HIGHLIGHTS

- Confirmation of both epithermal and porphyry gold/copper

potential beyond current resource

- New magnetic high porphyry targets and demagnetized

epithermal target extensions to existing mineral resources have

been identified

- Multiple untested drill target areas demonstrating potential

for expansion of the existing resource and new proximal resource

targets to the existing resource

- Adyton is preparing logistics for immediate follow-up field

work to ground truth targets and fast-track to drilling on the Feni

project, targeting epithermal and porphyry gold/copper

mineralization.

- Fergusson Island JV progressing well, aiming for

mobilization to commence Feasibility Study works

TSX Venture Exchange: ADY

OTC: ADYRF

FSE: 701GR

PORT

MORESBY, Papua New Guinea, June 26,

2024 /CNW/ - Adyton Resources Corporation (TSX: ADY)

is pleased to announce the successful completion of a comprehensive

geophysical review of its Feni Island project in Papua New Guinea (PNG). The review was

conducted by Perth based

specialist geoscientist group Southern Geoscience Consultants (SGC)

and focused on reprocessing historical airborne magnetic and

radiometric data. Significantly, this work defined several

tectono-stratigraphic blocks with distinct magnetic and radiometric

signatures, confirming that epithermal gold and porphyry-style

gold-copper (and associated breccias) are valid exploration

targets. Interpretation of geophysical data has for the first time

identified several high value exploration targets which have never

been drill tested, some of which have associated significant copper

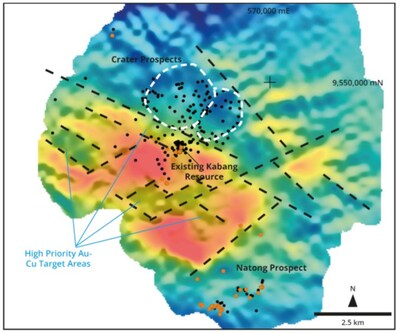

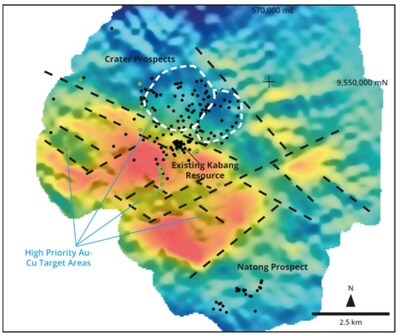

gold mineralization in historical surface rock samples (see Figures

1 and 2).

CEO Statement:

"We are excited with the outcomes of the geophysical review for

Feni Island," said Tim Crossley, CEO

of Adyton Resources. "The integration of historical data with

modern geophysical techniques has significantly enhanced our

understanding of the project's potential. The identification of new

targets and the refinement of existing ones position us strongly

for the next phase of exploration. We are confident that Feni

Island has the potential to become a major gold-copper discovery,

and we are eager to advance our exploration efforts." Mr Crossley

went on to say, "if you look beyond the exploration potential and

think about project development, we really like the ease of access

an island location gives us as well as having both Simberi and

Lihir (both world class island operations nearby) providing an

existing development blueprint".

Adyton Chief Geologist and Director Dr Chris Wilson, BSc (Hons), PhD comments:

"reprocessing of historical airborne magnetic data, in

conjunction with integration of other historical datasets, has

provided significant clarity with respect to the magmatic and

tectonic evolution of Feni and thus mineral deposit target type.

Magnetic signatures define: 1) a central graben or down-faulted

corridor with low magnetic response that hosts the Ambitle Crater;

and, 2) an area of approximately 20 km2 of broadly

elevated magnetic response with structurally controlled areas of

subdued magnetic response. These signatures are consistent with an

intrusive complex defined by multiple intrusive events, some of

which have been magnetite destructive. The gold-copper Kabang

Prospect is part of this under-explored complex".

Highlights of the Geophysical Review:

- Advanced Data Processing: SGC re-processed and

re-modelled historical magnetic and radiometric data. The use of a

proprietary processing algorithm and RTP grids with MVI inversion

has resulted in significantly improved geological interpretations,

particularly in handling low latitude effects and remanent

bodies.

- Comprehensive Data Integration: SGC integrated airborne

magnetic data, radar DTM, and induced polarization (IP) data, into

a single 3D project. This compilation allows for detailed 3D

analysis and provides a better understanding of the spatial

relationship between anomalous gold and copper values and key

magnetic, radiometric and IP signatures.

- Historical Data Digitization: Key geological maps and

sections from previous studies were digitized and georeferenced,

ensuring that key controls on mineralization were placed in the

broader context of mineral deposit development, structural

architecture and tectono-stratigraphic evolution.

- Porphyry and Epithermal Gold-Copper Potential: The

report outlines the geophysical characteristics of porphyry and

epithermal deposits, emphasizing Feni Island's potential to host

significant mineralization. The combination of magnetic,

radiometric, and IP data points to several high-priority

exploration targets.

Magnetic High Terrane (Intrusive Complex with Copper-Gold

Mineralization)

The newly re-processed geophysics has for the first time

highlighted that the southwest of the island comprises an intrusive

complex which is characterized by multiple intrusive events, some

of which have been magnetic destructive (see Figures 1 and 2). The

Kabang Prospect with an Inferred Mineral Resource Estimate

of 1.46 Moz

Au1 is located at the northern

boundary of this complex in an area of relatively subdued magnetic

response between intrusive stocks with higher magnetic response.

This geophysical signature has analogies to the Simberi Deposit in

PNG and is characteristic of copper-gold epithermal/porphyry

systems worldwide.

|

___________

|

|

1

|

The Feni Island Project

currently has a mineral resource prepared in accordance with

National Instrument 43-101 – Standards of Disclosure for Mineral

Projects NI 43-101 dated October 14, 2021, which has outlined

an initial inferred mineral resource of 60.4 million tonnes at an

average grade of 0.75 g/t Au, for contained gold of 1,460,000

ounces, assuming a cut-off grade of 0.5 g/t Au. See

the NI 43-101 technical report entitled "NI 43-101 Technical Report

on the Feni Gold-Copper Property, New Ireland Province, Papua New

Guinea" (the "Feni Technical Report") dated October 14, 2021 and

prepared for Adyton Resources by Mark Berry (MAIG), Simon Tear

(MIGI PGeo), Matthew White (MAIG) and Andy Thomas (MAIG), each an

independent mining consultant and "qualified person" as defined in

NI 43-101, available under Adyton's profile on SEDAR+

at www.sedarplus.ca. Mineral resources are

not mineral reserves and have not demonstrated economic

viability.

|

Historical Drilling – Modern Implications

Historical drilling on Feni Island was conducted by several

companies over multiple campaigns and typically comprised shallow

vertical drillholes that focused on prospects within the Ambitle

Crater. Most historical drilling was not assayed for

copper. More recent drilling by Adyton targeted the Kabang

Prospect and comprised five angled diamond drill holes that were

assayed for gold, copper and a multi-element suite. Intercepts from

these holes were previously reported (see TSXV

Announcement 01 December 2021:

Adyton hits significant copper at Feni Island

6.4m

@ 5.1% Cu (including 3.6m @ 6.9% Cu))

and included intercepts such as 84.1

m @ 1.0 g/t Au (72 m

-156.1 m) including 35.9 m 0.3% Cu and 1.1 g/t Au

(70.7 m -106.6

m) and 6.4 m @ 5.1% Cu

& 1.6 g/t Au (149.7 to 156.1

m downhole in ADK004). Adyton hole ADK 004 was significant

as it confirmed continuity of copper mineralization (noted on slide

14 of the Company Presentation as presented at The Mining

Investment Event of the North, Quebec

City on the 5th of June and available on the Company web

site) that had been identified in three previous exploration

programs including, KAD - 001 57 m @

1.1 g/t Au incl. 55m 0.4% Cu,

AMD - 002 114m @ 1.1 g/t Au

incl.21.3 m @2.0 g/t Au and

10.2 m @ 0.5% Cu, MAD -

005 284m @ 0.7 g/t Au incl.

48m @1.5 g/t Au and 72 m 0.3% Cu.

The Adyton drill program was significant for several

reasons:

|

1)

|

The historical resource

was modelled using gold assays only, despite the presence of

visible chalcopyrite in core. Drilling by Adyton confirmed the

presence of copper-gold mineralization. This has significant

implications with respect to gold equivalent grades and upgrading

the overall resource size and grade.

|

|

2)

|

A small number of

historical surface rock samples were collected from drainages to

the south of Kabang within the recently identified intrusive

complex. Whilst Adyton has not been able to verify these rock assay

results, considers them historical, and cautions that they should

not be relied upon, they suggest that porphyry-style copper gold

mineralization may be more extensive than previously

reported.

|

|

3)

|

The magnetic high

terrane to the south of Kabang has never been effectively explored,

despite the likelihood that there are several intrusive events

evident from magnetic highs, with surrounding magnetic low response

implying magnetite-destructive alteration (typical of a porphyry

related mineralized system), and significantly anomalous surface

rock copper-gold assay results.

|

Adyton is planning an aggressive field mapping and sampling

program within and around this intrusive complex, and at additional

target areas, with an emphasis on defining additional copper-gold

targets.

Kabang Deposit and Mineral Resource Estimate

Historical drilling on Feni was conducted over several campaigns

and primarily targeted the near surface gold potential through

shallow vertical holes. In general, drill core was not assayed for

copper. Adyton drilled five angled diamond drill holes at Kabang

which demonstrated the depth potential and the close association of

copper and gold mineralization.

Mineralization at Kabang occurs coincident with a broadly

south-southeast trending moderate magnetic response bounded by a

higher magnetic response. This is typical of porphyry mineralized

systems worldwide. Significantly, the Kabang deposit is at the

southern edge of this corridor, which is untested along strike (and

to depth) to the south-southeast, and likewise to the

north-northwest, and along related structures trending to the

south-west – in combination, multiple kilometers of untested

structures now identified (see Figure 3).

The assay results from the Adyton drilling have significant

implications for the size and grade of a gold equivalent mineral

resource estimate. Drilling by Adyton has: 1) highlighted that

historical drill holes were too shallow to effectively test the

Kabang system; and, that 2) mineralization is open both along

strike and down dip (see Figures 4 and 5). The drill results from

the Adyton holes have not yet been integrated into the current

Mineral Resource Estimate – but given the length and grade of

intercepts, and their spatial occurrence near and within the

current block model, they are likely to have a positive impact on

the resource.

Copper-gold mineralization at Kabang is open in all directions

and detailed mapping and sampling of this area is also planned (see

Figurs 3, 4 and 5).

Central Magnetic Low and Natong (Epithermal Gold)

The magnetic response of the central magnetic low (which hosts

the Ambitle Crater) and the Natong area to the southeast of the

Island is more consistent with low-sulphidation style epithermal

mineralization. SGC is currently fine tuning the re-processing of

historical data for these areas, to better define structure. The

company will be reporting these results shortly.

Fergusson Island Update

Planning works continue with East Vision International Holdings

Pte Ltd. pursuant to its Investment and Development Agreement with

Adyton with a target date of late Q3 / early Q4 to be mobilized on

the island to commence infill drilling, drilling samples for

metallurgical test works, and bulk sampling works - all of which

will inform the Feasibility Study and Mining Lease application. On

Friday 21 June Managing Director Tim

Crossley also presented to the Mineral Resources Authority

(MRA) Mining Executive Council on the company's Fergusson Island development plans with the MRA

fully supportive of Adyton's plans.

ON BEHALF OF THE BOARD OF ADYTON RESOURCES

CORPORATION

Tim Crossley, Chief Executive

Officer

Neither the TSX Venture

Exchange nor its Regulation Services

Provider (as that term is defined in the policies

of the TSX Venture Exchange)

accepts responsibility for the adequacy

or accuracy of this press release.

ABOUT ADYTON RESOURCES CORPORATION

Adyton Resources Corporation is focused on the development of

gold and copper resources in world class mineral jurisdictions. It

currently has a portfolio of highly prospective mineral exploration

projects in Papua New Guinea on

which it is exploring to expand its identified gold Inferred and

Indicated Mineral Resources and expand on its recent significant

copper drill intercepts on the 100% owned Feni Island project. The

Company's mineral exploration projects are located on the Pacific

Ring of Fire on easy to access island locations which hosts several

globally significant copper and gold deposits including the Lihir

gold mine and Panguna copper/gold mine on Bougainville Island,

both neighboring projects to the Company's Feni Island

project.

Adyton has a total declared Resource inventory (disclosed in

accordance with NI 43-101) within its PNG portfolio of projects

comprising indicated resources of 173,000 ounces gold and inferred

resources of 2,000,000 ounces gold.2,3

Adyton is also quoted on the OTC under

the code ADYRF and on the

Frankfurt Stock Exchange under the code 701:GR.

For more information about Adyton and its projects, visit www.adytonresources.com

|

___________

|

|

2

|

The Feni Island Project

currently has a mineral resource prepared in accordance with NI

43-101 dated October 14, 2021, which has outlined an initial

inferred mineral resource of 60.4 million tonnes at an average

grade of 0.75 g/t Au, for contained gold of 1,460,000 ounces,

assuming a cut-off grade of 0.5 g/t Au. See the NI

43-101 technical report entitled "NI 43-101 Technical Report on the

Feni Gold-Copper Property, New Ireland Province, Papua New Guinea"

(the "Feni Technical Report") dated October 14, 2021 and prepared

for Adyton Resources by Mark Berry (MAIG), Simon Tear (MIGI PGeo),

Matthew White (MAIG) and Andy Thomas (MAIG), each an independent

mining consultant and "qualified person" as defined in NI 43-101,

available under Adyton's profile on SEDAR+ at

www.sedarplus.ca.. Mineral resources are not mineral

reserves and have not demonstrated economic

viability.

|

|

|

|

3

|

The Fergusson Island

Project currently has a mineral resource prepared in accordance

with NI 43-101 dated October 14, 2021 which outlined an indicated

mineral resource of 4.0 million tonnes at an average grade of

1.33 g/t Au for contained gold of 173,000 ounces and an

inferred mineral resource of 16.3 million tonnes at an average

grade of 1.02 g/t Au for contained gold of 540,000 ounces. See the

technical report entitled "NI 43-101 Technical Report on the

Fergusson Gold Property, Milne Bay Province, Papua New Guinea"

dated October 14, 2021 and prepared for Adyton Resources by

Mark Berry (MAIG), Simon Tear (MIGI PGeo), Matthew White (MAIG)

and Andy Thomas (MAIG), each an independent mining consultant and

"qualified person" as defined in NI 43-101, available under the

Company's profile on SEDAR+ at www.sedarplus.ca. Mineral resources

are not mineral reserves and have not demonstrated economic

viability.

|

Qualified Person

The scientific and technical information contained in this press

release has been prepared, reviewed, and approved by Dr

Chris Wilson BSc (Hons), PhD,

FAusIMM (CP), FSEG, FGS, the Chief Geologist and a Director

of Adyton, who is a "Qualified Person" as defined by National

Instrument 43‐101 ‐ Standards of Disclosure for Mineral

Projects.

Forward looking statements

This press release includes "forward‐looking statements",

including forecasts, estimates, expectations, and objectives for

future operations that are subject to several assumptions, risks,

and uncertainties, many of which are beyond the control

of Adyton. Forward‐ looking statements and information can

generally be identified by the use of forward‐looking terminology

such as "may", "will", "should", "expect", "intend", "estimate",

"anticipate", "believe", "continue", "plans" or similar

terminology. Forward looking statements in this news release

include all statements with respect to the funding of the Initial

Investment Amount, the completion of the Initial Investment

Milestones and the funding and development of the Project. The

forward‐looking information contained herein is provided for the

purpose of assisting readers in understanding management's current

expectations and plans relating to the future. Readers are

cautioned that such information may not be appropriate for other

purposes. Forward‐looking information are based on management of

the parties' reasonable assumptions, estimates, expectations,

analyses and opinions, which are based on such management's

experience and perception of trends, current conditions and

expected developments, and other factors that management believes

are relevant and reasonable in the circumstances, but which may

prove to be incorrect. Such factors, among other things, include:

impacts arising from the global disruption to global supply chains

caused by hostilities in the Ukraine and the Middle East, changes in general macroeconomic

conditions; changes in securities markets; changes in the price of

gold or certain other commodities; change in national and local

government, legislation, taxation, controls, regulations and

political or economic developments; risks and hazards associated

with the business of mineral exploration, development and mining

(including environmental hazards, industrial accidents, unusual or

unexpected formations pressures, cave‐ins and flooding);

discrepancies between actual and estimated metallurgical

recoveries; inability to obtain adequate insurance to cover risks

and hazards; the presence of laws and regulations that may impose

restrictions on mining; employee relations; relationships with and

claims by local communities and indigenous populations;

availability of and changes in the costs associated with mining

inputs and labour; the speculative nature of mineral exploration

and development (including the risks of obtaining necessary

licenses, permits and approvals from government authorities); and

title to properties. Investors are cautioned that any such

statements are not guarantees of future performance and that actual

results or developments may differ materially from those projected

in the forward‐looking statements. Such forward‐looking information

represents management's best judgment based on information

currently available. No forward‐looking statement can be

guaranteed, and actual future results may vary materially. Readers

are cautioned not to place undue reliance on forward looking

statements or information. Adyton Resources Corporation undertakes

no obligation to update forward‐looking information except as

required by applicable law.

SOURCE Adyton Resources Corporation