false

0001279620

0001279620

2024-02-27

2024-02-27

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT PURSUANT TO

SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

February 27, 2024

| Zoned Properties, Inc. |

| (Exact Name of Registrant as Specified in its Charter) |

| |

| Nevada |

| (State or Other Jurisdiction of Incorporation) |

| 000-51640 |

|

46-5198242 |

| (Commission File Number) |

|

(IRS Employer

Identification No.) |

8360 E. Raintree Drive, #230

Scottsdale, AZ |

|

85260 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

(Registrant’s telephone number, including

area code): (877) 360-8839

N/A

(Former name, former address and former fiscal

year, if changed since last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2.)

| ☐ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| N/A |

|

N/A |

|

N/A |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities

Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01. Regulation FD Disclosure.

On February 27, 2024, Zoned Properties, Inc. (the

“Company”) issued a press release announcing that the Company will present virtually at the Emerging Growth Conference on

Wednesday, March 6, 2024 at 1:45 PM Eastern Time. A copy of this press release is attached hereto as Exhibit 99.1 and incorporated herein

by reference. The information contained in the website is not a part of this Current Report on Form 8-K.

Beginning February 27, 2024, the Company’s

management will deliver the investor presentation attached hereto as Exhibit 99.2 and incorporated herein by reference.

The information included in this Item 7.01, including

Exhibits 99.1 and 99.2, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934,

as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall such information be deemed

incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly

set forth by specific reference in such a filing. The information set forth under this Item 7.01 shall not be deemed an admission as to

the materiality of any information in this Current Report on Form 8-K that is required to be disclosed solely to satisfy the requirements

of Regulation FD.

Item 9.01 Financial

Statement and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

ZONED PROPERTIES, INC. |

| |

|

| Dated: February 27, 2024 |

/s/ Bryan McLaren |

| |

Bryan McLaren |

| |

Chief Executive Officer & Chief Financial Officer |

2

Exhibit 99.1

Zoned Properties to Present at the Emerging

Growth Conference on March 6, 2024

Live Webcast to be Held at 1:45pm ET on Wednesday

March 6, 2024

SCOTTSDALE, Ariz., February 27, 2024 /AccessWire/

-- Zoned Properties®, Inc. (“Zoned Properties” or the “Company”) (OTCQB: ZDPY), a technology-driven property

investment company for emerging and highly regulated industries, including legalized cannabis, today announced that the Company will

present virtually at the Emerging Growth Conference on Wednesday March 6, 2024 at 1:45 PM Eastern Time.

Zoned Properties invites individual and institutional

investors as well as advisors and analysts, to attend its real-time, interactive presentation at the Emerging Growth Conference. This

live, interactive online event will give existing shareholders and the investment community the opportunity to interact with the Company’s

CEO, Bryan McLaren in real time.

“We

are excited to announce our participation in the Emerging Growth Conference on March 6, 2024 as our company continues to engage with

a wider audience about the impactful strides we are making in the business. This event will provide us with a platform to share our strategic

vision, recent achievements, and discuss our growth trajectory in the dynamic direct to consumer cannabis real estate sphere,”

commented Bryan McLaren, Chief Executive Officer of Zoned Properties.

Mr. McLaren will perform a presentation and may

subsequently open the floor for questions. Please submit your questions in advance to Questions@EmergingGrowth.com or ask your questions

during the event.

Please register here to ensure you are able to

attend the conference and receive any updates that are released.

https://goto.webcasts.com/starthere.jsp?ei=1650531&tp_key=ca9510e531&sti=zdpy

If attendees are not able to join the event

live on the day of the conference, an archived webcast will also be made available on EmergingGrowth.com and on the Emerging Growth

YouTube Channel, http://www.YouTube.com/EmergingGrowthConference.

About the Emerging Growth Conference

The Emerging Growth conference is an effective

way for public companies to present and communicate their new products, services and other major announcements to the investment community

from the convenience of their office, in a time efficient manner.

The Conference focus and coverage includes companies

in a wide range of growth sectors, with strong management teams, innovative products & services, focused strategy, execution, and

the overall potential for long term growth. Its audience includes potentially tens of thousands of Individual and Institutional investors,

as well as Investment advisors and analysts.

All sessions will be conducted through video

webcasts and will take place in the Eastern time zone.

About Zoned Properties, Inc. (OTCQB: ZDPY):

Zoned Properties is a specialized real estate

development firm for emerging and highly regulated industries, including regulated cannabis. The Company is redefining the approach to

commercial real estate investment through its integrated growth services.

Headquartered in Scottsdale, Arizona, Zoned Properties

has developed a full spectrum of integrated growth services to support its real estate development model; the Company’s Property

Technology, Advisory Services, Commercial Brokerage, and Investment Portfolio collectively cross-pollinate within the model to drive

project value associated with complex real estate projects. With national experience and a team of experts devoted to the emerging cannabis

industry, Zoned Properties is addressing the specific needs of a modern market in highly regulated industries. Zoned Properties does

not grow, harvest, sell or distribute cannabis or any substances regulated under United States law such as the Controlled Substance Act

of 1970, as amended (the “CSA”). Zoned Properties corporate headquarters are located at 8360 E. Raintree Dr., Suite 230,

Scottsdale, Arizona. For more information, call 877-360-8839 or visit www.ZonedProperties.com.

Twitter: @ZonedProperties

LinkedIn: @ZonedProperties

Investor Relations

Zoned Properties, Inc.

Bryan McLaren

Tel (877) 360-8839

Investors@zonedproperties.com

www.zonedproperties.com

Exhibit 99.2

March 2024 Corporate Presentation OTCQB: ZDPY www. ZonedProperties .com The Cannabis Friendly Landlord

2 Safe Harbor Statement This presentation contains forward - looking statements . All statements other than statements of historical facts included in this press release are forward - looking statements . In some cases, forward - looking statements can be identified by words such as "believe," "expect," "anticipate," "plan," "potential," "continue" or similar expressions . Such forward - looking statements include risks and uncertainties, and there are important factors that could cause actual results to differ materially from those expressed or implied by such forward - looking statements . These factors, risks and uncertainties are discussed in the Company's filings with the Securities and Exchange Commission . Investors should not place any undue reliance on forward - looking statements since they involve known and unknown, uncertainties and other factors which are, in some cases, beyond the Company's control which could, and likely will, materially affect actual results, levels of activity, performance or achievements . Any forward - looking statement reflects the Company's current views with respect to future events and is subject to these and other risks, uncertainties and assumptions relating to operations, results of operations, growth strategy and liquidity . The Company assumes no obligation to publicly update or revise these forward - looking statements for any reason, or to update the reasons actual results could differ materially from those anticipated in these forward - looking statements, even if new information becomes available in the future . COVID - 19 Statement In March 2020 , the World Health Organization declared COVID - 19 a global pandemic and recommended containment and mitigation measures worldwide . The Company is monitoring this closely, and although operations have not been materially affected by the COVID - 19 outbreak to date, the ultimate duration and severity of the outbreak and its impact on the economic environment and our business is uncertain . Currently, all of the properties in the Company’s portfolio are open to its Significant Tenants and will remain open pursuant to state and local government requirements . The Company did not experience in 2020 or 2021 and does not foresee in 2022 , any material changes to its operations from COVID - 19 . The Company’s tenants are continuing to generate revenue at these properties, and they have continued to make rental payments in full and on time and we believe the tenants’ liquidity position is sufficient to cover its expected rental obligations . Accordingly, while the Company does not anticipate an impact on its operations, it cannot estimate the duration of the pandemic and potential impact on its business if the properties must close or if the tenants are otherwise unable or unwilling to make rental payments . In addition, a severe or prolonged economic downturn could result in a variety of risks to the Company’s business, including weakened demand for its properties and a decreased ability to raise additional capital when needed on acceptable terms, if at all . Forward Looking Statements

Company Overview

Our MISSION To acquire value - add Retail Dispensary Properties for best - in - class Cannabis Operators . Our VISION Our VALUES To Own a Portfolio of Premier Dispensary Properties approved and operating in every Local Community. Sophistication , Safety , Sustainability , Stewardship Our Motto The Cannabis Friendly Landlord Company Philosophy 4

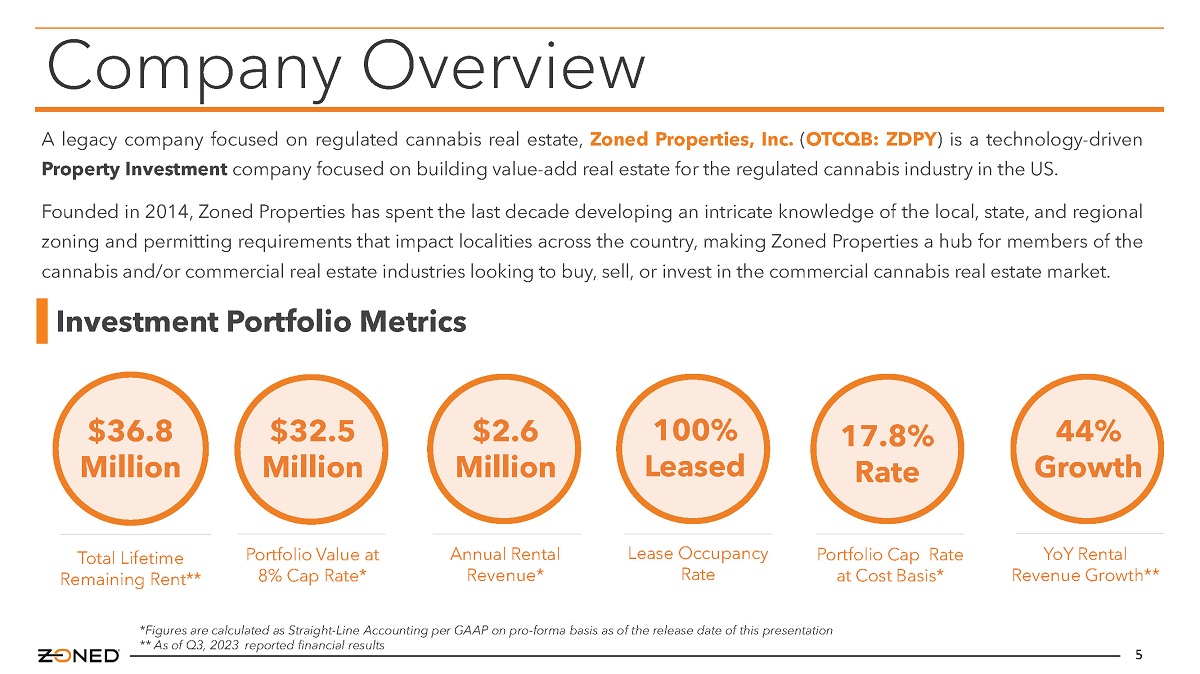

5 A legacy company focused on regulated cannabis real estate, Zoned Properties, Inc . ( OTCQB : ZDPY ) is a technology - driven Property Investment company focused on building value - add real estate for the regulated cannabis industry in the US . Founded in 2014 , Zoned Properties has spent the last decade developing an intricate knowledge of the local, state, and regional zoning and permitting requirements that impact localities across the country, making Zoned Properties a hub for members of the cannabis and/or commercial real estate industries looking to buy, sell, or invest in the commercial cannabis real estate market . Company Overview Lease Occupancy Rate 100% Leased Portfolio Cap Rate at Cost Basis* 17.8% Rate Portfolio Value at 8% Cap Rate* Annual Rental Revenue* $2.6 Million YoY Rental Revenue Growth** 44% Growth $32.5 Million Total Lifetime Remaining Rent** $36.8 Million Investment Portfolio Metrics *Figures are calculated as Straight - Line Accounting per GAAP on pro - forma basis as of the release date of this presentation ** As of Q3, 2023 reported financial results

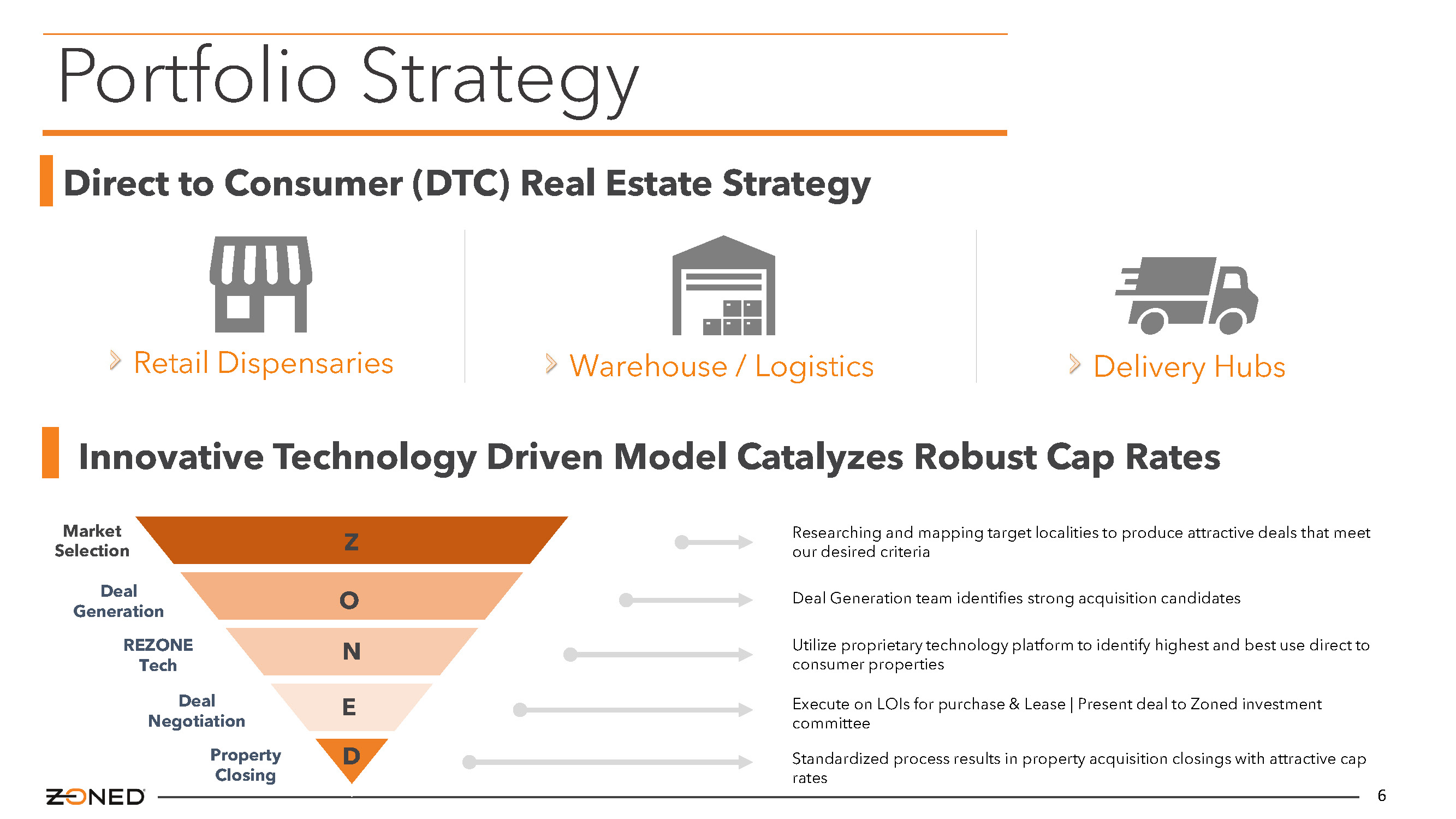

6 Direct to Consumer (DTC) Real Estate Strategy Warehouse / Logistics Delivery Hubs Retail Dispensaries Portfolio Strategy Z O N E D Market Selection Deal Generation REZONE Tech Deal Negotiation Property Closing Deal Generation team identifies strong acquisition candidates Researching and mapping target localities to produce attractive deals that meet our desired criteria Execute on LOIs for purchase & Lease | Present deal to Zoned investment committee Utilize proprietary technology platform to identify highest and best use direct to consumer properties Standardized process results in property acquisition closings with attractive cap rates Innovative Technology Driven Model Catalyzes Robust Cap Rates

Marketplace Relationships 7

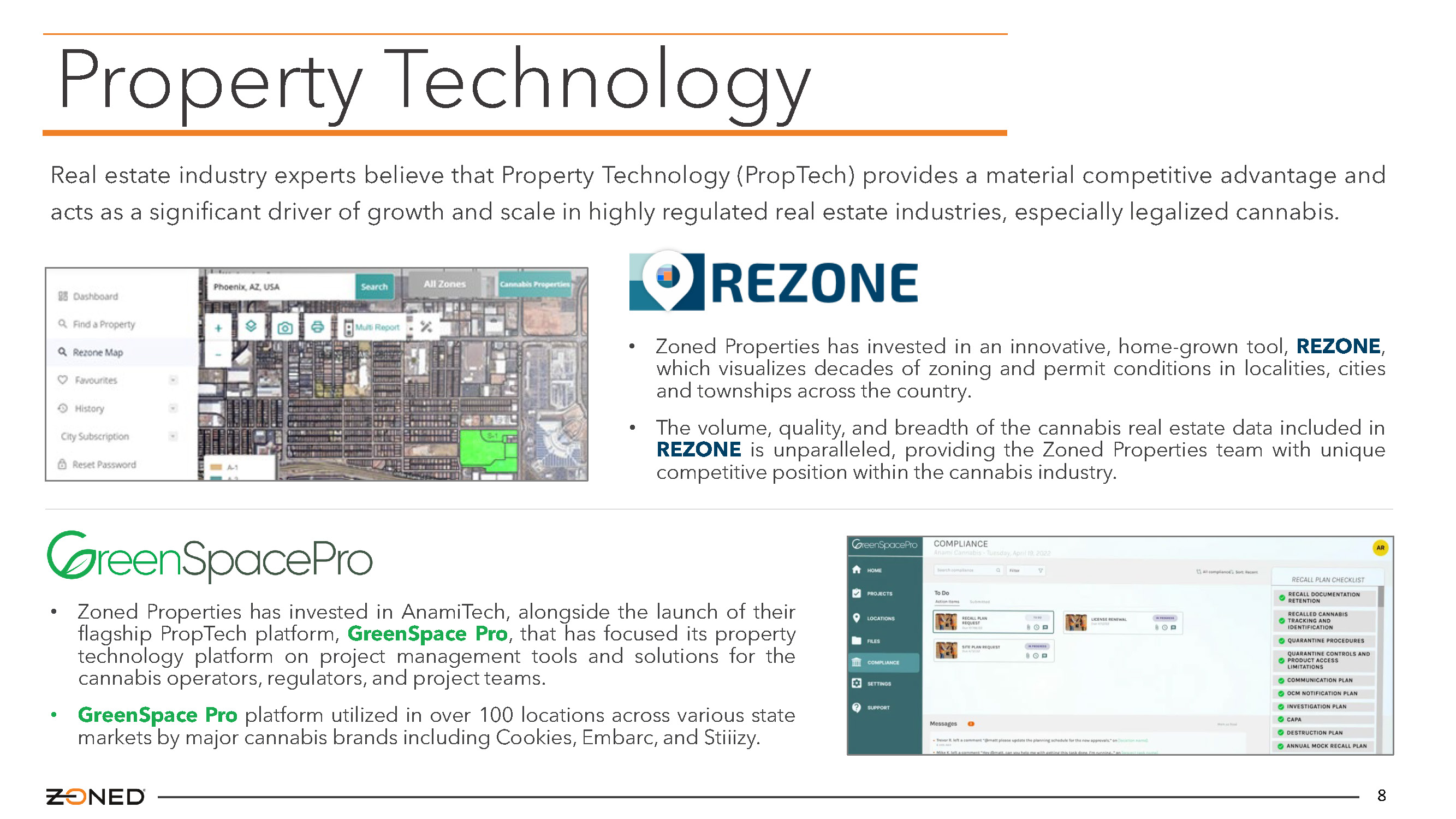

8 Property Technology • Zoned Properties has invested in an innovative, home - grown tool, REZONE , which visualizes decades of zoning and permit conditions in localities, cities and townships across the country . • The volume, quality, and breadth of the cannabis real estate data included in REZONE is unparalleled, providing the Zoned Properties team with unique competitive position within the cannabis industry . • Zoned Properties has invested in AnamiTech, alongside the launch of their flagship PropTech platform, GreenSpace Pro , that has focused its property technology platform on project management tools and solutions for the cannabis operators, regulators, and project teams . • GreenSpace Pro platform utilized in over 100 locations across various state markets by major cannabis brands including Cookies, Embarc, and Stiiizy . Real estate industry experts believe that Property Technology (PropTech) provides a material competitive advantage and acts as a significant driver of growth and scale in highly regulated real estate industries, especially legalized cannabis .

9 Development Project for future dispensary property located in Chicago, Illinois . The Investment Property was acquired for approximately $1.6 Million , including a commitment from the tenant's operating partner of up to $1 million for renovation and construction improvements. Justice Cannabis Co.'s BLOC Dispensaries under a long - term, absolute - net lease agreement, which will produce an approximate 16.5% Cap Rate when straight - lined over the 15 - year term of the lease agreement. The lease includes 3% annual increases in base rent over the life of the lease term, yielding approximately $265,000 in annual base rental revenue when straight - lined over the life of the lease term. Justice Cannabis Co. (formerly known as Justice Grown), has been a steady force in the U.S. cannabis industry for over 7 years. Project Highlights Recent Transaction Spotlight

Market Landscape

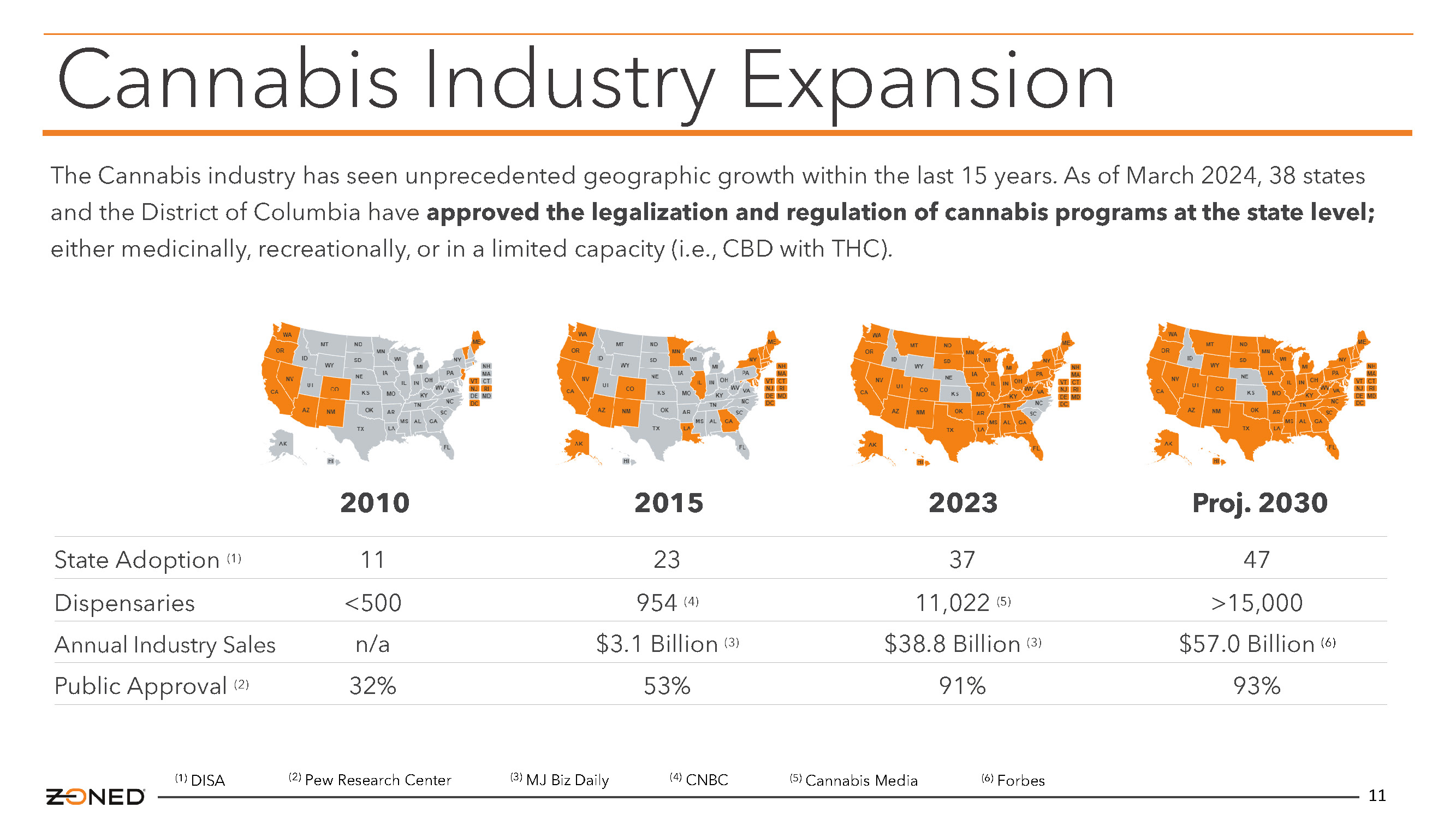

11 The Cannabis industry has seen unprecedented geographic growth within the last 15 years. As of March 2024, 38 states and the District of Columbia have approved the legalization and regulation of cannabis programs at the state level; either medicinally, recreationally, or in a limited capacity (i.e., CBD with THC). Cannabis Industry Expansion State Adoption (1) Dispensaries Annual Industry Sales Public Approval (2) 11 <500 n/a 32% 23 954 (4) $3.1 Billion (3) 53% 37 11,022 (5) $38.8 Billion (3) 91% 47 >15,000 $57.0 Billion (6) 93% 2010 2015 2023 Proj. 2030 (1) DISA (2) Pew Research Center (3) MJ Biz Daily (4) CNBC (5) Cannabis Media (6) Forbes

Executive Management

Executive Management 13 Mr . McLaren has a strong professional background in the social, economic, and environmental development of complex business organizations . Over his professional career, he has successfully implemented large - scale projects for corporate and community organizations . Mr . McLaren has been certified as a Licensed REALTOR, Green Roof Professional, LEED Green Associate, and is an active Forbes Contributor as part of the Forbes Real Estate Council . Prior to his role at Zoned Properties, McLaren worked as a Sustainability Consultant for Waste Management where he led the strategic development and operational implementation of zero - waste programs for Higher Education clients . Sustainable development has been a life - long passion for McLaren, who strives to create a global impact by forging a strong foundation for principles of sustainability in emerging industries . Mr . Blackwell has served as our Chief Operating Officer since July 1 , 2021 , and as our President since July 1 , 2022 . Prior to his appointment to these positions and since September 2020 , Mr . Blackwell served as our Director of Business Development . From December 2018 until June 2021 , Mr . Blackwell also served as President of Daily Jam Holdings LLC . From January 2016 to December 2018 , he served as Vice President of Due North Holdings LLC . Prior to joining the Company, Mr . Blackwell developed domestic and international markets for Kahala Brands, a global franchise organization with more than 3 , 000 retail locations in over a dozen countries . He also led emerging brand and portfolio operations for several private equity groups investing in the restaurant franchise space . Mr . Blackwell earned his B . A . in Finance from Fort Lewis College . Berekk Blackwell | President & Chief Operating Officer Bryan McLaren, MBA | Chairman of the Board, Chief Executive Officer, & Chief Financial Officer

Capital Structure

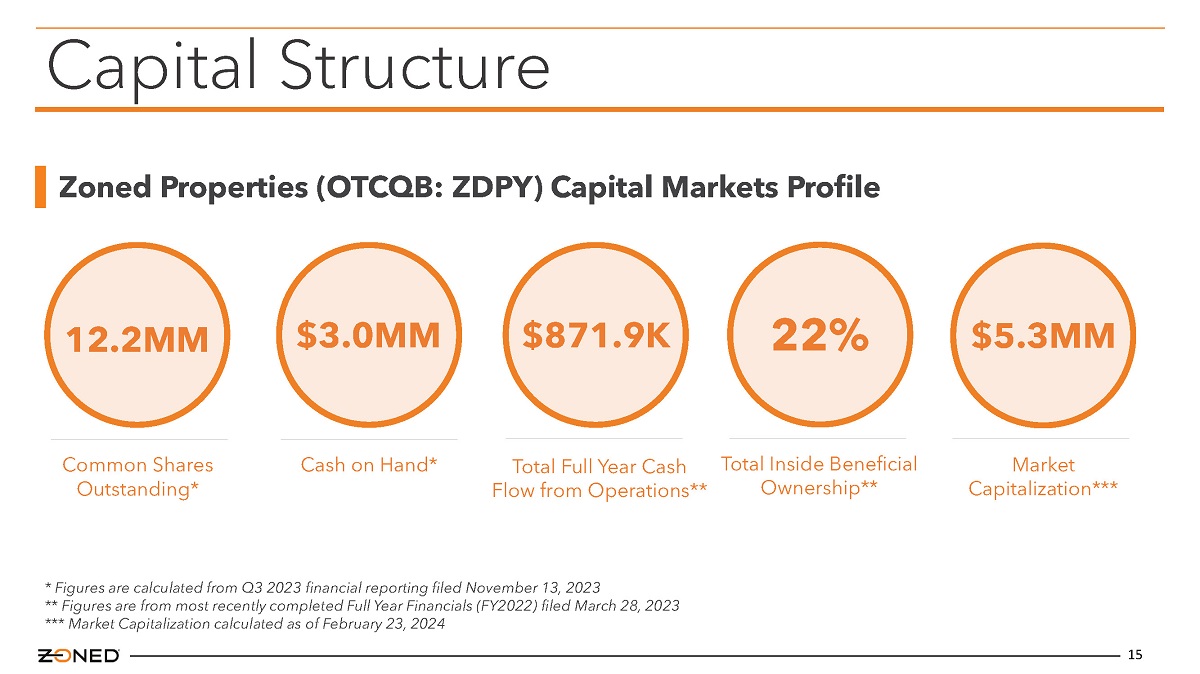

15 Capital Structure Common Shares Outstanding* Cash on Hand* 12.2MM $3.0MM Market Capitalization*** $5.3MM Total Full Year Cash Flow from Operations** $871.9K Total Inside Beneficial Ownership** 22% Zoned Properties (OTCQB: ZDPY) Capital Markets Profile * Figures are calculated from Q3 2023 financial reporting filed November 13, 2023 ** Figures are from most recently completed Full Year Financials (FY2022) filed March 28, 2023 *** Market Capitalization calculated as of February 23, 2024

Investment Thesis

17 Property Investment Portfolio Generating >$2.5 Million Passive Rental Revenue (Annually) Focused on Direct - to - Consumer commercial real estate investments within the regulated cannabis industry Competitive Positioning with Access to Unique Pipeline of New Property Acquisitions Technology - driven business model that fuels its property investments, which can produce 12% - 20% Cap Rate properties. Non - Plant Touching Company in the High Growth Emerging Cannabis Industry The commercial cannabis industry topped $38 billion in 2022, with analysts expecting the industry to reach $57 billion by 203 0 Innovative Technology Driven Property Acquisition Model Catalyzes Robust Cap Rates The standardized in conjunction with REZONE platform results in property acquisition closings with attractive cap rates Increasing Ability to Access Capital with Strong Reputation Established Banking Relationships & Capital Broker Partnerships. Most recently, secured a $4.5mm debt facility @ 7.65%. Investment Thesis

Company Contact Information 18 Bryan McLaren Chairman, CEO, & CFO Zoned Properties, Inc. | Scottsdale, AZ www.ZonedProperties.com Tel 480.351.8193 | Investors@ZonedProperties.com

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

Zoned Properties (QB) (USOTC:ZDPY)

過去 株価チャート

から 11 2024 まで 12 2024

Zoned Properties (QB) (USOTC:ZDPY)

過去 株価チャート

から 12 2023 まで 12 2024