 million (before commissions and expenses) pursuant to the

conditional Placing and Subscription.

Background to the CCyB

The increase in the CCyB in July 2023 mandated by the Prudential

Regulation Authority ("PRA") will require all banks to hold

additional capital balances. The CCyB is a macroprudential tool

that enables the PRA's Financial Policy Committee ("FPC") to adjust

the resilience of the banking system to the changing scale of risk

it faces over time. By increasing the CCyB when risks are judged to

be building up, banks will have an additional cushion of capital to

absorb potential losses. When threats to stability are judged to

have receded, or when credit conditions are weak and banks' capital

buffers are judged to be more than sufficient to absorb future

losses, the CCyB can be reduced by the FPC. By aligning resilience

with risk, the CCyB seeks to reduce the extent to which economic

shocks will be amplified by the banking system, including through

contracting the supply of credit and other services. The CCyB

applies to all banks, building societies and investment firms

(other than those exempted by the FCA) incorporated in the United

Kingdom. The CCyB is applied at both individual entity and

consolidated group levels. Each bank must calculate its

'institution-specific' CCyB rate, defined as the weighted average

of the CCyB rates in effect across the jurisdictions in which it

has credit exposures. The institution-specific CCyB rate is then

applied to the firm's total risk weighted assets.

The current UK CCyB rate is 1 per cent., which will increase to

2 per cent. with effect from 5 July 2023.

3. Related party transaction

The participation of Sir Henry Angest, through Flowidea Limited,

in the Subscription as a Director of the Company and a substantial

shareholder for the purposes of the AIM Rules and the AQSE Rules,

constitutes a related party transaction pursuant to Rule 13 of the

AIM Rules and Rule 4.6 of the AQSE Rules. Following Admission, the

beneficial interest in the Ordinary Shares of Sir Henry Angest will

be as follows:

Shareholder Number of existing Percentage of Number of Ordinary Percentage of Enlarged

Ordinary Shares existing Ordinary Share Shares following Ordinary Share

capital (excluding completion of the Capital (excluding

Ordinary Shares held in Fundraising Ordinary Shares held in

treasury) treasury)

Sir Henry Angest 8,376,401 56.26% 9,106,244 56.26%

Sir Henry Angest also holds a beneficial interest in 86,674

Ordinary Non-Voting Shares, representing 64.88 per cent. of the

Ordinary Non-Voting Shares in issue. No Ordinary Non-Voting Shares

are being issued pursuant to the Fundraising.

For the purpose of the AIM Rules, the Independent Directors

consider, having consulted with Grant Thornton, the Company's

nominated adviser, that the terms of Sir Henry Angest's

participation in the Subscription are fair and reasonable insofar

as Shareholders are concerned. For the purpose of the AQSE Rules,

the Independent Directors consider that, having exercised

reasonable care, skill and diligence, the participation by Sir

Henry Angest in the Subscription is fair and reasonable as far as

Shareholders are concerned.

4. General Meeting

Set out at the end of the Circular will be a notice convening

the General Meeting to be held at the offices of Arbuthnot at

Arbuthnot House, 7 Wilson Street, London EC2M 2SN on 4 May 2023 at

11.00 a.m., at which an ordinary and a special resolution will be

proposed which will, if passed, give the Directors authority to

allot up to 1,297,297 New Ordinary Shares on a non-pre-emptive

basis.

An ordinary resolution requires a simple majority of members

entitled to vote and present in person or by proxy to vote in

favour in order for it to be passed. A special resolution requires

a majority of at least 75 per cent. of members entitled to vote and

present in person or by proxy to vote in favour in order for it to

be passed.

5. Recommendation

The Directors consider the Fundraising to be in the best

interests of the Company and its Shareholders as a whole and

accordingly unanimously recommend Shareholders to vote in favour of

the Resolutions to be proposed at the General Meeting, as they

intend to do in respect of their beneficial holdings amounting, in

aggregate, to 8,460,162 existing Ordinary Shares, representing

approximately 56.82 per cent. of the issued Ordinary Share capital

of the Company.

Expected Timetable of Principal Events

2023

Publication of the Circular on or around 18 April

Latest time and date for receipt of proxy 11.00 a.m. on 2 May

votes for the General Meeting

General Meeting 11.00 a.m. on 4 May

Admission, completion of the Fundraising 8.00 a.m. on 5 May

and commencement of dealings in the New Ordinary

Shares

CREST accounts credited 5 May

Dispatch of share certificates in respect By 19 May

of the New Ordinary Shares

Notes:

1. Each of the times and dates above is indicative only and

subject to change. If any of the above times and/or dates change,

the revised times and/or dates will be notified by the Company to

Shareholders by announcement through a Regulatory Information

Service.

2. All of the times above refer to London time.

Definitions

"Act" the Companies Act 2006 (as amended);

"Admission" admission of the New Ordinary Shares to trading

on: (i) AIM becoming effective in accordance

with Rule 6 of the AIM Rules; and (ii) the AQSE

becoming effective;

"AIM" the AIM Market operated by the London Stock Exchange;

"AIM Rules" the AIM Rules for Companies published by the

London Stock Exchange from time to time;

"AQSE" AQSE Growth Market, Apex Segment;

"AQSE Rules" the rules governing companies whose securities

are traded on AQSE as published by the Aquis

Exchange from time to time being, in relation

to the Ordinary Shares, the rules set out in

the Aquis Exchange's APEX Rulebook;

"CCyB" countercyclical capital buffer;

"Circular" the circular to be sent to Shareholders containing

details of the Fundraising and the Notice of

General Meeting;

"Company" or "Arbuthnot" Arbuthnot Banking Group plc, a company incorporated

in England and Wales with company number 01954085;

"CREST" the relevant system (as defined in the CREST

Regulations) in respect of which Euroclear is

the operator (as defined in those regulations);

"CREST Regulations" the Uncertificated Securities Regulations 2001

(S.I. 2001 No. 3755);

"Directors" or the directors of the Company, or any duly authorised

"Board" committee thereof;

"Enlarged Ordinary the issued Ordinary Share capital of the Company

Share Capital" (excluding 390,274 Ordinary Shares held in Treasury)

as enlarged by the Placing Shares and the Subscription

Shares;

"Euroclear" Euroclear UK & International Limited, the operator

of CREST;

"Existing Shares" the 14,889,048 Ordinary Shares (which excludes

the 390,274 Ordinary Shares held in treasury)

and 152,621 Ordinary Non-Voting Shares in issue;

"FCA" the UK Financial Conduct Authority;

"FSMA" the Financial Services and Markets Act 2000 (as

amended);

"Fundraising" together the Placing and the Subscription;

"General Meeting" the general meeting of the Company to be held

at the offices of Arbuthnot at Arbuthnot House,

7 Wilson Street, London EC2M 2SN on 4 May 2023

at 11.00 a.m., notice of which will be set out

at the end of the Circular;

"Grant Thornton" Grant Thornton UK LLP, the Company's nominated

adviser and corporate adviser for the purposes

of the AIM Rules and AQSE Rules, respectively;

"Group" the Company and its subsidiaries from time to

time;

"Independent Directors" the Directors with the exception of Sir Henry

Angest and Frederick Angest;

"London Stock Exchange" London Stock Exchange plc;

"Net Proceeds" the gross proceeds of the Fundraising, less expenses

and commissions incurred;

"New Ordinary Shares" the Placing Shares and the Subscription Shares;

"Notice of General the notice convening the General Meeting which

Meeting" will be set out at the end of the Circular;

"Ordinary Non-Voting ordinary shares of GBP0.01 (1 penny) each without

Shares" voting rights attached in the capital of the

Company;

"Ordinary Shares" ordinary shares of GBP0.01 (1 penny) each with

voting rights attached in the capital of the

Company;

"Placing" the conditional placing of the Placing Shares

by SCS, as agent on behalf of the Company, pursuant

to the Placing Agreement;

"Placing Agreement" the conditional agreement dated 14 April 2023

and made between the Company and Shore Capital

in relation to the Placing;

"Placing Price" 925 pence per New Ordinary Share;

"Placing Shares" the 567,454 new Ordinary Shares to be issued

and allotted by the Company pursuant to the Placing;

"Resolutions" the resolutions set out in the Notice of General

Meeting;

"SCC" Shore Capital and Corporate Limited, the Company's

financial adviser;

"SCS" Shore Capital Stockbrokers Limited, the Company's

broker for the purposes of the AIM Rules and

the Fundraising;

"Shareholders" holders of Ordinary Shares and/or Ordinary Non-Voting

Shares, as the context requires;

"Shore Capital" SCC and/or SCS as the context requires;

"Subscription" the conditional subscription for 729,843 new

Ordinary Shares at the Placing Price pursuant

to the Subscription Agreement;

"Subscription Agreement" the conditional agreement dated 14 April 2023

and made between the Company and Flowidea Limited,

a company of which Sir Henry Angest is the sole

beneficial owner, in relation to the Subscription;

and

"Subscription Shares" the 729,843 new Ordinary Shares to be issued

and allotted by the Company pursuant to the Subscription.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IOESFAFMLEDSEEL

(END) Dow Jones Newswires

April 14, 2023 12:30 ET (16:30 GMT)

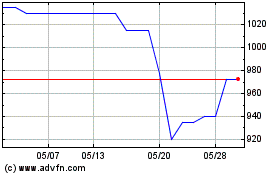

Arbuthnot Banking (AQSE:ARBB)

過去 株価チャート

から 10 2024 まで 11 2024

Arbuthnot Banking (AQSE:ARBB)

過去 株価チャート

から 11 2023 まで 11 2024