GreenPower Reports First Quarter Results With a Record of 88 All-Electric Buses in Production

2019年8月27日 - 9:59AM

GreenPower Motor Company Inc. (TSXV: GPV) (OTCQX: GPVRF)

(“GreenPower” or the “Company”), a leading designer, manufacturer,

and distributer of a range of all-electric buses, today announced

results for its first quarter ended June 30, 2019.

Quarterly and Recent Highlights:

- Reported revenue of $2.4 million for the quarter and a gross

profit of $0.7 million – representing a gross margin of 30%

- During the quarter the Company delivered three EV Stars to

Sacramento Regional Transit and received a follow-on order for

three EV Star Plus buses with wheelchair lifts and other ADA

features. The Company also delivered one EV350 to Porterville and

two EV Stars to San Diego Airport Parking Company

- Finished the first quarter with $7.9 million of inventory due

to a record level of production with 88 all-electric buses in

various stages of production or in finished goods

- Improved working capital to $2.8 million at the end of the

quarter

- In April filed the initial application to uplist to the NASDAQ

stock exchange

- In May closed an equity financing for gross proceeds of $4

million

- In July delivered the first ten EV Stars to Creative Bus Sales,

the largest bus distributor in the US, delivered the first three EV

Stars to Green Commuter, and delivered an EV Star to Sacramento

Regional Transit

- In August GreenPower delivered another five all-electric

buses

“I am pleased to report that GreenPower had a

record number of 88 all-electric buses in production at the end of

the quarter,” said Fraser Atkinson, Chairman and CEO of GreenPower

Motor Company. “The Company continued to execute on its previously

stated goals during the quarter as we increased the utilization of

our manufacturing facilities in California, raised $4 million in an

equity financing to fuel top line growth, and significantly

increased production. Moving forward, we remain optimistic about

the company’s prospects as we are focused on ramping up vehicle

deliveries, rapidly scaling the business, improving our financial

position and continue to work towards uplisting to the NASDAQ stock

exchange later this year.”

Results for the Quarter Ended June 30, 2019

The Company reported quarterly revenue of over

$2.4 million versus $2.5 million for the prior-year period. Revenue

from vehicle sales and vehicle leases was generated from the sale

of one EV 350 and five EV Stars, two of which were accounted for as

finance leases, as well as revenue from the sale of vehicle

chargers and other sources. Gross profit for the quarter was $0.7

million or 30% of revenues. The Company reported a consolidated net

loss for the quarter of $1.3 million or $0.01 per share.

For further information

contact:

Fraser AtkinsonChairman and CEO(604) 220-8048

Michael SieffertCFO(604) 563-4144

GreenPower Investor RelationsChris Witty(646) 438-9385

About GreenPower Motor Company

Inc.

GreenPower designs, builds and distributes a

full suite of high-floor and low-floor vehicles, including transit

buses, school buses, shuttles, a cargo van and a double

decker. GreenPower employs a clean-sheet design to

manufacture all-electric buses that are purpose built to be battery

powered with zero emissions. GreenPower integrates global suppliers

for key components, such as Siemens or TM4 for the drive motors,

Knorr for the brakes, ZF for the axles and Parker for the dash and

control systems. This OEM platform allows GreenPower to meet the

specifications of various operators while providing standard parts

for ease of maintenance and accessibility for warranty

requirements. For further information go to

www.greenpowerbus.com

Forward-Looking Statements

This Press release contains “forward- looking

statements.” Statements in this news release that are not purely

historical are forward-looking statements and include any

statements regarding beliefs, plans, expectations or intentions

regarding the future. Such forward looking statements include,

among other things, the following: that the Company will ramp up

vehicle deliveries, rapidly scale our business, improve our

financial prospects and continue to work towards uplisting to the

NASDAQ stock exchange. The material assumptions supporting

these forward-looking statements include, among others, that the

demand for the Company’s products will continue to significantly

grow; that the production capacity of the Company can be increased

as planned; that the suppliers of materials will be able to satisfy

the increased demand; that there will not be interruptions on

production of the Company’s products; that there will not be a

significant increase in the direct production costs for the

Company’s products; that the Company will not be faced with

significant increases in its overhead, general and administrative

costs; that there will not be a recall of products due to adverse

events relating to the Company’s products; and that the Company

will be able to obtain additional capital to meet the Company’s

growing demand and satisfy the financial requirements needed to

list on NASDAQ. Actual results could differ from those projected in

any forward-looking statements due to numerous factors. Such

factors include, among others: the risk that government policies or

laws may change and that additional governmental regulations may be

implemented regarding the production and sale of electric vehicles;

the risk that purchasers may not purchase the Company’s EV

products; the risk that there may be additional competitors selling

EV products; the risk that the Company will not be able to deliver

completed buses on time; the risk that the Company’s clients will

not default on their purchase terms; the risk that governmental

regulations and taxation will change to adversely affect the

Company’s business and financial results; the risk that government

grants that reduce the cost of purchasing electric vehicles will be

reduced, cancelled, or delayed; the risk that the Company has a

limited number of suppliers; the potential for supply-chain

interruption due to factors beyond the Company’s control; the risk

that there may be a recall of products; the inherent uncertainties

associated with operating as an early-stage company; the Company’s

ability to raise the additional funding that it will need to

continue to pursue its business, planned capital expansion and

sales activity; general economic conditions in Canada, the United

States, China and globally; transportation industry conditions;

potential delays or changes in plans with respect to deployment of

services or capital expenditures; availability of sufficient

financial resources to pay for the development and costs of the

Company’s products; competition for, among other things, capital

and skilled personnel; changes in economic and market conditions

that could lead to reduced spending on green energy initiatives;

competition in our target markets; management of future growth and

expansion; the development, implementation and execution of the

Company’s strategic vision; risk of third-party claims of

infringement; legal and/or regulatory risks relating to the

Company’s business and strategic acquisitions; protection of

proprietary information; the success of the Company’s brand

development efforts; risks associated with strategic alliances;

reliance on distribution channels; product concentration; the

Company’s ability to hire and retain qualified employees and key

management personnel. These forward-looking statements are made as

of the date of this news release, and the Company assumes no

obligation to update the forward-looking statements, or to update

the reasons why actual results could differ from those projected in

the forward-looking statements, except as required by applicable

law, including the securities laws of the United States and Canada.

Although the Company believes that any beliefs, plans, expectations

and intentions contained in this news release are reasonable, there

can be no assurance that any such beliefs, plans, expectations or

intentions will prove to be accurate. Readers should consult all of

the information set forth herein and should also refer to the risk

factors disclosure outlined in the reports and other documents the

Company files with on the SEDAR, available at www.sedar.com

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release. All amounts in U.S.

dollars. © 2019 GreenPower Motor Company Inc. All rights

reserved.

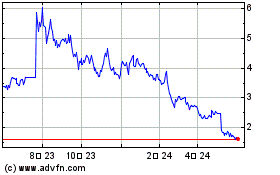

GreenPower Motor (TSXV:GPV)

過去 株価チャート

から 11 2024 まで 12 2024

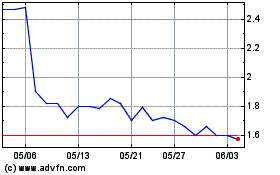

GreenPower Motor (TSXV:GPV)

過去 株価チャート

から 12 2023 まで 12 2024