false

0000732026

0000732026

2024-05-14

2024-05-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): May 14, 2024

TRIO-TECH INTERNATIONAL

(Exact Name of Registrant as Specified in Its Charter)

California

(State or Other Jurisdiction of Incorporation)

|

1-14523

|

95-2086631

|

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

| |

|

|

Block 1008 Toa Payoh North, Unit 03-09 Singapore

|

318996

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

(65) 6265 3300

(Registrant’s Telephone Number, Including Area Code)

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| |

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered or to be registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading

Symbol(s)

|

Name of each exchange on which registered

|

| |

|

|

|

Common Stock, no par value

|

TRT

|

NYSE American

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR 230.405) or Rule 12b2 of the Securities Exchange Act of 1934 (17 CFR 240.12b2) Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ☐

Item 2.02 Results of Operations and Financial Conditions

On May 13, 2024, Trio-Tech International issued a press release announcing its financial results for the fiscal quarter ended March 31, 2024. A copy of the press release is attached as Exhibit 99.1.

The information in this Current Report, including the exhibit attached hereto, is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section. The information in this Current Report, including the exhibit attached hereto, shall not be incorporated by reference into any filings under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

104 Cover Page Interactive Data File (embedded within the Inline XBRL document)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: May 14, 2024

| |

TRIO-TECH INTERNATIONAL |

| |

|

| |

|

| |

|

| |

|

| |

By: /s/ SRINIVASAN ANITHA

|

| |

Name: Srinivasan Anitha

|

| |

Title: Chief Financial Officer

|

EXIBIT INDEX

|

Exhibit Number

|

Description

|

| |

|

|

99.1

|

Press Release of Trio-Tech International dated May 13, 2024

|

Exhibit 99.1

|

|

LOS ANGELES

SINGAPORE

KUALA LUMPUR

BANGKOK

SUZHOU

TIANJIN

CHONGQING

JIANGSU

|

|

FOR IMMEDIATE RELEASE

|

Company Contact:

Siew Wai Yong

Chairman & CEO

(818) 787-7000

|

Investor Contact:

Berkman Associates

(310) 927-3108

robert.jacobs@jacobscon.com

|

Trio-Tech Reports Improved Third Quarter Results

$7.47 Book Value; $4.04 in Cash, Short-Term Deposits Per Share

Van Nuys, CA – May 13, 2024 – Trio-Tech International (NYSE MKT: TRT) today announced financial results for the third quarter and first nine months of fiscal 2024.

Fiscal 2024 Third Quarter Results

For the three months ended March 31, 2024, total revenue increased 6% to $10,398,000 compared to $9,842,000 for same quarter last year. Manufacturing segment revenue increased 62% to $4,813,000, compared to $2,963,000 for the same quarter last year. Distribution segment revenue increased 51% to $1,783,000, compared to $1,179,000 for the same period last year. Testing Services segment revenue decreased 33% to $3,796,000 from $5,697,000 for the same quarter last year.

Overall gross margin increased 10% to $2,703,000, or 26% of revenue, compared to $2,458,000, or 25% of revenue for the same period last year. The increase in gross margin reflects improved operations in the Manufacturing and Distribution segments, partially offset by lower gross margin in Testing Services.

Total operating expenses for the third quarter of fiscal 2024 increased to $2,644,000, or 25% of revenue, from $2,495,000, or 25% of revenue, in the same quarter last year.

Pre-tax Income from continuing operations increased to $306,000, compared to pre-tax income from continuing operations of $57,000 for the same quarter last year.

Net income attributable to Trio-Tech International Common Shareholders for the three months ended March 31, 2024 increased to $70,000, or $0.02 per diluted share, which included non-cash stock compensation expense of $338,000. This compares to a net loss for the third quarter of fiscal 2023 of $7,000, or $0.00 per diluted share, which included non-cash stock compensation expense of $283,000.

CEO Comments

S.W. Yong, Trio-Tech's CEO, said, "Higher capital spending by our key customers and increased backlog enabled the Manufacturing segment to achieve a 62% revenue gain in the seasonally weakest quarter of our fiscal year. Increasing demand for electronic components and display products, a market we specifically targeted for growth in the past year, drove a 51% increase in Distribution revenue. We are cautiously optimistic that these favorable trends in revenue and profitability for these two segments of our business will continue throughout this calendar year.

“The performance of our Testing Services segment reflects continued weakness in global semiconductor demand. The cost control measures we have implemented across the Company have enabled Trio-Tech to maintain solid margins despite the decline in revenue in the Testing Services segment. We are confident that our tight manufacturing cost controls, strong cash flow and attention to market developments position Trio-Tech to exploit any near-term opportunities and developments in the semiconductor industry.”

Fiscal 2024 Nine Months Results

For the first nine months of fiscal 2024, revenue decreased 5% to $32,566,000 compared to $34,171,000 for the first nine months of fiscal 2023. Manufacturing revenue increased 8% to $12,488,000 from 11,592,000 for the first nine months of fiscal 2023. Distribution revenue increased 33% to $6,453,000 from $4,855,000 for the first nine months from fiscal 2023. Testing Services revenue decreased 23% to $13,606,000 from 17,709,000 for the first nine months of fiscal 2023.

(more)

16139 Wyandotte Street, Van Nuys, CA 91406, USA ● TEL: (818) 787-7000 ● FAX (818) 787-9130

Trio-Tech Reports Improved Third Quarter Results

May 13, 2024

Page Two

Gross margin for the first nine months of fiscal 2023 decreased 14% to $8,077,000, or 25% of revenue, compared to $9,415,000, or 27% of revenue, for the same period last year.

Operating expenses were $7,342,000, or 23% of revenue, for this year’s first nine months compared to $7,316,000, or 21% of revenue, for the same period a year ago.

Net income attributable to Trio-Tech International Common Shareholders for the first nine months of fiscal 2024 was $807,000, or $0.19 per diluted share. This compares to net income of $1,382,000, or $0.33 per diluted share, for the first nine months of fiscal 2023.

Balance Sheet Highlights

Shareholders’ equity at March 31, 2024 increased to $31,452,000, or $7.47 per outstanding share, compared to shareholders’ equity of $29,571,000, or $7.21 per outstanding share, at June 30, 2023. Cash, cash equivalents and short-term deposits at March 31, 2024 increased to $17,025,000, or $4.04 per outstanding share, compared to $14,210,000, or $3.47 per outstanding share, at June 30, 2023.

Trio-Tech reported total non-current liabilities at March 31, 2024 of $1,839,000. This compares to total non-current liabilities at June 30, 2023 of $3,289,000.

There were approximately 4,210,305 common shares outstanding at March 31, 2024 compared to approximately 4,096,680 at June 30, 2023.

About Trio‑Tech

Established in 1958, Trio-Tech International is located in Van Nuys, California, with its Principal Executive Office and regional headquarter in Singapore. Trio-Tech International is a diversified business group with interests in semiconductor testing services, manufacturing and distribution of semiconductor testing equipment, and real estate. Our subsidiary locations include Tianjin, Suzhou, Chongqing and Jiangsu in China, as well as Kuala Lumpur Malaysia and Bangkok Thailand. Further information about Trio-Tech's semiconductor products and services can be obtained from the Company's Web site at www.triotech.com and www.universalfareast.com.

Forward Looking Statements

This press release contains statements that are forward looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and may contain forward looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and assumptions regarding future activities and results of operations of the Company. In light of the "safe harbor" provisions of the Private Securities Litigation Reform Act of 1995, the following factors, among others, could cause actual results to differ materially from those reflected in any forward looking statements made by or on behalf of the Company: market acceptance of Company products and services; or the divestiture in the future of one or more business segments; among other factors, changing business conditions or technologies and volatility in the semiconductor industry, which could affect demand for the Company's products and services; the impact of competition; problems with technology; product development schedules; delivery schedules; changes in military or commercial testing specifications which could affect the market for the Company's products and services; difficulties in profitably integrating acquired businesses, if any, into the Company; risks associated with conducting business internationally and especially in Asia, including currency fluctuations and devaluation, currency restrictions, local laws and restrictions and possible social, political and economic instability; changes in U.S. and global financial and equity markets, including market disruptions and significant interest rate fluctuations; public health issues related to the COVID-19 pandemic; trade tension between U.S. and China; inflation; the war in Ukraine and Russia, the war between Israel and Hamas; and other economic, financial and regulatory factors beyond the Company's control. Other than statements of historical fact, all statements made in this release are forward looking, including, but not limited to, statements regarding industry prospects, future results of operations or financial position, and statements of our intent, belief and current expectations about our strategic direction, prospective and future financial results and condition. In some cases, you can identify forward looking statements by the use of terminology such as "may," "will," "expects," "plans," "anticipates," "estimates," "potential," "believes," "can impact," "continue," or the negative thereof or other comparable terminology. Forward looking statements involve risks and uncertainties that are inherently difficult to predict, which could cause actual outcomes and results to differ materially from our expectations, forecasts and assumptions. Many of these risks and uncertainties are beyond the Company's control. Reference is made to the discussion of risk factors detailed in the Company's filings with the Securities and Exchange Commission including its reports on Form 10-K and 10-Q. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the dates on which they are made.

(tables attached)

|

TRIO‑TECH INTERNATIONAL AND SUBSIDIARIES

|

|

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME (LOSS)

|

|

UNAUDITED (IN THOUSANDS, EXCEPT EARNINGS PER SHARE)

|

| |

|

Three Months Ended

|

|

|

Nine Months Ended

|

|

| |

|

March 31,

|

|

|

March 31,

|

|

|

|

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

| Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Manufacturing

|

|

$ |

4,813 |

|

|

$ |

2,963 |

|

|

$ |

12,488 |

|

|

$ |

11,592 |

|

|

Testing Services

|

|

|

3,796 |

|

|

|

5,697 |

|

|

|

13,606 |

|

|

|

17,709 |

|

|

Distribution

|

|

|

1,783 |

|

|

|

1,179 |

|

|

|

6,453 |

|

|

|

4,855 |

|

|

Real Estate

|

|

|

6 |

|

|

|

3 |

|

|

|

19 |

|

|

|

15 |

|

| |

|

|

10,398 |

|

|

|

9,842 |

|

|

|

32,566 |

|

|

|

34,171 |

|

|

Cost of Sales

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of manufactured products sold

|

|

|

3,594 |

|

|

|

2,451 |

|

|

|

9,252 |

|

|

|

8,825 |

|

|

Cost of testing services rendered

|

|

|

2,601 |

|

|

|

3,940 |

|

|

|

9,849 |

|

|

|

11,813 |

|

|

Cost of distribution

|

|

|

1,482 |

|

|

|

975 |

|

|

|

5,334 |

|

|

|

4,064 |

|

|

Cost of real estate

|

|

|

18 |

|

|

|

18 |

|

|

|

54 |

|

|

|

54 |

|

| |

|

|

7,695 |

|

|

|

7,384 |

|

|

|

24,489 |

|

|

|

24,756 |

|

|

Gross Margin

|

|

|

2,703 |

|

|

|

2,458 |

|

|

|

8,077 |

|

|

|

9,415 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General and administrative

|

|

|

2,351 |

|

|

|

2,248 |

|

|

|

6,326 |

|

|

|

6,472 |

|

|

Selling

|

|

|

204 |

|

|

|

160 |

|

|

|

639 |

|

|

|

526 |

|

|

Research and development

|

|

|

89 |

|

|

|

87 |

|

|

|

305 |

|

|

|

311 |

|

|

Loss on disposal of property, plant and equipment

|

|

|

-- |

|

|

|

-- |

|

|

|

72 |

|

|

|

7 |

|

|

Total operating expenses

|

|

|

2,644 |

|

|

|

2,495 |

|

|

|

7,342 |

|

|

|

7,316 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (Loss) from Operations

|

|

|

59 |

|

|

|

(37 |

) |

|

|

735 |

|

|

|

2,099 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Income (Expenses)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expenses

|

|

|

(17 |

) |

|

|

(29 |

) |

|

|

(63 |

) |

|

|

(83 |

) |

|

Other income (expenses), net

|

|

|

252 |

|

|

|

40 |

|

|

|

366 |

|

|

|

(49 |

) |

|

Government grant

|

|

|

12 |

|

|

|

83 |

|

|

|

89 |

|

|

|

108 |

|

|

Total other income (expenses)

|

|

|

247 |

|

|

|

94 |

|

|

|

392 |

|

|

|

(24 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income from Continuing Operations before Income Taxes

|

|

|

306 |

|

|

|

57 |

|

|

|

1,127 |

|

|

|

2,075 |

|

|

Income Tax Expenses

|

|

|

(142 |

) |

|

|

(8 |

) |

|

|

(274 |

) |

|

|

(474 |

) |

|

Income from Continuing Operations before Non-controlling Interest, net of tax

|

|

|

164 |

|

|

|

49 |

|

|

|

853 |

|

|

|

1,601 |

|

|

(Loss) Income from Discontinued Operations, net of tax

|

|

|

(1 |

) |

|

|

5 |

|

|

|

3 |

|

|

|

(4 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET INCOME

|

|

|

163 |

|

|

|

54 |

|

|

|

856 |

|

|

|

1,597 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Less: Net income Attributable to Non-controlling Interest

|

|

|

93 |

|

|

|

61 |

|

|

|

49 |

|

|

|

215 |

|

|

Net Income (Loss) Attributable to Trio-Tech International

|

|

|

70 |

|

|

|

(7 |

) |

|

|

807 |

|

|

|

1,382 |

|

|

Net Income Attributable to Trio-Tech International:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (Loss) from Continuing Operations, net of tax

|

|

|

71 |

|

|

|

(10 |

) |

|

|

801 |

|

|

|

1,384 |

|

|

(Loss) Income from Discontinued Operations, net of tax

|

|

|

(1 |

) |

|

|

3 |

|

|

|

6 |

|

|

|

(2 |

) |

|

Net Income (Loss) Attributable to Trio-Tech International

|

|

$ |

70 |

|

|

$ |

(7 |

) |

|

$ |

807 |

|

|

$ |

1,382 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic Earnings per Share

|

|

$ |

0.02 |

|

|

$ |

0.00 |

|

|

$ |

0.19 |

|

|

$ |

0.34 |

|

|

Diluted Earnings per Share

|

|

$ |

0.02 |

|

|

$ |

0.00 |

|

|

$ |

0.19 |

|

|

$ |

0.33 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted Average Shares Outstanding - Basic

|

|

|

4,176 |

|

|

|

4,075 |

|

|

|

4,131 |

|

|

|

4,075 |

|

|

Weighted Average Shares Outstanding - Diluted

|

|

|

4,282 |

|

|

|

4,159 |

|

|

|

4,274 |

|

|

|

4,161 |

|

|

TRIO‑TECH INTERNATIONAL AND SUBSIDIARIES

|

|

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

|

|

UNAUDITED (IN THOUSANDS)

|

| |

|

Three Months Ended

|

|

|

Nine Months Ended

|

|

| |

|

March 31,

|

|

|

March 31,

|

|

| |

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

|

Comprehensive (Loss) / Income Attributable to Trio-Tech International:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income

|

|

$ |

163 |

|

|

$ |

54 |

|

|

$ |

856 |

|

|

$ |

1,597 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign Currency Translation, net of tax

|

|

|

(753 |

) |

|

|

166 |

|

|

|

222 |

|

|

|

521 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Comprehensive (Loss) Income

|

|

|

(590 |

) |

|

|

220 |

|

|

|

1,078 |

|

|

|

2,118 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Less: Comprehensive Income (Loss) Attributable to Non-controlling Interest

|

|

|

93 |

|

|

|

(85 |

) |

|

|

49 |

|

|

|

127 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Comprehensive (Loss) Income Attributable to Trio-Tech International

|

|

$ |

(683 |

) |

|

$ |

305 |

|

|

$ |

1,029 |

|

|

$ |

1,991 |

|

|

TRIO‑TECH INTERNATIONAL AND SUBSIDIARIES

|

|

CONDENSED CONSOLIDATED BALANCE SHEETS

|

|

(IN THOUSANDS, EXCEPT NUMBER OF SHARES)

|

| |

|

Mar. 31,

|

|

|

Jun. 30,

|

|

| |

|

2024

|

|

|

2023

|

|

| |

|

(Unaudited)

|

|

|

(Audited)

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

CURRENT ASSETS:

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

10,716 |

|

|

$ |

7,583 |

|

|

Short-term deposits

|

|

|

6,309 |

|

|

|

6,627 |

|

|

Trade account receivables, net

|

|

|

10,083 |

|

|

|

9,804 |

|

|

Other receivables

|

|

|

1,089 |

|

|

|

939 |

|

|

Inventories, net

|

|

|

2,742 |

|

|

|

2,151 |

|

|

Prepaid expenses and other current assets

|

|

|

577 |

|

|

|

694 |

|

|

Assets held for sale

|

|

|

-- |

|

|

|

274 |

|

|

Financed sales receivable

|

|

|

-- |

|

|

|

16 |

|

|

Restricted term deposits

|

|

|

754 |

|

|

|

739 |

|

|

Total current assets

|

|

|

32,270 |

|

|

|

28,827 |

|

| |

|

|

|

|

|

|

|

|

|

NON-CURRENT ASSETS:

|

|

|

|

|

|

|

|

|

|

Deferred tax assets

|

|

|

117 |

|

|

|

100 |

|

|

Investment properties, net

|

|

|

433 |

|

|

|

474 |

|

|

Property, plant and equipment, net

|

|

|

6,081 |

|

|

|

8,344 |

|

|

Operating lease right-of-use assets

|

|

|

2,277 |

|

|

|

2,609 |

|

|

Other assets

|

|

|

149 |

|

|

|

116 |

|

|

Restricted term deposits

|

|

|

1,760 |

|

|

|

1,716 |

|

|

Total non-current assets

|

|

|

10,817 |

|

|

|

13,359 |

|

|

TOTAL ASSETS

|

|

$ |

43,087 |

|

|

$ |

42,186 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS’ EQUITY

|

|

|

|

|

|

|

|

|

|

CURRENT LIABILITIES:

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$ |

2,406 |

|

|

$ |

1,660 |

|

|

Accrued expense

|

|

|

3,904 |

|

|

|

4,291 |

|

|

Contract liabilities

|

|

|

1,499 |

|

|

|

1,277 |

|

|

Income taxes payable

|

|

|

328 |

|

|

|

418 |

|

|

Current portion of bank loans payable

|

|

|

308 |

|

|

|

475 |

|

|

Current portion of finance leases

|

|

|

56 |

|

|

|

107 |

|

|

Current portion of operating leases

|

|

|

1,295 |

|

|

|

1,098 |

|

|

Total current liabilities

|

|

|

9,796 |

|

|

|

9,326 |

|

| |

|

|

|

|

|

|

|

|

|

NON-CURRENT LIABILITIES:

|

|

|

|

|

|

|

|

|

|

Bank loans payable, net of current portion

|

|

|

676 |

|

|

|

877 |

|

|

Finance leases, net of current portion

|

|

|

10 |

|

|

|

42 |

|

|

Operating leases, net of current portion

|

|

|

982 |

|

|

|

1,511 |

|

|

Income taxes payable, net of current portion

|

|

|

141 |

|

|

|

255 |

|

|

Deferred tax liabilities

|

|

|

3 |

|

|

|

10 |

|

|

Other non-current liabilities

|

|

|

27 |

|

|

|

594 |

|

|

Total non-current liabilities

|

|

|

1,839 |

|

|

|

3,289 |

|

|

TOTAL LIABILITIES

|

|

$ |

11,635 |

|

|

$ |

12,615 |

|

| |

|

|

|

|

|

|

|

|

|

EQUITY

|

|

|

|

|

|

|

|

|

|

TRIO-TECH INTERNATIONAL'S SHAREHOLDERS' EQUITY:

|

|

|

|

|

|

|

|

|

|

Common stock, no par value, 15,000,000 shares authorized; 4,210,305 and 4,096,680 shares issued and outstanding at March 31, 2024 and June 30, 2023, respectively

|

|

|

13,194 |

|

|

|

12,819 |

|

|

Paid-in capital

|

|

|

5,494 |

|

|

|

5,066 |

|

|

Accumulated retained earnings

|

|

|

11,570 |

|

|

|

10,763 |

|

|

Accumulated other comprehensive income-translation adjustments

|

|

|

984 |

|

|

|

758 |

|

|

Total Trio-Tech International shareholders' equity

|

|

|

31,242 |

|

|

|

29,406 |

|

|

Non-controlling interest

|

|

|

210 |

|

|

|

165 |

|

|

TOTAL EQUITY

|

|

|

31,452 |

|

|

|

29,571 |

|

|

TOTAL LIABILITIES AND EQUITY

|

|

$ |

43,087 |

|

|

$ |

42,186 |

|

v3.24.1.1.u2

Document And Entity Information

|

May 14, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

TRIO-TECH INTERNATIONAL

|

| Document, Type |

8-K

|

| Document, Period End Date |

May 14, 2024

|

| Entity, Incorporation, State or Country Code |

CA

|

| Entity, File Number |

1-14523

|

| Entity, Tax Identification Number |

95-2086631

|

| Entity, Address, Address Line One |

Block 1008

|

| Entity, Address, City or Town |

Toa Payoh North

|

| Entity, Address, Country |

SG

|

| Entity, Address, Postal Zip Code |

318996

|

| City Area Code |

65

|

| Local Phone Number |

6265 3300

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

TRT

|

| Security Exchange Name |

NYSE

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000732026

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

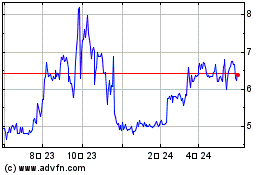

Trio Tech (AMEX:TRT)

過去 株価チャート

から 10 2024 まで 11 2024

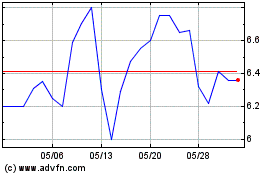

Trio Tech (AMEX:TRT)

過去 株価チャート

から 11 2023 まで 11 2024