false 0001393311 0001393311 2023-07-24 2023-07-24 0001393311 us-gaap:CommonStockMember 2023-07-24 2023-07-24 0001393311 us-gaap:SeriesFPreferredStockMember 2023-07-24 2023-07-24 0001393311 us-gaap:SeriesGPreferredStockMember 2023-07-24 2023-07-24 0001393311 us-gaap:SeriesHPreferredStockMember 2023-07-24 2023-07-24 0001393311 psa:DepositarySharesEachRepresenting11000OfA4.875CumPrefShareSeriesI0.01ParValueMember 2023-07-24 2023-07-24 0001393311 psa:DepositarySharesEachRepresenting11000OfA4.700CumPrefShareSeriesJ0.01ParValueMember 2023-07-24 2023-07-24 0001393311 psa:DepositarySharesEachRepresenting11000OfA4.750CumPrefShareSeriesK0.01ParValueMember 2023-07-24 2023-07-24 0001393311 psa:DepositarySharesEachRepresenting11000OfA4.625CumPrefShareSeriesL0.01ParValueMember 2023-07-24 2023-07-24 0001393311 psa:DepositarySharesEachRepresenting11000OfA4.125CumPrefShareSeriesM0.01ParValueMember 2023-07-24 2023-07-24 0001393311 psa:DepositarySharesEachRepresenting11000OfA3.875CumPrefShareSeriesN0.01ParValueMember 2023-07-24 2023-07-24 0001393311 psa:DepositarySharesEachRepresenting11000OfA3.900CumPrefShareSeriesO0.01ParValueMember 2023-07-24 2023-07-24 0001393311 psa:DepositarySharesEachRepresenting11000OfA4.000CumPrefShareSeriesP0.01ParValueMember 2023-07-24 2023-07-24 0001393311 psa:DepositarySharesEachRepresenting11000OfA3.950CumPrefShareSeriesQ0.01ParValueMember 2023-07-24 2023-07-24 0001393311 psa:DepositarySharesEachRepresenting11000OfA4.000CumPrefShareSeriesR0.01ParValueMember 2023-07-24 2023-07-24 0001393311 psa:DepositarySharesEachRepresenting11000OfA4.100CumPrefShareSeriesS0.01ParValueMember 2023-07-24 2023-07-24 0001393311 psa:NotesDue2032Member 2023-07-24 2023-07-24 0001393311 psa:NotesDue2030Member 2023-07-24 2023-07-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): July 24, 2023

PUBLIC STORAGE

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Maryland |

|

001-33519 |

|

95-3551121 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

|

|

|

|

| 701 Western Avenue, Glendale, California |

|

91201-2349 |

| (Address of principal executive offices) |

|

(Zip Code) |

(818) 244-8080

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of Class |

|

Trading Symbol |

|

Name of exchange on which registered |

| Common Shares, $0.10 par value |

|

PSA |

|

New York Stock Exchange |

| Depositary Shares Each Representing 1/1,000 of a 5.150% Cum Pref Share, Series F, $0.01 par value |

|

PSAPrF |

|

New York Stock Exchange |

| Depositary Shares Each Representing 1/1,000 of a 5.050% Cum Pref Share, Series G, $0.01 par value |

|

PSAPrG |

|

New York Stock Exchange |

| Depositary Shares Each Representing 1/1,000 of a 5.600% Cum Pref Share, Series H, $0.01 par value |

|

PSAPrH |

|

New York Stock Exchange |

| Depositary Shares Each Representing 1/1,000 of a 4.875% Cum Pref Share, Series I, $0.01 par value |

|

PSAPrI |

|

New York Stock Exchange |

| Depositary Shares Each Representing 1/1,000 of a 4.700% Cum Pref Share, Series J, $0.01 par value |

|

PSAPrJ |

|

New York Stock Exchange |

| Depositary Shares Each Representing 1/1,000 of a 4.750% Cum Pref Share, Series K, $0.01 par value |

|

PSAPrK |

|

New York Stock Exchange |

| Depositary Shares Each Representing 1/1,000 of a 4.625% Cum Pref Share, Series L, $0.01 par value |

|

PSAPrL |

|

New York Stock Exchange |

| Depositary Shares Each Representing 1/1,000 of a 4.125% Cum Pref Share, Series M, $0.01 par value |

|

PSAPrM |

|

New York Stock Exchange |

| Depositary Shares Each Representing 1/1,000 of a 3.875% Cum Pref Share, Series N, $0.01 par value |

|

PSAPrN |

|

New York Stock Exchange |

| Depositary Shares Each Representing 1/1,000 of a 3.900% Cum Pref Share, Series O, $0.01 par value |

|

PSAPrO |

|

New York Stock Exchange |

| Depositary Shares Each Representing 1/1,000 of a 4.000% Cum Pref Share, Series P, $0.01 par value |

|

PSAPrP |

|

New York Stock Exchange |

| Depositary Shares Each Representing 1/1,000 of a 3.950% Cum Pref Share, Series Q, $0.01 par value |

|

PSAPrQ |

|

New York Stock Exchange |

| Depositary Shares Each Representing 1/1,000 of a 4.000% Cum Pref Share, Series R, $0.01 par value |

|

PSAPrR |

|

New York Stock Exchange |

| Depositary Shares Each Representing 1/1,000 of a 4.100% Cum Pref Share, Series S, $0.01 par value |

|

PSAPrS |

|

New York Stock Exchange |

| 0.875% Senior Notes due 2032 |

|

PSA32 |

|

New York Stock Exchange |

| 0.500% Senior Notes due 2030 |

|

PSA30 |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards pursuant to Section 13(a) of the Exchange Act. ☐

| Item 7.01 |

Regulation FD Disclosure. |

On Monday, July 24, 2023, Public Storage (the “Company”) posted on its website the presentation attached to this Form 8-K as Exhibit 99.1 and issued the press release attached to this Form 8-K as Exhibit 99.2 regarding the acquisition described below.

The information in Item 7.01 of this Form 8-K and the information contained in Exhibit 99.1 and Exhibit 99.2 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 (the “Securities Act”) or the Exchange Act, except as expressly set forth by specific reference in such filing.

On Monday, July 24, 2023, the Company announced that it entered into a definitive agreement to acquire BREIT Simply Storage LLC, a self-storage company that owns and operates 127 self-storage facilities (9.4 million square feet) and manages 25 self-storage facilities (1.8 million square feet) for third parties, for a cash acquisition price of $2.2 billion (the “Acquisition”). The owned facilities are located in Texas (33), Florida (18), Oklahoma (12), Tennessee (9), Indiana (8), Michigan (8), New Jersey (5), California (4), Mississippi (4), Washington (3) and other states (23). The Acquisition, which is subject to the satisfaction of customary closing conditions, is currently expected to close in the third quarter of 2023. However, there can be no assurances that these closing conditions will be satisfied or that the Acquisition will close on the terms described herein, or at all.

Forward-Looking Statements

This Form 8-K includes “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. All forward-looking statements speak only as of the date of this Form 8-K. These forward-looking statements involve known and unknown risks and uncertainties, which may cause the Company’s actual results and performance to be materially different from those expressed or implied in the forward-looking statements. Factors and risks that may impact future results and performance are described in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022. The Company disclaims any obligation to update publicly or otherwise revise any forward-looking statements, whether as a result of new information, new estimates, or other factors, events or circumstances after the date of this report, except where required by law.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits

1

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

PUBLIC STORAGE |

|

|

|

|

|

|

|

|

By: |

|

/s/ H. Thomas Boyle |

| Date: July 24, 2023 |

|

|

|

|

|

H. Thomas Boyle Senior Vice President, Chief Financial and Investment Officer |

2

Simply Self Storage Acquisition

Overview July 2023 Exhibit 99.1

FORWARD-LOOKING STATEMENTS: This

presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include statements relating to our 2023 outlook and all underlying assumptions, our expected

acquisition, disposition, development, and redevelopment activity, supply and demand for our self-storage facilities, information relating to operating trends in our markets, expectations regarding operating expenses, including property tax changes,

expectations regarding the impacts from inflation and a potential future recession, our strategic priorities, expectations with respect to financing activities, rental rates, cap rates, and yields, leasing expectations, our credit ratings, and all

other statements other than statements of historical fact. Such statements are based on management’s beliefs and assumptions made based on information currently available to management and may be identified by the use of the words

“outlook,” “guidance,” “expects,” “believes,” “anticipates,” “should,” “estimates,” and similar expressions. These forward-looking statements involve known and

unknown risks and uncertainties, which may cause our actual results and performance to be materially different from those expressed or implied in the forward-looking statements. Risks and uncertainties that may impact future results and performance

include, but are not limited to those described in Part 1, Item 1A, “Risk Factors” in our most recent Annual Report on Form 10-K filed with the Securities and Exchange Commission (the “SEC”) on February 21, 2023 and in our

other filings with the SEC. These include changes in demand for our facilities, impacts of natural disasters, adverse changes in laws and regulations including governing property tax, evictions, rental rates, minimum wage levels, and insurance,

adverse economic effects from the COVID-19 Pandemic, international military conflicts, or similar events impacting public health and/or economic activity, increases in the costs of our primary customer acquisition channels, adverse impacts to us and

our customers from inflation, unfavorable foreign currency rate fluctuations, changes in federal or state tax laws related to the taxation of REITs, security breaches, including ransomware, or a failure of our networks, systems, or technology. These

forward-looking statements speak only as of the date of this presentation or as of the dates indicated in the statements. All of our forward-looking statements, including those in this presentation, are qualified in their entirety by this cautionary

statement. We expressly disclaim any obligation to update publicly or otherwise revise any forward-looking statements, whether as a result of new information, new estimates, or other factors, events, or circumstances after the date of these

forward-looking statements, except when expressly required by law. Given these risks and uncertainties, you should not rely on any forward-looking statements in this presentation, or which management may make orally or in writing from time to time,

neither as predictions of future events nor guarantees of future performance. NON-GAAP MEASURES: This presentation contains non-GAAP measures, including FFO and NOI. Non-GAAP measures should not be considered as an alternative to, or more meaningful

than, net income (determined in accordance with GAAP) or other GAAP financial measures, as an indicator of financial performance and is not an alternative to, or more meaningful than, cash flow from operating activities (determined in accordance

with GAAP) as a measure of liquidity. Non-GAAP measures have limitations as they do not include all items of income and expense that affect operations and, accordingly, should always be considered as supplemental financial results to those presented

in accordance with GAAP. In addition, other REITs may compute these measures differently, so comparisons among REITs may not be helpful. Please refer to our SEC periodic reports for definitions of our non-GAAP measures and reconciliations to the

nearest GAAP measures. Important Information

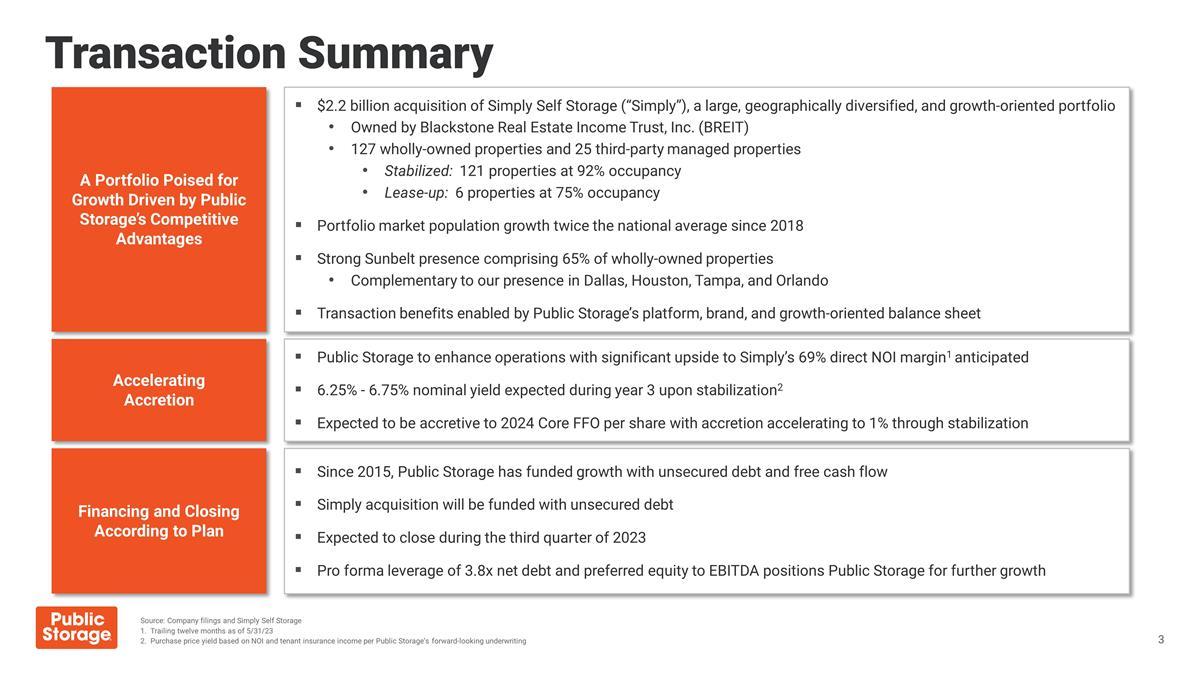

Transaction Summary Source: Company

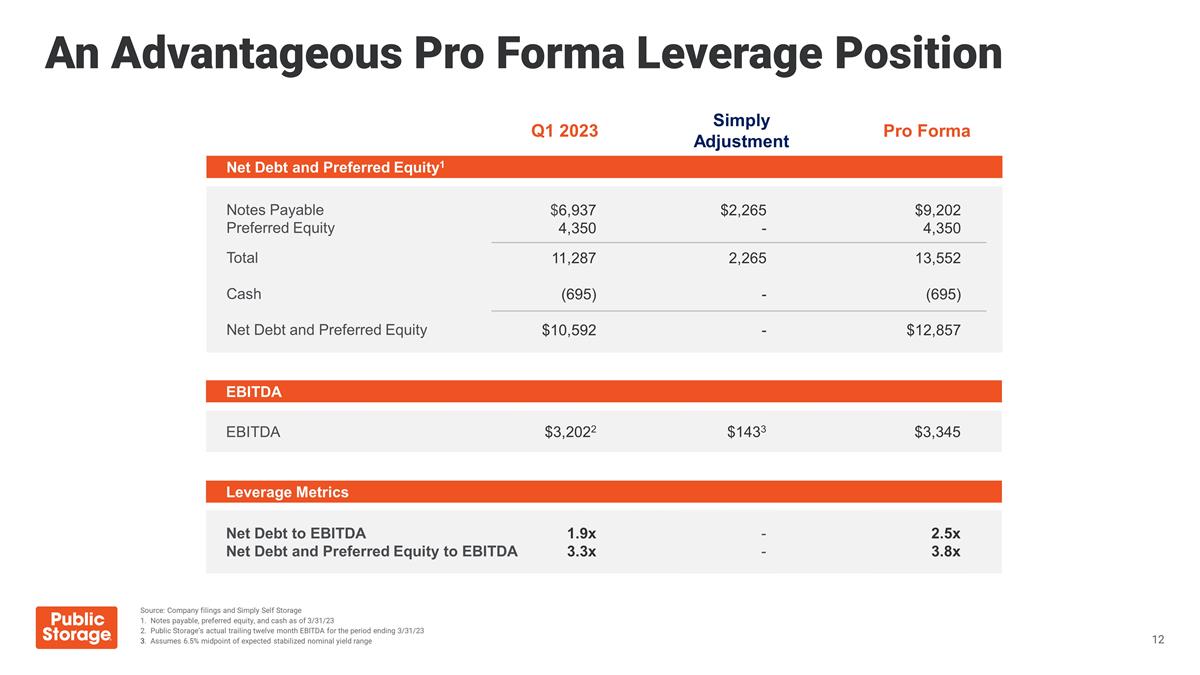

filings and Simply Self Storage 1. Trailing twelve months as of 5/31/23 2. Purchase price yield based on NOI and tenant insurance income per Public Storage’s forward-looking underwriting Accelerating Accretion Financing and Closing According

to Plan Public Storage to enhance operations with significant upside to Simply’s 69% direct NOI margin1 anticipated 6.25% - 6.75% nominal yield expected during year 3 upon stabilization2 Expected to be accretive to 2024 Core FFO per share with

accretion accelerating to 1% through stabilization Since 2015, Public Storage has funded growth with unsecured debt and free cash flow Simply acquisition will be funded with unsecured debt Expected to close during the third quarter of 2023 Pro forma

leverage of 3.8x net debt and preferred equity to EBITDA positions Public Storage for further growth A Portfolio Poised for Growth Driven by Public Storage’s Competitive Advantages $2.2 billion acquisition of Simply Self Storage

(“Simply”), a large, geographically diversified, and growth-oriented portfolio Owned by Blackstone Real Estate Income Trust, Inc. (BREIT) 127 wholly-owned properties and 25 third-party managed properties Stabilized: 121 properties at 92%

occupancy Lease-up: 6 properties at 75% occupancy Portfolio market population growth twice the national average since 2018 Strong Sunbelt presence comprising 65% of wholly-owned properties Complementary to our presence in Dallas, Houston, Tampa, and

Orlando Transaction benefits enabled by Public Storage’s platform, brand, and growth-oriented balance sheet

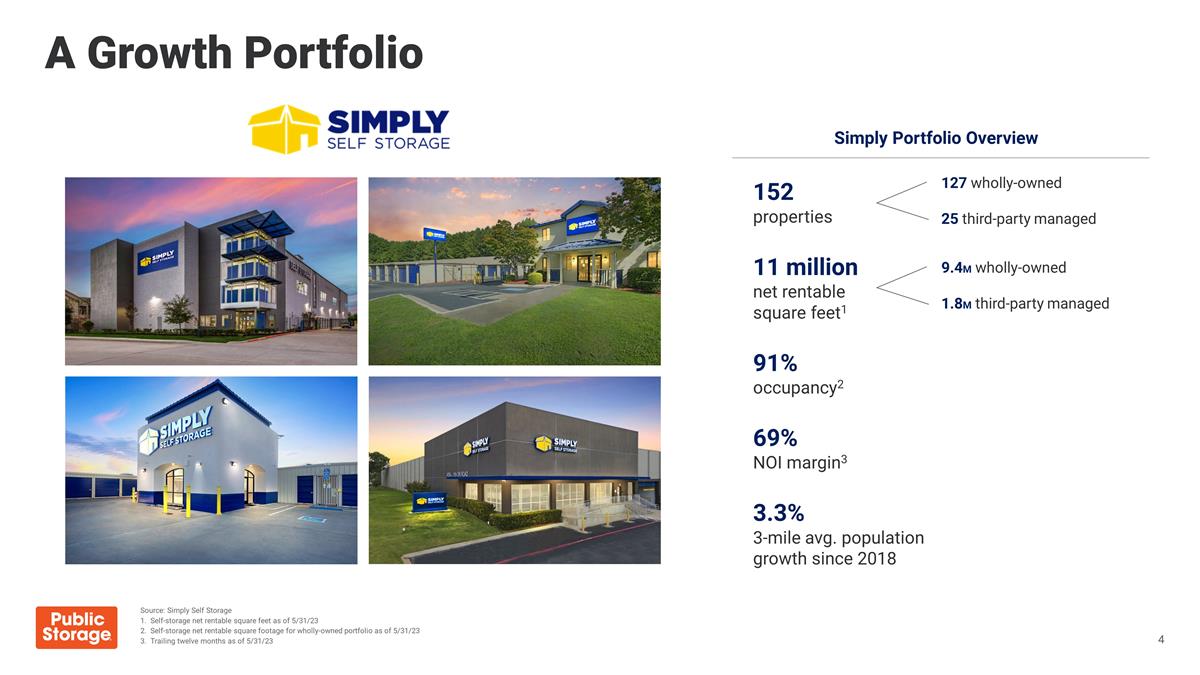

A Growth Portfolio 152 properties 11

million net rentable square feet1 91% occupancy2 69% NOI margin3 3.3% 3-mile avg. population growth since 2018 127 wholly-owned 25 third-party managed 9.4M wholly-owned 1.8M third-party managed Simply Portfolio Overview Source: Simply Self Storage

1. Self-storage net rentable square feet as of 5/31/23 2. Self-storage net rentable square footage for wholly-owned portfolio as of 5/31/23 3. Trailing twelve months as of 5/31/23

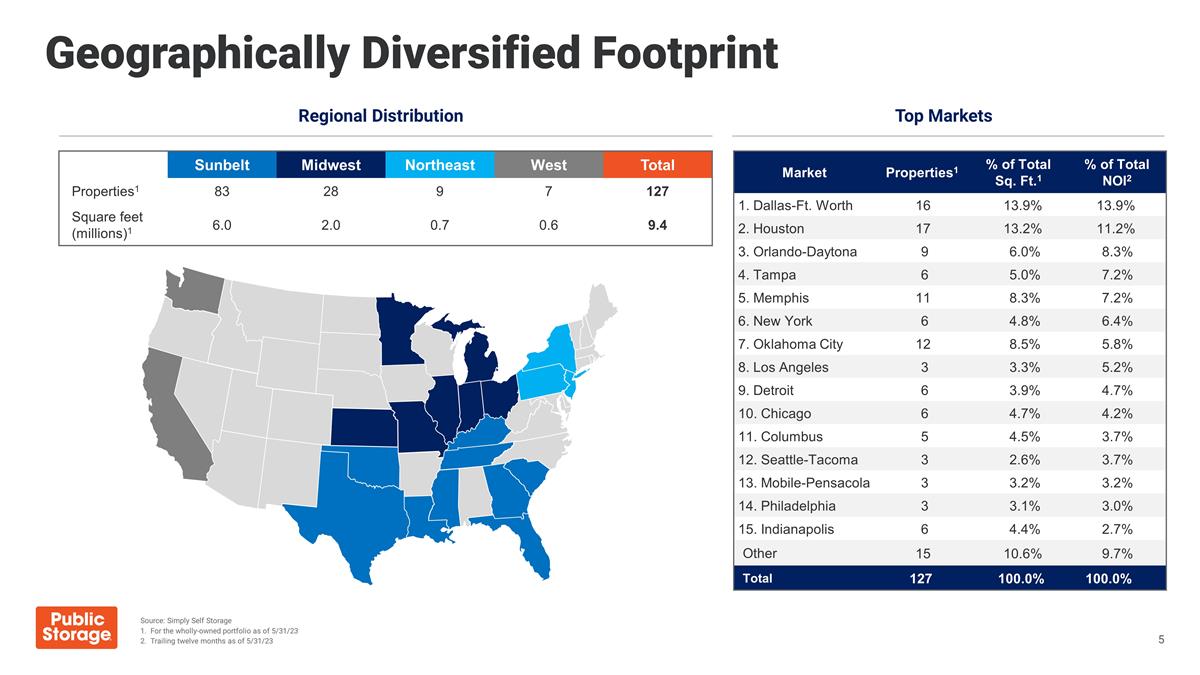

Geographically Diversified Footprint

Sunbelt Midwest Northeast West Total Properties1 83 28 9 7 127 Square feet (millions)1 6.0 2.0 0.7 0.6 9.4 Regional Distribution Top Markets Market Properties1 % of Total Sq. Ft.1 % of Total NOI2 1. Dallas-Ft. Worth 16 13.9% 13.9% 2. Houston 17

13.2% 11.2% 3. Orlando-Daytona 9 6.0% 8.3% 4. Tampa 6 5.0% 7.2% 5. Memphis 11 8.3% 7.2% 6. New York 6 4.8% 6.4% 7. Oklahoma City 12 8.5% 5.8% 8. Los Angeles 3 3.3% 5.2% 9. Detroit 6 3.9% 4.7% 10. Chicago 6 4.7% 4.2% 11. Columbus 5 4.5% 3.7% 12.

Seattle-Tacoma 3 2.6% 3.7% 13. Mobile-Pensacola 3 3.2% 3.2% 14. Philadelphia 3 3.1% 3.0% 15. Indianapolis 6 4.4% 2.7% Other 15 10.6% 9.7% Total 127 100.0% 100.0% Source: Simply Self Storage 1. For the wholly-owned portfolio as of 5/31/23 2. Trailing

twelve months as of 5/31/23

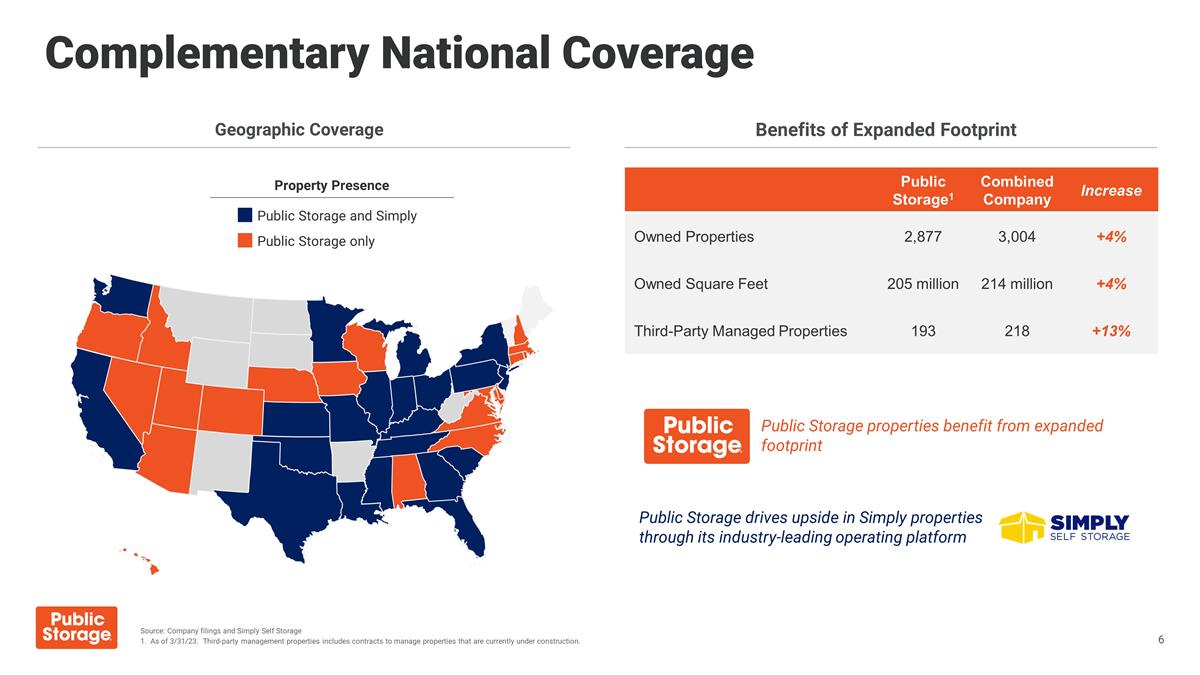

Complementary National Coverage

Property Presence Public Storage only Public Storage and Simply Public Storage1 Combined Company Increase Owned Properties 2,877 3,004 +4% Owned Square Feet 205 million 214 million +4% Third-Party Managed Properties 193 218 +13% Geographic Coverage

Benefits of Expanded Footprint Public Storage properties benefit from expanded footprint Public Storage drives upside in Simply properties through its industry-leading operating platform Source: Company filings and Simply Self Storage 1. As of

3/31/23. Third-party management properties includes contracts to manage properties that are currently under construction.

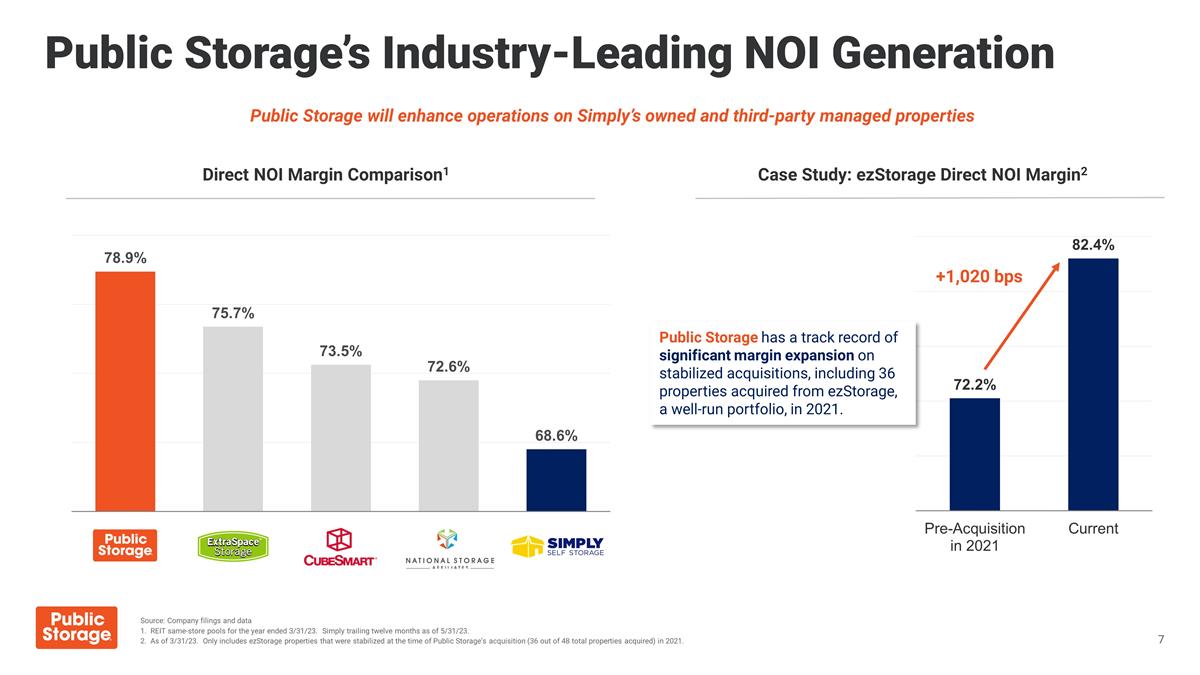

Public Storage’s

Industry-Leading NOI Generation Case Study: ezStorage Direct NOI Margin2 Direct NOI Margin Comparison1 Public Storage has a track record of significant margin expansion on stabilized acquisitions, including 36 properties acquired from ezStorage, a

well-run portfolio, in 2021. +1,020 bps Public Storage will enhance operations on Simply’s owned and third-party managed properties Source: Company filings and data 1. REIT same-store pools for the year ended 3/31/23. Simply trailing twelve

months as of 5/31/23. 2. As of 3/31/23. Only includes ezStorage properties that were stabilized at the time of Public Storage’s acquisition (36 out of 48 total properties acquired) in 2021.

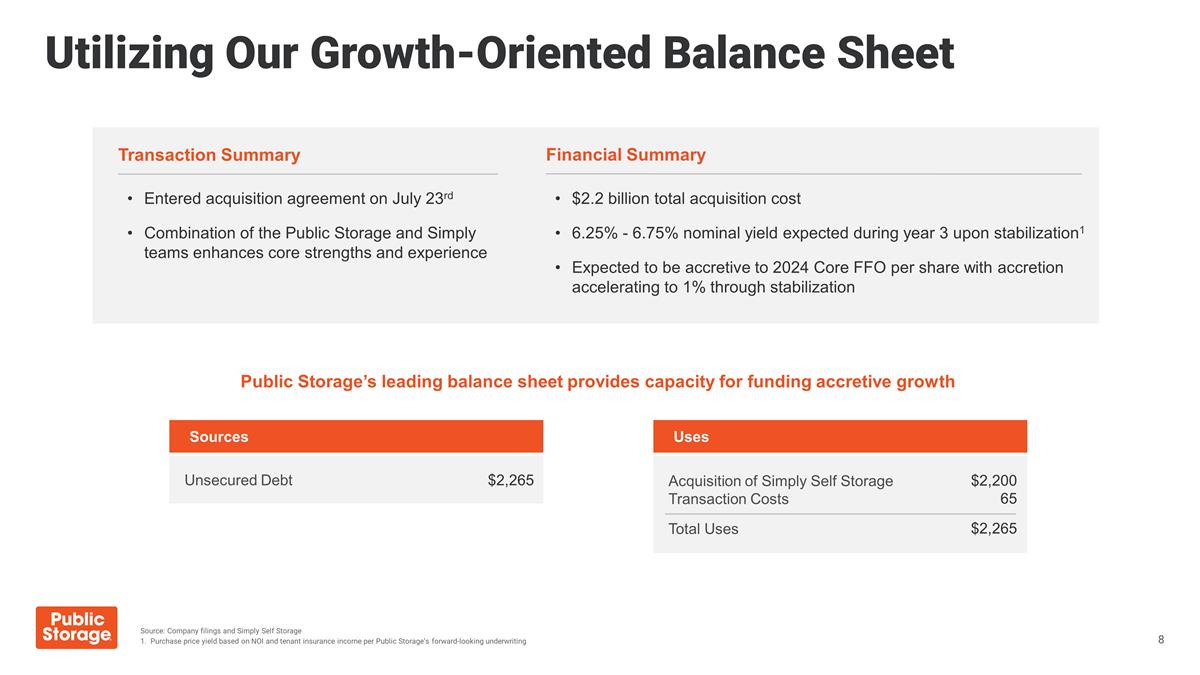

Utilizing Our Growth-Oriented Balance

Sheet Transaction Summary Entered acquisition agreement on July 23rd Combination of the Public Storage and Simply teams enhances core strengths and experience Financial Summary $2.2 billion total acquisition cost 6.25% - 6.75% nominal yield expected

during year 3 upon stabilization1 Expected to be accretive to 2024 Core FFO per share with accretion accelerating to 1% through stabilization Public Storage’s leading balance sheet provides capacity for funding accretive growth Source: Company

filings and Simply Self Storage 1. Purchase price yield based on NOI and tenant insurance income per Public Storage’s forward-looking underwriting Unsecured Debt Sources $2,265 Acquisition of Simply Self Storage Transaction Costs Total Uses

Uses $2,200 65 $2,265

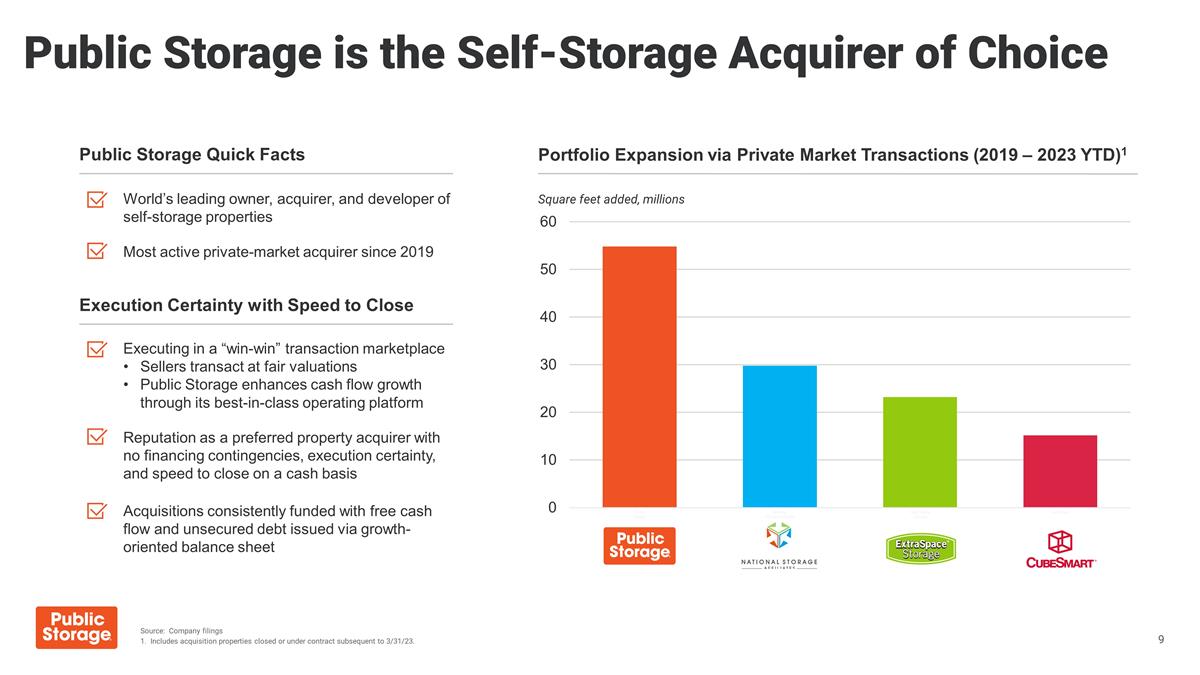

Public Storage is the Self-Storage

Acquirer of Choice Public Storage Quick Facts World’s leading owner, acquirer, and developer of self-storage properties Most active private-market acquirer since 2019 Execution Certainty with Speed to Close Executing in a “win-win”

transaction marketplace Sellers transact at fair valuations Public Storage enhances cash flow growth through its best-in-class operating platform Reputation as a preferred property acquirer with no financing contingencies, execution certainty, and

speed to close on a cash basis Acquisitions consistently funded with free cash flow and unsecured debt issued via growth-oriented balance sheet Square feet added, millions Portfolio Expansion via Private Market Transactions (2019 – 2023 YTD)1

Source: Company filings 1. Includes acquisition properties closed or under contract subsequent to 3/31/23.

A Growth Transaction As We

Are… Strengthening our wide-ranging competitive advantages Transforming our operating model through customer experience, employee satisfaction, and margin expanding digitalization Enhancing our industry-leading property and income stream

quality Generating significant earnings upside through multi-factor external growth Achieving superior returns on invested capital through industry-best operations and a growth-oriented balance sheet Uniquely positioned for continued industry

leadership, innovation, and growth

Appendix

An Advantageous Pro Forma Leverage

Position Notes Payable Preferred Equity Total Cash Net Debt and Preferred Equity Net Debt and Preferred Equity1 Q1 2023 Simply Adjustment Pro Forma $6,937 4,350 11,287 (695) $10,592 $2,265 - 2,265 - - $9,202 4,350 13,552 (695) $12,857 EBITDA EBITDA

$3,2022 $1433 $3,345 Leverage Metrics Net Debt to EBITDA Net Debt and Preferred Equity to EBITDA 1.9x 3.3x - - 2.5x 3.8x Source: Company filings and Simply Self Storage 1. Notes payable, preferred equity, and cash as of 3/31/23 2. Public

Storage’s actual trailing twelve month EBITDA for the period ending 3/31/23 3. Assumes 6.5% midpoint of expected stabilized nominal yield range

Source: Company filings 1. Excludes

$2.7 billion of proceeds from the sale of our equity investment in PS Business Parks, Inc. on July 20, 2022. Net income Net operating income attributed to noncontrolling interests Depreciation and amortization Interest expense Extraordinary and

nonrecurring gains and losses PS Business Parks and Shurgard equity earnings Distributions received from PS Business Parks and Shurgard1 EBITDA Net Income to EBITDA Reconciliation 1Q23 TTM $4,370 (16) 888 139 (2,167) (70) 58 $3,202 Non-GAAP

Reconciliation

Exhibit 99.2

News Release

Public Storage

701 Western Avenue

Glendale, CA 91201-2349

PublicStorage.com

|

|

|

| For Release: |

|

Immediately |

| Date: |

|

July 24, 2023 |

Public Storage Accelerates Growth with Simply Self Storage Acquisition

GLENDALE, California and New York – Public Storage (NYSE:PSA) (the “Company”) and Blackstone Real Estate Income Trust, Inc.

(“BREIT”) announced today an agreement for Public Storage to acquire Simply Self Storage (“Simply”) from BREIT for $2.2 billion.

The portfolio comprises 127 wholly-owned properties and 9 million net rentable square feet that are geographically diversified across 18 states and

located in markets with population growth that has been approximately double the national average since 2018. Approximately 65% of the properties are located in high-growth Sunbelt markets. During BREIT’s ownership period, Blackstone made

investments into the Simply platform that enabled the company to enhance the quality of the portfolio and management team, and ultimately significantly increased Simply’s net operating income.

Public Storage will deploy its industry-leading brand and operating platform to drive customer recognition and further enhance performance. The Company will

integrate an additional 25 properties into its PS Advantage® third-party management platform. By combining the Simply team with Public Storage’s leading platform, the Company will deepen

its presence in fast-growing markets, bolster its core strengths, and unlock additional opportunities for growth and value creation.

This acquisition

reflects Public Storage’s continued execution of its opportunistic growth strategy. Since 2019, Public Storage has expanded its portfolio by approximately 55 million net rentable square feet, or 34%, through $10.6 billion of

acquisitions, development, and redevelopment, including Simply and additional properties previously announced as under contract.

“We are pleased to

welcome Simply’s team, customers, and third-party management partners to Public Storage’s industry-leading brand and platform,” said Joe Russell, Public Storage’s Chief Executive Officer. “This acquisition reflects the

continued execution of our multi-factor external growth platform, which includes acquisitions, development, redevelopment, expansion, and third-party management. We are pleased to complete this important transaction with Blackstone, which further

demonstrates our position as an acquirer of choice in the industry. Blackstone has done a tremendous job of growing and improving the quality and operations of the Simply portfolio over the past few years.”

Nadeem Meghji, Head of Blackstone Real Estate Americas, said “Where you invest matters, and this transaction demonstrates the strong investor demand for

the high-quality assets and platforms we have assembled within BREIT. This sale is a terrific outcome for BREIT stockholders and enables us to further concentrate BREIT’s portfolio in its highest growth sectors. Public Storage is a leader in

its space and will be a terrific steward of this portfolio.”

The acquisition is currently expected to close in the third quarter of 2023, subject to

the satisfaction of customary closing conditions. A detailed presentation is available in the Investor Relations section of Public Storage’s website.

Eastdil Secured served as financial advisor to Public Storage, and Wachtell, Lipton, Rosen & Katz and Hogan Lovells US LLP acted as legal advisors.

Wells Fargo and Newmark Group, Inc. served as lead financial advisors to BREIT, and BMO Capital Markets and Sumitomo Mitsui Banking Corporation (SMBC) also served as financial advisors. Simpson Thacher & Bartlett LLP acted as BREIT’s

legal advisor.

About Public Storage

Public Storage, a member of the S&P 500 and FT Global 500, is a REIT that primarily acquires, develops, owns, and operates self-storage facilities. At

March 31, 2023, we had: (i) interests in 2,877 self-storage facilities located in 40 states with approximately 205 million net rentable square feet in the United States and (ii) a 35% common equity interest in Shurgard Self

Storage Limited (Euronext Brussels:SHUR), which owned 266 self-storage facilities located in seven Western European nations with approximately 15 million net rentable square feet operated under the Shurgard® brand. Our headquarters are located in Glendale, California.

About Blackstone Real Estate

Income Trust

Blackstone Real Estate Income Trust, Inc. (BREIT) is a perpetual-life, institutional quality real estate investment platform that

brings private real estate to income focused investors. BREIT invests primarily in stabilized, income-generating U.S. commercial real estate across asset classes in the United States and, to a lesser extent, real estate debt investments. BREIT is

externally managed by a subsidiary of Blackstone (NYSE: BX), a global leader in real estate investing. Blackstone’s real estate business was founded in 1991 and has approximately $333 billion in investor capital under management. Further

information is available at www.breit.com.

Forward-Looking Statements

This press release includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of

the Securities Exchange Act of 1934. All forward-looking statements speak only as of the date of this release. These forward-looking statements involve known and unknown risks and uncertainties, which may cause the Company’s or BREIT’s

actual results and performance to be materially different from those expressed or implied in the forward-looking statements. Factors and risks that may impact the Company’s or BREIT’s respective future results and performance are described

in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022 and BREIT’s Annual Report on Form 10-K for the most recent fiscal year,

its periodic filings with the SEC, as well as under the section entitled “Risk Factors” in BREIT’s prospectus, each of which is accessible on the SEC’s website at www.sec.gov. Each of the Company and BREIT disclaims any

obligation to update publicly or otherwise revise any forward-looking statements, whether as a result of new information, new estimates, or other factors, events or circumstances after the date of this release, except where required by law.

Contacts

Public Storage

Ryan Burke

(818)

244-8080, Ext. 1141

Blackstone

Jeffrey Kauth

Jeffrey.Kauth@Blackstone.com

(212) 583-5395

# # #

v3.23.2

Document and Entity Information

|

Jul. 24, 2023 |

| Document And Entity Information [Line Items] |

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001393311

|

| Document Type |

8-K

|

| Document Period End Date |

Jul. 24, 2023

|

| Entity Registrant Name |

PUBLIC STORAGE

|

| Entity Incorporation State Country Code |

MD

|

| Entity File Number |

001-33519

|

| Entity Tax Identification Number |

95-3551121

|

| Entity Address, Address Line One |

701 Western Avenue

|

| Entity Address, City or Town |

Glendale

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

91201-2349

|

| City Area Code |

(818)

|

| Local Phone Number |

244-8080

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre Commencement Tender Offer |

false

|

| Pre Commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock [Member] |

|

| Document And Entity Information [Line Items] |

|

| Security 12b Title |

Common Shares, $0.10 par value

|

| Trading Symbol |

PSA

|

| Security Exchange Name |

NYSE

|

| Series F Preferred Stock [Member] |

|

| Document And Entity Information [Line Items] |

|

| Security 12b Title |

Depositary Shares Each Representing 1/1,000 of a 5.150% Cum Pref Share, Series F, $0.01 par value

|

| Trading Symbol |

PSAPrF

|

| Security Exchange Name |

NYSE

|

| Series G Preferred Stock [Member] |

|

| Document And Entity Information [Line Items] |

|

| Security 12b Title |

Depositary Shares Each Representing 1/1,000 of a 5.050% Cum Pref Share, Series G, $0.01 par value

|

| Trading Symbol |

PSAPrG

|

| Security Exchange Name |

NYSE

|

| Series H Preferred Stock [Member] |

|

| Document And Entity Information [Line Items] |

|

| Security 12b Title |

Depositary Shares Each Representing 1/1,000 of a 5.600% Cum Pref Share, Series H, $0.01 par value

|

| Trading Symbol |

PSAPrH

|

| Security Exchange Name |

NYSE

|

| Depositary Shares Each Representing 11000 Of A 4.875 Cum Pref Share Series I 0.01 Par Value [Member] |

|

| Document And Entity Information [Line Items] |

|

| Security 12b Title |

Depositary Shares Each Representing 1/1,000 of a 4.875% Cum Pref Share, Series I, $0.01 par value

|

| Trading Symbol |

PSAPrI

|

| Security Exchange Name |

NYSE

|

| Depositary Shares Each Representing 11000 Of A 4.700 Cum Pref Share Series J 0.01 Par Value [Member] |

|

| Document And Entity Information [Line Items] |

|

| Security 12b Title |

Depositary Shares Each Representing 1/1,000 of a 4.700% Cum Pref Share, Series J, $0.01 par value

|

| Trading Symbol |

PSAPrJ

|

| Security Exchange Name |

NYSE

|

| Depositary Shares Each Representing 11000 Of A 4.750 Cum Pref Share Series K 0.01 Par Value [Member] |

|

| Document And Entity Information [Line Items] |

|

| Security 12b Title |

Depositary Shares Each Representing 1/1,000 of a 4.750% Cum Pref Share, Series K, $0.01 par value

|

| Trading Symbol |

PSAPrK

|

| Security Exchange Name |

NYSE

|

| Depositary Shares Each Representing 11000 Of A 4.625 Cum Pref Share Series L 0.01 Par Value [Member] |

|

| Document And Entity Information [Line Items] |

|

| Security 12b Title |

Depositary Shares Each Representing 1/1,000 of a 4.625% Cum Pref Share, Series L, $0.01 par value

|

| Trading Symbol |

PSAPrL

|

| Security Exchange Name |

NYSE

|

| Depositary Shares Each Representing 11000 Of A 4.125 Cum Pref Share Series M 0.01 Par Value [Member] |

|

| Document And Entity Information [Line Items] |

|

| Security 12b Title |

Depositary Shares Each Representing 1/1,000 of a 4.125% Cum Pref Share, Series M, $0.01 par value

|

| Trading Symbol |

PSAPrM

|

| Security Exchange Name |

NYSE

|

| Depositary Shares Each Representing 11000 Of A 3.875 Cum Pref Share Series N 0.01 Par Value [Member] |

|

| Document And Entity Information [Line Items] |

|

| Security 12b Title |

Depositary Shares Each Representing 1/1,000 of a 3.875% Cum Pref Share, Series N, $0.01 par value

|

| Trading Symbol |

PSAPrN

|

| Security Exchange Name |

NYSE

|

| Depositary Shares Each Representing 11000 Of A 3.900 Cum Pref Share Series O 0.01 Par Value [Member] |

|

| Document And Entity Information [Line Items] |

|

| Security 12b Title |

Depositary Shares Each Representing 1/1,000 of a 3.900% Cum Pref Share, Series O, $0.01 par value

|

| Trading Symbol |

PSAPrO

|

| Security Exchange Name |

NYSE

|

| Depositary Shares Each Representing 11000 Of A 4.000 Cum Pref Share Series P 0.01 Par Value [Member] |

|

| Document And Entity Information [Line Items] |

|

| Security 12b Title |

Depositary Shares Each Representing 1/1,000 of a 4.000% Cum Pref Share, Series P, $0.01 par value

|

| Trading Symbol |

PSAPrP

|

| Security Exchange Name |

NYSE

|

| Depositary Shares Each Representing 11000 Of A 3.950 Cum Pref Share Series Q 0.01 Par Value [Member] |

|

| Document And Entity Information [Line Items] |

|

| Security 12b Title |

Depositary Shares Each Representing 1/1,000 of a 3.950% Cum Pref Share, Series Q, $0.01 par value

|

| Trading Symbol |

PSAPrQ

|

| Security Exchange Name |

NYSE

|

| Depositary Shares Each Representing 11000 Of A 4.000 Cum Pref Share Series R 0.01 Par Value [Member] |

|

| Document And Entity Information [Line Items] |

|

| Security 12b Title |

Depositary Shares Each Representing 1/1,000 of a 4.000% Cum Pref Share, Series R, $0.01 par value

|

| Trading Symbol |

PSAPrR

|

| Security Exchange Name |

NYSE

|

| Depositary Shares Each Representing 11000 Of A 4.100 Cum Pref Share Series S 0.01 Par Value [Member] |

|

| Document And Entity Information [Line Items] |

|

| Security 12b Title |

Depositary Shares Each Representing 1/1,000 of a 4.100% Cum Pref Share, Series S, $0.01 par value

|

| Trading Symbol |

PSAPrS

|

| Security Exchange Name |

NYSE

|

| Notes Due 2032 [Member] |

|

| Document And Entity Information [Line Items] |

|

| Security 12b Title |

0.875% Senior Notes due 2032

|

| Trading Symbol |

PSA32

|

| Security Exchange Name |

NYSE

|

| Notes Due 2030 [Member] |

|

| Document And Entity Information [Line Items] |

|

| Security 12b Title |

0.500% Senior Notes due 2030

|

| Trading Symbol |

PSA30

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesFPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesGPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesHPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=psa_DepositarySharesEachRepresenting11000OfA4.875CumPrefShareSeriesI0.01ParValueMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=psa_DepositarySharesEachRepresenting11000OfA4.700CumPrefShareSeriesJ0.01ParValueMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=psa_DepositarySharesEachRepresenting11000OfA4.750CumPrefShareSeriesK0.01ParValueMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=psa_DepositarySharesEachRepresenting11000OfA4.625CumPrefShareSeriesL0.01ParValueMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=psa_DepositarySharesEachRepresenting11000OfA4.125CumPrefShareSeriesM0.01ParValueMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=psa_DepositarySharesEachRepresenting11000OfA3.875CumPrefShareSeriesN0.01ParValueMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=psa_DepositarySharesEachRepresenting11000OfA3.900CumPrefShareSeriesO0.01ParValueMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=psa_DepositarySharesEachRepresenting11000OfA4.000CumPrefShareSeriesP0.01ParValueMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=psa_DepositarySharesEachRepresenting11000OfA3.950CumPrefShareSeriesQ0.01ParValueMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=psa_DepositarySharesEachRepresenting11000OfA4.000CumPrefShareSeriesR0.01ParValueMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=psa_DepositarySharesEachRepresenting11000OfA4.100CumPrefShareSeriesS0.01ParValueMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=psa_NotesDue2032Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=psa_NotesDue2030Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

Public Storage (NYSE:PSA-S)

過去 株価チャート

から 10 2024 まで 11 2024

Public Storage (NYSE:PSA-S)

過去 株価チャート

から 11 2023 まで 11 2024