PART II – PRELIMINARY OFFERING CIRCULAR - FORM 1-A: TIER I

An Offering statement pursuant to Regulation A relating

to these securities has been filed with the Securities and Exchange Commission. Information contained in this Preliminary Offering

Circular is subject to completion or amendment. These securities may not be sold nor may offers to buy be accepted before the

Offering statement filed with the Securities and Exchange Commission

is qualified. This Preliminary Offering Circular shall not constitute an offer to sell or the solicitation of an offer to buy

nor may there be any sales of these securities in any state in which such offer, solicitation or sale would be unlawful before

registration or qualification under the laws of any such state. We may elect to satisfy our obligation to deliver a Final Offering

circular by sending you a notice within two business days after the completion of our sale to you that contains the URL where

the Final Offering Circular or the Offering statement in which such Final Offering Circular was filed may be obtained.

PRELIMINARY OFFERING CIRCULAR

Dated: July 15, 2024

Subject to Completion

PURSUANT TO REGULATION A OF THE SECURITIES ACT OF 1933

GOLD ENTERTAINMENT GROUP, INC.

2412 Irwin St.

Melbourne, FL 32901

Best Efforts Offering of up to Seven Billion (7,000,000,000) Shares of Common Stock

at a price of $0.00015 per Share

Minimum Investment: $15,000 (100,000,000 Shares)

Maximum Offering: $1,050,000

See The Offering - Page 9 and Securities

Being Offered - Page 44 For Further Details. This Offering Will Commence Upon Qualification of this Offering by the Securities

and Exchange Commission and Will Terminate 365 days from the date of qualification by the Securities And Exchange Commission, Unless

Extended or Terminated Earlier By The Issuer

PLEASE REVIEW ALL RISK FACTORS ON

PAGES 10 THROUGH PAGE 20 BEFORE MAKING AN INVESTMENT IN THIS COMPANY. AN INVESTMENT IN THIS COMPANY SHOULD ONLY BE MADE

IF YOU ARE CAPABLE OF EVALUATING THE RISKS AND MERITS OF THIS INVESTMENT AND IF YOU HAVE SUFFICIENT RESOURCES TO BEAR THE ENTIRE

LOSS OF YOUR INVESTMENT, SHOULD THAT OCCUR.

THE UNITED STATES SECURITIES AND EXCHANGE

COMMISSION DOES NOT PASS UPON THE MERITS OF OR GIVE ITS APPROVAL TO ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES

IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SELLING LITERATURE. THESE SECURITIES ARE OFFERED PURSUANT

TO AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION; HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE

SECURITIES OFFERED HEREUNDER ARE EXEMPT FROM REGISTRATION.

Because these securities are being offered on a “best

efforts” basis, the following disclosures are hereby made:

| | |

Price to Public | |

Commissions (1) | |

Proceeds to

Company (2) | |

Proceeds to

Other Persons (3) |

| Per Share | |

$ | 0.00015 | | |

$ | 0 | | |

$ | 0.00015 | | |

| None | |

| Minimum Investment | |

$ | 15,000 | | |

$ | 0 | | |

$ | 15,000 | | |

| None | |

| Maximum Offering | |

$ | 1,050,000 | | |

$ | 0 | | |

$ | 600,000 | | |

$ | 450,000 | |

| (1) | The Company shall pay no commissions to underwriters

for the sale of securities under this Offering. |

| | | |

| | (2) | Does not reflect payment of expenses of this Offering, which are estimated to not exceed $50,000.00 and which include, among other

things, legal fees, accounting costs, reproduction expenses, due diligence, marketing, consulting, administrative services other

costs of blue sky compliance, and actual out-of-pocket expenses incurred by the Company selling the Shares. This amount represents

the proceeds of the offering to the Company, which will be used as set out in “USE OF PROCEEDS TO ISSUER.” |

| | | |

| | (3) | There are no finder’s fees or other fees being paid to third parties from the proceeds of shares sold by the Company. The

Company shall receive no proceeds from the sale of 3,000,000,000 shares, nor the one hundred thousand PREFERRED SERIES B (100,000) convertible shares, being offered by the Selling Shareholders. |

This Offering (the “Offering”)

consists of Common Stock (the “Shares” or individually, each a “Share”) that is being offered on a “best

efforts” basis, which means that there is no guarantee that any minimum amount will be sold. The Shares are being offered

and sold by Gold Entertainment Group, Inc. a Wyoming Corporation (the “Company”) and certain shareholders of the Company (the

“Selling Shareholders”). There are 4,000,000,000 Shares being offered by the Company at a price of $0.00015 per Share with

a minimum purchase of 100,,000,000 shares per investor. We may waive the minimum purchase requirement on a case-by-case basis in our

sole discretion. There are an additional 3,000,000,000 shares of Common Stock being offered and a further one hundred thousand PREFERRED SERIES B (100,000) convertible shares by the Selling Shareholders. Under Rule 251(d)(2)(i)(C) of Regulation of Regulation A+, non-accredited, non-natural investors are subject to the investment limitation and may only invest funds which do not exceed 10% of the greater of the purchaser’s revenue or net assets (as of the purchaser’s most recent fiscal year end). A non-accredited, natural person may only invest funds which do not exceed

10% of the greater of the purchaser’s annual income or net worth (please see below on how to calculate your net worth). The maximum aggregate amount of the Shares offered 7,000,000,000 Shares of Common Stock, and a further one hundred thousand PREFERRED SERIES B (100,000) convertible shares, is one million and fifty-thousand dollars ($1,050,000). There is no minimum number of Shares

that needs to be sold in order for funds to be released to the Company and for this Offering to close. The Company will retain all proceeds received from the shares sold on their account in this offering. The Company will not receive any proceeds from sales by the Selling Shareholders.

Our Common Stock is currently quoted

on the OTC Pink tier of the OTC Market Group, Inc. under the symbol “GEGP” On July 15, 2024, the last reported sale price of our common stock was $0.0002 (made on July 11, 2024).

The Shares are being offered pursuant

to Regulation A of Section 3(b) of the Securities Act of 1933, as amended, for Tier I offerings. The Shares will only be issued

to purchasers who satisfy the requirements set forth in Regulation A. The offering is expected to expire on the first of: (i) all

of the Shares offered are sold; or (ii) the close of business 365 days from the date of qualification by the Commission, unless

sooner terminated or extended by the Company’s CEO. Pending each closing, payments for the Shares will be paid directly to

the Company. Funds will be immediately transferred to the Company where they will be available for use in the operations of the

Company’s business in a manner consistent with the “USE OF PROCEEDS TO ISSUER” in this Offering Circular.

THIS OFFERING CIRCULAR DOES NOT CONSTITUTE

AN OFFER OR SOLICITATION IN ANY JURISDICTION IN WHICH SUCH AN OFFER OR SOLICITATION WOULD BE UNLAWFUL. NO PERSON HAS BEEN AUTHORIZED

TO GIVE ANY INFORMATION OR TO MAKE ANY REPRESENTATIONS CONCERNING THE COMPANY OTHER THAN THOSE CONTAINED IN THIS OFFERING CIRCULAR,

AND IF GIVEN OR MADE, SUCH OTHER INFORMATION OR REPRESENTATION MUST NOT BE RELIED UPON.

PROSPECTIVE INVESTORS ARE NOT TO

CONSTRUE THE CONTENTS OF THIS OFFERING CIRCULAR, OR OF ANY PRIOR OR SUBSEQUENT COMMUNICATIONS FROM THE COMPANY OR ANY OF ITS EMPLOYEES,

AGENTS OR AFFILIATES, AS INVESTMENT, LEGAL, FINANCIAL OR TAX ADVICE.

GENERALLY, NO SALE MAY BE MADE TO YOU

IN THIS OFFERING IF THE AGGREGATE PURCHASE PRICE YOU PAY IS MORE THAN 10% OF THE GREATER OF YOUR ANNUAL INCOME OR NET WORTH. DIFFERENT

RULES APPLY TO ACCREDITED INVESTORS AND NON-NATURAL PERSONS. BEFORE MAKING ANY REPRESENTATION THAT YOUR INVESTMENT DOES NOT EXCEED

APPLICABLE THRESHOLDS, WE ENCOURAGE YOU TO REVIEW RULE 251(d)(2)(i)(C) OF REGULATION A. FOR GENERAL INFORMATION ON INVESTING, WE

ENCOURAGE YOU TO REFER TO WWW.INVESTOR.GOV (WHICH IS NOT INCORPORATED BY REFERENCE INTO THIS OFFERING CIRCULAR).

This Offering is inherently risky. See “Risk Factors”

beginning on page 10.

Sales of these securities will commence

within three calendar days of the qualification date and the filing of a Form 253(g)(2) Offering Circular AND it will be a continuous

Offering pursuant to Rule 251(d)(3)(i)(F).

The Company is following the “Offering

Circular” format of disclosure under Regulation A.

AN OFFERING STATEMENT PURSUANT TO

REGULATION A RELATING TO THESE SECURITIES HAS BEEN FILED WITH THE SECURITIES AND EXCHANGE COMMISSION. INFORMATION CONTAINED IN

THIS PRELIMINARY OFFERING CIRCULAR IS SUBJECT TO COMPLETION OR AMENDMENT. THESE SECURITIES MAY NOT BE SOLD NOR MAY OFFERS TO BUY

BE ACCEPTED BEFORE THE OFFERING STATEMENT FILED WITH THE COMMISSION IS QUALIFIED. THIS PRELIMINARY OFFERING CIRCULAR SHALL NOT

CONSTITUTE AN OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO BUY NOR MAY THERE BE ANY SALES OF THESE SECURITIES IN ANY STATE

IN WHICH SUCH OFFER, SOLICITATION OR SALE WOULD BE UNLAWFUL BEFORE REGISTRATION OR QUALIFICATION UNDER THE LAWS OF SUCH STATE.

THE COMPANY MAY ELECT TO SATISFY ITS OBLIGATION TO DELIVER A FINAL OFFERING CIRCULAR BY SENDING YOU A NOTICE WITHIN TWO BUSINESS

DAYS AFTER THE COMPLETION OF THE COMPANY’S SALE TO YOU THAT CONTAINS THE URL WHERE THE FINAL OFFERING CIRCULAR OR THE OFFERING

STATEMENT IN WHICH SUCH FINAL OFFERING CIRCULAR WAS FILED MAY BE OBTAINED.

NASAA UNIFORM LEGEND

FOR RESIDENTS OF ALL STATES: THE

PRESENCE OF A LEGEND FOR ANY GIVEN STATE REFLECTS ONLY THAT A LEGEND MAY BE REQUIRED BY THAT STATE AND SHOULD NOT BE CONSTRUED

TO MEAN AN OFFER OR SALE MAY BE MADE IN A PARTICULAR STATE. IF YOU ARE UNCERTAIN AS TO WHETHER OR NOT OFFERS OR SALES MAY BE LAWFULLY

MADE IN ANY GIVEN STATE, YOU ARE HEREBY ADVISED TO CONTACT THE COMPANY. THE SECURITIES DESCRIBED IN THIS OFFERING CIRCULAR HAVE

NOT BEEN REGISTERED UNDER ANY STATE SECURITIES LAWS (COMMONLY CALLED ‘BLUE SKY’ LAWS).

IN MAKING AN INVESTMENT DECISION

INVESTORS MUST RELY ON THEIR OWN EXAMINATION OF THE PERSON OR ENTITY CREATING THE SECURITIES AND THE TERMS OF THE OFFERING, INCLUDING

THE MERITS AND RISKS INVOLVED. THESE SECURITIES HAVE NOT BEEN RECOMMENDED BY ANY FEDERAL OR STATE SECURITIES COMMISSION OR REGULATORY

AUTHORITY. FURTHERMORE, THE FOREGOING AUTHORITIES HAVE NOT CONFIRMED THE ACCURACY OR DETERMINED THE ADEQUACY OF THIS DOCUMENT.

ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

NOTICE TO FOREIGN INVESTORS

IF THE PURCHASER LIVES OUTSIDE THE

UNITED STATES, IT IS THE PURCHASER’S RESPONSIBILITY TO FULLY OBSERVE THE LAWS OF ANY RELEVANT TERRITORY OR JURISDICTION OUTSIDE

THE UNITED STATES IN CONNECTION WITH ANY PURCHASE OF THE SECURITIES, INCLUDING OBTAINING REQUIRED GOVERNMENTAL OR OTHER CONSENTS

OR OBSERVING ANY OTHER REQUIRED LEGAL OR OTHER FORMALITIES. THE COMPANY RESERVES THE RIGHT TO DENY THE PURCHASE OF THE SECURITIES

BY ANY FOREIGN PURCHASER.

PATRIOT ACT RIDER

The Investor hereby represents and warrants

that Investor is not, nor is it acting as an agent, representative, intermediary or nominee for, a person identified on the list

of blocked persons maintained by the Office of Foreign Assets Control, U.S. Department of Treasury. In addition, the Investor has

complied with all applicable U.S. laws, regulations, directives, and executive orders relating to anti-money laundering , including

but not limited to the following laws: (1) the Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept

and Obstruct Terrorism Act of 2001, Public Law 107-56, and (2) Executive Order 13224 (Blocking Property and Prohibiting Transactions

with Persons Who Commit, Threaten to Commit, or Support Terrorism) of September 23, 2001.

NO DISQUALIFICATION EVENT (“BAD

BOY” DECLARATION)

NONE

OF THE COMPANY, ANY OF ITS PREDECESSORS, ANY AFFILIATED ISSUER, ANY DIRECTOR, EXECUTIVE OFFICER, OTHER OFFICER OF THE COMPANY PARTICIPATING

IN THE OFFERING CONTEMPLATED HEREBY, ANY BENEFICIAL OWNER OF 20% OR MORE OF THE COMPANY’S OUTSTANDING VOTING EQUITY SECURITIES,

CALCULATED ON THE BASIS OF VOTING POWER, NOR ANY PROMOTER (AS THAT TERM IS DEFINED IN RULE 405 UNDER THE SECURITIES ACT OF 1933)

CONNECTED WITH THE COMPANY IN ANY CAPACITY AT THE TIME OF SALE (EACH, AN “ISSUER COVERED PERSON”)

IS SUBJECT TO ANY OF THE “BAD ACTOR” DISQUALIFICATIONS DESCRIBED IN RULE 506(D)(1)(I) TO (VIII) UNDER THE SECURITIES

ACT OF 1933 (A “DISQUALIFICATION EVENT”),

EXCEPT FOR A DISQUALIFICATION EVENT COVERED BY RULE 506(D)(2) OR (D)(3) UNDER THE SECURITIES ACT. THE COMPANY HAS EXERCISED REASONABLE

CARE TO DETERMINE WHETHER ANY ISSUER COVERED PERSON IS SUBJECT TO A DISQUALIFICATION EVENT.

Continuous Offering

Under Rule 251(d)(3) to Regulation A,

the following types of continuous or delayed Offerings are permitted, among others: (1) securities offered or sold by or on behalf

of a person other than the issuer or its subsidiary or a person of which the issuer is a subsidiary; (2) securities issued upon

conversion of other outstanding securities; or (3) securities that are part of an Offering which commences within two calendar

days after the qualification date. These may be offered on a continuous basis and may continue to be offered for a period in excess

of 30 days from the date of initial qualification. They may be offered in an amount that, at the time the Offering statement is

qualified, is reasonably expected to be offered and sold within one year from the initial qualification date. No securities will

be offered or sold “at the market.” The supplement will not, in the aggregate, represent any change from the maximum

aggregate Offering price calculable using the information in the qualified Offering statement. This information will be filed no

later than two business days following the earlier of the date of determination of such pricing information or the date of first

use of the Offering circular after qualification.

Sale of these shares will commence within

three calendar days of the qualification date and it will be a continuous Offering pursuant to Rule 251(d)(3)(i)(F).

Subscriptions are irrevocable and the

purchase price is non-refundable as expressly stated in this Offering Circular. The Company, by determination of the Board of Directors,

in its sole discretion, may issue the Securities under this Offering for cash, promissory notes, services, and/or other consideration

without notice to subscribers. All proceeds received by the Company from subscribers for this Offering will be available for use

by the Company upon acceptance of subscriptions for the Securities by the Company.

Forward Looking Statement Disclosure

This Form 1-A, Offering Circular,

and any documents incorporated by reference herein or therein contain forward-looking statements and are subject to risks and uncertainties.

All statements other than statements of historical fact or relating to present facts or current conditions included in this Form

1-A, Offering Circular, and any documents incorporated by reference are forward-looking statements. Forward-looking statements

give the Company’s current reasonable expectations and projections relating to its financial condition, results of operations,

plans, objectives, future performance, and business. You can identify forward-looking statements by the fact that they do not relate

strictly to historical or current facts. These statements may include words such as ‘anticipate,’ ‘estimate,’

‘expect,’ ‘project,’ ‘plan,’ ‘intend,’ ‘believe,’ ‘may,’

‘should,’ ‘can have,’ ‘likely’ and other words and terms of similar meaning in connection with

any discussion of the timing or nature of future operating or financial performance or other events. The forward-looking statements

contained in this Form 1-A, Offering Circular, and any documents incorporated by reference herein or therein are based on reasonable

assumptions the Company has made in light of its industry experience, perceptions of historical trends, current conditions, expected

future developments and other factors it believes are appropriate under the circumstances. As you read and consider this Form 1-A,

Offering Circular, and any documents incorporated by reference, you should understand that these statements are not guarantees

of performance or results. They involve risks, uncertainties (many of which are beyond the Company’s control) and assumptions.

Although the Company believes that these forward-looking statements are based on reasonable assumptions, you should be aware that

many factors could affect its actual operating and financial performance and cause its performance to differ materially from the

performance anticipated in the forward-looking statements. Should one or more of these risks or uncertainties materialize, or should

any of these assumptions prove incorrect or change, the Company’s actual operating and financial performance may vary in

material respects from the performance projected in these forward- looking statements. Any forward-looking statement made by the

Company in this Form 1-A, Offering Circular or any documents incorporated by reference herein speaks only as of the date of this

Form 1-A, Offering Circular or any documents incorporated by reference herein. Factors or events that could cause our actual operating

and financial performance to differ may emerge from time to time, and it is not possible for the Company to predict all of them.

The Company undertakes no obligation to update any forward-looking statement, whether as a result of new information, future developments

or otherwise, except as may be required by law.

About This Form 1-A and Offering

Circular

In making an investment decision,

you should rely only on the information contained in this Form 1-A and Offering Circular. The Company has not authorized anyone

to provide you with information different from that contained in this Form 1-A and Offering Circular. We are offering to sell,

and seeking offers to buy the Shares only in jurisdictions where offers and sales are permitted. You should assume that the information

contained in this Form 1-A and Offering Circular is accurate only as of the date of this Form 1-A and Offering Circular, regardless

of the time of delivery of this Form 1-A and Offering Circular. Our business, financial condition, results of operations, and prospects

may have changed since that date. Statements contained herein as to the content of any agreements or other documents are summaries

and, therefore, are necessarily selective and incomplete and are qualified in their entirety by the actual agreements or other

documents.

TABLE OF CONTENTS

ITEM 1

Cover Page of Offering Circular

|

-

|

ITEM 2

Summary Information

|

6

|

ITEM 3 Risk Factors - COVID-19 Risks Related to the Company

|

9

|

ITEM 3 Risk Factors (contd)

|

9

|

ITEM 4 Dilution

|

15

|

ITEM 5. Plan of Distribution and Selling Securityholders

|

16

|

ITEM 6 Use of Proceeds

|

17

|

ITEM 7 Description of Business

|

18

|

ITEM 8. Description of Property

|

22

|

ITEM 9. Managements Discussion and Analysis

|

23

|

ITEM 10. Directors, Executives, and Significant Employees

|

27

|

ITEM 11. COMPENSATION OF DIRECTORS AND EXECUTIVE OFFICERS

|

29

|

ITEM 12. Security Ownership of Management and Control Persons

|

30

|

ITEM 13. Interest of Management and Others In Certain Transactions

|

31

|

ITEM 14. Securities Being Offered

|

32

|

ITEMS 15A & 15B. Financial Statements

|

F1

|

Exhibits

|

|

Signatures

|

|

5

SUMMARY

OF INFORMATION IN OFFERING CIRCULAR

As used in this

prospectus, references to the Company, company, we, our, us, The

Company, or Company Name refer to GOLD ENTERTAINMENT GROUP, INC.,

unless the context otherwise indicated.

You should carefully

read all information in the prospectus, including the financial

statements and their explanatory notes, under the Financial

Statements prior to making an investment decision.

|

|

The Company

|

|

Organization:

|

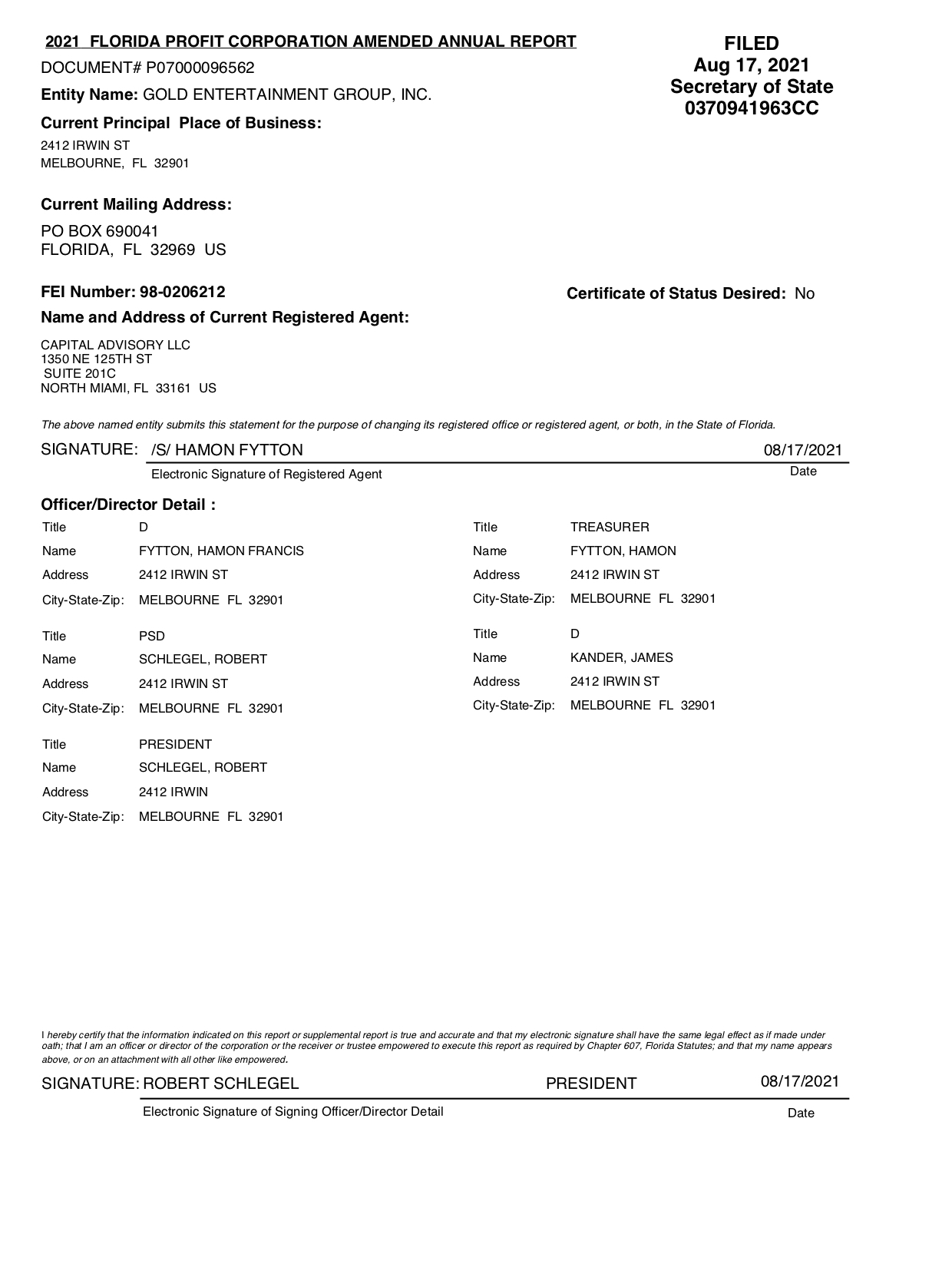

Gold Entertainment Group, Inc. was originally incorporated in the

State of Nevada on February 3, 1999 as a C corporation under the

name ADVANCED MEDICAL TECHNOLOGIES INC. / CANADA. The fiscal year

end is January 31st.

On June 27, 2018, Gold Entertainment

Group, Inc. ("we" or "Company") entered into

an agreement with IceLounge Media Inc., a Wyoming corporation

("ICELOUNGE"), (the "Agreement"). Pursuant to

the terms of the Agreement, the Company authorized a new class of

Preferred Shares. The new class, SERIES B Preferred Shares were

issued as part of the payment due to the Company's CEO and

Director, Mr. Fytton, for the acquisition of the Company's

controlling block of Series A Preferred Stock, by ICELOUNGE; whose

rights remain unchanged. Following conformation from the State of

Florida of these changes, the Effective Date for the previously

announced ICELOUNGE Agreement is amended to be August 10, 2018.

On the effective date of August 10, 2018, Mr. Fytton

resigned as President and CEO, and was appointed as Chief

Financial Officer and Director of the Company. Our principal

office is located at 2412 Irwin St. Melbourne, FL 32901

In November 2023, M. Schiegal resigned as CEO and Director and

retained his shares. Mr Fytton was, again, appointed as CEO and

Cathy Julian as CFO and as a Director.

|

Capitalization:

|

Our articles of incorporation provide for the issuance of up to

(i) 25,000,000,000 shares of Common Stock, par value $0.0001 and

(ii) 5,000,000 shares of Preferred Stock, par value $0.0001. As

of the date of this Prospectus there are 16,812,001,513 shares of

Common Stock, and 2,000,000 shares of Preferred SERIES A and

200,000 Preferred SERIES B issued and outstanding.

|

Management:

|

Our Chief Executive Officer and Director is Hamon Fytton. He also

acts as President and Secretary. Cathy Julian as CFO and Director,

the only other officer, and one other director of the Company as

of the date of this filing. The Company does not plan to add

additional Officers and Directors upon qualification of this

offering. The CEO spends approx. 25 hours per month to the affairs

of the Company. This is expected to continue following

qualification of this offering and as Company operations commence.

|

Controlling Shareholders:

|

Our CEO owns 3,500,000,000 shares of Common Stock. The

shareholders of IceLounge Media, Inc., collectively own

3,500,000,000 shares of Common Stock and are the 100% owner of the

SERIES A Preferred shares. The CFO also owns 3,500,000,000 shares

of Common Stock. As such, our current CEO is dependent on the

other Officers and Directors to be able to exert significant

influence over the affairs of the Company.

|

Independence:

|

We are not a blank check company, as such term is defined by Rule

419 promulgated under the Securities Act of 1933, as amended, as

we have a specific business plan and we presently have no binding

plans or intentions to engage in a merger or acquisition with an

unidentified company, companies, entity or person.

|

6

Our Business

|

|

|

|

Description of Operations:

|

Our corporate office is located at 2412 Irwin St., Melbourne, FL 32901. This is the office of our CEO, and is provided at no cost to the Company. The Company also has an office in Hudson, Florida for the Medical Device operations. This is provided at no cost to the Company by its CFO who, in another company, owns the building.

|

Historical Operations:

|

Commencing January 31, 2004, Gold Entertainment Group, Inc. was a developer and marketer of a national multi-level, fixed- price DVD rental program, and sought to become a leading home entertainment sales and rental company. Gold Entertainment Group, Inc. marketed its products and programs exclusively through an independent network of distributors whereby its distributors promoted the Company's DVD rental service with products shipped directly to consumers. The Company maintains the web site: www.GoldEntertainment.com

At the time, the Company had

operations through its main office in Florida, and a Canadian

subsidiary in Toronto, Ontario. As of our quarterly report ending April 30, 2024 we have an

accumulated deficit of $(20,227).

|

Growth Strategy:

|

The Company has expanded its healthcare operations with a 20% ownership in MEDWORX A INC, a medical billing company, during the first quarter of 2024.. Upon completion of this offering, and following a successful capital raise, the Company intends to seek other acquisitions in the healthcare industry. The

timing of commencement of expanding operations may be influenced

by our relative success of this offering. We may not raise

sufficient proceeds through this offering in order to fully

execute our business plans.

|

Expansion Strategy:

|

Its current business plan is the

expansion of this business following the successful funding

through this offering. This will involve the expansion of its

existing products into new markets and the development and

acquisition additional products. This will be accomplished through

business acquisitions, joint ventures or re-sale agreement, or any

combination thereof.

The Company also, intends to use its capital stock,

debt, or a combination of

these to effect an acquisition of a complimentary business. We are

an emerging growth company, and we expect to use substantially all

of the net proceeds from this offering to engage in acquisition

and product development business described herein. We expect to

build a high-quality brand portfolio intended to generate income

and to provide capital preservation, capital appreciation and

portfolio diversification.

|

|

|

Current Operations:

|

The Company is a distributor of orthopedic products.

|

|

|

|

|

Growth Strategy:

|

The Company will expand its healthcare operations upon completion

of this offering, and following a successful capital raise. The

timing of commencement of expanding operations may be influenced

by our relative success of this offering. We may not raise

sufficient proceeds through this offering in order to fully

execute our business plans.

|

The Offering

|

|

Securities Offered:

|

4,000,000,000 shares of Common Stock at $0.00015 per share.

|

Common

Stock Outstanding

before the Offering:

|

16,812,001,513 shares of Common Stock.

|

Common

Stock Outstanding

after the Offering

|

20,812,001,513 shares of Common Stock.

|

Use of Proceeds

|

The proceeds will be deployed for acquisitions and product

development and related working capital expenses. See ITEM 6 for a

detailed explation.

|

Termination of the Offering:

|

The offering will commence

as soon as practicable after this Offering Circular has been

qualified by the Securities and Exchange Commission (the "SEC")

and the relevant state regulators, as necessary and will terminate

on the sooner of the sale of the maximum number of shares being

sold, twelve months from the effective date of this Offering

Statement or the decision by Company management to deem the

offering closed.

|

Offering Cost:

|

We estimate our total offering registration costs to be $50,000.

If we experience a shortage of funds prior to funding, our

CFO and director has verbally agreed to advance funds to the

Company to allow us to pay for offering costs, filing fees, and

correspondence with our shareholders; however our officer and

director has no legal obligation to advance or loan funds to the

Company.

|

Market for the Shares:

|

The Shares being offered herein are not listed for trading on any

exchange or automated quotation system. The Company does not

intend to seek such a listing at any time hereinafter.

|

8

ITEM 3. RISK FACTORS

COVID-19 Risks

Related to the Company

The COVID-19

pandemic poses specific risks related to our Company

The COVID-19 pandemic poses specific risks related to our Company.

Specifically it makes it difficult for us to evaluate specific

business opportunities, visit certain areas easily, meet with

potential investors and joint venture partners. Some investment

companies may also determine that because we are a company with

limited revenue and assets, that we will delayed unreasonably in our

ability to create new products and expand in a timely manner. This

may influence them in a negative manner and make decisions based on

those estimates of our potential future performance.

We intend to pursue

business expansion via acquisition. With these existing

opportunities, there may be unforeseen delays and late payments due

to COVID-19. This may reduce our ability to obtain investment

financing for those opportunities. This will require the Company to

acquire these opportunities being asked to agree to unreasonable

terms or abandon those opportunities altogether. This will increase

our cost and create delays in acquiring opportunities.

There is, however, a

potential upside to the COVID-19 disruption. If we can obtain the

confidence of investors, we may be able to target opportunities where

the income has been delayed or disrupted by the pandemic. We would

typically have to make a fast offer on such opportunities in order to

negotiate a sale. We would expect to obtain such opportunities at a

discount relative to a normal market appraisal.

In either case the

COVID-19 pandemic will cause continued disruption in the consumer

market for an unknown time period. This may result in the delays in

the Company's operations.

Investing in our shares

involves risk. In evaluating the Company and an investment in the

shares, careful consideration should be given to the following risk

factors, in addition to the other information included in this

Offering circular. Each of these risk factors could materially

adversely affect The Company's business, operating results or

financial condition, as well as adversely affect the value of an

investment in our shares. The following is a summary of the most

significant factors that make this offering speculative or

substantially risky. The company is still subject to all the same

risks that all companies in its industry, and all companies in the

economy, are exposed to. These include risks relating to economic

downturns, political and economic events and technological

developments (such as cyber-security). Additionally, early-stage

companies are inherently more risky than more developed companies.

You should consider general risks as well as specific risks when

deciding whether to invest.

Risks Related to

the Company

The Company has a limited operating history in its current business operations.

Our company was incorporated on February 3, 1999, and were in a different line of business, which makes a present day evaluation of our business operations difficult. In addition, we have recently shifted our focus from the technology and internet operations to becoming a distributor of orthopedic products. There is a risk that we will be unable to successfully continue to operate this new line of business or be able to successfully integrate it with our current management and structure. Our estimates of capital and personnel required for our new line of business are based on the experience of management and businesses that are familiar to them. We are subject to the risks such as our ability to implement our business plan, market acceptance of our proposed business and services, under-capitalization, cash shortages, limitations with respect to personnel, financing and other resources, competition from better funded and experienced companies, and uncertainty of our ability to generate revenues. There is no assurance that our activities will be successful or will result in any revenues or profit, and the likelihood of our success must be considered in light of the stage of our development. In addition, no assurance can be given that we will be able to consummate our business strategy and plans, as described herein, or that financial, technological, market, or other limitations may force us to modify, alter, significantly delay, or significantly impede the implementation of such plans. We have insufficient results for investors to use to identify historical trends or even to make quarter to quarter comparisons of our operating results. You should consider our prospects in light of the risk, expenses and difficulties we will encounter as an early-stage company. Our revenue and income potential is unproven, and our business model is continually evolving. We are subject to the risks inherent to the operation of a new business enterprise and cannot assure you that we will be able to successfully address these risks.

The

company has realized significant operating losses to date and expects

to incur losses in the future

The

company has operated at a loss since inception, and these losses are

likely to continue. The Company's net loss for the period ending April 30, 2024 is $20,227. Until the company achieves profitability, it

will have to seek other sources of capital in order to continue

operations.

The Company has

limited capitalization and a lack of working capital and as a result

is dependent on raising funds to grow and expand its business.

The Company lacks sufficient working capital in order to execute its

business plan. The ability of the Company to move forward with its

objective is therefore highly dependent upon the success of the

offering described herein. Should we fail to obtain sufficient

working capital through this offering we may be forced to abandon our

business plan.

Because

we do not have a recent history of operations we may not be able to

successfully implement our business plan.

We

are a public company trading under the symbol GEGP. We have limited

recent operational history, accordingly, our future operations are

subject to similar risks inherent in the establishment of a new

business enterprise, including access to capital, successful

implementation of our business plan and generating revenue from

operations. We cannot assure you that our intended activities or plan

of operation will be successful or result in revenue or profit to us

and any failure to implement our business plan may have a material

adverse effect on the business of the Company.

9

We are a publicly traded corporation with over ten years of

operating history, however we may not be able to successfully operate

our business or generate sufficient operating cash flows to make or

sustain distributions to our stockholders.

Our growth strategy

could fail or present unanticipated problems for our business in the

future, which could adversely affect our ability to make acquisitions

or realize anticipated benefits of those acquisitions. Our financial

condition, results of operations and ability to make or sustain

distributions to our stockholders will depend on many factors,

including:

|

|

|

|

|

|

|

diversion

of management's attention;

|

|

|

|

|

|

|

|

our

ability to consummate financing on favorable terms;

|

|

|

|

|

|

|

|

the

need to integrate acquired operations;

|

|

|

|

|

|

|

|

potential

loss of key employees of the acquired companies;

|

|

|

|

|

|

|

|

an

increase in our expenses and working capital requirements; and

|

|

|

|

|

|

|

|

economic

conditions in our markets, as well as the condition of the

financial investment markets and the economy generally.

|

We

are dependent on funding from our Officers and Directors and the sale

of our securities to fund our operations.

We are dependent on

funding from our Officers and Directors and the sale of our

securities to fund our operations, and will remain so until we

generate sufficient revenues to pay for our operating costs. Our

Officers and Directors have not made any written commitments with

respect to providing a source of liquidity in the form of cash

advances, loans and/or financial guarantees. There can be no

guarantee that we will be able to successfully sell our equity

securities. Such liquidity and solvency problems may force the

Company to cease operations if additional financing is not available.

No known alternative resources of funds are available in the event we

do not generate sufficient funds from operations.

The Company is

dependent on key personnel and loss of the services of any of these

individuals could adversely affect the conduct of the Company's

business.

Our business plan is

significantly dependent upon the ability to hire and retain qualified

individuals and key personal, who may be appointed as officers and

directors, and their continued participation in our Company. It may

be difficult to replace any of them at an early stage of development

of the Company. The loss by or unavailability to the Company of their

services would have an adverse effect on our business, operations and

prospects, in that our inability to replace them could result in the

loss of your investment. There can be no assurance that we would be

able to locate or employ personnel to replace any of our officers,

should their services be discontinued. In the event that we are

unable to locate or employ personnel to replace our officers we would

be required to cease pursuing our business opportunity, which would

result in a loss of your investment.

10

The Company may

not be able to attain profitability without additional funding, which

may be unavailable.

The Company has limited

capital resources. Unless the Company begins to generate sufficient

revenues to finance operations as a going concern, the Company may

experience liquidity and solvency problems. Such liquidity and

solvency problems may force the Company to cease operations if

additional financing is not available. No known alternative resources

of funds are available in the event we do not generate sufficient

funds from operations.

Risks Relating to

Our Business

The profitability of attempted

acquisitions and other business developments is uncertain.

We intend to acquire

and develop new marketing technologies and companies selectively. The

acquisition and development of these technologies entails risks that

investments may fail to perform in accordance with expectations. In

undertaking these projects, we will incur certain risks, including

the expenditure of funds on, and the devotion of management's time

to, transactions that may not come to fruition. Additional risks

inherent in the projects include risks that the intended advertisers

will not accept our new products and may not achieve additional

anticipated sales using these new products. As a result capital

expenditure used to develop these new products, may be amortized over

a much longer time than expected. Expenses may be greater than

anticipated.

Some of

our investments may be illiquid.

Because

some of our investments may be illiquid, our ability to vary our

portfolio promptly in response to economic or other conditions will

be limited. This is because there may be apprehension among investors

in general, because of relative newness pf the companies we attract

as investments or acquisition. The foregoing and any other factor or

event that would impede our ability to respond to adverse changes in

the performance of our investments could have an adverse effect on

our financial condition and results of operations.

11

Risks Relating to Our Business - continued

Our opportunities may not be

diversified.

Our potential

profitability and our ability to diversify our investments may be

limited, both geographically and by type of opportunities purchased.

We will be able to purchase or develop additional opportunities only

as additional funds are raised and only if owners of businesses

accept our stock in exchange for an interest in the target business.

Our opportunities may not be well diversified and their economic

performance could be affected by changes in local economic

conditions.

Competition with

third parties for opportunities and other investments may result in

our paying higher prices for opportunities which could reduce our

profitability and the return on your investment.

We compete with many

other entities engaged in brand development and investment

activities, including individuals, corporations, REITs, and limited

partnerships, many of which have greater resources than we do. Some

of these investors may enjoy significant competitive advantages that

result from, among other things, a lower cost of capital and enhanced

operating efficiencies. In addition, the number of entities and the

amount of funds competing for suitable investments may increase. Any

such increase would result in increased demand for these assets and

increased prices. If competitive pressures cause us to pay higher

prices for opportunities, our ultimate profitability may be reduced

and the value of our opportunities may not appreciate or may decrease

significantly below the amount paid for such opportunities. At the

time we elect to dispose of one or more of our opportunities, we will

be in competition with sellers of similar opportunities to locate

suitable purchasers, which may result in us receiving lower proceeds

from the disposal or result in us not being able to dispose of the

property due to the lack of an acceptable return. This may cause you

to experience a lower return on your investment.

The Company may

not be able to effectively control the timing and costs relating to

the acquisition opportunities, which may adversely affect the

Companys operating results and the its ability to make a return

on its investment or disbursements of dividends or interest to our

shareholders.

Nearly all of the

opportunities to be acquired by the Company will require some

level of capital expenditure immediately upon their acquisition or in

the near future. The Company may acquire opportunities that it

plans to extensively develop and require significant capital

infusion. The Company also may acquire opportunities that it

expects to be in good standing and operations, but has problems that

require extensive capital expenditure to fix.

If the Companys

assumptions regarding the costs or timing of business improvements

prove to be materially inaccurate, the Companys operating

results and ability to make distributions to our Shareholders may be

adversely affected.

The Company has not yet identified any specific

opportunities to acquire or improve with net proceeds of this

offering, and you will be unable to evaluate the economic merits

of the company's investments made with such net proceeds before

making an investment decision to purchase the Companys

securities.

The Company will have

broad authority to invest a portion of the net proceeds of this

offering in any opportunities the Company may identify in the future,

and the Company may use those proceeds to make investments and

improvements with which you may not agree. You will be unable to

evaluate the economic merits of the Company's opportunities before

the Company invests in them and the Company will be relying on its

ability to select attractive investment opportunities. In addition,

the Company's investment policies may be amended from time to time at

the discretion of the Company's Management, without out notice to the

Company's Shareholders. These factors will increase the uncertainty

and the risk of investing in the Company's securities.

12

Risks Related to

Our Securities

There is a

limited established trading market for our Common Stock and if a

trading market does not develop, purchasers of our securities may

have difficulty selling their securities

GEGP is a non-reporting

company as defined by the SEC. It does not presently, as of the date

of this prospectus, file periodic reports with the SEC. It is quoted

on the OTC Markets as a PINK sheet company. There is a limited

established public trading market for our Common Stock and an active

trading market in our securities may not develop or, if developed,

may not be sustained. While we intend to seek a quotation

on a major national exchange or automated quotation system in the

future, there can be no assurance that any such trading market will

develop, and purchasers of the common stock may have difficulty

selling their common stock. No market makers have committed to

becoming market makers for our common stock and none may do so.

The offering

price of the Shares being offered herein has been arbitrarily

determined by us and bears no relationship to any criteria of value;

as such, investors should not consider the offering price or value to

be an indication of the value of the shares being registered.

Currently, there is a

limited public market for our Shares. The offering price for the

Shares being registered in this offering has been arbitrarily

determined by us and is not based on assets, operations, book or

other established criteria of value. Thus, investors should be

aware that the offering price does not reflect the market price or

value of our common shares.

We

may, in the future, issue additional shares of Common Stock, which

would reduce the investor's percentage of ownership and may dilute

our share value.

Our Articles of

Incorporation authorize the issuance of 25,000,000,000 shares of

Common Stock; up to 5,000,000 shares of Preferred Stock. As of July 15, 2024, the Company has 16,812,001,513 shares of Common Stock, and As of the date of this offering, there are 2,000,000 PREFERRED SERIES A (super voting only) and 322,000 PREFERRED SERIES B (convertible) shares have been issued and outstanding. If

we sell the entire 4,000,000,000 shares of Common Stock in this

Offering, we will have 20,812,001,513 shares of Common Stock issued

and outstanding. Accordingly, we may issue additional shares of

Common Stock at a later date to employees or for services. The future

issuance of common stock may result in substantial dilution in the

percentage of our common stock held by our then existing

shareholders. We may value any common stock issued in the future on

an arbitrary basis. The issuance of common stock for future services

or acquisitions or other corporate actions may have the effect of

diluting the value of the shares held by our investors, and might

have an adverse effect on any trading market for our common stock.

13

We are publicly traded company and we may finance our business

through debt at a future date

As

with other public companies, we may choose, from time to time, to

finance our business through the sale of stock or promissory notes

collateralized by our common stock We may also acquire debt in the

form of mezzanine or bridge financing. We may borrow such funds from

a traditional bank, or non-bank third party. We hope to finance

acquisitions mostly with the sale of our common stock in this

offering. As a result, our balance sheet may be unduly leveraged and

if we cannot sell or liquidate our opportunities, we will be burdened

by debt service, including, but not limited to payment of principal

and interest and other fees.

We are subject to

compliance with securities law, which exposes us to potential

liabilities, including potential rescission rights.

We may offer to sell

our common stock to investors pursuant to certain exemptions from the

registration requirements of the Securities Act of 1933, as well as

those of various state securities laws. The basis for relying on such

exemptions is factual; that is, the applicability of such exemptions

depends upon our conduct and that of those persons contacting

prospective investors and making the offering. We may not seek any

legal opinion to the effect that any such offering would be exempt

from registration under any federal or state law. Instead, we may

elect to rely upon the operative facts as the basis for such

exemption, including information provided by investor themselves.

If any such offering

did not qualify for such exemption, an investor would have the right

to rescind its purchase of the securities if it so desired. It is

possible that if an investor should seek rescission, such investor

would succeed. A similar situation prevails under state law in those

states where the securities may be offered without registration in

reliance on the partial preemption from the registration or

qualification provisions of such state statutes under the National

Securities Markets Improvement Act of 1996. If investors were

successful in seeking rescission, we would face severe financial

demands that could adversely affect our business and operations.

Additionally, if we did not in fact qualify for the exemptions upon

which it has relied, we may become subject to significant fines and

penalties imposed by the SEC and state securities agencies.

14

ITEM 4. DILUTION

If you invest in our shares, your

interest will be diluted to the extent of the difference between the

offering price per share of our common stock in this offering and the

as adjusted net tangible book value per share of our capital stock

after this Offering. The following table demonstrates the dilution

that new investors will experience relative to the Company's net

tangible book value as of July 15, 2024. Net tangible book value is

the aggregate amount of the Company's tangible assets, less its total

liabilities. The table presents three scenarios: a $262,500 raise

from this Offering, a $525,000 raise from this

Offering and a fully subscribed $1,050,000 million raise from this

Offering.

Proceeds

from Sale

|

|

$0.2625 MM

|

$0.5250 MM

|

$1.050 MM

|

Percentage

of Shares Sold

|

|

25%

|

50%

|

100%

|

Price

Per Share

|

|

$0.00015

|

$0.00015

|

$0.00015

|

Shares

Issued

|

|

1,000,000,000

|

2,000,000,000

|

4,000,000,000

|

Capital Raised

|

|

262,500

|

525,000

|

1,050,000

|

Less

Offering Costs

|

|

50,000

|

50,000

|

50,000

|

Net

Proceeds

|

|

212,500

|

475,000

|

1,000,000

|

Net

Tangible Value Pre-Financing

|

|

(273.748)

|

(273.748)

|

(273.748)

|

Net Tangible Value Post-Financing

|

|

(61,248)

|

201,252

|

726,252

|

Shares

Issued and Outstanding - Pre Financing

|

|

16,812,001,513

|

16,812,001,513

|

16,812,001,513

|

Shares

Issued and Outstanding - Post Financing

|

|

17,812,001,513

|

18,812,001,513

|

20,812,001,513

|

Net

Tangible Value Pre-Financing

|

|

$0.000016

|

$0.000016

|

$0.000016

|

Increase/Decrease

per Share Attributable To New Investors

|

|

($0.0000126)

|

($0.000005)

|

$0.000019

|

Net Tangible Book Value per Share, Post Offering

|

|

$0.0000034

|

$0.000011

|

$0.000035

|

Another important way of looking at

dilution is the dilution that happens due to future actions by the

company. The investor's stake in a company could be diluted due to

the company issuing additional shares. In other words, when the

company issues more shares, the percentage of the company that you

own will go down, even though the value of the company may go up. You

will own a smaller piece of a larger company. This increase in number

of shares outstanding could result from a stock offering (such as an

initial public offering, a venture capital round, angel investment),

employees exercising stock options, or by conversion of certain

instruments (e.g. convertible bonds, convertible notes, preferred

shares or warrants) into stock. If the company decides to issue more

shares, an investor could experience value dilution, with each share

being worth less than before, and control dilution, with the total

percentage an investor owns being less than before.

The company has authorized and issued

Common stock and two classes of Preferred Stock. Therefore, all of

the company's current shareholders and the investors in this Offering

will experience the same dilution if the company decides to issue

more shares in the future.

NOTE: As of the date of this offering, there are 2,000,000 PREFERRED SERIES A (super voting only) and 322,000 PREFERRED SERIES B (convertible) shares have been issued.

15

ITEM 5. PLAN OF DISTRIBUTION

We are offering a

maximum of 4,000,000,000 Common Shares with no minimum, on a best

efforts basis. We will sell the shares ourselves and do not plan to

use underwriters or pay any commissions. We will be selling our

shares using our best efforts and no one has agreed to buy any of our

shares. This prospectus permits our existing, and future, officers

and directors to sell the shares directly to the public, with no

commission or other remuneration payable to them for any shares they

may sell. There is currently no plan or arrangement to enter into any

contracts or agreements to sell the shares with a broker or dealer.

Our officers and directors will sell the shares and intend to offer

them to friends, family members and business acquaintances. There is

no minimum amount of shares we must sell; so no money raised from the

sale of our shares will go into escrow, trust or another similar

arrangement.

The shares are being

offered by the Company. The Company will be relying on the safe

harbor in Rule 3a4-1 of the Securities Exchange Act of 1934 to sell

the shares. No sales commission will be paid for shares sold by the

Company. None of our Officer and Directors are subject to a statutory

disqualification and are not associated persons of a broker or

dealer.

Additionally, our

Officer and Directors perform substantial duties on behalf of the

registrant other than in connection with transactions in securities.

None has not been a broker or dealer or an associated person of a

broker or dealer within the preceding 12 months and they have not

participated in selling an offering of securities for any issuer more

than once every 12 months other than in reliance on paragraph (a)4(i)

or (a)4(iii) of Rule 3a4-1 of the Securities Exchange Act of 1934.

The offering will

terminate upon the earlier to occur of: (i) the sale of all

4,000,000,000 shares being offered, or (ii) 365 days after this

Offering Circular is declared qualified by the Securities and

Exchange Commission or (iii) or the decision by Company management to

deem the offering closed.

There are an additional 3,000,000,000 shares of Common Stock being offered and a further one hundred thousand PREFERRED SERIES B (100,000) convertible shares by the Selling Shareholders. The Company will not receive any proceeds from sales by the Selling Shareholders.

16

ITEM 6. USE OF

PROCEEDS TO ISSUER

We estimate that, at a

per share price of $0.0015, the net proceeds from the sale of the

4,000,000,000 shares in this Offering will be approximately $1,000,000,

after deducting the estimated offering expenses of approximately

$50,000.

Purpose of

Offering

We will utilize

the net proceeds from this offering to identify and acquire business

opportunities and to develop our products. Some funds will be used

for operating expenses and other expenses.

We have made

allowance for the expenses to file and become an SEC Reporting

Company, and therefore be required to file reports periodically with

the Securities and Exchange Commission under section 12, 13 or 15(d)

of the Securities Exchange Act of 1934.

Accordingly, we

expect to use the net proceeds, estimated as discussed above as

follows, if we raise the maximum offering amount:

|

|

|

Use

|

Amount

|

Percentage

|

Acquisition

Costs

|

$450,000

|

43%

|

Accounting,

Audit & Legal fees

|

$200,000

|

19%

|

Working

Capital

|

$200,000

|

19%

|

Salaries

|

$150,000

|

14%

|

Offering

Expenses

|

$50,000

|

5%

|

TOTAL

|

$1,050,000

|

100%

|

(1)

"Acquisition Costs" are costs related to the

selection and acquisition of opportunities, including financing and

closing costs. These expenses include but are not limited to travel

and communications expenses, legal and accounting fees and

miscellaneous expenses. The presentation in the table is based on the

assumption that we will always finance the acquisition of

opportunities whenever posable.

(2) Offering

Expensesinclude projected costs for Legal and Accounting,

Publishing/Edgar and Transfer Agents Fees.

The above figures

represent only estimated costs. This expected use of net proceeds

from this offering represents our intentions based upon our current

plans and business conditions. The amounts and timing of our actual

expenditures may vary significantly depending on numerous factors,

including the status of and results from operations. As a result, our

management will retain broad discretion over the allocation of the

net proceeds from this offering. We may find it necessary or

advisable to use the net proceeds from this offering for other

purposes, and we will have broad discretion in the application of net

proceeds from this offering. Furthermore, we anticipate that we will

need to secure additional funding for the fully implement our

business plan.

The company reserves the right to

change the above use of proceeds if management believes it is in the

best interests of the company.

17

ITEM 7. DESCRIPTION OF BUSINESS

Our Company

The Company has recently expanded its healthcare operations with a 20% ownership in MEDWORX A INC, a medical billing company, during the first quarter of 2024.. Upon completion of this offering, and following a successful capital raise, the Company intends to seek other acquisitions in the healthcare industry. The

timing of commencement of expanding operations may be influenced

by our relative success of this offering. We may not raise

sufficient proceeds through this offering in order to fully

execute our business plans.

The Company does not propose to restrict its

search for a business opportunity to any particular industry or

geographical area and may, therefore, engage in essentially any

business in any industry. The Company has unrestricted discretion in

seeking and participating in a business opportunity, subject to the

availability of such opportunities, economic conditions, and other

factors. The selection of a business opportunity in which to

participate is complex and risky. Additionally, as the Company has

only limited resources and may find it difficult to locate good

opportunities. There can be no assurance that the Company will be

able to identify and acquire any business opportunity which will

ultimately prove to be beneficial to the Company and its

shareholders. The Company will select any potential business

opportunity based on management's business judgment. The activities

of the Company are subject to several significant risks, which arise

primarily as a result of the fact that we have no specific business,

and may acquire or participate in a business opportunity based on the

decision of management, which potentially could act without the

consent, vote, or approval of the Company's shareholders.

Business Information

Introduction

Gold Entertainment Group, Inc. is a Medical Device distributor.

The Company signed an agreement on December 31, 2022, to acquire 51% of Devon Orthopedic Implants, LLC ("ORTHO") a Delaware limited liability company with offices in New Port Richey, Florida. ORTHO is an operating company and operates as a subsidiary of GOLD effective January 31, 2023. The other 49% ownership is EXLITES HOLDINGS INTERNATIONAL INC. a New Mexico corporation with a public trading symbol of EXHI.

The Company has recently expanded its healthcare operations with a 20% ownership in MEDWORX A INC, a medical billing company, during the first quarter of 2024.

We expect to use substantially all of the net

proceeds from this offering to engage in the acquisition of existing

businesses and becoming an SEC reporting Company. We expect to build

a high-quality brand portfolio intended to generate income and to

provide capital preservation, capital appreciation and portfolio

diversification. These opportunities may be existing opportunities,

new opportunities which we intend to acquire, make business

improvements and provide financing for business expansion. We intend

to conduct our operations so that neither we nor, our subsidiaries

are required to register as an investment company under the

Investment Company Act of 1940, as amended, or the 1940 Act.

Our Competitive

Strengths

We believe that The

Company will be able to attract experienced directors and officers

and other key personal with the necessary experience. We believe our

investment strategy will assist in their recruitment, and distinguish

us from other brand development companies. Specifically, our

competitive strengths include the following:

|

|

|

|

|

Experienced

and Dedicated Management. The Company intends

to recruit a committed management team with experience in various

business projects. This team, who in place, will assist in

establishing a robust infrastructure of service providers,

including financial and business development managers for assets

under management.

|

|

|

Investing

Strategy. Our Management has an extensive deal flow

network in various markets due to long-standing relationships with

business owners and public company lenders.

|

|

|

|

|

|

Highly

Disciplined Investing Approach. We intend to take a

time-tested and thorough approach to analysis, management and

investor reporting.

|

Market

Opportunity

The economic outlook, in our view, presents an opportunity for our

business. The Company believes that recent corrections in the

national, regional and local markets are healthy and, in many cases,

overdue. Over the course of the past several months, the Company have

noticed that consumers have begun to explore the development of

market-appropriate product with realistic absorption projections and

expectations of realizable upside upon completion of their project in

one to three years. Many businesses are experiencing a critical lack

of investment capital. The contraction in capital supply to the small

to mid-sized business has not only added to the potential acquition

base for the Company but also is expected to produce higher credit

borrowers and enhanced the Company's investment power. As a result of

tight lending rules, outside of SBA incentives, many smaller business

operators, of all types, become more favorable to the concept of

acquisition by a public company, combined with financing.

18

Investment Objectives

Our

primary investment objectives are:

|

|

|

|

-

|

to

maximize the capital gains of our opportunities;

|

|

|

|

|

-

|

to

preserve and protect your capital contribution;

|

|

-

|

to enable

investors to realize a return on their investment by beginning the

process of liquidating and distributing cash to investors within

approximately five years of the termination of this offering, or

providing liquidity through alternative means such as in-kind

distributions of our own securities or other assets; and

|

|

-

|

To

achieve long-term capital appreciation for our stockholders

through increases in the value of our company.

|

We will also seek to realize growth in

the value of our investments and to optimize the timing of their

expansion.

However, we cannot

assure you that we will attain these objectives or that the value of

our investments will not decrease. We have not established a specific

policy regarding the relative priority of these investment

objectives.

Investment

Criteria

We believe the most

important criteria for evaluating the markets in which we intend to

purchase investment opportunities include:

|

|

|

|

historic

and projected population growth;

|

|

|

high

historic and projected employment growth;

|

|

|

markets with high levels of insured populations; and

|

|

stable

household income and general economic stability.

|

|

The businesses and

markets in which we invest may not meet all of these criteria and the

relative importance that we assign to any one or more of these

criteria may differ from market to market or change as general

economic and market conditions evolve. We may also consider

additional important criteria in the future.

Investment

Policies

Our investment

objectives are to maximize the capital gains of our opportunities and

achieve long-term capital appreciation for our stockholders through

increases in the value of our company. We have not established a

specific policy regarding the relative priority of these investment

objectives.

We expect to pursue our

investment objectives primarily through the ownership of businesses,

of various types, and with tangible assets. We currently intend to

invest primarily in the acquisition, development and management of

existing businesses, instead of developing our own. While we may

diversify in terms of business types , we do not have any limit on

the amount or percentage of our assets that may be invested in any

type of business, or any one geographic area.

We may also participate

with third parties in business ownership, through joint ventures or

other types of co-ownership. These types of investments may permit us

to own interests in larger assets without unduly restricting our

diversification and, therefore, provide us with flexibility in

structuring our portfolio. We will not, however, enter into a joint

venture or other partnership arrangement to make an investment that

would not otherwise meet our investment policies.

19

Equity investments in

acquired opportunities may be subject to existing financing and other

indebtedness or to new indebtedness which may be incurred in

connection with acquiring or refinancing these opportunities. Debt

service on such financing or indebtedness will have a priority over

any dividends with respect to our common stock. Investments are also

subject to our policy not to be treated as an investment company

under the Investment Company Act of 1940, as amended, or the 1940

Act.

Due Diligence Process

We will consider a

number of factors in evaluating whether to acquire any particular

asset, including: geographic location; business assets; historical

performance; current and projected cash flow; potential for capital

appreciation; potential for economic growth in the area where the

asset is located; presence of existing and potential competition;

prospects for liquidity through sale, financing or refinancing of the

assets; and tax considerations. Because the factors considered,

including the specific weight we place on each factor, vary for each

potential investment, we will not assign a specific weight or level

of importance to any particular factor. Our obligation to close on

the purchase of any investment generally will be conditioned upon the

delivery and verification of certain documents from the seller,

including, where available and appropriate: plans and specifications;

environmental reports; surveys; evidence of marketable title subject

to any liens and encumbrances as are acceptable to the Company; and

title and liability insurance policies.

Acquisition of

opportunities

The Company intends on

acquiring businesses primarily through industry contacts, including

debt financiers who may have distressed businesses that they would be

willing to transfer to our management. The number of businesses

opportunities that may be available from all of the foregoing sources

will vary from time to time, depending on numerous factors including,

without limitation, trends in delinquent debt and capital

availability.

Tax Treatment of

Registrant and its Security Holders.

We are a publicly

traded company and investment typically takes the form of Common

Stock as the final delivered asset. Therefore, we operate a, C

corporation. As such, our profits are taxable at corporate level and

dividends, if any, are taxable at individual level. These are

typically taxed as a capital gain or dividend.

Competition

The business

acquisition market is highly competitive. We will compete based on a

number of factors that including experienced management and capital

availability. As a public company, the Common Stock as a viable

financial exit is attractive to business owners.

20

We will compete with many third parties engaged in investment

activities including REITs, specialty finance companies, hedge funds,

investment banking firms, lenders and other entities. Some of these

competitors have substantially greater marketing and financial

resources than we will have and generally may be able to accept or

manage more risk than we can prudently manage, including risks with

respect to the businesses being acquired. In addition, these same

entities may seek financing through the same channels that we do.

Therefore, we will compete for investors and funding in a market

where funds for business investment may decrease, or grow less than

the underlying demand.

Competition may limit

the number of suitable investment opportunities offered to us and

result in higher prices, making it more difficult for us to acquire

new investments on attractive terms. In addition, competition for

desirable investments could delay the investment of net proceeds from

this offering in desirable assets, which may in turn reduce our cash

flow from operations and negatively affect our ability to make or

maintain distributions.

Government

Regulation

Our business is subject

to many laws and governmental regulations. Changes in these laws and

regulations, or their interpretation by agencies and courts, occur

frequently.

Investment

Company Act of 1940

We

intend to conduct our operations so that we are not required to

register as an investment company under the Investment Company Act of

1940, as amended, or the 1940 Act.

Environmental

Matters

Many environmental regulations require specific zoning and

environmental regulations at the State, local and Federal level. The

Company may be held liable under these regulations when making

acquisitions. These laws and liabilities may be extended to the

Company's employees.

Under various federal,

state and local laws, ordinances and regulations, a current or

previous owner or operator of real property may be held liable for

the costs of removing or remediating hazardous or toxic substances.

These laws often impose clean-up responsibility and liability without

regard to whether the owner or operator was responsible for, or even

knew of, the presence of the hazardous or toxic substances. The costs

of investigating, removing or remediating these substances may be

substantial, and the presence of these substances may adversely

affect our ability to rent or sell the property or to borrow using

the property as collateral and may expose us to liability resulting

from any release of or exposure to these substances. If we arrange

for the disposal or treatment of hazardous or toxic substances at

another location, we may be liable for the costs of removing or

remediating these substances at the disposal or treatment facility,

whether or not the facility is owned or operated by us. We may be

subject to common law claims by third parties based on damages and

costs resulting from environmental contamination emanating from a

site that we own or operate. Certain environmental laws also impose

liability in connection with the handling of or exposure to

asbestos-containing materials, pursuant to which third parties may

seek recovery from owners or operators of real opportunities for

personal injury associated with asbestos-containing materials and

other hazardous or toxic substances.

The Company may