false

--06-30

0001300524

0001300524

2024-01-31

2024-01-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of Earliest Event Reported): January 31, 2024

AMERICAN

INTERNATIONAL HOLDINGS CORP.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

000-50912 |

|

90-1898207 |

(State

or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S.

Employer

Identification No.) |

| 205S

Bailey Street Electra, Texas |

|

76360 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (940) 495-2155

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) Securities registered pursuant to Section 12(b)

of the Act: None. |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Section

5 — Corporate Governance and Management

Item

5.03. Amendments to Articles of Incorporation or Bylaws; Change in Management.

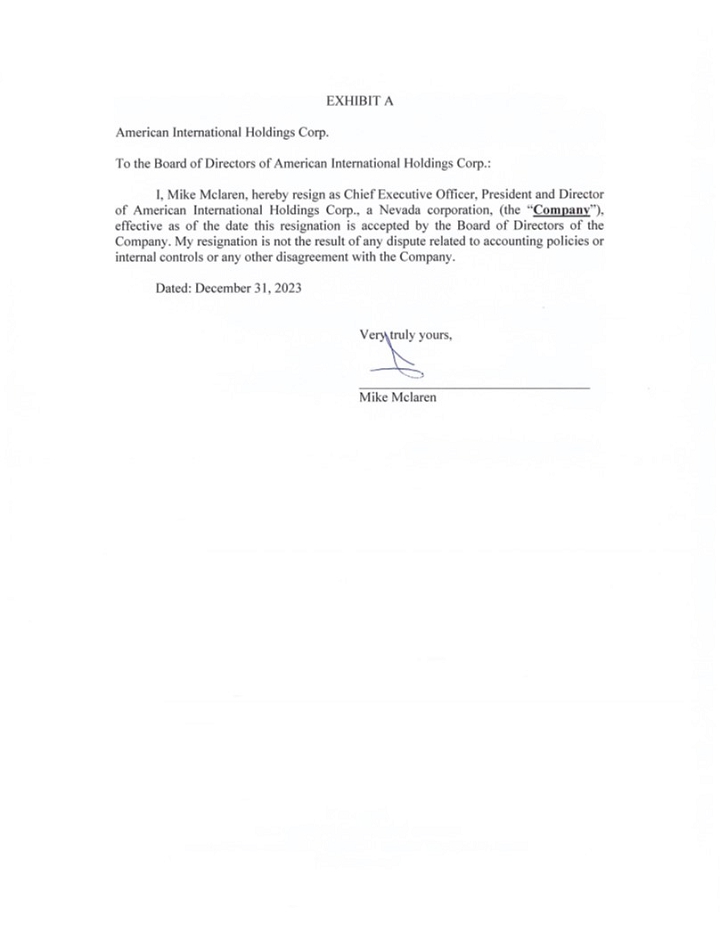

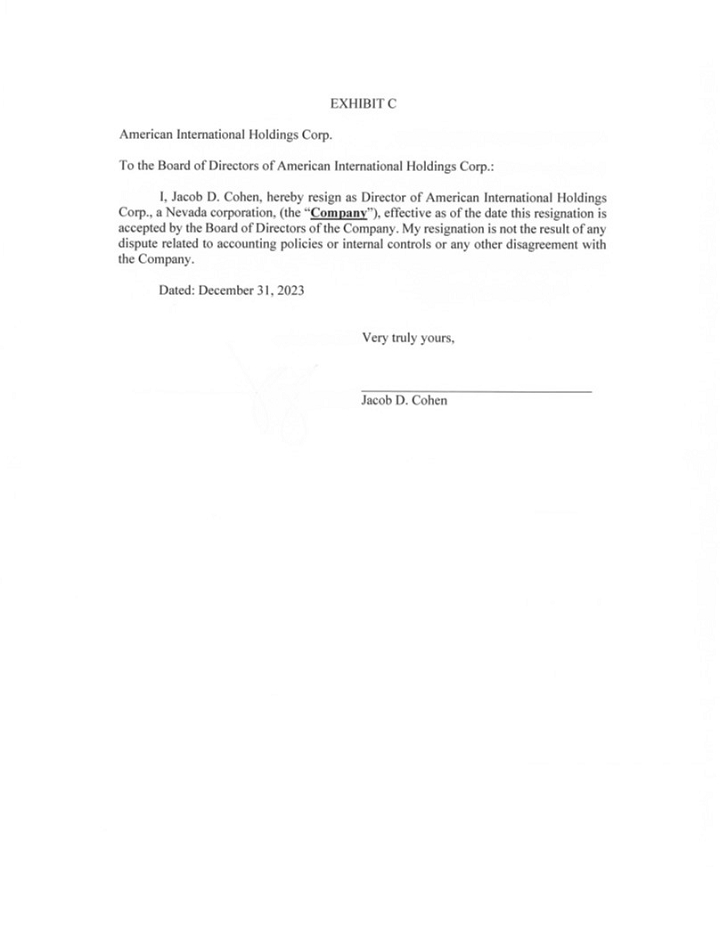

On

January 30, 2024, the Board of Directors accepted the resignation of all prior Board Members and officers and appointed Caren Currier

as sole officer and Director. At such time, Cycle Energy Corp and Marble Trital Inc., also preformed a reverse merger out of AMIH. At

this time, the shares issued will be cancelled and new shares will be issued to Ms. Currier’s incoming company or subsidiary.

Item

9.01. Financial Statements and Exhibits.

| Page 2 of 3 |

American International Holdings Corp. Board of Directors Approving Marble Exchange Agreement December 31, 2023 |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its

behalf by the undersigned hereunto duly authorized.

| |

AMERICAN

INTERNATIONAL HOLDINGS CORP. |

| |

|

|

| Dated:

March 4, 2024 |

By: |

/s/

Caren Currier |

| |

Name: |

Caren

Currier |

| |

|

Chief

Executive Officer |

| Page 3 of 3 |

American International Holdings Corp. Board of Directors Approving Marble Exchange Agreement December 31, 2023 |

Exhibit 1

| Page 1 of 15 |

American International Holdings Corp. Board of Directors Approving Marble Exchange Agreement December 31, 2023 |

| Page 2 of 15 |

American International Holdings Corp. Board of Directors Approving Marble Exchange Agreement December 31, 2023 |

| Page 3 of 15 |

American International Holdings Corp. Board of Directors Approving Marble Exchange Agreement December 31, 2023 |

| Page 4 of 15 |

American International Holdings Corp. Board of Directors Approving Marble Exchange Agreement December 31, 2023 |

| Page 5 of 15 |

American International Holdings Corp. Board of Directors Approving Marble Exchange Agreement December 31, 2023 |

| Page 6 of 15 |

American International Holdings Corp. Board of Directors Approving Marble Exchange Agreement December 31, 2023 |

| Page 7 of 15 |

American International Holdings Corp. Board of Directors Approving Marble Exchange Agreement December 31, 2023 |

| Page 8 of 15 |

American International Holdings Corp. Board of Directors Approving Marble Exchange Agreement December 31, 2023 |

| Page 9 of 15 |

American International Holdings Corp. Board of Directors Approving Marble Exchange Agreement December 31, 2023 |

UNANIMOUS

WRITTEN CONSENT TO ACTION WITHOUT MEETING OF THE BOARD OF DIRECTORS AND AUDIT COMMITTEE OF AMERICAN INTERNATIONAL HOLDINGS CORP.

Pursuant

to Section 78.315 of the Nevada Revised Statutes (“NRS”), which authorizes the taking of the action by the

unanimous written consent of the Board of Directors (or a committee thereof) of a Nevada corporation, without a meeting, the undersigned,

being all of the members of (a) the Board of Directors (the “Directors” of the “Board”)

of American International Holdings Corp., a Nevada corporation (the “Company”); and (b) the Audit Committee

of the Board, hereby acknowledge the following statements, give their unanimous written consent, adopt the following resolutions and

take the following actions pursuant to this Consent to Action Without Meeting (the “Consent”):

American

International and Marble Trital, Inc. Share Exchange

WHEREAS,

the Board believes it to be in the best interest of the Company to enter into an Exchange Agreement with Marble Trital, Inc. (the “Marble

Exchange Agreement”); and

WHEREAS,

the Marble Exchange Agreement contemplates, among other things, Marble Trital Inc., a New York corporation (“Marble”)

exchanging its 1,000,000 outstanding shares of Series A Preferred Stock for all of the issued and outstanding capital stock held by the

Company in Cycle Energy Corp, a Texas corporation (“Cycle Energy”)(representing 100% of Cycle Energy)(the “Cycle

Energy Interests (collectively, the “Marble Exchange Agreement Terms”);

WHEREAS,

the Directors have reviewed the Marble Exchange Agreement and Marble Exchange Agreement Terms and have determined that it is advisable

and in the best interests of the Company and its stockholders to approve the Marble Exchange Agreement and the terms and conditions thereof,

including, but not limited to the Marble Exchange Agreement Terms; and

WHEREAS,

the Directors believe that it is in the best interests of the Company to confirm, ratify and approve all officer’s certificate,

closing certificates and all other certificates, documents or agreements executed in connection with the Marble Exchange Agreement (collectively,

the “Closing Documents”).

| Page 10 of 15 |

American International Holdings Corp. Board of Directors Approving Marble Exchange Agreement December 31, 2023 |

NOW

THEREFORE BE IT RESOLVED, that after robust discussion among the Board, and after review of the Marble Exchange Agreement, and after

taking into account all relevant facts, circumstances, contingencies, including (1) the interests of the corporation’s employees,

suppliers, creditors or customers; (2) the economy of the State or Nation; (3) the interests of the community or of society; (4) the

long-term and short- term interests of the Company, including the possibility that these interests may be best served by the continued

independence of the corporation; and (5) the long-term and short- term interests of the Company’s stockholders, including the possibility

that these interests may be best served by the continued independence of the corporation, as well as certain other facts, circumstances

and contingencies, and following an inclusive process undertaken by the officers to ensure that the transactions contemplated by the

Marble Exchange Agreement would provide the highest value for the Company (and its stockholders) is obtained, maximizing the value of

the Company, and further after each of the Directors has informed themselves of all material information reasonably available, to decide

which alternative is most likely to offer the best value reasonably available to the stockholders, the Directors resolve as set forth

below:

RESOLVED,

that the Directors have reviewed the Marble Exchange Agreement and believe that such documents and agreements, the terms and conditions

thereof and the transactions contemplated thereby, including, but not limited to the Marble Exchange Agreement Terms, are fair, reasonable

and in the best interests of the Company; and it is further

RESOLVED,

that the Board approves, confirms and ratifies the Marble Exchange Agreement, the Marble Exchange Agreement Terms and the terms and conditions

thereof and the transactions contemplated thereby; and it is further

RESOLVED,

that the Board deems it to be in the best interests of the Company for the Company to consummate (a) the Marble Exchange Agreement and

transactions contemplated therein (collectively, the “Transaction Documents”); and it is further

RESOLVED,

that the closing of the transactions contemplated by the Marble Exchange Agreement shall be subject to the conditions of closing set

forth in the Marble Exchange Agreement; and it is further

RESOLVED,

that the form, terms and conditions of the Marble Exchange Agreement and all other transactions and agreements contemplated thereby,

be, and the same hereby are, approved, ratified and adopted in all respects, together with such changes, amendments or modifications

as the officer or officers executing the same may, in their sole discretion, deem necessary, appropriate or advisable, and the officers

of the Company be, and each of them acting alone hereby is, authorized and directed, in the name and on behalf of the Company, to negotiate,

execute and deliver the Marble Exchange Agreement and amendments, restatements and modifications thereto, and to execute, deliver and

file such other agreements, documents, certificates and instruments which are required to be executed, delivered or filed pursuant to

the Marble Exchange Agreement or that such officers deem necessary, appropriate or advisable to execute, deliver and file, in order to

carry out the terms of the Marble Exchange Agreement and amendments, restatements and modifications thereto, and the other transactions

as contemplated thereby; and it is further

| Page 11 of 15 |

American International Holdings Corp. Board of Directors Approving Marble Exchange Agreement December 31, 2023 |

RESOLVED,

that the Marble Exchange Agreement Terms are hereby approved, confirmed and ratified as fair to the Company and its stockholders; and

it is further

RESOLVED,

that the officers of the Company, be, and each of them hereby is, authorized and directed, in the name and on behalf of the Company,

to take all action and to execute and deliver all documents and certificates as such officers deem necessary, appropriate or advisable

in order to implement the foregoing; and it is further

RESOLVED,

that the officers of the Company be, and each of them hereby is, authorized, directed and empowered, for and on behalf of the Company,

to execute all documents and take such further action, as they may deem necessary, appropriate or advisable to effect the Marble Exchange

Agreement; and it is further

Securities

Law Matters

RESOLVED,

that the Preferred Shares (the “Company Securities”), shall be issued in accordance with the terms of the exemption

from registration under the Securities Act of 1933, as amended (the “Act”), provided for in Section 4(a)(2),

and/or Rule 506(b) of Regulation D promulgated thereunder, and the exemption from registration or qualification under applicable state

securities laws, and that each officer of the Company is hereby authorized and directed to take all steps necessary or desirable to qualify

under an applicable exemption, including the execution and filing of any Form D with the SEC, and to execute and file with the appropriate

federal or state government offices for and on behalf of the Company, any other forms or notices as required pursuant to federal and

state securities laws; and it is further

RESOLVED,

that the officers of the Company be, and each of them hereby is, authorized and directed, in the name and on behalf of the Company, to

take all action and to execute and deliver all documents and certificates as such officers deem necessary, appropriate or advisable in

order to implement the foregoing issuances and to qualify for the aforementioned exemptions from registration under the Act and applicable

state securities laws; and it is further

RESOLVED,

that, if applicable, the officers of the Company be, and each of them hereby is, authorized and directed, in the name and on behalf of

the Company, to execute and file irrevocable written consents and/or powers of attorney in all such states or territories of the United

States wherein such consents to service of process are necessary, appropriate or advisable under the securities laws thereof or in connection

with the registration, qualification, or exemption therefrom of the aforesaid securities, and to appoint the appropriate person or persons

as agent or agents of the Company for the purpose of receiving and accepting process; and it is further

| Page 12 of 15 |

American International Holdings Corp. Board of Directors Approving Marble Exchange Agreement December 31, 2023 |

RESOLVED,

that the one million (1,000,000) shares of Series A Preferred Stock of the Company held by Marble Trital shall be cancelled by the Company

upon return to the Company by Marble Trital pursuant to the terms of the Marble Exchange Agreement; and it is further

RESOLVED,

that the Preferred Shares hereby are, approved, authorized and adopted in all respects, which approval also constitutes approval of such

transactions under Section 78.438 of the NRS; and it is further

Effective

Date

RESOLVED,

that this Consent shall become effective, and each of the resolutions above shall be deemed effective, adopted, ratified and approved,

only when this Consent is signed by all members of the Board of the Company and all members of the Audit Committee below (subject to

the provisions hereof relating to electronic signatures below). The effective date and time of this Consent and the resolutions above

shall be deemed to be the date and time that this Consent is signed by the last member of the Board and Audit Committee (the “Effective

Date”), provided that the Effective Date occurs prior to December 31, 2023 at 11:59:59 P.M. Dallas, Texas time (the “Deadline”).

In the event this Consent is not signed by all members of the Board and Audit Committee, prior to the Deadline, this Consent and the

resolutions set forth herein shall be deemed not approved or authorized and this Consent shall be of no force or effect; and it is further

RESOLVED,

that the Effective Date is hereby approved, confirmed and ratified by the Directors and Audit Committee, for all purposes; and it is

further

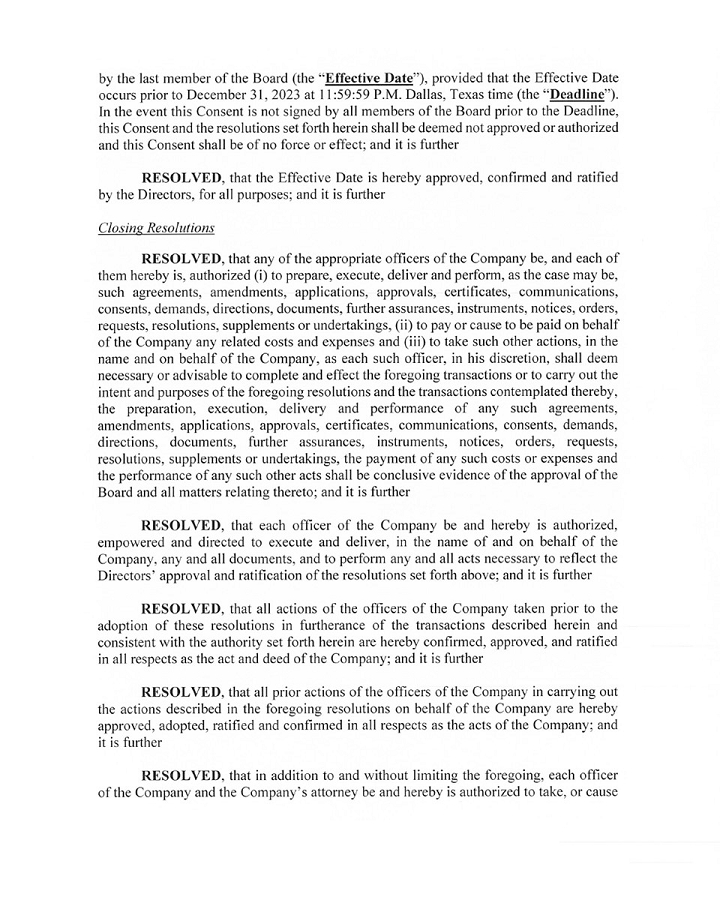

Closing

Resolutions

RESOLVED,

that any of the appropriate officers of the Company be, and each of them hereby is, authorized (i) to prepare, execute, deliver and perform,

as the case may be, such agreements, amendments, applications, approvals, certificates, communications, consents, demands, directions,

documents, further assurances, instruments, notices, orders, requests, resolutions, supplements or undertakings, (ii) to pay or cause

to be paid on behalf of the Company any related costs and expenses and (iii) to take such other actions, in the name and on behalf of

the Company, as each such officer, in his discretion, shall deem necessary or advisable to complete and effect the foregoing transactions

or to carry out the intent and purposes of the foregoing resolutions and the transactions contemplated thereby, the preparation, execution,

delivery and performance of any such agreements, amendments, applications, approvals, certificates, communications, consents, demands,

directions, documents, further assurances, instruments, notices, orders, requests, resolutions, supplements or undertakings, the payment

of any such costs or expenses and the performance of any such other acts shall be conclusive evidence of the approval of the Board and

Audit Committee and all matters relating thereto; and it is further

| Page 13 of 15 |

American International Holdings Corp. Board of Directors Approving Marble Exchange Agreement December 31, 2023 |

RESOLVED,

that each officer of the Company be and hereby is authorized, empowered and directed to execute and deliver, in the name of and on behalf

of the Company, any and all documents, and to perform any and all acts necessary to reflect the Directors’ and Audit Committee’s

approval and ratification of the resolutions set forth above; and it is further

RESOLVED,

that all actions of the officers of the Company taken prior to the adoption of these resolutions in furtherance of the transactions described

herein and consistent with the authority set forth herein are hereby confirmed, approved, and ratified in all respects as the act and

deed of the Company; and it is further

RESOLVED,

that all prior actions of the officers of the Company in carrying out the actions described in the foregoing resolutions on behalf of

the Company are hereby approved, adopted, ratified and confirmed in all respects as the acts of the Company; and it is further

RESOLVED,

that in addition to and without limiting the foregoing, each officer of the Company and the Company’s attorney be and hereby is

authorized to take, or cause to be taken, such further action, and to execute and deliver, or cause to be delivered, for and in the name

and on behalf of the Company, any and all forms, certificates, agreements, documents, instruments or other items as he may deem appropriate

in order to effect the purpose or intent of the foregoing resolutions (as conclusively evidenced by the taking of such action or the

execution and delivery of such forms, certificates, agreements, documents, instruments or other items, as the case may be) and all action

heretofore taken by such person in connection with the subject of the foregoing recitals and resolutions be, and it hereby is approved,

ratified and confirmed in all respects as the act and deed of the Company; and it is further

RESOLVED,

that this Consent may be executed in one or more counterparts, each of which will be deemed to be an original, but all of which

taken together will constitute one and the same instrument. Any electronic signature of a signatory to this Consent is intended to

authenticate such writing and shall be as valid, and have the same force and effect as a manual signature. Any such electronically

signed Consent shall be deemed (1) an “electronic transmission”; (2) to be

“written” or “in writing”; (3) to have been signed; and (4) to constitute a

record established and maintained in the ordinary course of business, and an original written record when printed from electronic

files. For purposes hereof, “electronic signature” includes, but is not limited to (i) a scanned copy (as

a “pdf” (portable document format) or other replicating image) of a manual ink signature, (ii) an

electronic copy of a traditional signature affixed to this Consent, (iii) a signature incorporated into this Consent utilizing

touchscreen capabilities, (iv) a signature incorporated into this Consent as a (x) graphic, (y) image file or (z) manually typed

characters, added to such document with the intention of such characters representing the signatory’s execution of such

Consent; or (v) a digital signature. A photocopy, facsimile, .pdf, .tif, .gif, .jpeg, or similar electronic copy of this Consent (or

any signature hereto) shall be effective as an original for all purposes.

| Page 14 of 15 |

American International Holdings Corp. Board of Directors Approving Marble Exchange Agreement December 31, 2023 |

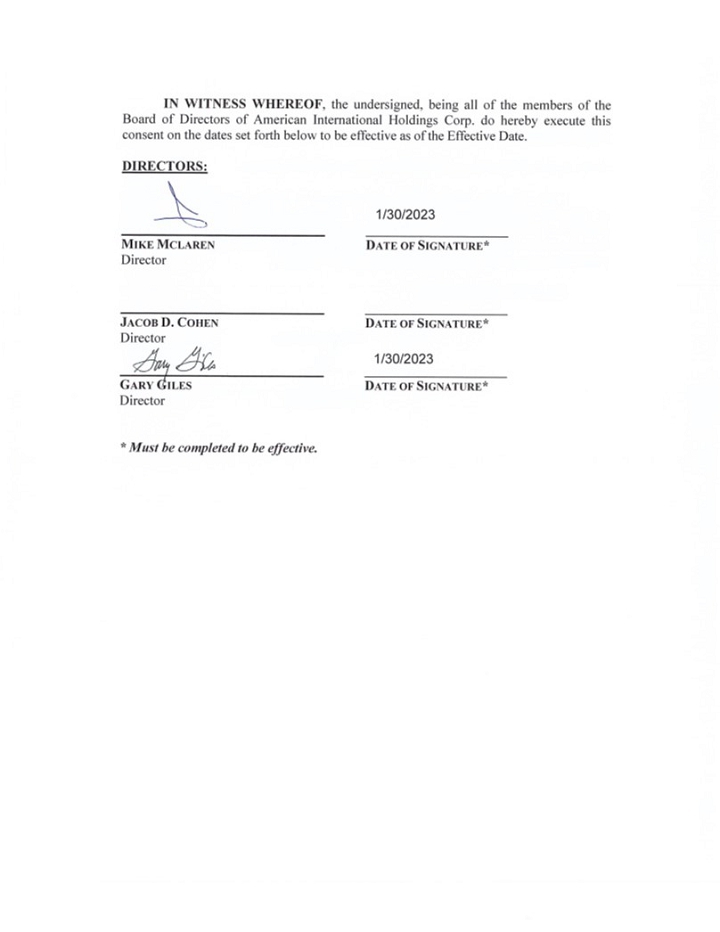

IN

WITNESS WHEREOF, the undersigned, being all of the members of the Board of Directors and Audit Committee of American International

Holdings Corp. do hereby execute this consent on the dates set forth below to be effective as of the Effective Date.

| DIRECTORS: |

|

|

| |

|

|

|

|

01/30/2023 |

| Mike

Mclaren |

|

Date

of Signature* |

| Chairperson

of Board of Directors |

|

|

| |

|

|

|

|

01/30/2023 |

| JACOB

COHEN |

|

|

| Directo |

|

Date

of Signature* |

|

|

|

|

|

01/30/2023 |

| Gary

Giles |

|

Date

of Signature* |

| Directo |

|

|

| |

|

|

| *

Must be completed to be effective. |

|

|

| Page 15 of 15 |

American International Holdings Corp. Board of Directors Approving Marble Exchange Agreement December 31, 2023 |

EXCHANGE

AGREEMENT

This

Exchange Agreement (this “Agreement”) dated December 31, 2023 and effective as of the Effective Date, defined

below (except as provided below), is by and between, American International Holdings Corp., a Nevada corporation (the “Company”)

and Marble Trital, Inc., a New York corporation (“Stockholder”), each a “Party”

and collectively the “Parties”.

W

I T N E S S E T H:

WHEREAS,

the Stockholder currently holds 1,000,000 shares of the Series A Preferred Stock (the “Preferred Shares”),

$0.0001 par value per share of the Company;

WHEREAS,

the Company is the owner of all of the outstanding capital stock of Cycle Energy Corp., a Texas corporation (“Cycle Energy”),

totaling one hundred percent (100%) of the issued and outstanding common stock of Cycle Energy; and

WHEREAS,

the Stockholder desires to exchange the Preferred Shares for the Cycle Energy Interests, as discussed and defined below; and

WHEREAS,

the Company and Stockholder desire to set forth in writing the terms and conditions of their agreement and understanding concerning exchange

of the Preferred Shares for the Subsidiary Consideration.

NOW,

THEREFORE, in consideration of the premises and the mutual covenants, agreements, and considerations herein contained, and other

consideration, which consideration the Parties hereby acknowledge and confirm the sufficiency and receipt of, the Parties hereto agree

as follows:

1.

Mutual Representations, Covenants and Warranties of the Parties. Each of the Parties, for themselves and for the benefit of

each of the other Parties hereto, represents, covenants and warranties that:

1.1.

Such Party has all requisite power and authority, corporate or otherwise, to execute and deliver this Agreement and to consummate the

transactions contemplated hereby. This Agreement constitutes the legal, valid and binding obligation of such Party enforceable against

such Party in accordance with its terms, except as such enforcement may be limited by applicable bankruptcy, insolvency, reorganization,

moratorium or similar laws affecting creditors’ rights generally and general equitable principles;

1.2.

The execution and delivery by such Party and the consummation of the transactions contemplated hereby and thereby do not and shall not,

by the lapse of time, the giving of notice or otherwise: (i) constitute a violation of any law; or (ii) constitute a breach of any provision

contained in, or a default under, any governmental approval, any writ, injunction, order, judgment or decree of any governmental authority

or any agreement, contract or understanding to which such Party or its assets are bound or affected; and

| American International Holdings Corp. / Marble Trital, Inc. |

| Exchange Agreement Page 1 of 6 |

1.3.

Any individual executing this Agreement on behalf of an entity has authority to act on behalf of such entity and has been duly and properly

authorized to sign this Agreement on behalf of such entity.

2.

Exchange.

2.1.

In exchange for the Preferred Shares, the Company agrees to transfer, assign and pay to the Stockholder all of the outstanding capital

stock held by the Company in Cycle Energy (the “Cycle Energy Interests”);

2.2.

The Exchange of the Preferred Shares in consideration for the Cycle Energy Interests is referred to herein as the “Exchange”).

2.3.

Prior to the Effective Date of this Agreement:

2.3.1.

The Stockholder shall return the certificate representing the Preferred Shares to the Company for cancellation, together with a stock

power, or if the Preferred Shares is uncertificated, the Stockholder shall provide the Company an Uncertificated Stock Transfer form,

and the Stockholder agrees to take such other actions and execute such other documents as may be required by the Company or the Company’s

Transfer Agent to perfect the cancellation of the Preferred Shares in connection with the Exchange.

2.4.

Within five (5) Business Days of the Effective Date of this Agreement:

2.4.1.

The Company shall transfer the Stockholder the Cycle Energy Interests and shall deliver to the Stockholder a certificate evidencing the

Cycle Energy Interests in the name of the Stockholder (the “Cycle Energy Certificate”), and the Company agrees to

take such other actions and execute such other documents as may be reasonably requested by the Stockholder to perfect the transfer of

the Cycle Energy Interests in connection with the Exchange; and

2.5.

Effective as of the Effective Date (or at the option of the Stockholder, such date prior to the Effective Date), the Stockholder hereby

contributes, transfers, assigns and conveys to the Company all right, title and interest in and to the Preferred Shares, together with

any and all rights, privileges, benefits, obligations and liabilities appertaining thereto, reserving unto such Stockholder no rights

or interests therein whatsoever, to have and to hold the same unto the Company and its heirs, legal representatives, successors and assigns,

from and after the date hereof to its own proper use forever.

2.6.

Effective as of the Effective Date, the Company hereby grants, assigns, transfers, contributes, and conveys to Stockholder all right,

title and interest in and to all of the Cycle Energy Interests, together with any and all rights, privileges, benefits and obligations

appertaining thereto and all benefits and advantages to be derived therefrom.

| American International Holdings Corp. / Marble Trital, Inc. |

| Exchange Agreement Page 2 of 6 |

3.

Effective Date. The effective date of the Exchange shall be December

31, 2023

4.

Representations, Warranties, Confirmations and Acknowledgements of Stockholder and the Company.

4.1.

Stockholder hereby represents and warrants to the Company, that:

4.1.1.

The Stockholder is the sole record and beneficial owner of the Preferred Shares and has good and marketable title to the Preferred Shares,

free and clear of all liens, security interests, claims, charges, equities, pledges, options and encumbrances of any kind. Stockholder

has not previously assigned, sold, transferred, encumbered (including, but not limited to, providing anyone an option or other right

to purchase such Preferred Shares) the Preferred Shares;

4.1.2.

Stockholder is an “accredited investor”, as such term is defined in Regulation D of the Securities Act of 1933, as

amended (the “Securities Act”);

4.1.3.

Stockholder is familiar with the business and operations of the Company and Cycle Energy;

4.1.4.

Stockholder will acquire the Cycle Energy Interests for its own account and not with a view to a sale or distribution thereof as that

term is used in Section 2(a)(11) of the Securities Act, in a manner which would require registration under the Securities Act or any

state securities laws;

4.1.5.

Stockholder acknowledges that the Cycle Energy Interests have not been registered under the Securities Act, nor registered or qualified

under any state securities laws, and that they are being offered and sold pursuant to an exemption from such registration and qualification;

4.1.6.

Stockholder has such knowledge and experience in financial and business matters that Stockholder is capable of evaluating the merits

and risks of the Cycle Energy Interests. Stockholder can bear the economic risk of the Cycle Energy Interests, has knowledge and experience

in financial business matters and is capable of bearing and managing the risk of investment in the Cycle Energy Interests. Stockholder

has carefully considered and has, to the extent Stockholder believes such discussion necessary, discussed with its professional, legal,

tax and financial advisors, the suitability of an investment in the Cycle Energy Interests for its particular tax and financial situation

and it and its advisers, if such advisors were deemed necessary, have determined that the Cycle Energy Interests are a suitable investment

for it. Stockholder confirms that it has not been offered the Cycle Energy Interests by any form of general solicitation or advertising;

| American International Holdings Corp. / Marble Trital, Inc. |

| Exchange Agreement Page 3 of 6 |

4.1.7.

Stockholder understands and acknowledges that each certificate or instrument representing the Cycle Energy Interests will be endorsed

with the following legend (or a substantially similar legend), unless or until registered under the Securities Act, or unless an exemption

from registration exists in connection therewith:

THE

SECURITIES EVIDENCED BY THIS CERTIFICATE HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED, AND MAY NOT BE SOLD,

TRANSFERRED, ASSIGNED OR HYPOTHECATED UNLESS THERE IS AN EFFECTIVE REGISTRATION STATEMENT UNDER SUCH ACT COVERING SUCH SECURITIES, THE

TRANSFER IS MADE IN COMPLIANCE WITH RULE 144 PROMULGATED UNDER SUCH ACT OR THE COMPANY RECEIVES AN OPINION OF COUNSEL FOR THE HOLDER

OF THESE SECURITIES WHICH IS REASONABLY SATISFACTORY TO THE COMPANY, STATING THAT SUCH SALE, TRANSFER, ASSIGNMENT OR HYPOTHECATION IS

EXEMPT FROM THE REGISTRATION AND PROSPECTUS DELIVERY REQUIREMENTS OF SUCH ACT.

4.2.

The Company hereby represents and warrants to the Stockholder, that:

4.2.1.

The Company is the sole record and beneficial owner of the Cycle Energy Interests and is free and clear of all liens, security interests,

claims, charges, equities, pledges, options and encumbrances of any kind. Stockholder has not previously assigned, sold, transferred,

encumbered (including, but not limited to, providing anyone an option or other right to purchase such Cycle Energy Interests).

5.

Further Assurances. The Company and Stockholder agree that, from time to time, each of them will take such other action and

to execute, acknowledge and deliver such contracts, deeds, representations, confirmations or other documents as may be reasonably requested

and necessary or appropriate to allow for the transactions contemplated herein, including, but no limited to the Exchange.

6.

Entire Agreement. This Agreement sets forth all of the promises, agreements, conditions, understandings, warranties and representations

among the Parties with respect to the transactions contemplated hereby and thereby, and supersedes all prior agreements, arrangements

and understandings between the Parties, whether written, oral or otherwise.

7.

Controlling Law. This Agreement shall be governed by and construed in accordance with the laws of the State of Texas and applicable

laws of the United States of America.

| American International Holdings Corp. / Marble Trital, Inc. |

| Exchange Agreement Page 4 of 6 |

8.

Expenses. All fees, costs and expenses incurred in connection with this Agreement and the transactions contemplated hereby

shall be paid by the Party incurring such fees, costs and expenses.

9.

Savings Clause. If any provision of this Agreement is prohibited by law or held to be unenforceable, the remaining provisions

hereof shall not be affected, and this Agreement shall continue in full force and effect as if such unenforceable provision had never

constituted a part hereof, and the unenforceable provision shall be automatically amended so as best to accomplish the objectives of

such unenforceable provision within the limits of applicable law.

10.

Review and Construction of Documents. Stockholder represents to the Company and the Company represents to Stockholder, that

(a) before executing this Agreement, said Party has fully informed itself of the terms, contents, conditions and effects of this Agreement;

(b) said Party has relied solely and completely upon its own judgment in executing this Agreement; (c) said Party has had the opportunity

to seek and has obtained the advice of its own legal, tax and business advisors before executing this Agreement; (d) said Party has acted

voluntarily and of its own free will in executing this Agreement; and (e) this Agreement is the result of arm’s length negotiations

conducted by and among the Parties and their respective counsel.

11.

Specific Performance. Without limiting or waiving in any respect any rights or remedies of any Party under this Agreement

now or hereinafter existing at law or in equity or by statute, each of the Parties hereto shall be entitled to seek specific performance

of the obligations to be performed by the other in accordance with the provisions of this Agreement.

12.

Counterparts and Signatures. This Agreement and any signed agreement or instrument entered into in connection with this Agreement,

and any amendments hereto or thereto, may be executed in one or more counterparts, all of which shall constitute one and the same instrument.

Any such counterpart, to the extent delivered by means of a facsimile machine or by .pdf, .tif, .gif, .jpeg or similar attachment to

electronic mail (any such delivery, an “Electronic Delivery”) shall be treated in all manner and respects as an original

executed counterpart and shall be considered to have the same binding legal effect as if it were the original signed version thereof

delivered in person. At the request of any Party, each other Party shall re execute the original form of this Agreement and deliver such

form to all other parties. No Party shall raise the use of Electronic Delivery to deliver a signature or the fact that any signature

or agreement or instrument was transmitted or communicated through the use of Electronic Delivery as a defense to the formation of a

contract, and each such Party forever waives any such defense, except to the extent such defense relates to lack of authenticity.

| American International Holdings Corp. / Marble Trital, Inc. |

| Exchange Agreement Page 5 of 6 |

IN

WITNESS WHEREOF, the Parties hereto have executed this Agreement as of the date above to be effective as of the Effective Date (except

as otherwise discussed above).

| “Company”

_____________ |

|

| |

|

|

| American

International Holdings Corp. |

|

| |

|

|

| By: |

|

|

| |

|

|

| Its: |

Incoming

President |

|

| Printed

Name: |

Caren

Currier |

|

“Stockholder”

Marble

Trital, Inc.

| By: |

|

Its: |

President |

| Printed

Name: |

Michael

McLaren |

|

| American International Holdings Corp. / Marble Trital, Inc. |

| Exchange Agreement Page 6 of 6 |

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

American (CE) (USOTC:AMIH)

過去 株価チャート

から 11 2024 まで 12 2024

American (CE) (USOTC:AMIH)

過去 株価チャート

から 12 2023 まで 12 2024