NOT FOR DISTRIBUTION TO UNITED STATES

NEWSWIRE SERVICES OR FOR DISSEMINATION IN UNITED

STATES

Metalla Royalty & Streaming Ltd.

(“

Metalla” or the “

Company”)

(TSXV: MTA) (OTCQX: MTAFF) (FRANKFURT: X9CP) is pleased to announce

that the Company has entered into a definitive agreement (the

"

Royalty Purchase Agreement") to acquire from

Patagonia Gold S.A. ("

Patagonia Gold”) a 1.5% net

smelter return royalty (the "

Royalty") for $1.5

million in cash (the “

Royalty Transaction”). The

Royalty is in connection with certain mining rights located on the

Cap-Oeste Sur East property located in the province of Santa Cruz,

Argentina (the "

COSE Property") and includes a net

smelter return on all products mined or otherwise recovered from

the COSE Property.

The COSE Property is a gold and silver project

that is 100% owned by Minera Triton Argentina S.A. (the

“Royalty Payor”), a wholly-owned subsidiary of Pan

American Silver Corp (“Pan American Silver”)

(NASDAQ: PAAS; TSX: PAAS).

Brett Heath, President, and CEO of Metalla

commented, “Metalla is pleased to add another producing royalty on

a high-grade deposit with proven operator Pan American Silver. This

acquisition consolidates royalties on two separate properties (COSE

and previously acquired Joaquin) that represents all of the future

growth at Pan American Silver’s Manantial Espejo mine complex.” Mr.

Heath continued, “The royalty complements our existing portfolio,

will increase our cash flow, and will further enhance our strong

growth profile. This is consistent with our long-stated strategy of

acquiring existing royalties on quality assets with tier-one

operators.”

COSE PROPERTY

The COSE Property is a fully-permitted mine that

has been developed by Pan American Silver at a total cost of $23.9

million, since Pan American Silver acquired the property from

Patagonia Gold for $15 million in May 2017. Pan American Silver

recently reported that COSE project remains on time and within

budget for the commencement of commercial production by the end of

2018. The COSE Property is another high-grade satellite deposit

within trucking distance to Pan American Silver’s Manantial Espejo

mine, offering synergies similar to their Joaquin project on which

Metalla holds a 2.0% NSR royalty.

In 2014, a mineral resource estimate on the COSE

Property (See Note 1) was prepared as summarized below:

|

Category |

Tonnes (T) |

Grade (g/t) |

Metal (Ozs) |

|

Au (Gold)

Estimate |

|

|

|

|

Indicated |

49,000 |

27.8 |

44,000 |

|

Inferred |

20,000 |

12.5 |

8,000 |

|

Ag (Silver)

Estimate |

|

|

|

|

Indicated |

49,000 |

1,466 |

2,325,000 |

|

Inferred |

20,000 |

721 |

464,000 |

|

Au Equivalent

Estimate(2) |

|

|

|

|

Indicated |

49,000 |

52.2 |

83,000 |

|

Inferred |

20,000 |

24.5 |

16,000 |

(2) Au Equivalent (g/t) = Au (g/t) +

Ag(g/t)/60

ROYALTY PURCHASE AGREEMENT

Pursuant to the Royalty Purchase Agreement, a

wholly-owned Argentinian subsidiary of Metalla (“Metalla

Argentina”) and Patagonia Gold will enter into an

assignment agreement under which the Royalty will be transferred

from Patagonia Gold to Metalla Argentina. Metalla expects to close

the purchase of the Royalty on or about December 21, 2018. The

Royalty Purchase Agreement also includes a right of first refusal

in favour of Metalla to acquire a future net smelter returns

royalty that may be granted by, or received by, Patagonia Gold (or

an affiliate of Patagonia Gold) on its Cap-Oeste mine and

surrounding property.

PRIVATE PLACEMENT

Metalla is also pleased to announce it has

entered into an agreement with Haywood Securities Inc.

("Haywood"), as lead agent on behalf of a

syndicate of agents including PI Financial Corp. and

Canaccord Genuity Corp., (together with Haywood, the

"Agents"), in connection with a "best efforts"

private placement offering (the "Offering") of up

to 3,846,153 units (the "Units") of the Company,

at a price of C$0.78 per Unit (the "Issue Price"),

for gross proceeds to the Company of up to C$3,000,000. Each Unit

will consist of one common share in the capital of the Company (a

“Common Share”) and one-half of one Common Share

purchase warrant (each whole Common Share purchase warrant, a

"Warrant"). Each Warrant will entitle the holder

thereof to acquire one Common Share of the Company at a price of

C$1.17 for a period of 24 months from the closing of the Offering

(the “Closing”). In the event that the closing

price of the Common Shares on the TSX Venture Exchange

(“TSXV”) (or other stock exchange) is greater than

C$1.50 per Common Share for a period of 10 consecutive trading days

at any time after the Closing, the Company may accelerate the

expiry date of the Warrants by written notice (or by way of news

release in lieu of written notice) to the holders of the Warrants

and in such case the Warrants will expire on the 30th day after the

date of such notice.

The Company has agreed to grant the Agents an

over-allotment option (the “Agents’ Option”) at

the Issue Price, to purchase up to 1,923,076 additional Units, on

the same terms and conditions as the Offering, increasing the size

of the Offering to a maximum of C$4,500,000 gross proceeds to the

Company. The Agents’ Option may be exercised in whole or in part at

any time up to 48 hours prior to Closing.

The Company has agreed to pay to the Agents a

cash fee in an amount equal to 6.0% of the gross proceeds of the

Offering, excluding any proceeds raised from a president’s list of

subscribers for up to a maximum of C$2 million in Units (the

“President’s List Subscribers”), in respect of

which the Company agrees to pay a cash fee equal to 3.0% of the

aggregate proceeds raised from such President’s List Subscribers.

The Company has also agreed to issue compensation options to the

Agents entitling the Agents to purchase that number of Common

Shares equal to 6.0% of the aggregate number of Units issued under

the Offering with an exercise price per Common Share that is equal

to the Issue Price until the date that is 24 months after the

Closing (other than with respect to President’s List Subscribers,

for which the number of compensation options issuable shall be

reduced to 3.0%).

The net proceeds received by the Company from

the Offering will be used to finance the Royalty Transaction and

other royalty and stream acquisitions. The Offering is integral to

the Royalty Transaction, and therefore the Company expects to rely

on the 'part and parcel pricing' exemption allowed by the TSXV.

The closing of the Offering is expected to occur

on or about December 21, 2018, and is subject to the receipt of any

necessary regulatory approvals, including the approval of the TSXV.

All securities issued in connection with the Offering will be

subject to a statutory four-month hold period.

The securities to be offered pursuant to the

Offering have not been, and will not be, registered under the U.S.

Securities Act of 1933, as amended (the "U.S. Securities

Act"), or any U.S. state securities laws, and may not be

offered or sold to, or for the account or benefit of, persons in

the United States or U.S. persons (as such term is defined in

Regulation S promulgated under the U.S. Securities Act), absent

registration or any applicable exemption from the registration

requirements of the U.S. Securities Act and applicable U.S. state

securities laws. This news release shall not constitute an offer to

sell or the solicitation of an offer to buy securities to, or for

the account or benefit of, persons in the United States or U.S.

persons, nor shall there be any sale of these securities in any

jurisdiction in which such offer, solicitation or sale would be

unlawful.

LOAN AGREEMENT

Metalla has increased its previously announced

(November 7th, 2018) syndicated loan agreement with a group of

arm’s length lenders (the “Lenders”) by $250,000

(the “Loan”) for total proceeds of $2,000,000. The

proceeds from the Loan will be used to fund royalty

acquisitions.

Terms of the Loan include interest at a rate of

5.0% per annum, calculated annually, and a term one year from the

date of the advance of the Loan (the "Maturity

Date") with early repayment provisions. As an inducement

for providing the Loan, Metalla has agreed to provide the Lenders a

3% origination discount and, subject to the approval of the

Exchange, to issue an aggregate of 75,000 non-transferable common

share purchase warrants (the “Loan Warrants”).

Each Loan Warrant will entitle the holder to acquire one common

share of Metalla at an exercise price of C$0.85 for a period of two

years. The Company has also granted as collateral to the Lender, a

corporate guarantee on a wholly-owned subsidiary of Metalla.

QUALIFIED PERSON

The technical information contained in this news

release has been reviewed and approved by Charles Beaudry,

geologist M.Sc., member of the Association of Professional

Geoscientists of Ontario and the Ordre des Géologues du Québec and

a consultant to Metalla. Mr. Beaudry is a Qualified Person as

defined in “National Instrument 43-101 Standards of disclosure for

mineral projects”.

ABOUT METALLA

Metalla is a precious metals royalty and

streaming company. Metalla provides shareholders with leveraged

precious metal exposure through a diversified and growing portfolio

of royalties and streams. Our strong foundation of current and

future cash-generating asset base, combined with an experienced

team gives Metalla a path to become one of the leading gold and

silver companies for the next commodities cycle.

For further information, please visit our

website at www.metallaroyalty.com

ON BEHALF OF METALLA ROYALTY &

STREAMING LTD.

(signed) “Brett Heath”

President and CEO

CONTACT INFORMATION

Metalla Royalty & Streaming Ltd.

Brett Heath, President & CEOPhone: 604-696-0741Email:

info@metallaroyalty.com

Kristina Pillon, Investor RelationsPhone:

604-908-1695Email: kristina@metallaroyalty.com

Website: www.metallaroyalty.com

Neither the TSXV nor its Regulation Services

Provider (as that term is defined in the policies of the Exchange)

accept responsibility for the adequacy or accuracy of this

release.

Technical and Third-Party

Information

Note 1 – See technical report titled "COSE

Gold-Silver Project" dated October 29, 2014, and prepared by Brian

Fitzpatrick, BSc, and MAusIMM of Cube Consulting Pty Ltd for

Patagonia Gold PLC (the effective date of the mineral resource

estimate is August 22, 2014) (the “COSE Technical

Report”). Mineral resources which are not mineral

reserves do not have demonstrated economic viability. The estimate

of mineral resources may be materially affected by environmental,

permitting, legal, title, taxation, sociopolitical, marketing, or

other relevant issues. The mineral resources in this estimate were

calculated in accordance with the Australasian Code for Reporting

of Exploration Results, Mineral Resources and Ore Reserves prepared

by the Joint Ore Reserves Committee of the Australasian Institute

of Mining and Metallurgy, Australian Institute of Geoscientists and

Minerals Council of Australia. For more information about

this mineral resource estimate and other technical and scientific

aspects of the COSE Property, including, without limitation, key

assumptions, parameters and risks associated with the COSE Property

refer to the COSE Technical Report, a copy of which can be

obtained from the Company on request.

Cautionary Note Regarding

Forward-Looking Statements

This press release contains “forward-looking

information” and “forward-looking statements” within the meaning of

applicable Canadian and U.S. securities legislation. The

forward-looking statements herein are made as of the date of this

press release only, and the Company does not assume any obligation

to update or revise them to reflect new information, estimates or

opinions, future events or results or otherwise, except as required

by applicable law.

Often, but not always, forward-looking

statements can be identified by the use of words such as “plans”,

“expects”, “is expected”, “budgets”, “scheduled”, “estimates”,

“forecasts”, “predicts”, “projects”, “intends”, “targets”, “aims”,

“anticipates” or “believes” or variations (including negative

variations) of such words and phrases or may be identified by

statements to the effect that certain actions “may”, “could”,

“should”, “would”, “might” or “will” be taken, occur or be

achieved. Forward-looking statements and information include, but

are not limited to, statements with respect to the transactions

contemplated under the Royalty Purchase Agreement, Loan Agreement,

and Offering, anticipated cash flows upon completion of the Royalty

Transaction, Loan Agreement and Offering, the completion of the

Royalty Transaction, the Loan Agreement and the Offering and

proposed future transactions Metalla may undertake and their

expected timing. Forward-looking statements and information are

based on forecasts of future results, estimates of amounts not yet

determinable and assumptions that, while believed by management to

be reasonable, are inherently subject to significant business,

economic and competitive uncertainties, and contingencies.

Forward-looking statements and information are subject to various

known and unknown risks and uncertainties, many of which are beyond

the ability of Metalla to control or predict, that may cause

Metalla's actual results, performance or achievements to be

materially different from those expressed or implied thereby, and

are developed based on assumptions about such risks, uncertainties

and other factors set out herein, including but not limited to: the

requirement for regulatory approvals and third party consents, the

impact of general business and economic conditions, the absence of

control over the mining operations from which Metalla will purchase

gold and receive royalties, including risks related to

international operations, government relations and environmental

regulation, the inherent risks involved in the exploration and

development of mineral properties; the uncertainties involved in

interpreting exploration data; the potential for delays in

exploration or development activities; the geology, grade and

continuity of mineral deposits; the possibility that future

exploration, development or mining results will not be consistent

with Metalla's expectations; accidents, equipment breakdowns, title

matters, labor disputes or other unanticipated difficulties or

interruptions in operations; fluctuating metal prices;

unanticipated costs and expenses; uncertainties relating to the

availability and costs of financing needed in the future; the

inherent uncertainty of production and cost estimates and the

potential for unexpected costs and expenses, commodity price

fluctuations; currency fluctuations; regulatory restrictions,

including environmental regulatory restrictions; liability,

competition, loss of key employees and other related risks and

uncertainties. Metalla undertakes no obligation to update

forward-looking information except as required by applicable law.

Such forward-looking information represents management's best

judgment based on information currently available. No

forward-looking statement can be guaranteed, and actual future

results may vary materially. Accordingly, readers are advised not

to place undue reliance on forward-looking statements or

information. Some of the disclosure in this press release is based

on information publicly disclosed by the owners or operators of

these properties and information/data available in the public

domain as at the date hereof, and none of this information has been

independently verified by Metalla.

Readers are cautioned that forward-looking

statements are not guarantees of future performance. All of the

forward-looking statements made in this press release are qualified

by these cautionary statements.

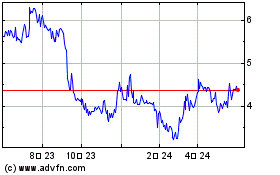

Metalla Royalty and Stre... (TSXV:MTA)

過去 株価チャート

から 12 2024 まで 1 2025

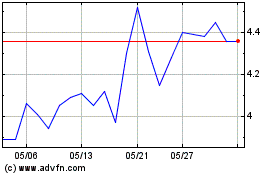

Metalla Royalty and Stre... (TSXV:MTA)

過去 株価チャート

から 1 2024 まで 1 2025