Quisitive Technology Solutions Inc.

(“Quisitive” or the “Company”) (TSXV: QUIS, OTCQX:

QUISF), a premier Microsoft Cloud and AI solutions

provider, announced that it has entered into a definitive stock

purchase agreement dated March 27, 2024 (the

“

Agreement”) pursuant to which Quisitive has

agreed to sell its BankCard USA Merchant Services, Inc.

(“

BankCard”) business unit (the

“

Transaction”) to BUSA Acquisition Co. (the

“

Acquiror”), a Nevada incorporated entity owned by

a consortium of current employees of BankCard, including Shawn

Skelton, Scott Hardy and Jason Hardy, as well as other arm’s length

third parties. The details of the Transaction are set forth in the

Agreement, which was negotiated at arm’s length, and further

summarized below.

“Over the past twelve months, Quisitive’s

executive leadership team and board of directors have taken

decisive actions to focus resources on our core Microsoft cloud and

AI business where we have meaningful scale, de-risk the

organization, reduce volatility and meaningfully strengthen the

balance sheet,” said Mike Reinhart, Chief Executive Officer of

Quisitive. “The divestiture of PayiQ and the Bankcard payments

business allows management to focus on the growing market demand

for Microsoft Cloud and AI solutions and services. We will continue

to evaluate strategic options available to the Company to further

enhance its growth, development, and prosperity in the short and

long terms with the goal of maximizing shareholder value.”

“We are excited to announce the acquisition of

BankCard USA and look forward to this exciting new chapter for the

business,” said Felix Danciu, CEO of Elmcore Group, Inc. “We want

to especially thank Mr. Reinhart and the board of directors of

Quisitive for their collaborative efforts on this transaction, and

congratulate them on their pathway forward. We’d also like to thank

WhiteHorse Capital for their financial support. Furthermore, we are

delighted to reveal that Quisitive will be supporting BankCard by

supplying Microsoft cloud licensing and managed services as part of

a three-year agreement to facilitate our business operations.”

BankCard will continue to be led by Shawn

Skelton as CEO, Scott Hardy as President, and Jason Hardy as COO,

with Felix Danciu joining as CFO. William Hui-Chung Chang will also

join as Chairman and both Vijay Jog and Gary Prioste as board

members, in addition to the four executives as board members.

Compelling Strategic and Financial

Benefits:

- Transaction Simplifies

Company into a Pure-Play Microsoft Cloud and AI Solutions

Provider: The divestiture of the Payments arm simplifies

the Company into a single segment, as a leading global partner of

Microsoft, focusing on offering transformative solution services

and upholding high standards of customer service.

- Improved Financial Profile

with US$34.6 million Debt Reduction and Pro Forma trailing twelve

month (“TTM”) Adjusted EBITDA of US$16.4 million as of December 31,

2023: Following the close of the Transaction, the Company

will have US$34.0 million in debt, implying a pro forma leverage

ratio of approximately 2.1x net debt to TTM Adjusted EBITDA.

Assuming the Transaction closes on the basis currently

contemplated, the Company is providing guidance for fiscal 2023 as

if the Transaction and the divestiture of PayiQ (which was

completed in January 2024) closed on January 1, 2023 with pro forma

Adjusted EBITDA expected to be US$16.4 million. The pro forma

Adjusted EBITDA run rate includes full year adjustments for

headcount capacity savings made during fiscal 2023 as well as

corporate cost savings that will be realized after the completion

of both the Transaction and divestiture of PayiQ. Less than all of

the savings were realized in fiscal 2023 (with the balance expected

to be realized in fiscal 2024) which will result in the Company

reporting fiscal 2023 results that will be lower than the pro forma

Adjusted EBITDA of US$16.4 million.

- Meaningful Growth

Initiatives in Microsoft Artificial Intelligence Services and

Recurring Revenue: The Company expects to capitalize on

customer interest in artificial intelligence by rolling out

Microsoft solutions in Azure OpenAI and CoPilot. To enhance

shareholder value, the Company expects to expand recurring managed

services, develop custom copilot solutions, and Industry Software

as a Service (SaaS) offerings, such as MazikCare and MazikCare

CoPilot, a proprietary offering purpose-built for healthcare.

Transaction Summary

Pursuant to the terms of the Agreement, the

consideration to be received by Quisitive for the sale of BankCard

consists of: (i) US$40,000,000 in cash; (ii) the return by the

Acquiror of 133,095,158 common shares of Quisitive (the

“Quisitive Shares”) to a wholly-owned subsidiary

of Quisitive; and (iii) delivery by the former vendors of BankCard

of a settlement agreement releasing Quisitive (and certain of its

subsidiaries) of any and all obligations to pay a US$10,000,000

earnout payment (plus accrued interest) as provided pursuant to the

terms of a stock purchase agreement between Quisitive, a

wholly-owned subsidiary of Quisitive, and the former vendors of

BankCard dated March 29, 2021. Following the completion of the

Transaction and the return and cancellation of the Quisitive Shares

by Quisitive, a total of 272,532,461 Quisitive Shares will remain

issued and outstanding. No new Insiders or Control Persons (as each

such term is defined under the policies of the TSX Venture Exchange

(the “TSXV”)) will be created as a result of the

cancellation of the Quisitive Shares, and no single person will own

or control, directly or indirectly, over 50% of the Quisitive

Shares. The parties to the Transaction have agreed to full and

final customary mutual releases. Total fees payable by the Company

in connection with the Transaction are estimated to be

approximately US$2 million, which includes payments to the

Company’s advisors listed under the heading “Advisors” below and

the sole finder’s fees payable by the Company to William Blair

& Company, L.L.C. in accordance with the policies of the TSXV.

The summary of the key terms of the Agreement referred to herein

are expressly qualified in their entirety by the full text of the

Agreement, a copy of which will be filed and available for download

on the Company’s issuer profile on SEDAR+ at www.sedarplus.ca.

Completion of the Transaction is expected to occur on or before

April 30, 2024.

Concurrently with the execution of the

Agreement, Acquiror entered into a loan and security agreement

establishing credit facilities (the “BUSA Credit

Facilities”) with WhiteHorse Capital Management, LLC as

the lead arranger, the administrative agent and collateral agent,

and certain affiliates of WhiteHorse Capital Management, LLC as the

initial lenders thereunder (the “Lenders”),

pursuant to the terms of which the Lenders will provide the

Acquiror with up to an aggregate of US$49 million of senior secured

debt financing. The BUSA Credit Facilities consist of a US$44

million senior secured term loan (the “BUSA Term

Loan”), a portion of which will be advanced to fund the

cash portion payable in connection with Transaction, and US$5

million of senior secured revolving credit commitments, which may

be used for funding general working capital requirements from time

to time. The Lenders have committed to advancing the full amount of

the BUSA Term Loan on the closing date of the Transaction, subject

to the satisfaction of certain customary conditions precedent which

Acquiror expects to satisfy on or before the closing of the

Transaction.

The TSXV has conditionally approved the

Transaction. In accordance with the policies of the TSXV, the

Company also received the requisite consent from the majority of

disinterested shareholders (which excluded the 133,095,158

Quisitive Shares held by the Acquiror) by written resolution

approving the proposed Transaction. Closing of the Transaction is

subject to the final approval of the TSXV (including payment of the

finder’s fees), which is subject to the completion of customary

requirements, including the receipt of all required documentation.

Closing of the Transaction is also subject to receipt of

third-party consents together with other customary closing

conditions of a transaction of this nature.

The Acquiror is considered a “related party” of

Quisitive by virtue of its beneficial ownership of, or control or

direction over, directly or indirectly, 133,095,158 Quisitive

Shares, which represents approximately 33% of the issued and

outstanding Quisitive Shares, and therefore the Transaction is a

“related party transaction” pursuant to Multilateral Instrument

61-101 – Protection of Minority Security Holders in Special

Transactions (“MI 61-101”). The Company will

be exempt from the requirements to obtain a formal valuation or

minority shareholder approval in connection with Transaction in

reliance of sections 5.5(b) and 5.7(1)(e) of MI 61-101. A material

change report will be filed in connection with Transaction less

than 21 days in advance of the closing of the Transaction, which

the Company deemed reasonable in the circumstances so as to be able

to complete the Transaction in an expeditious manner.

Advisors

William Blair & Company, L.L.C. acted as

financial advisor and Bass, Berry & Sims PLC and Cassels Brock

& Blackwell LLP acted as legal counsel to the Company in

connection with the Transaction. Stikeman Elliott LLP and Shearman

& Sterling LLP acted as legal counsel to the Acquiror.

McDermott Will & Emery LLP acted as legal counsel to the

Lenders.

Corporate Updates

The Company is also pleased to announce the

appointment of Nick Lim as Chair of the Board. Mr. Lim was first

appointed as an independent director of the Company on October 12,

2023.

Fiscal Year 2023 and 2024

Guidance

Quisitive is providing the following guidance

for fiscal years 2023 and 2024:

|

|

Low (US$) |

High (US$) |

| Fiscal Year 2023 Revenue |

121,000,000 |

121,400,000 |

| Fiscal Year 2023 Pro Forma

Adjusted EBITDA |

16,200,000 |

16,600,000 |

| Fiscal Year 2024 Revenue |

123,000,000 |

137,000,000 |

| Fiscal Year 2024 Pro Forma

Adjusted EBITDA |

15,000,000 |

18,000,000 |

The Revenue and Pro Forma Adjusted EBITDA for

fiscal year 2023 are based on the assumption that both the

Transaction and the divestiture of PayiQ, which was completed in

January 2024, were finalized on January 1, 2023. This calculation

only includes outcomes for the remaining Cloud segment and

corporate expenses. For fiscal year 2024, the Revenue and Pro Forma

Adjusted EBITDA projections also assume the completion of the

Transaction and the divestiture of PayiQ on December 31, 2023,

focusing solely on financial forecasts for the remaining Cloud

segment and corporate costs.

Loan Facility

Quisitive also announced that it has signed a

term sheet with respect to a proposed second amendment and

restatement to its existing credit facility (the

“Quisitive Credit Facility”) with

a syndicate of institutions led by Bank of Montreal and including

Desjardins Capital Markets that, among other things, will provide

for a reduction of the Company’s: (i) term loan credit facility

from approximately US$68.6 million to US$34 million; and (ii)

revolving loan credit facility from US$5 million to US$3.5 million.

The amendment to the Quisitive Credit Facility will result in a

significant reduction of interest payments owed by the Company. A

portion of the cash proceeds to be received from the sale of

BankCard will be used to partially repay the existing Quisitive

Credit Facility, which is expected to occur concurrently on

completion of the Transaction.

About Quisitive:Quisitive

(TSXV: QUIS, OTCQX: QUISF) is a premier, global Microsoft partner

leveraging the power of the Microsoft cloud platform and artificial

intelligence, alongside custom and proprietary technologies, to

drive transformative outcomes for its customers. Our Cloud

Solutions business focuses on helping enterprises across industries

leverage the Microsoft platform to adopt, innovate, and thrive in

the era of AI. For more information, visit www.Quisitive.com and

follow @BeQuisitive.

Quisitive Investor ContactMatt Glover and John

YiGateway Investor RelationsQUIS@gatewayir.com 949-574-3860

Tami AndersChief of Stafftami.anders@quisitive.com

972.573.0995

Reconciliation of Non-GAAP Financial Measures - Adjusted

EBITDA

There are measures included in this news release

that do not have a standardized meaning under generally accepted

accounting principles (GAAP) and therefore may not be comparable to

similarly titled measures and metrics presented by other publicly

traded companies. The Company includes these measures because it

believes certain investors use these measures and metrics as a

means of assessing financial performance. EBITDA (earnings before

interest, taxes, depreciation and amortization is calculated as net

earnings before finance costs (net of finance income), income tax

expense, and depreciation and amortization of intangibles) is a

non-GAAP financial measure that does not have any standardized

meaning prescribed by IFRS and may not be comparable to similar

measures presented by other companies. We prepare and release

quarterly unaudited and annual audited financial statements

prepared in accordance with IFRS. We also disclose and discuss

certain non-GAAP financial information, used to evaluate our

performance, in this and other releases and investor conference

calls as a complement to results provided in accordance with IFRS.

We believe that current shareholders and potential investors in the

Company use non-GAAP financial measures, such as Adjusted EBITDA in

making investment decisions about the Company and measuring our

operational results. The term "Adjusted EBITDA" refers to a

financial measure that we define as earnings before certain charges

that management considers to be non-operating expenses and which

consist of interest, taxes, depreciation, amortization, stock-based

compensation (for which we include related fees and taxes), changes

in fair value of derivatives, transaction, acquisition and

disposition related expenses, US payroll protection plan loan

forgiveness, earn-out settlement losses and non-recurring

development costs associated with obtaining bank sponsorship and

operational certifications. Management believes that investors and

financial analysts measure our business on the same basis, and we

are providing the Adjusted EBITDA financial metric to assist in

this evaluation and to provide a higher level of transparency into

how we measure our own business. However, Adjusted EBITDA is a

non-GAAP financial measure and may not be comparable to similarly

titled measures reported by other companies. Adjusted EBITDA should

not be construed as a substitute for net income determined in

accordance with IFRS or other non-GAAP measures that may be used by

other companies, such as EBITDA. The use of Adjusted EBITDA does

have limitations. As these acquisition- and disposition-related

expenses charges may continue as we pursue our business strategy,

some investors may consider these charges and expenses as a

recurring part of operations rather than expenses that are not part

of operations.

Cautionary Note Regarding Forward Looking

Information

This news release contains certain

“forward‐looking information” and “forward‐looking statements”

(collectively, “forward‐looking statements”) within the meaning of

applicable Canadian securities legislation regarding Quisitive and

its business. Any statement that involves discussions with respect

to predictions, expectations, beliefs, plans, projections,

objectives, assumptions, future events or performance (often but

not always using phrases such as “expects”, or “does not expect”,

“is expected”, “anticipates” or “does not anticipate”, “plans”,

“budget”, “scheduled”, “forecasts”, “estimates”, “believes” or

“intends” or variations of such words and phrases or stating that

certain actions, events or results “may” or “could”, “would”,

“might” or “will” be taken to occur or be achieved) are not

statements of historical fact and may be forward‐looking

statements. Forward‐ looking statements are necessarily based upon

a number of estimates and assumptions that, while considered

reasonable, are subject to known and unknown risks, uncertainties,

and other factors which may cause the actual results and future

events to differ materially from those expressed or implied by such

forward‐looking statements. These forward-looking statements

include, but are not limited to, statements relating to: the

completion of the Transaction; the final approval of the

Transaction by the TSXV; the anticipated benefits of the

Transaction to Quisitive and its shareholders; the future growth

potential of the Company on a post-Transaction basis; the financial

outlook of the Company on a post-Transaction basis; the possible

impact of any potential transactions referenced herein on the

Company's shareholders and any potential future arrangements and

engagements in regards to any such potential transactions;

execution of definitive agreements with respect to the BUSA Credit

Facilities and the Quisitive Credit Facility and closing of the

transactions contemplated therein; possibility of improved future

market conditions; and future financial performance.

These forward-looking statements are based on

reasonable assumptions and estimates of management of the Company

at the time such statements were made. Actual future results may

differ materially as forward-looking statements involve known and

unknown risks, uncertainties and other factors which may cause the

actual results, performance or achievements of the Company to

materially differ from any future results, performance or

achievements expressed or implied by such forward-looking

statements. Such factors, among other things, include: the expected

results from the completion of the Transaction; fluctuations in

general macroeconomic conditions; fluctuations in securities

markets; the Company’s limited operating history; future capital

needs and uncertainty of additional financing; the competitive

nature of the technology industry; unproven markets for the

Company’s product offerings; lack of regulation and customer

protection; the need for the Company to manage its future strategic

plans; the effects of product development and need for continued

technology change; protection of proprietary rights; network

security risks; the ability of the Company to maintain properly

working systems; foreign currency trading risks; use and storage of

personal information and compliance with privacy laws; use of the

Company’s services for improper or illegal purposes; global

economic and financial market conditions; uninsurable risks;

changes in project parameters as plans continue to be evaluated;

and those factors described under the heading "Risks Factors" in

the Company's annual information form dated May 23, 2023 available

on SEDAR+ at www.sedarplus.ca. Although the forward-looking

statements contained in this news release are based upon what

management of the Company believes, or believed at the time, to be

reasonable assumptions, the Company cannot assure shareholders that

actual results will be consistent with such forward-looking

statements, as there may be other factors that cause results not to

be as anticipated, estimated or intended. Accordingly, readers

should not place undue reliance on forward-looking statements and

information. There can be no assurance that forward-looking

information, or the material factors or assumptions used to develop

such forward-looking information, will prove to be accurate. The

Company does not undertake any obligations to release publicly any

revisions for updating any voluntary forward-looking statements,

except as required by applicable securities law.

This news release also contains future-oriented

financial information and financial outlook information (together,

“FOFI”) about the Company’s prospective results of operations,

including statements regarding expected pro-forma Adjusted EBITDA

following the completion of the Transaction. FOFI is subject to the

same assumptions, risk factors, limitations and qualifications as

set forth in the above paragraph. The Company has included the FOFI

to provide an outlook of management’s expectations regarding the

Company on a post-Transaction basis and other anticipated

activities and results, and such information may not be appropriate

for other purposes. The Company and management believe that the

FOFI has been prepared on a reasonable basis, reflecting

management’s reasonable estimates and judgements; however, actual

results of operations and the resulting financial results may vary

from the amounts set forth herein. Any financial outlook

information speaks only as of the date on which it is made and the

Company undertakes no obligation to publicly update or revise any

financial outlook information except as required by applicable

securities laws.

Neither the TSXV nor its Regulation Services

provider (as that term is defined in the policies of the TSXV)

accepts responsibility for the adequacy or accuracy of this

release.

Additional Early Warning Disclosure

In connection with the execution and delivery of

the Agreement and in order to give effect to the Transaction in

accordance with the terms of the Agreement, Shawn Skelton, Jason

Hardy, Scott Hardy, Felix Danciu, Elmcore Group Inc., Vijay Jog,

William Hui-Chung Chang, Gary Prioste and certain affiliated

entities and related persons (collectively, the “BUSA

Stockholders”), have entered into certain related

agreements in support of the Transaction, including a contribution

and transfer agreement and a stockholders’ agreement pertaining to,

among other things, the capitalization of the Acquiror, BUSA

Holdings Corp. (“BUSA Holdings”) and certain

post-closing governance arrangements following the completion of

the Transaction.

Prior to the capitalization of the Acquiror in

accordance with the terms of the contribution and transfer

agreement, the Acquiror did not beneficially own, or exercise

control or direction over, directly or indirectly, any Common

Shares of Quisitive. Following the capitalization and transfer of

the Quisitive Shares to the Acquiror by the BUSA Stockholders and

as of the date of this press release, the Acquiror beneficially

owned, or exercised control or direction over, directly or

indirectly, the Quisitive Shares previously beneficially owned, or

over which control or direction was exercised, directly or

indirectly by the BUSA Stockholders, representing approximately 33%

of the issued and outstanding common shares of Quisitive on a

non-diluted basis. Assuming completion of the Transaction, all of

the Quisitive Shares will be delivered and returned by the Acquiror

to Quisitive Payment Solutions, Inc. in accordance with the terms

of the Agreement and thereafter, neither Acquiror, BUSA Holdings

nor any BUSA Stockholder anticipates beneficially owning, or

exercising control or direction over, directly or indirectly, any

Common Shares of Quisitive.

The address and head office of the Acquiror is

located at 2625 Townsgate Road, Suite 100, Westlake Village, CA

91361, USA. An early warning report has or will be filed by the

Acquiror, on behalf of itself and its joint actors, BUSA Holdings

and the BUSA Stockholders, in accordance with applicable securities

laws and will be available on SEDAR+ at www.sedarplus.ca or may be

obtained directly from the Acquiror upon request. To obtain a copy

of the early warning report, please contract Felix Danciu at

+1.312.488.4008, Fax: +1.312.561.3134, Email:

felix.danciu@elmcore.com.

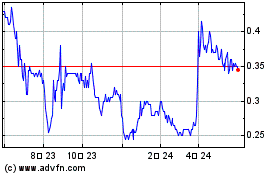

Quisitive Technology Sol... (TSXV:QUIS)

過去 株価チャート

から 10 2024 まで 11 2024

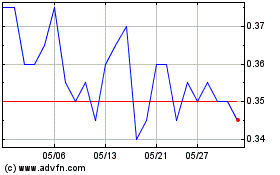

Quisitive Technology Sol... (TSXV:QUIS)

過去 株価チャート

から 11 2023 まで 11 2024