Suncor accelerates increased returns to shareholders

2021年10月28日 - 7:15AM

Given the strength of the company and confidence in the execution

of Suncor Energy’s strategic plans, the Board of Directors has

approved the acceleration of increased returns to shareholders by

the reinstatement of the dividend to 2019 levels. The reinstatement

to $0.42 per common share from $0.21 per share is a 100% increase

in the quarterly dividend, commencing with the dividend payable on

December 24, 2021 to shareholders of record at the close of

business on December 3, 2021. The dividend increase is enabled

through disciplined capital spending and allocation, as well as

progress in generating an incremental $2 billion of free funds flow

by 2025.

In addition, the Board has also authorized a

further 2% increase in the normal course issuer bid (NCIB) to

purchase by February 7, 2022 up to approximately 7% (107 million

shares) of Suncor’s public float as at January 31, 2021.

2021 Performance to Date

Operational initiatives and higher commodity prices than expected

have accelerated the achievement of two key objectives, namely

increasing return of capital to shareholders and reducing net debt.

Highlights include:

- Safe and reliable operating performance continues to

strengthen, including:

- In Q3, Downstream demand has returned to near 2019 levels and

is expected to continue to strengthen, enabling industry leading

refinery utilization rates and cash generation going forward;

- Significant progress has been achieved on overburden removal at

Fort Hills and the project is on track to ramp to full rates by the

end of 2021; and

- Our remaining upstream assets are performing at strong

operating levels with all 2021 planned major maintenance

successfully completed.

- Substantial progress has been made on the company’s plan to

realize $2 billion of incremental annual free funds flow by 2025 as

outlined on Investor Day, with approximately $465 million on track

to be achieved in 2021 and similar progress expected to continue in

2022. As outlined on Investor Day, this annual free funds flow

increase for 2021 is being achieved through increased revenue and

margin, and increased productivity on tailings asset retirement

spend.

- As at September 30, 2021 net debt has been reduced by $3.1

billion in 2021. With expected free funds flow in the fourth

quarter and the receipt of the Golden Eagle asset sales proceeds in

October, the net debt balance by year end 2021 is anticipated to be

near $15 billion, an approximate $5 billion reduction in 2021, $1

billion lower than the December 31, 2019 net debt level and near

the top of 2025 target net debt range set out Investor Day. Net

debt reduction will continue to be a focus as we further fortify

the balance sheet, accelerating the pace of deleveraging outlined

on Investor Day.

- Share buybacks for the year-to-date period ending September 30,

2021 totalled $1.7 billion for approximately 63 million shares, or

4.1% of the outstanding shares at January 31, 2021, significantly

higher than assumed in the Investor Day scenario.

- As part of our disciplined capital allocation, we will continue

to execute on our Environment, Social and Governance (ESG)

strategic initiatives and invest in energy expansion at mid teens

returns to achieve our 10 Megatonne (MT) emission reduction target

by 2030.

2022 Guidance We will release our

detailed 2022 Guidance as usual in December 2021.

For 2022, our business environment assumptions are

significantly improved relative to those discussed at Investor Day

due to the substantial improvements in market conditions. Our key

assumptions are: WTI at Cushing of US$70/bbl; New York Harbor 2-1-1

crack of US$21/bbl; AECO-C Spot of $3.80 CDN$/mcf and a US$ FX rate

of $0.80. 2022 Capital guidance is expected to be approximately

$4.7 billion, $300 million below the $5.0 billion annual cap

outlined at Investor Day. We are expecting to renew the NCIB upon

expiry of the current program in February 2022 and further fortify

the balance sheet with additional net debt reduction in 2022. After

funding the capital program and dividend, we plan to allocate

available free funds flow half towards share buybacks and half

towards debt reduction.

This dividend increase demonstrates Suncor

Energy’s Board of Directors and Executive Management team’s

commitment to increasing the return of capital to shareholders and

accelerating performance relative to our plan.

Legal Advisory – Forward-Looking

Information

This news release contains certain forward-looking

information and forward-looking statements (collectively referred

to herein as “forward-looking statements”) within the meaning of

applicable Canadian and U.S. securities laws. Forward-looking

statements in this news release include statements and expectations

regarding: Suncor's incremental $2 billion of free funds flow by

2025 target including Suncor's expectation that it is on track to

achieve $465 million of this in 2021 with similar progress expected

to continue in 2022; statements about the NCIB, including the

amount and timing of purchases and Suncor's expectation that it

will renew the NCIB upon expiry of the current program in February

2022; Suncor's expectation that Downstream demand will continue to

strength which will enable industry leading refinery utilization

rates and cash generation going forward; Suncor's expectation that

the Fort Hills project is on track to ramp to full rates by the end

of 2021; Suncor's expected net debt balances by year end 2021 to be

near $15 billion and the belief that net debt reduction will

continue to be a focus for Suncor and that there will be additional

net debt reduction in 2022; Suncor's anticipated capital allocation

plans of allocating half of available free funds flow towards share

buybacks and half towards debt reduction; Suncor's expectation that

it will continue to execute on its ESG strategic initiatives and

invest in energy expansion at mid teens returns to achieve its 10

MT emission reduction target by 2030; Suncor's commitment to

increasing the return of capital to shareholders and accelerating

performance relative to its previously communicated plan; and

Suncor's full year 2022 outlook on capital guidance as well as

business outlook assumptions for WTI at Cushing, New York Harbor

2-1-1 crack, AECO-C Spot and the Cdn$/US$ exchange rate.

Forward-looking statements are based on Suncor’s current

expectations, estimates, projections and assumptions that were made

by the company in light of its information available at the time

the statement was made and consider Suncor’s experience and its

perception of historical trends, including expectations and

assumptions concerning: the accuracy of reserves estimates; the

current and potential adverse impacts of the COVID-19 pandemic;

commodity prices and interest and foreign exchange rates; the

performance of assets and equipment; capital efficiencies and cost

savings; applicable laws and government policies; future production

rates; the sufficiency of budgeted capital expenditures in carrying

out planned activities; the availability and cost of labour,

services and infrastructure; the satisfaction by third parties of

their obligations to Suncor; the development and execution of

projects; and the receipt, in a timely manner, of regulatory and

third-party approvals.

Forward-looking statements are not guarantees of

future performance and involve a number of risks and uncertainties,

some that are similar to other oil and gas companies and some that

are unique to Suncor. Suncor’s actual results may differ materially

from those expressed or implied by its forward-looking statements,

so readers are cautioned not to place undue reliance on them.

Suncor’s Management's Discussion and Analysis for

the third quarter of 2021 dated October 27, 2021 (MD&A), its

Annual Information Form and Annual Report to Shareholders, each

dated February 24, 2021, Form 40-F dated February 25, 2021, and

other documents Suncor files from time to time with securities

regulatory authorities describe the risks, uncertainties, material

assumptions and other factors that could influence actual results

and such factors are incorporated herein by reference. Copies of

these documents are available without charge from Suncor at 150 6th

Avenue S.W., Calgary, Alberta T2P 3E3, by calling 1-800-558-9071,

or by email request to invest@suncor.com or by referring to the

company’s profile on SEDAR at sedar.com or EDGAR at sec.gov. Except

as required by applicable securities laws, Suncor disclaims any

intention or obligation to publicly update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise. Non-GAAP Financial

Measures

Certain financial measures referred to in this

news release (free funds flow) are not prescribed by GAAP. Free

funds flow is defined and reconciled, as applicable, to the most

directly comparable GAAP measures in the Non-GAAP Financial

Measures Advisory section of the MD&A. This non-GAAP financial

measure is included because management uses this information to

analyze business performance, leverage and liquidity and it may be

useful to investors on the same basis. This non-GAAP measure does

not have a standardized meaning and therefore is unlikely to be

comparable to similar measures presented by other companies and

should not be considered in isolation or as a substitute for

measures of performance prepared in accordance with GAAP.

Suncor Energy is Canada's leading integrated

energy company, with a global team of over 30,000 people. Suncor's

operations include oil sands development, production and upgrading,

offshore oil and gas, petroleum refining in Canada and the US, and

our national Petro-Canada retail distribution network (now

including our Electric Highway network of fast-charging EV

stations). A member of Dow Jones Sustainability indexes, FTSE4Good

and CDP, Suncor is responsibly developing petroleum resources,

while profitably growing a renewable energy portfolio and advancing

the transition to a low-emissions future. Suncor is listed on the

UN Global Compact 100 stock index. Suncor's common shares (symbol:

SU) are listed on the Toronto and New York stock exchanges.

For more information about Suncor, visit our web

site at suncor.com, follow us on Twitter @Suncor

Media inquiries: 1-833-296-4570

media@suncor.com

Investor inquiries: 800-558-9071

invest@suncor.com

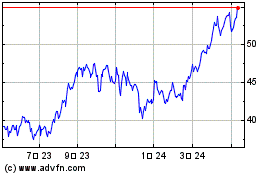

Suncor Energy (TSX:SU)

過去 株価チャート

から 10 2024 まで 11 2024

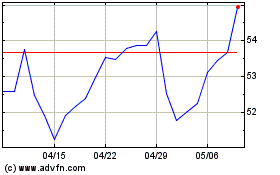

Suncor Energy (TSX:SU)

過去 株価チャート

から 11 2023 まで 11 2024