UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the

Registrant ☐

Filed by a Party other than the Registrant ☒

| Check |

the appropriate box: |

| ☐ |

Preliminary Proxy Statement |

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule

14a-6(e)(2)) |

| ☐ |

Definitive Proxy Statement |

| ☒ |

Definitive Additional Materials |

| ☐ |

Soliciting Material Under Rule 14a-12 |

AIM IMMUNOTECH INC.

(Name of Registrant as Specified in Its Charter)

TED D. KELLNER

TODD

DEUTSCH

ROBERT L. CHIOINI

PAUL W. SWEENEY

(Name of

Persons(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☐ |

Fee paid previously with preliminary materials |

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules

14a-6(i)(1) and 0-11 |

Ted D. Kellner, Todd Deutsch, Robert L. Chioini and Paul W. Sweeney (the “Kellner Group”) have

filed a definitive proxy statement and accompanying GOLD proxy card with the Securities and Exchange Commission (“SEC”) to be used to solicit votes for their election to the Board of Directors of AIM Immunotech Inc., a Delaware

corporation (the “Company” or “AIM”), at the 2024 Annual Meeting of Stockholders scheduled to be held on December 17, 2024 (the “Annual Meeting”).

The following are materials the Kellner Group intends to present to stockholders and proxy advisory firms commencing on November 20, 2024:

The Urgent Case for Change at AIM

ImmunoTech Inc. The Kellner Group

Important Information and Participants in

the Solicitation The Kellner Group has filed a definitive proxy statement and associated GOLD proxy card with the Securities and Exchange Commission (“SEC”) to be used to solicit votes for the election of its slate of highly-qualified

director nominees at the upcoming annual meeting of stockholders of AIM Immunotech Inc. (“AIM” or the “Company”). Details regarding the Kellner Group nominees are included in its proxy statement. THE KELLNER GROUP STRONGLY

ADVISES ALL STOCKHOLDERS OF AIM TO READ THE PROXY STATEMENT AND OTHER PROXY MATERIALS AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Information regarding the identity of participants in the Kellner Group’s

solicitation, and their direct or indirect interests, by security holdings or otherwise, is set forth in the Kellner Group’s proxy statement. Stockholders can obtain a copy of the proxy statement, and any amendments or supplements thereto and

other documents filed by the Kellner Group with the SEC for no charge at the SEC’s website at www.sec.gov. Copies will also be available at no charge at the following website: https://www.okapivote.com/AIM. Investors can also contact Okapi

Partners LLC at the telephone number or email address set forth at the end of this presentation.

The Kellner Group - Who We Are The Kellner

Group is comprised of Ted D. Kellner, Todd Deutsch, Robert L. Chioini and Paul W. Sweeney, each highly qualified, independent nominees. Together, the beneficial ownership of the Kellner Group is 3,211,100 shares, or approximately 5.04% of

outstanding shares of AIM as of record date. The Kellner Group is collectively the largest AIM stockholder and the only motive is to improve performance. Mr. Kellner, the nominating stockholder, and the other nominees do not have a history of

activism beyond AIM. Mr. Kellner, Mr. Deutsch, Mr. Chioini and Mr. Sweeney have strong, relevant backgrounds in business, finance, life science, clinical trial execution, corporate governance and public company success – all critically needed

skills for a public biotech company such as AIM – and are committed to fully unlocking and maximizing stockholder value. Mr. Kellner, Mr. Deutsch, Mr. Chioini and Mr. Sweeney are convinced that, with their appointment to the AIM Board of

Directors (the “Board”), they can turn around AIM’s fortunes and finally start creating value for stockholders.

Overview of AIM ImmunoTech Inc. AIM (NYSE

American: AIM) is an immuno-pharma company focused on the research and development of therapeutics to treat multiple types of cancers, immune disorders, and viral diseases, including COVID-19. The Company’s lead product, Ampligen®

(rintatolimod) is an immuno-modulator with broad spectrum activity being developed for globally important cancers, viral diseases and disorders of the immune system. Market Capitalization: $15M The current entrenched Board has: Breached its

fiduciary duty of loyalty (as found by Delaware Supreme Court) by adopting bylaw amendments to maintain control and prevent a stockholder vote; Separately, a Florida district court sanctioned AIM for pursuing an improper purpose in its Section 13(d)

claims that have been dismissed multiples times; and Wasted $15-20 million* in this ongoing bad faith effort to pursue an improper purpose of entrenchment and disenfranchisement of stockholders As a result: Stock price has declined by more than 99%;

Losses have accelerated; Clinical progress is lacking; AIM’s financial condition is distressed and has undertaken increasingly desperate financing transactions that are detrimental to stockholders; and Substantial doubt about ability to

continue as going concern and equity below requirements for continued listing on NYSE American The Kellner Group believes Ampligen has the potential to be extremely valuable to patients and stockholders, but this has yet to come to fruition and will

not under the control of the incumbent Board. *Represents Kellner Group estimate based on increase in Company’s G&A expense from 2021 to 2023 and explanations provided as disclosed in AIM’s Annual Reports on Form 10-K for past two

years, together with continued elevated G&A expenses in 2024 to date as disclosed AIM’s most recently Quarterly Report on Form 10-Q.

Urgent Board Change is Needed - AIM is

Plagued by 4 Key Issues Value Destruction and Financial Mismanagement Current Strategy is Aimless and Fundamentally Flawed Self-Interested Entrenchment Efforts, Improper Purpose Misaligned and Excessive Compensation Since Mr. Equels, Dr. Mitchell

and Mr. Appelrouth took control of the Board in 2016, they have destroyed the AIM stock price causing it to decline by 99% Stockholders have lost essentially their entire investment over this period This has continued since Ms. Bryan was added to

the Board in 2023, with stock price down 40% in 2024 alone $15-20 million spent in bad faith entrenchment efforts and improper litigation against shareholders during past two years Financial condition has become increasingly distressed Pursues

vanishing, highly dilutive and increasingly desperate financing alternatives to the detriment of stockholders, but has done little to improve financial condition AIM's clinical strategy lacks focus and consistency, with limited investment in

company-sponsored trials, and has resulted in a lack of progress and no clear path or timeline to approvals or commercialization Wasteful G&A spending has increased from $8.6M in 2021 to $21.1M in 2023, largely driven by the Board’s

entrenchment efforts, while R&D spending has consistently suffered, well below G&A and approximately half in 2023 and the first half of 2024 AIM touts numerous potential indications for Ampligen in its filings, but the reality is that many

are stale collaborations with minimal investment and little, if any, progress over time Lack of consistent focus and execution has resulted in years of foundering and failure Recently, the Delaware Supreme Court found the Board breached its

fiduciary duty of loyalty by adopting bylaws in 2023 with an improper purpose to maintain control and entrench itself and to prevent Kellner’s nominees from an election AIM continues to pursue the Section 13(d) litigation in Florida despite

multiple dismissals and sanctions for pursuing improper purpose The Board has committed gross waste - we estimate $15-20M in the past two years – to retain control while disenfranchising stockholders Failed to get majority support for its say

on pay for 3 consecutive years This was due to years of excessive executive and director compensation, including egregious CEO employment agreement with guaranteed compensation and extreme severance/change of control provisions AIM claimed it would

conduct a review after 2022 annual meeting Cursory, selective and self-affirming review conduct by same small consultant that recommended CEO compensation in the first place No changes communicated Source: Company filings | nyse.com, which data with

respect to the Company account for reverse stock splits of 1 for 12 in 2016 and 1 for 44 in 2019.

New Board Needed Now, or We can Only

Expect the Years of Value Destruction by the AIM Board to Continue On February 25, 2016, the day that Mr. Equels assumed the role of CEO, AIM’s stock closed at $87.15. Seven months later, the day that the three incumbent directors – Mr.

Equels, Dr. Mitchell and Mr. Appelrouth – assumed control of the Board, AIM’s stock had lost 36%, closing at $55.44/share. In the ensuing years, the value of AIM’s stock has plummeted. On October 15, 2024, AIM’s stock closed

at $0.25 per share. In other words, the value of AIM’s stock has declined by over 99% since Mr. Equels became CEO and Mr. Equels, Dr. Mitchell and Mr. Appelrouth assumed control of the Board. In order to avoid getting delisted from the NYSE

American, AIM has undertaken reverse stock splits cumulating to a ratio of 1-for-528 (a 1-for-12 reverse split in 2016 and a 1-for-44 reverse split in 2019). Now, management has raised substantial doubt about AIM’s ability to continue as a

going concern. AIM’s stockholders’ equity is below the minimum requirement for continued listing on the NYSE American stock exchange. Without change, AIM appears headed toward another reverse split in the near future as the stock price

continues to hover in the 20 cents range. Through Nov 15, 2024, AIM returns are -46%, -80%, and -45% on a YTD, 3-year, and 5-year basis, respectively Mr. Equels becomes CEO Incumbent Board Assumes Control Source: Company filings | nyse.com, which

data with respect to the Company account for reverse stock splits of 1 for 12 in 2016 and 1 for 44 in 2019.

Company has Suffered Significant Net

losses Under the Incumbent AIM Board Net losses, totaling over $120M have occurred from 2016 through June 30, 2024, and have been accelerating, going from $9.5 million in 2019 to $28.9 million in 2023. G&A spending is excessive and increasing,

driven largely by entrenchment efforts, going from $8.67 million in 2021 to $21.1 million in 2023. The increase in G&A expenses in 2023 were largely due to increases in legal fees of $6.5M related to AIM’s entrenchment and

disenfranchisement efforts of stockholders. R&D is consistently well below G&A, approximately half, in recent periods. As of September 30, 2024, effective liquidity of less than $1.0 million (cash and equivalents plus marketable securities,

minus accounts payable). Runway of less than month based 10+million in cash used from operations in 9 months through 9/30. $4.9m in unpaid legal fees – we believe largely from the Board’s wasteful campaign against shareholders. Source:

Capital IQ and Company filings

Dilutive and Damaging Financing

Transactions by AIM Board AIM’s financial condition and lack of prospects have resulted in a series of increasingly desperate financing transactions that are extremely dilutive and detrimental to existing stockholders. Consider the financing

transactions that AIM has pursued thus far in 2024: Receipt of a usurious two-year loan bearing an effective interest rate of approximately 25% per year from a lender controlled by an individual with a history of securities law

violations – someone the SEC described as a “recidivist violator of the federal securities laws.” An equity line of credit (“ELOC”) with a different entity controlled by this same troubling individual, providing that

the Company could sell up to almost 10.0 million shares (almost 20% of outstanding shares at the time) at a discount to market price, and allowing this individual with a history of securities law violations to profit at the expense of existing

stockholders when the shares are quickly dumped into the market. The sale of 10.3 million shares in two separate transactions to a short-term hedge fund for approximately $2.9 million of proceeds after expenses and granting that hedge fund

warrants to purchase another 20.6 million shares at the same prices – effectively granting the hedge fund the upside of over one-third of the entire Company at the time for minimal proceeds. According to the recent resale registration

statement filed by AIM, this hedge fund has already sold the entire 10.3 million initial shares since its first purchase in June 2024, contributing to significant downward pressure on the stock price. AIM also maintains

an at-the-market (“ATM”) offering program currently allowing it to sell up to $3.3 million of shares (which would be approximately 12.5 million shares at current prices). AIM has a long history of excessive ATM usage

– selling 20 million shares in 2020 alone (which was twice the total number of shares outstanding at the beginning of the year). These financings are highly dilutive and incredibly damaging to future prospects. In the short term, we believe

the additional shares being sold into the market by the Company or short-term investors create downward pressure on the stock price, hampering the ability to raise additional funds at attractive prices. In the longer term, we believe the significant

overhang caused by the 20.6 million shares underlying warrants held by a single short-term hedge fund will continue weigh down the stock price. Source: Capital IQ and Company filings

The Board’s Aimless and Flawed

Strategy Since 1987, AIM has stated it has been focused on preclinical and clinical activities with respect to Ampligen since 1987. Yet, 37 years later, Ampligen has not been approved for sale in the United States nor generated any meaningful

revenues. Under the incumbent Board, strategy involves touting numerous potential diseases that Ampligen can potentially treat, but no clear focus or communicated goals and timelines. Characterized by shifting focuses – ME/CFS until 2013,

Ebola in 2014 when U.S. cases were in the news, COVID-19 in 2020, then moved on to long-COVID, and now back to oncology. Press releases are issued with “positive news,” often repackaged and repeated and based on preliminary data, without

clear follow through on next steps or timelines. Although AIM’s filings mention double-digit potential indications for Ampligen being studied, the vast majority of these are third party studies. With limited financial commitment and control

over these studies, little progress is made. AIM’s filings have described many studies for years with little update from period to period or visibility into what’s next. Letting third party clinicians research Ampligen on a small scale

on their own time just to publish in a journal and issue a PR will never provide relevant data nor commercial value. AIM must dedicate resources and investment itself to Ampligen clinical trials to be successful. Very few trials are actually

Company-sponsored trials that AIM invests meaningful resources into. Only two of ongoing trials are Company’s sponsored – not clear if either are actively being run at this time or if AIM can continue to fund them. Both being conducted

Amarex, as AIM’s contract research organization. Amarex is a troubled CRO that recently paid a multi-million dollar settlement to a client as a result of its practices. And whose former CEO – an individual quoted in several AIM press

releases in recent years – is facing criminal fraud trial as a result. AIM has an approved drug, Alferon, but no plans or timelines for production or commercialization or other monetization have been communicated. AIM also actually did get

Ampligen approved for severe CFS in Argentina in 2016, but still has not generated any sales or communicated a strategy for doing so. As a result, stockholders can see no clear path or timeline to FDA approvals or commercialization.

AIM’s most recent Form 10-Q does not mention any specific plans for Phase 3 studies, and it is not even clear when disclosed Phase 1 and 2 studies will be completed. See Appendix B for more details on AIM’s stagnant clinical program.

Source: Company filings

Wasteful Spending on Board Entrenchment

Efforts The entrenched Board undertook a significant effort in March 2023 to radically change the advance notice bylaws and make them substantially more burdensome and ambiguous than before. The Delaware Supreme Court eventually ruled that

these amended bylaws were inequitable and unenforceable. The court found that the “primary purpose was to interfere with [Mr.] Kellner’s nomination notice, reject his nominees, and maintain control.” The court ruled that these

amendments were the “product of an improper motive and purpose, which constitutes a breach of the duty of loyalty.” The Board initiated and continues to pursue the Florida Section 13(d) litigation despite multiple dismissals

and sanctions against AIM and its counsel and a finding by the Florida court that AIMs arguments were “factually and legally frivolous and advanced for an improper purpose.” The incumbent Board bears sole responsibility for this waste

– the incumbent directors initiated and perpetuated this effort in order to entrench themselves and to disenfranchise stockholders. Collectively, we estimate AIM’s incumbent Board has recklessly spent almost $15-20 million in the past

two years on their self-interested, stockholder attack campaign to maintain control and avoid any accountability to stockholders. The Incumbent Board Chose to Spend approximately $15-20 Million Bullying and Attacking its Stockholders in its

Entrenchment Efforts, Rather than for Clinical Advancement! Source: Company filings

AIM’s Misaligned and Excessive

Compensation Director and executive compensation from 2016 through 2023 has totaled approximately $21.5 million (based on amounts included in summary compensation tables for executives and director compensation tables for directors in SEC

filings), compared to over $100 million in net loss during that time period. On November 10, 2020, AIM’s stock closed at $1.96, down 98% from the date Mr. Equels was appointed CEO. Yet, despite that massive stock price decline, in

the wake of a disappointing say-on-pay result and with still more than two years before expiration of Mr. Equels’s then current employment agreement, the incumbent Board – with the compensation committee consisting of just

Dr. Mitchell and Mr. Appelrouth – inexplicably saw fit to generously reward Mr. Equels with a new, long-term, higher pay contract. Mr. Equels’s contract has outrageous severance provisions - salary and other benefits

(including equity compensation) for the full 5-year term in the event of a termination without cause (and a 3-year extension of the term and accompanying severance benefits in the event of termination without cause following a change of control). As

a result, the potential severance payments increased from $0.8 million, assuming a January 1, 2020 termination date (whether or not following a change of control), to $2.6 million (without a change of control) and $5.0 million

(with a change of control), assuming a January 2, 2024 termination date. Egregious plan that provides Mr. Equels with the 3% of gross proceeds that for certain significant events and the sale of the Company or substantially all of its assets.

Short 1-year, exclusively time-based vesting on options. No performance conditions on cash bonus or equity awards. Beholden compensation committee regularly approves full cash bonus – no explanatory disclosure provided. Average CEO

compensation in past 3 years: $1.4M ($1.1M cash). Apparent decline is only because of (1) a fixed number of stock options having less fair value due to AIM’s stock price continuing to plummet, and (2) not including 2023 bonusses in the summary

compensation table, even though theses bonusses were fully paid without explanation in spring 2024. Bad practices continue: In 2023, deferred cash bonuses until after year end and omitted from the 2023 summary compensation table, but paid in full

without explanation in 2024. More recently, CEO and COO were issued 900,000 fully vested shares, prior to the record date with knowledge of pending proxy contest, as an advance on a portion of salary for the next 12 months. Source: Company

filings

AIM Repeatedly Ignores Say-on-Pay Votes

and Misleads Stockholders Source: Company filings Say-on-Pay Results AIM’s Lack of Response In October 2020, AIM saw deteriorating say-on-pay results, with 43% of votes cast against the proposal, more the double the negative feedback

from the prior year. Yet just one month later, at a time when AIM’s stock price was already down 98% from the time Mr. Equels became CEO, the Board awarded Mr. Equels a new employment agreement with massive compensation increases -

$2.7 million in 2020 compensation, an outlandish severance package valued in the many millions and an entitlement to a 3% commission on licensing and sale transactions. In October 2021, unsurprisingly in the wake of Equels’s massive

compensation increase, AIM’s say-on-pay vote failed spectacularly with only 16% approval. Yet AIM made no improvements to its compensation practices. Quite the opposite, months later, in March 2022, AIM decided to

grant off-cycle option awards to directors and management. In November 2022, again unsurprisingly in the wake of previous events, AIM’s say-on-pay vote failed spectacularly once again with only 16% approval. AIM’s

response was a press release announcing they would engage a nationally recognized independent compensation consultant to review executive compensation. But the incumbent Board brazenly did not follow through – the same small firm the

Board has used before, including in connection with the massive increase in Mr. Equels’s compensation in 2020 that was supposedly subject to review, conducted a superficial analysis using an extremely limited data set. AIM did not engage a new

nationally recognized independent compensation consultant, conduct any sort of meaningful review or make any changes. In January 2023, AIM’s say-on-pay vote failed yet again receiving only 37% approval. AIM continued the abusive compensation

practices – AIM reported lower executive compensation in 2023 as compared to 2022, but the difference is due to 2023 bonuses being deferred to 2024 ($350,000 to Mr. Equels, an increase from the prior year, and $150,000 to Mr. Rodino, the same

as the prior year, were paid in May 2024). This created the impression of lower compensation, even though the bonuses were paid in full months later without explanation. In addition, the CEO and COO were issued 900,000 fully vested shares, prior to

the record date with knowledge of pending proxy contest, as an advance on a portion of salary for the next 12 months.

Former President of BioFlorida

Hand-selected by Mr. Equels without any independent search and rubber-stamped by Dr. Mitchell and Mr. Appelrouth No prior public board experience Since appointed to the Board in the spring of 2023: AIM has continued its outrageous entrenchment

efforts Denied Mr. Kellner’s notice last year and continued to pursue improper Florida litigation, resulting in significant waste of assets, disenfranchisement of stockholders and increasing distressed financial condition Renewed poison pill

without stockholder vote until 2028, at which point it will have been in effect without stockholder vote for 25 years As chair of compensation committee, has continued poor practices and recently issued an 900,000 fully vested shares to the CEO and

COO in advance of the record date AIM Board Lacks Relevant Skills, Experience and is Not Independent Thomas K. Equels CEO and President of AIM Excessive tenure – 16 years since 2008 No prior experience running clinical trials, public company

or even executive experience in the biotech industry No prior public board experience Leads significant value destruction of AIM William M. Mitchell, M.D., Ph.D. Professor at Vanderbilt University Excessive tenure – 26 years since 1998 (and

prior to that served on the Board as early as 1987) No prior public board or executive leadership experience Chairman since 2016 and oversaw significant value destruction at AIM Steward L. Appelrouth Partner at Appelrouth, Farah & Co. Excessive

tenure – 8 years since 2016 and consulted for the Board’s audit committee for five prior years going back to 2011 Pre-existing relationship with Mr. Equels prior to his appointment in 2016 (provided personal tax returns for Mr. Equels

and used as expert witness for Mr. Equels law firm) No prior public board experience No industry experience Oversaw significant value destruction at AIM during his tenure Nancy K. Bryan

Kellner Nominees are Highly-Qualified,

Independent and Have the Skill Set and Experience to Fix AIM Ted D. Kellner Retired Founder, CEO, PM and investment manager of Fiduciary Management, which currently manages ~$16 billion. Additional key skills, experiences, and attributes Ted brings

to the Board Significant business, investor and financial management experience Vast investment network Prior board service with large, sophisticated organizations like Metavante Technologies, Marshall & Ilsley Corp, American Family Mutual

Insurance Company Significant AIM stock ownership creates alignment with stockholders Mr. Deutsch brings an extensive investor network and financial experience as well as valuable insight into managing and overseeing a business. Additional key

skills, experiences, and attributes Todd brings to the Board Significant financial management and analysis experience Spent decades in hedge fund industry with significant understanding of public markets and relations with institutional investor

community; vast investor network Public board service, including compensation committee (Esquire Financial Holdings Inc – ESQ) Significant AIM stock ownership creates alignment with stockholders Todd Deutsch Private investor and entrepreneur

Mr. Kellner brings 50 years of investment and financial expertise, and substantial senior management experience.

Kellner Nominees are Highly-Qualified,

Independent and Have the Skill Set and Experience to Fix AIM Robert L. Chioini Managing Member of Bright Rock Holdings LLC, a Life Science consultancy business helping biotech companies succeed. Additional key skills, experiences, and attributes Rob

brings to the Board As CEO, led successful clinical trial programs resulting in 4 new FDA approved drugs, 14 FDA medical devices and secured multiple license agreements with big pharma As CEO, Director of SQI Diagnostics, increased company valuation

933% to a $155 million market cap As CEO, Director of Rockwell Medical, grew company into a successful, vertically integrated, publicly traded biotech increasing market cap from $5M to ~$1B Vast business and investment network Mr. Sweeney brings

over 30 years of extensive investment and management experience. Additional key skills, experiences, and attributes Paul brings to the Board Significant experience in a wide range of private equity investing from venture capital to leveraged buyouts

and recapitalizations Prior board service with many portfolio companies of PS Capital Partners Vast investment network Successfully invested in and managed numerous companies across a variety of industries, creating value through long-term

investments and collaboration with management. Paul Sweeney Co-founder and principal of PS Capital Partners, a private equity firm with a focus in manufacturing and process-oriented industries. Mr. Chioini brings ~30 years of successful life science

business experience as a Founder, CEO and director of public traded biotech companies.

The Kellner Group’s Plan will

Begin Immediately Review of Financing and Investor Communications Review Management and Practices Summary of the Full Board Strategic Review of the Most Important Issues Plaguing AIM Today Review of Governance & Executive Compensation Review of

excessive G&A spending and current levels of R&D Leverage internal and external resources to review the numerous different indications of Ampligen Create real, focused clinical strategy to help patients and stockholders Rectifying

AIM’s abysmal governance track record and excessive compensation practices. Identify an additional independent director to add to the Board, with a focus on finding a candidate with no past history with AIM, with scientific or other relevant

expertise, and with a diverse background Complete Review of Ampligen and invest resources in the most promising applications Despite AIM’s complete lack of transparency, the Kellner Group has a plan to do the hard work to get AIM on the right

track to start creating value for stockholders Reallocate spending from G&A to R&D Cut back on excessive G&A spending, starting with excessive compensation and legal spending Right size and focus R&D as dictated by comprehensive

review of Ampligen Review current management and key personnel Attempt to work constructively with current team to ensure sufficient continuity If this is not possible, the Kellner Group has the experience and background to lead a turn around If it

becomes necessary, Mr. Chioini is committed to doing whatever the Board needs, including serving as interim CEO while Board runs a succession process Leverage director expertise and networks to create financial plan to ensure AIM can continue to

operate in future years without taking on costly and overly dilutive financing Actually communicate with shareholders AIMs plans and begin to rebuild trust

Our Plan to Fix AIM and Enhance

Stockholder Value Review Management and Practices Focus on the most promising indications for Ampligen and invest resources into those efforts Under the incumbent Board, AIM has pursued numerous and varied potential indications for Ampligen without

communicating a clear and consistent strategy and focus. A lot of this has been done through collaborations rather than company-sponsored trials. The Kellner Group Nominees will put an end to the perpetual lack of transparency and credibility of the

incumbent Board. The Kellner Group Nominees intend to responsibly determine and communicate strategy after they are able to conduct an independent review of all available information. The Kellner Group Nominees intend to bring in much needed

expertise, in oncology and other relevant fields, to work together with the Company’s existing scientific personnel to conduct a thorough assessment of all relevant data to ensure the most value-resulting clinical programs are properly

executed and report the findings to stockholders. Mr. Kellner has significant connections to top Midwest research hospitals through his membership on the board of the Medical College of Wisconsin and the charitable activities of the Kelben

Foundation, his family foundation, and intends to utilize this network to identify appropriate personnel for this process. This independent review will be especially important given that AIM’s company-sponsored trials are being conducted by

Amarex, a troubled CRO that recently paid a multi-million dollar settlement to a client as a result of its practices (and whose former CEO – an individual quoted in several AIM press releases in recent years – is facing criminal fraud

trial as a result). We believe significant change is needed in the way AIM is operated for all the reasons described in this communication and in our proxy statement. This must include some level of change in management. In particular, after being

found by the Delaware Supreme Court, along with other directors, to have breached his fiduciary duty of loyalty to the Company and its stockholders, and causing severe damage to the Company’s financial condition and reputation in furtherance

of his wrongful acts, we believe it would be difficult for the Company to turn around its fortunes and regain investor confidence while Mr. Equels remains the Company’s CEO. The Kellner Group Nominees, if elected, intend to conduct a

review to gather all necessary information and meet with management and key personnel before making any decisions and ultimately will do what they believe to be in the best interest of the Company and its stockholders after conducting such review.

As part of this process, the Kellner Group Nominees intend to attempt to work constructively with existing management, including Mr. Equels, to ensure continuity in key roles and functions and, to the extent changes are deemed necessary, to provide

for appropriate transition arrangements. However, if this is not possible, the Kellner Group Nominees believe they collectively have the necessary skill set and network to lead a turnaround for AIM including the recruitment of qualified personnel in

short order.

Our Plan to Fix AIM and Enhance

Stockholder Value (continued) We believe the incumbent Board has burned bridges with the investment community through its gross waste, inadequate performance and lack of transparency and accountability to stockholders. It is absolutely necessary for

AIM to attract long-term, institutional health care investors that can support clinical development through commercialization. The Kellner Group Nominees will bring credibility to the Board and clearly communicate a focused strategy for the creation

of stockholder value. Through their networks and business reputations, they believe they can build relationships and attract capital and new investors. Review of Financing and Investor Communications Reduce excessive G&A spending; focus on

effective and targeted R&D spending AIM’s G&A expending has clearly been excessive under the incumbent Board, largely as a result of improper entrenchment efforts and excessive executive and director compensation in our view. The

Kellner Group Nominees will seek to meaningfully reduce G&A spending, and direct funds to the most critical areas that produce the highest, value-driven result. At the same time, they will ensure that R&D spending is at appropriate levels

relative to G&A – it is unacceptable for G&A to consistently exceed R&D by significant amounts, almost double in recent periods, for a clinical-stage life sciences company.

Additional Governance and Compensation

Commitments Governance Improve corporate governance structures and board composition. Identify an additional independent director to potentially add to the Board, with a focus on finding a candidate with no past history with AIM, with scientific or

other relevant expertise, and with a diverse background. Review AIM’s poison pill, which has been in effect for almost 25 years without stockholder approval, with consideration of putting it to a stockholder vote if it will be maintained

long-term. Actually engage, clearly communicate and respond to stockholders concerns, rebuilding the trust of current and new investors. Reign in excessive compensation and other G&A spending that is not clearly and directly supporting clinical

efforts. Decrease director fees to align with industry peers of similar size and shift value away from cash and to equity. Engage a new, independent compensation consultant to overhaul existing compensation structures with goals of: reducing

guaranteed compensation, reducing executive and director fixed and cash compensation, implementing an incentive-based compensation structure with objective performance measures and appropriate vesting schedules, and eliminating excessive severance

agreements. Executive Compensation

Plan Timeline Full Board Strategic

Review Q1 Q2 Q3 Q4 Begin Review of Ampligen Begin the review of various indications Begin to work with current staff supplemented by

additional experts in the area of oncology, and clinical development and design to create clinical plans Focus on effective and targeted R&D for most promising indications

Communicate clear clinical goals and timelines and hold ourselves accountable Review of Financial Plan

Engage with investors and potential new sources of capital through networks to rebuild trust and obtain more favorable financing Create and communicate strategic financial plan that

aligns with results of Ampligen review Right size G&A expenses to appropriate levels and align them with actual needs Management

Review Evaluate current management team Ensure appropriate management team is in place

Communicate plan to investors Governance Review Identify a potential additional qualified director candidate with the right skills and a diverse background

Review current governance structures and consider changes to better align with market best practices (e.g., removal of poison pill or putting it up to vote)

Executive Compensation Hire new, truly independent compensation consultant to support in the creation of compensation program that actually aligns pay and performance

Engage with shareholders on compensation issues and listen to their feedback

Do not Be Fooled – Nothing Will

Change Unless You Vote For The Kellner Group The incumbent Board wants you to believe that it is addressing your concerns and success is right around the corner; they want you to focus on meaningless headlines and believe there is real progress

being made The truth is, this Board has been given enough time to show what they can accomplish, and highlights of their tenure include: 99% decline in stock price Years of foundering and no FDA approvals for its key drug Engaging in gross waste and

jeopardizing the Company’s financial condition in pursuit of breach of fiduciary duty of loyalty and pursuit of improper purpose As a direct result of the Board’s waste and improper purpose, AIM has resorted to increasingly desperate

financing transactions that do little to improve financial condition and are extremely detrimental to stockholders Substantial doubt about ability to continue as going concern and equity below requirements for continued listing on NYSE American The

continuing free fall of the stock price - 40% in 2024 alone - and the utter and complete lack of long-term investor interest in AIM tell the true story - the incumbent Board has failed and lacks credibility Incumbent has communicated no plans for

change and only promises more of the same failed practices, with better outcomes somehow perpetually right around the corner The incumbent Board does not have the skills, experience or credibility to create real value for all stockholders After

almost nine years of control, and decades of collective involvement with AIM, time is up for the incumbent Board The Choice is Clear: Vote FOR the Kellner Group’s Four Highly Qualified, Independent Nominees (Kellner, Deutsch, Chioini and

Sweeney) and vote WITHHOLD on all Four of AIM’s Nominees Only on the GOLD CARD! Source: Company filings | nyse.com, which data with respect to the Company account for reverse stock splits of 1 for 12 in 2016 and 1 for 44 in 2019.

Contact Okapi Partners Okapi Partners

LLC Stockholders may call toll-free: (844) 343-2621 Banks and brokers call: (212) 297-0720 Email: info@okapipartners.com

APPENDIX A | The Truth to AIM’s

Misleading Narratives The Activist Group Includes Criminals and Individuals Who Have Attempted to Mislead AIM Shareholders for Years Our Board and Management Team are Driving Significant Momentum Our Well-Qualified Board Has the Right Experience to

Drive AIM Forward Mr. Chioini was fired as Rockwell Medical’s CEO There is absolutely no one other than Mr. Kellner, Mr. Deutsch, Mr. Chioini and Mr. Sweeney who has any involvement in the Kellner Group’s efforts. Likewise, no one other

than Mr. Kellner, Mr. Deutsch and Mr. Chioini was involved in Mr. Kellner's nominations with respect to the 2023 annual meeting. The AIM Board’s tired and pathetic attempt to connect the Kellner Group to Mr. Tudor and Mr. Xirinachs –

whose past histories with respect to AIM are well-known at this point – is a misleading distraction. This is an entrenched Board that has overseen a massive destruction of stockholder value, years of ineptitude, a lack of clinical progress,

and financial mismanagement. They continue to push out press releases with flashy headlines, but there is no meaningful clinical progress and no transparency on Company’s clinical programs and financial condition. The current structure and

composition of the Board does not provide any meaningful oversight of management and has been disastrous for stockholders. The Board continues its entrenchment efforts, and wasteful spending of company money has reached shocking new levels with

wasteful litigation, despite a finding by the Delaware Supreme Court that the Board breached its duty of loyalty in the process and multiple dismissals and sanctions against AIM in the Florida Section 13(d) case. Ms. Bryan’s board appointment

was just another “non-independent” director who also has a pre-existing relationship with the Company and Mr. Equels, and who was hand-picked by Mr. Equels to try and further Board entrenchment (no director search firm was engaged; no

follow-up on promise to add second director). No meaningful review or changes to executive or director compensation occurred despite the promise to engage independent nationally recognized compensation consultant to review executive compensation.

The truth is that Mr. Chioini was not fired. He and the Rockwell CFO at the time filed a whistleblower and retaliation claim against conflicted directors and upon a settlement agreement received a significant financial payout to resolve the issue.

This is demonstrated by the public record and the AIM Board is fully aware of these facts. The incumbent Board will say anything and spend any amount of STOCKHOLDER MONEY to continue to maintain control The AIM Board Misleads The Truth

Clinical Trial Status Locally Advanced

Pancreatic Adenocarcinoma (Phase 2 AMP-270)** Significantly delayed – the FDA cleared the trial in March 2022 and AIM just recently amended and resubmitted the study protocol to the FDA in October 2024 to expand inclusion criteria and

treatment arms. AIM hasn’t communicated a clear reason for the delay or the late amendment to the study protocol. Late-Stage Pancreatic Cancer (Phase 1b/2 DURIPANC) AIM did release preliminary data in its Phase 1b/2 clinical trial being

conducted with a study partner in September 2024, but has not been able to report on PFS yet or provide timeline when it expects to do other next steps. Ampligen as an Antiviral to treat COVID FDA study suspended/MHRA study application withdrawn.

Despite touting Ampligen’s potential as an antiviral treatment, AIM stopped pursuing this once COVID vaccines were introduced. Early-Stage Prostate Cancer FDA study suspended due to a discontinuation of a third-party produced antiviral drug.

AIM has continually indicated that it expects the trial to resume in the near future since early 2023, but has provided no clear timeline. Refractory Melanoma FDA study was suspended due to a discontinuation of a third-party produced antiviral drug.

AIM resumed recruitment, but has otherwise provided no clear timeline or updates on progress. Myalgic Encephalomyelitis/Chronic Fatigue Syndrome (ME/CFS) AIM received a CRL from the FDA stating that it should conduct at least one additional clinical

trial, complete various nonclinical studies and perform a number of data analyses in February 2013. AIM has been saying it plans a comprehensive follow-through with the FDA and is working on CRL responses for several years, with no progress or

timeline update. Incidentally, AIM did receive approval in Argentina in 2016, but almost a decade later, still no commercial launch or clear timeline. Advanced Recurrent Ovarian Cancer (Ampligen + Pemborlizumab) Topline data reported in April

2024 in Phase 2 study of advanced recurrent ovarian cancer, with additional clinical studies underway and planned but no clear timeline or additional details. Advanced Recurrent Ovarian Cancer (Intraperitoneal Chemo-Immunotherapy) Results of Phase 1

portion of Phase 1/2 study published in early 2022; Phase 2 still only recruiting with no clear timeline. Post-COVID Conditions (Phase 2 AMP-518)** AIM reported topline results from its AMP-518 Phase 2 study in February 2024 and further analysis in

September 2024; no clear timeline or details for planned follow-up clinical trial. Stage 4 Metastatic Triple Negative Breast Cancer No new information since findings published in 2022. Stage 4 Colorectal Cancer Metastatic to the Liver No new

information since findings published in 2022. Early-Stage Triple Negative Breast Cancer Phase 1 topline results reported in 2022; no update on next steps or plans. Metastatic or Unresectable Triple Negative Breast Cancer Little information provided

other than Phase 1a/2 has been recruiting patients throughout 2024. Alferon N Injection Company’s other product. Approved for certain treatments in US and Argentina. No production ongoing or planned and no strategy communicated for

this product. * Other potential Indications briefly mentioned in AIM filings without details or follow through include Ebola, MERS, Alzheimer’s, Endometriosis, and RNA respiratory viruses, such as influenza, Rhinoviruses. **Represent

company-sponsored trials being administered by a Amarex Clinical Research, the contract research organization retained by AIM. Amarex recently paid a multi-million settlement to a former clients as a results of its practices. It’s

former CEO – an individual quoted in several AIM press releases in recent years – is facing a criminal trial for fraud as a result. APPENDIX B | Underwhelming Clinical Trial Progress

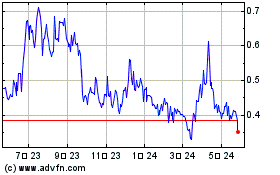

AIM ImmunoTech (AMEX:AIM)

過去 株価チャート

から 11 2024 まで 12 2024

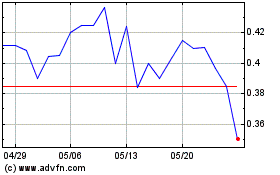

AIM ImmunoTech (AMEX:AIM)

過去 株価チャート

から 12 2023 まで 12 2024