Athabasca Minerals Inc. (“AMI” or the “Corporation”) – TSXV:AMI –

is pleased to announce a non-brokered private placement (the

“Private Placement”) of $1,480,000 based on the issuance of

9,866,668 common shares (the “Common Shares”) at a premium price of

$0.15 per Common Share.

HIGHLIGHTS:

- The Private

Placement, priced at $0.15/share, represents a 30% premium to the

market’s last closing price of AMI, with no finders-fee

payable.

- The Private

Placement is anchored by JMAC Resources Ltd. (“JMAC”) as lead

investor, where Mr. Jon McCreary, CEO of JMAC, is also appointed to

AMI’s Board of Directors.

- Insider ownership

of the Corporation’s Common Shares has increased to 22.5% (from

previously 8.1%) based on contributions from officers, existing

Board Directors, and recognizing Mr. McCreary’s new Board

appointment.

-

Proceeds from the Private Placement will be primarily used to

advance Front-End Engineering & Development (“FEED”) activities

for the Duvernay Sand Project (“Duvernay Project”) and for general

corporate purposes.

- Turn-key Processing

Solutions (“TPS”), the design-build contractor currently conducting

the FEED for the Duvernay Project, is also participating in the

Private Placement.

MERITS OF THE PRIVATE

PLACEMENT:

The Duvernay Project, which resides under the

Corporation’s wholly-owned subsidiary, AMI Silica Inc., is making

meaningful progress with FEED, on what aims to be one of the

greenest sand processing operations in North America, in

conjunction with its international industrial partner. As project

activities ramp up toward Final Investment Decision (“FID”),

planned in 1H-2021, this Private Placement primarily supports AMI’s

contribution to associated FEED expenditures, and to a lesser

extent for general corporate purposes.

JMAC, the Canadian affiliate of JMAC Resources

Inc. in the United States, has subscribed to receiving 6,666,667

Common Shares based on gross proceeds of $1,000,000, pursuant to

the terms of a subscription agreement. At closing of the Private

Placement, JMAC’s ownership of AMI’s outstanding Common Shares will

represent a 13.5% stake in the Corporation.

The Private Placement is further supported by

TPS, an experienced design-build contractor headquartered in

Franklin, Tennessee, with extensive background in engineering,

constructing and operating numerous silica production facilities in

North America totaling over 30 million tons in annual capacity.

Current insiders of the Corporation (not

including Mr. McCreary’s interest on behalf of JMAC) collectively

subscribed to receiving 1,316,668 Common Shares based on gross

proceeds of $197,500 pursuant to the terms of a subscription

agreement. Participation by the Insiders in the Private Placement

was considered a “related party transaction” pursuant to

Multilateral Instrument 61-101 – Protection of Minority Security

Holders in Special Transactions (“MI 61-101”). The Corporation was

exempt from the requirements to obtain a formal valuation or

minority shareholder approval in connection with the Insiders’

participation in the Private Placement in reliance of sections

5.5(a) and 5.7(1)(a) of MI 61-101. A material change report was

filed in connection with the participation of Insiders in the

Private Placement less than 21 days in advance of the closing of

the Private Placement, which the Corporation deemed reasonable in

the circumstances so as to be able to avail itself of potential

financing opportunities and complete the Private Placement in an

expeditious manner.

All securities issued in connection with the

Private Placement will be subject to a statutory four-month and

one-day hold period under applicable Canadian securities laws. The

Private Placement remains subject to receipt of all necessary

regulatory and other approvals, including the final approval of the

TSX Venture Exchange. Any securities issued have not been and will

not be registered under the United States Securities Act of 1933,

as amended (the “U.S. Securities Act”) or any state securities laws

and may not be offered or sold within the United States or to U.S.

Persons unless registered under the U.S. Securities Act and

applicable state securities laws or an exemption from such

registration is available.

Mark Smith, the Corporation’s Chief Financial

Officer, stated: “We are very pleased with the results of the

Private Placement initiative. The strong support and response to

achieve $1.48 million financing at a 30% premium to the previous

day market closing price for AMI stock recognizes the merits of the

Corporation’s strategic initiatives. With this capital investment,

Athabasca is well-positioned to advance the FEED toward FID for the

Duvernay Project with a solid balance sheet.”

BOARD APPOINTMENT (MR. JON

MCCREARY)

The Corporation is additionally pleased to

announce that Mr. Jon McCreary, CEO of JMAC Resources Inc, and its

affiliate JMAC Resources Ltd in Canada, will be joining AMI’s Board

as an independent Director effective November 1, 2020.

Robert Beekhuizen, AMI’s Chief Executive

Officer, stated: “We are excited to have Mr. McCreary joining

Athabasca’s Board at a pivotal stage in the Corporation’s delivery

on its strategic plan. Mr. McCreary has proven industry experience

in successfully building JMAC Resources Inc. in the United States

into a strong company with many synergies and overlapping interests

relevant to AMI’s business model. We look forward to his role on

the Board as we continue to expand and grow AMI’s business

interests in the North American marketplace.”

ABOUT ATHABASCA MINERALS INC.

Athabasca is an integrated group of companies

focused on the aggregates, industrial minerals and resource

sectors, including exploration and development; aggregates

marketing and midstream supply-logistics solutions. Business

activities include aggregate production, sales and royalties from

corporate-owned pits, management services of third-party pits,

acquisitions of sand and gravel operations, integrated

supply/delivery solutions of industrial minerals, and new venture

development. The Corporation is strategically focused on growing

its three core business units: the AMI Aggregates division, the AMI

RockChain division and the AMI Silica division. Management is

continually pursuing opportunities for sustained growth and

diversification in supplying aggregate products and industrial

minerals.

Athabasca’s business is comprised of the

following three reportable segments:

- AMI Aggregates

division produces and sells aggregate out of its corporate pits and

manages the Coffey Lake Public Pit on behalf of the Province of

Alberta for which aggregate management services revenue are

earned.

- AMI Silica division

is positioning to become a leading supplier of premium domestic

silica sand with regional deposits in Alberta and NE British

Columbia. This reporting segment encompasses all silica assets

including Firebag, the Duvernay Project and the Montney In-Basin

Project.

- AMI RockChain

division is a midstream technology-based business using its

proprietary RockChain™ digital platform, associated algorithm and

quality assurance & control services to provide cost-effective

integrated supply / delivery solutions of industrial minerals to

industry, and the construction sector.

- TerraShift

Engineering Ltd. is a newly acquired entity of RockChain. It offers

technology-based applications that support resource exploration and

development, environmental and regulatory engineering, resource

management, compliance reporting, and reclamation for a growing

customer base across Western Canada and Ontario.

For further information, please contact:

- Tanya Finney, Director, Investor and Stakeholder RelationsTel:

587-391-0548 / Email: tanya.finney@athabascaminerals.com

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

FORWARD LOOKING STATEMENTS

This news release contains certain statements or

disclosures relating to Athabasca that are based on the

expectations of its management as well as assumptions made by and

information currently available to Athabasca which may constitute

forward-looking statements or information (“forward-looking

statements”) under applicable securities laws. All such statements

and disclosures, other than those of historical fact, which address

activities, events, outcomes, results or developments that

Athabasca anticipates or expects may, or will occur in the future

(in whole or in part) should be considered forward-looking

statements. In some cases, forward-looking statements can be

identified by the use of the words: “continue”, “estimate”,

“expect”, “may”, “intends”, “will”, “should”, “position”, “to be”,

“can”, “plan”, “believe” and similar expressions.

In particular, but without limiting the

foregoing, this news release contains forward-looking statements

pertaining to the following: closing of the Private Placement; the

ability to raise the capital needed for the development and

advancement of the Duvernay Project; a positive final investment

decision for the Duvernay Project; the completion of the FEED for

the Duvernay Project; the Corporation’s future growth in the North

American marketplace; the Corporation’s ability to become a leading

supplier of premium domestic silica sand; and the expectations for

industry activity, management's assessment of Athabasca’s future

projects and financing plans.

The forward-looking statements contained in this

news release reflect several material factors and expectations and

assumptions of Athabasca including, without limitation: that

Athabasca will continue to conduct its operations in a manner

consistent with past operations; the general continuance of current

or, where applicable, assumed industry conditions; availability of

debt and/or equity sources to fund Athabasca's capital and

operating requirements as needed; and certain cost assumptions.

Athabasca believes the material factors,

expectations and assumptions reflected in the forward-looking

statements are reasonable at this time but no assurance can be

given that these factors, expectations and assumptions will prove

to be correct. The forward-looking statements included in this news

release are not guarantees of future performance and should not be

unduly relied upon. Such forward-looking statements involve known

and unknown risks, uncertainties and other factors that may cause

actual results or events to differ materially from those

anticipated in such forward-looking statements including, without

limitation: a significant expansion in COVID-19 restricting or

prohibiting the operation of the Athabasca’s operations or supply

chain; the duration and extent of the relatively low global oil

prices, development and production in the Western Canadian

Sedimentary Basin; general economic, market and business conditions

including those in the event of an epidemic, natural disaster or

other event; Athabasca may be unable to resolve mechanical or

operational issues in the timelines anticipated, in the manner

anticipated or at all; increased costs and expenses; reliance on

industry partners; and certain other risks detailed from time to

time in Athabasca's public disclosure documents including, without

limitation, those risks identified in this news release, and in

Athabasca's annual information form, copies of which are available

on Athabasca's SEDAR profile at www.sedar.com. Moreover, the

duration and impact of the COVID-19 pandemic is unknown at this

time and it is not possible to reliably estimate the length and

severity of these developments and the impact on the financial

results and condition of the Corporation. Readers are cautioned

that the foregoing list of factors is not exhaustive and are

cautioned not to place undue reliance on these forward-looking

statements.

The forward-looking statements contained in this

news release are made as of the date hereof and the Corporation

undertakes no obligation to update publicly or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise, unless so required by applicable

securities law.

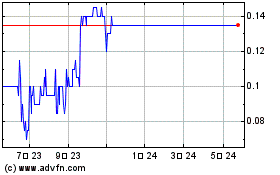

Athabasca Minerals (TSXV:AMI)

過去 株価チャート

から 2 2025 まで 3 2025

Athabasca Minerals (TSXV:AMI)

過去 株価チャート

から 3 2024 まで 3 2025