Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

2023年6月7日 - 6:00AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of June 2023

Commission File Number 001-36671

Atento S.A.

(Translation of Registrant's name into English)

1, rue Hildegard Von Bingen, 1282, Luxembourg

Grand Duchy of Luxembourg

(Address of principal executive office)

Indicate by check mark whether the registrant files or will

file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F: ☒ Form 40-F: ☐

Indicate by check mark if the registrant is submitting the

Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes: ☐ No: ☒

Note: Regulation S-T Rule 101(b)(1) only permits the submission

in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the

Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes: ☐ No: ☒

Note: Regulation S-T Rule 101(b)(7) only permits the

submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish

and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s

“home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as

long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s

security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing

on EDGAR.

Atento S.A. (NYSE: ATTO, "Atento"

or the "Company"), one of the world's largest customer relationship management and business process outsourcing (CRM / BPO)

service providers and an industry leader in Latin America, announced that it is evaluating its financing alternatives and is engaged in

discussions with the counterparties to its cross-currency swap agreements and an ad hoc group of investors in its senior secured notes

for a potential transaction to provide additional capital for Atento to support operations and accelerate cost efficiency and growth initiatives,

and to optimize Atento’s balance sheet. The ad hoc group of investors collectively hold or control more than 70% of the $500 million

senior secured notes due 2026 issued by Atento Luxco 1 and more than 75% of $39.6 million senior secured notes due 2025 issued by Atento

Luxco 1.

In addition to the contemplated

recapitalization, the proposed transaction is expected to involve a significant deleveraging of Atento’s balance sheet to position

Atento to execute on its long-term strategic plan and to continue its focus on its leading service to clients. Atento expects that any

balance sheet deleveraging transaction would occur at a holding company level and involve only financial or funded debt obligations, ensuring

operations continue fully unaffected until the complete implementation of the transaction.

Atento is represented in these discussions

by Houlihan Lokey and FTI Consulting as financial advisors and Sidley Austin as legal advisor. The ad hoc group of investors is represented

by Rothschild & Co. as financial advisor and Hogan Lovells as legal advisor.

In connection with these discussions,

Atento also announced that it has agreed to the unwinding of its remaining cross-currency interest rate swap agreements. Atento entered

into swap agreements in connection with the $500 million senior secured notes due 2026 to swap amounts payable in US dollars (USD) for

the semi-annual coupons on the notes until February 2026 into amounts payable in Brazilian Reais (BRL), Peruvian Sole (PEN) and euro (EUR)

based on floating or fixed interest rates. The PEN and EUR swap agreements were previously unwound. The treatment of the outstanding amounts

from unwinding the BRL amount, which amount to approx. $120 million, form part of the Company’s discussions with the swap counterparties

and ad hoc group of investors. Unwinding of the swap agreements does not trigger the payment default or cross acceleration provisions

of Atento’s other debt.

Atento further announced that on

June 2, 2023, Roberto Rittes tendered his resignation as a member of the Board of Directors, effective immediately. His resignation was

not due to any disagreement with Atento. The Board of Directors of the Company fully appreciates Mr. Rittes’ service to the Board.

Atento has issued today a press

release announcing its engagement with the noteholder group and the unwinding of the swaps, a copy of which is filed as Exhibit 99.1 to

this Report.

Forward-Looking Statements

This report contains forward-looking statements. Forward-looking

statements can be identified by the use of words such as "may," "should," "expects," "plans,"

"anticipates," "believes," "estimates," "predicts," "intends," "continue"

or similar terminology. These statements reflect only Atento’s current expectations and are not guarantees of future events. These

statements are subject to risks and uncertainties that could cause actual results and events to differ materially from those contained

in the forward-looking statements. Such risks and uncertainties include, but are not limited to, the actual outcomes of the Company’s

engagement with major investor groups; obtaining required consents from third-parties and satisfying other conditions precedent for any

additional financing that might be outside Atento’s control; actions by Atento’s lenders and other financing sources;

Atento’s future cash requirements; competition in Atento’s highly competitive industries; increases in the cost of voice

and data services or significant interruptions in these services; Atento’s ability to keep pace with its clients’ needs for

rapid technological change and systems availability; the continued deployment and adoption of emerging technologies; the loss, financial

difficulties or bankruptcy of any key clients; the effects of global economic trends on the businesses of Atento’s clients; the

non-exclusive nature of Atento’s client contracts and the absence of revenue commitments; security and privacy breaches of the

systems Atento uses to protect personal data; the cost of pending and future litigation; the cost of defending Atento against intellectual

property infringement claims; extensive regulation affecting many of Atento’s businesses; Atento’s ability to protect its

proprietary information or technology; service interruptions to Atento’s data and operation centers; Atento’s ability to

retain key personnel and attract a sufficient number of qualified employees; increases in labor costs and turnover rates; the political,

economic and other conditions in the countries where Atento operates; changes in foreign exchange rates; Atento’s ability to complete

future acquisitions and integrate or achieve the objectives of its recent and future acquisitions; future impairments of our substantial

goodwill, intangible assets, or other long-lived assets; and Atento’s ability to recover consumer receivables on behalf of its

clients. Atento is also subject to other risk factors described in documents filed by the company with the United States Securities and

Exchange Commission. These forward-looking statements speak only as of the date on which the statements were made. Atento undertakes

no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

Date: June 6, 2023 |

ATENTO S.A.

By: /s/ Dimitrius Oliveira

Name: Dimitrius Oliveira

Title: Chief Executive Officer |

Exhibit 99.1

Press Release

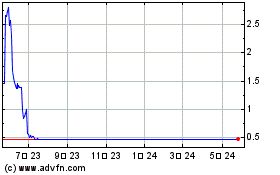

Atento (NYSE:ATTO)

過去 株価チャート

から 5 2024 まで 6 2024

Atento (NYSE:ATTO)

過去 株価チャート

から 6 2023 まで 6 2024